Abstract

A better understanding of the process of setting wholesale electricity prices does benet not only the generating companies but also the end users as it forces them to be responsible with their energy use in the time of peak electricity demand leading to smaller fluctuations in demand. Determining when a generator could maximise the prot based on demand fluctuations reduces risk and potential losses that could occur for generating companies. Based on this premise, this paper will outline the use of agent-based models (ABM) in future wholesale energy markets. By comparing agent-based modelling with methods currently employed by economists, this paper will show the impact ABM can have on developing a safer market structure. The results will propagate the idea of agent-based models influence on managing risks, controlling demand, and maximising prot in a time of smart grid technology. This paper is a proposal for work on smart grids in union with agent-based modelling being done in the future if suitable and useful.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction to Electricity Market Modelling

As the worldwide need for electricity grows, so does the necessary generating capacity and the associated costs. Using peaker plants to compensate for additional demand is expensive due to the plants only being operated during the time of peak electricity demand. To better understand electricity market dynamics and in order to offer a realistic visualisation of what might happen in the wholesale market in the future, economists use various mathematical tools, with one of the more common ones being equilibrium modelling. Equilibrium modelling follows the rational choice theory, the framework for modelling economic and social behaviour. It also gives consumers more credit about their knowledge of electricity markets and ability to make rational decisions than some research is inclined to agree with. These types of models are Nash Equilibrium models, which compute prices and quantities on the basis that all markets are in equilibrium (i.e., no single market participant has an incentive to choose a different price or quantity - doing so will only decrease its prots). This implicitly assumes that everybody knows everything: particularly, the other market participants prot functions and constraints. If there are only a few market participants, this may be reasonable; if there are more, perhaps not. Equilibrium modelling is useful because basic assumptions that economists generally make about people (e.g., rationality) are not necessarily satisfied in agent-based models (if people were rational and prot maximising, they would not obey a simple set of rules but really try to gure out the equilibrium and adapt their behaviour accordingly), [1]. Furthermore, the structure of the wholesale energy market is unique and thus standard economic models cannot always be applied to better help us understand its dynamics. From electricity generators, energy travels to transmission system operators and then to distribution network operators to major suppliers, who then sell it to industrial and commercial customers or residential customers. The identities of these actors are incomparable and applying a broad general model to them would be naïve. Some of the main electricity market modelling trends are represented in Fig. 1.

Electricity market modelling trends, [2]

This equilibrium approach lends itself to expression in equation form. And because equilibrium by definition is a pattern that does not change, in equation form it can be studied for its structure, its implications, and the conditions under which it obtains. Of course the simplicity that makes such analytical examination possible has a price. To ensure tractability we usually have to assume homogeneous (or identical) agents, or at most two or three classes of agents. It has to be assumed that human behaviour a notoriously complicated affair can be captured by simple mathematical functions. Agent behaviour that is intelligent but has no incentive to change has to be assumed; hence it must be assumed that agents and their peers deduce their way into exhausting all information they might find useful, so they have no incentive to change. Still, as a strategy of advancement of analysis, this equilibrium approach has been enormously successful.

2 ABM Applications in Electricity Markets

Actors in ABM provide us with useful tools we can use to design a hypothetical market, where each agent caters to our unique demands. Each agent can represent a distributor or a generator, or if we choose to, the end-user. The agents can also be used to portray, for example, a solely generator based market and we can use them to predict how a number of generators would act in a competitive market. The main difference between agent-based modelling and economists preferred manner of equilibrium-modelling, which is typically used in energy economics as in [6, 7] is the fact that in ABM participants are not assumed to be omniscient and super smart, which is a more realistic approach. We have a large group of actors, who follow fairly simple rules and who do not know everything. Even if they did, they could not compute optimal strategies based on market equilibria because they are not super computers. Economists argue that using ABM takes away the rationality the participants have, however, applying these models to wholesale market transactions in which end users are not participating they are a lot more realistic as we are not dealing with the bounded rationality of human consumer behaviour. When additional consideration is given to the validity of the underlying model and the assumption and simplications that have been made, ABM allows us to control our own over-condense when interpreting the results from a simulation.

One thing noticeable about agent-based studies is that they are nearly always evolutionary in approach because agents are adaptive and heterogeneous. On first thought, this might seem to yield at most a trivial extension to standard homogeneous theory. If heterogeneous agents (or heterogeneous strategies or expectations) adjust continually to the overall situation they together create, then they adapt within an ecology they together create. And in so adapting, they change that ecology. Agent-based, non-steady-state economics is also a generalization of equilibrium economics. Out-of- equilibrium systems may converge to or display patterns that are consistent that call for no further adjustments. If so, standard equilibrium behaviour becomes a special case. It follows that out-of-equilibrium economics is not in competition with equilibrium theory. It is merely economics done in a more general, generative way, [3].

In this paper, we focus on an alternative modelling approach utilising artificial intelligence to replicate the behaviour of these actors by using agent-based modelling. Agent-Based Modelling (ABM) platforms are tools that allow the modelling of complex adaptive systems by using agents, providing a way to output the simulation results in a graphical manner according to several designed scenarios. The simulation results can be used to extract conclusions about the systems behaviour and consequently to rene the specification of the agent-based model. These tools provide an easy and powerful simulation capability which enables a fast testing and prototyping environment. ABM aims to recreate and predict the occurrence of complex phenomena. These platforms are being used to simulate agent-based models for different application domains, such as economics, chemical, social behaviour and logistics, [4]. Sophisticated ABM sometimes incorporates neural networks, evolutionary algorithms, or other learning techniques to allow realistic learning and adaptation. In agent-based modelling, a system is modelled as a collection of autonomous decision-making entities called agents. Each agent individually assesses its situation and makes decisions on the basis of a set of rules. Agents may execute various behaviours appropriate for the system they represent for example, producing, consuming, or selling, [5]. The advantage of agent-based modelling is that it allows mimicking each actor separately by using an individual agent. specie. This helps to obtain more realistic results, describing the behaviour and reactions of every energy market actor chosen to study. Comparisons and benefits of each type of modelling are shown in Table 1.

3 Types of Agents

The basic agents are used to model entities related to elementary functions such as: the Consumer (C), the Generator (G), the Transmission Network (N), the Distributor (D), the Market Operator (M), the Wholesaler (W), the Retailer (R), and the Regulator (T), as we can see in Fig. 2. Each basic agent has well-dened roles and is characterized by a set of static attributes, a set of dynamic attributes and a set of capabilities, [7]. Consumers eventually use the electricity for any purpose (from watching TV to heating to industrial production processes). There is a difference between small and large consumers, since the latter ones may be allowed to directly participate in the wholesale electricity markets. Generators own or lease one or multiple power plants, operate them and sell electricity to the spot and/or the multilateral market through wholesalers. Transmission networks companies own or lease one or several transmission networks.

Basic agents in an electricity market, [9]

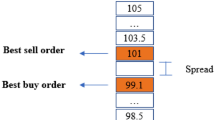

4 Electricity Pricing

An increase in commodity demand or a decrease in its supply leads to a rise in the market price, which leads to additional investments and production capacity and a new equilibrium. There is a lack of elasticity when it comes to electricity demand so instead of witnessing gradual price increases on electricity markets we observe price spikes, which are very large increases in price over a short period of time, when demand begins to approach the total installed generation capacity. In times of tight but adequate demand to meet the load there is a sharp price rise during periods of peak demand as the market price is determined by the bids of generating units, which operate infrequently. However, under peak load conditions when all of generation capacity is in use price spikes get even higher. This could happen due to the current generation capacity not keeping up with the load growth, because generation capacity has been downsized or because of it is unavailable (like low or no wind leading to less wind supply). Under these conditions, the only factor that would limit the price increase is the elasticity of demand. Price spikes can thus be used as an indicator of insufficient capacity to meet the required demand and the extra revenue that they produce is essential to give generating companies the incentive that they need to invest in new generation capacity or keep older units available. Price spikes are very expensive for the consumers and should incentivise them to be more responsive to price signals. An increase in the price elasticity of the demand leads to a decrease in the magnitude of the spikes, even if the balance between peak load and generation capacity does not improve. Price spikes also give consumers a strong incentive to enter into contracts that encourage generators to invest in generation capacity. Based on this theory, an equilibrium should eventually be reached. At this equilibrium, the balance between investments in generation capacity and investments in load control equipment is optimal and the global welfare is maximum. Many issues, be it socio-behavioural or entirely pragmatic and their political consequences can stop the equilibrium from being reached. Currently, there is no technology to make demand responsive to short-term price signals. Until such technology becomes available, an implementation of quantity rationing instead of price rationing when demand exceeds supply may be needed. This means the system operator may have to disconnect loads to keep the system in balance during periods of peak demand. However, smart grids can help better meet those demands and decrease the risk of demands exceeding supply. Widespread load disconnections are widely unpopular and often have negative social consequences in addition to being economically inefficient. Their impact can be estimated using the value of lost load (VOLL), which is several orders of magnitude larger than the cost of the energy not supplied. Consumers are not used to such disruptions and their political representatives would not tolerate them for extended periods of time. Exposing consumers to spot prices and having them adjust their demand makes price spikes very unpopular. Why spiking occurs is not common knowledge among consumers so they often think they are being ripped off. Price spikes also force people with a lower income to cut back on essential electricity needs normally used for cooking and heating. For this reason electricity markets incorporate a price cap, which aims to prevent large price spikes. On the other hand, price caps decrease incentive for building or keeping generation capacity. An electricity market that relies on spikes in the price of electrical energy to encourage the development of generation capacity is not necessarily good for investors either. Price spikes may not materialise and the average price of electricity may be substantially lower if the weather is more temperate or if higher than average precipitations make hydroenergy more abundant. Basing investment decisions on such signals represents a significant risk for investors. This risk may deter them from committing to the construction of a new plant, [10].

5 Profit Maximization in Current Electricity Markets

Currently the way to maximize prot in an electricity market is by determining a cheaper way to generate electricity and continue selling it to the consumers for the same price, which is the socially desirable approach. However, generators can try and increase prots by gaining and exercising market power. This reduces efficiency, but market power is the ability to raise the market price, so it can be portable. Generally, there are three main ways to gain market power: gaining significant market share, generator collusion, and influencing the regulator to set higher prices. Gaining market share is easier on peak because you only need a small share, however, off peak you need huge market share. Colluding with other generators is generally illegal, however, it is extremely popular. The most popular way for generators is tacit collusion such as shadow pricing. Shadow pricing means generating companies implicitly agree on their prices. In game theory, this is a better long term decision, because if a generating company would try to undercut their competitors, there is nothing stopping the remaining companies from undercutting that generating company in the next game. Such approaches are dated and often illegal. This continues to show that there is a need for implementing a new technology into the electricity system that offers an unbiased way towards pricing and handling faults in the system such a peak demand and blackouts. Although there is a convincing reason for concern, staying put and not doing anything to change the way electricity is currently generated and transmitted benets no one in the long run especially generating companies, who themselves suffer from huge costs when dealing with demand not matching supply.

6 Objectives

In this paper we apply previously described assumptions to discuss a modern, efficient, and more representative way to model the future electricity markets of the United Kingdom, demonstrated in Fig. 3. Papers on modelling of electricity markets in Europe, [8], using agents with a focus on Central Europe, displayed an agent-based modelling framework, which uses the model predictive bidding algorithm to simulate the German electricity market under reference conditions as well as a higher wind energy contribution. However, this paper considers future smart grid technology participation in the energy market as well as large scale deployment of distributed energy resources, and how being modelled with agents benefits this incoming technology. There is a concern among generating companies about the consequences of introducing smart grid technology and demand side management and on the way they could influence the consumers. The general consensus is that such technology gives the user an opportunity to be more involved. It also allows the users to be more aware of the way their electricity costs arise. Because of such outcomes the generating companies are afraid of a potential loss in prot that would come along with a potentially more self-aware consumer.

It is important to help them realise how they can prevent such technology from hurting them, learn to adapt to it and see how in the long run it could even benet their business. Such technology could potentially lead to less operating power needed so the prot would remain proportional to the operating costs. However, the goal is to make these companies prot from the novel approaches, as change is inevitable. Smart grid technology brings a new way to monitor users and helps generating companies decrease the need for peaker plant use. This prevents unnecessary costs that occur from starting and maintaining peaker plants and allows for the companies to be able to better fluctuations. Agent-based modelling is the approach that makes that easiest as it accounts for the individual needs of each agent and acts based on its memory, developed by the historical information it uses to function.

7 Conclusions

This paper merely aimed at describing the necessary adjustments in former and novel types of modelling to achieve an accurate representation of the models in the future. The hope for the future work is to apply both models in reality, compare them, and see how both can aid our predictions. Although equilibrium modelling has long been the go-to tool for depicting market dynamics in order to stay current and in touch with the incoming technology, there is a need for a new type of modelling that makes it easier to include novel energy technologies as they come along. Agent-based modelling allows for a modelling framework that will be able to process and essentially predict electricity market dynamics, accounting for the impact of smart grids on the prices and demand of electricity. Choosing to model a developing market with agents instead of somewhat dated economical modelling approaches helps pinpoint the issues in electricity markets when it comes to pricing and quantity determination and how to eliminate them without hurting end users. ABM illustrates the benets of smart grid technology and demand side management for generating companies as the general misconception is they can only be damaging for the prots of the generating companies. This novel technology agrees with the objective of not causing damage to the consumers yet it also helps generating companies with their demand predictions. If generating companies make a stride towards adopting to smart grid technology and invest in it first-handedly it will be much easier for them to regulate the transition and make sure there is no loss in profits. The longer they wait the less they will be able to influence and readjust the progress of smart grids the way it best suits them. If they become accepting of smart grids now, generating companies can have an influential and fundamental role in the path smart grids take. They can arrange the technology to benefit them as they can minimize unnecessary costs, especially those coming from persistent and unplanned peaker plant use. Allowing for consumers to have large control over their energy use and price could result in pointless and costly maintenance of larger generating capacity during times active consumers will learn to avoid. They face a decision of an opportunity cost. What is the best financial decision for them to make - working with smart grids or trying to reach an ultimatum and block them out? Not only would that result in a potential intervention of regulatory bodies it would also make them look unfavourable in the eye of the consumer, who do not want to have their generating companies taking advantage of them. Ultimately, it would lead to consumers choosing progressive generating companies accepting smart grids in their daily mechanisms, which could then lead to an increased market share for companies, which were astute enough to act first to aid their customers’ needs. Taking advantage of both energy storage and smart grids would in my opinion lead to best financial results, even though the initial costs would be higher. It would teach the generating companies how to act responsibly with their generating capacity in terms of when to store energy for certain peak demand times.

References

Besanko, D.A., Braeutigam, R.R.: Microeconomics: an integrated approach, pp. 534–536. Wiley, New York (2002)

Ventosa, M., Baíllo, Á., Ramos, A., Rivier, M.: Electricity market modeling trends. Energy Policy 33(7), 897–913 (2005)

Arthur, W.: Out-of-equilibrium economics and agent-based modeling. Handb. Comput. Econ. 2, 1551–1564 (2006)

Barbosa, J., Leitão, P.: Simulation of multi-agent manufacturing systems using agent-based modelling platforms. In: 9th IEEE International Conference on Industrial Informatics (INDIN), pp. 477–82 (2011)

Aletti, G., Naimzada, A.K., Naldi, G.: Mathematical Modeling of Collective Behavior in Socio-Economic and Life Sciences, pp. 203–204. Birkhauser, Basel (2010)

Gabriel, S.A., Kiet, S., Zhuang, J.: A mixed complementarity-based equilibrium model of natural gas markets. Oper. Res. 53(5), 799–818 (2005)

García-Bertrand, R., Conejo, S.A., Gabriel, S.A.: Electricity market near-equilibrium under locational marginal pricing and minimum prot conditions. Eur. J. Oper. Res. 174, 457–479 (2006)

Gnansounou, E., Pierre, S., Quintero, A., Dong, J., Lahlou, A.: Toward a multi-agent architecture for market oriented planning in electricity supply industry. Int. J. Power Energy Syst. 27(1), 82–89 (2007)

Wehinger, L.A., Hug-Glanzmann, G., Galus, M.D., Andersson, G.: Modeling electricity wholesale markets with model predictive and prot maximizing agents. IEEE Trans. Power Syst. 28(2), 868–876 (2013)

Kirschen, D.S., Strbac, G.: Fundamentals of Power System Economics. Wiley, Chichester (2004)

Acknowledgements

The authors would like to thank Harry van der Weijde for his generous advice on writing this paper and his help explaining the economic aspects of electricity markets.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Institute for Computer Sciences, Social informatics and Telecommunication Engineering

About this paper

Cite this paper

Lupo, S., Kiprakis, A. (2015). Agent-Based Models for Electricity Markets Accounting for Smart Grid Participation. In: Pillai, P., Hu, Y., Otung, I., Giambene, G. (eds) Wireless and Satellite Systems. WiSATS 2015. Lecture Notes of the Institute for Computer Sciences, Social Informatics and Telecommunications Engineering, vol 154. Springer, Cham. https://doi.org/10.1007/978-3-319-25479-1_4

Download citation

DOI: https://doi.org/10.1007/978-3-319-25479-1_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-25478-4

Online ISBN: 978-3-319-25479-1

eBook Packages: Computer ScienceComputer Science (R0)