Abstract

Research on the various aspects of consumer product risk including severity of harm, risk assessment, risk management and compliance are at the core of academic research in the marketing and public policy field. An overview of the various product risks present in the marketplace and their subsequent effects on consumers is presented. Additionally, how risk is measured in the population, an important subject for multiple constituencies (e.g. manufacturers, consumers, legal and regulatory) is examined. Multiple methodologies exist and best practices including types of epidemiological studies, indexing, observational techniques and exposure-based studies are highlighted. Lastly, how to manage risk, the role of compliance and suggested best practices are explained.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Consumer Risk

Consumers face a number of risks throughout the course of their daily lives. For example, a quick glance at a recent report released by the Center for Disease Control identifying the leading causes of death in the United States highlights the many health risks faced by consumers. The leading cause of death is heart disease, followed by cancer, chronic lower respiratory diseases and of particular import to this contribution, accidents, or unintentional injuries, which can have a variety of causes (including those emanating from consumer product risk). There are, of course, numerous types of accidents that can cause serious injury and death—many directly tied to the use (or misuse) of a product. For example, over 30,000 people are typically killed in car accidents each year. Additionally, there are many other types of accidents associated with product use that range from the unsurprising (e.g., ladders, All-Terrain-Vehicles) to the tragic (e.g., toys). Yet health risk is only one type of risk faced by consumers. There are monetary risks, functional risks, social risks, and psychological risks associated with product purchase and use that consumers must consider.

Taking a historic perspective on consumer risk, Bauer (1960) proposed that consumer behavior could be viewed as an instance of risk taking. Subsequently this notion of risk has been incorporated into a number of consumer behavior theories (e.g., Engel et al. 1973; Howard and Sheth 1969). Bauer argued that, “Consumer behavior involves risk in the sense that any action of a consumer will produce consequences which he cannot anticipate with anything approximating certainty, and some of which at least are likely to be unpleasant” (1960, p. 24). This is because, as others have noted, the central problem of consumer behavior is choice (Taylor 1974).

Taylor (1974) noted that when consumers are in the processes of deciding among products, two types of risk are apparent. First there is uncertainty about the outcome. Second, there is uncertainty about the consequences that are associated with product use. Risk can be viewed as a loss or as one’s expectation of loss that is associated with an exchange. Interestingly this loss can be considered in psycho-social terms or in functional/economic terms. Under some conditions, the consumer may experience both types of loss. Stone and Winter (1985) extend this early discussion of the concept of risk to a broader context. They note that according to Bauer’s (1960) original conceptualization of risk, consumer researchers focused on two aspects of risk—objective risk and perceived risk. Objective risk refers to specific risks that are quantifiable such as morbidity and mortality measures. For example, consumers engaging in risky surgical procedures, smoking cigarettes, eating raw meat or skydiving subject themselves to real objective risk. Perceived risk is a psychological construct, also quantifiable and inherent in consumer product evaluations and decisions. Some researchers, such as Stone and Winter (1985) argue that the distinction between objective and perceived risk is meaningless. More specifically, they state, “During information processing, concepts are not only dealt with to the degree perceived, but also most probably only ‘exist’ to this degree, as well…this holds true not only for positive valued concepts such as price, beauty, power, and believability, but also for the negatively valued concept of risk” (p. 12). In other words, they argue that the distinction between perceived risk and objective, or real world risk, is meaningless. For example consider psychological risk, social risk, or time risk. To imagine a legitimate, real world aspect of time risk is challenging. Stone and Winter (1985) ask, “could someone conceive of an ‘objective’ time risk? This hardly seems possible” (p. 3). The same holds true for social and psychological risk, for it would not seem reasonable for consumers to conceive of some “real world” psychological risk that exists beyond that which would be perceived” (p. 3). The most important consideration is to view risk from the perspective of the consumer. That is, when considering product risk, risk should represent the importance of the consequences associated with the use of the product, not the importance of the product to the consumer.

Bettman (1973) developed a model of the components of risk. He differentiated between inherent risk and handled risk. Inherent risk refers to the latent risk a product class holds for a consumer. That is, it is the “innate degree” of conflict the product class is able to arouse. On the other hand, handled risk is the amount of conflict the product class is able to arouse when the buyer chooses a brand from a product class in his usual buying situation. “That is, handled risk to a first approximation represents the end results of the action of information and risk reduction processes on inherent risk” (Bettman 1973, p. 184). Bettman uses the product class of aspirin to demonstrate the difference. “For example, a consumer may feel there is a great deal of risk associated with the product class aspirin. However, she has a favorite brand which she buys with confidence. In such a case, inherent risk is high, but handled risk may be low for aspirin” (p. 184).

Cunningham (1964, 1966, 1967a, b, c) measured the uncertainty and danger (consequences) consumers considered in different product categories. He was concerned with two issues uncertainty (i.e. would an untried brand work as well) and consequences (i.e., how much danger would the consumer experience trying a new brand).

Early conceptualizations of risk in the literature include Cox (1967). He proposed the risk associated with product purchase is related to “financial” or” social-psychological” risk. Woodside (1968) considered risk along the following three dimensions: “social”, “functional” and “economic”; then (1971) indicated that consumer risk includes time loss, hazard loss, ego loss and money loss. Jacoby and Kaplan (1972) reinforced the concept of financial risk and added physical risk, and thus proposed the following five types of risks: financial risk; functional or performance risk; physical or health risk; psychological risk; and social risk.

To summarize the types of risks faced by consumers, a segmentation analysis combined with a purchase typology is warranted. The first type of risk, monetary risk is evidenced most acutely in consumers with little income, discretionary money or property. From a purchase typology standpoint, high-ticket items requiring significant expenditures are most susceptible to monetary risk. Common examples of monetary or financial risk include: credit risk, foreign exchange risk and interest rate risk. Practical consumers are most susceptible to the second form of risk, functional risk, which is defined as performance-related risk. If alternative means of performing the function are available, risk is enhanced both from a purchase and use standpoint. For example, technological products (e.g. cellphones, computers) and automobiles present functional risk for consumers. Health risk, while amenable to the entire population, is particularly salient to those vulnerable populations such as the elderly, frail or in ill health. Food and drug purchases are the most sensitive to health risk along with mechanical, electrical or chemical goods. Social risk arises from threats to self-esteem and self-confidence. Consumers lacking in such traits are most susceptible to social risk. Symbolic goods (e.g. clothing, jewelry, cars, homes) are most vulnerable to purchase-related social risk. Lastly, psychological risk cuts through a broad swath of traits including affiliations and status concern. Consumers lacking such traits are most sensitive. Purchase-related psychological risk is highest among personal luxury categories.

2 Risks to the Environment and Society

Sustainability Concerns and Stakeholder Response

Environmental risk and sustainability continues to be an issue of considerable interest to manufacturers, non-profit organizations, government agencies, and consumers. It is becoming increasingly evident that current patterns of consumption are not sustainable in the long-term; the world’s natural resources are being rapidly depleted while environmental risks are pervasive. This is especially true with respect to the United States. Although only accounting for 4.6% of the world’s population, the United States consumes over 33% of the world’s resources (EarthTrends 2007).

Environmental risk has been identified as a component of sustainable policy for decades. In 1987 the United States World Commission on the Environment and Development defined sustainability as, “Meeting the needs of the present without compromising the needs of future generations”. The triple bottom line of sustainability (e.g. good for business/good for the environment/good for society) has become a benchmark norm for corporate, governmental and consumer organizations. Through the adoption of best practices there is an emerging opportunity for manufacturers to secure an integral role in driving the consumer demand for sustainable business practices, integrating CSR and sustainability into the consumer perception of value, promoting the visibility of triple bottom line efforts and thus mitigating consumer product risks. Environmental risk became a salient consumer characteristic with the Exxon Valdez oil spill and manufacturers and marketers subsequent response to said consumer concerns (Mayer et al. 2001).

Several key findings from the academic literature illuminate the concept of sustainability as it relates to product risk. First, many consumers have difficulty when asked to describe the concept of product sustainability (Dobson 2000; Sonneveld et al. 2005). Second, if a product’s environmental risk is considered at all during evaluative and choice processes, it is generally not the primary attribute that influences consumers’ product evaluations (e.g., Sammer and Wüstenhagen 2006; Vermeir and Verbeke 2006). For example, when purchasing food products, taste, price, and convenience are important considerations (Glanz et al. 1998). Similarly, safety, performance, and style are key product features when consumers evaluate automobiles (Roberts and Urban 1988). However, sustainability and environmental risk play a key role in certain consumer evaluative processes. For example, within the household cleaners and laundry detergent product categories, product risk and sustainability are of greater consumer concern (Schuhwerk and Lefkoff-Hagius 1995). Also consumers have indicated willingness to give up convenience for environmentally safer products or packaging (Hume and Strnad 1989). Consumers’ willingness to pay higher taxes for government support of environmental initiatives and the growth of “green” retailers and manufacturers that adhere to rigorous environmental standards (beyond those mandated at the regulatory level) have also risen in importance (Rapert et al. 2010).

The EU has long recognized the importance of sustainability to the future of business and society by outlining general frameworks by which companies’ environmental risk and sustainability efforts can be assessed. In 2001, the Sustainable Development Strategy for Europe stated that, “in the long term, economic growth, social cohesion and environmental protection must go hand in hand” (European Commission 2001). Additionally, the European Commission identified Corporate Social Responsibility as “a concept whereby companies integrate social and environmental concerns in their business operations and in their interaction with their stakeholders on a voluntary basis” (European Commission, p. 8). This definition of CSR makes note of the social and environmental risk components of the triple bottom line integral to sustainability. Thus, from definitions established by the EU, the concepts of environmental risk and sustainability are closely linked. Moreover, steps continue to be taken to improve sustainability efforts as evidenced by the EU Sustainable Development Strategy (European Commission 2001). The strategy focuses specifically on addressing the following seven global challenges in an attempt to effectively manage environmental risk, establish sustainable communities, and improve quality of life: (1) climate change and clean energy, (2) sustainable transport, (3) sustainable consumption and production processes, (4) conservation and management of natural resources, (5) public health, (6) social inclusion, demography/migration and (7) global poverty. The International Standards Organization (ISO) provides guidance on both environmental manufacturing and product risk compliance as well as on first- and third- party environmental claims (Hedblom 1998). Specifically, in addition to environmentally compliant good manufacturing practices, ISO provides guidelines on direct environmental impact of a company’s manufacturing practices on brand attributes and third party seal of approval legitimacy.

From a U.S. standpoint both the Environmental Protection Agency (EPA) and Federal Trade Commission (FTC) provide “safe harbor” guidelines for mitigating and communicating environmental risk to consumers.

3 An Evidence-Based Approach to Risk Assessment: Measuring Risk Throughout the Product Life Cycle

3.1 Defining Product Risk Assessment Throughout the Product Life Cycle

Product risk assessment is the systematic use of available information to identify products, or features of products, which may cause or contribute to physical injury or death. From an ISO perspective, Risk assessment is comprised of both the identification of risks followed by their evaluation or ranking (IRM 2010). Specifically, risk assessment is an interdisciplinary evaluation process based on information derived from data such as exposure rates (OECD 2016). Standard practice includes comprising different data sources to inform regulatory options thus aiding in the selection of the appropriate response to a potential product hazard. Consequently, risk assessment provides valuable guidance to the formulation and conduct of sound risk management policy. Product risk assessments evolve in the scope of products being assessed based on different factors. For example, a range of products covered in a risk assessment may vary during the course of the analysis as more information about the hazards become available. This may lead to a single manufacturer’s product becoming a class-wide recall based on competing product risks. Thus, risk assessment data has important implications for brand managers concerned with reputation as well as product liability litigators. Risk assessments are typically comprised of four core goals: (1) hazard identification, (2) injury scenarios, (3) threat severity and (4) likelihood estimation as well as reconciliation with societal laws and norms. Regulatory agencies use product risk assessment to determine which products require government action to reduce or manage stakeholder risk. The product life cycle stages of introduction (product development), growth (product refinement), maturity (backward innovation/low cost competitors) and decline (product withdrawal) all have implications both for consumer product use and misuse therefore product risk assessment is warranted throughout the life cycle.

3.2 Common Components of Consumer Product Risk Assessment

In addition to the common goals mentioned above, typical components of a consumer product risk assessment include: (1) product identification, (2) product use, (3) scenario estimation, (4) estimation of threat severity, (5) probability of occurrence, (6) risk estimation and (7) risk evaluation (OECD 2016). Safety goals incorporate the measurable performance of safety processes from the design process through manufacture, distribution and sales with subsequent accident analysis (Morgan 2001). Methodological factors common to consumer product risk assessment consist of proper sample selection including vulnerable (e.g. children) and affected populations; the frequency of product use and in what risk contexts the product is being used (DeBruin et al. 2007). Scenario development must be comprehensive to yield relevant safety data. Thorough recording and elucidation of all events in a scenario, including where and how they could occur achieves the goal of optimal consumer product safety data. Human factors such as consumers’ attention or lack of attention to risk communication including warnings and instructions are also important in scenario development. In addition to perceptual issues, behavioral aspects such as compliance to safety instructions must also be considered. Properly framed warnings and usage information are important risk mitigation mechanisms as misuse and abuse (noncompliance) can result in regulatory scrutiny and liability for manufacturers.

Scenario development is a complex and idiosyncratic process. From a goal-based perspective, an optimal use scenario demonstrates the interaction between the product, its use environment and the affected population to create potentially unsafe situations. Subsequently, every scenario yields a typology of potential injuries indexed for severity of harm. Such an injury severity scale must comprise the full domain impact of an injury. This allows for proper regulatory guidance and response (Mann 2003).

ISO 10377 (and ISO/IEC Guide 51) includes risk analysis guidelines for manufacturers and suppliers as well as guidance for risk evaluation. Product risk assessments performed by manufacturers and suppliers are a key source of consumer product risk information. Specifically, the ISO guideline describes how to: (1) identify, assess, reduce or eliminate hazards, (2) manage risks by reducing them to tolerable levels and (3) provide consumers with hazard warnings or instructions essential to the safe use or disposal of consumer products (ISO 2013). Factors considered in the guidelines include hazard identification, exposure analysis, scenario estimation, and the probability of injury. Pre-purchase analysis, ongoing data assessment through the supply chain and consumer-level testing are components of the standard.

ISO 10377 is comprised of several core components that must be fully integrated into the product life cycle including: (1) general principles, (2) safety in design, (3) safety in production and (4) safety at the retail level (ISO 2013, 2014). General principles include a human resource/organizational behavior component; that is, promoting a safety culture within an organization. Such a culture is comprised of several elements including (1) continuous process improvement processes, (2) monitoring of production activities with an emphasis on safety and (3) recording incidents and procedures for data analysis (ISO 2013). Safety in design, another component of the ISO standard is crucial to the product life cycle stage of product introduction and growth. Specifically, this component includes what constitutes an acceptable level of product risk through the process of hazard identification, risk assessment and risk reduction/elimination. Product launches may be delayed to unacceptable hazards or product modifications may be made during the growth phase of a product. Human factors also play a role here as product warnings, disclosures and instructions provide a communication of any residual risks to the consumer as well as proper usage guidelines. Safety in production touches all four stages of the product life cycle as it emphasizes essential supply chain processes including manufacturing, product specification and sample testing. Standards must be adhered to as product modifications are made to (a) cater to customer needs or (b) facilitate cost savings (as in the case of reverse innovation for cost modification); hence the need to monitor throughout the PLC. Lastly, safety in the retail environment must be adhered to as it has a direct impact on consumers throughout the PLC. Therefore, the safety responsibilities of channel members including wholesalers, distributors, and retailers in product handling, service and consumer communication are of key importance.

Throughout the supply chain, risk assessments are performed by channel members. Assuming a stepwise approach, risk assessment begins at the design stage. An individual channel member’s risk assessment of their product may not be relevant to competing products, because of differences in product design, production, intended users, and risk tolerance. Risk assessments are also conducted at the component part/assembly stage by suppliers as well as the manufacturing stage. Additionally, brand owners, importers and retailers may perform a risk assessment. Standards vary from voluntary to mandatory dependent on the specific product or product class. Third parties may be contracted to perform product risk assessments with agreements ranging from outsourcing for specialist knowledge to contracting with a confirmatory assessment or certification group.

A risk assessment takes on particular importance throughout the product life cycle as it determines whether steps should be taken by manufacturers or regulators to reduce consumer risk. Risk acceptability is a moving target. Differing product safety contexts produce differing responses (and scrutiny) from regulatory authorities. Several factors account for differing evaluations of risk including (1) whether vulnerable populations such as young children, the infirm or the elderly are affected and (2) one can reasonably foreseeable use or misuse of a product. An additional consideration is consumers’ potential for hazard recognition. While consumers may recognize the inherent risk in some products such as firearms, they may be unable to recognize risks inherent in chemical products (DeBruin et al. 2007). Product age is also often a germane factor in the risk assessment. Second-hand goods or older supplied goods supplied may develop defects due to product lifespan limits.

At the macro-supplier level, product risk assessments performed by regulators typically share a core set of characteristics. First, risks are assessed by product category and are supplied by a range of suppliers across a broad set of situations. Second, many product risk assessments occur post-market (vs. pre-market). Third, regulators tend to place safety issues at the forefront of a risk assessment (termed “risk prioritization”). This is a stakeholder-based approach where regulators assess safety concerns from consumers, industry, and affected constituencies with the most serious potential safety hazards given priority and resource allocation for thorough risk assessment. Fourth, regulatory risk assessment is typically utilized in the following ways: the evaluation of existing pre-market requirements, the establishment of new pre-market requirements or whether intervention is necessary to reduce product risks to consumers.

3.3 Types of Risk Assessment

Both quantitative and qualitative approaches to risk assessment are utilized in different consumer risk contexts (Eliasson et al. 2015). Quantitative risk analysis is the more exhaustive, costly and time consuming risk assessment method. Quantitative risk analysis entails calculating the likelihood of occurrence of particular threats and the risks related to these particular threats are then estimated according to predetermined measurement scales. Qualitative risk analysis is more common than quantitative due to the time and cost involved. Qualitative analysis entails a broader approach, is more subjective and less costly for the business involved. For example, in one method, consumer product risks are reviewed for known vulnerabilities against a database of potential vulnerabilities by expert analysts. The risk is then indexed against relative scales to determine threat probability.

When deciding on the appropriate consumer product risk assessment technique, one must have an understanding of exposure assessment and analysis. Exposure assessment is a risk assessment technique used to establish the level of exposure under a particular use or exposure situation (Bruinen de Bruin et al. 2007). Typical to any exposure assessment are several key questions which can be illustrated with an example. First, when assessing for chemical risk (exposure to hazardous chemicals), during the product life cycle and through the supply chain could consumers be exposed to potential risks? Several possible answers exist including during manufacturing, during distribution, during end-use or (if plausible) outside the supply chain. Second, what are the possible routes for exposure? Routes include industrial sources, within-product sources or distributed environmental sources. Third, what is the magnitude of exposure through these key routes? Fourth, how does this exposure compare to relevant hazards? Fifth, What actions regarding chemical risk need to be taken?

A specific type of exposure assessment commonly used to assess consumer product risk is epidemiological investigation. This technique provides estimates of risk magnitude related to a particular level of exposure in a population (Blumenthal et al. 2001). In addition to quantifying probabilities of occurrence, epidemiological methods, have the potential to control for alternative explanations or other risk factors of the consumer risk outcome under observation. Epidemiological studies are often used in the establishment of guidelines and safety standards. The basic elements of an epidemiological study can be characterized as follows: (1) formulation of a research question, (2) sample selection, (3) selection of exposure indicators, (4) exposure measurement, (5) data analysis, (6) evaluation of alternative explanations (e.g. bias, chance) in data conclusions (Blumenthal et al. 2001; OECD 2013).

Additional epidemiological studies utilize observational techniques (e.g. case control studies) including standard cross-sectional studies, ecological studies, longitudinal and cohort studies. While the obvious limitation of observational studies is the lack of experimental controls and internal validity provided by a randomized experimental design, these observational studies give valuable insights to harm occurrence and incidence within a population; thereby informing supply chain members as well as regulators. Let it be noted that studies can be either descriptive or causal in nature. Properly designed epidemiological studies yield data that is generalizable to the affected population. These studies require that the product or service has been used for a sufficient number of consumers over a sufficient period of time.

Indexing is another commonly used technique in risk assessment. By definition, indexing is a systematic approach to identify, classify, and order sources of risk and to examine differences in risk perception (Birkmann 2007; Quinn 2001). Indexing has several important functions from a risk assessment standpoint including: risk identification and severity, identifying and prioritizing risks by population segment, identifying affected populations by location and discerning need for additional action. Risk indexing also aids in the identification of the nature and variation of within-population risks, risk variation based on independent variables such as exposure or individual difference variables such as demographic or economic variables. Risk indices are used by regulatory authorities as a baseline for policy formulation via the classification methodology.

Overall, risk assessment is a crucial factor in effective product life cycle management. Throughout each phase of the supply chain, risk assessments must be conducted to for the protection of all participants. Manufacturers and suppliers, from both a brand management and a liability protection standpoint, must have risk assessment frameworks in place to: (1) protect consumers from any potential product risk, (2) inform consumers of risks that can be mitigated with proper handling (behavioral compliance) and (3) comply with regulatory guidelines. Utilizing recognized and accepted risk assessment techniques in one’s sector yields actionable data that informs proper risk management policies.

4 Managing Risk: The Role of Proper Compliance

4.1 Global Regulatory Standards

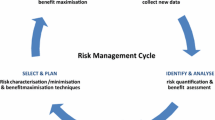

As previously discussed, typical risk management frameworks includes evaluation, risk confrontation, intervention, risk communication, and subsequent risk management components. There are numerous industrywide, national and international standards that exist for proper risk management. While there are different jurisdictions and guidelines, commonalities due exist that rise to the level of best practice in risk management. This contribution will highlight certain important regulatory standards while highlighting common principles that guide proper management for consumer product risk.

Compliance with mandatory safety standards is important for some products and jurisdictions. A regulator’s assessment for a product that breaches a product safety prohibition or mandatory safety standard is likely to include legal aspects of non-compliance rather than rely on risk analysis considerations alone. Some jurisdictions emphasize compliance with relevant voluntary safety standards as an important consideration that influences their risk evaluation. Voluntary standards often specify safety requirements for the product.

While one specific ISO standard concerning supply chain assessment was discussed, ISO 31000 provides proper guidance for effective risk management and is recognized internationally (Purdy 2010; ISO 2009a). Specifically, ISO 31000 is an international standard that provides principles and guidelines for effective risk management. The standard is not industry specific, amenable to any type of risk, can be applied cross-sector and can be tailored to meet specific organizational needs (ISO 2009a). In addition, the standard contains risk management terminology, principles for guiding effective risk management, and guidance in forging an effective risk management framework.

ISO 31000 provides for the proper implementation of a risk management process. Board mandate and organizational dissemination is the primary component of ISO 31000 guidelines extremely pertinent to consumer product risk mitigation. Four key components are provided by the standard and present a common risk approach for organizations. The first set of guidelines concerns the design of a framework which includes the formation of a risk management policy. Implementing the risk management policy including the risk management process constitutes the second set of guidelines. Assessing the framework is the next step followed lastly by modification and improvement of risk management processes and procedures. International consumer product risk and hazard recognition and mitigation regulations consistently refer to ISO guidelines as a baseline for proper risk management formulation.

4.2 U.S. Standards

The U.S. has taken a more activist stance on consumer product risk management in the past decade. Precipitating factors include negative public response to environmental disasters such as Hurricane Katrina and financial crises such as the subprime mortgage crisis. Common elements exist for risk assessment across the various regulatory agencies. From the Consumer Product Safety Commission, Food and Drug Administration and Federal Trade Commission, to the Environmental Protection Agency and USDA, a shared commonality of consumer safety and product risk mitigation.

4.3 Consumer Product Safety Commission (CPSC)

The CPSC is tasked with ensuring safety in the design, manufacture and distribution of consumer products throughout the product life cycle. In addition to regulatory oversight, the CPSC recommends best practices for supply chain actors including: (1) making safety a priority at the design stage through the safety hierarchy of risk (i.e. eliminating the risk, guarding against the risk and warning users of the risk), (2) how to build safety within the supply chain, (3) monitoring the business and regulatory environment for risk regulations and (4) risk preparedness processes and procedures (CPSC 2016).

4.4 Food and Drug Administration (FDA)

Residing within the Department of Health and Human Services (DHS), FDA is comprised of seven centers and offices. The FDA assures the safety, efficacy, and security of the U.S. food supply, human and veterinary drugs, biological products, medical devices, cosmetics, tobacco products and products that emit radiation (FDA 2016). From a consumer product risk standpoint, FDA approves medications, medical devices and other medical products for public use, and then, through a continuous risk assessment (post-market risk surveillance), evaluates the products’ risks and benefits after they have been made publicly available.

4.5 Department of Homeland Security (DHS)

Consumers’ experiences in the travel and tourism sector are at the core of DHS’s mission. Terror threats present a number of risks to critical infrastructure. DHS has three agencies (U.S. Coast Guard, the Office for Domestic Preparedness and the Information Analysis and Infrastructure Protection (IAIP) Directorate) accountable for critical infrastructure security (DHS 2016).

4.6 National Transportation Safety Board (NTSB)

Consumer product safety practices in the railroad, highway, air and marine sectors are regulated by the NTSB. All significant safety incidents and accidents within these sectors are investigated by the NTSB with the agency issuing safety recommendations aimed at preventing future accidents.

4.6.1 Canadian Standards

The objective of Canadian risk management policy is to safeguard the government’s property, interests, and certain interests of employees during the conduct of government operations. Departments within the Public Service of Canada are required to identify, minimize, and contain risks and to compensate for, restore and recover from risk events. The Canadian risk management process includes the following phases: identifying issues, assessing key risk areas, measuring likelihood and impact, indexing, milestoning, strategy selection and implementation, follow-up monitoring and continuous process adjustment (Hardy 2010).

4.6.2 British Standards

In addition to following ISO 31000 protocols, the British Risk Management Code of Practice emphasizes the future business operations from a risk-based perspective. This includes strategic implementation through program, project and change management. Additionally, ongoing operations are emphasized including people, processes, and information security (BSI British Standard 2016).

4.6.3 European Union Standards

EU risk assessment principles for consumer products are based around: (1) hazard identification, (2) exposure assessment and (3) risk characterization. In addition to adhering to ISO protocols the European Union established the Community Rapid Information System (i.e. RAPEX) as a means of communication concerning consumer product risks between member states and the Commission. The RAPEX risk assessment guidelines describe a three-step process of risk assessment and communication. First, there is the development of an injury scenario that establishes a link between the product and an estimated severity of injury. Second, probability estimation of the likelihood of occurrence is undertaken. Lastly, the risk estimation is produced by combining the estimated severity and probability (OECD 2013).

4.6.4 Best Practices

When discussing best practices for consumer product risk mitigation, certain core principles should be identified. Specifically, a risk management initiative must comply with applicable internal and regulatory governance requirements; thus assuring all stakeholders risk is minimized while improving decision making and operational efficiency throughout the supply chain (Lalonde and Boiral 2012; International Organization for Standardization 2009a, b). Best practice principles also include proportionality (the risk management initiative should fit the size, nature and complexity of the supply chain member), alignment (with corporate mission and function), scope and embeddedness into corporate activities (RIMS 2011). Any consumer product risk management initiative must be adaptable to changing environmental circumstances. Lastly, risk management must be a Board-level priority thus integrated into organizational culture.

As previously discussed, best practices can be conveyed through various frameworks. Standard risk management frameworks convey antecedent conditions, a stepwise approach to problem formulation and hazard identification, a detailed risk assessment that comprises elements of exposure assessment, risk estimation and consequence analysis. Lastly, a risk evaluation is made that leads to proper risk management measures (RMM’s) in accordance with regulatory and industry standards (Leitch 2010). Common responses to risk recognition follow a “4T” typology: tolerate the risk, treat the risk, transfer it or terminate the risk (ISO 2009b).

5 Conclusion

Consumers face numerous risks in their daily lives. From a normative standpoint, consumers depend on a sound risk management ecosystem to reduce and eliminate risks in their respective environments. Organizations throughout supply chain and in various phases of the product life cycle must maintain rigorous safety standards to (1) mitigate risk and maintain reputational equity, (2) comply with regulatory standards and (3) reduce their own liability and risk of litigation. With the increased risk of litigation and class actions surrounding consumer product risk in certain jurisdictions such as the U.S., continuous risk assessment and risk management measures are likely to grow in both sophistication and frequency.

References

Association of Insurance and Risk Managers, Alarm and the Institute for Risk Management. A structured approach to enterprise risk management. (2010). pp. 1–18.

Bauer, R. A. (1960). Consumer behavior as risk-taking. In R. S. Hancock (Ed.), Dynamic marketing for a changing world (pp. 389–398). Chicago: American Marketing Association.

Bettman, J. R. (1973). Perceived risk and its components: A model and empirical test. Journal of Marketing Research, 10, 184–189.

Birkmann, J. (2007). Risk and vulnerability indicators at different scales: Applicability, usefulness and policy implications. Environmental Hazards, 7(1), 20–31.

Blumenthal, U. J., Fleisher, J. M., Esrey, S. A., & Peasey, A. (2001). Epidemiology: A tool for the assessment of risk. In L. Fewtrell (Ed.), Water quality: Guidelines, standards and health (pp. 135–160). London: IWA Publishing.

British Standards Institution. (2016). Information about standards. Accessed June 1, 2016, from http://www.bsigroup.com/en-GB/standards/Information-about-standards/

Consumer Product Safety Commission. (2016). Accessed July 1, 2016, from https://www.cpsc.gov/Regulations-Laws--Standards/Statutes/

Cox, D. F. (1967). Risk-taking and information-handling in consumer behavior. Boston: Harvard University.

Cunningham, S. M. (1964). Perceived risk as a factor in product-oriented word-of-mouth behavior: A first step. In L. G. Smith (Ed.), Reflections on progress in marketing (pp. 229–238). Chicago: American Marketing Association.

Cunningham, S. M. (1966). Perceived risk as a factor in the diffusion of new product information. In R. M. Hass (Ed.), Science, technology. and marketing (pp. 698–721). Chicago: American Marketing Association.

Cunningham, S. M. (1967a). The major dimensions of perceived risk. In D. F. Cox (Ed.), Risk-taking and information-handling in consumer behavior (pp. 82–108). Boston: Harvard University.

Cunningham, S. M. (1967b). Perceived risk as a factor in informal consumer communications. In D. F. Cox (Ed.), Risk-taking and information-handling in consumer behavior (pp. 265–288). Boston: Harvard University.

Cunningham, S. M. (1967c). Perceived risk and brand loyalty. In D. F. Cox (Ed.), Risk-taking and information-handling in consumer behavior (pp. 507–523). Boston: Harvard University.

De Bruin, Y. B., Lahaniatis, M., Papameletiou, D., Del Pozo, C., Reina, V., Van Engelen, J., & Jantunen, M. (2007). Risk management measures for chemicals in consumer products: documentation, assessment, and communication across the supply chain. Journal of Exposure Science and Environmental Epidemiology, 17, S55–S66.

Department of Homeland Security. (2016). Accessed August 1, 2016. https://www.dhs.gov/about-dhs

Dobson, A. (2000). Green political thought. London: Psychology Press.

Earthtrends. (2007). EarthTrends update July 2007: Vulnerability and adaptation to climate change. Accessed August 1, 2016, from http://armspark.msem.univ-montp2.fr/bfpvolta/admin/biblio/EarthTrends%20Update%20July%202007.pdf

Eliasson, K., Nyman, T., & Forsman, M. (2015). Usability of six observational risk assessment methods. In Proceedings 19th Triennial Congress of the IEA, Melbourne 9–14, pp. 1–2.

Engel, J. F., Kollat, D. T., & Blackwell, R. D. (1973). Consumer behavior (2nd ed.). New York: Holt, Rinehart, & Winston.

European Commission. (2001). Promoting a European framework for corporate social responsibility. Accessed June 1, 2016, fromhttp://ec.europa.eu/employment_social/soc-dial/csr/pdf/044-compnetnat_bitc_uk_011218_en.ht

Food and Drug Administration. (2016). What does FDA do? Accessed August 1, 2016, from http://www.fda.gov/AboutFDA/Transparency/Basics/ucm194877.htm

Glanz, K., Basil, M., Maibach, E., Goldberg, J., & Snyder, D. (1998). Why Americans eat what they do: Taste, nutrition, cost, convenience, and weight control concerns as influences on food consumption. Journal of the American Diabetic Association, 98(10), 1118–1126.

Hardy, K. (2010). Managing risk in government; An introduction to enterprise risk management (pp. 1–50). Washington, DC: IBM Center for Business and Government.

Hedblom, M. O. (1998). Environment, for better or worse (Part 3). Ericsson Review, 1, 1–15.

Howard, J. A., & Sheth, J. N. (1969). The theory of buyer behavior. New York: Wiles.

Hume, S., & Strnad, P. (1989, September 25). Consumers go green. Advertising Age, 3, 92.

International Organization for Standardization. (2009a). ISO 31000: 2009(a). Risk management: Principles and guidelines.

International Organization for Standardization. (2009b). ISO Guide 73(b): Risk vocabulary.

International Organization for Standardization. (2013). ISO 10377. Consumer product safety. Guidelines for suppliers.

International Organization for Standardization/International Electrotechnical Commission. (2014). ISO/IEC Guide 51: Safety aspects—Guidelines for their inclusion in standards.

Jacoby, J., & Kaplan, L. (1972). The components of perceived risk. In M. Venkatesan (Ed.), Proceedings, third annual convention of the association for consumer research (pp. 382–393). Chicago: Association for Consumer Research.

Lalonde, C., & Boiral, O. (2012). Managing risks through ISO 31000: A critical analysis. Risk management, 14(4), 272–300.

Leitch, M. (2010). ISO 31000: 2009. The new international standard on risk management. Risk Analysis, 30(6), 887–892.

Mann, C. J. (2003). Observational research methods. Research design II: Cohort, cross sectional, and case-control studies. Emergency Medicine Journal, 20(1), 54–60.

Mayer, R. N., Lewis, L. A., & Scammon, D. L. (2001). The effectiveness of environmental marketing claims. In P. Bloom & G. Gundlach (Eds.), Handbook of marketing and society (pp. 399–420). Thousand Oaks, CA: Sage.

Morgan, F. (2001). The effectiveness of product safety regulation and litigation. In P. Bloom & G. Gundlach (Eds.), Handbook of marketing and society (pp. 436–461). Thousand Oaks, CA: Sage.

Organization for Economic Co-operation and Development. (2013). Summary of The OECD Workshop on Product Risk Assessment, www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=dsti/cp/cps%282012%2916/final&doclanguage=en . Accessed 1 June 2016

Organization for Economic Co-operation and Development. (2016). Product risk assessment practices of regulatory agencies. pp. 1–19

Purdy, G. (2010). ISO 31000: 2009—Setting a new standard for risk management. Risk analysis, 30(6), 881–886.

Quinn, C. (2001). Risk mapping in semi-arid Tanzania: Review of common pool resource management in Tanzania. Report prepared for NRSP Project R7857 (DRAFT). Accessed July 1, 2016, from http://www.york.ac.uk/res/celp/webpages/projects/cpr/tanzania/pdf/Annex7.pdf

Rapert, M. I., Newman, C., Park, S. Y., & Lee, E. M. (2010). Seeking a better place: Sustainability in the CPG industry. Journal of Global Academy of Marketing Science, 20(2), 199–207.

Risk and Insurance Management Society. (2011). An overview of widely used risk management standards and guidelines, pp. 1–24.

Roberts, J. H., & Urban, G. L. (1988). Modeling multiattribute utility, risk, and belief dynamics for new consumer durable brand choice. Management Science, 34(2), 167–185.

Sammer, K., & Wüstenhagen, R. (2006). The influence of eco-labelling on consumer behavior—results of a discrete choice analysis. Business Strategy and the Environment, 15(3), 185–199.

Schuhwerk, M. E., & Lefkoff-Hagius, R. (1995). Green or non-green? Does type of appeal matter when advertising a green product? Journal of Advertising, 24(2), 21–31.

Sonneveld, K., James, K., Fitzpatrick, L., & Lewis, H. (2005). Sustainable packaging: How do we define and measure it? Proceedings of the 22nd IAPRI Symposium.

Stone, R.N., & Winter, F. (1985). Risk in buyer behavior contexts: A clarification. BEBR faculty working paper No. 1216, pp. 20–22.

Taylor, J. W. (1974). The role of risk in consumer behavior. Journal of Marketing, 38, 54–60.

Vermeir, L., & Verbeke, W. (2006). Sustainable food consumption: Exploring the consumer attitude-behavioral intention gap. Journal of Agricultural and Environmental Ethics, 19(2), 169–194.

Woodside, A. (1968). Social character, product use and advertising appeals. Journal of Advertising Research, 8, 31–35.

Woodside, A. (1971, October). Product advertising and price perceptions of the small business customer. Journal of Small Business Management, 9, 15–20.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Kozup, J. (2017). Risks of Consumer Products. In: Emilien, G., Weitkunat, R., Lüdicke, F. (eds) Consumer Perception of Product Risks and Benefits. Springer, Cham. https://doi.org/10.1007/978-3-319-50530-5_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-50530-5_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-50528-2

Online ISBN: 978-3-319-50530-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)