Abstract

This chapter discusses how temporal discounting might lead a consumer to choose a smaller, more immediate reward over a larger, delayed reward because the present value of the delayed reward is discounted. Time discounting models, such as exponential and hyperbolic pattern discounting, are useful in explaining people’s intertemporal preferences and choices. Neuroscience-based models combine the cognitive models with quantitative measures of temporal discounting and help clarify why a particular brain region may dominate choice behavior in one situation but not in others. Previous empirical research and our experimental results show evidence of domain differences and individual differences in temporal discounting. Temporal discounting models are useful in explaining individuals’ addictive and unhealthy behaviors. The concept of temporal discounting can be used to explain consumers’ daily decisions—such as saving for retirement, recycling, and purchasing environmentally friendly products—and has important marketing and policy implications.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Concept of Temporal Discounting

Temporal discounting describes people’s tendency to lower the subjective value of future outcomes. A consumer might choose a smaller and more immediate reward over a larger but delayed reward because the present value of the delayed reward is discounted (Myerson and Green 1995; Chapman and Elstein 1995). Standard discounted utility theory assumes that consumers make rational tradeoffs between immediate rewards and delayed rewards and captures consumers’ intertemporal choices using discount rates (Grossman 1972). Some researchers have argued that temporal discounting might reflect the increased risks involved in waiting for a future outcome (Myerson and Green 1995; Chapman and Elstein 1995; Hardisty and Weber 2009). For example, Dasgupta and Maskin (2005) suggested that when uncertainty is involved in the realization time of the payoffs, the corresponding intertemporal preferences may entail hyperbolic discounting.

Overall, temporal discounting is useful in explaining how an individual consumer or a society acts when there are future financial, health, or environmental risks/benefits. For example, hyperbolic discounting models are often used to explain an individual’s unhealthy behaviors such as addiction to alcohol and tobacco (Scharff and Viscusi 2011; Roewer et al. 2015) as well as health outcomes such as obesity (Richards and Hamilton 2012; Scharff 2009). Studies also have investigated how temporal discounting affects environmental outcomes such as air quality deterioration and water quality improvement (Hardisty and Weber 2009). Therefore, understanding consumer temporal discounting behavior for future risks/benefits is very important in designing, evaluating, and implementing financial, environmental, and health policies and strategies.

1.1 Exponential and Hyperbolic Discounting

In general, two major types of models have been used to characterize the temporal discounting of future outcomes. According to the standard discounted utility theory, the utility of future outcomes is discounted to the present using a constant discounting factor in which the individual’s choices between two future outcomes are independent from the time when future outcomes occur. In this case, consumers’ intertemporal choices are assumed to be time-consistent, which can be explained by exponential discounting models in the following functional form:

where V is the present value of the delayed reward, A is the delayed amount of reward, t is the delayed time, and k is the discount rate.

However, extensive studies have revealed that consumers’ intertemporal behaviors violate rational choice theory and that exponential discounting models cannot explain the mechanisms underlying the intertemporal decision-making (Loewenstein and Prelec 1992; Hardisty and Weber 2009). First of all, temporal discounting rate is not fixed but appears to vary over time. In particular, discount rates for longer delays are lower than those for shorter delays. The tendency to choose more immediate alternatives, also called impulsivity or temporal myopia, is more aligned with the hyperbolic patterns of discounting (Frederick et al. 2002).

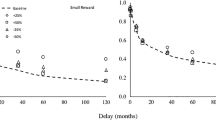

Moreover, evidence of “preference reversals” has been found in both laboratory and field experiments, which is not consistent with exponential discounting model. For instance, when people are asked to choose between two future rewards, $105 in a year and a day or $100 in 1 year, they often choose the larger amount. But 1 year later, when they are asked to choose between getting $100 now and getting $105 tomorrow, they become impatient and choose to get $100 immediately. Such preference reversals, as presented in Fig. 1, have been extensively discussed in pervious literature. One theory consistent with preference reversals is “diminishing impatience,” where subjects discount the future with a declining discount rate. Experiments conducted by both behavioral economists and psychologists using various rewards such as money, durable goods, and sweets also suggest that impatience at the present time is higher than impatience with respect to trade-offs occurring in the future (e.g., Frederick et al. 2002).

Discounting curves for two rewards of different sizes available at different times (preference reversals) (Adapted from Figure 1 in Ainslie, 1975)

Time-inconsistent discounting models such as hyperbolic discounting and quasi-hyperbolic discounting functional forms are often used to capture people’s tendency to give higher weight to payoffs that are closer to the present time when weighing trade-offs between two future moments. The hyperbolic discounting model, for example, has the following functional form:

where V is the present value of the delayed reward, A is the delayed amount of reward, t is the delayed time, and k is the discount rate (Ainslie, 1975).

As shown in Fig. 2, the discount factor in hyperbolic discounting falls very rapidly at short-delayed periods but falls slowly at longer-delayed periods, which is different from exponential discounting, where discount factor falls by a constant rate per unit of delay. Numerous studies have shown that temporal discounting behavior can be better described by a hyperbolic rather than an exponential discounting model (e.g., Green and Myerson 2004; Richards and Hamilton 2012).

Quasi-hyperbolic discounting is also introduced and explored in intertemporal choice studies where the value of rewards declines rapidly over the short run but at a slower rate over the long run, or the short-term impulses supersede long-term goals (Loewenstein and Prelec 1992). In other words, subjects exhibit a strong present bias for earlier payoffs. Present-biased preferences have also been interpreted in terms of self-control problems (Ainslie 1975) or a lack of self-awareness (Frederick et al. 2002). The quasi-hyperbolic model developed by Laibson (1997) is also known as the β − δ model, where the discount function is a discrete time function with values ϕ(t)= {1, βδ, βδ 2, βδ 3, …, βδ t, ….} for time from present t = {0, 1, 2, 3, …, t, …}, β ∈ (0, 1) is the short-run discount factor capturing the present bias, and δ ∈ (0, 1) is the long-run discount factor.

Other hyperbola-like models, such as the generalized hyperbolic discounting model, were also proposed and widely discussed in both theoretical and empirical studies to explain distinct consumer behaviors in intertemporal choice decisions. Specifically, Loewenstein and Prelec (1992) suggested the generalized hyperbolic discount function to be \( \phi (t)={\left(1+\alpha t\right)}^{-\frac{\beta}{\alpha}} \), (α > 0 and β > 0), where α is the parameter capturing the degree of decreasing impatience, which determines how much the function departs from the exponential discounting.

1.2 Contributions from Cognitive Neuroscience

Although hyperbolic discounting provides a useful quantitative measure of intertemporal discounting, it only focuses on stimulus input and behavioral output and is limited in explaining different temporal discounting phenomena. Specifically, the hyperbolic discounting model does not account for various discounting behaviors across situations, and it fails to illustrate the cognitive processes of decision-making. Recent studies suggest that neuroscience-based theory can demonstrate the cognitive process of intertemporal choices at the brain level.

Neurobiology frameworks suggest that decision-making takes place in several basic stages (Bos and McClure 2013). In the past decade, brain-imaging techniques such as functional magnetic resonance imaging (fMRI) have frequently been used in decision-making tasks to determine the relative brain activation areas and explore the specific areas of the brain used. Brain-imaging studies have consistently shown that temporal discounting involves activities in different regions of the brain, such as subcortical and cortical regions. These regions are commonly divided into two networks: a valuation network and a control network (Bos and McClure 2013). The valuation network is involved in estimating the incentive value of the different options, and the control network is involved in action selection, maintaining future goals, and inhibiting prepotent responses.

The valuation network consists of some important nodes, such as the ventromedial prefrontal cortex (vmPFC), ventral regions of striatum (VS), amygdala, and the posterior cingulate cortex (PCC). Several human neuroimaging studies have shown that various brain areas are associated with the brain’s dopamine system. Particularly, greater activities in the VS, vmPFC, and PCC are related to more impulsive choices. These areas also show a clear present bias tendency when receiving signals of future rewards. Although there is still debate on the role of vmPFC, many studies in cognitive neuroscience agree that the vmPFC works at the intersection of the valuation and control networks. Information from each of these two systems is integrated in the vmPFC to determine behaviors. Findings also suggest that the VS and possibly other areas are central components of a valuation network that biases behavior toward immediate rewards (Bos and McClure 2013).

The control network includes the dorsal anterior cingulate cortex (dACC), dorsal and ventral lateral prefrontal cortex (dlPFC/vlPFC), and the posterior parietal cortex (PPC). Among the control network, dACC supports the selection and maintenance of behavior directed toward long-term goals. Activities in the LPFC and PPC are associated with an increase in the likelihood of choosing larger, delayed outcomes over smaller, sooner outcomes (Bos and McClure 2013).

Overall, the control network has been found to be involved in guiding behaviors to plan for the future and to seek rewards with significant delays. In the context of intertemporal choice, the dominant effect of increased control is to bias behavior in favor of larger, later outcomes.

Moreover, distinct pathways are associated with temporal discounting. For instance, Bos et al. (2014) suggest that reward-based and goal-oriented decisions rely on the striatum and its interactions with other cortical and subcortical networks. Using connectivity analyses in both structural and functional MRIs, their results indicate that connectivity between the striatum and the lateral prefrontal cortex is associated with increased patience, whereas connectivity between subcortical areas and the striatum is associated with increased impulsivity.

When facing intertemporal choices, imagining or simulating the benefit from a future reward plays an important role since it is impossible to experience future rewards at the time of making choices. Hakimi and Hare (2015) suggested that the quality of reward imagination might affect the degree of temporal discounting of future outcomes. Using fMRI to monitor the brain activities of subjects, they found that the vmPFC responds actively when subjects are imagining receiving primary rewards, which is correlated with reduced monetary temporal discounting.

Bos and McClure (2013) conclude that the brain-based model shows how cognitive models can be linked to hyperbolic discounting curves in a very natural way. The neuroscience-based model integrates the cognitive models and quantitative measures of temporal discounting. Furthermore, it can help clarify why a particular brain region may dominate choice behavior in one situation but not in others.

2 Empirical Findings

2.1 Domain Differences in Temporal Discounting

Many previous studies in temporal discounting considered all goods and services (for example, health, air quality, etc.) to be potentially tradable with money, assuming that future outcomes in different domains are therefore discounted at the same rate. Some research, however, has shown that temporal discounting may vary across different domains and that it is inappropriate to use one general estimation of discount rate for all situations (Chapman and Elstein 1995). For example, Hendrickx and Nicolaij (2004) concluded that temporal discounting is less pronounced for environmental risks than for other types of risks. Hardisty and Weber (2009) found that health gains are discounted more than monetary and environmental gains. Lawless et al. (2013) suggested that discount rates for health are higher than those for money in both social and private contexts.

We compared temporal discounting across three different domains (financial, environmental, and health) using an online experiment with 697 U.S. consumers to study their intertemporal preferences in terms of rewards with short-term (6 months) and long-term (24 months) delays. In the choice experiment, participants were presented with a series of hypothetical choices between receiving a smaller reward sooner or a larger reward later (the rewards are money for the financial domain, square feet of park improvement for the environmental domain, and days of relief from chronic back pain for the health domain).

We found that, on average, participants had the highest discount rates in the health domain, followed by environmental domain and financial domain, for both the short-term and long-term delays. The discount rates for the financial and environmental domains are quite similar, but the short-term discount rate in the environmental domain is slightly higher than that in the financial domain. The pairwise t-test results show that the discount rates in the health domain are significantly higher than those in the other two domains, which is consistent with previous findings that the discount rates for health gains are higher than those for monetary and environmental gains (Lawless et al. 2013; Hardisty and Weber 2009). Overall, the short-term environmental discount rate is more correlated with the short-term discount rate in the health domain than that in the financial domain. The correlations between the long-term environmental discount rate and the long-term discount rates in the other two domains are not significantly different from one another. For both short-term and long-term discount rates, very low correlations (0.3 for short-term outcomes and 0.36 for long-term outcomes) are found between financial and health domains, indicating that discount rates in these two domains may not be good substitutes for each other.

Consistent across domains, we found that the short-term temporal discounting rate is higher than the long-term temporal discounting rate, which implies that temporal discounting is significantly influenced by the realization time of future rewards and that temporal myopia is less pronounced for longer delays.

2.2 Individual Differences in Temporal Discounting

In addition to the variation across domains, temporal discounting also varies considerably across individuals. Demographic characteristics have significant impact on temporal discounting behavior. For instance, Weller et al. (2008) found that obese women show greater temporal discounting than women in the control group, but obese and healthy-weight men do not differ significantly in temporal discounting.

Several studies also find individual heterogeneity in temporal discounting using the quasi-hyperbolic (β − δ) model. Andreoni and Sprenger (2012) found average values of δ in the range of 0.74–0.8, and only 16.7% of their respondents were characterized as present biased. More evidence of individual differences in temporal discounting has been found in the neuroscience studies. For example, individual differences in the quality of reward imagination are significantly correlated with the temporal discounting rate of future monetary rewards; enhanced activity in vmPFC during reward imagination can predict choice behavior differences between and within individuals (Hakimi and Hare 2015).

Even within individuals, temporal discounting behaviors could be distinct in different situations. Tsukayama and Duckworth (2010) found that adults discount delayed rewards they find particularly tempting more steeply than less tempting rewards.

Our experimental results also show that consumer socio-demographic characteristics affect temporal discounting behaviors in different domains in different ways.

Our results indicate that discount rates in the financial domain tend to decrease as participants get older. Female participants tend to discount future financial outcomes more compared to male participants. Additionally, participants with higher education levels have lower discount rates, and participants with higher household income are more likely to have lower discount rates. As suggested by Becker and Mulligan (1997), poverty increases an individual’s need for immediate income more than future income. Therefore, participants with higher household income discount less for future financial rewards due to their patience. The presence of children under the age of 12 also has a significant impact on participants’ discount rates in the financial domain. Other variables—such as marital status, household size, and home location—do not significantly impact their financial discount rates.

As for the environmental temporal discounting, our experimental results suggest that age is not a significant factor. Similar to the results in the financial domain, having a graduate school education greatly decreases participants’ discount rate, while the influence of college education is not statistically significant. The presence of children also has a negative and significant effect on the environmental discount rate, suggesting that families with children discount less and care about future environmental outcomes.

Notably, our results suggest that age has a positive effect on health discount rate, which is different from the results in the other two domains. Older participants have higher discount rates compared to younger participants in the health domain (i.e., older participants would like to receive a sooner, albeit small, health reward compared to younger respondents), which was also found by van der Pol and Cairns (2001). Our results indicate that college education does not significantly affect the health discount rate, but graduate school education decreases health discount rate by a similar amount to that in the environmental domain. The income effect is less prominent in the health domain. Moreover, the presence of children does not significantly affect an individual’s discount rate in the health domain, indicating that having a child may not change an individual’s preference for future health rewards.

2.3 Temporal Discounting on Addiction and Unhealthy Behaviors/Outcomes

Numerous studies have demonstrated the relationship between temporal discounting and addictive behaviors such as smoking, drinking, and drug use. In general, many studies found that decision-makers value future health outcomes (such as high probability of getting cancer or obesity) much less than present outcomes (consumption of tobacco, alcohol, or unhealthy food). Subjects with addictive behaviors discount the future steeply or have higher temporal discount rates compared to those without addictive behaviors (Scharff and Viscusi 2011; Harrison et al. 2010; Bos and McClure 2013). In neuroscience-based studies, there are clear associations between impulsivity and dopamine function in patients with dopamine-related disorders such as addiction and attention-deficit/hyperactivity disorder (ADHD) (Bos and McClure 2013).

Many studies find significant relationships between temporal discounting and smoking. Scharff and Viscusi (2011) found that the individual discount rate is higher for smokers than nonsmokers, or smokers are more present biased than non-smokers. However, omitted variables such as severity of addiction, self-efficacy, and social support among others may confound the analysis. Both individual characteristics and current smoking status influence temporal discounting behaviors. Harrison et al. (2010) found that male smokers have significantly higher temporal discount rates than male non-smokers, but the rates are not significantly different between female smokers and female non-smokers. Roewer et al. (2015) suggested that heavy smokers respond more slowly when making intertemporal choices after nicotine deprivation.

Furthermore, studies suggest that drinking behaviors are correlated with temporal discounting rates; people who frequently consume alcohol tend to discount future outcomes more and are more impulsive to enjoy sooner rewards (Vuchinich and Simpson 1998). For instance, Vuchinich and Simpson (1998) found that the hyperbolic discounting function described temporal discounting behavior of alcohol consumption more accurately than exponential functions. They also suggest that light drinkers are less impulsive and more future-oriented compared to heavier drinkers.

Some unhealthy outcomes, such as obesity, have been well examined by temporal discounting models (Richards and Hamilton 2012; Scharff 2009). In particular, consumers suffering from self-control problems often ignore the unforeseeable health outcomes of overeating, drinking, and other unhealthy behaviors. They often fail to consider the long-term health goals when making tradeoffs between immediate and future consequences. Obesity, for example, is often related to steeper temporal discounting (or impulsivity for immediate rewards over delayed rewards). Many previous studies have found significant correlations between obesity and temporal discounting of monetary rewards (e.g., Richards and Hamilton 2012; Scharff 2009). For instance, using quasi-hyperbolic models to capture time-inconsistent preferences, Courtemanche et al. (2014) found that both long-run discount factor and present bias significantly impact an individual’s body mass index; thus both rational intertemporal tradeoffs and time inconsistency are associated with obesity.

It is also worth noting that many studies compared addiction and unhealthy behaviors with the discount rate in monetary rewards (as a proxy for temporal discounting). As previously discussed, intertemporal preferences may vary across different domains, and these studies potentially fail to differentiate temporal discounting behavior in the health and financial domains, which might lead to biased results.

3 Scope

Empirical findings suggest that, in many situations, more distant future rewards are discounted less than rewards in the near future. In other words, consumers exhibit more temporal myopia (or impatience) when facing short-term delays compared to long-term delays. Decreased temporal discounting rates given longer delays suggest that temporal discounting is inconsistent over time and more likely to have a hyperbola shape; therefore, employing appropriate temporal discounting models is critical in explaining consumers’ time-inconsistent behaviors. Hyperbolic and quasi-hyperbolic discounting models are found to be more appropriate than exponential discounting models in explaining individuals’ intertemporal choice behavior. The neuroscience-based models account for contextual factors that are known to affect individuals’ intertemporal preferences and demonstrate the cognitive process of intertemporal choices at the brain level. The neuroscience-based model preserves much of the functional form of the hyperbolic discounting models but overcomes their limitations, such as the ignorance of contextual effects and the inability to capture the cognitive process of decision-making.

The inconsistent temporal discounting models, such as hyperbolic and quasi-hyperbolic discounting models, can be used to explain a wide range of anomalies in individuals’ life-cycle consumption, such as consumption discontinuities at retirement and under-saving (Laibson 1997). To help individuals overcome temporal myopia and self-control problems, commitment mechanisms can be introduced. For instance, Laibson (1997) illustrated how impatience could be overcome by mandatory investment of a portion of income into illiquid assets. Other studies (for example, Basu 2011) introduced saving programs as commitment devices, where the majority of participants successfully increased their saving toward retirement.

The findings of temporal discounting and brain activities from neuroscience are critical for understanding addictions and ADHD. In particular, the valuation system is thought to develop during early adolescence, while the control system is developed later and more gradually (Bos et al. 2014). The imbalance in the development of these two systems may result in steeper temporal discounting and greater impulsivity, as is the case with ADHD. Therefore, it is necessary to understand how different neural systems contribute to intertemporal preferences and impulsive behavior.

Previous studies suggest that temporal discounting rates are different across different domains, indicating that temporal discounting should be domain-specific. Much of the previous research on temporal discounting simply used the discount rate for monetary outcomes as a proxy to measure the temporal discounting for environmental outcomes or health outcomes (e.g., Richards and Hamilton 2012). However, our conclusions suggest that using one universal discount rate for different domains may not be appropriate and thus might lead to biased results. Even within a specific domain, temporal discounting may also be different. Previous studies estimated discount rates ranging from negative to several thousand percent per year for environmental outcomes, and it is still unclear what discount rate should be used in many cases. Similarly, temporal discounting rates for health outcomes vary significantly depending on the delay of illness or health improvement as well as the severity of the health outcomes (Chapman and Elstein 1995; Pol and Cairns 2001). Therefore, it is helpful for policy makers to distinguish the temporal discounting rates for different future outcomes and understand which temporal discounting rates individuals use when facing future rewards.

Understanding consumers’ time-inconsistent discounting behaviors has important implications for environmental organizations and policy makers. The positive discount rates for future environmental rewards indicate that individuals put less weight on future environmental outcomes. Compared to temporal discounting in other domains, environmental risks or benefits often take effect in an even more distant future, sometimes in decades or hundreds of years. As a consequence, future environmental outcomes are highly discounted, resulting in little present value and losing almost all significance. The presence of temporal myopia may lead individuals to overlook the effect of environmental risks for future generations; therefore, it is crucial for individuals to understand the benefit of environmental sustainability in the long run. Public policies and education could help consumers understand that supporting the environment may only take little daily efforts. In particular, public media and environmental organizations could educate consumers about the long-run environmental benefits of everyday behaviors such as recycling and using energy-saving and water-saving technologies/devices.

Furthermore, these findings can provide useful implications for health policy makers as well as individual consumers. Consumers discount future health outcomes more compared to future outcomes in other domains. Many studies have investigated consumers’ temporal discounting behaviors in drug or alcohol use and concluded that addicted individuals may be more myopic (Ainslie 1975). When making tradeoffs between current rewards (for example, gratification from consuming unhealthful products) and future health outcomes, myopic individuals tend to put less weight on future outcomes. The high discount rates in the health domain also suggest that health improvement in the future is discounted and valued so little that many individuals may not engage in preventive behaviors. The analysis of smoking behavior using temporal discounting models could generate implications about the effectiveness of public policies. For instance, if the temporal discounting behaviors for addictive smokers are mostly time-inconsistent, policies such as increasing cigarette taxes and anti-smoking campaigns may not work well (Lawless et al. 2013). Public policies should also promote generally healthy behavior and introduce commitment mechanisms to help addicted individuals overcome their self-control problems.

Additionally, individuals with temporal myopia should be educated about the future health risks of current behaviors such as overeating and eating an unhealthful diet. Public health policies could also focus on improving people’s awareness of future health risks. For example, helping consumers understand the relationship between temporal myopia and obesity could improve their recognition of self-control problems when consuming food. As Richard and Hamilton (2012) suggested, to deal with obesity, public policy could target behaviors associated with impatience and immediate gratification instead of focusing only on nutritional education or fitness messages. More specifically, in the weight-control effort, consumers are suggested to purchase limited quantities of unhealthy foods or buy smaller quantities of food during each shopping trip. Moreover, commitment devices can be used for those consumers who lack the self-control to overcome their inconsistent time preferences. For example, peer groups such as Weight Watcher programs are often useful to reinforce an individual’s self-control (Scharff 2009).

In summary, temporal discounting—the tendency for individuals to prefer immediate but small rewards to future but sizable rewards—is far from a simple matter. On-going research in this area is being conducted by researchers around the globe. Both behavioral economics and neuroscience studies have found solid evidence that temporal discounting affects individuals’ intertemporal preferences. Accumulated evidence indicates that temporal discounting is not consistent over time. Appropriate temporal discounting models need to be investigated and adopted when examining consumers’ discounting behaviors. Moreover, individual heterogeneity and domain differences should be considered when studying temporal discounting behaviors.

References

Ainslie, G. (1975). Specious reward: A behavioral theory of impulsiveness and impulse control. Psychological Bulletin, 82(4), 463–496.

Andreoni, J., & Sprenger, C. (2012). Estimating time preferences from convex budgets. American Economic Review, 102(7), 3333–3356.

Basu, K. (2011). Hyperbolic discounting and the sustainability of rotational savings arrangements. American Economic Journal: Microeconomics, 3(4), 143–171.

Becker, G., & Mulligan, C. (1997). The endogenous determination of time preference. The Quarterly Journal of Economics, 112(3), 729–758.

Chapman, G. B., & Elstein, A. S. (1995). Valuing the future: Temporal discounting of health and money. Medical Decision Making, 15(4), 373–386.

Courtemanche, C., Heutel, G., & Mcalvanah, P. (2014). Impatience, incentives and obesity. Economic Journal, 125, 1–31.

Dasgupta, P., & Maskin, E. (2005). Uncertainty and hyperbolic discounting. American Economic Review, 95(4), 1290–1299.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Green, L., & Myerson, J. (2004). A discounting framework for choice with delayed and probabilistic rewards. Psychological Bulletin, 130(5), 769–792.

Grossman, M. (1972). On the concept of health capital and the demand for health. Journal of Political Economy, 80(2), 223.

Hakimi, S., & Hare, T. A. (2015). Enhanced neural responses to imagined primary rewards predict reduced monetary temporal discounting. Journal of Neuroscience, 35(38), 13103–13109.

Hardisty, D. J., & Weber, E. U. (2009). Discounting future green: Money versus the environment. Journal of Experimental Psychology: General, 138(3), 329–340.

Harrison, G. W., Lau, M. I., & Rutström, E. E. (2010). Individual discount rates and smoking: Evidence from a field experiment in Denmark. Journal of Health Economics, 29(5), 708–717.

Hendrickx, L., & Nicolaij, S. (2004). Temporal discounting and environmental risks: The role of ethical and loss-related concerns. Journal of Environmental Psychology, 24(4), 409–422.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112(2), 443–478.

Lawless, L., Drichoutis, A. C., & Nayga Jr., R. M. (2013). Time preferences and health behaviour: A review. Agricultural and Food Economics, 1(17), 1–19.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. The Quarterly Journal of Economics, 107(2), 573–597.

Myerson, J., & Green, L. (1995). Discounting of delayed rewards: Models of individual choice. Journal of the Experimental Analysis of Behavior, 64(3), 263–276.

Richards, T., & Hamilton, S. (2012). Obesity and hyperbolic discounting: An experimental analysis. Journal of Agricultural and Resource Economics, 37(2), 181–198.

Roewer, I., Wiehler, A., & Peters, J. (2015). Nicotine deprivation, temporal discounting and choice consistency in heavy smokers. Journal of the Experimental Analysis of Behavior, 103(1), 62–76.

Scharff, R. L. (2009). Obesity and hyperbolic discounting: Evidence and implications. Journal of Consumer Policy, 32(1), 3–21.

Scharff, R. L., & Viscusi, W. K. (2011). Heterogeneous rates of time preference and the decision to smoke. Economic Inquiry, 49(4), 959–972.

Tsukayama, E., & Duckworth, A. L. (2010). Domain-specific temporal discounting and temptation. Judgment and Decision Making, 5(2), 72–82.

Van den Bos, W., & McClure, S. M. (2013). Towards a general model of temporal discounting. Journal of the Experimental Analysis of Behavior, 1(99), 1–16.

Van den Bos, W., Rodriguez, C. A., Schweitzer, J. B., & McClure, S. M. (2014). Connectivity strength of dissociable striatal tracts predict individual differences in temporal discounting. Journal of Neuroscience, 34(31), 10298–10310.

Van der Pol, M., & Cairns, J. (2001). Estimating time preferences for health using discrete choice experiments. Social Science & Medicine, 52(9), 1459–1470.

Vuchinich, R. E., & Simpson, C. A. (1998). Hyperbolic temporal discounting in social drinkers and problem drinkers. Experimental and Clinical Psychopharmacology, 6(3), 292–305.

Weller, R. E., Cook, E. W., Avsar, K. B., & Cox, J. E. (2008). Obese women show greater delay discounting than healthy-weight women. Appetite, 51(3), 563–569.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Yue, C., Wang, J. (2017). Temporal Discounting of Future Risks. In: Emilien, G., Weitkunat, R., Lüdicke, F. (eds) Consumer Perception of Product Risks and Benefits. Springer, Cham. https://doi.org/10.1007/978-3-319-50530-5_14

Download citation

DOI: https://doi.org/10.1007/978-3-319-50530-5_14

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-50528-2

Online ISBN: 978-3-319-50530-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)