Abstract

Task 17 of the International Energy Agency’s Implementing Agreement for Hybrid and Electric Vehicles was working on the System Optimization and Vehicle Integration of electrified vehicles to enhance the overall vehicles performance. The Task successfully demonstrated that lightening the vehicle (by using bionic concepts, smart materials and functional integration), improving the electric power control unit (trough improvement of the electrical and electronic architecture), optimizing thermal management solutions and improving the battery management system, can help to improve the energy efficiency and the overall system performance of such a vehicle. These improvements can significantly increase the drive range and reduce costs and therefore can make the vehicle more attractive in terms of customer acceptance. Some of the developed methods and improvements are now being used in current vehicles, which highlight the significant importance and success of this Task.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

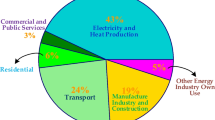

Worldwide industry and government are forced to consider alternative and sustainable solutions for transportation. Vehicles, driven by alternative drive train offer a unique advantage concerning energy efficiency, emissions reduction, and reduced petroleum use and have thus become a research focus around the world.

Studies—conducted by the IEA—pointed out, that there are approximately 700,000 BEVs and PHEVs on the streets (as per May 1st 2015). It’s expected to reach the 1 million mark till the end of 2015. There are predictions that the EV market will reach 8 % of total car sales by 2020 (2.5 Mio. BEVs, 3.1 Mio. PHEVs and 6.5 Mio. HEVs (Source: Bosch, 2015)).

Electronic systems involved in the operation and monitoring of such vehicles have been the subject of substantial improvements during the past few years. Consequently, these systems not only have gained importance in conventional transport systems, but they also have improved the perspectives for electric drive trains. Nevertheless, further optimization of these components and new concepts for their integration in the overall system tuned to the specific requirements of different vehicle applications is necessary.

Task 17 was running for a period of five years (2010–2015) and was working on the system optimization and vehicle integration of xEVs to enhance the overall vehicles performance. During that period nine expert-workshops took place on several locations worldwide (including 43 speaker and about 143 participants).

Task 17 successfully demonstrated that lightening the car, improving the electric power control unit, optimizing of thermal management solutions and improving of the battery management system, helps to improve the energy efficiency and the overall system performance of such a vehicle.

These improvements can significantly increase the drive range and reduce costs and therefore makes the vehicle more attractive in terms of customer acceptance.

1 Batteries

During the past decade, there has been a lot of progress, especially in the field of electrochemical storage devices and FCEVs (see Fig. 1). Beside durability and energy density, cost is one of the main areas where improvements are required to compete with conventional fossil fuels. Within the last years, costs have been falling rapidly and are expected to continue doing so for the next 10 years. The battery’s durability is already expected to be sufficient for automotive use, giving ten years calendar life and 150,000 miles of range. Fuel cell stacks appear to still be falling short of the US DoE’s 2009 target of 2,000 h operation, corresponding to approximately 25,000 mi. before a 10 % drop in power output. Energy density is still the Achilles heel of batteries. The next generation of lithium-based chemistries are expected to approach the perennial problem of ‘range anxiety’.

PHEVs battery progress: costs have fallen while energy density rose [1]

Currently, 80 % of the total amount of e-drive costs belongs to the battery, while the 10 % attributable to the e-motor and further 10 % to the power electronics.

2 Improvements by Thermal and Battery Management

Thermal-, and battery management is playing an important role (and will still play one of the most important roles in the future) as it can increase the range and efficiency through optimized system configurations. Knowing the precise thermal interaction of components is necessary for an optimal design as it influences fatigue, energy consumption, noise, emissions, etc.

Workshops of this Task pointed out that:

-

driving at higher speeds but also aggressive driving will increase the energy consumption in an electric car,

-

cold start energy consumption is larger than the hot start energy consumption (BEV),

-

the largest energy consumption increase for an EV occurs at −7 ℃ (20 ℉) and for a conventional one at 35 ℃ (95 ℉),

-

a conventional vehicle has the largest absolute energy consumption penalty on a cold start,

-

powertrain type, driving style, and ambient temperatures all impact the energy consumption significantly and

-

generally increased speeds and accelerations translate to higher energy consumption except for the conventional due to low efficiency in the city

3 Simulation and Virtual Vehicle

With the introduction of xEVs, the number of components that can populate a vehicle has increased considerably, and more components translate into more possible drive train configurations. In addition, building hardware is expensive. Traditional design paradigms in the automotive industry often delay control-system design until late in the process—in some cases requiring several costly hardware iterations. To reduce costs and improve time to market, it is imperative that greater emphasis has to be placed on modeling and simulation. This only becomes truer as time goes on because of the increasing complexity of vehicles and the greater number of vehicle configurations. Thus, the necessary expertise to perform the required sophisticated simulations and calculations becomes more and more complex. Especially predicted future driving information like route based energy management, supported by a mixture between deterministic and stochastic information, will play a key role as they can help to optimize the energy consumption. The work on Task 17 pointed out, that the demand for companies, focusing on simulation tools for EVs, is still increasing. These companies and R&D institutes will play an important role in the future.

4 Lightweight Through Advanced Materials, Bionic Concepts and Functional Integration

Vehicle weight and size reduction is one known strategy to improve fuel economy in vehicles, and presents an opportunity to reduce fuel use from the transportation sector. By reducing the mass of the vehicle, the inertial forces that the engine has to overcome when accelerating are less, and the work or energy required to move the vehicle is thus lowered. A general rule of thumb is that for every 10 % reduction in vehicle weight, the fuel consumption of vehicles is reduced by 5–7 %. Vehicle weight reduction can be effective, but is a challenging way to achieve significantly greater fuel economy gains. Especially light weighting the vehicle has a massive impact on the driving range (depending on the driving type cycle).

The light weighting benefits on fuel/energy consumption depends on the driving type:

-

in city type driving and aggressive type driving with many and/or larger accelerations, light weighting any vehicle type will reduce the energy/fuel consumption,

-

in highway type driving, where a vehicle will cruise at relative steady speed light weighting vehicles does not significantly reduce the energy/fuel consumption and light weighting a conventional vehicle will provide the largest improvement in fuel consumption due to the relative lower powertrain efficiency of the conventional vehicle, compared to a BEV.

Especially the use of bionic concepts can help to reduce the amount of materials needed. Bionic design can reduce development time, minimizes development costs, identifies new light weight solutions and helps to find efficient concepts in product development.

Also the use of new materials as carbon or sandwich materials (combination of different materials in order to improve the total abilities) contributes to light weighting the car. But it should be kept in mind to have a look at the life cycle assessment too. For example carbon has two main advantages: its low weight and its strength. But the increasing use of carbon in xEVs (e.g. BMW i3) requires the need for new recycling processes.

Comparing HSS versus aluminum in lightweight vehicles: HSS is less costly, and has lower production energy demands. However, aluminum remains competitive in select applications.

Functional integration will play a major role in future vehicles in order to reduce the amount of total parts being used in a vehicle. Functional integration (e.g. CFRP wheel with integrated hub motor) doesn’t only have an impact on reducing weight, it can also help to improve the driving abilities and can lead to a fundamental technology turnaround.

Future new vehicles are still expected to become steadily lighter, as automakers seek all means to achieve higher fuel economy. Further, the new fuel economy standards for 2016+ are aggressive, and will require rapid rates of new and improved vehicle technology deployment. More-fuel efficient vehicles, like those with more sophisticated propulsion systems, tend to require more energy during their material processing and production phase. The material production energy demand for a current conventional gasoline car is 5 % of its life-cycle energy impact. The energy expended over its long use-phase in form of fuel use dominates its life-cycle impact at 76 %. However, the total automotive material production energy demand for all new U.S. vehicles was substantial at 0.94 Exajoules in 2010 [2].

Vehicle light weighting and vehicle downsizing, coupled with efficiency gains in material processing over time can greatly reduce the production energy footprint of new vehicles.

5 Power Electronics and Drive Train Technologies Require New Software Concepts

The increasing demand for ADAS and autonomous driving results in an increasing amount of software and electronics within the vehicles. Especially in terms of xEVs the amount of embedded systems and software within the powertrain is rapidly growing. This leads to a fundamental technology turnaround which requires adapted software within the powertrain. Thus, the systems are becoming very complex. This results in required embedded systems and E/E-Architecture in order to process all the data and sources. Power Electronics and adaptive drive train technologies are thus playing an important role and will have a massive impact in the future.

In today’s commercial vehicles driven by an ICE, the proportion of electrical, electronic and IT components is between 20 and 35 % (dependent on the vehicles class). In xEVs, this share will increase to up to 70 %. This includes around 70 main control units with more than 13,000 electronic devices.

In the future, every second euro/dollar is spent on the production for electronics. Currently, the share of electronic components to the manufacturing cost is around 30%, by 2017 it will grow to 35 % and will still increase to 50 % in 2030.

The Task 17 workshop pointed out, that today’s manufacturers are focusing very intense on that field of thematic which indicates the importance on that area. As the future is hard to predict, modular drive train topologies can increase the chances for a market breakthrough of xEVs by providing a better opportunity for high production volumes. Future generations of xEVs require a layered, flexible and scalable architecture addressing different system aspects such as uniform communication, scalable/flexible modules as well as hardware and software. System integration of power electronics is inevitable to fulfill the cost and package volume requirements on future xEVs. New technologies emerge which may greatly improve power density and system integrability. The optimization of a power electronic vehicle component always requires a comprehensive survey of the whole drive train.

Further, this Task successfully demonstrated that the automotive industry is dealing with two major trends: the electrification of the drive train and autonomous driving.

6 Change Within the Automotive Value Chain

The trend towards e-mobility leads to massive changes along the automotive sector’s entire value chain. The new vehicles require a number of technically innovative components and systems to operate. This will impact key parts of the component and vehicle creation value chain, from R&D in specific components like batteries, all the way to integrating and assembling vehicles, down to new fields in the mobility value chain such as new infrastructure and new business models. While the ICE was almost the component with the highest value within the value chain, the introduction of xEVs are changing the hierarchy. Due to the fact that components like ICE, clutch, exhaust system, etc. won’t be needed in xEVs any more, new and additional components as power electronics, e-motor, software will be necessary.

It can be foreseen that the power electronic unit and the e-motor will be on the top of the hierarchy and thus will replace the ICE, which won’t be needed any more.

This key massage has to be transferred to policy makers and representatives of industry in order to aware them of the upcoming change in value chain. Furthermore the R&D has to be prepared and informed to, to guarantee qualification and education in that kind of fields and to ensure enough qualified employees.

7 We Have to Change

The demand for xEVs is still at a low level and far behind expectations (except in a few countries like Norway). However, in order to reach the various global consumption requirements, further hybridization and thus electrification is inevitable.

In the European Union, by 2021, phased in from 2020, the fleet average to be achieved by all new cars is 95 g CO2/km. This means a fuel consumption of around 4.1 l/100 km of petrol or 3.6 l/100 km of diesel. Only in the sub compact class (up to 1,200 kg (2,645 lb) of vehicle weight), petrol engines with consumptions of less than 95 g CO2/km are possible.

For conventional cars there is still potential for optimization like through downsizing, use of alternative fuels, etc. Experts from Bosch Engineering are of the opinion that for conventional cars there are still further fuel savings possible (diesel: 10 % and for petrol up to 20 %). However, in their point of view SUVs and heavy vehicles won’t reach the 95 g CO2/km limits though. Here a (partial) electrification is indispensable.

The introduction of xEVs doesn’t mean the ‘end of the ICE’. These vehicles will still exist for further decades of years. But it is predictable that due to global trends like interconnectivity, autonomous driving, limited resources and global consumption requirements, the electrified drive train—xEVs—will sooner or later dominate the automotive market.

References

IEA. Global EV Outlook Available online at: http://www.iea.org/evi/Global-EV-Outlook-2015-Update_1page.pdf (accessed: June 8th, 2015)

Chea, L., Cars on a Diet. Available online at: http://web.mit.edu/sloan-auto-lab/research/beforeh2/files/LCheah_PhD_thesis_2010.pdf (accessed June 8th, 2015)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Nikowitz, M. (2016). Final Results and Recommendations. In: Nikowitz, M. (eds) Advanced Hybrid and Electric Vehicles. Lecture Notes in Mobility. Springer, Cham. https://doi.org/10.1007/978-3-319-26305-2_6

Download citation

DOI: https://doi.org/10.1007/978-3-319-26305-2_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-26304-5

Online ISBN: 978-3-319-26305-2

eBook Packages: EngineeringEngineering (R0)