Abstract

This book addresses the impact of different input factors of production, market, consumer, and producers’ characteristics on the industrial sector’s energy demand for South Korea during the period 1970–2007. The book aims at formulating an energy demand structure for the South Korean industrial sector as a tool to enable producers and policy makers to evaluate different alternatives toward reducing energy consumption, and using energy in an efficient way. Industrial policy decision makers need to understand the importance of the energy input in the industrial production structure, in order to assess and formulate necessary measures for energy conservation.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

This book addresses the impact of different input factors of production, market, consumer, and producers’ characteristics on the industrial sector’s energy demand for South Korea during the period 1970–2007. The book aims at formulating an energy demand structure for the South Korean industrial sector as a tool to enable producers and policy makers to evaluate different alternatives toward reducing energy consumption, and using energy in an efficient way. Industrial policy decision makers need to understand the importance of the energy input in the industrial production structure, in order to assess and formulate necessary measures for energy conservation. Hence, it is required to acquire knowledge about the energy demand and its characteristics such as possible substitutability between energy as an input with the other input factors of production, and to develop a better relationship between various input factors of production and energy demand. Since some energy types such as electricity and natural gas cannot be stored, this will help to identify optimal investment in these input factors of production and for better optimization of energy consumption.

1.1 Introduction

The overall energy consumption worldwide is continuously increasing. According to the International Energy Outlook report published in 2011 by the US Energy Information Administration (EIA), the energy consumption will increase worldwide by 53 % in 2035. The total energy consumption in year 2008 was about 505 quadrillion Btu (British thermal unit). It is expected to reach 770 Btu by the year 2035 (EIA 2011). This steady increase of energy consumption will negatively affect the environment and the availability of depletable energy sources of fuel, or primary energy needed to produce energy output such as electricity.

The estimated world energy consumption by region for the period 2008–2035 is shown in Table 1.1 (The 2008 numbers are actual energy demand). This noticeable increase in energy consumption is due to the rapid economic development, industrialization, and population growth , especially in developing countries such as China and India with vast population size.

Strong economic development leads to increase in the industrial sector’s demand for energy. The industrial sector consumes at least 37 % of the total energy supply, which is relatively more energy intensive than any other major sectors including household, agriculture, and public services (Abdelaziz et al. 2011; Friedemann et al. 2010). A recent study conducted by the US Environmental Protection Agency (EPA) in 2007 revealed that 30 % of the energy consumed by the industrial and commercial premises is wasted due to inefficient way of using, and lack of risk management tools (Environmental Protection Agency EPA 2007).

Energy use efficiency is an important issue, due to limits in replacing energy as an input factor by other possible substitutable factors in the production process . Efficient use of energy may reduce the amount of fuel or primary energy needed to produce energy output such as electricity. Efficient use of energy will reduce the energy intensity , which may leads to reduction in the corresponding global emissions of air pollution and greenhouse gases (EIA 2011). A key variable of interest in a study of efficiency and productivity in the industrial sector is the energy demand. It can be considered as a significant variable in the cost structure of any industry, and an essential determinant of the level of energy demand (Allan et al. 2007; Mukherjee 2008). This book is concerned with determining the following measures:

-

1.

The overall energy demand at the industrial sector.

-

2.

The rate of technical change that causes shifts in the energy demand over time.

-

3.

The variance of energy demand and its determinants.

-

4.

The efficiency in the use of energy, given production output and industrial sector’s characteristics of South Korea.

The productivity with a single factor, such as labor or capital productivity has the advantage of simplicity. However, such measure ignores the possible substitution between input factors of production, and may cause false interpretation. The total factor productivity (TFP) is a measure of overall productivity change. It is a weighted average of each single factor of productivity growth. Hence, this study uses the TFP as a measure of productivity, and decomposes the TFP growth for the South Korean industrial sector. The TFP growth is estimated parametrically and decomposed into neutral and non-neutral technical change components. The technical emphases are on the modeling and explaining the variations in the demand for energy, and the effects of different input factors of production on the level of energy use.

1.2 The Concept of Energy Use Efficiency

Any increase in the demand for energy will lead to a corresponding increase in its price. According to EIA (2011), the crude oil price will average 100 USD per barrel for the next 20 years, it will reach more than 200 USD per barrel in 2030. This increase in the energy price according to the report is due to increase in the demand for oil and the production cost. Industrial policy decision makers need to understand the importance of the energy in the industrial production structure, in order to assess and formulate necessary measures of energy conservation. Accordingly, it is important to acquire knowledge about the energy demand and its characteristics such as the possible substitutability between energy and other input factors of production (Dargay 1983; Koetse et al. 2008).

The energy input is considered as an important factor of production in many industries. It is considered as an important source of economic growth and effectiveness in production. The efficiency in energy use has continuously improved due to increase in the use of high technology in production, and in response to increase in the price of fuel (Soytas and Sari 2009; Stern 2011). The energy sector is undergoing reforms toward using more advanced technology in generation, transmission, and distribution stages (Fukao et al. 2009). The aim of such reform is to increase energy efficiency by reducing the cost of generation and waste in transmission and distribution stages of energy (Here referring mainly to electricity as a source of energy).

Unlike normal goods where supply response is used to meet increase in demand, in the case of energy, the demand response of the market is employed to reduce increase in the demand. For example, the use of smart grid technology as part of demand response program allows for the application of price variation /discrimination by type of consumer, location, season, and hours of the day, with the aim to reduce energy consumption. Smart grid technology improves the producer’s and consumer’s ability to optimize generation and consumption of energy. A better optimization improves energy use and efficiency , which will also reduce the amount of energy generated by peak time reserve capacity at high cost, and also reduces energy consumption during peak time at high price (Heshmati 2013).

This book aims at developing a better relationship between various input factors of production and energy demand. Since some energy types such as electricity and natural gas cannot be stored, this will help to identify optimal investment in these input factors of production and a better optimization of energy consumption.

1.3 Objectives

Energy input is considered an essential factor in the manufacturing industrial production. It is also an important factor in the production process , as it can be used directly to produce final goods. The intensity of energy use in the modern production technology is a critical issue, the modern production technology is often using energy in intensive way (Stern 2011; Zahan and Kenett 2013).

Input factors of production in economic theory are often divided into two main components. The primary component, or so-called production factors, consists of non-ICT capital input and labor input, while the secondary component is the intermediate inputs which consists of factors such as materials, ICT capital, supplied services, and energy. The Energy input as an intermediate input factor influences the productivity change. Hence, efficiency in energy use will have impact on the single and multiple or total factor productivity (Dimitropoulos 2007).

The main objectives of this book are summarized as follows:

-

1.

To formulate an energy demand structure by examining the energy use in the production process in the industrial sector , particularly in the South Korean industrial sector. Special attention is given to the factors that increase the risk or variations of using more energy input in production. The elasticity of energy demand with respect to output and other input factors are studied. Structural changes in energy demand pattern is explored for the period 1970–2007.

-

2.

To investigate to what extent the energy is considered as a complement or a substitute to other input factors of production such as labor, non-ICT capital, materials, value added services, and ICT capital in the production process. The pattern of substitutability or complimentarity will be useful to assess and determine the level of energy demand.

In this book three groups of models will be estimated: A production model and two groups of energy demand models. From estimating the production model, the objective is to maximize output for given inputs, where energy is one of the key input factors of production. The models for energy demand are based on a factor requirement function (Hicks 1961; Urga and Walters 2003), where the industry’s objective is to minimize the use of energy to produce a given level of output. In the former model energy input is considered as one of the determinants of output, while in the latter model, the factor requirement function is employed to estimate the energy demand and to identify the determinants of the level of energy use.

Following the estimation of the production and factor requirement models, the South Korean industry-wide level of energy efficiency ratio is estimated by using panel data model and methodology. The efficiency is estimated relative to the best industry sector technology in a given year. The model includes estimation of production risk , or in other words variations in energy use.

1.4 Theoretical Justification

This book will mainly study and address four aspects of production, energy requirement, and efficiency in manufacturing as follows:

-

1.

Establish a relationship between production (output) and energy use.

-

2.

Investigate whether the energy demand in the South Korean industrial sector is varied (increased/decreased) through complimentarity /substitutability relations between energy and other input factors of production such as ICT capital and labor.

-

3.

Explore whether there are possible differentiations between the input compliments/substitutes to energy.

-

4.

Examine which factor(s) increase(s) or decrease(s) the demand for energy in the industrial sector, respectively. The information can be used in policy analysis and policy recommendations.

The significance of this subject is imperative to five groups of participants in the market, namely, environmental policy makers; and in its message to industrial sector’s stakeholders: The policy makers, and the regulators; and the new entrants or the investors who might be contemplating to enter the industrial sector , and finally energy consumers:

-

1.

The environmental policy makers will benefit from this study through the following:

-

a.

Identifying the factors that increase the energy demand, in which it leads to an increase in greenhouse gas emission.

-

b.

To include these enhancing factors into existing programs of energy conservation and efficiency enhancement toward lowering the greenhouse gas emission, and fossil fuel switching to use of renewable energy and programs for nuclear and carbon capture and storage.

-

a.

-

2.

The policy makers of the industrial sector’s stakeholders will benefit from this study through the following:

-

a.

Directing necessary public supports to increase the energy use efficiency , and thereby reduce the energy consumption and dependency.

-

b.

Providing necessary justifications to increase the share of renewable energy in the energy mix, as it requires policies to stimulate changes in the energy system.

-

a.

-

3.

The regulators from the industrial sector’s stakeholders may benefit from this study to introduce new or update existing regulatory frameworks regarding for example public utilities, standards for fuel economy, and provide subsidies to investors and producers of alternative fuels.

-

4.

This study can also be an input for investment decisions by new entrants to the industrial sector business in a number of ways as follows:

-

a.

To provide essential data and information in order to set up business strategies.

-

b.

To efficiently allocate the amount of energy used in the production process .

-

c.

To employ appropriate and sufficient amount of ICT capital and new technology to help in producing the same amount of production with less energy use.

-

a.

-

5.

The energy consumers especially energy intensive industries may use the information provided in this book to be able to reduce their energy consumption, to make a tradeoff between the consumed amounts of energy with consuming other factors that substitute energy. This tradeoff may lead to efficiency in their energy consumption.

The results from this study may add to the bodies of knowledge for the industrial sector especially in high energy consumed countries such as China, the US, North America, and high energy consumed countries of OECD and non-OECD, with energy intensive production structure to identify alternatives to propose strategies for low carbon economy and production structure.

In order to confront possible future energy crises, the consumption of energy should be restructured and reduced. According to Finley (2012), the largest source of increase in energy consumption is China, where it is estimated to grow up to 50 % by the year 2030 in its oil consumption. This vast growing is expected to remain in the industrial sector. China is expected to implement policies to slow the growth rate of its oil consumption. Different policies and strategies are needed to achieve the stated goal. It is necessary to know how certain factors for example ICT capital can be used to affect the level of energy use, and how to quantify and assess this impact. In the aftermath of oil crisis, Europe was able to reduce its energy use and dependency through improvement of energy use efficiency and diversification of its energy sources (Favennec 2005; Terrados et al. 2007).

In the periods of economic shocks that witness extraordinary energy price change, it is difficult to apply the traditional econometric models to explain the energy demand. Advance methods such as dynamic model specification is highly desirable, as they allow for flexibility in adjustment of the input factors in the long run (Kim and Labys 1988). Although dynamic model formulation leads to increase the complexity in modeling, estimating, and interpreting the results, it has the advantage of deriving the elasticities as well as accounting for responsive heterogeneity over time and by industry’s characteristics.

1.5 The Research Design

The research design adopted in this book is quantitative, correlational, and descriptive. It is based on existing literature of production risk and energy requirement, existing literature that construct a relationship between energy consumption or energy requirement with other input factors of production, and literature which analyze the risk related to energy demand in the production process (Apostolakis 1990; Dietmair and Verl 2009; Field and Grebenstein 1980; Frondel and Schmidt 2002; Imran and Siddiqui 2010; Kuemmel et al. 2008; Park et al. 2009; Pindyck 1979; Zahan and Kenett 2013).

The review of relevant literature, as well as other studies analogous to studies by the authors quoted above, literature on production function and Translog production function (Berndt and Wood 1975, 1979; Christensen et al. 1973; Griffin and Gregory 1976; Just and Pope 1978), literature on production risk and efficiency (Heshmati 2001; Just and Pope 1978, 1979; Kumbhakar 1997; Tveterås 2000; Tveterås and Heshmati 2002), and exploratory research through analysis of secondary data and longitudinal design, served as key inputs for the design of this study.

These studies provide knowledge of applying quantitative, correlational, and descriptive study, knowledge in applying different forms of production function, and knowledge in analyzing the production risk . Accordingly, this book is employing the knowledge gained from these studies, it is compiling all in one study. Through the use of quantitative, correlational, and descriptive approach (Johnson 2001) in order to establish a wide range of basic areas of knowledge for the dependent variables output and energy requirement, and basing it on the existing literature in determining the production and energy requirement, a correlational descriptive quantitative analysis is conducted to examine a panel data sample from a secondary data source of 25 main industries in South Korea for the period 1970–2007.

A secondary data analysis is a noticeable time and cost-effective tool of data collection. Researchers with limited funding can access huge datasets for small cost and expediency in comparison with the other means of data collection, such as a survey, in which it requires time and expensive process of planning to conduct in addition to data mining and documenting (Dale et al. 2008). The panel data for this study was collected from EUKLEMS Growth and Productivity Account database (For details about the databse, see: Mahony et al. 2009). The data was then transferred and the initial statistical analysis (descriptive statistics) is conducted. Finally, detailed analysis using SAS codes is conducted.

1.6 Empirical Motivations

The study addresses three research questions with respect to the production technology and the nature of the production uncertainty in the South Korean industrial sector. The research questions can be stated as follows:

-

1.

What is the impact of energy use on the production level in the South Korean industrial sector?

-

2.

Is there any factor substitution pattern between energy and other inputs of production in the South Korean industrial sector?

-

3.

What factor(s) affect(s) the variability of energy demand in the South Korean industrial sector?

The empirical motivation behind research question one is that there is little knowledge about the relative importance of energy in the South Korean industrial sector when it comes to industry heterogeneity and stochastic shocks such as oil shock and financial crisis (Benjamin and Meza 2009). The research question two is motivated due to the continuous debates about the fact that whether energy and other input factors, especially non-ICT capital are substitutes or compliments; the inconsistencies in the results are still controversial and need further investigation (Koetse et al. 2008; Thompson and Taylor 1995; Welsch and Ochsen 2005). The research question three is motivated by the predictions of theoretical models as depicted by (Ramaswami 1992) in comparing between risk averse and risk neutral producers, which argues that the risk averse producers tend to use less of risk increasing input factors of production, while using more input factors that have risk decreasing effects than the risk neutral producers (Wang and Webster 2007). Therefore, if the producers in the South Korean industrial sector are risk averse, then the risk properties of input are of interest.

These research questions and their related hypotheses will be tested based on panel data estimation for 25 main industries in South Korea for the period 1970–2007. In addition, several other determinants of energy use level and efficiency will be identified and their impacts will be estimated. The differences in the responsiveness to other determinants by industry can be exploited for the purpose of policy analysis.

1.7 Assumptions and Limitations

This section outlines the following types of assumptions made to complete the book as follows: Methodological assumptions, theoretical assumptions, topic-specific assumptions, and assumptions about instruments used in the empirical estimation. The limitations of the design illustrate the boundaries of the study, and its generalizability to other factors of production, economic sectors, and countries.

1.7.1 Energy Price

The energy policy of the South Korean government aims at securing energy supply at low cost. The price of electricity, gas, and fuel are highly regulated by the government. Hence, the variable of price may fail to act as an applicable indicator for both demand and supply side of consumers and producers responses to price changes. The energy demand will be determined by supply constraint not by the ordinary low of supply and demand. Countries such as South Korea that heavily rely on import for their energy use are mostly incorporating non-market based mechanisms, rather than energy price to stabilize their local energy market (Cho et al. 2004; Kim and Labys 1988).

1.7.2 Methodological and Theoretical Assumptions

Some specific assumptions are needed in order to formulate the production and factor requirement models. The explanatory variables used to formulate the models are assumed to be independent from each other, but highly correlated with the dependent variable. In other words, the relative input factor demands are assumed to be independent of the output (production) level.

Another assumption is related to the variable materials, which is assumed to be weakly separable from the other input factors (i.e. non-ICT capital, labor, value added services, energy, and ICT capital).

Moreover, in this study it is assumed that industries are maximizing their profits through maximizing production output and minimizing the inputs used in the production, in other words, hiring the optimal input to minimize the production cost of producing a given amount of output. These assumptions permit the construction of energy requirement function.

1.8 Operational Definitions

Different terms are used throughout this book, a brief definition for each of these terms is provided as follows (definitions are listed in alphabetical order):

-

1.

Allocative Efficiency: The allocative efficiency is defined by Heshmati (2003) as a firm’s capability to equate the marginal cost with its marginal value of product.

-

2.

Btu: An acronym for British thermal unit, it is used to measure energy consumption and defined as an amount of energy required to heat one pound of water by one degree of Fahrenheit.

-

3.

Coefficient of Determination: A measure used in the regression analysis often knows as R-square (R2), it measures the proportion of the variability in the response that is explained by the explanatory variables. It can be defines as 1-(SSE/SST) where SSE is the residual (error) sum of squares and SST is the total sum of squares that is corrected for the mean (Wooldridge 2006).

-

4.

Cross Price Elasticity of Demand: It is defined as the change in energy demand with respect to change in price of substitutes (Allen et al. 2009):

$$E_{PS} = \frac{\varDelta E}{\varDelta PS}{\cdot}\frac{PS}{E} = \frac{{{\raise0.7ex\hbox{${E_{t} }$} \!\mathord{\left/ {\vphantom {{E_{t} } {E_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${E_{t - 1} }$}}}}{{{\raise0.7ex\hbox{${PS_{t} }$} \!\mathord{\left/ {\vphantom {{PS_{t} } {PS_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${PS_{t - 1} }$}}}}{\cdot}\frac{PS}{E}$$(1.1)where E PS is the cross price elasticity of demand, E, E t , and E t−1 are energy variable, energy variable at time t, and energy variable at time t−1, respectively, PS, PS t , and PS t−1 are price of substitutes, price of substitutes at time t, and price of substitutes at time t−1, respectively. \(\varDelta E\) and \(\varDelta PS\) are changes from time t−1 to time t for energy and price of substitutes, respectively.

If the measure above is positive, the two goods are said to be substitutes. The demand for energy increases as the price of the other goods increase. While a negative cross price elasticity implies that goods are complements , the demand for energy decreases if the prices of other goods increase.

-

5.

Cross Price Elasticity of Substitution: It is another measure used for the degree of substitutability between input factors of production. It measures a proportional change in quantity of input factor. It is a change that results from changes in the price of other input factors used in production. This measure is more appropriate for policy issues in comparison to the partial elasticity of substitution’s measure (Saicheua 1987).

-

6.

Efficiency: Is a measure of the firm’s ability to produce output in comparison to firms with the best practice technology.

-

7.

Economic Efficiency: Is a measure of overall efficiency which is decomposed into technical and allocative efficiency components. It is measured as the product of the two components (Heshmati 2003).

-

8.

Firm Performance: The firm’s performance is a concept depending on economic efficiency, in which it consists of two parts, technical efficiency and allocative efficiency (Heshmati 2003).

-

9.

F-test: A statistical test used to evaluate a model’s performance to test whether one or more explanatory variables used in the model is contributing to the model’s explanation of the dependent variable. It can be also used to compare two models when one model is a special case (nested model) of the other model (Lomax 2007).

-

10.

Inefficiency : Is a measure of percentage degree of inability to produce output compared with the firm that has the best practice technology.

-

11.

Multicollinearity: A statistical phenomenon often used when the explanatory variables that are needed to construct a regression model is linearly related with each other. A regression model with high correlation between two or more explanatory variables is suffering from multicollinearity problem. In the presence of multicollinearity, the estimated coefficients will be sensitive to any change in the model specification or in the data; hence, the predicted estimates will not be efficient in predicting the outcome of the model (O’Mahony and Timmer 2009; O’brien 2007; Wheeler and Tiefelsdorf 2005; Wooldridge 2006).

-

12.

MSE: Mean square error, it is the variance of the error term calculated as the proportion of the residual sum of squares (SSE) to the degree of freedom defined as the difference between the number of observations and the number of parameters. MSE can be expressed as SSE/(n−k), where n is the number of observations and k is the number of parameters (Lomax 2007). The standard deviation of the dependent variable can then be calculated taking the square root of MSE and is defined as Root MSE.

-

13.

Output Elasticity of Energy Demand: The output elasticity of energy demand is a measure that explains the change in energy demand as a response to change in total production (Allen et al. 2009):

$$E_{Y} = \frac{\varDelta E}{\varDelta Y}{\cdot}\frac{Y}{E} = \frac{{{\raise0.7ex\hbox{${E_{t} }$} \!\mathord{\left/ {\vphantom {{E_{t} } {E_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${E_{t - 1} }$}}}}{{{\raise0.7ex\hbox{${Y_{t} }$} \!\mathord{\left/ {\vphantom {{Y_{t} } {Y_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Y_{t - 1} }$}}}}{\cdot}\frac{Y}{E}$$(1.2)where E y is the output elasticity of energy demand, Y, Y t , and Y t−1 are output variable, output at time t, and output at time t−1. E, E t , and E t−1 are energy variable, energy variable at time t, and energy variable at time t−1. \(\varDelta E\) and \(\varDelta Y\) are changes from time t−1 to time t for energy and output, respectively.

Ey is positive in general because any increase in total output implies that more input is demanded. 1/Ey (inverse) indicates returns to scale . An inverse value less than one indicates an increasing return to scale, while a value higher than one indicates a decreasing returns to scale (Kumbhakar et al. 1997).

-

14.

Outsourcing: It measures the amount of goods and services produced previously in-house that are outsourced to outside suppliers Heshmati (2003).

-

15.

Productivity: The productivity of a firm is defined as the ratio of the output produced to the input used to produce the output, i.e. Productivity = Output/Input. As emphasized by Coelli and Battese (1998), this relationship is simple to obtain when the production process involves only one output produced by a single input. For multiple inputs used to produce one or more units of outputs then the requirement to obtain a measure of productivity relation is that the inputs should be aggregated to obtain one single index of input. The most known factor productivities are labor and energy.

-

16.

Production Possibilities Frontier (PPF): The production frontier is defined as a graph that shows all possible combinations of simultaneous produced goods in a given time period assuming all other factors held constant (Kumbhakar and Lovell 2000).

-

17.

Partial Elasticity of Substitution: A measure used for the degree of substitutability between input factors of production. It was first found by Allen (1938). It measures the proportionate change in the relative input factors shares that caused by the proportionate changes in the relative price of these factors (Knut and Hammond 1995; Saicheua 1987).

-

18.

Price Elasticity of Energy Demand: This can be explained as a measure of how a change in price of energy will change the amount of energy used in the production. If the measure is greater than one, the demand is elastic, which means the higher the energy price, the more energy demand is reduced; less than one then the demand is inelastic, the higher the energy price, the less of energy demand will be reduced; or equal to one, which means unit elastic (Allen et al. 2009). Mathematically, the price elasticity of energy demand called often own price elasticity and can be expressed as follows:

$$E_{PE} = \frac{\varDelta E}{\varDelta P}{\cdot}\frac{P}{E} = \frac{{{\raise0.7ex\hbox{${E_{t} }$} \!\mathord{\left/ {\vphantom {{E_{t} } {E_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${E_{t - 1} }$}}}}{{{\raise0.7ex\hbox{${P_{t} }$} \!\mathord{\left/ {\vphantom {{P_{t} } {P_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${P_{t - 1} }$}}}}{\cdot}\frac{P}{E}$$(1.3)where E PE is the price elasticity of energy demand, P, P t , and P t−1 are price variable, price at time t, and price at time t−1. E, E t , and E t−1 are energy variable, energy variable at time t, and energy variable at time t−1. \(\varDelta E\) and \(\varDelta P\) are changes from time t−1 to time t for energy and price, respectively. The sign in general is negative as the demand curve is used to have a negative slope, implying an increase in energy price reduces demand for energy. If the variable E and P are expressed in logarithms, the elasticity is directly interpretable as percentage change in demand in response to a percent increase in price of energy without the second component ratio. It can be expressed as:

$${\text{E}}_{\text{PE}} = \frac{{\partial {\text{lnE}}}}{{\partial {\text{lnP}}}}$$(1.4) -

19.

The Rate of Technical Scale: It is defined by Strassmann (1959) as the productivity’s rate of change resulted from changes in the production technology or technique. It measures increase in production from proportional (1 %) increase in all inputs. The measure equals to one, less than one or higher than one indicates constant, decreasing, or increasing returns to scale , respectively.

-

20.

toe: An acronym for ton of oil equivalent, it is used to measure energy consumption , an amount of energy released by burning one ton of crude oil, 1 toe = 39.68320 million Btu (EIA n.d.).

-

21.

Total Factor Productivity (TFP): Is the productivity involving all the input factors to produce the output. Technical changes, scale, and technical efficiency are considered important components of TFP. In other words the TFP can be decomposed into measures of technical change, scale, and technical efficiency components (Lovell 1996).

-

22.

Technical Changes: It is defined as a shift in the production function (Solow 1957), and hence, in the production frontier. If the technological change results in producing more output with the same given inputs, then the production is said to be subjected to technical progress. On the other hand, if the technological change leads to lower the production given the same amount of inputs, then it is defined as being subjected to technical regress (Lovell 1996). The technical change can be decomposed into two components: Pure technical change which depends on only time, and non-neutral technical change, which is affected by changes in inputs over time (Kumbhakar et al. 2002).

-

23.

Technical Efficiency (TEF): According to Koopmants (1951) definition, the technical efficiency is the firm’ ability to minimize the level of inputs used for producing a given amount of output. Hence a firm’s production said to be technically inefficient if it fails to maximize its output with the given inputs in production (Coelli and Battese 1998; Timmer 1971).

-

24.

Total Factor Productivity Growth: It is defined as annual growth rate (for example in an output variable like GDP for a country or output for a firm over time). It comes from changes in technology and in inputs utilization. Changes in technology increase productivity for a given input and positive changes in specific input increases output (Sahu and Narayanan 2011). The TFP growth can be decomposed into several components. In the case of this study, it will be decomposed into two: Technical change and scale components. Technical change is the derivative of output with respect to time or to shift in the production function over time. The technical change has two components: Neutral, which depends on only time, and non-neutral, which depends on changes in the level of inputs. When time elapses and technology changes, the intensity in the use of inputs will change as well (like energy saving, or capital using). The scale component is due to deviation from the constant returns to scale RTS (if all inputs are increased by 1 %, output increases by 1 %). If the RTS is less than unity, TFP decreases, while it will increase if RTS is bigger than unity (Heshmati 1996).

-

25.

Time Elasticity of Demand: It measures how changes in some factors such as technology lead to change in energy demand (Allen et al. 2009). Mathematically, it can expressed as follows:

$$E_{t} = \frac{\varDelta E}{\varDelta T} \cdot \frac{T}{E} = \frac{{E_{t} /E_{t - 1} }}{{T_{t} /T_{t - 1} }} \cdot \frac{T}{E}$$(1.5)Here in the absence of a true measure of technology, time represents un-specified technology, it is interpreted as rate of technical change. If positive, changes in technology increase the demand for energy, while if negative, changes in technology decrease the demand for energy. In general, technology development progresses postulate that technology is energy saving, meaning for the same level of output less energy is expected to be used in production, or alternatively for the same level of energy input more output is produced.

1.9 Expected Outcome

The expected result from this study is to provide the industrial sector’s stakeholders, and environmental and industrial policy makers with a flexible model that has the capacity to assess outcomes of various policies under certain scenarios. Through the use of the developed models, they will be able to identify the factors that affect the level of energy use and output and their effectiveness. Better policies and regulations are expected to be derived concerning energy use, efficiency programs, and greenhouse gas emission issues.

1.10 The Structure of the Book

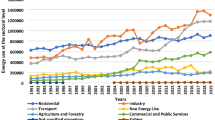

This book is organized into 11 chapters. It is organized as a monograph consisting of chapters that are interrelated and sequentially developed into a final product. Following this introductory chapter which provided a general overview, Chap. 2 provides details about the energy consumptions in the industry sector and their development over time, focusing on the energy consumption in the South Korean industrial sector, and sheds lights on the energy intensity and energy use efficiency programs, it further provides detail descriptions of the current status of the energy demand in the South Korean industrial sector.

Chapters 3 and 4 review the relevant literature pertaining to this study. They are divided into sections include inter-factor substitutability and complementarity, literature on energy efficiency, the theory of firm behavior under production risk, and previous literature concern the production risk estimation, as well as research paradigm assumption and theoretical ordination of the study.

Chapter 5 provides the methodology applied in this study. It discusses econometric issues in estimating panel data with production and energy requirement models. It discusses the advantages, disadvantages, and limitations of panel data sets. Industry heterogeneity and heteroskedasticity issues related to panel data are also discussed in this chapter. The methodological focus will be on the specification of heteroskedastic panel data models, and the assessment of their performance compared with homoskedastic panel data models and heteroskedastic production models that ignore firm heterogeneity . The chapter then elaborates with the issues of the econometric model specification, model estimation, testing for functional forms , and regularity conditions.

For a matter of sensitivity analysis, three groups of models are estimated and compared as follows:

-

1.

A production model where energy is a key input factor in the production process .

-

2.

A factor requirement function (or so called energy demand model) is estimated, where the output is considered as one of the determinants of energy use.

-

3.

The factor requirement function is estimated by accounting for risk or variations in the demand for energy.

For each of these three models, two nested and frequently used functional forms Cobb-Douglas and Translog forms are used. Since the Translog model is flexible, it will allow for non-linearity in model specification (Berndt and Wood 1975; Christensen et al. 1973; Griffin and Gregory 1976), and allows to draw inference on substitutability and complementary relationship between input factors of production. Significant statistical tests are conducted to choose among the best functional forms . This book based on the theory of production and energy consumption utilizes a panel data approach with descriptive statistics to identify and define the specific independent variables that significantly relate to the dependent variables output and the energy requirement, respectively. The study focuses on 25 South Korean main industries. The utilized method in the case of energy requirement model provides a statistical investigation of the relationship between the independent variables of non-ICT capital, labor, materials, value added services, ICT capital, output level, and energy price, where the dependent variables is the energy requirement.

Chapter 6 describes the data used for the empirical methodology of this book. It then provides information about population and sampling strategy, research instruments, discussion of the data collection procedures, and the logistics of the different data sources. It further introduces basic analysis based on raw data. It starts with a presentation of descriptive statistics of the data, and analyzes the energy intensity based on the raw data.

Chapter 7 provides a description of the production process. It provided details about the estimation procedure of production function when the energy variable is considered as one of the input factors of production.

Chapter 8 deals with the energy demand model without risk consideration. The model is constructed and specified in two forms: Cobb-Douglas and Translog functional to allow for consistency and comparability. The Translog production function is used to measure elasticities of substitution, technical change , and total factor productivity growth.

Chapter 9 describes the risk model structure in the South Korean industrial sector. It proposes a new structure and magnitude of production risk in the South Korean industrial sector for the period 1970–2007 by means of estimation of energy demand model. Since efficiency analysis and analysis of industry behavior under risk aversion require knowledge about the conditional mean and variance of output, this chapter investigates both the mean production function and the variance production function. This has mainly been achieved through the estimation of Just and Pope model.

Chapter 10 provides conclusion for this study by summarizing the estimated models and discussion on implications of the results. In addition, policy recommendations and suggestions for further and future research related to energy demand are provided. Chapter 11 concludes this study by providing overall summary.

1.11 Summary

The overall consumption of energy worldwide is continuously increasing. The energy consumption will increase worldwide by 53 % in 2035. This increase in the energy demand will negatively affect the environment and the availability of depletable energy sources of fuel, or primary energy needed to produce energy output such as electricity.

Strong economic development leads to increase in the industrial sector’s demand for energy. The industrial sector consumes at least 37 % of the total energy supply, which is relatively more energy intensive than any other major sectors including household, agriculture, and public services.

The increase in the demand for energy leads to increase in its price. This increase is attributed to increase in the demand for oil and in the production cost. Industrial policy decision makers need to understand the importance of the energy in the industrial production structure in order to assess and formulate necessary energy conservation measures. Efficient use of energy will reduce the energy intensity , which may contribute to reduction in the corresponding global emissions of air pollution and greenhouse gases.

This book addresses the econometric specification and estimation of stochastic production technologies when a panel data set is available. It will study and address mainly four aspects of production, energy requirement, and efficiency in manufacturing, First, It will establish a relationship between production (output) and energy use. Second, it will investigate whether the energy demand in the industrial sector in South Korea is varied (increased/decreased) through complimentarity /substitutability between energy and other input factors of production such as ICT capital and labor. Third, it will explore whether there are possible differentiations between the input compliments/substitutes to energy, and finally, it will examine which factor(s) increase(s) or decrease(s) the demand for energy in the industrial sectors , respectively. The information can be used in policy analysis and policy recommendations.

The expected result for this study is to provide the industrial sector’s stakeholders and environmental and industrial policy makers with a flexible model that has the capacity to assess outcomes of various policies under certain scenarios.

References

Abdelaziz, E. A., Saidur, R., & Mekhilef, S. (2011). A review on energy saving strategies in industrial sector. Renewable & Sustainable Energy Reviews, 15(1), 150–168. doi:10.1016/j.rser.2010.09.003.

Allan, G., Hanley, N., McGregor, P., Swales, K., & Turner, K. (2007). The impact of increased efficiency in the industrial use of energy: A computable general equilibrium analysis for the United Kingdom. Energy Economics, 29(4), 779–798. doi:10.1016/j.eneco.2006.12.006.

Allen, R. G. D. (1938). Mathematical analysis for economists. New York, USA: St. Martin’s Press.

Allen, W. B., Weigelt, K., Doherty, N., & Mansfield, E. (2009). Managerial economics: Theory, applications, and cases. New York, USA: Norton.

Apostolakis, B. E. (1990). Energy-capital substitutability/complementarity. Energy Economics, 12(1), 48–58. doi:10.1016/0140-9883(90)90007-3.

Benjamin, D., & Meza, F. (2009). Total factor productivity and labor reallocation: The case of the Korean 1997 crisis. B E Journal of Macroeconomics, 9(1), 1–39. doi:10.2202/1935-1690.1625.

Berndt, E. R., & Wood, D. O. (1975). Technology, prices, and the derived demand for energy. The Review of Economics and Statistics, 57(3), 259–268.

Berndt, E. R., & Wood, D. O. (1979). Engineering and econometric interpretations of energy-capital complementarity. American Economic Review, 69(3), 342–354.

Cho, W. G., Nam, K., & Pagan, J. A. (2004). Economic growth and interfactor/interfuel substitution in Korea. Energy Economics, 26(1), 31–50. doi:10.1016/j.eneco.2003.04.001.

Christensen, L. R., Jorgenson, D. W., & Lau, L. J. (1973). Transcendental logarithmic production frontiers. The Review of Economics and Statistics, 55(1), 28–45. doi:10.2307/1927992.

Coelli, T., & Battese, R. D. G. (1998). An introduction to efficiency and productivity analysis. London, England: Kluwer Academic Publisher.

Dale, A., Wathan, J., & Higgins, V. (2008). Secondary analysis of quantitative data sources. In P. Alasuutari, L. Bickman, & J. Brannen (Eds.), The sage handbook of social research methods (pp. 520–535). London: Sage.

Dargay, J. M. (1983). The demand for energy in Swedish manufacturing-industries. Scandinavian Journal of Economics, 85(1), 37–51. doi:10.2307/3439909.

Dietmair, A., & Verl, A. (2009). A generic energy consumption model for decision making and energy efficiency optimisation in manufacturing. International Journal of Sustainable Engineering, 2(2), 123–133. doi:10.1080/19397030902947041.

Dimitropoulos, J. (2007). Energy productivity improvements and the rebound effect: An overview of the state of knowledge. Energy Policy, 35(12), 6354–6363. doi:10.1016/j.enpol.2007.07.028.

EIA. (2011). International Energy Outlook. U.S. Energy Information Administration. Retrieved from EIA http://www.eia.gov/forecasts/ieo/pdf/0484(2011).pdf.

EIA. (n.d.). International Energy Statistics-Units. U.S. Energy Information Administration. Retrieved from EIA http://www.eia.gov/cfapps/ipdbproject/docs/unitswithpetro.cfm.

EPA. (2007). Energy Trends in Selected Manufacturing Sectors: Opportunities and Challenges for Environmentally Preferable Energy Outcomes. Enviromental Protection Agency. Retrieved from EPA http://www.epa.gov/sectors/pdf/energy/report.pdf.

Favennec, J. P. (2005). Oil and natural gas supply for Europe. Catalysis Today, 106(1–4), 2–9. doi:10.1016/j.cattod.2005.07.171.

Field, B. C., & Grebenstein, C. (1980). Capital-energy substitution in U.S. manufacturing. The Review of Economics and Statistics, 62(2), 207. doi:10.2307/1924746.

Finley, M. (2012). The oil market to 2030: Implications for investment and policy. Economics of Energy and Environmental Policy, 1(1), 25–36.

Friedemann, M., Staake, T., & Weiss, M. (2010). Ict for green: How computers can help us to conserve energy. Paper presented at the proceedings of the 1st international conference on energy-efficient computing and networking, Passau, Germany.

Frondel, M., & Schmidt, C. M. (2002). The capital-energy controversy: An artifact of cost shares? Energy, 23(3), 53–79.

Fukao, K., Miyagawa, T., & Pyo, H. K. (2009). Estimates of multifactor productivity, ICT contributions and resource reallocation effects in japan and korea. RIETI Discussion Paper Series 09-E-021. Retrieved from The Research Institute of Economy, Trade and Industry http://www.rieti.go.jp/jp/publications/dp/09e021.pdf.

Griffin, J. M., & Gregory, P. R. (1976). An intercountry translog model of energy substitution responses. The American Economic Review, 66(5), 845–857. doi:10.2307/1827496.

Heshmati, A. (1996). On the single and multiple time trends representation of technical change. Applied Economics Letters, 3(8), 495–499. doi:10.1080/135048596356104.

Heshmati, A. (2001). Labour demand and efficiency in Swedish savings banks. Applied Financial Economics, 11(4), 423–433. doi:10.1080/096031001300313983.

Heshmati, A. (2003). Productivity growth, efficiency and outsourcing in manufacturing and service industries. Journal of Economic Surveys, 17(1), 79–112. doi:10.1111/1467-6419.00189.

Heshmati, A. (2013). Demand, customer base-line and demand response in the electricity market: A survey. Journal of Economic Surveys, n/a–n/a. doi:10.1111/joes.12033.

Hicks, J. R. (1961). Marshall’s third rule: A further comment. Oxford Economic Papers, 13(3), 262–265.

Imran, K., & Siddiqui, M. M. (2010). Energy consumption and economic growth: A case study of three SAARC countries. European Journal of Social Sciences, 16(2), 206–213.

Johnson, B. (2001). Toward a new classification of nonexperimental quantitative research. Educational Researcher, 30(2), 3–13.

Just, R. E., & Pope, R. D. (1978). Stochastic specification of production functions and economic implications. Journal of Econometrics, 7(1), 67–86. doi:10.1016/0304-4076(78)90006-4.

Just, R. E., & Pope, R. D. (1979). Production function estimation and related risk considerations. American Journal of Agricultural Economics, 61(2), 276–284. doi:10.2307/1239732.

Kim, B. C., & Labys, W. C. (1988). Application of the translog model of energy substitution to developing-countries—the case of Korea. Energy Economics, 10(4), 313–323. doi:10.1016/0140-9883(88)90043-6.

Knut, S., & Hammond, P. (1995). Mathematics for economic analysis. Prentice Hall.

Koetse, M. J., de Groot, H. L. F., & Florax, R. J. G. M. (2008). Capital-energy substitution and shifts in factor demand: A meta-analysis. Energy Economics, 30(5), 2236–2251. doi:10.1016/j.eneco.2007.06.006.

Koopmants, T. C. (1951). An analysis of production as an efficient combination of activities. In T. C. Koopmants (Ed.), Activity analysis of production and allocation (pp. 33–97). New York: USA Wiley.

Kuemmel, R., Stresin, R., Lindenberger, D., & Journal, B. (2008). Co-integration of output, capital, labor and energy. The European Physical, 66(2), 279–287.

Kumbhakar, S. C. (1997). Efficiency estimation with heteroscedasticity in a panel data model. Applied Economics, 29(1 SRC—GoogleScholar), 379–386.

Kumbhakar, S. C., Heshmati, A., & Hjalmarsson, L. (1997). Temporal patterns of technical efficiency: Results from competing models. International Journal of Industrial Organization, 15(5), 597–616. doi:10.1016/S0167-7187(96)01053-3.

Kumbhakar, S. C., Hjalmarsson, L., & Heshmati, A. (2002). How fast do banks adjust? A dynamic model of labour-use with an application to Swedish banks. Journal of Productivity Analysis, 18(1), 79–102.

Kumbhakar, S. C., & Lovell, C. A. K. (2000). Stochastic frontier analysis. Cambridge: U. K.

Lomax, R. G. (2007). Statistical concepts: A second course for education and the behavioral sciences (3rd ed.). Lawrence Erlbaum Associates: Mahwah, NJ.

Lovell, C. A. K. (1996). Applying efficiency measurement techniques to the measurement of productivity change. Journal of Productivity Analysis, 7(2–3), 329–340.

Mahony, M., Timmer, M. P., & Klems, U. E. (2009). Output, input and productivity measures at the industry level. 119(538 SRC—GoogleScholar), F374–F403.

Mukherjee, K. (2008). Energy use efficiency in U.S. manufacturing: A nonparametric analysis. Energy Economics, 30(1), 76–96. doi:10.1016/j.eneco.2006.11.004.

O’Mahony, M., & Timmer, M. P. (2009). Output, input and productivity measures at the industry level: The EU KLEMS database. The Economic Journal, 119(538), F374–F403. doi:10.1111/j.1468-0297.2009.02280.x.

O’brien, R. M. (2007). A caution regarding rules of thumb for variance inflation factors. Quality & Quantity, 41(5), 673–690. doi:10.1007/s11135-006-9018-6.

Park, C., Kwon, K., Kim, W., Min, B., Park, S., Sung, I., & Seok, J. (2009). Energy consumption reduction technology in manufacturing—A selective review of policies, standards, and research. International Journal of Precision Engineering and Manufacturing, 10(5), 151–173. doi:10.1007/s12541-009-0107-z.

Pindyck, R. S. (1979). Interfuel substitution and the industrial demand for energy: An international comparison. The Review of Economics and Statistics, 61(2 SRC—GoogleScholar), 169–179.

Ramaswami, B. (1992). Production risk and optimal input decisions. American Journal of Agricultural Economics, 74(4), 860–869. doi:10.2307/1243183.

Sahu, S. K., & Narayanan, K. (2011). Total factor productivity and energy intensity in Indian manufacturing : A cross-sectional study. International Journal of Energy Economics and Policy, 1(2 SRC—GoogleScholar), 47–58.

Saicheua, S. (1987). Input substitution in Thailand’s manufacturing sector: Implications for energy policy. Energy Economics 9(1 SRC—GoogleScholar), 55–63.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39(3), 312–320. doi:10.2307/1926047.

Soytas, U., & Sari, R. (2009). Energy consumption, economic growth, and carbon emissions: Challenges faced by an EU candidate member. Ecological Economics, 68(6), 1667–1675. doi:10.1016/j.ecolecon.2007.06.014.

Stern, D. I. (2011). The role of energy in economic growth. Annals of the New York Academy of Sciences, 1219(1), 26–51. doi:10.1111/j.1749-6632.2010.05921.x.

Strassmann, W. P. (1959). Interrelated industries and the rate of technological-change. Review of Economic Studies, 27(72–7), 16–22. doi:10.2307/2296047.

Terrados, J., Almonacid, G., & Hontoria, L. (2007). Regional energy planning through SWOT analysis and strategic planning tools: Impacts on renewable development. Renewable and Sustainable Energy Reviews, 11(1), 1275–1287.

Thompson, P., & Taylor, T. G. (1995). The capital-energy substitutability debate: A new look. The Review of Economics and Statistics, 77(3), 565–569. doi:10.2307/2109916.

Timmer, C. P. (1971). Using a probabilistic frontier production function to measure technical efficiency. Journal of Political Economy, 79(4), 776–794. doi:10.1086/259787.

Tveterås, R. (2000). Flexible panel data models for risky production technologies with an application to Salomon aquaculture. Journal of Econometric Reviews, 19(3 SRC—GoogleScholar), 367–389.

Tveterås, R., & Heshmati, A. (2002). Patterns of productivity growth in the norwegian salmon farming industry. International Review of Economics and Business, 2(3), 367–393.

Urga, G., & Walters, C. (2003). Dynamic translog and linear logit models: a factor demand analysis of interfuel substitution in US industrial energy demand. Energy Economics, 25(1), 1–21. doi:10.1016/S0140-9883(02)00022-1.

Wang, C. X., & Webster, S. (2007). Channel coordination for a supply chain with a risk-neutral manufacturer and a loss-averse retailer. Decision Sciences, 38(3), 361–389. doi:10.1111/j.1540-5915.2007.00163.x.

Welsch, H., & Ochsen, C. (2005). The determinants of aggregate energy use in West Germany: factor substitution, technological change, and trade. Energy Economics, 27(1), 93–111. doi:10.1016/j.eneco.2004.11.004.

Wheeler, D., & Tiefelsdorf, M. (2005). Multicollinearity and correlation among local regression coefficients in geographically weighted regression. Journal of Geographical Systems, 7(2), 161–187. doi:10.1007/s10109-005-0155-6.

Wooldridge, J. M. (2006). Introductory Econometrics: A modern approach (4th ed.). Michigan State University.

Zahan, M., & Kenett, R. S. (2013). Modeling and forecasting energy consumption in the manufacturing industry in South Asia. International Journal of Energy Economics and Policy, 2(1), 87–98.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

Khayyat, N.T. (2015). Overview. In: Energy Demand in Industry. Green Energy and Technology. Springer, Dordrecht. https://doi.org/10.1007/978-94-017-9953-9_1

Download citation

DOI: https://doi.org/10.1007/978-94-017-9953-9_1

Published:

Publisher Name: Springer, Dordrecht

Print ISBN: 978-94-017-9952-2

Online ISBN: 978-94-017-9953-9

eBook Packages: EnergyEnergy (R0)