Abstract

Supported by policy, electric vehicles (EVs) powered by lithium batteries are being commercialised in an increasing number of models and their global stock surpassed two million units in 2016. However, there is uncertainty around the future price and availability of lithium, which has consequences on the feasibility of manufacturing lithium batteries at scale. Reaching the EV penetration levels foreseen by governments implies a substantial growth in lithium demand. In this chapter, we review the evidence around future lithium availability for the manufacturing of EV batteries. We examine the methods used to estimate both lithium demand from EVs and lithium supply from brines and ore. The main variables influencing demand are the future size of the EV market, the average battery capacity and the material intensity of the batteries. Supply projections depend on global reserve and resource estimates, forecast production and recyclability. We find that the assumptions made in the literature on the key variables are characterised by significant uncertainty. However based on the available evidence, it appears that lithium production may be on a lower trajectory than demand and would have to rapidly increase in order not to prove a bottleneck to the expansion of the EV market. More research is needed in order to reduce uncertainty on lithium intensity of future EVs and improve understanding of the potential for lithium production expansion and recycling.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Electric vehicles (EVs) have the potential to contribute to meeting energy and environmental policy objectives of governments worldwide such as reducing dependence on oil-derived fuels and related emissions of greenhouse gases and improving air quality in urban areas. However, the question has been raised whether the availability of critical metals can prove a constraint to the manufacturing of EV batteries at scale [1,2,3]. Given that lithium batteries are currently the only viable technology for EVs and are likely to remain so for the foreseeable future, it can be expected that large quantities of lithium will be needed to manufacture enough automotive batteries to meet the desired policy objectives [4,5,6]. This raises questions as to the mining sectors ability to satisfy demand [7, 8]. This chapter addresses the question of lithium availability for the manufacturing of EVs based on research published by the authors in 2014 [9] and updated as appropriate. In Sect. 2, we examine the relevant literature, focusing on the relationship between metal availability and EV manufacturing, highlighting the main variables and assumptions used in previous studies. In Sect. 3, we describe the difficulties in calculating future lithium demand for EV batteries. Section 4 discusses the issues surrounding future supply of lithium. Section 5 compares supply and demand and presents the conclusions that follow from the analysis.

It is important to mention that the term EV can be used to indicate all road vehicle types that have an electric powertrain, including hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), battery electric vehicles (BEVs) and fuel cell vehicles (FCVs). This classification is broad and does not fully represent all possible powertrain architectures. It is however practical for two reasons: (1) the literature often classifies vehicle technology in a similar way; and (2) these vehicle types all potentially use lithium batteries. In this chapter, we will therefore initially consider all EV types above and we will then restrict our attention to those that use larger lithium batteries and hence account for most of the demand for lithium.

2 The Literature on Availability of Lithium for EV Batteries

A number of authors have explored the relationship between lithium availability and EV uptake over the last 10 years, ranging from pessimistic studies that suggest future EV demand cannot be met by lithium supply [7, 8], to optimistic studies that find no significant constraint to ambitious EV market development projections [10]. These were reviewed by the authors in [9]. Within these studies are a range of different assumptions which lead to a wide range of findings of Table 1.

In particular, the studies we have reviewed generally disagree on the quantity of lithium needed by the future EV market.

The variables leading to this range of outcomes include:

-

the time horizon;

-

the number of vehicles manufactured at a given point in the future;

-

the size of batteries in different EV types;

-

the share of the future EV market taken by different EV types; and

-

the quantity of lithium per unit of battery capacity.

Aside from the inherent uncertainty, assumptions tend to vary over time as they are influenced by the development of EV technology as well as its market uptake. The variables above and related assumptions are further discussed in Sect. 3.

As for lithium supply estimates, these are influenced by the following variables:

-

lithium reserves;

-

future lithium production rates; and

-

future recycling rates.

The variables and related assumptions are discussed in detail in Sect. 4.

3 Estimating Lithium Demand from EVs

As mentioned above, the calculation of future lithium demand from EVs involves estimating several variables and hence is subject to significant uncertainty. However, the common elements typically considered are:

-

the number of EVs manufactured in the future;

-

the size of EV batteries in kWh; and

-

the lithium intensity per kWh of battery.

We examine projections of future EV deployment in Sect. 3.1 and the issue of material intensity per vehicle in Sect. 3.2.

3.1 The Future Size of the EV Market

There are several studies presenting a range of different scenarios of the future EV market. To illustrate the range of scenarios found in the literature, in our earlier work [9], we compared high-profile studies [17,18,19,20,21] providing uptake scenarios disaggregated by EV type. The scenarios compared cover a range of timeframes, the earliest beginning in 2008 and the longest projecting to 2050. In the studies reviewed in [9], global PHEV sales estimates in 2050 range from 10 to 79 million vehicles per year, and BEV from 12 to 84 million vehicles per year. It is worth noting that EV uptake scenarios contained in more recent studies [22,23,24,25,26] are generally much more aggressive, with the lower end of the range broadly overlapping with the higher end of the range provided by the older studies.

The scenario selected for the analysis we conducted in [9] was the BLUE Map scenario contained in the 2010 Energy Technology Perspectives (ETPs) report of the International Energy Agency (IEA) [27]. The BLUE scenarios are a set of normative scenarios that allow halving global CO2 emissions by 2050 compared with 2005 levels at the least cost under different assumptions. The global EV sales by EV type projected in the BLUE Map scenario are summarised in Table 2.

The BLUE scenarios have now been discontinued by the IEA and substituted in more recent editions of the ETP by other normative scenarios that are named according to the level at which they are expected to contain global temperature rise, i.e. the 2 °C scenario (2DS) and the below 2 °C scenario (B2DS). Comparing the EV projections of the 2010 ETP with those of the 2017 ETP [24], it is apparent that the latter is much higher, which reflects the progress made by EV technology and market uptake over the last few years, and hence, the much bigger role EVs are expected to play in climate change mitigation over the coming decades. The EV uptake levels in the BLUE Map scenario of the 2010 ETP however are broadly comparable with those in the Reference Technology Scenario (RTS) of the 2017 ETP. The RTS is a scenario that depicts a plausible future where today’s policy measures are implemented and new measures are introduced based on current policy trends, and where technology develops as is currently expected. For this reason, we decided not to substitute the EV projections of the 2010 BLUE Map scenario with more recent ones, but it is important to stress that the projections should be seen as a lower bound to future EV uptake and that therefore lithium demand from EVs as estimated by our analysis could be much higher if EV uptake proceeded more rapidly.

3.2 Estimating Lithium Intensity

Since their re-emergence in the last 10 years, EVs have been relying on lithium-ion (Li-ion) batteries for their propulsion [28]. As discussed below, a number of Li-ion and Li-metal chemistries are currently being developed and it is likely that lithium batteries will continue to dominate the EV market for the foreseeable future. The lithium intensity, i.e. the weight of lithium per vehicle, must be estimated before any estimates of future EV lithium demand can be made based on the EV uptake scenario previously discussed.

Deriving lithium intensity for Li-ion batteries ideally requires knowledge of:

-

the nominal voltage of the battery (volts, V);

-

the specific capacity of the battery chemistry considered (Ampère-hours per gram, Ah/g); and

-

the concentration of lithium in the active materials of the battery when this is assembled (weight per cent, wt%).

While large batteries are required for BEV and PHEV designs, smaller batteries of the order of 1–1.5 kWh are generally sufficient for HEVs and FCVs, where they are only used for storing energy generated on board via regenerative braking and, in the latter case, also shaving the peaks and troughs of fuel cell duty cycles. Since the capacity of PHEV and BEV batteries is likely to be 10–20 times that of HEV and FCV batteries, and since HEVs and FCVs make up a relatively small proportion of the total vehicle market in 2050 based on the scenario presented in Table 2 above, the total lithium demand from HEVs and FCVs is likely to be negligible for the purposes of our study and is hence excluded from our previous analysis [9].

As mentioned above, the amount of lithium contained in an EV battery is a function of its size, particular type of chemistry, construction and rated performance. Hence, it is impossible to define with certainty the amount of lithium that each individual EV battery model will require. Nevertheless, we will discuss each of the main factors influencing the amount of lithium required in an individual EV battery in turn, following the approach used in [9]. On this basis, we identify a range of values for lithium demand per vehicle which is then combined with the global EV demand projections discussed above in order to estimate future global demand for lithium for the EV market.

The calculation of global lithium demand from EVs in year y (D Li,y ) can be summarised by the following equation:

where M is the market size (annual vehicle sales) of BEVs/PHEVs in year y, S is the average size (kWh) of a BEV/PHEV battery in year y and I is the average intensity (amount of lithium per unit energy capacity (kWh) of a BEV/PHEV battery in year y).

A similar approach has been taken, either implicitly or explicitly, in a number of relevant studies reviewed in [9] (see Table 1). In the remainder of this section, we discuss in turn average battery sizes and average amounts of lithium per unit energy stored. This will allow us to arrive at a plausible lithium demand range, which we will discuss in Sect. 5.

-

Average battery sizes for BEVs and PHEVs

The rated energy of the battery, expressed in kWh, is one of the main parameters determining the all-electric range (AER) of a BEV or PHEV. The rated energy is declared by the manufacturer and cannot be directly translated into a value for the lithium content of the battery. This is due to a number of reasons, including that the energy stored in an EV battery (and hence its lithium content) is usually significantly higher than its rated energy would suggest, i.e. the battery is over-specified; this is further discussed later on. Let us begin by focusing on the average rated energy of EV batteries, which we will refer to as battery size.

There is no standard battery size for BEVs and PHEVs. It is the prerogative of automotive Original Equipment Manufacturers (OEMs) to manufacture BEVs and PHEVs with different AER capabilities and therefore different battery sizes. Trade-offs exist between AER on the one hand and cost, weight and volume of the battery on the other. This somewhat constrains the extent to which battery size can vary across different models, although for BEVs in particular we are observing that, as the cost of batteries declines [29], OEMs are equipping them with increasingly large batteries in order to meet the range requirements of prospective buyers.

BEV models commercialised over the last 10 years use Li-ion batteries of a wide range of sizes, depending on the size of the car and the desired AER. Battery sizes start at a minimum of around 15 kWh which gives a small city car a range in the order of 130–150 km, up to 100 kWh which gives a large high-performance sedan or crossover a range in the order of 500 km (see Table 3).

Today’s PHEVs also use Li-ion batteries, the size of which varies somewhat across vehicle models (see Table 4). Different powertrain architectures are possible for PHEVs, which are suited to different modes of operation and achieve different AERs, and this largely explains the range of battery sizes observed. In particular, the Toyota Prius Plug-in Hybrid has been designed to have limited all-electric operation capabilities and hence has a relatively small battery pack (8.8 kWh). On the other hand, range-extended electric vehicles such as the Vauxhall Ampera are capable of delivering high performance while operating in EV mode and hence have a significantly larger battery pack (16 kWh).

-

Lithium content per unit energy stored in BEV and PHEV batteries

Another important parameter for determining the total demand for lithium in EVs is the amount of lithium required per kWh of battery. However, its estimation is far from straightforward, which contributes to the wide range of figures reported in the literature. The studies reviewed in [9] use different methods to derive their estimates, each with its own limitations. Here we discuss the approach we have taken in [9] to estimate the amount of lithium required per kWh of battery, the main factors affecting it and the main differences between our approach and that of others. Our approach shows similarities with those adopted by a number of previous studies [13, 17, 32,33,34].

As mentioned above, estimating material intensity in batteries ideally requires knowledge of the voltage that the battery is capable of delivering while in operation, its specific capacity and the chemical composition of its active materials. However, this information is only readily available to the battery manufacturers. One method of estimating material intensity (labelled method ‘A’ in Table 5) is to use industry data where available. This is done in several of the studies cited in Table 5. Alternatively, it is possible to measure voltage and specific capacity of a battery, then disassemble it and analyse its composition in a laboratory. This process (labelled ‘B’), sometimes referred to as ‘reverse engineering’, is often not practical as it is expensive, and results obtained for one particular type of cell would not apply to others. The two remaining options are: to use published data for battery voltage and specific capacity and then make assumptions on their composition (labelled ‘C’); or, knowing the particular chemistry of the battery, to estimate the amount of lithium required by starting from the theoretical value required under ideal conditions and then adding to it in order to account for real operating conditions (labelled ‘D’). In [9], we have adopted the latter approach. As will become apparent from the discussion, we were not being able to arrive at specific lithium intensity values for EV batteries by simply following this approach. However, it enabled us to derive upper and lower boundaries for the possible range of lithium intensity values and, based on this, assess the validity of some of the figures found in the literature.

As stated in [9], there are three key factors that vary and must be accounted for in a theoretical assessment of lithium intensity in EV batteries:

-

Impact of the specific battery chemistry on lithium intensity. A number of lithium battery chemistries are possible, which are characterised by different performance and lithium intensities.

-

Impact of energy losses on lithium intensity. Lithium batteries, like any other battery, when operating only deliver as electrical energy part of the chemical energy stored, while the rest is lost as heat due to internal resistance mechanisms called ‘overpotentials’.

-

Impact of over-specification on lithium intensity. The actual capacity of a lithium battery is often much higher than the rated capacity, in order to guarantee durability.

These are dealt with in turn below.

-

(i)

Variation in lithium intensity between different battery chemistries

The amount of lithium used per kWh depends on the stoichiometry of the particular electrochemical reaction that is associated with the battery chemistry considered and on its corresponding electromotive force (E0). Based on Faraday’s laws, the theoretical lithium demand per kWh can be calculated as:

where I is the lithium intensity in g/kWh, m is the molar mass of lithium in g/mol, E 0 is the electromotive force in volts, a is the fraction of lithium available and c is the charge of 1 mol of lithium ions in Ah/mol.

Using the appropriate values, we get the following:

The conventional Li-ion chemistry (originally commercialised by Sony) is based on the following redox process:

where the cathode material LiCoO2 can only exchange roughly half of its lithium content, hence the fraction of lithium available a is 50%. Entering the appropriate values for E 0 and a in formula (3), we estimate the theoretical amount of lithium needed per kWh of a conventional Li-ion battery to be 129.5 g.

Another Li-ion chemistry of practical interest is the one that uses lithium iron phosphate (LiFePO4) at the cathode and lithium titanium oxide (Li4Ti5O12) at the anode. This chemistry is inherently safer than the conventional one and hence potentially more suited to EVs, particularly PHEVs. The electromotive force E 0 of this system however is substantially lower, at ≈ 2 V. If we assume that 100% of the lithium contained in LiFePO4 and 75% of the lithium contained in Li4Ti5O12 can be made available, the theoretical amount of lithium needed per kWh will be 172.6 g.

The two examples here provided clearly illustrate that lithium intensity is not the same for different chemistries. Calculating g(Li)/kWh in this way provides a theoretical minimum and not the actual lithium intensity of real EV batteries. However, starting from the theoretical value is useful, not least because it shows that lithium intensity changes from one battery chemistry to another simply as a result of the different electrochemical processes involved. Actual lithium intensity will be higher than the theoretical value for the reasons mentioned above and further discussed below, i.e. the voltage losses that occur during the operation of a battery and the degradation processes that occur during the lifetime of the battery which reduce its capacity, leading manufacturers to over-specify them.

-

(ii)

Impact of energy losses on lithium intensity

The voltage of a lithium-ion battery when operating is significantly lower than its electromotive force E 0, the difference being the result of resistance within the battery. When the cell is operating, its actual voltage, ∆V (the difference in potential between the electrodes), can be expressed as follows:

where i is the current being drawn from the cell and R I is the internal resistance of the cell. R I is the sum of the ohmic resistance of the electrolyte and electrodes as well as the resistance due to the kinetics of charge transfer at the interface between electrodes and electrolyte. The difference between E 0 and ∆V, usually referred to as overpotential, is a function of both how the cell is operated (i.e. how fast the cell is discharged and its temperature at the time of operation) and how it is constructed (i.e. the chemical composition of the electrodes, their density and thickness, the size of the particles of active material that they contain, the concentration of the lithium salt used as electrolyte and the chemical composition of the solvents used). Hence if we replace E 0 with ∆V in Eq. (3), the lithium demand per kWh will be higher than the theoretical value because ∆V is always smaller than E 0 . The difference between E 0 and ∆V depends on a number of complex processes and cannot be estimated theoretically from first principles for any battery chemistry. Its experimental measurement on the other hand is straightforward, though the values obtained for a specific battery model cannot be generalised, not even to other batteries that use the same chemistry.

-

(iii)

Impact of over-specification on lithium intensity

Manufacturers often ‘over-specify’ batteries, typically to reduce the impact of degradation over the lifetime of the battery and hence guarantee the necessary cycle life, which is typically calculated as the number of charge–discharge cycles achievable before the capacity of the battery falls below 80% of its rated value. In many cases, the over-specification of the battery is quite substantial and the battery is operated at reduced depth of charge and discharge. The extent to which the battery is over-specified can vary greatly across manufacturers, chemistries and intended use of the battery. As a result, in the case of heavily over-specified batteries, the actual amount of lithium can be twice the theoretical value.

From the discussion above, it is apparent that directly calculating lithium intensities based on methodology ‘D’ is problematic. Hence, in [9], we examine lithium intensity values for Li-ion batteries available in the literature (see Table 5) and we compare them with the range of values that we have derived by applying methodology ‘D’. The range of lithium intensities in the literature varies widely, between 50 g/kWh and 562 g/kWh, and not all of the estimates listed in Table 5 have the same merit. Firstly, not all methodologies labelled ‘A’ are actual industry data, as many rely on sources quoted in the media or in corporate presentations without reference to either public or proprietary industry data. We discount a number of these estimates on this basis, and we also discount those that provide values that are below the theoretical limits that we have calculated [18, 35]. Methodology ‘C’ is valid, although the study using it [12] does not disclose references or provide justifications for the assumptions used. Within the studies employing methodology ‘D’, Tahil [34] and Angerer et al. [17] appear to overstate lithium intensity, while Gruber et al. [13] assume lower values. Finally, a number of studies do not disclose the full details of their assumptions or methods [15, 32]. These observations make it difficult to judge the value of many estimates in Table 5. For this reason in Sect. 5, we use a range (190–380 g/kWh) of lithium intensity which we consider as broadly representative of that found in commercial lithium batteries. The range is based on the lithium intensity estimates we have found in the literature [9], excluding those that appear close to the theoretical minimum [18, 35] as well as the apparent overestimates [34].

Aside from the three factors discussed above that are essential to the theoretical assessment of lithium intensity in EV batteries, it is also worth mentioning that battery research and development may result in a more efficient use of lithium in EV batteries or in its substitution through the development of alternative, non-lithium-based battery chemistries for EVs. Both these developments could in principle impact the demand for lithium from EVs quite substantially, and hence, they are discussed in turn below.

-

(iv)

Potential for lithium weight shedding

The focus of research and development in lithium batteries over the last decades has been on increasing safety, lowering cost, increasing energy density and improving cycle life, with a long-term view towards low environmental impact [37, 38]. Lithium contributes only 1–2% of final battery cost [32]. Accordingly, little discussion about reductions in lithium content can be found in the literature. Rade and Andersson [33] provide one of the few estimates of future lithium intensity of Li-ion batteries based on the improvement of active material utilisation from a current 50% to 60–80% depending on chemistry, leading to intensity reductions of 21–34%. Utilisation of active materials is defined as the share of electrochemically active material contained in the anode and cathode that actually participates in the electrochemical reactions occurring during charge and discharge of the battery. It is unclear whether the lithium intensity reduction suggested in [33] has since been realised or will ever be, so it is not possible to account for it based on the available evidence.

-

(v)

Potential for substitution

Early BEVs such as General Motors’ EV1 used lead–acid batteries and more recently the Think City used sodium/nickel chloride (also known as ZEBRA) batteries. However, lithium batteries have significant advantages over these two battery types and it is unlikely that the latter will be used in future BEVs and PHEVs. Since lithium is the lightest metal and has an extremely negative electrode potential, lithium batteries have much higher energy density than lead–acid batteries, allowing EVs to achieve acceptable ranges without imposing a high weight penalty. Moreover, unlike ZEBRA batteries which use molten sodium at 300–350 °C, most lithium battery chemistries operate at room temperature, and because they do not need preheating, they are always available for use, which is a very desirable characteristic for vehicles with no fixed usage patterns such as passenger cars. These favourable characteristics, together with the high power density and long cycle life, explain why lithium batteries are the current technology of choice for BEVs and PHEVs.

Other non-lithium chemistries are being researched that may compete with lithium batteries. However, alternatives to lithium are limited, because prospective systems need to have high energy density and this requires using light metals such as sodium, magnesium and aluminium. Battery systems under investigation include magnesium/sulphur and aluminium/graphite fluoride. However, the practical viability of these systems has not been demonstrated and their future use in EVs depends on significant technological improvement [37]. Metal air chemistries such as sodium air and zinc air are also possible alternatives to lithium air. Sodium air batteries in particular have the potential to mitigate some of the problems of Li-air technology, but technological improvement is needed before this technology becomes practical [39].

4 Lithium Supply

The availability of lithium over the coming decades is contingent upon the rate at which the metal can be produced from natural sources or recycled from spent batteries and brought to market. In order to understand future lithium supply issues, in [9], we explored its geological characteristics and routes to extraction, its existing reserve estimates and current production rate, the extent to which it can be recovered from spent batteries and its forecast production. These are discussed in turn below, based on [9] and with figures updated as necessary.

4.1 Geological Characteristics of Lithium

Due to its reactivity, lithium metal never occurs freely in nature and is instead found in the form of lithium compounds in four main deposit types as follows: minerals, brines, sedimentary rocks and sea water. Minerals and brines constitute the world’s main source of lithium today. Lithium-containing minerals are typically coarse-grained intrusive igneous rocks known as pegmatites, such as spodumene, petalite, lepidolite, amblygonite and eucryptite [13]. Brine deposits are currently the largest and cheapest sources of lithium [10] and are mostly found in dry lakes such as the Salar de Atacama in Chile, as well as geothermal deposits and saline aquifers. The third source of lithium is in sedimentary rocks, notably clays such as hectorite and lacustrine evaporates such as the newly discovered jadarite [13, 40]. These sedimentary deposits are currently not commercially recovered. Finally, sea water contains diffuse but very large quantities of lithium. According to Yaksic and Tilton [10], 44.8 billion tonnes of lithium are recoverable from the world’s oceans. The economic viability of extracting lithium from sea water is uncertain. The lithium recovered from the above sources is produced in the form of a number of compounds, such as lithium carbonate, lithium hydroxide, lithium chloride and others. Different lithium compounds are used in different applications, lithium carbonate being the one typically used in Li-ion batteries.

4.2 Production and Reserves

Known reserves of lithium exist and are commercially exploited in a number of countries, the relative distribution of which is presented in Fig. 1. The largest share of production is currently in Australia, where lithium is recovered from spodumene deposits. Chile is the second largest producer and has the largest reported reserves of lithium from brine pools located in salt flats throughout the Andes mountain range. The geographical distribution of both reserves and production indicates that lithium supply is unlikely to suffer from the geopolitical supply constraints witnessed for materials with less well geographically distributed resources such as rare earth metals or indium [41,42,43,44].

In order to understand the future potential of lithium reserves and production, it is essential to look at their historical development. Figure 2 presents historical world lithium production data by gross weight of the minerals and compounds extracted, published by the USGS [46]. Since 1967, lithium production was reported as ‘ore and ore concentrates’ from mines and lithium carbonate from brine deposits. Calculating the lithium weight in lithium carbonate is straightforward. However, calculating the lithium content of ore and ore concentrate is problematic given that the composition of these ores and concentrates is unknown. Despite some inconsistencies in the data, Fig. 2 appears to present a resource which is being exploited through an exponential phase of production.

Similarly, reported reserves are substantially increasing, thanks to continuing exploration [45]. Figure 3 presents different lithium reserve and resource estimates as they developed over time. It is important to note that the estimates are based on different classifications of resources; hence, they are not all directly comparable. The issue is compounded by the fact that explicit descriptions of reserve classifications are not always provided.

In particular, the USGS provides figures for both reserves and reserve base, though reserve base reporting was discontinued in 2010 [45]. Roskill (cited in [36]) provides reserve data for 2009. Garrett [47] provides disaggregate reserve figures for 2004. Tahil [7, 8] provide reserve and reserve base estimates for the years 2005 and 2007. Evans [48, 49] provides reserve and ‘in situ’ data for year 2008. Finally, Yaksic and Tilton [10] provide estimates of recoverable resources and in situ resources in 2009. The data in Fig. 3 provide a wide range of estimates, with the largest estimate in 2009 over 700% greater than the smallest. This can in part be explained by the different nature of reserve classifications used, but it also reflects the uncertainty around future prospects for lithium production. It is also worth mentioning that the USGS [45] refers to additional ‘resources’ for several countries, including Bolivia, which as yet has no recorded production or reserves, but the USGS estimates it to have 9 million tonnes of resources. What prevents any of these resources from being reported as reserves by the USGS is unclear. The USGS in 2017 [45] estimates world resources at 47 million tonnes, over three times their reserve estimate but still well below the Yaksic and Tilton [10] estimate.

Given the rapidly growing nature of production (Fig. 2) and the relative increase in reserve estimates over time (Fig. 3), lithium appears to be relatively immature in terms of its exploration and production, with the latter increasing rapidly every year and reserve estimates indicating that new resources are still being discovered.

4.3 Recycling

Historically, only small quantities of lithium have been recycled [45]. The United Nations Environment Programme has estimated lithium end-of-life recycling rates at less than 1% in 2011 [50]. However, more recently we are witnessing an increase in recycling of lithium batteries due to their growing market size which brought about new regulation on their disposal. In Europe, Member States have been obliged to collect 25% of end-of-life batteries by 2012 and 45% by 2016 [51]. This legislation however does not mandate the recycling of lithium. In fact, some Li-ion battery recycling facilities recover cobalt and nickel hydroxides but not lithium [52].

In spite of this, the potential for recycling of lithium from end-of-life batteries is estimated to be significant. Gaines and Nelson [12] estimate that over 40,000 tonnes of lithium could be recycled from batteries in the USA by 2050, assuming 100% recycling rates and a 10-year battery life. Gruber et al. [13] model lithium recycling and estimate that this could satisfy between 50 and 63% of cumulative demand over the 2010–2100 period, assuming recycling rates of 90–100%. Buchert et al. [52], however, note that while the large growth in battery production implies a significant recycling potential, the economic case for recycling lithium remains weak unless its price grows significantly.

A primary issue in recycling lithium from end-of-life batteries is the sorting of collected waste batteries, as even the Li-ion batteries from automotive applications will not all have the same chemistry. In order to develop an efficient recycling process, it is necessary to know the composition of the batteries to be treated [53]. To address this, a number of automatic sorting systems have been developed which use magnetic or electrodynamic sensors, photograph recognition of the label and X-ray imaging, all resulting in varying levels of purity of the separated fractions [54].

For the reasons outlined above, the recovery of lithium from spent batteries remains a niche market [52] and the lithium battery industry has no tradition of using recycled material for manufacturing new batteries [55]. It therefore appears difficult for recycled lithium to contribute half of future supply, as suggested by Gruber et al. [13], unless more targeted legislation is introduced or stronger market incentives develop.

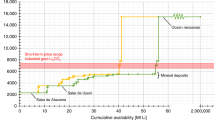

4.4 Estimates of Future Supply

Because the exploitation of lithium as a natural resource is still immature, both production and reserve estimates have been changing over time and several authors have tried to account for these changes within projections of future production or availability. In [9], we had examined a number of estimates of future production to year 2020, which were based on the analysis of lithium reserve exploitation projects that were either in the pipeline or expected, and of future availability, based on assessments of total recoverable resources. These estimates were in the range of 60–110 thousand tonnes per year of lithium metal production in 2020 and ~2 to ~20 million tonnes of lithium metal available in total [7, 8, 10, 13, 18, 33, 56, 57]. In this chapter, we will not discuss the estimates in detail. Instead in Fig. 4, we provide a comparison between the range of production estimates to year 2020 that were made some years ago, with a high-case projection based on [18] and a low-case projection based on [56], and the actual production that has taken place since, as reported by the USGS [45]. As is apparent from Fig. 4, lithium production has substantially underperformed the estimates we had assessed in [9], and extrapolating from the data we can expect lithium production to be at the lower end of the estimated range by year 2020.

As for the assessments of total recoverable resources that we had reviewed in [9], it is worth noting that these tend to be conservative and increase over time. Hence, significantly more lithium may be available if its price increases. Yaksic and Tilton [10] estimate that, at a price of 1.40–2 $ per lb of lithium carbonate, 22 million tonnes of lithium are available. However, they also estimate that at a price of 7–10 $ per lb of lithium carbonate, lithium can be extracted from sea water, more than doubling their estimate of available lithium. Hence, it is practical to assume the higher part of the range of estimates reviewed in [9] as a lower bound for future lithium availability.

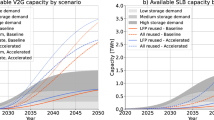

5 The Balance of Lithium Supply and Demand

In Table 6, we present the range of global lithium demand from BEV and PHEV batteries for the years 2030 and 2050 that we have derived based on the analysis presented in Sect. 3, using Eq. (1) and the values previously discussed for the relevant variables, updated from [9] as necessary. Our estimates of future lithium demand from EV batteries are presented as ‘low’ and ‘high’. Due to the complexity of estimating the lithium content of batteries, we use the range of figures for lithium content per unit energy stored (gLi/kWh), or lithium intensity, that we have discussed in Sect. 3.2 and are the same as in [9]. As for battery sizes, in the ‘low’ case, we use an average of 8 kWh for PHEVs and 30 kWh for BEVs, and in the ‘high’ case, we use 16 kWh for PHEVs and 60 kWh for BEVs. We have revised the figures originally used in [9] in order to account for the trend towards using larger batteries, especially in BEVs (see Tables 3 and 4). Finally, annual EV sales figures are the same as in [9], i.e. based on the IEA’s BLUE Map scenario presented in Table 2, which we decided to keep because it represents a conservative estimate of future EV market uptake, as discussed in Sect. 3.1. No account of other uses of lithium is included in the demand estimates, and these are purely based on demand for EVs.

As can be seen from Table 6, our estimated lithium demand from EVs increases significantly between 2030 and 2050. This is due to the large growth in annual vehicle sales between the two timeframes, and the changing ratio between PHEV and BEV sales, which have different battery sizes (kWh). The scale of future lithium demand is also very large, with almost 1.5 million tonnes of lithium demand annually in the 2050 market (high case).

In Fig. 5, we combine lithium demand and production estimates, which enables us to derive insights into possible future lithium availability issues. On the left of Fig. 5, we present historical lithium metal production using data from Fig. 2 which shows an approximately geometric growth trend. On the right of Fig. 5 we provide estimates of future lithium supply and demand. The supply estimate is based on modelling by Vikström et al. [58] that extrapolates from historical production; hence, it is on the low end of the production forecast range to year 2020 provided in Fig. 4. The supply projection in [58] stretches to year 2050.

The quantitative impact of recycling on supply is not taken into account, given the ongoing concerns regarding lack of economic incentive and the low recycling rate experienced to date. However, if lithium recycling increased in the future, this would have a positive impact on future lithium availability relative to the estimates presented in Fig. 5.

The range of demand presented in Fig. 5 is large, driven by several factors. First, there is a significant uncertainty regarding the future average battery size and lithium intensity in batteries. There is a paucity of literature discussing the likely development of these factors over time; and the current EV models on the market and the available studies we have reviewed provide a very wide range of battery sizes and material intensities. Moreover, the future sales of both BEVs and PHEVs are subject of much speculation and a wide range of forecasts is available in the literature. Combining all these factors makes for great uncertainty in future demand for lithium from EV batteries. We can further observe that over the last decade, a clear trend is present where automotive OEMs equip their BEVs with increasingly larger batteries which give their vehicles longer ranges. The increased material intensity that this entails is however likely to be at least in part offset by improvements in battery engineering both at the cell and at the pack levels.

Comparing future supply and demand projections, it is apparent that, if production does not increase rapidly to match the likely rapid growth of demand, lithium availability may become a bottleneck in the manufacturing of EV batteries. Indeed in the last few years, demand has been moderately exceeding supply, which resulted in price increase [45]. The estimated range of future demand is many times greater than current supply. While this is challenging, there is no evidence that future production cannot increase at a sufficient pace. Though long-term exponential growth in lithium production would be unsustainable, if growth could be sustained over the next two decades, meeting future demand may be possible. Supporting this optimism are the significant resource estimates for lithium seen in Fig. 3, though these estimates make no assessment of how easy these resources are to access, and over what timescales they can be produced. In addition to the substantial resources that have been identified, even excluding sea water, end-of-use recycling could contribute to future supply, although it is unclear which lithium price levels will make recycling viable.

Further analysis of material demand for EVs is needed in order to reduce uncertainty concerning the quantity of lithium demanded per battery in the future. Analysis of the production potential of lithium is also needed to better assess which parts of identified lithium resources are economic. While there is evidence in the literature that these steps are being taken, a thorough assessment of the long-term effects of material availability on the deployment of EVs still requires a much improved understanding of the potential for, and the economic implications of, expansion in both lithium production and recycling.

References

U. S. Department of Energy (DOE), Critical Materials Strategy. Washington D.C. (2010)

U. S. Department of Energy (DOE), Critical Materials Strategy. Washington, DC. (2011)

H. Kara et al., Lanthanide Resources and Alternatives: A report for Department for Transport and Department for Business, Innovation and Skills (Oakdene Hollins: Aylesbury, UK, 2010)

Climate Change Committee (CCC), Building a Low Carbon Economy—The UK’s contribution to Tackling Climate Change. London, UK (Dec. 2008)

International Energy Agency (IEA), Energy Technology Perspectives. Paris, France (2016)

UK Energy Research Centre (UKERC), Energy 2050. Making the Transition to a Secure and Low-Carbon Energy System: Synthesis Report. London, UK (2009)

W. Tahil, The Trouble with Lithium: Implications of Future PHEV Production for Lithium demand. Meridian International Research. Martainville, France (2007)

W. Tahil, The Trouble with Lithium 2: Under the Microscope, Meridian International Research. Martainville, France (2008)

J. Speirs et al., Renew. Sust. Energy Rev. 35, 183 (2014)

A. Yaksic, J.E. Tilton, Resour. Policy 34, 185 (2009)

K.R. Evans, The future of electric vehicles: setting the record straight on lithium availability. J. Energ. Security (2009) Available from: http://www.ensec.org/index.php?option=com_content&view=article&id=213

L. Gaines, P.A. Nelson, Lithium-Ion Batteries: Examining Material Demand and Recycling Issues. Argonne National Laboratory. Argonne, IL, USA (2009)

P.W. Gruber et al., J. Ind. Ecol. 15, 760 (2011)

D. Kushnir, B.A. Sandén, Resour. Policy 37, 93 (2012)

J. Neubauer, The Impact of Lithium Availability on Vehicle Electrification, Plug-In 2011 Conference. National Renewable Energy Laboratory. Raleigh, NC, USA

G. Martin et al., Energy Storage Mater. 6, 171 (2017)

G. Angerer et al., Raw materials for emerging technologies: A report commissioned by the German Federal Ministry of Economics and Technology (English Summary). Fraunhofer ISI 2009 [31/10/2011]; Available from: http://www.isi.fraunhofer.de/isi-en/service/presseinfos/2009/pri09-02.php

Dundee Capital Markets (DCM), Lithium—Hype or Substance: A look at Lithium Demand and Supply (Dundee Securities Corporation: Toronto, Canada, 2009)

International Energy Agency (IEA), Technology Roadmap: Electric and Plug-In Electric Hybrid Vehicles. Paris, France (2011)

S. Marcus et al., A cleantech Resource Crisis: Will Rare Earth and Lithium Availability Thwart Cleantech Growth? (Cleantech Insight, Cleantech Group LLC, 2010)

McKinsey and Company, Roads Toward a Low-Carbon Future: Reducing CO 2 Emissions from Passenger Vehicles in the Global Road Transportation System. New York, NY (2009)

BP Energy Outlook, 2017 Edition. London, UK

International Energy Agency (IEA), World Energy Outlook. Paris, France (2016)

International Energy Agency (IEA), Energy Technology Perspectives 2017. Catalysing Energy Technology Transformations. Paris, France

OPEC, World Oil Outlook (Vienna, Austria, 2016)

Energy Perspectives Statoil, Long-Term Macro and Market Outlook (Stavanger, Norway, 2016)

International Energy Agency (IEA), Energy Technology Perspectives 2010. Scenarios& Strategies to 2050. Paris, France

M. Rosenberg, E. Garcia, Known Lithium Deposits Can Cover Electric Car Boom. Reuters, Feb. 11, 2010 [15/11/2011]

B. Nykvist, M. Nilsson, Nat. Clim. Change 5, 329 (2015)

CAR Magazine, 2017. [November 2017]; Available from: http://www.carmagazine.co.uk/

Green Car Congress, 2017. [November 2017]; Available from: http://www.greencarcongress.com/

D. Kushnir, B.A. Sandén, Resour. Policy 37, 93 (2012)

I. Rade, B.A. Andersson, J. Power Sources 93, 55 (2001)

W. Tahil, How Much Lithium does a Li-ion EV Battery Really Need? Meridian International Research. Martainville, France (2010)

T. Engel, Lithium bewegt die Welt. Deutsche Gesellschaft für Sonnenenergie e. V. [International Solar Energy Society, German Section], 2007. [15/1/2012]; Available from: http://www.dgs.de/164.0.html?&tx_ttnews%5Btt_news%5D=1330&cHash=5cf989b243

M. Engel-Bader, Chemetall Corporate Presentation: Lithium and the National Economy (Seminar Sociedad Nacional de Minería, Santiago de Chile, 2010)

M. Armand, J.M. Tarascon, Nature 451, 652 (2008)

A.G. Ritchie, J. Power Sources 136, 285 (2004)

E. Peled et al., J. Power Sources 196, 6835 (2011)

G.M. Clarke, P.W. Harben, Lithium Availability Wallmap (LAWM) (2009)

C. Candelise, J. Speirs, R. Gross, Renew. Sust. Energy Rev. 15, 4972 (2011)

C. Hurst, China’s Rare Earth Elements Industry: What Can the West Learn? Institute for the Analysis of Global Security (IAGS). Fort Leavenworth, KS, USA, (2010)

J. Speirs et al., Materials Availability: Potential Constraints to the Future Low-Carbon Economy. Working Paper II: Batteries, Magnets and Materials. UK Energy Research Centre. London, UK (2013)

J. Speirs et al., Materials Availability: Potential Constraints to the Future Low-Carbon Economy—Working Paper I: A Thin-Film PV Case Study. UK Energy Research Centre. London, UK, 2011

U.S. Geological Survey (USGS), Mineral Commodity Summaries 2017. U.S. Department of Interior. Reston, VA, USA

T.D. Kelly, J.A. Ober, B.W. Jaskula, Lithium Statistics. U.S. Geological Survey. Reston, VA, USA (2017)

D.E. Garrett, Handbook of Lithium and Natural Calcium Chloride (Academic Press, Cambridge, MA, 2004)

K. Evans, An Abundance of Lithium, 2008. [1/12/2011]; Available from: http://www.worldlithium.com/An_Abundance_of_Lithium_1_files/An%20Abundance%20of%20Lithium.pdf

K. Evans, An Abundance of Lithium: Part Two, 2008. [1/12/2011]; Available from: http://www.evworld.com/library/KEvans_LithiumAbunance_pt2.pdf

United Nations Environment Programme (UNEP), Recycling Rates of Metals: A Status Report, in Report of the Working Group on the Global Metal Flows to the International Resource Panel, 2011

European Parliament, Directive 2006/66/EC on Batteries and Accumulators and Waste Batteries and Accumulators (Belgium, Brussels, 2006)

M. Buchert, D. Schüler, D. Bleher, Critical Metals for Sustainable Technologies and their Recycling Potential. United Nations Environment Programme (UNEP) and Oko-Institut. Nairobi, Kenya (2009)

M. Contestabile, S. Panero, B. Scrosati, J. Power Sources 83, 75 (1999)

A.M. Bernardes, D.C.R. Espinosa, J.A.S. Tenório, J. Power Sources 130, 291 (2004)

K. Kotaich, S.E. Sloop, Recycling: Lithium and Nickel–Metal Hydride Batteries, in Encyclopedia of Electrochemical Power Sources, J. Garche, Ed., 2009, p. 188, Elsevier. Amsterdam, Netherlands

E.R. Anderson, Sustainable Lithium Supplies through 2020 in the Face of Sustainable Market Growth, in: 3rd Lithium Supply & Markets Conference. TRUGroup. Toronto, Canada (2011)

A. Ebensperger, P. Maxwell, C. Moscoso, Resour. Policy 30, 218 (2005)

H. Vikström, S. Davidsson, M. Höök, App. Energy 110, 252 (2013)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Speirs, J., Contestabile, M. (2018). The Future of Lithium Availability for Electric Vehicle Batteries. In: Pistoia, G., Liaw, B. (eds) Behaviour of Lithium-Ion Batteries in Electric Vehicles. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-69950-9_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-69950-9_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-69949-3

Online ISBN: 978-3-319-69950-9

eBook Packages: EnergyEnergy (R0)