Abstract

Previous studies of the income convergence hypothesis for Latin American economies indicate that almost all are not systematically closing their income gap with developed nations. The few studies to consider whether they instead exhibit club convergence—i.e., convergence to a steady-state equilibrium significantly inferior to that of the developed economies—offer little convincing evidence of this either. We argue that this reflects the limitations of their measure of relative income (which includes their sample’s average income) and/or the assumptions underlying the discrete-break unit-root tests they employ. By avoiding these limitations, we obtain evidence of two Latin American convergence clubs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With very few exceptions, Latin American economies are not catching-up with the developed economies in general and the United States in particular in terms of real per capita income (Maeso-Fernandez 2003; Dawson and Sen 2007; Galvão and Gomes 2007; King and Ramlogan 2008; Dawson and Strazicich 2010). This raises the question of whether the region’s economies are instead converging to a steady-state equilibrium position that is fundamentally different from—and markedly inferior to—that enjoyed by the world’s rich nations. In other words, are they trapped in a middle-income ‘convergence club’?

Two previous studies have tested for club convergence among Latin American economies but neither offers convincing evidence that such a club exists (Dawson and Sen 2007; Galvão and Gomes 2007). However, there are grounds for believing that their use of a regional average as the benchmark when measuring the international income differential and/or the assumptions underlying the discrete-break unit-root tests they employ to test the club convergence hypothesis have contributed to this outcome. Therefore, we reassess the hypothesis for 22 Latin American and Caribbean economies using a single-country benchmark for the income differential, to which the recently developed Fourier-type unit-root tests are applied. The key advantage of the Fourier-type tests is that they allow for structural breaks in a data series’ deterministic trend but do not restrict their number, timing or functional form. The discrete-break tests, by contrast, impose very specific assumptions in all these respects.

Our main finding is that the income differential of most economies (representing almost 90 % of the region’s population) is behaving in a manner consistent with club convergence. However, not all of them are converging to the same steady-state position. Instead, we find evidence of two separate convergence clubs within the region. Aside from implying that the distribution of income within Latin America is becoming increasingly polarized over time, the formation of these clubs indicates the existence of a binding constraint on their members’ economic development. If the region’s policymakers do not take steps to identify and address this constraint, their economies have little prospect of escaping their middle-income status and closing their income differential with the developed world.

The remainder of the paper is structured as follows. Section 2 discusses the theory underlying the club convergence hypothesis and how it can be evaluated for individual economies using time-series econometric methods. In Sect. 3, the existing Latin American studies of the convergence club hypothesis are reviewed and their methodological limitations discussed. The tests we employ are described in Sect. 4, which is followed by the details of our dataset and a discussion of the econometric results obtained. Section 6 summarizes the main findings and concludes the paper.

2 The club convergence hypothesis

The standard income convergence hypothesis states that the income differential between rich and poor countries should systematically diminish over time. Ultimately, economies with the same structural characteristics are expected to converge to the same steady-state equilibrium position regardless of their initial conditions, as predicted by the standard neoclassical growth model (Solow 1956; Swan 1956). Club convergence, by contrast, implies that an economy’s initial conditions do matter—countries with different initial conditions will converge to different steady-state positions. A consequence of this is that the global distribution of income does not narrow over time—as would be expected under the standard convergence hypothesis—but instead becomes more polarized (Galor 1996). More specifically, income differentials between economies with similar initial conditions (i.e., those belonging to the same convergence club) are expected to narrow as they move toward the same steady-state position, but that position would be markedly inferior to that enjoyed by the economies with more favorable initial conditions.

A number of theoretical growth models predict that convergence clubs will arise as a result of a dynamical system characterized by multiple locally stable steady-state equilibria instead of the unique globally stable equilibrium of the neoclassical growth model.Footnote 1 Such a situation could arise, for example, because of barriers to the imitation of new technologies due to significant differences in human and physical capital per worker across countries (Basu and Weil 1998), coordination failures arising from complementarity in innovation (Ciccone and Matsuyama 1996) or the state of financial development and the associated ability to diversify idiosyncratic risk (Acemoglu and Zilibotti 1997).

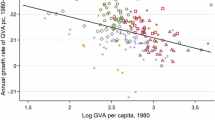

Alternative dynamical systems (adapted from Galor 1996). a Unique globally stable steady-state equilibrium. b Multiple locally stable steady-state equilibria

The difference between the two types of dynamical system is illustrated in Fig. 1. Figure 1a contains that of the neoclassical growth model with its unique equilibrium value of the capital-labor ratio \((\bar{k})\) that all economies (with the same structural characteristics) achieve, regardless of their initial position. However, in Fig. 1b, \(\bar{k}_{a}\) and \(\bar{k}_{c}\) are two locally stable equilibria, whereas \(\bar{k}_{b}\) represents an unstable equilibrium. Within this dynamical system, economies with similar initial conditions (and structural characteristics) move to the same steady-state position. If their initial value of \(\bar{k}\) fell below \(\bar{k}_{b}\), this equilibrium position would be markedly inferior to that of other economies with comparable structural characteristics, but which happen to enjoy more favorable initial conditions (i.e., their initial value of \(\bar{k}\) exceeds \(\bar{k}_{b})\). Hence, two distinct convergence clubs would emerge over time.

Evidence of club convergence can be found by assessing the time-series properties of the bilateral international income differential (yd), i.e., the natural log of the real per capita income for one economy \((y_{i})\) less than that of another \((y_{j})\). If Country i and Country j are both members of the same convergence club, and both have reached their steady-state equilibrium, then forecasts of their income differential should tend to zero as the forecast horizon tends to infinity (Bernard and Durlauf 1995):

where \(I_{t}\) is the information set at time t. In other words, yd should be a zero-mean stationary process; all shocks to yd should be transitory in nature.

However, if either or both economies had yet to reach their steady state, but were systematically moving toward it during the sample period, this would also be consistent with club convergence (even though yd would have a nonzero sample mean). In this case, the economy still in transition to the steady-state would be ‘catching-up’ with the other (Bernard and Durlauf 1995, 1996). Hence, given that \(y_{i} < y_{j}\) initially (i.e., \({ yd}_{t} < 0\)), there would be evidence of club convergence if

Equation (2) would be satisfied if yd were found to be a trend-stationary process with a positive slope (Carlino and Mills 1993; Oxley and Greasley 1995).Footnote 2

Therefore, the club convergence hypothesis can be assessed by testing whether yd has a unit root and, if it does not, estimating is deterministic trend. In order to account for the possibility that an economy has completed its transition to steady state during the sample period or has been subject to some other form of structural change in its underlying relative growth path, empirical studies of the standard and club convergence hypotheses commonly apply unit-root tests that allow for one or more breaks in the deterministic trend for yd.

3 Existing evidence of club convergence in Latin America

Only two previous studies to our knowledge have tested for club convergence in Latin America and neither provides convincing evidence that such a club exists. Dawson and Sen (2007), first of all, test yd for eight economies (with \(y_{j}\) defined as the weighted average level of per capita income across their sample). They find only three countries (Argentina, Brazil and Colombia) have deterministic trends consistent with catching-up to the group’s average level of income.Footnote 3 However, in Brazil’s case catching-up with the group average to a large extent only means it is catching-up with itself, due to its large weighting in the regional average.

Galvão and Gomes (2007) test two regionally benchmarked measures of yd for a broader sample of 19 Latin American economies. In the first, \(y_{j}\) is the (simple) average of per capita income across all 19 countries, whereas the second uses either the Central American or the South American average, as appropriate. They reject the unit-root hypothesis for both definitions of yd for all eight Central American countries, but the rejection rate for the South American countries in their sample rises from four to seven when yd is based on the South American, rather than the full 19-country, average income measure.

However, Galvão and Gomes (2007) rely on the critical values for a sample twice the size of theirs and no allowance is made for the presence of either autoregressive or moving-average components in \(\Delta { yd}\).Footnote 4 Re-evaluating their results with critical values tailored to their sample size alone reveals that, at best, the yd series for only half the sample show significant evidence of having a trend-stationary process. Moreover, of these, only El Salvador’s estimated deterministic trend function indicates it is currently catching-up to its region’s average; the other countries are mostly diverging from their region’s average.Footnote 5

Hence, the results of these studies suggest that in most cases the underlying growth path followed by one economy is quite different from that followed by others in the region and so there is little indication of club convergence. It would seem that, even though the economies of Latin America share a number of geographic, historical, institutional and cultural characteristics, the differences in their resource endowments, international trade patterns, economic systems, industrial structures, etc. have influenced their relative economic performance in a way that prevents club convergence from taking place.

Such a conclusion may be premature, however, as both studies have two methodological features in common that are potentially problematic when testing for club convergence. In particular, they both use a sample average measure of \(y_{j}\) when constructing each country’s yd variable, to which they both apply discrete-break unit-root tests.

Defining \(y_{j}\) as an average immediately raises the issue of how such an average should be calculated. Galvão and Gomes (2007) choose a simple average, but this places equal importance on economies of vastly different size (e.g., Brazil versus Guyana, Mexico versus Trinidad and Tobago). Dawson and Sen (2007) choose a weighted average, but as indicated above this can also be problematic if the sample includes a relatively large economy, like Brazil, which essentially ends up being tested for convergence on itself.

Calculating the average across the countries that happen to be in the sample set can also be problematic, as it is implicitly assumed that the countries selected for study match the membership of the suspected convergence club. Should the sample exclude a club member (or include a nonmember), then any average will be subject to measurement error. As there is no reason for all members of such a club to be located in the same geographic region (or for all countries in the same region to belong to the same club), this is not a trivial problem.

The use of discrete-break unit-root tests can be problematic as well because they incorporate a number of assumptions about the shape an economy’s underlying relative growth path may take. In particular, as Enders and Lee (2004, 2012) and Becker et al. (2006) observe, such tests assume a data series has a pre-specified number of instantaneous structural breaks in its deterministic trend. Moreover, the trend is assumed to be composed of segments that are strictly linear between breakpoints, and which may be discontinuous at each breakpoint. Finally, when these breakpoint(s) are allowed to be chosen by the test, the search process is applied to a trimmed sample period that excludes the observations near its endpoints. Hence, the power of the test can be adversely affected by a break that occurs at an excluded observation.

These assumptions may be appropriate in some contexts, but they are difficult to justify for yd. Quite apart from the fact that the actual number of structural breaks is normally unknown, it seems unreasonable to expect the transitional process of catching-up could end at a specific moment in time so as to produce a sharp breakpoint. Instead, an economy in transition would seem more likely to approach its steady-state equilibrium position along a smoothly curving path, a scenario that could be only roughly approximated by a small number of strictly linear segments. Hence, even when a discrete-break test is able to reject the null hypothesis of a unit root, there is a chance the deterministic trend it implies for yd will only crudely describe the economy’s true underlying growth path.

To determine whether these two factors affect the level of evidence for club convergence, we make two changes to the approach taken by the previous studies. First, our measure of yd will use a single regional economy as the benchmark. We do this because the theoretical growth models that predict club convergence expect all club members to gravitate toward a similar steady-state position and so their income differential with any other club member should systematically diminish over time. Therefore, any member of the club could be the benchmark.

The use of a single economy as the benchmark also has an advantage over a sample average in that the test results for any individual country would be independent of the composition of the rest of the sample. The accidental exclusion of some club members, or the inclusion of nonmembers, would be of no consequence. The only risk is that the selected benchmark country is not a club member—and that possibility should be revealed by the test results obtained.

The second change we make is to employ the recently developed Fourier-type unit-root tests of Enders and Lee (2012) to test yd. These avoid the potentially restrictive assumptions inherent in the discrete-break unit-root tests with respect to the nature of the deterministic component of yd. Instead of assuming that this is adequately described by a succession of strictly linear segments, the Fourier-type tests allow for a wider (and arguably, in the present context, more realistic) range of functional forms.

4 Econometric methodology

Enders and Lee (2004) and Becker et al. (2006) argue that the limitations of the discrete-break tests can be avoided by incorporating a single frequency component of a Fourier approximation into a standard unit-root test, as this can mimic a wide variety of breaks (including ones spread over multiple periods) as well as other forms of nonlinearity (including smooth curves) in the data series’ deterministic trend function. A strictly linear trend is also retained as a special case.

The broken linear trend case considered by the discrete-break tests is not nested within the single-frequency Fourier functional form. Hence, if the trend for yd is actually linear with one or two sharp and possibly discontinuous breaks, a Fourier-type unit-root test will not identify that trend as accurately as might be possible using a discrete-break test. However, as discussed in Sect. 3, this is not expected to represent a serious limitation in the context of the club convergence hypothesis. Moreover, Enders and Lee (2012) (hereafter, E&L) demonstrate that the power of their Fourier-type Lagrange Multiplier (FLM) unit-root test, at least, is comparable to that of a discrete-break test even when discrete breaks in the trend and/or intercept are present.

To describe E&L’s FLM test consider a series, x, with the following data generating process (DGP):

where \(u_{t}\) is a stationary disturbance term and d(t) is a deterministic function of time of unknown form incorporating structural breaks of unknown number and timing, or any other source of nonlinearity.

E&L note that d(t) can be approximated to any desired level of accuracy by a sufficiently complex Fourier function:

where n is the number of cumulative frequencies in the approximation, k represents a specific frequency, \(\pi = 3.1415926{\ldots }\) and T is the number of observations.

For several reasons, including tractability and to avoid an over-fitting problem, E&L recommend that a single frequency should be sufficient in most cases. Hence, substituting (5) (with \(n = 1\)) into (3) gives the following DGP for x:

where k now represents the selected single frequency.

To test the hypothesis that x has a unit root (i.e., \(\rho = 1\)) against the alternative (\(\rho < 1\)), E&L employ the Lagrange Multiplier (LM), or Score, principle by imposing the null on Eq. (6) and estimating it after taking first-differences:

The coefficient estimates obtained (\(\tilde{\delta }_{0}\), \(\tilde{\delta }_{1}\), \(\tilde{\delta }_{2}\)) are used to construct the following detrended series:

where \(\tilde{\psi } = x_{1} - \tilde{\delta }_{0} - \tilde{\delta }_{1}\hbox {sin}(2\pi k/T) - \tilde{\delta }_{2}\hbox {cos}(2\pi k/T)\), and \(x_{1}\) is the first observation of x. This detrended series forms the core of the FLM test equation which, once augmented with m lags of \(\Delta \tilde{S}\) to control for serial correlation, takes the following form:

The null that x has a unit root is assessed using the t-statistic for the estimate of \(\varphi \), which has a nonstandard distribution. Specifically, E&L show that the asymptotic distribution of this t-statistic depends on the value taken by k, but it is invariant to the other parameters that determine d(t). As our sample size does not match that for the critical values E&L provide and as these values are, to some extent at least, sensitive to the particular autoregressive, moving-average (ARMA) characteristics of the data, we estimate the t-statistic’s distribution using the simulation method outlined in Sect. 5.

If the value of k were known a priori, it could be imposed on the test equation. As this is not normally the case, E&L propose a data-driven search method for selecting k. This involves estimating Eq. (9) for a range of values of k and choosing the one (\(\hat{k}\)) minimizing the sum of squared residuals. E&L suggest that \(\hat{k}\) be chosen from the integer values 1 through 5, but this forces the function’s trigonometric component to end at its starting position (relative to the linear trend). Therefore, we follow Christopoulos and Leon-Ledesma (2011) by selecting \(\hat{k}\) from the range [0.1, 0.2, ..., 4.9, 5.0].

It is possible, of course, that x has a strictly linear trend, in which case Eq. (9) is over-specified and the standard LM test is likely to be more powerful. Consequently, E&L provide an F-test of the null that \(\gamma _{1} = \gamma _{2} = 0\). The distribution of this test statistic (\(F(\hat{k})\)) is also nonstandard, as E&L assume that x has a unit root under the test’s null hypothesis.

Although the FLM test allows for nonlinearities in the trend function for x, it retains the standard unit-root test assumption of linear mean-reversion to that trend. It is possible, however, that the rate of mean-reversion varies with the economy’s distance from its underlying (relative) growth path. For example, a large shock may provoke a faster and stronger corrective response from policymakers than a small one would (Beechey and Österholm 2008). Therefore, in case the FLM test is unable to reject the null because of its assumption of linear mean-reversion, we also employ a variant of the test incorporating nonlinear mean-reversion that is derived by following Chortareas et al’s (2002) approach.

Their nonlinear mean-reversion variant of the standard Schmidt-Phillips LM unit-root test (i.e., the NLM test) assumes the data series follows an exponential smooth transition autoregressive process under the alternative hypothesis. This is represented in the NLM test equation by its first-order Taylor series approximation, with the effect that \(\tilde{S}_{t-1}\) is replaced by its cube. By replacing the linear deterministic trend function in Chortareas et al’s (2002) NLM test with one incorporating a single-frequency Fourier function, we get a nonlinear mean-reversion version of the FLM test (i.e., the NFLM test):

As is the case with the FLM test, the null hypothesis that x has a unit root is also evaluated using the t-statistic for the estimate of \(\varphi \). As with Chortareas et al’s (2002) NLM test, the NFLM test statistic also has a nonstandard distribution and, in common with the FLM test, this distribution also depends on the value taken by k. Therefore, we also estimate series-specific distributions for this test statistic using the simulation method described in Sect. 5.

5 Data and econometric results

All data for the construction of yd for 22 Latin American and Caribbean countries are taken from the Penn World Table version 7.1 (Heston et al. 2012). The specific real per capita income series chosen to construct yd is gross domestic product per capita at 2005 constant prices (series code: RGDPL2). This series covers the period 1950–2010 for most countries, but begins a little later in the case of Chile, the Dominican Republic, Ecuador, Paraguay (all 1951), Jamaica (1953), and Haiti and Barbados (both 1960).

The benchmark economy chosen for yd is Argentina. Although not the largest economy in the region, Argentina is of reasonable size and was also the most developed of the Latin American economies over the first half of the 20th century. In any case, as discussed in Sect. 3, what matters is that the benchmark is in the same club as the other economies, which cannot be known a priori but may be revealed by the test results.

As indicated in Sect. 4, all four unit-root tests (i.e., FLM, NFLM, LM, and NLM) generate t-statistics with nonstandard distributions. As their published critical values relate to sample sizes greater than those available here and/or can be sensitive to the ARMA properties of a data series, the distribution of the t-statistic for each test on each country’s measure of yd is estimated by a simulation process. Specifically, an ARMA(p, q) model is fitted to the first difference of each yd series and its optimal values of p and q are selected (from the range 0 to 5) using the Schwarz Bayesian Criterion. Each test is then applied (using, in the case of FLM and NFLM, the value of \(\hat{k}\) selected for the actual series in question) to 40,000 artificial series (with T matching that of the actual data series) constructed with the coefficient estimates from the optimal ARMA model and residuals randomly drawn from a \(N(0, \sigma ^{2})\) distribution (where \(\sigma ^{2}\) is the variance on the errors from the ARMA model). This gives a country-specific estimate of the distribution of each test’s t-statistic from which its p value may be determined.

A similar issue arises with the \(F(\hat{k})\) statistic, and its distribution is similarly derived. Specifically, 100,000 artificial data series conforming to the DGP described by Eqs. (6) and (4) (with \(\rho = 1\) and \(\gamma = \alpha _{k} = \beta _{k} = 0\), in accordance with the null) are tested. The initial values, \(y_{0}\) and \(e_{0}\), for each are chosen randomly and \(u_{t}\) is drawn from a N(0, 1) distribution.

The maximum number of lagged augmentation terms for each test is set at seven, and insignificant lags are removed by a general-to-specific process. The test results obtained are presented in Table 1. The null hypothesis that a unit root is present cannot be rejected by either the FLM test or the NFLM test for El Salvador, Guatemala and Trinidad & Tobago. Hence, the underlying growth paths of these three economies do not appear to have a stable or systematic relationship with that for Argentina and so cannot be members of the same convergence club. However, the unit-root null hypothesis can be rejected by at least one test for the other 18 countries, which indicates that they have a deterministic relative growth path with respect to Argentina.

To determine whether these relative growth paths are consistent with club convergence, the deterministic trend function for each is estimated as follows:

where \(\varTheta \) is one minus the sum of the autoregressive components \((\theta _{j})\) and m is chosen to control for serial correlation. The results obtained are reported in Table 2 and plotted against the actual values of yd (represented by a thin line) in Fig. 2.Footnote 6 (Note: The countries are presented in Fig. 2 in the order they will be discussed.)

Fitted deterministic trend functions (thick line) for yd (Argentina benchmark; thin line). a Chile (\(k = 1.2\)). b Costa Rica (\(k = 0.1\)). c Dominican Republic (\(k = 1.2\)). d Jamaica (\(k = 2.0\)). e Mexico (\(k = 1.2\)). f Panama (\(k = 1.5\)). g Uruguay (\(k = 0.8\)). h Bolivia (\(k = 1.0\)). i Haiti (\(k = 1.3\)). j Honduras (\(k = 1.2\)). k Nicaragua (\(k = 1.2\)). l Brazil (\(k = 1.1\)). m Colombia (\(k = 1.4\)). n Ecuador (\(k = 1.0\)). o Paraguay (\(k = 1.6\)). p Barbados (\(k = 0.1\)). q Peru (\(k = 1.4\)). r Venezuela (\(k = 0.4\))

Of the 18 countries, seven (Chile, Costa Rica, the Dominican Republic, Jamaica, Mexico, Panama, and Uruguay) could be considered to be members of a convergence club along with Argentina. Specifically, the deterministic trends found for all except Jamaica indicate that catching-up has taken place over much, if not all, of the sample period and their rate of catch-up can be seen to slow as yd approaches zero. In fact, Chile and Mexico appear to have converged to a steady-state level of income that is a little higher than Argentina’s, whereas Uruguay seems to have reached a steady state that lies a little below Argentina’s.

Jamaica’s relatively large value of \(\hat{k}\) (2.0) suggests that the oscillations in its relative underlying growth path are transitory in nature and so its convergence status may be established from the linear component of its trend function alone (Christopoulos and Leon-Ledesma 2011). As its linear slope (\(\gamma \)) and intercept (\(\alpha _{0}\)) coefficients are both statistically significant, but take opposing signs, they indicate that Jamaica’s income differential with Argentina is slowly diminishing (Carlino and Mills 1993).

Several of the 11 other countries (i.e., Bolivia, Haiti, Honduras, and Nicaragua) exhibit divergence for most if not all of the sample period and so clearly do not belong to the same convergence club as Argentina. Several others—specifically Brazil, Columbia, Ecuador and Paraguay—all have periods during which they have made notable progress in closing their income gap with Argentina, but the opposite has been true since the early 1990s and so they are unlikely to be members of the same club as Argentina either.

Of the three remaining countries, the fitted trend for Barbados suggests that it has recently begun to catch-up (from above) with Argentina, but this development comes too close to the end of the sample period to be confident that it represents a sustained change. A more conservative assessment of this case is that Barbados and Argentina have followed essentially parallel growth paths over the sample period, but their large income differential is inconsistent with the idea that they belong to the same club. Peru could also be said to have recently shifted onto a growth path that is slowly closing its income gap with Argentina, but its trend could as easily be interpreted as showing a large and persistent income differential that is subject to only mild and relatively transitory oscillations. Finally, the negative slope of Venezuela’s deterministic trend since the early 1980s has transformed its initially positive income differential into a negative one. As there is no sign its current rate of divergence from Argentina is slowing, they cannot be considered members of the same club.

In summary, these results provide evidence of an eight-country (i.e., including Argentina) convergence club, but this represents only a minority (in both numerical and population terms) of the region’s economies. However, a visual comparison of the estimated deterministic trends of the other 11 countries (and the yd series of the three countries that are not stationary) suggests seven (namely, Brazil, Colombia, Ecuador, El Salvador, Guatemala, Peru and Venezuela) that may represent a second convergence club.

We formally consider this possibility by testing an alternative measure of yd in which Venezuela is the benchmark. The results obtained are shown in Panel A of Table 3. These reveal that the unit-root hypothesis can be comfortably rejected by at least one test for all countries, except Guatemala. Panel B of Table 3 and Fig. 3 contain the fitted deterministic trends for these five countries. All five trend functions indicate that each country’s income gap with Venezuela has been systematically closing during the sample period. It is also notable that the rate of catch-up exhibited by both Brazil and Colombia has declined in recent decades as their measures of yd approach zero, as would be expected of members of the same club.

Taking these two sets results together, we find that most of the economies in our sample can be classified as belonging to one of two convergence clubs. The first contains eight countries (i.e., Argentina, Chile, Costa Rica, the Dominican Republic, Jamaica, Mexico, Panama and Uruguay) and the second contains six countries (i.e., Brazil, Colombia, Ecuador, El Salvador, Peru and Venezuela).

This leaves eight countries in our sample that cannot be assigned to either club, but almost all of these are either (in the Latin American context) very rich (i.e., Barbados and Trinidad & Tobago) or very poor (Bolivia, Haiti, Honduras, Nicaragua and Paraguay). In other words, they occupy the two extremes of the Latin American income distribution and it is possible they belong to convergence clubs primarily populated by economies located outside the region. It is also worth noting that the 14 countries that can be assigned to one of the two clubs contain almost 90 % of the region’s population. Hence, Latin America can be broadly characterized as being composed of two convergence clubs.

One implication of this finding is that the distribution of income across the region is becoming increasingly polarized over time. Moreover, our results offer some support for the group of theoretical growth models that predicts the existence of multiple steady-state equilibrium positions. By the same token, our results represent evidence against the standard, single steady-state, neoclassical growth model.

The existence of multiple equilibria in turn implies that the process of convergence to the income level of rich nations is not automatic and a developing economy will face barriers to growth that must be overcome if it is to advance beyond a particular level of economic development. Moreover, these barriers appear to remain effective even when, as is the case in Latin America, considerable effort has been made to implement a broad range of economic reforms designed to stabilize macroeconomic fundamentals, privatize industry and liberalize markets à la the Washington Consensus. This suggests that policies targeted at overcoming the particular barriers to growth and structural transformation facing Latin American economies are required. This, of course, first requires the nature of these barriers to be identified.

The theoretical multiple-equilibria growth models suggest that barriers to further economic development could arise for a variety of reasons. For example, they may arise as a consequence of an economy’s initial level of human capital per capita, its state of financial development, or externalities caused by complementarity in innovation (Ciccone and Matsuyama 1996; Acemoglu and Zilibotti 1997; Basu and Weil 1998). These models, in turn, suggest that policies designed to substantially increase investment in human capital or even a temporary ‘big-push’ targeted at increasing incentives for firms to adopt new production technologies would be necessary to overcome these barriers and move the economy onto the growth path to a superior steady-state position (Gancia and Zilibotti 2005).

However, it is important to note that, although our results indicate that two groups of economies are facing some form of barrier to their further development, finding evidence of club convergence only supports the concept of multiple-equilibria growth models and does not provide support for any particular model based on a specific cause of multiple equilibria. It is also important not to presume that all members of a convergence club must be facing the same barrier to growth. It is possible that there is a set of barriers an economy must overcome when it reaches a particular stage of development. However, depending on the actual set of policies, institutions, etc. an individual economy has adopted, not all of those barriers may be relevant in its case. Hence, the particular barrier (or barriers) actually impeding one club member could differ from those faced by another.

For example, we find evidence that Brazil and El Salvador are members of the same convergence club, but when Hausmann et al. (2008) employ their framework for growth diagnostics to identify the most binding constraint on each country’s economic activity, they come to very different conclusions. Brazil’s economic growth, they argue, is constrained by its heavy burden of transfers (e.g., pensions) and high public debt, whereas they conclude that problems with self-discovery—i.e., identifying and implementing profitable new ideas and activities—is the binding constraint in El Salvador’s case.

In this light, identifying a set of countries that belong to the same convergence club does not imply that there must be a common strategy or policy that would enable all of them to escape their shared steady-state equilibrium and advance to a superior one. Furthermore, even when some club members are subject to the same binding constraint, it is possible that each requires a different solution because what is most effective for one economy may be less so when set in another economy’s context (Rodrik 2006, 2010). It may even prove necessary for countries to experiment with different and possibly quite unorthodox policies to see what works in their setting, as Rodrik (2006, 2009, 2010) advocates, in part based on the success of countries like China, Vietnam, Malaysia among others at achieving a prolonged period of high economic growth.

6 Conclusions

In contrast to earlier studies, we find strong evidence that most of the 22 Latin American economies we examined belong to one of two convergence clubs. The first of these contains eight countries (i.e., Argentina, Chile, Costa Rica, the Dominican Republic, Jamaica, Mexico, Panama and Uruguay), whereas the second is comprised of six countries (i.e., Brazil, Colombia, Ecuador, El Salvador, Peru and Venezuela).

The existence of these two clubs provides support for the class of theoretical growth models that predict the existence of multiple steady-state equilibrium positions, as opposed to the unique equilibrium that characterizes the neoclassical growth model. This in turn implies that even if a developing country adopts the institutions of a developed country and its government pursues sound macroeconomic policies, this may not be sufficient to promote the structural transformation needed for economic development. Instead, additional policy action would be needed to overcome the barriers that currently prevent their economy from converging to a superior steady-state position.

The various multiple-equilibria growth models identify different causes of convergence clubs. It is possible there are multiple factors contributing to the existence of a particular convergence club and that the particular factor responsible for the membership of any one country (i.e., its binding constraint) is not the same as that for other members of the same club. Our analysis cannot isolate the specific nature of the barriers that have created the two convergence clubs we identify but, by providing evidence that barriers to economic development exist, it adds weight to calls for a country-by-country diagnosis of the binding constraint on their growth and the development of targeted, context-specific policies to overcome it.

Finally, given that most Latin American economies belong to one of two convergence clubs and there is no particular reason to believe that the membership of such clubs should be confined to a specific geographic region, it seems natural to ask whether either club contains members from other parts of the world. We leave this question for future research.

Notes

Equivalently, if \({ yd}_{t}\) is initially positive, then its deterministic trend would need to be negatively sloped to be considered evidence for the club convergence hypothesis. Note that Carlino and Mills (1993) refer to catching-up as \(\beta \)-convergence.

Dawson and Sen (2007) conclude that Chile and Mexico are converging on the average as well. However, although the trends for both countries imply that their income gap is initially shrinking, by the end of the sample period it is expanding (i.e., the trend cuts through the point where yd = 0).

The one- and two-break Lagrange Multiplier (LM) tests they apply are reasonably sensitive to both of these factors. For example, the 10 % critical value for the two-break test (\(T = 100\); breakpoints at \(\lambda _{1} = 0.4\), \(\lambda _{2} = 0.8\)) is \(-5.32\). Its value when \(T = 50\) is \(-6.20\) (based on 10,000 simulations). If a moderate (+0.6) autoregressive component or a small (+0.3) moving-average component is also present, it becomes \(-6.58\) and \(-6.76\), respectively.

Two trend functions are estimated for Bolivia, Brazil, Costa Rica, the Dominican Republic, Ecuador, Nicaragua, Panama, and Venezuela, as the unit-root hypothesis can be rejected for these countries by both the FLM and NFLM tests for different values of \(\hat{k}\). As King and Ramlogan-Dobson (2014) demonstrate, very different combinations of the Fourier coefficients can produce very similar-looking trends, and this turns out to be the case for all of the above-mentioned countries. Therefore, to avoid cluttering the graphs, only one of their trend functions is shown in Fig. 2.

References

Acemoglu D, Zilibotti F (1997) Was Prometheus unbounded by chance? Risk, diversification and growth. J Pol Econ 105:710–751

Basu S, Weil DN (1998) Appropriate technology and growth. Q J Econ 113:1025–1054

Becker R, Enders W, Lee J (2006) A stationarity test in the presence of an unknown number of smooth breaks. J Time Ser Anal 27:381–409

Beechey M, Österholm P (2008) Revisiting the uncertain unit root in GDP and CPI: testing for non-linear trend reversion. Econ Lett 100:221–223

Bernard AB, Durlauf SN (1995) Convergence in international output. J Appl Econom 10:97–108

Bernard AB, Durlauf SN (1996) Interpreting tests of the convergence hypothesis. J Econom 71:161–173

Carlino GA, Mills LO (1993) Are US regional incomes converging? A time series analysis. J Monet Econ 32:335–346

Chortareas GE, Kapetanios G, Shin Y (2002) Nonlinear mean reversion in real exchange rates. Econ Lett 77:411–417

Christopoulos DK, Leon-Ledesma MA (2011) International output convergence, breaks and asymmetric adjustment. Stud Nonlinear Dyn Econom 15:67–97

Ciccone A, Matsuyama K (1996) Start-up costs and pecuniary externalities as barriers to economic development. J Dev Econ 49:33–59

Dawson JW, Sen A (2007) New evidence on the convergence of international income from a group of 29 countries. Empir Econ 33:199–230

Dawson JW, Strazicich MC (2010) Time-series tests of income convergence with two structural breaks: evidence from 29 countries. Appl Econ Lett 17:909–912

Enders W, Lee J (2004) Testing for a unit root with a nonlinear Fourier function. Department of Economics, Finance and Legal Studies, University of Alabama Working Paper

Enders W, Lee J (2012) A unit root test using a Fourier series to approximate smooth breaks. Oxf Bull Econ Stat 74:574–599

Galor O (1996) Convergence? Inference from theoretical models. Econ J 106:1056–1069

Galvão AF Jr, Gomes FAR (2007) Convergence or divergence in Latin America? A time series analysis. Appl Econ 39:1353–1360

Gancia G, Zilibotti F (2005) Horizontal innovation in the theory of growth and development. In: Aghion P, Durlauf SN (eds) Handbook of economic growth, vol 1A. Elsevier, Amsterdam, pp 111–170

Hausmann R, Rodrik D, Velasco A (2008) Growth diagnostics. In: Stiglitz J, Serra N (eds) The Washington consensus reconsidered: towards a new global governance. Oxford University Press, New York Ch. 15

Heston A, Summers R, Aten B (2012) Penn World Table Version 7.1. Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania. http://pwt.econ.upenn.edu/ Accessed 5 June 2013

King A, Ramlogan C (2008) Is Latin America catching up? A time-series approach. Rev Dev Econ 12:397–415

King A, Ramlogan-Dobson C (2014) Are income differences within the OECD diminishing? Evidence from Fourier unit root tests. Stud Nonlinear Dyn Econom 18:185–199

Maeso-Fernandez F (2003) A time series approach to \(\beta \) convergence. Appl Econ 35:1133–1146

Oxley L, Greasley D (1995) A time-series perspective on convergence: Australia, UK and USA since 1870. Econ Rec 71:259–270

Rodrik D (2006) Goodbye Washington consensus, hello Washington confusion? A review of the World Bank’s “economic growth in the 1990s: learning from a decade of reform”. J Econ Lit 44:973–987

Rodrik D (2009) The new development economics: we shall experiment, but how shall we learn? In: Cohen J, Easterly W (eds) What works in development? Thinking big and thinking small. Brookings Institution Press, Washington Ch. 2

Rodrik D (2010) Diagnostics before prescription. J Econ Perspect 24:33–44

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Swan T (1956) Economic growth and capital accumulation. Econ Rec 32:334–361

Acknowledgments

The authors wish to thank Steve Dobson, Dorian Owen, an anonymous referee and one of the journal’s associate editors for their constructive feedback on earlier drafts of the paper. Their comments have materially improved the paper, but responsibility for its content rests entirely with its authors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

King, A., Ramlogan-Dobson, C. Is there club convergence in Latin America?. Empir Econ 51, 1011–1031 (2016). https://doi.org/10.1007/s00181-015-1040-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-1040-x