Abstract

A time-varying parameters Bayesian structural vector autoregression (TVP-BVAR) model with stochastic volatility is employed to characterize the monetary policy stance of the Bank of Canada (BoC) in terms of an interest rate rule linking the policy rate to the output gap, inflation and the exchange rate. Using quarterly bilateral Canadian–US data, we find such an interest rate rule to have little explanatory power for the early part of our sample starting in the mid-1980s, but to become more suitable to explain interest rate dynamics from the mid-1990s onwards. Whereas the exchange rate turns out to be the major determinant of the policy rate in the 1980s, its importance declines throughout the 1990s and 2000s, although it continues to be influential even towards the end of the sample period ending in 2015Q2. We also find interest rate shocks to have become more effective in influencing the macroeconomy over time, indicating that the BoC has continually gained monetary policy credibility. We associate this development with the BoC successively de-emphasizing the role of the exchange rate in informing interest rate decisions, thereby alleviating the potential monetary policy conflict between targeting the exchange rate and maintaining the price stability goal.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Bank of Canada (BoC) has traditionally paid close attention to the exchange rate in the conduct of monetary policy. Throughout the 1980s and 1990s, the BoC on many occasions adjusted interest rates to counteract potentially destabilizing exchange rate movements. The BoC also intervened directly in foreign exchange markets to prevent excessive volatility of the Canadian dollar. Such interventions were at times heavy, particularly during the 1980s when the Canadian exchange rate came under repeated speculative pressure (Weymark 1995). Even after the adoption of its inflation targeting strategy in the early 1990s, the BoC continued to focus on the exchange rate on account of its pioneering use of a monetary conditions index (MCI) in gauging nominal demand pressures.Footnote 1 However, starting in the late 1990s the BoC began to de-emphasize the role of the exchange rate in the conduct of monetary policy. The instrument of systematic foreign exchange market interventions was abandoned in 1998, after which it has been used only in exceptional circumstances. The BoC also stopped publishing the MCI and discontinued its use as an input for monetary policy decisions after 2006 (Osborne-Kinch and Holton 2010).

The role of the exchange rate in Canadian monetary policy has been analysed in a number of recent studies. Bjørnland (2009) and Bjørnland and Halvorsen (2014) use structural vector autoregression (SVAR) models to obtain reduced-form estimates of policy rules for small open economies, finding that the interest rate rule for Canada includes direct responses to the nominal exchange rate. Lubik and Schorfheide (2007) estimate the structural parameters of interest rate rules for a number of small open economies, and in particular for Canada, within a dynamic stochastic general equilibrium (DSGE) model. They find the BoC to have explicitly targeted the exchange rate in their monetary policy rule throughout the 1980s and 1990s. On the basis of a related DSGE model, Dong (2013) generally confirms these results, but finds that the BoC has put less emphasis on exchange rate movements since the adoption of inflation targeting.

Whereas the aforementioned studies assume constant parameter values in the interest rate rule, Alstadheim et al. (2013) allow for regime shifts in the monetary policy responses using a Markov switching open-economy DSGE model. For Canada, the authors identify a high (low) policy response regime characterized by a strong (weak) exchange rate response coupled with a weak (strong) response to output and inflation as well as a low (high) degree of interest rate smoothing. Whereas Canada starts in the high policy response regime from the beginning of the sample in 1982, Alstadheim et al. (2013) identify a single regime change to the low policy response regime around 1998, after which there are no more regime switches until the end of their sample in 2011. While this evidence is in line with the BoC’s abandonment of systematic foreign exchange market interventions at the end of the 1990s, and also corresponds loosely to the evidence provided by Dong (2013), the use of a Markov switching set-up alternating only between these two states may be too crude to differentiate among the multifaceted adjustments that have taken place in the monetary policy stance of the BoC since the 1980s.

In order to shed more light on the implications of the various monetary policy shifts for the characterization of the interest rate rule we follow a different path and link the Canadian policy interest rate to its potential driving forces through a time-varying parameters Bayesian structural vector autoregression model with stochastic volatility (TVP-BVAR). This model allows for time variation with respect to the coefficients and the covariance matrix of the innovations and has been utilized by Primiceri (2005) to characterize US monetary policy. A growing body of literature has subsequently applied TVP-BVAR models to investigate monetary policy (see, e.g. Cogley and Sargent 2005; Canova et al. 2007; Franta et al. 2014; Michaelis and Watzka 2017). We adapt the set-up to characterize the monetary policy stance of the BoC. In particular, we are interested in evaluating the extent to which interest rate variations have been influenced by the exchange rate. Our results can be briefly summarized as follows: (1) An interest rate rule has generally little explanatory power for the early part of our sample starting in the mid-1980s, but becomes more suitable to explain interest rate dynamics from the mid-1990s onwards. (2) We find the explanatory power of inflation to increase substantially after the BoC’s switch to inflation targeting in the early 1990s. (3) Whereas the exchange rate turns out to be the major determinant of the policy rate in the 1980s, its importance declines throughout the 1990s and 2000s, although it continues to be influential even towards the end of the sample period ending in 2015Q2. (4) We also find interest rate shocks to have become more effective in influencing the macroeconomy over time, indicating that the BoC has continually gained monetary policy credibility. We associate this development with the BoC successively de-emphasizing the role of the exchange rate in informing interest rate decisions, thereby alleviating the potential monetary policy conflict between targeting the exchange rate and maintaining the price stability goal.

The next section discusses some pertinent details of the TVP-BVAR methodology, Sect. 3 presents our results, Sect. 4 considers various robustness checks, and Sect. 5 concludes.

2 A TVP-BVAR model for Canada

We employ the TVP-BVAR model with stochastic volatility as proposed by Primiceri (2005) and Del Negro and Primiceri (2014). The model has originally been designed to characterize US monetary policy, with a short-term nominal interest rate representing the policy block, and inflation and the unemployment rate representing the non-policy block. We adapt the set-up to the case of Canada by taking account of the close Canadian–US trade links, as well as the small open-economy property of the Canadian economy. To this end, we follow the tradition of Clarida and Galí (1994) and Farrant and Peersman (2006) in specifying the VAR in relative variables vis-à-vis the US, with a short-term interest rate representing the policy block, and inflation, the output gap and the exchange rate constituting the non-policy block. Our identification scheme follows Uhlig (2005) in resorting to a sign restriction approach.

2.1 The model

The following descriptions of the model and its estimation, as well as notations, are in the style of Pereira and Lopes (2014) and Rathke and Sarferaz (2014).

The reduced-form VAR(\(p\)) is given by

where \(\varvec{\mathrm {y_{t}}}\) is an \(n \times 1\) vector of endogenous variables, \(\varvec{\upbeta }_{0,t}\) is an \(n \times 1\) vector of time-varying constants, \(\varvec{\upbeta }_{j,t}\) are \(p\) time-varying \(n \times n\) parameter matrices, and \(\varvec{\mathrm {u_{t}}}\) is an \(n \times 1\) vector of Gaussian reduced-form errors. We define \(\varvec{\Uptheta }_{t}=(\varvec{\upbeta }_{0,t}, \varvec{\upbeta }_{1,t}, \ldots , \varvec{\upbeta }_{p,t})\) and \(\varvec{\mathrm {Z}}_{t-1} = (\varvec{\mathrm {1}},\varvec{\mathrm {y}}_{t-1},\ldots ,\varvec{\mathrm {y}}_{t-p})^{\prime }\) to express the model in matrix form

which can be re-written as

with \(\varvec{\uptheta }_{t}=\text {vec}(\varvec{\Uptheta }_{t})\).

The structural decomposition of the reduced-form innovations is given by

where \(\mathbf A _{t}\) is the \(n\times n\) matrix of contemporaneous coefficients,

and \(\mathbf e _{t}\) is an \(n \times 1\) vector of Gaussian structural innovations. To complete the model, the structural innovations are specified as

where \(\varvec{\upvarepsilon }_{t}\) is an \(n\times 1\) Gaussian vector with \(\text {E}(\varvec{\upvarepsilon }_{t})=0\) and \(\text {E}(\varvec{\upvarepsilon }_{t}\varvec{\upvarepsilon }_{t}^{\prime })=\mathbf I _{n}\). \(\mathbf D _{t}\) is an \(n\times n\) matrix containing the standard deviations of the orthogonal shocks on the diagonal:

Under these assumptions the reduced-form covariance matrix can be recovered by

Following Uhlig (2005), we employ sign restrictions to jointly identify both a monetary policy shock and an exchange rate shock.Footnote 2 Specifically, we draw an \(M\times M\) matrix \(\mathbf S ^{sign}\) (where M is the number of variables) from the standard normal distribution N(\(\mathbf 0 ,\mathbf I _{n}\)). Using the QR decomposition \(\mathbf S ^{sign} = \mathbf Q \cdot \mathbf R \) (where \(\mathbf Q \) satisfies \(\mathbf Q \times \mathbf Q ^{\prime }=\mathbf I _{n}\)) we compute \(\varvec{\Upphi }_{k,t} = \mathbf A ^{-1}_{t} \mathbf D _{t} \mathbf Q ^{\prime }\) (where k denotes the horizon for which the sign restriction is supposed to hold). Multiplying \(\varvec{\Upphi }_{k,t}\) with the reduced-form coefficients in \(\varvec{\Uptheta }_{t}\) results in a candidate for the time-varying structural impulse response function at time t. We keep the draw if it simultaneously satisfies the sign restrictions for both shocks as specified in Sect. 2.4 below and discard it otherwise. For each period t, this procedure is repeated until 50 fitting draws are found. As Fry and Pagan (2011) note, sign restrictions do not generate a unique model, such that impulse responses that satisfy the same set of sign restrictions may very well come from different models. A summary measure such as the median then mixes different models, resulting in biased estimates. We therefore follow their approach in selecting from all fitting draws the single response function that comes closest to the median to ensure that our results are consistently generated by a single model.

2.2 Estimation procedure

To compute the impulse response functions and the forecast error variance decompositions (FEVD) for the above model, we estimate the time-varying covariance matrix \(\varvec{\Upsigma }_{t}\) in three blocks. The first block consists of the time-varying coefficient states in vector \(\varvec{\uptheta }_{t}\) of (3). The second block embodies the nonzero and non-unity covariance states of \(\mathbf A _{t}\) as given in (5). The third block comprises the volatility states contained on the main diagonal of \(\mathbf D _{t}\) as given in (7).

In line with the vector notation in (3) the free parameters of \(\mathbf A _{t}\) and \(\mathbf D _{t}\) are stacked in vectors, row by row, in which \(\mathbf a _{t}=[\alpha _{21,t},(\alpha _{31,t} \alpha _{32,t}), \ldots , (\alpha _{n1,t} \, \alpha _{n(n-1),t}) ]^{\prime }\) and \(\mathbf d _{t}=\text {diag}(\mathbf D _{t})\). The coefficient and covariance states are assumed to evolve as random walks, and the volatility states as geometric random walks,

For the estimation it is assumed that all innovations are jointly normally distributed such that

in which \(\mathbf S \) is restricted to be block diagonal. All other covariance matrices are left unrestricted.

The model has a normal linear state-space form, which can be estimated using Bayesian simulation methods. (3), (4) and (6) constitute the measurement equations for each block, linking the time-varying parameters to the data. These time-varying parameters resemble unobserved state variables whose laws of motion are defined by the transition Eqs. (9), (10) and (11). The Gibbs sampler is applied sequentially to draw the state vectors from posterior Gaussian distributions. The means and variances of these posterior distributions are obtained by a forward run of the Kalman filter, followed by a backward recursion of the simulation smoother (see Carter and Kohn 1994; Kim et al. 1998). Starting from initial states for \(\varvec{\uptheta }^{T}, \mathbf A ^{T}, \mathbf D ^{T}\) and \(\mathbf V \) the Gibbs sampler iterates over the following steps to sample histories of the parameters, e.g. \(\varvec{\uptheta }^{t}= [\varvec{\uptheta }_{1} \, \varvec{\uptheta }_{2} \,\ldots \,\varvec{\uptheta }_{t}]\).Footnote 3

-

I

Initialize \(\mathbf a ^{T}\), \(\mathbf D ^{T}\), \(\mathbf s ^{T}\), \(\mathbf V \).

-

II

Sample \(\varvec{\uptheta }^{T}\) from the conditional posterior \(p(\varvec{\uptheta }^{T}|\mathbf y ^{T},\mathbf a ^{T}, \mathbf D ^{T}, \mathbf V )\).

-

III

Sample \(\mathbf a ^{T}\) from the conditional posterior \(p(\mathbf a ^{T}|\mathbf y ^{T},\varvec{\uptheta }^{T}, \mathbf D ^{T}, \mathbf V )\).

-

IV

Sample \(\mathbf s ^{T}\) from the conditional posterior \(p(\mathbf s ^{T}|\mathbf y ^{T},\varvec{\uptheta }^{T}, \mathbf a ^{T}, \mathbf V )\).

-

V

Sample \(\mathbf D ^{T}\) from the conditional posterior \(p(\mathbf D ^{T}|\mathbf y ^{T},\varvec{\uptheta }^{T}, \mathbf a ^{T}, \mathbf s ^{T}, \mathbf V )\).

-

VI

Sample \(\mathbf V \), by sampling \(\mathbf Q , \mathbf W \) and \(\mathbf S \) from \(p(\mathbf Q , \mathbf W , \mathbf S |\mathbf y ^{T},\varvec{\Uptheta }^{T}, \mathbf A ^{T}, \mathbf D ^{T})\) \(=\) \(p(\mathbf Q |\mathbf y ^{T},\varvec{\Uptheta }^{T}, \mathbf A ^{T}, \mathbf D ^{T})\) \(\cdot \) \(p(\mathbf W |\mathbf y ^{T},\varvec{\Uptheta }^{T}, \mathbf A ^{T}, \mathbf D ^{T})\) \(\cdot \) \(p(\mathbf S _{1}|\mathbf y ^{T},\varvec{\Uptheta }^{T}, \mathbf A ^{T}, \mathbf D ^{T})\) \(\cdot \ldots \cdot \) \(p(\mathbf S _{n-1}|\mathbf y ^{T},\varvec{\Uptheta }^{T}, \mathbf A ^{T}, \mathbf D ^{T})\).

-

VII

Go back to II.Footnote 4

2.3 Choice of priors

We follow conventional choices from the TVP-BVAR literature in calibrating the priors for our model. Mainly, we choose priors very similar to those by Primiceri (2005). To this end, a time-invariant version of (1) is estimated using the first 10 years of the sample and the respective observations are discarded afterwards. Prior distributions for both the initial states and the hyperparameters are calibrated according to estimates of the recursive time-invariant VAR on the training sample. We use point estimates (\(\varvec{\hat{\uptheta }}^{OLS}, \hat{\mathbf{a }}^{OLS}, \text {log}\,\hat{\mathbf{d }}^{OLS}\)) as mean values for the Gaussian initial states. With the exception of the covariance matrix of the volatility states, which takes the form of an identity matrix, covariance matrices are set to multiples of the respective estimated coefficient covariance matrices on the training sample:

The hyperparameters (\(\mathbf Q , \mathbf W , \mathbf S \)) have conjugate inverse-Wishart priors. Their scaling parameters consist of the respective estimated coefficient covariance matrices on the training sample, multiplied by a scaling factor and their respective degrees of freedom. The scaling factors (\(k_{Q}, k_{S}, k_{W})\), taken from Primiceri (2005), express the prior beliefs about the degree of time variation.Footnote 5

where \(k_{Q} = 0.01, k_{S} = 0.1\) and \(k_{W}=0.01\).

As in Primiceri (2005), we use a lag length of \(p=2\) which constitutes a compromise between a realistic representation of the underlying economic structure on the one hand, and statistical parsimony on the other hand. A stability check ensures that only those draws are kept whose roots lie inside the unit circle. Of the 70, 000 candidate draws, we discard the first 60, 000 as a burn-in sample. Of the remaining 10, 000 draws we keep only every 10th draw to account for distortion through autocorrelation. Estimates for the unobserved states are based on the median of the remaining draws.

2.4 Identification scheme

We use sign restrictions to identify shocks to monetary policy and the exchange rate. A positive (contractionary) monetary policy shock is associated with a slowdown in economic activity and an appreciation of the exchange rate. We therefore postulate a positive response of the interest rate, and negative reactions of the inflation rate, the output gap and the exchange rate, with the latter defined as the home currency price of foreign exchange. The negative relation between interest rates on the one hand and inflation, output and the exchange rate on the other hand is well established in the theoretical DSGE literature (Christiano et al. 2005; Galí and Monacelli 2005; Sims and Zha 2006; Jääskelä and Jennings 2011) and frequently employed in empirical VAR models (see, e.g. Cushman and Zha 1997; Canova and de Nicolo 2002; Uhlig 2005, Franta et al. 2014).

By specifying the signs of the responses of all four of the variables in the model we make sure that the monetary policy shock is identified properly. The sign restrictions are imposed on the interest rate and the exchange rate for the impact reaction only, but span the first four quarters for the responses of the inflation rate and the output gap in order to account for potential transmission lags of monetary policy. The identification scheme for the monetary policy shock is summarized in the first row of Table 1.

An exchange rate shock, interpreted as an appreciation of the Canadian dollar against the US dollar, is associated with a slowdown in economic activity mainly through its effect on the balance of payments. We therefore impose negative signs for the impact reactions of the exchange rate as well as for inflation and output. However, we leave the reaction of the interest rate to an exchange rate shock unrestricted. This way we can trace potential within-sample shifts in the relative importance of the exchange rate for monetary policy decisions by the BoC during the sample period. We thus let the data determine both the monetary policy regime (i.e. the sign of the response) and its time profile (i.e. the relative size of the responses). The sign restrictions for the exchange rate shock are summarized in the second row of Table 1.

3 Results

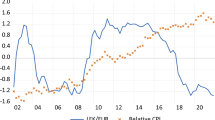

We focus on the post-Bretton Woods era and use quarterly data for the period 1974Q1 to 2015Q2. By starting in 1974 we avoid any potential distortion arising from the productivity slowdown affecting Canadian GDP in the early 1970s. As the first 10 years of the sample are used for the calibration of the priors, the sample of usable observations thus starts in 1984Q1. We use the 3-month Canadian Treasury Bill rate obtained from the Statistics Canada CANSIM database relative to the US Federal Funds rate obtained from the OECD Main Economic Indicators as the policy interest rate.Footnote 6 In the non-policy block we use the seasonally adjusted bilateral output gap as a measure of real economic activity, and the rate of change of the GDP deflator as a measure of inflation, both taken from the OECD Main Economic Indicators. Finally, we employ the CANSIM bilateral exchange rate of the Canadian dollar against the US dollar (CAD/USD).Footnote 7

Figure 1 displays the standard deviations of the residuals associated with the endogenous variables of the TVP-BVAR. The residuals of the interest rate equation displayed at the bottom of the figure capture monetary policy shocks and reflect the non-systematic component of the implied interest rate rule.Footnote 8 The 1980s exhibit substantially higher variances of monetary policy shocks compared to the 1990s and 2000s. Thus, the model does not explain monetary policy actions very well in the early phase of the sample, but becomes a better approximation of monetary policy after the switch to inflation targeting in the early 1990s.

Figure 2 presents the one-period-ahead time-varying forecast error variance decompositions (FEVD) of the interest rate equation to changes in inflation, output, the exchange rate and the interest rate itself. The area on top of the graph measures the contribution of inflation in explaining movements in the policy interest rate. This share is around 10% in the late 1980s, increases to about 20% after the adoption of inflation targeting in the early 1990s, intermittently gaining importance in explaining the policy rate throughout the 1990 and 2000s, and accounting for almost 50% of interest rate variation in the last years of the sample. The contribution of the output gap is depicted in the graph as the second component from the top, with a share of interest rate variability of around 10% staying more or less constant throughout the entire sample period. Finally, the two bottom areas represent the autoregressive component of the interest rate and the exchange rate, which jointly account for the majority of movements in the policy rate, particularly throughout the first half of the sample.Footnote 9 The autoregressive component of the interest rate reaches its maximum impact around the time of the BOC’s switch to inflation targeting in the early 1990s and declines more or less steadily thereafter, explaining about one quarter of interest rate variability towards the end of the sample.

The contribution of the exchange rate in determining monetary policy actions by the BoC is depicted at the bottom of Fig. 2. The exchange rate explains about one half of the variance of the Canadian 3-month Treasury Bill rate at the beginning of the sample in the mid- and late 1980s, a period in which the BoC frequently intervened in the foreign exchange market in response to excessive exchange rate volatility (see Murray et al. 1997 for an analysis of this period). The exchange rate becomes substantially less important in informing interest rate decisions around the time of the adoption of the inflation targeting strategy by the BoC, dropping to about 30% of interest rate variability by the mid-1990s. The importance of the exchange rate declines further throughout late 1990s and into the early 2000s, a time period in which the BoC abandoned its mechanistic approach to foreign exchange market intervention. This downward trend is only interrupted by a brief surge in 2003–2004 when the Canadian dollar appreciated sharply against the US dollar, and which triggered an expansionary monetary policy response by the BoC. Interestingly, the exchange rate starts to regain importance thereafter even as the BoC abandoned the last vestiges of a formal exchange rate objective by discontinuing its use of the MCI as an input for monetary policy decisions in 2006. The renewed importance of the exchange rate can at least partly be explained by the onset of the Great Recession in 2007, with the Canadian exchange rate rising sharply, and the BoC initiating an unprecedented monetary loosening. However, the exchange rate continues to account for around a quarter of interest rate movements even during the most recent years of the sample.

In comparison with DSGE models, utilizing the VAR methodology only yields reduced-form estimates of the policy rule. As a consequence, the identified shares of the exchange rate have to be interpreted with caution as they may still contain indirect policy responses to exchange rate developments working through their influence on expectations on the inflation forecast, as pointed out by Taylor (2001). Nevertheless, the fact that our results are in line with the evidence presented in both the related DSGE and the VAR literature provides some confirmation that the continued role of the exchange rate in influencing the monetary policy stance of the BoC particularly towards the end of the sample is unlikely to be explained by indirect effects of the exchange rate in the monetary policy rule alone.

Figure 3 presents impulse response functions (IRFs) of inflation, output, the exchange rate and the interest rate for the policy experiment of a 0.5% increase in the 3-month Treasury Bill rate. In accordance with the sign restrictions, the interest rate shock lowers the inflation rate, where the strongest reaction occurs right on impact before quickly reverting back to its pre-shock level. Similar evidence is obtained for the exchange rate, except that the dynamic adjustment is somewhat slower, at least during the first few quarters following the shock. In contrast, the response of the output gap is hump-shaped, where the maximum decline occurs in the second quarter after the shock, and with the speed of mean reversion being comparatively slow. These results compare well to the characteristics reported previously in the literature regarding the domestic effects of a Canadian monetary policy shock (Cushman and Zha 1997; Kim 1999; Kim and Roubini 2000; Bhuiyan and Lucas 2007; Bhuiyan 2012).

Whereas the evidence of Fig. 3 is based on sample period averages, the TVP-BVAR model also allows for an analysis of the time profile of the IRFs across each individual time period. To this end, Fig. 4 displays the period-by-period impact responses of inflation, output and the exchange rate following the interest rate shock. It turns out that the responses of all three variables are significantly different from zero throughout the entire sample period and also become quantitatively stronger starting in the early 1990s. The fact that the interest rate shock becomes more effective in influencing the macroeconomy throughout the latter part of the sample can be taken as evidence that the BoC has continually gained monetary policy credibility over time. Whereas this credibility gain has occurred rather gradually in the immediate aftermath of the switch to inflation targeting in 1991, it has become increasingly more substantial throughout the 1990 and 2000s,Footnote 10 a time period in which the BoC abandoned systematic foreign exchange market interventions and no longer used the MCI as an input for monetary policy decisions. As a general implication, this evidence suggests that monetary policy credibility is gained rather slowly, but can be fostered by a clear and transparent mandate. In the case of the BoC this involved the abandonment of the explicit commitment to intervene in the foreign exchange market, thereby alleviating the potential monetary policy conflict between targeting the exchange rate and maintaining the price stability goal.

Next we consider the policy experiment of a 1-cent appreciation in the CAD-USD exchange rate. Figure 5 presents the IRFs based on sample period averages, with the initial responses of inflation, the output gap and the exchange rate again dictated by the sign restrictions, and with shapes similar to those of Fig. 3. In contrast, the response of the interest rate is left unrestricted and displays a significant and negative impact reaction to the exchange rate shock, with the drawn-out dynamics reflecting the substantial autoregressive component of the interest rate adjustment.

Finally, Fig. 6 shows the period-by-period impact responses of inflation, the output gap and the interest rate following the exchange rate shock. Again all variables turn out to be significantly different from zero throughout most of the sample period. Moreover, the time profile of inflation displays somewhat stronger reactions to the exchange rate shock in the more recent years of the sample, whereas the output gap appears to have become slightly less responsive over time. However, these differences in the time profiles are statistically insignificant as the confidence bands for the IRFs in the early part overlap with those in the latter part of the sample. Much stronger evidence is obtained for the interest rate, where the strength of the policy response declines substantially and significantly from the 1980s and early 1990s to the 2000s and 2010s. This observation can be taken as confirmation of our earlier result of a diminished role of the exchange rate in influencing interest rate decisions by the BoC.

4 Robustness

In order to explore the influence of our identification strategy on the benchmark results, we now discuss some variations of the model set-up. First, we test for the robustness of the results when we vary the number of horizons for which the sign restrictions are imposed. In the benchmark model, both inflation and the output gap are required to decrease for four quarters following the shock. However, one might argue that this is overly restrictive as the effects especially of the exchange rate shock abate more quickly. Reducing the number of restricted periods might also help to let the data speak more freely. In a first variant we reduce the number of restricted periods for both of these variables to two. Conversely, one might argue that the restriction of both the interest rate and the exchange responding on impact only might be too loose, as it was the declared intention of the BoC to actively counteract on movements in the exchange rate. We thus increase the number of restricted periods for these variables to two. This alternative identification scheme is summarized as variation ‘I’ in Table 2.

As a second variation, we further reduce the number of restricted periods for the responses of inflation and the output gap and impose the required sign to hold on impact only. The main purpose of this exercise is to test for the influence of the sign restrictions on the hump-shaped impulse responses of these two variables. This modification is summarized as variation ‘II’ in Table 2.

In the benchmark model we consciously stay agnostic regarding the response of the interest rate to an exchange rate shock. This allows us to evaluate the BoC’s policy stance when the economy faces an exchange rate appreciation, where we find a negative response of the interest rate throughout the sample period. Here we follow Franta et al. (2014) and Bjørnland and Halvorsen (2014) by directly imposing a negative sign on the impact response of the interest rate to an exchange rate shock as an additional robustness check. This modification is summarized as variation ‘III’ in Table 2.

The results in terms of the impulse response functions are presented in Figs. 7 and 8. The median responses estimated over the full sample period reveal that our benchmark results do not seriously hinge on the identification strategy. The responses of all variations are well contained within the confidence bands of the benchmark results for the overwhelming part of the forecast horizons, indicating no statistically significant differences. If any, inflation and output gap responses tend to be slightly smaller following the exchange rate shock when the sign restrictions bind on impact only (variation ‘II’). The hump-shaped responses of both variables persist across all variations, indicating this feature to be deeply anchored in the data. We thus find our results to be largely robust to these modifications in the identification scheme.

Variations on the identification scheme. Benchmark median impulse response functions (solid black line) of a inflation, b output, c the exchange rate and d the interest rate to a 50 basis-point increase in the policy interest rate with 16th and 84th percentiles (shaded areas) over the whole sample. Dashed-dotted line variation ‘I’. Dashed-circled line variation ‘II’. Dashed line variation ‘III’

Variations on the identification scheme. Benchmark median impulse response functions (solid black line) of a inflation, b output and c the exchange rate and d the interest rate to a 1-cent appreciation in the CAD/USD exchange rate with 16th and 84th percentiles (shaded areas) over the whole sample. Dashed-dotted line variation ‘I’. Dashed-circled line variation ‘II’. Dashed line variation ‘III’

Apart from the identification strategy, we also check the robustness of our results with respect to the selection of variables in the model. Recent evidence shows that monetary policy decisions of central banks are influenced by the degree of financial stress in the economy. For example, Baxa et al. (2013) estimate time-varying interest rate rules for various central banks, including the BoC, and show that these central banks set interest rates with a view to financial variables. In order to assess the impact on our results, we add a financial variable to our set-up. To this end, we alternatively use the log returns of the Toronto Stock Exchange (TSE) index and the MSCI index for Canada. Instead, we also consider the one-year rolling standard deviations of both stock price returns as proxy indicators of financial stress. In all cases, our results are not materially affected by the incorporation of the financial variable. In terms of a representative result of this exercise, Fig. 9 presents the FEVD when the TSE is incorporated as an additional variable into the model.Footnote 11

We find that the financial variable explains about 10% of interest rate decisions of the BoC. This share is fairly constant throughout the sample period and mostly comes at the expense of the share of the lagged interest rate in the FEVD, without affecting the timeline of the relative shares of the other variables in the model. In particular, our main results that inflation becomes increasingly more important as a determinant of interest rate behaviour, whereas the importance of the exchange rate declines, while still being influential towards the end of the sample, still holds in this alternative scenario.

5 Conclusion

The Bank of Canada (BoC) has traditionally paid close attention to the exchange rate in the conduct of monetary policy, even after the switch to an inflation targeting regime in 1991. However, starting in the late 1990s the BoC began to gradually shift attention away from the exchange rate by first discontinuing its practice of systematic foreign exchange market interventions in 1998, and then by abandoning its monetary conditions index as a gauge to monetary policy decisions after 2006. This paper investigates whether these policy shifts are reflected in the time profile of an appropriately specified monetary policy reaction function. To this end, we model the links between a short-term nominal interest rate and its potential driving forces within a time-varying parameters Bayesian structural vector autoregression (TVP-BVAR) model which allows for time variation with respect to both the coefficients and the covariance matrix of the innovations. In particular, we adapt the TVP-BVAR model with stochastic volatility due to Primiceri (2005) to an open-economy context by utilizing quarterly bilateral Canadian–US data to link the policy interest rate to the output gap, inflation and the exchange rate. In particular, we are interested in evaluating the extent to which interest rate variations have been influenced by the exchange rate.

We find that an interest rate rule does not explain monetary policy actions very well in the early phase of our sample starting in the mid-1980s, but becomes more suitable to explain interest rate dynamics from the mid-1990s onwards. In particular, we find the explanatory power of inflation to increase substantially after the BoC’s switch to inflation targeting in the early 1990s, continuing to rise in importance to account for almost 50% of the policy interest rate variation in the most recent years of the sample ending in 2015Q2. In contrast, the exchange rate turns out to be the most important determinant of the interest rate throughout the early part of the sample period, explaining about one half of the interest rate variability in the mid- to late 1980s. This share recedes to around 30% by the mid-1990s and keeps on falling throughout the late 1990s and early 2000s. The exchange rate starts to regain importance thereafter, a development which can be explained to some extent by the onset of the Great Recession in 2007. However, even towards the end of the sample the exchange rate continues to account for around a quarter of interest rate movements.

We use the TVP-BVAR to also analyse the time variation of the resulting impulse response functions, and find interest rate shocks to have become more effective in influencing the macroeconomy throughout the latter part of the sample, indicating that the BoC has continually gained monetary policy credibility over time. We associate this development with the BoC successively de-emphasizing the role of the exchange rate in informing interest rate decisions, thereby alleviating the potential monetary policy conflict between targeting the exchange rate and maintaining the price stability goal.

Notes

The BoC constructed the MCI by weighting short-term interest rates and the effective exchange rate by the relative size of their estimated effects on aggregate demand. For a detailed exposition of the index see, e.g. Freedman (1994).

See the Appendix for a more detailed description of the Gibbs sampling algorithm.

All computations have been carried out using MATLAB.

Until 1994, the BoC used the Bank Rate as its key interest rate, and since then has targeted the overnight rate to influence short-term interest rates. The 3-month Canadian Treasury Bill rate has historically tracked both of these rates rather closely.

The BoC uses an effective exchange rate rather than the bilateral US dollar rate as a measure of the currency value. However, different exchange rate indices like the G-10, the C-6 and the CERI have been used throughout the sample period, with the US dollar featuring very prominently in all of them. More detailed information on these indices can be found in, e.g. Ong 2006, or Twomey 2012, Ch. 3.

This non-systematic component may comprise both policy mistakes and interest rate movements that are responses to variables other than the output gap, inflation or the exchange rate.

This evidence is in line with Lubik and Schorfheide (2007) who find that in the 1980s and 1990s the BoC adjusted interest rates in response to exchange rate movements, with a high degree of interest rate smoothing.

Note that the confidence intervals associated with the inflation and exchange rate impact responses of the 1980s and early 1990s do not overlap with those of the 2000s and 2010s, implying that the differences in the responses are also statistically significantly different from each other.

Inclusion of the other financial variables leads to very similar FEVDs, with no effect on the impulse response functions. A complete set of results is available from the authors upon request.

See the Appendix of Primiceri (2005) for a more detailed discussion of this estimation block.

References

Alstadheim R, Bjørnland HC, Maih J (2013) Do central banks respond to exchange rate movements? A Markow-switching structural investigation. Centre for Applied Macro- and Petroleum Economics, CAMP working papers 0018, BI Norwegian Business School

Baxa J, Horváth R, Vašíček B (2013) Time-varying monetary-policy rules and financial stress: Does financial instability matter for monetary policy? J Financ Stab 9:117–138

Benati L, Surico P (2008) Evolving US monetary policy and the decline of inflation predictability. J Eur Econ Assoc 6:634–646

Bhuiyan R (2012) Monetary transmission mechanisms in a small open economy: a Bayesian structural VAR approach. Can J Econ 45:1037–1061

Bhuiyan R, Lucas RF (2007) Real and nominal effects of monetary policy shocks. Can J Econ 40:679–702

Bjørnland HC (2009) Monetary policy and exchange rate overshooting: Dornbusch was right after all. J Int Econ 79:64–77

Bjørnland HC, Halvorsen JI (2014) How does monetary policy respond to exchange rate movements? New international evidence. Oxf Bull Econ Stat 76:208–232

Canova F, de Nicolo G (2002) Monetary disturbances matter for business fluctuations in the G-7. J Monet Econ 49:1131–1159

Canova F, Gambetti L (2009) Structural changes in the US economy: Is there a role for monetary policy? J Econ Dyn Control 33:477–490

Canova F, Gambetti L, Pappa E (2007) The structural dynamics of output growth and inflation: some international evidence. Econ J 117:167–191

Carter CK, Kohn R (1994) On Gibbs sampling for state space models. Biometrika 81:541–553

Christiano LJ, Eichenbaum M, Evans CL (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 1:1–45

Clarida R, Galí J (1994) Sources of real exchange-rate fluctuations: How important are nominal shocks? Carnegie-Rochester Conf Ser Public Policy 41:1–56

Cogley T, Sargent T (2005) Drifts and volatilities: monetary policies and outcomes in the post WWII US. Rev Econ Dyn 8:262–302

Cushman DO, Zha T (1997) Identifying monetary policy in a small open economy under flexible exchange rates. J Monet Econ 39:433–448

Del Negro M, Primiceri G (2014) Time-varying structural vector autoregressions and monetary policy: a corrigendum. Staff reports no. 619, Federal Reserve Bank of New York, New York, NY

Dong W (2013) Do central banks respond to exchange rate movements? Some new evidence from structural estimation. Can J Econ 46:555–586

Farrant K, Peersman G (2006) Is the exchange rate a shock absorber or a source of shocks? New empirical evidence. J Money Credit Bank 38:939–961

Franta M, Horvath R, Rusnak M (2014) Evaluating changes in the monetary transmission mechanism in the Czech Republic. Empir Econ 46:827–842

Freedman C (1994) The use of indicators and of the Monetary Conditions Index in Canada. In: Balino T, Cottarelli C (eds) Frameworks for monetary stability: policy issues and country experiences. International Monetary Fund, Washington, DC, pp 458–476

Fry R, Pagan A (2011) Sign restrictions in structural vector autoregressions: a critical review. J Econ Lit 49:938–960

Fuller WA (1996) Introduction to statistical time series, 2nd edn. Wiley, Hoboken

Galí J, Monacelli T (2005) Monetary policy and exchange rate volatility in a small open economy. Rev Econ Stud 72:707–734

Jääskelä JP, Jennings D (2011) Monetary policy and the exchange rate: evaluation of VAR models. J Int Money Finance 30:1358–1374

Kim S (1999) Do monetary policy shocks matter in the G-7 countries? Using common identifying assumptions about monetary policy across countries. J Int Econ 48:387–412

Kim S, Roubini N (2000) Exchange rate anomalies in the industrial countries. A solution with a structural VAR approach. J Monet Econ 45:561–586

Kim S, Shephard N, Chib S (1998) Stochastic volatility: likelihood inference and comparison with ARCH models. Rev Econ Stud 65:361–393

Lubik T, Schorfheide F (2007) Do central banks respond to exchange rate movements? A structural investigation. J Monet Econ 54:3–24

Michaelis H, Watzka S (2017) Are there differences in the effectiveness of quantitative easing at the zero-lower-bound in Japan over time? J Int Money Finance 70:204–233

Mumtaz H, Sunder-Plassmann L (2013) Time-varying dynamics of the real exchange rate: an empirical analysis. J Appl Econom 28:498–525

Murray J, Zelmer M, McManus D (1997) The effectiveness of foreign exchange intervention and the volatility of the Canadian dollar. In: Bank of Canada (ed) Exchange rates and monetary policy, Ottawa, pp 311–360

Osborne-Kinch J, Holton S (2010) A discussion of the monetary conditions index. Central Bank of Ireland Quarterly Bulletin 01 (January), Central Bank of Ireland, Dublin, pp 68–80

Ong J (2006) A new effective exchange rate index for the Canadian dollar. Bank of Canada review (Autumn), Bank of Canada, Ottawa, pp 41–46

Pereira MC, Lopes AS (2014) Time-varying fiscal policy in the US. Stud Nonlinear Dyn Econ 18:157–184

Primiceri G (2005) Time varying structural vector autoregressions and monetary policy. Rev Econ Stud 72:821–852

Rathke A, Sarferaz S (2014) Malthus and the industrial revolution: evidence from a time-varying VAR. CESifo working paper series no. 4667, ifo Institut, Munich

Sims CA, Zha T (2006) Does monetary policy generate recessions? Macroecon Dyn 10:231–272

Taylor JB (2001) The role of the exchange rate in monetary-policy rules. Am Econ Rev 91:263–267

Twomey B (2012) Inside the currency market: mechanics, valuation, and strategies. Wiley, Hoboken

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monet Econ 52:381–419

Weymark D (1995) Estimating exchange market pressure and the degree of exchange market intervention for Canada. J Int Econ 39:273–295

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

The Gibbs sampling algorithm

1.1 Step I: initialization

Initialize \(\mathbf a ^{T}\), \(\mathbf D ^{T}\), \(\mathbf s ^{T}\), \(\mathbf V \).

1.2 Step II: drawing VAR parameters \(\theta ^{T}\)

Conditional on \(\mathbf a ^{T}, \mathbf D ^{T}\) and \(\mathbf V \), the measurement Eq. (3) together with the transition Eq. (9) form a linear normal state-space system

Therefore, the algorithm of Carter and Kohn (1994) can be applied to draw a history of \(\varvec{\uptheta }^{T}\).

1.3 Step III: drawing covariance states \(a^{T}\)

Taking \(\varvec{\uptheta }^{T}\) as given, it is possible to observe \(\mathbf u _{t}\) by rewriting (3) as

Under consideration of (6), we can express (4) as follows

and by defining \(\hat{\mathbf{y }}_{t} = \mathbf u _{t}\), we can rewrite (A.1) as

Due to the recursive identification structure imposed in (5), \(\mathbf A _{t}\) is a lower triangular matrix with ones on the main diagonal. Therefore, (A.2) can be written as

where \(\mathbf L _{t}\) has the following structure

Together with the transition equation \(\mathbf a _{t}= \mathbf a _{t-1}+\varvec{\upzeta }_{t}\) from (10) this constitutes a Gaussian state-space system. As some dependent variables in the measurement equation also appear on the RHS of the equation, the system is nonlinear. This problem is solved by the additional assumption of \(\mathbf S \) being block diagonal. The algorithm of Carter and Kohn (1994) can again be applied equation by equation, starting with the second equation. In this case, not only does \(\hat{y}_{i,t}\) not show up on the RHS of the \(i\)th equation, but due to the triangular structure, the vectors \(\hat{y}_{i,t}\) in matrix \(\mathbf L _{t}\) can be treated as predetermined in the same equation.Footnote 12

1.4 Step IV and V: drawing volatility states \(D^{T}\)

With \(\varvec{\uptheta }_{t}\) and \(\mathbf A _{t}\) given, we can combine (3), (4) and (6) to observe \(\mathbf e _{t}\),

Note that this system of measurement equations is nonlinear. To linearize this system we take the square and logarithm of every element,

where we define \(y_{i,t}^{*}=e_{i,t}\). Since \((y_{i,t}^{*})^{2}\) can take on very small values, an offset constant is used to make the estimation procedure more robust. The approximated linear state-space form then becomes

where \(y_{i,t}^{**}=\text {log}[(y_{i,t}^{*})^{2}+\bar{c}]\), \(h_{i,t}=\text {log}\, d_{i,t}\), and \(\vartheta _{i,t}=\text {log}\, \varepsilon ^{2}_{i,t}\). \(\bar{c}\) denotes an offset constant set to \(0.001\) as introduced by Fuller (1996, pp. 494–497). This linear state-space system is not Gaussian, as the innovations of the measurement equation are distributed as \(\text {log}\, \chi ^{2}(1)\). By approximating each element of \(\varvec{\upvartheta }_{t}\) with a mixture of normal densities as described in Kim et al. (1998), we can transform this system to be Gaussian. As the covariance matrix of \(\varvec{\upvarepsilon }_{t}\) is an identity matrix, the covariance matrix of \(\varvec{\upvartheta }_{t}\) is also diagonal, making the approximation possible for each element of \(\varvec{\upvartheta }_{t}\). Kim et al. (1998) match a number of moments of the \(\text {log}\, \chi ^{2}(1)\) distribution with a mixture of seven normal densities. The constants to match the moments are the component probabilities \(q_{j}\), means \(m_{j}-1.2704\), and variances \(\upsilon _{j}^{2}\), \(j=1,\ldots ,7\), as reported in Table 3. The approximation of each element of \(\varvec{\upvartheta }_{t}\) is

An alternative formulation of (A.9) is

where \(\mathbf s ^{T}=[\mathbf s _{1},\ldots ,\mathbf s _{T}]\) is a matrix of unobserved states \(s_{i,t} \in \{1,\ldots ,7\}\) that indicate which member of the normal distribution mixture is used for the approximation of each \(\upvartheta _{i,t}\). Conditional on \(\mathbf y ^{**T}\) and \(\mathbf h ^{T}\), it is possible to sample each \(s_{i,t}\) independently from the probability mass function defined by

with \(j=1,\ldots ,7\), \(i=1,\ldots ,n\), and \(t=1,\ldots ,T\). Conditional on \(\mathbf y ^{T},\varvec{\uptheta }^{T}, \mathbf a ^{T}, \mathbf s ^{T}\) and \(\mathbf V \), and the normal approximation as in Kim et al. (1998), the measurement equation of (A.7 A.8) and the transition equation of (A.9) form a linear Gaussian state-space system, to which the algorithm of Carter and Kohn (1994) can be applied.

Rights and permissions

About this article

Cite this article

Dybowski, T.P., Hanisch, M. & Kempa, B. The role of the exchange rate in Canadian monetary policy: evidence from a TVP-BVAR model. Empir Econ 55, 471–494 (2018). https://doi.org/10.1007/s00181-017-1305-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1305-7