Abstract

We provide evidence on the relative importance of cyclical and structural factors in explaining unemployment, including the sharp rise in U.S. long-term unemployment during the Great Recession of 2007–09. About 75 % of the forecast error variance of unemployment is accounted for by cyclical factors—real GDP changes (“Okun’s Law”) and monetary and fiscal policies. Structural factors, which we measure using the dispersion of industry-level stock returns, account for the remaining 25 %. For long-term unemployment the split between cyclical and structural factors is closer to 60–40, including during the Great Recession. Examination of the industry-level stock returns suggests that adverse shocks to the construction sector and, to a lesser extent, the finance sector were responsible for the increase in structural unemployment. The Great Recession appears similar to the recession of 1973–75, as sectoral shocks played a large role at that time as well.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Are persistent increases in unemployment cyclical or structural? The question is timely and timeless. It is timely because the sharp run-up in U.S. unemployment rates since 2007 has triggered a debate on the contribution of structural factors. Krugman (2010) states that the present “high unemployment in America is the result of inadequate demand—full stop”, whereas Kocherlakota (2010) asserts that “firms have jobs, but can’t find appropriate workers. The workers want to work, but can’t find appropriate jobs.” It is timeless because nearly every persistent increase in unemployment over the past 100 years has been marked by a debate of this kind. For instance, the persistent unemployment of the Great Depression was attributed by some to “a great shortage of labor of certain kinds” (Clague 1935). Likewise, the causes of the high unemployment in Great Britain during the interwar years were a matter of intense debate then and to this day (see Benjamin and Kochin 1979; Brainard 1992; Nason and Vahey 2006).Footnote 1

During the Great Recession, the sharp increase in the U.S. unemployment rate from 4.4 % in May 2007 to 10.1 % in October 2009 was accompanied by a striking increase in the duration of unemployment. As shown in Fig. 1, while the average duration of unemployment has been inching upwards for a while, it rose sharply in the recession and continued to increase well after the peak in the unemployment rate. Recent readings, which show average unemployment spells in excess of 40 weeks, are about 20 weeks above the previous highest duration seen in data going back to the early 1960s.Footnote 2 Figure 2 shows the breakdown of unemployment by duration of unemployment spells, which underlie the changes in average duration. While short-term spells (less than 5 weeks) also showed an uptick, it is the increase in medium-term and long-term spells (greater than 27 weeks) that is particularly alarming.

The severity and persistence of output declines during the Great Recession have likely had a significant effect on unemployment (Elsby et al. 2010). However, a number of studies suggest that structural factors have played a part as well. Kirkegaard (2009) extends the analysis of Groshen and Potter (2003) to study structural and cyclical employment trends during the Great Recession. He finds that there has been a sharp increase in “the relative employment weight of industries undergoing structural change in the current cycle”, which he concludes “can be expected to increase the necessity for unemployed Americans to take new jobs in industries different from the ones in which they were previously employed.”

Other studies have looked for evidence of structural change in terms of mismatch in the labor market, and tend to find that while mismatch is not the dominant factor, it has played a non-negligible role in the increase in unemployment over the recession. Sahin et al. (2011) define mismatch as the distance between the observed allocation of unemployment across sectors and the allocation that would prevail under costless mobility. They find that between 0.8 and 1.4 percentage points of the increase in U.S. unemployment during the Great Recession can be attributed to mismatch. This corresponds to between 20 % and 25 % of the observed increase in unemployment. They also find industrial and occupational mismatches, rather than geographic mismatch, are the sources of the increased unemployment.

Barnichon and Figura (2010) find that until 2006, most of the changes in matching efficiency could be explained by changes in the composition of the unemployed (for instance, the relative prevalence of workers on temporary vs. permanent layoffs). Since 2006, however, composition has played a much diminished role relative to the role of “dispersion in labor market conditions, the fact that tight labor markets coexist with slack ones.” They estimate that in the 2008–2009 recession, the decline in aggregate matching efficiency added 1½ percentage points to the unemployment rate.

Estevao and Tsounta (2011) find that “increases in skill mismatches in states with worse housing market conditions … are associated with even higher unemployment rates, after controlling for all cyclical factors.” They suggest that this could be because “bad local housing conditions may slow the exodus of jobless individuals from a depressed area, thus raising equilibrium unemployment rates.” They estimate that the combined impact of skill mismatches and higher foreclosure rates might have raised the natural rate of unemployment by about 1½ percentage points since 2007. Lazear (2012) constructs a mismatch index based on the ratio of vacancies to unemployment. He concludes that while mismatch did rise substantially during the recent recession, it is no longer an issue for the labor market.

This paper provides further evidence on the role of structural factors in accounting for the recent rise in unemployment, especially the long-term component, using a different methodology. We use the stock market valuation of the firms in an industry to construct a measure of the shocks hitting that industry. More specifically, our measure of the intensity of structural shocks implements a conjecture by Black (1987) that periods of greater cross-industry dispersion in stock returns should be followed by increases in unemployment. The cross-industry dispersion of stock returns provides an “early signal of shocks that affect sectors differently, and puts more weight on shocks that investors expect to be permanent” (Black 1995). This latter point is important because it is presumably permanent shocks that motivate reallocation of labor across industries.

The paper makes three contributions relative to previous research on the topic (Loungani et al. 1990; Brainard and Cutler 1993; Loungani and Trehan 1997). First, it considerably extends the sample length to incorporate the last 20 years or so, an eventful period in US macroeconomic history. The extended sample confirms the main messages in earlier research—namely, that unemployment rates rise in the wake of persistent sectoral shocks, as proxied by the cross-industry dispersion of stock returns, and that these shocks account for a sizable fraction of unemployment rate fluctuations. Second, the share of unemployment fluctuations attributed to sectoral shocks increases substantially in moving from shorter duration to longer duration unemployment. In addition, long-duration unemployment exhibits very different response dynamics to innovations in the monetary policy and dispersion variables. These new results strengthen the case for a sectoral shifts interpretation of the empirical relationship between unemployment rates and the cross-industry dispersion of stock returns. Third, the paper provides evidence that the unusually large cross-industry dispersion of stock returns associated with the Great Recession helps explain why long-term unemployment has been such a prominent feature of its aftermath.

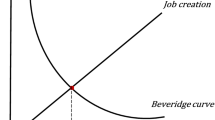

While not a direct test, our evidence provides support for theoretical work that assigns an important role to structural shocks. Phelan and Trejos (2000) show that permanent changes in sectoral composition can lead to aggregate downturns in a calibrated job creation/job destruction model of the U.S. labor market.

Section 2 deals with matters of measurement. The next two sections present the empirical evidence. In Sect. 3, we use bivariate regressions as in Romer and Romer (2004) to see how aggregate factors affect overall unemployment and long-term unemployment. Complementing this evidence, results from a VAR model are presented in Sect. 4. Section 5 concludes.

2 Measuring Sectoral Shocks and the Costs of Reallocation

Conditions in any given sector often evolve quite differently from the economy as a whole; witness the relative performance of the energy sector in the 1970s. Such differences in relative performance will typically be accompanied by a need to reallocate resources across sectors. This is likely to be an expensive, time consuming process. For instance, Lilien (1982) argues that labor reallocation is likely to take time because workers may have strong attachments arising from industry-specific skills and wage premiums associated with seniority. Search models suggest other reasons. In Phelan and Trejos (2000), reallocation is slow because the cost of creating a job is higher in the expanding sector.

Reallocation is likely to be costly in other ways as well. Lee and Wolpin (2006) estimate that the direct cost of an inter-sectoral move is 50–75 % of an individual’s annual earnings. In a study of the Aerospace sector, Ramey and Shapiro (2001) find that firms recover just 28 % of the replacement cost of capital sold during a sectoral downturn. Here, we follow Lilien (1982), as well as many others, who measure the costs of reallocation in terms of what happens in the labor market. More specifically, we estimate the effect that sectoral shocks have on the unemployment rate and—importantly—on the duration of unemployment.

Measuring sectoral shocks is not a straightforward exercise either. As pointed out by Barro (1986) and Davis (1985), sectoral shocks are typically unobservable disturbances to technology and preferences, and are unlikely to come repeatedly from the same source. One solution is to turn to the stock market, in the expectation that any kind of shock specific to a particular industry is likely to show up in the relative performance of that industry’s stock price. Importantly, permanent shocks to the industry are expected to have a larger impact on industry stock returns than temporary shocks.

Figure 3a and b provide some informal evidence in support. The top panel in Fig. 3a shows excess returns to homebuilders since the beginning of 2000. Excess returns turned negative in late 2005 and by early 2006 the (3 quarter average of the) excess return had fallen below −10 % per quarter. The middle panel shows the average duration of unemployment in the construction industry over the same period.Footnote 3 This is the average number of weeks for which workers whose last job was in the construction industry have been unemployed. Notice that duration in the construction sector does not begin to rise till early in 2008. The bottom panel shows duration in the construction industry relative to the aggregate economy. Here, again, it is the pronounced rise in relative duration since early 2008 that is noticeable.

The top panel of Fig. 3b shows excess returns in the commercial banking sector, while the bottom two panels show the average duration of unemployment in the finance industry.Footnote 4 The decline in excess returns here happens somewhat later than that for homebuilders, though by the end of 2006 excess returns are below −5 %. Both average and relative duration move up noticeably in 2008 and beyond.

These figures provide some informal evidence that stock prices can be used as early signals about sectoral shocks. But we still have to determine which sectors have been hit by sectoral shocks at any point in time. Instead of continuing with an industry by industry examination of stock market returns and labor market developments, we will employ a dispersion index, following previous work by Loungani et al. (1990), Brainard and Cutler (1993), and others. The hypothesis is that the dispersion of stock returns across industries can be used as a proxy for shocks to the desired allocation of labor, i.e., as a measure of sectoral shifts. For instance, the arrival of negative news regarding the relative profitability of a particular industry is likely to be followed by an increase in stock price dispersion. In the long run, this news is likely to shift the economy’s output mix away from the affected industry. This will necessitate a reallocation of resources, and the unemployment rate will rise as part of this process of reallocation of labor across sectors. Thus, an increase in stock price dispersion will be followed by an increase in the unemployment rate.

The stock market dispersion index follows Lilien (1982), who constructed a cross-industry employment dispersion index to proxy for the intersectoral flow of labor in response to allocative shocks. Subsequent researchers, most notably Abraham and Katz (1986), argued that employment dispersion may simply be reflecting the well-known fact that the business cycle has non-neutral effects across industries. An advantage of the stock price dispersion measure relative to Lilien’s measure is that unlike employment changes, stock prices respond more strongly to disturbances that are perceived to be permanent rather than temporary. The industry stock price represents the present value of expected profits over time. If the shocks are purely temporary, the innovations will have little impact on the present value of expected profits and, hence, will have little impact on industries’ stock prices. But persistent shocks will have a significant impact on expected future profits and will lead to large changes in industries’ stock prices. Thus, a dispersion index constructed from industries’ stock prices automatically assigns greater weight to permanent structural changes than to temporary cyclical shocks, and so will be less likely to reflect aggregate demand disturbances than a measure based on employment. Furthermore, it is these persistent shocks that are likely to cause productive resources, such as capital and labor, to move across industries.

For this paper, we update the stock market index used in earlier studies. The basic data consist of Standard and Poor’s indexes of industry stock prices, providing comprehensive coverage of manufacturing as well as nonmanufacturing sectors of the economy. The sectoral shifts index is defined as

where R it is the growth rate of industry i’s stock price index, R mt is the growth rate of the S&P500 (a composite index), and W i is a weight based on the industry’s share in total employment. Hence, the sectoral shifts index can be interpreted as the weighted standard deviation of industry stock returns.

Brainard and Cutler (1993) noted that some industry stock returns may be more cyclically sensitive, so aggregate shocks could increase the dispersion of returns. They introduced a modified measure that attempts to eliminate these cyclical effects by first regressing industry returns on market returns,

Then the dispersion index is constructed from the ‘excess returns,’ that is, the unexplained portions (intercepts and residuals) from the regressions (2).

Figure 4 shows the behavior of the two measures of stock price dispersion index for the U.S. over the period 1963–2012. As is evident, the two measures are highly correlated, with a correlation coefficient of 0.82. The results in the remained of the paper are unaffected by which of the two indices is used. Since the Brainard and Cutler (1993) measure is preferable in theory, the empirical results shown are based on that measure.

Recession periods are typically associated with an increase in the dispersion index. However, the magnitude of the increase in the index during a particular recession is not necessarily reflective of the depth of the recession. The index increases by much more during the 1974–75 recession than it does during the 1982 recession, even though the latter recession was more severe in terms of output loss and the increase in the unemployment rate. This evidence suggests that changes in the relative profitability of industries during a contraction are not closely correlated with the size of the contraction, which is consistent with the interpretation that different recessions are marked by different mixes of sectoral and aggregate shocks. Similarly, the dispersion index has also recorded increases during expansionary periods. The dot-com boom experienced in the late 1990s provides a clear example, as stock prices in the information, technology, and communication sectors experienced much more rapid gains than the market average.

3 Alternative Explanations for Changes in Unemployment by Duration

The behavior of the unemployment rate can potentially be influenced by a variety of factors, both cyclical as well as structural, not all of which can be simultaneously included in a moderately sized VAR. Accordingly, in this section we compare the effects of the dispersion index on unemployment rates (of different durations) with the effects of other key macroeconomic variables, using a single-equation framework similar to Romer and Romer (2004) and Cerra and Saxena (2008). Specifically, we regress changes in the unemployment rate (ΔU) on its own lags as well as lagged values of the various “shocks”. The lagged values allow for delays in the impact of the shocks on unemployment.Footnote 5 The estimated equation is

Four candidate shocks are evaluated using this framework. The first two are monetary and fiscal (tax rate) policy shocks, as identified by Romer and Romer (2004). Both these shocks are constructed so as to be exogenous to changes in output through the use of narrative records of the Federal Reserve Open Market Committee meetings, presidential speeches and Congressional reports. The third shock examined is related to oil prices, and is simply measured as the percentage change in the real price of oil. Finally, we look at the effect of changes in the stock price dispersion index. For each of these shocks, standard errors for the impulse response functions are estimated using a bootstrap method.Footnote 6

The impact of a one standard-deviation change in the various shocks on the level of the unemployment rate is shown in Fig. 5. The unemployment rate increases following each shock, though the magnitude and significance of the responses vary across shocks. The response of unemployment to a monetary policy tightening is particularly large and persistent. A one standard deviation shock to monetary policy results in an increase in the unemployment rate of more than 0.5 % after 2 years. Shocks to fiscal policy, on the other hand, are small and insignificant. In contrast, increases in the real price of oil are associated with increases in the unemployment rate, with the peak impact occurring after 2 years. Finally, increases in the dispersion index are associated with a positive and significant change in the unemployment rate. A 1 standard deviation increase in the index results in an increase in the unemployment rate of about 0.2 % after a year and a half.

The long term unemployment rate (where duration exceeds 26 weeks) responds very differently to these shocks; see Fig. 6. The typical response of the long-term unemployment rate to either a monetary policy shock, a fiscal policy shock or an increase in the real price of oil is small in magnitude and of the opposite sign to the response of the unemployment rate observed in Fig. 5. These responses are counter intuitive, but not significant at the 90 % confidence interval. The response of the long-term unemployment rate to an increase in the dispersion index, however, is positive (as it is in Fig. 5) and statistically significant. A one standard-deviation increase in the index results in a gradual increase in the long-term unemployment rate, peaking at around 0.1 percentage points after 2 years. Given that the average long-term unemployment rate in the U.S. for the last 40 years is about 0.9 %, the impact of changes in the dispersion index on long-term unemployment is relatively substantial.

The findings above highlight the importance of the dispersion index, relative to other standard macroeconomic factors, in explaining variations in unemployment—particularly, long-term unemployment. Given our results here, we will not carry over the fiscal policy and oil price variables into the next section. Before going further, it is worth pointing out that a regression of the dispersion index on lagged values of the monetary and fiscal policy shocks revealed that the index is not systematically correlated with these macro shocks.

4 Multivariate Specifications

In this section, we present the results from a VAR estimated on quarterly data from 1963:Q1 to 2012:Q4. The baseline model contains six variables, including the stock market dispersion index and the unemployment rate U t . The other variables are real GDP growth, inflation, the federal funds rate, and the growth rate of the S&P500 index, \( {R}_{mt} \). The inclusion of real GDP controls for the stage of the business cycle; it also means that our model allows for a version of “Okun’s Law.” The variable measuring returns on the S&P500 index is included to rule out the possibility that the dispersion index explains unemployment because it is mimicking the behavior of the aggregate stock market. Finally, following Bernanke and Blinder (1992), the fed funds rate is included as a measure of monetary policy. The system is identified following the standard recursive ordering procedure. To avoid exaggerating the role of the dispersion index, we place it last in the estimation ordering. The other variables in the system are ordered as follows: GDP growth is placed first, followed by on the growth rate of the S&P 500, the unemployment rate, inflation and the fed funds rate. The lag length is set at 4 quarters.

4.1 The Effects of Sectoral Shocks

Figure 7 shows how unemployment responds to different shocks to the system, along with the associated 90 % confidence intervals.Footnote 7 The unemployment rate declines following a shock to output growth, with a one standard deviation increase in the output growth rate leading to a nearly 0.3 percentage point decrease in the unemployment rate after 1 year. Innovations to the fed funds rate, meanwhile, result in higher unemployment. Focusing on the response of unemployment to innovations in the dispersion index, we see that the unemployment rate gradually increases, with the response reaching a peak of above 0.25 percentage points 2 years after the shock. The impact of these identified shocks to the dispersion index—purged of the aggregate influence of GDP, total market return, inflation and monetary policy—on unemployment is higher than what we obtained from the regressions shown in the last section.Footnote 8

The long-term unemployment rate (Fig. 8a) shows a hump shaped response to innovations in the dispersion index, just as the overall unemployment rate (Fig. 7). However, long-term unemployment reacts more gradually, reaching its peak closer to 3 years after the shock. The magnitude of the peak impact is again higher than what was found in the previous section. Long-term unemployment declines in response to output growth innovations, though just as with regards to dispersion shocks, the response is more delayed relative to the response of the overall unemployment rate. Long-term unemployment eventually increases following a shock to monetary policy, although the magnitude of the response is insignificant at the 90-percent confidence level. In contrast, the short-term unemployment rate (Fig. 8b) shows an insignificant response to innovations in the dispersion index, which supports the previous argument that the dispersion index mostly affects longer-duration unemployment.

A decomposition of the variance of unemployment forecast errors provides further evidence as to the importance of the dispersion index in explaining unemployment fluctuations. Tables 1 and 2 show the proportion of the forecast-error variance of overall unemployment and long-term unemployment, respectively, that is explained by the various shocks, given our identification scheme. At the 5-year horizon, close to a fourth of the variance of unemployment forecast errors is explained by innovations to the dispersion index. The proportion is much higher when we consider variations in long-term unemployment. Looking once again at the 5-year horizon, innovations to the dispersion index account for close to 40 % of the overall variance, making it more important than any other variable in the VAR, including the unemployment rate itself.

Figure 9 shows how the role played by dispersion shocks changes as we look at different durations of unemployment. For each duration of unemployment, the figure shows the proportion of the forecast error variance of the unemployment rate explained by innovations to the dispersion index at a 5 year horizon. In each case, the dispersion index is placed last in the ordering. The figure displays a striking pattern, where the proportion of the variation in unemployment explained by shocks to the dispersion index increases monotonically with the duration of unemployment. For short-term unemployment (less than 5 weeks), shocks to the dispersion index account for less than 5 % of the overall variation in the unemployment rate. But at the other end, where duration exceeds 26 weeks, dispersion shocks account for about 40 % of the variance of the forecast error.

4.2 Sectoral Shocks and Long-Term Unemployment During the Great Recession

We now use the VAR estimated above to examine long-term unemployment during the Great Recession. Long term unemployment (defined as those who were unemployed for more than 26 weeks) constituted 16 % of total unemployment in the fourth quarter of 2007 and 40 % in the fourth quarter of 2012. Notably, it has remained high despite a resumption of growth in output.

Figure 10 plots the long-term unemployment rate since the beginning of 2008, together with two forecasts. The base period for both forecasts is chosen to be the fourth quarter of 2007, the start of the recession as declared by the National Bureau of Economic Research. The forecast horizon extends to the fourth quarter of 2012, or 20 quarters. The line labeled “baseline projection” plots the conditional expectation of the long term unemployment rate over these 20 quarters as of 2007Q4. In other words, it is the VAR’s forecast of the long-term unemployment rate as of 2007Q4. For the first year of the forecast horizon, long-term unemployment remained close to the baseline projection. Subsequently, however, long-term unemployment increased dramatically. At its peak in the first half of 2010, the long-term unemployment rate was more than 2 ½ percentage points higher than the baseline value.

The third line in the chart shows what the VAR’s forecast of the long-term unemployment rate would have been if the orthogonalized dispersion shocks over the 2008Q1–2012Q4 period had been known at the end of 2007. Dispersion shocks turn out to be quite important in explaining the departure of the realized unemployment rate from the baseline forecast. From the beginning of 2009 up until the fourth quarter of 2012, shocks arising from the dispersion index accounted (on average) for more than 40 % of the difference between the actual long-term unemployment rate and its baseline projection. The contribution of shocks to GDP growth, on the other hand, was less than 15 % on average.

5 Conclusion

We have shown that structural shocks (as measured by an index of the cross section variance of stock prices) have a substantial impact on the unemployment rate in a sample that includes the Great Recession of 2007–2009 and the ‘Not-So-Great’ Recovery of 2010–12. Further, these shocks become more important as the duration of unemployment increases, a finding that accords with the intuition that such shocks should be associated with longer spells of search, as they cause workers to move across sectors.

An examination of the Great Recession shows that sectoral shocks account for close to half of the increase in the long duration unemployment rate that has taken place over this period. Once again, this accords with informal evidence about employment conditions in the construction sector and, to a lesser extent, in finance. In this, the Great Recession is similar to the recession of 1973–75, as sectoral shocks appear to have played a large role at that time as well.

We have also shown that our measure of cross section volatility does better the longer the duration of unemployment under consideration. This seems reasonable as our measure is meant to capture shocks that cause reallocation across sectors, and such reallocation takes time.

Notes

- 1.

- 2.

Effective January 2011, the Current Population Survey (CPS) was modified to allow respondents to report durations of unemployment of up to 5 years. Prior to that time, the CPS accepted unemployment durations of up to 2 years; any response of unemployment duration greater than this was entered as 2 years. For the first 6 months of 2011, the new measure of mean duration exceeded the old by 2.3 weeks on average.

- 3.

Homebuilders are a subset of the construction industry, but the unemployment data are only available at relatively high levels of aggregation. We are currently engaged in constructing matching unemployment and stock market series.

- 4.

Once again, commercial banks are a subset of the finance industry.

- 5.

A lag length of 4 quarters was found to be optimal.

- 6.

Specifically, 500 pseudo-coefficients are drawn from a multivariate normal distribution based on the estimates of the mean and variance-covariance matrix of the regression coefficient vector.

- 7.

Standard errors are computed using the statistics based on the asymptotic distribution.

- 8.

We also estimate the VAR using levels of variables with quadratic trends instead of the log of difference of the variables. The impact of dispersion on unemployment is reduced somewhat but it remain statistically significant and the variance decomposition is not much changed.

References

Aaronson, D., Rissman, E. R., & Sullivan, D. G. (2004). Can sectoral reallocation explain the jobless recovery? Economic Perspectives, Federal Reserve Bank of Chicago.

Abraham, K., & Katz, L. (1986). Cyclical unemployment: Sectoral shifts or aggregate disturbances? Journal of Political Economy, 94, 507–522.

Barnichon, R., & Figura, A. (2010). What drives matching efficiency? A tale of composition and dispersion. Finance and Economics Discussion Series, Federal Reserve Board, 2011-10.

Barro, R. J. (1986). Comment on ‘Do equilibrium real business theories explain postwar U.S. Business Cycles?’. NBER Macroeconomics Annual, 1, 135–139.

Benjamin, D., & Kochin, L. (1979). Searching for an explanation of unemployment in interwar Britain. Journal of Political Economy, 87(3), 441–478.

Bernanke, B., & Blinder, A. (1992). The Federal funds rate and the channels of monetary transmission. American Economic Review, 82(4), 901–921.

Black, F. (1987). Business cycles and equilibrium. New York: Basil Blackwell.

Black, F. (1995). Exploring general equilibrium. Cambridge: MIT Press.

Brainard, L. (1992). Sectoral shifts and unemployment in interwar Britain. NBER Working Paper No. W3980.

Brainard, L., & Cutler, D. (1993). Sectoral shifts and cyclical unemployment. Quarterly Journal of Economics, 108(1), 219–243.

Cerra, V., & Saxena, S. C. (2008). Growth dynamics: The myth of economic recovery. American Economic Review, 98(1), 439–457.

Clague, E. (1935). The problem of unemployment and the changing structure of industry. Journal of the American Statistical Association, 30(189), 209–214.

Davis, S. (1985). Allocative disturbances and temporal asymmetry in labor market fluctuations. Working Paper. University of Chicago Graduate School of Business.

Elsby, M., Hobijn, B., & Sahin, A. (2010, March). The labor market in the great recession. Brookings Panel on Economic Activity.

Estevao, M., & Tsounta, E. (2011). Has the great recession raised U.S. Structural Unemployment? IMF Working Paper.

Groshen, E., & Potter, S. (2003). Has structural change contributed to a jobless recovery? Current Issues in Economics and Finance (Vol. 9, No. 8). Federal Reserve Bank of New York.

Kirkegaard, J. F. (2009). Structural and cyclical trends in net employment over U.S. Business Cycles, 1949-2009: Implications for the next recovery and beyond. Peterson Institute for International Economics, WP 09-5.

Kocherlakota, N. (2010, August 17). Inside the FOMC, Speech at Marquette, Michigan.

Krugman, P. (2010, September 28). Debunking the structural unemployment myth. New York Times.

Lazear, E. P. (2012). The United States Labor Market: Status quo or a new normal?, Mimeo.http://www.kansascityfed.org/publicat/sympos/2012/el-js.pdf

Lee, D., & Wolpin, K. I. (2006). Intersectoral labor mobility and the growth of the service sector. Econometrica, 74(1), 1–46.

Lilien, D. (1982). Sectoral shifts and cyclical unemployment. Journal of Political Economy, 90, 777–793.

Loungani, P., Rush, M., & Tave, W. (1990). Stock market dispersion and unemployment. Journal of Monetary Economics, 25(June), 367–388.

Loungani, P., & Trehan, B. (1997). Explaining unemployment: Sectoral vs. aggregate shocks. Federal Reserve Bank of San Francisco Economic Review, pp. 3–15.

Nason, J., & Vahey, S. (2006). Interwar U.K. unemployment: The Benjamin and Kochin hypothesis or the legacy of “just” taxes? Federal Reserve Bank of Atlanta, Working Paper 2006-04.

Phelan, C., & Trejos, A. (2000). The aggregate effects of sectoral reallocations. Journal of Monetary Economics, 45(2), 249–268.

Ramey, V., & Shapiro, M. (2001). Displaced capital: A study of aerospace plant closings. Journal of Political Economy, 109, 958–992.

Romer, C. D., & David H. Romer. (1989). Does monetary policy matter: A new test in the spirit of Friedman and Schwartz. NBER Macroeconomics Annual, pp. 121–170.

Romer, C. D., & Romer, D. H. (2004). A new measure of monetary shocks: Derivation and implications. American Economic Review, 94, 1055–1084.

Sahin, A., Song, J., Topa, G, & Violante, G. (2011). Mismatch in the labor market: Evidence from the U.S. and the U.K.

Shin, K. (1997). Inter- and intrasectoral shocks: Effects on the unemployment rate. Journal of Labor Economics, 15(2), 376–401.

Thomas, J. (1996). An empirical model of sectoral movements by unemployed workers. Journal of Labor Economics, 14(1), 126–153.

Toledo, W., & Marquis, M. (1993). Capital allocative disturbances and economic fluctuations. Review of Economics and Statistics, 75(2), 233–240.

Valletta, R. G. (1996, February 16). Has job security in the U.S. declined? Federal Reserve Bank of San Francisco Economic Letter 96-06.

Acknowledgements

We thank our discussants, Steve Davis and Valerie Ramey, and other participants at the 2012 Annual Macro Conference of the Federal Reserve Bank of San Francisco. We thank Hites Ahir, Sam Choi and Jair Rodriguez for outstanding research assistance. We acknowledge useful comments from Daniel Aaronson, Larry Ball, Olivier Blanchard, Menzie Chinn, Robert Hall, Joao Jalles, Sam Kortum, Daniel Leigh, Akito Matsumoto, Gian Maria Milesi-Ferretti, Dale Mortenson, Romain Ranciere, Ellen Rissman, Jorge Roldos, David Romer, Kenichi Ueda, Ken West and participants at the Conference on “Globalization: Strategies and Effects” (organized by Bent Jesper Christensen and Carsten Kowalczyk in Kolding, Denmark), Conference on “Long-Term Unemployment” (organized by Menzie Chinn and Mark Copelovitch at University of Wisconsin, Madison), IMF, Paris School of Economics and the Midwest Economic Association meetings in Chicago.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Chen, J., Kannan, P., Loungani, P., Trehan, B. (2017). Cyclical or Structural? Evidence on the Sources of U.S. Unemployment. In: Christensen, B., Kowalczyk, C. (eds) Globalization. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-49502-5_10

Download citation

DOI: https://doi.org/10.1007/978-3-662-49502-5_10

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-49500-1

Online ISBN: 978-3-662-49502-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)