Abstract

A more complex logistics network has to be managed by retailers that also offer online sales, since new shipping and drop off options are offered to consumers in order to satisfy their expectations. The main goal of this paper is to propose a mixed integer linear programming (MILP) model that integrates forward and reverse material flows in a retailer’s omnichannel logistics network. The model proposed helps to determine the mix of orders and returns flows that minimizes costs, and also allows to quantify key trade offs associated to the different options offer in omnichannel models.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Online shopping and electronic commerce (e-commerce) continues to grow in importance since the advent of the Internet in the 1990s. In 2011, it represented 4.7 % of the total retail trades (U.S. Census Bureau 2013) and it is expected to grow to 10 % by 2017 with an average annual growth rate of 9 % (Forrester et al. 2013). At the end of 2010 mobile e-commerce represents 3 % and just one year later, mobile e-commerce was 9 % of e-commerce (Kleinman 2012). Growth rates may even be higher as Internet access has shifted from traditional computers to smartphones, increasing multichannel capabilities and the adoption of web retailing by large brick and mortar retailers.

The surge of Business to Consumer (B2C) e-commerce not only has made direct shipments from manufacturers and retailers to individuals grow, but it has also increased the rate of commercial returns that retailers need to manage in this new context. According to Guide et al. (2006) the return rates vary widely by product category, by season, and across global markets. For example, large traditional retailers, such as Home Depot, can have return rates of 10 % of sales or even higher due to liberal returns policies (Guide and Van Wanssenhove 2009). In the fashion apparel industry, this rate could increase up to 35 %. Returns percentages are also typically much higher for catalog sales and online sales (Guide et al. 2006).

Commercial returns are products returned to the retailer (or other actor in the reverse supply chain) by consumers after purchase. Tibben-Lembke (2004) provides a more detailed explanation of different types of commercial returns. Different retailers have different return policies (30, 60, 90 days), other have more liberal policies, allowing 365 days or even more. For instance, the returning online orders policy in Lands’ End, an online retailer in the USA, allows that online customers can return products at any time for an exchange or refund or tis purchase price (this policy only applies within the U.S.).

Reasons for returns also vary from products and industries. In the online retail fashion industry, where return rates are higher, color matching or sizing are the more typical reasons for returns. Many companies have identified the proper management of these commercial returns as a key aspect to achieve competitive advantage. According to Mollenkopf et al. (2007) online retailers should invest more in a more responsive and effective management of commercial returns.

There are also online retailers that are working on solutions that help them reduce online returns. For instance, Running Warehouse, an U.S. footwear retailer, has introduced an app which allows customers to find more accurate information about their shoe size and, as a result, this has reduced fit-related returns rates by 23 %.

In this new context more coordination between consumers, retailers and other actors in the direct and reverse supply chain is needed for both traditional and online sales. On the other hand, a more complex logistics network has to be managed by retailers and other actors, since new shipping and drop off options are offered to consumers in order to satisfy their expectation.

The management of a third party logistics (3PL’s) or a retailer’s network for the transportation and processing of commercial returns may require returns centers and collection points. Several authors, like Fleischmann et al. (2001), Fleischmann et al. (2003) and Jayaraman et al. (2003) have developed a zero-one mixed integer linear programming (MIP) models to define the right path for returns in reverse logistics systems. Such network design problems can be used to determine the flow between an intermediate transshipment sites, the refurbishment/recycling/return processing sites, and the collection points (origination sites) that minimize overall costs.

Due to the recent increasing development of omnichannel retailing, the newness of this paper rests on solving a network design problem that considers countless channels for both direct and reverse flows. In Sect. 2 a conceptual framework is introduced in order to identify the physical flows and associated costs of products in the logistics network of omnichannel retailers. Section 3 relates the trade offs in a MILP model to determine the optimal combination of flows that minimizes costs. Finally, conclusions and further research lines are proposed in Sect. 4.

2 Physical Flows of Products in Omnichannel Retailers

There are several options for both consumers and retailers to manage physical or online purchases and their associated commercial returns. The factors that affect the decisions for both depend on the costs and the lead times involved in the process.

Based on the available information found in the web sites of significant retailers that represented 79 % of online retail sales in 2012 in Spain (Euromonitor 2012), Table 1 shows the different options offered by retailers to online consumers for pickup and return their online purchased products.

The order fulfillment facilities are the facilities where online orders are processed:

-

Distribution centers for store replenishment and online orders fulfillment.

-

Fulfillment centers, exclusively for online order fulfillment.

-

Stores, that allow traditional purchases and fulfillment of online orders.

Once the merchandise is ready for being delivered, it can be transported to any of these product exchange points (PEP):

-

Stores. The customer picks up the online order in a traditional retailer.

-

Convenience collection points for pickup online orders such as: post offices; kiosks; automated package stations (APS); gas stations; and convenience stores.

-

Homes. Merchandise is delivered to consumers’ homes.

There are also different options in omnichannel models where consumers can drop-off their commercial returns. We named these points as “return exchange points” (REP), and the choices identified are the same as the PEP.

Finally, commercial returns can be processed in the order fulfillment facilities or they can be sent to a dedicated returns processing center.

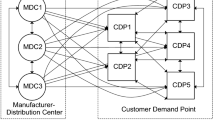

The red arrows in Fig. 1 represent the forward material flow, ε represents the demand (online purchased orders) and Xij the ordered units prepared at order fulfillment facilities (i) and delivered through the Product Exchange Points (j). Customers are depicted by l index, and Zjl represents the ordered units collected by customer l at PEP j. The blue arrows represents the reverse material flows associated with commercial returns (θ is the total commercial returns that enter into the system). Drop-off options for end customers that want to return their products are represented by REP at facilities j. Fixed and variables costs are associated to each facility represented in Fig. 1. In addition, customer costs associated to use each channel for pickup or drop-off options are also included.

Blackburn et al. (2004) identified the trade offs between responsive (short lead times) and efficient (low costs) supply chains and defined the product marginal value of time as a depreciation cost of the product affected by the total time of the recovery process and by the product characteristics. Depending on the combination of the locations in Fig. 1, costs and lead times will vary.

3 Model Proposed

Based on Fig. 1, a MILP model is proposed in this paper to determine the optimal combination of flows that minimizes overall costs in a forward/reverse logistic network that combines different channels for pickup online orders (different pickup collection options for customers) and different shipping returns options (drop-off options offer to customers for commercial returns).

Index sets

- i :

-

orders fulfillment facilities

- j :

-

product/return exchange points

- k :

-

returns processing facilities

- l :

-

customers

Decision variables

- X ij :

-

ordered units prepared at i and sent to j in a period of time T

- \( {{ \tilde{X}}}_{jk} \) :

-

returned units collected at j and sent to k in a period of time T

- \( \tilde{X}_{ki} \) :

-

processed units at k and sent to i to be redistributed in time T

- Z jl :

-

ordered units pickup/received by customer l from PEP j

- \( \tilde{Z}_{lj} \) :

-

returned units by customer l to REP j

- Y i , Y j , Y k :

-

binary variables, 1 if facility/option index is open, 0 otherwise

Parameters

- p i :

-

order fulfilment cost (cost of preparing the order in facility i)

- p j :

-

processing cost (of ordered units) in j

- r j :

-

returns management cost (of returns collected) in j

- p k :

-

returns processing cost in k

- f i , f j , f k :

-

fixed cost of opening a facility in the locations represented by the index sets

- c ij :

-

transportation costs from i to j

- c jk :

-

transportation costs from j to k

- c ki :

-

transportation costs from k to i

- d jl :

-

customer costs associated to pickup option from PEP j

- r lj :

-

customer costs associated to drop-off returns through REP j

- g i , g j , h j , g k :

-

maximum capacity of processed units in i, j, k

- ε l :

-

total units ordered by customers l

- ε :

-

total demand

- θ l :

-

total units returned by customers l

- θ :

-

total units returned by customers (total commercial returns collected)

- ρ k :

-

total units processed in k, but not sent to i in order to be re-distributed

- M :

-

very large number

The objective function and constraints of the model are:

Transportation variable cost

Fixed cost of facility operations

Processing cost of facility operations

Consumer variable cost associated to pick up and drop/off choices

s.t.:

Constraints (1)–(6) reinforce that any flow entering at each facility does not exceed its processing capacity. Constraint (3) and (5) refers to the capacity of location j to process returns (the capacity of each REP). Constraint (7) guarantees that all demand (ordered units) received at facilities i, are sent to customers l through j facilities (PEP options), and constraint (8) guarantees the balance of the reverse flows (all returned units collected through all REP j flow out to one of the k facilities in order to be processed). Constraint (9) means that returns can´t be bigger than the ordered units sent to customers, and (10) represents that the units of returns sent to i for being re-distributed can’t be bigger than the amount of returns plus the unit processed at k, but not sent for re-distribution. Constraints (11a)–(11e) allow inflow of units only to open facilities. Constraint (12) represents that orders collected by customers l from a PEP (j) need to be prepared in i facilities. Same idea represents constraint (13) but for commercial returns (the reverse flow), where all the returns collected in REP j need to be sent to k facilities to be processed. Constraints (14) and (15) represent the balance between customers l and demand per each channel j (PEP), and among customers l and returns per each j (REP) respectively. Finally constraints (16a)–(16e) and (17) define non-negativity and binary variables respectively.

4 Conclusions and Further Research

The main contribution of this paper is the proposal of a MILP model to evaluate key trade-offs when different options for pick up online purchase and drop-off commercial returns arise in omnichannel models. In this research paper, a conceptual framework of a complex forward and reverse logistics problem is proposed and the formulation of the MILP model is developed.

As a further research we propose to apply the model to a real case study (any of the retailers included in Table 1).

For any retailer that offers online sales, the comparison between their current logistics network and the solution of the model proposed in this paper would provide an interested insight of the appropriateness of the different channels and options offered in an omnichannel network. In order to improve business performance, the model could help retailers to determine which channels should have to be limited and which ones should be boosted.

A sensitivity analysis could be also conducted to analyse different commercial return rates in product categories, and how these rates could affect network configurations. Commercial return rates for fast moving consumer goods are much lower than the rates for electronics or apparel products, and also require less collection and returns processing resources. As online sales have higher commercial return rates there is also a greater interest to analyse and quantify the costs related to these reverse flows.

References

Blackburn JD, Guide VDR Jr, Souza GC, Van Wanssenhove LN (2004) Reverse supply chains for commercial returns. Calif Manage Rev Sci 46(2):6–22

Euromonitor (2012) Internet retailing in Spain

Fleischmann M, Beullens P, Bloemhorf-Ruwaard JM, Van Wassenhove LN (2001) The impact of recovery on logistics network design. Prod Oper Manage 10(2)

Fleischmann M, Bloemhof-Ruwaard JM, Beullens P, Dekker R (2003) Reverse logistics network design. In: Dekker R et al (eds) Reverse logistics, quantitative models for closed-loop supply chains. Springer, Berlin, pp 65–94

Forrester, Mulpuru S, Johnson C, Roberge D (2013) U.S. Online retail forecast, 2012 to 2017. Forrester. Forrester Research

Guide VDR Jr, Van Wanssenhove L (2009) The evolution of closed-loop supply research. Oper Res 57:10–18

Guide VDR Jr, Souza LN, Van Wanssenhove L, Blackburn JD (2006) Time value of commercial product returns. Manage Sci 52:1200–1214

Jayaraman V, Patterson RA, Rolland E (2003) The design of reverse distribution networks: models and solution procedures. Eur J Oper Res 150(2003):128–149

Kleinman S (May 2012) Online shopping customer experience study. ComScore

Mollenkopf DA, Rabinovich E, Laseter TM, Boyer KK (2007) Managing internet product returns: a focus on effective service operations. Decis Sci 38(2)

Tibben-Lembke R (2004) Strategic use of the secondary market for retail consumer goods. Calif Manage Rev 46:90–104

U.S. Census Bureau (2013) U.S. retail trade sales total and E-commerce

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing Switzerland

About this paper

Cite this paper

Guerrero-Lorente, J., Ponce-Cueto, E., Blanco, E.E. (2017). A Model that Integrates Direct and Reverse Flows in Omnichannel Logistics Networks. In: Amorim, M., Ferreira, C., Vieira Junior, M., Prado, C. (eds) Engineering Systems and Networks. Lecture Notes in Management and Industrial Engineering. Springer, Cham. https://doi.org/10.1007/978-3-319-45748-2_10

Download citation

DOI: https://doi.org/10.1007/978-3-319-45748-2_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-45746-8

Online ISBN: 978-3-319-45748-2

eBook Packages: EngineeringEngineering (R0)