Abstract

Controlling and managing project costs in infrastructure construction projects within budget is a matter of prime importance since these projects require a large amount of capital investment. The use of cost contingencies is found as an effective tool for reducing the cost overrun. Traditionally, the contingency is estimated using a fixed percentage of the estimated cost. Project costs’ sensitivity to risk factors impacting the cost is not considered in this method resulting in underestimated or overestimated values. Therefore, in this paper, an alternate methodology is presented for developing a risk-induced model to predict the cost contingency after identifying and quantifying the risks involved in the projects. To develop the model, a rule-based fuzzy inference system has been used. The fuzzy theory can deal with incomplete, imprecise and uncertain data intrinsic to complex construction projects. This methodology provides a practical approach for estimating cost contingency by considering the frequently occurring and important risk factors impacting the cost of construction projects. Details about the development and validation of the model are presented in this research study. Project managers and decision-makers will find this model very useful for making decisions regarding various issues related to the project such as contingency estimation, bid price calculation, mark-up estimation and assessment of different projects.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The issue of cost overrun in the construction projects is a frequent and critical both in developed and developing countries. Controlling and managing project costs in infrastructure construction projects within budget is a matter of prime importance because of the investment of a considerable capital cost. The use of cost contingencies is found as an effective tool for reducing the cost overrun. The primary aim of contingency planning is to avoid the cost overrun problem in construction projects [5]. The contingency can be defined as the total quantity of budget, funds or time required above the estimated amount to reduce the risk of overruns of project goals to an acceptable level for the organisation [25]. Traditionally, the contingency is estimated using a fixed per cent of estimated cost. This technique has also been called as ‘across-the-board’ percentage addition [1] and ‘Crystal ball’ [23]. Using this method, the contingency estimation usually varies from 1 to 5% and it rarely goes beyond 10% [23]. The amounts are estimated on basis of the maximum cost, average cost, expert judgement and experience which can result in the underestimated or overestimated quantity [22]. This method is described as arbitrary and unscientific by various researchers [1, 6]. Project costs’ sensitivity to risk factors impacting the costs is not considered in this method. However, it is observed that on account of the complexities involved with construction activities, risks and uncertainties are increasing rapidly in construction projects. Effective risk management and adopting contingency as a tool can be useful for construction project managers to control and handle these risks and uncertainties [16, 25]. As stated by Ford [12] and Marco et al. [21], contingency amount is a matter of prime importance for managing risks associated with construction projects. Therefore, the contingency modelling using knowledge-based risk assessment and incorporating integrating risk management strategy is gaining importance. Various authors [8, 18, 23, 24] adopted a risk analysis approach to estimate cost contingency in construction projects.

The risk can be analysed using quantitative and statistical methods such as Monte Carlo simulation, fault tree analysis, sensitive analysis and failure mode analysis. However, these methods require exact and accurate data. Acquiring these data for complex situations such as those associated with construction projects is a challenging task as they contain too many variables with a high degree of uncertainty and ambiguity. For dealing with the complex and subjective nature of the problems, advanced techniques such as fuzzy logic have been gaining popularity. By comparing the various techniques and theories which are employed for handling uncertainty in the construction projects, Baloi and Price [2] proposed for FST as a robust tool for analysing the uncertainties associated with construction-related activities. The fuzzy set theory (FST) manages data that are partially defined, inexact and uncertain. It is well-suited to deal with almost identical situations to those encountered in complex and large infrastructure construction projects. Hence, this study attempts to provide a framework for model development to predict project cost contingency by using the fuzzy risk analysis approach.

Section 2 of this research paper describes the relevant literature review. In Sect. 3, the methodology is presented for developing the cost contingency model. The developed model is validated in Sect. 4 of this paper, and finally, the conclusion has been drawn.

2 Literature Survey

Sections 2.1 and 2.2 present a brief literature review related to the development of a model for estimating cost contingency in construction projects and fuzzy inference systems, respectively.

2.1 Cost Contingency Models

Various methods such as the method of moments, factor rating, range estimating, artificial neural network, Monte Carlo simulation, regression, analytical hierarchy process, fuzzy set theory, CALM (computer-based), probabilistic model, PERT and standard deviation have been used by the researchers for estimating cost contingency. References [7, 23, 34] employed method of moments, whereas a probabilistic model was suggested by Touran [31] to estimate the cost contingency of a project by taking into consideration the expected number of variations and the average cost of change orders. Barraza and Bueno’s [3] presented a method based on Monte Carlo simulation. Activity costs in this model were assumed to be independent and normally distributed [3]. Later on, Barraza [4] presented an empirical methodology by employing Monte Carlo Simulation, and cost contingency was allocated to project activities according to the detail of the work breakdown structure. Lorance and Wendling [17] also proposed a Monte Carlo simulation for estimating the cost contingency. Sonmez et al. [29] suggested a model based on regression analysis to forecast the cost contingencies for international projects after collecting the data from Europe, Asia, Africa and the Middle East. Thal et al. [30] also suggested a regression model to forecast the amount of contingency for a new construction project after examining 203 projects of the U.S. Air Force. Artificial neural network and multiple linear regression methods were investigated by Chen and Hartman [6] on the basis of data collected from an oil and gas company for the prediction of contingency; it was concluded by them that the artificial neural network method was more accurate than the multiple linear regression method for the estimation of contingency. Moselhi et al. [4] also found, based on an extensive literature review, that the artificial neural network model had the potential of identifying the pattern knowledge and data prediction. Artificial neural network methods were used by Jin and Zhang [15] and Williams [33] also. It is found that to learn the knowledge or the pattern by artificial neural network (ANN) is somewhat difficult, but the Fuzzy system can improve the qualitative aspect of human knowledge such as reasoning, inference and explicit knowledge. Therefore, fuzzy methods have been used for predicting the cost contingency. The important studies have discussed here in this section. The probabilistic cost estimate of a project was predicted by Hassanein and Cherlopalle [13] using fuzzy theory by considering the risks and uncertainties. Another model was recommended by Paek et al. [24] to present a methodology for evaluating project risk and contingency for reducing the risks related to a project based on fuzzy logic. Fuzzy sets were also used by Shaheen et al. [26] for calculating project cost estimates. Many authors have suggested extracting fuzzy numbers from the expert group and analysing the data in the fuzzy range estimating analysis. Idrus et al. [14] recently proposed cost contingency estimating by using risk analysis and a fuzzy expert system. The method is flexible, rational, and it is based on fuzzy expert system. A neuro-fuzzy hybrid model, designed by Dominic et al. [9], is used to predict the final cost of infrastructure projects of water. Wang et al. [32] developed a method using neuro-fuzzy and multi-factor evaluation for estimation the cost of projects.

Based on the comprehensive literature survey, it can be concluded that a variety of models have been developed by researchers using several techniques such as Monte Carlo simulation, multiple regression, artificial neural network and probabilistic model. However, these techniques necessitate complex mathematical calculations, and predicting any information by recognising the knowledge and patterns is relatively difficult. In contrast, fuzzy systems are proven to be more effective for forecasting information since they can improve the qualitative aspect of human knowledge, such as reasoning, inference and explicit knowledge. Models based on fuzzy and fuzzy hybrid approaches have also been suggested for estimating the cost contingencies depending on the research question and problem under consideration. Despite the efficacy of fuzzy theory, there are only a few studies in the literature for evaluating cost contingency, which motivated the author to propose an alternate methodology using a rule-based fuzzy inference system for estimating cost contingency in a construction project.

2.2 Concept of Fuzzy Theory

The fundamentals and concepts of the fuzzy theory, which are used for designing the model, have been explained here in this section. The fuzzy inference system is also described briefly as the model is developed using a rule-based fuzzy inference system.

Fuzzy set

The concept of fuzzy logic was originally established by Zadah [35]. A fuzzy set A of a universe of discourse X can be defined through Eq. (1):

Here μA(x) = Degree of membership function which provides X a membership value in the range from 0 to 1.

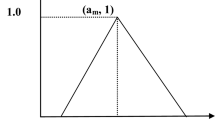

Membership functions

Membership functions (MF) are used for the fuzzification and defuzzification process of fuzzy inference system (FIS), for transforming the non-fuzzy or crisp input values to fuzzy values in the form of linguistic terms and vice versa. MF can be defined by a curve that represents the degree of membership of an element x in a fuzzy set in the range from 0 and 1. Triangular, Gaussian, trapezoidal, piecewise-linear, bell-shaped, sigmoid membership function, etc. are generally used as membership function. In this study, a trapezoidal membership function is taken for input and output variables based on literature review.

Fuzzy inference system

Fuzzy inference system (FIS) can be described as a rule-based reasoning system for mapping a given input to an output by applying fuzzy logic theory. Takagi–Sugeno and Mamdani processes are very important approaches for fuzzy inference. In this research, study the Mamdani type fuzzy inference process has been used as it is intuitive, well suitable to human cognition, and widely used in literature [11, 19, 20]. In the Mamdani process of FIS input members of the system are transformed into fuzzy numbers by fuzzification using membership function, by which crisp inputs are converted into a set of linguistic variables. A set of fuzzy rules in the form of if–then is then formed with the help of various fuzzy operators. The fuzzified input members are summed together as per the constructed rules, and the output distribution in the form of fuzzy sets are obtained Finally, after the defuzzification process, a crisp quantity is obtained from a fuzzy set.

3 Methodology for Developing the Model for Evaluating Cost Contingency

In this section, the methodology has been presented for developing the model for evaluating the cost contingency of a project. For this purpose, a case study has been taken from Indian construction projects.

3.1 Identification of Risk Factors Impacting the Cost of Construction Projects

For identification of the risk factors impacting the cost of construction, an extensive literature survey was carried out across the globe by Sharma and Goyal [27] for the construction industry. Fifty-five important factors impacting the construction cost were identified through systematic and intensive literature review (Journals, Proceedings, Web). After conducting interviews and a questionnaire survey with 50 construction practitioners from the Indian construction industry, only 20 important factors are selected for developing the cost contingency model. Table 1 indicates 20 main factors impacting the cost of the Indian construction projects. These factors are divided into four groups: ‘Finance’, ‘Construction’, ‘Management’ and ‘Project and Contract’.

3.2 Risk Quantification of the Identified Factors Using the Risk Matrix

The risk is then quantified using fuzzy theory and risk matrix as presented by Sharma and Goyal [28]. In this method, the magnitude of the risk factors impacting cost has been calculated after considering the probability and severity level of a certain factor. The probability and severity index were estimated based on an interview conducted with 50 experts in the construction industry of India. The calculated magnitude of the risk factors impacting cost has been presented in Table 2.

3.3 Developing a Model for Evaluating Cost Contingency by Using Fuzzy Inference Process

To develop the model for evaluating cost contingency, a fuzzy inference process has been implemented in two phases. In the first phase of the fuzzy inference process, the impact of the various risk factors of a group is taken as ‘input variables’, and ‘output variable cost contingency’ is determined for this group. For example, as shown in Fig. 1, the cost contingency of the group ‘Finance’ (‘C.C. Finance’) is estimated by considering the impact of risk factors (I.L.F. 1, I.L.F.2, I.L.F. 3, I.L.F. 4, I.L.F. 5, I.L.F. 6, I.L.F. 7) related to the group ‘Finance’ as input variables. Similarly, The output variable ‘C.C. Construction’, ‘C.C. Management’ and ‘C.C. Project and Contract’ is determined for ‘Construction’, ‘Management’and ‘Project and Contract’ group.

In the second phase of the fuzzy inference process, ‘C.C. Finance’, ‘C.C. Construction’, ‘C.C. Management’ and ‘C.C. Project and Contract’ determined in the first phase of the model are taken as ‘input variables’ and output variable ‘cost contingency of the project’ is then estimated.

3.3.1 Steps of Fuzzy Inference Process for Designing the First Phase of the Model

The process is performed using Fuzzy Logic Toolbox™ software of MATLAB Program. It consists of five primary graphical user interfaces (GUI) tools such as FIS Editor, MF Editor, Rule Editor, Rule Viewer, and Surface Viewer. The various steps of fuzzy inference system to design the model are as follows.

3.3.1.1 Defining Input and Output

The first step of model designing using the fuzzy inference process is to define the input and output variables. The impact level of the factors is taken as the input variables and cost contingency is taken as output. The various factors of group ‘Finance’ are Fluctuation in the prices of materials, Inflation, Financial difficulty experienced by contractor, Exchange rate, Material Cost, High level of interest rate of bank loan and High project charge of labour. These factors’ impact level is considered input variables for determining the output cost contingency for the finance group (‘C.C. Finance). During model design, the impact level of factors is abbreviated as I.L.F.1, I.L.F.2, I.L.F.3, I.L.F.4, and I.L.F.5, I.L.F.6 and, I.L.F.7 and the output variable is abbreviated as ‘C.C.F’.

In Fig. 2 the input variables I.L. F1- to I.L.F.7, and output variables Cost Contingency Finance (C.C.F) are shown in the FIS Editor window of the Fuzzy Logic toolbox.

Similarly, input variables for group ‘Construction’ are I.L.F8, I.L.F9, I.L.F10, and I.L.F.11. I.L.F. 12., I.L.F.13 and I.L.F.14. I.L.F.15 are input variables for the ‘Management’ group. I.L.F.16, I.L.F.17, I.L.F.18, and I.L.F. 19., I.L.F.20 are considered input variables for ‘Project & Contract’. Output variables for the groups are ‘C.C. Construction’, ‘C.C. Management’, and ‘C.C. Project and Contract’.

3.3.1.2 Fuzzy Membership Functions

The membership function associated with all the input variables and output variables of all the factors of group ‘Finance’ are shown in Fig. 3.

3.3.1.3 Fuzzy Rules

The formation of fuzzy rules is an essential component of the fuzzy inference system. The rules for this study are formed with the help of experienced practitioners in Indian construction projects. Considering 20 risk factors, a total of 100 rules are formed. Samples of the fuzzy rules of group ‘Finance’ are presented in Table 3.

Since the cost contingency of group ‘Finance’ is directly related to the magnitude of impact level of factors fluctuation in the prices of materials, inflation, financial difficulty experienced by contractor, exchange rate, material cost, high level of interest rate of bank loan and high project charge of labour, therefore the cost contingency will get affected by the impact level of the factors of the group ‘Finance’. The magnitude of the risk calculated in Sect. 3.2 will be taken as weighting for the rules. The sample rules constructed for the fuzzy model are shown in Table 4.

Similarly, the fuzzy rules were constructed for group ‘Construction’, ‘Management’and ‘Project and Contract’.

3.3.1.4 Defuzzification

Finally, the ‘cost contingency C.C.F’ for group ‘Finance’ is estimated by defuzzifying the rules by ‘centroid of area’ method as shown in Fig. 4

3.3.2 Fuzzy Inference System for the Second Phase of Model Designing

For the second phase of the model designing the same steps for fuzzy inference are performed. The input members for this phase are cost contingency of finance group (‘C.C. Finance’), cost contingency of construction group (‘C.C. Construction’), cost contingency of management group (‘C.C. Management’) and cost contingency of project and contract group (‘C.C. Project and Contract’). The output of the model is overall contingency of the project. It is abbreviated as O.C.P. The fuzzy inference process has been performed using Fuzzy Logic toolbox of MATLAB.

4 Testing of the Model

To test the reliability of the designed fuzzy model an interview has been conducted with a team of experts of a leading Indian construction company. The panel of the experts included the top 25 executive engineers, project managers, and site engineers of the company. The experts were requested to examine the risk factors considered for this research and filled in the required information regarding risk factors to test the proposed model. The information provided by the group of experts is presented as shown in Table 5.

The determined impact level of the group by the model is given in Table 6. The cost contingency of the project evaluated by the proposed model was 14.4%, as shown in Table 6, whereas the actual cost contingency was taken as 10% in this project, which shows an error of only 4.4%.

5 Conclusion

This paper has presented an alternate methodology for developing a risk-induced model to predict the cost contingency. The risk factors have been analysed using fuzzy theory as the theory is capable of dealing with incomplete, imprecise, and uncertain data Intrinsic to real-world complex problems such as those found in construction projects. The application of the proposed methodology has been illustrated for developing a model, by considering a case study of the Indian construction industry. Through an extensive literature review, 20 frequently occurring and important risk factors impacting the cost of construction projects were identified and classified into four groups as ‘Finance’, ‘Construction’, ‘Management’, and ‘Project & Contract’. After taking into account the likelihood and severity index, the risk magnitude of these factors was then calculated by interviewing 20 experts involved in Indian construction projects and then using the Mamdani type rule-based fuzzy inference system a model was developed. Trapezoidal type membership function was defined for the input and output variables. The Fuzzy logic toolbox of MATLAB software was used for the process of the fuzzy inference system. This model was validated also for a construction project. The value obtained from the model was 14.4% and the actual cost contingency in the project was taken as 10%, which is very close to the results obtained from the model. Therefore, the proposed model for predicting the cost contingency can be used by customising according to the specific project. The methodology provides a practical approach for estimating cost contingency by taking into consideration the frequently occurring and important risk factors impacting the cost of construction projects. Project managers and decision-makers will find this model very useful for making decisions regarding various issues related to the project such as contingency estimation, bid price calculation, mark-up estimation, and assessment of different projects.

References

Baccarini D (2006) The maturing concept of estimating project cost contingency—a review. In: 31st Australasian University Building Educators Association Conference (AUBEA 2006), Curtis University of Technology, Australia

Baloi D, Price ADF (2003) Modeling global risk factors affecting construction cost performance. Int J Proj Manag 21(4):261–269

Barraza G, Bueno R (2007) Cost contingency management. J Constr Eng Manag 23(3):140–146

Barraza G (2011) Probabilistic estimation and allocation of project time contingency. J Constr Eng Manag 137(4):259–265

Boukendour S (2005) A new approach to project cost overrun and contingency management. In: OCRI partnership conferences series process and project management, 22 March 2005, Ottawa

Chen D, Hartman FT (2000) A neural network approach to risk assessment and contingency allocation. AACE international transactions. Risk.07.01- Risk.07.06 Contingencies. J Constr Eng Manag 126(2):130–136

Diekmann JE (1983) Probabilistic estimating: mathematics and applications. J Constr Eng Manag 109(3):297–308

Dikmen I, Birgonul MT, Han S (2007) Using fuzzy risk assessment to rate cost overrun risk in international construction project. Int J Project Manage 25:495–505

Ahiaga-Dagbui DD, Tokede O, Smith SD, Wamuziri S (2013) A neuro-fuzzy hybrid model for predicting final cost of water infrastructure projects. In: Conference: 29th ARCOM conference at: reading, UK, September 2013. https://doi.org/10.13140/2.1.2382.6880

Elizabeth S, Sujatha L (2015) Project scheduling method using triangular intuitionistic fuzzy numbers and triangular fuzzy numbers. Appl Math Sci 9(4):185–198

Esragh F, Mamdani EH (1981) A general approach to linguistic approximation, fuzzy reasoning, and its application. Academic Press, Cambridge, MA, USA

Ford DN (2002) Achieving multiple project objectives through contingency management. J Constr Eng Manage 128(1):30–39

Hassanein AAB, Cherlopalle V (1999) Fuzzy sets theory and range estimating. AACE International Transactions, K4111. Hassanein, 1999.pdf, AACE Int Trans, K4 (1)

Idrus A, Nuruddin MF, Rohman MA (2011) Development of project cost contingency estimation model using risk analysis and fuzzy expert system. Expert Syst Appl 38:1501–1508

Jin XH, Zhang G (2011) Modelling optimal risk allocation in PPP projects using artificial neural networks. Int J Proj Manag 29(5):591–603

Kutsch E, Hall M (2010) Deliberate ignorance in project risk management. Int J Proj Manag 28(3):245–255

Lorance RB, Wendling RV (2001) Basic techniques for analysing and presenting cost risk analysis. Cost Eng 43(6):25–31

Mak S, Picken D (2000) Using risk analysis to determine construction project. J Constr Eng Manag. https://doi.org/10.1061/(ASCE)0733-9364(2000)126:2(130)

Mamdani EH (1997) Application of fuzzy logic to approximate reasoning using linguistic synthesis. IEEE Trans Comput 26(12):1182–1191

Mamdani H, Assillian S (1975) An experimental in linguistic synthesis with a fuzzy logic controller. Int J Man Mach Stud 7(1):1–13

Marco AD, Rafele C, Thaheem MJ (2015) Dynamic management of risk contingency in complex design-build projects. J Manage Eng. ISSN 0733–9364/04015080(10)

McGrew JF, Bilotta JG (2000) The effectiveness of risk management: measuring what didn’t happen. Manag Decis 38(4):293–301

Moselhi O (1997) Risk assessment and contingency estimation. AACE Int Trans 90–95

Paek J, Lee YW, Ock JH (1993) Pricing construction risk: fuzzy set application. J Constr Eng Manag 119(4):743–756

Project Management Institute (2013) A guide to the project management body of knowledge (PMBOK® Guide)

Shaheen A, Robinson FA, AbouRizk SM (2007) Fuzzy numbers in cost range estimating. J Constr Eng Manag 133(4):325–334

Sharma S, Goyal PK (2014) Cost overrun factors and project cost risk assessment in construction industry—a state of the art review. Int J Civil Eng 3(4):139–154

Sharma S, Goyal PK (2019) Fuzzy assessment of the risk factors causing cost overrun in construction industry. Evol Intel. https://doi.org/10.1007/s12065-019-00214-9

Sonmez R, Ergin A, Birgonul MT (2007) Quantitative methodology for determination of cost contingency in international projects. J Manag Eng 23(1):35–39

Thal AE, Cook JJ, White ED (2010) Estimation of cost contingency for air force construction projects. J Constr Eng Manage 136(11):1181–1188

Touran A (2003) Probabilistic model for cost contingency. J Constr Eng Manag 129(3):280–284

Wang WC, Bilozerov T, Dzeng RJ, Hsiao FY, Wang KC (2017) Conceptual cost estimations using neuro-fuzzy and multi-factor evaluation methods for building projects, pp 1–14. https://doi.org/10.3846/13923730.2014.948908

Williams TP (2003) Predicting final cost for competitively bid construction projects using regression models. Int J Project Manage 21:593–599

Yeo KT (1990) Risks, classification of estimates and contingency management. J Manag Eng 6(4):458–470

Zadah LA (1965) Fuzzy sets. Inf Control 8(3):338–353

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Ethics declarations

Conflict of Interest Statement

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Goyal, P.K., Sharma, S. (2022). Evaluating Cost Contingency for Construction Projects: A Fuzzy Risk Analysis Approach. In: Hu, YC., Tiwari, S., Trivedi, M.C., Mishra, K.K. (eds) Ambient Communications and Computer Systems. Lecture Notes in Networks and Systems, vol 356. Springer, Singapore. https://doi.org/10.1007/978-981-16-7952-0_58

Download citation

DOI: https://doi.org/10.1007/978-981-16-7952-0_58

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-7951-3

Online ISBN: 978-981-16-7952-0

eBook Packages: EngineeringEngineering (R0)