Abstract

Customers can create value to the firm by purchasing products, not returning these products, recommending products to other potential customers, influencing other customers, and providing feedback to the company. In this chapter, we first discuss how product returns and engagement behaviors can be included in the customer value framework. Second, we discuss the antecedents of a customer’s product return decision, namely, return policies, information at the moment of purchase, and customer and product characteristics. Third, we focus on the consequences of product returns: the effects on future purchase and product return behavior, as well as on customer engagement behaviors. Thus, this chapter provides a comprehensive synthesis of current knowledge on antecedents and consequences of product returns and how this relates to measuring and managing customer value.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Production Issues

- Customer Engagement Behavior

- Online Customer Reviews

- Customer Lifetime Value (CLV)

- Product Return Policies

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

Marketing scientists and practitioners acknowledge that it is essential to measure and manage customer value (Petersen and Kumar 2015). Customers can create value to the firm by purchasing products, not returning these products, recommending products to other potential customers, influencing other customers, and providing feedback to the company (Kumar et al. 2010a). Importantly, these customer behaviors will be interrelated. For example, product returns may affect future purchases, product returns, and engagement behaviors—which all affect customer value . Hence, customer value goes beyond customer purchase behavior, and customer value management should also include customer engagement behavior and customer product return behavior (Van Doorn et al. 2010; Kumar et al. 2010a).

First, customer engagement involves customer behaviors that are not directly purchase-related behavior. Van Doorn et al. (2010, p. 253) define customer engagement behaviors as “the customer’s behavioral manifestations toward a brand or a firm, beyond purchase, resulting from motivational drivers”. This behavioral dimension of customer engagement incorporates writing reviews and customer referrals. Customers can create value to the firm by writing reviews. A recent meta-analysis demonstrates that product reviews affect sales , where more reviews and more positive reviews lift sales (Babic et al. 2016). In addition, product reviews have an impact on product returns (Minnema et al. 2016). Hence, academic research examined customer referral behavior and demonstrated its impact on firm profit (Kumar et al. 2010b).

Second, including product returns in customer value management is critical because product returns can be a substantial economic cost for retailers. Return rates reportedly vary between 10% and 50%, with substantial profit impact (Banjo 2013; Forrester 2015). Annually, US customers return $264 billion worth of products (Kerr 2013). Product returns not only result in lost sales but also lead to other costs such as shipping fees, often paid by the retailer, and remanufacturing costs such as repackaging the product (Guide et al. 2006). Consequently, Gartner (2014) labels product returns “the ticking time bomb of multichannel retailing”.

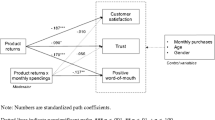

The large financial impact of product returns has spurred academic research in several fields. For instance, one solution to reduce the costs of product returns is to make the reverse logistics more efficient, a problem that has been addressed extensively in the operations literature (Dekker et al. 2004). However, the focus of this chapter is on managing product returns from a marketing perspective, which we cluster around three major topics. First, we discuss how product returns and engagement behaviors should be included in the customer value framework (see Fig. 5.1). Second, we discuss the antecedents of a customer’s product return decision. These include the impact of product return policies and the effect of information provision at the moment of purchase on purchase and return decisions. We also discuss the impact of customer and product characteristics on product return decisions. Third, we focus on the consequences of product returns. We discuss the effect of product returns on future purchase and product return behavior, as well as on customer engagement behaviors. Thus, the aim of this chapter is to support both researchers and practitioners through a comprehensive, research-based synthesis of current knowledge on antecedents and consequences of product returns and how this relates to measuring and managing customer value (Fig. 5.1).

The Relationship Between Product Returns and Customer Value

A customer’s decision to return a product has an immediate economic impact on a firm’s profitability, both in terms of the loss in the profit margin from the customer’s original purchase of that product as well as the cost the firm bears to process the product return. Because of this many firms still treat product returns as an economic cost that needs to be managed (and often minimized). At a minimum some firms try to manage these costs at the aggregate level given that product returns are such a substantial cost for firms (Blanchard 2007). They do this by setting return policies that try to minimize the number of products returned by providing disincentives for customers to return products (e.g., a restocking fee or offering only a limited time window to return a product) or by attempting to streamline the reverse supply chain to reduce the average costs of product returns (see Dekker et al. 2004).

Some firms have even taken it a step further by implementing strategies which are responsive to an individual customer’s product return behavior. For instance, research has shown that some firms actually reduce marketing expenditures to customers that return products in the hopes that these return-prone customers will make fewer future purchases that have the potential to be returned (Petersen and Kumar 2009). However, managing customers based on their product return behavior does not seem to be a common practice by retailers as of yet. A recent survey suggests that many retailers (over 60% of those surveyed) did not consider an individual customer’s product return behavior when determining optimal marketing resource allocation decisions (Petersen and Kumar 2015). This seems shortsighted as recent research has shown that there could be positive consequences that arise out of customer product returns (e.g., improving future customer relationships).

This leads to the question of what firms should do to better manage customers accounting for the relationship between purchases, product returns, engagement behaviors, and profitability. It is important for firms to adjust their processes for customer management and optimal marketing resource allocation. From a customer management perspective, this should start by including customer product return and engagement behaviors in the customer value framework. Based on recent work by Kumar et al. (2010a) and Petersen and Kumar (2015), we propose that customer value can be measured in the following way:

where:

CV i,t=0 = Customer value for customer i at time t = 0

CLV i,t=0 = Customer lifetime value for customer i at time t = 0

π1(Purchasesit) = Expected profit from purchases by customer i in time t

π2(Returnsit) = Expected profit lost and costs incurred from returns by customer i in time t

π3(Engagementit) = Expected profit from engagement behaviors by customer i in time t

Marketingit = Expected marketing costs spent on customer i in time t

Returnsit = Expected number of returns by customer i in time t

ReverseLogistics = Expected reverse logistics costs per return

Priceit = Expected average price per returned purchase by customer i in time t

r = Discount rate (Approximately 3.56% by quarter—or 15% annually)

n = All customers in the sample

T = Number of time periods in the prediction horizon

P(Relationshipi,t=1) = The probability customer i is active in the relationship at t = 1

First, scholars argued that customer engagement behaviors, such as providing referrals and writing reviews, should be included when measuring customer value (Kumar et al. 2010a). Hence, customers can create value through engagement behaviors, as shown in Eq. (5.1). Second, a recent study by Petersen and Kumar (2015) adapted the traditional customer value framework to include the cost of product returns when measuring customer lifetime value (CLV). By measuring CLV as in Eq. (5.2), it is clear that customers can increase value to the firm by making more purchases but also by returning fewer products. It is important to include return behavior in Eq. (5.2) because the traditional CLV model may prefer selecting a customer who has purchased a lot even if that customer has returned the majority of products purchased. In fact, Petersen and Kumar (2015) found that the correlation between customer selection based on the traditional CLV framework and a CLV framework which includes product returns was only weak (0.27).

Product returns are a relatively new addition to the customer value framework, and the question becomes how much the inclusion can improve a firm’s marketing resource allocation decisions. Petersen and Kumar (2015) ran a field experiment and found that allocating resources on the value framework including product returns can lead to significant benefits to the firm relative to the resource allocation strategy based on the traditional customer value model. The study was able to increase the profit from purchases by 18.1%, decrease the profit lost from product returns by 30.7%, and decrease the marketing costs to the firm by 29.7%. This lead to an increase in short-term average customer profit by 28.5% and long-term average customer profit by 19.7%. Thus, product returns play a significant role in the value of the customer to the firm which indicates that product returns should be taken into account.

Equation 5.3 shows that profit or loss due to product returns depends on both the number of returns and the reverse logistics costs. The focus of the next section is on antecedents of customer product return decisions which is directly related to the number of returns.

Antecedents of Customer Product Return Decisions

For today’s retailers it is important to understand the drivers of customer return decisions because product returns affect profitability considerably and thereby form a key component of customer value management as explained in Section “The Relationship Between Product Returns and Customer Value”. Extant literature defines the customer journey in three stages, namely, pre-purchase, purchase, and post-purchase (Lemon and Verhoef 2016). A mix of behavioral and empirical research has examined various antecedents of product returns at each stage of the customer journey. Prior research can be clustered around how product return decisions are affected by the seller’s decisions influencing the pre-purchase stage of the customer journey, seller decisions targeted toward the post-purchase stage, customer characteristics, and product characteristics. In the following sections, we review the key findings of these streams of research.

Seller’s Decisions During Pre-purchase Stage

Sellers often take actions in the pre-purchase stage to avoid the substantial cost of product returns. In the pre-purchase stage, the customer collects information about the products that could be purchased. Typically, this information does not reveal the product at full and so customers make their purchase decisions on imperfect information (Shulman et al. 2015). When customers are allowed to return purchases, consumers follow the pre-purchase stage with two additional stages in the customer journey : the customer decides to purchase the product (purchase stage) and next the customer decides to keep or return the purchased product (post-purchase stage) (Anderson et al. 2009a; Minnema et al. 2016). In the post-purchase stage, the customer inspects the product and ultimately the product will be revealed at full (Wood 2001). If the product does not meet the expectations formed in the pre-purchase stage, the customer will be dissatisfied and hence is more likely to return the product (Bechwati and Siegal 2005). Therefore, the information provided pre-purchase will affect both the purchase and return decision.

Especially when purchasing online, customers have limited ability to evaluate and test products before purchasing them (Shulman et al. 2015). As a consequence, retailers offer multiple sources of information on their website to inform customers, such as product specifications, product pictures, and online customer reviews. These information sources will affect the customer’s expectations regarding the product.

Prior studies show that there is a tension in the effect of information on purchase and product return decisions (Shulman et al. 2015). On the one hand, more information may prevent customers from purchasing the product if there is a poor fit between the product and the customer. Without additional information, the customer might have purchased the product which he would probably have returned due to the poor fit: the purchase prevention effect. On the other hand, providing more information may increase customer expectations which leads to more purchases and more returns because the product does not meet these expectations: the marginal loss aversion effect. Thus, information at the moment of purchase affects the decision to return or keep a purchased product.

To provide more detailed product information, retailers invested in web technologies such as zoom features and alternative pictures to help customers to make better decisions (De et al. 2013). In general, zoom technology allows customers to see finer product details such as fabric and small decorative features which conveys mainly factual product information. When a customer gains more factual information, the customer expectations will be more realistic and hence, use of zoom technologies lowers product returns (De et al. 2013) due to less product uncertainty (Hong and Pavlou 2014). A second web technology to convey product information is the alternative photo technology, which enables the customer to see the focal products rotation but also the contextualization. The contextualization provides mainly impression-based information because in clothing this contains models wearing the product. Impression-based information may be more ambiguous and hard to verify, which may lead customers form unrealistic expectations which results in higher product returns and more importantly, lower net sales (i.e., purchases—returns) (De et al. 2013). Thus, web technologies can either help or hurt retailers in reducing product return rates and increasing net sales , all depending on the type of information provided.

The presentation of products also affects the decision to return the product. When products are simultaneously presented, customers generate many comparative thoughts. In contrast, when products are sequentially presented, this will result in more non-comparative thoughts (Bechwati and Siegal 2005). Hence, when customers are faced with an alternative not in the initial choice set after they decided to purchase, they are more likely to remain with their initial choice when the products are sequentially presented. They do so because their non-comparative thoughts regarding the product are still valid to defend their initial purchase decision.

An additional source of information that is available on many retailers’ websites is formed by online customer reviews (OCRs) , which are the result of customer engagement behavior. OCRs complement retailer-provided information (Chen and Xie 2008) and make other information available on the retailer’s website less important (Kostyra et al. 2016). Online customer reviews may help to form pre-purchase expectations about a product, and thus may affect return decisions, next to customer purchase decisions (Babic et al. 2016). Review valence (i.e., average product rating) helps to form or alter product expectations at the moment of purchase. If reviews are overly positive (i.e., valence is higher than the long-term product average), this leads to high expectations about the product which increases the purchase probability. After the purchase, the high expectations due to overly positive reviews are not met, which results in negative expectation disconfirmation and consequently increases return probability as well (Minnema et al. 2016). The effect of overly positive reviews is—more notable—negative for a retailer’s financial performance because of the high reverse logistics costs associated with product returns. The other OCR characteristics (volume and variance) mainly affect purchase decisions, and have little to no effect on product returns. Thus, a substantial body of research shows that information provided at the moment of purchase affects both the decision to purchase and the decisions to return the product.

Seller Return Policy in Post-purchase Stage

The firm’s product return policy may have an impact on customer purchase behavior as well as on their return behavior, and hence on customer value (Fig. 5.1). One might think that firms with a lenient product return policy will just have to process more product returns which can lead to costs spiraling out of control potentially outweighing the benefits of increases in future purchase behavior (Eq. 5.2). However, the effect of the return policy on purchases and product returns may depend on specific dimensions of that policy. A meta-analytic review study classifies return policy leniency along five dimensions (Janakiraman et al. 2016): monetary leniency, time leniency, effort leniency, scope leniency, and exchange leniency (see Table 5.1). The results of the meta-analysis indeed indicate that different return policy dimensions have different effects on purchase and return decisions. In what follows, we provide a more detailed overview of the literature along dimensions of leniency.

Monetary Leniency

A key dimension of product return policies is whether a firm asks a restocking fee or refunds the full monetary amount paid (monetary leniency). A large body of literature provides guidance as to when a firm should offer a money-back guarantee . A general rule of thumb is that a retailer should accept returns if it can earn greater value from salvaging the returned item than the customer’s cost of returning the item. This rule of thumb established in Davis et al. (1995) holds when the retailer sells on a consignment agreement with the manufacturer (Hu et al. 2014), when the retailer sets inventory levels with demand uncertainty (Akcay et al. 2013), and when accounting for reduced clearance prices intended to clear inventory (Altug and Aydinliyim 2016). One concern with a money-back guarantee is that customers may decide to rent for free by buying and then returning. Davis et al. (1995) shows that if customers experience a transaction cost smaller than their trial value obtained from free renting, then a money-back guarantee is less profitable.

Building on the general rule of thumb, research provides guidance about how the quality of the product affects the decision to offer a money-back guarantee . The suggestions depend on whether or not quality is known by the customers. If product quality is unobservable, then high-quality sellers should offer a money-back guarantee to signal quality, but low-quality sellers will find such an offer too costly (Moorthy and Srinivasan 1995). If quality is observable, product returns arise because of uncertainty about product fit rather than because of quality. In this case, the low-quality seller has a greater gain as a result of offering a money-back guarantee than the high-quality retailer, though both retailers should allow returns.

A variety of factors have been shown to affect a company’s optimal restocking fee. The greater importance customers place on how well a product matches their needs, the higher the restocking fee should be (Shulman et al. 2009). The higher return penalty ensures that customers keep their purchase when they would otherwise return it without subsequently exchanging for another product. Competition can actually increase restocking fees because firms want to dissuade customers from making a return in order to buy from the competition (Shulman et al. 2011). Moreover, a more generous return policy attracts customers who are less likely to keep their purchase, thereby increasing the company’s cost disadvantage relative to its competitor.

Product quality also affects the optimal restocking fee, though there is no consensus in the academic literature on exactly how. Gu and Tayi (2015) find that a monopolist should have a tightened return policy if the product value is high as a means to encourage consumers to mend the product to improve fit. In contrast, Inderst and Tirosh (2015) find that when quality is observable and customers vary both in their ex ante appreciation of quality and their ex post evaluations, high-quality retailers will be more generous in their refund than their low-quality competitors. This is consistent with the empirical finding of Bonifield et al. (2010) that in practice return leniency increases as the ratings of e-tailer quality increases. There is apparently room for further research to resolve the discrepancies between findings and develop a unifying theory of when the high-quality seller will be more or less generous in its refund.

Manufacturers often cannot set the return policy retailers offer to customers, but can influence these policies with their contract to the retailer. Research has found that the manufacturer should accept returns from the retailer at an overly generous refund in order to incentivize the retailer to offer an efficient refund to customers, thereby boosting sales (Shulman et al. 2010). Additionally, Su (2009) shows that a manufacturer can improve profitability with a differentiated buy-back contract that pays the retailer different rates for returned units than units the retailer was unable to sell. However, when this is not possible, a manufacturer can use a sales rebate contract to achieve the same channel profits.

A monetary lenient product return policy (no restocking fee) leads to increases in purchases (Bower and Maxham 2012). For the return decision, the results are mixed: economic models indicate that monetary lenient return policies increase returns (e.g., Shulman et al. 2009). An analytic review study based on experimental and field studies find a positive, albeit insignificant effect of a monetary lenient return policy on costumer return decisions (Janakiraman et al. 2016). Hence, more research is needed to conclude on the impact of monetary lenient return policies on product return decisions.

Time Leniency

Return deadlines (time leniency) have little to no impact on purchase decisions, but do affect customer return decision: when offering more lenient return deadlines (longer deadlines), customers have a lower likelihood to return the product. This happens because a customer may postpone the returning decision and next forgets to return the product or starts to appreciate the product more, the so-called endowment effect (Janakiraman and Ordóñez 2012).

Scope Leniency

Some stores restrict the items they consider “return-worthy”, and some retailers do not allow customers to return sales items (low scope leniency). Scope leniency mainly influences the return decision: if a retailer does not allow customers to return items on sale, purchases probability is not affected, but customer return rates decrease. Hence, higher scope leniency increases the product return probability.

Effort Leniency

Companies can make decisions that impact the effort required to return a product. For instance, some retailers create “hassle” for customers who aim to return the product, such as requiring the original receipt and that the product package should be retained (low effort leniency). Higher effort leniency, where the retailer reduces the hassle to customers, increases the purchase probability, but does not influence customer return decision (Janakiraman and Ordóñez 2012). Research shows that companies should impose a greater hassle for returns when the product’s benefits can be consumed in a short period of time (Davis et al. 1998). This will reduce the number of customers who get “free rent” by buying and returning after use.

Exchange Leniency

The final leniency factor studied is exchange leniency. Some retailers offer cash refunds whereas others only allow product exchange or store credit. Having a lenient exchange policy does not have an impact on purchase probabilities, but does result in lower return probabilities; a potential explanation is that customers with minor product complaints are more likely to exchange products when exchange clauses are more salient (Janakiraman et al. 2016), and hence a more strict exchange policy results in more returns.

Summary of Return Leniency

A less lenient return policy is one way to reduce the costs of product returns. However, there is an inherent trade-off in that such a cost-reducing policy will also reduce revenue due to its negative impact on demand. For example, in women’s footwear category, allowing returns generates $15 in value to the customer per purchase (Anderson et al. 2009a). Hence, a key decision firms have to make to handle product returns is to set product return policies.

There is a large and growing body of academic research (see Janakiraman et al. 2016) to help managers as they decide whether to accept returns, how much of a refund to offer for returns, and how long to allow a customer to hold the product before making the return. The effectiveness of these decisions, at both the retailer and manufacturer level, interacts with customer-level factors, the firm’s cost structure, and the competitive landscape. Yet, overall, the impact of a more lenient return policy on purchase decisions outweighs the impact on return decisions. In engaging customers to make a purchase and to manage returns, managers should recognize the strategic and cost implications of their return policy as well as the revenue implications.

Customer Characteristics

Most studies found non-significant effects of customer demographics on product returns, but some differences exist across studies. So far, research did not find significant effects on return likelihood for income, marital status , education, and age (Hong and Pavlou 2014; Petersen and Kumar 2009). The effects for gender are mixed: Minnema et al. (2016) found that males have lower return rates in electronics and furniture category, whereas Hong and Pavlou (2014) found no significant difference in return rate between males and females for online auctions at Taobao and eBay. In addition, customers who are new in the category tend to have higher return rates (Petersen and Kumar 2009). When customers purchase for the first time in a category, they have higher levels of uncertainty and are therefore more likely to return purchased products.

Return rates may also vary depending on specific contextual settings. Schulze and Srinivasan (2016) find that return rates vary from country to country. They argue that this between-country variation is not driven by variation in customer characteristics but by variation in the efficiency of the postal system between countries. Customers may purchase products as gifts, which are given to a recipient and hence do carry both economic value reflected in the product price but also have an added value from a social dimension. Because returning a gift can cause tension in the relationship between the gift giver and the recipient, products purchased as gift are returned less compared to when the customers purchased the product not as a gift (Petersen and Kumar 2009).

Product Characteristics

Product return rates vary considerably across product categories. For categories such as fashion and footwear, return rates are reportedly higher than for categories such as electronics and furniture (Mollenkopf et al. 2007; Minnema et al. 2016). A major difference between categories is the degree to which it is difficult for customers to assess the fit between the product and their own preferences (fit uncertainty; Hong and Pavlou 2014). Customers perceive higher fit uncertainty for experience products compared to search products, and hence we observe higher return rates for experience products. However, prior studies did not find differences in return likelihood between durable and consumable products, where consumable products are immediately consumed or last a short period of time (Janakiraman et al. 2016). For more expensive products, customers are more critical, and hence more likely to return a product that lacks fit (Anderson et al. 2009b; Hess and Mayhew 1997). This also holds for the temporary price differences; the return rate for items on sale is lower because if the product is less expensive, customers are not as critical (Petersen and Kumar 2009). Multiple studies suggest that average review valence can be used as a proxy for average perceived product quality (De Langhe et al. 2016). For products with higher average valence, product return rates are lower which suggests that for higher perceived quality, lower return rates are observed (Minnema et al. 2016; Sahoo et al. 2016).

Consequences of Customer Returns on Transactional and Non-transactional Behaviors

In this section, we review the key findings of research related to the consequences of product returns. Specifically, we discuss the impact of product returns on future purchase and return behavior and the impact on customer engagement behaviors.

Impact on Future Purchase and Return Behavior

For firms it is important to understand the relationship between contemporary customer product returns and the future purchase and return behavior, and in this way account for the indirect effect of product returns on customer value.

First, a study by Petersen and Kumar (2009) with a catalog retailer that has a lenient product return policy empirically showed that increases in a customer’s product returns led to increases in that customer’s future purchase behavior relative to customers that did not return products. In fact, a simulation in this study found that the optimal product return rate which generated the highest profit for the retailer was around 13% at which the costs of product returns outweighed the benefits of increases in future purchases. Other studies confirm this finding, so does improved refund speed help to improve total relationship value (Griffis et al. 2012) and can increase total spending at the retailer by 158%–457% after customers have experienced a free return (Bower and Maxham 2012). In addition, a higher proportion of returned items result in longer relations with the firm. This is explained by the positive encounter with the firm’s service representatives which enhance loyalty to the firm (Reinartz and Kumar 2003). Thus, firms need to think about creating strategies that might encourage customer behaviors (e.g., cross-buying) that also lead to increases in product returns when customers have not returned many (or any) products in the past. However, retailers should be cautious in asking customers a fee to return the purchased product when the retailers perceive that the customer is at fault (equity-based return policy). When customers perceive this policy as unfair, their post-return spending decreases by 75%–100% at the retailer (Bower and Maxham 2012).

Second, contemporary purchase and return behavior also influences future return behavior. In general, customers who purchase more products, return more products (Petersen and Kumar 2009) because customers must buy products in order to return them. However, there are significant differences based on previous return behavior. Some customers consistently return previously purchased products, whereas 20% of the customers did not exhibit any incidence of return behavior (Shah et al. 2014). Also other studies reported higher return rates for customers who returned in the past (Petersen and Kumar 2009; Minnema et al. 2016). Therefore, habitual returners are more likely to be unprofitable cross- category buyers (Shah et al. 2012) and are likely to contribute negatively by their CLV to the firm, see Eqs. (5.1, 5.2 and 5.3) in Section “The Relationship Between Product Returns and Customer Value” (Shah et al. 2014). Hence, examining product returns becomes even more critical in customer value management, because of a positive indirect effect through increasing future purchases and a negative indirect effect through increasing future returns.

Impact on Customer Engagement Behaviors

Customer value is not limited to the value of the transaction itself, but also comprises behavioral manifestations after a purchase (Van Doorn et al. 2010). Customers can help acquire new customers by providing referrals and can influence customers by, for example, writing reviews (Kumar et al. 2010a). Hence, ignoring non-transactional behavior may not provide the complete impact of product return behavior, see Eq. (5.1). A study by Petersen and Kumar (2010) ran a field experiment with a retailer which changed its return policy from being somewhat strict (only allowing product returns when products are defective or the wrong products have been shipped) to a more lenient return policy (allowing product returns at any point after purchase). The results of this field experiment showed that product return leniency did result in an increase in product returns, but the increase in purchase behavior was significantly larger, leading to a beneficial effect on net sales . Additionally, the study found that there were additional indirect benefits from this change in product return policy—a significant increase in customer referrals. When customers have a product return experience that is low in hassle due to a lenient product return policy , this leads to an increase in profitability due to purchases outpacing product returns, and it also has a positive indirect effect on firm profitability through mechanisms such as increases in customer referral behavior.

The effort in returning the product has similar consequences: higher effort in the customer product return experience negatively influences customer satisfaction with the return process which lowers the loyalty intentions toward the firm (Mollenkopf et al. 2007). Although a satisfactory return process between customer and retailer creates positive attitudes toward the retailer, customers are obviously less satisfied with the product. Hence, product return behavior also influences the arrival of customer reviews for the returned product. Customers are less likely to write a review for a product they have returned, and if customers do write a review, the expected star rating is lower (Minnema et al. 2016). Given the profit impact of non-transaction behaviors such as referrals and customer reviews, it is important for firms to take these behaviors into account (Kumar et al. 2010a).

To conclude this section, the existing literature on the consequences of product returns provides the following insights. First, product returns are not just an economic cost that needs to be minimized. A satisfactory product return experience between a customer and a firm can actually lead to future benefits for the firm in several ways. It can lead to a decrease in the customer’s perceived risk to purchase in the future, making the customer more likely to engage in future purchases with the firm. The positive interaction can also lead to increases in a customer’s attitude toward the firm which can lead to increases in positive word of mouth and/or referrals. However, the customer may also learn from a product return and have a higher probability to return future purchases, which has a negative impact on customer value.

Conclusion and Discussion

In this chapter, we have discussed product returns and its relation with purchase and customer engagement behavior, within the customer value framework. Product returns form a key component of customer value and one of the main drivers of profitability for today’s retailers. In the past decade, we have observed a growing stream of research on product returns, due to the increasing use of distant channels for purchasing and associated higher return rates that are observed for these channels. One of the most important findings is that product returns are not a necessary evil in the exchange process: product returns have positive consequences on the future purchase behavior and help to foster loyalty and engagement toward the retailer. A large body of studies showed that retailers have instruments to manage product returns, such as customer relationship management tools, effective product return policies, and information provision at the moment of purchase. Based on extent research, we provide ten important findings on product returns (see Table 5.2).

This synthesis also helps to provide guidance in the identification of important areas for future research on product returns. Although research related to product returns spurred during the last decade, we believe that research can contribute to further improve understanding. One of the main directions for future research deals with examining under which conditions and for what type of firms, products, and customers a more or less lenient return policy is called for, and how this is different for the five dimensions of the return policy . For example, one could develop a unifying theory of when the high-quality seller should be more or less generous in its return policy compared to a low-quality retailer. Although studies showed the positive impact of return policy leniency dimensions (Janakiraman et al. 2016), future research should examine how this effect is contingent on retailer quality and product characteristics.

A second direction for future research is related to the antecedents of product returns. A substantial body of research showed the impact of pre-purchase information on product return decisions (Shulman et al. 2015). With respect to the customer engagement behaviors, extant research shows that reviews affect returns (Minnema et al. 2016). However, future research could examine the impact of the other behavioral dimensions of customer engagement on product returns. For example, when customers discuss their return behavior in (electronic) word of mouth , what is the social influence of these behaviors on the return behavior of other customers?

A third direction for future research is related to the consequences of product return decisions. Kumar et al. (2010a) propose four core dimensions of customer engagement value (CEV): (1) customer purchasing behavior, (2) customer referral behavior, (3) customer influencer behavior, and (4) customer knowledge behavior. Prior studies showed that product returns have a positive effect on customer purchase (Petersen and Kumar 2009), referral behavior (Petersen and Kumar 2010), and customer information value (Minnema et al. 2016). However, research on the impact on customer knowledge behavior is lacking. A positive relation between product return behavior and customer knowledge behavior can be expected. Customers who return a product can provide the firm of very valuable feedback regarding the information provision that may have caused the misfit or can help firms better understand for what kind of customer the product fits best. More broadly, the consequences of product returns on customer engagement behaviors are not completely clear as of yet. Recent managerial research discusses the “loyalty loop” (see Court et al. 2009), which suggests that in the post-purchase stage, a trigger may either strengthen the bond with the retailer or that customers may consider alternative retailers (Lemon and Verhoef 2016). A positive return experience results in more purchases and referrals but future research should examine the long-term impact on these relations.

This overview aims to provide readers a better understanding of product returns and how product returns should be managed and be taken into account in customer value management. In addition, we hope this overview fuels research on the important topics related to product returns, in particular in retailing and in customer relationship management.

References

Akcay, Y., Boyaci, T., & Zhang, D. (2013). Selling with Money-Back Guarantees: The Impact on Prices, Quantities, and Retail Profitability. Production and Operations Management, 22(4), 777–791.

Altug, M. S., & Aydinliyim T. (2016). Counteracting Strategic Purchase Deferrals: The Impact of Online Retailers’ Return Policy Decisions. Manufacturing & Service Operations Management, 18(3), 376–392.

Anderson, E. T., Hansen, K., & Simester, D. (2009a). The Option Value of Returns: Theory and Empirical Evidence. Marketing Science, 28(3), 405–423.

Anderson, E. T., Hansen K., Simester D., & Wang L. K. (2009b). How Price Affects Returns: The Perceived Value and Incremental Customer Effects (Working paper). Kellogg School of Management, Northwestern University.

Babic, A., Sotgiu, F., de Valck, K., & Bijmolt, T. H. A. (2016). The Effect of Electronic Word of Mouth on Sales: A Meta-Analytic Review of Platform, Product, and Metric Factors. Journal of Marketing Research, 53(3), 297–318.

Banjo, S. (2013, December 22). Rampant Returns Plague E-retailers. The Wall Street Journal. http://online.wsj.com/news/articles/SB10001424052702304773104579270260683155216. Last Accessed 23 June 2014.

Bechwati, N. N., & Siegal, W. S. (2005). The Impact of the Prechoice Process on Product Returns. Journal of Marketing Research, 42(3), 358–367.

Blanchard, D. (2007). Supply Chains also Work in Reverse. Industry Week.

Bonifield, C., Cole, C., & Schultz, R. L. (2010). Product Returns on the Internet: A Case of Mixed Signals? Journal of Business Research, 63(9), 1058–1065.

Bower, A. B., & Maxham, J. G., III. (2012). Return Shipping Policies of Online Retailers: Normative Assumptions and the Long-Term Consequences of Fee and Free Returns. Journal of Marketing, 76(5), 110–124.

Chen, Y., & Xie, J. (2008). Online Consumer Review: Word-of-Mouth as a New Element of Marketing Communication Mix. Management Science, 54(3), 477–491.

Court, D., Elzinga, D., Mulder, S., & Vetvik, O. J. (2009). The Customer Decision Journey. McKinsey Quarterly, 3, 96–107.

Davis, S., Gerstner, E., & Hagerty, M. (1995). Money Back Guarantees in Retailing: Matching Products to Consumer Tastes. Journal of Retailing, 71(1), 7–22.

Davis, S., Hagerty, M., & Gerstner, E. (1998). Return Policies and the Optimal Level of “Hassle”. Journal of Economics and Business, 50(5), 445–460.

De, P., Hu, Y., & Rahman, M. S. (2013). Product-Oriented Web Technologies and Product Returns: An Exploratory Study. Information Systems Research, 24(4), 998–1010.

De Langhe, B., Fernbach P. M., & Lichtenstein D. R. (2016). Navigating by the Stars: Investigating the Actual and Perceived Validity of Online User Ratings. Journal of Consumer Research, forthcoming.

Dekker, R., Fleischmann M., Inderfurth K., & van Wassenhove L. N. (2004). Reverse Logistics: Quantitative Models for Closed-Loop Supply Chains. Berlin/New York: Springer.

Forrester. (2015, March 2). Forrester Research: The State of Retailing Online 2015: Key Metrics, Initiatives, and Mobile Benchmarks, Media Release (Accessed 25 May 2016). https://www.apteligent.com/wp-content/uploads/2015/10/The_State_Of_Retailing_On-1.pdf. Last Accessed 26 February 2016.

Gartner. (2014). Returns—The Ticking Time-Bomb of Multichannel Retailing. https://www.gartner.com/doc/2849018/returns--ticking-time-bomb. Last Accessed 25 May 2016.

Griffis, S. E., Rao, S., Goldsby, T. J., & Niranjan, T. T. (2012). The Customer Consequences of Returns in Online Retailing: An Empirical Analysis. Journal of Operations Management, 30(4), 282–294.

Gu, Z. J., & Tayi, G. K. (2015). Consumer Mending and Online Retailer Fit-Uncertainty Mitigating Strategies. Quantitative Marketing and Economics, 13(3), 251–282.

Guide, V., Daniel, R., Souza, G. C., Van Wassenhove, L. N., & Blackburn, J. D. (2006). Time Value of Commercial Product Returns. Management Science, 52(8), 1200–1214.

Hess, J. D., & Mayhew, G. E. (1997). Modeling Merchandise Returns in Direct Marketing. Journal of Direct Marketing, 11(2), 20–35.

Hong, Y., & Pavlou, P. A. (2014). Product Fit Uncertainty in Online Markets: Nature, Effects, and Antecedents. Information Systems Research, 25(2), 328–344.

Hu, W., Li, Y., & Govindan, K. (2014). The Impact of Consumer Return Policies on Consignment Contracts with Inventory Control. European Journal of Operations Research, 233(2), 398–407.

Inderst, R., & Tirosh, G. (2015). Refunds and Returns in a Vertically Differentiated Industry. International Journal of Industrial Organization, 38(1), 44–51.

Janakiraman, N., & Ordóñez, L. (2012). Effect of Effort and Deadlines on Consumer Product Returns. Journal of Consumer Psychology, 22(2), 260–271.

Janakiraman, N., Syrdal, H. A., & Freling, R. (2016). The Effect of Return Policy Leniency on Consumer Purchase and Return Decisions: A Meta-Analytic Review. Journal of Retailing, 92(2), 226–235.

Kerr, J. C. (2013, August 12). Buyers Beware: Retailers Track Serial Returners. NBC Today. http://www.today.com/money/serial-returners-beware-retailers-are-tracking-you-6C10900265. Last Accessed 20 Mar 2016.

Kostyra, D. S., Reiner, J., Natter, M., & Klapper, D. (2016). Decomposing the Effects of Online Customer Reviews on Brand, Price and Product Attributes. International Journal of Research in Marketing, 33(1), 11–26.

Kumar, V., Aksoy, L., Donkers, B., Venkatesan, R., Wiesel, T., & Tillmanns, S. (2010a). Undervalued or Overvalued Customers: Capturing Total Customer Engagement Value. Journal of Service Research, 13(3), 297–310.

Kumar, V., Petersen, J. A., & Leone, R. P. (2010b). Driving Profitability by Encouraging Customer Referrals: Who, When, and How. Journal of Marketing, 74(5), 1–17.

Lemon, K. N., & Verhoef, P. C. (2016). Understanding Customer Experience Throughout the Customer Journey. Journal of Marketing, 80(6), 69–96.

Minnema, A., Bijmolt, T. H. A., Gensler, S., & Wiesel, T. (2016). To Keep or Not to Keep: Effects of Online Customer Reviews on Product Returns. Journal of Retailing, 92(3), 253–267.

Mollenkopf, D. A., Rabinovich, E., Laseter, T. M., & Boyer, K. K. (2007). Managing Internet Product Returns: A Focus on Effective Service Operations. Decision Sciences, 38(2), 215–250.

Moorthy, S., & Srinivasan, K. (1995). Signaling Quality with a Money-Back Guarantee: The Role of Transaction Costs. Marketing Science, 14(4), 442–466.

Petersen, J. A., & Kumar, V. (2009). Are Product Returns a Necessary Evil? Antecedents and Consequences. Journal of Marketing, 73(3), 35–51.

Petersen, J. A., & Kumar, V. (2010). Can Product Returns Make You Money? MIT Sloan Management Review, 51(3), 85–89.

Petersen, J. A., & Kumar, V. (2015). Perceived Risk, Product Returns, and Optimal Resource Allocation: Evidence from a Field Experiment. Journal of Marketing Research, 52(2), 268–285.

Reinartz, W. J., & Kumar, V. (2003). The Impact of Customer Relationship Characteristics on Profitable Lifetime Duration. Journal of Marketing, 67(1), 77–99.

Sahoo, N., Dellarocas, C., & Srinivasan, S. (2016). The Impact of Online Product Reviews on Product Returns. MSI Working Paper Series, 16–101.

Schulze, C., & Srinivasan, S. (2016). Managing Product Returns for Multinational Online Retailers. Paper Presented at the 2016 Informs Marketing Science Conference.

Shah, D., Kumar, V., Yingge, Q., & Chen, S. (2012). Unprofitable Cross-buying: Evidence from Consumer and Business Markets. Journal of Marketing, 76(3), 78–95.

Shah, D., Kumar, V., & Kim, K. H. (2014). Managing Customer Profits: The Power of Habits. Journal of Marketing Research, 51(6), 726–741.

Shulman, J. D., Coughlan, A. T., & Canan Savaskan, R. (2009). Optimal Restocking Fees and Information Provision in an Integrated Demand-Supply Model of Product Returns. Manufacturing & Service Operations Management, 11(4), 577–594.

Shulman, J. D., Coughlan, A. T., & Canan Savaskan, R. (2010). Optimal Reverse Channel Structure for Consumer Product Returns. Marketing Science, 29 (6), 1071–1085.

Shulman, J. D., Coughlan, A. T., & Canan Savaskan, R. (2011). Managing Consumer Returns in a Competitive Environment. Management Science, 57 (2), 347–362.

Shulman, J. D., Cunha, M., Jr., & Saint Clair, J. K. (2015). Consumer Uncertainty and Purchase Decision Reversals: Theory and Evidence. Marketing Science, 34(4), 590–605.

Su, X. (2009). Consumer Returns Policies and Supply Chain Performance. Manufacturing & Service Operations Management, 11(4), 595–612.

Van Doorn, J., Lemon, K. N., Mittal, V., Nass, S., Pick, D., Pirner, P., & Verhoef, P. C. (2010). Customer Engagement Behavior: Theoretical Foundations and Research Directions. Journal of Service Research, 13(3), 253–266.

Wood, S. L. (2001). Remote Purchase Environments: The Influence of Return Policy Leniency on Two-Stage Decision Processes. Journal of Marketing Research, 38(2), 157–169.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Minnema, A., Bijmolt, T.H.A., Petersen, J.A., Shulman, J.D. (2018). Managing Product Returns Within the Customer Value Framework. In: Palmatier, R., Kumar, V., Harmeling, C. (eds) Customer Engagement Marketing. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-61985-9_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-61985-9_5

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-61984-2

Online ISBN: 978-3-319-61985-9

eBook Packages: Business and ManagementBusiness and Management (R0)