Abstract

In this paper we consider a Hotelling model on the linear city, where the location is not a free good. We assume that firms play a location-cum-price game, and that the game is played into two steps. After the first step, in which the classical duopoly game is played, we suppose that in a second step a third firm enters the market and that the incumbents are allowed to react to this entry. In both steps firms have to face a cost for location, for which we consider two different cases.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

In Industrial Organization Theory, the Horizontal Product Differentiation emerges in the market when consumers do not agree on the preference ordering. Price and location can be viewed as a metaphor of products characteristics. In this perspective, Hotelling [12] provide a two-stage model where two firms first choice their location and then fix the price of an homogenous good. Consumers are uniformly distributed along a segment of unitary length and their utility is a function of prices and transportation costs. In this context Hotelling derive the principle of minimum differentiation, for which the equilibrium solution is that both firms choose their location in the middle of the road.

Since this seminal work, several types of extensions have been provided in the literature, regarding the number of firms, the structure of the city and the functional forms of the model. The first attempts are Chamberlin [3] and Lerner and Singer [16], in which models with more than two firms are considered. Eaton and Lipsey [5] study a model with an arbitrary number of players, several possible structures of the city and different distributions of the consumers, and they conclude that the principal of minimum differentiation holds just under strong hypothesis. Moreover, d’Aspremont et al. [4] show that neither this strategy neither any other possible location are subgame perfect, because they fail to imply an equilibrium in price in every subgame. If the utility function is altered, assuming a quadratic transportation cost, then the principle of maximum differentiation is established. That means that the two firms maximize the distance between them. Economides [7] consider a linear utility for consumers and more than two firms, supporting a non-cooperative equilibrium in prices for each subgame, but the model fails to imply an equilibrium in locations. More recently, Stuart [27] uses the core of cooperative games in the price stage, while Brenner [1] analyze a multi-firm unit interval Hotelling model under quadratic transportation costs. Peters et al. [25] add the expected waiting time in consumers’ utility function, which depends on the number of consumer that choose the same firm.

Salop [28] and Economides [6] analyze models with linear utility and multiple firms located on a circumference. In particular, Salop shows that when firms are equidistant then exists an equilibrium in prices. In the model of Lederer and Hurter [15] firms are different and consumers are distributed non uniformly on the plane, while Eiselt and Laporte [9] consider a model where three firms are on a tree. Papers where consumers are distributed on a graph start to appear in literature just in the last years (see e.g., Mavronicolas et al. [19], Nuñez and Scarsini [22, 23]). Simultaneously entry is a common assumption in this kind of literature.

For that reason Prescott and Visscher [26] introduce the concept of sequential location games, where firms enter the market sequentially, paying a fixed setup cost and have no possibilities to relocate as response to new firm entry. Neven [21] proposes a model of sequential entry in a standard Hotelling framework with quadratic transportation costs. Extensions of this model are in Economides, Howell and Meza [8], in which they also analyze consumer welfare and calculate various measures of degree of asymmetry among firms, while Götz [10] reexamines the results of both papers. Moreover, Palfrey [24], Weber [29], Callander [2] and Loertscher and Muehlheusser [17] combine the sequential entry with a not uniform distribution of consumers. Jost et al. [13] consider a model of sequential location in which the two incumbent firms can react to the entry of the third, choosing a new location.

An implicit assumption in the Hotelling model is that the cost of location is independent of location and normalized to zero. Also, the literature followed this idea that location itself is free good. That means that the effects of location costs on equilibrium are still poorly explored. An attempt in this sense is Mayer [20], in which the production cost is conditioned on firm’s location, while Hinloopen and Martin [11] consider the geographic interpretation of Hotelling model adding in firms profit function a location cost that is independent on production. Mallozzi [18] uses the cooperative game tools to address the problem of a single facility location, when an installation cost that depends on the region occurs.

The aim of this paper is to make another step in exploring the effects of costs of location in the Hotelling model. We are in the classical linear city, where consumers have to face a quadratic transportation cost. We solve the game backward, assuming a general form of costs of locations in the price stage. Also, we will show that this terms can lead to multiple equilibrium in the location stage, when a third firm enters in the market. To solve the location problem we consider two different functional forms, to take into account that the costs of location are function of location themselves. For example, in Europe centre-city locations are more expensive than the periphery, while in the USA is just the opposite (see Karmon [14]). Moreover, we want to analyze the impact of cost of locations in a dynamic framework, then we divide the paper in two step. In the first one two firms play the classical location-cum-price Hotelling game. In the second step a third firm enters the market choosing price and location, and we allow the two incumbent players to react.

The rest of the paper is organized as follows: in Sect. 2 we present the model; in Sect. 3 the case of two firms is considered, while in Sect. 4 we analyze the impact of the entry of a third firm. Section 5 concludes.

2 The Model

As in d’Aspremont et al. [4] and Brenner [1], a classical Hotelling game, where consumer are uniformly distributed on the unitary interval, is considered. Assuming that each consumer i, located in a point s, has a quadratic transportation cost, the utility function can be written as follows

where x j and p j are, respectively, the position and the price charged by the firm j. The parameter k > 0 represents the reservation price and it is assumed to be high enough to guarantee that every consumer buys a unit of product.

Following Jost et al. [13], the model considers a dynamic version of the Hotelling problem, in which the game is played into two steps. In both steps the game is a two stage, in which the firms choose location in the first stage and fix the prices in the second stage. Also, in both steps the two stage game is solved backward, addressing the price game first and using the optimal solutions to solve the location game.

-

Step One. In the first step the set of players I is composed of two firms, denoted by A and B, that play simultaneously a location-cum-price game. The set of strategies in the first stage are the locations (x A , x B ), where x j ∈ [0, 1], while strategies are given by prices (p A , p B ) in the second stage. This step is a classical Hotelling situation.

-

Step Two. In the second step a third firm, denoted by C, enters the market. The difference in this step is that the location stage is not played simultaneously by every players. The stage is played as follows

-

1.

Firm C maximizes its own profit function to find the optimal location x C .

-

2.

The incumbent firms A and B internalize the optimal location x C and evaluate their profit function taking it into account. Then, the incumbents are allowed to react to the entry of firm C changing the locations (x A , x B ) chosen in the first step.

-

3.

The price stage is played simultaneously by the three firms.

-

1.

Respect Jost et al. [13] in this model the location is not a free good. A cost of location function affects the payoff of each player. This function is assumed to be continuous and depending only on the locations. Then, it has no effects in the price stage, but it can change significantly the choice of the optimal location.

3 Two-Firm Case

In this section the first step with two firms is considered. The two players, denoted by A and B, address a two stage game in which they have to choice first their locations (x A , x B ), where the admissible positions are on a road of unitary length. In the second stage the firms fix the prices (p A , p B ). In order to find the Nash equilibrium the game is solved backward, then the price stage is solved first, taking as given the locations.

The payoff of the firm j, denoted by Π j (⋅ , ⋅ ), depends on the vector of locations \(\bar{x} = (x_{A},x_{B})\), on the vector of prices \(\bar{p} = (p_{A},p_{B})\) and on the costs of location, as follows

where \(D_{j}(\bar{x},\bar{p})\) is the demand function and l(x j ) is the location cost of the firm j.

Given the uniformly distribution of consumers on the unitary segment, the two demand functions are determined by the indifferent consumer, that is the individual for which is indifferent to buy from firm A or firm B. The location s AB of the indifferent consumer is given by solving the equation u(x A , p A ) = u(x B , p B ), as follows

Then, the demand functions are \(D_{A}(\bar{x},\bar{p}) = s_{AB}\) and \(D_{B}(\bar{x},\bar{p}) = 1 - s_{AB}\).

The functional form of l(x j ) is not established in the price stage. The backward approach requires to find first the equilibrium in prices, that is given by solving the system of maximization problems

Computing the first order conditions the optimal prices are given by

In order to solve the first stage of the game and find the optimal locations, it is necessary to substitute the solutions (2) in the payoff function (1) and derive respect the variables x A and x B as follows

The system (3) can be reduce to

The system of Eqs. (4)–(5) is non linear in the variables x A and x B and require a specific functional form of the cost of location to be solved. The next proposition characterizes the solution for some classes of cost of location.

Proposition 1

If the cost of location function is constant or increasing going toward the centre, then the maximum differentiation principle holds.

Proof

Consider a function l(x j ) = q, where q is a constant, so that l ′(x A ) = l ′ (x B ) = 0. In this case the system (4)–(5) become

After some algebras it is possible to show that \(\frac{\partial \varPi _{A}} {\partial x_{A}} <0\) and \(\frac{\partial \varPi _{B}} {\partial x_{B}}> 0\), for every allowed values of x A and x B . Consequently, the firm A chooses the minimum value possible, that is x A = 0, while the firm B chooses the maximum value possible, that is x B = 1. For the second part of the proof consider a location cost function that is not constant, but that increase going toward the center.

This function l(x j ) is assumed to be always positive in the interval [0, 1], and that it has a maximum in x j = 1∕2. In order to proof the proposition the only condition required is that l(0) = l(1) = min x l(x).

Consider first the firm A. Its payoff is given by the function

where R(⋅ ) represents the revenues and C(⋅ ) represents the costs. Assuming that payoff is always positive, the aim is to prove that

From Eq. (4) it is known that R(0) ≥ R(x A ), while for hypothesis holds C(0) ≤ C(x A ), \(\forall x_{A} \in [0,1]\). As consequence, the inequality R(0) − R(x A ) ≥ C(0) − C(x A ) always holds and the proposition is proved for firm A.

Heuristically, it is possible to say that the location x A = 0 maximize the revenues and minimize the location cost, and for that is the optimal location for the firm A.

A specular reasoning leads to conclude that the location x B = 1 is the optimal one for firm B.

Then, the two firms has no incentives to move and the equilibrium of the game is given by

Remark 1 (Costly Periphery)

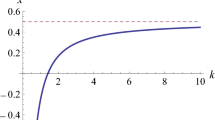

The locations are not more expensive in the centre-city everywhere. For that reason it is interesting to analyze also the case of costs of location that increase in the periphery. Then the function l(x j ) is chosen as follows

where r is a constant. The derivative of this function is

Substituting (7) in the system (4)–(5), the optimal locations solve the following

This system has a unique solution in the set of admissible values that is given by the couple (x A ⋆, x B ⋆) = (0. 31, 0. 69). Then the game has a unique Nash equilibrium, in which prices are still symmetric, given by

4 Three-Firm Case

In this section the second step of the game is presented. Consider a third firm, denoted by C, that enters in the market in position x C , such that x A ≤ x C ≤ x B , and that offers the product at the price p C .

Then, there are two indifferent consumers that are located in s AC and s CB , given by the points

The indifferent consumer positions imply the demand functions of the three firms, as follows

As in the first step, the three firms have to maximize their own payoff, respect price and location, that are given by

4.1 Price Stage

Also in the second step the game is solved backward looking first to the equilibrium in prices. Then, the three firms maximize the profit function respect the vector of prices. The optimal prices are the triple (p A ⋆, p C ⋆, p B ⋆) that solves the system

In this stage players are supposed to play simultaneously, then substituting the demand functions and solving the system (10), the prices of equilibrium are given by

4.2 Location Stage

The location game is solved first by the entrant firm C. The payoff of this player is given at this stage by the function

Computing the first order conditions the solution x C ⋆ solves the equation

Again, the effective positioning of the firm depends on the functional form of the location cost function. If it is constant, so that l ′(x C ) = 0, then the firm C chooses a location exactly halfway between firms A and B:

4.2.1 Costly Centre-City

In the first step, in case of locations that are more expensive in the centre of the city the maximum differentiation principle holds and the equilibrium locations are (x A ⋆, x B ⋆) = (0, 1). What happens if a third firm is present in the market?

A quadratic function is assumed to represent the location costs, as follows

Substituting the first derivatives of l(x C ) in Eq. (12) and solving respect x C , the optimal location is given by

The incumbent firms react to the entrance of the firm C internalizing its optimal position (13) and maximizing their payoff. The payoff functions of firms A and B are as follows

The first order conditions, \(\frac{\partial \varPi _{A}} {\partial x_{A}} = 0\) and \(\frac{\partial \varPi _{B}} {\partial x_{B}} = 0\), constitute the system that brings to the optimal response. Solving this system leads to multiple Nash equilibria in the location game, more specifically there are two solutions (x A ⋆, x B ⋆) allowed by the model:

Substituting these solutions in Eq. (13), the complete Nash equilibria for the location stage are given by

Both solutions highlight the tendency of firms A and B to deal with higher location costs to react to the entry of firm C. From these results seems that the incumbent firms prefer to pay more for location and stay close to the entrant instead of minimize the cost of location giving more space to the firm C. That is clearly a result that overturn the solution of the first stage in which the two firms prefer to maximize the distance between them.

4.2.2 Costly Periphery

The entry of the firm C in case of more expensive centre locations leads the incumbents to pay more for location in order to relocate close to the entrant. In the first step higher costs of location in the periphery lead the firm A and B to move toward the centre. Then, it is interesting to analyze what equilibrium is achieved in the second step, also in this last case. Consider the following location cost function

where r is a constant. The computational process is the same of Sect. 4.2.1.

The first move is made by the firm C that addresses the payoff maximization and looks for the optimal location that is given by the solution of the equation

respect the variable x C . The two incumbent firms internalize x C ⋆ solution of (15) and maximize their own welfare, in order to choose the best response to the entry of firm C. In this case there is a unique Nash equilibrium allowed by the model, that is given by the triple

Figure 1 shows how the incumbent firms reply to the entry of firm C changing their position and prices. On the horizontal axis there are locations, while on the vertical one there are prices. In the second step (the blue lines), the two incumbent firms react moving toward the end of the street respect the first step (the green lines). Moreover, the entry on the firm C, cause a sensible decreasing in prices, that are given by the triple

Independently on the location cost function, the entrant firm C chooses a location that is around the middle of the road. Instead, the reaction of the incumbents changes as the location costs change. When the structure of this costs causes higher costs in the centre of the city the firms A and B prefer to pay these higher costs and relocate closer to the firm C. When the location costs are higher in the periphery, the incumbents move toward the end of the line, that means that the firm A pays lower location costs and relocate itself near the entrant, while the firm B pays higher location costs and choose to move away from the firm C.

5 Conclusions

The effects of costly locations were largely not considered in the literature. The aim of this paper was to address the location-cum-price problem when the location is not a free good. Moreover, we wanted to consider also how it can affects the choice of the firms when a dynamic interaction is allowed. Then the game was played in two different step, a first one in which a classical Hotelling duopoly is played and a second one in which a third firm enters the market producing the reaction of the incumbents. In the first step the classical result of maximum differentiation is confirmed, if the location costs are constants or more expensive in the centre-city. Nevertheless, we showed that when the periphery is more expensive the firms tend to move toward the centre.

In the second step a third firm enters in the market and chooses the location. As consequence, the incumbents reconsider their optimization problem internalizing the presence of the entrant and react to the new situation. The results are different and depend on the functional form of the location cost function. In both cases considered in the paper, the entrant choose to locate itself around the middle of the road, but the reaction of the incumbents change as the structure of location cost change. Moreover, we showed that in some cases multiple equilibria may be present in the location stage.

References

Brenner, S.: Hotelling games with three, four, and more players. J. Reg. Sci. 45 (4), 851–864 (2005)

Callander, S.: Electoral competition in heterogeneous districts. J. Polit. Econ. 113, 1116–1144 (2005)

Chamberlin, E.H.: The Theory of Monopolistic Competition. Harvard University Press, Cambridge (1933)

d’Aspremont, C., Gabszewicz, J.J., Thisse, J.-F.: On Hotelling’s “stability in Competition”. Econometrica 47, 1145–1150 (1979)

Eaton, B.C., Lipsey, R.G.: The principle of minimum differentiation reconsidered: some new developments in the theory of spatial Competition. Rev. Econ. Stud. 42, 27–49 (1975)

Economides, N.: Symmetric equilibrium existence and optimality in differentiated product markets. J. Econ. Theory 47, 178–194 (1989)

Economides, N.: Hotelling’s “main street” with more than two competitors. J. Reg. Sci. 33, 303–319 (1993)

Economides, N., Howell, J., Meza, S.: Does it Pay to be the First? Sequential Location Choice and Foreclosure, EC-02-19. Stern School of Business, New York University, New York (2002)

Eiselt, H.A., Laporte, G.: The existence of equilibria in the 3-facility Hotelling model in a tree. Transp. Sci. 27, 39–43 (1993)

Götz, G.: Endogenous sequential entry in a spatial model revisited. Int. J. Ind. Organ. 23, 249–261 (2005)

Hinloopen, J., Martin, S.: Costly location in Hotelling duopoly. Tinbergen Institute Discussion Paper. http://works.bepress.com/hinloopen/8/ (2013)

Hotelling, H.: Stability in competition. Econ. J. 3, 41–57 (1929)

Jost, P.-J., Schubert, S., Zschoche, M.: Incumbent positioning as a determinant of strategic response to entry. Small Bus. Econ. 44, 577–596 (2015)

Karmon, J.: Rental costs, city vs. suburbs: a handy infographic. https://www.yahoo.com/news/blogs/spaces/rental-costs-city-vs-suburbs-handy-infographic-225331978.html (2012)

Lederer, P.J., Hurter, A.P., Jr.: Competition of firms: discriminatory pricing and location. Econometrica 54, 623–640 (1986)

Lerner, A.P., Singer, H.W.: Some notes on duopoly and spatial competition. J. Polit. Econ. 45, 145–186 (1937)

Loertscher, S., Muehlheusser, G.: Sequential location games. RAND J. Econ. 42 (4), 639–663 (2011)

Mallozzi, L.: Cooperative games in facility location situations with regional fixed costs. Optim. Lett. 5, 173–181 (2011)

Mavronicolas, M., Monien, B., Papadopoulou, V.G., Schoppmann, F.: Voronoi games on cycle graphs. In: Mathematical Foundations of Computer Sciences 2008. Lecture Notes in Computer Science, vol. 5162, pp. 503–514. Springer, New York (2008)

Mayer, T.: Spatial Cournot competition and heterogeneous production costs across locations. Reg. Sci. Urban Econ. 30, 325–352 (2000)

Neven, D.J.: Endogenous sequential entry in a spatial model. Int. J. Ind. Organ. 5, 419–434 (1987)

Nuñez, M., Scarsini, M.: Competing over a finite number of locations. Econ. Theory Bull. (2015, forthcoming)

Nuñez, M., Scarsini, M.: Large location models. Technical report, SSRN 2624304. http://ssrn.com/abstract=2624304 (2015)

Palfrey, T.: Spatial equilibrium with entry. Rev. Econ. Stud. 51, 139–156 (1984)

Peters, H., Schröder, M., Vermeulen, D.: Waiting in the queque on Hotelling’s main street. Technical report RM/15/040, Maastricht University (2015)

Prescott, E.C., Visscher, M.: Sequential location among firms with foresight. Bell J. Econ. 8, 705–729 (1977)

Stuart, H.W., Jr.: Efficient spatial competition. Games Econ. Behav. 49, 345–362 (2004)

Salop, S.C.: Monopolistic competition with outside goods. Bell J. Econ. 10, 141–156 (1979)

Weber, S.: On Hierarchical spatial competition. Rev. Econ. Stud. 59, 407–425 (1992)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Patrí, S., Sacco, A. (2017). Sequential Entry in Hotelling Model with Location Costs: A Three-Firm Case. In: Mallozzi, L., D'Amato, E., Pardalos, P. (eds) Spatial Interaction Models . Springer Optimization and Its Applications, vol 118. Springer, Cham. https://doi.org/10.1007/978-3-319-52654-6_12

Download citation

DOI: https://doi.org/10.1007/978-3-319-52654-6_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-52653-9

Online ISBN: 978-3-319-52654-6

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)