Abstract

The optimal income taxation literature focuses on the tradeoff between the equity gains of higher progressivity versus its greater incentive costs at the individual level. This paper highlights a neglected aspect of redistribution—greater progressivity requires a higher volume of gross redistributive flows, across income levels. If these flows are costly to manage, administratively, or politically, then progressivity will be lower. Moreover, if redistribution across income levels implies redistribution across sociopolitically salient groups because of the way in which these groups line up relative to the income distribution, this can be an added cost in the objective function and progressivity is further disadvantaged. The paper develops a simple framework in which these questions can be addressed. Among the many interesting results is that when the capacity for the volume of redistributive flows, across income levels or across sociopolitical groups, is reached, an increase in market inequality can lead to a fall in progressivity in the tax-transfer regime without any change in the government’s preferences for equity. A focus on the volume of redistribution thus opens up an important set of theoretical and empirical questions for analysis and for policy.

Paper written as contribution to Festschrift for Satya Chakravarty upon his retirement from the Indian Statistical Institute. This chapter has been published by the author under (i) the ECINEQ Society for the Study of Economic Inequality Working Paper Series as ECINEQ WP 2018–462, (ii) the CEPR Discussion Paper Series as DP 12816, and (iii) Dyson Cornell Working Papers Series as 18–03.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Volume of redistribution

- Administrative costs of redistribution

- Progressivity

- Sociopolitically salient groups

- Political costs of redistribution

JEL Codes

1 Introduction

Why has post-tax and transferFootnote 1 inequality increased in many countries around the world? In simple accounting terms, to get the post-tax distribution we start with the market distribution of income and superimpose on that the redistribution implemented by the government, to arrive at the distribution of post-tax or “take home” income. Thus, if post-tax inequality rises, it must be because of the net effect of change in the inequality of market income and change in progressivity of redistribution. For example, an often discussed narrative is that while in the US and the UK both changes went in the direction of raising inequality, in Latin America redistribution overcame increasing market inequality to reduce post-tax inequality.

In the standard Mirrleesian model of optimal nonlinear income taxation (Mirrlees 1971), the optimal degree of tax progressivity depends on three key parameters—the degree of market or “inherent” inequalityFootnote 2; the preference for equality (the government’s inequality aversion); and the strength of incentive effects (captured in the model by the elasticity of labor supply). It can then be shown in such Mirrleesian models that, holding fixed government’s inequality aversion and individuals’ incentive effects, an increase in “inherent” inequality will increase the optimal progressivity of the tax system, although the net effect on post-tax inequality will be to increase it (Kanbur and Tuomala 1994). It is now generally agreed that the skill premium in labor markets is on the rise, the result of skill-biased technical progress,Footnote 3 and this is leading to rising market inequality at any given level of progressivity of redistribution. However, in the US and UK at least, it seems as though the tax system has become less progressive not more, compounding the effects of rising market inequality. This would seem to suggest either that incentive effects have become stronger, or that the preference for equity has declined, or both.

It can indeed be argued that in the era of globalization incentive effects have become stronger, certainly for capital and for skilled labor as relocation prospects have improved for them. However, incentive effects will not be the focus of this paper. It could also be argued that the political system has been captured by the wealthy, with the result that the tax system reflects this capture, with lowered inequality aversion in the government’s objective function. Indeed, there could be a vicious spiral, whereby rising inequality leads to greater political capture and thence greater inequality still.Footnote 4 However, this type of mechanism will also not be the primary focus of this paper.

Rather, I wish to highlight the effects of what I call “the volume of redistribution.” The idea is simple. Redistribution involves taking resources away from some and giving these resources to others. Both the taking and the giving will have individual-level incentive effects and these are well modeled in the economics literature. But the taking and the giving requires administrative and other mechanisms for transfer. One can visualize these as the “pipes” which take the flow of redistribution from one set of incomes to others. These pipes, these mechanisms, do not just exist—they have to be built. And if the pipes have been laid for an earlier period, they may not be able to take a greatly increased flow of redistribution, and begin to impose costs which militate against redistribution. We can think of these mechanisms and pipes in physical, administrative, terms; but another interpretation is the flexibility of current political economy, having arrived at a given political equilibrium level of redistribution, to now adjust to a far greater flow required by new circumstances. Although I have this at the back of my mind, I will not model the political economy, preferring at this stage to stay with the physical analogy of pipes and their ability to withstand the force of greater flow.

Suppose now that individuals differ not only in levels of income but also in characteristics which define sociopolitically salient groups, such as ethnic groups, immigrant versus natives, young versus old, regional groupings, and so on. Then, except in particular special cases, redistribution flows across income levels through an income tax-transfer system will also imply flows across these groups. If there are political costs to flows across groups, these have to be further accounted for in the social objective function and their implications for progressivity need to be worked out. How should we think about the dependence of costs on the volume of flows (across income levels or across groups)? The pipes analogy helps. For a given width of piping, more flow can be accommodated up to capacity with marginal cost of additional flow. But once this capacity is reached, there is a fixed cost in building new capacity to take the next level of flow. Such fixed costs, as might be expected, also affect the levels and patterns of progressivity in response to increasing market inequality.

The plan of the paper is as follows. Section 2 sets out the basic idea of the volume of redistribution and analyzes its dependence on distributional parameters. In particular, it traces a possible line of linkage between greater inherent inequality leading to the desire for greater progressivity in the tax and transfer system, but this being blocked by the inability of the system to handle the higher volume of flows of redistribution implied by greater progressivity. Section 3 plays out the flows perspective through the lens of the implications for transfers between politically salient groups such as ethnic groups, or natives and immigrants. Section 4 concludes with an extended discussion of the metaphor of the “volume of redistribution” which the model of the paper tries to set out in a simple and precise way. It argues that the concept opens up an interesting line of theoretical and empirical research.

2 The Volume of Redistribution

Let the market distribution of income y be represented by its density f(y). Let the tax (and transfer) function be denoted t(y), and the post-tax income by x

Note that t(y) will be positive if it is a net tax and negative if it is a net transfer. The volume of redistribution is simply the aggregate of absolute values of the difference between x and y, whether positive or negative—the total flow through the redistribution pipes.

A particular simplification which will prove useful for us is the linear tax and transfer regime:

We have a demogrant of a for every individual and a constant marginal tax rate of b. Normalizing population size to unity, total tax revenue T is

where μ is the mean income. Sticking to a pure redistributive role for taxation and setting T = 0, we get

which leaves us with one free parameter in the linear tax function. We choose this to be b, the marginal tax rate, which captures the degree of progressivity of the tax system.

There is a single switch point of market income, where t changes from negative to positive. Denoting this by s, it is clear that

Thus, all those with market incomes below the mean receive a net transfer; all those with incomes above are taxed positively on net to finance those transfers. This is an obvious feature of a linear tax system with no net revenue requirement. In this setting, the volume of redistribution, as defined by (2), is given by

where ӱ and ӯ are the minimum and maximum levels of income, respectively. However, since we have assumed revenue neutrality the two components of the right-hand side of (5) must be identical. Thus, in the linear case, we have the following expression for the volume of distribution:

Further analytical tractability is provided by the case where f(y) is the uniform density lying between μ +d/2 as maximum and μ − d/2 as the minimum, so that f(y) = (1/d) and d is a measure of the inequality of market income. In this case, simple integration of (8) shows that

Expression (9) captures in tractable form the relationship between the volume of redistribution needed when the attempted progressivity is b, and market inequality is d. We focus on the case where mean is constant, in other words, pure redistribution. In this linear, uniform, fixed mean case, market inequality measured by the variance of income is given by

and final inequality is given by

Expressions (9), 10), and (11) provide the links we need between market inequality, tax progressivity, and volume of redistribution.

Taking d as the proxy for market inequality and b as the proxy for attempted redistribution to achieve the desired post-tax inequality, we see from (11) that an increase in market inequality requires an increase in progressivity to hold final inequality Ix constant. But from (9) we see that an increase in progressivity for any given d will increase the required volume of redistribution. In fact, there is an interaction between market inequalities in determining the volume of required redistribution:

Thus, the higher the degree of market inequality, the greater is the redistribution volume increase required for a given increase in progressivity.

If there were no other costs, then an inequality averse government would simply choose to equalize all incomes with a 100% marginal tax rate and a demogrant equal to mean income. But the key assumption of this paper is that redistribution volume is not simply available to policy-makers but needs costly construction of administrative and political infrastructure—the “pipes.” Let the per capita cost of volume V of redistribution be γV. Then one specification of social welfare combines mean income, variance of final income, and cost of the volume of redistribution:

Substituting from (9) and (11) and maximizing with respect to b gives us an expression for the optimal degree of progressivity.

From (7), the volume of distributive effort for this level of progressivity is given by

and with this response, final inequality is given by

Final inequality is higher, the higher is the cost of redistribution. Optimal progressivity increases with market inequality but decreases with the costs of redistribution. In this case, an increase in market inequality leads to just enough increase in progressivity to leave final inequality unchanged.

Suppose now that the cost of the volume for redistribution is nonlinear, γV2. Then, the expressions corresponding to (13), (14), (15), and (16) are as follows:

In this case, optimal progressivity is independent of market inequality but decreases in the cost of redistribution. Final inequality is increasing in market inequality and in the cost of redistribution.

The argument above shows that use of progressivity as a measure of “redistributive effort” may be misleading. When market inequality increases, even with progressivity unchanged, the volume of distributive effort increases. Indeed, it must do so to keep progressivity constant. Unchanged redistribution volume will imply a decrease in progressivity. Thus, in many ways, an appropriate measure of redistributive effort (within the progressive taxation regime) is in fact the volume of redistribution. From (18) and (19), it is seen that with rising market inequality the flows through the pipes have to be greater to maintain progressivity at the optimal level—one has to run harder to keep still.

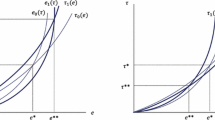

This feature, in which the degree of progressivity and volume of redistribution may not move together when market inequality increases, appears even more sharply when the cost function for volume of redistribution takes a different form. Up to now, we have supposed that the costs of increasing distributive flow are all marginal costs—a little bit more redistributive effort can be achieved at a little bit more cost. But what if some of these costs are in the nature of fixed costs? If the increased flow required is substantial, or crosses a critical threshold, then new investment may be needed, new pipes need to be installed, for the increased flow.

Let the cost function be \( \gamma V\,for\,V \le \hat{V}\,and\,F + \gamma V\,for\,V > \hat{V} \). Then from (15), as d increases up to

the cost function remains at \( \gamma V \), and the optimal volume and progressivity are given by (15) and (14). However, as d crosses the threshold to values higher than \( \hat{d} \), the fixed cost component F kicks in. If this additional cost was not present, optimal policy would simply follow along (14) and (15). However, with the additional cost, the impact on welfare is quite different. To see this more clearly, rewrite the problem as one of choosing V rather than b, and rewrite the objective function (13) in terms of V by writing Ix in terms of V using (9):

Differentiating each portion of this with respect to V and setting equal to zero gives the solution (15). Now, beginning with \( d = \hat{d} \) and \( V = \hat{V} \), the corresponding optimal volume of redistribution, it is clear that the optimal policy when d increases marginally is to stay at \( V \le \hat{V} \), since the marginal benefits from increasing V are zero but in doing so the fixed cost F is incurred.

But consider now the implications of the result above that V stays fixed at \( \hat{V} \) as d increases. From (9), this must mean that b decreases. In other words, the degree of progressivity of the tax and transfer system as we usually measure it, the marginal tax rate, falls, and so from (11) inequality of post-tax income rises for two reasons—because market inequality rises and progressivity falls. As argued in the Introduction, this is the narrative that has played out in the US and the UK over the past three decades. Notice, however, that distributive effort as measured by the volume of redistribution remains constant.

Eventually, as market inequality becomes so high that the gain to the social welfare function from increasing the value of redistribution dominates the fixed (and marginal) cost of the higher volume beyond the current level. It can be shown that this level of market inequality is the (higher) solution in d to the quadratic formed by equating the optimized value of (20) for \( V > \hat{V} \) with its value when \( V = \hat{V} \)

If such a solution exists, denoting it \( \tilde{d} \), we get a further interesting phenomenon. Progressivity and the volume of redistribution both jump up to the values given by (14) and (15) for the now higher value of \( \tilde{d} \). We can thus see a cycle emerging, which is intuitively clear once the fixed costs of adjustment are factored in. Starting with a given system of pipes for redistribution, as market inequality increases, progressivity and volume both increase to mitigate the market inequality (in the linear marginal costs case, post-tax inequality is held constant as in (16)). However, once these pipes become strained and new pipes have to built, the fixed cost of this keeps the volume constant, progressivity declining, and compounding the rise in market inequality. However, once market inequality gets sufficiently high, the fixed cost is worth paying and there is a big jump in volume and progressivity, and the cycle can start again from this point onward. Such processes could perhaps explain long cycles and sudden jumps in tax progressivity and redistributive effort.

3 Group Divisions

The metaphor I have used in motivating the costs of the volume of redistribution is primarily an “administrative/infrastructure” one. The visualization of flows through pipes has been useful here. I have also indicated, but not developed, a political economy metaphor. Starting from the thinking that a “political settlement” is needed for redistribution of those with market income to those without, the costs of greater redistribution can be thought of, in a very reduced form way, as the costs of achieving the new political settlement. Although I have not and will not model this political economy here, I believe it has considerable political appeal. But the political settlement metaphor also raises another important issue, that of transfers across politically salient groups.

The rise of far-right Xenophobic parties in Europe and elsewhere is often predicated on the appeal to the notion that some groups, usually ethnic minorities, are takers from society. In particular, the platform of these political entrepreneurs is that some long-established ethnic groups, or newly arrived immigrant groups, get transfers from the existing political settlement. This is not just the argument of demagogues. Albeit in more measured tones, academics like Miller (2016) and Collier (2013) also argue that greater heterogeneity has the potential to undermine the social redistributive contract which has characterized the post-war political settlement in much of Western Europe and to some extent the US. The issue here is not redistribution from rich to poor, which was or is the current social contract, but redistributing in favor of certain identifiable groups who are poor.

It should be noted that this perspective on transfers across groups as an impediment to redistribution is very different from the literature which views group-specific information and group—contingent tax and transfer policies as being an advantage. At least since Akerlof (1978), the idea of “tagging” an individual with easily observable characteristics and implementing separate tax and transfer schedules for each tag is seen as overcoming informational disadvantages and providing the policymaker with more instruments. The idea has been applied to targeting of anti-poverty transfers (Kanbur 1987, 2017), and to nonlinear income taxation more generally (Immonen et al. 1998; Kanbur and Tuomala 2016). But these very same transfers across groups, whether intentional or not, are seen in the new dispensation as politically problematic and undermining agreement on redistribution in general.

The simple model developed in the previous section can be used to highlight and sharpen some of these concerns in a precise way. Let there be two groups in society A and B. These two “tags” can be found at different points in the income distribution, but the tags have salience in and of themselves, irrespective of the income of the individual to whom they attach. Specifically, let us suppose that flows across these two groups are of political salience and, in effect, impose a cost on attempts to redistribute income generally. The costs of these cross-group flows G have to be added to the costs of the flows across income levels, V.

Clearly, for any income tax-transfer regime, the implication for cross-group flows will depend on how the groups are distributed across the income distribution. To fix ideas, take the basic model of Sect. 2, suppose that the two groups are of equal size, and suppose that all those above the mean μ are of group A and all those below the mean are of group B. Then the cross-group flow G is simply the volume of redistributive flow V. At the other end, suppose that the groups are to be found equally at every income level. Then the cross-group flow G is zero. In effect, each group is representative of the whole society so redistribution can be seen as taking place within each group and none across groups. This is true even when the groups are not of equal size, so long as their representation at each income level is the same as their representation in the whole population. In between, as the representation of group B below the mean increases relative to its population share, cross-group flow increases from zero to V.

For simplicity, return to the case of equal group size overall, but let representation of group B be θ below the mean and (1-θ) above the mean. In other words, at each income level below the mean, a fraction θ of the population is of group B and at each income level above the mean, the fraction is (1-θ). We focus on the case where θ ≥ (1/2). In this case, group A is taxed by an amount θ(1/2)V and receives an amount (1-θ)(1/2)V, so the net flow from this group out is (2θ-1)(1/2)V, whereas the net receipt for group B is the mirror of this, (1-2θ)(1/2)V. Thus, the sum of the net outflow and the net inflow in absolute terms is

This is the offending cross-group flow with political salience and a political cost for policy-makers.

If we represent the cost of cross-group flow in the usual linear manner with marginal cost δ, we have a social welfare function analogous to (13)

This is simply the social welfare function in (11) with an augmented marginal cost of the volume of cross-income flow, denoted by γ*, which is the marginal cost of volume γ plus the additional term (2θ-1) which comes from the cost of cross-group flow:

All of the previous analysis now goes through with γ replaced by (the higher) γ*. Thus, from (14), (15), and (16), progressivity and volume are lower, and final inequality is higher with the cross-group factor added in. Notice that the more heavily represented is group B in the lower half of the population (the higher is θ), the higher will be the cost of a unit of flow across income classes, because this will now involve more flows between politically salient groups, and the lower will be the progressivity and higher will be the final inequality. Clearly, the gist of the analysis also goes through when the groups are of unequal size; what will matter then is the representation of group B individuals in the below mean income population, relative to their representation in the population as a whole. The key point is that if an ethnic minority or an immigrant group, say, is concentrated at lower income levels, then this will reduce progressivity. This matches the analysis of Tabellini (2017, pp. 38–39) which shows for US jurisdictions, “the inflow of immigrants” led “cities to cut tax rates and limit redistribution.”

Analogously to the discussion on fixed costs for volume of transfer across income levels, we can now consider what happens when a political settlement reaches its limit in terms of the amount of cross-group transfers it will permit. Let this be denoted \( \hat{G} \). Then, from (24), there is a corresponding critical value for volume of redistribution across income levels:

Going beyond \( \hat{G} \) requires a new settlement, which can be represented by a fixed cost. A similar analysis can then be carried out as in (22) and (23) with \( \hat{V} \) given by (27). Then beyond a critical value of market inequality \( \hat{d} \), as in (21) but with γ replaced by γ*, the volume of distribution will stay fixed at (27) and as market inequality rises, progressivity will decline and final inequality will rise. But these effects are now coming not from the fixed costs of managing increasing redistribution across income levels, but from the fixed costs of a new political settlement to manage the redistribution across politically salient groups to which redistribution across income levels gives rise as a corollary.

Is (25) the right way to represent political tensions in flows across groups? It is based on the idea that it is the total flows that matter. But what if per capita flows matter; in other words, it is the amount given by the typical person and the amount received by the typical person which matter. In this case, the right correction factor is not (2θ-1) but (2θ-1)/θ = [2 – (1/θ)]. The same arguments still go through. A higher θ, i.e., a greater representation of group B among below mean income individuals, still increases the correction factor on γ. However, the correction factor is greater for the relevant range of 1 ˃ θ ˃ (1/2). Per capita perceptions will lead to greater perceived cost of redistribution and thus lower progressivity and higher final inequality for any given degree of market inequality.

4 Conclusion

The optimal income taxation literature focuses on the tradeoff between the equity gains of higher progressivity versus its greater incentive costs at the individual level. This paper highlights a neglected aspect of redistribution—greater progressivity requires a higher volume of gross redistributive flows, across income levels. If these flows are costly to manage, administratively or politically, then progressivity will be lower. Moreover, if redistribution across income levels implies redistribution across sociopolitically salient groups because of the way in which these groups line up relative to the income distribution, this can be an added cost in the objective function and progressivity is further disadvantaged. When the capacity for the volume of redistributive flows, across income levels or across sociopolitical groups, is reached, increase in market inequality can lead to a fall in progressivity in the tax-transfer regime without any change in the government’s preferences for equity.

The term “capacity of redistribution” has been used in the literature, but in a different sense to the one used in this paper. Thus, Ravallion (2010, p. 1) defines it as “the marginal tax rate (MTR) on the ‘rich’—defined as those living in a developing country who would not be considered poor by rich country standards—that is needed to provide the revenue for a specific redistribution.” Hoy and Sumner (2016) also apply the same measure to updated and more extensive data. Kanbur and Mukherjee (2007, pp 52–53) have a similar perspective when they characterize poverty reduction failure as “is the extent of poverty relative to the resources available in the society to eradicate it?” Thus, they all highlight the resources available for redistribution. But none of these papers focus on the gross flows needed to achieve a given redistribution and the cost associated with these flows.

How might we think of the costs of the volume of gross flows needed for redistribution across income levels? The easiest interpretation is in terms of administrative costs. Not surprisingly perhaps, these costs are often highlighted by economists more oriented to the free market:

Some fraction of each dollar taxed will always be absorbed in wages and salaries of the administrative bureaucracy, costs of purchasing, powering, maintaining and replacing equipment, buildings, etc., and other overhead costs. Only the remainder will actually be received by the target population in the form of cash or in kind payments…… Using government data, Woodson (1989, p. 63) calculated that, on average, 70 cents of each dollar budgeted for government assistance goes not to the poor, but to the members of the welfare bureaucracy and others serving the poor. Tanner (1996, p. 136 n. 18) cites regional studies supporting this 70/30 split. (Edwards 2007, pp. 3–4).

One issue with simply calculating the manpower costs of the “welfare bureaucracy” is to separate out the simple cash shifting function of administration from that part of the function which provides direct services—the first is more like our costs of redistribution. Nevertheless, even if the administrative costs were significantly lower than the 70/30 split, they are not negligible.

In the developing country context, the literature on targeting of transfers for poverty reduction has often remarked on the administrative costs of “fine targeting.” Caldes et al. (2006), for example, calculate the cost of making a one-unit transfer to a beneficiary, the “cost–transfer ratio” for a range of Latin American transfer programs. They find a wide range, with a low of 4% but a high of 25%, the range depending on how finely the program attempted to target the poor.

One perspective on the costs of an attempted volume of redistribution is provided by corruption. The former Indian Prime Minister Rajiv Gandhi is famously said to have remarked that only 15% of the outlay on the public food distribution system reached the poor. More formal estimates are provided by Olken (2006) for a particular program in Indonesia:

I find that corruption is substantial—the central estimate is that at least 18% of the subsidized rice in the Indonesian program I study went missing…. The estimates suggest that corruption in developing countries such as Indonesia may substantially inhibit a government’s ability to carry out redistributive programs, particularly in rural areas. (Olken 2006, p. 867).

Correspondingly on the taxation side, there is a literature on the “compliance gap” in tax revenue raising (Keen and Slemrod 2017).

The issue of fixed versus marginal costs of redistributive flows is not addressed very much in the administrative costs literature, partly because of the lack of sufficiently disaggregated data to allow allocation of costs. Caldes et al. (2006) do mention that some programs have low average costs of transfer because of economies of scale. But the general idea that managing redistribution can hit capacity constraints, and creation of new capacity will incur fixed costs before additional redistribution can be handled, needs deeper empirical investigation.

Another area for deeper investigation, this time theoretical, is the political economy interpretation of the capacity for redistribution. We need models which can make precise and test the intuition advanced in this paper that (i) greater redistribution incurs greater political cost even within a given political settlement and (ii) once that capacity is reached, a new political settlement, with its higher costs, is needed to increase the capacity for redistribution. The political economy interpretation is clearly the appropriate one for the costs of cross-group flows introduced in this paper. There is of course a significant literature on the impact of population heterogeneity on economic and distributional outcomes. Alesina et al. (1999) find lower public spending in more ethnically diverse jurisdictions in the US; Dahlberg et al. (2012) find negative effects of increase immigration on support for redistribution in Sweden; and Tabellini (2017) finds that immigrant inflow led US cities to “cut tax rates and limit redistribution.” From a different perspective, Dasgupta and Kanbur (2007) advance a theory of why cross-group flows might induce group tensions.

A central point made in this paper is that redistribution of income across income levels is also redistribution of income across sociopolitically salient groups when these groups are spread unrepresentatively across the income distribution. A focus purely on the costs of flows across income levels—micro-level individual incentive effects as in the optimum income taxation literature, or macro-level costs of managing and administering gross flows as emphasized in this paper—may prove to be incomplete and thus misleading. If greater progressivity in taxes and transfers across income levels also leads to, say, redistribution across natives and immigrants, the political costs of this will have to be borne in mind by economists in analyzing and in designing tax and transfer regimes. The framework in this paper provides a start.

A focus on the volume of redistribution, across income levels and across groups, thus opens up an important set of theoretical and empirical questions for analysis and for policy.

References

Akerlof G (1978) The economics of “Tagging” as applied to the optimal income tax, welfare programs, and manpower planning. Am Econ Rev 68(1):8–19

Alesina A, Baqir R, Easterly W (1999) Public goods and ethnic divisions. Q J Econ 114(4):1243–1284

Autor D (2014) Skills, education, and the rise of earnings inequality among the “other 99 percent”. Science 344:843–851

Caldes N, Coady D, Maluccio J (2006) The cost of poverty alleviation transfer programs: a comparative analysis of three programs in Latin America. World Dev 34(5):818–837

Collier P (2013) Exodus: How migration is changing our world. Oxford University Press

Dahlberg M, Edmark K, Lundqvist H (2012) Ethnic diversity and preferences for redistribution. J Polit Econ 120(1):41–76

Dasgupta I, Kanbur R (2007) Community and class antagonism. J Public Econ 91(9):1816–1842

Edwards JR (2007) J Libert Stud 21(2):3–20

Hoy C, Sumner A (2016) Global poverty and inequality: Is there new capacity for redistribution in developing countries? J Glob Dev 7(1):117–157

Immonen R, Kanbur R, Keen M, Tuomala M (1998) Tagging and taxing: the optimal use of categorical and income information in designing tax/transfer schemes. Economica 65(258):179–192

Kanbur R (1987) Measurement and alleviation of poverty: with an application to the impact of macroeconomic adjustment, IMF Staff Pap 34(1):60–85

Kanbur R (2017) The digital revolution and targeting public expenditure for poverty reduction. In: S. Gupta et. al. (Eds.) Digital revolutions in public finance, International Monetary Fund

Kanbur R, Muherjee D (2007) Poverty, relative to the ability to eradicate it: an index of poverty reduction failure. Econ Lett Sci Direct 97(1):52–57

Kanbur R, Tuomala M (1994) Inherent inequality and the optimal graduation of marginal tax rates (with M. Tuomala). Scand J Econ 96(2):275–282

Kanbur R, Tuomala M (2016) Groupings and the gains from targeting. Res Econ 70:53–63

Keen M, Slemrod J (2017) Optimal tax administration. IMF Working Paper WP/17/8

Miller D (2016) Strangers in Our Midst: the political philosophy of immigration. Harvard University Press, Cambridge, MA

Mirrlees JA (1971) An exploration in the theory of optimum income taxation. Rev Econ Stud 38(175–208):1971

Olken BA (2006) Corruption and the costs of redistribution: micro evidence from Indonesia. J Public Econ 90:853–870

Ravallion M (2010) Do poorer countries have less capacity for redistribution? J Glob Dev 1(2), Article 1

Stiglitz J (2017) Inequality, stagnation and market power: the need for a new progressive era. Roosevelt Institute Working Paper. Roosevelt Institute

Tabellini M (2017) Gifts of the immigrants, woes of the natives: lessons from the age of mass migration. http://economics.mit.edu/files/13646

Tanner M (1996) The end of welfare. Cato Institute, Washington, D.C

Woodson RL (1989) Breaking the poverty cycle: private sector alternatives to the welfare state. Commonwealth Foundation, Harrisburg, Penn

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Kanbur, R. (2019). On the Volume of Redistribution: Across Income Levels and Across Groups. In: Dasgupta, I., Mitra, M. (eds) Deprivation, Inequality and Polarization. Economic Studies in Inequality, Social Exclusion and Well-Being. Springer, Singapore. https://doi.org/10.1007/978-981-13-7944-4_4

Download citation

DOI: https://doi.org/10.1007/978-981-13-7944-4_4

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-7943-7

Online ISBN: 978-981-13-7944-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)