Abstract

This book attempts to synthesize research that contributes to a better understanding of how to reach sustainable business value through information systems (IS) outsourcing. Important topics in this realm are how IS outsourcing can contribute to innovation, how it can be dynamically governed, how to cope with its increasing complexity through multi-vendor arrangements, how service quality standards can be met, how corporate social responsibility can be upheld, and how to cope with increasing demands of internationalization and new sourcing models, such as crowdsourcing and platform-based cooperation. These issues are viewed from either the client or vendor perspective, or both. The book should be of interest to all academics and students in the fields of Information Systems, Management, and Organization as well as corporate executives and professionals who seek a more profound analysis and understanding of the underlying factors and mechanisms of outsourcing.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The notion of outsourcing—making arrangements with an external entity for the provision of goods or services to supplement or replace internal efforts—has been around for centuries. Kakabadse and Kakabadse (2002) track one of the earliest occurrences of outsourcing to the ancient Roman Empire, where tax collection was outsourced. In the early years of American history, the production of wagon covers was outsourced to Scotland, where they used raw material imported from India in the production process (Kelly 2002). Outsourcing remained popular in the manufacturing sector, with part of the assembling in many industries being sub-contracted to other organizations and locations where the work could be done more efficiently and cheaply. Commenting on this unstoppable trend, Pastin and Harrison (1974) wrote that such outsourcing of manufacturing functions was creating a new form of organization which they termed the “hollow corporation” (i.e. an organization that designs and distributes, but does not produce anything). They note that such an organizational form would require considerable changes in the way organizations were managed. While they limited their research to the role of management in the hollow corporation, they comment on the substantial (and unpleasant) social and economic changes that the outsourcing of manufacturing was causing.

It was not long before the idea of outsourcing was applied to the procurement of information technology (IT) services also. While the current wave of IT outsourcing can be traced back to EDS’ deal with Blue Cross in the early sixties, it was the landmark Kodak deal in 1989 that won acceptance for IT outsourcing as a strategic tool. Many large and small outsourcing deals were inked in the years that followed. From its beginnings as a cost-cutting tool, IT outsourcing has evolved into an integral component of a firm’s overall information systems strategy (Linder 2004). Still, reducing costs is an idea that never loses its appeal, and the opportunity to meet the IT demands of the organization with a less-expensive but well-trained labor pool has led organizations to look past the national borders, at locations both far and near, for such resources. There is little doubt about the continued acceptance and popularity of IT outsourcing as well as the trend towards outsourcing to different global locations. A recent Gartner study placed the global IT outsourcing market at $288 billion in 2013 (Gartner 2013). Moreover, outsourcing has grown beyond the domain of IT embodying decisions such as where and how to source IT to a much wider set of business functions. This inexorable trend towards outsourcing and offshoring brings unique sets of challenges to all parties involved. Western organizations have to walk a tightrope between the savings and efficiencies that offshoring could provide and the adverse reactions from a society increasingly disenchanted by the job displacement and loss that outsourcing brings.

2 IT Outsourcing Motivation and History

Although organizations outsource IT for many reasons, the growth of IT outsourcing can be attributed to two primary phenomena: (1) a focus on core competencies and (2) a lack of understanding of IT value (Lacity et al. 1994). First, motivated by the belief that sustainable competitive advantage can only be achieved through a focus on core competencies, the management of organizations have chosen to concentrate on what an organization does better than anyone else while outsourcing the rest. As a result of this focus strategy, IT came under scrutiny. The IT function has largely been viewed as a non-core activity in organizations; further, senior executives believe that IT vendors possess economies of scale and technical expertise to provide IT services more efficiently than internal IT departments. Second, the growth in outsourcing may also be due to a lack of clear understanding of the value delivered by IT (Lacity and Hirschheim 1993). Though senior executives view IT as essential to the functioning of the organization, it is viewed as a cost that needs to be minimized. Believing that outsourcing will help meet the IT needs of the organization less expensively, organizations have chosen to outsource. Interestingly, some researchers (e.g. Hirschheim and Lacity 2000) have found that outsourcing has not always yielded the benefits that organizations had hoped for. This has led to numerous normative strategy proposals to help organizations achieve success (Cullen et al. 2005; Linder 2004).

Initially, when organizations looked to external sources for the provision of IT services, the vendor provided a single basic function to the customer, exemplified by facilities management arrangements where the vendor assumed operational control over the customer’s technology assets, typically a data center. The agreement between Blue Cross and Electronic Data Systems (EDS) in 1963 for the handling of Blue Cross’ data processing services was different from such previous ‘facilities management’ contracts. EDS took over the responsibility for Blue Cross’s IT people extending the scope of the agreement beyond the use of third parties to supplement a company’s IT services. EDS’s client base grew to include customers such as Frito-Lay and General Motors in the seventies, and Continental Airlines, First City Bank and Enron in the eighties. Other players entered the outsourcing arena as well, the most noteworthy of those being the Integrated Systems Solutions Corporation (ISSC) division of IBM. ISSC’s deal with Kodak in 1989 heralded the arrival of the IT outsourcing mega-deal and legitimized the role of outsourcing for IT. Following the success of the Kodak deal, well-known companies around the world quickly followed suit—General Dynamics, Xerox, and McDonnell Douglas in the U.S.; Lufthansa and Deutsche Bank in Germany; Rolls Royce and British Aerospace in Britain; KF Group in Sweden; Canada Post in Canada; Telestra, LendLease, and the Commonwealth Bank of Australia in Australia and ABN Amro in the Netherlands (Dibbern et al. 2004).

IT outsourcing has evolved from sole-sourcing and total sourcing arrangements of yester-years where one vendor provides all IT services to its client to complex arrangements involving multiple vendors and multiple clients (Gallivan and Oh 1999). According to Mears and Bednarz (2005) companies are also outsourcing on a much more selective basis than ever before. The tools and resources available today make it easier for IT executives to manage their IT portfolio and achieve the economies they need without outsourcing everything. (Of course a key challenge is determining what pieces of the IT portfolio to outsource and what to keep internal.) Outsourcing also now embraces significant partnerships and alliances, referred to as co-sourcing arrangements, where client and vendor share risk and reward. These co-sourcing arrangements build on the competencies of the client and vendor to meet the client’s IT needs. Kaiser and Hawk (2004) provide recommendations to organizations considering co-sourcing arrangements with offshore vendors. They note that organizations should avoid total dependency on the vendor by maintaining their IT competencies in-house.

IT outsourcing—as it was practiced through the turn of this past century—was primarily domestic outsourcing. While it had considerable impact on the way organizations structured and managed their IT, and to some extent, redefined the roles of IT managers, the impacts were largely limited to the client and vendor firms’ boundaries with the possible exception of the creation of some new intermediary organizations (e.g. outsourcing consulting firms). Domestic IT outsourcing barely created a stir in the public press perhaps because no one foresaw that the outsourcing of a critical knowledge-work function (i.e. IT) might have more dramatic effects if these tasks could be performed not domestically but globally. In some way this is surprising because most international firms were hiring numerous foreign IT people, and importing people from places like the Philippines, India, etc. on staff augmentation contracts. Indeed, according to Sheshabalaya (2004) and Friedman (2005), major changes were already taking place in IT in the late 80s and throughout the 90s in the US but went unnoticed, mostly because of the dot.com boom and Y2 K remediation needs. However, this was about to change.

3 Offshore Outsourcing

A prominent change in the outsourcing arena is the growth in offshore outsourcing (Lacity and Willcocks 2001; Morstead and Blount 2003; Robinson and Kalakota 2004). Driven by the pressures of globalization and the ensuing need to address opportunities and threats from global competition, companies are increasingly looking at less-expensive resources available in offshore locations. And these less expensive resources are readily available in countries like India, China and the Philippines.

An outsourcing arrangement is considered ‘offshore outsourcing’ when the responsibility for management and delivery of information technology services is delegated to a vendor who is located in a different country from that of the client (Sabherwal 1999). While the three well-known countries in the offshore outsourcing arena (the so-called three I’s) are India, Israel, and Ireland (Carmel 2003a, b), near-shore providers in Canada and Mexico are also popular among U.S. clients just as eastern Europe has become a prime near-shore option for central European countries, because of geographic and cultural proximity. Some clients find the near-shore scenario more attractive because these locations facilitate continuous monitoring (Rao 2004). China is also quickly gaining popularity because of its low labor costs.

As in domestic outsourcing, a primary driver of offshore outsourcing is the continued pressure organizations face to cut costs associated with IT while maintaining and improving processes (Nicholson and Sahay 2001; Rajkumar and Dawley 1998). The time differences between the client and the offshore vendor locations create extended work days which could contribute to increased IT productivity. With efficient distribution of work between the client and vendor locations, projects can theoretically be finished faster (Apte 1990; Carmel and Agarwal 2001; Carmel and Agarwal 2002; Morstead and Blount 2003; Rajkumar and Dawley 1998; Ramanujan and Lou 1997).

Organizations also turn to offshore outsourcing because of the lack of IT resources to perform required tasks. Faced with the lack of trained professionals, organizations look to foreign shores to gain access to knowledgeable IT personnel and valuable IT assets (Apte et al. 1997; Morstead and Blount 2003; Rottman and Lacity 2004; Sahay et al. 2003; Terdiman 2002). Offshore vendors typically have well-trained IT personnel with the requisite technical knowledge and skills. These vendors have also recognized the need to train their staff not only in the latest technologies, but also in management and communication skills and have established numerous world-class facilities to do so (Khan et al. 2003). Such technical expertise and qualifications of the staff make these vendor firms very attractive to clients, since clients look to outsource activities that involve high level of technical skills (Aubert et al. 2004).

In addition, offshore vendors have obtained certifications to prove their ability to execute and deliver quality work. These certifications assure the client organizations that the vendor is following quality practices in the management of the project and are important in gaining the client’s trust and developing the client–vendor relationship (Heeks and Nicholson 2004). Vendors aim to align their practices with standards in different areas including software development processes (e.g. CMM), workforce management (e.g. PeopleCMM), and security (e.g. ISO 17779) (Hirschheim et al. 2004). Qu and Brocklehurst (2003) find that client organizations pay particular attention to these certifications in the vendor evaluation and selection process. However, Coward (2003) comments that while large organizations look towards certifications for quality assurance and success in offshore projects, small and medium enterprises focus on personal connections in the selection of vendors.

Finally, as in domestic outsourcing, the bandwagon effect (Lacity and Hirschheim 1993) comes into play in offshore outsourcing as well. The sheer fact that these offshore choices are available and that other organizations are taking advantage of these options prompt other organizations to consider offshore outsourcing (Carmel and Agarwal 2001; Carmel and Agarwal 2002; Gopal et al. 2002; Overby 2003; Qu and Brocklehurst 2003). With such drivers, offshore outsourcing is growing at a faster rate in many countries than domestic outsourcing.

Offshore arrangements come in a variety of flavors to match the client’s desire for ownership and control: conventional offshore outsourcing arrangements, joint ventures, build-operate-transfer arrangements, and captive centers. These arrangements span the continuum from complete hand-over of the project to an offshore vendor in conventional offshore outsourcing arrangements to establishing a captive center in the foreign country. While the client usually has a low to medium level of control on the operation and delivery services in conventional offshore outsourcing, the client retains full ownership and control of the assets, personnel, management and operations of a captive center. Such captive center arrangements are not strictly outsourcing arrangements, since in outsourcing the responsibility for the management of the IT services is handed off to an external vendor. These captive center arrangements fit under the umbrella of “offshoring” (Robinson and Kalakota 2004). In joint ventures and build-operate-transfer arrangements, the client is able to take advantage of the vendor’s knowledge of the local market, while retaining a certain amount of control. Such shared ownership can reduce the risk of offshore outsourcing. A build-operate-transfer is an arrangement where a domestic client contracts with an offshore vendor to set up an offshore center, with the goal of taking over the ownership and management of the center once it is established (Anthes 1993; Khan et al. 2003; Kumar and Willcocks 1996; Morstead and Blount 2003).

A related development has been the offshore outsourcing of IT-enabled services and business processes. Many offshore IT vendors have produced offshoots to manage business process outsourcing (BPO) deals. Examples are Wipro’s Spectramind and Infosys’ Progeon. The BPO market is making giant strides and is growing more rapidly than the IT offshoring market. Currently, IT outsourcing dominates offshore outsourcing, but this is likely to change in the future.

More recently, the field has seen the emergence of new form of sourcing variously referred to as ‘microsourcing’ (Carmel 2008), ‘human cloud’ (Kaganer et al. 2013), ‘crowd sourcing’ (Howe 2006), ‘collective intelligence’ (Malone at al 2010) whereby clients use online platforms for the provision of global sourcing of services, including website development, programming, legal service, creative design, etc. (Kaganer et al. 2013; Lu et al. 2013). Carmel (2008) viewed this phenomenon as the “commoditization of process” of services from the e-marketplace. Microsourcing is gradually becoming a mainstream method of outsourcing for personal users, entrepreneurs, small business owners (Obal 2006), but more recently even large companies are taking notice. Indeed, there are now dozens of websites used as online platforms for the settlement of microsourcing deals, including vWorker.com, E-lance.com, Guru.com, CrowdSpring, InnoCentive, Odesk, etc. According to Smartsheet (2009), over two million service providers registered on the 10 major online sourcing websites between the years 2000 and 2009, with over $700 million dollars paid to the providers.

4 Motivation for the Fourth Edition

When we produced the first edition of the book Information Systems Outsourcing in the New Economy: Enduring Themes, Emergent Patterns and Future Directions in 2002, the motivation rested on the need to take stock of a field which had been around for about 10 years. Since then, we published a paper which offered a good overview of the field (Dibbern et al. 2004). But because it was a paper, it could not do justice to the depth and breadth of the outsourcing landscape which includes the more recent development of offshore outsourcing and business process outsourcing. To that end, a second edition was developed in 2006. In that follow-up edition, we reproduced a number of what we consider more ‘classic’ papers in the field and supplemented them with a large number of new contributions, in particular on the topic IT offshoring. This new direction was reflected by the subtitle: Enduring Themes, New Perspectives and Global Challenges.

Following on from the second, came the third edition in 2009 which included a completely new collection of papers on the topic of information systems outsourcing. Similar to the first edition, the contributions of the third edition were based on an international conference that we held for the third time involving key researchers from around the world with a proven track record in the field of Information Systems Outsourcing. The third edition book was based on the research presented by the participants attending the 3rd International Conference on Outsourcing of Information Services which was held in Heidelberg, Germany, May 29–30, 2007. This edition was reflected by the subtitle: Enduring Themes, Global Challenges, and Process Opportunities.

Recently, we held our 4th International Conference on Outsourcing of Information Services (www.ICOIS.de) which was held in Mannheim, Germany, June 9–11, 2013. As in previous ICOIS events, this brought together key researchers in the field discussing their latest research and thinking about outsourcing. The papers presented at the conference are the basis of this current edition of the book. It is important to note, that the majority of the contributions to the conference shifted their focus towards new forms and mechanisms of outsourcing that aim at offering a more long-term and value-oriented perspective on IT outsourcing. Hence, the subtitle of this fourth edition has been changed to: Towards Sustaining Business Value.

We believe this new edition offers an excellent roadmap of the current IT outsourcing academic literature, highlighting new perspectives while also considering what has been learned so far and how the work fits together under a common umbrella.

5 Book Structure and Outline

5.1 Towards Sustaining Business Value

In providing such a common umbrella, we refer to the notion of sustainable business value. As IT outsourcing has matured, the focus has shifted from a cost savings and short-term orientation to one where outsourcing is seen to facilitate long-term sustainability including objectives beyond cost savings (Dibbern et al. 2004). Sustainability refers to the capability of an organization to endure over a long period of time (Barney 1991; Ross et al. 1996). For such sustainability to occur, organizations must produce sustainable business value. This involves providing avenues for organizational profitability which need to handle a dynamic and changing world. Indeed, sustainability is ‘multifaceted, involving economic, social, and environmental concerns’ (Hart and Milstein 2003). This would likely include multiple and possibly conflicting objectives and dynamic changes by which organizations need to adapt. The challenge for organizations then is to develop a framework which on the one hand provides a stable base for integrating multiple objectives while also being flexible enough to react to both endogenous and exogenous changes.

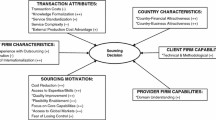

This book addresses this challenge from two alternative perspectives that need to be taken into account when attempting to create sustainable business value through outsourcing: the client perspective and the vendor perspective. Each has their own view about what would be necessary to both create and sustain such business value. Moreover, as the papers presented at our conference attest, there are a variety of areas where sustainable business value can be created from both the client and vendor side. Figure 1 offers an overview of the broad areas covered in our book.

Each of these themes is explored—to a greater or lesser extent—in this book. More specifically, the papers in this volume cover a multitude of issues associated with the seven identified themes. Figure 1 provides an overview of the structure of the fourth edition of Information Systems Outsourcing.

The focus of the following outline will be on the main IT outsourcing content of each chapter and its papers. Each contribution has focused on different aspects within each category.

5.2 Innovation Management

The first issue of sustainable business value refers to (I) Innovation Management where outsourcing is seen as a tool to help organizations to radically or incrementally change core elements of their information (technology) systems, including their underlying technologies, business processes, products or stakeholders and people. Although early work on outsourcing has pointed to the transformational potential of outsourcing (DiRomualdo and Gurbaxani 1998), this view that outsourcing can leverage the innovation potential of a firm has mostly been ignored in the literature. Innovation has mostly been considered as something that came primarily from within an organization. The first two papers in our book stand in opposition to this view. They offer some new insights into how innovation can take place in IT outsourcing arrangements.

Aubert, Iriyama, Kay, and Kishore develop a set of propositions on how outsourcing can stimulate innovation. The key premise of their theorizing is that it matters what kind of innovation is being considered. Specifically, it is important to differentiate between modular versus systemic innovations, and whether the innovation process is characterized by exploration or exploitation learning. The innovation objective and the innovation process have implications for sourcing, contracting, supplier selection, and transaction costs.

Lacity and Willcocks focus on innovation in business process outsourcing (BPO). They argue that innovations accumulate over time and that it is hence important to take a dynamic view of the innovation process. Based on both qualitative and quantitative data of BPO arrangements they identify a set of effective versus ineffective practices supporting dynamic innovation. These practices can be grouped into those incentivizing innovations and those supporting the process of delivering innovations throughout the duration of an outsourcing relationship. These practices should be enacted and supported by strong leadership pairs involving both sides of the relationship: the client and vendor.

Taken together, these two studies show that in order to realize innovation in outsourcing it requires an adequate up-front configuration and dynamic adaptations. Configuration and adaptation are also two important themes in IT outsourcing governance in general and are taken up in the next two parts on (II) Governance Frames and on (III) Dynamic Governance Adaptation.

5.3 Governance Frames

Providing solid governance frames where vendors and clients develop specific provisions for effectively managing the outsourcing arrangement has been an enduring theme in IS outsourcing research. It is largely agreed that the research issues in outsourcing have evolved from whether to outsource to how to manage outsourcing. Despite the understanding offered by the studies on IT outsourcing relationships, PricewaterhouseCoopers (2009) found that only 40 % of client/vendor relationships were working effectively, indicating that many organizations and vendors still need to resolve relationship issues. While the contract has been viewed as a foundation of the outsourcing relationship, there is increasing interest in the interaction between the contract and its execution in the form of formal control as well as interactions between formal and informal governance mechanisms. Moreover, there is increasing interest in overarching governance frames that provide an overall umbrella for steering all sourcing arrangements of an organization. This includes general guidelines and rules for the decision, vendor selection, contracting, and relationship management. Establishing such stable governance frames provides the basis for steering the client–vendor-relationship and makes up an important component for achieving sustainable outsourcing success. Three papers in our book provide fresh insights into the design and impact of such governance frames.

Langer, Mani and Srikanth focus on formal control mechanisms and how they can facilitate the integration of two seemingly opposing objectives, namely that of client satisfaction and vendor profitability. They view control from the vendor perspective. Based on the analysis of a significant number of strategic IS outsourcing contracts they find evidence for the importance of choosing the right control mechanisms to ensure that both client and vendor objectives are met. Thus, balancing controls is a key factor for balancing objectives. Formal controls should manifest the commitment of the vendor to act in accordance with the client’s strategic objectives. The issue of commitment also plays a central role in the next paper.

Currie and Gozman take a broader perspective on control by including regulatory controls that are enforced by the institutional environment in which IS outsourcing arrangements are embedded. This is exemplified by a case of a major IS vendor responsible for implementing an IT system at eight clients in the finance industry where the implementation of financial regulations was a key aspect of the implementation of the IT systems. This provides an interesting case as the trust that the clients gain in the IT vendor is linked to a network of trust relationships including the ones between the financial organizations and the financial regulator, the financial organizations and the investors, and the investors and the IT system. In other words, in order to provide sustainable business value, IT vendors do not only need to understand the business of the client, they also need to understand how the client business is influenced by its institutional environment and how the IT systems that they provide should embed such institutional regulations.

Another important aspect that is often overlooked in establishing governance frames is that of governing the upfront sourcing decision. While many organizations have established central sourcing units that seek to oversee the entire portfolio of IS functions, tasks and projects to make holistic sourcing decisions, there is little guidance in terms of decision aids. This gap is taken up next.

Kramer, Eschweiler and Heinzl develop a decision support method and tool that helps firms to choose appropriate candidates for outsourcing among various software development projects. Essentially, the model takes software requirements as inputs and considers the specific properties and interdependencies between requirements to identify outsourcing candidates. Such decision support systems can add to sustainable business value as they help to ensure that all sourcing decisions are made on the basis of a consistent frame that ensures alignment with a firm’s strategic objectives.

5.4 Dynamic Governance Adaptation

Given the importance of establishing stable governance frames, two key questions remain unanswered. First, how can such stable frameworks be established and, second, will they endure for a long time or do they need to be constantly adapted? Due to dynamics in the environment, such as business changes, technology changes, partner changes, or regulatory changes, organizations are often confronted with unforeseen events. Such unforeseen events may not only make it difficult to establish stable frames but they may also call for adaptions over time. Understanding such dynamics is the motivation of a rather new stream of research that strives towards a process-theoretic understanding of outsourcing governance (Huber et al. 2013). Three papers in our book address the issue of Dynamic Governance Adaptation.

Huber, Fischer, Dibbern and Kirsch examine control adaptations in the context of outsourced software development projects. Such projects are usually initiated with a number of high level project goals that may be written into the contract. The key premise of the study by Huber et al. is that as IS outsourcing projects evolve, high level project goals may be translated into more and more project-specific controls which may affect project success in different ways. The results of a multiple case study show that increasing control specificity can be both beneficial and detrimental to the achievement of the initial project goals. Control specificity is beneficial if it results from a translation process where only the stakeholder context (and not the task) is adapted. It is detrimental if the project becomes highly dynamic and independent where the nature of the software development task is significantly altered over time eventually leading to a misfit with the initial project objectives. The results provide implications on the interaction between such goal and control drifts in IT outsourcing projects and how such drifts may be interrupted.

Heisekanen, Hekkala, Newman, and Eklin examine a number of system development projects that over time were outsourced by a University to the same vendor. Their focus lies on the changing role of the client boundary persons (or spanners) in steering the projects and the vendor. For example, the role of the boundary spanning person may shift from a problem solver to a gatekeeper that ensures that the project stays on track as defined in the contract. While emotions and learning play an important role for the boundary spanner practices to evolve, the study also shows the importance of the contract as the foundation for the actions taken by the boundary spanner.

Krancher and Dibbern seek to explain the effect of governance adaptations during the early stage of an IT outsourcing arrangement. They focus on the transition phase in software maintenance outsourcing projects, where the key objective is to transfer knowledge to the incoming new vendor personnel so that they can effectively and self-responsibly perform the maintenance tasks. Based on case evidence and system dynamics modeling they show how effective learning during transition can be stipulated by balancing the cognitive load of the learner (i.e. the incoming vendor software engineer) through a number of interrelated managerial activities, such as selecting vendor engineers with the right level of prior expertise, adapting the complexity of the learning tasks (i.e. training maintenance tasks), and adapting the level of help. They also show how these activities interact with changes in vendor expertise and trust in the vendor.

Overall, these three studies show how enacting and adapting governance frames can add to achieving sustainable outsourcing success.

5.5 Multi-vendor and Multi-client Ecosystem Management

The governance issue is further noted in (IV) Multi-vendor and Multi-client Ecosystem Management which relates to how outsourcing can be effective when the arrangement involves multiple vendors and/or multiple clients. In an effort to streamline their sourcing arrangements many organizations have focused their outsourcing endeavors on a selection of strategic partners that need to be orchestrated in a multiple-vendor arrangement. The flipside of multi-vendor arrangements are multi-client arrangements which have been enabled by new technological interfaces and standardization of services. A case in point is Software-as-a-Service arrangements. These arrangements constitute a shift from the classical dyadic client–vendor relationship with customized services for each client to one where multiple clients are served by the same vendor that draws on a portfolio of standard services that can be composed individually for each client, but still qualify a standard service. Overall, such outsourcing arrangements which involve multiple vendors and/or multiple clients offer new challenges that organizations are often ill-prepared for. Four papers provide new insights into how to cope with such challenges.

Fisher, Hirschheim, Jacobs and Lazaro provide a historical perspective of the emergence and evolution of a multi-vendor outsourcing arrangement in a large Australian telecommunications company. The longitudinal case shows the preconditions of the initiation of a multi-sourcing arrangement including four vendors of which three were offshore vendors in India. They further show how the challenges of managing the multiple vendors were addressed, and how a strategic shift and associated new technological demands led to the conversion to a prime-contractor arrangement with a fading out of the multi-vendor arrangement.

Wiener and Saunders reflect on the case of an internationally operating German company in the footwear and apparel industry that moved from a single vendor to a multi-vendor offshore outsourcing arrangement. The results from their case analysis show that increasing the number of vendors from one to three helps to avoid vendor lock-in and increases flexibility; however adding new vendors to an existing vendor, also leads to challenges of balancing the trade-off between upholding competition and cultivating cooperation between the vendors. Moreover, such arrangements create internal challenges, such as encouraging acceptance of the incoming vendors and coping with increased management overhead.

Jin, Kotlarsky and Oshri also focus on multi-sourcing arrangements, where the tasks outsourced to the particular vendors are interdependent and hence require coordination. They argue that the key challenge of coordination lies in the integration of knowledge between vendors. Accordingly, they develop a number of propositions on how such knowledge integration can be achieved and how this affects overall performance.

Stuckenberg, Kude and Heinzl take the perspective of a Software-as-a-Service (SaaS) vendor that faces the challenge of simultaneously operating and further developed the same software for multiple clients. While previous research has largely treated operation and development as separate processes, the authors show how both are integrated. Based on six case studies of SaaS vendors they highlight the key challenges and opportunities of this integration effort.

5.6 International Growth: The Case of China

There is a myriad of issues associated with the emergence of outsourcing in a global context especially in terms of both new global clients and global vendors. As outsourcing clients as well as vendors emerge from all corners of the globe, the challenges and opportunities become immense. One case in point for international growth is the Chinese outsourcing market, which is gaining increasing attention in research. While China has been a key outsourcing destination for the Japanese market for quite some time, it faces the challenge to grow internationally. Two papers take a closer look at the conditions and strategic moves for sustained global growth.

Gallivan and Tao examine how IT service standards are being developed in China. They report on a country case study in which the authors document (over a 3 year period) the process of standard development of IT services. The results show that this process deviates quite strongly from the typical patterns observed in other standard setting processes. In particular, there was no evidence of conflict between the participating parties during the process. Some conclusions are drawn on why this is the case. In general, however, the speed with which such standards are being developed is impressive showing the strong desire of the Chinese market to make progress in the global IT services market.

Su shows how Chinese IT services firms enter into new markets. This is exemplified by a multiple case study project involving 13 major Chinese IT vendors and how they expanded their business internationally (into the U.S. and Japan) and domestically. Their results suggest that both the decision in which markets to enter and the decision on how to enter a market are strategically driven by capability and relational considerations, while also being flexible and adaptive.

Overall, these two studies show that in order to create sustained business value internationally IT vendors need to adopt the quality assurance processes of their industry and their home market and they need to constantly adapt their capabilities to enter new markets. They will also need to enter new markets in order to develop new capabilities.

5.7 Social Responsibility and Social Capital Management

As the example of China has shown, the capacities for IT service provisioning have grown significantly around the world. Countries like India are now among the leading counties in terms of the absolute number of people employed in the IT sector. And yet, the relative number of people employed in the IT sector in established and emerging IT offshore regions is still relatively small and concentrated in a few regional hubs with high population density. Poverty is still widespread among the rest of the population and the rural areas in particular.

Accordingly, companies are increasingly confronted with the need to take social responsibility into account in their IT offshoring engagements. This is true for both the customers of IT offshore services and the providers. Ideally, client and vendor develop a shared social responsibility. The basis of such a shared responsibility may be the general social capital developed in an IT outsourcing relationship. The first two papers in this chapter focus on issues of social responsibility. The third focuses on social capital management in general which provides the basis for reaching shared objectives.

Carmel, Lacity and Doty view the issue of social responsibility in the broader context of impact sourcing. Impact sourcing refers to sourcing models where services are delivered by employees with extremely low wages (i.e. that fall into the poverty category). In particular, in BPO there are many labor-intensive jobs that require low level skills. This creates an interesting trade-off; on the one hand, BPO creates jobs; on the other hand, employees should not be exploited. The paper provides an overview of different models of impact sourcing arrangements that can be viewed from various perspectives with different value propositions, where social responsibility is one key issue.

Bin and Nicholson focus on the issues of shared social responsibility between the client firm and the offshore vendor. Based on a single case study they show how the client and the vendor can jointly develop social responsibility practices as part of their corporate social responsibility. Such practices can contribute to the generation of mutual trust as a key enabler of relationship quality and hence outsourcing success.

George, Hirschheim, Jayatilaka and Das broaden the view on the client–vendor relationship by analyzing it from a social capital perspective. As such, trust is one dimension of the relational dimension of social capital which is complemented by the structural and cognitive dimensions of social capital. They argue that the development of all three dimensions of social capital along the different phases of an outsourcing arrangement (from partner selection to outsourcing evaluation) can lead to new intellectual capital that feeds back into the generation of social capital.

5.8 Crowdsourcing and Open Platforms

Finally, there are new arrangements that move beyond the classical dyadic outsourcing relationships between client and vendor, and that appear to be gaining momentum in the IT sourcing market. These are models of (VII) Crowdsourcing and Open Platforms, where organizations seek to integrate a wider range of service entities into their service production and delivery chain. The key premise of such arrangements is to make use of distributed knowledge resources in order to leverage one’s own knowledge base.

Nevo, Kotlarsky and Nevo explore the implications of crowd sourcing for IT vendors. They argue that IT vendors can draw on the crowd in generating and providing IT services to their clients. The results of a case study of a technology organization with crowd sourcing experiences shows that the integration of the crowd requires new vendor capabilities driven by the duality of roles that vendors take in such outsourcing arrangements; they are both clients of the crowd and providers to their clients.

Frutiger, Slaughter, and Narasimhan examine the role of open platform ecosystem to enable the integration of various vendors in the process of software development. While software ecosystems are increasingly formed in the standard software industry (e.g. around SAP, Oracle or Apple) as well as in open source software development (e.g. Linux) such platforms have rarely been deployed to provide the basis for project-based cooperation among software firms. The authors take the case of the military aviation industry as an example where such a platform ecosystem is emerging and actually replacing a former complex multi-vendor network dominated by a keystone player. They show that such an open platform ecosystem brings in new players with new coordination roles that likely lead to a significant reduction in the cycle time of developing, enhancing, updating, and maintaining avionics software which makes up a fundamental asset in the process of innovating military aircrafts.

While both papers point out the challenge of integrating multiple parties in large IT projects—which has also been viewed as key challenge in our chapter on (4) Multi-vendor and Multi-client Ecosystem Management—the coordination and integration challenges in such crowdsourcing and open platform ecosystem arrangements are leveraged by the openness of such arrangements regarding both the IT solution itself as well as the number of parties engaged in such arrangements. If the challenges are appropriately mastered, then they are a strong leverage factor for creating sustained business value through outsourcing.

6 Conclusions

In reading the various chapters in this book, we reflected upon what we know and what we don’t know about the field. Although the fourth edition of the book did much to document what has been learned about IT outsourcing since our last edition in 2008, numerous interesting questions remain. In this book we have framed the contributions under the topic of sustained business value. This is not merely a shift towards a new value proposition. Instead sustained business value is a multifaceted issue that manifests in various aspects that have to do with a more holistic and more long-term oriented perspective on IT outsourcing. While in the early days of IT outsourcing each particular IT outsourcing deal was custom-tailored to the needs of the organization, including custom contracting and custom governance, the increasing complexity of IT outsourcing arrangements including multi-vendor, multi-client, global sourcing and impact souring arrangements as well as new coordination mechanisms such as platform ecosystem and crowdsourcing, suggests the need for simplicity, standardization and durability, while at the same time increasing the need to remain flexible and adaptive to react to endogenous and exogenous change.

In general, the future of IT outsourcing appears wide open with many unanswered questions. For example, will the outsourcing model evolve into more of a (standard) services model such as we are now seeing with software (i.e. SaaS)? If this service model prevails, what areas will it cover—infrastructure, platform, desktop, etc.? Will outsourcing continue to expand to embrace even more business functions such as accounting & finance, legal, HR, logistics, R&D, engineering, knowledge processing, and marketing and to what extend can IS remain to be separate component from other business functions that can be sourced individually? And what about innovation? Will outsourcing enhance or destroy innovation? How will outsourcing differ between different organizations in different industries in different countries (e.g. first, second, third world)? Will organizations tire of outsourcing and offshoring and decide to bring IT back in-house? How will organizational politics influence outsourcing—especially global outsourcing—decisions now and in the future? And what about new outsourcing trends such as micro-sourcing and crowdsourcing? How will they disrupt the way small, medium and large organizations choose amongst sourcing options?

We have tried to articulate some of these important questions but there are many more. Hopefully this book will help motivate individuals to either begin research in the field or continue engaging in outsourcing research. Much has been done, but there is still much more to be done. We hope the reader enjoys the papers in this volume. Happy reading!

References

Anthes, G. (1993) In depth; Not made in the USA. In Computerworld.

Apte, U. (1990). Global Outsourcing of Information Systems and Processing Services. Information Society, 7(4), 287–303.

Apte, U. M., Sobol, M. G., Hanaoka, S., Shimada, T., Saarinen, T., Salmela, T., et al. (1997). IS outsourcing practices in the USA, Japan and Finland: A comparative study. Journal of Information Technology, 12, 289–304.

Aubert, B. A., Patry, M., & Rivard, S. (2004). A transaction cost model of IT outsourcing. Information & Management, 41(7), 921–932.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Carmel, E. (2003a). The new software exporting nations: Success factors. Electronic Journal of Information Systems in Developing Countries, 13(4), 1–12.

Carmel, E. (2003b). Taxonomy of new software exporting nations. Electronic Journal of Information Systems in Developing Countries, 13(2), 1–6.

Carmel, E. (2008). Micro-sourcing, is this the eventual global sourcing landscape? In E. Carmel (Ed.), Global tech: Software, offshoring, distributed teams, time zones, tech policy, information technology and more.

Carmel, E., & Agarwal, R. (2001). Tactical approaches for alleviating distance in global software development. IEEE Software, 1(2), 22–29.

Carmel, E., & Agarwal, R. (2002). The maturation of offshore sourcing of information technology work. MIS Quarterly Executive, 1(2), 65–78.

Coward, C. T. (2003). Looking beyond India: Factors that shape the global outsourcing decisions of small and medium sized companies in America. EJISDC: The Electronic Journal on Information Systems in Developing Countries, 13, 10.

Cullen, S., Seddon, P., & Willcocks, L. (2005). Managing outsourcing: The lifecycle imperative. MISQ Executive, 4(1), 229–246.

Dibbern, J., Goles, T., Hirschheim, R. A., & Jayatilaka, B. (2004). Information systems outsourcing: A survey and analysis of the literature. The DATA BASE for Advances in Information Systems, 35(4), 6–102.

DiRomualdo, A., & Gurbaxani, V. (1998). Strategic intent for IT outsourcing. Sloan Management Review (Summer), 39, 67–80.

Friedman, T. (2005). The world is flat: a brief history of the twenty-first century. NY: Farrar, Straus & Giroux.

Gallivan, M. J., & Oh, W. (1999). Analyzing IT outsourcing relationships as alliances among multiple clients and vendors. Annual International Conference on System Sciences, IEEE, Hawaii, 1999.

Gartner. (2013). Forecast analysis: IT outsourcing, Worldwide.

Gopal, A., Beaubien, L., & Marcon, T. (2002). Old wolf, new wool suit: India, IT, and the legacy of colonialism. Proceedings of the 23rd International Conference on Information Systems, Barcelona, December 15–18, 2002 (pp 525–532).

Hart, S. L., & Milstein, M. B. (2003). Creating sustainable value. Academy of Management Executive, 17(2), 56–67.

Heeks, R., & Nicholson, B. (2004). Software export success factors and strategies in follower nations. Competition and Change, 8(3), 267–303.

Hirschheim, R., George, B., & Wong, S. F. (2004). Information technology outsourcing: The move towards offshoring. Indian Journal of Economics and Business, 3, 103–124.

Hirschheim, R. A., & Lacity, M. C. (2000). The Myths and realities of information technology insourcing. Communications of the ACM, 43(2), 99–107.

Howe, J. (2006). The rise of crowdsourcing. Wired magazine, 14(6), 1–4.

Huber, T. L., Fischer, T. A., Dibbern, J., & Hirschheim, R. (2013). A process model of complementarity and substitution of contractual and relational governance in IS outsourcing. Journal of Management Information Systems, 30(3), 81–114.

Kaganer, E., Carmel, E., Hirschheim, R., & Olsen, T. (2013). Managing the human cloud. MIT Sloan Management Review, 54(2), 23–32.

Kaiser, K., & Hawk, S. (2004). Evolution of offshore software development: From outsourcing to co-sourcing. MISQ Executive, 3(3), 69–81.

Kakabadse, A., & Kakabadse, N. (2002). Trends in outsourcing: Contrasting USA and Europe. European Management Journal, 20(2), 189–198.

Kelly, T. (2002). A brief history of outsourcing. Global Envision.

Khan, N., Currie, W. L., Weerakkody, V., & Desai, B. (2003). Evaluating offshore IT outsourcing in India: Supplier and customer. Proceedings of the 36th Annual Hawaii International Conference on System Sciences, IEEE, 2003 (p. 10).

Kumar, K., & Willcocks, L. (1996). Offshore outsourcing: A country too far? Proceedings of the 4th European Conference on Information Systems, 1996 (pp. 1309–1325).

Lacity, M. C., & Hirschheim, R. A. (1993). Information systems outsourcing: Myths, metaphors, and realities (p. xiv, 273). Chichester, New York: Wiley.

Lacity, M. C., Hirschheim, R. A., & Willcocks, L. P. (1994). Realizing outsourcing expectations: Incredible promise, credible outcomes. Journal of Information Systems Management, 11(4), 7–18.

Lacity, M. C., & Willcocks, L. P. (2001). Global information technology outsourcing. Chichester: In Search of Business Advantage Wiley.

Linder, J. (2004). Outsourcing for radical change. NY: AMACOM.

Lu, B., Hirschheim, R., & Schwarz, A. (2013). Examining the antecedent factors of online microsourcing. Information Systems Frontiers, pp. 1–17.

Malone, T., Laubacher, R., & Dellarocas, C. (2010). The collective intelligence genome. MIT Sloan Management Review, 51(3), 21–31.

Mears, J., & Bednarz, A. (2005). Take it all’ outsourcing on the wane. Computerworld, May 30.

Morstead, S., & Blount, G. (2003). Offshore ready: Strategies to plan & profit from offshore IT-enabled services. USA: ISANI Press.

Nicholson, B., & Sahay, S. (2001). Some political and cultural implications of the globalisation of software development: Case experience from UK and India. Information and Organisation, 11(1), 25–43.

Obal, L. (2006). Microsourcing—using information technology to create unexpected work relationships and entrepreneurial opportunities. Proceedings of the 2006 ACM Sigmis Cpr Conference on Computer Personnel Research: Forty Four Years of Computer Personnel Research: Achievements, Challenges & The Future, ACM, 2006 (pp. 60–62).

Overby, S. (2003). The hidden costs of offshore outsourcing. CIO Magazine.

Pastin, M., & Harrison, J. (1974). Social Responsibility in the Hollow Corporation. Business & Society Review, 87(63), 54.

PricewaterhouseCoopers. (2009). Outsourcing comes of age: The rise of collaborative partnering.

Qu, Z., & Brocklehurst, M. (2003). What will it take for China to become a competitive force in offshore outsourcing? An analysis of the role of transaction costs in supplier selection. Journal of Information Technology, 18, 53–67.

Rajkumar, T. M., & Dawley, D. L. (1998). Problems and issues in offshore development of software. In L. P. Willcocks & M. C. Lacity (Eds.), Strategic sourcing of information systems. Chichester: Wiley.

Ramanujan, S., & Lou, H. (1997). Outsourcing maintenance operations to off-shore vendors: Some lessons from the field. Journal of Global Information Management, 5(2), 5–15.

Rao, M. T. (2004). Key issues for global IT sourcing: Country and individual factors. Information Systems Management (Summer), 21(3), 16–21.

Robinson, M., & Kalakota, R. (2004). Offshore outsourcing: Business models, ROI and best practices. Alpharetta: Milvar Press.

Ross, J. W., Beath, C. M., & Goodhue, D. L. (1996). Develop long-term competitiveness through IT assets. Sloan Management Review, 38(1), 31–42.

Rottman, J. W., & Lacity, M. C. (2004). Twenty practices for offshore sourcing. MIS Quarterly Executive, 3(3), 117–130.

Sabherwal, R. (1999). The role of trust in outsourced IS development projects. Communications of the ACM, 42(2), 80–86.

Sahay, S., Nicholson, B., & Krishna, S. (2003). Global software work: Micro-studies across borders. Cambridge: Cambridge University Press.

Sheshabalaya, A. (2004). Rising elephant: The growing clash with India over white collar jobs and its challenge to America and the world. Monroe, ME: Common Courage Press.

Smartsheet. (2009). Paid crowdsourcing: Current state and progress toward mainstream business use.

Terdiman, R. (2002). Offshore outsourcing can achieve more than cost savings. Note number: CS-16-3520, Gartner Research, 2002.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Hirschheim, R., Dibbern, J. (2014). Information Technology Outsourcing: Towards Sustainable Business Value. In: Hirschheim, R., Heinzl, A., Dibbern, J. (eds) Information Systems Outsourcing. Progress in IS. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-43820-6_1

Download citation

DOI: https://doi.org/10.1007/978-3-662-43820-6_1

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-43819-0

Online ISBN: 978-3-662-43820-6

eBook Packages: Business and EconomicsBusiness and Management (R0)