Abstract

The purpose of this study is to determine the factors affecting non-performing loans (NPLs) of banks in the context of the COVID-19 pandemic. The feasible generalized least square (FGLS) regression method is used to quantify the impact of groups of macro-factors, specific characteristics of banks, and the impact of the COVID-19 pandemic on the NPLs of 25 banks listed in Vietnam in the period 2016–2021 according to three research models. The results show that higher unemployment rate, higher bank size, and higher profitability of banks lead to lower NPL ratio, but higher credit growth rate and higher credit provision ratio lead to higher NPL ratio. The study found that the COVID-19 pandemic in Vietnam has a significant negative impact on the NPL ratio in 2020, a significant positive impact on the NPL ratio in 2021, but the coefficient is negative but not statistically significant when combining the effects of both 2020 and 2021, has shown the complex and unexpected impact of the pandemic on the NPL ratio of the banking system. This result is an early warning and suggests some suggestions for regulators and banks to control the NPL ratio in the near future.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Non-performing loans (NPLs) are the biggest risk of commercial banks when targeting credit growth (Tanasković & Jandrić, 2015). This risk is even more concerned by regulators and banks when the context of the economy is adversely affected by financial crises or epidemics. There are many factors that can affect NPLs (such as macro-factors and specific characteristics of the bank), so in order to effectively manage and handle these debts, it is very important to study the factors affecting NPLs (Phuong, 2022a).

The previous financial and non-financial crises have resulted in an increase in underperforming loans in many countries around the world (Bayar, 2019; Goodell, 2020; Turan & Koskija, 2014). It was found that the COVID-19 pandemic was the cause of strong fluctuations in financial markets and also in banking stocks in many countries (Contessi & De-Pace, 2021; Phuong, 2021, 2022b). The application of unprecedented measures to prevent the spread of the COVID-19 pandemic in countries has negatively affected the business activities of many businesses, leading to the increased risk of bad debts at banks (Ari et al., 2021; Demary, 2021). However, the number of studies on the impact of COVID-19 on NPLs to date is still quite limited.

This fact shows the need to study the factors affecting non-performing loans of banks in the context of the COVID-19 pandemic. Therefore, this topic will be studied for banks listed in Vietnam in the period 2016–2021.

2 Literature Review

There are many different expressions when defining NPLs, but organizations such as the International Monetary Fund and the Basel Committee on Banking all agree that loans should be classified as NPLs when payment of interest and principal is past due by more than three months (90 days) or more (Basle Committee, 2016; IMF, 2019).

The groups of factors were studied by the authors about NPLs which are as follows: analysis of macro-factors, analysis of micro-factors, and a combination of analysis of macro- and micro-factors affecting NPLs (Žunić et al., 2021). Among these factors, macro-factors (external factors) have stronger influence than micro-factors (internal factors or specific characteristics of banks) (Klein, 2013; Sanjeev, 2007).

2.1 Macro-Factors Affecting Non-performing Loans of Banks

Espinoza and Prasad (2010) studied 80 banks in the Gulf Cooperative Council (GCC) region in the period 1995–2008, showing macro-factors (removing oil from GDP and interest rates) and specific factors (bank size, credit growth, management efficiency) all contributed to the increase in NPLs in these countries. The financial accelerator theory is a widely used theoretical framework to link NPLs to a country's macroeconomic environment (Bernanke & Gertler, 1989; Kiyotaki & Moore, 1997). Lawrence (1995) proposed the theory of the life cycle consumption pattern as a way to determine the probability of default. The default probability model implies that NPLs are associated with uncertainty about future earnings. Low-income borrowers have higher default rates as the risk of unemployment increases. In addition, banks charge higher interest rates to riskier customers, so the probability of default depends on current income and the unemployment rate.

Studies show both economic growth (RGDP) and unemployment rate as two important factors affecting NPLs. Low RGDP and high unemployment negatively affect the wealth and ability of borrowers to repay, so under these macro-conditions NPLs are forecast to increase higher (Bernanke & Gertler, 1989; Bernanke et al., 1999; Kiyotaki & Moore, 1997). An economy with a high RGDP and a falling unemployment rate can lead to an excessive credit boom that reduces credit quality and causes higher NPLs (Kirti, 2018; Schularick & Taylor, 2012).

Studies in developed and emerging countries have shown that NPLs are affected by macro-factors. Babouček and Jančar (2005) studied the Czech economy and credit channel activity for 11 years from 1995 to 2004 and found that unemployment and inflation are positively correlated with banks' NPLs, and vice versa, RGDP is negatively correlated with NPLs. Similar to Babouček and Jančar (2005), Klein (2013) studies 16 countries in Central, Eastern, and South-Eastern Europe (CESEE) for the period 1998–2011 also showing RGDP, unemployment, and inflation significant impact on the asset quality of banks. In addition, Klein (2013) also shows that a falling exchange rate increases NPLs in CESEE countries. Ghosh (2015) investigated state-by-state macroeconomic factors in the United States during the period 1984–2013 that affected the NPLs of commercial banks and thrift institutions. The results show that the state's RGDP reduces NPLs, while inflation, state unemployment, and US public debt significantly increase NPLs (Ghosh, 2015).

Research in emerging countries, Radivojevic and Jovovic (2017) and Bayar (2019) both show that RGDP has an important role in bank asset quality. A decrease in RGDP will increase the banking NPL ratio in emerging countries (Bayar, 2019; Radivojevic & Jovovic, 2017). Using the generalized method of moments to study the banking sector, in addition to RGDP, Bayar (2019) also shows that macro-factors such as inflation and economic freedom have a negative impact on NPLs, and unemployment has a positive impact on NPLs. Analysis of inflation: Ari et al. (2021) argue that inflation can affect the NPL ratio in two opposite directions. Rising inflation can reduce NPLs as rising inflation reduces the real value of debt and makes it easier to pay off debt in local currency. Conversely, rising inflation can also lead to higher nominal and real interest rates, increasing the cost of debt services. In this case, high inflation may also be accompanied by macroeconomic instability that exacerbates the NPL ratio (Ari et al., 2021).

2.2 Internal Factors or Specific Characteristics Affecting Non-performing Loans of Banks

The relationship between bank size and NPL ratio is often explained by the moral hazard hypothesis and the “too big to fail” view. Studying commercial banks and thrifts in the period 1984–2013 to determine the factors affecting NPL at the state level in the United States, Ghosh (2015) shows the size of the banking industry as well and capitalization of banks affects NPLs. Low-cap banks have more problems with NPLs (Berger & DeYoung, 1997) because managers of these banks have a moral hazard incentive to engage in risky lending practices (Keeton & Morris, 1987). Therefore, the moral hazard hypothesis implies an inverse relationship between bank capitalization and NPLs. However, there is also a view that large-cap banks will be more relaxed in credit scoring and monitoring customers because they believe in the “too big to fail” concept of Rajan (1994). In this case, the relationship between bank capitalization and NPLs is positive. Thus, the relationship between bank capitalization or bank size and NPLs has not been consistent so far.

Some studies have emphasized that the increase in NPLs of banks is due to poor credit quality control (Keeton, 1999; Asfaw et al., 2016). Survey of Federal Reserve Senior Lenders for the 1967–1983 and 1990–1998 periods, and statewide data for the 1982–1996 period, Keeton (1999) points to as credit growth faster and excessive relaxation of credit standards will result in higher loan losses, especially if the economy is in recession. Asfaw et al. (2016) studied the factors affecting NPLs of the Development Bank of Ethiopia, Central Region by surveying 43 borrowers and 55 employees. The authors found that poor credit ratings and poor credit monitoring were responsible for the increase in NPLs at this bank. Asfaw et al. (2016) suggested that banks should strengthen the borrower's screening criteria and credit assessment before and after disbursement. Disbursement of capital for the right purposes should be focused through strengthening credit supervision.

In addition, large-scale banks often increase excessive leverage and loosen credit quality, leading to increased NPLs (Stern & Feldman, 2004). The loosening of credit quality causes the risk of loan portfolio to increase rapidly, and banks will have to make higher provisions for credit risks (Keeton & Morris, 1987). This can be explained by the moral hazard hypothesis of bank managers.

The hypothesis of “bad management” and the concept of “liberal credit policy” are often applied to explain the impact of management quality on banks' NPLs. Management quality is often measured by the profitability or performance of a bank (Bayar, 2019; Berger & DeYoung, 1997; Klein, 2013; Rajan, 1994). The “bad management” hypothesis of Berger and DeYoung (1997) suggests that banks with high profitability are less likely to engage in high-risk activities so their NPLs will be low. In other words, profitability is negatively related to NPLs. However, Rajan (1994) argues that banks with higher profitability can also increase bad debt because from the point of view of “liberal credit policy”. This policy implies that bank managers may try to make adjustments to increase current earnings to preserve their short-term reputation but will lead to increased NPLs in future.

A study of 43 banks in the Czech Republic, Podpiera and Weill (2008) showed that poor management was the cause of reduced cost efficiency leading to high NPL ratio in the period 1994–2005. Based on these results, Podpiera and Weill (2008) suggest that for countries in transition such as the Czech Republic, banking supervisors should focus on improving the cost-effectiveness of banks in order to reduce the NPL ratio. In agreement with Podpiera and Weill (2008), studies show that higher bank management quality (return on equity in the previous period) can improve lower NPL ratios in CESEE countries (Klein, 2013), increased bank profits reduced NPLs at US commercial banks and thrifts over the period 1984–2013 (Ghosh, 2015), higher return on assets, and return on equity have the effect of reducing bank NPLs in emerging countries (Bayar, 2019).

In addition, low equity and high loan-to-total assets ratio tend to exacerbate bad debt (Klein, 2013), increased liquidity risk, poor credit quality and less efficient costs significantly increase NPLs (Ghosh, 2015), credit growth, increasing cost-to-income ratio, and financial crisis will increase NPLs (Bayar, 2019).

2.3 Impact of Crises on Non-performing Loans of Banks

Using quarterly data from 2003 to 2013 from the Albanian bank, Turan and Koskija (2014) demonstrated that NPLs started to increase shortly after the outbreak of the financial crisis in 2008, but strong growth in NPLs occurred a year later when RGDP in most of the CESEE countries fell. Using annual data for 14 emerging economies from 2000 to 2013, Bayar (2019) also reaffirms that the financial crisis will cause NPLs to increase rapidly in these countries.

Goodell (2020) believes that the COVID-19 pandemic can affect banks because it is one of the causes of the decline in loan portfolio quality, which in turn leads to an increase in NPLs. Demary (2021) warns that NPLs are likely to increase in the euro area due to the impact of the COVID-19 pandemic, especially in countries where the bankruptcy system is inefficient. Therefore, Demary (2021) emphasizes that the extent to which the negative impact of the COVID-19 pandemic will depend heavily on the effectiveness of countries' restructuring measures.

3 Methodologies

Based on theory and the previous studies, in order to determine the factors affecting NPLs of Vietnamese banks in the context of the COVID-19 pandemic, the article proposes the following research model:

The model includes 3 groups of variables: macro-factors, specific characteristics of banks, variables affected by the COVID-19 pandemic.

The dependent variable NPL is calculated by the annual total outstanding loans for each bank.

Independent variables:

The group of macro-variables consists of three variables, namely annual GDP growth (RGDP), annual inflation rate (INF), and annual unemployment rate (UNEMP).

The group of variables with specific characteristics of banks includes the following variables:

-

Bank size (size) is the natural logarithm of total assets

-

Credit growth (CREDIT) is the growth of outstanding loans of year t compared to year (t-1)

-

Financial leverage (FLEV) is calculated as total debt to total assets

-

Profitability (ROE) is calculated as profit after tax on equity

-

Provision for credit risk (PCR) is provision for credit risk on total assets.

The group of dummy variables measuring the impact of the COVID-19 pandemic includes:

The impact of the COVID-19 pandemic on Vietnam in 2020 and 2021 is very different. Vietnam is known as one of the best countries to control the spread of COVID-19 in the world in 2020 (Phuong, 2022b; World Bank, 2020). However, with the emergence of many new strains of the corona virus spreading at a fast rate while the source of a vaccine against COVID-19 is limited, Vietnam's economy in 2021 has suffered a much more negative impact than in 2020. In 2020, the distance due to COVID-19 in Vietnam is about 1 month, and there are no deaths, but until 2021, Southern provinces had to be separated for the last 6 months of 2021 with the number of deaths from COVID increasing rapidly in Ho Chi Minh City, Binh Duong, Dong Nai, and Long An.Footnote 1

To remove difficulties for businesses and borrowers due to the impact of COVID-19, the State Bank has issued Circular No. 01/2020/TT-NHNN, Circular 14/2021/TT-NHNN, Decree 31/2022/ ND-CP to restructure debt repayment terms, exempt and reduce interest charges, and support interest rates so that businesses can recover their production and business activities soon. Therefore, this paper uses three dummy variables to quantify the impact of the COVID-19 pandemic as follows:

All research data was collected during the period from 2016 to 2021. The macro-data group is collected from the General Statistics Office of Vietnam, the data group on the characteristics of banks, and the dependent variable is collected in the annual audit reports of 25 listed banks in Vietnam.

Estimation method: The article uses the feasible generalized least square (FGLS) estimation method for the regression equations. This method has the advantage that it can overcome the phenomenon of variable variance and autocorrelation compared with conventional estimation methods on panel data such as pool original least square, fixed effects model, and random effects model.

4 Results

With 25 listed commercial banks in the period 2016–2022, the research data includes 150 observations. Table 1 shows the results of descriptive statistics of the variables included in the research models (Table 2).

The average non-performing loan ratio of listed banks is 1.8%, which is a relatively safe level. However, the statistical results in Table 1 show that the risk of NPLs is high for KLB bank when the NPL ratio is very high at 7.62% in 2020. Therefore, to ensure safety, banks need to come up with synchronous measures to reduce the NPL ratio below 3%.

Due to the impact of COVID-19, the lowest GDP growth is in 2020, the lowest inflation is in 2021, and the highest unemployment rate is 3.22% in 2021. The bright spot in 2021 is VIB's ROE of 26.39%, the highest of all banks in the research period.

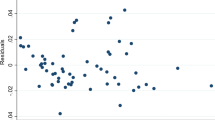

The correlation coefficient of the variable COVID with the variables covid20 and covid21 is 0.633 so these variables will be regressed separately for each regression model. The remaining pairs have correlation coefficients in the range ±0.57, so the variables are linearly independent (Farrar & Glauber, 1967) and are suitable for use in regression models based on panel data.

Breusch & Pagan test results from Table 3 show that models have heteroskedasticity but not autocorrelation according to Wooldridge test. Therefore, the heteroskedasticity phenomenon is overcome on the models, and the FGLS regression results after overcoming are shown in Table 3.

Unemployment rate: The results from Table 3 show that unemployment rate has a significant negative impact on NPLs in all three research models. It rejects Lawrence's (1995) view of the life cycle consumption model due to the characteristics of unemployment and loan structure in Vietnam during the research period. The unemployment rate in Vietnam in the period 2016–2021 remains low at less than 3.22%. In addition, personal loans account for a low percentage of total outstanding loans as well as in NPLs. This result is similar to banks in 14 developed countries for the period 1870–2008 (Schularick & Taylor, 2012) and bond-derived NPLs in 38 countries with the longest being in the range of 1980–2016 (Kirti, 2018).

Bank size: At 1% significance level, bank size (SIZE) has a negative impact on NPLs. This result rejects the “too big to fail” notion that large banks have high NPLs (Ghosh, 2015). In Vietnam, large-scale banks are those with better management experience and better loan quality, thereby limiting NPLs. The negative relationship between bank size and NPLs in Vietnam is similar to that of banks in the CCC region in the period 1995–2008 (Espinoza & Prasad, 2010).

Credit growth: With 90% confidence, credit growth (CREDIT) has a positive impact on NPLs. This result implies that when the economy grew in the face of competitive pressure, some banks may have experienced rapid credit growth along with loosened credit standards, weak credit monitoring will increase NPLs.

The positive relationship between credit growth and NPLs in this study has added empirical evidence in Vietnam besides the studies of Keeton (1999), Asfaw et al. (2016) and Bayar (2019).

Profitability: Profitability (ROE) has a significant negative impact on NPLs. The negative relationship between profitability and NPLs has refuted the “liberal credit policy” view as in Rajan's (1994) study and supported the “bad management” view that Berger and DeYoung (1997) proposed. This shows that banks with high profitability have less incentive to relax credit standards, so the NPLs of these banks are lower. This result is similar to Klein (2013), Bayar (2019), Ghosh (2015) but does not support the results of Rajan (1994).

PCR: Provision for credit risk has a positive impact on NPLs at 5% significance level. Bank credit quality is positively correlated with NPLs supporting the “moral hazard” hypothesis first discussed by Keeton and Morris (1987). Banks with low credit quality often have a moral hazard incentive by accepting a higher level of risk when lending, leading to high NPL ratios, while banks with high credit quality often avoid high-risk activities, so the NPL ratio is low. This result is similar to the study of Keeton (1999), Asfaw et al. (2016), and Bayar (2019).

Both the COVID20y and COVID21y variables are statistically significant at 10%, demonstrating that the NPLs of banks are affected by the COVID-19 pandemic in both 2020 and 2021. However, the regression coefficients of these two variables have opposite signs. This shows the mixed effects of COVID-19 developments in Vietnam in these two years and can be explained by many reasons.

In 2020, Vietnam is one of the countries that has successfully controlled the COVID-19 pandemic and has no deaths. Socio-economic activities were interrupted in April 2020 for social distancing, and activities have returned to almost normal for the rest of 2020. In addition, the Vietnamese government has timely provided support for those infected with COVID-19 and those who are in difficulty due to COVID-19, so the NPLs of banks in 2020 have even decreased.

In 2021, the COVID-19 pandemic in Vietnam spread rapidly with high speed, the number of deaths increased rapidly in Ho Chi Minh City and southern provinces. Therefore, there have been 4 consecutive rounds of social distancing in Ho Chi Minh City starting from May 31, 2021 to the end of 2021. The large-scale separation in the second half of 2021 in the southern provinces (the largest economic center of Vietnam) due to COVID-19 has severely affected almost all businesses and people in the southern economic region. As a result, the impact of the COVID-19 pandemic in 2021 is an important reason for the rapid increase in NPLs of Vietnamese banks. This result is similar to the impact of previous crises (Bayar, 2019; Turan & Koskija, 2014) and the impact of COVID-19 (Demary, 2021; Godell, 2020) on banks' NPLs.

When quantifying the aggregate impact in both 2020 and 2021, the COVID variable has a negative regression coefficient, showing the trend of the impact of this pandemic on banks' NPLs. This regression coefficient is not statistically significant, so there is not enough evidence to conclude, but its sign is also a sign for banks to be cautious.

5 Conclusions and Recommendations

5.1 Conclusions

The COVID-19 pandemic spreading on a global scale has affected the production and business activities of many businesses, thereby leading to the risk of non-performing loans (NPLs) for banks. In order to manage NPLs well, it is very necessary to identify the factors affecting the bank's NPLs. Therefore, this article studies 25 banks listed in Vietnam in the period 2016–2021 to determine the factors affecting the NPLs of these banks in the context of the COVID-19 pandemic. FGLS regression results from three research models show that both macro-factors, specific characteristics of banks, and the COVID-19 pandemic are important factors affecting the NPL ratio of commercial banks. Unemployment rate, bank size, and profitability are factors that negatively affect NPL ratio. Factors including credit growth and credit provision have a positive impact on NPL ratio. The study found that the COVID-19 pandemic had a significant negative impact on the NPL ratio in 2020, a significant positive impact on this ratio in 2021, but when quantifying the combined impact of both years, the coefficient regression is negative but not statistically significant. This result is a warning sign for regulators, and banks need to pay special attention to the impact of the COVID-19 pandemic on banks' NPLs in order to have a solution to this problem.

5.2 Recommendations

Based on the research results, this article makes some recommendations for regulators and banks to manage NPLs of banks in the context of COVID-19.

Based on the actual situation of commercial banks, the state bank of vietnam (SBV) needs to carefully consider and realize the merger of banks with weak business results and high NPL ratio into the top good banks in Vietnam where the ownership rate of State shareholders is dominant. This way brings many benefits to the whole banking system. Firstly, the proactive merger of weak banks will ensure the safety of the entire banking system, the interests of customers and related parties. Second, the merged bank can apply its skills and experience to restructure the merged bank to operate more efficiently. Besides, the merger increases the scale and improves the competitiveness of the banking system, thereby helping to reduce the NPL ratio.

Banks with NPL ratio above 3% (the level is considered safe according to the Vietnam currency advisory council): It is necessary to review to give synchronous measures to handle NPLs, to avoid the situation of old NPLs not being handled, new NPLs have increased.

Commercial banks need to increase the level of provision for risks commensurate with the increase in NPL ratio to have a source to handle NPLs when Circular 14/2021/TT-NHNN on rescheduling, giving exemption from or reduction of loan interests and charges, and maintaining classified loan groups in order to help their clients affected by the COVID-19 pandemic expires.

In addition, to avoid adverse effects from NPLs risk, banks should increase the “buffer zone” for existing NPLs, actively deduct additional capital for new loans when the NPL ratio exceeds an acceptable level. However, banks should not deduct more than necessary because it will affect the efficiency of capital use of banks.

Commercial banks should also pay attention not to relax credit standards compared to current regulations in order to create a competitive advantage for credit growth. Because the pursuit of “liberal credit policy” will lead to deterioration in credit quality, potentially increasing the risk of PCR, failed to bring about effective credit growth and sustainable profits for banks, especially after the crisis.

Commercial banks need to reduce costs by effectively applying effective information technology in services to reduce lending interest rates to support customers to quickly recover production and business after the pandemic. Because the faster and more effectively the customer's production and business activities recover, the less risky the bank's profit will be, helping to limit NPLs.

Effectively and practically deploying credit support policies from the state budget to remove difficulties for customers due to the COVID-19 pandemic. Specifically, at the end of May 2022, the Government issued Decree 31/2022/ND-CP on the state budget spending VND 40,000 billion, which will support 2% of interest rates for businesses to develop the economy, restore production, and support economic growth. Due to the impact of the COVID-19 epidemic in the two years 2022–2023, but by the end of July 2022, businesses have not yet been able to access this support package. Therefore, the State Bank of Vietnam needs to give specific and detailed instructions and clearly divide the responsibilities of coordinating agencies, industry associations, so that the right businesses can quickly access this low-interest capital source. In addition, in order to avoid profiting from support policies during the implementation process, the SBV needs to inspect to ensure that the support policies are objective, transparent, and to the right audience. On the side of commercial banks: It is necessary to quickly determine the list of eligible customers (for example: Issuing internal documents to have clear criteria when determining the group of subjects eligible for interest rate support under Decree No. 31/2022/ND-CP, the evaluation criteria of debt repayment ability, ability to recover and use loans for the right purposes after the pandemic, …) to support interest rates in accordance with regulations and create convenient for customers.

In addition, the SBV can refer to the European Union's bad debt directive (Directive (EU) 2021/2167Footnote 2) effective from December 28, 2021 to handle NPLs of the banking system under the impact of the pandemic during the COVID-19 epidemic, thereby proposing to the National Assembly on a legal framework for credit institutions to handle bad debts on the balance sheet and reduce the risk of NPLs accumulation in future.

The National Assembly of Vietnam needs to continue to pay attention to and support the NPLs settlement process of the banking system through decisions on objectives, policies, basic task of annual, and long-term economic development of the country.

Notes

- 1.

Vietnam Business Operations and the Coronavirus: Updates, link https://www.vietnam-briefing.com/news/vietnam-business-operations-and-the-coronavirus-updates.html/.

- 2.

References

Ari, A., Chen, S., & Ratnovski, L. (2021). The dynamics of non-performing loans during banking crises: A new database with post-COVID-19 implications. Banking & Finance, 133, 106140. https://doi.org/10.1016/j.jbankfin.2021.106140

Asfaw, A. S., Bogale, H. N., & Teame, T. T. (2016). Factors affecting non-performing loans: case study on development bank of Ethiopia central region. International Journal of Scientific and Research Publications, 6(5), 656–670.

Babouček, I., & Jančar, M. (2005). Effects of macroeconomic shocks to the quality of the aggregate loan portfolio (Vol. 22, pp. 1–62). Czech National Bank.

Bayar, Y. (2019). Macroeconomic, institutional and bank-specific determinants of non-performing loans in emerging market economies: A dynamic panel regression analysis. Central Banking Theory and Practice, 8(3), 95–110. https://doi.org/10.2478/jcbtp-2019-0026

Bemanke, B., & Gertler, M. (1989). Agency costs, net worth, and business fluctuations. American Economic Review, 79(1), 14–31.

Berger, A. N., & DeYoung, R. (1997). Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance, 21(6), 849–870. https://doi.org/10.1016/S0378-4266(97)00003-4

Bernanke, B. S., Gertler, M., & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. Handbook of Macroeconomics, 1, 1341–1393.

Basle Committee. (2016). Prudential treatment of problem assets–definitions of non-performing exposures and forbearance. Bank for International Settlements, Basel, Switzerland.

Contessi, S., & De Pace, P. (2021). The international spread of COVID-19 stock market collapses. Finance Research Letters, 42, 101894. https://doi.org/10.1016/j.frl.2020.101894

Demary, M. (2021). Will COVID-19 cause insolvencies, zombification or debt deleveraging? (No. 3/2021). IW-Kurzbericht.

Espinoza, M. R. A., & Prasad, A. (2010). Nonperforming loans in the GCC banking system and their macroeconomic effects. International Monetary Fund, 10(5089/9781455208890), 001.

Ghosh, A. (2015). Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Financial Stability, 20, 93–104. https://doi.org/10.1016/j.jfs.2015.08.004

Goodell, J. W. (2020). COVID-19 and finance: Agendas for future research. Finance Research Letters, 35, 101512. https://doi.org/10.1016/j.frl.2020.101512

International Monetary Fund (IMF). (2019). Financial soundness indicators compilation guide. Prepublication Draft, https://www.imf.org/Files/Data/fsicg2019-prepublicationfinal-042519.

Keeton, W. R. (1999). Does faster loan growth lead to higher loan losses? Economic Review-Federal Reserve Bank of Kansas City, 84(2), 57.

Keeton, W. R., & Morris, C. S. (1987). Why do banks’ loan losses differ. Economic Review, 72(5), 3–21.

Kirti, D. (2018). Lending standards and output growth. International Monetary Fund, 10(5089/9781484339671), 001.

Kiyotaki, N., & Moore, J. (1997). Credit cycles. Political Economy, 105(2), 211–248.

Klein, N. (2013). Non-performing loans in CESEE: Determinants and impact on macroeconomic performance. International Monetary Fund, 10(5089/9781484318522), 001.

Lawrence, E. C. (1995). Consumer default and the life cycle model. Money, Credit and Banking, 27(4), 939–954.

Phuong, L. C. M. (2021). How COVID-19 impacts Vietnam’s banking stocks: An event study method. Banks and Bank Systems, 16(1), 92–102. https://doi.org/10.21511/bbs.16(1).2021.09

Phuong, L. C. M. (2022b). Industry-level stock returns response to COVID-19 news. Finance: Theory and Practice, 26(1), 103–114. https://doi.org/10.26794/2587-5671-2022-26-1-103-114

Phuong, L. C. M. (2022a). Determination of factors affecting non-performing loans of banks in Vietnam. In International conference proceedings: local economic and social development in the post Covid-19 era (pp. 125–136). Publishing house of the National Economics University.

Podpiera, J., & Weill, L. (2008). Bad luck or bad management? Emerging banking market experience. Financial Stability, 4(2), 135–148. https://doi.org/10.1016/j.jfs.2008.01.005

Radivojevic, N., & Jovovic, J. (2017). Examining of determinants of non-performing loans. Prague Economic Papers, 26(3), 300–316.

Rajan, R. G. (1994). Why bank credit policies fluctuate: A theory and some evidence. The Quarterly Journal of Economics, 109(2), 399–441. https://doi.org/10.2307/2118468

Sanjeev, G. M. (2007). Bankers' perceptions on causes of bad loans in banks. Management Research (09725814), 7(1), 40–46.

Schularick, M., & Taylor, A. M. (2012). Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870–2008. American Economic Review, 102(2), 1029–1061. https://doi.org/10.1257/aer.102.2.1029

Stern, G. H., & Feldman, R. J. (2004). Too big to fail: The hazards of bank bailouts. Brookings Institution Press.

Tanasković, S., & Jandrić, M. (2015). Macroeconomic and institutional determinants of non-performing loans. Central Banking Theory and Practice, 4(1), 47–62. https://doi.org/10.1515/jcbtp-2015-0004

Turan, G., & Koskija, A. (2014). Nonperforming loans in Albania. Academic Journal of Interdisciplinary Studies, 3(3), 491–491. https://doi.org/10.5901/ajis.2014.v3n3p491

World Bank. (2020). Taking Stock, July 2020: What will be the new normal for Vietnam? The economic impact of COVID-19 (pp. 1–33). World Bank. https://doi.org/10.1596/34268

Žunić, A., Kozarić, K., & Dželihodžić, E. Ž. (2021). Non-performing loan determinants and impact of covid-19: Case of Bosnia and Herzegovina. Central Banking Theory and Practice, 10(3), 5–22. https://doi.org/10.2478/jcbtp-2021-0021

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Phuong, L.C.M. (2023). Factors Affecting Non-performing Loans of Vietnamese Banks in the Context of the Covid-19 Pandemic. In: Nguyen, A.T., Pham, T.T., Song, J., Lin, YL., Dong, M.C. (eds) Contemporary Economic Issues in Asian Countries: Proceeding of CEIAC 2022, Volume 1. CEIAC 2022. Springer, Singapore. https://doi.org/10.1007/978-981-19-9669-6_32

Download citation

DOI: https://doi.org/10.1007/978-981-19-9669-6_32

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-9668-9

Online ISBN: 978-981-19-9669-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)