Abstract

Eco-efficiency as an important measure for integration of environmental and economic performance has been studied extensively in the past. However, previous studies are either conceptual or take a macro view of the empirical relationship between economic and environmental performance in an economy or industry. Little research has explored the actual integration in corporate practice. Using carbon emissions and their integration with corporate economic performance among Australian heavy polluters during 2009 and 2013, we analysed actual integration levels, improvements, patterns at the corporate level. Based on a typological classification of carbon efficiency developed in this study, we differentiate strong and weak eco-efficiency and identify the potential value drivers for the eco-efficiency results with regard to carbon emissions. The study finds that 54% of Australian top polluters have improved carbon efficiency since the implementation of Australian National Greenhouse and Energy Reporting (NGER) Act 2007. Among this, nearly 30% of companies achieve a strong carbon efficiency outcome. Economically strong carbon efficient firms (Golden Stars) are more common than environmentally strong carbon efficient firms (Green Stars). This pattern is consistent among weak carbon efficient and inefficient firms. Dirty Cash Cows whose focus is purely on economic growth while ignoring environmental images are a minority among the companies examined. For financially stressed companies, environmental engagement appears more likely to be a reaction to regulatory requirements. Consistently, the eco-efficiency improvement changes with the government carbon policy changes over the reporting periods, indicating an influence of regulatory pressures on corporate eco-efficiency.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Eco-efficiency has been proposed as one of the key sustainability performance indicators for over two decades. This indicator measures economic value added relative to environmental impacts generated. In a broader context, eco-efficiency calls for efficiency with which ecological resources are used to meet human needs. According to World Business Council for Sustainable Development ’s (WBCSD) definition, eco-efficiency is “achieved by the delivery of competitively-priced goods and services that satisfy human needs and bring quality of life, while progressively reducing ecological impacts and resource intensity to a level at least in line with the earth’s estimated carrying capacity” (Schmidheiny and Stigson 2000, p. 4). Under this context, the significance of eco-efficient GDP (or green GDP) has been increasingly acknowledged (Korhonen and Seager 2008).

In the context of business corporations, Schaltegger and Burritt (2000, p. 358) define eco-efficiency as the “integration of economic information (the flow of financial funds such as income, expense, revenues and costs, which is linked to changes in stocks of funds [assets, liabilities and equities]) from conventional accounting with environmental information (environmental interventions such as emissions and resource use, which is linked with changes in eco-asset balances) derived from ecological accounting”. Clearly, the essence of eco-efficient business is to integrate economic and environmental performance in core business strategies so as to achieve a “win-win” solution for sustainability. It is believed that business can do well by doing good or creating more value with less impact (e.g. Schaltegger 1997; Schaltegger and Müller 1998; Ehrenfeld 2005). The business case, i.e. win & win, is able to motivate a practical and incremental change for corporate sustainability (Schaltegger and Wagner 2006; Falck and Heblich 2007).

While today’s business world has paid much more attention to environmental performance and impacts than the past, environmental and economic performances are still measured differently and managed separately. These two performances are often contained in different corporate reports with financials in annual reports and environmental issues in sustainability reports . Integration of the two in performance measurement is limited in early development of business reporting and management practice (de Villiers et al. 2014). In academic debate, eco-efficiency is more or less a conceptual term that has triggered many discussions in the past but few empirical investigations and evidences (Ehrenfeld 2005; Erkko et al. 2005; Ciroth 2009; Huppes 2009; Figge and Hahn 2013). Extant literature of social and environmental accounting is predominantly focused on corporate reporting, with little representation of environmental management accounting (EMA) or performance measurement research in mainstream accounting journals (see reviews in Parker 2005, 2011; Schaltegger et al. 2013). Empirical studies of corporate performance have made numerous attempts to justify the alignment of corporate economic value creation and environmental performance , and a positive or negative relationship between the two has been evidenced (see e.g., Konar and Cohen 2001; Derwall et al. 2005; Orsato 2006). However, an investigation into the actual integration, such as its levels, practices, improvements, differences and issues, is still uncharted water. An important question is unknown, that is, how companies are managing eco-efficiency, particularly the extent to which they are performing on a strong (i.e. increase both economic and environmental performances) or weak (i.e. increase either economic or environmental performance but the increase in one performance is larger than the decrease in the other) trajectory of eco-efficiency? Given that ever less businesses today can act with little regard or concern for their impacts on the environment and the demands for integration from not only internal business management but also external investors , lenders, suppliers and other stakeholders continue to increase, an investigation of corporate practice on eco-efficiency is clearly needed. Motivated by this research gap, we aim to examine the level and improvement of corporate carbon emissions and the integration of corporate carbon and financial performance among Australian heavy emitters.

With the international climate change agreements and the increased awareness and visibility of climate change and carbon pollution caused by industry development, the level of carbon emissions has become an important environmental indicator to business managers, government regulators as well as the community (Choi et al. 2013). Under Australian National Greenhouse and Energy Reporting Act 2007 (NGER 2007), top polluting companies have to disclose their annual carbon emissions and energy consumption to the public since 1 July 2008. The subsequent debates on Emission Trading Schemes (ETS) in 2009 and the enactment and then the repealing of Carbon Tax during 2012 and 2013 have provided Australian businesses enormous incentives as well as challenges and uncertainties to achieve eco-efficiency (in this case, carbon efficiency ). Therefore, the central objective of this study is to develop a carbon efficiency typology and use this typological classification to reveal and understand how Australian top polluters manage carbon efficiency and to what extent they achieve a strong carbon efficiency outcome towards the ultimate goal of sustainability.

We collected Australian NGER emission data during 2009 and 2013 and integrated the 5-year emission data with financial data collected from the database Company 360 Select (financials). A systematic comparison and analysis were performed to understand carbon related eco-efficiency in corporate practice.

The chapter is organised as follows. Following the introduction and justification of this study, Sect. 5.2 reviews the concepts and debates of eco-efficiency and the empirical studies of corporate environmental and economic performances and their integration. In Sect. 5.3, we elaborate and develop a typological classification differentiating eco-efficiency levels and then link these with different corporate eco-efficiency profiles. Section 5.4 outlines the method used to collect and analyse data for this study. In Sect. 5.5, we critically evaluate and compare the eco-efficiency results across top polluting companies in Australia. The concluding remarks are provided in Sect. 5.6.

2 Literature Review

The notion of eco-efficiency has been defined and redefined by many previous studies and in many ways. In essence, it derives from the concept of efficiency which measures the relation between inputs and outputs. A service or activity is considered to be efficient if it provides higher levels of output for a given input or utilises lower levels of input for a given output (Schaltegger and Burritt 2000). When integrating economic and environmental performances into the input and output relationship, eco-efficiency focuses on creating more goods and services using fewer resources and/or generating less waste and pollution (Schaltegger and Sturm 1990). To a company, eco-efficiency measures its ability to generate more economic value with less environmental impacts, i.e. expressed as the ratio below (Schaltegger 1998; Schaltegger and Sturm 1990):

In this definition economic value added represents financial performance of a company and – depending on the focus of analysis – can be expressed in both monetary terms (such as sales revenue and value added) and physical terms (units of production) (Schaltegger and Burritt 2000). Environmental impact added can be regarded as the sum of assessed environmental impacts generated by a company. Examples of eco-efficiency measures may include financial returns per tonne of CO2 emissions and the contribution margin of a product relative to its greenhouse effect (CO2 equivalents) (Schaltegger and Burritt 2006; Figge and Hahn 2013). The eco-efficiency of a company will increase when its environmental added value increases at a given level of environmental impacts and/or its environmental impact decreases at a given level of economic performance (Schaltegger 1998). The emphasis is on implementing environmental improvements and strategies that can yield parallel economic benefits. This concept urges business entities to seek innovation and opportunities which allow them to stay profitable while being environmentally responsible, thereby increasing their competitiveness for a longer term (Schmidheiny and Stigson 2000).The debate on the practicality of eco-efficiency and the alignment of environmental and economic performances has continued for two decades. Some prior studies repudiate the possibility of successful integration (i.e. being able to increase eco-efficiency) as they argue environmental management requires substantial corporate investments but financial returns on these investments are barely achieved (Walley and Whitehead 1994). In this strand of literature, initiatives to reduce environmental impacts are viewed as costly, risky and having a negative impact on economic value creation (Kiernan 2007; Aragon-Correa and Rubio-Lopez 2007). McDonough and Braungart (1998) even criticise eco-efficiency as an industrial buzz word as they consider the focus of eco-efficiency is still part of the industrial system that has caused environmental degradation. Hukkinen (2001) also questions the basic assumptions of eco-efficiency that an individual’s concern for the environment can be decoupled from his or her material dependency on ecosystem services and eco-efficiency builds upon decoupling environmental governance from the local socio-economic and cultural context.

In contrast, the other stream of literature argues that environmental initiatives can bring a wide variety of benefits that outweigh their financial costs (Russo and Fouts 1997; Nakao et al. 2007; Sharfman and Fernando 2008; Molina-Azorín et al. 2009). For example, they may reduce regulatory compliance costs, increase image and reputation, and enhance consumer confidence, operating performance, shareholder value and stakeholder relationship (Derwall et al. 2005; Trudel and Cotte 2009; Figge 2005; Horváthová 2010; Guenster et al. 2011; Osazuwa and Che-Ahmad 2016; Al-Najjar and Anfimiadou 2012; Herold et al. 2016; Henri et al. 2016).

Empirical studies observing a positive relationship between economic and environmental performances have become more prevalent in literature (Klassen and McLaughlin 1996). Clarkson et al. (2011) find that pursing proactive environmental strategies leads to better financial performance among the most polluting industries. Karagozoglu and Lindell’s (2000) study of environmental strategy and competitive advantage in high-tech and traditional manufacturing sectors also confirms that “win-win” outcomes do exist in different industries. Similar findings have been made by Porter and van der Linde (1995), Konar and Cohen (2001), Derwall et al. (2005), and Orsato (2006).

More recently, some studies have used larger samples or more robust evidence such as longitudinal data examinning the relationship between finanical and environmental performance. For example, Al-Najjar and Anfimiadou (2012) investigated 201 firms in the UK for a 10 year time period from 1999 to 2008 to reveal the positive association between eco-efficiency, environmental policy and firm value. Albertini (2013) conducted a meta-analysis of 52 studies over a 35-year period and the result also supports the positive relationship between financial and environmental performance. Osazuwa and Che-Ahmad (2016) analysed the content of annual reports by 667 Malaysian firms and in addition to confirm the association between financial and environmental performance, they also recognise the importance of stakeholder relationship in strengthening such association. In line with these empirical studies, Henri et al. (2016) examined the relationship between the management of environmental costs and financial performance. Their survey of 319 Canadian manufacturing firms reveals a positive and significant association between the tracking of environmental costs, the implementation of environmental initiatives and financial performance. They highlight that structural cost management can “align a firm’s resources and associated cost structure with long term strategy” through the re-designing of the value chain and cost structure (pp. 277–278). Focusing specifically on carbon emissions, Busch and Hoffman (2011) find a positive relationship between carbon emission reduction and financial performance in their investigation of 2500 largest companies according to the Dow Jones Global Index. A series of King and Lenox’s (2001, 2002) studies evidence that companies achieving lower emissions in their relevant industries are likely to experience higher market performance. Apart from large companies, Qian and Xing (2016) also confirm such positive relationship in private and smaller firms. However, most researchers supporting the rationale of eco-efficiency strategies believe that a business case for eco-efficiency is achievable but the change for the whole industry and the ecosystem will be incremental rather than overnight (Schaltegger and Wagner 2006; Falck and Heblich 2007; Wahba 2008).

While most empirics provide a strong support for eco-efficiency improvement in business practice, the focus of prior studies has largely been on testing the relationship between economic and environmental performances . As such, the two performances are treated and assessed separately. Limited studies have been undertaken to understand the actual integration, integration levels, changes and the way it is performed and achieved in individual firms. From the perspective of individual companies, practicing and reporting eco-efficiency still present a challenge. Erkko et al. (2005) find that despite discussing eco-efficiency as a broad concept, few Finnish companies actually quantify and operationalise the eco-efficiency concept, or report eco-efficiency indicators. Virtanen et al.’s (2013) study of an energy-intensive industry reveals many underdeveloped performance indicators in practice such as energy efficiency in production units or efficiency on a “product family” basis. Given the complexities involved in performance measurement, they highlight the need of further examination of eco-efficiency development. More recently, Passetti and Tenucci (2016) report a poor use of eco-efficiency measures in a study of 65 Italian companies. The study highlights that most companies possess only moderate understanding of eco-efficiency measurements. Therefore, the authors encourage companies to develop and use more articulated measurement and evaluation tools to analyse eco-efficiency performance. This echoes Burritt and Saka’s (2006) case study of Japanese businesses which reveals that eco-efficiency measurements are still underutilised and there is a lack of a generally accepted format to facilitate eco-efficiency analyses and comparisons between companies.

3 Development of a Typological Classification of Eco-efficiency

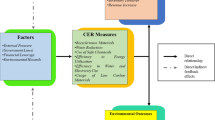

To analyse and compare eco-efficiency performance, it is necessary to explore different levels of eco-efficiency development rather than simply looking at the relationship between economic and environmental performances . Several studies detailing the theory, concept and measurement of eco-efficiency, for example, Schaltegger (1998), Schaltegger and Burritt (2000), and Figge and Hahn (2013), provide valuable insights for this investigation. Ideally, eco-efficient companies are able to improve both economic and environmental performances , i.e. as suggested by previous empirical studies, to follow a positive linear relationship between the two performances. Schaltegger and Sturm (1998; see also Schaltegger and Burritt 2000) define this movement as strong eco-efficiency development, as illustrated in the upper right area (dark grey) in Fig. 5.1. Companies within this area are viewed as green stars (Schaltegger and Sturm 1998; Schaltegger 1998). They are able to use lean technology and management processes to achieve low environmental impact and cost, and consumers are willing to pay a price premium for their environmental achievements which lead to better economic performance (Schaltegger 1998).

Matrix of eco-efficiency development (Source: adapted from Schaltegger and Burritt 2000)

However, value drivers for eco-efficiency may vary, which could lead to inconsistent development of efficiency in the use of economic and environmental resources (Figge and Hahn 2013). In this regard, companies may follow weak eco-efficiency development (striped areas) or fall into the inefficiency areas (areas to the left below the eco-efficiency hurdle line) as shown in Fig. 5.1. Weak eco-efficiency demonstrates one dimensional improvement, either economic or environmental, with the other dimension decreasing. If the value increase in one dimension is greater than the decrease in the other dimension, the eco-efficiency outcome may still be achieved, but this exhibits a weak sustainable improvement of eco-efficiency (Schaltegger and Burritt 2000). If the value increase in one dimension is lower than the decrease in the other, companies are clearly below the eco-efficiency line (the dashed line that separates the green and grey areas in Fig. 5.1). Broadly, Ilinitch and Schaltegger (1995) categorise companies with sound economic growth strategy and high profitability but high environmental impacts as dirty cash cows and the inverse as green question marks. Green question marks are environmentally friendly companies but they have relatively low economic performance which may raise questions on their long-term survival, in particular those falling below the eco-efficiency line. Companies that are not only economically uninteresting but also cause massive environmental damage are destructive. These “dirty dogs” struggle both financially and environmentally and are likely to be eliminated soon (Schaltegger 1998).

As the value drivers for eco-efficiency are not always congruent (Figge and Hahn 2013), economic efficiency may be significantly higher or lower relative to environmental performance in the same or different movement directions. This reflects the different focuses and strategies companies use to improve their eco-efficiency. For example, if the increase in economic performance is higher than the increase in environmental performance such improvement is considered an economically strong eco-efficiency improvement. If the increase in environmental performance is higher than the decrease in economic performance then such improvement is considered an environmentally favourable weak eco-efficiency improvement. As such, adapted and extended from the categorisation suggested by Schaltegger (1998), we develop eight areas of eco-efficiency improvements (or destructions) to reflect a full picture of corporate eco-efficiency developments in Table 5.1.

The explanation of the classification in each area of the eco-efficiency matrix is as follows:

-

1.

Golden stars: This area includes companies that have achieved strong eco-efficiency improvements while the increase in the economic performance is higher than the increase in environmental performance . Such increase demonstrates an economically strong eco-efficiency improvement. Companies in this area are considered golden stars as their current development is characterized by a relatively stronger capital efficiency increase than the environmental improvement. They may have economic potential to contribute further towards environmental sustainability in the future as more capital resources may be available for future environmental performance improvements.

-

2.

Green stars: This area includes companies that have shown strong eco-efficiency improvements while the increase in environmental performance exceeds their economic performance. These companies show high commitment to environmental sustainability and lead the industry for their environmental excellence. They are labelled as green star performers as environmental sustainability has been improved relatively more than the economic improvement as part of the eco-efficiency increase.

-

3.

Greedy cash cows: This area comprises companies with improved economic performance but more environmental impact added. Greedy cash cows exist when the increase in economic performance is higher than the decrease in environmental performance. These companies have accepted a somewhat limited trade-off between economic improvement and environmental decrease. They are economically favourable weak eco-efficient performers. Their focus has been placed on increasing profitability but at the same time trying to limit their negative environmental impacts generated.

-

4.

Dirty cash cows: Companies fall within this category if their damage to the environment outweighs the economic value created. Companies have clearly emphasised on economic value growth and are able to achieve favourable economic outcomes. However, their operations and management are based on strong trade-offs accepting large environmental impacts. Dirty cash cows are unsustainable and with the internalization of their environmental impacts may also prove to be economically inefficient in the long term.

-

5.

Green question marks: This area includes companies with low economic performance but high environmental performance . Green questions marks are environmentally favourable weak eco-efficient performers, thus accepting a trade-off between environmental improvement and economic decrease. Their eco-efficiency improvement stems from the environmental dimension, but this has not triggered a more efficient use of financial resources and creation of adequate economic benefits. Strengthening economic performance presents a challenge but also an opportunity for companies to turn “weak” into “strong” sustainable performers.

-

6.

Red question marks: This area exists when the increase in environmental performance is lower than the decrease in economic performance, thus resulting in an overall eco-efficiency decrease. This group includes companies that face financial difficulties but still make some marginal environmental improvements. Companies that are reactive to regulatory pressures to make necessary investments in green technologies may fall into this type of eco-efficiency development. However, these companies are under the radar (and the eco-efficiency hurdle) and may face high risk of shifting to destructive eco-efficiency zones in the future if the financial development persists.

-

7.

Dirty dogs: This area comprises companies with destructive, negative eco-efficiency change. Such type of eco-efficiency development exists when the decrease in environmental performance is more than the decrease in economic performance. Companies in this area may have chosen to reduce investments in environmentally friendly products in order to control the decrease in profitability.

-

8.

Stressed dogs: This area includes companies with low economic performance and high environmental impacts. This means the companies have entered a destructive eco-efficiency decrease zone. The ongoing stress under both financial and environmental pressures may result in an eventual withdrawal of the companies from the market.

4 Research Method

Based on the review of the concept and measurement of eco-efficiency and the analysis and exploration of corporate eco-efficiency developments, we designed our research investigation as follows. The empirical data in this study were collected in Australia. Although eco-efficiency measurement and accounting practice and research have developed rapidly and extensively in various countries, Australia is still lagging behind (Zhou et al. 2016). Given that Australia has one of the highest per capita coal consumption in the world (Perry et al. 2015), it becomes critical to investigate eco-efficiency performance of Australian top polluters.

To apply the proposed eco-efficiency typology in the context of carbon emission management, we develop the following table defining the typological classification of carbon efficiency . As part of environmental performance , carbon performance specifically focuses on the reduction of carbon emissions. Therefore, carbon efficiency reflects the increase of economic performance relative to the reduction of carbon emissions (Table 5.2).

4.1 Sample

In Australia, business entities that exceed the specified thresholdsFootnote 1 of greenhouse gas emissions are required to report emission and energy consumption information under the Australian National Greenhouse and Energy Reporting (ANGER) Act 2007 Act 2007. Our data coverage spanned 5 years between 2009 and 2013.Footnote 2 In 2009, when ANGER published its first carbon emission data, only 235 top polluters were included. This number increased to 450 in 2013. Except for a small number of non-corporate entities such as local councils and universities, the majority of reporting entities are business corporations. As the focus of this study is on corporate carbon emissions and performance, we excluded all not-for-profit organisations such as local councils and universities. Companies that were involved with merge and acquisition or delisted during the study periods were also excluded. To capture the change of environmental performance , we included companies that contain at least three consecutive years of environmental and financial data. After sorting out the dataset, our final sample included 236 top polluting companies, within which 82 were public companies and 154 were private companies. Public companies were listed and traded at the Australian Stock Exchange (ASX) and private companies were non-listed companies involving private equity, state owned and foreign controlled companies. The companies selected covered ten major industry sectors, of which nearly one third of the companies came from the Materials sector. Table 5.3 shows the industry profile of ANGER companies selected.

Based on our sample data, around half of the top polluting companies were within the Materials and the Industrials sectors. Other high environmentally sensitive industries such as Utilities and Energy have relatively similar numbers of companies to some low sensitive industries such as Consumer Discretionary and Financials. Health Care, Telecommunication Services and Information Technology sectors have only a few reporting companies. Majority of the industry sectors have more private than public companies while this is reversed in Financials and Health Care.

4.2 Measurements

ANGER classifies carbon emissions into Scope 1 and Scope 2 emissions. Scope 1 emissions are greenhouse gases released to the atmosphere as a direct result of an activity or series of activities that constitute the facility, while Scope 2 emissions are greenhouse gases emitted at a second facility because of the electricity, heating, cooling or steam that is consumed at the facility (Australian Government 2007). In this study, we used total emissions, i.e. the aggregate of Scope 1 and Scope 2 emissions, to measure corporate environmental performance . High energy intensive entities such as utility firms may generate more Scope 1 (direct) emissions while low intensive firms such as banks may involve more Scope 2 (indirect) emissions. An environmentally responsible firm should take an overall responsibility to reduce both direct and indirect emissions. Therefore, we considered total emissions a better measure of environmental performance than single scope of emissions. This is consistent with the measurement of environmental performance used in previous studies such as King and Lenox (2002) and Busch and Hoffmann (2011).

As carbon emissions were size sensitive, i.e. the bigger firms tend to generate higher emissions than smaller firms, we scaled total emissions by total assets for each company. This changed carbon emissions to carbon emission intensity. However, to consider company size carbon emissions or emission intensities reflect corporate carbon pollution levels. Corporate carbon performance should be read as a reduction of their emission or intensity levels, i.e. negative change of emissions and intensities.

Economic data in this study were collected from company profile reports and statements contained in the database Company 360° Select. We used financial return on assets (ROA), i.e. earnings before interest and tax (EBIT) over total assets, to measure economic performance. This is consistent with prior studies (e.g. King and Lenox 2001; Clarkson et al. 2011; Qian and Xing 2016) which consider that the ROA measure reflects a firm’s ability to use its assets to generate profit and revenue regardless of how assets are financed (interest bearing) or taxed. We calculated the changes of emission intensity and ROA for each company and compared the directions and absolute values of these changes. Both emission intensity and ROA were normalised by total assets. In actual calculations, we eliminated total assets in both performance measurements. In this regard, the change of economic performance was measured as the change of EBIT and the change of environmental performance was measured as the change of total emissions (the results were reversed as the reduction of emissions indicated an improvement of performance). Each company was then coded from “1” – Golden Stars, to “8” – Stressed Dogs, based on the typological classification defined in Table 5.2.

5 Result Analysis

We first analyse the proportion of companies falling within each carbon efficiency development over a 5 year reporting period. Figure 5.2 visualises this distribution.

For the time period from 2009 to 2013, we find about a quarter of NGER companies were Golden Stars, i.e. achieved overall economically strong carbon efficiency improvements. Only a small number of companies qualify as Green Stars (3%). However, altogether nearly 30% of high emitters have made a “win-win” case for sustainability. The substantially larger number of Golden Stars than Green Stars shows that economic performance has improved relatively more among strong carbon efficient performers. This may reinforce the necessity and practicability of making a business case for corporate sustainability (Salzmann et al. 2005; Schaltegger and Wagner 2006; Falck and Heblich 2007). Reflecting from Schaltegger and Burritt’s recent (2015) differentiation of motivations for business cases, significantly more Golden Stars than Green Stars appear to exhibit “technocratically responsible” business cases for sustainability among Australian top polluters. While they are able to create win-win improvements both for the environment and economically, their efficiency improvement and benefits are larger than their environmental improvements. However, when interpreting this result it is important to emphasize that for the natural environment it does not matter whether economic improvements which go along with the environmental improvement are larger or smaller in percentage. Of importance is that environmental improvements are created. Whether the economic improvements are larger in percentage is not relevant for the environment.

A similar pattern can be observed for companies that have achieved weak carbon efficiency developments. Twenty percent of the weakly carbon efficient firms are Greedy Cash Cows compared to 5% Green Question Marks. It appears that if companies are not able to overcome trade-offs and thus have to (or decide to) improve one dimension of efficiency at the cost of the other, they are more likely to improve economic benefits than environmental performance . This reflects conventional trade-off thinking in management decisions. Still, these companies seem to be able to limit the trade-off costs in a way that the overall carbon efficiency still improves, although weakly. When contrasting the 20% Greedy Cash Cows with the 4% Dirty Cash Cows, it seems that companies have moved away from being labelled as dirty and inefficient polluters with high energy use but low economic growth. For financially profitable companies, sacrificing environmental performance (with potentially related higher reputation risks) is relatively unpopular.

For financially challenged companies, the story is the other way around. The small number of Green Question Marks (5%) compared with nearly a quarter Red Question Marks (23%) indicate that few companies with weak carbon efficiency improvements are able to stay in business which favour environmental performance substantially over economic performance. Financially struggling firms are more likely to be reactive to environmental demands from regulatory authorities and other stakeholders. Their improvement of environmental performance or incurrence of environmental costs is likely to be used to protect business interests and maintain legitimacy and survival, and thus environmental management becomes costly and brings little or no economic benefits (Schaltegger and Burritt 2015). Most weak carbon efficiency improvements may also reflect a reactionary business case thinking where environmental improvements are only made at the last moment under pressure and thus result in costs which impact the conventional business case negatively. Taking strong and weak eco-efficient performers together, our data shows that 54% of Australian top polluters have managed their business eco-efficiently since the NGER Act 2007.

In carbon inefficient areas, companies are clearly struggling more with financial stress than environmental pressures. The data furthermore shows 17% Stressed Dogs and only 2% Dirty Dogs. This suggests that inefficient use of financial resources is a good indicator for failing to improve carbon efficiency. In a next analytical step we compare carbon efficiency development between reporting years (Table 5.4).

The comparison of annual carbon efficiency developments presents some interesting results. As a positive response to NGER Act 2007, the national carbon reporting requirement, nearly 40% of top polluters have managed to achieve strong carbon efficiency improvements (33% Golden Stars and 6% Green Stars) in their first movement during 2009 and 2010. The effect decreases in the following years, probably due to the three times rejection of the Emissions Trading Scheme (ETS) and the subsequent uncertainties in government climate change policy during 2010 and 2012. As a result, the strong carbon efficiency performers dropped to 26% in 2010–2011 and 24% in 2011–2012. In particular, Green Stars kept falling from 3% to 1%. However, for 2012–2013 the passage of Carbon Tax Bill in late 2011 and the implementation of carbon tax in 2012 seem to provide Australian companies another incentive to improve eco-efficiency. During 2012 and 2013, strong eco-efficiency performers have risen back to 32% and 5%, respectively, for Green Stars. With the repeal of the Carbon Tax in 2014, the uncertainty of carbon policy returns and this may lead to another change of corporate carbon efficiency developments.

While many carbon efficiency developments continue for the analysed reporting years, Table 5.4 also exhibits changes, particularly an increasing group of Red Question Marks. At one stage, Red Question Marks more than doubled (15% in 2009–2010 and 33% in 2011–2012). This may reflect the tightening of regulatory pressures over years whereas financially stressed firms had to increasingly respond to their environmental challenges and demonstrate compliance and improvement. It may also reflect the management belief that trade-offs between economic and environmental performance are inevitable under the given regulatory conditions. This would explain carbon management activities which are in line with a reactionary business case thinking. As companies following a reactionary or reputational business case for sustainability will not go beyond compliance or pursue a forward thinking to integrate environmental consideration in business strategies, environmental activities are merely cost drivers rather than profit generators (Schaltegger and Burritt 2015).

As public firms only represent one third of the top polluters and two thirds of the sample are private firms which are significantly smaller and subject to much less public scrutiny for their environmental performance , we further investigate the difference of eco-efficiency developments between these two groups of companies.

As shown in Table 5.5, despite a few variations of carbon efficiency developments between public and private firms, the general of carbon efficiency development pattern is similar in each category. Both groups achieve around 30% strong carbon efficiency performers. However, public firms have a higher percentage of weak carbon efficiency improvement. While 30% of public firms have achieved weak carbon efficiency improvement, only 20% of private firms show the same development. This is mainly attributed to a much higher percentage of Greedy Cash Cows (27%) among pubic firms than private firms (15%), perhaps due to the greater ability of public firms to access economic resources through both internal and external fund providers. Nevertheless, high profitability of public firms is still built upon an increase rather than reduction of carbon emissions .

Table 5.6 compares the eco-efficiency development in different industries.

The results present some diversity of carbon efficiency development between industries. Financials clearly stands out as the best performer. Sixty eight percent of Financials have achieved eco-efficiency improvements, of which, 43% have achieved strong carbon efficiency and 25% weak eco-efficiency improvements. Being a strong economic dominator (most NGER reporting financial firms in Australia are publicly traded), the Financials sector maintains its ability to generate relatively high profit and growth with 36% Golden Stars and 7% Green Stars. The Energy sector comes second (34%) in achieving strong eco-efficiency results. It has less Golden Stars (27%) in comparison to the Financials sector, but the same percentage of Green Stars (7%). The weak eco-efficiency performers in the Energy industry, however, are the lowest (17%). Utilities and Industrials have slightly fewer strong carbon efficiency improving firms, but more weak carbon efficiently developing firms (both over 30%), which lead to totals of 59% and 57% carbon efficiency improving firms respectively in these two sectors. As current legislations in Australia only focus on direct emissions which are more likely generated by energy intensive industries such as Energy and Utilities, their above-average performance may reflect their responses to regulatory as well as social expectations. To illustrate, we map some examples of best performers (i.e. Leading Stars), continuously improving performers (i.e. Rising Stars) and continuously deteriorating performers (i.e. Falling Stars) over the 5-year reporting periods in Fig. 5.3.

Several companies are clearly leaders in managing eco-efficiency improvements. Commonwealth Bank of Australia (Financials) and Energex Ltd. (Utilities) have been noticeable for their strong eco-efficiency performance for every single year in the sample. Many large firms such as Exxonmobil Australia (Energy), Wesfarmers (Consumer Staples), McDonald’s Australia (Consumer Discretionary), Amcor (Materials), Telstra (Telecommunication) and HRL (Industries) have started with a poor eco-efficiency performance, but became strong performers in later years. In contrast to these Rising Stars that are improving substantially, companies such as OzGen Holdings Australia (Utilities), Coca-Cola Amatil (Consumer Staples), CSR Ltd. (Industrials), Iluka Resources (Materials) and Incitec Pivot (Materials) have moved away from a win-win outcome. Coca-Cola Amatil as a food and beverage industry giant has fallen to a carbon efficiency destroyer (Stressed Dogs) in recent years, a warning signal for its business and environmental sustainability in both short and long terms.

6 Conclusions

This chapter is motivated by the recent debate and development of integration of environmental and economic performance and the discussion about business cases for sustainability. Eco-efficiency as an essential measure for integration has been studied extensively in the past, but mainly conceptually or in single case studies. Empirical examinations focus largely on the relationship between economic and environmental performances rather than the integration of the two to achieve “win-win” solutions. Although a positive relationship is increasingly reported as the result of large scale cross-sectional statistics, the actual business practice on integration is underexplored. Businesses may have paid much attention to environmental issues, especially environmental compliance costs. Yet, previous literature finds that managing eco-efficiency presents a different challenge (Burritt and Saka 2006; Erkko et al. 2005).

Extended from Schaltegger (1998), Schaltegger and Sturm (1998), and Schaltegger and Burritt (2000), we take corporate eco-efficiency development to the forefront of empirical investigation and propose a new typological classification for carbon efficiency development. Using carbon emissions and their integration with corporate economic performance among Australian heavy polluters during 2009 and 2013, we examine the actual integration levels, improvements, patterns, and more importantly, differentiate strong and weak carbon efficiency developments.

The study reveals that 54% of Australian top polluters have increased their eco-efficiency since the NGER Act 2007. Among this, nearly 30% of the companies have achieved a strong carbon efficiency improvement. Among the companies which have been able to create strong carbon efficiency improvements, more firms have increased their economic performance more strongly than their carbon performance (i.e. more Golden Stars than Green Stars). This pattern is consistent for firms which have improved their carbon efficiency weakly or which have become more inefficient. Dirty Cash Cows whose focus is purely on economic growth while ignoring environmental images are a minority among the companies examined. For financially stressed companies, environmental engagement appears more likely to be a reaction to regulatory requirements. Their reactive environmental/carbon compliance is not able to create profit or save costs, and thus potentially results in weaker economic performance.

Changes in carbon efficiency development seem to match against the government policy changes over the 5-year reporting periods. Almost 40% of companies achieved a strong carbon efficiency improvement subsequent to the reporting requirement under NGER Act 2007. This positive result was partially reduced in the following years. The visible decline of strong carbon efficiency performers during 2010 and 2012 may be attributed to the absence of clear climate change policies and the dismissal of ETS. Improvements were regained in 2012 under the new carbon tax motions. However, the repeal of carbon tax in 2014 may again cast some doubt on further corporate carbon efficiency improvements.

The comparison between public and private polluters does not indicate significant differences between these two groups, especially for strong carbon efficiency developments. The carbon efficiency development among industries clearly varies with Financials outperforming all other industries. Nearly 70% of the firms in the financial industry have improved their carbon efficiency during the reporting years, 43% of which have achieved strong carbon efficiency improvements. The Financials sector is followed by several high direct emission generators, such as Energy and Utilities. This may be due to their high environmental sensitivity and direct reporting and tax pressures on these direct emitters.

Taking the findings together, it seems that carbon regulations are likely to be an essential driver for corporate eco-efficiency development. As such, Australian top polluters have mainly reacted on regulations while a large group has been able to create technocratically optimized business cases. This highlights that companies are rather legitimacy oriented in their sustainability management and that profit-orientation is clearly not guiding the sustainability activities. These implications complement the recent findings by Schaltegger and Hörisch (2015) which reveal that the rationale of seeking legitimacy dominates corporate sustainability management practices. Companies predominantly react on societal pressure dealing with sustainability to secure legitimacy rather than to pursue economic success. Many companies do not seem to be able or willing to overcome trade-offs and are not integrating environmental and economic issues. This is particularly interesting because Australia has experienced most carbon regulatory changes and turmoils over the recent years. Future studies may extend the investigation of eco-efficiency developments after the abolishing of Carbon Tax in this country and the possible reintroduction of ETS under the new government.

Notes

- 1.

In 2009, entities that had total greenhouse gas emissions (CO2 equivalent or CO2-e) above 125 kilotonnes (KT) or total amount of energy produced or consumed above 500 terajoules (TJ) were required to report. The thresholds change to 87.5 KT and 350 TJ for 2010 and 50 KT and 200 TJ for later years.

- 2.

Under the NGER Act 2007 (Section 23), registered controlling corporations are obliged to report information on greenhouse gas emissions and energy consumption to the Greenhouse and Energy Data Officer (GEDO). The GEDO has published an extract of the information reported since 2009.

References

Albertini E (2013) Does environmental management improve financial performance? A meta-analytical review. Organ Environ 26(4):431–457

Al-Najjar B, Anfimiadou A (2012) Environmental policies and firm value. Bus Strateg Environ 21(1):49–59

Aragon-Correa JA, Rubio-Lopez EA (2007) Proactive corporate environmental strategies: myths and misunderstandings. Long Range Plan 40(3):357–381

Australian Government (2007) National Greenhouse and Energy Reporting Act 2007. Canberra

Burritt RL, Saka C (2006) Environmental management accounting applications and eco-efficiency: case studies from Japan. J Clean Prod 14(14):1262–1275

Busch T, Hoffmann VH (2011) How hot is your bottom line? Linking carbon and financial performance. Bus Soc 50(2):233–265

Choi BB, Lee D, Psaros J (2013) An analysis of Australian company carbon emission disclosures. Pac Account Rev 25(1):58–79

Ciroth A (2009) Cost data quality considerations for eco-efficiency measures. Ecol Econ 68(6):1583–1590

Clarkson PM, Li Y, Richardson GD, Vasvari FP (2011) Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J Account Public Policy 30(2):122–144

de Villiers C, Rinaldi L, Unerman J (2014) Integrated reporting: insights, gaps and an agenda for future research. Account Audit Account J 27(7):1042–1067

Derwall J, Guenster N, Bauer R, Koedijk K (2005) The eco-efficiency premium puzzle. Financ Anal J 61(2):51–63

Ehrenfeld JR (2005) Eco-efficiency. J Ind Ecol 9(4):6–8

Erkko S, Melanen M, Mickwitz P (2005) Eco-efficiency in the Finnish EMAS reports—a buzz word? J Clean Prod 13(8):799–813

Falck O, Heblich S (2007) Corporate social responsibility: doing well by doing good. Bus Horiz 50(3):247–254

Figge F (2005) Value-based environmental management. From environmental shareholder value to environmental option value. Corp Soc Responsib Environ Manag 12(1):19–30

Figge F, Hahn T (2013) Value drivers of corporate eco-efficiency: management accounting information for the efficient use of environmental resources. Manag Account Res 24(4):387–400

Guenster N, Bauer R, Derwall J, Koedijk K (2011) The economic value of corporate eco-efficiency. Eur Financ Manag 17(4):679–704

Henri J-F, Boiral O, Roy M-J (2016) Strategic cost management and performance: the case of environmental costs. Br Account Rev 48(2):269–282

Herold DM, Manwa F, Sen S, Wilde S (2016) It’s the yeast we can do: untapping sustainability trends in Australian Craft Breweries. J Asia Entrep Sustain 12(2):82

Horváthová E (2010) Does environmental performance affect financial performance? A meta-analysis. Ecol Econ 70(1):52–59

Hukkinen J (2001) Eco-efficiency as abandonment of nature. Ecol Econ 38(3):311–315

Huppes G (2009) Eco-efficiency: from focused technical tools to reflective sustainability analysis. Ecol Econ 68(6):1572–1574

Ilinitch AY, Schaltegger SC (1995) Developing a green business portfolio. Long Range Plann 28(2):29–38

Karagozoglu N, Lindell M (2000) Environmental management: testing the win-win model. J Environ Plan Manag 43(6):817–829

Kiernan MJ (2007) Universal owners and ESG: leaving money on the table? Corp Gov 15(3):478–485

King AA, Lenox MJ (2001) Does it really pay to be green? An empirical study of firm environmental and financial performance: an empirical study of firm environmental and financial performance. J Ind Ecol 5(1):105–116

King A, Lenox M (2002) Exploring the locus of profitable pollution reduction. Manag Sci 48(2):289–299

Klassen RD, McLaughlin CP (1996) The impact of environmental management on firm performance. Manag Sci 42(8):1199–1214

Konar S, Cohen MA (2001) Does the market value environmental performance? Rev Econ Stat 83(2):281–289

Korhonen J, Seager TP (2008) Beyond eco-efficiency: a resilience perspective. Bus Strateg Environ 17(7):411–419

McDonough W, Braungart M (1998) The next industrial revolution. Atl Mon 282(4):82–92

Molina-Azorín JF, Claver-Cortés E, López-Gamero MD, Tarí JJ (2009) Green management and financial performance: a literature review. Manag Decis 47(7):1080–1100. https://doi.org/10.1108/00251740910978313

Nakao Y, Amano A, Matsumura K, Genba K, Nakano M (2007) Relationship between environmental performance and financial performance: an empirical analysis of Japanese corporations. Bus Strateg Environ 16(2):106–118

Orsato RJ (2006) Competitive environmental strategies: when does it pay to be green? Calif Manag Rev 48:127–143

Osazuwa NP, Che-Ahmad A (2016) The moderating effect of profitability and leverage on the relationship between eco-efficiency and firm value in publicly traded Malaysian firms. Soc Responsib J 12(2):295–306

Parker LD (2005) Social and environmental accountability research: a view from the commentary box. Account Audit Account J 18(6):842–860

Parker LD (2011) Twenty-one years of social and environmental accountability research: a coming of age. Account Forum 35(1):1–10

Passetti E, Tenucci A (2016) Eco-efficiency measurement and the influence of organisational factors: evidence from large Italian companies. J Clean Prod 122:228–239

Perry FN, Henry S, Perry ME, MacArthur L (2015) California green innovation index: international edition. Next 10 and Collaborative Economics, San Francisco

Porter ME, Van der Linde C (1995) Green and competitive: ending the stalemate. Harv Bus Rev 73(5):120–134

Qian W, Xing K (2016) Linking environmental and financial performance for privately owned firms: some evidence from Australia. J Small Bus Manag. https://doi.org/10.1111/jsbm.12261

Russo MV, Fouts PA (1997) A resource-based perspective on corporate environmental performance and profitability. Acad Manag J 40(3):534–559

Salzmann O, Ionescu-Somers A, Steger U (2005) The business case for corporate sustainability: literature review and research options. Eur Manag Rev 23(1):27–36

Schaltegger S (1997) Economics of life cycle assessment: inefficiency of the present approach. Bus Strateg Environ 6(1):1–8

Schaltegger S (1998) Accounting for eco-efficiency. In: Nath B, Hens L, Compton P, Devuyst D (eds) Environmental management in practice. Routledge, London, pp 272–287

Schaltegger S, Burritt R (2000) Contemporary environmental accounting: issues, concepts and practice. Greenleaf Publishing, Sheffield

Schaltegger S, Burritt R (2006) Corporate sustainability accounting: a catchphrase for compliant corporations or a business decision support for sustainability leaders? In: Schaltegger S, Bennett M, Burritt R (eds) Sustainability accounting and reporting. Springer, Dordrecht, pp 37–59

Schaltegger S, Burritt R (2015) Business cases and corporate engagement with sustainability: differentiating ethical motivations. J Bus Ethics. https://doi.org/10.1007/s10551-015-2938-0

Schaltegger S, Hörisch J (2015) In search of the dominant rationale in sustainability management: legitimacy or profit-Seeking? J Bus Ethics. https://doi.org/10.1007/s10551-015-2854-3

Schaltegger S, Müller K (1998) Calculating the true profitability of pollution prevention. In: Bennett M, James P (eds) The green bottom line: Environmental accounting for management: current practice and future trends. Greenleaf Publishing, Sheffield, pp 86–99

Schaltegger S, Sturm A (1990) Ökologische Rationalität: Ansatzpunkte zur Ausgestaltung von ökologieorientierten Managementinstrumenten. Die Unternehmung 4:273–290

Schaltegger S, Sturm A (1998) Eco-efficiency by eco-controlling. Vdf, Zurich

Schaltegger S, Wagner M (2006) Managing the business case for sustainability: the integration of social, environmental and economic performance. Greenleaf Publishing, Sheffield

Schaltegger S, Gibassier D, Zvezdov D (2013) Is environmental management accounting a discipline? A bibliometric literature review. Meditari Account Res 21(1):4–31

Schmidheiny S, Stigson B (2000) Eco-efficiency: creating more value with less impact. World Business Council for Sustainable Development, Switzerland

Sharfman M, Fernando CS (2008) Environmental risk management and the cost of capital. Strateg Manag J 29:569–592

Trudel R, Cotte J (2009) Does it pay to be good. MIT Sloan Manag Rev 50(2):61–68

Virtanen T, Tuomaala M, Pentti E (2013) Energy efficiency complexities: a technical and managerial investigation. Manag Account Res 24(4):401–416

Wahba H (2008) Does the market value corporate environmental responsibility? An empirical examination. Corp Soc Responsib Environ Manag 15(2):89–99

Walley N, Whitehead B (1994) It’s not easy being green. Harvard Bus Rev 72:46–52

Zhou Z, Ou J, Li S (2016) Ecological accounting: a research review and conceptual framework. J Environ Prot 7(5):643–655

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Qian, W., Kaur, A., Schaltegger, S. (2018). Managing Eco-efficiency Development for Sustainability: An Investigation of Top Carbon Polluters in Australia. In: Lee, KH., Schaltegger, S. (eds) Accounting for Sustainability: Asia Pacific Perspectives. Eco-Efficiency in Industry and Science, vol 33. Springer, Cham. https://doi.org/10.1007/978-3-319-70899-7_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-70899-7_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-70898-0

Online ISBN: 978-3-319-70899-7

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)