Abstract

This paper attempts to extend the approach of quantitative investment and provide investors with suggestions about volatility timing. Based on the volatility-managed portfolios strategy, we propose two volatility–tail risk-managed portfolios strategies by combining the volatility and tail risk forecasting methods. We subject seven indices in China’s stock market to verify the performance of these two strategies. The empirical results show that volatility–tail risk-managed portfolios yield better performance than buy-and-hold portfolios and volatility-managed portfolios in terms of annualized average returns, Sharpe ratio, maximum drawdown and Calmer ratio. Furthermore, we find that the effectiveness also depends on the volatility clustering of portfolios and the selection of investment periods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Affected by various macro- and micro-factors, asset prices often exhibit volatility randomness. Determining the best time of buying and selling financial assets to obtain excess returns has become a major problem commonly faced by investors. With the emergence of financial innovation and the development of financial technology, quantitative investment has attracted much attention from academia and industry.

Prior literature documents that volatility is widely used in practice for quantitative timing. In order to meaningfully compare the momentum strategies of time-series between assets, Moskowitz et al. (2012) first introduce volatility scaling. Subsequently, Barroso and Santa-Clara (2015) suggest that using volatility to manage momentum risk can eliminate momentum crashes and increase the Sharpe ratios of momentum strategies. Further, Moreira and Muir (2017) find a negative correlation between the volatility in the previous period and the return per unit of risk in the next period. Motivated by this, they formally propose the volatility-managed portfolios strategy, which reduces positions when volatility is high and increases when volatility is low. They show that managed portfolios earn significantly positive excess returns and increase Sharpe ratios compared with unmanaged portfolios. Since then, many scholars have focused on studying the effectiveness and interpretation of volatility-managed portfolios strategy. Cederburg et al. (2020) show that when the sample is expanded to 103 stock portfolios, the strategy shows a positive in-sample excess return but performs poorly outside the sample. Barroso and Detzel (2021) explore the reasons why volatility-managed portfolios can produce abnormal returns. The results show that the abnormal returns generally concentrate in stocks with low arbitrage risk and impediments to short selling, and the strategy only performs well when sentiment is high.

As noted by the above literature, volatility-managed portfolios could earn excess returns in the US market. However, China’s stock market is distinct from the US stock market due to its unique system, laws, and trading rules (Bell and Feng 2009; O’Neill et al. 2016). In order to promote the stable and healthy development of China’s stock market, regulators often intervene and restrict stocks trading (Carpenter et al. 2021). Unlike the slow bull market and the fast bear market in the US market, the fast bull market and the slow bear market are characteristic of China’s market. Therefore, although the strategy has performed well in the US stock market, whether it can be effectively applied to China’s stock market is still a question worth discussing.

Chi et al. (2021) have studied the industry portfolios of China’s A-share stock market. They find a positive correlation between realized volatility and returns, contrary to the premise that volatility-managed portfolios can achieve abnormal returns. Given this, we choose the representative stock indices of China’s A-share market to explore the effectiveness of the strategy applied to China’s market. Furthermore, to improve the strategy performance, we propose forecast volatility management and tail risk management. At the same time, combining the characteristics of the above two strategies, we propose volatility–tail risk management, and the empirical results suggest that the strategy is a more effective method to manage portfolios.

First, we follow Moreira and Muir (2017) to manage seven representative indices of China’s stock market by volatility-managed portfolios strategy. The empirical results show that the strategy is valid for most indices, but performs poorly on others. The reason is that the implementation of the strategy depends on the negative correlation between realized volatility and current return per unit of risk. In contrast, the negative correlation is not significant in some indices. However, we find that the negative correlation between current volatility and current return per unit of risk is stronger for the above seven stock indices. Then we use current volatility to manage portfolios and obtain higher excess returns. Nevertheless, the current volatility is not available, so only the historical data can be accessed for predicting if investors want to apply this method in real time.

There are many pieces of research on volatility prediction (Wilhelmsson 2006; Xiao and Koenker 2009; Andersen et al. 2010; Kim and Won 2018; Aliyev et al. 2020; Zhang and Zhang 2020). Hallerbach (2012) finds that the more accurate the volatility prediction is in the target volatility strategy, the higher the Sharpe ratio will be. It indicates that the accuracy of prediction is crucial in volatility management. Since volatility is highly predictable in the short term (Christoffersen and Diebold 2000), the most common method is to replace current volatility with realized volatility (Andersen and Bollerslev 1998; Barndorff-Nielsen and Shephard 2002; Andersen et al. 2003). Realized volatility reflects past changes of assets, but the volatility of stock prices often has strong randomness; realized volatility cannot accurately predict the current volatility. Therefore, more and more scholars employ GARCH models to predict volatility.

Bali and Demirtas (2008) use GARCH models and EGARCH models based on normal distribution, GED distribution, and t distribution to predict the volatility of S &P500 index futures. They state that the GED-EGARCH model has the most accurate prediction results. Alberg et al. (2008) suggest that the EGARCH model based on skew-t distribution provides the best variance prediction for the Tel Aviv Stock Exchange (TASE) Stock index. Agnolucci (2009) finds that GARCH models perform better than implied volatility (IV) in predicting the volatility of crude oil futures. Cao and Tsay (1992) respectively employ the TAR model, ARMA model, GARCH model, and EGARCH model to predict stock volatility in the US market. They demonstrate that the EGARCH model performs best in predicting small-cap volatility. Perchet et al. (2015) use GARCH-type models to predict the volatility of the S &P500 index and apply the predictive value to the target volatility strategy. The results suggest that the target volatility strategy using the I-GARCH model could stabilize the volatility at the target level and improve the Sharpe ratio of the asset.

Further, we verify whether forecast-based current volatility management can obtain excess returns in real time. Because of the high kurtosis, fat-tails, and conditional heteroscedasticity of the indices, we choose GARCH-type models whose residuals obey the generalized hyperbolic distribution to predict the volatility. Finally, we compare them with realized volatility management. The results suggest that forecast volatility management is more advantageous.

Although using volatility to manage financial assets is a mainstream timing strategy, some scholars explore other risk measurement methods to manage risky assets. Qiao et al. (2020) present that downside volatility can provide investors with additional value that volatility cannot capture. Strub (2016) introduces a tail risk hedging algorithm that uses EVT theory to estimate CVaR and adjusts the level of risk exposure through the estimated value. Rickenberg (2020) proposes a tail risk targeting strategy and obtains a higher Sharpe ratio by replacing the volatility in the target volatility strategy with VaR and CVaR. Spilak and Härdle (2020) present a dynamic tail risk protection strategy and adopt the trading signals generated by the target VaR strategy for investment timing.

The above literature illustrates that tail risk, as another important measure of risk, can also adjust portfolios’ positions. However, whether it can be applied to the form of volatility management to achieve the same or even better performance as forecast volatility management in China’s market is still a question. Synthesizing the above studies and referring to the tail risk targeting strategy proposed by Rickenberg (2020), we present tail risk management. It uses VaR and ES to measure tail risk and analogizes the form of volatility management. We find that this strategy can obtain significant excess returns in China’s market and outperform forecast volatility management on some stock indices.

The empirical results of the above two parts show that forecast volatility and tail risk management perform inconsistently on different indices. So we integrate the advantages and disadvantages of various portfolio management strategies in the literature above and propose volatility–tail risk management. It uses the product of volatility and tail risk as a comprehensive measure of asset risk for portfolio timing. The results suggest that the combination strategy earns significantly higher excess returns than the single timing strategy. The reason is that, on the one hand, the combination strategy reduces the leverage of portfolios. On the other hand, it enhances the positive correlation between investment positions and returns.

This paper has the following academic innovations. First, we present forecast volatility management and tail risk management based on VaR and ES. In addition, we verify their effectiveness in China’s market. Second, we explain the reasons for the distinct performance between volatility management based on different forecasting methods from the perspective of volatility clustering. Third, we demonstrate the rationality of calculating VaR and ES with the daily return to rebalance portfolios’ monthly return. At last, we propose volatility–tail risk management, which uses the product of volatility and tail risk to manage portfolios.

The remainder of the paper is organized as follows. Section 2 is the introduction of data explanation and related methods. Section 3 contains our empirical tests on current volatility management, forecast volatility management, tail risk management, and volatility–tail risk management. Section 4 discusses the impact of investment time selection on portfolio management, the rationality of the VaR and ES calculation methods, and summarizes the similarities and differences between volatility management and volatility targeting strategy. Section 5 concludes.

2 Data and methodology

2.1 Data

We consider the representative stock indices published by Shanghai Stock Exchange and Shenzhen Stock Exchange in China’s stock market: SSE Composite Index (SSEC), SSE A Share Index (SSEA), SSE 50 Index (SSE50), CSI 300 Index (CSI300), SZSE Component Index (SCI), SZSE Composite Index (SZSC), SZSE A Index (SZSA). We collect their daily returns to explore the effectiveness of volatility management in China’s stock market. In terms of the risk-free rate, due to the availability of data, we use the 1-year deposit rate as the risk-free rate before 2002 and the 1-year treasury bond interest rate as the risk-free rate in 2002 and onwards.

Most scholars apply the excess return to portfolios timing, which is defined in Eq. (1),

where \({f}_{i}\) is the original, unscaled index’s excess return on day i, \({R}_{i}\) is the return on day i, and \({r}_{f}\) is the risk-free rate.

As China’s stock market started to implement the price-limit system on 13 December 1996, the market’s volatility at the beginning was significant. Additionally, due to the immature operation mechanism of China’s stock market at the beginning of its establishment, we verify that the performance of managed portfolios from the beginning of stock index establishment is not as good as from 1997. The empirical results are shown in Discussion 4.1. Accordingly, we use data from 1997 and onwards as the subject of this paper; the detailed daily excess returns are described in Table 1.

Table 1 shows that the daily excess returns for all seven indices have the characteristics of high kurtosis and left-skewed with positive mean values. Experience shows that financial series tend to have the characteristic of fat tail. After calculation, we found that each index above also has this characteristic. Hence, it is more accurate to fit the index return by using the distribution with the three characteristics theoretically.

We follow Moreira and Muir (2017), setting 22 trading days as a month and rebalancing portfolios monthly. The excess return in month can be calculated as follows:

where \({f}_{i}\) has been defined in Eq. (1).

2.2 Volatility-managed portfolios strategy

Moreira and Muir (2017) state that the volatility-managed portfolios strategy is effective in the US equity market due to the negative correlation between realized volatility and current return per unit of risk. Therefore, higher excess returns and Sharpe ratios can be obtained if exposure is reduced when realized volatility is high and increased when it is not. The adjustment method of this strategy is constructed asFootnote 1:

where \({{f}_{t}}\) is the monthly excess return of the buy-and-hold portfolio, the benchmark return used to compare different management strategies. \(f_{t}^{\sigma }\) is the excess return of the managed portfolio. \({c}/{\sigma _{t-1}^{2}}\) represents the position of the volatility-managed portfolio in month t. c is a constant chosen such that \(f_{t}^{\sigma }\) and \({{f}_{t}}\) have the same full-sample variance. \(\sigma _{t-1}^{2}\) is the realized volatility,Footnote 2 which is calculated as:

where \(f_{t-1}^{i}\) is the daily excess return of the buy-and-hold portfolio on day i of month \(t-1\). In addition, they use the following time series regression to estimate the excess return:

Since the full-sample variance of portfolios before and after management is controlled by c in Eq. (3), a positive \(\alpha \) implies that the volatility-managed portfolio has increased the Sharpe ratio relative to the original portfolio.

2.3 GARCH model and EGARCH model

There is empirical evidence that volatility clustering often occurs in financial assets, where large price movements tend to cluster together, leading to persistence in the magnitude of price changes (Cont 2007). Moreover, we construct the ARCH-LM test on indices, which shows an ARCH effect on these indices. Therefore, we use the GARCH model (Bollerslev 1986) to portray the time-varying characteristics of the volatility fully and predict it. The structure of the GARCH(p,q) model can be expressed by:

where \(f_{t}\) is the monthly excess return in month t; \({\xi }_{t}\) is an independent and identically(i.i.d.) normally distributed noise variable; the coefficients in Eq. (8) match the following conditions: \({{\alpha }_{0}}>0,{{\alpha }_{i}},{{\beta }_{j}}\ge 0,i,j=1,\ldots ,p\). Financial data often have high kurtosis, fat-tails, and skewness that the normal distribution cannot adequately characterize, thus Bollerslev (1987) and Hansen (1994) point that \({\xi }_{t}\) could obey generalized t and skew-t distributions, respectively. Since then, more and more distributions have been used in GARCH-type models to describe financial data.

By calculating the AIC and BIC values, we select the order of each model as \(p=q=1\) in Sect. 3.2. So, Eq. (8) can be transformed into the following equation:

The parameter \(\alpha \), \(\beta \) in Eq. (9) can be utilized to describe the degree of volatility clustering. The closer \({\alpha }+{\beta }\) is to 1, the slower the decay of the autocorrelation of \(\sigma _t\), and vice versa (Cont 2007).

To explain the leverage effect of the financial series and remove the non-negative restrictions on the coefficients in GARCH models, Nelson (1991) develop the EGARCH model. The conditional variance for the EGARCH can be written as:

A negative \({\alpha }_{i}\) indicates that there is a leverage effect: a negative shock of the same magnitude has a more substantial impact on volatility than a positive shock. \({{\gamma }_{i}}\) captures the magnitude of the leverage effect.

2.4 Tail risk management based on VaR and ES

VaR and ES are two conditional risk measures that can also be used for managing portfolios. VaR with significance level \({\alpha }\) at time t can be written as:

where \({{L}_{t}}=-{{f}_{t}}\) is the loss rate of the asset at time t; \({{I}_{t-1}}\) denotes the known information at time \(t-1\) and before; \(\text {VaR}_{t}^{\alpha }\) is the estimate of the maximum loss of the asset under confidence \(1-\alpha \). We apply VaR to construct a tail risk-managed portfolio with the following management process:

where c is still the constant such that \(f_{t}^{\sigma }\) and \(f_{t}\) have the same full-sample variance, and \(\widehat{ \text {VaR}}_{t}^{\alpha }\) is the estimated value of \({\text {VaR}_{t}^{\alpha }}\). Since VaR is not a consistent risk measure and cannot consider the loss beyond the threshold, it will generally underestimate the loss.

For this reason, Rockafellar and Uryasev (1999) introduce the ES, which represents the conditional expectation of the loss exceeding VaR in a given period and confidence level. Thus, it is an adequate measure of tail risk than VaR. ES with significance level \(\alpha \) at time t is given by:

Similarly, we employ ES to construct a tail risk-managed portfolio with the following management process:

where c is defined in the same way as Eq. (12) and \(\widehat{\text {ES}}_{t}^{\alpha }\) is an estimated value of \({ \text {ES}_{t}^{\alpha }}\). In this paper, VaR and ES are calculated by two methods:

The historical simulation method calculates the quantile and the conditional expectation of the series within the window. Let \({{L}_{(1)}}\le {{L}_{(2)}}\le \cdots \le {{L}_{(n)}}\) be the series of losses sort in ascending order within the window, then

The conditional distribution method is based on the assumption that the data within the window can be described by a given distribution. Then VaR and ES are calculated by the quantile and conditional expectation of this distribution:

In the empirical part of Sects. 3.4 and 3.5, we carefully adopt the rolling window before time t for out-of-sample estimation of \(\text {VaR}_{t}^{\alpha }\) and \(\text {ES}_{t}^{\alpha }\) to avoid look-ahead bias. Further, the information of time t is not needed in time \(t-1\), so investors can use it to invest in real time.

2.5 Volatility–tail risk management

In order to integrate the positive effects of volatility and tail risk on portfolio management, we construct a volatility–tail risk-managed portfolio. Taking ES as an example, it can be illustrated by:

where \({\widehat{\sigma }} _{t}^{2}\) is the estimated value of the variance at time t, \(\widehat{\text {ES}}_{t}^{\alpha }\) is the estimated value of ES at the significance level \(\alpha \). The implementation of the volatility-managed portfolios strategy proposed by Moreira and Muir (2017) is primarily based on the negative correlation between risk and return per unit of risk. Therefore, it is vital to measure the risk for this strategy adequately. As common risk measures, volatility focuses on uncertainty, and ES pays attention to tail risk. Volatility–tail risk management combines both risk measures to measure the risk of a portfolio more adequately and thereby achieve higher excess returns.

3 Result

3.1 The comparison of realized volatility management with current volatility management

Moreira and Muir (2017) construct a volatility-managed portfolio, which inspired by the negative correlation between realized volatility and current return per unit of risk in the US market. This section explores whether this negative correlation holds in China’s market, the results are shown in Fig. 1.

Relationship between realized volatility and average return per unit of risk. We divide the monthly time series of realized volatility into five buckets. The lowest, “low vol,” looks at the lowest 20% of realized volatility months. We show the average return per unit of risk in the next month of every bucket. In other words, the horizontal coordinates of the graph indicate the division of realized volatility \({\sigma }_{t-1}\) into five groups from lowest to highest by quintile, and the vertical coordinates indicate the current average return per unit of risk for different groups (i.e., \(E[{{{f}_{t}}}/{{{\sigma }_{t}}}]\)). To ensure that the data we used in this graph are consistent with Table 3, we remove the first 100 months’ excess return data for each index used in this graph

Figure 1 confirms that most indices do not have this significant negative correlation in China’s stock market, except SSE50 and CSI300. As a consequence, the effect of realized volatility management may not be effective in China’s market. Based on this, we explore the correlation between current volatility \({\sigma }_{t}\) and average return per unit of risk \(E[{{{f}_{t}}}/{{{\sigma }_{t}}}]\) in China’s market. Here we apply the historical data within the sample to try to give readers some enlightenment from the past experience. The results are presented in Fig. 2.

Relationship between current volatility and average return per unit of risk. We divide the monthly time series of current volatility into five buckets. The lowest, “low vol,” looks at the lowest 20% of current volatility months. We show the current average return per unit of risk of every bucket. In other words, the horizontal coordinates of the graph indicate the division of current volatility \({\sigma }_{t}\) into five groups from lowest to highest by quintile, and the vertical coordinates indicate the average return per unit of risk for different groups(i.e., \(E[{{{f}_{t}}}/{{{\sigma }_{t}}}]\)). To ensure that the data we used in this graph is consistent with Table 3, we remove the first 100 months’ excess return data for each index used in this graph

As shown in Fig. 2, the negative correlation between current volatility and return per unit of risk is more significant in terms of the overall trend compared to it between realized volatility and return per unit of risk. For Fig. 1, most indices have a high average return per unit of risk during a period of high volatility. According to Eq. (3), the position in high volatility periods is small, so the realized volatility management will give up the return in these periods. Considering Fig. 2, the average return per unit of risk for each index in high volatility periods is small or even negative; reducing position in these periods will result in higher excess returns. Similarly, the return per unit of risk is higher in low volatility periods in Fig. 2 compared to Fig. 1, so giving higher leverage to these periods will result in higher excess returns. Therefore, we consider that using current volatility instead of realized volatility in Eq. (3) will result in better performance theoretically.

So as to verify the ability of current management to bring excess returns (i.e., utilize \({\sigma }_{t}^2\) to replace the volatility \({\sigma }_{t-1}^2\) in Eq. (3)), we apply the two strategies to adjust the position of the buy-and-hold portfolio.

Table 2 suggests that current volatility management can generate annualized average returns and Sharpe ratios that far outperform realized volatility management except in SSE50. For SZSC and SZSA, the realized volatility management generates negative annualized \(\alpha \), which indicates that this strategy is invalid in these indices. On the contrary, the current volatility management performs well in these two indices, confirming the findings in Figs. 1 and 2. However, current volatility is not observable in practice, so some methods for accurately forecasting current volatility are required to pursue the excess returns.

3.2 Performance of forecast volatility management

We use four methods to forecast volatility. The most common forecast method is to replace current volatility with realized volatilityFootnote 3 (Andersen et al. 2003). The remaining three prediction methods are the GARCH model based on normal distribution, the GARCH model, and the EGARCH model based on generalized hyperbolic distribution.

We apply the predictive value of volatility to manage portfolios. In this case, we get the forecast volatility management:

We compare the performance of different forecast volatility management strategies from the return and risk perspective by calculating four statistics: annualized average return, Sharpe ratio,Footnote 4 maximum drawdown, and Calmar ratio. The results of annualized average return and Sharpe ratio are summarized in Table 3, and the maximum drawdown and Calmar ratio are shown in “Appendix” Table 11.

As shown in Table 3, forecast volatility management achieves a higher annualized average return and Sharpe ratio than the buy-and-hold strategy. In comparison, realized volatility management attains the highest annualized average returns in SSE50 and CSI300. The annualized average return increases by 14.01% and 12.34% compared to the buy-and-hold, but this method underperforms on the rest indices. The EGARCH-GHD captures the highest annualized average return and Sharpe ratio across SSEC, SSEA, SCI, SZSC, and SZSA, which increases the annualized average return by 11.51%, 11.85%, 5.39%, 6.84%, and 5.96% compared to the buy-and-hold.

Table 11 suggests that the EGARCH-GHD significantly reduces the maximum drawdown of the portfolio, with the lowest maximum drawdown across SSEA, SCI, SZSC, and SZSA. In addition, the results show that the EGARCH-GHD gains the highest Calmar ratioFootnote 5 across SSEC, SSEA, SCI, SZSC, and SZSA, which is the same as the conclusion observed by annualized average returns, further demonstrating the superiority of this strategy.

Accordingly, we obtain several interesting findings. First, management strategies based on generalized hyperbolic distribution can attain better performance than those based on the normal distribution. Comparing the GARCH-norm with the GARCH-GHD, the latter significantly improves annualized average return, Sharpe ratio, maximum drawdown, and Calmar ratio. It indicates that the generalized hyperbolic distribution with high kurtosis, fat-tails, and skewness is more suitable for describing the return data. Second, the EGARCH-GHD significantly outperforms the GARCH-GHD, meaning that there is a leverage effect in the index series, thus applying EGARCH models to forecast volatility can lead to higher accuracy.

3.3 Volatility clustering

According to the results in Sect. 3.2, we find realized volatility management only performs best in SSE50 and CSI300, while forecast volatility management performs better on the remaining indices. Consequently, we explore the reasons for this phenomenon below.

The main difference between realized volatility and volatility predicted by GARCH-type models is that the former only reflects the volatility one month before, while the latter can combine volatility information over the previous period. Intuitively, GARCH-type models could obtain higher prediction accuracy on indices with low volatility clustering, resulting in better management performance. Therefore, in this section, we explore the correlation between the extent of volatility clustering and the performance of realized volatility management on different indices.

Table 4 reports the correlation of volatility clustering with the effectiveness of realized volatility management. The smaller the volatility clustering is, the larger the difference between the realized volatility management and the optimal strategy will be. The Pearson correlation coefficient between \({\alpha }+{\beta }\) and \(CV-RV\) can reach \(-\)0.86, which indicates the two have a strong negative linear correlation with each other. The reason is that realized volatility uses the last month’s volatility in place of the current volatility, so it will only perform well on indices with the slow decay of the autocorrelation of \(\sigma _{t}\). In contrast, using GARCH-type models to forecast volatility will effectively capture previous periods’ volatility information. Thus, it can be applied to portfolios management to achieve better performance on data with weak volatility clustering. We therefore provide a reasonable recommendation to investors: for portfolios with stronger volatility clustering, the realized volatility management should be chosen; otherwise, they should select forecast volatility management based on GARCH-type models.

3.4 Performance of tail risk management based on VaR and ES

Inspired by Rickenberg’s study on target tail risk strategy(Rickenberg 2020), we extend the volatility management to tail risk management to explore whether it can also achieve excess returns, and we measure the tail risk by VaR and ES. Table 5 presents the annualized average return and Sharpe ratio of managed indices. The maximum drawdown and Calmar ratio are written in “Appendix” Table 12.

Tables 5 and 12 illustrate no significant differences in annualized average return, Sharpe ratio, maximum drawdown, and Calmar ratio of three VaR-based tail risk management strategies. Comparing different ES-based tail risk management strategies, we suggest that the ES-stew-t has the best performance across the seven indices, which improve the annualized average returns by 6.59%, 7.23%, 0.75%, 2.64%, 5.67%, 10.02%, and 10.06% respectively compared with the buy-and-hold. In addition, the ability to obtain excess returns of ES-based management strategies has the following relationship: ES-stew-t>ES-HS>ES-GPD> buy-and-hold, which illustrates the effectiveness of tail risk managements and reaffirms the superiority of using distributions with high kurtosis, fat-tailed, and skewed characteristics to describe the index series. We also find ES-based management strategies gain higher annualized average returns of 2–3%, Sharpe ratios of around 0.02, and lower maximum drawdowns than VaR-based management strategies. This conclusion confirms that ES is an adequate measure of tail risk empirically.

3.5 Performance of volatility–tail risk management

From the above analysis, the estimations of volatility and tail risk are essentially the prediction of the possible risks faced by the portfolio in the future. Comparing volatility management with tail risk management, both have methods’ advantages across different indices. The EGARCH-GHD performs best on SSEC and SSEA, the realized volatility management performs best on SSE50 and CSI300, and the ES- stew-t performs best on the remaining three indices. The basic idea is to combine the strengths of the two risk measures and apply them to manage the portfolio to achieve higher excess return and lower maximum drawdown. Therefore, we combine the two best volatility management strategies: the realized volatility management and the EGARCH-GHD, with the best tail risk management: the ES-stew-t.Footnote 6 Then, we get two kinds of volatility–tail risk management strategies. (We also refer to it as a combination strategy in the following.)

Table 6 reports the performance of combination management. Both the RV*ES and the EGARCH*ES show significant improvement compared with the single strategy.Footnote 7 The RV*ES, compared with the realized volatility management, improves the average annualized return by 6.58%, 8.41%, 3.94%, 13.82%, 17.30%, 17.23% except for SSE50, and reduces the maximum drawdown by 9.29%, 8.04%, 5.92%, 3.08%, 15.37%, 23.07%, 23.12%, respectively, across the seven indices. As the result of the reduction in maximum drawdown, the RV*ES obtains a higher Calmar ratio than the realized volatility management across all indices. Compared with the EGARCH-GHD, the EGARCH*ES improves the annualized average return by 4.70%, 3.82%, 3.02%, 10.45%, 10.49%, and 9.29% except for SSE50, and shows the same superiority on other metrics. In addition, both two combination strategies also have significant improvements over the ES-stew-t. As current volatility management underperforms realized volatility management in SSE50, it is logical that EGARCH*ES underperforms RV*ES in this index.

We compare the RV*ES with the EGARCH*ES, the former performs best in SSE50 and CSI300, while the latter performs best across the remaining five indices. It has the same conclusion as comparing the realized volatility management with the EGARCH-GHD, which illustrates the robustness of the combination strategy.

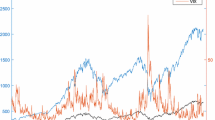

To visually demonstrate the superiority of the combination strategy, we plot the cumulative return curve for each index. We show the results in Fig. 3:

Figure 3 highlights that the cumulative returns of the combination managed portfolios are higher than those of the buy-and-hold portfolios over the last 15 years. SSE50 and CSI300 perform best in the RV*ES, while the others reach the best in the EGARCH*ES, further supporting the previous conclusions. For the first graph in Fig. 3, if an investor invested 1 CNY in SSEC in February 2006, the EGARCH*ES would increase its value to 14.84 CNY by 2021. The cumulative returns of SSEC reached a peak in late 2007 and showed a downtrend that lasted nearly a year due to the global financial crisis in 2008. However, the RV*ES and the EGARCH*ES allow the portfolio to maintain a more stable cumulative return at this time. The reason is that combination management reduces risk exposures in high-risk crisis periods; thus, the losses are avoided.Footnote 8 China’s stock market saw a new bull market in 2014 after a multi-year bear market, and combination strategies show more significant gains at this time, which suggests that combination strategies can deliver more excess returns in low-risk periods.

In order to analyze the risk reduction effect of the combination strategy, we also plot the drawdowns of the above seven managed indices. The curves of the seven indices are shown in Fig. 4:

As Fig. 4 shows, the EGARCH*ES and the RV*ES can significantly reduce portfolios’ drawdowns at almost all times. During the financial crisis in 2008, the drawdown of SSEC reached about 70%, while the EGARCH*ES managed index suffered a drawdown around 30%, and the RV*ES managed version suffered a drawdown less than 20%. It demonstrates the significant risk reduction effect of combination strategies in times of crisis. Figure 4 also shows that the drawdown of SSE50 and CSI300 is less than 0.2 in almost all periods after being managed. The strategies have a more prominent effect on reducing drawdown in these two indices than in the other indices. We analyze that this is because the sample stocks of the two indices are large, liquid, and stable stocks. This result means that the effectiveness of the timing strategy is related to the performance of the underlying portfolio.

3.6 Average return decomposition

To explore the reasons for the superior performance of the volatility–tail risk-managed portfolios, refer to Wang and Yan (2021); we decompose the excess average returns difference of portfolios before and after management.

where \({w}_{t}\) is the investment position (i.e. \(\frac{c}{\widehat{\sigma _{t}^{2}}\cdot \widehat{\text {ES}_{t}^{\alpha }}}\)). Since \({w}_{t}\) is dimensionless, the first part \({\text {cov}}({{w}_{t}},{{f}_{t}})\) describes the correlation between the investment position and the portfolio’s excess return. It illustrates that the stronger the correlation is, the higher the average return obtained by the managed portfolio. The second part \(\overline{{{f}}_{t}}(\overline{{{w}}_{t}}-1)\) represents the leverage size, which is affected only by the leverage of the management strategy. Since \(\overline{{{f}}_{t}}\) is the average return of the buy-and-hold portfolio, under the assumption of positive average return, the higher the average leverage is, the higher the average return of the managed portfolio will be.

Table 7 reveals, for \({\text {cov}}({{w}_{t}},{{f}_{t}})\), the covariance of the RV*ES is 0.81% higher than the Realized-Vola on average, and the covariance of the EGARCH*ES is 0.58% higher than the EGARCH-GHD on average. We acknowledge that the positive relationship between the investment position of the combination strategy and the buy-and-hold portfolio’s return is stronger than the relationship of the single strategy. For \(\overline{{{f}}_{t}}(\overline{{{w}}_{t}}-1)\), so we only need to compare the value of \(\overline{{{w}}_{t}}-1\). Table 7 demonstrates that the average leverage of the RV*ES is less than that of the Realized-Vola, which is 0.939 and 1.073, respectively. The average leverage of the EGARCH*ES is smaller than EGARCH-GHD’s, which is 0.662 and 0.822. Moreover, the value of \(\overline{{{f}}_{t}}(\overline{{{w}}_{t}}-1)\) is small, so it has less impact on the strategy than the first part. According to the results of the two aspects, the reason why the combination strategy can obtain higher returns is the stronger positive correlation between the investment position and the return of the buy-and-hold portfolio, rather than the increased leverage.

4 Discussion

4.1 The influence of investment period

Many documents point out that China’s stock market was unstable at the beginning of its establishment. Subsequently, the market began to implement the price limit system in 12/1996. Therefore, in this section, we explore the performance of current volatility management and realized volatility management in three periods:Footnote 9 Start-12/1996, 01/1997-06/2021, Start-06/2021.

Table 8 shows the Sharpe ratio of the managed portfolios. Panel B of Table 8 illustrates that the current volatility management outperforms the buy-and-hold strategy in 01/1997-06/2021, but the realized volatility management underperforms the buy-and-hold strategy. On the one hand, the result indicates the effectiveness of the current volatility management at this time. On the other hand, it indicates that current volatility is more suitable for volatility management than realized volatility. Panel C shows that both management strategies underperform the buy-and-hold strategy, thus applying the management strategy to this time is ineffective. Panel A explains the phenomenon in Panel C by applying the two strategies to the Start-12/1996; we find that the managed portfolio obtains a much lower Sharpe ratio than the buy-and-hold portfolio. Because China’s stock market was in its infancy with low stock diversity and high stock market volatility. Therefore, it is challenging to achieve excess returns from volatility management during this unstable period. In summary, we adopt the data after 1997 to study the managed-portfolios strategy, which is of practical significance.

The results above show that the performance of the management strategy depends on the choice of investment periods. In Table 9, we analyze the performance of the current volatility management strategy before and after the financial crisis.

We find the buy-and-hold portfolio during the surge period generally outperforms the current volatility-managed portfolio, with the opposite conclusion during the plunge period. The reason is that market volatility is higher during these two periods. Volatility management will allow the portfolio to take a lower position, giving up some gains during the surge period. However, in the plunge period, the lower position effectively weakens the potential exposure to future losses. After the crash, there is often a period of stable growth followed. When the market is less volatile and steadily rising, the management strategy will allow the portfolio to take higher leverage, which further increases the portfolio’s excess return. In summary, the current volatility management is effective during the plunge period and the stable growth period after the crisis, while it has no significant effect during the pre-crisis surge period.

4.2 Transaction costs

We refer to Fleming et al. (2003) to analyze the performance of strategies after accounting for transaction costs. Transaction costs include establishing initial positions and implementing monthly rebalancing. Only the result of the SSEC index is given here, and the results of other indices are similar. We set the transaction costs as 0 bps, 1 bps, 10 bps, 100 bps, respectively. Under normal circumstance, the transaction cost of China’s stock market is 3bps, so the results given in this paper have guiding significance for real transactions.

Table 10 shows the performance of Realized-Vola, RV*ES and EGARCH*ES on SSEC index after considering transaction costs. The results show that with the increase of transaction costs, the annualized average return shows a downward trend, but it still performs better than the buy-and-hold strategy. This means that the strategy in this paper is robust to transaction costs. The reason is that the leverage of the trading strategy in this paper is constrained by the weight calculation method, and only adjusts the position by monthly frequency. Compared with the daily trading method in Fleming et al. (2003) and other high-frequency trading methods, the strategy in this paper is less affected by transaction costs, so transaction costs will not weaken the performance of the strategy. Even when the transaction cost is 10bps, it has far exceeded the transaction cost of 3bps in the China’s stock market, and the annualized average return of the three strategies has only decreased by 1% or less, and still can make profits compared with the buy-and-hold strategy.

4.3 Rationality of tail risk management based on VaR and ES

When constructing the tail risk-managed portfolio, we use daily excess returns to calculate \(\widehat{\text {VaR}}_{t}^{\alpha }\), \(\widehat{\text {ES}}_{t}^{\alpha }\) and rebalance the monthly excess return. The reason is that a large number of data is required to fit the time series. At the same time, the time horizon of the window is too long when using monthly returns, but the returns of early months would not provide valuable information for the estimation of VaR and ES.

We explore the rationality for this by using the calculation of ES as an example. The conditional distribution method requires the data within the window to fit a given distribution when calculating \(\widehat{\text {ES}}_{t}^{\alpha }\). Due to the large sample size in the window, changing a value will have a minimal impact on the distribution fitting; thus, it will not bias the estimated value. The \(\widehat{\text {ES}}_{t}^{\alpha }\) in each day of month t calculated by daily data are basically the same. Since the monthly return is approximately equal to the daily return multiplied by the number of trading days included in a month, namely:

The ES calculated by the monthly return can be transformed from the ES calculated by the daily return without losing a large amount of information:

The above transformations do not have any impact on \({f}_{t}^{\text {ES}}\). It can be illustrated by the calculations below. Since the volatility management strategy defines a constant c which is chosen such that the managed portfolio has the same full-sample variance as the buy-and-hold portfolio, c can be calculated as follows:

substitute it into the tail risk management strategy based on ES, then:

Equation (26) shows that the number of trading days 22 will be dropped in the calculation process, so whether or not to convert the daily estimated value to monthly will have no impact on the results of this strategy. The advantages of this approach are mainly twofold.

First, it solves the problem that the data of China’s stock market is insufficient to use monthly returns to calculate the ES.

Second, most ES-based managed portfolios are rebalanced daily, whereas this approach allows rebalancing monthly, which significantly reduces transaction costs.

4.4 Contrast between volatility-managed portfolios strategy with volatility target strategy

The target volatility strategy had been widely used in risk control before volatility management (Hocquard et al. 2013; Benson et al. 2014; Dachraoui 2018). The target volatility strategy could stabilize the portfolio’s volatility at a target level and improve its Sharpe ratio at the same time. The basic idea of this strategy is to allocate money between the risky and the riskless asset, thus maintaining the volatility at the target level. The strategy is given by:

where \({L}_{t}\) is the weight of risky asset at time t, \({{\sigma }_{\text {target}}}\) is the desired volatility target, \({{\hat{\sigma }}_{t-1}}\) is the portfolio’s volatility at time \(t-1\), \({{r}_{t}}\) is the risky asset’s return, \({{r}_{f}}\) is the risk-free rate, and \(R_{t}^{p}\) is the portfolio’s return. When the volatility is lower than the volatility target, the investor will invest in more than 100% of risky assets, and they need to add leverage to the portfolio. When the volatility is higher than the volatility target, the weight of the risky assets is less than 1, so they can draw a portion to invest in risk-free assets and obtain a risk-free return. The target volatility strategy and volatility management are similar in format, but few papers explore the connection and difference. Next, we explore their similarities and differences from the purpose and principle of the above strategies.

First, the strategies have different purposes: volatility management is to earn excess returns. However, the target volatility strategy controls the portfolio’s volatility at a target level, thereby controlling its risk.

Second, the principle of management is different: volatility management reduces exposure when volatility is high and increases exposure when volatility is low, based on the negative correlation between realized volatility and return per unit of risk. Thereby, this strategy could increase the Sharpe ratio of the portfolio, and the Sharpe ratio is independent of c. The reason is as follows:

The principle of the target volatility strategy is to adjust the ratio of risky and risk-free assets in the portfolio in real-time, thereby keeping the volatility of the portfolio at the level of the volatility target.

Figure 5 presents the impact of the volatility target on the target volatility strategy. We find that the higher the preset-volatility target, the higher the average return and volatility of the portfolio. Because a higher volatility target corresponds to higher leverage, which leads to an increase in return and risk simultaneously. However, the volatility increases faster than the return; thus, it will decrease the Sharpe ratio as the volatility increases, so investors need to decide the level of the volatility target according to their appetite for risk.

The advantage of volatility management is that the managed portfolio can deliver abnormal returns without considering issues related to setting volatility targets. At the same time, it can avoid the failure of strategy due to inappropriate volatility target settings and simplify the process of strategy implementation. The advantage of the target volatility strategy is that risk-averse investors can apply the strategy to reduce risk, and risk-preference investors can use the strategy to pursue higher risk for higher returns. In summary, we suggest that the two strategies are proposed from different purposes and ideas, but volatility management can be a particular case of the target volatility strategy (when \({{\sigma }_{\text {target}}}=c\)).

Impact of the volatility target on strategy. To investigate the impact of different volatility target settings on the strategy, we employ the target volatility strategy to SSEC and calculate the annualized average return, Sharpe ratio, maximum drawdown, and standard deviation of the portfolio under the annualized volatility target of 10–25%

5 Conclusion

Much empirical literature suggests that using volatility to adjust portfolios’ exposures dynamically can yield significant excess returns in the US stock market. However, it is still worth exploring whether it can get the same results in China’s stock market and improve the ability to earn excess returns. This paper proposes volatility–tail risk management based on volatility and tail risk management from China’s stock market. By applying this strategy, we obtain a higher performance compared with the buy-and-hold strategy.

First, we find that using current volatility to adjust portfolios’ positions can lead to higher returns. Therefore, we use different methods to predict volatility and manage portfolios. The results show that the EGARCH-GHD performs optimally on five indices. On the one hand, it suggests that the generalized hyperbolic distribution is suitable for describing the index returns. On the other hand, the index series has a leverage effect, and the use of EGARCH models is better than GARCH models in predicting volatility.

Second, the effectiveness of volatility management in China’s stock market relies on the choice of investment periods. Significantly, the current volatility management can obtain higher Sharpe ratios than buy-and-hold strategy in the mid-crisis plunge periods and post-crisis stable growth periods while missing out on huge risk compensation and underperforming in surge periods.

Third, the application of tail risk management in China’s market could also earn excess returns over the buy-and-hold strategy. The results suggest that risk measure methods other than volatility can also be applied to timing strategies. Therefore, finding the best measure of risk is one way to optimize volatility management.

Finally, we propose volatility–tail risk management, which uses the product of volatility and tail risk to adjust portfolios’ positions dynamically. This strategy achieves performance that far exceeds the single management strategy, due to the significant positive correlation between the combination strategy’s investment position and the excess return of the buy-and-hold portfolio. We can get the following insights from the above results: At first, volatility and tail risk are two measures of risk, and combining them may be a new approach to measure risk. Second, the combined risk may be a better pricing factor than the volatility factor.

Data availability statement

The data that support the findings of this study are available from CSMAR and Choice. Restrictions apply to the availability of these data, which were used under license for this study. Data are available from the authors with the permission of CSMAR and Choice.

Notes

For monthly rebalancing, the time of adjustment can be set to the first trading day of the month t.

Volatility indicates the degree of asset returns’ dispersion and is generally measured as the sample standard deviation, but sometimes variance is used also as a volatility measure (Poon 2005).

Cederburg et al. (2020) suggest that a positive \(\alpha \) in regression (5) is a lower bar for declaring success of a given managed strategy relative to a positive Sharpe ratio difference in a direct comparison. Therefore, we employ the Sharpe ratio instead of the \(\alpha \) used by Moreira and Muir (2017).

The Calmar ratio is a common metric that combines excess return and maximum drawdown. The Sterling ratio and the Burke ratio are also metrics which combine excess return and maximum drawdown(Eling and Schuhmacher 2007).

We use different distributions to calculate volatility and tail risk, but it is not contradictory for the following reasons: First, the two distributions describe different objects: the GHD in the GARCH model describes the distribution of the random variable in Eq. (7), thus indirectly affects the distribution of returns, whereas the skew-t distribution in the ES calculation is directly fitted by the series of returns within the window. Second, the window lengths for the two calculations are different.

Table 13 shows the statistical significance of the return and Sharpe ratio differences.

Only SSEC, SSEA, SCI, SZSC, SZSA are managed here, as SSE50 and CSI300 were published since 2004 and 2005, these two indices are not valuable to discuss in the above time segment.

References

Agnolucci P (2009) Volatility in crude oil futures: a comparison of the predictive ability of GARCH and implied volatility models. Energy Econ. 31(2):316–321. https://doi.org/10.1016/j.eneco.2008.11.001

Alberg D, Shalit H, Yosef R (2008) Estimating stock market volatility using asymmetric GARCH models. Appl Financ Econ 18(15):1201–1208. https://doi.org/10.1080/09603100701604225

Aliyev F, Ajayi R, Gasim N (2020) Modelling asymmetric market volatility with univariate GARCH models: Evidence from Nasdaq-100. J. Econ. Asymmetries 22(e00):167. https://doi.org/10.1016/j.jeca.2020.e00167

Andersen TG, Bollerslev T (1998) Answering the skeptics: yes, standard volatility models do provide accurate forecasts. Int Econ Rev. https://doi.org/10.2307/2527343

Andersen TG, Bollerslev T, Diebold FX et al (2003) Modeling and forecasting realized volatility. Econometrica 71(2):579–625. https://doi.org/10.1111/1468-0262.00418

Andersen TG, Bollerslev T, Diebold FX (2010) Parametric and nonparametric volatility measurement. In: Aït-Sahalia Y, Hansen LP (eds) Handbook of financial econometrics: tools and techniques. Elsevier, Amsterdam, pp 67–137. https://doi.org/10.1016/B978-0-444-50897-3.50005-5

Bali TG, Demirtas KO (2008) Testing mean reversion in financial market volatility: evidence from s &p 500 index futures. J Futures Mark Futures Options Other Deriv Prod 28(1):1–33. https://doi.org/10.1002/fut.20273

Barndorff-Nielsen OE, Shephard N (2002) Econometric analysis of realized volatility and its use in estimating stochastic volatility models. J R Stat Soc Ser B (Stat Methodol) 64(2):253–280. https://doi.org/10.1111/1467-9868.00336

Barroso P, Detzel A (2021) Do limits to arbitrage explain the benefits of volatility-managed portfolios? J Financ Econ 140(3):744–767. https://doi.org/10.1016/j.jfineco.2021.02.009

Barroso P, Santa-Clara P (2015) Momentum has its moments. J Financ Econ 116(1):111–120. https://doi.org/10.1016/j.jfineco.2014.11.010

Bell S, Feng H (2009) Reforming china’s stock market: institutional change Chinese style. Political Stud 57(1):117–140. https://doi.org/10.1111/j.1467-9248.2008.00726.x

Benson R, Furbush T, Goolgasian C (2014) Targeting volatility: a tail risk solution when investors behave badly. J Index Invest 4(4):88–101. https://doi.org/10.3905/jii.2014.4.4.088

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31(3):307–327. https://doi.org/10.1016/0304-4076(86)90063-1

Bollerslev T (1987) A conditionally heteroskedastic time series model for speculative prices and rates of return. Rev Econ Stat. https://doi.org/10.2307/1925546

Cao CQ, Tsay RS (1992) Nonlinear time-series analysis of stock volatilities. J Appl Econom 7(S1):S165–S185. https://doi.org/10.1002/jae.3950070512

Carpenter JN, Lu F, Whitelaw RF (2021) The real value of China’s stock market. J Financ Econ 139(3):679–696. https://doi.org/10.1016/j.jfineco.2020.08.012

Cederburg S, O’Doherty MS, Wang F et al (2020) On the performance of volatility-managed portfolios. J Financ Econ 138(1):95–117. https://doi.org/10.1016/j.jfineco.2020.04.015

Chi Y, Qiao X, Yan S et al (2021) Volatility and returns: evidence from China. Int Rev Finance 21(4):1441–1463. https://doi.org/10.1111/irfi.12336

Christoffersen PF, Diebold FX (2000) How relevant is volatility forecasting for financial risk management? Rev Econ Stat 82(1):12–22. https://doi.org/10.1162/003465300558597

Cont R (2007) Volatility clustering in financial markets: empirical facts and agent-based models. Long Mem Econ. https://doi.org/10.1007/978-3-540-34625-8_10

Dachraoui K (2018) On the optimality of target volatility strategies. J Portf Manag 44(5):58. https://doi.org/10.3905/jpm.2018.44.5.058

Eling M, Schuhmacher F (2007) Does the choice of performance measure influence the evaluation of hedge funds? J Bank Finance 31(9):2632–2647. https://doi.org/10.1016/j.jbankfin.2006.09.015

Fleming J, Kirby C, Ostdiek B (2003) The economic value of volatility timing using “realized’’ volatility. J Financ Econ 67(3):473–509. https://doi.org/10.1016/S0304-405X(02)00259-3

Georgantas A, Doumpos M, Zopounidis C (2021) Robust optimization approaches for portfolio selection: a comparative analysis. Ann Oper Res. https://doi.org/10.1007/s10479-021-04177-y

Hallerbach WG (2012) A proof of the optimality of volatility weighting over time. J Invest Strateg 1:87–89. https://doi.org/10.21314/JOIS.2012.011

Hansen BE (1994) Autoregressive conditional density estimation. Int Econ Rev. https://doi.org/10.2307/2527081

Hocquard A, Ng S, Papageorgiou N (2013) A constant-volatility framework for managing tail risk. J Portf Manag 39(2):28–40. https://doi.org/10.3905/jpm.2013.39.2.028

Jobson JD, Korkie BM (1981) Performance hypothesis testing with the Sharpe and Treynor measures. J Finance. https://doi.org/10.2307/2327554

Kim HY, Won CH (2018) Forecasting the volatility of stock price index: a hybrid model integrating LSTM with multiple GARCH-type models. Expert Syst Appl 103:25–37. https://doi.org/10.1016/j.eswa.2018.03.002

Moreira A, Muir T (2017) Volatility-managed portfolios. J Finance 72(4):1611–1644. https://doi.org/10.1111/jofi.12513

Moskowitz TJ, Ooi YH, Pedersen LH (2012) Time series momentum. J Financ Econ 104(2):228–250. https://doi.org/10.1016/j.jfineco.2011.11.003

Nelson DB (1991) Conditional heteroskedasticity in asset returns: a new approach. Econom J Econom Soc. https://doi.org/10.2307/2938260

O’Neill M, Wang K, Liu Z (2016) A state-price volatility index for China’s stock market. Account Finance 56(3):607–626. https://doi.org/10.1111/acfi.12124

Perchet R, De Carvalho RL, Heckel T et al (2015) Predicting the success of volatility targeting strategies: application to equities and other asset classes. J Altern Invest 18(3):21–38. https://doi.org/10.3905/jai.2016.18.3.021

Poon SH (2005) A practical guide to forecasting financial market volatility. Wiley, London

Qiao X, Yan S, Deng B (2020) Downside volatility-managed portfolios. J Portf Manag 46(7):13–29. https://doi.org/10.3905/jpm.2020.1.162

Rickenberg L (2020) Tail risk targeting: target var and CVAR strategies. Available at SSRN 3444999. https://doi.org/10.2139/ssrn.3444999

Rockafellar RT, Uryasev S (1999) Optimization of conditional value-at-risk. J Risk 2(3):21–42

Spilak B, Härdle WK (2020) Tail-risk protection: machine learning meets modern econometrics. arXiv preprint arXiv:2010.03315

Strub IS (2016) Tail hedging strategies. Available at SSRN 2261831. https://doi.org/10.2139/ssrn.2261831

Wang F, Yan XS (2021) Downside risk and the performance of volatility-managed portfolios. J Bank Finance 131(106):198. https://doi.org/10.1016/j.jbankfin.2021.106198

Wilhelmsson A (2006) Garch forecasting performance under different distribution assumptions. J Forecast 25(8):561–578. https://doi.org/10.1002/for.1009

Xiao Z, Koenker R (2009) Conditional quantile estimation for generalized autoregressive conditional heteroscedasticity models. J Am Stat Assoc 104(488):1696–1712. https://doi.org/10.1198/jasa.2009.tm09170

Zhang W, Zhang JE (2020) Garch option pricing models and the variance risk premium. J Risk Financ Manag 13(3):51. https://doi.org/10.3390/jrfm13030051

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Figs. 6, 7, Tables 11, 12, 13.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Guo, Z., Li, Y. & Jia, G. Research on the effectiveness of the volatility–tail risk-managed portfolios in China’s market. Empir Econ 66, 1191–1222 (2024). https://doi.org/10.1007/s00181-023-02493-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02493-9

Keywords

- Volatility timing

- Quantitative investment

- Volatility-managed portfolios strategy

- Volatility–tail risk-managed portfolios

- Volatility forecasting