Abstract

We study global and local dynamics of a simple search and matching model of the labor market. We show that the model exhibits chaotic and periodic dynamics for empirically plausible parameter values both in backward and forward time. In contrast to the global results, we show that the model can be locally indeterminate or have no equilibrium at all, but only for parameterizations that are empirically unreasonable. In contrast to earlier work, we establish these results analytically without placing numerical restrictions on the parameters.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The search and matching model of the labor market has proved to be a convenient framework for studying the joint behavior of unemployment and job vacancies. Much of the qualitative and quantitative analysis in this framework relies on linear approximations and local solutions of fundamentally nonlinear environments, as does most of the dynamic literature in macroeconomics. Yet, researchers increasingly have come to realize that the global dynamics of such frameworks can have quite different implications than those derived from local counterparts. In particular, nonlinear dynamics can be periodic or chaotic, which a linear approach cannot capture. Moreover, a purely linear approach may rule out steady-state equilibria as unstable with explosive dynamics, and therefore miss on cyclical equilibria or stable dynamics elsewhere in the economic domain. Without a full characterization of the nature of the processes that generate economic data, any conclusions drawn based on a local approach can therefore be misleading.

In this paper, we study the global and local dynamics of the simple search and matching model in light of these concerns. Specifically, we add to the literature by showing analytically that the model exhibits periodic and chaotic dynamics for a wide range of plausible parameterizations that have been used in the quantitative literature. We employ analytic proofs that are derived without placing numerical restrictions on the parameters. We are aided in this effort by the specific structure of the search and matching framework, which can be reduced to a recursive two-variable system. The model is thereby amenable to analytical characterization of its local and global properties. The key dynamics arise from the model’s job-creation condition, whereby we show that this holds both in backward and forward time. For the backward dynamics, we derive a mapping that can be easily analyzed after introducing a variable change. This mapping ensures that the evolution of labor market dynamics is both economically meaningful in the sense that trajectories of the model’s variables are well defined, and that it is consistent with the model’s job-creation condition in terms of uniqueness of the steady state. This differentiates our work from prior analysis of this model, which uses a map that can have more than one steady state for certain parameter values and may not always be defined on its domain.

Our paper contributes to the literature along two dimensions. First, the phenomenon of chaotic dynamics in economic models is interesting on its own. However, most work has focused on the Real Business Cycle (RBC) model or variants of the New Keynesian model, although there is recent interest in global dynamics in the literature, best exemplified by the contribution of Gu et al. (2013) in the monetary search model. While this and our model both rest on search theory, the general frameworks are different enough to make ours an independent contribution in this area, as the study of the global dynamics of the labor market search and matching model is new. Second, our paper emphasizes the importance of considering global dynamics more broadly, especially since there is a growing awareness that reliance on local dynamics can be misleading. For example, as is the case with our model, it can be shown that under certain conditions the steady state may be a repeller, and it may therefore be tempting to conclude the model exhibits explosive dynamics. We show that this is not always the case—the loss of stability in the steady state coincides with emergence of cyclical behavior.

Our work builds on papers by Medio and Raines (2007) and Mendes and Mendes (2008).Footnote 1 The former authors study backward dynamics in general economic models and provide the general template for our analysis. Specifically, they develop general conditions under which periodic and chaotic dynamics can arise in a wide class of economic models that can be conveniently characterized by classes of mappings. The work in Mendes and Mendes (2008) applies some of these insights to a labor market framework that is similar to ours. They show that the backward dynamics in the search and matching model can undergo a period-doubling bifurcation that leads to chaos. However, this result is established under strict restrictions on parameter values. Moreover, they show period doubling and existence of periodic points of period 3 and 5 only numerically. Our work improves upon theirs by establishing existence of periodic and chaotic solutions in the model analytically, which allows us to extend the range of acceptable parameter values under which cycles and chaos can occur. From a technical perspective, Mendes and Mendes (2008) uses symbolic dynamics and inverse limit theory to establish cycles and chaos going forward in time, when backward dynamics exhibit similar behavior. Using the result established by Kennedy and Stockman (2008), we establish chaotic and periodic solutions in forward time more generally, without imposing numerical restrictions on parameter values.Footnote 2

Our paper is most closely related to recent work by Sniekers (2017), who studies a labor market search and matching model in continuous time. Continuous-time models are often easier to analyze than their discrete-time counterparts since stability and local indeterminacy analysis requires checking only one threshold, namely the behavior around zero of the first derivative of a mapping as opposed to the behavior around ± 1 in the discrete case. As such, results for two-equation systems are easier to come by, whereas we assume a specific parameterization, namely risk-neutral agents, to allow for a recursive system, where we can analyze the global behavior using a single equation. The second difference is that the model in Sniekers (2017) has multiple steady states on account of a demand externality, while we study the standard search and matching model with a unique steady state, as we show. This assumption allows him to generate plausible cycles that can replicate a reduced-form relationship between unemployment and vacancies, the so-called Beveridge curve.

This paper is also close in spirit to recent contributions that analyze global dynamics in Real Business Cycle models, such as Coury and Wen (2009), Growiec et al. (2018) and Sorger (2016). In a RBC model with production externalities, the work in Coury and Wen (2009) shows that the unique steady state is surrounded by stable deterministic cycles, which implies global indeterminacy that is not apparent from a local analysis. Their paper is similar to ours in that we also work in a two-equation environment that is amenable to straightforward, and intuitive, analytical and numerical analysis. As in our paper, they find that indeterminacy is more pervasive than previously believed. The work in Sorger (2016) extends this analysis to show that under standard monotonicity and convexity assumptions on technology and preferences the basic RBC model can have periodic solutions of any period as well as chaotic solutions. However, this does not arise for typical parameterizations that are employed in the literature. In contrast, we show that in the search and matching framework chaotic dynamics arise even under standard parameterization. Finally, Growiec et al. (2018) show that in an extended version of the RBC model limit cycles can explain the empirical evidence on substantial medium-to-long run, pro-cyclical swings in the labor share in the USA.

The paper is structured as follows. In the next section, we describe the simple search and matching model of the labor market. Section 3 is the central part of the paper. It presents the global analysis, showing more general results on the presence of periodic and chaotic dynamics. In Sect. 4, we provide further insights on the general results by studying a special case analytically and by conducting a numerical analysis based on a calibration of the model. This section also contains a local determinacy analysis and a comparison with the global results. The final section concludes. Relevant mathematical concepts and proofs are presented in Appendix.

2 A simple search and matching model of the labor market

We develop a simple version of the search and matching model of the labor market. The model has become the workhorse framework for studying unemployment and vacancy dynamics and employment flows more generally, especially since Shimer’s (2005) seminal contribution. The exposition follows Krause and Lubik (2010) closely, to which we refer for further details.

We assume time is discrete and a model period is one quarter. A continuum of identical firms employs workers who inelastically supply one unit of labor.Footnote 3 Output y of a typical firm is linear in employment n:

where A is exogenous aggregate productivity.Footnote 4 The matching process between workers and firms is described by the function \(m(u_{t},v_{t})=mu_{t}^{\xi }v_{t}^{1-\xi }\), with unemployment u, vacancies v, and parameters \(m>0\) and \(0<\xi <1\). m is match efficiency and measures the effectiveness of the matching process, while \(\xi \) is the match elasticity. The matching function captures the number of newly formed employment relationships that arise from the contacts between unemployed workers and firms seeking to fill open positions. Unemployment is defined as:

which is the measure of all potential workers in the economy who are not employed at the beginning of the period and are thus available for job search activities.

We can write the law of motion for employment as follows:

where new hires add to the existing stock of workers. The end-of-the-period workforce is subject to separation at the rate \(0<\rho <1\).Footnote 5 We define \(q(\theta _{t})\) as the probability of filling a vacancy, or the firm-matching rate, where \(\theta _{t}=v_{t}/u_{t}\) is labor market tightness. In terms of the matching function, we can write this as \(q(\theta _{t})=m(u_{t},v_{t})/v_{t}=m\theta _{t}^{-\xi }\). Similarly, the job-finding rate is \(p(\theta _{t})=m(u_{t},v_{t})/u_{t}=m\theta _{t}^{1-\xi }\). An individual firm is atomistic in the sense that it takes the aggregate matching rate \(q(\theta _{t})\) as given. The employment constraint on the firm’s decision problem is therefore linear in vacancy postings:

Firms maximize profits, using the discount factor \(\beta ^{t}\frac{\lambda _{t}}{\lambda _{0}}\) (to be determined below):

Wages paid to the workers are w, while \(\kappa >0\) is a firm’s cost of posting a vacancy. \(\mu \) is the Lagrange multiplier on the firm’s employment constraint. It can be interpreted as the marginal value of a filled position. Firms decide how many vacancies to post and how many workers to hire. The first-order conditions are:

which imply the job-creation condition (JCC):

This optimality condition trades off expected hiring cost \(\kappa /q(\theta _{t})\) against the benefits of a productive match. This consists of the output accruing to the firm net of wage payments and the future savings on hiring costs when the current match is successful. The existence of positive vacancy posting costs also ensures that \(\theta _{t}>0\) and therefore \(v_{t}>0\) since the marginal value of an open position is strictly positive.

As is common in the literature, we assume the economy is populated by a representative household. The household is composed of workers, who are either unemployed or employed. If they are unemployed, they are compelled to search for a job, but they can draw unemployment benefits \(b\ge 0\). Employed members of the household receive pay w, but share this with the unemployed. They do not suffer disutility from working and supply a fixed number of hours.Footnote 6 Since the household’s only choice variable is consumption, and since there is no mechanism to transfer resources intertemporally, the utility maximization problem is trivial. Assuming constant relative risk aversion, this determines the marginal utility of wealth, \(\lambda _{t}=C_{t}^{-\sigma }\), where C is consumption and \(\sigma ^{-1}>0\) is the intertemporal elasticity of substitution. In equilibrium, total income accruing to the household equals net output in the economy, which is composed of production less real resources lost in the search process, \(Y_{t}=y_{t}-\kappa v_{t}\). Since \(C_{t}=Y_{t}\), we can now derive the discount factor \(\beta ^{t}\frac{\lambda _{t}}{\lambda _{0}}=\beta ^{t}\frac{Y_{t}^{-\sigma }}{Y_{0}^{-\sigma }}\), where \(0<\beta <1\).

Finally, we need to derive how wages are determined. We assume that wages are set according to the Nash bargaining solution.Footnote 7 As this is a lengthy, but standard, derivation, we refer to Krause and Lubik (2010) for further exposition. The Nash-bargained wage is thus:

where the bargaining parameter \(0<\eta <1\) captures the worker’s bargaining power. As shown by Hosios (1990), the model attains its social optimum when \( \eta =\xi \). The works in Bhattacharya and Bunzel (2003a) and Bhattacharya and Bunzel (2003b) restrict their analysis to this case, whereas we allow for a more general parameterization. We consider \(\xi =0.5\) as our benchmark case since it allows analytical characterization of some results. The wage equation can then be substituted into the JCC to derive:

This completes the description of the model.

We now establish some preliminary results and properties of the model that frame the later global and local analysis. Moreover, we also introduce a regularity condition that ensures the economic plausibility of the findings. We first show that the model has a unique steady state. Steady state \(\theta _{\mathrm{SS}}\) solves the following nonlinear equation:

which is derived from the JCC (10) after rearranging terms. We now prove the following Lemma.

Lemma 1

The job-creation condition has a unique steady state \(\theta _{\mathrm{SS}}\).

Proof

Consider the left-hand side and the right-hand side of the above equation separately. The left-hand side \(f_{1}=\left[ 1-\beta (1-\rho )\right] \theta _{\mathrm{SS}}^{\xi }\) has an intercept at the origin and is strictly increasing in \( \theta _{\mathrm{SS}}\) since \(1-\beta (1-\rho )>0\). The right-hand side \(f_{2}=\beta (1-\rho )(1-\eta )m\frac{A-b}{\kappa }-\beta (1-\rho )\eta m\theta _{\mathrm{SS}}\) is linear in \(\theta _{\mathrm{SS}}\) and strictly decreasing with a positive intercept. It therefore follows that the two functions intersect once and that there is a unique steady state \(\theta _{\mathrm{SS}}\). \(\square \)

The simple search and matching model does not suffer from the multiple steady-state problem identified, for example, by Benhabib et al. (2001) in a monetary model with an interest rate feedback rule for monetary policy, which can raise considerable issues for interpreting data or developing policy recommendations.Footnote 8 This is not an issue in our model. Instead, our focus of investigation is whether the unique steady state is locally and globally stable or unstable and whether there are chaotic endogenous dynamics. The remaining steady-state values can be computed in a straightforward manner. The steady-state unemployment rate \(u_{\mathrm{SS}}\) can be derived from the law of motion for employment, that is, \(\frac{\rho }{1-\rho }\frac{1-u_{\mathrm{SS}}}{u_{\mathrm{SS}}} =m\theta _{\mathrm{SS}}^{1-\xi }\). The rest of the variables then follow immediately.

We also derive a regularity condition that imposes a parametric restriction to ensure economic plausibility. The job-matching and job-finding rates are defined as, respectively, \(q(\theta )=m\theta ^{-\xi }\) and \(p(\theta )=m\theta ^{1-\xi }\). These should properly be interpreted as the probabilities of a firm filling a vacancy and a worker finding a job, respectively. It is a quirk of the discrete-time matching model that mathematically these variables can take on values above one. Intuitively, at a low enough frequency, everyone in the pool of searchers transitions out of unemployment at least once, which translates into a job-finding rate of above one. While this is conceptually valid—the rate counts the number of new matches per searchers over a long enough period—it arguably violates the spirit of the search and matching model in that successful matching is probabilistic. We note that this is not an issue for the continuous-time version of the search and matching model since \(q(\theta )\) and \(p(\theta )\) are instantaneous transition rates and thus are true probabilities. In what follows, we therefore restrict these rates to lie on the unit interval (see also Bhattacharya and Bunzel 2003a, b; Shimer 2004). The following Lemma establishes the necessary parametric restriction.

Lemma 2

If the transition rates \(q(\theta )\) and \(p(\theta )\) are less than one then \(m<1\).

Proof

Define \(q(\theta )=m\theta ^{-\xi }\) and \(p(\theta )=m\theta ^{1-\xi }\). \( q(\theta )<1\) implies \(\theta >\left( \frac{1}{m}\right) ^{-1/\xi }\); \( p(\theta )<1\) implies \(\theta <\left( \frac{1}{m}\right) ^{1/(1-\xi )}\). For both transition rates to be less than one, this requires: \(\left( \frac{1}{m} \right) ^{-1/\xi }<\theta <\,\left( \frac{1}{m}\right) ^{1/(1-\xi )}\). This is a nonempty interval for \(\theta \) if \(m<1\). \(\square \)

3 Global dynamics

We now turn to an analysis of the global dynamics of the standard search and matching model. We first provide some general insights into its properties and set up the map that we use to study global equilibria. We then perform a stability analysis of the steady state and focus on the bifurcation that occurs when the dynamics switch from stable to unstable in backward time. We show that this switch corresponds to cyclical behavior in the model and then establish the presence of chaotic dynamics in backward and forward time.

3.1 Preliminaries

We analyze the benchmark case of an economy with risk-neutral agents as described above. The dynamics are governed by the job-creation condition, which we replicate here for convenience:

This is an autonomous first-order nonlinear difference equation in \(\theta \). It describes the evolution of labor market tightness \(\theta _{t}\) and can be solved independently from the rest of the model. This allows us to study the evolution of \(\theta _{t}\) in isolation.Footnote 9 We rewrite the JCC by isolating terms in \(\theta _{t+1}\) on the left-hand side:

Expressing this equation in coefficient form, we have:

where the regularity conditions \(0<m<1\) and the assumption \(A>b\) allow us to bound the parameters:

Equation (14) describes the forward dynamics of labor market tightness \(\theta \). It is expressed in implicit form and is not invertible; that is, we cannot explicitly relate \(\theta _{t+1}\) to \(\theta _{t}\). In other words, the forward dynamics are captured by a correspondence. In cases like this, it is therefore much more convenient to study the global properties using the backward dynamics, that is, by expressing \(\theta _{t}\) as a function of \(\theta _{t+1}\) as the dynamics of tightness evolve backwards in the sense that its current value depends on its future value one period ahead. We can then use the results of Kennedy and Stockman (2008) to relate the backward dynamics to those in forward time.Footnote 10

In the previous literature, for example Mendes and Mendes (2008) and Bhattacharya and Bunzel (2003a), Bhattacharya and Bunzel (2003b), the backward dynamics are defined via the map \(g\left( \theta \right) \) by rearranging (14) to isolate \(\theta _{t}\):

However, the choice of the map g is problematic, since it can produce results that are inconsistent with the logic of the JCC. We show in Appendix A.2 that for plausible values of the parameter \(\xi \) the map g can have multiple positive steady states, whereas the positive steady state \(\theta _{\mathrm{SS}}\) in JCC is unique (see Lemma 1). To avoid this inconsistency, we therefore introduce a change of variables such that for economically meaningful values \(\theta _{t}\ge 0\):

This allows us to rewrite Eq. (14) as the following backward recurrence relation:

where the coefficients are defined as above. Backward solutions of (14) and (17) are well defined for any \(\xi \in (0,1)\), as long as \(z_{t}\) and \(\theta _{t}\) are nonnegative which is the economically meaningful range. The solutions of (14) in terms of the original variable can then be obtained by using \(\theta _{t}=z_{t}^{1/\xi }\). The model in the form of (17) thus provides us with a more convenient and consistent means for studying the backward dynamics of the model.

3.2 Stability properties

We now study the dynamics of the backward map \(z_{t}=f\left( z_{t+1}\right) \). We first establish the properties of the function f. We then study the stability properties of the steady state, where we distinguish two broad areas of dynamics in the backward map, namely stable and unstable. The backward dynamics are governed by the properties of the map:

where \(f(0)=d>0\) defines the intercept. The first derivative of f is given by:

and the map f has a global maximum \(z_{\mathrm{max}}\) at:

Given that f is increasing on \([0,z_{\mathrm{max}})\) and decreasing on \((z_{\mathrm{max}},\infty )\), the map f is a Type-B map as defined in Appendix A.3. The point \(z_{0}>0\) is the unique positive intersection point such that \( f(z_{0})=az_{0}-cz_{0}^{1/\xi }+d=0\).Footnote 11 Note that the coefficients are independent of the match elasticity \(\xi \), which therefore only determines the shape of the mapping but not its location in \((\theta _{t+1},\theta _{t})\)-space. Furthermore, the term \( \frac{A-b}{\kappa }\) scales the intercept d but does not affect other coefficients. We can also express the maximum of f in terms of the structural parameters of the model: \(z_{\mathrm{max}}=\left( \frac{a\xi }{c}\right) ^{ \frac{\xi }{1-\xi }}=\left( \frac{\xi }{m\eta }\right) ^{\frac{\xi }{1-\xi } } \). The maximum only depends on three parameters, which reduce to two under the Hosios condition \(\xi =\eta \). In this special case, \(z_{\mathrm{max}}>1\) since \( m<1\). In the general case, \(z_{\mathrm{max}}\) can be less than one if \(m>\frac{\xi }{ \eta }\). Notably, the location of the maximal point does not depend on other parameters, chiefly the scale term \(\frac{A-b}{\kappa }\). In the next step, we establish that the equation in (17) has a unique positive steady state. It is straightforward to see that the fixed point \(z_{\mathrm{SS}}\) of the map f, i.e., the steady state of (17), is the same as \( z_{\mathrm{SS}}=\theta _{\mathrm{SS}}^{\xi }\), or \(\theta _{\mathrm{SS}}=(z_{\mathrm{SS}})^{1/\xi } =(f(z_{\mathrm{SS}}))^{1/\xi }\) as established in Lemma 1 (see Appendix A3 for the formal proof).

We now analyze the stability properties of the steady state. These properties are determined around the thresholds \(\pm 1\) and are given by the first derivative \(f^{\prime }\left( z_{\mathrm{SS}}\right) \). If \(\left| f^{\prime }\left( z_{\mathrm{SS}}\right) \right| <1\), the steady state \(z_{\mathrm{SS}}\) is stable in its backward dynamics and unstable otherwise. At \(\left| f^{\prime }\left( z_{\mathrm{SS}}\right) \right| =1\) a bifurcation occurs, and the dynamics switch from stable to unstable. Clearly, the stability properties of \(z_{\mathrm{SS}}\) translate directly to that of \(\theta _{\mathrm{SS}}\). We can establish the following thresholds. \(\left| f^{\prime }\left( z_{\mathrm{SS}}\right) \right| <1\) if and only if:

or, alternatively:

Since the value of the parameter a is less than one, the first inequality above holds trivially, given Lemma 1 and the restrictions on the parameters. This also means that whenever \(f^{\prime }\left( z_{\mathrm{SS}}\right) \) is positive, it is less than one. In other words, if \(z_{\mathrm{SS}}\le z_{\mathrm{max}}\), then \(z_{\mathrm{SS}}\) is stable. Since a bifurcation cannot occur in this region of the map, we focus our attention on the other case, namely \(0>f^{\prime }\left( z_{\mathrm{SS}}\right) >-1\). In the case when \(z_{\mathrm{SS}}>z_{\mathrm{max}}\), \(f^{\prime }\left( z_{\mathrm{SS}}\right) \) is negative, and the steady state \(z_{\mathrm{SS}}\) may or may not be stable. Since \(f^{\prime }\left( z_{\mathrm{SS}}\right) >-1\) implies that:

then \(z_{\mathrm{SS}}\) is stable if (23) holds; it is unstable otherwise. We collect these results and classification for types of equilibria in Table 1 for further reference.

These conditions can also be expressed in terms of the underlying structural parameters of the model, which allow for a more meaningful economic interpretation. The stability condition (23) can be written in terms of \(\theta _{\mathrm{SS}}\) as follows:

We note that the conditions in (23) and, equivalently, in (24) are in implicit form since \(z_{\mathrm{SS}}\) and \(\theta _{\mathrm{SS}}\) are functions of the composite parameters a, c, d, and \(\xi \), and ultimately the structural parameters; at the same time, the analytical expression for \( z_{\mathrm{SS}}\) cannot always be obtained explicitly. We find it therefore convenient to express the stability threshold in terms of a boundary condition for the job-finding rate \(p\left( \theta _{\mathrm{SS}}\right) =m\theta _{\mathrm{SS}}^{1-\xi }\), as it is useful for developing intuition and for ease of economic interpretation. In that sense, the stable equilibrium is an outcome of condition (24), in which the steady-state job-finding rate is less than the given threshold. Moreover, while \(p\left( \theta _{\mathrm{SS}}\right) \) is an endogenous variable, it is often treated parameterically in quantitative analyses as a target value for calibration (see Haan et al. 2000, and the discussion further below). For our benchmark case \(\xi =0.5\), we can solve for \(z_{\mathrm{SS}}\) directly and express Eqs. (26) and (24) in terms of model parameters only. We present quantitative results and discuss the benchmark case in a later subsection.

Condition (24) states that the steady state of the standard search and matching model is stable if the job-finding rate is below the threshold. Under the Hosios condition \(\xi =\eta \), the threshold reduces to \(\frac{ 1+\beta (1-\rho )}{\beta (1-\rho )}>1\). Given the parameteric restriction \( m<1\) developed in Lemma 2, the steady state would thus always be stable. The solution to the model is such that starting from an initial value in a close neighborhood of the steady state, the economy will converge nonmonotonically (since \(f^{\prime }\left( z_{\mathrm{SS}}\right) <0\)) to the steady state, which is an attractor in the forward dynamics. The law of motion is given by the correspondence (14). The steady state loses stability if the job-finding rate is above the threshold. This is consistent with a high enough \(p\left( \theta _{\mathrm{SS}}\right) \) and requires \(\xi <\eta \). In this case, the equilibrium is unstable. While it is tempting to conclude that \(\theta _{t}\) and \(v_{t}\) would grow without bound, we show that under appropriate parameterization solutions stay bounded. In fact, we show in the next section that the loss in stability coincides with the emergence of cyclical and chaotic behavior.Footnote 12

3.3 Periodic and chaotic solutions

We first establish under which conditions we observe nonexplosive dynamics.

Lemma 3

If \(f(z_{\mathrm{max}})\le z_{0}\), then the solutions stay bounded in the interval \( [0,z_{0}]\).

Proof

Let \(x\in [0,z_{0}]\). Then \(f(x)\le f(z_{\mathrm{max}})\le z_{0}\) for all \( x\ge 0\). Further, if \(0\le x\le z_{\mathrm{max}}\), then \(f(x)\ge f(0)=d>0\) since f is increasing on \([0,z_{\mathrm{max}})\), and if \(z_{\mathrm{max}}\le x\le z_{0}\), then \( f(x)\ge f(z_{0})=0\) since f is decreasing on \([0,z_{0}]\). \(\square \)

We now establish that the transition in backwards time between stable and unstable dynamics at \(f^{\prime }\left( z_{\mathrm{SS}}\right) =-1\) corresponds to a period-doubling bifurcation, namely the emergence of a sequence of cycles of doubling periods. As the steady state \(z_{\mathrm{SS}}\) loses its stability and goes through this bifurcation, a new attractor emerges with double the period of the steady state, that is, a 2-cycle when compared to stable adjustment dynamics before the threshold. The solution exhibits oscillations, but in a nonexplosive manner. As the value of the bifurcation parameter changes, new attractors continue to appear with double the period of the previous ones. Eventually, this leads to bounded aperiodic and chaotic fluctuations in the dynamics of the model. We first establish this result analytically in terms of the composite coefficients of the map defined above. We choose d as the bifurcation parameter, since it scales in \(\frac{A-b}{\kappa }\). Whereas the parameters in the coefficients a and c are comparatively tightly restricted, the parameters in this scale coefficient are less economically restricted.Footnote 13

The change in stability of \(z_{\mathrm{SS}}\) occurs at \(f^{\prime }\left( z_{\mathrm{SS}}\right) =-1\), or:

We rewrite (25) in terms of the bifurcation parameter d as follows. At the steady state, we have \(f(z_{\mathrm{SS}})=az_{\mathrm{SS}}-cz_{\mathrm{SS}}^{1/\xi }+d=z_{\mathrm{SS}}\), or \(a-c\left( z_{\mathrm{SS}}\right) ^{\frac{1-\xi }{\xi }}+\frac{d}{ z_{\mathrm{SS}}}=1\). Hence, \(c\left( z_{\mathrm{SS}}\right) ^{\frac{1-\xi }{\xi }}=a-1+\frac{d }{z_{\mathrm{SS}}}\). Substituting this expression into (25), yields:

where \(\mu =\xi (1+a)+1-a\). When \(d<\mu z_{\mathrm{SS}}\), \(-1<f^{\prime }(z_{\mathrm{SS}})<0\); and when \(d>\mu z_{\mathrm{SS}}\), \(f^{\prime }(z_{\mathrm{SS}})<-1\). In addition, note that if \(\xi \ge 0.5\), \(\mu \ge 1+0.5(1-a)>1\), since \(a<1\). We can now establish the following theorem for period doubling.Footnote 14

Theorem 1

The point \(d^{*}=\mu z_{\mathrm{SS}}^{*}\) is a bifurcation point for period doubling. Passing of d through the bifurcation threshold corresponds with emergence of cycles of period 2, 4, 8, etc.

Proof

It is relatively straightforward to check the conditions required for period-doubling bifurcations given in Elaydi (2007) and summarized in Theorem 9 in Appendix A.1. For fixed values of \(a,c,\xi \), the parameterized map is:

Observe that the parameterized map \(f_{d}(z_{\mathrm{SS}})=z_{\mathrm{SS}}\) for \(d>0\), i.e., \( f_{d}\) has a unique positive fixed point \(z_{\mathrm{SS}}\) for all positive values of d. At the bifurcation point \(d^{*}=\mu z_{\mathrm{SS}}^{*}\), \(\frac{ \partial f_{d}}{\partial z_{\mathrm{SS}}}(z_{\mathrm{SS}})=-1\). Finally, \(\frac{\partial ^{2}f^{2}}{\partial d\partial z_{\mathrm{SS}}}(d^{*},z_{\mathrm{SS}}^{*})\) cannot be zero, where \(f_{d}^{2}\) is the composition of the map f with itself, i.e., \(f_{d}^{2}(d,z_{\mathrm{SS}})=f_{d}(f_{d}(d,z_{\mathrm{SS}}))\). We have:

and:

for \(z_{\max }<z_{\mathrm{SS}}<z_{0}\), which is our domain of analysis. \(\square \)

We illustrate the emergence of period-doubling cycles at this bifurcation point by means of a simple numerical example. We fix the match elasticity at our benchmark value \(\xi =0.5\) and choose the composite parameters \(a=0.891\) and \(c=0.4\) for expositional convenience.Footnote 15 Given a range of parameter values for \(d>0\) we generate 500 iterates of the map f and plot the last 200 against d. Figure 1 shows the period doubling numerically. For low values of d, the iterates converge to a single steady state. Around \(d=2.5\), we see the emergence of a 2-cycle. Four cycles appear as d passes through 3.7. Past 4, one can also discern the emergence of an 8-cycle, while a little past \( d=5 \), there is a stable 3-cycle. For larger values of d, the shaded region of the diagram shows aperiodic oscillations and is the chaotic region at this bifurcation. Right at the threshold between stability and instability small changes in parameters that preserve the bifurcation can lead to dramatically different behavior of the endogenous variables. Instead of gradual adjustment toward the unique steady state, labor market tightness \(\theta \) can oscillate between two values without ever converging. At the threshold for a 2-cycle this requires a benefit parameter b of around 0.4 at a vacation creation cost of \(\kappa =0.1\), both values of which are not implausible. We provide more numerical examples in the next section. In the next step, we establish existence of periodic and chaotic solutions more generally.

Theorem 2

For certain parametrization, the map f is chaotic, i.e., the equation in (17) has chaotic as well as coexisting periodic equilibria of multiple periods.

Proof

The proof of the theorem relies on the results from the literature on discrete dynamical systems, which are presented in Appendix A.1. Since the proof relies on an application of these theorems we only give an outline of the arguments here and refer to Appendix A.1 and A.4 for further details. For example, for a map f to generate chaotic solutions, it is sufficient for it to have a periodic point that is not a power of 2 (see Theorem 7). In particular, existence of a 3-cycle implies chaos in the sense of Li and Yorke, Block and Coppel and Devaney (Theorems 6, 7 and 8, respectively). Sufficient conditions for existence of periodic points of odd period p for a map f, as shown in Lemma 5 are:

where x is a point in the domain of f, and \(f^{p}\) is the composition of f with itself p times. Furthermore, by Sharkovski’s and Li and Yorke’s Theorems (5 and 6), if a map has a periodic point of period 3, then it also has periodic points of all possible periods (and in the case of a 5-cycle, of all possible periods except for period 3).

We now outline several cases where periodic points of odd periods (3 and 5-cycles) are found for the map f in (18). This is largely determined by the shape of f, in the sense that for chaotic behavior to occur, its peak has to be sufficiently high, but not too high so that the solutions stay bounded, positive and economically meaningful. This is accomplished by setting \(f(z_{\max })=z_{0}\) (Theorem 12), where \( z_{0}>z_{\max }\) is the preimage of 0 under f, i.e., \(f(z_{0})=0\). Graphically, this is shown in Fig. 2. We then have the following:

- (i)

If \(d<z_{\max }\) and \(f(z_{\mathrm{max}})=z_{0}\), then the map f has a periodic point of period 3, as:

$$\begin{aligned} z_{\max }<f(z_{\mathrm{max}})=z_{0}, \end{aligned}$$(31)and

$$\begin{aligned} f^{3}(z_{\max })=f(f(f(z_{\max })))=f(f(z_{0}))=f(0)=d<z_{\max }. \end{aligned}$$(32)Hence,

$$\begin{aligned} d=f^{3}(z_{\max })<z_{\max }<f(z_{\mathrm{max}})=z_{0}. \end{aligned}$$(33) - (ii)

For the case when \(d>z_{\max }\), if we let \(z_{+}\) be the right preimage of \(z_{\max }\), i.e., \(z_{+}>z_{\max }\) is such that \(f(z_{+})=z_{\max }\), then if \(f(d)\ge z_{+}\), the function f has a period point of period 5, as under f, \(z_{+}\) is iterated as follows:

$$\begin{aligned} z_{+}\rightarrow z_{\max }\rightarrow f(z_{\max })=z_{0}\rightarrow f(z_{0})=0\rightarrow d\rightarrow f(d), \end{aligned}$$(34)and hence:

$$\begin{aligned} z_{\max }=f(z_{+})<z_{+}\le d=f^{5}(z_{+}). \end{aligned}$$(35) - (iii)

Finally, setting \(f(d)=z_{0}\) pins down the cycle:

$$\begin{aligned} \{\ldots 0,d,z_{0},0,d,z_{0}\ldots \}, \end{aligned}$$(36)since \(f(d)=z_{0},f(z_{0})=0,f(0)=d\).

\(\square \)

While Theorem 1 showed the existence of a bifurcation point that leads to period doubling in the map that captures the key relationship in the search and matching model, Theorem 2 proves the existence of chaos in this map and gives conditions on the map’s parameters for it to arise.Footnote 16 We relegate a discussion of these boundaries to the next section since analytical results can only be partially obtained under a specific parameterization so that we have to rely on numerical results. In addition, this also allows us to interpret the conditions in the proof of Theorem 2 in terms of the structural model parameters. What remains to be done as a final step is to relate the equilibria in backward time to those of their forward representation. This is accomplished in the following Theorem.

Theorem 3

Under certain parameterization, the equations in (17) and (14) have periodic as well as chaotic equilibria going both forward and backward in time.

Proof

Translating cycles from backward to forward time (and vice-versa) is straightforward. Kennedy and Stockman in Kennedy and Stockman (2008) show that equilibria in forward dynamics are chaotic if and only if they are chaotic in backward time (as stated in Theorem 10 in Appendix). Hence this result is a corollary to Theorems 2 and 10. \(\square \)

4 Quantitative analysis

After establishing general results in the previous section, we now provide further analysis for a restricted version of the model together with some numerical examples. We first discuss calibration of the model which informs how empirically relevant our general results are. We then provide analytical results for a benchmark parameterization of the model that delineates the parameter regions where chaos can occur. In the next step, we discuss more general numerical results and explicitly link the bifurcation to the structural parameters of the economic model. Finally, we contrast and compare our analysis of the global dynamics to results for local determinacy that have been derived for linearized versions of the search and matching model.

4.1 Calibration

This section describes our choice for parameter values and ranges that we use in the numerical analysis of the global and local properties (see Table 2). We assume, as in Shimer (2005), that households are risk-neutral, that is, \(\sigma =0\). This simplifies derivation of analytical results considerably; in fact, it makes it possible to obtain analytical results for global dynamics (see also Bhattacharya and Bunzel 2003a). We set the discount factor \(\beta =0.99\) and normalize the productivity level \(A=1\) without loss of generality. The separation rate \(\rho \in \left( 0,1\right) \). A typical value for quarterly data is \(\rho =0.1\), which is consistent with the evidence reported in Shimer (2005). The bargaining parameter \(\eta \in \left( 0,1\right) \). Most of the literature assumes \(\eta =0.5\), as independent observations on its value are not obvious to obtain. An alternative calibration is to impose the Hosios condition \(\xi =\eta \). However, we largely treat \(\eta \) as a free parameter. The match elasticity \( \xi \in \left( 0,1\right) \). In a well-known study, Petrongolo and Pissarides (2001) argue for values between 0.5 and 0.7. The plausibility of this range is supported by the evidence in Lubik (2013). However, we regard values outside this range as plausible enough. The level parameter in the matching function \(m>0\) can be used to scale the unemployment rate, for instance, but it is otherwise generally left unrestricted in the literature. However, we restrict this parameter to obey \(m\in \left( 0,1\right) \) based on the reasoning in Lemma 2. As for the remaining parameters, benefits \(b\in \left( 0,A\right) \) since they cannot exceed the marginal product of the firm, in which case it could not offer any wage that would induce an unemployed person to work. Given our normalization \(A=1\), this restricts b to the unit interval. Typical values in the literature range from \(b=0.4\) to \(b=0.9\) (as in Shimer 2005; Hagedorn and Manovskii 2008 respectively). Vacancy posting cost \(\kappa >0\). It is a scale variable that can be measured in terms of resource loss as a percentage of GDP. Typical values are in the low percentage points when measured relative to output.

We also consider calibrating the steady-state unemployment rate \(u_{\mathrm{SS}}\) directly. This has the advantage that we can bring direct observations to bear on the model, such as the unemployment rate. In order to obtain a specific target value, a parameter that may not be easy to pin down otherwise thus needs to be adjusted endogenously. Another advantage of this approach is that a judicious choice of setting steady-state values can allow for analytical solutions. For instance, the stability condition (24) is expressed for an endogenous variable. Using the law of motion for employment (3), we can compute \(\theta _{\mathrm{SS}}=\left( \frac{1}{m} \frac{\rho }{1-\rho }\frac{1-u_{\mathrm{SS}}}{u_{\mathrm{SS}}}\right) ^{1/(1-\xi )}\) without having to solve the nonlinear Eq. (11). Similarly, we can fix the job-finding rate \(p_{\mathrm{SS}}=p(\theta _{\mathrm{SS}})\), which implies \(\theta _{\mathrm{SS}}=\left( p_{\mathrm{SS}}/m\right) ^{1/(1-\xi )}\). The JCC then delivers the following restriction on the imputed parameter: \(\frac{A-b}{\kappa }=\frac{ \eta }{1-\eta }\theta _{\mathrm{SS}}+\frac{1}{1-\eta }\frac{1-\beta (1-\rho )}{\beta (1-\rho )}\frac{\theta _{\mathrm{SS}}^{\xi }}{m}\), from which we can obtain either b, \(\kappa \), or even \(\eta \). We note that in this expression b and \( \kappa \) are not separately identifiable. However, the term \(\frac{A-b}{ \kappa }\) scales various expressions, which we can then treat as a bifurcation parameter as discussed before. In terms of numerical values assigned to the steady-state values, \(u_{\mathrm{SS}}\) can be chosen to correspond to observed sample means, which typically is around 5%. An alternative approach is to target the observed employment rates, which would imply an unemployment rate that is much higher, for instance, 25%. Both approaches have been used in the literature, with different implications for the dynamic behavior of the calibrated model.Footnote 17

4.2 A simple illustration for a benchmark parameterization

We derive analytic conditions for the existence of periodic and chaotic equilibria in the special case when the match elasticity \(\xi =0.5\). We regard this specification as empirical plausible, as discussed above. Moreover, it is often implicit in the imposition of the Hosios condition with equal bargaining power. This is also the case studied by Bhattacharya and Bunzel (2003a) and Bhattacharya and Bunzel (2003b). In this special case, the map f becomes the quadratic:

which allows us to explicitly solve for \(z_{\mathrm{SS}},z_{0},\) and \(z_{+}\). We find that \(z_{\mathrm{SS}}=\frac{1}{2c}\left( (1-a)+\sqrt{(1-a)^{2}+4cd}\right) \), \(z_{0}= \frac{1}{2c}\left( a+\sqrt{a^{2}+4cd}\right) \) and \(z_{+}=\frac{1}{2c}\left( a+\sqrt{a^{2}+4cd-2a}\right) \). The critical value for a period doubling bifurcation \(d^{*}=\mu z_{\mathrm{SS}}^{*}\) then corresponds to:

where the coefficients a and c are defined above. This equation is in implicit form and defines a surface in a three-dimensional coefficient space for a, c, and d. For any fixed values of one of these parameters, we can plot implicit curves in two dimensions to show parameter ranges that satisfy this condition.

We depict the relationship between the three composite parameters given \(\xi =0.5\) in Fig. 3. We plot c on the horizontal axis against \(d>0\) on the vertical axis and vary \(a\in \left( 0,1\right) \) to satisfy the threshold condition above. This traces out a downward-sloping narrow band of combinations of the composite parameters that imply period doubling. Over the admissible region \(0<c<1\), there is a wide range of parameter combinations where periodic and chaotic behavior can occur.Footnote 18 This is associated with high values of match efficiency m and the scale coefficient \(\left( A-b\right) /\kappa \) which translates into low unemployment benefits and vacancy posting costs. We will dig deeper into the parameter regions that can imply periodic behavior in the next section.Footnote 19 We can also solve for period-3 points of the map f more generally. Specifically, we solve for the fixed points of the composite map \(f^{3}\) that are different from \( z_{\mathrm{SS}} \). The parameter values where such points are found are given in Fig. 4 for the same ranges as before. The results are qualitatively close to those in the previous figure. We thus conclude that periodic and chaotic behavior is a feature of the standard search and matching model over a reasonably wide range of economically plausible parameter values.

4.3 Chaos regions for structural parameters

We now provide further insight on the conditions in the proof of Theorem 2 and describe them in terms of the model parameters. We proceed in two steps. First, we delineate parameter ranges that imply chaos for the composite coefficients of the map (18), while in the second step we capture the range of equilibria by expressing them in terms of the structural parameters of the underlying model. The main challenge is that we cannot solve for the relevant expressions analytically. Moreover, the model is richly parameterized with a fairly large number of structural parameters. It is therefore convenient to look at the composite coefficients first.

The key values are the z-intercept \(z_{0}\) and the maximum \(z_{\mathrm{max}}\) of the map and the condition \(f(z_{\mathrm{max}})=z_{0}\), which we need to solve to derive restrictions for the existence of chaotic equilibria. In most cases, we cannot solve for \(z_{0}\) analytically. Instead, we use the insight that for \(f(z_{\mathrm{max}})=z_{0}\), it is necessary that the second iterate of \(z_{\max } \) maps to zero, i.e., \(f^{2}(z_{\mathrm{max}})=0\). Since \(f(z_{\max })=a\left( \frac{a\xi }{c}\right) ^{\frac{\xi }{1-\xi }}-c\left( \frac{a\xi }{c}\right) ^{\frac{1}{1-\xi }}+d\), the condition \(f^{2}(z_{\max })=0\) implies:

As in the previous section, this equation is in implicit form and defines a surface in a four-dimensional coefficient space for a, d, c, and \(\xi \). For any fixed values of two of these parameters, we can plot implicit curves in two dimensions to show parameter ranges that satisfy this condition. Figure 5 shows the plot of a family of such curves that also satisfy \(d<z_{\mathrm{max}}\) for ranges of parameters when a is set at 0.891 and \(0<c<1\). In this case, corresponding to (i) in the proof of Theorem 2, cycles emerge only at unreasonably low values of the match elasticity.

The case (ii) where \(d>z_{\mathrm{max}}\) and \(f(d)\ge z_{+}\) implies that \(f^{2}(d)\le z_{\max }\), since we cannot always solve for \(z_{+}\) analytically. This corresponds with the inequality:

The family of curves that satisfy (39) and the above inequality are presented graphically in Fig. 6 for ranges of parameters \( a=0.891\) and \(0<c<1\). Period-5 cycles occur for a range of the match elasticity from around 0.28 to upwards of 0.7 which covers an empirically plausible range. This is consistent with a wide range of values for the scale parameter d and thus implicitly \(\left( A-b\right) /\kappa \). Finally, the condition \(f(d)=z_{0}\) exactly pins down the three cycle \( \{\ldots ,0,d,z_{0},0,d,z_{0},\ldots \}\), as \(0\rightarrow d\rightarrow f(d)=z_{0}\rightarrow 0\). This condition can be rewritten as \(f^{2}(d)=0\), or:

as shown in Fig. 7. In this case, cycles occur only for low values of \(\xi \) and d, with the latter being consistent with very high unemployment benefits and vacancy posting costs.

In summary, Figs. 5, 6 and 7 give an idea for which parameterizations periodic and chaotic dynamics can arise in the nonlinear model. Previously, Mendes and Mendes (2008) have established chaos under the restriction \(\xi =0.2\). This is consistent with our finding that conditions in (39) and \(d<z_{\mathrm{max}}\), as well as (41), imply low values of the match elasticity \(\xi \), e.g., as in Fig. 7. We generalize their findings to the full parameter space. Moreover, empirical estimates of the match elasticity \(\xi \) in the literature are considerably higher.Footnote 20 In contrast to this earlier work, we find that the conditions in (39) and (40) yield values of \(\xi \) that are consistent with the empirical estimates. We can now summarize these results and reformulate Theorem 2 more concretely in the following Lemma. The conditions are also collected in Table 1.

Lemma 4

For certain parametrization, the map f is chaotic, i.e., the equation in (17) has chaotic as well as coexisting periodic equilibria of multiple periods. In particular,

- (i)

If (39) holds and \(z_{\max }>d\), then the equation in (17) has periodic equilibria of every period \(p\ge 3\), as well as aperiodic and chaotic solutions.

- (ii)

If (39) and (40) hold and \(z_{\max }<d\), then the equation in (17) has periodic equilibria of every period \(p\ge 5\), as well as aperiodic and chaotic solutions.

- (iii)

In a final step, we link these chaos regions identified for the composite parameters of the map to the structural parameters of the search and matching model. This is not straightforward since the model is richly parameterized in the sense that the equilibrium and the dynamic behavior of one endogenous variable, namely labor market tightness \(\theta \), is determined by eight parameters in the JCC. In order to identify the relevant regions where chaos can occur, we therefore have to condition judiciously on specific parameters values. Recall that the location of \(z_{\max }=\left( \frac{1}{m}\frac{\xi }{\eta }\right) ^{\frac{\xi }{1-\xi }}\) is determined by three parameters only. Furthermore, we keep the separation rate \(\rho \) and the discount factor \(\beta \) fixed for the purposes of this analysis since they pin down the coefficient a and are a component in c and d. We then analyze the equilibria in terms of the remaining model parameters that affect the type of equilibria and the shape of the map. This leaves the scale coefficient \(\frac{A-b}{\kappa }\) as the key component, whereby we normalize \(A=1\) without loss of generality. We note that \(\frac{A-b}{\kappa } \) shifts the map \(f\left( z\right) \) vertically, thereby changing the location of the steady state \(z_{\mathrm{SS}}\) and the intercept \(z_{0}\) with the zero line. The shape of the map, however, is unaffected.

As before, we describe the analytical properties of the map in terms of the steady-state values of endogenous variables. Specifically, we consider the steady-state unemployment rate \(u_{\mathrm{SS}}\) as a calibration target. Since \( \theta _{\mathrm{SS}}=z_{\mathrm{SS}}^{1/\xi }\), we can back out the implied labor market tightness \(\theta _{\mathrm{SS}}=\left( \frac{1}{m}\frac{\rho }{1-\rho }\frac{1-u_{\mathrm{SS}} }{u_{\mathrm{SS}}}\right) ^{1/(1-\xi )}\) from the law of motion for employment when we treat \(u_{\mathrm{SS}}\) parametrically. Given the JCC, this strategy restricts the parameterization of either b or \(\kappa \) based on the relationship \(\frac{ A-b}{\kappa }=\frac{\eta }{1-\eta }\theta _{\mathrm{SS}}+\frac{1}{1-\eta }\frac{ 1-\beta (1-\rho )}{\beta (1-\rho )}\frac{\theta _{\mathrm{SS}}^{\xi }}{m}\). It thus leaves one remaining parameter for which we can do bifurcation analysis. Intuitively, this approach targets a specific unemployment rate by setting, for instance, benefits b at a specific level. Changing of b (or \(\kappa \) ) necessarily changes the steady state \(u_{\mathrm{SS}}\). Instead of discussing the effects of changes in this parameter on the implied \(u_{\mathrm{SS}}\), this reparameterization allows us a more direct and economically intuitive consideration.

We focus on the case where the first derivative of the map f is negative since it admits a bifurcation. We have that for \(z_{\max }<z_{\mathrm{SS}}<z_{0}\), \( f^{\prime }\left( z_{\mathrm{SS}}\right) <0\), which establishes the bifurcation point at \(f^{\prime }\left( z_{\mathrm{SS}}\right) =-1\):

which is the counterpart to condition (24) written in terms of \( u_{\mathrm{SS}}\).Footnote 21 If the parameterization is such that this condition holds, that is, if the endogenous unemployment rate is equal to the threshold \(\left[ 1+\frac{\beta ^{-1}+\left( 1-\rho \right) }{\rho }\frac{\xi }{\eta }\right] ^{-1}\), then the equilibrium undergoes a bifurcation. We can now depict this scenario in terms of the structural parameters of the model. This is shown in Fig. 8. These graphs are created for ranges of composite parameter values where chaos is observed. For a given point in the shaded region (for instance m and u), there exist parameter values a, c, d, and \(\xi =0.5\), which result in chaotic behavior in the model.Footnote 22 We observe that chaos is prevalent in the nonlinear model for economically plausible parameter values. Generally, we observe chaos for values of the match efficiency parameter m above 0.5, which is consistent with empirical estimates of this parameter. At the same time, chaotic behavior requires a high bargaining parameter \(\eta \), a comparatively low job-matching rate q, and is consistent with a moderately high steady-state unemployment rate u. On the other hand, combinations of the separation rate \(\rho \) and m that imply chaos are in the plausible range for the former but not the latter.

4.4 Local indeterminacy

Finally, we contrast our results on global dynamics to those derived from a local analysis. Much of the macroeconomic labor market literature relies on local approximation of fundamentally nonlinear models in a neighborhood of the steady state. The thus approximated model is solved using standard techniques such as the “root-counting” approach developed by Blanchard and Kahn (1980). Equilibria are classified as unique or determinate, indeterminate, or non-existent depending on whether the number of explosive eigenvalues of the linear equation system derived from the local approximation is, respectively, equal to, less than, or larger than, the number of state or backward-looking variables in the model. There is a rough correspondence between the concept of global stability and local non-uniqueness, and global instability and local nonexistence, but local analysis cannot consider by construction periodic and chaotic dynamics. It is therefore instructive to compare the local determinacy results to global dynamics.

The local dynamics of the simple search and matching model have been studied by Krause and Lubik (2010), whom we follow in the description below. As discussed above, we consider the case \(\sigma =0\) so that we can obtain an analytical characterization. The job-creation condition then becomes:

We linearize this equation around the unique steady state, which results in:

where \({\widehat{\theta }}_{t}=\theta _{t}-\theta _{\mathrm{SS}}\) is the deviation from the steady state \(\theta _{\mathrm{SS}}\).Footnote 23 This is an autonomous first-order linear difference equation in \(\theta \), the dynamic properties of which depend on the coefficient \(\beta (1-\rho ) \left[ 1-\frac{\eta }{\xi }m\theta _{\mathrm{SS}}^{1-\xi }\right] \). Since this is a forward-looking equation, a unique and determinate equilibrium requires that the eigenvalue lies within the unit circle (see Blanchard and Kahn 1980). More formally, we establish the following Theorem.

Theorem 4

The equilibrium dynamics of the job-creation condition are locally unique if:

The equilibrium dynamics are locally indeterminate if:

Proof

The equilibrium is locally unique if \(\left| \beta (1-\rho )\left( 1- \frac{\eta }{\xi }m\theta _{\mathrm{SS}}^{1-\xi }\right) \right| <1\). Consider the boundaries in turn. Denote \(p(\theta _{\mathrm{SS}})=m\theta _{\mathrm{SS}}^{1-\xi }\). \( \beta (1-\rho )\left( 1-\frac{\eta }{\xi }p(\theta _{\mathrm{SS}})\right) <1\) implies \(p(\theta _{\mathrm{SS}})>0>-\frac{\xi }{\eta }\frac{1-\beta (1-\rho )}{\beta (1-\rho )}\), which is always true. Second, \(-1<\beta (1-\rho )\left( 1-\frac{\eta }{ \xi }p(\theta _{\mathrm{SS}})\right) \) implies \(p(\theta _{\mathrm{SS}})<\frac{\xi }{\eta } \frac{1+\beta (1-\rho )}{\beta (1-\rho )}\). Since \(0<p(\theta _{\mathrm{SS}})\), this proves the first part of the theorem. The equilibrium is indeterminate if \( \left| \beta (1-\rho )\left( 1-\frac{\eta }{\xi }m\theta _{\mathrm{SS}}^{1-\xi }\right) \right| >1.\)\(\square \)

The theorem establishes that for a wide range of parameter values the dynamic equilibrium is locally unique. Under the Hosios condition \(\xi =\eta \), the threshold is always above one, so that under the requirement that we only admit job-matching rates \(0<p(\theta _{\mathrm{SS}})<1\), the equilibrium is always determinate. In the context of this deterministic model the unique equilibrium is \({\widehat{\theta }}_{t}=0\), which can be found by iterating the linearized JCC forward since it is stable in its forward dynamics. This puts labor market tightness at its steady-state value as the only possible equilibrium. The steady state \(\theta _{\mathrm{SS}}\) is locally unstable in this case. As time goes forward, the path for tightness will become unbounded unless the economy is placed on the initial condition \(\theta _{0}=\theta _{\mathrm{SS}}\). Starting values in a small neighborhood of the steady state will thus lead to explosive paths. In the terminology of linear difference equations, the equilibrium is saddle-path stable.Footnote 24 The equilibrium is locally indeterminate if the job-finding rate is high enough. In this case, the JCC is a stable difference equation, one solution of which is:

The steady state is therefore an attractor under this parameterization. All paths with starting values in a small neighborhood around \(\theta _{\mathrm{SS}}\) converge to it. Different adjustment paths are indexed by their starting values \(\theta _{0}^{i}\), which correspond to the various dynamic equilibria.Footnote 25

The theorem is stated in terms of boundary conditions for the job finding rate \(p(\theta _{\mathrm{SS}})\), which parallels the results from the global stability analysis in Sect. 3.2. In fact, the threshold between determinacy and indeterminacy coincides with the stability threshold in (24). High enough job-finding rates result in indeterminacy. They are high when the labor market is tight, that is, when there is a relatively large number of vacancies compared to the pool of unemployed. In this case, equilibria can be self-fulfilling because firms post additional vacancies even without supporting underlying fundamentals, such as high productivity, because the high job-finding rate stimulates job search by the unemployed and thereby validates the original vacancy posting. If the parameterization is such that the economy falls into the indeterminacy region, then any initial condition is consistent with stable adjustment dynamics to the steady state.

We can now draw a more precise distinction between the implications of local and global analysis. Local indeterminacy in forward time as established in Theorem 4 coincides with instability in backward time as shown in Eq. (24). Intuitively, in the linearized model this just implies inversion of the eigenvalues of the difference equation in question. We also show in Sect. 3.3 that loss of stability of the steady state in backward time gives rise to cyclical and chaotic behavior both in backward and forward time as shown by Kennedy and Stockman (2008). This gives one example that analysis focused on local dynamics only may omit potentially interesting and economically relevant behavior away from the steady state.

Figure 9 depicts indeterminacy regions for various structural parameter combinations.Footnote 26 The panels show that for wide ranges of the parameter space, the steady-state equilibrium is locally unique. Indeterminacy generally arises when the match elasticity \( \xi \) is small. A special case is when \(\xi =\eta \). In this case, \(p(\theta _{\mathrm{SS}})<1<\frac{1+\beta (1-\rho )}{\beta (1-\rho )}\), and local indeterminacy can never arise, which is the main finding by Bhattacharya and Bunzel (2003a) and Bhattacharya and Bunzel (2003b). In the lower right-hand panel, the Hosios condition can be represented by the 45-degree line where \(\eta =\)\(\xi \). The indeterminacy region lies in the upper left-hand corner where the bargaining parameter \( \eta \) is high and \(\xi \) small, which is consistent with the theorem above. However, the Hosios condition is empirically violated as the literature has amply demonstrated, and we do not regard this as a likely parameterization. The threshold is tightened as the term \(\frac{\xi }{\eta }\) becomes smaller. Low values of the match elasticity and high values for the bargaining share are therefore more likely to imply indeterminacy. For instance, for \(\beta =0.99\), \(\rho =0.1\), \(\xi =0.4\), and \(\eta =0.9\), the threshold coefficient is 0.94. The work in Haan et al. (2000) reports an estimate for \(p(\theta )\) of 0.45. Although this is far away from the threshold, we would nevertheless regard the possibility of local indeterminacy as more than a curiosity.

Finally, it is instructive to contrast these findings to the results on global dynamics as described in the previous section and depicted in Fig. 8. While we cannot talk about chaotic and periodic behavior locally, one conclusion we can draw from analysis of the local dynamics is that for a wide region of the parameter space the search and matching model exhibits locally unique dynamics. It is only in extreme regions of the parameter space that we observe explosive or excessively stable behavior, or in the language of local analysis nonexistence or indeterminacy, respectively. In contrast, the possibility of periodic and chaotic dynamics is more prevalent in the sense that we can obtain such equilibria for an economically plausible and reasonably large region of the parameter space. More specifically, at \(\xi =0.5\) local analysis would show a determinate equilibrium, while the corresponding regions seen in Fig. 8 reveal chaotic dynamics for high m and unemployment and job-finding rates between 0.1 and 0.2. Figure 9 shows that indeterminacy arises for small values of the match elasticity \(\xi \). This compares with the emergence of chaotic behavior for small \(\xi \) in Figs. 5 and 7.

5 Conclusion

This paper demonstrates that periodic and chaotic dynamics are an economically plausible feature of the simple search and matching model of the labor market. This contrasts with findings from the literature on local dynamics that the model exhibits locally unique and stable equilibria over the wide range of the parameter space. Compared to previous literature on global dynamics in this class of models, we are able to characterize analytically a larger set of regions implying chaotic dynamics. Specifically, we show existence of chaos for parameterizations that are economically plausible and that have been used in the literature before. We specifically accomplish this by utilizing some recent results from the literature on chaotic equilibria.

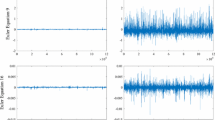

Our paper is purely theoretical in nature, although we highlight the economic plausibility of the results in light of conventional calibration. This paper does not dig deeper into the question whether the theoretically plausible periodic behavior can in fact be observed in the data; that is, whether the fully nonlinear model with parameters that fall into the chaotic region is an actual data-generating process in a statistical sense. Specifically, it seems important to study whether actual labor market time series, such as the unemployment rate and vacancies, exhibit behavior of the type that are consistent with such equilibria. As an example, Fig. 10 depicts time paths of labor market tightness with periodic and chaotic behavior generated under different values of the match elasticity \(\xi \). At first pass, such actual observations seem unlikely since we do not typically observe oscillating behavior in the data, or at least not at the frequency depicted here. A formal empirical investigation of the global behavior uncovered in this paper is thus a fruitful direction for future research. A second issue is the degree to which local theoretical models or linear empirical methods fail in describing such global dynamics. Most empirical studies use empirical methods relying on linearity, which cannot uncover global effects. Research in this area is still sparse. However, the analytic results in this paper can serve as a background against which to conduct such an analysis.

Notes

There is also earlier work by Bhattacharya and Bunzel (2003a) and Bhattacharya and Bunzel (2003b), who study global dynamics in a search and matching framework but impose parametric restrictions and only consider the social-planner solution of the model. They establish the potential for n-period cycles in the model, but the modeling restrictions have been criticized by Shimer (2004). Our paper can be seen as contribution that unifies and clarifies these previous results.

Another paper that studies global dynamics in a search and matching setting in labor and capital markets is Ernst and Semmler (2010). Their model has multiple steady states, one of which is a local attractor while another is saddle-path stable. Their analysis is fully numerical based on value-function iteration, whereas we solve the nonlinear equilibrium conditions that emerge from the first-order conditions.

For expositional convenience, we present the problem of a representative firm only. We abstract from indexing the individual variables.

Labor productivity \(A_{t}\) is generally assumed to be the main driver of business cycle fluctuations in the search and matching model (see Shimer 2005). We assume that \(A_{t}=A\) is constant throughout the exposition since we are abstracting from stochastic fluctuations.

Note that newly matched workers who are separated from their job within the period reenter the matching pool immediately.

We thus assume income pooling between employed and unemployed households and abstract from potential incentive problems concerning labor market search. This allows us to treat the labor market separate from the consumption choice. See Merz (1995) and Andolfatto (1996) for a discussion of these issues.

This is a standard assumption in the literature. Shimer (2005) provides further discussion.

They show that the interaction of the Fisher equation, that is, the relationship between nominal and real interest rates and expected inflation, with an ad hoc policy rule results in the existence of two steady states, one stable and one that is unstable globally. The key finding is that the globally unstable steady state is locally saddle-path stable and is actually the one that is imposed in linearized analyses. Benhabib et al. (2001) therefore argue that policy recommendations based on local analysis can be perilous in the global context (see Wolman and Couper 2003, for further discussion, and also Aruoba et al. 2018, for developing the empirical implications).

Under risk aversion, the dynamics depend on the time path of output \(y_{t}\). Output is a function of employment \(n_{t}\), which evolves based on the law of motion (3). Since this feeds back onto the JCC via the definition of \(\theta _{t}=v_{t}/u_{t}\), it results in an interconnected two-equation system that cannot be solved analytically.

The relationship between the backward and forward dynamics of nonlinear systems is an active area of research (see, for example, Kennedy and Stockman 2008 and references thereof). This distinction is immaterial for the study of linear systems since they are always invertible in this sense. That is, the properties of the forward dynamics are the ‘inverse’ of the properties of the backward map. If, on the other hand, one of the dynamic maps is a correspondence, this equivalence fails.

It is straightforward to show that \(z_{0}\) is unique over \([0,\infty )\). Since \(f(0)=d>0\) and f is increasing on \([0,z_{\mathrm{max}})\), then \(f(z_{\mathrm{max}})>0\). Given that f is decreasing on \([z_{\mathrm{max}},\infty )\), the intersection point \(z_{0}\) such that \(f(z_{0})=0\) is unique. Note that the point \(z_{0}\) corresponds to the point q in the general notation used in Appendix A.3.

In a linear model, an unstable equilibrium implies that \(\theta _{t}\) and \( v_{t}\) do grow without bound. While this is a possibility mathematically, it cannot be a rational expectations equilibrium since the resources \(\kappa \) needed to support increased vacancy postings would eventually exhaust finite production since the total size of the labor force is limited to one, see Eq. (2).

We discuss this aspect in more detail in Sect. 4, as it bears more relevance for the quantitative implications of the model.

The condition in (26) is expressed in implicit form since \(z_{\mathrm{SS}}\) depends on d, as well as a, c, and \(\xi \). We show explicit analytical results in terms of the structural model parameters for the benchmark case \( \xi =0.5\) in the next section.

This parameterization is only one example of emergence of periodic doubling and chaos. These values are, however, economically plausible, as \(a=0.891\) is obtained by setting the discount rate \(\beta =0.99\) and the job separation rate \(\rho =0.1\). Under the Hosios condition \(\eta =\xi =0.5\), the value of \(c=0.4\) implies that m is around 0.9. For values of d between 5 and 5.5, the implied steady-state unemployment rate \(u_{\mathrm{SS}}\) ranges between 0.167 and 0.174, which is well within economically plausible bounds.

The idea is to capture both measured unemployment in terms of recipients of unemployment benefits and potential job searchers that are only marginally attached to the labor force but are open to job search. Since we do not model labor force participation decisions, this is a shortcut to capturing effective labor market search. This approach has been taken by Cooley and Quadrini (1999) and Trigari (2009).

In the figure, we extend the range of \(c=\beta \left( 1-\rho \right) m\eta \) beyond what is economically permissible since the map (37) is in principle not restricted in such manner.

We also want to highlight one additional case under this benchmark parameterization. An alternative way to establish chaotic behavior is to use the logistic map \(r(\mu )=\mu r(1-r)\), which in the literature is a canonical example for demonstrating chaos in one-dimensional maps, as, for example, in Elaydi (2007). For the quadratic case \(\xi =0.5\), it is straightforward to pin down the values of parameters a, c, d that establish qualitative, or topological, equivalence of the dynamic behavior of the iterates of the map f to those of the logistic map.

In their benchmark study, Petrongolo and Pissarides (2001) find a value \(\xi \) of 0.7, while Hall and Schulhofer-Wohl (2015) report estimates that range between 0.28 and 0.7 from a wide variety of studies, data, and empirical approaches. Nevertheless, \(\xi =0.2\) would be considered below the plausible empirical range.

For completeness, we also have that at \(0>f^{\prime }\left( z_{\mathrm{SS}}\right) >-1 \):

$$\begin{aligned} \frac{1}{1+\frac{\beta ^{-1}+\left( 1-\rho \right) }{\rho }\frac{\xi }{\eta } }<u_{\mathrm{SS}}<\frac{1}{1+\frac{1-\rho }{\rho }\frac{\xi }{\eta }}, \end{aligned}$$(43)and at \(-1>f^{\prime }\left( z_{\mathrm{SS}}\right) \):

$$\begin{aligned} u_{\mathrm{SS}}<\frac{1}{1+\frac{\beta ^{-1}+\left( 1-\rho \right) }{\rho }\frac{\xi }{\eta }}. \end{aligned}$$(44)Except for the case shown in m-\(\rho \) space of Fig. 8, a is fixed at 0.891, which is obtained by setting \(\beta =0.99\) and \( \rho =0.1\). We also impose the Hosios condition that sets \(\xi =\eta \).

Log-linearizing this equation around the steady state would result in the same dynamic properties.

An alternative way of seeing this is by inverting the linearized JCC. This implies the backward-looking representation \({\widehat{\theta }}_{t+1}=\left[ \beta (1-\rho )\left( 1-\frac{\eta }{\xi }m\theta _{\mathrm{SS}}^{1-\xi }\right) \right] ^{-1}{\widehat{\theta }}_{t}\). The root of this representation is the inverse of the root of the forward equation. Forward stability therefore implies backward instability, and vice versa. Given the parametric restrictions established in the theorem, the JCC would have explosive dynamics if expressed backward. Consequently, the only solution to be consistent with local stability is \({\widehat{\theta }}_{t}=0\). One important insight is that in the linear case the roots of the forward and the backward representation of the difference equation in question are the inverse of each other. Local analysis can therefore rely on either representation. This is, in general, not the case for global dynamics.

The figure also shows regions where the equilibrium does not exist. But for the purposes of this paper we rule these out on account of Lemma 2, which restricts the match efficiency to be less than one.

The result is taken from Elaydi (2007).

References

Andolfatto, D.: Business cycles and labor market search. Am. Econ. Rev. 86, 112–132 (1996)

Aruoba, B., Cuba-Borda, P., Schorfheide, F.: Macroeconomic dynamics near the ZLB: a tale of two countries. Rev. Econ. Stud. 85, 87–118 (2018)

Aulbach, B., Kieninger, B.: On three definitions of chaos. Nonlinear Dyn. Syst. Theory 1, 23–37 (2001)

Benhabib, J., Schmitt-Grohé, S., Uribe, M.: The perils of Taylor rules. J. Econ. Theory 96, 40–69 (2001)

Bhattacharya, J., Bunzel, H.: Chaotic planning solutions in the textbook model of labor market search and matching. In: CentER at Tilburg University Discussion Paper No. 2003-15 (2003a)

Bhattacharya, J., Bunzel, H.: Dynamics of the planning solution in the discrete-time textbook model of labor market search and matching. Econ. Bull. 5, 1–10 (2003b)

Blanchard, O.J., Kahn, C.M.: The solution of linear difference models under rational expectations. Econometrica 48, 1305–1312 (1980)

Block, L.S., Coppel, W.A.: Stratification of continuous maps of an interval. Trans. Am. Math. Soc. 297, 587–604 (1986)

Cooley, T.F., Quadrini, V.: A neoclassical model of the Phillips curve relation. J. Monet. Econ. 44, 165–193 (1999)

Coury, T., Wen, Y.: Global indeterminacy in locally determinate real business cycle models. Int. J. Econ. Theory 5, 49–60 (2009)

den Haan, W., Ramey, G., Watson, J.: Job destruction and the propagation of shocks. Am. Econ. Rev. 90, 482–498 (2000)

Elaydi, S.: Discrete Chaos: With Applications in Sciences and Engineering, 2nd edn. Chapman and Hall/CRC, Boca Raton (2007)

Ernst, E., Semmler, W.: Global dynamics in a model with search and matching in labor and capital markets. J. Econ. Dyn. Control 34, 1651–1679 (2010)

Farmer, R.E.A., Khramov, V., Nicolò, G.: Solving and estimating indeterminate DSGE models. J. Econ. Dyn. Control 54, 17–36 (2015)

Growiec, J., McAdam, P., Mućk, J.: Endogenous labor share cycles: theory and evidence. J. Econ. Dyn. Control 87, 74–93 (2018)

Gu, C., Matessini, F., Monnet, C., Wright, R.: Endogenous credit cycles. J. Polit. Econ. 121, 940–965 (2013)

Hagedorn, M., Manovskii, I.: The cyclical behavior of equilibrium unemployment and vacancies revisited. Am. Econ. Rev. 98, 1692–1706 (2008)

Hall, R., Schulhofer-Wohl, S.: Measuring job-finding rates and matching efficiency with heterogeneous jobseekers. In: Federal Reserve Bank of Minneapolis Working Paper 721 (2015)

Hosios, A.J.: On the efficiency of matching and related models of search and unemployment. Rev. Econ. Stud. 57, 279–298 (1990)

Kennedy, J., Stockman, D.: Chaotic equilibria in models with backward dynamics. J. Econ. Dyn. Control 32, 939–955 (2008)

Krause, M.U., Lubik, T.A.: Instability and indeterminacy in a simple search and matching model. Fed. Reserve Bank Richmond Econ. Q. 96, 259–272 (2010)

Li, T.-Y., Yorke, J.: Period 3 implies chaos. Am. Math. Mon. 82, 985–992 (1975)

Lubik, T.A.: The shifting and twisting Beveridge curve: an aggregate perspective. In: Federal Reserve Bank of Richmond Working Paper 13–16 (2013)

Lubik, T.A., Schorfheide, F.: Computing sunspot equilibria in linear rational expectations models. J. Econ. Dyn. Control 28, 273–285 (2003)

Medio, A., Raines, B.: Backward dynamics in economics. J. Econ. Dyn. Control 31, 1633–1671 (2007)

Mendes, D.A., Mendes, V.M.: Stability analysis of an implicitly defined labor market model. Physica A 387, 3921–3930 (2008)

Merz, M.: Search in the labor market and the real business cycle. J. Mon. Econ. 36, 269–300 (1995)

Petrongolo, B., Pissarides, C.: Looking into the black box: a survey of the matching function. J. Econ. Lit. 39, 390–431 (2001)

Shimer, R.: The planning solution in a textbook model of search and matching: discrete and continuous time. Manuscript, University of Chicago (2004)

Shimer, R.: The cyclical behavior of equilibrium unemployment and vacancies. Am. Econ. Rev. 95, 25–49 (2005)

Sniekers, F.: Persistence and volatility of Beveridge cycles. Int. Econ. Rev. (2017) (forthcoming)

Sorger, G.: Cycles and chaos in the one-sector growth model with elastic labor supply. Econ. Theory 65, 55–77 (2016). https://doi.org/10.1007/s00199-016-1005-0

Trigari, A.: Equilibrium unemployment, job flows, and inflation dynamics. J. Money Credit Bank. 41, 1–33 (2009)

Wolman, A., Couper, E.: Potential consequences of linear approximation in economics. Fed. Reserve Bank Richmond Econ. Q. 89(1), 51–67 (2003)

Acknowledgements

The authors wish to thank the editor Nicholas Yannelis and an anonymous referee for useful comments that improved the paper. We are also grateful to Andreas Hornstein, Hassan Sedaghat and Alex Wolman for many discussions. We would like to thank participants at the 25th Annual Symposium of the Society for Nonlinear Dynamics and Econometrics in Paris for constructive comments. The views expressed in this paper are those of the authors and should not be interpreted as those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In this appendix, we list definitions and results necessary for the establishment of periodic and chaotic solutions in the search and matching model, as discussed in the paper.

1.1 Preliminaries

Let \(f:\mathbb {R}\rightarrow \mathbb {R}\) be a map and consider the first-order difference equation given by: