Abstract

Standard unit-root tests of the hysteresis hypothesis specify a unit root under the null against the stationary alternative of the natural-rate hypothesis, making the two theories of unemployment mutually exclusive over the sample period. In this paper, we allow switches between hysteresis and natural-rate theory using the Kejriwal, Perron, and Zhou test. The null hypothesis of the test is that the unemployment rate is I(1) throughout the sample, and the alternative hypothesis is that the unemployment rate changes persistence [i.e., switches between I(0) and I(1) regimes]. We apply the test to the unemployment rate of 20 metropolitan statistical areas (MSAs) and the USA. We use monthly observations over the period 1990:1–2016:12 and apply the test to seasonally unadjusted and seasonally adjusted data. Important differences exist between these tests. We find that with seasonally adjusted data, the Great Recession associates with a change in persistence from I(0) to I(1) in eight MSAs and the USA and to a change from I(1) to I(0) in six MSAs. Conversely, with seasonally unadjusted data, the Great Recession only associates with a change in persistence from I(0) to I(1) in four MSAs and to a change from I(1) to I(0) in three MSAs. This differential resilience to the shocks of the Great Recession provides a new aspect of the heterogeneity of the US labor markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In their early work, Friedman (1968) and Phelps (1967) explained the movements in the unemployment rate using the natural-rate theory, also called the non-accelerating-inflation-rate-of-unemployment (NAIRU) theory. The natural rate of unemployment measures the long-run equilibrium unemployment rate. The natural-rate theory predicts that inflation is stable only when the unemployment rate equals the natural rate of unemployment and suggests that deviations of the actual rate of unemployment from the natural rate are short-lived and eventually die out. The natural-rate theory is a central topic in macroeconomics. According to natural-rate theory, expansionary economic policies will create only temporary decreases in unemployment, as the economy will return to the natural rate. When unemployment falls below the natural rate, inflation will accelerate. When unemployment lies above the natural rate, inflation will decelerate. When the unemployment rate equals the natural rate, inflation is stable, or non-accelerating. If the government decides to pursue expansionary economic policies, inflation will increase as aggregate demand increases. This creates a movement along the short-run Phillips curve that generates an unstable equilibrium. As aggregate demand increases, firms hire more workers to produce more output to meet the rising demand, and unemployment will decrease. Due to higher inflation, however, workers’ expectations of future inflation change, which shifts the short-run Phillips curve upward, from an unstable equilibrium to a new stable equilibrium, where the rate of unemployment, once again, equals the natural rate, but inflation remains higher than its initial level. In the long run, therefore, the natural-rate theory predicts a vertical Phillips curve.

Friedman (1968) and Phelps (1967) do not explain the determination of the natural rate and take the rate as a constant. As a consequence, we can characterize the dynamics of the unemployment rate as a stationary process around a constant mean. Phelps (1994) and Phelps and Zoega (1998), on the other hand, attempt to explain the determination of the natural rate by appealing to structural factors responsible for the differences of the natural rate across countries and over time. These structural factors include, among other factors, technological change, labor productivity, and energy prices. Thus, while most shocks to the unemployment rate are temporary, a few, affected by changes in structural factors, can change the natural rate. As a consequence, we can characterize the dynamics of the unemployment rate as a stationary process with an infrequently changing mean. From the natural-rate perspective, the need for policy interventions proves less compelling, since the unemployment rate will eventually return to its equilibrium level, albeit possibly a shifted natural rate. That is, if the economy experiences temporary unemployment rate shocks, then short-term demand management policies can prove unnecessary to stabilize the labor market around a long-run equilibrium level. Interventionist economists disagree with this last statement, arguing that “temporary” may extend for too long a period. They argue in favor of stabilizing demand management policy.

In contrast, Blanchard and Summers (1986) argue that the movement of the unemployment rate exhibits the characteristic of hysteresis. Hysteresis in the unemployment rate means that the actual unemployment rate is path dependent (i.e., dependent on a linear combination of its past values, with coefficients summing to one). This is equivalent to a unit-root process, which implies that temporary shocks exert permanent effects on the unemployment rate. This usually associates with a lack of adjustment of the wage rate. As opposed to the natural-rate and structural explanations of unemployment, which imply that shocks exert temporary effects on the unemployment rate, the hysteresis hypothesis argues that the unemployment rate follows non-stationary dynamics, specifically unit-root dynamics. The hysteresis hypothesis of the unemployment rate entails important policy implications. The hypothesis suggests that a high unemployment rate, if left alone, may persist and constitute a serious problem even in the long run. It also implies that recessions impose much higher costs than the natural-rate theory indicates, as it requires systematic structural policy measures to return the unemployment rate to its former lower level. Moreover, policy makers should augment the short-term demand management policies with structural and supply-side reforms. Noninterventionist economists demure, arguing that timing and uncertainty issues make demand management policy open to serious mistakes.

Unit-root tests provide the natural econometric framework to test the hysteresis hypothesis, which researchers have extensively applied to OECD countries.Footnote 1 In fact, as Lee and Chang (2008) observe, the sizable empirical literature that appeared after Blanchard and Summers (1986) evolves in line with the development of unit-root tests in time-series econometrics. The general findings of hysteresis in unemployment rates, however, prove mixed and depend in large part on the type of unit-root test employed, the frequency of the data, and the length of the sample. Blanchard and Summers (1987), Alogoskoufis and Manning (1988), Brunello (1990), Mitchell (1993), Roed (1996), and León-Ledesma (2002) employ standard unit-root tests to examine unemployment rates in European countries and provide evidence mostly in favor of the hysteresis hypothesis. Mitchell (1993), and Arestis and Biefang-Frisancho Mariscal (1999, 2000) apply unit-root tests that allow for structural breaks in the unemployment rate and provide evidence mostly in favor of the natural-rate hypothesis. Song and Wu (1997, 1998), León-Ledesma (2002), Camarero and Tamarit (2011), Romero-Ávila and Usabiaga (2007, 2008, 2009), and Lee (2010) apply panel unit-root tests and find strong evidence mostly against the hysteresis hypothesis. In contrast, Chang et al. (2005) fail to reject the hysteresis hypothesis in most of the countries in their panel unit-root tests. Murray and Papell (2000) and Camarero et al. (2006) use panel unit-root tests with structural breaks, combining the advantages of the two testing procedures, to investigate unemployment rate hysteresis in OECD countries and decidedly reject the unit-root hypothesis.

The various strands of the unit-root literature share the conventional assumption of constant order of integration. From standard unit-root tests, one concludes that either all shocks cause permanent effects or all shocks dissipate over time. Unemployment rates are either I(1) or I(0). That means that the hysteresis and natural-rate hypotheses are mutually exclusive hypotheses over the history of the data. Rejecting the unit root is consistent with the natural-rate hypothesis, and failing to reject the unit root is consistent with the hysteresis hypothesis. In more general terms, this also means that unemployment rate persistence is an inherent unchanging characteristic of the economy and, thus, invariant to policy shifts.

Substantial evidence exists that the properties of many macroeconomic variables, such as inflation and the unemployment rate, are unstable across time, often displaying both stationary and non-stationary structures within the history of the data (see, e.g., Stock and Watson 1996, and the reviews in Kim 2000 and Leybourne et al. 2003). Thus, a deeper and more important issue than whether the unemployment rate is an I(0) or an I(1) process, is whether the persistence of the unemployment rate changes over time [i.e., whether the order of integration of unemployment rate changes over the history of the data, from I(1) to I(0) or from I(0) to I(1)]. The characterization of the unemployment rate into separate I(0) and I(1) segments has important implications for effective model building and accurate forecasting (Leybourne et al. 2003) and relates directly to the timing and effectiveness of policy decisions. That is, the unemployment rate may change between I(1) and I(0) regimes, rather than simply exhibiting only I(1) or I(0) dynamics throughout the data. This is indeed the essence of the Lucas critique, according to which parameters of macroeconomic models do not remain stable as policy makers change their behavior. A non-exhaustive list of macroeconomic variables for which observable changes in persistence occur include inflation (Kim 2000; Busetti and Taylor 2004; Halunga et al. 2009; Chiquiar et al. 2010), real interest rates (Haug 2014; Apergis et al. 2015), real output (Leybourne et al. 2007b), the government deficit (Kim 2000), exchange rates (Gadea and Gracia 2009; Gabas et al. 2011), and the unemployment rate (Fosten and Ghoshray 2011; Ghoshray and Stamatogiannis 2015).

The literature on breaks in persistence is less extensive than the standard unit-root literature and generally more recent.Footnote 2 Two groups of tests exist in the literature. The first group, called ratio-based tests, tests the null of stationarity against the alternative of a change in persistence and includes Kim (2000), Busetti and Taylor (2004), Leybourne and Taylor (2004), Leybourne et al. (2007a) and Taylor and Leybourne (2004). The second group of tests, called regression-based tests, takes the unit root as the null and includes Leybourne et al. (2003), and Kurozumi (2005). These tests detect a single change in persistence, but do not allow for multiple changes.

Recently, Kejriwal et al. (2013) proposed a new approach (KPZ test) to detect single and multiple structural breaks in persistence and, for our purposes, to locate endogenously periods of hysteresis and periods of the natural rate. Their methodology uses sup-Wald tests, where they test the null hypothesis that the time series follows an I(1) process throughout the sample period against the alternative hypothesis that the time series alternates between I(0) and I(1) regimes. We only found two uses of this test to unemployment rates in the USA and the UK (Ghoshray and Stamatogiannis 2015) and to real exchange rates (Gabas et al. 2011).

We apply the KPZ test to investigate whether the order of integration of monthly unemployment rates of 20 metropolitan economies and the USA has changed over the period 1990–2016 and, in particular, whether the change takes place as a result of reactions to recessionary shocks. Recessions generate system-wide shocks that periodically interrupt and disrupt the process of economic development. Three major recessionary shocks have hit the USA during the past thirty years: in the early 1990s (1990:7–1991:5), the early 2000s (2001:3–2001:11), and, most recently, the Great Recession (2007:12–2009:6). The dates in parenthesis are the NBER recession dates. We define a metropolitan economy as a metropolitan statistical area (MSA). As defined by the US Office of Management and Budget, a MSA is a statistical designation of a US geographical region that contains a core urban area (nucleus) with a relative high population density, together with adjacent communities that have a high degree of social and economic integration with that core.

Most tests on the hysteresis hypothesis in the USA associate with the national unemployment rate. The dynamics of metropolitan unemployment rate persistence has received little, if any, attention in the literature,Footnote 3 but can offer an important and interesting perspective on the structure of the US labor markets, the regional sensitivity of regional labor markets to recessionary shocks, and, in general, on the “geography of recessions.” Do the dynamics of persistence of unemployment rates follow the same pattern across the metropolitan areas? Do the dynamics of metropolitan unemployment rates depart from the dynamics of the nationwide rate? The deep financial and economic crisis that swept across much of the world in 2008–2010 has directed attention to the resilience of local and regional economies to these events. Labor market dynamics differ across MSAs, and the effect of recessionary shocks does not fall uniformly across geography (Decressin and Fatás 1995). The nationwide unemployment rate aggregates heterogeneous local dynamics and may conceal important disparities that exist between unemployment rates at the metropolitan level. Differences in population, stocks of human capital, and industrial composition in different metropolitan areas may prevent national economic shocks from affecting the local labor markets in an undifferentiated manner. Even within a highly developed country like the USA, large differences in wages, labor force participation rates, and employment rates across local labor markets still exist (see, e.g., Partridge and Rickman 1995, 1997; Murphy and Payne 2002). Thus, the analysis of the unemployment rate dynamics at the metropolitan level proves important not only per se, but also because differences in unemployment rates, together with differences in labor productivity and labor force participation rates, exert a significant influence on inequalities in local per capita income (Drennan et al. 2004).

The application of the KPZ test explores the role of the Great Recession in defining the stochastic properties of the unemployment rate series. The Great Recession generated the most severe downturn in the postwar era and the subsequent recovery followed a faltering and uneven path. During the Great Recession, the US economy lost more than 7.5 million jobs and the unemployment rate peaked at more than 10% in 2009, persisting near this level through 2010 and 2011. This represents the most substantial systemic shock to the US economy since the Great Depression. The Great Recession also witnessed a sharp and widespread increase in unemployment rates across MSAs. Every MSA experienced significant increases in the unemployment rate, and the average MSA saw the unemployment rate nearly double between 2007 and 2009. Possibly even more important, unemployment duration more than doubled from the previous peak in the post-WWII period. Since the recent crisis in the US labor markets represents a rare event not seen since the Great Depression, the most recent data may highlight alternative ways to view the dynamics of unemployment rates (Cheng et al. 2012). From standard unit-root tests, one concludes that either all shocks cause permanent effects or all shocks dissipate over time. Standard unit-root tests do not allow for the possibility that while most shocks dissipate, a few remain as permanent shocks, which reflect structural breaks.

One issue that arises in unit-root testing when using high-frequency data is whether to conduct the tests on seasonally adjusted or seasonally unadjusted data. A long tradition exists in time-series econometrics that applies unit-root tests to seasonally adjusted data (see, e.g., Song and Wu 1998; Romero-Ávila and Usabiaga 2007; Arestis and Biefang-Frisacho Mariscal 1999, 2000; Cheng et al. 2012). In the context of non-stationary series, Ghysels (1990) and Ghysels and Perron (1993, 1996) conclude from both analytical and Monte Carlo perspectives that the use of seasonally adjusted data raises several practical problems. Among others, the standard seasonal adjustment procedures, such as the filters used in the Census methodology, generally lead to a high-order non-invertible moving average (MA) component in the adjusted data. As (zero-frequency) unit-root tests do not satisfactorily deal with a high-order non-invertible MA, inference about the presence of unit roots can be unreliable for seasonally adjusted data. Ghysels and Perron (1993) show that the standard unit-root tests lack power and are biased toward the non-rejection of the unit-root hypothesis when applied to seasonally adjusted data. Furthermore, Ghysels and Perron (1996) indicate that unit-root tests with structural change tend to disguise structural instability. These arguments suggest, at the very least, that we should exercise care when testing for unit roots using seasonally adjusted data, and, when possible, we should confirm these unit-root results with seasonally unadjusted data.

The rest of the paper is organized as follows: Section 2 provides a brief overview of the KPZ test. Section 3 presents the empirical results of standard unit-root tests and the KPZ testFootnote 4 with both seasonally adjusted and seasonally unadjusted data. Section 4 concludes.

2 The KPZ test

To test for a change in persistence, Kejriwal et al. (2013) consider a process, \(y_t\), which is generated by

for \(t\in [T_{i-1} +1,T_i ]\), \(i=1,\dots ,m+1\), \(T_0 =0, T_{m+1} =T\), where T is the sample size. The error sequence \(u_{it} \) is assumed to follow a stationary linear process. There are m breaks in persistence and m+1 regimes. The null hypothesis is that \(y_t \) is I(1) throughout the sample (i.e., \(H_0 :c_i =c \hbox { and } \alpha _i =1)\). The data generating process (DGP) is

Unlike Leybourne et al. (2003), Kejriwal et al. (2013) distinguish the direction of change and consider two models. In model A, \(y_t \) alternates between I(1) and I(0) with a unit root in the first regime. In model B, \(y_t \) alternates between I(0) and I(1) with I(0) in the first regime. To account for the possibility of residual autocorrelation, Kejriwal et al. (2013) consider the following regression

where the coefficients \(\pi _j \) do not change between regimes. Kejriwal et al. (2013) consider three Wald-type tests. The first test applies when the alternative involves a fixed number \(m=k\) changes in persistence.

For model \(\hbox {A}\), the test is defined as

Similarly, for model \(\hbox {B}\), the test is defined as

In Eqs. (4)–(7), \(\lambda =(\lambda _1 ,\ldots ,\lambda _m )\) is the vector of break fractions with \(\lambda _i =T_i /T\) and \(\hbox {SSR}_0 \) denotes the sum of squared residuals under \(H_0 \) [i.e., obtained from OLS estimation of Eq. (3) under the constraints \(c_i =c\) and \( \alpha _i =1\) for all i]. Similarly, \(\hbox {SSR}_{A,k} \) and \(\hbox {SSR}_{B,k} \) denote the sum of the squared residuals obtained from estimating Eq. (3) under the restrictions imposed by model A and model B, respectively. The sup-Wald tests for model A and model B are then defined as

respectively, where \(\Delta \) is the set of permissible break fractions. The second Wald-type test uses the presumption that persistence in the first regime is unknown [i.e., no prior knowledge exists that the initial regime is I(0) or I(1)]. The test is then computed as

Finally, the third test accommodates the case where both the number of breaks and the order of integration in the first regime are unknown. The test is given by

where M is the maximum number of breaks set a priori.

3 Empirical results

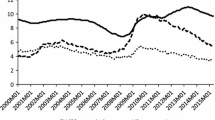

The data consist of monthly unemployment rates in 20 major US MSAs, namely Atlanta, Boston, Charlotte, Chicago, Cleveland, Dallas, Denver, Detroit, Las Vegas, Los Angeles, Miami, Minneapolis, New York, Phoenix, Portland, San Diego, San Francisco, Seattle, Tampa, and Washington, DC, as well as the US national rate. The MSAs match the 20 MSAs that comprise the S&P CoreLogic Case-Shiller Composite Home Price NSA Index. The data cover the period of 1990:1–2016:12, yielding 324 observations. We measure all unemployment rate series in percent. The unadjusted data come from the US Bureau of Labor Statistics and downloaded from the Federal Reserve Economic Data (FRED) database at the Federal Reserve Bank of St Louis at http://research.stlouisfed.org/fred2. The seasonally adjusted data are obtained using the X-12 seasonal adjustment procedure of the US Census.

We proceed in two steps. First, we apply standard unit-root tests to the data to establish the “apparent” order of integration of the series. Then, to expose any possible change in the order of integration, we implement the KPZ test for a change in persistence.

3.1 Standard unit-root tests

Table 1 reports the results of the augmented Dickey–Fuller (ADF) test (Dickey and Fuller 1981) and the Phillips–Perron (PP) test (Phillips and Perron 1988) using seasonally adjusted and unadjusted data applied to each of the 20 MSA unemployment rates and to the US unemployment rate. All tests include an intercept, but not a trend. We determine the lag structure of the ADF tests using the modified SIC with a maximum number of lags equal to 16. The bandwidth of the PP tests is based on the Newey–West procedure using the quadratic spectral kernel.

The results of the tests using seasonally adjusted data provide solid, uniform, and strong evidence in favor of the hysteresis hypothesis in the unemployment rate both at the MSA and at the national levels. These findings imply that the seasonally adjusted metropolitan and US unemployment rates do not fluctuate around a constant mean. This, in turn, rejects the traditional natural-rate hypothesis and suggests that metropolitan labor market shocks are not short-lived. The use of seasonally unadjusted data, however, weakens the findings of a unit root in seasonally adjusted data, particularly in the ADF case, which is generally associated with lower p values, and with Chicago, Los Angeles, San Diego, San Francisco, Seattle, and Tampa on the borderline of rejecting the hysteresis hypothesis. Thus, the use of seasonally adjusted data yields a higher probability for the non-rejection of the null hypothesis, which reflects the bias discussed by Ghysels (1990) and Ghysels and Perron (1993).

The ADF and PP tests, however, suffer from low power when the autoregressive parameter approaches unity (DeJong et al. 1992; Elliott et al. 1996) and display significant size distortions in the presence of a large negative MA root (Perron and Ng 1996). Consequently, to address the concerns of low power and size distortions, we also perform the four modified tests (M-unit root tests) developed by Ng and Perron (2001), which address both problems and exhibit maximum power against I(0) alternatives. Tables 2 and 3 display the results of the four M-unit root tests for the seasonally adjusted and unadjusted data, respectively. In Tables 2 and 3, \(\hbox {MZ}_{\upalpha }\) and \(\hbox {MZ}_{\mathrm{t}}\) are the modified Phillips–Perron (1988) tests, MSB is the modified Sargan and Bhargava (1983) test, and \(\hbox {MP}_{\mathrm{T}}\) is the modified version of the point optimal test by Elliott et al. (1996). The bandwidth in each test is selected based on the Newey–West procedure using the quadratic spectral kernel.

The \(\hbox {MZ}_{\upalpha }\) and MSB tests with seasonally adjusted data do not reject the hysteresis hypothesis for all 20 MSAs and the US unemployment rates. The p values of their respective test statistics all exceed 0.10. For the \(\hbox {MZ}_{\mathrm{t}}\) and \(\hbox {MP}_{\mathrm{T}}\) tests, Dallas and Seattle fall on the borderline of rejecting the null hypothesis. Using seasonally unadjusted data, the evidence in favor of hysteresis weakens with Boston, Chicago, Cleveland, and Minneapolis on the borderline of rejecting the hysteresis hypothesis. Overall, the use of unadjusted data weakens the support for the hysteresis hypothesis, but, in final analysis, does not reject it, at least at the 5% level. Shocks to the US and MSA unemployment rates, including the shocks of the Great Recession, exert permanent effects, although at different probability levels.

Still, we do not wish to over-interpret these findings. Even though our empirical results appear at first glance to favor the hysteresis hypothesis, we interpret them with caution, as they do not accommodate changes in unemployment persistence. Thus, the next subsection extends the unit-root analysis and reexamines the unemployment rate data using the KPZ test, which allows for one or more switches in the order of integration between I(1) and I(0).

3.2 Test for changes in persistence

Following Ghoshray and Stamatogiannis (2015), we choose to report only the findings of the Wmax test to avoid imposing a priori arbitrary restrictions on both the numbers of breaks and the nature of the persistence in the first regime. For all series, we use the specification that includes an intercept, but no trend. We set the maximum number of breaks to five (i.e., \(M = 5\)) and obtain the number of lags according to the SIC with a maximum lag length equal to 16. We also employ a trimming parameter of 0.15. The construction of the Wald test uses the dynamic programming algorithm of Perron and Qu (2006), which minimizes the global sum of squares.

Tables 4 and 5 display the results of the KPZ test for the seasonally adjusted and unadjusted data, respectively, under the null of I(1). No matter the type of data used in the tests, when the null of I(1) is rejected, the dominant model of unemployment persistence is Model A, [i.e., the initial regime is an I(1) process]. The final regime is also an I(1) process.

From Table 4, we can identify three different groups of MSAs. The first group, which includes Cleveland, Denver, Las Vegas, Los Angeles, Phoenix, and Portland, does not exhibit any change in the seasonally adjusted unemployment rate persistence. In this group, the unemployment rates exhibit no stationary regimes over the whole sample. The unemployment rate follows an I(1) process throughout the data, and thus, hysteresis dominates the dynamics of the seasonally adjusted unemployment rates. In the second group, which includes Atlanta, Boston, Charlotte, Chicago, Detroit, Miami, Minneapolis, New York, San Diego, San Francisco, Seattle, Tampa, and Washington DC, as well as the USA, seasonally adjusted unemployment rate persistence is unstable. One stationary regime exists in this group of MSAs, so that the unemployment rate follows an I(1)–I(0)–I(1) switching process. The third group includes only Dallas and is the only case in which two stationary regimes exist, so that the unemployment rate follows an I(1)–I(0)–I(1)–I(0)–I(1) switching process.

The seasonally adjusted national unemployment rate is I(1) in 1990:02–2004:08, switches to I(0) in 2004:9–2008:7, and returns to I(1) in 2008:8–2016:12, implying that the Great Recession and its aftermath experienced unemployment rate hysteresis, while the pre-Great Recession period experienced the natural rate. Thus, the Great Recession switches the dynamics of the seasonally adjusted nationwide unemployment rate from I(0) to I(1). A similar pattern also occurs in eight MSAs. The dates of the I(1)–I(0)–I(1) breaks in persistence in the seasonally adjusted national unemployment rate coincide closely with the switching dates of the I(1)–I(0)–I(1) break in persistence in eight MSAs: Boston, Charlotte, Detroit, Miami, Minneapolis, San Francisco, Seattle, and Tampa, suggesting that the dynamics of unemployment rate persistence in these MSAs parallels the dynamics of unemployment rate persistence in the national unemployment rate. For these MSAs, the Great Recession and its aftermath experienced unemployment rate hysteresis. Conversely, the seasonally adjusted unemployment rate in Atlanta, Chicago, Dallas, New York, San Diego, and Washington DC during the Great Recession and its aftermath follow an I(0) process. For Atlanta, the I(0) process starts on 2007:2. For Chicago, Dallas, San Diego, and Washington DC, the switch to I(0) occurs on 2007:7, while New York exhibits the change in persistence a few months later. The I(0) segment lasts an average of four years before the unemployment rate switches back to I(1). Except for Dallas during the early 2000s recession, we do not find a stationary regime in the proximity of the recessions of the early 1990s and 2000s.

Important differences exist between the tests results using seasonally adjusted data and the test results using unadjusted data. From Table 5, we also identify three different groups of MSAs. In the first group, which includes Atlanta, Boston, Chicago, Cleveland, Dallas, Denver, Las Vegas, Los Angeles, New York, Phoenix, San Francisco, Seattle and Washington DC, as well as the USA, the seasonally unadjusted unemployment rate does not exhibit any change in persistence. For five MSAs in the group (Cleveland, Denver, Las Vegas, Los Angeles, and Phoenix), we also cannot reject the null of I(1) using seasonally adjusted data. The remaining eight MSAs (Atlanta, Boston, Chicago, Dallas, New York, San Francisco, Seattle, and Washington DC) as well as the USA exhibit a change in persistence only when we use seasonally adjusted data. In the second group, which includes Charlotte, Detroit, Miami, Minneapolis, San Diego and Tampa, the unadjusted unemployment rate persistence is unstable. One stationary regime exists in this group of MSAs so that the unemployment rate follows an I(1)–I(0)–I(1) switching process. Finally, the third group includes Portland, the only case in which two stationary regimes are detected, so that the unadjusted unemployment rate follows an I(1)–I(0)–I(1)–I(0)–I(1) switching process.

The unadjusted US unemployment rate is I(1) before, during, and after the Great Recession, implying that the Great Recession does not switch the dynamics of persistence of the US seasonally unadjusted unemployment rate. Conversely, the Great Recession switches the dynamics of the US seasonally adjusted unemployment rate. The dates of the I(1)–I(0)–I(1) switching coincide closely with the dates of the Great Recession. The seasonally unadjusted unemployment rate in Charlotte, Detroit, Miami, and Portland during the Great Recession and its aftermath follows an I(1) process. For Detroit, the I(1) process starts in 2007:08. For Charlotte, Miami, and Portland, the I(1) process starts in 2008:5, 2008:9, and 2008:6, respectively. Conversely, the seasonally unadjusted unemployment rate in Minneapolis, San Diego, and Tampa during the Great Recession and its aftermath follows an I(0) process. For Tampa, the I(0) process starts in 2006:7 and lasts approximately four years. For Minneapolis and San Diego, the I(0) process starts in 2007:2 and 2007:7, respectively, and lasts approximately five years. We do not find a stationary regime in the proximity of the recession of the early 1990s and 2000s.

In sum, we make two additional observations. First, the results of the standard unit-root tests lead erroneously to infer that the unemployment rate series are I(1) throughout the sample period. The KPZ test results explain these findings, since the I(1) segments of the unemployment rates series dominate the I(0) segments. Second, the results of the KPZ test are particularly revealing of the heterogeneity of the US labor markets and suggest that the Great Recession shock exerted permanent effects in some MSAs and only temporary effects in others.

4 Conclusions

The issue of whether the unemployment rate follows an I(0) or I(1) process has been the subject of a long debate. A deeper issue, however, is whether we can better characterize the unemployment rate by a change in persistence between separate I(1) and I(0) regimes rather than simply as only an I(1) or I(0) process. We test this hypothesis by applying the change of persistence test by Kejriwal et al. (2013) to the unemployment rates of 20 MSAs and the USA. We use monthly observations over the period 1990:1–2016:12 and apply the test to seasonally unadjusted and seasonally adjusted data.

Notable differences exist between the tests results using seasonally adjusted and unadjusted data. Using seasonally adjusted data, we find that the unemployment rate in six MSAs does not experience a change in persistence and remains I(1) over the entire sample period. In thirteen MSAs and the USA, the unemployment rate follows an I(1)–I(0)–I(1) switching process. Finally, in one MSA, the unemployment rate experiences two stationary regimes and follows an I(1)–I(0)–I(1)–I(0)–I(1) switching process. Using seasonally unadjusted data, however, we find that the unemployment rate in thirteen MSAs does not exhibit a change in persistence and remain I(1) over the entire sample period. In six MSAs, the unemployment rate follows an I(1)–I(0)–I(1) switching process. Finally, in one MSA, the unemployment rate experiences two stationary regimes and follows an I(1)–I(0)–I(1)–I(0)–I(1) switching process.

While the pure statistical approach undertaken in this paper cannot identify the economic reasons that may cause the changes in unemployment rate persistence, our findings suggest that the Great Recession associates with regime switching. We find that with seasonally adjusted data, the Great Recession associates with a change in persistence from I(0) to I(1) in eight MSAs and the USA and to a change from I(1) to I(0) in six MSAs. Further, with seasonally unadjusted data, the Great Recession only associates with a change in persistence from I(0) to I(1) in four MSAs and to a change from I(1) to I(0) in three MSAs. This differential resilience to the shocks of the Great Recession provides a new aspect of the heterogeneity of the US labor markets.

Notes

We note that the mainstream macroeconomic literature differs somewhat from the recent econometric literature on the use of the term “persistence.” In the former case, persistence refers to the speed of adjustment of a macroeconomic process to economic shocks and is generally measured by the sum of the coefficients in an autoregressive process, which is assumed to be I(0). In contrast, the literature on breaks in persistence concerns switches in the order of integration of the process.

A few analyses use state-level data in conjunction with panel unit-root tests. Song and Wu (1997), using the Levin et al. (2002) panel unit-root test, find that hysteresis does not characterize the unemployment rate dynamics of the US states. León-Ledesma (2002) reaches similar conclusions, using the Im et al. (2003) panel unit-root test. Cheng et al. (2012), on the contrary, employing the PANIC method that permits cross-sectional dependence between the US states find strong evidence of hysteresis in state-level data, especially when the tests include the new data from the recent Great Recession. Clemente et al. (2005) use national, regional, and state-level data to construct panels for the nine divisions and four regions considered by the US Census. They provide evidence against a unit root for the US economy and most of the US states. The evidence against a unit root weakens when considering the Census nine divisions, and even weaker when considering the four Census regions. They conclude, therefore, suggesting that the time-series properties of the unemployment rate may depend, among other things, on the assumed level of disaggregation. García-Cintado et al. (2015) find strong support for the hysteresis hypothesis in Spanish regional unemployment rates. Lanzafame (2012) rejects the hysteresis hypothesis in Italian regional unemployment rates. Fallahi and Rodriguez (2011) investigate the degree of persistence in the Canadian provinces allowing for structural breaks and find evidence against the hysteresis hypothesis.

Although the issue of seasonal adjustment does not appear to have received attention in the context of tests of change in persistence, the issue may prove even more important in this context, since the tests relate to the long-run properties of the data. Halunga et al. (2009) also use both seasonally adjusted and seasonally unadjusted monthly data to analyze changes in inflation persistence in the UK.

References

Alogoskoufis G, Manning A (1988) Wage setting and unemployment persistence in Europe, Japan and the USA. Eur Econ Rev 32:698–706

Apergis N, Christou C, Payne JE, Saunoris JW (2015) The change in real interest rate persistence in OECD countries: evidence from modified panel ratio tests. J Appl Stat 42:202–213

Arestis P, Biefang-Frisacho Mariscal I (1999) Unit roots and structural breaks in OECD unemployment. Econ Lett 65:149–156

Arestis P, Biefang-Frisacho Mariscal I (2000) OECD unemployment: structural breaks and stationarity. Appl Econ 32:399–403

Bianchi M, Zoega G (1998) Unemployment persistence: Does the size of the shock matter? J Appl Econom 13:283–304

Blanchard O, Summers LH (1986) Hysteresis and the European unemployment problem. In: Fisher S (ed) NBER Macro Ann 1986. MIT Press, Cambridge

Blanchard O, Summers LH (1987) Hysteresis in unemployment. Eur Econ Rev 31:288–295

Brunello G (1990) Hysteresis and ‘the Japanese unemployment problem’: a preliminary investigation. Oxf Econ Pap 42:483–500

Busetti F, Taylor AMR (2004) Tests of stationarity against a change in persistence. J Econom 123:33–66

Camarero M, Tamarit C (2011) Hysteresis vs. natural rate of unemployment: new evidence for OECD countries. Econ Lett 84:413–417

Camarero M, Carrion-i-Silvestre JL, Tamarit C (2006) Testing for hysteresis in unemployment in OECD countries: new evidence using stationarity panel tests with breaks. Oxf Bull Econ Stat 68:167–182

Cheng KM, Durmaz N, Kim H, Stern M (2012) Hysteresis vs. natural rate of US unemployment. Econ Model 29:428–434

Chang T, Lee KC, Nieh CC, Wei CC (2005) An empirical note on testing hysteresis in unemployment for ten European countries: panel SURADF approach. Appl Econ Lett 12:881–886

Chiquiar D, Noriega A, Ramos-Francia M (2010) A time-series approach to test a change in inflation persistence: the Mexican experience. Appl Econ 42:3067–3075

Clemente J, Lanaspa F, Montañés A (2005) The unemployment structure of the US states. Q Rev Econ Finance 45:848–868

Coakley J, Fuertes AM, Zoega G (2001) Evaluating the persistence and structuralist theories of unemployment. Stud Nonlinear Dyn Econ 5:179–202

Decressin J, Fatás A (1995) Regional labor market dynamics in Europe. Eur Econ Rev 39:1627–1655

DeJong D, Nankervis J, Savin N, Whiteman C (1992) The power problems of unit root tests for time series with autoregressive errors. J Econom 53:323–43

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Drennan MP, Lobo J, Strumsky D (2004) Unit root tests of sigma income convergence across us metropolitan areas. J Econ Geogr 4:583–595

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Fallahi F, Rodriguez G (2011) persistence of unemployment in the Canadian provinces. Int Reg Sci Rev 34:438–458

Fosten J, Ghoshray A (2011) dynamic persistence in the unemployment rate of OECD countries. Econ Mod 28:948–954

Friedman M (1968) The role of monetary policy. Am Econ Rev 58:1–17

Gabas S, Gadea MD, Montañés A (2011) Change in the persistence of the real exchange rates. Appl Econ Lett 18:189–192

Gadea MD, Gracia AB (2009) European monetary integration and persistence of real exchange rates. Financ Res Lett 6:242–249

García-Cintado A, Romero-Ávila D, Usabiaga C (2015) Can the hysteresis hypothesis in Spanish regional unemployment be beaten? New evidence from unit root tests with breaks. Econ Mod 47:244–252

Ghysels E (1990) Unit root tests and the statistical pitfalls of seasonal adjustment: the case of U.S. post war real GNP. J Bus Econ Stat 8:145–152

Ghysels E, Perron P (1993) The effect of seasonal adjustment filters on tests for a unit root. J Econom 55:59–99

Ghysels E, Perron P (1996) The effect of linear filters on dynamic time series with structural change. J Econom 70:69–97

Ghoshray A, Stamatogiannis MP (2015) Centurial evidence of breaks in the persistence of unemployment. Econ Lett 129:74–76

Gil-Alana LA, Henry SGB (2003) Fractional integration and the dynamics of the UK unemployment. Oxf Bull Econ Stat 65:221–240

Halunga AG, Osborn DR, Sensier M (2009) Changes in the order of integration of US and UK inflation. Econ Lett 102:30–32

Haug A (2014) On real interest rate persistence: the role of breaks. Appl Econ 46:1058–1066

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115:53–74

Kejriwal M, Perron P, Zhou J (2013) Wald tests for detecting multiple structural changes in persistence. Econom Theory 29:289–323

Kim J (2000) Detection of change in persistence of a linear time series. J Econom 95:97–116

Kurozumi E (2005) Detection of structural change in the long-run persistence in a univariate time series. Oxf Bull Econ Stat 67:181–206

Lanzafame M (2012) Hysteresis and the regional NAIRU’s in Italy. Bull Econ Res 64:415–429

Lee C-F (2010) Testing for unemployment hysteresis in nonlinear heterogeneous panels: international evidence. Econ Mod 27:1097–1102

Lee C, Chang C (2008) Unemployment hysteresis in OECD countries: centurial time series evidence with structural breaks. Econ Mod 25:312–325

León-Ledesma MA (2002) Unemployment hysteresis in the US states and the EU: a panel approach. Bull Econ Res 54:95–103

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data asymptotic and finite-sample properties. J Econom 108:1–24

Leybourne SJ, Kim T, Newbold P, Smith V (2003) Tests for a change in persistence against the null of difference-stationarity. Econom J 6:291–311

Leybourne S, Kim T, Taylor AM (2007a) CUSUM of squares-based tests for a change in persistence. J Time Ser Anal 28:408–433

Leybourne S, Kim T, Taylor AM (2007b) Detecting multiple changes in persistence. Stud Nonlinear Dyn Econ 11:1–23

Leybourne S, Taylor R (2004) On tests for changes in persistence. Econ Lett 84:107–115

Mitchell WF (1993) Testing for unit roots and persistence in OECD unemployment rates. Appl Econ 25:1489–1501

Murphy KJ, Payne JE (2002) Explaining change in the natural rate of unemployment: a regional approach. Q Rev Econ Finance 190:1–24

Murray CJ, Papell DH (2000) Testing for unit roots in panels in the presence of structural change with an application to OECD unemployment. In: Baltagi BH (ed) Nonstationary panels, panel cointegration and dynamic panels (Advances in econometrics 15). JAI Press, Amsterdam, pp 223–238

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Partridge MD, Rickman DS (1995) Differences in state unemployment rates: the role of labor and product market structural shifts. South Econ J 62:89–106

Partridge MD, Rickman DS (1997) The dispersion of U.S. state unemployment rates: the role of market and non-market factors. Reg Stud 31:593–606

Perron P, Qu Z (2006) Estimating restricted structural change models. J Econom 134:373–399

Perron P, Ng S (1996) Useful modifications to unit root tests with dependent errors and their local asymptotic properties. Rev Econ Stud 63:435–465

Phelps ES (1967) Phillips curves, expectations of inflation and optimal unemployment over time. Economica 34:254–281

Phelps ES (1994) Structural slumps: the modern equilibrium theory of unemployment, interest, and assets. Harvard University Press, Cambridge

Phelps E, Zoega G (1998) Natural rate theory and OECD unemployment. Econ J 108:782–801

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Romero-Ávila D, Usabiaga C (2007) Unit root tests, persistence, and the unemployment rate of US states. South Econ J 73:698–716

Romero-Ávila D, Usabiaga C (2008) On the persistence of Spanish unemployment rates. Empir Econ 35:77–99

Romero-Ávila D, Usabiaga C (2009) The unemployment paradigms revisited: a comparative analysis of US state and European unemployment. Contemp Econ Policy 27:321–334

Roed K (1996) Unemployment hysteresis—macro evidence from 16 OECD countries. Empir Econ 21:589–600

Sargan JD, Bhargava A (1983) Testing residuals from least squares regression for being generated by the Gaussian random walk. Econometrica 51:153–174

Song FM, Wu Y (1997) Hysteresis in unemployment: evidence from 48 U.S. states. Econ Inq 35:235–243

Song FM, Wu Y (1998) Hysteresis in unemployment: evidence from OECD countries. Q Rev Econ Finance 38:181–192

Stock JH, Watson MW (1996) Evidence on structural instability in macroeconomic time series relations. J Bus Econ Stat 14:11–30

Taylor R, Leybourne S (2004) Some new tests for a change in persistence. Econ Bull 3:1–10

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Canarella, G., Gupta, R., Miller, S.M. et al. Unemployment rate hysteresis and the great recession: exploring the metropolitan evidence. Empir Econ 56, 61–79 (2019). https://doi.org/10.1007/s00181-017-1361-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1361-z

Keywords

- Stationary and non-stationary data

- Seasonally unadjusted and Seasonally adjusted data

- Kejriwal–Perron–Zhou (KPZ) test

- Unemployment rate persistence