Abstract

The primary renewable energy system (RES) investment decision-making criteria are economics. These criteria are focused on the RES and its support ancillary infrastructure technical superiorities, such as efficiency and cost, which is reasonable in the context of generous financial support schemes. However, when financial supports are phased out the energy market becomes technologically diversified environmental, political and social concerns, which include both quantitative as well as qualitative criteria, become significant. The technical superiorities may fail to describe RES or the relevant technology properly. This chapter is structured in two parts. Firstly, the available knowledge with regards to the general decision making processes is described, followed by a critical perspective about today’s decision making. The second part presents a review of three enhanced approaches using Real Options Theory, Multi-Criteria Decision Analysis and Multi-Criteria Cost Benefit Analysis which are applied to RES decision making both from the personal or investment point of view as well to the policy and the latter pan-European point of view. Finally, the society challenges are discussed within this context.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1.1 Introduction

Historically, the choice of energy has been economics and local conditions. Our society has been driven to choose inexpensive energy. However nowadays, the technical superiorities of energy systems may fail to describe for instance renewable energy systems (RESs) or its technology properly.

In this chapter, the RESs decision making process is examined with a number of analytical lenses that may not give priority to their technological superiorities. Although the real life decision-making process is far from the aspired process in this chapter, this chapter will provide the understanding of the complex multidisciplinary decision making approach that today’s experts and policy makers are faced to address the challenges that society will dictate in the future.

The large scale definition in this chapter is not limited to large system size magnitudes such as in Mega Watt equivalent but also considers the high deployment rates of micro-generation which when collected together may provide a large scale renewable power generation potential.

1.2 The Decision-Process Complexity

The decision process starts when there is more than one alternative to a solution. As will be described later on in the second part of the chapter, with the use of Real Options (RO) Theory decision-process kicks-off even between two simple alternatives do nothing or do something. There is no fixed framework or a single sequential approach how to achieve to the best decision.

Figure 1.1 tries to depict the complexity of choosing among alternatives.

The first phase is the Problem Definition which is the crucial stage in decision-making. It is usually difficult or impossible to fully complete one component in the process without reflecting on the other components within a decision making process. This first phase groups the components into more malleable and therefore more realistic manner. This phase involve data processing that filters the relevant data and the feasible alternatives by their attributes leading to objective mapping. The criteria description helps the evaluation which is subjectively mapped to quantitative of qualitative attributes. While several components of the decision making process may be considered in parallel, there is no dictated or standardised procedure of what component comes before the other. Hence, Fig. 1.1 to some difficulty tries to draw the interrelationships between all components. It also includes a very important component in today’s world, the perspective of the decision maker. Information and data can be gathered to understand more holistically the perspective of the decision maker being at political level, business level or individual customer level. Perspective change depending on the decision maker position and during the next phase due importance may be provided. This will lead to the most missing aspect in decision making which is usually referred to ‘feedback’ and will help finding the trade-off between different decision makers’ perspectives.

The objective of a decision making process is the focus of the problem definition. The objective may have a multi-dimension perspective and several impacts. This is illustrated by the following example for decision making:

-

To integrate nationwide renewable energy systems, an example using multi-criteria decision making technique is further illustrated in second part of this chapter.

-

To inform stakeholders including policy, business and end-user on diversified renewable energy technology for example in case of photovoltaic (PV) technologies. An example is also illustrated in second part of the chapter.

-

To evaluate production high throughput practices in producing renewable energy systems or components.

The second phase is the modelling and decision analysis. Figure 1.1 shows a wide range of techniques that may be used, while the importance of results can differ for decision makers. The decision analytics methods may be undertaken combined such as with simulation models which are fed to multi-attribute utility analysis. There is an extensive classic works on decision making techniques [1, 2] which goes beyond the scope for this chapter, including aspects related to the behavioural viewpoint in Kahneman et al. [3] which aspect has already been highlighted above. In the next subsections, a brief description is given to all the named techniques.

1.2.1 Voting

In voting methods, the stakeholders that have the right to vote can voice up and choose democratically an alternative over another. However this allows for the possibility of political interference and may not result in complete unbiased solution to be the right choice. Voting can take many forms such as using simple voting system or preferential voting system. Voting technique may also inform decision makers to form the “big picture” that is the holistic approach and fed back to the decision support system.

1.2.2 Cost-Benefit

Cost-Benefit Analysis (CBA) computes the “net present value” (NPV) which is usually monetary value based on one time snap-shot all the benefits and costs of a project, decision or policy. CBA has been widely used in RES projects to justify investment or compare projects and sometimes even coupled by other economic theories such as the RO Theory which will be further described in the second part of this chapter.

Related formal techniques include cost-effectiveness analysis, cost–utility analysis, economic impact analysis, fiscal impact analysis, and social return on investment (SROI) analysis. When Life Cycle Costing (LCC) is incorporated within CBA, the technique finds out the total cost of ownership. It is a structured methodology which deals with all the elements of this total cost of ownership. Hence an expenditure profile of a system over its anticipated life-span can be formed. The results of an LCC study can be employed in the decision-making process over a number of products or systems. The accuracy of LCC analysis diminishes, as the project’s finances are more into the future. Hence, long term assumptions are preferred on all alternatives.

Investment appraisal may be assessed with varies LCC metrics. The NPV which is the basis for CBA, or worth present value, is the most common technique [4, 5], representing the investment wealth level. The NPV is calculated on net annual cumulative present value cash flows, that is annual inflows less annual outflows. The benefit of an investment is indicated by a positive NPV. All net annual cash flows are discounted over the lifetime of the investment. This incorporates the time preference, which reflects the investor’s preference of having money today versus future revenues.

Similarly, the Internal Rate of Return (IRR) indicates the rate of return generated by the investment and is the discount rate by which the NPV equals zero. The selection over alternative investments is based on the highest IRR. IRR entails more complex calculations than NPV and does not always provide a single answer [5]. In fact, IRR does not provide an indication of NPV sensitivity to cost of capital.

Another LCC metric for investment appraisal is the Profitability Index (PI), which represents the present value of future cash flows generated by the project per unit of invested capital. The viability is indicated by PI greater than one.

Some other investment appraisal tools are Payback Time (PBT), defined as the period it takes for a project to recover cost outlays. Feasibility by payback period is predetermined by a period which is always significantly less than the project lifetime. Last but not least is the Annualised Life-Cycle Cost (ALCC) appraisal metric which averages upfront present value of the life cycle project cost over the investment lifetime [5].

The basis for CBA based on LCC was recently used to determine the cost of electricity from emerging plastic-based PV systems [6] and the impact and affordability of PV RES financial support schemes such as the feed-in-tariffs (FIT) in the UK [7].

1.2.3 Payoff Matrix Analysis

Originating from Game Theory, a payoff matrix analysis tabulates the advantages and disadvantages of a choice. This includes the uncertainty of a possible outcome, however the technique is limited to a set of alternatives and outcomes under the decision maker’s control. Payoff Table Analysis is widely used in the energy field such as in energy markets [8].

1.2.4 Weighing Scoring

A less political dependent but powerful and flexible tool is the weighted-scoring method. These kind of methods compare and prioritise the attributes of alternatives against a fixed set of “must have” (high importance) to “no need” (low importance) criteria. It is a commonly used tool when we normally buy things to make an objective impression to our decision from a subjective process. The final score will rank the alternatives for example on submitted RES projects for a public tender, product selection by a bidder within a RES project tender call, risk analysis and design.

1.2.5 Mathematical Optimisation

Mathematical optimisation also known as mathematical programming technique is the selection of best available variables to an objective function within a domain defined by a number of equalities and inequalities constraints. The objective function, also described as cost function and indirect utility function in case of minimsation, utility function in case of maximisation and energy function incase of other fields, represent the decision maker’s objective such as maximising profits, or minimising environmental impacts. In complex scenarios where there exits conflicting objectives, multi-objective optimisation provides trade-offs between the objective functions, and a possible compromised solution may be suggested. Optimisation may also be used in combination with modelling and simulation especially in large complex problems where uncertainty would require to analysis the system dynamically-such attempts are called stochastic optimisation. Optimisation has been used widely in scholarly studies such as in recent studies [9] and has been useful in many power systems scheduling examples. The methodology may become useful in the case for real-time optimisation for smart grid application. However this application would have to see novel mathematical solutions to achieve fast-response solutions as optimisation problems are usually iterative and require processing time and machine power to solve.

1.2.6 Utility Function

This analysis is the process for structuring a logical framework which may even include the use of other decision making methods and techniques, while informing the decision maker and other stakeholders. Graphical representations are commonly used in decision analysis such as influence diagrams and decision trees. Uncertainty may also be incorporated with the use of probability distributions. The objective is represented by the ‘utility’ functions maximisation, hence the name.

1.2.7 Economic Models

Complex models were developed based on ‘free market’ approach which basically is surrounded by the assumption that prices dictate choices and that the economy may be modeled as a system. The assumption leads that if there is any change in prices, a general equilibrium is reached and that self-interested individuals in a free market economy would collectively produce benefits for the society. However these models have been discussed in depth that assumptions taken may be too drastic and not real-life scenarios. Hence micro-economists learned that these models are not necessary stable. Later on in this chapter we shall discuss further theories to enhance such models.

1.2.8 Simulation Models

This technique usually models a time-series historical collected data to assess the real life behavior of a physical model based on a soft prototype. Simulation modelling is an inexpensive process to predict the performance of engineering systems, including for example grid control with RES penetration or simply RES generation capacity for the next day. Uncertainties are usually addressed through a number of case scenario studies.

1.2.9 Multi-Attribute Utility Analysis

Multi-Attribute Utility Analysis, also called Multi-Criteria Analysis (MCA) is an extension to the utility function technique in which multiple criteria and set of defined alternatives are evaluated in a hierarchical decision that allows a mathematical solution to be found. A family of methods has recently seen an increase interest in the energy field. Typical used methodologies such as SMART, PROMETHEE and ELECTRE outranking methods rank alternatives from best preferred to worse according to the decision makers preferences. In the second part of this chapter the ELECTRE III is applied on PV technology selection.

1.2.10 System Dynamics Modelling

This technique models complex systems, which incorporate feedback loops and time delays that are present in a system and effects the holistic performance. This technique although might look as describing a simple system the influence on these mathematical formulation to represent the system dynamics may lead to a computational time and power demanding problem.

The third and final phase of a decision making process is adjudicating. Here results are plotted, listed or tabled, and a final decision can be taken after testing the robustness of the decision analysis framework through sensitivity analysis.

In the end, the choice for an alternative over another or the decision is yours. The general techniques, which have been basically developed in mid-twentieth century have been described above. Further details on recently enhanced methodologies to address the shortcomings of these techniques is described in the second part of the chapter.

1.3 How are Decisions Taken?

Unfortunately even though there exist multiple techniques to analyse the most suitable or optimal or feasible solution, it is still early days that complex techniques are truly being exploited. As individual concerns for example we face decisions on a daily basis that would require time and money to analyse each decision properly, even though some techniques discussed are quire straightforward these techniques are unlikely being used on individual basis.

On the political aspect, politicians would like to keep protecting re-election chances. While the use of regulators which may balance these political interference situations in many cases in EU regulators, sometimes the regulators themselves have been over passed by the political will of politicians.

On the other hand decision analysis is important in business and planning. However at the end these dimensions are still at risk due to any political interference which may change the scenario completely within especially an emerging market. A case in point is the generous FIT support schemes that emerged in the EU during the last decades. While initially, the purpose of these tariffs has been achieved by early adaptors that is to increase RES deployment these schemes are nowadays obsolete. Many companies that invested a lot in research and development in new promising technologies, such as in the case of PV technologies, most often even supported by government funds, had to file bankruptcy in view that mature technology dominated the market with the old engineering decision analysis that is biased towards cost and efficiency. This basically let to downgrading innovation.

1.4 Engineering Decision Analysis

Engineering decision making is based on the same components highlighted in Fig. 1.1 and Sect. 1.2, plus one final important phase, phase four, that is the post audit of results. The post audit of results is a verification stage that decisions taken had the right course of action and if required amendments may be considered. This verification process is performed in some cases at regular intervals such as in the manufacturing process of products for RES or even in real-time such as for grid monitoring.

Engineering decision analysis has often focused on technical superiorities such as costs and efficiency. Hence the economic decision analysis using criteria such as NPV, IRR and PBT has dominated the decision approach within the industry in general for many decades.

However the social responsibility adopted by major entities and the ‘greeness’ criteria that reflect the impact or benefits one makes towards the environmental criteria are taking shape within decision making frameworks. In addition qualitative criteria which most often are difficult to quantify cannot be missed out either. These added complexity to decision making will be described more in the next section.

1.5 Decision Support Systems

This second part of the chapter provides a brief overview of selected three approaches that apply a combination of techniques described in Sect. 1.2, and further developed more robust frameworks for decision support systems to choose among a number of green energy and/or technology solutions.

The first is using the enhanced economic theory of RO Thoery used in recent studies exploring the investment decision on PV technologies and systems [10]. Although the work was when the FIT in UK was not yet tracked with an IRR, the framework provides a degree of understanding on the uncertainty, which can be used in many scenarios worldwide as well as on many different technologies and energy systems. RO Theory has recently increased its popularity within academia on energy systems. A comprehensive review is given in Martinez-Cesena [11].

The second approach uses Weighed in system planning: ENTSO-E’s cost/benefit method, a new European method developed by the European Network of Transmission System Operators for Electricity (ENTSO-E) [12]. The methodology falls under the Ten Year Network Development Projects (TYNDP) and includes network and market modelling for a harmonised energy system-wide cost-benefit analysis at Union-wide level for projects of common interest.

The third approach is a complex decision support system that integrates the technical, economic and environment qualitative and quantitative criteria to help with a diversified technology decision choice. A number of quantitative criteria are pre-calculated through simulation and modelling. This example also contains different perspective of the decision maker being political, business or end-customer.

1.5.1 The Real Options (RO) Theory Approach

As discussed earlier, the failure and dissatisfaction in economic models using discounted cash flow methods (DCF) [13], and the introduction of the Black–Scholes equation [14] gave rise to the creation of RO theory. In fact what RO theory does is enhance DCF methods to better address uncertainty for example with technology development and derive its options.

RES projects and their associated investment projects from manufacturing to site installations possess ‘real’ options that if identified and implemented may increase the investment worth [15]. These ‘real’ options may be defined as projects adjustments that the decision maker seem fit in response to the evolution of uncertainty such as delaying or rushing investment and building additional infrastructure [16].

Today, the RO theory has been applied widely to RES, and a comprehensive literature review is available [11]. The applications have also differed from assessing investment time [17], examining the investment indifference [18] and addressing uncertainty in the LCC of RES systems due to the Emissions Trading market [19].

In this study, RO theory was based on indifference, and cost and efficiency forecasts [20] for a diversified range of PV technologies to assess investment, while considering solely the option for delay.

The indifference within this developed RO theory model was based on the assumption that PV module prices will not increase and efficiencies will not decrease in the future for a particular technology. However if the price for PV module is higher, efficiency increase is expected to achieve the indifference. The normalised result of this process is shown in Fig. 1.2a showing the combinations of Mono-Si PV type modules’ cost reduction and efficiency increase.

Meanwhile the forecasted technology development is based on the targeted efficiency values [20], while those for costs are based on PV module predictions [21] and experience curves. Figure 1.2b shows the forecast for CdTe module costs based on available efficiency predictions and learning rates of 15 and 22 %.

These indifference and forecast curves are then normalised by their current average values and contrasted on top of each other as shown in Fig. 1.2c for a-Si PV and (d) CIS PV systems delay assessment examples. Further from the origin means higher efficiency improvements and cost reductions while the area above the indifference curve represent a convenient delay, below is vice versa.

In summary this approach has simplified the assessment of the economic convenience of delaying projects such as in this case investments in PV technology within a domestic grid-connected PV system. It has been noticed that the option to delay investment is mainly affected by the time-value of money, type of loan and technology forecasts. An interesting aspect is that a delay option may become a driver for emerging technologies exhibiting inferior technical superiorities over mature technologies to penetrate the market.

1.5.2 Weighed in System Planning Approach

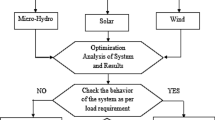

The EU Regulation 347/2013 requires the European Network of Transmission System Operators for Electricity (ENTSO-E) to establish a methodology, including on network and market modelling, for a harmonised energy system-wide cost-benefit analysis at Union-wide level for projects of common interest [12]. The developed framework is a Multi-Criteria Cost Benefit Analysis for candidate projects (feasible alternatives) of common trans-European interest and projects which fall within the scope of Ten Year Network Development Plan (TYNDP).

Fast developments and deployments in RES as well as the EU electricity market liberisation has moved towards large scale diversified power generation portfolio offering more and more interdependent power flows across Europe, with large and correlated variations. Therefore, Transmission System Operators (TSOs) must look beyond traditional boundaries, usually based on national conditions, and move towards regional and European solutions. Hence the scope of developing this Multi-Criteria Cost Benefit Analysis, Fig. 1.3, with mid and long term objectives which addresses system safety, security, sustainability, market access and increase energy efficiency within the liberised EU power and electricity market regulations, policies, national legislations and procedures.

The scope of the multi-criteria cost benefit analysis [22]

The methodology facilitates the planning of pan-European transmission system and assess new transmission assets which is one of the many number of feasible solutions. However it does not exclude other possible alternatives in particular energy storage, as well as generation and/or demand side management. The quantitative assessment is performed both by translating the inner ring attributes in Fig. 1.3 to a monitised value in € for example as well as through the measured physical units such as kgCO2-eq or kWh for the outer ring attributes in CO2 emissions reduction would have benefits on production cost savings given an adequate carbon price. Considering emissions as a separate attribute and an adequate carbon price may lead to double counting. Similarly, integration of renewable energy would have benefits on production cost savings. On the other hand, local and environmental costs contribute to the infrastructure costs. Such impacts includes the impact on human beings, on the local fauna and flora, on material assets, and on cultural heritage, as described in the Environmental Impact Assessment (Directive 85/337/EEC) [22].

This set of common European-wide indicators will form a complete and solid basis, both for project evaluation within the TYNDP, and coherent project portfolio development for the common interest selection process. Initially, the planning process consists of the definition of scenarios, which represent a coherent, comprehensive and internally consistent description of a plausible future. The aim of scenario analysis is to depict uncertainties on future system developments on both the production and demand sides. In order to incorporate these uncertainties in the planning process, a number of planning cases are built, taking into account forecasted future demand level and location, dispatch and location of generating units, power exchange patterns, as well as planned transmission assets.

1.5.3 Multi-Criteria Analysis (MCA) Approach

During the past decade, decision support systems using multi-criteria analysis (MCA) models and techniques has been widely applied for energy systems in a multitude scenario on political and national level to technology specific and manufacturing processes. MCA techniques such as utility theory, hierarchy process, weighted sum and others are available in literature [23, 24].

In this approach, the outranking ELECTRE III method was chosen as it makes use of the discordance concept and do not hold structural properties in outranking relations. In addition the ELECTRE III has other superior features of partially having non-compensatory treatment of the problem and proportional thresholds for imprecise data from other outranking methods such as SMART and PROMETHEE, which may turn out to be a difficult task [25–27].

The purpose of this study was to elaborate and demonstrate the first multi-criteria decision support tool for an investment in PV systems [28]. Currently the PV micro-generation market, which is the largest PV market, is dominated by mainly five technologies namely mono-crystalline silicon (mono-Si), multi-cyrstalline silicon (multi-Si), amorphous silicon (a-Si), copper indium gallium diselenide (CIGS) and cadmium telluride (CdTe). Additionally, emerging polymeric organic-based PV (OPV) technologies have the potential to enter this market [6].

In the future, the use of PV technologies will have to be diversified to ensure a sustainable PV energy supply to the market. This implies that the overall assessment and selection of PV technologies will have to consider several criteria to address the particular technical, environmental, and economic factors associated to a wide range of available PV technologies [29].

The application of MCA can combine the various viewpoints into a standardised evaluation procedure. Figure 1.4 illustrates the final ranking considering all technical, environmental and economic quantitative and qualitative criteria such as PV contribution to local load, Module Design, CO2 impact, aesthetic aspects, NPV and technology maturity. Of interest is the result in the ranking of crystalline silicon based technology alternatives (A1 and A2) and thin film technologies (a-Si A3, CIGS A4 and CdTe A5) which illustrates their incomparability.

Final ranking under all three perspectives with 0.80 PR (Performance Ratio), where A1 refer to mono-Si, A2 refer to multi-Si, A3 refer to a-Si, A4 refer to CIS, A5 refer to CdTe and A6, A7, A8 and A9 refers to stable/fixed, reference, optimistic and pessimistic technology developments respectively in organic-based PV (OPV) technologies with respect to efficiency, lifetime and price

In summary the study demonstrated that reduction in cost and enhanced technology developments are required for preferential ranking. Today the thin-film (TF) PV technology and the crystalline (c-Si) PV technology have a competitive edge in the market, and this study shows certain insuperabilities. In this context, crystalline technologies are more expensive. However, this PV technology offers a much better CO2 benefit than emerging technologies due to high efficiency levels. MCA study as demonstrated in this study can be used as a preferential indicator for any PV technology integration within a competitive market under three categories namely technical, environmental and economic.

1.6 The Challenges to Society

Several international cooperative programme frameworks, protocols and summits have taken shape to address global concerns such as population growth, greenhouse gas emissions and climate change. These frameworks such as the Framework Convention on Climate Change (FCCC) and the Kyoto Protocol led by the United Nations are a first step to enhance the conservative engineering decision making focused on purely efficiency and cost economic analysis and provide achievable targets to enhance the future sustainability of the planet and the current living population.

The energy debate is open but decision making to the society is only reserved to the big players. Better access to the energy markets by consumer will provide more stability and improve the functionality of markets, as well as their transparency and information on the demand and supply side. This includes the removal of harmful subsidies both for long standing support to fossil fuels and the generous financial supports for renewable that distorts the markets.

On the other hand energy poverty needs to be elevated and improve access to reliable, affordable, economically viable, social acceptable and environmentally sound energy services and resources. In this chapter we have seen that not all criteria are quantitative, some are qualitative ones which brings about the problem of measuring their attributes. Using decision making techniques can help also provide more knowledgeable decisions and may act as a key to resolve syndromes such as the NIMBY (Not In My Back Yard) or BANANA (Build Absolutely Nothing Anywhere Near Anything) ones.

1.7 Summary

This chapter has assessed the decision making of technologies in RES. The defined large scale renewable power generation in this chapter is not limited to large size system magnitudes of Mega Watt equivalent but also considers the high deployment rates of micro-generation which when collected together may provide a large scale renewable power generation potential. Therefore the chapter has considered key decision making techniques across a range of applications in industry from manufacturing RES components or products for large scale generation, operations decision within an energy grid, investment decisions as well as policy guidance.

We took off with the thesis that the technical superiorities of efficiency and cost may not describe well all the alternatives of green energy and technology and therefore we need to move forward from the traditional engineering decision making. Unfortunately, today most real-life decision making within traditional industries such as the utilities are still based on conservative old style of thinking. In addition traditional decision making techniques may have also failed to take into account the likely technology developments.

A case in point is the lack of uncomfortable use of net demand planning that is considering also all distributed and intermittent generating sources within the demand profiles, over conservative demand planning that is considering only dispatched generation sources regulated by the utilities. In addition there exists conflicts in the context of generous financial support schemes or even to some extent support of fossil fuels, mostly in terms of subsidies, which is leading to dominant mature players take up the market while emerging technologies end up investing but hard to integrate.

The chapter therefore described three main enhanced approaches:

-

RO Theory, where the technology developments and the scenario changes are taken into consideration for an investment decision in case of RES for instance-making a wiser and knowledgeable investor decision,

-

Weighed in system planning: the Multi-Criteria Cost Benefit Approach being developed by ENSTO-E for transmission system planning, and

-

Multi-Criteria Decision Analysis, where multiple criteria and several alternatives may be brought together under many different techniques, even in some cases considering or combining both quantitative and qualitative matrices to help with decision support under a respective perspective.

Beyond the economic costs and benefits green energy and technology solutions offer, there are other considerations to be taken into account when choosing truly from alternatives. Here we tried to highlight some of these criteria which may stand well, but not limited, under one of these four streams technical, environment, economic and social.

All energy systems and their technologies have both positive and negative impacts under these streams be it termed ‘Green’ or ‘Dark’ energy. The task that engineers, politicians and basically human kind face as we transit to a sustainable energy future is to weigh up all relevant criteria and decide more transparent and structurally correct way.

References

Raiffa H (1968) Decision analysis: introductory lectures on choices under uncertainty. McGraw-Hill, New York

Keeney RL (1992) Value-focused Thinking: a path to creative decisionmaking. Harvard University Press, Cambridge, Massachusetts

Kahneman D, Slovic P, Tversky A (1982) Judgment under uncertainty: heuristics and biases. Cambridge University Press, Cambridge

Lumby S (1988) Investment appraisal and financing decisions. International Thomson Business Press, London

McLaney E (2009) Business finance: theory and practice. Pearson Education, Essex

Azzopardi B, Emmott CJM, Urbina A, Krebs FC, Mutale J, Nelson J (2011) Economic assessment of solar electricity production from organic-based photovoltaic modules in a domestic environment. Energ Environ Sci 4(10):3741

Candelise C (2009) Technical and regulatory developments needed to foster gridconnected photovoltaic (PV) within the UK electrcity sector. Imperial College London, London

Ferrero RW, Shahidehpour SM, Ramesh VC (1997) Transaction analysis in deregulated power systems using game theory. IEEE Trans Power Syst 12(3):1340–1347

Azzopardi B, Mutale J (2009) Optimal integration of grid connected PV systems using emerging technologies. In: 24th European photovoltaic solar energy conference. Hamburg, pp 3161–3166

Martinez-Cesena EA, Azzopardi B, Mutale J (2013) Assessment of domestic photovoltaic systems based on real options theory. Prog Photovoltaics Res Appl 21(2):250–262

Martinez-Cesena EA (2012) Real options theory applied to renewable energy generation projects planning. University of Manchester

ENTSO-E (2013) ENTSO-E guideline for cost benefit analysis of grid development projects, European Network of Transmission System Operators for Electricity (ENTSO-E), Belgium

Hastie KL (1974) One businessman’s view of capital budgeting. Financ Manag 3(4):36–44

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Dixit RK, Pindyck RS (2012) Investment under uncertainty. Princeton University Press, Princeton, New Jersey

Trigeorgis L (1996) Real options: managerial flexibility and strategy in resource allocation. MIT Press, Cambridge, Massachusetts

Hoff TE, Margolis R, Herig C (2003) A simple method for consumers to address uncertainty when purchasing photovoltaics, S Consulting, cleanpower.com

Clean Power Estimator®—Clean Power Research. Available http://www.cleanpower.com/products/clean-power-estimator/. Accessed 08 Aug 2013

Sarkis J, Tamarkin M (2008) Real options analysis for renewable energy technologies in a GHG emissions trading environment. In: Antes R, Hansjürgens B, Letmathe P (eds) Emissions trading. Springer, New York, pp 103–119

Frankl P, Nowak S, Gutschner M, Gnos S, Rinke T (2010) Technology roadmap: solar photovoltaic energy. France, International Energy Agency (IEA)

Hoffman SW, Pietruszko W, Viaud M (2004) Towards an effective european industrial policy for PV solar electricity. In: Presented at the 19th European photovoltaic science and engineering conference and exhibition, Paris

Home—THINK—European University Institute (2013) Available http://www.eui.eu/Projects/THINK/Home.aspx. Accessed 08 Aug 2013

Bana e Costa CA (1990) Readings in multiple criteria decision aid. Springer, Heidelberg

Bragge J, Korhonen P, Wallenius H, Wallenius J (2010) Bibliometric analysis of multiple criteria decision making/multiattribute utility theory. In: Ehrgott M, Naujoks B, Stewart TJ, Wallenius J (eds) Multiple criteria decision making for sustainable energy and transportation systems, vol 634. Springer, Berlin, pp 259–268

Bouyssou D (1996) Outranking relations: do they have special properties? J Multi-Criteria Decis Anal 5(2):99–111

Simpson L (1996) Do decision makers know what they prefer?: MAVT and ELECTRE II. J Oper Res Soc 47(7):919–929

Salminen P, Hokkanen J, Lahdelma R (1998) Comparing multicriteria methods in the context of environmental problems. Eur J Oper Res 104(3):485–496

Azzopardi B, Martínez-Ceseña E-A, Mutale J (2013) Decision support systems for ranking photovoltaic technologies. IET Renew Power Gener 7(6):669–679. doi:10.1049/iet-rpg.2012.0174

Azzopardi B (2010) Integration of hybrid organic-based solar cells for micro-generation. PhD, The University of Manchester, Manchester

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer Science+Business Media Singapore

About this chapter

Cite this chapter

Azzopardi, B. (2014). Green Energy and Technology: Choosing Among Alternatives. In: Hossain, J., Mahmud, A. (eds) Renewable Energy Integration. Green Energy and Technology. Springer, Singapore. https://doi.org/10.1007/978-981-4585-27-9_1

Download citation

DOI: https://doi.org/10.1007/978-981-4585-27-9_1

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-4585-26-2

Online ISBN: 978-981-4585-27-9

eBook Packages: EnergyEnergy (R0)