Abstract

The core target of this chapter is numerical analysis and computing of novel finite difference methods related to several different option pricing models, including jump-diffusion, regime switching and multi-asset options. A special attention is paid to positivity, consistency and stability of the proposed methods. The consideration of jump processes leads to partial integro-differential equation (PIDE) for the European option pricing problem. The problem is solved by using quadrature formulas for the approximation of the integrals and matching the discretization of the integral and differential part of the PIDE problem. More complicated model under assumption that the volatility is a stochastic process derives to a PIDE problem where the volatility is also an independent variable. Such a problem is solved by introducing appropriate change of variables. Moreover, American options are considered proposing various front-fixing transformations to treat a free boundary. This free boundary challenge can be treated also by a recent rationality parameter approach that takes into account the irrational behavior of the market. Dealing with multidimensional problems the core difficulty is the appearance of the cross derivative terms. Appropriate transformations allow eliminating the cross derivative terms and reduce of the computational cost and the numerical instabilities. After using a semidiscretization approach, the time exponential integration method and appropriate quadrature integration formulas, the stability of the proposed method is studied independent to the problem dimension.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

This chapter deals with numerical analysis and computing of novel finite difference methods related to several option pricing models that correct the lack of adaptability of the classic Black-Scholes (BS) model to the reality of the market. As the best model may be wasted with a disregarded analysis, we will pay attention to important issues such as consistency and stability of the proposed methods.

Dealing with prices, the guarantee of positivity of the numerical solution is a necessity that will be always considered here. After the 2008 financial crisis, the multidimensional option pricing problems became more relevant for both market industries and academia claiming for comfortable methods that be quick and reliable at the same time.

In Sect. 10.2, we consider finite difference methods for solving partial integro-differential equations (PIDEs) related to a wide class of Lévy processes introducing jump processes in the changes of the underlying assets. The consideration of jump processes motivates the appearance of the integral part of the PIDE. In Sect. 10.2.1, we solve the problem by introducing quadrature formulas for the approximation of the integrals and matching the discretization of the integral and differential part of the PIDE problem. Sect. 10.2.2 assumes that the volatility is a stochastic process deriving to a PIDE problem where the volatility is also an independent variable.

In Sect. 10.3, for dealing with American option pricing problems we follow the front-fixing approach initiated by [40] adding the numerical analysis in the numerical treatment of the problem and another transformation of the original PDE problem. To our knowledge we are the first users of the front-fixing method for regime-switching models fitting better the changing reality of the market.

Section 10.4 incorporates the rationality parameter approach recently proposed by [30] having the relevant issue that American option pricing problems can be approximated by solving a PDE instead of partial differential inequalities. This approach takes into account the irrational behavior of the market.

Section 10.5 addresses the challenge of the dimensionality. Firstly, in Sect. 10.5.1 the elimination of the cross derivative terms of the multidimensional PDE by using appropriate transformations allows the reduction of the computational cost and the numerical instabilities. After using a semidiscretization approach, the time exponential integration method and appropriate quadrature integration formulas, the stability of the proposed method is studied independent to the problem dimension.

2 Solving PIDE Option Pricing Using Finite Difference Schemes

The financial markets show that the underlying assets do not behave like a Brownian motion with a drift and a constant volatility. This fact motivates the emergence of alternative models to the pioneering Black-Scholes model [3]. Alternative models are stochastic volatility [35], deterministic volatility [17], jump diffusion [46, 64] and infinite activity Lévy models. Jump diffusion and Lévy models are characterized by a partial integro-differential equation (PIDE). This PIDE involves two major parts, namely, the differential part as in the Black-Scholes model and the non-local integral part due to the assumption of having assets with jumps. The option pricing under jump diffusion has been studied using the double discretization [7] and the integral term is approximated using the trapezoidal rule.

In this section, we propose positive stable and consistent methods to solve a wide class of infinite activity Lévy models using Gauss-Laguerre quadrature for approximating the integral part. Furthermore, the Bates model that incorporates both stochastic volatility and Jump diffusion is studied.

2.1 Solving PIDE for a Wide Class of Infinite Activity Lévy Processes

One of the most relevant and versatile Lévy models is the one proposed by Carr et al. the so called CGMY [6], that belongs to the family of KoBoL models [4]. Apart from these models, other Lévy processes such as Meixner [44, 57], Hyperbolic and Generalized Hyperbolic (GH) are used to obtain better estimation for the stock returns [56]. The Meixner process was introduced in 1998, it is used when the environment is changing stochastically over the time showing a reliable valuation for some indices such as Nikkei 225 [57].

The option pricing partial integro-differential equation (PIDE) unified model for several Lévy measures ν(y), given by [14, Chap. 12]

where \(\mathcal{C}\) is the value of a contingent claim, S is the underlying asset and τ = T − t is the time to the maturity. The Lévy measures ν(y) are given in Table 10.1.

Note that the Hyperbolic process is obtained from the GH process when β = 0 and λ = −1.

The KoBoL model and in particular the CGMY, see Table 10.1 with parameter C − = C +, has been widely studied because its versatile and includes the finite and infinite activity cases as well as the finite and infinite variation, obtained by changing the value of Yor parameter Y < 2. A fairly complete revision of the methods used to solve the CGMY model can be found in [9, 15, 53, 65].

In this study we focus on the numerical analysis of the unified model (10.1)– (10.3) for the European case, by proposing a consistent, explicit and conditionally positive and stable finite difference scheme while the integral part is approximated using Gauss-Laguerre quadrature formula. We also include the computation of the linear complementarity problem (LCP) for the American option case using both the projected successive over relaxation method (PSOR) and the multigrid method (MG). The discretization for the differential operator is done using the three-level approximation, while the integral part is discretized as the same as in the European case. So, the integral part of the PIDE operator for the American and European cases is discretized using the Gauss-Laguerre quadrature. Although the three-level method is widely used and it is argued that the approximation error is of order two, however such method has two unsuitable properties, in fact as the method needs the first time step that must be obtained using another method (usually by implicit Euler method), in practice the accuracy is reduced.

Let us begin by transforming the PIDE (10.1) into a simpler one. Since the kernel of the integral in (10.1) presents a singularity at y = 0, a useful technique is to split the real line, for an arbitrary small parameter ɛ > 0, into two regions Ω 1 = [−ɛ, ɛ] and \(\varOmega _{2} = \mathbb{R}\setminus \varOmega _{1}\), the complementary set of Ω 1 in the real line. The integral on Ω 1 is replaced by a suitable coefficient in the diffusion term of the differential part of (10.1) obtained by Taylor expansion of V (Se y, τ) about S, see [9, 15, 53, 65]. This coefficient depending on ɛ is a convergent integral and takes the form

The resulting approximating PIDE is given by

where

The convergent integrals (10.4) and (10.6) are evaluated using Gauss quadrature approximation. In order to obtain an approximation for \(\breve{\sigma }^{2}(\varepsilon )\), the Gauss-Legendre quadrature approximation is used, so the weighting function w(ϕ) = 1 such that

where ϕ m are the roots of the Legendre polynomial P M (ϕ) of degree M and ω m is calculated based on [1, Eq. (25.4.29), p. 887]. Here M is chosen to be an even number so that zero is not a root of P M . The improper integrals λ(ɛ) and γ(ɛ) are approximated using the shifted Gauss-Laguerre quadrature [19, p. 226]. Note that under change of variables η = −y −ɛ for y < 0 and η = y −ɛ for y > 0 then λ(ɛ) and γ(ɛ) have the following forms

and

From (10.8), (10.9) and since the weighting function is w(η) = e −η, then we have

where

Here η m are the roots of the Laguerre polynomial L M (η) of degree M and the weighting function ϖ m is given in [1, Eq. (25.4.45), p. 890].

Coming back to (10.5) in order to eliminate the convection and reaction terms, using the transformation defined by

one gets

with the initial and boundary conditions

Next, for the sake of convenience in the numerical treatment we rewrite the integral part of (10.12) as follows

where

After that, in order to match the interval of the integration with the spatial domain of the problem, we use the following substitution ϕ = xe y into (10.15), obtaining

Hence the PIDE for the European option under Lévy model, takes the following form

Now, we are in a good situation to construct an efficient explicit numerical scheme for the transformed problem (10.18) after choosing our numerical domain [0, x max] × [0, T] for large enough value of x max. For the time discretization, we take τ n = nk, n = 0, 1, …, N τ where \(k = \frac{T} {N_{\tau }}\) and the spatial variable x is discretized by x j = jh, j = 0, 1, 2, …, N x , \(h = \frac{x_{\max }} {N_{x}}\).

Since the Laguerre-Gauss quadrature will be used for approximating the integral part of (10.18), then we have the sequence of roots {ϕ m } m = 1 M of the Laguerre polynomial L M (ϕ). The suitable value for M is selected such that E < ϕ M < x max.

By using explicit forward approximation for the time derivative of V and the central difference approximation for second spatial derivative, one gets

In order to approximate the integral part of (10.18) matching the discretization of the integral and differential parts, taking into account that zeroes of Laguerre polynomial do not need to be nodes of the mesh, we use linear Lagrange interpolation polynomial. For any m, 1 ≤ m ≤ M, let us denote by ℓ m the last integer such that the mesh point \(x_{\ell_{m}} <\phi _{m}\). The approximating value V n(ϕ m ) is given by

where the interpolation coefficients are

Note that the linear interpolation approximation (10.20) has an error of order \(\mathcal{O}(h^{2})\) that coincide with the associated error of the central approximation of the spatial derivative (10.19). Hence the discretization for the integral part is given by

Summarizing, from (10.19) to (10.22), the discretization of (10.18) with (10.13) and (10.14) takes the form

1 ≤ j ≤ N x − 1, 0 ≤ n ≤ N τ − 1, where

satisfying

In what follows, we state that the solution is conditionally positive and stable. The proof of this statement and consistency of the scheme can be found in [28].

Theorem 10.1

The numerical solution {V j n} of the scheme (10.23)– (10.25) is nonnegative under the condition.

Based on Von Neumann approach, the stability of the numerical scheme (10.23) has been studied and summarized in the following theorem.

Theorem 10.2

Under the positivity condition (10.26), the numerical scheme (10.23) for (10.18) is conditionally stable see [ 29 ].

The objective of the first example is to exhibit the importance of the positivity condition (10.26) for the three studied Lévy models.

Example 10.1

Here, we have an European option with E = 30, T = 0. 5, r = 0. 08, q = 0, σ = 0. 2, x min = 0, x max = 90, M = 15, ɛ = 0. 5 and N x = 128. The parameters for Lévy models are given in Table 10.2.

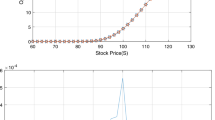

Figures 10.1, 10.2, and 10.3 display the behavior of the option price \(\mathcal{C}\) evaluated by the proposed explicit scheme when the positivity condition (10.26) holds for N τ = 25e3 and when it is broken for N τ = 1e3 represented by the solid and dot curves respectively under several Lévy processes.

The aim of the next example is to show the variation of the error for the Variance Gamma VG model as the stepsizes h and k change. The VG is obtained from the CGMY model when Y = 0, the reference option values for S = {20, 30, 40, 50} are obtained using the closed form solution given in [45].

Example 10.2

Consider an European option under the VG process with parameters E = 30, T = 0. 5, r = 0. 1, q = 0, σ = 0. 25, C − = C + = 11. 718, \(\mathcal{G} = 15\) and \(\mathcal{M} = 25\), x min = 0, x max = 90, M = 15, ɛ = 0. 35.

Table 10.3 reveals the variation of the absolute error (AE) as h changes as well as the spatial numerical convergence rate α and the CPU time while N τ = 4. 5e3 for the explicit scheme (10.23). The change of the error due to the variation of N τ , its convergence rate β and the elapsed time are shown in Table 10.4 while N x = 128.

2.2 Positive Finite Difference Schemes for Partial Integro-Differential Option Pricing Bates Model

The Bates model is considered one of the effective mathematical models that has ability to describe the behavior of real markets of options usually of complex types for instance, currency options. In the Bates model, the Heston stochastic volatility model [35] and the Merton jump-diffusion model [46] are combined to describe the behavior of the underlying asset S and its variance ν [2]. The PIDE for the unknown option price U(S, ν, τ) under Bates model is given by

and the density function f(η) is given by

where μ is the mean of the jump and \(\hat{\sigma }\) is the standard deviation. For the European call option we consider the initial condition

where E is the strike price. We assume the boundary conditions applied to the Heston model, see [20], but modified for ν = 0 due to the additional integral term appearing in Bates model. For the boundaries S = 0 and S → ∞ one gets

Note that this last condition means a linear behavior of the option price for large values of S with slope 1 when no dividend payments are considered, q = 0. Based on that fact, we replace it by the following condition, see [66, Chap. 3, p. 54]

For ν → ∞ and ν = 0, the corresponding boundary conditions are imposed as follows

where φ = Sη.

The model (10.28)– (10.33) has two challenges from the numerical analysis point of view. Firstly, the presence of a mixed spatial derivative term involves the existence of negative coefficient terms into the numerical scheme deteriorating the quality of the numerical solution such as spurious oscillation and slow convergence, see the introduction of [70]. Secondly, the discretization of the improper integral part should be adequate with the bounded numerical domain and the incorporation of the initial and boundary conditions.

Dealing with prices, guaranty of the positivity of the solution is essential. In this chapter we construct an explicit difference scheme that guarantees positive solutions. We transform the PIDE (10.27) into a new PIDE without mixed spatial derivative before the discretization, following the idea of [10], and avoiding the above quoted drawbacks. Furthermore, this strategy has additional computational advantage of the reduction of the stencil scheme points, from nine [22] or seven [54] to just five.

We begin this section by eliminating the mixed spatial derivative term of (10.28), inspired by the reduction of second order linear partial differential equation in two independent variables to canonical form, see [31, Chap. 3] and [10] for details. Let us consider the following transformation

where \(\tilde{\rho }= \sqrt{1 -\rho ^{2}},\) 0 < | ρ | < 1, obtaining the following transformed equation

with

where

For the sake of convenience in the matching of the further discretization of the differential and integral parts of (10.35), we consider now the substitution

Hence from (10.29) and (10.36) one gets

where \(m = \frac{\rho }{\tilde{\rho }}\). Note that from (10.34), we have y = mx −ν.

The initial and boundary conditions (10.29)– (10.33) are transformed into the corresponding conditions using (10.34) and (10.38).

From [27] a suitable bound for the underlying asset variable S is available and generally accepted. In an analogous way, considering an admissible range of the variance ν, we can identify a convenient-bounded numerical domain \(\mathcal{R} = [S_{1},S_{2}] \times [\nu _{1},\nu _{2}]\) in the S −ν plane. Under the transformation (10.34) as it is shown in [10] the rectangle \(\mathcal{R}\) is transformed into the rhomboid ABCD see [28]. In light of the transformation (10.34) we use a discretization of the numerical domain where the space step sizes h = Δx and h y = Δy = | m | h are related by the slope \(m = \frac{\rho }{\tilde{\rho }}\). Here we subdivide space-time axes into uniform spaced points using

where \(h = \frac{b-a} {N_{x}},\) y 0 = ma −ν 2, \(N_{y} = \frac{\nu _{2}-\nu _{1}} {\vert m\vert h}\) and \(k = \frac{T} {N_{\tau }}\). Note that any mesh point in the computational spatial domain has the form

By denoting the approximate value of w at a representative mesh point P(x i , y j , τ n) by W i, j n, we implement the center difference approximation for spatial partial derivatives. On the other hand the improper integral I(w) (10.39) is truncated into [a, b], then the composite four points integration formula of open type has been implemented using the same step size for the variable x as in the differential part. Hence the corresponding finite difference equation for (10.35) is given by

where

and the integral part is given by

assuming that N x has been previously chosen as a multiple of 5. The weight function g i, ℓ is given by

The following theorem is established in order to guarantee nonnegative numerical solutions such that

Theorem 10.3

If stepsizes h and k satisfy

- C1.:

-

\(h \leq \min \left \{ \frac{2\sigma \tilde{\rho }\nu _{i}} {\vert 2\hat{\xi }-\nu _{i}\vert },\ \frac{\sigma ^{2}\tilde{\rho }^{2}\nu _{ i}} {2m^{2}\vert \alpha \nu _{i}+\beta \vert },\ i = 1,2\right \}\)

- C2.:

-

\(k \leq \min \left \{\frac{m^{2}h^{2}} {\sigma ^{2}\nu _{2}},\ \frac{2h} {3\sigma \tilde{\rho }\vert \hat{\xi }\vert },\ \frac{\vert m\vert h} {3\kappa \theta } \right \}\),

then the numerical solution {W i, j n} of the scheme (10.45) is nonnegative.

The numerical scheme (10.45) is written in a matrix form in order to study its stability, see [28]. It has been shown that under the positivity conditions, the infinite norm of the vector solution is bounded such that

Establishing a conditional strong uniform stable scheme.

Example 10.3

The parameters are selected as follows T = 0. 5, E = 100, r = 0. 05, q = 0, θ = 0. 05, κ = 2. 0, σ = 0. 3, \(\hat{\sigma }= 0.35\), μ = −0. 5, λ = 0. 2 and ρ = −0. 5 with a tolerance error ɛ = 10−4.

The boundary points a and b of the spatial computational domain are obtained from [28], while ν 1 = 0. 1 and ν 2 = 1. Table 10.5 shows the variation of the RMSRE for several values of the time step sizes, for fixed N x = 70 and N y = 35, with respect to reference values computed at (N x , N y , N τ ) = (500, 146, 7000).

The variation of error due to the change of the spatial step sizes, while N τ = 500 has been presented in Table 10.6.

3 Front-Fixing Methods for American Option Pricing Problems

American option pricing problem leads to a free boundary value problem, that is challenging because one has to find the solution of a PDE that satisfies auxiliary initial conditions and boundary conditions on a fixed boundary as well as on an unknown free boundary. This complexity is reduced by transforming the problem into a new nonlinear PDE where the free boundary appears as a new variable of the PDE problem.

This technique which originated in physics problems is the so called front-fixing method based on the Landau transform [41] to fix the optimal exercise boundary on a vertical axis. The front-fixing method has been applied successfully to a wide range of problems arising in physics (see Crank [18]) and finance (see [11, 59, 68], etc.) In this section the front-fixing method combined with the use of an explicit finite difference scheme avoid the drawbacks of alternative algebraic approaches since it avoids the use of iterative methods and underlying difficulties such as how to initiate the algorithm, when to stop it and which is the error after the stopping.

3.1 Front-Fixing Methods for American Vanilla Options

First of all, classical Black-Scholes model for American call option (10.50)–(10.53) is considered. The option price C(S, τ), where τ = T − t is the time to maturity, with constant dividend yield q is the solution of linear PDE of the second order

supplied with the following initial conditions

and the boundary conditions

Since an additional unknown function S f (τ) is included in the free boundary formulation, one extra condition is necessary. This condition is called smooth pasting condition and requires that the slope of the option price curve at the free boundary coincides with the slope of payoff function. Thus, for put option it is presented as follows

A dimensionless Landau transformation [41] is proposed as follows

The spatial variable x transfers the free boundary domain S < S f (τ) to the fixed, but unbounded domain (0; ∞). In new coordinates (x, τ) the problem (10.50)–(10.53) is rewritten in the following normalized form

where s f ′ denotes the derivative of s f with respect to τ. The new transformed equation (10.55) is a nonlinear PDE on the domain (0, ∞) × (0, T] since s f and its derivative are involved. The problem (10.55) is solved by explicit FDM.

Further, let us consider American call option problem with another dimensionless transformation that allows to fix the computational domain as in [68] and to simplify the boundary conditions like [66, p. 122],

Using transformation (10.56) the problem (for call option) can be rewritten in normalized form

with new initial conditions

Analytical or closed form solution of the transformed problems (10.55) or (10.57) does not exist. Therefore explicit and fully implicit FDMs are employed for constructing effective and stable numerical solution.

The problem (10.57)–(10.59) can be numerically studied on the fixed domain [0, x max ] × [0, τ]. The value x max is chosen big enough to guarantee the boundary condition. The computational grid of M + 1 spatial points and N + 1 time levels is chosen to be uniform with respective step sizes h and k:

The approximate value of option price at the point x j and time τ n is denoted by c j n ≈ c(x j , τ n) and the approximate value of the free boundary is denoted by \(S_{f}^{n} \approx S_{f}\left (\tau ^{n}\right )\). Then a forward two-time level and centred in a space explicit scheme is constructed for internal spatial nodes as follows

where

Special attention is paid to study positivity and monotonicity of the numerical solution as well as stability and consistency of the proposed schemes. Note, that using expressions (10.63) it is easy to obtain that the constants of the scheme a 1, b and a 2 are positive for both cases: r ≤ q and r > q under following conditions

If \(r = q + \frac{\sigma ^{2}} {2}\), then under the condition (10.64), coefficients a 1, b and a 2 are positive. Note, that these conditions are sufficient also for stability of the proposed explicit scheme. The details of the stability and consistency analysis can be found in [12].

Stability conditions on step sizes for explicit methods have been found. The implicit method is unconditionally stable, that allows to reduce computational time. But, there exist additional calculations of the inverse Jacobian matrix on each iteration. It has been shown that for the same step sizes the explicit method is ten times faster than the implicit one. The solution of (10.57) calculated by the proposed fully implicit method is shown in Fig. 10.4.

3.2 Moving Boundary Transformation for Nonlinear Models

For the case of American options with constant volatility various front-fixing transformations have been studied in [12, 40, 47, 58]. In this section an efficient front-fixing method for a nonlinear Black-Scholes equation is proposed. Under the transformation the free boundary is replaced by a time-dependent known boundary. In the resulting equation there is no reaction term and the convection term is simplified in a such way that the operator splitting technique is not required. This ensured a single numerical scheme is suitable for the entire equation. The connection between the transformed boundary conditions with the transformed option price and the free boundary does not require additional information.

The proposed formulation of the nonlinear problem allows the use of a versatile numerical treatment. In this chapter an explicit Euler and alternating direction explicit (ADE) method [21, 49] together with implicit methods are studied.

With the previous notation, nonlinear American call option pricing models may be formulated as the free boundary PDE problem

where the adjusted volatility function is given by \(\tilde{\sigma }^{2} =\tilde{\sigma } ^{2}\left (\tau,S,C_{SS}\right )\). Two nonlinear models with different adjusted volatility functions are considered:

-

RAPM model: \(\tilde{\sigma }^{2} =\sigma _{ 0}^{2}\left (1 +\mu \left (S\frac{\partial ^{2}C} {\partial S^{2}} \right )^{\frac{1} {3} }\right )\),

-

Barles and Soner model: \(\tilde{\sigma }^{2} =\sigma _{ 0}^{2}\left (1 +\varPsi \left (e^{r\tau }a^{2}S^{2}C_{SS}\right )\right )\),

where \(a =\mu \sqrt{\gamma N}\), γ is the risk aversion factor and N denotes the number of options to be sold. The function Ψ is the solution of the nonlinear singular initial value problem

$$\displaystyle{ \varPsi ^{{\prime}}(A) = \frac{\varPsi (A) + 1} {2\sqrt{A\varPsi (A)} - A},\quad A\neq 0,\quad \varPsi (0) = 0. }$$(10.66)

Taking advantages of the Landau transformation [41] with modifications in the exponential factors like those described in [10], it is possible to remove the reaction term and partially the convection term by using the transformation given below.

Using transformation (10.67) the equation (10.65) takes the form

where

Note that the transformation described in (10.67) transforms the original free boundary value problem to a known moving boundary problem. In the case r > q the computational domain increases with respect to time, otherwise it decreases. The numerical solution of the transformed problem can be found by explicit, ADE and implicit methods.

In Table 10.7 the results and comparisons are presented. Since the domain is changing in time and is covered by an equidistant grid, the spatial step size h n is varying in time. The time step is fixed at k = 0. 0001 to guarantee stability of all numerical solutions. For the implicit method the tolerance was chosen as ε = 10−4.

Note that the main part of the computational time is pertained for the calculation of Ψ(A). For the implicit methods it has to be calculated on each iteration of Newton’s method. Thus, their computational costs may be noticeably reduced by choosing another model. The details of the proposed methods can be found in [26].

3.3 Front-Fixing Method for Regime-Switching Model

An American put option on the asset S t = S with strike price E and maturity T < ∞ is considered under regime-switching model. Let V i (S, τ) denote the option price functions, where τ = T − t denotes the time to maturity, the asset price S and the regime α t = i. Then, V i (S. τ), 1 ≤ i ≤ I, satisfy the following free boundary problem:

where S i ∗(τ) denote optimal stopping boundaries of the option. Initial conditions are

In spite of the apparent complexity of the transformed problem due to the appearance of new spatial variables, one for each equation, the explicit numerical scheme constructed becomes easy to implement, computationally cheap and accurate when one compares with the more relevant existing methods. Implicit weighted schemes have been developed for the sake of performance comparison.

Based on the transformation used by the authors in [11, 68] for the case of just one equation, the following multi-variable transformation is considered

Note that the new variables x i lie in the fixed positive real line. The price V i of i-th regime involved in i-th equation of the system and i-th free boundary are related by the dimensionless transformation

Then the value of option l-th regime appearing in i-th coupled equation, l ≠ i, becomes \(P_{l,i}(x^{i},\tau ) = \frac{V _{l}(S,\tau )} {E}.\)

Since from (10.72), \(\frac{V _{l}(S,\tau )} {E} = P_{l}(x^{l},\tau )\) and taking into account transformation (10.71) for indexes i and l one gets that

and it occurs when the variables are related by the equation

From (10.71) to (10.73) the problem (10.69) for 1 ≤ i ≤ I takes a new form

PDE problem (10.75) is solved by the explicit FDM. Let us denote u i, j n ≈ P i (x j , τ n) the approximation of P i in i-th equation at mesh point (x i = x j , τ = τ n) and \(\tilde{u}_{l_{i},j}^{n} \approx P_{l,i}(x_{j},\tau ^{n})\) be the approximation of P l in i-th equation evaluated at the point (x i = x j , τ = τ n). The discretization of the transformed optimal stopping boundary is denoted by X i n ≈ X i (τ n). Then an explicit finite difference scheme can be written in the form

where

are obtained by linear interpolation of values u l, j n at the point \(x_{j} +\ln \frac{X_{i}^{n}} {X_{l}^{n}}\) known from the previous time level n.

We have studied the stability of the proposed explicit scheme following the von Neumann analysis approach originally applied to schemes with constant coefficients. However, such approach can be used also for the variable coefficients case by freezing at each level (see [61, p. 59], [24, 34]).

In order to avoid notational misunderstanding among the imaginary unit with the regime index i used in previous section, here we denote the regime index by R. An initial error vector for every regime g R 0, R = 1, …, I, is expressed as a finite complex Fourier series, so that at x j the solution u i, j n can be rewritten as follows

where i = (−1)1∕2 is the imaginary unit and θ is phase angle. Then the scheme is stable if for every regime R = 1, …, I the amplification factor \(G_{R} = \frac{g_{R}^{n+1}} {g_{R}^{n}}\) satisfies the relation

where the positive number K is independent of h, k and θ, see [60, p. 68], [61, p. 50].

After some manipulations, one gets

where \(C(n) = \left \vert \frac{g_{l_{0}(n)}^{n}} {g^{n}} \right \vert \left \vert q_{R,R}\right \vert\) is independent of θ, h and k and depends only on the index n.

Thus, in agreement with (10.78) the scheme is stable, if

Summarizing the following result can be established:

Theorem 10.4

With previous notation the scheme (10.76) is conditionally stable under the constraint

Stability conditions on step sizes are found and proven by numerical experiments (see Figs. 10.5 and 10.6). Consistency of the proposed scheme is studied in [25].

4 Rationality Parameter Approach

Recently, in [30] a new nonlinear BS model that takes into account irrational exercise behaviour is proposed. We confirm numerically that the solution of the irrational problem proposed in [30] for large values of rationality parameter tends to the solution of the rational American option problem. This technique has been successfully applied to a regime switching model described in previous subsection.

With the previous notation, let (f λ) λ > 0 be a family of positive deterministic intensity functions. For each λ > 0, let the stochastic intensity process be given by

where P λ(t, S t ) = P λ(t, S t ; τ ∗(λ) and τ ∗(λ) is the exercise strategy of the American put given as the first jump time of a point process with intensity μ λ. Let ν λ (x) = 1(x < 0)sup y ≤ x f λ(y) + 1(x ≥ 0)sup y ≥ x f λ(y) and assume that

-

ν λ (0+) → ∞ as λ → ∞.

-

There exists a function ε: (0, ∞) → (0, ∞) such that ν λ (−ε(λ))) → 0 and ε(λ)ν λ (0−) → 0 as λ → ∞.

Then λ is a rationality parameter in the sense that for every t ∈ [0, T] we have that P λ(t, S t ) tends to P A(t, S t ) when λ → ∞. Moreover, if f λ is increasing then f λ = ν λ .

We first consider the two cases proposed in [30] and we additionally propose two alternative expressions:

We have proposed two intensity functions that are the smooth analogue of the stepwise function (10.81):

This irrational behaviour model of the American put option is studied and solved numerically in the following subsection. Then we apply this approach to model of the American option under regime-switching.

4.1 Irrational Behaviour Model of American Put Option

The following nonlinear Black-Scholes equation in the unbounded domain Ω = (0, +∞) × (0, T) is considered (sub-index and super-index of f are skipped):

when S → 0, the standard condition for American options, P(0, τ) = E, is no longer valid in the irrational case, as prices bellow exercise price may occur due to irrational exercise, which is more evident when the rationality parameter tends to zero. The typical boundary condition for European options P(0, τ) = Ee −rτ is not consistent with the equation for λ → −∞, as the solution converges to the one of the rational case of American options. Since Eq. (10.83) is nonlinear and describes option pricing with rationality parameter, a new boundary condition has to be established. Therefore, we propose to pass to the limit in Eq. (10.83) when S → 0:

The previous equation allows to adapt the option price when S = 0 according to rationality of the holder.

We introduce the new variable

Then the original problem is transformed to the following problem for \(x \in \mathbb{R}\):

For the transformed problem the numerical solution is constructed by the explicit FDM.

In the previous notation, let us denote u j n ≈ u(x j , τ n), then the explicit finite difference scheme can be written in the form

where

Note that under conditions

where depending on the chosen rationality function

the coefficients b 1, b 2 and b 3 defined in (10.86) are positive and rationality term k | | f n | | is bounded.

In order to study the stability of the scheme we first choose the minimum index m, such that u m n+1 = | | u n+1 | |. Note that if m = 0 or m = N x , then the scheme is stable by the definition.

Suppose for the index 1 ≤ m ≤ N x − 1, then taking into account that all coefficients are positive, one gets

The connection between (n + 1)-th and n-th level is obtained:

Therefore, under conditions (10.87), the scheme (10.85) is stable.

Assuming that u(x, τ) is continuously differentiable four times with respect to x and twice with respect to τ and following the procedure of consistency study, one finds that the truncation error behaves

The aim of this part of work is to study numerically the rationality parameter approach and to prove the convergence of the solution to American option price with growing rationality parameter λ, that is presented in Fig. 10.7.

Numerical solution for the intensity function belonging to family f 2 (10.81) for various values of λ

4.2 Rationality Parameter Approach for Regime-Switching Model

For an intensity function f: [−E, E] → [0, ∞) in the regime switching setting we assume that the relation between the profitability and the stochastic exercise intensity is f((E − S)+ − V i (S, τ)) for each regime. After incorporating this term to the system of PDEs satisfied by the option price in describing the regime switching model (10.69) one gets for i = 1, …, I,

In order to construct an effective FDM with constant coefficients in the differential part, let us introduce the following normalized transformation

Then, problem (10.90) takes the following equivalent form:

The resulting nonlinear system of PDEs is solved by a weighted FDM, also known as θ-method. In order to avoid the need of an iterative method for the nonlinear system, the term with rationality parameter and the coupling term are treated explicitly. Next, the resulting linear system is solved by the Thomas algorithm. Stability conditions for the numerical scheme are studied by using the von Neumann approach.

Consistency of the θ-scheme for the PDE system is established and the truncation error takes the following form

Numerical experiments illustrate the efficiency and accuracy of the proposed method. In order to find computational convergence rate, a series of numerical results has been provided with fixed time step and various spatial steps h. The convergence rate γ h has been calculated by formula

for the proposed scheme with θ = 0, 0. 5, 1. The results are collected in Table 10.8 showing the expected orders for the approximation with λ = 103 and various intensity function families.

An analogous formula can be used in order to estimate the convergence rate in time, γ k , for a fixed space step h:

The convergence rates γ k of the proposed method for various intensity function families (10.81) and (10.82) are presented in Table 10.9. The numerical convergence rate are in agreement with the theoretical study of consistency.

5 A Semi-Discretization Technique for Multi-Asset Option Pricing Problems

5.1 Removing Transformation Techniques for Multi-Asset Option Pricing

This section mainly covers removing the cross derivative terms in the formulation of an option pricing problem where the exercise value depends on more than one risky asset.

Basically the techniques for transformations aim at constructing the corresponding PDE with constant coefficients and also at removing the mixed derivative terms from the structure. Each of these transformations have some pros and cons.

The merit of transformations for removing the cross derivative terms is that the re-constructed PDE is easy to handle numerically since it has fewer number of terms which obviously ends in fewer mesh nodes in stencil in contrast to its non-transformed version. Furthermore, it may avoid the oscillation and spurious behaviors [39, 50] of the numerical solutions in the presence of mixed derivatives. A transformation of spatial variables based on obtaining the canonical form of the second order PDE [31] can be used for the two correlated assets problems.

Technically speaking, it should be noticed that enforcing any types of transformations would change the initial and boundary conditions for the Black-Scholes multi-dimensional PDE problem.

In this section, we handle the new boundary conditions in order to obtain accurate and stable numerical solutions.

Considering a system of stochastic ordinary differential equations for an option pricing problem with two state variables, the authors in [38] used a transformation (with the Itô lemma and standard arbitrage arguments) that makes the instantaneous standard deviation of each to be constant. To be more precise, they suggest that a transformation be carried out to diagonalize a correlation matrix (tensor) in order to remove the cross derivative terms. This corresponds to a stretching and rotation of the coordinate system.

In the well-known stochastic volatility model (Heston model) [35], two space variables are existed in the presence of a cross derivative term. Such models are basically in the form of a the partial integro-differential equations (PIDEs) while they do not endure the pitfall of not capturing features like heavy tails and asymmetries observed in market-data log-returns densities unlike the normality of the log returns considered originally by Black-Scholes.

In [10], the authors applied two transformations in order to remove the reaction term and the cross derivative term from the Heston model and construct an elliptic form of it which is defined on rhomboid domain but with fewer terms which yielded to the construction of a stable and accurate numerical scheme.

One of the state-of-the-art techniques to remove the cross derivative terms is the use of eigenvalue decomposition [43, 52] which is also an algebraic transformation. In this technique, the eigenvalue decomposition of the diffusion matrix is constructed and used for deriving the multi-asset option pricing PDE without mixed derivative terms. We recall that the diffusion matrix in a multidimensional second order PDE is a symmetric matrix containing the coefficients of the second order derivatives in the PDE.

The multi-asset Black-Scholes PDE is expressed as follows [23, 62]:

where T, V, S i , q i , r, σ i ρ are the maturity, the value of the option price, the i-th asset, the constant dividend yield of i-th asset, risk-free rate, the i-th volatility, the correlation parameter, respectively, while τ = T − t and ρ ii = 1, ρ ij = ρ ji , i ≠ j, and

The mixed derivative terms appearing in (10.94) show the correlation among the prices of the assets S i .

The logarithmic transformation [8] could transform the multi-dimensional PDE (10.94) into a PDE with constant coefficients as follows:

with V (S, τ) = W(X, τ), where X = (x 1, x 2, …, x M )⊤, and we may achieve

Note that for a M-dimensional Black-Scholes PDE, the number of cross derivative terms is

This evidently shows that by increasing the number underlying assets, the number of mixed derivative terms gets bigger which could cause several certain issues in the process of solving (10.94).

Apart from the appearance of instability and inaccuracy due to the presence of the cross derivative terms mentioned above, the number of stencil nodes or matrices that must be filled and computed in the development of the numerical schemes would be higher and subsequently relinquish further computational burden [67].

Here the main objective is to remove the mixed derivatives so as to reduce unsuitable instability drawbacks for the (10.94). Essentially, this may be pursued by applying transformations. This new transformation is different from the eigenvalue transformation and it is based on LDL ⊤ factorization.

Toward this goal, let us consider the symmetric positive semi-definite correlation matrix [55]:

as the diffusion matrix corresponding to the PDE (10.97). Accordingly, in this section we present a general way by means of an easy to implement transformation based on Gaussian elimination and pivoting strategies [37] to remove the cross derivative terms.

Let us first recall the definition of the LDL ⊤ factorization in what follows. If R be a symmetric positive semidefinite matrix in \(\mathbb{R}^{M\times M}\). Then, there exists a unit lower triangular matrix L and a diagonal matrix D = (d ij ) in \(\mathbb{R}^{M\times M}\) with d ii ≥ 0, 1 ≤ i ≤ M, such that [33]:

Generally speaking, if the matrix R is only positive semidefinite, then (10.100) is not valid, but when R is positive definite then it is unique.

Here in order to have stable computation of this factorization [36], basically a permuted version of (10.100) on the matrix R should be performed, viz, this permuted factorization could be written as comes next:

where P is a permutation matrix, | l ij | ≤ 1 and

Now in order to remove the cross derivative terms in the parabolic second-order constant-coefficient PDE (10.96), we take into account a linear transformation as follows:

where C is the matrix that should be computed such that the mixed derivative terms get vanished.

Now by applying (10.103), the PDE (10.97) reads

where U(Y, τ) = W(X, τ) and c i = (c i1, c i2, ⋯ , c iM ) is the ith row vector of matrix C. Here, c i denotes the ith row of matrix L −1 P:

Using

we obtain

Hence, Eq. (10.104) becomes:

Here we remark that the discussed transformation based on the permuted Cholesky factorization has several upsides from the computational cost and stability points of view, but it is not the only way to eliminate mixed derivative terms. In fact, if one uses the standard diagonalization transform of

even when F −1 = F T is available, the transformation

also transforms Eq. (10.94) into a PDE without cross derivative terms.

Example 10.4

In this experiment, we consider the general multi-asset option pricing problem (10.94) with M = 7 underlying assets, where the correlation matrix R is given by

with the parameters

r = 0. 045, T = 1 year, and

Applying the factorization (10.101), (10.96) and (10.103), one gets

Subsequently, the transformation matrix which is a lower triangular matrix can be expressed as:

Now, the corresponding problem (10.94) is transformed into the following compact notation form

where \(\nabla = \left ( \frac{\partial } {\partial y_{1}}, \frac{\partial } {\partial y_{2}},\ldots, \frac{\partial } {\partial y_{M}}\right )^{\top }\), U(Y, τ) = V (S, τ) and Q = (Q 1, Q 2, …, Q M )⊤. The interesting point is that the original multi-asset PDE with 37 terms has now been re-constructed into one with only 16 terms.

In the rest of this section, we discuss the cases when the diffusion matrix is symmetric possibly indefinite. This would be practical in the general case of solving PDEs with cross derivative terms [42]. Let us consider the equation

where A = (a ij )1 ≤ i, j ≤ M is a real symmetric matrix, \(\mathbf{b} = (b_{1},\ldots,b_{M})^{\top }\in \mathbb{R}^{M}\) and \(c \in \mathbb{R}\).

In this case, the matrix A could be indefinite. So, the factorization (10.100) breaks [37] but we may use an alternative as discussed below which is called as Bunch-Kaufman factorization [5]. This approach does not always provide a diagonal factorization of A, but only a block-diagonal matrix B with 1 × 1 or 2 × 2 diagonal blocks such that

where the permutation matrix P provides a partial pivoting strategy. Thus, one gets a more efficient method than other diagonal pivoting strategies as complete pivoting. In this way, only a part of mixed derivative terms are removed. However, with the use of eigenvalues decomposition on the final 2 × 2 block, we may remove all the mixed derivative terms and obtain a corresponding PDE without such terms.

The next example is related to multi-asset cross currency option pricing [38, Chap. 29] with indefinite sample correlation matrix.

Example 10.5 ([67])

Consider Eq. (10.94) for M = 3, with indefinite sample correlation matrix

Using Bunch-Kaufman strategy, one gets the transformation matrix C and the resulting matrix B,

Hence, the original partial differential equation is transformed into a new one without cross derivative terms.

5.2 Stability and Numerical Example

Options with multi assets are based upon more than one underlying asset, unlike the well-known standard vanilla options. In this situation, due to the curse of dimensionality which is of exponential growth, the complexity of the problem grows when the dimensionality increases. That is to say, the number of unknowns for solving the corresponding PDE simultaneously grows exponentially [63].

One of the main restrictions here in the process of solving a multi-asset option pricing problem is that the mixed derivative of the solution has to be bounded and its presence could cause instability and further computational burdensome.

Efficient pricing of American and European options that are dependent on more than one asset is discussed in this section. The holder of a multi-asset contract has the right to buy a set of assets if the conditions are profitable which is known as a basket of assets.

To formulate this problem, we may choose S = (S 1, …, S M ) to be the vector consisting the asset prices, where M is the number of assets in a portfolio while P(S, τ) is the value of the option pricing.

This class of basket options (for put) can be described by a general equation for the contract function [48]

where E is the exercise price of the complete basket and α i are the percentages in the set of assets. The option price P(S, τ) is the solution of the following PDE problem

where σ i is the volatility of S i , ρ i, j is the correlation between S i and S j , r is the risk free rate, q i is the constant dividend yield of i-th asset and F(P) is the rationality parameter term.

In the formulation (10.122), we applied the penalty approach [50] in order to handle the American options by transforming the free boundary value problem into a nonlinear PDE. In fact, due to opportunity to exercise at any time to maturity, American option pricing problems introduce a free exercise boundary which is more difficult than European options.

In this work, we consider the rationality term as follows [30]:

which is a simpler version of the following general form

where f λ(x) is an intensity function and λ is a rationality parameter.

It is required to state that the boundary of a M-dimensional Black-Scholes PDE in option pricing is the solution of the (M − 1)-dimensional problem while in infinity they approach to zero. Furthermore, at each boundary S i = 0 we have

There are several approaches to value this option pricing problem in the presence of multi assets using finite difference, finite element schemes and Monte-Carlo method [32]. The most challenging issue in dealing with such nonlinear PDEs is to control the boundedness of the numerical solution, i.e., stability of the numerical scheme when the size of the discretized system gets bigger by considering higher number of assets and nodal points for discretization.

As discussed in the second section of this chapter, another problem is the presence of the cross derivative terms which cause instability and oscillation in the process of solving (10.122) numerically. Thus, the objective of this section is to address a numerically stable finite difference schemes for multi-asset American/European option pricing problems based on the semi-discretization technique.

The matrix involving the second order partial derivative terms, so called the diffusion matrix, can be diagonalized by means of its orthogonal transformation. This technique could be applied to remove the cross derivative terms as it has been done in [43].

But in this section, we follow the suggested LDL ⊤ factorization given previously in the second section so as to construct a corresponding nonlinear PDE without mixed derivative terms.

In [69] a semi-discretized method has been applied for multi-asset problem under regime-switching. In that work the spatial step sizes are fixed, and so the size of the matrix A in order to obtain L-stability.

To keep going, we first do a same procedure as in the second section by obtaining the corresponding PDE with constant coefficient and then the PDE without cross derivative terms. Thus using the dimensionless logarithmic substitution

where x = [x 1, …, x M ]⊤, we obtain

where \(\delta _{i} = \frac{r-q_{i}-\frac{\sigma _{i}^{2}} {2} } {\sigma _{i}}\).

Now by applying the linear transformation discussed before based on the LDL ⊤ factorization of the correlation matrix [13]

where \(C = \left (c_{ij}\right )_{1\leq i,j\leq M} = L^{-1}\), we can obtain the following simplified transformed nonlinear PDE for multi-asset option pricing problem

where the cross derivative terms have been removed. Under transformations (10.126) and (10.128) the initial condition (10.121) takes the form

where

For dealing with the above time-dependent PDEs, one way is the method of lines based on the semi-discretization with respect to spatial variables which results in a system of (linear or nonlinear) ordinary differential equations in time with the corresponding matrix of coefficients A.

Then semi-discretization of Eq. (10.129) is obtained by using the central difference approximation for the spatial derivatives, resulting in the system of (nonlinear) ordinary differential equations (ODEs) of the form

which its stencil has only 2M + 1 mesh points in contrast to M 2 + M + 1 mesh points based on the recent finite difference method given in [69].

To construct conditions for finding stable solutions, we first consider that for i = 1, …, M:

The nonlinear system (10.132) with the boundary and initial conditions can be presented in the following vector form

where \(u_{j}(0) = U(\boldsymbol{\xi }_{j},0) = \left (1 -\sum _{i=1}^{M}\alpha _{i}e^{\sigma _{i}x_{i}(\boldsymbol{\xi }_{j})}\right )^{+},\) wherein \(x_{i}(\boldsymbol{\xi }_{j}) = \left (C^{-1}\boldsymbol{\xi }_{j}\right )_{i}\) is the i-th entry of \(C^{-1}\boldsymbol{\xi }_{j}\).

The entries of the matrix A are given by:

Note that as the chosen artificial boundary conditions do not change with τ, then their derivative with respect to τ are zero which motivates the appearance of zeros in the corresponding rows of A.

If \(k = \frac{T} {N_{\tau }}\), so τ n = nk, n = 0, …, N τ . Thus for full discretization we have [16]:

Now, by replacing u(τ n+1 − s) by the known value u(τ n) corresponding to s = k, we attain

We use the accurate Simpson’s rule

where \(\varphi (A,k) = \frac{1} {6}\left (I + 4e^{A\frac{k} {2} } + e^{Ak}\right ).\)

Denoting u n = u(τ n), we get the final explicit scheme

This is the proposed explicit full-discretized FD method for solving multi-asset option pricing problem which is stable under two conditions along spatial and temporal variables.

Coefficients a −i and a +i , i = 1, …, M, depend on d i and c i , see (10.134) and (10.135) respectively. If step size h is chosen as

then a −i and a +i are non-negative. This is the first condition on the step size along spatial variable which could result in the positivity of the numerical schemes after several investigations on the structure of the schemes using bounds on matrix exponential and Metzler matrices.

Subsequently we may prove that u i n ≤ 1, 0 ≤ i ≤ N, 0 ≤ n ≤ N τ using the induction principle. We remark that

and from (10.144) u i n+1 is a function g i on the arguments u 0 n, …, u N n, given by

And furthermore by the non-negativity of e Ak and φ(A, k) one gets

Finally, we attain the following bound for the temporal step size

Theorem 10.5

With previous notation under conditions (10.145) and (10.149) the numerical solution u n of the scheme (10.144) is non-negative and \(\left \|\cdot \right \|_{\infty }\) -stable, with \(\left \|\mathbf{u}^{n}\right \|_{\infty }\leq 1\) for all values of λ ≥ 0 and any time level 0 ≤ n ≤ N τ .

In what follows, we try to investigate the robustness of the proposed approach for solving several experiments in the presence of multi assets.

Example 10.6

The American basket call option of two assets is considered with the following parameters [51]

In the following table, we include the results at S = (100, 100) for λ = 100, various spatial step sizes h and corresponding k under the discussed conditions. The numerical solution by high-order computational method of [51] is denoted by HOC (Table 10.10).

Example 10.7

As a numerical example we consider the European basket call option with no dividends and the following parameters (see [43, p. 76])

The spot price is chosen to be S 1 = S 2 = S 3 = E. The reference value P ref = 13. 245 is computed by using an accurate Fast Fourier Transform technique (see [43, Chap. 4]). Since the considered option is of European style, penalty term is not necessary and λ is chosen to be zero.

The numerical results of the proposed method P h are presented in the following table and compared with the sparse grid solution technique P l on an equidistant grid of [43] and the method of [69] denoted by KM with rationality approach [30] (Table 10.11).

As could be seen from the numerical experiments, the theoretical bounds for the temporal and spatial variables are quite useful and necessary in solving real-life problems. The transformations made the process of solving this type of options quite easier and much more efficient. After spatial semi-discretization, the problem is fully discretized. We could handle American/European put/call options.

References

Abramowitz, M., Stegun, I.A.: Handbook of Mathematical Functions: With Formulas, Graphs, and Mathematical Tables. Dover Books on Mathematics. National Bureau of Standard, USA (1961)

Bates, D.S.: Jumps and stochastic volatility: exchange rate processes implicit Deutsche Mark options. Rev. Financ. Stud. 9, 69–107 (1996)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Boyarchenko, S.I., Levendorskii, S.Z.: Option pricing for truncated Lévy processes. Int. J. Theor. Appl. Finance 3(3), 549–552 (2000)

Bunch, J.R., Kaufman, L.: Some stable methods for calculating inertia and solving symmetric linear systems. Math. Comput. 137, 163–179 (1977)

Carr, P., Geman, H., Madan, D.B., Yor, M.: The fine structure of asset returns: an empirical investigation. J. Bus. 75(2), 305–332 (2002)

Casabán, M.C., Company, R., Jódar, L., Romero, J.V.: Double discretization difference schemes for partial integro-differential option pricing jump diffusion models. Abstr. Appl. Anal. 2012, 1–20 (2012)

Clift, S.S., Forsyth, P.A.: Numerical solution of two asset jump diffusion models for option valuation. Appl. Numer. Math. 58, 743–782 (2008)

Company, R., Jódar, L., Fakharany, M.: Positive solutions of European option pricing with CGMY process models using double discretization difference schemes. Abstr. Appl. Anal. 2013, 1–11 (2013)

Company, R., Jódar, L., Fakharany, M., Casabán, M.-C.: Removing the correlation term in the option pricing Heston model: numerical analysis and computing. Abstr. Appl. Anal. 2013, 1–11 (2013)

Company, R., Egorova, V.N., Jódar, L.: Solving American option pricing models by the front-fixing method: numerical analysis and computing. Abstr. Appl. Anal. 9 pp. (2014). Article ID 146745

Company, R., Egorova, V., Jódar, L.: Constructing positive reliable numerical solution for American call options: a new front-fixing approach. J. Comput. Appl. Math. 291, 422–431 (2016)

Company, R., Egorova, V., Jodar, L., Soleymani, F.: A mixed derivative terms removing method in multi-asset option pricing problems. Appl. Math. Lett. 60, 108–114 (2016)

Cont, R., Tankov, P.: Financial Modelling with Jump Processes. Chapman & Hall/CRC, Boca Raton, FL (2004)

Cont, R., Voltchkova, E.: A finite difference scheme for option pricing in jump diffusion and exponential Lévy models. SIAM J. Numer. Anal. 43(4), 1596–1626 (2005)

Cox, S., Matthews, P.: Exponential time differencing for stiff systems. J. Comput. Phys. 176(2), 430–455 (2002)

Cox, J.C., Ross, S.A.: The valuation of options for alternative stochastic processes. J. Financ. Economet. 3, 145–166 (1976)

Crank, J.: Free and Moving Boundary problems. Oxford University Press, Oxford (1984)

Davis, P., Rabinowitz, P.: Methods of Numerical Integration, 2nd edn. Academic, New York (1984)

Duffy, D.J.: Finite Difference Methods in Financial Engineering: A Partial Differential Approach. Wiley, Chichester (2006)

Duffy, D.: Unconditionally stable and second-order accurate explicit finite difference schemes using domain transformation: part I one-factor equity problems. Technical report, SSRN, 2009. Available at SSRN: http://ssrn.com/abstract=1552926

Düring, B., Fournié, M.: High-order compact finite difference scheme for option pricing in stochastic volatility models. J. Comput. Appl. Math. 236, 4462–4473 (2012)

Düring, B., Heuer, C.: High-order compact schemes for parabolic problems with mixed derivatives in multiple space dimensions. SIAM J. Numer. Anal. 53, 2113–2134 (2015)

Düring, B., Fournié, M., Jüngel, A.: Convergence of a high-order compact finite difference scheme for a nonlinear Black-Scholes equation. ESAIM: Mathematical Modelling and Numerical Analysis - Modélisation Mathématique et Analyse Numérique 38(2), 359–369 (2004)

Egorova, V.N., Company, R., Jódar, L.: A new efficient numerical method for solving American option under regime switching model. Comput. Math. Appl. 71(1), 224–237 (2016)

Egorova, V., Tan, S.-H., Lai, C.-H., Company, R., Jódar, L.: Moving boundary transformation for American call options with transaction cost: finite difference methods and computing. Int. J. Comp. Math. 94, 345–362 (2017)

Ehrhardt, M., Mickens, R.: A fast, stable and accurate numerical method for the Black-Scholes equation of American options. Int. J. Theor. Appl. Financ. 11, 471–501 (2008)

Fakharany, M., Company, R., Jódar, L.: Positive finite difference schemes for a partial integro-differential option pricing model. Appl. Math. Comp. 249, 320–332 (2014)

Fakharany, M., Company, R., Jódar, L.: Solving partial integro-differential option pricing problems for a wide class of infinite activity Lévy processes. J. Comput. Appl. Math. 296, 739–752 (2016)

Gad, K.S.T., Pedersen, J.L.: Rationality parameter for exercising American put. Risks 3(2), 103 (2015)

Garabedian, P.R.: Partial Differential Equations. AMS Chelsea Publishing, USA (1998)

Glasserman, P.: Monte Carlo Methods in Financial Engineering. Springer, New York (2003)

Golub, G.H., van Loan, C.F.: Matrix Computations, 4th edn. Johns Hopkins University Press, Baltimore (2012)

Gustafsson, B., Kreiss, H.O., Oliger, J.: Time-Dependent Problems and Difference Methods, 2nd edn. Wiley, New York (2013)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Higham, N.J.: Stability of the diagonal pivoting method with partial pivoting. SIAM J. Matrix Anal. Appl. 18, 52–65 (1997)

Higham, N.J.: Accuracy and Stability of Numerical Algorithms, 2nd edn. SIAM, Philadelphia (2002)

Hull, J., White, A.: The pricing of options with stochastic volatilities. J. Finan. 42, 281–300 (1987)

in ’t Hout, K.J.: Stability of ADI schemes for multidimensional diffusion equations with mixed derivative terms. Appl. Numer. Math. 74, 83–94 (2013)

Kwok, Y.K.: Mathematical Models of Financial Derivatives. Springer, Berlin (2008)

Landau, H.: Heat conduction in a melting solid. Quart. Appl. Math. 8, 81–95 (1950)

Lapidus, L., Pinder, G.F.: Numerical Solution of Partial Differential Equations in Science and Engineering. Wiley-Interscience, New York (1982)

Leentvaar, C.C.W.: Pricing multi-asset options with sparse grids. PhD thesis, TU Delft (2008)

Madan, D., Yor, M.: Representing the CGMY and Meixner Lévy processes as time changed Brownian motions. J. Comput. Finance 12(1), 27–47 (2008)

Madan, D.B., Carr, P., Chang, E.C.: The Variance Gamma process and option pricing. Eur. Financ. Rev. 2, 79–105 (1998)

Merton, R.C.: Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Nielsen, B., Skavhaug, O., Tvelto, A.: Penalty and front-fixing methods for the numerical solution of American option problems. J. Comput. Finance 5, 69–97 (2002)

Nielsen, B.F., Skavhaug, O., Tveito, A.: Penalty methods for the numerical solution of American multi-asset option problems. J. Comp. Appl. Math. 222(1), 3–16 (2008)

Pealat, G., Duffy, D.: The alternating direction explicit (ADE) method for one-factor problems. Wilmott Mag. 2011(54), 54–60 (2011)

Pooley, D.M., Forsyth, P.A., Vetzal, K.R.: Numerical convergence properties of option pricing PDEs with uncertain volatility. IMA J. Numer. Anal. 23, 241–267 (2003)

Rambeerich, N., Tangman, D., Lollchund, M., Bhuruth, M.: High-order computational methods for option valuation under multifactor models. Eur. J. Oper. Res. 224(1), 219–226 (2013)

Reisinger, C., Wittum, G.: Efficient hierarchial approximation of high-dimensional option pricing problems. SIAM J. Sci. Comput. 29, 440–458 (2007)

Saib, A., Tangman, Y., Thakoor, N., Bhuruth, M.: On some finite difference algorithms for pricing American options and their implementation in Mathematica. In: Proceedings of the 11th International Conference on Computational and Mathematical Methods in Science and Engineering, 2011

Salmi, S., Toivanen, J., Von Sydow, L.: Iterative methods for pricing American options under the bates model. Procedia Comput. Sci. 18, 1136–1144 (2013)

Sauer, T.: Computational solution of stochastic differential equations. WIREs Comput. Stat. 5, 362–371 (2013)

Schoutens, W.: Lévy Processes in Finance: Pricing Financial Derivatives. Wiley, New York (2003)

Schoutens, W., Teugels, J.L.: Lévy processes, polynomials and martingales. Commun. Statist.-Stoch. Models 14(1, 2), 335–349 (1998)

Ševčovič, D.: Analysis of the free boundary for the pricing of an American call option. Eur. J. Appl. Math. 2, 25–37 (2001)

Ševčovič, D.: Transformation methods for evaluating approximations to the optimal exercise boundary for linear and nonlinear Black-Scholes equations. In: Nonlinear Models in Mathematical Finance: New Research Trends in Option Pricing, pp. 173–218. Nova Science Publishers, Inc., New York (2008)

Smith, G.D.: Numerical Solution of Partial Differential Equations: Finite Difference Methods, 3rd edn. Clarendon Press, Oxford (1985)

Strikwerda, J.: Finite Difference Schemes and Partial Differential Equations, 2nd edn. Society for Industrial and Applied Mathematics, Philadelphia (2004)

Tavella, D.: Quantitative Methods in Derivatives Pricing. Wiley, New York (2012)

Tavella, D., Randall, C.: Pricing Financial Instruments: The Finite Difference Method. Wiley, New York (2007)

Toivanen, J.: Numerical valuation of European and American options under Kou’s jump-diffusion model. SIAM J. Sci. Comput. 30(4), 1949–1970 (2008)

Wang, I.R., Wan, J.W., Forsyth, P.A.: Robust numerical valuation of European and American options under the CGMY process. J. Comput. Finance 10(4), 31–69 (2007)

Wilmott, P., Dewynne, J., Howison, S.: Option Pricing: Mathematical Models and Computation. Oxford Financial Press, Oxford (1998)

Witelski, T.P., Bowen, M.: ADI schemes for higher-order nonlinear diffusion equations. Appl. Numer. Math. 45, 331–351 (2003)

Wu, L., Kwok, Y.-K.: A front-fixing method for the valuation of American option. J. Financ. Eng. 6, 83–97 (1997)

Yousuf, M., Khaliq, A.Q.M., Liu, R.: Pricing American options under multi-state regime switching with an efficient L-stable method. Int. J. Comput. Math. 92, 2530–2550 (2015)

Zvan, R., Forsyth, P.A., Vetzal, K.R.: Negative coefficients in two-factor option pricing models. J. Comput. Finance 7, 37–73 (2003)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Company, R., Egorova, V.N., El Fakharany, M., Jódar, L., Soleymani, F. (2017). Numerical Analysis of Novel Finite Difference Methods. In: Ehrhardt, M., Günther, M., ter Maten, E. (eds) Novel Methods in Computational Finance. Mathematics in Industry(), vol 25. Springer, Cham. https://doi.org/10.1007/978-3-319-61282-9_10

Download citation

DOI: https://doi.org/10.1007/978-3-319-61282-9_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-61281-2

Online ISBN: 978-3-319-61282-9

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)