Abstract

As is the case in most developed countries, the population of New Zealand is ageing numerically and structurally. Population ageing can have important effects on the distribution of personal income within and between urban areas. The age structure of the population may affect the distribution of income through the life-cycle profile of earnings but also through the spatial-temporal distribution of income within the various age groups. By decomposing New Zealand census data from 1986 to 2013 by age and urban area, this chapter examines the effects of population ageing on spatial-temporal changes in the distribution of personal income to better understand urban area-level income inequality (measured by the Mean Log Deviation index). We focus explicitly on differences between metropolitan and non-metropolitan urban areas. New Zealand has experienced a significant increase in income inequality over the last few decades, but population ageing has slightly dampened this trend. Because metropolitan areas are ageing slower, the inequality-reducing effect of ageing has been less in these areas. However, this urban-size differential-ageing effect on inequality growth has been relatively small compared with the faster growth in intra-age group inequality in the metropolitan areas.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

This chapter examines the role of changes in age structure of the population on income inequality in New Zealand over the 27-year period from 1986 to 2013. The spatial unit of analysis is the urban area, which captures about 85% of the population. More specifically, we contrast metropolitan with non-metropolitan areas. We compare results from two popular approaches—the population decomposition by sub-group approach used in Mookherjee and Shorrocks (1982) and the density decomposition approach of DiNardo et al. (1996).

Much previous research on income inequality in New Zealand has been using survey data.Footnote 1 A disadvantage of using survey data in New Zealand is that that the number of observations in a survey is often small, leading to relatively large sampling errors at sub-national levels. This limits the extent to which survey data can be used to study sub-national income inequality. This limitation of survey data is avoided in the present study by using micro-level data on individuals in urban areas from the previous six Censuses of Population and Dwellings in New Zealand between 1986 and 2013. We focus specifically on the role of changes in age structure and age-specific incomes within and between urban areas on the personal distribution of income. This is an important topic because the ageing of the population is expected to accelerate in the decades to come.

Our main finding is that, contrary to studies in some other countries, the ageing of the population in New Zealand has slowed down overall inequality growth.Footnote 2 We find that this effect is smaller in magnitude in metropolitan areas because these areas remain relatively more youthful. The slower ageing of the population in these large cities has made a small contribution to the faster growing inequality in metropolitan areas vis-à-vis non-metropolitan areas. However, most of the difference in inequality growth between the big cities and other urban areas is due to relatively faster growing inequality within specific age groups in metropolitan areas.

Inequality has risen in most of the developed world, especially over the last three decades. The literature suggests that growing inequality is inter alia due to: changing patterns of household formation; growing international economic integration through migration, trade and capital mobility; growing unemployment; skill-biased technical change; as well as institutional factors such as decreasing levels of unionisation and minimum wages. Most studies have found that economic factors are the biggest drivers of growing income inequality,Footnote 3 but demographic factors have played a role as well.Footnote 4

New Zealand stands out among the developed countries as having seen the relatively fastest growth in inequality, particularly during the structural and economic reforms of the late 1980s and early 1990s.Footnote 5 Changes in income inequality in New Zealand have been well documented.Footnote 6 At the subnational level, rapid inequality growth in the two largest metropolitan areas of Auckland and Wellington stands out (Alimi et al. 2016). This is largely in line with the rest of the developed world where large metropolitan areas are often areas with high—and fast growing—dispersion of income.Footnote 7 We examine here whether ageing of the population has played a role in rising income inequality and what role spatial differences in age composition have had in this context.

In New Zealand, only few studies have examined the distributional impact of changes in the age composition of the population and these studies did so at the national level.Footnote 8 The relationship between population ageing and inequality is not clear a priori. The impact of population ageing on the income distribution is uncertain due to the possibility of opposing within-age and between-age effects (von Weizsäcker 1996). Spatially, the age structure will have effects on both intra-area and inter-area inequality, as areas often have different age profiles. Bigger areas tend to have a greater share of young people. This may mean a higher intra-area inequality, particularly when accounting for post-compulsory education and family formation. At the same time, ‘prime aged’ workers in the large cities have higher average incomes due to agglomeration and productivity effects. Generally, population size is positive correlated with inequality.Footnote 9 In contrast, areas that possess amenities that attract retirees may have lower intra-area inequality due to the relatively narrow dispersion of incomes among retirees. New Zealand offers a relatively generous universal pension to all citizens and most other residents aged 65 and over. Hence retirement migration from big cities to lower average income areas lowers intra-area inequality in the retirement areas and increases intra-area inequality in the big cities. Retirement migration also contributes to higher inter-area inequality. However, the nature of the relationship between age structure and income inequality is blurred by the fact that the underlying dynamics of changing age structure can be complex and dependent on the relative impacts of natural increase and migration on age composition. Additionally, the way in which migration impacts on income inequality will be strongly dependent on the type of migration.Footnote 10

The chapter proceeds as follows: Sect. 2 reviews the literature on ageing and inequality. Section 3 discusses the two decomposition techniques that are used to analyse spatial-temporal changes in income inequality in New Zealand. Section 4 describes the data and reports the results. Section 5 concludes.

2 Literature Review

The patterns of ageing and income inequality in New Zealand have both been well documented at the national and sub-national levels. Jackson (2011) and Johnson (2015) provide descriptive accounts of changes in age structure at the national and sub-national levels. Perry (2014, 2015) and Easton (2013) provide evidence of the long-run upward trend in inequality at the national level. Karagedikli et al. (2000, 2003) and Alimi et al. (2016) provide a sub-national analysis of income inequality trends at the regional council level. The relationship between population ageing and the distribution of income has long been examined in the literature, alongside other socio-demographic influences on inequality.Footnote 11 However, very few studies use formal theoretical foundations to link ageing to the distribution of income. Notable exceptions are Deaton and Paxson (1994, 1995) and von Weizsäcker (1996). Deaton and Paxson (1994, 1995) use the implications of the permanent income hypothesis to show that income inequality increases as the population ages while von Weizsäcker (1996) examines the role of the public transfer system. He concludes that the effect of ageing on population is ambiguous and distinguishes several channels with opposing effects through which ageing may affect the distribution of income.

Most of the recent research on this topic has been empirically oriented. Fortin et al. (2011) provide a review of the adopted methodologies and emphasise the decomposition approaches that have become common in the literature.

Just as the theory suggests, empirical evidence on the relationship between changes in the age structure and the distribution of income has been mixed, although most studies finds that population ageing increases income inequality.Footnote 12 Nonetheless, some studies find a very small effect or no effect at all. Barrett et al. (2000) focussed on 1975–1993 consumption and income inequality in Australia and concluded that the ageing of the population had played only a minor role in growing inequality. Fritzell (1993) examined data from five countries (Canada, Germany, Sweden, UK and US) and concluded that changes in age distribution or changes in family composition cannot explain changes in inequality in these countries. Jantti (1997) came to similar conclusions when examining data from the Luxembourg Income Study on Canada, Netherlands, Sweden, UK and US.

The varied evidence from empirical studies is not surprising. As earlier identified by Lam (1997), any conflicting results on the role of age structure on income distribution can be due to variations between studies in the relative strength of between-group effects and within-group effects. The combined effect of the two depends on which effect is stronger. This may vary across populations.

In New Zealand, few studies to date have examined the effects of age structure on income inequality. Hyslop and Maré (2005) examined the factors contributing to changes in the New Zealand distribution of income between 1983 and 1998. Using the density decomposition approach of DiNardo et al. (1996), they examined the role of household structure, national superannuation (old age pension), socio-demographic attributes (which include number, age, sex, ethnicity and education levels of adults in the household, together with the numbers of children in various age groups), employment outcomes, and economic returns’ to such attributes. They found that changes in household structure and socio-demographic attributes were the major factors contributing to changes in the income distribution in New Zealand (each contributing around one-sixth of the overall increase in the Gini coefficient). Changes in household structure tended to raise the top end of the income distribution while lowering the bottom end. Changes in household socio-demographic attributes also widened the distribution of income, particularly at higher incomes.

Ball and Creedy (2015) analysed income and expenditure data from 1983 to 2007 and found that the age and gender composition of the population was important for understanding inequality. However, Aziz et al. (2015) show, using the New Zealand Treasury’s microsimulation model to forecast demographic changes that are expected over the next 50 years, that population ageing and expected changes in labour force participation by themselves do not have a significant impact on aggregate income inequality.

Our present study is similar to earlier work by Hyslop and Maré (2005) but instead of taking a national approach and examining the role of several economic and socio-demographic factors using survey data, we take a sub-national approach and focus exclusively on the spatial-temporal role of the age structure on the distribution of income.

3 Decomposition Methods

We use two popular approaches in the literature—the decomposition by population subgroup approach of Mookherjee and Shorrocks (1982) and the semi-parametric density decomposition method of DiNardo et al. (1996)—to examine different ways in which changes in the age structure could affect the aggregate distribution of income at the urban area level. We use both methods to analyse the inter-temporal effect of changes in the age structure nationally as well as spatially across metropolitan and non-metropolitan areas between 1986 and 2013.Footnote 13 There are two ways in which age structure can affect the distribution of income:

-

The composition effect (or the age shares effect): This reveals how much of a role the population composition of an area plays in observed inequality. It is the effect on inequality of differences in the shares of different age groups for given mean incomes at various ages.

-

The age-specific income distribution effect: This examines the effect of differences in the age-specific income distribution on observed inequality for a given age composition of the population.

For both effects, we consider changes over time and across places.

We focus on the class of Generalised Entropy (GE) measures of inequality due to their property of permitting the expression of overall inequality as a weighted sum of sub-level inequalities. Within this class, we use the Mean Log Deviation (MLD) index as our measure of inequality because the MLD weights the inequality measure for a group by the group’s population share. Hence MLD provides a direct evaluation of the effect of changes in age composition. One alternative GE measure is the Theil index of inequality which weights groups by income share. In the present context of analysing the impact of changes in demographic composition, the MLD is the more natural and more easily interpretable index.

Without loss of generality, let’s assume that a population of size N is grouped in A age groups indexed by a = 1, 2, …, A. Within each age group a there are N a individuals, with individuals indexed by i = 1, 2, …, N a. Hence, \( N={\sum}_{a=1}^A{N}_a \). Given that we have access to microdata, the income of the individuals is known and defined as y ia, i.e. the income of individual i in age group a. However, in many data collections, such as the census, income is only observed in income brackets. Let there be j income brackets, j = 1,2,…,J. We will denote the income of individual i in age group a and in income bracket j by y ija. As is done commonly, we will assume that income of each individual i in income bracket j and age group a is the same for everyone, denoted by y j, namely the midpoint of the bracket (and a statistically estimated amount for the open-ended top bracket, see Sect. 4). We assume that there are N ja individuals in income bracket j and age group a, who then each earn y j. Hence, \( N={\sum}_{a=1}^A{N}_a={\sum}_{a=1}^A{\sum}_j^J{N}_{\!ja}={\sum}_{j=1}^J{\sum}_{a=1}^A{N}_{\!ja}={\sum}_{j=1}^J{N}_{\!j} \). It is convenient to also introduce notation for the population fraction in each age group, π a = N a/N.

We can now also define various income aggregates. The aggregate income of all individuals in income bracket j in age group a is Y ja = y j N ja. The aggregate income of all those in age group a is \( {Y}_a={\sum}_{j=1}^J{Y}_{\!ja}={\sum}_{j=1}^J{y}_j{N}_{\!ja} \)while the aggregate income of those in income bracket j is \( {Y}_{\!j}={\sum}_{a=1}^A{Y}_{\!ja}={\sum}_{a=1}^A{y}_j{N}_{\!ja}={y}_j{\sum}_{a=1}^A{N}_{\!ja}={y}_j{N}_{\!j} \). Total income in the economy is \( Y={\sum}_{a=1}^A{Y}_a={\sum}_{a=1}^A{\sum}_{j=1}^J{y}_j{N}_{\!ja}={\sum}_{j=1}^J{\sum}_{a=1}^A{y}_j{N}_{\!ja}={\sum}_{j=1}^J{y}_j{\sum}_{a=1}^A{N}_{\!ja}={\sum}_{j=1}^J{y}_j{N}_{\!j}={\sum}_{j=1}^J{Y}_{\!j} \). Finally, we denote average income in the economy by μ = Y/N, average income of those in age group a by μ a = Y a/N a, and relative income of those in age group a by r a = μ a/μ.

Given this notation, MLD can be expressed as follows (see, e.g., Mookherjee and Shorrocks 1982):

It is useful to note that MLD in invariant to population scale N and the unit of measurement of income (e.g. nominal or real). It is straightforward to show that overall inequality can be decomposed into the sum of within-age-group inequality and between-age-group inequality:

in which \( \sum_{a=1}^A{\pi}_a{MLD}_a \) is the age-group-weighted sum of within-age-group inequality and \( \sum_{a=1}^A{\pi}_a\log \left(\frac{1}{r_a}\right) \) the age-group-weighted sum of the logarithm of the inverse of age-group-relative income (i.e., between-age-group inequality). It should be noted that such decompositions hold also true for any other mutually exclusive and collectively exhaustive classifications, such as gender and location. The decomposition can also be applied hierarchically, for example when overall income inequality is decomposed by age and sex.

When gauging a change in overall inequality over a given period, eq. (8.2) clearly shows that there are three contributing factors: firstly, changes in the age group shares (structural population ageing); secondly, changes in inequality within each age group; and, thirdly, changes in the age-group-relative incomes (for example due to changes in the lifecycle profile of earnings). It is easy to see that a change in the MLD, can be expressed exactly as follows:

in which a bar over an expression represents the simple arithmetic average of the variable over the two periods, i.e. \( \overline{x}=\frac{1}{2}\left({x}_{t-1}+{x}_t\right) \).

Component C4 in eq. (8.3) above represents the aggregate impact on inequality of growth (the change in natural logarithmic values) in age-group-specific mean incomes, but relative to overall mean income. Mookherjee and Shorrocks (1982) argue that it is more natural to think of growth in the levels of age-group-specific mean incomes rather than growth in relative incomes. For this reason, they replace Eq. (8.3) by a decomposition that holds only approximately, but which explicitly includes age-specific mean income growth:Footnote 14

In the next section we will report result by using this approximate decomposition given in Eq. (8.4).

The second decomposition method considers the income distribution as a density which may have a different shape for different age groups. Inequality is quantified by a dispersion measure applied to a given distribution of income of individuals or households. Besides the MLD measure of inequality described above, common alternative dispersion measures are the Gini coefficient, Theil index, the Coefficient of Variation, etc. We can quantify the effect of any change in the shape of the distribution of income by any of these inequality measures. DiNardo et al. (1996) consider it useful to decompose overall change in inequality into a contribution from within-group inequality change, calculated for a counterfactual income distribution in which population composition is assumed to have stayed the same, and a contribution from between-group change calculated for a counterfactual income distribution at which inequality within groups is assumed to remain the same.

One advantage of this approach is that it provides in our context a visual representation of the roles of the age composition effect and the age-specific distribution effect respectively. Let f Y(y; x) = ∫ f Y | X dF X represent the general distribution of income with respect to personal characteristic X. The integral sign is used to depict aggregate income with respect to attributes X that can be quantified by continuous variables. When X is a discrete variable, such as an age group, the corresponding expression is f Y(y; x)= ∑ f Y | X φX where φ = Prob(X = x).

In this paper we focus exclusively on the age distribution (denoted by A as before). This distribution may be specific to a certain location, say urban area U, and at a particular point in time. Hence the overall income distribution in urban area U is then given by

To illustrate this, consider Fig. 8.1 which presents a hypothetical distribution with two broad age categories in U: younger people and older people. In this Figure older people do not only have higher incomes than younger people have but they are also more numerous.

The impact of age structure on change in the overall distribution of income in U could be through a composition effect, i.e. through changes in Prob(A = a) or through changes in the age-specific conditional distribution of income \( {f}_{Y\mid A}^U \). To calculate both effects, we employ a benchmarking approach. To proceed we will need to introduce some notation and keep in mind the application to New Zealand Census data from 1986 until 2013. The beginning census year of the study (1986) will be compared to the last census year (2013). We now define:

-

\( {f}_Y^{N86\mid N86}=\sum {f}_{Y\mid A}^{N86}\ {\pi}_a^{N86} \) represents the actual 1986 national distribution of incomes based on the 1986 conditional age-specific distributions \( {f}_{Y\mid A}^{N86} \) and the 1986 shares of people in each age group \( {\pi}_a^{N86} \). Similarly, \( {f}_Y^{N13\mid N13}=\sum {f}_{Y\mid A}^{N13}\ {\pi}_a^{N13} \) represents the corresponding 2013 distribution of income;

-

\( \check{f}_Y^{N13\mid N86}=\sum {f}_{Y\mid A}^{N13}\ {\pi}_a^{N86} \) represents a 2013 counterfactual distribution, based on the 2013 age-specific conditional distribution of incomes but 1986 shares of people in each age group i.e. \( \check{f}_Y^{N13\mid N86}=\sum {f}_{Y\mid A}^{N13}\ {\pi}_a^{N86}=\sum {f}_{Y\mid A}^{N13}\ {\pi}_a^{N13}.\frac{\pi_a^{N86}}{\pi_a^{N13}} \)

Changes in inequality over time can either be attributed to changes in the age composition effect or due to changes in the age-specific distribution of income. The role of changes in age composition between 1986 and 2013 can be calculated by comparing the 2013 original distribution \( {f}_Y^{N13} \)to the counterfactual distribution \( \check{f}_Y^{N13\mid N86} \) which is based on 2013 age-specific conditional distribution of incomes but 1986 shares of people in each age group. i.e. the difference is \( {f}_Y^{N13}-\check{f}_Y^{N13\mid N86} \). The \( \check{f}_Y^{N13\mid N86} \) holds changes in the age-specific distribution over the period constant so any differences between the actual 2013 distribution and this counterfactual distribution are due to the changes in age composition. Since the population aged between 1986 and 2013, this will estimate the effect of the ageing of the population on the income distribution.

The effect of changes in the age-specific distribution between 1986 and 2013 will be calculated by comparing the counter factual distribution \( \check{f}_Y^{N13\mid N86} \)to the 1986 original distribution i.e. by calculating \( \check{f}_Y^{N13\mid N86}-{f}_Y^{N86} \). Since \( \check{f}_Y^{N13\mid N86} \)is based on the 1986 age structure, any difference between this distribution and the 1986 distribution is due to the changes in the age-specific conditional distribution.

This benchmarking approach provides an alternative way of decomposing the change in inequality measured by the MLD index. Here we can write changes in income inequality between 1986 and 2013 as:

This is a very simple way of decomposing the change in the MLD index into two parts: the first part shows the contribution of the changing age composition for given age-specific inequality while the second component shows how much, for a given age distribution, the change in age-specific inequality contributed to the overall change.

Finally, it should be noted that the calculation of the effect of the changing age composition on inequality can be done separately for every urban area. Of particular interest is then the extent to which the age composition effects play a greater or lesser role in explaining inequality change in certain areas and whether the sign of the age composition effect (positive or negative) is the same in all areas. Here we simply consider the distinction between metropolitan and non-metropolitan areas.

There are certain limitations to the density decomposition approach. Firstly, it follows a partial equilibrium analysis: we calculate the effect on inequality if the population composition changes but age-specific distributions remain the same, or vice versa. Hence this approach ignores the interaction between these two effects: changes in population composition can in general equilibrium also affect the age-specific distribution of income, and vice-versa, through migration and labour market adjustments.

Another limitation, which is a characteristic of all decomposition methods, is that such methods do not contribute to understanding the various economic mechanisms through which ageing affects inequality. Instead, decomposition provides simply an accounting framework that allows us to quantify the relative magnitude of the impact of compositional change.

4 Data and Results

4.1 Data on Personal Income

All data used are from the six New Zealand Censuses of Population and Dwelling from 1986 to 2013. The population is limited to people aged 15 and above who are earning positive incomes. Age data are available by single year of age. However, because we are interested in the broad trend of structural population ageing, we collapse all ages into four age groups: 15–24, 25–44, 45–64 and those 65 and over.

The income data represent total personal income before tax of people earning positive income in the 12 months before the census night.Footnote 15 It consists of income from all sources such as wages and salaries, self-employment income, investment income, and superannuation. It excludes social transfers in kind, such as public education or government-subsidised health care services. Instead of recording actual incomes, total personal incomes are captured in income bands in each census with the top and bottom income bands open ended. For example, the top band in the 2013 census data captures everybody earning $150,000 and over. An important issue with the open-ended upper band is the calculation of mean income in the open ended band. At the national level this is not a problem as Statistics New Zealand publishes an estimate of the midpoint of the top band for the country based on Household Economic Survey (HES) estimates. However, HES top-band mean incomes for sub-national areas are not reliable due to sampling errors. To resolve this problem, Pareto distributions have been fitted to the upper tail of the urban-area specific distributions. We use the Stata RPME command developed by von Hippel et al. (2016).

4.2 Changes in the Age Distribution of the Population

Population ageing is a key feature of the changes in the New Zealand age structure between 1986 and 2013. Jackson (2011) identified increasing longevity and declining birth rates as the main drivers of this trend. The patterns of ageing have been well described nationally and sub-nationally. Plenty of studies have examined the implications of an ageing population on the labour force, government revenues and economic growth (see Jackson 2011; Stephenson and Scobie 2002; McCulloch and Frances 2001). Spatially, attention has been given to examining the impact of accelerated aging of the rural areas and the role of rural-urban migration in driving this decline. Here we focus on differences between metropolitan and non-metropolitan areas in ageing. Table 8.1 shows the trends in population composition by age groups for metropolitan and non-metropolitan areas, and for all urban areas combined, from 1986 to 2013.

The ageing of the population between 1986 and 2013 is very clear. Nationally (all urban areas combined), the proportion of the population in the youngest age group 15–24 declined from 22% in 1986 to 14% in 2013 while for the oldest age group, 65+, the proportion increased from 15% to 18%. By 2013, the proportion of the population in the oldest age group exceeded that in the youngest age group.

Spatially, there is disparity across urban areas in the patterns of ageing. Non-metropolitan areas age more rapidly. In 1986, metro and non-metro had almost the same proportion of people in the youngest age group, 15–24, (around 22%) but by 2013 the proportion in non-metropolitan areas had fallen by about nine percentage points while in metropolitan areas it fell by only seven percentage points. The disparity is even starker when comparing the changes in the oldest age group 65+: the proportion in this group increased by about two percentage points in metropolitan areas compared to a six percentage point increase in non-metropolitan areas. It is evident that non-metropolitan areas have undergone more rapid ageing and were older on average than metropolitan areas by 2013.

4.3 Changes in the Mean Log Deviation Measure of Income Inequality

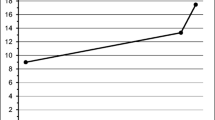

As noted in the introduction, New Zealand stands out among the developed countries as having seen the relatively fastest growth in inequality in recent decades, particularly during the 1980s and early 1990s. Across all urban areas, inequality grew by about 18% between 1986 and 2013 (see Table 8.2). It increased in all intercensal periods apart from between 1986 and 1991, and between 2001 and 2006 (see Fig. 8.2). Like the changes in age structure, the changes in income inequality are not the same everywhere. Much like what has been found in other countries, inequality increased more rapidly in metropolitan areas.Footnote 16 The metropolitan and non-metropolitan divide had been highlighted in previous New Zealand studies by Karagedikli et al. (2000, 2003) and Alimi et al. (2016). They found the highest rates of income and inequality growth in the metropolitan areas of Auckland and Wellington. Table 8.2 shows that metropolitan areas saw a 25% increase in the MLD, as compared with only 2% growth in non-metropolitan areas. It is clear that most of the growth in inequality that happened in New Zealand between 1986 and 2013 was driven by the changes in the metropolitan areas.

The 1986–2013 change in MLD displayed in Fig. 8.2 is disaggregated in tabular form into changes in the inequality index for each age group in Table 8.3. Focusing on the aggregate patterns, but with the same conclusions also true for metro and non-metro areas, within-age-group inequality increased the most between 1986 and 2013 in the 65+ group, closely followed by the 15–24 age group. The within-group measure of inequality for these two groups rose across all urban areas by around 68% and 35% respectively. The 25–44 group was the only age group to experience a decline in within-group inequality, at around 10%.

One factor explaining these trends in within-group income inequality is labour force participation. Among the 15–24 group, the proportion of those attending tertiary education, and therefore only working part-time and at low wages, has been increasing. Among those aged 65+, labour force participation has been increasing, thus leading to a larger number receiving income over and above New Zealand superannuation. Both trends increase inequality. The proportion of the 65+ age group participating in the labour force in urban areas rose from 3% in 1986 to 11% in 2013. This change led to an increase in the dispersion of income between those mostly relying on superannuation (plus perhaps some income from investments or private pensions) and those still in paid work. The opposite effect happened at the other end of the scale where those in the 15–24 age group experienced a reduction in labour force participation. This is due to an increasing proportion of this group spending more time in education and formal training. The reduction in labour force participation in this group, especially the reduction in those working full time, contributed to an increase the dispersion of income within the 15–24 age group.Footnote 17

In terms of the life course, inequality is higher within the 15–24 age group than at other ages. Apart from the high inequality in the first age group, and excluding 1986 and 1991, inequality does follow the usual life course pattern suggested in the literature, with increases in income inequality as a specific age cohort ages, until the public pension (New Zealand superannuation) becomes available at age 65.Footnote 18

With respect to relative mean income, the 15–24 group have seen the biggest drop, irrespective of urban location. Across all urban areas, the relative income of this age group dropped by 29 percentage points, falling from 71% of average income in 1986 to around 42% of 2013 average income. In contrast, the 45–64 and 65+ groups increased their relative incomes by ten and two percentage points respectively.

Using Eq. (8.2), Table 8.4 shows how each age group contributes to income inequality measured by the MLD index: within-group inequality makes the largest contribution to total inequality (varying between 83.7% in 2006 and 91.5% in 1986. However, between-age-group inequality is becoming a bigger share of total inequality: its contribution increased from around 8.5% in 1986 to 15.7% in 2013. This is primarily due to the increased divergence in relative mean incomes across age groups.

From 1986 to 2006, the 25–44 age group made the biggest contribution to within-group inequality. The large population share of this group was responsible for this effect (see Table 8.3). By 2013 however, within-inequality of the 45–64 age group made the greatest contribution to total inequality, reflecting the combined effect of population ageing and growing inequality within this group. The trends for those aged 15–24 and those aged 65+ provide an interesting contrast. In the 15–24 age group, within-inequality rose very fast but the diminishing population share of this group reduced their contribution to aggregate within-inequality over time. For the 65+ group, both within-inequality as well as population share increased, thereby increasing this group’s impact on overall inequality.

The combined effect of changing age-specific relative incomes and changed age-group shares of population can be clearly seen in the middle panel of Table 8.4. Incomes in the 25–44 and 45–64 age groups are above average, thereby yielding negative between-group contributions to MLD. The most striking trend is the contribution of declining relative incomes of the young (see also Table 8.3) to growing overall inequality measured by the MLD.

4.4 Changes in the Density of the Income Distribution

We will now proceed with a visual approach to present the contribution of each age group to the overall change in the distribution of income across all urban areas between 1986 and 2013. Figure 8.3 presents the standardized 1986 and 2013 log income distribution for each age group and all urban areas combined. The densities diagrams are standardized by de-meaning all income data by overall average income. The areas under the curves represent the population shares of the age groups. Hence, the overall income distribution in panel E is the sum of the densities A to D and has total density equal to one (as in the stylised example of Fig. 8.1). Overlaying the density diagrams for 1986 and 2013 provides a visual appreciation of the changes in the distribution over time.

Focusing on age groups, the 2013 distribution of the 15–24 age group is wider than the 1986 distribution (see Fig. 8.3, panel A) and this is due to an increase in the number and/or share of people in the bottom of the distribution and a reduction in the middle and top. Panel B shows that changes in the income distribution of those aged 25–44 group have been relatively minor (although they have, given the size of this group, still a major impact on the overall distribution). Panels C and D show the changes in the 45–64 and 65+ age groups respectively. The distributions for these groups are wider in 2013 than in 1986. The increase in inequality for these groups is predominantly due to an increase in the number of people in the middle and top of the distributions. Panel E pools all age groups together and shows that the overall distribution is wider in 2013 compared with 1986. This change is driven by a ‘hollowing out’ of the middle of the income distribution, due to more people at both the bottom and top ends of the distribution. Panel F graphs the difference between the 2013 and 1986 distributions by age group.Footnote 19 This figure shows clearly how the younger age groups (15–24 and 25–44) have been predominantly responsible for the ‘hollowing out at the middle of the distribution.’Footnote 20

Similarly to disaggregating inequality changes by the MLD index, changes in the aggregate income distribution density are due to the combined effect of changes in the number of people at the various age groups and changes in the age-group-specific densities. We will therefore now proceed with calculating the counterfactual densities as outlined in the previous section. Given the counterfactual densities, the change in inequality between 1986 and 2013 can be decomposed by means of the MLD index as given in Eq. (8.6).

Figure 8.4 presents the 2013 and 1986 original distributions, the counterfactual distribution (with age distribution fixed at the 1986 shares and within-age-group inequality as in 2013), as well as the differences between them for metropolitan, non-metropolitan and the combined areas.

Figure 8.4 shows that the age-composition effects are a very small component of the overall difference between 1986 and 2013. There are only small differences in the shape of the original distribution and the counterfactual distribution. Visually, it is difficult to tell these distributions apart although the age composition effect in metropolitan areas appears larger and is driven by more people at the top of the distribution in comparison to non-metropolitan areas. In other words, the difference between the original distribution and the counterfactual distribution in metropolitan areas shows a bigger bump at the top of the distribution than for non-metropolitan areas. To quantify the effect of age composition, we report the MLD of the original and counterfactual distribution and the differences between them. Table 8.5 presents these results.

The actual MLDs are of course identical to those in Table 8.2. In line with the graphical evidence, Table 8.5 shows that the age-share effect has been relatively small but negative. Hence, had age-specific distributions been the same in 1986 as in 2013, the changes in the age structure from 1986 to 2013 would have led to lower income inequality. Across all urban areas, the changes in the age structure (ageing of the population) reduced the MLD by about 0.0295. In contrast, the age-specific distribution effect was positive and much larger, leading to an overall 1986–2013 increase in the MLD of 0.0939 for all urban areas combined.

While ageing has had an inequality-reducing effect overall, the magnitude of this effect varies spatially. This is not surprising giving the spatial variation in the rates of ageing. The faster ageing of the non-metropolitan areas contributed to a larger inequality-reducing age composition effect (−0.0314, compared with −0.0265 in metropolitan areas).

We see from Table 8.5 that the difference in inequality growth between metropolitan areas and non-metropolitan areas is not fully accounted for by the difference in age composition. The results show that most of the difference in the inequality trends of metropolitan and non-metropolitan areas is due to the much greater age-group-specific inequality growth in the former.

It is easy to reconcile the results based on the MLD decomposition approach with those based on the density decomposition approach. This can be seen from Table 8.6, which compares the MLD decomposition of Eq. (8.4) with the density decomposition of Eq. (8.6). Both methods show that population ageing has had income inequality-reducing effect. The effects are similar, but somewhat smaller in absolute value with the MLD decomposition approach. Had the age-specific income distributions remained the same, the MLD would have decreased by −0.0223 for all urban areas combined (the sum of effects C2 and C3′ in Table 8.6). The corresponding quantity from the density decomposition approach is −0.0295. Examination by age group shows that this inequality-reducing effect is driven by the negative contributions of the two younger age groups. The youngest age group (15–24) has seen rapidly rising within-group inequality but a reduction in the share of this group has contributed negatively to the change in within-group inequality.

The 25–44 age group experienced a narrowing of their within-group distribution as well as a reduction in their population share. Both have a negative effect on overall within-group inequality. Table 8.6 shows that the age-specific distribution effect (C1 + C4′ in Eq. (8.4)) and the age share effect (C2 + C3′) are indeed mostly negative for the 25–44 age group. Interestingly, the metropolitan areas form the exception. In these areas, growth in the mean income of this group relative to growth in overall mean income (C4′) more than offsets the reduction in within-age group inequality (C1).

The contributions of the 45–64 and 65+ groups are in the opposite direction: changes in both groups contribute to growing inequality. This is because within-group inequality, relative income, as well as population share increased for both groups between 1986 and 2013. Thus, for both age groups most components of inequality change are positive. The only exception is the negative component C4′ for those aged 65+, despite the growth in this group’s mean income.Footnote 21

Taking a spatial view by comparing metropolitan areas to non-metropolitan areas, Table 8.6 confirms the smaller inequality-reducing age-composition effect in metropolitan areas. This is as expected due to the less rapid rates of population ageing in the metropolitan areas. The population decomposition by subgroup approach shows that the 1986–2013 changes in the age structure in metropolitan areas reduced MLD by about 0.0191, compared to 0.0275 in non-metropolitan areas. As with the national results, we find that most of the growth in inequality is due to changes in the age-specific distribution effect.

Age composition only explains a negligible part of the difference between the changes in inequality between metropolitan areas and non-metropolitan areas. The increase in the age-specific distribution effect on MLD has been greater in metropolitan areas (0.1057, about three times the corresponding effect in non-metropolitan areas). The almost equal counteracting age-specific and age-composition effects in non-metropolitan areas explains the very small inequality growth in these areas. If the changes in the age-specific income distribution remain relatively small in non-metropolitan areas in the years to come and ageing there accelerates due to continuing net migration to metropolitan areas, then we may expect inequality to decrease or remain constant in non-metropolitan areas in the foreseeable future.

5 Conclusion

In this chapter we examined the relationship between age structure and income inequality in New Zealand using two approaches that have proven popular in the literature. We focussed on differences between metropolitan and non-metropolitan areas in the two ways in which age structure can affect inequality: an age-composition effect and an age-specific distribution effect. We found that the 1986–2013 increase in inequality has been mostly due to the changes in the age-specific income distributions. In fact, the age-composition effect has been negative. Population ageing has served to reduce inequality. However, at the same time, age-specific mean incomes diverged, at least until 2001, leading to an increasing share of between-group inequality to overall inequality.

In line with previous analyses on inequality and age structure in New Zealand, we found a notable disparity between metropolitan and non-metropolitan areas in the trends in inequality and age structure. Metropolitan areas have experienced rapid growth in inequality but slower rates of ageing (mostly due to net inward migration rather than greater fertility), while non-metropolitan areas have had slow growth in inequality and faster ageing. We also found that the inequality-reducing effect of population ageing (resulting from the declining shares of younger people) varies across areas and is smaller in metropolitan areas. Notwithstanding this differential age-composition effect, our results show that most of the difference between metropolitan and non-metropolitan areas in inequality growth is due to the much larger age-specific income distribution widening in metropolitan areas.

We complemented the decomposition of changes in the MLD index of inequality with a visualisation of changes in density along the income distribution. This revealed a thinning of the density in the middle of the overall distribution, for which the 15–24 and 25–44 age groups were mostly responsible. At the same time, the age group 45–64 added more density to the upper end (right tail) of the distribution, while those aged 15–24 contributed to an increase in density at the lower tail. Together, these changes led to a hollowing out of the distribution.

In this research we have simplified the analysis of spatial differences in income inequality by adopting a metropolitan versus non-metropolitan dichotomy. In future work we intend to use a more refined spatial disaggregation of areas, as well as examine the role of other population composition effects on inequality, such as effects due to country of birth and migrant status, household type and education. Jointly, this may provide further in-depth insights into how population ageing impacts on mean incomes and income inequality across regions and cities.

Notes

- 1.

- 2.

- 3.

See for example Castells-Quintana et al. (2015) for a review of the literature of the trends and determinants of income inequality in Europe.

- 4.

- 5.

See Evans et al. (1996) for a description of these reforms.

- 6.

- 7.

See OECD (2016).

- 8.

- 9.

A 2016 OECD report, which examines 153 metropolitan areas in 11 countries, finds that inequality in metropolitan areas is higher than the national average in all countries apart from Canada (OECD 2016 , p. 33).

- 10.

Given that migrants are predominantly young, net inward migration contributes to the relative youthfulness of the big cities. However, a study of the effects of migration on the income distribution would need to take into account the differential effects of net permanent & long term migration (which is on average more skilled than the local labour force and, like student migration, disproportionally towards the metropolitan areas) and temporary migration (which is less skilled and more attracted to non-metropolitan areas). The explicit analysis of the effects of migration on income inequality is beyond the scope of the present chapter.

- 11.

See Lam (1997) for a review of the literature that examines the role of demographic variables (including changes in age structure) on income inequality.

- 12.

- 13.

Metropolitan areas defined as urban areas that make up the six largest New Zealand cities (in order of size) of Auckland, Wellington, Christchurch, Hamilton, Tauranga and Dunedin. All other urban areas are considered non-metropolitan areas.

- 14.

Mookherjee and Shorrocks (1982) note that this approximation appears sufficient for computational purposes (p. 897). However, experimentation with a range of changing income distributions shows that the sign of C3 can be sometimes different from that of C3′ and, similarly, the sign of C4 can be different from that of C4′. This may lead to slightly different interpretations. In this chapter we follow Mookherjee and Shorrocks (1982) and use the approximate decomposition. Results for the exact decomposition are available upon request.

- 15.

Hence people not in paid employment and business owners reporting a loss have been excluded.

- 16.

See OECD (2016).

- 17.

The labour force participation rate for those aged 15–24 declined from 76% in 1986 to 61% in 2013, with full-time employment falling by even more at 40 percentage points.

- 18.

New Zealand Superannuation is the public pension paid to all residents over the age of 65 (immigrants must have resided in the country for 10 years or longer). Any eligible New Zealander receives NZ Super regardless of how much they earn through paid work, savings and investments, what other assets they own or what taxes they have paid. NZ Super is indexed to the average wage. The after-tax NZ Super rate for couples (who both qualify) is based on 66% of the ‘average ordinary time wage’ after tax. For single people, the after-tax NZ superannuation rate is around 40% of that average wage. See https://www.workandincome.govt.nz/eligibility/seniors/superannuation/payment-rates.html

- 19.

The graphs in panel F are scaled. To calculate the scaled age group contribution to total difference, the density of each age group in each year is scaled by their respective income share.

- 20.

This hollowing out of the income distribution is not necessarily evidence of a ‘vanishing middle class’ phenomenon that has been reported for the USA and other developed countries (e.g., Foster and Wolfson 2010). To investigate a ‘vanishing middle class’ phenomenon would require a comparison of lifetime income across population groups rather than a comparison of age-specific income. This is beyond the scope of the present chapter.

- 21.

This is due to the approximation method. For this age group, (\( \overline{\pi_a{r}_a}-\overline{\pi_a} \)) < 0. See Eq. (8.4).

References

Alimi O, Maré DC, Poot J (2016) Income inequality in New Zealand regions. In: Spoonley P (ed) Rebooting the regions. Massey University Press, Auckland, pp 177–212

Aziz OA, Ball C, Creedy J, Eedrah J (2015) The distributional impact of population ageing in New Zealand. N Z Econ Pap 49(3):207–226

Ball C, Creedy J (2015) Inequality in New Zealand 1983/84 to 2013/14. Working Paper 15/06. Wellington, New Zealand Treasury

Barrett GF, Crossley TF, Worswick C (2000) Consumption and income inequality in Australia. Economic Record 76(233):116–138

Cameron LA (2000) Poverty and inequality in Java: examining the impact of the changing age, educational and industrial structure. J Dev Econ 62(1):149–180

Castells-Quintana D, Ramos R, Royuela V (2015) Income inequality in European regions: recent trends and determinants. Rev Reg Res 35(2):123–146

Deaton AS, Paxson CH (1994) Intertemporal choice and inequality. J Polit Econ 102(3):437–467

Deaton AS, Paxson CH (1995) Saving, inequality and aging: an East Asian perspective. Asia Pac Econ Rev 1(1):7–19

DiNardo J, Fortin NM, Lemieux T (1996) Labor market institutions and the distribution of wages, 1973–1992: a semiparametric approach. Econometrica 64(5):1001–1044

Easton B (2013) Income inequality in New Zealand: a user's guide. NZ Sociol 28(3):19–66

Evans L, Grimes A, Wilkinson B, Teece D (1996) Economic reform in New Zealand 1984–95: the pursuit of efficiency. J Econ Lit 34(4):1856–1902

Fortin, N., Lemieux, T., & Firpo, S. (2011). Decomposition methods in economics. In: O. Ashenfelter & D. Card (Eds.), Handbook of labor economics (Vol. 4, Part A, pp. 1-102): Elsevier: Amsterdam.

Foster JE, Wolfson MC (2010) Polarization and the decline of the middle class: Canada and the U.S. J Econ Inequal 8(2):247–273

Fritzell J (1993) Income inequality trends in the 1980s: a five-country comparison. Acta Sociologica 36(1):47–62

Hyslop DR, Maré DC (2005) Understanding New Zealand’s changing income distribution, 1983–1998: a semi-parametric analysis. Economica 72(287):469–495

Jackson N (2011) The demographic forces shaping New Zealand’s future. What population ageing [really] means. Working Paper No. 1, National Institute of Demographic and Economic Analysis. Hamilton, University of Waikato

Jantti M (1997) Inequality in five countries in the 1980s: The role of demographic shifts, markets and government policies. Economica 64(255):415–440

Johnson A (2015) Mixed fortunes. The geography of advantage and disadvantage in New Zealand. Social Policy & Parliamentary Unit, Salvation Army, Auckland

Karagedikli Ö, Maré DC, Poot J (2000) Disparities and despair: changes in regional income distributions in New Zealand 1981–96. Australas J Reg Stud 6(3):323–347

Karagedikli Ö, Maré DC, Poot J (2003) Description and analysis of changes in New Zealand regional income distributions, 1981–1996. In: Gomez ET, Stephens R (eds) The state, economic development and ethnic co- existence in Malaysia and New Zealand. Kuala Lumpur, CEDER University of Malaya, pp 221–244

Lam D (1997) Demographic variables and income inequality. In: Rosenweig MR, Stark O (eds) Handbook of population and family economics, vol 1B. Elsevier, Amsterdam, pp 1015–1059

Lin CHA, Lahiri S, Hsu CP (2015) Population aging and regional income inequality in Taiwan: a spatial dimension. Soc Indic Res 122(3):1–21

Mookherjee D, Shorrocks A (1982) A decomposition analysis of the trend in UK income inequality. Econ J 92(368):886–902

McCulloch B, Frances J (2001). Financing New Zealand superannuation (Working Paper No. 01/20). Wellington: New Zealand Treasury.

OECD (2016) Making cities work for all: data and actions for inclusive growth. OECD Publishing, Paris. https://doi.org/10.1787/9789264263260-en

OECD (2008) Growing unequal? Income distribution and poverty in OECD countries. OECD, Organisation for Economic Co-operation and Development, Paris

Peichl A, Pestel N, Schneider H (2012) Does size matter? The impact of changes in household structure on income distribution in Germany. Rev Income Wealth 58(1):118–141

Perry B (2014) Household incomes in New Zealand: trends in Indicators of Inequality and Hardship 1982 to 2013. Ministry of Social Development, Wellington

Perry B (2015) Household incomes in New Zealand: Trends in Indicators of Inequality and Hardship 1982 to 2014. Ministry of Social Development, Wellington

Stephenson J, Scobie G (2002) The economics of population ageing (Working Paper No. 02/04). Wellington: New Zealand Treasury

von Hippel PT, Scarpino SV, Holas I (2016) Robust estimation of inequality from binned incomes. Sociol Methodol 46(1):212–251

von Weizsäcker RK (1996) Distributive implications of an aging society. Eur Econ Rev 40(3):729–746

Zhong H (2011) The impact of population aging on income inequality in developing countries: evidence from rural China. China Econ Rev 22(1):98–107

Disclaimer

Access to the data used in this study was provided by Statistics New Zealand (SNZ) under conditions designed to give effect to the security and confidentiality provisions of the Statistics Act 1975. All frequency counts using Census data were subject to base three rounding in accordance with SNZ’s release policy for census data.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Alimi, O.B., Maré, D.C., Poot, J. (2018). More Pensioners, Less Income Inequality? The Impact of Changing Age Composition on Inequality in Big Cities and Elsewhere. In: R. Stough, R., Kourtit, K., Nijkamp, P., Blien, U. (eds) Modelling Aging and Migration Effects on Spatial Labor Markets. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-319-68563-2_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-68563-2_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-68562-5

Online ISBN: 978-3-319-68563-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)