Abstract

This paper presents a bi-objective stochastic optimization problem of supplier selection and customer orders scheduling in the presence of major disruption risks. The supplies are subject to independent random local disruptions of each supplier individually and regional disruptions of all suppliers in the same geographic region simultaneously. Given a set of customer orders for products, the decision maker allocates the demand for parts among certified suppliers and schedules the orders over the planning horizon, to optimize expected cost and expected customer service level. The obtained combinatorial stochastic optimization problem is formulated as a mixed integer program with weighted-sum aggregation of the two conflicting objective functions. Numerical examples and some computational results are presented.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

In global supply chain networks a variety of conflicting optimality criteria should be simultaneously considered to optimize material flows. In view of the global competition and the flow disruption risks, a crucial issue becomes how to best schedule the flows with reduced cost and higher customer service level, e.g., (Sawik 2011). In particular, the selection of part suppliers and allocation of order quantities may have a great impact on the performance of global supply chain networks in the presence of unexpected disruption events. For example, in (Gurnani et al. 2012; Berger and Zeng 2006; Yu et al. 2009) the various impacts of supply disruption risks on the choice between single, dual, multiple and contingent sourcing strategies were considered. The performance of a customer driven supply chain under major disruption risks may be significantly improved by the coordinated selection of part suppliers and scheduling of customer orders.

The major contribution of this paper is that it presents a bi-objective selection of supply portfolio and scheduling of customer orders in a customer driven supply chain under disruption risks, to optimize the two conflicting objectives: expected cost and expected customer service level. The supplies of parts are subject to independent random local and regional disruptions. The cost includes the cost of ordering, purchasing and shortage of parts, while the customer service level is defined as the fraction of customer demand, fulfilled on or before customer requested due dates.

The stochastic mixed integer programming model proposed is based on the stochastic optimization approach presented in (Sawik 2013, 2014a, 2014b) for a single-objective problem of integrated supplier selection, order quantity allocation and customer orders scheduling under disruption risks.

The paper is organized as follows. The description of the integrated selection of supply portfolio and scheduling of customer orders with multiple suppliers subject to independent local and regional disruptions is presented in Sect. 2. The stochastic mixed integer program for the efficient optimization of expected cost and customer service level is described in Sect. 3. Numerical examples and some computational results are provided in Sect. 4, and final conclusions are made in the last section.

2 Problem Description

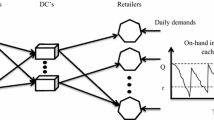

Consider a customer driven supply chain in which various types of products are assembled by a single producer to meet customer orders, using the same critical part type that can be manufactured and provided by many suppliers.

Let \(I=\{1,\\ldots{}~M\}\) be the set of M certified suppliers, \(J=\{1,\\ldots{}~N\}\) the set of N customer orders for products and \(T=\{1,\\ldots{}~H\}\) the set of H planning periods. Denote by b j and d j , respectively the size and the due date of customer order \(j\in J.\)Let a j be the unit requirement for the critical part of each product in customer order \(j\in J.\)The total demand for parts is, \(A=\sum_{j\in J}{ajbj},\) and the total demand for products is, \(B=\sum_{j\in J}{bj}.\)

The orders for parts are assumed to be placed at the start of the planning horizon, when all customer orders for products are known. Let o i be the unit purchasing price of parts from supplier \(i\in I\) and denote by e i the fixed ordering cost of creating contracts and maintaining relationships with supplier \(i\in I.\) Assume that the suppliers are located in a number of disjoint geographic regions and denote by \({{I}^{r}}\subseteq I\) the subset of suppliers in region \(r\in R.\)

The supplies are subject to independent random local disruptions of each supplier individually and regional disruptions of all suppliers in the same geographic region simultaneously. Denote by p i the local disruption probability for supplier \(i\in I\)and by p r the probability of regional disruption of all suppliers \(i\in {{I}^{r}}\) in region \(r\in R.\) The regional disasters in each region and the local disasters at each supplier are assumed to be independent events. Let \(S=\{1,\\ldots{}~q\}\) be the index set of all disruption scenarios, where each scenario is comprised of a unique subset \({{I}_{s}}\subseteq I\) of suppliers who deliver parts without disruptions. All potential disruption scenarios, \(q={{2}^{M}},\) will be considered. For each scenario \(s\in S,\) the supplies from every supplier, \(i\in I\backslash {{I}_{s}},\) can be disrupted either by a local or by a regional disaster event. The formula for probability P s for disruption scenario \(s\in S\) with the subset I s of non-disrupted suppliers was developed in (Sawik 2014b).

The producer can be charged with a contractual, order specific penalty cost for delayed or unfulfilled customer orders, caused by the shortage of parts, that are delivered late or not at all due to supply disruptions. Let g j and h j be, respectively the per unit and per period penalty cost of delayed customer order \(j\in J\) and the per unit total penalty cost of unfulfilled customer order \(j\in J.\)

The problem objective is to allocate the total demand for parts among a subset of selected suppliers and to schedule the customer orders for products over the planning horizon to minimize the weighted-sum of normalized expected cost of ordering, purchasing and shortage of parts and normalized expected customer service level.

3 Problem Formulation

In this section the weighted-sum mixed integer programming model is proposed for the bi-objective supplier selection and customer order scheduling to optimize expected cost per product and expected customer service level. The following three basic decision variables are introduced in the proposed mixed integer programming model:

-

1.

Supplier selection variable: \({{u}_{i}}=1,\) if supplier i is selected; otherwise \({{u}_{i}}=0;\)

-

2.

Order-to-period assignment variable: \({{v}_{jt}}^{s}=1,\) if under disruption scenario s customer order j is assigned to planning period t; otherwise \({{v}_{jt}}^{s}=0;\)

-

3.

Demand allocation variable: \({{w}_{i}}\in [0,\text{ }1 ]\) is the fraction of total demand for parts ordered from supplier i.

The demand for parts allocation vector \(({{w}_{1}},\\ldots{}~{{w}_{M}}),\) where \(\sum_{i\in I}{{{w}_{i}}}=1\) and \(0\le {{w}_{i}}\le 1,i\in I,\) defines the selected supply portfolio.

Let \({{E}_{1}}\) be the minimized expected cost per product and \({{E}_{2}},\) the maximized expected customer service level. In order to avoid dimensional inconsistency among the two objectives, the values of the optimized objective functions are scaled into the interval [0, 1]. Denote by \({{f}_{1}}=({{E}_{1}}-{{\underline{E}}_{1}})/({{\overline{E}}_{1}}-{{\underline{E}}_{1}}),\) the normalized expected cost per product and by \({{f}_{2}}=({{\overline{E}}_{2}}-{{E}_{2}})/({{\overline{E}}_{2}}-{{\underline{E}}_{2}}),\) the normalized expected service level. \({{\underline{E}}_{1}},{{\overline{E}}_{1}}\) are the minimum, the maximum values of \({{E}_{1}},\) and \({{\underline{E}}_{2}},{{\overline{E}}_{2}}\) are the minimum, the maximum values of \({{E}_{2}},\)respectively. The normalized objective functions \({{f}_{1}}\) and \({{f}_{2}}\) are defined below:

The mixed integer program for the bi-objective supplier selection and customer order scheduling to optimize the weighted-sum of expected cost per product and expected fraction of customer demand fulfilled by due dates, is based on the model Em proposed in (Sawik 2013) to minimize expected cost per product for a multiple sourcing strategy.

Minimize \({}\lambda{}{{\text{f}}_{\text{1}}}\text{+(1-}\lambda){{\text{f}}_{\text{2}}}\)subject to constraints of model Em in (Sawik 2013).

By the parameterization of the above weighted-sum program on \(\text{(0}\le {}\lambda{}\le \text{1),}\) a subset of non-dominated solutions of the bi-objective supply portfolio and customer order schedule can be found.

4 Numerical Example

In this section, the proposed stochastic mixed integer programming approach is illustrated with a simple numerical example: H = 10, M = 9, N = 25 and q = 2M = 512;

The detailed values of input parameters are based on the dataset presented in (Sawik 2014c):

The corresponding vector of disruption probabilities \({{{}\pi{}}_{\text{i}}}={{p}^{r}}+(1-{{p}^{r}})pi\) of every supplier \(i\in {{I}^{r}}\) in each region \(r\in R\) is: π = (0.00613057, 0.00765688, 0.0100207, 0.0404425, 0.0449741, 0.0343219, 0.0614767, 0.0918943, 0.0831672). The above data indicates that the most reliable is supplier 1, (π1 = 0.00613057), the least reliable is supplier 8, (π8 = 0.0918943), the most expensive is supplier 1, (o 1 = 13), and the cheapest is supplier 7, (o 7 = 2).

Figure 1 shows the non-dominated supply portfolios (the allocation of total demand for parts among selected suppliers) for 11 levels of trade-off parameter λ. The subset of selected suppliers consists of four suppliers i = 1, 2, 6, 7 of which suppliers i = 1, 2 are most reliable and suppliers i = 6, 7 are the cheapest suppliers in region r = 2, 3, respectively.

5 Conclusions

In this paper the decision-making problem associated with supplies of parts and deliveries of finished products under major disruption risks has been formulated as a mixed integer program with the weighted-sum aggregation of the two conflicting, objective functions: expected cost and expected service level. The obtained supply portfolio and the schedule of customer orders aim at minimizing the weighted-sum of normalized expected cost and normalized expected customer service level to minimize the weighted-sum of relative distance from optimality of each objective function. While for the pure minimum cost objective, \(({}\lambda\text{=}1),\) the cheapest supplier is selected, and for the pure maximum service level objective, \(({}\lambda\text{=0}),\) a subset of most reliable and most expensive suppliers is usually chosen, for the remaining values of trade-off parameter, \((0<{}\lambda{}<1),\) the non-dominated solutions usually allocate total demand for parts among the two types of suppliers.

References

Berger PD, Zeng AZ (2006) Single versus multiple sourcing in the presence of risks. J Oper Res Soc 57(3):250–261

Gurnani H, Mehrotra A, Ray S (eds) (2012) Supply chain disruptions: theory and practice of managing risk. Springer, London

Sawik T (2011) Scheduling in supply chains using mixed integer programming. Wiley, Hoboken

Sawik T (2013) Integrated selection of suppliers and scheduling of customer orders in the presence of supply chain disruption risks. Int J Prod Res 51(23–24):7006–7022

Sawik T (2014a) Joint supplier selection and scheduling of customer orders under disruption risks: single vs. dual sourcing. Omega: Int J Manage Sci 43(2):83–95

Sawik T (2014b) Optimization of cost and service level in the presence of supply chain disruption risks: single vs. multiple sourcing. Comp Oper Res. doi:10.1016/j.cor.2014.04.006 (article in press)

Sawik T (2014c) On the robust decision-making in a supply chain under disruption risks. International. J Prod Res. doi:10.1080/00207543.2014.916829 (article in press)

Yu H, Zeng AZ, Zhao L (2009) Single or dual sourcing: decision-making in the presence of supply chain disruption risks. Omega: Int J Manage Sci 37:788–800

Acknowledgements

This work has been partially supported by NCN research grant and by AGH.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Sawik, T. (2015). Cost Vs. Customer Service Level in Supply Chains Under Major Disruptions. In: Zhang, Z., Shen, Z., Zhang, J., Zhang, R. (eds) LISS 2014. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-43871-8_184

Download citation

DOI: https://doi.org/10.1007/978-3-662-43871-8_184

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-43870-1

Online ISBN: 978-3-662-43871-8

eBook Packages: Business and EconomicsBusiness and Management (R0)