Abstract

Do firms that engage in relative payoff maximizing (RPM) behavior always choose a strategy profile that results in tougher competition compared to firms that engage in absolute payoff maximizing (APM) behavior? We address this question by way of a simple model of symmetric oligopoly where firms simultaneously select a two-dimensional strategy set consisting of a price variable and a non-price (i.e., quality) variable. Our results show that equilibrium solutions of RPM and APM are distinct. It is further shown that the standard result of Nash equilibrium in oligopoly, namely, that the non-price variable is used to soften price competition, survives also when firms are concerned with relative payoff considerations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is a well-known result by Schaffer (1988, 1989) that the concept of a finite population evolutionarily stable strategy (FPESS) can be characterized by relative payoff maximization and that this solution concept is different from Nash equilibrium and absolute payoff maximization. As Schaffer explains, agents in economic and social environments survive in the evolutionary process if they can perform better than their opponents, and so, players adhere to relative payoff maximizing (RPM) rather than absolute payoff maximizing (APM) behavior. The behavior induced by RPM or spiteful behavior (Hamilton 1970) leads to more competition between firms in a Cournot oligopoly game. Vega-Redondo (1997) reveals that a Walrasian equilibrium turns out to be the unique stochastically stable state in a symmetric Cournot oligopoly. Tanaka (1999), Apesteguia et al. (2010) and Leininger and Moghadam (2018) investigate the equivalence of evolutionary equilibrium and Walrasian competitive equilibrium in an asymmetric Cournot oligopoly. While Tanaka (1999) shows that an asymmetric cost structure does not change the long-run outcome of Walrasian equilibrium in a homogeneous oligopoly competition, Apesteguia et al. (2010) prove that the above-mentioned Walrasian result of Vega-Redondo is sensitive to cost asymmetry. They consider a setup where one firm has a small (fixed) cost advantage over other firms in the market. As a result of this cost asymmetry, other quantities apart from Walrasian quantity are chosen in long-run outcomes of the game. In Tanaka’s evolutionary analysis, indeed firms are only allowed to imitate each other from the same cost group. Using an alternative analysis of the asymmetric oligopoly game, Leininger and Moghadam (2018) show that weighted average cost pricing arises in equilibrium when individual firm quantities do not correspond to Walrasian quantities.

In this paper, we consider a symmetric oligopoly game where each firm has a two dimensional strategy set consisting of a price variable and a non-price variable (the quality). Using a non-price strategy by firms in oligopoly competition is common since firms can become exceedingly competitive in price strategy. Therefore, firms may also decide to compete in another dimension of non-price strategy to soften price competition. Hereafter we refer to this non-price strategy as quality. The firm’s cost function structure considered in this model is in line with the industrial organization literature. (See e.g. Shaked and Sutton 1987; Banker et al. 1998; Berry and Waldfogel, 2010 and Brécard 2010.) We assume that quality improvement requires fixed costs, but that it does not change variable costs.Footnote 1 In the present paper, we contribute to the literature that studies the evolutionary game-theoretic approach to oligopoly theory by showing the role of cross-elasticities of demand in determining the evolutionary equilibrium. Specifically, our analysis verifies that market power is determined in the Nash equilibrium by the firm’s own elasticities of demand. Alternatively, in the FPESS equilibrium, market power is determined not only by own elasticities of demand but also cross-elasticities of demand. The same interpretation applies to the quality improvement intensity, i.e., the ratio of quality cost to revenue. A Nash equilibrium analysis demonstrates that if demand is somewhat more sensitive to changes in own quality than to changes in own price, then quality improvement expenditure (or R&D expenditure) is a large percentage of the revenue. By contrast, an evolutionary equilibrium analysis demonstrates that the quality improvement intensity is determined by both the firm’s own elasticities of demand and cross elasticities of demand. Interestingly, for a model with linear demand and quadratic costs, we prove that RPM firms bring into play one of the two dimensions of competition to soften competition in the other dimension. This is a standard result in the Nash equilibrium which survives also in the case of evolutionary equilibrium.

In general, the notion of the FPESS equilibrium and Nash equilibrium are not related. Ania (2008) and Hehenkamp et al. (2010) study this relationship in different classes of games and particularly in the framework of the Bertrand oligopoly with homogeneous product. The papers by Tanaka (2000), Hehenkamp and Wambach (2010), and Khan and Peeters (2015) are related to our paper. Tanaka (2000) studies evolutionary game-theoretic models for a price-setting and for a quantity-setting differentiated oligopoly with a linear demand function. Hehenkamp and Wambach (2010) investigate an evolutionary model of horizontal product differentiation in a duopoly setup and show that minimum differentiation along all product characteristics, i.e., repositioning a product to the center of the product space, establishes the unique evolutionary equilibrium. Khan and Peeters (2015) show that Nash equilibrium outcomes in a Salop-circle model with firms simultaneously choosing price and quantity coincide with outcomes in the stochastically stable state. They obtain this result by allowing for a capacity constraint in their model that justifies the Nash equilibrium (i.e., the price above marginal cost) as the long run outcome of the evolutionary game.

The paper is organized as follows. The next section presents the model and its assumptions. Section 3 analyzes differences between the FPESS equilibrium and the Nash equilibrium in a model of quality improvement with fixed costs and further examines the link between these equilibrium concepts. Section 4 concludes.

2 The model

In this section, we describe our oligopoly setup and further define two different types of equilibrium concepts: the standard Nash equilibrium and the evolutionary equilibrium.

2.1 Nash equilibrium

We assume an industry of i = 1,...,n firms, each offering a quantity xi of a product that may vary in its quality qi and its price pi. It is also assumed that the non-price variable (i.e., quality) is a measurable attribute with values in the interval \([0,\infty )\). The quality level has a lower bound that is known as the zero quality or the minimum technologically feasible quality level.

Following Dixit (1979), demand functions for goods are given by

where p = (p1,p2,...,pn) and q = (q1,q2,...,qn).

Di(p,q) are continuous, twice-differentiable, and concave functions. An increase in any pj and qj raises or lowers each xi depending on whether the product pair (i,j) consists of complements \(\left (\frac {\partial D_{j}}{\partial p_{i}}<0 , \frac {\partial D_{j}}{\partial q_{i}}>0\right )\) or substitutes \(\left (\frac {\partial D_{j}}{\partial p_{i}}>0 , \frac {\partial D_{j}}{\partial q_{i}}<0\right )\). Moreover, we assume that the demand function Di for each firm i is more affected by changes in its own price and quality than by those of its competitors (see Tirole 1988).

Concerning the cost function, we assume that the quality level selected by a firm influences its cost only through fixed costFootnote 2f(.). Therefore, firm i faces a cost function C(xi,qi) = f(qi) + c(xi). The functions f(.) and c(.) are increasing and convex with respect to each of their arguments and, without loss of generality, all fixed costs that are not related to the quality are normalized to zero. Therefore, the firm i’s profit function is

The strategic variables are price and quality. Since the interaction between the price and quality strategies of the firms only occurs through the common demand function, the price vector p = (p1,p2,...,pn) and the quality vector q = (q1,q2,...,qn) are denoted by (pi,p−i) and (qi,q−i), respectively.

Let the number of firms n be fixed. Consider a simultaneous-move game where each firm chooses a pair of quality and price (pi,qi). Assuming that all firms produce a strictly positive quantity in equilibrium, we have the following definition of the standard Nash equilibrium.

Definition 1

The Nash equilibrium in an oligopoly competition is given by a price vector pN and a quality vector qN such that each firm maximizes its profit, i.e.,

2.2 Evolutionary stability

In symmetric infinite population games, it has been widely verified that the concept of an evolutionarily stable strategy is a refinement of the Nash equilibrium. However, in the finite-population framework, the behavior implied by evolutionary stability may have distinctive features from strategic Nash equilibrium behavior. The reason for this is as follows: when one player deviates from the incumbent strategy to a new strategy in a population with a small number of players, both the incumbent and the mutant players do not encounter the same population profile. In fact, mutant player confronts with a homogeneous profile of n − 1 incumbent players and incumbent players face a profile of one single mutant and n − 2 other incumbent players.

Recall that the firm’s strategy choices are two-dimensional: price level and quality level. Then consider a state of the system where all firms’ strategy sets are the same and suppose that one firm experiments with a new different strategy. We say that a state is evolutionarily stable if no mutant firm that chooses a different strategy can realize higher profits than the firms that employ the incumbent strategy. In other words, no mutant strategy can invade a population of incumbent strategists successfully.

Formally, consider a state where all firms choose the same strategies (p∗,q∗). This state (p∗,q∗) is a finite population evolutionarily stable strategy (FPESS) when one mutant firm (an experimenter) chooses a different strategy (pm,qm)≠(p∗,q∗) its profit must be smaller than the profits of the incumbent firms (i.e., the rest of firms). Formally speaking, we have

Definition 2

(p∗,q∗) is FPESS if πi(p,q) < πj(p,q) ∀j≠i,∀(pm,qm)≠(p∗,q∗), and i = 1,...,n, where p = [p∗,...,p∗,pi = pm,p∗,...,p∗], q = [q∗,...,q∗,qi = qm,q∗,...,q∗], and firm i is the mutant firm.Footnote 3

2.3 Evolutionary stable strategies and relative payoffs

In the classical economics literature, firms are assumed to be entities aiming to maximize their payoffs. Yet, despite this standard behavior of absolute payoff maximizing, firms may engage in a competitive behavior of relative payoff maximizing. A firm may pursue a different behavior being ahead of its opponents making higher payoff than the others. According to Schaffer (1989), in a so-called playing the field game, we can also find a FPESS by solving a relative payoff function of firm i.

Definition 3

In a symmetric oligopoly, FPESS is obtained as the solution of the following relative payoff optimization problem:

The interpretation of this definition is as follows: the equilibrium condition of the finite population evolutionarily stable strategy in Definition 2 is equivalent to saying that, when (pm,qm) = (p∗,q∗), then πi(p,q) − πj(p,q) as a function of (pm,qm) approaches its maximum value of zero. In fact, FPESS can be characterized as a relative payoff maximization and this solution concept is different from the Nash equilibrium and absolute payoff maximization. However, note that this also implies that the FPESS equilibrium is a Nash equilibrium for relative payoff maximizing (RPM) firms.

3 Analysis

In addition to the strategic variable price p, firms often bring into play non-price strategic variables with the intention of softening market competition. Firms may decide, for instance, how much revenue to allocate to improve the quality of their product or to research and develop new features to add to the basic product. In this section, we focus on the quality improvement decision of the firm. In particular, we are interested in analyzing the outcomes of both the Nash equilibrium and the evolutionary equilibrium of this game. Then we compare the two equilibrium concepts and discuss the results.

We begin by analyzing the game through the lens of the classical approach, i.e., maximization of absolute payoffs. By Definition 1 and the profit function of firm i as specified in the previous section, we obtain

We derive the first order conditions for the Nash equilibrium with respect to pi and qi as follows:

and

Equation 5 is the familiar equality between marginal revenue and marginal cost. Equation 6 states that the marginal revenue associated with a one-unit increase in the quality level is equal to the marginal cost of achieving this quality. We express the above conditions in terms of elasticities and then, combining the price decision and the quality decision in one rule yieldsFootnote 4

where \(\varepsilon _{D_{i} , p_{i}}= -\frac {\partial D_{i}}{\partial p_{i}} \frac {p_{i}}{x_{i}}\) and \(\varepsilon _{D_{i} , q_{i}}=\frac {\partial D_{i}}{\partial q_{i}} \frac {q_{i}}{x_{i}}\) are own price elasticity of demand and own quality elasticity of demand, respectively, and \(\varepsilon _{f , q_{i}}= f^{\prime }(q_{i}) \frac {q_{i}}{f(q_{i})}\) denotes elasticity of fixed costs with respect to quality.

Furthermore, by substituting the profit function in the optimization problem of Definition 3, we obtain

where pi = pm and qi = qm and ∀j≠ipj = p∗ and qj = q∗.

Thus, the first order conditions for the maximization of φ with respect to pi and qi are as follows:

and

Then combining Eqs. 8 and 9 for FPESS, we obtain:Footnote 5

where \(\varepsilon _{D_{j} , p_{i}}= -\frac {\partial D_{j}}{\partial p_{i}} \frac {p_{i}}{x_{j}}\) and \(\varepsilon _{D_{j} , q_{i}}=\frac {\partial D_{j}}{\partial q_{i}} \frac {q_{i}}{x_{j}}\) are the cross-price elasticity of demand and the cross-quality elasticity of demand, respectively.

The above conditions indicate that the FPESS equilibrium does not conform to competitive behavior where price is equal to marginal cost (\(p_{i} =c^{\prime }(x_{i})\)). By comparing the outcomes of the FPESS equilibrium (expression (10)) and the Nash equilibrium (expression (7)), we see obviously that the solutions for Nash and FPESS equilibrium are different.

Our analysis is extended to study market power as well. Market power can be defined as the ability of a firm to raise its prices higher than the perfectly competitive level. As we know, market power can be measured by the Lerner index, where \(L = \frac {p_{i} - c^{\prime }(x_{i})}{ p_{i}}\). Expression (7) is familiar, which implies that market power is determined by the firm’s own elasticities of demand. But expression (10) implies that market power, measured by the Lerner index, is influenced in an evolutionary equilibrium not only by the firm’s own elasticities of demand but also by cross-elasticities of demand.

Furthermore, the ratio of quality cost f(qi) to revenue Ri = pixi is termed the quality improvement intensity. This ratio determines how much a firm is willing to invest in quality improvement plans. In a Nash equilibrium, rephrasing expression (7), we obtain the following interesting equality \(\frac {f(q_{i})}{ p_{i} x_{i}}=\frac {\varepsilon _{D_{i} , q_{i}}}{\varepsilon _{D_{i} , p_{i}}} \frac {1}{\varepsilon _{f , q_{i}}}\), which states that the quality improvement intensity, i.e., \(\frac {f(q_{i})}{ p_{i} x_{i}}\) is equal to the ratio of the quality elasticity of demand \((\varepsilon _{D_{i} , q_{i}})\) to the price elasticity of demand \((\varepsilon _{D_{i} , p_{i}})\) multiplied by the inverse of the quality elasticity of fixed costs \((\varepsilon _{f , q_{i}})\). Our theoretical model suggests that, if we want to measure the quality improvement intensity, we must estimate the demand and cost functions. Therefore, if demand is somewhat more sensitive to changes in quality than to changes in price, then quality improvement spending (or R&D expenditure) is a large percentage of the revenue. The quality improvement intensity is also affected by the inverse of the quality elasticity of the fixed costs. In the case of evolutionary equilibrium, using expression (10), we obtain a different equality for the quality improvement intensity, i.e., \(\frac {f(q_{i})}{ p_{i} x_{i}}=\frac {\left (\varepsilon _{D_{i} , q_{i}}- \frac {x_{j}}{x_{i}} \varepsilon _{D_{j}, q_{i}} \right )}{\left (\varepsilon _{D_{i} , p_{i}}- \frac {x_{j}}{x_{i}} \varepsilon _{D_{j}, p_{i}} \right )} \frac {1}{\varepsilon _{f , q_{i}}}\).

This is summarized in the following two propositions 1 and 2.

Proposition 1 (Nash equilibrium)

Consider a symmetric oligopoly game where each firm has a two-dimensional strategy set consisting of a price level and a quality level. Assuming existence and uniqueness of the interior equilibrium solution, a firm in the symmetric Nash equilibrium sets it’s quality improvement intensity on the basis of the expression \(\frac {f(q_{i})}{ p_{i} x_{i}}=\frac {\varepsilon _{D_{i} , q_{i}}}{\varepsilon _{D_{i} , p_{i}}} \frac {1}{\varepsilon _{f , q_{i}}}\).

Proposition 2 (Evolutionary equilibrium)

Consider a symmetric oligopoly game where each firm has a two-dimensional strategy set consisting of a price level and a quality level. Assuming existence and uniqueness of the interior equilibrium solutions, the FPESS equilibrium is different from the symmetric Nash equilibrium and does not correspond to competitive behavior. Moreover, in the FPESS equilibrium, the firm’s quality improvement intensity is determined by the equality \(\frac {f(q_{i})}{ p_{i} x_{i}}=\frac {\left (\varepsilon _{D_{i} , q_{i}}- \frac {x_{j}}{x_{i}} \varepsilon _{D_{j}, q_{i}} \right )}{\left (\varepsilon _{D_{i} , p_{i}}- \frac {x_{j}}{x_{i}} \varepsilon _{D_{j}, p_{i}} \right )} \frac {1}{\varepsilon _{f , q_{i}}}\).

As a matter of fact, when policy decisions of firms include both price and quality, firms set its quality improvement intensity equal to the ratio of the two demand own elasticities multiplied by the inverse of quality elasticity of fixed costs. Therefore, the quality improvement intensity depends on three factors:

- (1)

The quality elasticity of demand: the greater the sensitivity of consumers to quality level, the greater the quality improvement intensity will be.

- (2)

The firm market power: the greater the power of firms to raise price above marginal cost, the greater the quality improvement intensity will be.

- (3)

The cost structure: the smaller the quality elasticity of fixed cost, the greater the quality improvement intensity will be.

When the target of firms is relative profit, the first and the second factors are influenced by cross-elasticities of demand as well.

In order to differentiate these two equilibrium concepts, we need to make two assumptions about the structure of the demand and cost functions. First, we assume that the fixed cost \(f (q_{i} )=\psi {q_{i}^{2}}\) is increasing and convex in quality level qi since improving the product’s quality level requires an initial investment by the firm. Using a standard linear variable cost, the cost function for firm i has the following form:

where ψ > 1/4.

Second, we assume that the demand function has the following linear form:

where |β| < 2/(n − 1), |γ| < 1 and β,γ≠ 0.Footnote 6 Note that, if the price effect of good j on the demand for good i (β) and the quality effect of good j on the demand for good i (γ) are both positive, the goods of the firms are substitute, whereas if β and γ are both negative, the two goods are complements.

Assuming the cost function (11) and the linear demand function (12), Eqs. 5 and 6 for Nash equilibrium can be rewritten like the following:

and

Rearranging above equations, they yield qN and pN as follow:

and

Likewise, Eqs. 8 and 9 for FPESS can be also inscribed along these lines:

and

After solving for q∗ and p∗, we obtain

and

In the following proposition, we characterize the comparison between two equilibrium concepts.

Proposition 3

Suppose that the cost function and the linear demand function are as in Eqs. 11 and 12, respectively. Suppose also that the following two assumptions A1: a ≥ (1 − (n − 1)β)ν and A2: 2ψβ < γ hold. Then the FPESS equilibrium leads to higher quality compared to the Nash equilibrium quality, i.e.,

Moreover, the FPESS equilibrium leads to a lower price compared to the Nash equilibrium, i.e.,

Proof

First of all, to ensure a positive quality in equilibrium, we need to assume that the numerator and the denominator of both expressions of Eqs. 13 and 15 are positive. By assumption A1, we have already that the numerators of both expressions are positive. Therefore, it is only necessary to show that both denominators are positive.

The denominator of qN is 2ψ(2 − (n − 1)β) − (1 − (n − 1)γ) = (4ψ − 1) + (n − 1)(γ − 2ψβ). Using solvability condition 4ψ − 1 > 0 and assumption A2 and the fact that n is greater equal than 2 in oligopoly game (n ≥ 2), we see easily that (4ψ − 1) + (n − 1)(γ − 2ψβ) > 0.

Furthermore, the denominator of q∗ is \( \frac {2 \psi }{ 1+ \gamma } (2 - (n-2) \beta )- (1- (n-1) \gamma ) = \left (\frac {4 \psi }{1+\gamma }-1+\gamma \right )+ (n-2)\left (\gamma -\frac {2\psi \beta }{1+\gamma }\right )\) which its first term, i.e., \(\left (\frac {4 \psi }{1+\gamma }-1+\gamma \right )\) is also positive, since \(\psi > \frac {1- \gamma ^{2}}{4}\) always holds (knowing that ψ > 1/4 and 0 < γ2 < 1). Therefore, a sufficient but not necessary condition for the denominator of q∗ to be positive is that \(\gamma -\frac {2\psi \beta }{1+\gamma }>0\) or 2ψβ < γ(1 + γ). Assumption A2, i.e., 2ψβ < γ will imply that 2ψβ < γ(1 + γ) must be satisfied (knowing that γ < γ + γ2). So we have \(\left (\frac {4 \psi }{1+\gamma }-1+\gamma \right )+ (n-2)\left (\gamma -\frac {2\psi \beta }{1+\gamma }\right )>0.\enlargethispage {-.5pt}\)

Next, we verify that these assumptions A1 and A2 are not mutually exclusive. For assumption A1 to hold we must have β ≥ (1 − a/ν)/(n − 1), where the RHS is negative (as a > ν). Hence, we have the following inequalities 2ψ(1 − a/ν)/(n − 1) ≤ 2ψβ < γ. Since we can always find a range for each parameter such that 2ψ(1 − a/ν)/(n − 1) ≤ 2ψβ < γ fulfills, it is verified that A1 and A2 are not mutually exclusive.

Then, we have q∗ > qN if and only if \( 2 \psi (2 - (n-1) \beta )>\frac {2 \psi }{ 1+ \gamma } (2 - (n-2) \beta )\).

Simplifying this inequality, we get the first condition of proposition 3:

To see that 2ψ(1 − a/ν)/(n − 1) ≤ 2ψβ < γ do not exclude the condition \( \beta < \frac { 2 \gamma }{1+ (n-1) \gamma }\), this condition can be rewritten as β < 2γ + γβ(1 − n). Moreover, the inequality 2ψβ < γ can be rephrased as β < γ/2ψ. Since we have also ψ > 1/4, that means that we must have β < 2γ. Therefore, it does not exclude our condition \(\beta < 2 \gamma + \overset {+}{\gamma \beta } \overset {-}{(1-n)}\), since the term γβ(1 − n) is negative. Note that β and γ have the same sign: they are both positive in the case of substitute goods and both negative in the case of complement goods.

We have p∗ < pN if and only if \( (2 - (n-2) \beta )- \frac {((1- (n-1) \gamma )(1+ \gamma ) }{2 \psi }> (2 - (n-1) \beta )- \frac {((1- (n-1) \gamma )}{2 \psi }\), and this inequality leads to the following condition

Note that, in this case, this inequality can be also rephrased as 2ψβ > γ − (n − 1)γ2 and it is obvious that γ > γ − (n − 1)γ2. Therefore, our assumptions do not exclude this condition. But clearly under our assumptions the region of relevant parameters becomes very small for γ. □

Assumptions A1 and A2 guarantee that we have strictly positive quality both in Nash equilibrium and FPESS. Note that a − (1 − (n − 1)β)ν is the derivative of absolute profit and relative profit functions with respect to pi when all firms choose p1 = ... = pn = ν and q1 = ... = qn = 0. This explains why prices will raise above marginal costs in both equilibria when quality is not provided. Moreover, when qi = 0 and prices are above marginal cost, the derivative of absolute profit and relative profit functions with respect to qi is strictly positive. Thus, in that case firms will start providing positive quality.Footnote 7

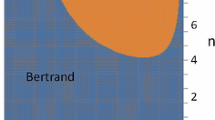

Proposition 3 demonstrates that an RPM firm engages in more price (quality) competition if the price effect of other competitors on the demand for good i, i.e., β, is greater (smaller) than the threshold β2(β1). The two conditions, derived in this proposition, determine the circumstances under which FPESS equilibrium induces more competition or less competition w.r.t. the price or non-price variable. Note that the threshold values of β1 and β2 are smaller for larger n. Therefore, the higher the market size, the lower are β1 and β2. For a larger (smaller) range of β, the FPESS equilibrium leads to more competition in price (quality), compared to the Nash equilibrium.

It can be seen that the comparison between the two equilibrium concepts is influenced by the parameters of demand and costs. To see the dissimilarities between strategic behavior and evolutionary behavior in greater detail, consider now the following four cases:

- a)

p∗ > pN and q∗ > qN;

- b)

p∗ < pN and q∗ < qN;

- c)

p∗ > pN and q∗ < qN; and

- d)

p∗ < pN and q∗ > qN.

The following Corollary 1 shows that, if goods are substitutes, then less price competition (higher price) and less quality competition (lower quality), i.e., the case c) p∗ > pN and q∗ < qN is not feasible under FPESS equilibrium. Moreover, Corollary 2 proves that if goods are complements, then more price competition and more quality competition, i.e., the case d) p∗ < pN and q∗ > qN, is not feasible under FPESS equilibrium.

Corollary 1

If goods of firms are substitutes, the FPESS equilibrium cannot lead to less price competition and less quality competition, compared to the Nash equilibrium.

Proof

To prove so, first we provide one example of parameters values that are feasible for each of the cases a), b) and d). Let ψ = 1/2, γ = 0.1, and n = 2. We then have β1 = 2/11 and β2 = 0.09. Therefore, β = 0.01, β = 0.2, and β = 0.1 give us feasible examples for each of the cases a), b), and d), respectively. Second, to prove that the case c) is excluded. we employ a proof by contradiction. Suppose that the case c) p∗ > pN and q∗ < qN is included when goods of firms are substitutes, i.e., β and γ are both positive. p∗ > pN and q∗ < qN require β1 < β < β2. So, we have \(\frac { 2 \gamma }{1+ (n-1) \gamma }<\frac {(1- (n-1)\gamma ) \gamma }{2\psi }\) which can be rewritten as 4γψ < (1 − (n − 1)2γ2)γ. As γ is positive, then we obtain \(\psi < \frac {1-(n-1)^{2} \gamma ^{2}}{4}\). Knowing that (n − 1)2γ2 > 0, this yields a contradiction to solvability condition ψ > 1/4. □

Corollary 2

If goods of firms are complements, the FPESS equilibrium cannot lead to more price competition and more quality competition, compared to the Nash equilibrium.

Proof

First, the following parameters values give us one feasible example for each of the cases a), b), and c):

- a)

ψ = 1/2, n = 2, γ = − 0.1, and β = − 0.3;

- b)

ψ = 1/2, n = 2, γ = − 0.1, and β = − 0.1; and

- c)

ψ = 1/2, n = 2, γ = − 0.1, and β = − 0.2.

Note that, in these examples, we have β1 = − 2/9 and β2 = − 0.11. Next, a similar proof by contradiction as in Corollary 1 is employed to show that the case d) is excluded. Let’s assume that the case d) p∗ < pN and q∗ > qN is included when goods of firms are complements, i.e., β and γ are both negative. p∗ < pN and q∗ > qN require β2 < β < β1. So, we have \(\beta _{2}=\frac {(1- (n-1)\gamma ) \gamma }{2\psi }<\frac { 2 \gamma }{1+ (n-1) \gamma }=\beta _{1}\), which can be rewritten as 4γψ > (1 − (n − 1)2γ2)γ. As γ is negative, then we obtain \(\psi < \frac {1-(n-1)^{2} \gamma ^{2}}{4}\). Knowing that (n − 1)2γ2 > 0, this is obviously a contradiction to solvability condition ψ > 1/4. □

Since the FPESS equilibrium is a Nash equilibrium for relative payoff maximizing (RPM) firms, one interpretation of these results is that, if goods are substitutes, less price competition (higher price) and less quality competition (lower quality) are not feasible for a RPM firm. If, however, goods are complements, more price competition and more quality competition are not feasible for a RPM firm.

Note that, in our model with the existence of non-price strategy, when goods are substitutes (β,γ > 0) a RPM firm may choose less price competition, i.e., p∗ > pN; in fact, it uses a non-price strategy to soften price competition. When goods are complements (β,γ < 0), a RPM firm may possibly decide on more price competition, i.e., p∗ < pN.

Our evolutionary analysis can be directly applied to a different setup such as an oligopoly-technology model of price competition with technology choice rather than quality choice (see e.g. Vives 2008 and Acemoglu and Jensen 2013). In this type of game, firms decide about technology choice besides setting output or price. In fact, firm i incurs a similar cost of C(xi,ai) = f(ai) + c(ai,xi) by choosing technology ai together with the quantity xi, but the demand is not affected by the technology choice ai.

4 Conclusion

The evolutionary oligopoly literature was initiated by Alchian (1950), who were the first to argue bounded rationality in economic behavior. In Alchian’s own words:

“Profit maximization” is meaningless as a guide to specifiable action. ... Observable patterns of behavior and organization are predictable in terms of their relative probabilities of success or viability if they are tried.” (Alchian (1950, pp. 211-220))

In the present paper, a concept of finite population evolutionarily stable strategy (FPESS) by Schaffer (1989), in which agents in economic and social environments adhere to relative payoff maximizing rather than absolute payoff maximizing behavior, has been applied in an oligopoly framework. The solution concept FPESS can be considered as a minimal check for a stochastically stable state in learning dynamic models with imitation and mutation. Imitation of the most successful behavior results in some limit state where all firms choose the same strategy. The imitation dynamic will continue as long as one firm experiments with a new strategy and attains a higher payoff than others. The relative performance considerations are the core of these dynamic models.

We have focused on explaining the behavior of a RPM firm and compared it with a rational APM firm in a symmetric oligopoly setup, nevertheless extending their strategic choice in an additional dimension, i.e., a price variable and a non-price variable. We pose the question, whether a standard result of Nash equilibrium in oligopoly, namely, that the non-price variable is strategically used to soften price competition, survives in an evolutionary set up under FPESS solution concept. Since an FPESS under absolute profit maximization is equivalent to a Nash equilibrium under relative profit maximization, we show that this is equivalent to the question as to whether it also holds for RPM firms in the Nash equilibrium. A comparison of both equilibria with respect to price and quality is difficult. We see that, for Nash equilibrium, own demand elasticities matter, whereas for FPESS, own and cross elasticities of demand matter. While APM captures the behavior of self-interested rational players, RPM perceives the spiteful behavior of players that involve in a relative game. As a result, we show that market power, measured by the Lerner index, is influenced in an evolutionary equilibrium not only by the firm’s own elasticities of demand but also cross-elasticities of demand. Above all, it plays an important role whether the qualitatively differentiated goods are substitutes or complements. A complete solution for linear demand and quadratic cost functions can be worked out. We identify parameters ranges for which relative profit maximizers engage in even less competition w.r.t the price or non-price variable than absolute profit maximizers. Interestingly, we show that an evolutionary equilibrium may entail less competition than the Nash equilibrium in one dimension, but not in both. Our findings, therefore, indicate that less competition in both dimensions of price and non-price together, for firms that engage in RPM behavior, is not viable.

Notes

We obtain a similar result for a model of variable cost of quality improvement, see the working paper version Moghadam (2015).

The analysis here leads to the same results when the cost of quality improvement requires only an increase in variable costs; see the discussion paper version Moghadam (2015).

Clearly, this definition includes any one-dimensional deviation (such as (pm,q∗) or (p∗,qm)) by a mutant.

Rephrasing both FOCs of Eqs. 5 and 6 for the Nash equilibrium, we obtain

$$ \frac{p_{i} - c^{\prime}(x_{i})}{ p_{i}}=- \frac{x_{i}}{ p_{i} \frac{\partial D_{i}}{\partial p_{i}}}=\frac{1}{\varepsilon_{D_{i} , p_{i}}}, $$and

$$ \frac{p_{i} - c^{\prime}(x_{i})}{ p_{i}}=\frac{f^{\prime}(q_{i})}{ p_{i} \frac{\partial D_{i}}{\partial q_{i}}}=\frac{x_{i}}{ q_{i} \frac{\partial D_{i}}{\partial q_{i}}} \frac{f^{\prime}(q_{i}) q_{i}}{f(q_{i})} \frac{f(q_{i})}{ p_{i} x_{i}}=\frac{\varepsilon_{f , q_{i}}}{\varepsilon_{D_{i} , q_{i}}} \frac{f(q_{i})}{ p_{i} x_{i}}. $$In symmetric situations, by imposing pi = pj,qi = qj and \(c^{\prime }(x_{i})=c^{\prime }(x_{j})\), the FOCs of Eqs. 8 and 9, can be rewritten as

$$ p_{i} - c^{\prime}(x_{i})=-\frac{x_{i}}{\left( \frac{\partial D_{i}}{\partial p_{i}}-\frac{\partial D_{j}}{\partial p_{i}}\right)}, $$and

$$ p_{i} -c^{\prime}(x_{i})=\frac{f^{\prime} (q_{i})}{\left( \frac{\partial D_{i}}{\partial q_{i}}-\frac{\partial D_{j}}{\partial q_{i}}\right)}. $$After some algebraic manipulation, these FOCs can be rewritten as

$$ \frac{p_{i} - c^{\prime}(x_{i})}{ p_{i}}=\frac{1}{ \left( - \frac{\partial D_{i}}{\partial p_{i}} \frac{p_{i}}{x_{i}}+\frac{\partial D_{j}}{\partial p_{i}} \frac{p_{i}}{x_{j}}\frac{x_{j}}{x_{i}}\right)}=\frac{1}{\left( \varepsilon_{D_{i} , p_{i}}- \frac{x_{j}}{x_{i}} \varepsilon_{D_{j}, p_{i}} \right)}, $$and

$$ \frac{p_{i} - c^{\prime}(x_{i})}{ p_{i}}=\frac{1}{\left( \frac{\partial D_{i}}{\partial q_{i}} \frac{q_{i}}{x_{i}}-\frac{\partial D_{j}}{\partial q_{i}} \frac{q_{i}}{x_{j}}\frac{x_{j}}{x_{i}}\right) } \frac{f^{\prime}(q_{i}) q_{i}}{f(q_{i})} \frac{f(q_{i})}{ p_{i} x_{i}}=\frac{\varepsilon_{f , q_{i}}}{\left( \varepsilon_{D_{i} , q_{i}}- \frac{x_{j}}{x_{i}} \varepsilon_{D_{j} , q_{i}}\right)} \frac{f(q_{i})}{ p_{i} x_{i}}. $$The restrictions on β, γ, and ψ ensure that we have a unique symmetric Nash equilibrium. To see this, first we assume upper bounds for price and quality so that we have a compact strategy space. Second, given that payoff functions \(\pi _{i}=p_{i} D_{i}(\mathbf {p} ,\mathbf {q})-C_{i} (D_{i}(\mathbf {p} ,\mathbf {q}) ,q_{i} )= (p_{i} - \nu ) D_{i}(\mathbf {p} ,\mathbf {q})- \psi {q_{i}^{2}}\) are continuous, we show that a sufficient condition for πi to be strictly concave is that the second order conditions have a negative definite Hessian matrix. Consider the following Hessian matrix:

$$ H_{i}= \left( \begin{array}{ccccc} \frac{\partial^{2} \pi_{i}}{\partial {p_{i}^{2}}}& \frac{\partial^{2} \pi_{i}}{\partial p_{i}\partial q_{i}}\\ \frac{\partial^{2} \pi_{i}}{\partial p_{i}\partial q_{i}}&\frac{\partial^{2} \pi_{i}}{\partial {q_{i}^{2}}} \end{array}\right) = \left( \begin{array}{ccccc} 2\frac{\partial D_{i}}{\partial p_{i}}& \frac{\partial D_{i}}{\partial q_{i}}\\ \frac{\partial D_{i}}{\partial q_{i}}& - 2\psi \end{array}\right) $$Since Di(.) is linear, the following condition guarantees that |Hi| < 0 and hence that the solvability condition is satisfied:

$$ 4 \psi-1>0. $$Finally, to ensure uniqueness as well, we check the following contraction condition (see Vives2001):

$$\frac{\partial^{2} \pi_{i}}{\partial {p_{i}^{2}}}+ {\sum}_{j \neq i}^{n} | \frac{\partial^{2} \pi_{i}}{\partial p_{i}\partial p_{j}}| <0.$$We thus obtain the following condition:

$$-2+(n-1) |\beta| <0.$$Note that a similar contraction condition for qi does not lead to an additional constraint. The condition |β| < 2/(n − 1) means that the cross effect of a price change β is limited by the number of firms. The condition becomes more restrictive as the number of firms increases.

An anonymous referee made this point.

References

Acemoglu D, Jensen MK (2013) Aggregate comparative statics. Games Econ Behav 81:27–49

Alchian AA (1950) Uncertainty, evolution, and economic theory. J Polit Econ, 211–221

Ania AB (2008) Evolutionary stability and Nash equilibrium in finite populations, with an application to price competition. J Econ Behav Org 65(3):472–488

Apesteguia J, Huck S, Oechssler J, Weidenholzer S (2010) Imitation and the evolution of Walrasian behavior: theoretically fragile but behaviorally robust. J Econ Theory 145(5):1603–1617

Banker RD, Khosla I, Sinha KK (1998) Quality and competition. Manag Sci 44(9):1179–1192

Berry S, Waldfogel J (2010) Product quality and market size*. J Ind Econ 58(1):1–31

Brécard D (2010) On production costs in vertical differentiation models. Econ Lett 109(3):183–186

Dixit A (1979) Quality and quantity competition. Rev Econ Stud 46(4):587–599

Hamilton WD (1970) Selfish and spiteful behaviour in an evolutionary model. Nature 228(5277):1218–1220

Hehenkamp B, Wambach A (2010) Survival at the center—the stability of minimum differentiation. J Econ Behav Org 76(3):853–858

Hehenkamp B, Possajennikov A, Guse T (2010) On the equivalence of Nash and evolutionary equilibrium in finite populations. J Econ Behav Org 73(2):254–258

Khan A, Peeters R (2015) Imitation by price and quantity setting firms in a differentiated market. J Econ Dyn Control 53:28–36

Leininger W, Moghadam HM (2018) Asymmetric oligopoly and evolutionary stability. Mathematical Social Sciences 96:1–9

Moghadam HM (2015) Price and non-price competition in oligopoly–an analysis of relative payoff maximizers. Ruhr Economic Paper, Discussion Paper, (575)

Moghadam HM (2017) Evolutionary models of market structure. PhD thesis, Universitätsbibliothek Dortmund

Schaffer ME (1988) Evolutionarily stable strategies for a finite population and a variable contest size. J Theor Biol 132(4):469–478

Schaffer ME (1989) Are profit-maximisers the best survivors?: a Darwinian model of economic natural selection. J Econ Behav Org 12(1):29–45

Shaked A, Sutton J (1987) Product differentiation and industrial structure. J Ind Econ, 131–146

Tanaka Y (1999) Long run equilibria in an asymmetric oligopoly. Economic Theory 14(3):705–715

Tanaka Y (2000) Stochastically stable states in an oligopoly with differentiated goods: equivalence of price and quantity strategies. J Math Econ 34(2):235–253

Tirole J (1988) The theory of industrial organization. MIT press

Vega-Redondo F (1997) The evolution of Walrasian behavior. Econometrica: J Econometr Soc, 375–384

Vives X (2001) Oligopoly pricing: old ideas and new tools. MIT Press

Vives X (2008) Innovation and competitive pressure. J Ind Econ 56(3):419–469

Acknowledgments

The author is grateful to Wolfgang Leininger, Lars Metzger, Marc Escrihuela Villar, and all conference participants at the University of Macedonia, Corvinus University of Budapest, SING11, the European Meeting on Game Theory in St. Petersburg, the China Meeting of the Econometric Society in Wuhan, and XXXII Jornadas de Economia Industrial for helpful comments and suggestions. I particularly thank an anonymous referee whose suggestions made invaluable contributions to my revisions. Financial support from TU Dortmund University and Ruhr Graduate School in Economics is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The author has received financial supports from TU Dortmund University and Ruhr Graduate School in Economics. This work is a development of part of the doctoral thesis by Moghadam (2017) discussed at Dortmund University, as a member of Ruhr Graduate School in Economics. The author declares that he has no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Moghadam, H.M. Price and non-price competition in an oligopoly: an analysis of relative payoff maximizers. J Evol Econ 30, 507–521 (2020). https://doi.org/10.1007/s00191-019-00653-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-019-00653-8

Keywords

- Relative payoff maximizing (RPM)

- Oligopoly

- Finite population evolutionary stable strategy (FPESS)

- Quality