Abstract

Sustainable development in the manufacturing system is the developments that reduce negative environmental impact, save natural resources and energy, and create a safe and economically healthy atmosphere for employees, communities, and consumers in the production of items. On the other hand, customers are always motivated to purchase low electric consumption goods. In this study, a sustainable manufacturing model is developed under the assumption that the manufacturer will use the latest technology to reduce the electric consumption. Here, the electric consumption reduction level and selling price-dependent customers’ demand is considered. The manufacturer’s social sustainable development cost is also incorporated, which depends on the electric consumption level. This study concludes that the electric consumption reduction level and selling price-dependent customers’ demand will help both the manufacturer and customer’s environmental and economic benefits.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Many manufacturing firms realize that they are responsible for social, economic, and environmental development. This responsibility can make a difference in the sustainable development of human settlements. On the other hand, every developed country aims to reduce the use of natural resources. So, the goal of the sustainable development of the manufacturing system is to maximize the average profit or minimize the average cost. In 2015, the 21st session of the State Party in Paris, France, adopted the UNFC (United Nations Framework Convention) on climate change, which brings the regulations of carbon emission reduction and energy-saving policy by promoting in an alternative way. Sometimes we can say that sustainable development is the transition towards sustainable consumption during production. The natural resource-saving concept is one kind of sustainable development. Wolf and Chomkhamsri (2015) described the consumption decision affects of the consumer’s household resources, space, time etc., in a sustainable production and consumption system. Turkay et al. (2016) studied social and environmental criteria in supply chain management to incorporate attainability. Abreu et al. (2017) studied Lean-Green models for sustainable production. Manna et al. (2019) addressed an imperfect production inventory model with GHG emission control from industrial waste under the fuzzy environment to incorporate sustainable development. Daryanto and Wee (2018) developed a sustainable production model by considering carbon emission from production, holding and waste disposal activities. Shen et al. (2019) addressed a sustainable model on the production process by considering preservation investment for perishable items and carbon tax. Mishra et al. (2020) and Manna et al. (2020a) considered carbon emission cost in their production model to sustain the environment. Lu et al. (2020) also proposed a sustainable development in a production model by reducing carbon emissions. Also, they considered price-dependent demand and solved the problem by the Stackelberg game approach. Tang et al. (2020) investigated sustainable development in a transportation system under a carbon tax policy via a multiplayer dynamic game approach.

Customers’ demand plays a vital role in a manufacturing firm to optimize the system’s average cost or profit. The management of a manufacturing firm incorporates various types of features for electronic goods such as low radiation level, low electric consumption level, etc., of the produced items to attract the customers. Several researchers reported various types of demand function in their inventory model. You and Hsieh (2007) proposed stock and selling price linked to demand in an EOQ model. Hovelaque and Bironneau (2015) developed a carbon emission dependent demand-based inventory model. Shah (2015) addressed credit-linked and selling price-dependent demand in the formulation of an inventory model. Zerang et al. (2016) suggested marketing effort and selling price based demand in their supply chain model. Bhunia et al. (2017) developed a production model considering variable demand dependent on the item’s frequency of advertisement and selling price. Bhunia et al. (2018) assumed advertisement frequency, displayed inventory level and selling price-dependent demand in an inventory model for a perishable item. Kumar and Uthayakumar (2019) proposed price discount and stochastic demand in an inventory model. Manna et al. (2020b) investigated the effects of selling price and warranty policy linked to demand in the production model addressing imperfect items’ inspection errors.

This chapter has established a sustainable manufacturing model with reduced electricity consumption of produced electronic goods. It is assumed that the customers will purchase the product verifying the product’s electricity consumption level and selling price. Also, the manufacturer’s social sustainable development cost has been considered dependent on the electric consumption level. This study’s main objective is to determine the optimal selling price and electric consumption reduction level of the manufacturing product, which maximizes the production system’s average profit. A numerical experiment has been done by solving a numerical example for testing the validity of the model. Finally, sensitivity analyses have been performed w.r.t. various system parameters.

2 Problem Description

2.1 Notation

- \(I_{m} (t)\)::

-

On hand inventory level of the product

- \(P_{m}\)::

-

Manufacturer’s production rate

- \(t_{m}\)::

-

Manufacturing time

- \(T_{b}\)::

-

Business period

- \(e_{l}\)::

-

Electricity consumption reduction level of the product

- \(s_{r}\)::

-

Selling price per unit product

- \(D(e_{l} ,\,s_{r} ,\,t)\)::

-

Customers’ demand rate

- \(C(e_{l} )\)::

-

Unit production cost

- \(h_{c}\)::

-

Holding cost/unit time/unit product

- \(c_{d} (e_{l} )\)::

-

Sustainable development cost/unit product

- \(A_{m}\)::

-

Set-up cost/cycle

- \(\pi (e_{l} ,\,s_{r} ,\,T)\)::

-

Manufacturer’s average profit.

2.2 Assumptions

-

(i)

The manufacturing firm produces the non-deteriorating product, and a part of the produced product is defective. The production and defective rates are constants. Also, the demand rate is less than the rate of produced perfect items, i.e. \(P > D(e_{l} ,\,s_{r} ,\,t)\).

-

(ii)

The customers’ demand rate is decreased with the increase of time as well as the selling price of the product. Also, it is increased with the electricity consumption reduction level of the product. Hence the mathematical expression of customers’ demand rate is given by

$$\begin{aligned} D(e_{l} ,\,s_{r} ,\,t) &= \alpha_{0} + \alpha_{1} e_{l} - \alpha_{2} s_{r} - \alpha_{3} t \\ & = d(e_{l} ,\,s_{r} ) - \alpha_{3} t, \end{aligned}$$where \(d(e_{l} ,\,s_{r} ) = = \alpha_{0} + \alpha_{1} e_{l} - \alpha_{2} s_{r}\) and \(\alpha_{0} ,\alpha_{1} ,\alpha_{2} ,\,\alpha_{3}\) are positive constants.

-

(iii)

Unit production cost is increased with the increase in electricity consumption reduction level of the product. The mathematical expression of unit production cost is as follows:

$$C(e_{l} ) = c_{p} e^{{\delta e_{l} }}$$where \(c_{p}\) is the fixed production cost and \(\delta\) is the control parameter of the electricity consumption reduction level.

-

(iv)

Due to government regulation, the manufacturer is bound to spend an amount of money for society’s sustainable development. This amount is proportional to \(e_{l}\). The sustainable development cost per unit production is given by

$$c_{d} (e_{l} ) = a - be_{l}$$where \(a\) is the fixed sustainable development cost and \(b\) is sustainable development sensitive cost.

3 Mathematical Representation of the Model

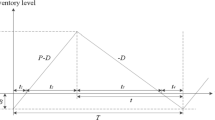

Let us suppose that a manufacturing firm initially starts the production to fulfil the demand of the customers. During the production period \((0,\,t_{m} )\), the inventory level of perfect item increases at the rate \(P_{m} - D(e_{l} ,\,s_{r} ,\,t)\), whereas it decreases at the rate \(D(e_{l} ,\,s_{r} ,\,t)\) and reaches zero at time \(t = T_{b}\). The graphical nature of the production inventory system during \([0,\,T_{b} ]\) is represented in Fig. 1.

The governing differential equations of the inventory level \(I_{m} (t)\) are as follows:

with the conditions \(I_{m} (0) = 0 = \,I_{m} (T_{b} ).\) Also \(I_{m} (t)\) is continuous at \(t = t_{m}\).

The solutions of the Eqs. (1) and (2) are as follows:

where \(d(e_{l} ,\,s_{r} ) = = \alpha_{0} + \alpha_{1} e_{l} - \alpha_{2} s_{r}\) is independent of t.

From the continuity of \(I_{m} (t)\) at \(t = t_{m} ,\) we get

The manufacturer’s average holding cost (AHC) during \([0,\,T_{b} ]\) is as follows

The manufacturer’s average production cost (APC) is as follows

The manufacturer’s average sales revenue (ASR) is given by

The average set-up cost of the manufacturer is \(\frac{{A_{m} }}{{T_{b} }}\).

The average sustainable development cost (ASDC) of the manufacturer is calculated as follows:

Hence the average profit of the manufacturer is calculated as follows

Now the problem is to find the optimal values of \(e_{l}\) (electricity consumption reduction level of the product), \(s_{r}\) (selling price/unit product), and \(T_{b}\) (business period), which give the maximum average profit \(\pi (e_{l} ,\,s_{r} ,\,T_{b} )\) of the manufacturer.

Hence the corresponding maximization problem is as follows:

4 Numerical Experiment

To verify the model, the following numerical example is considered.

Example: Let us suppose that a manufacturing firm produces an electrical product (say, AC) at the rate of \(P_{m} = 600\) units per month and fulfils the customers’ demand. According to the assumptions, the demand parameters are \(a_{0} = 380\) units, \(a_{1} = 25\) units, \(a_{2} = 2.1\) units, \(a_{3} = 0.18\) units. Also, the unit production cost parameters are assumed as \(c_{p} = 35\) units and \(\delta = 0.34\). The manufacture is bound to spend any amount for sustainable development of the environment and society. It is assumed that the sustainable development cost parameters are \(a = 3\) units and \(b = 1.2\) units. Again, the set-up and holding costs are considered as \(A_{m} = 300\)unit and \(h_{c} = 3\) unit, respectively. The manufacturing authority wishes to find the extreme values of \(e_{l}\), \(s_{r}\), and \(T_{b}\)by maximizing the manufacturer’s average profit.

Solution: Using the mentioned parameters values in the optimization problem (7) and using MATHEMATICA, we get the optimal values of \(e_{l}\), \(s_{r}\) and \(T_{b}\) and \(\pi (e_{l} ,\,s_{r} ,\,T_{b} )\). The optimal solution of the example is shown in Table 1.

The concavities of the average profit w.r.t. \(e_{l}\), \(s_{r}\) and \(T_{b}\) are shown in Figs. 2, 3, 4, 5, 6 and 7, which are plotted by MATHEMATICA software.

5 Sensitivity Analyses and Result Discussion

In this subsection, the post optimality analyses are performed w.r.t. different system parameters like \(P_{m}\), \(\alpha_{0} ,\) \(\alpha_{1} ,\) \(\alpha_{2} ,\) \(\alpha_{3} ,\) \(c_{p} ,\) \(c_{h}\), and \(A_{m}\) by changing the values from −10% to +10% to investigate the effect of the values’ optimum values of the decision variables. The detailed results are shown in Table 2.

From Table 2, it is observed that

-

(i)

\(\pi (e_{l} ,\,s_{r} ,\,T_{b} )\) (average profit of the manufacturer) is equally sensitive directly and reversely w.r.t. \(\alpha_{0}\) (fixed demand rate) and \(\alpha_{2}\) (selling price sensitive demand parameter) respectively, whereas it is reversely less sensitive w.r.t. \(c_{p}\) (unit production cost). Also, it is insensitive w.r.t. \(c_{h}\) (holding cost), \(A_{m}\) (setup cost), \(P_{m}\) (production rate), \(\alpha_{1}\) (electric consumption reduction level sensitive demand parameter), and \(\alpha_{3}\) (time sensitive demand parameter).

-

(ii)

the electric consumption reduction level (\(e_{l}\)) is highly sensitive directly w.r.t. \(\alpha_{1}\), whereas it is highly sensitive reversely w.r.t. \(\alpha_{2}\) and \(c_{p}\). Moreover, it is insensitive w.r.t. \(\alpha_{0}\), \(\alpha_{3} ,\) \(c_{h}\), \(A_{m}\), and \(P_{m}\).

-

(iii)

\(s_{r}\)(selling price/items) is moderate sensitive directly and reversely w.r.t. \(\alpha_{0}\) and \(\alpha_{2}\) respectively, whereas it is less sensitive directly and reversely w.r.t. \(\alpha_{1}\) and \(c_{p}\) respectively. Also, it is insensitive w.r.t. \(\alpha_{3} ,\) \(c_{h}\), \(A_{m}\), and \(P_{m}\).

-

(iv)

the production period is moderate sensitive directly and reversely w.r.t. \(\alpha_{0}\) and \(P_{m}\) respectively, whereas it is less sensitive directly w.r.t. \(A_{m}\). Also, less sensitive reversely w.r.t. \(c_{h}\) and \(\alpha_{2}\). Moreover, it is insensitive with respect to \(\alpha_{3} ,\) \(\alpha_{1}\), and \(c_{p}\).

-

(v)

the business period is less sensitive directly w.r.t. \(\alpha_{2}\) and \(A_{m}\) whereas it is less sensitive reversely w.r.t. \(\alpha_{0}\), \(c_{h}\), \(P_{m}\). Also, it is insensitive w.r.t. \(\alpha_{1}\) and \(\alpha_{3}\).

6 Conclusions

In the present work, the concept of sustainable development has been incorporated in a manufacturing system by considering electric consumption reduction level and selling price-dependent demand. On the other hand, customers prefer less electric consumption electric goods at the time of purchasing. In this connection, manufacturing companies invest an amount for new technology to reduce the electric consumption of each electronic goods and increase the customers’ demand. Here, we have determined the optimal values of electric consumption reduction level and selling price per item by maximizing the manufacturer’s average profit. From the post optimality analyses, the following conclusions are summarized as follows:

-

Average profit is equally effective in a positive manner concerning fixed market demand, whereas it is equally effective in a negative sense w.r.t. the selling price per item. Furthermore, it is less effective in a negative sense w.r.t. the unit production cost.

-

On the other hand, the selling price per unit item and the production period is moderately positive effective w.r.t. fixed market demand, whereas the electric consumption reduction level is insensitive w.r.t. fixed market demand.

For further investigation, one can extend this work considering backlogged shortages (fully/partially). Also, the proposed demand function can be applied in a supply chain model. Moreover, this model may be extended considering the imprecise parameters relating to demand rate, production and different inventory costs in fuzzy and interval environments.

References

Abreu MF, Alves AC, Moreira F (2017) Lean-Green models for eco-efficient and sustainable production. Energy 137:846–853

Bhunia AK, Shaikh AA, Cárdenas-Barrón LE (2017) A partially integrated production-inventory model with interval valued inventory costs, variable demand and flexible reliability. Appl Soft Comput 55:491–502

Bhunia AK, Shaikh AA, Dhaka V, Pareek S, Cárdenas-Barrón LE (2018) An application of genetic algorithm and PSO in an inventory model for single deteriorating item with variable demand dependent on marketing strategy and displayed stock level. Sci Iran 25(3):1641–1655

Daryanto Y, Wee HM (2018) Sustainable economic production quantity models: an approach toward a cleaner production. J Adv Manag Sci 6(4):1–7

Kumar GM, Uthayakumar R (2019) Multi-item inventory model with variable backorder and price discount under trade credit policy in stochastic demand. Int J Prod Res 57(1):298–320

Hovelaque V, Bironneau L (2015) The carbon-constrained EOQ model with carbon emission dependent demand. Int J Prod Econ 164:285–291

Lu CJ, Lee TS, Gu M, Yang CT (2020) A multistage sustainable production inventory model with carbon emission reduction and price-dependent demand under Stackelberg game. Appl Sci 10(14):4878

Manna AK, Dey JK, Mondal SK (2019) Controlling GHG emission from industrial waste perusal of production inventory model with fuzzy pollution parameters. Int J Syst Sci Oper Logist 6(4):368–393

Manna AK, Das B, Tiwari S (2020a) Impact of carbon emission on imperfect production inventory system with advance payment base free transportation. RAIRO-Oper Res 54:1103–1117

Manna AK, Dey JK, Mondal SK (2020b) Effect of inspection errors on imperfect production inventory model with warranty and price discount dependent demand rate. RAIRO-Oper Res 54:1189–1213

Mishra U, Wu J-Z, Sarkar B (2020) A sustainable production-inventory model for a controllable carbon emissions rate under shortages. J Clean Prod 256:120268

Shah NH (2015) Manufacturer-retailer inventory model for deteriorating items with price-sensitive credit-linked demand under two-level trade credit financing and profit sharing contract. Cogent Eng 2(1):1012989

Shen Y, Shen K, Yang C (2019) A production inventory model for deteriorating items with collaborative preservation technology investment under carbon tax. Sustainability 11(18):5027

Tang Z, Liu X, Wang Y (2020) Integrated optimization of sustainable transportation and inventory with multiplayer dynamic game under carbon tax policy. Math Probl Eng 2020:1–16

Turkay M, Saraoglu O, Arslan MC (2016) Sustainability in supply chain management: aggregate planning from sustainability perspective. PloS One 11(1):e0147502

Wolf M-A, Chomkhamsri K (2015) From sustainable production to sustainable consumption. Life Cycle Manag 169–193

You P-S, Hsieh Y-C (2007) An EOQ model with stock and price sensitive demand. Math Comput Model 45(7–8):933–942

Zerang ES, Taleizadeh AA, Razmi J (2016) Analytical comparisons in a three-echelon closed-loop supply chain with price and marketing effort-dependent demand: game theory approaches. Environ Dev Sustain 20(1):451–478

Acknowledgements

The first author thankful to UGC, India, for providing DSKPDF through The University of Burdwan(Research grant no. F.4-2/2006(BSR)/MA/18-19/0023). Also the second author would like to acknowledge the financial support provided by WBDST & BT, West Bengal, India for this research (Memo No: 429(Sanc.)/ST/P/S & T/16G-23/2018 dated 12/03/2019).

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Manna, A.K., Bhunia, A.K. (2022). A Sustainable Production Inventory Model with Variable Demand Dependent on Time, Selling Price, and Electricity Consumption Reduction Level. In: Ali, I., Chatterjee, P., Shaikh, A.A., Gupta, N., AlArjani, A. (eds) Computational Modelling in Industry 4.0. Springer, Singapore. https://doi.org/10.1007/978-981-16-7723-6_7

Download citation

DOI: https://doi.org/10.1007/978-981-16-7723-6_7

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-7722-9

Online ISBN: 978-981-16-7723-6

eBook Packages: EngineeringEngineering (R0)