Abstract

We investigate whether the distribution of share price follows a power law distribution at the regional level, using data from companies publicly listed worldwide. Based on ISO country codes, 7,796 companies are divided into four regions: America, Asia, Europe, and the rest of the world. We find that, at the regional level, the distributions of share price follow a power law distribution and that the power law exponents estimated by region are quite diverse. The power law exponent for Europe is close to that of the world and indicates a Zipf distribution. We also find that the theoretical share price and fundamentals estimated using a panel regression model hold to a power law at the regional level. A panel regression in which share price is the dependent variable and dividends per share, cash flow per share, and book value per share are explanatory variables identifies the two-way fixed effects model as the best model for all regions. The results of this research are consistent with our previous findings that a power law for share price holds at the world level based on panel data for the period 2004–2013 as well as cross-sectional data for these 10 years.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Since Vilfredo Pareto (1848–1923) found more than 100 years ago that income distributions follow a power law, numerous studies have attempted to find and explain this phenomenon using a variety of real world data. Power laws, including Zipf’s law, appear widely in physics, biology, economics, finance, and the social sciences. Newman (2005) introduced examples of distributions that appear to follow power laws in a variety of systems, including Word frequency, Citations of scientific papers, Web hits, Copies of books sold, Telephone calls, Magnitude of earthquakes, Diameter of moon craters, Intensity of solar flares, Intensity of wars, Wealth of the richest people, Frequency of family names, and Populations of cities. All have been proposed to follow power laws by researchers. Examples of Zipf’s law, whose power exponent is equal to one, are also found in a variety of systems. Gabaix (1999) showed that the distribution of city sizes follows Zipf’s law. Axtell (2001) showed that distributions of company sizes follow Zipf’s law. Econophysics focuses on the study of power laws in economies and financial markets. (For a recent review of the development of Econophysics, see Chakraborti et al. (2011a, b)).

Using cross-sectional data for the period 2004–2013 from companies publicly listed worldwide, Kaizoji and Miyano (2016a) showed that share price and financial indicators per share follow a power law distribution. For each of the 10 years examined, a power law distribution for share price was verified. Using panel data for the same period, Kaizoji and Miyano (2016b) developed an econometric model for share price and showed that a two-way fixed effects model identified from a panel regression with share price as the dependent variable and dividends per share, cash flow per share, and book value per share as explanatory variables effectively explains share price. Based on the same data, Kaizoji and Miyano (2016c) also found that share price and certain financial indicators per share follow Zipf’s law and verified that company fundamentals estimated using a two-way fixed effects model also follow Zipf’s law.

The aim of this current study is to (1) verify that the distributions of share price and fundamentals follow power laws at the regional level, and (2) investigate the regional characteristics of share price behavior following previous studies (Kaizoji and Miyano 2016a, b, c).

For this study, a number of companies listed worldwide were divided into four regions: America, Asia, Europe, and rest of the world.Footnote 1

Using this scheme, we found that the distributions of share price and financial indicators per share follow a power law distribution at the regional level. Further, we found that the distribution of fundamentals estimated using the two-way fixed effects model that was selected as the best model for all regions follows a power law distribution at the regional level and that the estimated power law exponents for share price are quite diverse by region, in the range 0.98–3.42.

This paper is organized as follows: Section 6.2 gives an overview of the share price data at the regional level; Section 6.3 describes the econometric model and presents the estimated results; Section 6.4 examines the estimated distributions of the fundamentals; Section 6.5 examines the financial indicators per share data used in the study; Section 6.6 concludes.

2 Data

The data source used here is the OSIRIS database provided by Bureau Van Dijk containing financial information on globally listed companies. In this study, we employ annual data for the period 2004–2013. Stock and financial data for a total of 7,796 companies for which data were available over this 10-year period were extracted from the database. Using this data, we performed a statistical investigation of share price and dividends per share, cash flow per share, and book value per share, all of which were obtained by dividing available values by the number of shares outstanding.

For analysis at the regional level, we divided the 7,796 companies selected into the four regions described above, using the ISO country code appropriate to the individual companies. The number of companies in each region was as follows: America, 1,886 companies; Asia, 4,065 companies; Europe, 1,436 companies; the rest of the world, 409 companies.Footnote 2

2.1 Power Law Distributions of Share Price in Regional Data

Using the same company data in a previous study, Kaizoji and Miyano (2016c) found that in the upper tail, which includes approximately 2 % of the total observations, the distributions of share price and financial indicators per share follow a power law distribution at the worldwide level. In this section, we investigate whether the distributions of share price follow a power law distribution at the regional level.

Defining a power law distribution is straightforward. Let x represent the quantity in whose distribution we are interested. (In our research, x represents share price or various financial indicators per share.)

Observed variable, X follows a power law distribution if its distribution is described byFootnote 3:

where F(x) denotes the cumulative distribution function, k denotes a scaling parameter corresponding to the minimum value of the distribution, and \(\alpha \) denotes the shape parameter. We call \(\alpha \) power law exponent.

By taking the logarithm of both sides of Eq. (6.1), the following equation is obtained:

If the distribution is plotted using logarithmic horizontal and vertical axes and appears approximately linear in the upper tail, we can surmise that the distribution follows a power law distribution.

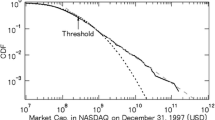

As a first step, we plotted complementary cumulative distributions for the data. Figure 6.1 shows the complementary cumulative distributions of share price by region, with logarithmic horizontal and vertical axes.Footnote 4

From Fig. 6.1, the regional complementary cumulative distributions of share price seem to be roughly linear in their upper tails, although the slopes differ, suggesting that the distributions of share price follow a power law distribution at the regional level. In addition, the distribution of share price for Europe appears to be close to that of the world in the upper tail. This suggests that a power law distribution for the world mostly originates from the European data.

In the second step, we estimate the power law exponent using the MLE (maximum likelihood estimator) method. The MLE is given by

where \(\hat{\alpha }\) denotes the estimates of \(\alpha , x_{i}, i=1,\cdots ,n\) are observed values of x, and \(x_{i}>x_{mim}\).Footnote 5 The results are presented in Table 6.1.

To test whether the distributions of share price observed at the regional level follow a power law distribution, we use a Cramér-von Mises test, one of the goodness-of-fit tests based on a measurement of distance between the distribution of empirical data and the hypothesized model. The distance is usually measured either by a supremum or a quadratic norm. The Kolmogorov-Smirnov statistic is a well-known supremum norm. The Cramér-von Mises family, using a quadratic norm, is given by

where \(F_{n}(x)\) denotes the empirical distribution function and F(x) denotes the theoretical distribution function. When \(\psi (x)=1\), Q is the Cramér-von Mises statistic, denoted \(W^{2}\). When \(\psi (x)=[F(x)(1-F(x))]^{-1}\), Q is the Anderson and Darling statistic, denoted \(A^{2}\).

Although a variety of goodness-of-fit statistics have been proposed, we use the \(W^{2}\) statistic of Cramér-von Mises in our research.Footnote 6 The test statistic of the Cramér-von Mises test is given by Eq. (6.4), with \(\psi (x)=1\).Footnote 7

The null hypothesis is that the distribution of observed data follows a power law distribution. Table 6.1 presents the estimates of the power law exponents and p-values for the tests.

As is evident here, the null hypothesis cannot be rejected at the 5 % significant level for all regions. As can be seen, the power law exponents are quite diverse by region. The power law exponent for Europe is close to that of the world, while the power law exponents for America and Asia are 3.4 and 2.1, respectively.

2.2 Changes in Averages and Variances of Share Price

Figures 6.2 and 6.3 show the changes in the averages and variances of share price, respectively. As indicated, Europe shows a notably high average, while Asia shows the lowest. All regions appear to show the same pattern of averages, experiencing an apparent fall in 2008 and slowly recovering after 2009. Regarding the changes in variance, in contrast with the average, America shows the largest variance and Europe shows the smallest variance before 2009. Variances tend to decline slightly after 2007, except for Europe, where they tend to rise slightly.

3 Econometric Model for Fundamentals

In our previous research, the model we chose to use was shown to have quite a high explanatory power with respect to share price. Therefore, we used a similar econometric model for our regional data in this current study.

3.1 Econometric Model

Assuming the relationship between share price and the set of financial indicators, that includes dividends per share, cash flow per share, and book value per share, to be logarithmic linear, the econometric model for our study can be written as

where i denotes cross-section (i.e., individual company), t denotes time point (year), and

\(Y_{it}\): share price for company i, at year t

a: constant term

\(X_{1,it}\): dividends per share for company i, at year t

\(X_{2,it}\): cash flow per share for company i, at year t

\(X_{3,it}\): book value per share for company i, at year t

\(u_{it}\): error term

We estimate the model in Eq. (6.5) using the Panel Least Squares method. In the panel regression model, the error term \(u_{it}\) can be assumed to be the two-way error component model. Details of the two-way error component model are described in Kaizoji and Miyano (2016b). The estimation models examined include the pool OLS model, the individual fixed effects model, the time fixed effects model, the two-way fixed effects model, the individual random effects model, and the time random effects model.Footnote 8

We perform the estimation by region. That is, we estimate 4 \(\times \) 6 models using the same method as the world model. The model selection tests are as follows: the likelihood ratio test and F-Test for the selection of the pool OLS model versus the fixed effects model; and the Hausman test for the selection of the random effects model versus the fixed effects model. The selection test for the pool OLS model vs the random effects model is based on the simple test proposed by Woodlridge (2010).Footnote 9

For all regions, the two-way fixed effects model is identified as the best model among the six alternatives. In a two-way fixed effects model, the error term consists of the following three terms:

\(\mu _{i}\): unobservable individual fixed effects

\(\gamma _{t}\): unobservable time fixed effects

\(\varepsilon _{it} \): pure disturbance

\(\mu _{i}\) is the individual fixed effect and represents the company’s effect on share price (among other factors). \(\gamma _{t}\) is the time fixed effect and is related to the point in time (year) affecting stock markets, among other factors (for example, factors caused by financial and economic shocks such as Global financial crisis in 2008).

Table 6.2 shows the regional results for the panel regression model described in Eq. (6.5). The signs of the three coefficients are all positive, consistent with corporate value theory. The p-values of the coefficients are quite small, indicating statistical significance for all regions. In addition, the \(R^{2}\) values are in the range 0.95–0.98, indicating that the estimated models explain the variation in share prices quite well. The econometric model for share price, using dividends per share, cash flow per share, and book value per share as explanatory variables, fits the actual data quite well at the regional level as well as at the world level.

Among the three financial indicators, the coefficient of book value per share (\(b_{3}\)) is largest in all regions, while the coefficient of dividends per share (\(b_{1}\)) is smallest, except for Europe. The constant term for Europe is quite large compared to the other regions.

3.2 Theoretical Value and Fundamentals

By multiplying both sides of Eq. (6.5) by the exponent function, \(\hat{Y}\)is obtained as written:

where \(\hat{Y}\) is the estimated value for share price, which we call the theoretical value.

We can remove the time fixed effects term, \(\gamma _{t}\), from the error term described in (6.6). After subtracting the time effects term from Eq. (6.6), \(\tilde{Y}\)is obtained by multiplying both sides of Eq. (6.5) by the exponent function:

As in our previous studies (Kaizoji and Miyano 2016b, c), we identify \(\tilde{Y}\) as the company fundamentals since the time effect common to all companies has been removed, leaving only the company fundamentals.

We investigated the distribution of fundamentals in the upper distribution tail by region. As described in Sect. 6.2, the distribution of share price follows a power law distribution at the regional level. Before investigating the distribution of fundamentals, we examined whether the distribution of fundamentals coincided with that of share price. Using a two-sample Kolmogorov-Smirnov test, we tested goodness-of-fit between company fundamentals and share price. Table 6.3 shows the results of the test as well as the relevant correlation coefficients. Given the test results shown in Table 6.3, the null hypothesis that the two distributions coincide cannot be rejected at the 5 % significant level, except in the case of Asia. With respect to the theoretical value, the null hypothesis cannot be rejected the 5 % significant level for all regions. Correlation coefficients with share price are in the range 0.97–0.99.

4 Power Law Distribution for Fundamentals

The complementary cumulative distributions of theoretical value and company fundamentals are shown in Figs. 6.4 and 6.5. As described in the previous section, the theoretical value is directly estimated using a two-way fixed effects model, while the fundamentals are computed by removing the time fixed effects term from the theoretical value. The two figures are plotted with logarithmic horizontal and vertical axes. Both figures show that the upper tails of the distributions appear roughly linear, although there are small differences among the regions. The distributions in Figs. 6.4 and 6.5 are quite similar to those shown in Fig. 6.1 for share price, suggesting that the regional distributions of theoretical value and company fundamentals also follow a power law distribution.

As described in Sect. 6.2.1, we performed an estimation of the power law exponents using the MLE method, then tested the null hypothesis of a power law distribution using the Cramér-von Mises test. Table 6.4 shows the estimated power law exponents and test results for the power law distribution hypothesis. For easy comparison with share price, we show the power law exponents and p-values for share price that were shown earlier in Table 6.1.

The power law exponents for theoretical value are similar to those of the company fundamentals and are close to share price, except in the case of America. For America, the power law exponents are extremely large for theoretical value and fundamentals, and differ from that of share price. The Cramér-von Mises test fails to reject the null hypothesis of a power law distribution for all regions. From these results, it can be said that the distributions of theoretical value and fundamentals follow a power law distribution at the regional level.

As can be seen here, the power law exponents of theoretical value and company fundamentals for Europe are close to 1, as are those for the world.

5 Power Law Distribution for Financial Indicators per Share

In the previous section, we showed that the distribution of fundamentals follows a power law distribution at the regional level. Kaizoji and Miyano (2016c) suggested that the reason why the distribution of company fundamentals follows a power law distribution is due to the fact that the distributions of financial indicators per share, representing corporate value, follows a power law distribution. In this study, we examined whether the distributions of financial indicators per share follow a power law distribution at the regional level.

Figures 6.6, 6.7 and 6.8 show the complementary cumulative distributions of dividends per share, cash flow per share, and book value per share using logarithmic horizontal and vertical axes. In these figures, it appears that the regional complementary cumulative distributions of financial indicators per share are roughly linear in their upper tails.

We show the estimated power law exponents and test results of the power law hypothesis in Table 6.5. Tests for the distributions of dividends per share and cash flow per share fails to reject the null hypothesis at 5 % significant level for America, Europe, and the rest of the world. However, the null hypothesis is rejected for Asia. For book value per share, the null hypothesis cannot be rejected at the 5 % significant level for all regions.

Figures 6.9, 6.10 and 6.11 show the changes in average of dividends per share, cash flow per share, and book value per share. The changes in average for dividends per share and cash flow per share fell slightly in 2009 except Asia. However, changes in average book value per share do not appear clearly in 2008–2009. As shown in Fig. 6.2, share prices in all regions seem to have been immediately affected by the global crisis in 2008, while the impact on the financial indicators per share seems to appear one year later.

Figures 6.12, 6.13 and 6.14 show the changes in the variance of dividends per share, cash flow per share, and book value per share. In contrast with the average, the variances of share price and the financial indicators per share are largest for America and relatively small for Europe. In addition, the variances of book value per share for America show a sharp decline from 2006 to 2008 and a relatively small difference from the other regions after 2008.

6 Concluding Remarks

In this study, we investigated whether the distribution of share price follows a power law distribution at the regional level. We found that the distribution of share price follows a power law distribution for all regions and that the regional power law exponents are quite diverse over the range 0.98–3.42.

Using a panel regression model for share price in which share price is the dependent variable and dividends per share, cash flow per share, and book value per share are the explanatory variables, we estimated the theoretical value. A two-way fixed effects model was identified as the best model for all regions. Since the two-way fixed effects model includes an individual fixed effects term and a time fixed effects term in its error term, we were able to produce a measure of company fundamentals by removing the time fixed effect from the theoretical value. The fact that the two-way fixed effects model was selected for all regions allowed us to consistently compute the fundamentals at the regional level in the same way.

The model was found to have quite a high power to explain share price at the regional level, showing large \(R^{2}\) values in the range of 0.95 to 0.98. As a result, we were able to show that the distributions of theoretical value coincide with the distributions of share price for all regions.

Investigating the distribution of company fundamentals at the regional level, we found that the distribution follows a power law distribution for all regions. In addition, the distribution of fundamentals was found to coincide with the distribution of share price for most regions.

Furthermore, the distributions of the financial indicators per share that were used as explanatory variables in the econometric model were shown to follow a power law distribution. From these results, it can be said that fundamentals consisting of the financial indicators per share and representing corporate value are the essential determinants of share price.

We found that the power law exponents were quite diverse by region. However, the power law exponents for Europe were close to those for the world. We surmised that the power law distribution for the world was heavily influenced by the European data. The power law exponents were not extensively examined at the regional level in this study but will be the theme for future studies.

Notes

- 1.

America includes North America, South America, and Central America. Asia includes eastern Asia, southern Asia, central Asia, and the Middle East. The rest of the world includes Oceania and Africa.

- 2.

Total observations available in each region were as follows: America, 8935; Asia, 27,407; Europe, 8,791; rest of the world, 2028.

- 3.

The probability density function for the Pareto distribution is defined as \(f(x)=\frac{\alpha k^{\alpha }}{x^{\alpha +1}}, \quad x \ge k > 0 \).

- 4.

The graph fo the rest of the world is excluded. This is done throughout since the numbers of companies in this is only 5.2 % of the total.

- 5.

Details of the derivations are presented (Kaizoji and Miyano 2016c).

- 6.

- 7.

The two classes of measurement and computational details for this test are found in Čížek and Weron (2005, Chap. 13)

- 8.

The two-way random effects model cannot be used since we use unbalanced panel observations.

- 9.

Woodlridge (2010, p.299) proposes a method that uses residuals from pool OLS and checks the existence of serial correlations.

References

Anirban Chakraborti, Ioane Muni Toke, Marco Patriarca & Frédéric Abergel (2011a) Econophysics review: I. Empirical facts, Quantitative Finance, Volume 11, Issue 7 991–1012.

Anirban Chakraborti, Ioane Muni Toke, Marco Patriarca & Frédéric Abergel (2011b) Econophysics review: II. Agent-based models, Quantitative Finance, Volume 11, Issue 7 1013–1041.

Axtell R L. (2001) Zipf’s Distribution of U.S.Firm Sizes, Science, Vol. 293, 1818–1820.

Clauset A., Shalizi C.R., and Newman M. E. (2009) Power law distributions in empirical data, SIAM Review, Vol. 51, No.4, pp.661–703.

Čížek P. Härdlle, W. Weron, R. (2005) Statiscal tools for finance and insurance. Springer, Berlin.

D’Agostino, R. B. and Stephans, M.A. (1986) Goodness-of-Fit Techniques, Marcel Dekker New York.

Gabaix, X. (1999). Zipf’s Law for Cities: An Explanation. The Quarterly Journal of Economics, 739–767.

Kaizoji T. and Miyano M. (2016a) Why does power law for stock price hold? Journal of Chaos Soliton and Fractals. (press).

Kaizoji T. and Miyano M. (2016b) Stock Market Crash of 2008: an empirical study on the deviation of share prices from company fundamentals, mimeo, to be submitted.

Kaizoji T. and Miyano M. (2016c) Zipf’s law for company fundamentals and share price, mimeo, to be submitted.

Newman M. E.J. (2005) Power laws, Pareto distributions an Zipf’s law, Contemporary Physics, Volume 46, Issue 5, 323–351.

Woodlridge J. M. (2010) Econometric Analysis of Cross Section and Panel Data, MIT press.

Acknowledgements

This research was supported by JSPS KAKENHI Grant Number 2538404, 2628089.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Miyano, M., Kaizoji, T. (2017). Power Law Distributions for Share Price and Financial Indicators: Analysis at the Regional Level. In: Abergel, F., et al. Econophysics and Sociophysics: Recent Progress and Future Directions. New Economic Windows. Springer, Cham. https://doi.org/10.1007/978-3-319-47705-3_6

Download citation

DOI: https://doi.org/10.1007/978-3-319-47705-3_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-47704-6

Online ISBN: 978-3-319-47705-3

eBook Packages: Physics and AstronomyPhysics and Astronomy (R0)