Abstract

This paper investigates club convergence in income per capita of 329 prefecture-level city regions in China over a period of 1990 to 2014. A nonlinear time-varying factor model is adopted to examine convergence trends as the model allows for transitional heterogeneity and divergence from the actual growth path. The study further explores the driving forces of convergence clubs using an ordered response model. Four convergence clubs are identified, showing no geographic regularity in club member locations. The highest income club and the lowest income club tend to converge strongly, whereas two middle-income clubs converge weakly. The findings indicate that initial conditions, sectorial characteristics, preferential development policy, general government spending, network effect, spatial effect, and the role of globalization are the significant factors responsible for the formation of club convergence in China.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Geographic inequality in economic growth has risen significantly across various scales. The increasing inequality becomes a primary source of societal instability and represents a great obstacle to economic growth in poor regions. Whether such growing inequality reflects the nature of contemporary capitalism under globalization and technological development is a topic of intense debates. Many prominent economists argue that the increasing inequality between the rich and the poor is a matter of political decision in making various public policies (Stiglitz 2014).Footnote 1

While it has made a remarkable economic success since 1978 when economic reforms were initiated, China’s income inequality is argued to be among the world’s worst.Footnote 2 However, how this inequality is reflected geographically remains unclear. Some argue that with some oscillation, regional inequality in China has been on the rise, especially since 1990s (Chen 2010; Xu et al. 2018). Others claim that there is no clear evidence about club convergence or divergence processes nor even an inverted-U trend of regional inequality over time (Liao and Wei 2016). Promoting even economic development across regions is among the top political agendas of Chinese government to ensure national unity and political stability. Given a more moderate rate of economic growth in recent years, it is imperative to understand if China is finally witnessing a trend of club convergence.

To date, the scholarly debates on convergence clubs in China are centered on three aspects. First, empirical studies have generated inconsistent results about the number of convergence clubs and their compositions. For example, some studies identify two convergence clubs (Tian et al. 2016; Lin et al. 2013). Other researches find there are three (Cheong and Wu 2013) or more convergence clubs (Westerlund 2013; Herrerias and Ordóñez 2012). It can be argued that these contradictory conclusions mainly originate from different statistical methods employed in various studies, which often fail to take into account of heterogeneous technological progresses across regions. Second, there is no agreement about the factors responsible for Chinese club convergence. Some scholars argue that the main driving forces of club convergence include preferential development policy by the state, open-door policy, market reforms, infrastructural conditions and development, capital intensity in regional economy, sectorial characteristics and size of local governments (Herrerias and Ordóñez 2012; Tian et al. 2016). Others find that the unique features of regions including the implementation of economic preferential policies and geographic factors do not contribute to the formation of convergence clubs (Westerlund 2013). Third, convergence clubs tend to be scale-dependent and most of the literature on China use the province as the research unit (Cheong and Wu 2013). However, it is well known that the provincial scale is too crude and the intra-provincial economic growth is quite different from what is observed at a provincial scale. Hence, the results based on the provincial scale may omit some convergence or divergence trends.

This paper investigates convergence clubs in China at a prefectural level, a scale below the province. A total of 329 Chinese prefectures are included in this paper. Meantime, the study takes heterogeneous technological progress into account and employs a nonlinear time-varying factor model to detect club convergence. Further, it also explores the driving forces behind club convergence formation using an ordered logit model to test our proposed hypotheses. Our paper differs from previous works in several ways. First, most of the existing empirical studies on club convergence in China have primarily employed provincial data, providing a crude estimation of club convergence in China. Very few papers examine the characteristics of club convergence at a finer prefecture scale. As it is demonstrated in this paper, the prefecture is a better-suited regional unit to analyze the club convergence of China’s regional economic growth. Second, contrary to the approaches that ignore technology heterogeneity, the methodology employed in our paper allows regional units to converge along different paths due to technological heterogeneity. By comparing with the existing literature, we find that clubs obtained by our method are more in line with the characteristics of club convergence. Third, apart from studying whether some regions in China share common convergence patterns in per capita income, the results of this research aim to provide some insights into the factors behind the formation of clubs across Chinese prefectures. Moreover, both initial value of the influencing factors and their changes over time are included in our analysis. In addition, the analysis of club convergence is sensitive to the initial years. This is one of the difficult problems in the field of club convergence research. Our paper has partly addressed this problem. We have employed the method of Phillips and Sul (2007) in which convergence clubs are determined mainly by the later part of the period under investigation. In reasoning club convergence mechanisms, in addition to the factors associated with initial year, their changes over time are also taken into account in our model.

After this introduction, the next section reviews the methods popularized in the literature studying convergence club and proposes our working hypothesis about the convergence mechanisms. Section 3 describes the log t test and ordered logit model used in this study, Sect. 4 presents the empirical results of the convergence test and its factors; and Sect. 5 discusses the robustness of model estimation. The final section discusses our findings in relation to the existing literature.

2 Club convergence identification and explanation

2.1 Club convergence identification

The coexistence of poor and affluent regions is a common economic phenomenon, triggering a prominent theme of research in club convergence in the existing literature. The empirical testing of club convergence hypothesis is generally divided into two steps, namely, club determination and convergence testing (Papalia and Bertarelli 2013). In the literature, the methods to detect clubs can be divided into exogenous and endogenous approaches. The exogenous approach uses priori criteria to define clubs. The criteria can include initial per capita income, human capital, educational level, or geographic setting (Sofi and Durai 2016). Often, the defined thresholds of the selected criteria decide the result of club identification. In the literature, little consensus exists on criterion selection and threshold definition. Due to this drawback, the endogenous approach of club determination populates and even dominates in the field.

In the endogenous methods, clubs are defined by selecting endogenous classification criteria within a given classification scheme. The endogenous methods of club determination may include classification and regression tree analysis (Durlauf and Johnson 1995; De Siano and D’Uva 2006), hierarchical clustering analysis (Brida et al. 2014), and exploratory spatial data analysis (Furková and Chocholatá 2016). In the classification and regression tree analysis and hierarchical clustering algorithm, multiple variables such as initial growth conditions and sectorial characteristics in industry are employed as criteria to classify convergence clubs. The similarity between regions within a club can be expressed in terms of distance in initial growth conditions and sectorial characteristics. In exploratory spatial data analysis, a single classification criterion, often initial per capita income, is used to classify convergence clubs. The method takes into account of spatial dependency associated with classification variables, such as income condition of neighboring regions, in the analysis. Such spatial dependency is often neglected in conventional classification methods.

Compared with methods of club determination, the methods of convergence testing are diverse. It can be argued that the types of convergence testing methods depend mainly on the definition of club convergence and technical homogeneity or heterogeneity.

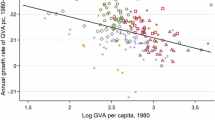

Barro and Sala-I-Martin (1992) propose the classic concept of club convergence, indicating that convergence occurs between the regions with similar initial conditions of economic growth and sectorial characteristics. Based on this definition, the cross-sectional regression is developed to verify the negative relationship between the initial per capita income and its growth rate across different regions. Due to heterogeneity, endogeneity and measurement error, the results of cross-sectional regression may be biased (Galor 1996). The panel data analysis can solve some of the above problems (Islam 2003). The biggest advantage of panel data analysis is that it allows the control of unobservable heterogeneity and the use of hysteresis variables as instrumental variables to reduce measurement errors and endogenous deviations. However, panel data analysis also has some shortcomings, such as the possibility of small sample bias, short frequency problems, individual effects and related independent variables. In addition, if the process of technology progress is stochastic, per capita income will fail this kind of club convergence, even though the underlying stochastic process of the economy is convergent (Pesaran 2007).

Galor (1996) argues that club convergence should be defined as the long-term convergence of different regional groups with similar sectorial characteristics in industry and the test of convergence needs to focus on the stationarity of the difference in per capita income. Accordingly, unit root tests ranging from the time series unit root test (Anagnostou et al. 2016) to the panel unit root test (Mérida et al. 2016) are widely applied in testing the existence of club convergence. However, transitional dynamics in the data often prevail in the period, and hence the unit root tests may not ‘catch’ convergence tendency (Apergis and Cooray 2014). Accordingly, Apergis and Payne (2012) argue that nonstationary difference in per capita income does not necessarily mean divergence due to the transitional dynamics in the data.

The above-mentioned concepts of club convergence consider the process of regional development as “island”. This analytical angle has been criticized in the literature. For example, Quah (1996) argues that club convergence studies should take into account the shape of the per capita GDP distribution and its internal distribution over time, rather than estimating the cross-sectional relationship between growth rates and per capita GDP levels. As a result, it is argued the method of growth dynamic distribution is an effective way to study convergence (Magrini et al. 2015). This method avoids the problem of estimating the deviation of endogenous variables. However, some scholars suggest that double peaks are neither sufficient nor necessary to reject the conditions of the convergence hypothesis (Caggiano and Leonida 2013).

In addition, scholar in the field of spatial econometrics argue that the current methods in the convergence studies neglect spatial dependence of economic growth, leading to an ineffective and unreliable statistical inference. It is proposed to examine systematically spatial autocorrelation and employ spatial econometric methods to test convergence clubs (Furková and Chocholatá 2016; Fischer and LeSage 2015). However, at present, most of the spatial weight matrix employed in spatial econometric methods is the simple adjacent matrix, which may not capture precisely the nature of spatial dependence in the data and, consequently, affect the robustness of the results.

The approaches aforementioned have all ignored that there exits possibly common technology heterogeneity across different regions. If technological progress is actually heterogeneous across units, the assumption of a homogeneous slope coefficient will lead to inconsistent parameter estimates (Papalia and Bertarelli 2013). To overcome this problem, Phillips and Sul (2007, 2009) propose a nonlinear time-varying factor model. This model can detect clubs and test convergence at the same time. There are several unique advantages in this method. First, it allows for different time paths and individual heterogeneity among regions, and therefore enables to uncover different patterns of economic transition behavior. Second, it can distinguish different kinds of convergence cases, such as absolute convergence, conditional convergence, club convergence, or divergence. Third, the method is not constrained by linear assumptions and more suitable for club convergence testing.

Due to these advantages, an increasing number of scholars have recently used the nonlinear time-varying factor model to study club convergence in per capita income (Von Lyncker and Thoennessen 2017; Borsi and Metiu 2015). Given substantial differences in development stage, economic size, factor endowment, and level of technology, technological heterogeneity prevails among the provinces in China and the nonlinear time-varying factor model is argued to be suitable for studying its economic convergence. For instance, Herrerias and Ordóñez (2012) apply this method to explore convergence in per capita income, labor productivity, and capital intensity among 28 Chinese provinces from 1985 to 2000. Tian et al. (2016) also use the same method to investigate club convergence in provincial real GDP per capita for 31 provinces of China from 1978 to 2013. Their empirical analyses discover that different regions in China experience variegated transitional dynamics and possess different capabilities of technological innovation. In this study, the nonlinear time-varying factor model will be employed to study China’s club convergence of income at a prefecture level.

2.2 Club convergence factors

In the literature, empirical studies have found that numerous factors could be responsible for club convergence. According to Barro and Sala-I-Martin’s classic concept of club convergence, two kinds of regions are likely to form “convergence club”: one with similar initial conditions of economic growth and industrial sectorial trajectories. In testing the influence of initial conditions, most studies insist that initial levels in per capita income, physical capital accumulation, human capital accumulation are the important factors determining the formation of club convergence (Galor 1996; Quah 1996; Herrerias and Ordóñez 2012; Bartkowska and Riedl 2012; Von Lyncker and Thoennessen 2017). In addition to initial conditions, many scholars assert that sectorial characteristics in industry play a key role in the formation of club convergence (Brida et al. 2014; Tian et al. 2016). For example, shares of manufacturing and service industries in GDP are often regarded as the determining factors of club convergence.

Theoretically, it is believed that network effect and spatial interaction should not be ignored as these effects may shape the process of club convergence. For example, Frenken and Hoekman (2006) argue that network nodal cities, such as state or provincial capital cities, relatively independent from their hinterland but playing a role in the global trade, tend to converge more quickly than other regions. This line of argument is also supported by the study of Chapman et al. (2012) and they find that the network effect of capital city stimulates growth in capital city regions in EU during the 1980 s and early 1990s. Some scholars test the effects of spatial interaction such as regional trade, flow of people, diffusion of technology and knowledge. It is found that the effects of spatial interaction may be significant factors in shaping spatial dependence between regions, implying that different types of regional groups tend to be geographically clustered and lead to convergence clubs (Borsi and Metiu 2015; Dapena et al. 2016).

Over the last four decades, China has experienced a remarkable economic transformation from a planned economy to a socialist market economy. Both the state and market are significant players in shaping regional economic change (Xu and Yang 2013; Liu et al. 2017; Wang and Rickman 2018). As a result, in studying club convergence in China, many scholars consider the role of the state as an important determinant. Factors revealing the role of the state may include local government expenditure, change in local government expenditure, and preferential policies by the central government. For example, using local municipality expenditure, Tian et al. (2016) conclude that the behavior of provincial governments play an important role in the formation of club convergence in China. Similarly, Hao (2008) finds that two convergence clubs are defined by initial opening-up policies in China and indicates initial preferential policies by the central government lead to club convergence in China. However, other scholars dispute the role of preferential policies by the central government in explaining the presence of convergence clubs in China (Westerlund 2013). Given that China’s economy is increasingly integrated into global market economy, the process of globalization is considered to be crucial in determining club convergence. Some studies find that globalization is still an important factor widening Chinese regional inequality even after controlling for other factors (Zhang and Zhang 2003). Moreover, Ma and Jia (2015) find FDI flow is an important driving factor to promote growth convergence in China.

In summary, while the literature has identified some broad categories of influencing factors associated with club convergence, there is no consistent view on how these factors actually shape the trajectories of club convergence. It can be argued that the driving forces of club convergence are largely contingent upon the empirical context. Analyzing club convergence factors need to be sensitive to the geographic contexts because the driving forces of club convergence may vary across different economic settings (Von Lyncker and Thoennessen 2017). The current explanation on the formation of club convergence focuses on the initial conditions and the initial sectorial characteristics in industry but ignores the effects of changes of these variables. Club convergence is a long-term trend of convergence and initial conditions change over time (Galor 1996). Not only will the initial value of the influencing factors affect the formation of club convergence, but also their changes over time will play an important role (He et al. 2017; Huang and Wei 2016). Accordingly, we propose that influencing factors of club convergence in China may include initial conditions, sectorial characteristics in industry and change, the role of the state and change, network effect, spatial effect and change, and the role of globalization.

In this paper, initial conditions refer to initial income per capita, physical capital and human capital at the beginning of research period. Sectorial characteristic and their change include initial manufacturing share, initial service share, change in manufacturing share and change in service share. The role of government includes three measures: initial preferential policy by the central government, general government spending and its change. Moreover, network effect is measured by a dummy variable of provincial capitals. Spatial effect and change refer to the initial income of neighboring prefecture units and the average annual growth rate in per capita income of neighboring prefecture units. In addition, the value of foreign direct investment at the beginning and ending years of the research period is used to measure the role of globalization.

Based on the above analysis, we propose a working hypothesis. That initial conditions, structural transformation characteristics, preferential policy by the central government’s, general government spending and change, network effect, space effect, network effect, and the process of globalization policy control lead to the formation of club convergence in China.

3 Methodology

3.1 Data

In this paper, we used China’s prefecture-level city regions as the club units. According to China’s administrative divisions in 2014, there are 335 prefectural units in mainland China. Due to data availability and spatial comparability, Hainan Province was considered as one prefecture unit, while Tibet Autonomous Region was not included. A total of 329 prefectural units were included in the analysis. The original data were derived from the statistical yearbooks of the selected provinces and municipalities from 1991 to 2015, including Chinese City Statistical Yearbooks. In case of changes in administrative boundaries of any selected prefectural units, county-level data were used to aggregate into relevant prefectural units in order to ensure the boundary consistency over time. The first reason to select 1990 as the starting year is that economic reforms in China has since been deepened and regional economic growth accelerated (Liu 2001). Another important reason is that the division of prefecture-level cities in China has undergone several major changes. It was not until 1990 that the names and numbers of prefecture-level cities in the provinces were basically stabilized. For example, in 1985, Yunnan province only had 9 prefecture-level cities. However, from 1990 to now Yunnan province has 16 prefecture-level cities. Hence, 1990 is the most suitable initial year to study the club convergence of China’s prefecture-level cities.

Income per capita was used as the measure to identify convergence clubs in the trajectory of economic growth. With respect to the price factors, we have inquired the statistical yearbooks of China’s provinces and the statistical yearbooks of China’s cities, and found that the price index data of all prefecture-level cities could not be obtained. We only gained 154 prefecture-level cities’ consumer price index from 2000 to 2014, only accounting for 46.8% of the total. Hence, the relative per capita income was adopted to eliminate the effect of price factors using a method developed by Quah (1996). Its mathematical form is as follow:

where \( Y_{it} \) is per capita income of the i-th prefecture in t year; \( Y_{it}^{*} \) is relative per capita income of the i-th prefecture in t year.

In order to facilitate comparison with the conclusions of the existing literature, our analysis starts with the provincial data. The same methodology is adopted in testing club convergence among 31 Chinese provinces from 1990 to 2014. Furthermore, a comparative analysis is applied between our results and those conclusions gained by other studies.

3.2 The nonlinear time-varying factor model

According to Phillips and Sul (2007), the logarithmic income, \( \log Y_{it}^{*} \) can be decomposed as Eq. (2):

where \( \mu_{t} \) is a common factor, and \( \delta_{i} \) is fixed, \( \xi_{it} \) is iid (0,1) across i but weakly dependent and stationary over t. \( L(t) \) is the slowly increasing varying function (with \( L(t) \to \infty \), as \( t \to \infty \)). Following Phillips and Sul (2007), \( L(t) \) is assumed to be \( \log t \) and \( \alpha \) is the decay rate.

Because club convergence is the long-run growth behavior, it may consist of long-term trend and short term disturbance in the convergence process. Based on Phillips and Sul (2007), we used the Hodrick–Prescott filter to separate the income series into trend and cyclical components. We observed the trend items of each prefectural unit and found basically the same change rule. Intuitively, there is no structural breakpoint.

In case of excessive observation units, Eq. 2 may give rise numbers of clubs that may need to be merged. To address this problem, Von Lyncker and Thoennessen (2017) proposed the merging algorithm for adjacent clubs and diverging regions. In this paper, we employed the Phillips and Sul’s method first to identify initial convergence clubs and then adopted the convergence algorithm by Von Lyncker and Thoennessen (2017) to merge initial convergence clubs.

3.3 The ordered logit model

To explore the determinants driving the formation of clubs, we employed an ordered logit model (Von Lyncker and Thoennessen 2017). In the model, the dependent variable represents the club to which a prefectural unit belongs, and is measured as an ordinal variable. This is because the observed clubs can be ranked according to the mean income of the clubs. The influencing factors constitute explanatory variables. The model can be written as

where the dependent variable \( y_{i}^{*} \) takes on ordinal values from 1 to K (K is the number of convergence clubs), \( X_{i} \) is the explanatory variable set and i = 1, …, 329 indicates prefectures. The column vector β corresponds to the regression coefficients and \( \varepsilon_{i} \) is the error term with a logistic distribution. Table 1 presents definition of the explanatory variables included in the ordered logit model.

4 Estimation results

4.1 Convergence clubs

Before we investigate club convergence using prefecture as the analytical unit, we conduct club convergence in per capita income at a provincial lever for the purpose of comparison and method justification. Three convergence clubs and one divergent province (Yunnan) are obtained (Table 2). Club 1 includes Beijing, Tianjin, Shanghai, Zhejiang, Jiangsu, Shandong, Shanxi, and Inner Mongolia. Among them, six provinces lie in the eastern region, and two of them belong to the western region. Club 2 includes Guangdong, Fujian, Liaoning, Hebei, Jilin, Heilongjiang, Hubei, Chongqing and Ningxia. The remaining 13 provinces constitute Club 3. About 44% of Club 2 members are in the east, 33% of them are in the middle, and the rest are in the West. Our conclusions are clearly different from the findings in the studies published so far. Table 3 shows that the extant studies have found two or three converging clubs.

Which method in estimating club convergence in China is more credible? One way to compare the results of club convergence studies is to examine the difference in economic features within and between convergence clubs. We employ Theil index to estimate income differences within each club and between clubs and the results are reported in Table 4.

Table 4 indicates that the result of three convergence clubs obtained in our test case better captures the characteristics of club convergence. Therefore, technological differences among different provinces must be considered in investigating club convergence, given China’s huge territorial size. It is appropriate to use the nonlinear time-varying factor model combining the technical heterogeneity to test club convergence of regional economic growth. Based on this method, the followings report club convergence results at the prefecture level.

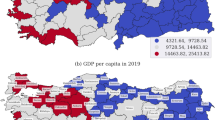

On the basis of club convergence algorithm, with a truncation parameter of 0.3, critical value of 0 and the significance level of 5% for t-statistic (Phillips and Sul, 2009). Initially 20 convergence clubs emerge. Then, a log t regression is run to test for convergence across each subsequent group. If the t-statistic is greater than − 1.65, the associated clusters are merged into a larger club. Finally, four convergence clubs emerge. Table 5 reports the statistical results of convergence club testing. There are four convergence clubs: high-income group, middle-income group, middle-low-income group and low-income group. From the relative per capita income indicator, the income gap between the first and fourth groups is 2720 Yuan in 1990. Whereas, this gap rises to 84,614 Yuan in 2014. Therefore, the income gap between high-income groups and low-income groups is widened.

Following Phillips and Sul (2009), the members of club 1 and club 4 converge evidently, with b value between 0 and 2, respectively. However, club 2 and club 3 are weak convergence clubs given their b coefficient value less than 0. The convergence speed \( \hat{\alpha } \) differs substantially across clubs. The convergence speed in Club 1 is only 0.86%, whereas it is 40.41% for Club 4. The result indicates that the convergence rate of higher-income group is lower than that of lower-income groups.

Compared with the existing literature, our conclusions are different (see Fig. 1). About club convergence of regional growth in China, some studies identify two convergence clubs (Tian et al. 2016; Lin et al. 2013). Other researches find there are three (Cheong and Wu 2013). All these studies hold that the eastern coast is a prosperous convergence club. While, in our paper, the richest club consists of 62 prefecture-level cities. Among them, 57% of the prefecture-level cities locate in the eastern region, 20% of the prefecture-level cities belong to the western region, 13% of the prefecture-level cities lie in the central region, and only 10% of the prefecture-level cities situate in the northeast region. In addition, about 50% of the prefectures in Club 3 and approximately 95% of the prefecture-level cities in Club 4 in the western region. Club 2 has a more scattered geographic distribution. Both Clubs 2 and 3 include more prefectures than clubs 1 and 4. Club 1 contains many provincial capital cities, the state-designated cities, the special economic zones and open coastal cities. Clubs 3 and 4 have no provincial capitals, state-designated cities, nor special economic zones. Further, Club 4 includes most of the remote ethnic minority areas.

Another interesting phenomenon is that the prefectures belonging to the same province do not necessarily belong to the same convergence club. For example, Guangdong province is the richest province in China. It has 21 prefectures which fall into three convergence clubs. Among them, 33% of its prefectures belong to Club 1, 29% of them in Club 2 and the rest of them in Club 3. Hence, the club convergence studies using province as the analytic unit tend to mask the fact that there are large economic differences within the same province, thus affecting the correct judgement of club convergence. At the prefecture level, such intra-provincial disparity can be captured.

4.2 Transitional behavior

Phillips and Sul (2007) construct the relative transition coefficient \( h_{it} \), as shown in Eq. (4):

where N represents the number of prefectures. These transformation coefficients describe the transitional path of each prefecture and can be used to analyze growth convergence as well as to measure transition effects. The results of relative transitional path are plotted in Fig. 2.

The transition paths vary across different convergence clubs. In Clubs 1, 2 and 3, the trend of convergence appears within each club from 1990 to 2008. In Club 4, except for 4 prefectural units with the lowest income, the other are all convergent. Several macro scale factors might be responsible for such convergence characteristics. The financial crisis that took place in 2008 has slowed the growth of coastal cities. Meanwhile, the new labor law was also promulgated in 2008 and this law raises the labor costs of coastal manufacturing enterprises. Numerous manufacturing firms started to move to inland China ever since. As a result, the difference in per capita income between coastal cities and major prosperous inland cities has been reduced.

4.3 Factors conditioning club membership

Table 6 reports average marginal effect on probabilities of belonging to each club when only initial conditions are considered. Table 7 reports the full model results including both the initial conditions and their changes.

Table 6 shows initial conditions are the most important drivers of club membership. A one-unit higher-income per capita in 1990 increases a region’s probability of belonging to Club 1 by 21.3% and decreases the probability of belonging to Club 4 by 2.44%. In other word, a small value addition in these initial condition variables raises the probability of belonging to a higher-income club (club 1 or club 2) and decreases the probability of belonging to a lower-income club (club 3 or club 4). The result indicates that the preferential policy by the central government plays a crucial role in the formation of convergence clubs. Particularly worth mentioning is the network effect, which is rare in the analysis of driving factors in Chinese club convergence. This variable passed the 15% significant level test. It implies that due to participating in global division of labor networks, capital cities are more likely to converge. In addition, cities with higher levels of globalization are more likely to belong to higher-income convergence clubs. On the contrary, spatial effect is not significant. Among the sectorial characteristics, only initial service share passed the significant test.

In Table 7, changes of factors are taken into account, and the conclusions drawn are different from what have emerged from Table 6. First, initial conditions are also significant. For clubs 1 and 4, their coefficients become smaller than those reported in Table 6. For clubs 2 and 3, their coefficients become bigger than those reported in Table 6. Moreover, both change in manufacturing share and change in service share are significant. Furthermore, general government spending and change plays a greater role. In particular, the increase in local government expenditure as a share of GDP over time will reduce the probability of belonging to higher-income clubs. The indicator measures the size of government. It means the larger general government spending as a ratio of GDP is, the larger the local government size will be. Our conclusion implies that increasing local government size will hinder economic development in China. This conclusion is consistent with the findings in the literature. Previous studies on the determinants of economic growth show strong evidence that a large government sector negatively influences economic growth (Fölster and Henrekson 2001).

In addition, many scholars emphasize the importance of spatial interaction effect. The results of this study indicate that the initial per capita income level of neighborhood prefectures is not a crucial factor. In fact, what really matters is the average annual growth rate of neighbors’ per capita income. Furthermore, regarding the role of globalization, it is found that initial foreign direct investment becomes insignificant when final foreign direct investment is considered. A small positive change in final foreign direct investment increases the probability of belonging to a higher-income club (club 1 or club 2), while it decreases the probability of belonging to a lower-income club (club 3 or club 4). Finally, network effect failed to pass the significant test in Table 7. This may be because other factors play a more important role in the formation of convergence clubs.

5 Robustness of convergence clubs

The club convergence detection methods in the paper require to fix several parameter values in the model, such as truncation parameter r, critical value c and significance level. When these parameter values are altered, the results of club convergence might change according to the literature. In addition, the results of club convergence analysis may also be dependent upon the selected study period. Therefore, it is necessary to test the robustness of our results.

First, we analyze truncation parameter r. Figure 3 describes the stability of club composition from r = 0.3 to r = 0.4. The majority of prefectures keep stable, and only 25 prefectures change their memberships from a higher-income club to a lower-income club.

Second, as to change of study period, it is well known that China’s five-year plan has had a great impact on regional development. Because 2010 is the last year of the 11th five-year plan, we alternatively select the period from 1990 to 2010 to test the robustness of club convergence analysis. Figure 4 depicts the stability of club composition from T = 2014 to T = 2010. The majority of prefectures remain in the same club. Only two prefectures shift from a lower-income club to a higher-income club, while 31 prefectures alter their memberships from a higher-income club to a lower-income club.

Third, with respect to significant level, in addition to our baseline value of 5%, we apply 1% and 10%. The results do not change.

The robust tests indicate that the memberships of clubs are relatively stable when different parameter values are applied. The membership of each club mostly is also stable. Alterations of club members from one club to another only exist in a few regions. Therefore, our result could be argued as robust.

6 Conclusions

In this paper, a nonlinear time-varying factor model proposed by Phillips and Sul (2007) is employed to investigate the club convergence in per capita income for 329 prefecture-level units in China. This sample covers almost all prefectures in China and makes up for the shortcomings of existing research on sample selection, allowing a more comprehensive reflection of club convergence in China’s regional economic growth. After identifying convergence clubs, further explanatory convergence factors are tested using an ordered response model. This model helps to identifies significant variables to explain the formation of club convergence and understand the influence of each driving force on probability change of club attributes.

Our main result is the identification of four convergence clubs. The analysis also indicates that membership of the clubs is robust. Among them, the highest income club and the lowest income club tend to converge strongly, whereas the two middle-income clubs converge weakly. The convergence speed of the highest income club is only 0.86%, while the convergence speed of the lowest income club is 40.41%. This might be probably because the lowest income club contains fewer members.

Compared with studies using provincial data, the results of convergence clubs in this study are different both in terms of club numbers and compositions. The majority of the literature based on provincial data gain two or three convergence clubs, namely coastal and interior regions, or eastern, central and western (Hao 2008; Cheong and Wu 2013; Tian et al. 2016). However, this study identifies four convergence clubs based on prefectures that cannot be defined by geographic location. Especially, the spatial distribution of Club 2 is geographically dispersed. Except Club 4 whose members are mostly located in the interior, members of three other clubs tend distribute across eastern, central and western regions. Importantly, it is found that prefectural cities belonging to the same province are usually classified into different convergence clubs. This may signal a within-province economic polarization trend in China, serving as a strong call for studying income inequality within each province.

Further, this paper explores the formation of club convergence under an ordered response model. It is found that six types of factors explain club convergence’s formation: initial conditions, sectorial characteristics, and preferential policy by the central government, general local government spending and change, network effect, spatial effect, and the role of globalization. Compared with the existing literatures, our conclusion about the driving forces of club formation in China shows unique features.

First, the results from an ordered response model catch the probability of each prefecture-level unit belonging to different clubs. The results from other methods indicate that influencing factors play the same role in different clubs (Lin et al. 2013; Wahiba 2015). However, our research shows that the role of influencing factors depend on the specific clubs and cannot be generalized. So ignoring club differences in the effect of influencing factors leads to the contradictory arguments on the driving forces of Chinese club convergence in the existing literature. For example, some scholars suggest that preferential policies play an important role in the formation of club convergence in China (Herrerias and Ordoñez 2012; Tian et al. 2016). Whereas, other scholars dispute that preferential policies do not play a positive role (Westerlund 2013). Our research indicate that it increase the probabilities of belonging to higher clubs and decrease the probabilities of belonging to lower clubs.

Moreover, both the network effect and spatial effect are important factors that cannot be ignored in the formation of club convergence. So far, the research on convergence of Chinese provincial clubs has not analyzed network effect. In our paper, dummy variable of provincial capitals is significant in Table 6. To a certain extent, network effect explains some cities still enter into rich groups although they do not locate in coastal regions or enjoy preferential development policies by the central government. With regarding to spatial effect, our finding indicates that the initial per capita income level of neighborhood prefectures is not a crucial factor. Bandyopadhyay (2012) analyzes club convergence in India and gains the same conclusion. However, this does not mean that spatial factors do not work in the formation of club convergence. Our conclusion indicates the average annual growth rate of neighbors’ per capita income plays an important role. This indicates the effect of spatial agglomeration on club convergence.

In addition, changes of influencing factors should be considered in studying club convergence mechanisms. They are the important factors that have been neglected in the club convergence studies. The result from Table 7 shows that in China, the formation of club convergence is more dependent on the changes in the factors, but not on their initial values. This finding has some important policy implications. Policy makers should focus on changing influencing factors in order to promote prefecture-level units to elevate into higher clubs. Specifically, for example, developing regions should encourage the upgrading of industrial structure transformation and vigorously develop the service industry. Local governments should take the initiatives to reduce its government size and let the market become the main body of resource allocation in a country that is transitional from a planned economy to a market-based one.

Finally, we would like to point to some possible avenues for future research on club convergence. Most studies focus on testing club convergence hypothesis, and some literature further analyzes its influencing factors. While, to our knowledge, the topic of evolutionary mechanism of club convergence has not been studied in the literature so far. In fact, the convergence clubs are dynamic, and their number and composition may vary depending on different periods. For example, Bartkowska and Riedl (2012) find that there are six convergence clubs in Europe from 1990 to 2002. While, another result gained by Von Lyncker and Thoennessen (2017) shows that there are only four convergence clubs in Europe from 1980 to 2011. Hence, in order to explain the change of club convergence, it is necessary to analyze its evolutionary mechanisms. A necessity of addressing this challenge is the extension of existing data sets to longer time periods.

References

Anagnostou A, Kallioras D, Kollias C (2016) Governance convergence among the EU28? Soc Indic Res 129(1):133–146

Apergis N, Cooray A (2014) Tax revenues convergence across ASEAN, Pacific and Oceania countries: evidence from club convergence. J Multinatl Financ Manag 27:11–21

Apergis N, Payne JE (2012) Convergence in US house prices by state: evidence from the club convergence and clustering procedure. Lett Spat Res Sci 5(2):103–111

Bandyopadhyay S (2012) Convergence clubs in incomes across Indian states: is there evidence of a neighbours’ effect? Econ Lett 116(3):565–570

Barro RJ, Sala-i-Martin X (1992) Convergence. J Political Econ 100(2):223–251

Bartkowska M, Riedl A (2012) Regional convergence clubs in Europe: identification and conditioning factors. Econ Model 29(1):22–31

Borsi MT, Metiu N (2015) The evolution of economic convergence in the European Union. Empir Econ 48(2):657–681

Brida JG, Garrido N, Mureddu F (2014) Italian economic dualism and convergence clubs at regional level. Quality Quantity, 1–18

Caggiano G, Leonida L (2013) Multimodality in the distribution of GDP and the absolute convergence hypothesis. Empir Econ 44(3):1203–1215

Chapman SA, Cosci S, Mirra L (2012) Income dynamics in an enlarged Europe: the role of capital regions. Ann Reg Sci 48(3):663–693

Chen A (2010) Reducing China’s regional disparities: is there a growth cost? China Econ Rev 21(1):2–13

Cheong TS, Wu Y (2013) Regional disparity, transitional dynamics and convergence in China. J Asian Econ 29:1–14

Dapena AD, Vázquez EF, Morollón FR (2016) The role of spatial scale in regional convergence: the effect of MAUP in the estimation of β-convergence equations. Ann Reg Sci 58(2):473–489

De Siano R, D’Uva M (2006) Club convergence in European regions. Appl Econ Lett 13(9):569–574

Durlauf SN, Johnson PA (1995) Multiple regimes and cross-country growth behaviour. J Appl Econ 10(4):365–384

Fischer MM, LeSage JP (2015) A Bayesian space-time approach to identifying and interpreting regional convergence clubs in Europe. Pap Reg Sci 94(4):677–702

Fölster Stefan, Henrekson Magnus (2001) Growth effects of government expenditure and taxation in rich countries. Eur Econ Rev 45(8):1501–1520

Frenken K, Hoekman J (2006) Convergence in an enlarged Europe: the role of network cities. Tijdschrift voor economische en sociale geografie 97(3):321–326

Furková A, Chocholatá M (2016) Spatial econometric modelling of regional club convergence in the European Union. Ekonomicky Casopis 64(4):367–386

Galor O (1996) Convergence? inferences from theoretical models. Econ J 106:1056–1069

Hao R (2008) Opening up, market reform, and convergence clubs in China. Asian Econ J 22(2):133–160

He C, Zhou Y, Zhu S (2017) Firm dynamics, institutional context, and regional inequality of productivity in China. Geogr Rev 107(2):296–316

Herrerias MJ, Ordóñez J (2012) New evidence on the role of regional clusters and convergence in China (1952–2008). China Econ Rev 23(4):1120–1133

Huang H, Wei YD (2016) Spatial inequality of foreign direct investment in China: Institutional change, agglomeration economies, and market access. Appl Geogr 69:99–111

Islam N (2003) What have we learnt from the convergence debate? J Econ Surv 17(3):309–362

Liao FH, Wei YD (2016) Sixty years of regional inequality in China: trends, scales and mechanisms (No. 202). Working Paper Series

Lin PC, Lin CH, Ho IL (2013) Regional convergence or divergence in China? evidence from unit root tests with breaks. Ann Reg Sci 50(1):1–21

Liu Q (2001) A study on the characteristics and causes of “Club Convergence” in China’s economic growth. Econ Res 6:70–77 (in Chinese)

Liu Ye, Wei Xu, Shen Jianfa, Wang Guixin (2017) Market expansion, state intervention and wage inequality across economic sectors in urban China: a multilevel analysis. Urban Stud 54(11):2631–2651

Ma JM, Jia HY (2015) The role of foreign direct investment on income convergence in China after early 1990s from a spatial econometric perspective. Rev Develop Econ 19(4):829–842

Magrini S, Gerolimetto M, Engin Duran H (2015) Regional convergence and aggregate business cycle in the United States. Reg Stud 49(2):251–272

Mérida AL, Carmona M, Congregado E, Golpe AA (2016) Exploring the regional distribution of tourism and the extent to which there is convergence. Tour Manag 57:225–233

Papalia RB, Bertarelli S (2013) Nonlinearities in economic growth and club convergence. Empir Econ 44(3):1171–1202

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Phillips PC, Sul D (2007) Transition modeling and econometric convergence tests. Econometrica 75(6):1771–1855

Phillips PC, Sul D (2009) Economic transition and growth. J Appl Econ 24(7):1153–1185

Quah DT (1996) Twin peaks: growth and convergence in models of distribution dynamics. Econ J 106:1045–1055

Sofi AA, Durai SRS (2016) Income convergence in India: a nonparametric approach. Econ Change Restruct 49(1):23–40

Stiglitz J (2014) Inequality is not inevitable. New York Times 27:1–2

Tian X, Zhang X, Zhou Y, Yu X (2016) Regional income inequality in China revisited: a perspective from club convergence. Econ Model 56:50–58

Von Lyncker K, Thoennessen R (2017) Regional club convergence in the EU: evidence from a panel data analysis. Empir Econ 52(2):525–553

Wahiba NF (2015) Convergence and divergence among countries. Asian Econ Financ Rev 5(3):510–520

Wang H, Rickman D (2018) Regional growth differences in China for 1995–2013: an empirical integrative analysis of their sources. Ann Reg Sci 60(1):99–117

Westerlund J (2013) A sequential test for pair-wise convergence in Chinese provincial income. J Asian Econ 27(8):1–6

Xu Wei, Yang Bo (2013) Labor market differentiation and segmentation in China. Science Press, Beijing, p 238

Xu Wei, Pan Zehan, Wang Guixin (2018) Market transition, labor market dynamics and reconfiguration of earning determinants structure in urban China. Cities 79:113–123

Zhang X, Zhang KH (2003) How does globalization affect regional inequality within a developing country? Evidence from China. J Develop Stud 39(4):47–67

Funding

This study was funded by the National Natural Science Foundation of China (grant number 41771124), the Humanities and Social Sciences Research Fund of Ministry of Education in China (Grant Number 17YJC790198), the philosophy and social science program in Henan province of China (Grant Number 2017BJJ009), Young Top-notch Talent Program of Henan University of Economics and Law (Grant Number hncjzfdxqnbjrc201602), and Outstanding scholars of philosophy and Social Sciences in Colleges and Universities of Henan province (2015-YXXZ-17).

Author information

Authors and Affiliations

Contributions

Weili Zhang and Wei Xu co-designed and performed the research. Weili Zhang provided the method of data analysis, Wei Xu modified the draft, and Xiaoye Wang designed our program. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

Author Weili declares that she has no conflict of interest. Author Wei declares that he has no conflict of interest. Author Xiaoye declares that she has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Zhang, W., Xu, W. & Wang, X. Regional convergence clubs in China: identification and conditioning factors. Ann Reg Sci 62, 327–350 (2019). https://doi.org/10.1007/s00168-019-00898-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-019-00898-y