Abstract

By analysing enterprise relationship networks across various dimensions, including enterprise investment relationships, industry affiliations, and risk diffusion, governments and investors can identify correlations between enterprises and mitigate risks in a timely manner. This approach enables government entities and investors to identify the level of interconnectedness between enterprises and proactively mitigate risks. During their development, enterprises require financing to grow, leading to investment relationships that can be both collaborative and antagonistic in nature. Currently, the analysis of enterprises primarily focuses on their economic characteristics, with a lack of multidimensional analysis of enterprise relationships. To address the aforementioned issues, we propose analysing enterprises in a specific region by integrating various dimensions. We use the force-directed and community partition algorithms in 3 dimensions to create clustered views of enterprise communities. In the 2.5 dimension, enterprises are classified into different levels based on their characteristics using spatial location transformations to achieve feature correlation analysis. Finally, a risk diffusion model is implemented based on the mortgage relationships and operational characteristics of enterprises, using a risk diffusion algorithm within a 2 dimensional detailed network. Building upon the aforementioned ideas, we developed a small and medium-sized enterprise investment relationship system using multiple network topology layouts to analyse investment relationships between enterprises. We then verified the effectiveness of our design. The experimental data are mainly from Shanghai, China.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Over the past 40 years, small and medium-sized enterprises (SMEs) in China have evolved from small and weak entities to strong and resilient businesses. They have continuously grown and expanded, becoming a main driving force behind economic development. SMEs in China have played a critical role in the country’s economy, contributing over 50% of tax revenue, more than 60% of GDP, over 70% of technological innovation, and more than 80% of urban employment. As such, they have become an indispensable and important sector. The European Union defines SMEs as companies with fewer than 250 employees and an annual turnover of less than €50 million. These enterprises account for 99% of all enterprises in the EU and have a significant impact on the EU economy [1]. Compared to large enterprises, SMEs face challenges when competing in complex markets and have relatively weaker market resistance capabilities. SMEs often lack sufficient resilience in the face of unstable factors such as natural disasters. SMEs seek financing for rapid development, which can be advantageous but also entails certain risks due to the cooperative and competitive nature of the relationship between investors and investees. The invested party hopes to receive long-term financial assistance from the investor to support sustainable development, but this often conflicts with the investor’s desire for short-term profit. The investment relationships between enterprises connect them to each other, forming a network of interconnected enterprise relation-ships. Well-developed enterprises contribute to the stability of the network of interfirm relationships. However, businesses may face difficulties during their development, such as financial or environmental issues, which could lead to their decline, ultimately affecting the network of interfirm relation-ships. In some cases, this can even cause large-scale diffusion of enterprise risks, such as financial crises.

Investment relations connect different enterprises to form a vast network of enterprise relation-ships. Network analysis is widely applied in physical, biological, social, and information systems. Graphs can be used to model many types of relationships and processes. In computer science, graphs are used to represent communication networks, and data structures, such as links between web pages. The network topology of a graph can represent the functional connections between brain regions, which interact to produce various cognitive processes. In this representation, vertices correspond to different brain regions and edges represent the connections between them. The investment relationships between enterprises can be viewed as a network relationship. In graph theory, different enterprises can be regarded as nodes, and the investment relationships between enterprises can be regarded as edges. Therefore, we can transform the relationships between enterprises into a network for further analysis and processing.

Traditional enterprise analysis often focuses solely on the internal operational characteristics of the enterprise, while network analysis, when utilized, often only superficially presents the relationships between enterprises, lacking in-depth information extraction. In multidimensional network topologies, analysis can be conducted from different perspectives. In large-scale relationship networks, utilizing three-dimensional network topology to display the relationships can help avoid cluttered structures and achieve effective exploration. In the 2.5-dimensional approach, nodes can be classified based on their characteristics, and the level of association between nodes at different levels can be observed. To examine local network details and analyse the diffusion of node risk, 2D visualization can be utilized.

Based on the issues and analysis methods mentioned above, we propose using network topology structures of various dimensions to analyse the relationships between enterprises. First, in response to the complex network of relationships formed by investments, we utilize community partitioning and 3D network visualization to enable effective exploration and analysis by observers. Simultaneously, we can utilize the 2.5-dimensional approach to conduct feature correlation analysis of enterprises. For instance, we can classify enterprises into different hierarchies based on their business scope. Considering the weak risk-resistance ability of small and medium-sized enterprises, the intercorrelation among these enterprises can be analysed by combining their investment relationships with their own characteristics. This analysis can be used to determine the degree of interrelation among the enterprises. Ultimately, a risk diffusion model is generated by combining the investment relationships and the characteristics of the enterprises. The model simulates the resilience of the enterprise network and enables early warning of potential impacts.

2 Related Work

The analysis of enterprise relationships in different dimensions can be mainly divided into two aspects: the analysis of small and medium-sized enterprises, and the analysis and application of a complex network. The analysis of SMEs mainly focuses on their business operations and abnormal information; The analysis of complex networks mainly focuses on network innovation and network application.

2.1 Analysis of SMEs

SMEs are an important part of the world economy. Zhibing [2] has developed a new financial metric, the contagion effect, to quantify the contagion consequences of guarantee chains in such networks. He has also developed a visual analysis tool [3] designed to monitor and mitigate systemic risk in conglomerate network secured loans. Guido [4] used the mechanism of distributing guarantees to assess the impact of guarantees on SMEs’ access to credit. Stjepan [5] examined the impact of business development grant programs and found that grant programs had a positive impact, particularly for smaller companies. Dvorský [6] studies the credit risk factors for SMEs and their assessment methods, and finds that the entrepreneur’s age, gender and education level all have an impact on the results. Through an online questionnaire survey of SMEs in the Czech Republic and Slovakia, Anna [7] found that personnel risk is one of the most important business risks for SMEs. Nenad [8] presented a conceptual framework for investigating the factors influencing the failure of SMEs and their levels of recovery. By deriving a structural equation model, researchers have found that both individual and nonindividual characteristics significantly influence the success of SMEs. Among these factors, external nonpersonal factors appear to have the greatest impact. Bolek [9] conducted a survey aimed at identifying and assessing the internal and external factors affecting the existence of information security risks in Slovak smes and agribusinesses. Siti [10] established a credit risk model for SMEs in Malaysia to predict the loan defaults of SMEs, and emphasized the importance of establishing a robust credit risk model for the low-cost and low nonperforming loan management of private banks. Bojing [11] proposes a novel model for enterprise credit ratings through a graph neural network. A heterogeneous-attention-network-based model (HAT) [12] is proposed to facilitate SME bankruptcy prediction using publicly-accessible data and has two major components: a heterogeneous neighborhood encoding layer and a triple attention output layer. This review provides a methodological overview of network techniques and discusses how network analysis can be used in public health, such as the spread of disease.

2.2 Analysis of Complex Network

In physical, biological, social, and information systems, network analysis can be used to model many types of relationships and processes. This book [13] introduces the basic concepts, mathematical representation, structure and location attributes of social network analysis and provides readers with a theoretical basis for social network analysis. Johannes [14] describes three areas of structural approaches to network analysis: location analysis and generalized block modelling, network evolution and dominant path analysis, and multilevel network analysis. This review [15] provides a methodological overview of network techniques and discusses how network analysis can be used in public health, such as the spread of disease. Aiming at the problem that the existing visualization of multilayer networks cannot clearly show the community structure, the author [16] proposes a visualization layout of multi-layer network topology based on Louvain community detection.

Edge binding can reduce confusion in the same unified area for a diagram with a high edge density [17]. Christoph [18] introduces an uncertain network visualization technique based on node link graphs that overcomes the limitations of force-oriented layouts by providing insight into the probability distribution of the entire network through probability graph lay-outs and Monte Carlo processes. In terms of 3D networks, Enns et al. proved that 3D objects with depth cues can accelerate visual search compared with 2D objects [19]. Network analysis is also applied to enterprise relationship research. Cheng [20] proposed a new method to evaluate the risk of contagion chains in the banking industry using deep neural networks to reduce or prevent potential systemic financial risks, enable loan managers to monitor risks from a broader perspective and avoid financial institutions suffering significant financial losses. Based on the k-shell decomposition method, Xiangfeng [21] proposes a new risk assessment strategy, NetRating, to evaluate the risk level of each firm participating in the secured loan, and extends it to deal with the direct guarantee network. Yang [22] proposes an innovative financial risk analysis framework for supply chain mining based on graphs. By mining the interactive relationship between small and medium-sized enterprises, it captures the topo-logical structure and time change information related to the credit of small and medium-sized enterprises and improves the performance of financial risk analysis.

The main focus of enterprise analysis is to study the nature of the enterprise itself, without considering the factors that may affect it. The existing research on the relationships between enterprises has not considered the characteristics of the enterprises themselves. Therefore, by combining their own characteristics, enterprises can be analysed from a multidimensional network perspective.

3 Multidimensional Enterprise Relationship Network

Small and medium-sized enterprises (SMEs) are a crucial component of the national economy. To keep pace with the rapidly developing society, SMEs need to develop rapidly themselves. However, most of the time, they have to secure funding from outside sources, which results in the formation of a complex enterprise relationship network. Unfortunately, SMEs have low resilience in emergency situations, and this intricate network can become quite fragile during critical moments. Investors and government officials aim to stay informed about the development status of SMEs and various industries and conduct timely assessments of enterprise risks to prevent unnecessary risk diffusion.

Considering the aforementioned phenomenon, to gain a better understanding of the status of local enterprises, we propose a multidimensional topo-logical network analysis that allows for a comprehensive examination of enterprises from multiple perspectives. By utilizing network and graph theory, we analyse the degree of correlation between enterprises, particularly those formed by investment, and consider the unique characteristics of each enterprise. Through this approach, we can analyse the relationships between enterprises from various dimensions and perspectives. Finally, we conduct a detailed analysis of the risk diffusion of enterprises (Fig. 1).

3.1 Enterprise Investment Relationship Network in 3D

In large-scale relational networks, 3D networks can alleviate the visual confusion caused by overlap and crossover. In this section, we propose the construction of enterprise networks and the division of enterprise communities from a three-dimensional perspective. The three-dimensional construction and division of enterprise relationships enables better observation of the correlations between enterprises.

The division of enterprise communities under three dimensions enables observation of both the internal situation of the community and differentiation between enterprise communities. It mainly involves two key problems: first, the spatial position relationship between enterprises, and second, the boundaries of the enterprise communities.

In this paper, we present a process for generating a 3D enterprise community network topology diagram using enterprise node relational data (Fig. 2).

In terms of the layout of enterprise nodes (Fig. 2A), we use the 3D force engine in the D3 force to process the data nodes and enterprise connection relationships to obtain location information for each node. Here, we introduce the force balance model in three dimensions (Formula 1). In formula one, \(F(i)\) represents the resultant force of node i. \(k_{ij}\) is the corresponding entry in the spring constant matrix, \(l_{ij}\) is the distance between node i and node j, and \(l_{o}\) is the original distance between these two nodes. \(d_{ij}\) is the unit vector from node i to node j, \(q_{ij}\) is the corresponding entry in the damping coefficient matrix, \(v_{j}\) and \(v_{i}\) are the velocity vectors of node j and node i. \(f_{i}\) is the external force acting on node i. When \(F(i)\) is less than a certain threshold value, node i is regarded as reaching the equilibrium state.

In a complex enterprise relationship network, each maximum connected subgraph is referred to as an enterprise community. The enterprise relationship network can be represented as a graph, and Formula 2 (shown in FIG. 2.B) can be used to obtain each maximum connected subgraph, or enterprise community. Let us start with one side: \(f_{n}\) represents a collection of nodes in a network, and \(f_{e}\) denotes the edge involved in the node set. The loop is repeated until there is no intersection between the existing node set \(f_{n} \left( {E_{i} } \right)\) and the remaining node set \(f_{n} (E_{n} )\). Finally, every maximum connected graph in the network is found.

To demarcate the boundaries of the enterprise community, we use the following algorithm: for each enterprise community, we obtain the position of each node after 3D-force engine calculation, and after bringing the enterprise nodes into Marching Cubes, we obtain the grid model of the enterprise community (Fig. 3C).

Finally, three.js is used to present the enterprise community relationship network under the three-dimensional network (Fig. 3D).

3.2 Industry Association Analysis in a 2.5D Network

Investment relationships are not the only characteristic of an enterprise. Traditional features, such as parameter comparison, can be easily understood by observers when the size of the enterprise object is small. However, when there are too many comparison objects, it can be difficult to start. Therefore, we introduce 2.5 dimensional feature association analysis.

Under the condition of maintaining the original enterprise community investment relationship network, to better observe the distribution of enterprise characteristics, the universality level is set up to realize the custom analysis.

Enterprises have many characteristics. For example, at the level of enterprise type, different enterprises can be classified into different industries according to their business scope, which helps to understand the development of regional industries. The enterprise management level can understand the development status of the enterprise community. Additionally, the enterprise risk level provides insight into the health of the enterprise community.

For example, at the level of enterprise type, industry correlation analysis can help investors and government organizations understand the development situation of regional enterprises. Industries can be classified into ten categories based on the International Standard Industry Classification, including (Table 1):

To gain a better understanding of the development situation of regional enterprises, we designed a 2.5-dimensional model to analyse the correlation between enterprise characteristics (as shown in Fig. 3). For instance, we used industry classification to categorize enterprises into different groups based on the International Standard Industry Classification. Figure 3 illustrates the process of converting a three-dimensional enterprise community into a 2.5-dimensional model. Each enterprise community is extracted and labelled according to its characteristics, and then divided into corresponding feature levels. By applying the edge-binding algorithm, we can observe the correlation between different levels and track the development of the enterprise at each level.

We define a spatial transformation to transform enterprise nodes in three-dimensional space into 2.5-dimensional space according to their own enterprise node characteristics. In Formula 3, \(l\) represents the 2.5 dimension level to which the characteristics of enterprise nodes are mapped. \(x^{\prime}_{e}\) and \(y^{\prime}_{e}\) represent the spatial coordinates of enterprise nodes after transformation. \(s_{x}\), \(s_{y}\), \(s_{z}\) represent the scale. \(\theta\) represents the angle of rotation. \(t_{x}\), \(t_{y}\), \(t_{z}\) represent the translation vector.

To achieve a better observation effect, the edges between the 2.5 dimensional levels are visually gathered together in space, which is realized by edge bundling (Fig. 4). The red lines show the original edge and the green lines show the changed effect. Formulas 4–8 show the principle of edges involved in FDEB edge binding algorithm. \(F\) represents the net force on the edges. \(F(s)\), \(F(r_{1} )\), \(F(a)\), \(F(r_{2} )\) represent the spring force, friction force, gravity, and repulsive force, respectively. \(k\) represents the corresponding constant, \(v\_rel\) represents the relative velocity, \(n\) is the direction vector of the side point, \(d_{ij}\) is the distance between the edge nodes, \(sigma\) and \(epsilon\) represent the range of force action.

Based on the classification of enterprises using the 2.5-dimensional model, we incorporated investment relationships and regional data into our analysis objectives. Our objectives mainly include the following:

-

1)

We analyse the correlation between different industries.

-

2)

We analyse the distribution of enterprises in different industries.

-

3)

We analyse the geographical distribution of different industries.

3.3 Enterprise Risk Diffusion in a 2D Network

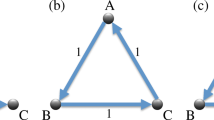

Investment relationships connect enterprises and form a network of relationships. Small and medium-sized enterprises (SMEs) are often vulnerable to risks, and external factors can potentially lead to the collapse of these enterprises. In this network of corporate relationships, a failing business may cause risks to spread across the network like a virus (see Fig. 5).

Based on the existing investment relationships and enterprise characteristics, we propose an enterprise risk communication model. When an enterprise suffers losses due to certain factors, it can seek help from relevant enterprises. If an enterprise provides assistance to another venture, we will consider whether the venture can bear the risk

In this paper, a propagation index \(R(i)\) (Formula 4) is proposed to represent the possibility of propagation from venture enterprise node i to the neighboring node. The enterprise relation network in this paper mainly involves the investment relation and the management information of the enterprise. \(A_{ij}\) represents the investment relationship between enterprise i and enterprise j (weight of edge), \(w_{ij}\) is a weight coefficient used to measure the influence of enterprise i on enterprise j, \(X_{i}\) and \(X_{j}\) represent an indicator of the business condition of an enterprise. We add \(MInflu(i)\) to indicate human influence and whether the enterprise supports the venture. When \(R(i)\) is below a certain threshold, the risk is about to spread.

In the above algorithm, in the enterprise relationship network \(G\left( {V,E} \right)\), \(V\) represents the enterprise node, and \(E\) represents the investment relationship between enterprises. A risk contagion radius is set up to simulate different degrees of diffusion for emerging venture enterprises. At the same time, a threshold \(tValue\) is set for enterprises in the infection chain to control the influence of infection. When an enterprise encounters a risk, the first step is to query the neighbors between enterprises. For these neighbors, we need to determine whether they appear in the existing risk diagram \(G_{r} (V_{r} ,E_{r} )\). \(G_{r} (V_{r} ,E_{r} )\) represents the relationship network formed by existing venture enterprises. The communication index is calculated for \(G_{r} (V_{r} ,E_{r} )\) medium - risk enterprise neighbors. If the \(Diffuse\) value is lower than a certain transmission threshold, the risk is transmitted to neighbors. The cycle is repeated until the radius of infection reaches \(M\). Finally, the new communication risk network \(G_{r} (V_{r} ,E_{r} )\) is obtained.

4 Case Study

4.1 Introduction

Building upon the content in Sect. 3, we have conducted enterprise analysis across various dimensions, as shown in Fig. 6. Figure 6A displays the division of enterprise communities in three dimensions, with each enclosing circle representing a distinct enterprise community network. Figure 6B showcases the arrangement of enterprises across different industries in 2.5 dimensions, with each plane denoting an industry, red nodes representing enterprises, and line segments between plane levels indicating investment relationships between enterprises. Finally, Fig. 6C presents a risk diffusion network of an enterprise in 2-dimensional space, with red nodes representing risk enterprises and yellow nodes signifying risk diffusion enterprises. Figure 6D depicts a regional correlation analysis of enterprises, utilizing a thermal map to represent the distribution of enterprises, a network diagram to represent the relationship between enterprises, and a bar chart to indicate the asset size of enterprises.

4.2 Enterprise Community Division in 3D

The enterprise community division in this paper is mainly based on the investment relationships between enterprises. Although a 3D perspective is conducive to displaying a larger scale enterprise relationship network, it is necessary to address the arrangement of the enterprise relationship network, the extraction of enterprise communities, and the generation of enterprise community surrounding clusters from a three-dimensional perspective.

A good network relationship arrangement is conducive to better analysis of enterprise relationships. Figure 7 shows the enterprise relationship network in three dimensions. Figure 7C depicts the randomly generated layout of enterprise nodes, where blue nodes represent enterprises and green line segments represent investment relationships between enterprises. Without any spatial arrangement rules (Fig. 7A), the enterprise relationship network appears chaotic and it is difficult to distinguish the relationships between nodes. However, after importing the force engine, the distribution of the relationship network is displayed in Fig. 7C. Figures 7B and 7D show the network relationships that can be rotated and scaled in three dimensions. Although some neighborhoods can be identified in Fig. 7A, there is an overall lack of clear visual effects. To address this issue, we introduce the concept of enterprise community clusters, which surround different enterprise communities to achieve boundary division. Figure 7B and 7C show the enterprise community network relationships after the introduction of the Marching Cubes algorithm. However, Fig. 7B is generated based on a random layout and there is overlap between communities. In contrast, Fig. 7D shows the surrounding clusters formed after the force engine, which are clearly divided. By comparing Fig. 7B and Fig. 7D, it can be observed that adding the community surrounding the cluster helps to divide the relationship network in 3D into different areas, achieving a better effect of community scope differentiation.

The inclusion of the force engine and Marching Cubes algorithm enables the partial research on the display characteristics of individual enterprise communities. For example, we extracted several enterprise community network diagrams (FIG. 7E, FIG. 7F, FIG. 7G) that appear more frequently in FIG. 7D. In FIG. 7E, the distribution of enterprise communities is concentrated and spherical, while in FIG. 7F, the distribution is more divergent and shows a columnar shape. In FIG. 7G, some regions are concentrated, while others are divergent, which has the common characteristics of the first two types. It is evident that the enterprise community cluster is another way of presenting enterprise community relations. By observing the enterprise relationship network, the nodes in the spherical area are relatively close, while the nodes in other areas are more dispersed. Therefore, the generation of enterprise community clusters in three dimensions helps observers better understand the correlation between enterprises.

4.3 Feature Analysis in 2.5D

Enterprises possess various characteristics, including asset size, establishment time, risk information, and more. Based on the available feature information, the enterprises are divided into different levels in 2.5 dimensions. This allows for a customized observation of the correlation between different features.

Enterprises exhibit varying characteristics, and in this analysis, industry types are selected for examination in 2.5 dimensions. The type of local enterprise can serve as a reflection of the local development situation. Following the international Standard Industry Classification in Sect. 3.2, enterprises are divided into ten types. We utilize a 2.5 dimensional network to conduct an industry analysis of local enterprises.

Figure 8 presents the analysis of local enterprises in dimension 2.5. Figure 8A displays the association of enterprises in different industries, with each plane dimension representing an industry. Figure 8B demonstrates the selection of different industries, allowing for the correlation between them to be shown. Figure 8C depicts the development of enterprises in each industry.

Observing the industrial development status shown in Fig. 8C, the red node represents the enterprise, and the line segment represents the investment relationship between enterprises. There are numerous enterprises in the electronics industry, wholesale and retail industry, transportation industry, financial industry, and service industry in this region, and they are closely connected. This indicates that the development of enterprises in this region is inclined towards emerging industries, which reflects the local characteristics of metropolis enterprise development. When examining the development status of the construction industry in this region, the horizontal axis represents the event of enterprise establishment, and the vertical axis represents the size of enterprise assets. From the observation of Fig. 8C, it can be concluded that most construction enterprises are in the upper half, indicating that the assets of construction enterprises in this region are large. This also reflects the high value of the real estate market in this region.

Several relatively developed industries are analysed, as shown in Fig. 8B. The edges between planes were optimized using edge binding calculations to reduce visual clutter (Fig. 8B). The lines between planes represent the investment relation-ships between enterprises. Figure 8B1 shows the connection between finance and electronics, Fig. 8B2 shows the connection between finance and re-tail and wholesale, Fig. 8B3 shows the connection between finance and transportation, and Fig. 8B4 shows the connection between finance and services. Based on the observations and analysis, it can be concluded that among these popular industries, the financial industry is closely related to the transportation and service industries, followed by the eletronic industry and the retail and wholesale industry. Similarly, pairwise analysis could be conducted for each pair of industries, but due to space constraints, only the above correlations are presented.

At the same time, regional analysis is added to show the geographical distribution of enterprises. Figure 8D shows the distribution of enterprises in some electronic information industries. It can be seen that enterprises of this type are mainly distributed in the central and eastern regions.

4.4 Risk Diffusion in 2D

The introduction of the 2D planar network topology diagram can help to see the details of the network. We introduce the risk propagation model to observe the local relationship network in 2D.

Figure 9 illustrates the communication effect diagram of the enterprise risk communication model in two dimensions. This figure aims to demonstrate the communication effect of enterprise risk in specific scenarios based on the study of the enterprise risk diffusion model in Sect. 3.3. In Fig. 9A, a partially detailed enterprise relationship network topology is presented, where blue nodes represent risk-free enterprises. Figures 9B and 9C show the communication effects of risks generated by different enterprises. The red nodes represent risky enterprises, the yellow nodes represent potentially risky enterprises, and the red dotted line indicates the result of the first round of communication. To set the scope of risk transmission, we used a risk radius of 2, which means two rounds at most. In the transmission process, a subjective factor is added, and the enterprise can choose whether to support the infected enterprise or not. Therefore, we can observe that in the first round of encirclement, some enterprises did not change. Furthermore, some enterprises chose to support the original risk-infected enterprises in the first round of risk transmission, which may lead to the enterprises becoming risky enterprises in the future. Analogously, enterprises that support risky enterprises in the first round have a certain probability of risk. Based on the first round, neighboring enterprises will choose whether to provide support or not, resulting in the second round of risk diffusion.

5 Evaluation

To verify the effectiveness of the multidimensional network analysis on regional enterprises, we designed a user evaluation questionnaire. We invited 20 participants, including business leaders, finance students, and professionals in the visualization field, to evaluate the analysis effects of enterprises using multiple dimensions. Specifically, we evaluated the division of the enterprise community in three dimensions, the industry association analysis in two and a half dimensions, and the risk diffusion model in two dimensions. The evaluation method used a 5-point system, where the lowest score represented “very dissatisfied” (1), and the highest score represented “very satisfied” (5), with the intermediate scores representing different degrees of satisfaction (Table 2).

The user evaluation results are presented in Fig. 10. Based on the results, our paper can effectively position enterprise nodes in three dimensions (Q1). The community cluster can also properly surround the enterprise community (Q2). Our community analysis, industry association analysis, and enterprise risk diffusion of regional enterprises can effectively and quickly comprehend local enterprises (Q5). However, in the industry association analysis in 2.5 dimensions, due to the large number of nodes and levels, it is necessary to switch between different levels to observe the degree of association between different industries (Q3). For enterprise risk diffusion, we may need to incorporate additional characteristics to evaluate the risk diffusion of enterprises (Q4).

6 Conclusion

This paper aims to observe the complex network formed by the investment relationships between enterprises from three dimensions: 3D, 2.5D and 2D. The enterprise community is divided into three dimensions, utilizing a cluster to achieve better encirclement. In the 2.5 dimension, enterprises are categorized into different industry planes for observing and analysing the correlation between industries. The diffusion of local enterprise risk is analysed in two dimensions. Starting from the overall large-scale enterprise community division, to analyzing the correlation between enterprises and industries, and then examining the spread of local enterprise risk, this approach can effectively analyse the situation of local enterprises from different dimensions, ranging from the macro level to the micro level. However, there are still some deficiencies, such as (1) the 2.5 dimension having too many industry levels, which requires manual screening, and (2) in the two dimensions, more factors can be considered for enterprise risk diffusion, such as the operation characteristics of the enterprise and whether it is a dishonest enterprise.

References

Bak, O., et al.: A systematic literature review of supply chain resilience in small–medium enterprises (SMEs): a call for further research. IEEE Trans. Eng. Manag. (2020)

Niu, Z., Li, R., Wu, J., et al.: iConViz: interactive visual exploration of the default contagion risk of networked-guarantee loans. In: 2020 IEEE Conference on Visual Analytics Science and Technology (VAST), pp. 84–94. IEEE (2020)

Niu, Z., Cheng, D., Zhang, L., et al.: Visual analytics for net-worked-guarantee loans risk management. In: 2018 IEEE Pacific Visualization Symposium (PacificVis), pp. 160–169. IEEE (2018)

De Blasio, G., De Mitri, S., D’Ignazio, A., et al.: Public guarantees to SME borrowing. A RDD evaluation. J. Bank. Financ. 96, 73–86 (2018)

Srhoj, S., Lapinski, M., Walde, J.: Impact evaluation of business development grants on SME performance. Small Bus. Econ. 57, 1285–1301 (2021)

Dvorský, J., Schönfeld, J., Kotásková, A., et al.: Evaluation of important credit risk factors in the SME segment. J. Int. Stud. (2018)

Kotaskova, A., Belas, J., Bilan, Y., et al.: Significant aspects of managing personnel risk in the SME sector. Manag. Market. Challenges Knowl. Soc. 15(2), 203–218 (2020)

Nikolić, N., Jovanović, I., Nikolić, Đ., et al.: Investigation of the factors influencing SME failure as a function of its prevention and fast recovery after failure. Entrep. Res. J. 9(3), 20170030 (2018)

Bolek, V., Látečková, A., Romanová, A., et al.: Factors affecting information security focused on SME and agricultural enterprises. Agris Online Papers Econ. Inf. 8(665–2016–45137), 37–50 (2016)

Yahaya, S.N., Mansor, N., Bakar, M.H.: Credit risk model: the conceptual framework of SME financing. Int. J. Res. Rev. Appl. Sci. 26(2), 113–119 (2016)

Feng, B., Xu, H., Xue, W., et al.: Every corporation owns its structure: corporate credit rating via graph neural networks. In: Yu, S., et al. (eds.) Pattern Recognition and Computer Vision: 5th Chinese Conference, PRCV 2022, Part I. LNCS, vol. 13534, pp. 688–699. Springer, Cham (2022). https://doi.org/10.1007/978-3-031-18907-4_53

Zheng, Y., Lee, V.C.S., Wu, Z., et al.: Heterogeneous graph attention network for small and medium-sized enterprises bankruptcy prediction. In: Karlapalem, K., et al. (eds.) PAKDD 2021, Proceedings, Part I. LNCS, vol. 12712, pp. 140–151. Springer, Cham (2021). https://doi.org/10.1007/978-3-030-75762-5_12

Wasserman, S., Faust, K.: Social network analysis: methods and applications (1994)

Glückler, J., Doreian, P.: Social network analysis and economic geography—positional, evolutionary and multilevel approaches. J. Econ. Geography 16(6), 1123–1134 (2016)

Luke, D.A., Harris, J.K.: Network analysis in public health: history, methods, and applications. Annu. Rev. Public Health 28, 69–93 (2007)

Zhang, X., Wu, L., Yao, Z., et al.: A multilayer network topology visualization layout based on Louvain community detection. In: 2018 IEEE Third International Conference on Data Science in Cyberspace (DSC), pp. 760–763. IEEE (2018)

Holten, D., Van Wijk, J.J.: Force-directed edge bundling for graph visualization. Comput. Graph. Forum 28(3), 983–990 (2009)

Schulz, C., Nocaj, A., Goertler, J., et al.: Probabilistic graph layout for uncertain network visualization. IEEE Trans. Visual Comput. Graphics 23(1), 531–540 (2016)

Enns, J.T., Rensink, R.A.: Influence of scene-based properties on visual search. Science 247(4943), 721–723 (1990)

Cheng, D., Niu, Z., Zhang, Y.: Contagious chain risk rating for networked-guarantee loans. In: Proceedings of the 26th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining, pp. 2715–2723 (2020)

Meng, X., Tong, Y., Liu, X., et al.: NetRating: credit risk evaluation for loan guarantee chain in China. In: Wang, G., Chau, M., Chen, H. (eds.) Intelligence and Security Informatics. PAISI 2017. LNCS, vol. 10241, pp. 99–108. Springer, Cham (2017). https://doi.org/10.1007/978-3-319-57463-9_7

Yang, S., Zhang, Z., Zhou, J., et al.: Financial risk analysis for SMEs with graph-based supply chain mining. In: Proceedings of the Twenty-Ninth International Conference on International Joint Conferences on Artificial Intelligence, pp. 4661–4667 (2021)

Acknowledgements

This work was supported by Natural Science Foundation of Sichuan Province (Grant No. 2022NSFSC0961) the Ph.D. Research Foundation of Southwest University of Science and Technology (Grant No. 19zx7144) the Special Research Foundation of China (Mianyang) Science and Technology City Network Emergency Management Research Center(Grant No. WLYJGL2023ZD04).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Liu, Y., Wang, S., Chen, S. (2024). Analysis of SME Investment Relationships with the Help of Multiple Topology Layouts. In: Zhang, M., Xu, B., Hu, F., Lin, J., Song, X., Lu, Z. (eds) Computer Applications. CCF NCCA 2023. Communications in Computer and Information Science, vol 1960. Springer, Singapore. https://doi.org/10.1007/978-981-99-8761-0_10

Download citation

DOI: https://doi.org/10.1007/978-981-99-8761-0_10

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-8760-3

Online ISBN: 978-981-99-8761-0

eBook Packages: Computer ScienceComputer Science (R0)