Abstract

The extraction and processing procedures in the metal industries have resulted in a wide range of environmental problems that need to be addressed to achieve net-zero in the UK. The current strategies are heavily biased toward end-of-life phase assessments (such as recycling), possibly neglecting other possible opportunities across entire life cycles, such as advances in product design, manufacturing and in-use phases.

TransFIRe is a proactive, interdisciplinary, inclusive research and practice-driven hub with visions to transform foundation industries. The current work represents the results from TransFIRe’s Metal Technical Working Group’s workshops and meetings with the industry and academic partners. Discussions covered the drivers and barriers for transformative change in the UK metal industries, actors in control of the drivers and barriers, actions they could take, and any gaps in the expertise they might face. Besides, the presented analysis includes the environmental impacts of UK metal industries and a review of the solutions offered in previous studies and roadmaps to meet Net Zero targets in the UK. PESTLE and SWOT analyses have been provided to help make a systematic and thorough evaluation of UK metal industries and identify and overcome its challenges for transformative change. Our preliminary assessment shows that lack of government support and capital investment, high energy cost, lack of skilled people, limited recycling facilities and strict recycling regulations are some of the main barriers to transforming UK metal industries.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Climate change is a critical worldwide challenge. Metal manufacturing requires large quantities of energy for mining, smelting, refining and recycling, resulting in considerable greenhouse gas (GHG) emissions. The impact of metal extraction, production and processing on climate change and human health doubled between 2000 and 2015 [1]. Metals accounted for 18% of worldwide resource-related climate change and 39% of Particulate Matter (PM) health impacts in 2011 [1]. The worldwide iron-steel production chain has the most significant influence on climate change compared to other metals and accounts for around one-quarter of global industrial energy consumption. Global aluminium production also contributes significantly to climate change due to large production volumes and high energy requirements, whereas toxicity implications are the primary issue for copper and precious metals.

From 1900 to 2015, worldwide steel manufacturing released around 147 billion tonnes (Gt) CO2-eq, accounting for approximately 8% of total GHG emissions [2]. During this period, process efficiency improved by 67%, but it was offset by 40-fold in annual steel production, leading to a 17-fold net increase in GHG emissions [2]. This could demonstrate the insufficiency of process efficiency alone in reducing absolute emissions to some extent [2]. Globally, including in the UK, technical improvements have not been implemented due to competition to reduce costs and a lack of capital. Before 2015, the global steel industry’s GHG intensity was stable for 15–20 years [2]. While technological efficiencies have improved over the last few decades, they were overridden by the expansion of low efficient steel production.

After steel, the metal industry with the most significant climate impact worldwide is aluminium, caused by fuel and electricity usage for bauxite ore refining and aluminium smelting. While some improvements have been made, additional energy savings of roughly 10% are still attainable by replacing outdated facilities [3]. For metals where energy is the primary input, renewable sources for electricity would also have a positive impact. For instance, hydro supplies around 75% of the aluminium production in Europe (including the UK), the US and South America [4].

The metal industries play an essential role in the UK economy. The industries are crucial for all other industries, including manufacturing, construction, transportation, power generation, etc. UK metal industries consist of around 11,100 companies and 230,000 employees, directly contributing £10.7 bn to the national GDP; and indirectly 750,000 jobs and £200bn UK GDP [5].

The UK has ambitious visions for upgrading its transportation and energy infrastructure to build a net-zero economy. The UK’s demand for resources is expected to skyrocket, draining more than twice its fair global share of known reserves of several crucial raw resources by 2035 (and up to five times by 2050) [6]. The dependency on critical materials also makes UK low-carbon sectors vulnerable. Moreover, the UK might harm the global transition to net-zero emissions by driving the growth of extractive industries and exporting hazardous wastes to low-income, resource-rich countries [7].

In order to minimise the environmental damage caused by UK metal industries, it is essential to move toward a circular economy [5]. The transition of the UK metal industries towards net-zero could be possible by working with the Government, communities and other sectors to create a comprehensive roadmap to maximise energy efficiency and minimise resource use. Besides working on product design for durability and easier disassembly to enable reuse and recycling, UKMC recommended optimising the metal industries’ manufacturing processes for waste prevention and greater use of by-products [5]. UK metal industries could embed a sustainability ethos across the industry by promoting best practices, benefiting small companies with lower innovative capacity in particular. Policymakers could support the development of a circular economy by implementing suitable regulations to support responsibly produced UK-based products while promoting durability, reuse, remanufacturing and recycling [5, 8].

TransFIRe is a proactive, interdisciplinary, inclusive research and practice-driven hub with visions for transformative change. TransFIRe envisages optimising flows of resources within and between six foundation industries (FIs, including metals, cement, ceramics, chemicals, glass and paper) and their supply chains by minimising resource use in processes and society and making better use of wastes and by-products. This will improve FIs competitiveness and support UK Net Zero 2050 targets. It will also open opportunities to work with communities in which FIs are located and improve equality, diversity and inclusion in FIs.

Roadmaps to Net Zero for metals align with many of TransFIRe’s goals to optimise resources (e.g. use of recycled metals, reduction of metal waste during processing), improve competitiveness and move toward Net Zero (e.g. improve technology). TransFIRe aims to promote maintaining (not necessarily growing) economic prosperity and improve social well-being and environmental quality, in line with global evidence. [9–11].

The FIs have several mutual processes such as heating, cooling, granulation, drying and transportation. Using the “Gentani principles”, i.e. minimum resource needed to carry out a process [12], TransFIRe is benchmarking and identifying best practices considering resource efficiencies and environmental impacts across sectors and sharing information horizontally. Moreover, the research investigates the use of waste as raw materials for other sectors. In metals, solutions could include better scrap metal assessment and separation methods, particularly important for aluminium as developing high-performance recycled alloys made from scrap would optimise its use for more applications.

TransFIRe works with communities to develop new business and social initiatives. For example, the warm air and water produced across metal industries can provide low-grade energy capture opportunities. While this method applies to all metal industries, some of the possible options for the steel industry are heat recovery at the coke ovens, rolling mill, annealing line, sinter plant, electric arc and the basic oxygen furnaces. A successful example of waste heat recovery (WHR) is at the Port Talbot Steelworks, where an evaporative cooling system in the Basic Oxygen Steelmaking (BOS) plant was implemented in 2013 to produce steam and electricity. Over the first six years of its implementation, the project led to an expansion of the electrical generation capacity of 12MWe and an indirect reduction in 2.3Mt of CO2 (equivalent to £45M)[13].

TransFIRe is a diverse consortium of twenty investigators from twelve institutions and over 70 companies, trade associations, professional engineering institutes, NGOs and government organisations related to the foundation sector. It aims to include diverse voices in the preparation of plans for the transformation of foundation industries and offer support for the implementation of changes, especially for SMEs (small and medium-sized enterprises) with limited resources for research and innovation. For more information about TransFIRe, please refer to their recently published article [14] or website [15].

This article aims to identify key intervention points for transformative change in the UK metal industries. The study reviews previous roadmaps and publications on transforming UK metal industries and presents the results from a PESTLE SWOT analysis. The analysis consisted of desk-based research, which formed the basis for focused interactions via TransFIRe’s Metal Technical Working Group’s (TWG) workshops and meetings with our industry and academic partners to identify the drivers and barriers, actors in control of the drivers and barriers, actions they can take, and any gaps in the expertise they might face in delivering transformative change [16]. The authors have contributed to facilitating the Metal TWG workshops and meetings, developing the PESTLE SWOT analysis and drafting a context analysis for UK metal industries.

2 Literature Review

There have been many roadmaps for meeting net-zero targets in the UK metal industries [6, 17, 18, 19, 20, 21, 23]. Core pathways for boosting sustainability identified so far include: lowering fossil fuel use, expanding renewable energy use, efficient use of raw materials, improving technology, using scrap, engaging with Government to improve policies, supporting recycling, reuse, improving the design, adopting science-based targets and using carbon removal options such as carbon capture, utilisation and storage (CCUS) to offset residual and historical emissions and provide ‘head room’ for carbon-intensive sectors. The available roadmaps have a robust agreement on near-term “low regrets” strategies, introduced in the recent UK Government Net Zero Strategy [20]. Low regrets strategies are defined as “current cost-effective actions which will continue to prove beneficial in the future” [24]. While roadmaps have similar nearer-term trends, their overall decarbonisation strategies vary, especially as net-zero goals approach.

Most previous works focused on supply-side solutions to tackle GHG emissions in the metals industries, such as new production technologies, carbon capture and storage, and hydrogen-based production [25]. Meanwhile, due to the uncertainty associated with technical innovation and social constraints, the necessity of demand-side solutions has been highlighted [26, 27], such as material efficiency measures [28]. Some previous works [26, 27] recommended stabilising the world’s per capita stock of aluminium and steel below that of the wealthy nations. This could be achieved through lightweight design and more intensive use measures. In other words, to prevent catastrophic climate change effects, countries are suggested to remain within a safe operating area for global metal use. This topic has been widely neglected in previous studies and roadmaps. The common net-zero strategies addressed in previous roadmaps are described below:

2.1 Circular Economy

A circular economy seeks to promote resource sufficiency, efficiency and dematerialisation by decoupling progress from unsustainable material use [29]. This will require changes in the practices of producers, consumers and government actors. A circular economy calls for systems thinking as companies are better to focus on whole system optimisation rather than individual gains [30]. It aims to minimise the extraction of natural resources from the environment, maximise waste prevention and optimise the environmental, social, economic and technical values of materials, components and products throughout their consecutive lifecycles [29]. Circular economy strategies can be grouped under measures to narrow the flow of resources (reducing the total size of the resource economy with measures to dematerialise), slow resource flows by extending the period between manufacturing something and the moment it goes to waste (e.g. repair, reuse, remanufacturing) [31], closing resource flows (i.e. recycling) and safely reintegrating resources back into natural biogeochemical processes if they cannot be circulated within our economy [32]. The Ellen MacArthur Foundation [33] presented a circular economy broadly by expanding the ‘waste hierarchy’, ‘circling longer’, and enabling cascaded use. This strategy would increase employment, more effectively capture value, reduce supply chain exposure and market risks, and foster stronger customer connections [33].

It would be possible to use less raw materials in the UK by improving freight efficiency, insulating homes, and promoting car-sharing, public transport, and non-motorised travelling. Circular economy approaches such as reusing or repurposing components, such as steel beams, would potentially save 5% and 8% energy in the UK [34]. Material substitutions, lowering the product weight, and using recyclate are other examples that could lead to lower GHG emissions. Moreover, final consumer decisions (whether made by a business, household, or Government) also affect the amount of energy contained in products and reduce energy requirements [35]. Consumption has long been connected with economic growth, and any attempt to limit it is likely to be challenged. However, the concept of ‘prosperity without growth’ [36] opposing the ongoing economic expansion in wealthy nations has gained considerable support, though less in circular economy studies, and no growth or degrowth is starting to gain momentum. The UK government has acknowledged the potential benefits of enhancing product life in its current waste prevention policy, having previously invested in research into product lifetimes [37]. Potential policies to guarantee minimum product lifetimes were also addressed in the recent European Commission’s Circular Economy Package [21]. The recent EU report highlights a need for complete information on the amount of raw materials in products, extractive waste and landfills potentially available for recovery or recycling [38]. The EU is at the forefront of circular economy in its use of secondary raw materials with, for example, more than 50% of metals such as iron, zinc, and platinum recycled, covering over 25% of the EU’s consumption. For scarce elements, gallium and indium, needed for renewable energy and high-tech applications, recycling makes only a marginal contribution. In primary production, many battery raw materials such as lithium, nickel, cobalt, graphite and manganese are present in coal-mining areas. Better methods for extracting these from mining waste could create new economic activity in former coal-mining areas while improving the environment. The EU also assumes that reducing resource use and halving waste is feasible by 2030 [38]. The UK did not adopt this target when the circular economy package was transposed into UK policy. In other words, the EU is going for dematerialisation, but the various UK governments are not following suit.

2.2 Recycling

In principle, most metals are infinitely recyclable [39], although such recycling rates would likely pose high energy demands and other environmental impacts. Nevertheless, scrap metals for production entail much lower energy consumption and GHG emissions than ore-based primary production [25, 40]. Ideally, primary extraction is recommended to be treated as a high risk, last resort option [6].

Recycling would positively impact the utilisation of raw material and GHG emissions (especially for aluminium as it is highly recyclable). Like steel, secondary aluminium production reduces environmental impact by eliminating the ore extraction, processing and reduction stages. The climate impact of secondary production could range from 10% to 38% of the primary manufacturing in steel and 3.5% to 20% in aluminium. Energy source differences cause the variations. For example, in secondary steel production, the 10% and 38% climate change compared to primary productions refer to steel produced in renewable energy sourced and coal-fired power plants, respectively. Countries like Norway with renewable energies have a lower impact than India and China, with high reliance on coal-fired power plants. In the case of copper, using scrap would save around 80% of the energy compared to primary production [41].

The emphasis on reuse and recycling is key to the UK’s “green growth” strategy and carbon-neutral vision, and the most recent net-zero strategy published by the Government has also discussed the importance of extending the lifetime and lifecycle of a product through sharing, reusing, repairing, redesign and recycling [20]. Secondary production could compensate for the limited physical availability of natural ore to some extent [42]. However, due to dissipative losses, long product lifetimes, and increasing demand, the secondary production would be insufficient to fulfil demand [43]. For instance, even in an ideal world with 90% recycling rates, the forecast demand might deplete current copper deposits by the twenty-first century [44].

2.3 Material Efficiency Strategies

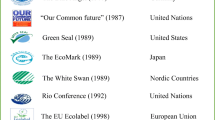

While recycling is important, there are vast opportunities to span the entire life cycle, such as light-weighting, substitution, fabrication yield improvements, more intensive use, lifetime extension, reuse, and remanufacturing. A recent work [45] reviewed previous studies on the long-term outlook for future demand, supply and environmental issues of major metals. They reviewed 70 peer-reviewed journal articles published between 1995 to May 2020. They selected articles that analyse the entire metal industry’s future condition (after 2025) and its metal flows rather than a limited product. The results illustrated in Fig. 1 show that most studies have focused on the end-of-life phase in material efficiency strategies, of which recycling is the most frequently analysed strategy. In the case of zinc, lead, and nickel, there have been no studies on strategies other than recycling and light-weighting [45]. These metals are critical as some low carbon technologies are dependent on critical raw materials, some of which are rare and only available in unique locations. Some examples are cobalt, lithium and nickel. As scarcity of these materials grows, geopolitics might determine future access.

Another example would be rare earth elements such as neodymium used in magnets. Recent work has suggested that recycling would not be sufficient to meet the rise in demand for metals or reduce environmental impact [46]. Therefore, a comprehensive and comparative assessment of various potential strategies is required to design the environmental policy to directly support governments’ and companies’ decision-making. Moreover, it is essential to provide science-based targets for major metal flows, stock, circularity, and efficiency. Available tools and digital technologies should be used for more intelligent and efficient production and better traceability and separation processes. Product designs could also be improved to produce a more comprehensive range of products using efficient routes such as using recycled materials.

The number of studies on different material efficiency strategies [45].

2.4 Dematerialisation

Dematerialisation is defined as reducing raw materials and metals used per capita [29]. Countries can help prevent climate change by remaining within a safe operating area for global metal use. The demands for metals in 2050 have been predicted to grow compared to 2010 as follows [45]: 215% (aluminium), 140% (copper and nickel), 86% (iron), 81% (zinc), and 46% (lead). Besides, the current mining and processing scenarios are not consistent with the Earth’s limited resources, and the increase in production is not environmentally sustainable. The depletion year (the year where cumulative production exceeds reserves) for primary metal resources is predicted as 2042 to 2045 for iron, 2030 to 2038 for copper, around 2025 for zinc, 2020 to 2025 for lead, and 2030 to 2040 for nickel [47]. Bauxite is anticipated to be depleted around the middle of the twenty-first century [45]. Besides, the peak year for primary production of major metals is estimated to be 2041 to 91 (iron), 2084 to 2130 (Aluminium), 2030 to 2072 (copper), 2025 to 2061 (zinc), 2018 to 2128 (lead), and 2030 to 2033 (nickel) [45].

The IEA forecast that the 1.5 ℃ greenhouse gas budget from 2010 to 2050 is around 106 Gt CO2-eq, 37% of which had been exhausted already by 2019. A recent study [2] showed that the 1.5 ℃ climate target [48] is achievable either through radical reduction of emission intensity with an average of 0.85 t CO2-eq/t steel per decade or a 39% reduction in steel demand. In other words, to meet climate targets, either the GHG intensity should be decreased immediately, requiring rapid innovation and implementation of low-carbon technologies, or the demand must be reduced significantly. Integrating supply and demand-side measures is essential, as both sides would require less radical changes.

Another study [49] defined five different shared socio-economic pathways (SSP) based on low, medium or high economic and population growth rates (based on climate goal analysis). Their results indicated that metal production’s GHG emission reduction target would not be achieved under any possible socio-economic scenarios. It would be impossible to meet climate goals with the predicted increase in future metal demand. In other words, the study suggests that we need to do what is best for the environment, not the economy.

2.5 Improving Process Efficiency

Another effective strategy to reduce GHG emissions is to increase operational efficiency through enhanced process control, predictive maintenance strategies and implementation of the best available technologies. For instance, in the case of steel, the blast furnace-basic oxygen furnace (BF-BOF) process relies on pig iron production, limiting it to only around 30% scrap steel. By contrast, the electric arc furnace (EAF) process can use almost 100% scrap steel to produce crude steel. Consequently, the steel produced using BF-BOF creates more than ten times the carbon dioxide emissions of the EAF process (if the manufacture of the original iron is included, then remelting in an EAF is worse) [6]. Currently, UK steelmakers can use up to 6.1 Mt of scrap steel in manufacturing plants. Technologies such as monitoring EAF furnaces with optical emission spectrometry can significantly improve energy and process efficiency [6].

By-products from metal production could provide valuable inputs for other processes or products. Waste heat is an obvious by-product used for heating or steam in the production sites or community heating. Other examples include slag and dust from steel production used to create asphalt, and aluminium drosses and slags, which contain various metals impurities and salts and are reduced to pure salts, which are then used in melting furnaces, potash (used as fertiliser), and aluminium returned for recycling. For instance, the steel produced by Celsa in Cardiff is made from scrap metal using the EAF process, and 93% of process waste is recovered or reused, while the dust from the EAF is used in products like white plastics [50]. SteelPhalt Cardiff uses the slag by-product (on-site at the steel plant) to create asphalt products that contain 95% recycled material with a 40% lower carbon footprint than conventional asphalts [51].

3 UK Metal Industries PESTLE Analysis

In order to promote resource recovery efficiency as part of the transition toward a circular economy, it is essential to understand how such a change could be achieved. Circular economy transitions involve diverse stakeholders, and it is therefore essential that relevant stakeholders are involved from the start [29]. Therefore TransFIRe held a Metal TWG Workshop in January 2022. The workshop facilitated a two-way conversation, and the participants included representatives from academia and industry.

Participation processes can help to explore different opinions from multiple stakeholders about a particular challenge and develop a shared understanding. This can become a basis to frame radical, transformative changes such as those required to transition towards a sustainable circular economy. The academic community can adapt these techniques to contribute to the development of transformative change through participatory action research (PAR). PAR approaches aim to bring societal change and contribute to scientific progress through a cycle of activities including [52, 53]: forming a stakeholder group (1), analysing problems and identifying solutions (2), sharing and reflecting upon solutions and implementing change (3), evaluating the PAR process (4), close or starting a new PAR process [52, 53].

Participatory Situational Analysis (PSA) is a variation on PAR, bringing together academic, government and industry partners with a view to articulate an action-oriented agenda for the development of research programmes and/or the uptake of research outcomes [54]. The PSA approach was followed (Fig. 2) to identify the key actions and gaps in expertise to enable transformative change that specific actors could take to either remove barriers or make the most of the drivers for transformative change [16]. Drivers and barriers were identified prior to the workshop via analyses of relevant roadmaps and a PESTLE SWOT analysis presented at the workshop as the starting point for discussion.

The PESTLE analysis provided in Table 1 helps to better understand the strategic orientation by evaluating the impact of the external environment on the industry.

Although we know each industry’s used resources and generated wastes, it is important to conduct a comprehensive analysis with a circular economy mindset. Another challenge would be the classification of wastes as hazardous, which could be prevented by allowing specific pre-treatments to make the material safe(r) to recycle. For instance, contaminants such as chlorides on the metal surface should be removed from the wastes before classification [55]. The main actors in control of actions that can lead to transformative change in the UK metal industries are as follows:

-

Political (and Legal): Department for Business, Energy and Industrial Strategy (BEIS), Treasury

-

Economic: Investors, oversea owners, Government;

-

Social: Schools, Government, NGOs, industry;

-

Technological: Industry, R&D;

-

Environmental: local Councils, BEIS, industry, consumers, media.

4 UK Metal Industries SWOT Analysis

SWOT analysis (Table 2) helps maximise the strengths and opportunities of a system and minimise weaknesses and threats. According to the results, the UK metal industries are suggested to develop strong economic cases on decarbonisation using the existing clusters such as South Wales Industrial Cluster and East Coast Cluster. For this purpose, the industry can engage more with BEIS (construction and materials units) and try to make longer-term decisions. The Government is also recommended to promote repair, reuse and recycling in the UK.

5 Conclusions

Production-based carbon-cutting approaches are not enough to reach net-zero, and it is essential to develop more effective solutions for reducing future GHG emissions from the metal industries. Due to the rapid increase of metal flows (production and consumption) and limited scrap supply, primary routes have dominated production, leading to increased GHG intensity. It would be impossible to meet climate targets with the predicted increase in demand, and demand-side reductions are also needed.

According to the available road maps for the UK metal industries and the inputs from our industry and academic partners in the TransFIRe’s metal TWG workshops, the main barriers to transforming the UK metal industries are lack of Government intervention and support, lack of capital investment and business models, lack of skills and people, limited recycling infrastructure (thus high transportation cost), regulatory barriers (e.g. REACH and ROHS ban or restrict the use of metals) and greenwashing. The following actions are recommended to make the UK metal industries more sustainable:

-

BEIS needs to develop a more comprehensive strategy to decarbonise metal, including demand-side measures, dematerialisation and durability.

-

More robust targets are needed to enforce the use of UK metals in Government-funded projects.

-

Long-term finance such as pension funds is needed to support local economies and manufacturing. Investors and Government should invest in local communities and low carbon projects. Starting with the regions, the government is recommended to develop a robust economic case.

-

In collaboration with the industry, schools and the Government should promote educational programmes accredited by the industry for primary schools, secondary schools and lifelong learning. Moreover, re-educating the education system is needed based on the jobs offered in the FIs to tackle the skill gap in the industry.

-

The industry should make the UK metal industries more attractive for job seekers, for example with better equality, diversity and inclusion performance and green jobs.

-

There is a lack of funds to bring technologies into full-scale deployment. Besides, there is a poor relationship between scrap merchants and the metal industry. An appropriate, coherent and supportive policy and regulatory framework are needed for recycling. Government and industry should foster transparency and promote design for recyclability and recycling supply chains within the country for which more local recycling facilities are needed.

-

A better understanding of the technical issues in the sector is needed. For instance, it is important to consider and discuss the effects of lubricants, coating and coolants on the recycling process.

References

Oberle, B., et al.: Global resources outlook. In: 2019: International Resource Panel, United Nations Envio (2019)

Wang, P., et al.: Efficiency stagnation in global steel production urges joint supply-and demand-side mitigation efforts. Nat. Commun. 12(1), 1–11 (2021)

International Aluminium Institute, Global Aluminium Cycle 2016 (2018)

IEA, Aluminium (2021)

UKMC. A Foundation Indsustry (2022) https://www.ukmetalscouncil.org/. Accessed 7 Apr 2022

GFG Alliance, Making GreenSteel Today’s Low-Carbon Reality (2021)

Evans, S., Plumpton, H., Peake, L.: Critical point - Securing the raw materials needed for the UK’s green transition London (2021)

Velenturf, A.P.: A framework and baseline for the integration of a sustainable circular economy in offshore wind. Energies 14(17), 5540 (2021)

Wiedmann, T.O., et al.: The material footprint of nations. Proc. Natl. Acad. Sci. 112(20), 6271–6276 (2015)

Raworth, K., Doughnut Economics: Seven Ways to Think like a 21st-Century Economist. Chelsea Green Publishing (2017)

Parrique, T., et al.: Decoupling Debunked: Evidence and Arguments Against Green Growth as a Sole Strategy for Sustainability. Brussels (2019)

Blomsma, F., et al.: Developing a circular strategies framework for manufacturing companies to support circular economy-oriented innovation. J. Clean. Prod. 241, 118271 (2019)

Giles, A., et al.: A waste heat recovery strategy and its deployment: an integrated steelworks case study. In: Proceedings of the Institution of Civil Engineers-Waste and Resource Management. Thomas Telford Ltd. (2021)

Jolly, M., et al.: The UK transforming the foundation industries research and innovation hub (TransFIRe). In: REWAS 2022: Developing Tomorrow’s Technical Cycles (Volume I), pp. 341–353. Springer (2022)

TransFIRe. TransFIRe (2022). https://transfire-hub.org/. Accessed Feb 2022

Velenturf, A., et al.: Participatory Situational Analysis: How can policy and regulation support resource recovery? Synthesis workshop report (2018)

Metals Forum, Vision 2030, The UK Metals Industry’s New Strategic Approach (2015)

DECC and BIS, Industrial Decarbonisation and Energy Efficiency Roadmaps to 2050 (2015)

BEIS, Industrial Decarbonisation Strategy. London, UK (2021)

BEIS, Net Zero Strategy: Build Back Greener (2021)

Commission, E.: Circular Economy Action Plan for a Cleaner and More Competitive Europe. Belgium, Brussels (2020)

The Aluminium Federation, Uk Aluminium Sustainability Roadmap to 2050. (2021)

International Energy Agency: Iron and Steel Technology Roadmap, IEA. Towards more sustainable steelmaking, Paris (2020)

BEIS, Heat and Buildings Strategy (2021)

Morfeldt, J., Nijs, W., Silveira, S.: The impact of climate targets on future steel production–an analysis based on a global energy system model. J. Clean. Prod. 103, 469–482 (2015)

Liu, G., Bangs, C.E., Müller, D.B.: Stock dynamics and emission pathways of the global aluminium cycle. Nat. Clim. Chang. 3(4), 338–342 (2013)

Milford, R.L., et al.: The roles of energy and material efficiency in meeting steel industry CO2 targets. Environ. Sci. Technol. 47(7), 3455–3462 (2013)

von Stechow, C., et al.: 2° C and SDGs: united they stand, divided they fall? Environ. Res. Lett. 11(3), 034022 (2016)

Velenturf, A.P., Purnell, P.: Principles for a sustainable circular economy. Sustain. Product. Consum. 27, 1437–1457 (2021)

Cooper, S.J., Hammond, G.P.: ‘Decarbonising’UK industry: towards a cleaner economy. Proc. Inst. Civil Eng.-Energy 171(4), 147–157 (2018)

Bocken, N.M., et al.: Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 33(5), 308–320 (2016)

Velenturf, A.P., et al.: Circular economy and the matter of integrated resources. Sci. Total Environ. 689, 963–969 (2019)

MacArthur, E.: Towards the circular economy, economic and business rationale for an accelerated transition. Ellen MacArthur Found. Cowes, UK, 21–34 (2013)

Cooper, S.J., et al.: Thermodynamic insights and assessment of the circular economy. J. Clean. Prod. 162, 1356–1367 (2017)

Griffin, P.W., Hammond, G.P.: The prospects for ‘green steel’making in a net-zero economy: a UK perspective. Global Trans. 3, 72–86 (2021)

Jackson, T.: Prosperity without growth? the transition to a sustainable economy (2009)

Environmental Resources Management, Longer Product Lifetimes, Summary Report, Department for Environment, Food and Rural Affairs. London, UK (2011)

European Commission, Critical Raw Materials Resilience: Charting a Path towards greater Security and Sustainability. Brussels (2020)

Reck, B.K., Graedel, T.E.: Challenges in metal recycling. Science 337(6095), 690–695 (2012)

Pauliuk, S., et al.: The steel scrap age. Environ. Sci. Technol. 47(7), 3448–3454 (2013)

Alliance, C.: Copper’s Contribution to a low-Carbon Future - A plan to Decarbonise Europe by 25 Percent. Belgium, Brussels (2014)

Van der Voet, E., et al.: Environmental implications of future demand scenarios for metals: methodology and application to the case of seven major metals. J. Ind. Ecol. 23(1), 141–155 (2019)

Elshkaki, A., et al.: Resource demand scenarios for the major metals. Environ. Sci. Technol. 52(5), 2491–2497 (2018)

Schipper, B.W., et al.: Estimating global copper demand until 2100 with regression and stock dynamics. Resour. Conserv. Recycl. 132, 28–36 (2018)

Watari, T., Nansai, K., Nakajima, K.: Major metals demand, supply, and environmental impacts to 2100: a critical review. Resour. Conserv. Recycl. 164, 105107 (2021)

Ciacci, L., et al.: Exploring future copper demand, recycling and associated greenhouse gas emissions in the EU-28. Glob. Environ. Chang. 63, 102093 (2020)

Elshkaki, A., Reck, B.K., Graedel, T.: Anthropogenic nickel supply, demand, and associated energy and water use. Resour. Conserv. Recycl. 125, 300–307 (2017)

IPCC, Global warming of 1.5 °C: an IPCC special report on the impacts of global warming of 1.5 °C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. Intergovernmental Panel on Climate Change (2018)

Yokoi, R., Watari, T., Motoshita, M.: Future greenhouse gas emissions from metal production: gaps and opportunities towards climate goals. Energy Environ. Sci. (2022)

CELSA, There’s more to CELSA than steel, Environmental Statement 2020. Cardiff, UK (2020)

Steelphalt (2022). https://www.steelphalt.com/environment.

Bacon, C., Mendez, E., Brown, M.: Participatory action research and support for community development and conservation: examples from shade coffee landscapes in Nicaragua and El Salvador (2005)

Defoer, T., et al.: Participatory action research and quantitative analysis for nutrient management in southern Mali: a fruitful marriage? Agr. Ecosyst. Environ. 71(1–3), 215–228 (1998)

Velenturf A, et al.: Participatory situational analysis: how can policy and regulation support resource recovery? in synthesis workshop report (2018)

Johnson, W.C.: Chloride removal from ferrous substrates. In: CORROSION 98. OnePetro (1998)

Acknowledgements

The Transforming the Foundation Industries Research and Innovation hub (TransFIRe (EP/V054627/1)) is funded by UKRI (https://gow.epsrc.ukri.org/NGBOViewGrant.aspx?GrantRef=EP/V054627/1).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Ahmadinia, M., Velenturf, A., Setchi, R., Evans, S.L., McKendree, J., Bolton, J. (2023). Transforming the UK Metal Industries: Challenges and Opportunities. In: Scholz, S.G., Howlett, R.J., Setchi, R. (eds) Sustainable Design and Manufacturing. SDM 2022. Smart Innovation, Systems and Technologies, vol 338. Springer, Singapore. https://doi.org/10.1007/978-981-19-9205-6_5

Download citation

DOI: https://doi.org/10.1007/978-981-19-9205-6_5

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-9204-9

Online ISBN: 978-981-19-9205-6

eBook Packages: EngineeringEngineering (R0)