Abstract

We consider the neoclassical one-sector growth model in continuous time with elastic labor supply and a learning-by-doing externality. It is shown that this model can have a continuum of balanced growth paths. Some of these balanced growth paths can be locally unique (determinate) whereas others can be indeterminate.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Journal of Economic Literature Classification Codes:

1 Introduction

The neoclassical one-sector growth model with infinitely-lived households and endogenous labor supply combines two of the most fundamental macroeconomic tradeoffs in a simple dynamic general equilibrium setting: the division of output between consumption and investment and the division of time between productive activities and leisure. It is therefore not surprising that this model forms the non-stochastic backbone of real business cycle theories, which have been developed to simulate the reaction of output and employment to various types of exogenous shocks.Footnote 1

The present note seeks to contribute to the understanding of the complexities that can arise in this rather simple model. More specifically, we augment the basic framework by a mechanism that generates endogenous growth and prove that the resulting model can have infinitely many different balanced growth paths. In order to see how this finding adds to existing knowledge, we start by providing a brief and selective survey of the literature. In doing this, it is useful to distinguish between results that have been proved for the discrete-time version of the model and those that hold in its continuous-time counterpart.

Using a discrete-time framework and considering the model without a growth-generating mechanism, De Hek (1998) shows by means of numerical examples that there can be multiple (i.e., finitely many) steady states as well as stable period-2 cycles. Kamihigashi (2015) addresses the multiplicity of steady states in a more systematic way and proves that the model can have any finite number of steady states or even a continuum of steady states. Moreover, multiplicity of steady states can occur for all values of the time-preference factor between 0 and 1 and for all production functions satisfying standard assumptions. Sorger (2015) proves a similar result for period-2 cycles by showing that such periodic solutions can occur for all values of the time-preference factor between 0 and 1 even if one restricts the technology to be of the Cobb-Douglas type. He also shows that the model can generate period-3 cycles and topological chaos if the time-preference factor is sufficiently small.

Whereas the findings of Kamihigashi (2015) can easily be transferred to the continuous-time setting, this is not the case for those of Sorger (2015). This follows from a result by Hartl (1987) according to which all optimal solutions to continuous-time dynamic optimization problems with a single state variable must be monotonic. Sorger (2000a) studies the model in continuous time without endogenous growth as a decentralized market economy and allows that the households differ from each other with respect to their initial capital holdings (they are assumed to be identical in all other respects). He finds that even with the standard parameterizations used in real business cycle models, there exists a continuum of steady states that differ from each other not only with respect to the distribution of capital among households but also with respect to the level of aggregate output. Sorger (2000b) transfers these results into a model with endogenous growth that is driven by a learning-by-doing externality à la Arrow (1962) and Romer (1986). He shows that such an endogenous growth model admits a continuum of balanced growth paths that differ from each other with respect to the income distribution and the long-run growth rate of the economy. It is important to emphasize, however, that the possibility of infinitely many steady states or balanced growth paths in Sorger (2000a,b), respectively, is solely due to the heterogeneous initial endowments of the households. In both papers, the steady state or balanced growth path, respectively, would be unique if a representative household assumption would be imposed. Benhabib and Farmer (1994) already note that the model with a representative household can have two interior balanced growth paths if one allows for production externalities that generate increasing returns to scale on the aggregate level. Eriksson (1996) uses a continuous-time model and standard parameterizations of preferences and technology to show that the long-run growth rate typically depends on the preference parameters both when growth is due to exogenous technological progress and when it is generated endogenously.

In view of the above mentioned results, the present note can be interpreted in two different ways: either as a translation of the results about the multiplicity of steady states from Kamihigashi (2015) into a setting with endogenous growth, or as a complement to Sorger (2000b) which shows the possibility of a continuum of balanced growth paths without resorting to heterogeneity of households. In this respect, it has to be noted that the translation of the results by Kamihigashi (2015) to a framework with endogenous growth is by no means trivial. This is so because the elasticity of marginal utility of consumption must be constant along every balanced growth path, which considerably restricts the preferences for which balanced growth paths can occur. Therefore one cannot proceed as in Kamihigashi (2015), namely by fixing the technology (in an arbitrary way) and choosing preferences such that multiple steady states exist. Instead we start from a fixed preference specification that is consistent with balanced growth and choose the production function so as to allow for a continuum of balanced growth paths.

The paper is organized as follows. Section 2 formulates the model and defines equilibria and balanced growth paths and Sect. 3 presents the results.

2 Model Formulation

In this section we formulate the one-sector growth model with elastic labor supply. The basic structure of the model is identical to the deterministic version of the standard real business cycle model in continuous time. In order to allow for endogenous growth, we include a learning-by-doing externality à la Arrow (1962) and Romer (1986). Similar formulations have been studied for example by Benhabib and Farmer (1994), Eriksson (1996), and Sorger (2000b).

Consider an economy that evolves continuously over the infinite time-horizon \(\mathbb{R}_{+}\). There exists a unit interval of identical and infinitely-lived households. The representative household is endowed with k(0) > 0 units of capital at time 0 as well as with a constant flow (normalized to 1) of time that can be used either for work or for leisure. Let us denote the rate at which the household consumes output at time t by c(t) ≥ 0, the rate at which it supplies labor to the firms by ℓ(t) ∈ [0, 1], and the capital holdings (wealth) of the household at time t by k(t). This implies that, at time t, leisure is consumed at rate 1 − ℓ(t). The flow budget constraint of the representative household can be expressed as

where δ > 0 is the rate at which capital depreciates and where q(t) and w(t) are the factor prices of capital and labor, respectively, at time t. The household maximizes the objective functional

subject to the flow budget constraint (1) and the no-Ponzi game condition

where ρ > 0 is the time-preference rate and where u is the instantaneous utility function.

Assumption 1

The function \(u: \mathbb{R}_{+} \times [0,1]\mapsto \mathbb{R}\) is continuous, non-decreasing, and concave. On the interior of its domain it is twice continuously differentiable as well as strictly increasing and strictly concave in each of its arguments.

There exists a unit interval of identical firms i ∈ [0, 1], which rent the factor inputs from the households and maximize their profits. Denoting the capital input and the labor input of firm i at time t by K i (t) and L i (t), respectively, firm i produces output at time t at the rate F(K i (t), A(t)L i (t)), where A(t) is the efficiency of labor at time t and where F is the production function. Every firm i takes the factor prices as well as the efficiency of labor as given and maximizes the profit rate, which is given by

at each time t subject to non-negativity constraints on both factor inputs.

Assumption 2

The function \(F: \mathbb{R}_{+}^{2}\mapsto \mathbb{R}_{+}\) is continuous, non-decreasing, concave, and homogeneous of degree 1. On the interior of its domain it is twice continuously differentiable as well as strictly increasing and strictly concave in each of its arguments. Furthermore, it holds that F(0, 1) = 0.

Since all firms are identical it holds that K i (t) = K(t) and L i (t) = L(t), where K(t) = ∫ 0 1 K i (t) di and L(t) = ∫ 0 1 L i (t) di are the aggregate factor inputs at time t. We follow Arrow (1962) and Romer (1986) and assume that the efficiency of labor is positively related to the aggregate capital stock. More specifically, we assume that A(t) is proportional to K(t) and we normalize the factor of proportionality without loss of generality by 1, that is,

An economy is a quadruple (u, ρ, F, δ) consisting of a utility function u satisfying Assumption 1, a time-preference rate ρ > 0, a production function F satisfying Assumption 2, and a capital depreciation rate δ > 0.

An equilibrium of the economy (u, ρ, F, δ) is a family of functions {k, ℓ, c, (K i , L i ) i ∈ [0, 1], K, L, A, q, w}, all defined on the common domain \(\mathbb{R}_{+}\), such that the following conditions hold:

-

1.

Given q and w, the triple (k, ℓ, c) maximizes (2) subject to (1) and (3).

-

2.

For all i ∈ [0, 1], all \(t \in \mathbb{R}_{+}\), and given (q(t), w(t), A(t)) it holds that the pair (K i (t), L i (t)) maximizes (4).

-

3.

The factor markets clear at all times, that is, L i (t) = L(t) = ℓ(t) and K i (t) = K(t) = k(t) hold for all \(t \in \mathbb{R}_{+}\).Footnote 2

-

4.

The externality condition (5) holds for all \(t \in \mathbb{R}_{+}\).

An equilibrium is said to be interior if none of the non-negativity constraints on the functions ℓ, 1 − ℓ, c, (K i , L i ) i ∈ [0, 1] binds at any time t.

A balanced growth path (BGP) is an equilibrium such that all functions k, ℓ, c, (K i , L i ) i ∈ [0, 1], K, L, A, q, and w take strictly positive values and have constant growth rates.Footnote 3

3 Results

Let us define the intensive production function \(f: \mathbb{R}_{+}\mapsto \mathbb{R}_{+}\) by f(x) = F(x, 1). Under Assumption 2 it follows that the intensive production function is continuous, strictly increasing, and concave, and that it is twice continuously differentiable on the interior of its domain. Moreover, it holds that f(0) = 0. The following lemma states necessary and sufficient equilibrium conditions.

Lemma 1

Consider an economy (u,ρ,F,δ) and let f be the intensive production function.

-

(a)

If {k,ℓ,c,(K i ,L i ) i∈[0,1] ,K,L,A,q,w} is an interior equilibrium of the economy (u,ρ,F,δ), then it follows that the functions k, ℓ, c satisfy the conditions Footnote 4

$$\displaystyle\begin{array}{rcl} & & \dot{k}(t)/k(t) =\ell (t)f(1/\ell(t)) -\delta -c(t)/k(t), {}\end{array}$$(6)$$\displaystyle\begin{array}{rcl} & & u_{2}(c(t),1 -\ell (t)) = k(t)[\,f(1/\ell(t)) - f'(1/\ell(t))/\ell(t)]u_{1}(c(t),1 -\ell (t)), {}\end{array}$$(7)$$\displaystyle\begin{array}{rcl} & & u_{11}(c(t),1 -\ell (t))\dot{c}(t) - u_{12}(c(t),1 -\ell (t))\dot{\ell}(t) \\ & & \quad = [\rho +\delta - f'(1/\ell(t))]u_{1}(c(t),1 -\ell (t)), {}\end{array}$$(8)$$\displaystyle\begin{array}{rcl} & & \lim _{t\rightarrow +\infty }e^{-\rho t}u_{ 1}(c(t),1 -\ell (t))k(t) = 0. {}\end{array}$$(9) -

(b)

Conversely, if there exist strictly positive functions k, ℓ, c such that ℓ(t) < 1 and conditions (6)–(9)hold, then one can find functions (K i ,L i ) i∈[0,1] , K, L, A, q, and w such that {k,ℓ,c,(K i ,L i ) i∈[0,1] ,K,L,A,q,w} is an equilibrium of the economy (u,ρ,F,δ).

Proof

The necessary and sufficient conditions for (K i (t), L i (t)) to be an interior maximum in (4) are q(t) = F 1(K i (t), A(t)L i (t)) and w(t) = A(t)F 2(K i (t), A(t)L i (t)). Since equilibrium requires K i (t) = K(t) = k(t), L i (t) = L(t) = ℓ(t), and (5) and since F is homogeneous of degree 1, this implies that

The Hamiltonian of the representative household’s optimization problem is

where λ denotes the adjoint variable. The necessary and sufficient first-order conditions for an interior maximum areFootnote 5

Eliminating the adjoint variable from these conditions and using the expressions for the factor prices from (10), we obtain the conditions stated in part (a). It is obvious that these steps can be reversed such that part (b) is proven as well. □

Let us now focus on BGP. Since ℓ(t) = L(t) = L i (t) ∈ [0, 1] must hold for all i ∈ [0, 1] and all \(t \in \mathbb{R}_{+}\), the growth rate of ℓ(t) must be non-positive. Eriksson (1996) focuses on the case where ℓ(t) has a negative growth rate because he wants to match the stylized fact of falling labor supply. BGP with declining labor supply, however, are only possible if the production function is of the Cobb-Douglas form (at least for sufficiently large capital-labor ratios), as Eriksson (1996) indeed assumes. Furthermore, capital and consumption must also be declining. This is shown in our next lemma.

Lemma 2

Consider an economy (u,ρ,F,δ) and assume that there exists a BGP along which labor supply declines. Then there exist numbers A, α, and κ such that the intensive production function f satisfies f(x) = Ax α for all x ≥ κ.Furthermore, the growth rates of capital and consumption along the BGP must be negative as well.

Proof

Suppose that there exists a BGP along which capital, consumption, and labor grow at the rates γ k , γ c , and γ ℓ . Suppose furthermore that γ ℓ < 0. From (6) it follows that

Suppose first that γ c = γ k . In this case it is obvious that \(\ell(0)e^{\gamma _{\ell}t}f(\ell(0)^{-1}e^{-\gamma _{\ell}t})\) must be independent of t, that is, there exists \(m \in \mathbb{R}_{+}\) such that \(\ell(0)e^{\gamma _{\ell}t}f(\ell(0)^{-1}\) \(e^{-\gamma _{\ell}t}) = m\) holds for all \(t \in \mathbb{R}_{+}\). This implies that

Differentiating this equation with respect to t we obtain \(f'(1/\ell(t)) = f'(\ell(0)^{-1}e^{-\gamma _{\ell}t}) = m\) for all \(t \in \mathbb{R}_{+}\). Obviously, this is a contradiction to the strict concavity of f and it follows that γ c ≠ γ k .

If γ c ≠ γ k , then Eq. (11) can only hold for all \(t \in \mathbb{R}_{+}\) if γ k = −δ and if

holds for all \(t \in \mathbb{R}_{+}\), where m = c(0)∕[k(0)ℓ(0)] and μ = γ c −γ k −γ ℓ . Differentiation with respect to t yields

Obviously, this implies that f(x) = Ax α for some \(A \in \mathbb{R}\), α = −μ∕γ ℓ , and all x ≥ κ = 1∕ℓ(0). Since γ ℓ < 0 and α = −μ∕γ ℓ = (γ k −γ c )∕γ ℓ + 1 ∈ (0, 1) must hold, it follows that γ c < γ k = −δ < 0. This completes the proof of the lemma. □

Note that the proof of the above lemma uses only the equilibrium condition (6), which is the capital accumulation equation. In other words, the lemma holds independently of the specification of the preferences. We consider the case of a BGP along which capital, consumption, and labor supply decline as rather uninteresting and will therefore from now on focus on those BGP, along which the labor supply remains constant. Furthermore, in what follows, we assume that the utility function is specified by

where σ ∈ (0, 1) is the elasticity of marginal utility of consumption. It is easy to see that this function satisfies Assumption 1. The following lemma characterizes those BGP along which labor supply remains constant.

Lemma 3

Consider an economy (u,ρ,F,δ) in which the utility function u is given by (12)and let f be the intensive production function. There exists an interior BGP along which labor supply is constant and equal to \(\hat{\ell}\) if and only if the conditions

hold.

Proof

Suppose that \(\ell(t) =\hat{\ell}\) holds for all \(t \in \mathbb{R}_{+}\). It follows immediately from (6) that k and c must grow at the same rate, such that k(t)∕c(t) = k(0)∕c(0) holds for all \(t \in \mathbb{R}_{+}\). Let us denote the common growth rate of capital and consumption by γ. With this notation, we can rewrite the equilibrium conditions for a BGP (with constant labor supply \(\hat{\ell}\)) from (6)–(9) as

Solving the first and the third of these conditions for γ and c(0)∕k(0) and substituting the results into the other two conditions, we obtain (13)–(14). □

We are now ready to state the main result of the paper.

Theorem 1

Fix any strictly positive values ρ and δ. There exist functions u and F satisfying Assumptions 1 and 2,respectively, such that the economy (u,ρ,F,δ) admits a continuum of mutually different BGP.

Proof

Because of Lemma 3 it is sufficient to show that there exists a strictly increasing, strictly concave, and smooth function \(f: \mathbb{R}_{+}\mapsto \mathbb{R}_{+}\) with f(0) = 0 such that conditions (13)–(14) hold for a continuum of values \(\hat{\ell}\in (0,1)\). We proceed in four steps.

- Step 1: :

-

Let Q be an arbitrary positive number and define the function \(\phi: [0,(2-\sigma )/(1-\sigma )]\mapsto \mathbb{R}_{+}\) by

$$\displaystyle{\phi (x) = Q[2 -\sigma -(1-\sigma )x]^{(1-\sigma )/(2-\sigma )}x^{1/(2-\sigma )} + \frac{\rho +(1-\sigma )\delta } {1-\sigma } x.}$$Obviously, ϕ is continuous, satisfies ϕ(0) = 0, and is twice continuously differentiable on the interior of its domain. The first- and second-order derivatives of ϕ are

$$\displaystyle{\phi '(x) = Q[1 - (1-\sigma )x][2 -\sigma -(1-\sigma )x]^{-1/(2-\sigma )}x^{-(1-\sigma )/(2-\sigma )} + \frac{\rho +(1-\sigma )\delta } {1-\sigma } }$$and

$$\displaystyle{\phi ''(x) = -Q(1-\sigma )[2 -\sigma -(1-\sigma )x]^{-(3-\sigma )/(2-\sigma )}x^{-(3-2\sigma )/(2-\sigma )}.}$$Because of Q > 0 and σ ∈ (0, 1) we have ϕ″(x) < 0 for all x ∈ (0, (2 −σ)∕(1 −σ)) and it follows that ϕ is strictly concave.

- Step 2: :

-

Define x = 1∕(1 −σ). It is easy to see that lim x → 0 ϕ′(x) = +∞, ϕ′(x) = [ρ + (1 −σ)δ]∕(1 −σ) > 0, and lim x → (2−σ)∕(1−σ) ϕ′(x) = −∞. Consequently, there exists a unique value x 0 ∈ (x, (2 −σ)∕(1 −σ)) for which ϕ′(x 0) = 0 holds. We choose an arbitrary number \(\bar{x} \in (\underline{x},x_{0})\) and note that \(\phi '(\bar{x}) > 0\) holds.

- Step 3: :

-

Let \(\tilde{\phi }: [\bar{x},+\infty )\mapsto \mathbb{R}_{+}\) be an arbitrary smooth, strictly increasing, and strictly concave function that satisfies \(\tilde{\phi }(\bar{x}) =\phi (\bar{x})\), \(\tilde{\phi }'(\bar{x}) =\phi '(\bar{x})\), and \(\tilde{\phi }''(\bar{x}) =\phi ''(\bar{x})\). We define the intensive production function \(f: \mathbb{R}_{+}\mapsto \mathbb{R}_{+}\) by

$$\displaystyle{f(x) = \left \{\begin{array}{cl} \phi (x)&\mbox{ if }0 \leq x \leq \bar{ x},\\ \tilde{\phi }(x) &\mbox{ otherwise} \end{array} \right.}$$and the production function \(F: \mathbb{R}_{+}^{2}\mapsto \mathbb{R}_{+}\) by F(K, AL) = ALf(K∕(AL)). From steps 1 and 2 and the construction of f it follows that f is continuous, strictly increasing, strictly concave, and twice continuously differentiable on the interior of its domain. Moreover, it holds that f(0) = 0. It is easy to see that these properties imply that F satisfies Assumption 2.

- Step 4: :

-

Finally consider an arbitrary \(\hat{\ell}\in [1/\bar{x},1/\underline{x})\) and define \(\hat{x} = 1/\hat{\ell}\). Note that this implies \(\hat{x} \in (\underline{x},\bar{x}]\) and, consequently, that \(f(\hat{x}) =\phi (\hat{x})\) and \(f'(\hat{x}) =\phi '(\hat{x})\) hold. It follows therefore that conditions (13)–(14) can be written as

$$\displaystyle{[1 - (1-\sigma )\hat{x}]\frac{\phi (\hat{x})} {\hat{x}} +\rho +(1-\sigma )\delta = [2 -\sigma -(1-\sigma )\hat{x}]\phi '(\hat{x})}$$and

$$\displaystyle{\phi '(\hat{x}) < \frac{\rho +(1-\sigma )\delta } {1-\sigma }.}$$Using the expressions for ϕ(x) and ϕ′(x) stated in step 1, it is straightforward to verify that the first condition holds. The second one follows from \(\hat{x} >\underline{ x}\) and the definition of x.The proof of Theorem 1 is now complete.

□

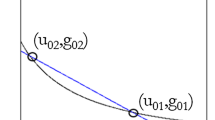

The above theorem demonstrates that there exists an economy with a continuum of interior BGP. Using arguments similar to those employed in the proof of Proposition 3 in Kamihigashi (2015) one can also show that, for every integer n, there exists an economy with exactly n different BGP. We will not provide the details of such a proof here. Instead, we want to illustrate a different way of proving the possibility of multiple BGP. This alternative proof has the advantage that it allows us also to verify local uniqueness or indeterminacy, respectively, of the BGP.

Lemma 4

Consider an economy (u,ρ,F,δ) in which the utility function is given by (12).Let f be the intensive production function and define \(W: \mathbb{R}_{+}\mapsto \mathbb{R}_{+}\) by W(x) = f(x) − xf′(x).

-

(a)

If {k,ℓ,c,(K i ,L i ) i∈[0,1] ,K,L,A,q,w} is an interior equilibrium of the economy (u,ρ,F,δ), then it follows that the function ℓ satisfies the differential equation

$$\displaystyle\begin{array}{rcl} \frac{\sigma W'(1/\ell(t))\dot{\ell}(t)} {\ell(t)^{2}W(1/\ell(t))}& =& \left [1 -\frac{1-\sigma } {\ell(t)} \right ]\ell(t)f(1/\ell(t)) +\rho +(1-\sigma )\delta \\ & & \quad -\left [2 -\sigma -\frac{1-\sigma } {\ell(t)} \right ]f'(1/\ell(t)). {}\end{array}$$(15) -

(b)

Conversely, if there exists a function ℓ such that ℓ(t) ∈ (0,1) and Eq. (15)hold, then one can find functions k, c, (K i ,L i ) i∈[0,1] , K, L, A, q, and w such that the family of functions {k,ℓ,c,(K i ,L i ) i∈[0,1] ,K,L,A,q,w} forms an interior equilibrium of (u,ρ,F,δ).

Proof

If the utility function is given by (12), then conditions (7)–(8) simplify to

From (16) it follows that

which, in turn, implies

Combining (6) with (18) one obtains

Using this equation to eliminate \(\dot{k}(t)/k(t)\) from (19) and substituting the resulting expression for \(\dot{c}(t)/c(t)\) into (17) we obtain after some algebraic manipulations equation (15). Conversely, if a solution ℓ of Eq. (15) is given such that ℓ(t) ∈ (0, 1) holds for all \(t \in \mathbb{R}_{+}\), then one can compute c(t)∕k(t) from (18). Substituting this result into (6) one obtains a differential equation that can be used to compute k. □

Note that Eq. (15) is a differential equation for the labor supply, which is a jump variable. Hence, no initial value ℓ(0) is given. This observation allows us to derive the following characterization of the determinacy of BGP.

Theorem 2

Consider an economy (u,ρ,F,δ) in which the utility function is given by (12)and let f be the intensive production function. Consider an interior BGP with constant labor supply equal to \(\hat{\ell}\) . This BGP is a locally unique equilibrium if

holds, and it is indeterminate if the above inequality holds with the reversed (strict) inequality sign.

Proof

The labor supply ℓ(t) is a jump variable for which no initial value is given. A BGP with constant labor supply \(\hat{\ell}\) is therefore locally unique if \(\hat{\ell}\) is an unstable fixed point of Eq. (15) and it is indeterminate if \(\hat{\ell}\) is a stable fixed point of (15). Denoting the right-hand side of Eq. (15) by g(ℓ(t)) it is easy to see that

Since W′(x) > 0 holds for all \(x \in \mathbb{R}_{+}\), it is clear that \(\hat{\ell}\) is an unstable fixed point of (15) if \(g'(\hat{\ell}) > 0\) holds and that it is locally asymptotically stable if \(g'(\hat{\ell}) < 0\) is satisfied. This completes the proof of the theorem. □

It is well known that the one-sector growth model with elastic labor supply and production externalities can have indeterminate equilibria; see Benhabib and Rustichini (1994) or Benhabib and Farmer (1994). The reason why we include the above theorem in this paper is that our setting allows for multiple BGP, whereas the existing literature typically makes assumptions under which there exists exactly one BGP. As will be illustrated in the following example, the model can simultaneously have determinate and indeterminate BGP.

Example 1

Suppose that the intensive production function f satisfies

It is not difficult to see that a smooth, strictly increasing, and strictly concave function f with these properties exists. Now consider the utility function from (12) with parameter σ = 1∕2. Furthermore, choose the unit of time in such a way that ρ +δ∕2 = 1. With these specifications it follows that conditions (13)–(14) hold for both \(\hat{\ell}= 3/8\) and \(\hat{\ell}= 2/5\). Hence, the economy (u, ρ, F, δ) has (at least) two interior BGP with labor supplies 3∕8 and 2∕5, respectively. Substituting the value \(\hat{\ell}= 3/8\) into the condition stated in Theorem 2, it can be seen that the BGP with \(\hat{\ell}= 3/8\) is indeterminate if f″(3∕8) < −459∕80 whereas it is locally unique if f″(3∕8) > −459∕80. Analogously, the BGP with \(\hat{\ell}= 2/5\) is indeterminate if f″(2∕5) < −16∕5 and it is locally unique if f″(2∕5) > −16∕5.

Finally, let us define the elasticities ɛ 0(x) = f′(x)x∕f(x) and ɛ 1(x) = | f″(x)x∕f′(x) | . Using this notation we can write the inequality stated in Theorem 2 as

This shows that the BGP with constant labor supply equal to \(\hat{\ell}\) is locally unique if both elasticities \(\varepsilon _{0}(1/\hat{\ell})\) and \(\varepsilon _{1}(1/\hat{\ell})\) are small, whereas it is indeterminate if at least one of these elasticities is sufficiently large.

Notes

- 1.

In growth theory, however, the labor-leisure trade-off is surprisingly often disregarded. Eriksson (1996) writes that “The choice between work and leisure has been remarkably neglected in the theory of economic growth” (Eriksson 1996, p. 533) and even the very comprehensive and more recent survey of economic growth theory provided by Acemoglu (2009) does not discuss the case of elastic labor supply except for briefly mentioning real business cycle models in Section 17.3.

- 2.

It follows from Walras’ law that the output market clears as well.

- 3.

The growth rate of a function \(z: \mathbb{R}_{+}\mapsto \mathbb{R}_{++}\) at time t is given by \(\dot{z}(t)/z(t)\).

- 4.

Partial derivatives are denoted by subscripts. For example, u 1 (c, 1 − ℓ) denotes the partial derivative of the function u with respect to its first argument evaluated at the point (c, 1 − ℓ).

- 5.

See Feichtinger and Hartl (1986).

References

Acemoglu, D. (2009). Introduction to modern economic growth. Princeton, NJ: Princeton University Press.

Arrow, K. J. (1962). The economic implications of learning by doing. Review of Economic Studies, 29, 155–173.

Benhabib, J., Farmer, R. E. A. (1994). Indeterminacy and increasing returns. Journal of Economic Theory, 63, 19–41.

Benhabib, J., Rustichini, A. (1994). Introduction to the symposium on growth, fluctuations, and sunspots: Confronting the data. Journal of Economic Theory, 63, 1–18.

De Hek, P. (1998). An aggregative model of capital accumulation with leisure-dependent utility. Journal of Economic Dynamics and Control, 23, 255–276.

Eriksson, C. (1996). Economic growth with endogenous labor supply. European Journal of Political Economy, 12, 533–544.

Feichtinger, G., & Hartl, R. F. (1986). Optimale Kontrolle Ökonomischer Prozesse. Berlin: de Gruyter.

Hartl, R. F. (1987). A simple proof of the monotonicity of the state trajectories in autonomous control problems. Journal of Economic Theory, 41, 211–215.

Kamihigashi, T. (2015). Multiple interior steady states in the Ramsey model with elastic labor supply. International Journal of Economic Theory, 11, 25–37.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94, 1002–1037.

Sorger, G. (2000a). Income and wealth distribution in a simple model of growth. Economic Theory, 16, 23–42.

Sorger, G. (2000b). Income distribution and endogenous growth. In E. J. Dockner, R. F. Hartl, M. Luptac̆ik, & G. Sorger (Eds.), Optimization, dynamics, and economic analysis (pp. 181–189). Wien: Physica.

Sorger, G. (2015). Cycles and chaos in the one-sector growth model with elastic labor supply. Working Paper, University of Vienna.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Sorger, G. (2016). Multiplicity of Balanced Growth Paths in an Endogenous Growth Model with Elastic Labor Supply. In: Dawid, H., Doerner, K., Feichtinger, G., Kort, P., Seidl, A. (eds) Dynamic Perspectives on Managerial Decision Making. Dynamic Modeling and Econometrics in Economics and Finance, vol 22. Springer, Cham. https://doi.org/10.1007/978-3-319-39120-5_11

Download citation

DOI: https://doi.org/10.1007/978-3-319-39120-5_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-39118-2

Online ISBN: 978-3-319-39120-5

eBook Packages: Business and ManagementBusiness and Management (R0)