Abstract

Economies that thrive most on their ambitions, innovative and productive firms are due to grow and develop. Our motivation is thus to uncover who are these fast-growing firms and where they operate. These interrogations provide the foundation for an exploration into what are the different choices for policy, and an opportunity to engage afresh with why and if they ought to receive support in the first place, infusing the discussion as to when and how it could be provided and what could the intended results be. We use the dataset Quadros de Pessoal to provide a stronger twofold measurement, according to the employment and turnover growth criteria. We find among Portugal’s distinctive characteristics its high share of SMEs in the population of fast-growing firms, the narrowing down of the difference between measurements according to the employment and turnover criteria and the disproportionate amount of employment generated by the largest segment of fast-growing firms. We find that gazelles are outstanding job creators, having a disproportionately larger impact in job creation than high-growth firms. Accordingly, it is the rapid growth of a few large firms, combined with the entry of a higher number of firms of a higher average size that generates positive net job creation in Portugal. A more thorough understanding of fast-growing firms ought to lead to adjustments in government policies to heighten their exceptional contribution to economic growth. We provide a conceptual framework for tapping into how to design policies for firms which are growing at a faster pace and a roadmap for tackling some of its most controversial issues.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Following the work of Birch (1979), the current thinking for over three decades was that small businesses (both young and old) were the engine behind job growth. In the present day, job creation and employment growth are still central indicators of labor market performance, thus bringing small businesses under the limelight and placing them at the core of the policy-making debate. However, recent academic research has established that not only small size, but a combination of characteristics of small size and young age make these firms a key source of job creation (Henrekson and Johansson 2010; Haltiwanger, et al. 2013; Van Praag and Versloot 2008; Acs et al. 2008; Storey 1994; Birch 1981, 1987). The implicit rational behind researching into this theme has been to put to good use the learning about these firms’ behavior and characteristics so as to intensify the amount of fast-growing firms and its impact on job creation. This interest has been demonstrated by the findings uncovered by empirical data exploration originating from several regions and countries (Brown and Mawson 2013; Lawless 2013; Anyadike-Danes et al. 2013; Dalton et al. 2011; Biosca 2010; Salas et al. 2010; Acs and Mueller 2008; Stam 2005; Schreyer 2000; Brüderl and Preisendörfer 2000; OECD 2002, 2008, 2009, 2013b; Picot and Dupuy 1998).

Unlocking the growth potential of the private sector has continuously been at the core of discussions on how to boost economic recovery, but has intensified recently due to the economic slowdown hitting Europe, especially since 2009. Predominantly following downturn periods, decision-makers avidly seek the appropriate levers to restore competitiveness, accelerate economic growth, and distribute its benefits equitably at the regional level. Recognizably, major labor market reforms in the Euro area are essential to spur job creation, lower unemployment, and help prevent further sliding into cycles of long-term deterioration of potential output growth (ECB 2012; Tilford and Whyte 2011; McKinsey Global Institute 2010). Accordingly, authorities’ statements and research findings in various countries have reinforced the catalytic role assigned to Small and Medium Enterprises (SMEs) in stimulating economic recovery and job creation, whose importance does not qualify at all as small, as its firm dimension may suggest (e.g., Goldman Sachs 2013; European Parliament 2011; Swedish Agency for Growth Policy Analysis 2011; CPA Australia/CGA-Canada 2010; OECD 1997; Schreyer 1996). However, the concern implicit in targeting young and small businesses with adequate support aimed at generating jobs is related to the higher uncertainty of these new ventures’ outcomes.

In Portugal, over 99 % of firms are SMEsFootnote 1 and in particular newcomers are born with quite a small size (Sarmento and Nunes 2010a). In 1995, around 40 % had fewer than five employees and 60 % fewer than ten. A decade later, in 2005, 64 % of these newly created employer enterprises were dead, of which 14% had not survived into their first year and 46 % into their first 5 years in businessFootnote 2 (Sarmento and Nunes 2010c). In fact, 78 % did not manage to endure 18 years of activity. One of the explanations is bestowed by the level of firm turbulence, given by the sum of employer enterprise births and deaths, which is remarkable in Portugal. During the period 1987–2005, it amounted to 29 %, with over a quarter of all jobs being either destroyed or created over a typical 12-month period. Furthermore, smaller businesses exhibit the highest churn and failure rates, thus not only creating but also destroying more jobs. Differences in survival rates across firm size-classes become particularly evident from the early stages of a firm’s life and are statistically significant for Portugal (Nunes and Sarmento 2012). Moreover, only a minority of new businesses grows phenomenally. On average during the period 1987–2005, Portuguese employer enterprises achieved an employment growth rate of 24.2 %, during their first year but only managed to sustain 3.7 % of growth ten years later. After 18 years in business, that firms cohort’s employment growth fell to −1.2 % (Sarmento and Nunes 2010c).

To restrict the attention to those firms that truly generate jobs, academics, policy-makers but also recently practitioners, started focusing on a very small subset of firms, the so-called “high-growth firms” (e.g., OECD 2013a, b; Europe INNOVA 2011; Stangler 2010; Mitusch and Schimke 2011). These firms are dynamic players in economic growth, known to play a significant role in job creation and prosperity in many countries, through productivity enhancements derived from technology development and innovative behavior (NESTA 2009; European Cluster Observatory 2009; Autio et al. 2007; OECD 2002; Birch et al. 1997; Storey 1994; Baldwin et al. 1996). At the regional level, in tandem with the direct effects of fast-growing firms on employment and job creation, indirect effects can materialize through structural change, increased competition, attractiveness, and spillovers, thus leading to productivity increases, higher employment levels, and long-term economic development (Fritsch 2011; Bos and Stam 2011). Furthermore, the amount of fast-growing firms operating in individual countries and regions and the swiftness of its emergence provides a clear indication of how well national and local authorities are laying the foundations for growth among their new and established businesses.

International comparative evidence on firm growth has revealed that European countries have on average a lower share of high-growth businesses than the United States and a much larger share of static firms. These differences have been shown to be significant in accounting for variations in productivity across these economies (Biosca 2010). But in Europe, enterprises with growth potential have already started being targeted by many European governments (e.g., BIS 2011) and the banking sector for specific support (Financial Times 2014; Santander 2013). In Europe, the European Commissions’ Strategy 2020 already assigns the contribution of high-growth firms a political objective (European Commission 2010).

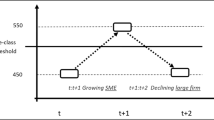

But the narrow focus on exceptionally fast-growing firms has been questioned, through at least three main lines of arguments. Firstly, we do not still know enough about firm growth, despite the extensive existing body of economic literature on the theory of the firm. For instance, Gibrat’s law (Gibrat 1931), which posits that both small and large firms will on average perform at the same rates of growth has been refuted by empirical evidence, whilst no consensual alternative theory has been posited.Footnote 3 Hence, the linkages between theory and reality checks in what concerns firm formation, growth, and decline are recognizable, rudimentary, and conflicting. Nonetheless, the growth process of these exceptional performers is perceived to be nonlinear and known to be more of an unstable kind (Levie and Lichtenstein 2010), contrary to the way depicted by the traditional life cycle theory of the firm (e.g., Churchill and Lewis 1983; Greiner 1972). One way of approaching these outbursts of sudden growth stems from identifiable “trigger points” that reconfigure the firm to induce rapid and transformative growth through a catalytic process. According to Storey (1994), these triggers can catapult moderate performing firms into high performing ventures, whereby they become “flyers”. Brown and Mawson (2013) offer an analogous insight of this process, by employing the concept of “growth triggers”Footnote 4 for looking into Scottish enterprises growth paths. They observe that most high-growth firms appear to have a “stepped” growth approach pattern, with periods of low or modest growth being combined with periods of high growth. In fact, moving away from growth rates towards analyzing growth trajectories might yield a more thorough understanding of the interplay between performance, growth, and business survival.

Secondly, recent research challenged the universally accepted assumption that firm growth is a sign of success in itself, pointing out that unprofitable growth can also lead to future profits via increased market shares (Davidsson et al. 2005; Steffens et al. 2009). Moreover, Davidsson et al. (2010) have also shown that profitable but low-growth firms are more likely to reach the desirable state of high-growth and profitability compared with high-growth and low-profitability type of firms. Similarly, dormant firms, such as “sleeping gazelles” (Bornhäll et al. 2013), which enjoy high profitability but do not generate new jobs, might also provide a good target for policies focused on cost-effectiveness and maximized impact on job creation.

Thirdly, the debate of whether it is the entry of many new firms or the rapid growth of a few well performing firms that generates employment growth and job creation. This discussion is still being fuelled by new evidence for high-growth (HG) firms (e.g., Lawless 2013; Davidsson and Delmar 2006; Storey 1994).

Most types of growth are beset with complex intricacies that also rely on a combination of territorial elements, which can favor or hinder growth. The question of why some businesses grow more than others in certain environments and regions can be partially answered by analyzing the presence of elements such as infrastructure, specialized labor, clusters, innovative ecosystems, scientific and technological environments, and institutional settings in a given territory. However, answering the question of which combination of economical–political, institutional, and territorial instruments can offset this gap is considerably more challenging in both theoretical and practical terms. It is demanding, and often impossible to create external elements which can mimic and compensate for the gaps that a high-growth environment provides. One must usually hope that firm adaptation to the local environment conveys the necessary speed of growth to overcome the barriers to faster growth so as to offset the advantages made available by more competitive territories. In order to address all these issues, we need a strong conceptual framework of analysis, able to deliver a rational, an approach method and a toolbox of different policy options, based on more in-depth, comprehensive, and multidimensional analysis of longitudinal data (Garnsey et al. 2006; Delmar et al. 2003; Chandler and Lyon 2001; Davidsson and Wiklund 2000), which is able to uncover empirical regularities, allowing a better response to the many challenging questions, such as those related to which types of firms ought to receive support in order to maximize job creation.

In this paper, we use Quadros de Pessoal data (an employee–employer linked longitudinal dataset of Portuguese employer enterprises) within the period 1985–2007, to provide estimates of the amount and incidence of high-growth and gazelle firms, its regional distribution to a geographical level of disaggregation of NUTS II, but also its employment and job creation. The microdata comprehensiveness of the dataset provides the platform for uncovering high-growth firms’ features which have not been examined to such a detail before. By applying the Eurostat and OECD’s methodology of the “Manual of Business Demography Statistics” (Eurostat/OECD 2007), we obtain a specific dataset for high-growth and gazelle enterprises active since 1990 and 1992, respectively, whose results can be directly compared to those from other datasets to which this same methodology has been applied to (e.g., OECD 2008, 2009, 2011, 2013b; Eurostat 2008; NESTA 2009; Anyadike-Danes et al. 2009). Two parallel accounts are provided, according to the turnover and employment criteria.

Our motivation is to uncover who are these fast-growing firms (high-growth and gazelles) and where they operate and the incidence of regional employment, and subsequently, what types of firms create most jobs. These interrogations provide the foundation for an exploration into what are the different choices for policy, thus disentangling its raison d’être, and an opportunity to engage afresh with why and if they ought to receive support in the first place, infusing the discussion as to when and how it could be provided and what could the intended results be (the “so what” question).

The following section intent is to describe the dataset, concepts, and methodology adopted. Section 17.3 introduces fast-growing firms in Portugal, describing its most common characteristics while profiling them at the firm, employment, and regional level, according to four distinct groups of fast-growing employer enterprises: high-growth, and gazelles categories, measured by employment and turnover. Section 17.4 provides an account of employment and job creation for high-growth and gazelles by employment. Section 17.5 conveys a conceptual framework that aims to facilitate policy-making design and support for fast-growing firms, while Sect. 17.6 offers concluding remarks.

2 Data and Methodology

Despite the consistency of findings concerning the importance of fast-growing firms,Footnote 5 no internationally accepted definition exists either for high-growth or gazelle firms (Anyadike-Danes et al. 2013; Nordic Council of Ministers 2010; Biosca 2010; Henrekson and Johansson 2009, 2010; Hölzl 2009; Ahmad 2008). The literature offers several definitions inspired by the work of David Birch (Birch 1987; Birch et al. 1995). In this particular area, definitions, ceilings, and calculation methods adopted for measurements matter as “summary statements which gloss over the detail of the definitions may seriously mislead researchers and policy-makers alike” (Anyadike-Danes et al. 2013, p. 5). This chapter follows the methodology adopted by the Eurostat/OECD 2007, which has been accepted internationally and used widely in the business demography field (OECD 2008, 2009; Salas et al. 2010).

The main data source in Portugal for the universe of employer enterprises (enterprises with more than one employee) is Quadros de Pessoal. This annual mandatory survey, conducted by the Portuguese Ministry of Labour and Social Security, provides a rich and comprehensive matched employer–employee-establishment dataset. According to the registrars of the Portuguese Social Security, it is composed of all active enterprises with at least one paid employee. The database obtained from the cleaning of Quadros de Pessoal, adheres to the Eurostat and OECD methodology “Manual on Business Demography Statistics” (Eurostat/OECD 2007). It focuses on employer enterprises, which are known to be an important source of job creation. The derived dataset from the application of this methodology consists of an annual average of 215,903 active employer enterprises, with an annual average of 36.803 births and 23,743 enterprise deaths over a 20-year period (1987–2007 and 1985–2005, respectively).

Although the dataset covers the period 1985–2009, 2 years at the beginning and end of the period are lost due to the application of the Eurostat/OCDE’s (2007) methodology, when calculating enterprise births and deaths. It is recommended looking 2 years into the past from the reference period, to check for reactivations, before enterprise births are actually considered (Eurostat/OECD 2007). Thus, enterprise births were only calculated from 1987 onwards, instead of 1985, the starting year of the dataset (Fig. 17.1).

The application of the Eurostat/OECD (2007) methodology and the timings required for the calculation of high-growth and gazelle firms

A high-growth enterprise is any employer enterprise with ten or more employees in the beginning of the observation period, with an average annualized growth greater than 20 % per annum,Footnote 6 over a 3-year period.Footnote 7 Enterprise growth can be measured according to two distinct definitions, either by the number of employees (employment) or by turnover.

Given the methodology employed, enterprise births start being calculated in 1987 but high-growth firms’ birth rates can only be calculated 3 years later, in 1990, to allow for the count of the annual average growth over a 3-year period, excluding first year newborn. The reason is that, in order to fully comply with the methodology, growth rates have to be always identified from the same base population, which means excluding enterprises born in the first year from the growth measurement. Consequently, the data on high-growth enterprises should be cleaned so as to remove firms that were born in year t − 3 (in our case, 1987), when measuring growth from t − 3 to t.

Gazelle enterprises are a subset of high-growth enterprises. Gazelles, measured by employment (or turnover), are all employer enterprises employing at least ten employees at the beginning of the 3-year period, which have been employers for a period up to 5 years, with an annual average growth in employment (or turnover) greater than or equal to 20 % over a 3-year period. In other words, they reflect high-growth enterprises born 5 years or less before the end of the 3-year observation period. Moreover, the data on gazelles should also be cleaned by removing firms that were born in year t − 5, when measuring growth from t − 5 to t.

A size threshold of ten employees,Footnote 8 for both turnover and employment, is set at the start of the observation period, to avoid the small size-class bias contained in the above definition of high-growth and gazelles. In setting the employment threshold, the methodology needed to balance two competing criteria, if the threshold was set too low, it would cause a disproportionate number of small enterprises appearing in the statistics, but on the other hand, would reduce disclosure problems related to the statistical confidentiality of the microdata. If it was set too high, disclosure problems could increase, in particular for smaller economies where large enterprises are less numerous than smaller-sized ones.

The employment measurement of high growth and gazelle firms is generally preferred and is more widely used (e.g., NESTA 2009, 2011; Anyadike-Danes et al. 2009; OECD 2002), as it refers to a real variable whereas turnover is nominal, thus suffering more influence from national and structural factors, such as inflation and a country’s fiscal system. Moreover, in our data, the turnover criteria shows a higher degree of volatility than employment, when we account for both enterprises and employment in high-growth and gazelles. According to the OECD (2011), greater country discrepancies are also uncovered when the turnover definition is used, particularly at sectoral level analysis. In our analysis, when possible, we shall provide an account along these two dimensions.

The application of the Eurostat/OECD (2007) methodology also required identifying and excluding mergers and acquisitions from the dataset. As a result, most of the growth reported here is mainly organic growth (growth through new appointments in a firm) and not to acquired growth (growth through acquisitions and/or mergers). Lastly, only employer enterprises classified in sectors from sections A to Q of the Portuguese Economic Classification of Economic Activities (CAE-Rev.2.1) were considered for the purposes of this research. This includes Manufacturing sector, Agriculture, and Services.

3 Fast-Growing Firms in Portugal: High-Growth and Gazelles

This section introduces fast-growing firms in Portugal at the firm, employment, and regional level, according to four distinct groups of fast-growing employer enterprises: high-growth and gazelles categories, measured by two different growth criteria, employment and turnover.

3.1 Profiling Fast-Growing Firms in Portugal

This section presents a characterization of high-growth and gazelles, according to the employment and turnover criteria, for its amount, employment, incidence, and size-class. During this 17-year period, ranging from 1990 to 2007, Portuguese high-growth firms and gazelles, when measured by turnover, decreased both in number and their amount of employees. However, a different picture arises when the employment criteria is used, whereby both number and employees of high-growth firms’ increase over time (Table 17.1).

In 1990, 8,557 high-growth firms by turnover and 1,453 according to the employment criteria operated in Portugal (24.6 % and 4.2 % of the enterprises with over ten employees, respectively). By 2007, the number of high-growth firms by turnover decreased 40 %, while those by employment definition increased by around 10 %. Thus, in 2007, only 9.5 % of all Portuguese employer enterprises (with more than ten employees) had a turnover in line with that of high-growth firms. If instead of turnover, the employment metrics is used, the percentage of high-growth firms drops by 6.5 percentage points (p.p) to only 3 %. Similarly, the number of gazelles is also higher when measured by turnover. Over the period, the proportion of gazelles by employment was kept around 30 % of that by turnover. In 2007, firms classified as gazelles constitute only 2.2 % of the total number of Portuguese employer enterprises as accounted by the turnover criteria and 0.7 % by the employment criteria. These shares are significantly lower than those at the beginning of the period considered in this study. In 1992, reported gazelles were 1,726 and 420 in number, by turnover and employment, respectively. The amount of gazelles (by turnover) suffered a considerable decline up to 2007 (−31 %), although not as large as that of high-growth firms, the same happening with gazelles accounted for by the employment definition, which declined by around 14 %. Gazelles (employment definition) represented 23 % of high-growth firms in 2007 and 34 % in 1992, respectively.

The gap between the two measurement criteria narrowed considerably, hinting at an overall slower growth of turnover and profitability over time relative to employment growth (Table 17.1). A similar pattern was observed for gazelle firms, indicating that more firms grew faster in employment than in turnover.Footnote 9

In 1990, the share of high-growth according to employment criteria was 17 % of that accounted by the turnover criteria, whereas in 2007 this share increased to 31 %. Put differently, in 2007 there were relatively more high-growth firms accounted by the employment criteria than 17 years ago. However, its share on the population of firms with more than ten employees decreased when compared to 1990 (3 %), although keeping a somehow stable performance since 2003. Employment in high-growth firms (by turnover) decreased almost by half, from 532,866 employees in 1990 (29 % of employment in active firms with more than ten employees) to 280,861 (12 %) by 2007, while employment, as measured by the employment criteria, increased from 134,331 (7.4 %) in 1990 to 175,259 employees (7.6 %) by 2007. Employment in gazelles, when measured by the turnover criteria, also faced a considerable decline (68,610 employees in 1992 to 46,968 in 2007) but conversely, when measured by the employment criteria it increased to 33,998 workers in 2007 (28,512 employees in 1992). Throughout the period, a minimum of 92 % of all Portuguese high-growth companies are SMEs, below the threshold of 250 employees (Fig. 17.2). However, the share of SMEs in Portugal scores higher, averaging over 99 % during the 17 years considered.

Although high-growth firms are larger on average than gazelles, both types of firms are of a much larger size than the average employer enterprise firm in Portugal (Table 17.1).Footnote 10 Throughout this period, all three types of fast-growing firms verify an average size increase, with the exception of high-growth firms by turnover, which display in 2007 a lower average size (55 employees) than that verified in 1990 (62 employees). Due to their smaller average size (that also stems from their young age), gazelles qualify more easily as SMEs, thus weighing considerably more in the number of active employer enterprises, where they are relatively more abundant than their high-growth counterparts. They also score higher when compared to high-growth firms’ share of employment (employment criteria), which is kept below 50 % in most years. As a matter of fact, the turnover criteria always yields a higher share of SMEs for gazelles.

The comparison between the two criteria shows that when accounted by the turnover criteria, SME’s and employment share in the population of both high-growth and gazelles is relatively higher. This means it is easier for a smaller firm to grow 20 % in turnover than the same amount in employment over the period.Footnote 11 In some of years (namely 1992, 1993, and 2006), gazelle SMEs (by employment criteria) managed to create over 70 % of all the employment generated by the overall gazelle firm population (Fig. 17.3).

The same peaks are also verified by the turnover criteria, whereby in those same years, gazelle SMEs generated 81 %, 79 %, and 84 % of all gazelle employment, hinting at the fact that these firms withstand considerably better the downturns of the economic cycle than other types of firms. In 1990, 0.6 % of high-growth firms (by employment) of the largest size-class (+250 employees), generated 42.6 % of the employment in high-growth firms. After 1999, 0.3 % of these largest gazelles generated over half of total employment in high-growth firms (61.3 % in 1999 and 53 % in 2007).

3.2 Regional Outlook

Empirical evidence shows that fast-growing firms are randomly distributed across size and regions (OECD 2013a). However, academic research has not yet provided unequivocal evidence on the locational characteristics and determinants of high-growth firms, besides those on the general findings on the turnover and mobility of firms (e.g., Bartelsman et al. 2005; Sutton 1997; Caves 1998), the streams of the literature focusing on regional variations in general entrepreneurial attitude and activity (e.g., Bosma and Schutjens 2011; Barbosa and Eiriz 2011), those on the linkages related to the benefits of clustering or agglomeration of complementary economic activity and supporting institutions (e.g., Gilbert et al. 2006, 2008; Lechner and Dowling 2003; Porter 1998) and that in which geographic proximity facilitates the access and absorption of localized knowledge spillovers (e.g., Audretsch and Feldman 1996; Jaffe et al. 1993).

However, it is now widely acknowledged that regional disparities in entrepreneurship are noteworthy, significant, and often persistent, which can frequently surmount differences at the country level (Bosma and Schutjens 2007; Fritsch and Mueller 2006; Tamásy 2006). Fast-growing firms are no exception (OECD 2013a). In this section, we will examine in greater detail, the regional incidence and distribution of high-growth and gazelle enterprises and that of its employment by NUT II regions in Portugal.

We find high-growth firms and gazelles scattered in every region of Portugal, but to different degrees. In 2007, the region which concentrates over 46 % of high-growth firms (by both criteria) is the capital region of Lisbon. Over time, both high-growth and gazelles have become more concentrated in the Lisbon area, and less represented in almost every Portuguese NUT II region, in particular in Centro, Algarve, and Alentejo. This contrast becomes sharper when the employment definition is used. The capital/periphery divide has also widened over time, employment-wise, for high-growth firms, except for the increases in the regions with the smallest share of high-growth and gazelles in the country, the Archipelagos of Madeira and Açores (Fig. 17.4) and for gazelles located in Alentejo and Algarve, according to the turnover definition, also regions with modest shares of fast-growing firms (Fig. 17.4).

Furthermore, in 1990, the weight of the NUT II region of Lisbon in the regional distribution of high-growth firms, according to the employment definition (34.6 %) was close, though smaller, of that accounted for with the turnover criteria (33.2 %). After 17 years, this gap widened substantially and the high-growth count with the employment definition is became 6.4 p.p. larger, indicating that there were comparatively more high-growth firms growing faster in employment than in turnover in Lisbon. Similarly to other countries, Portuguese urban areas seem to be more conducive to high-growth firms, which contribute to deepen regional inequality. This might be caused by the increasing servicitization of the Portuguese economy and specialization in services, which has also pushed high-growth firms into becoming relatively more labor intensive. Lisbon also concentrates the bulk of the public sector administration, being particularly intensive in services, such as financial and real estate activitiesFootnote 12 (Sarmento and Nunes 2010a, 2012).

On the other hand, the loss of prevalence of high-growth firms in other regions, namely in the Norte region becomes quite noticeable. In 1990, 33 % of high-growth firms (by employment) and a greater amount by turnoverFootnote 13 (36 %) emerged in the North, where manufacturing activities were still more prevalent than in other regions. After 17 years, in 2007, Norte lost 1.7 p.p. of its regional weight in high-growth firms and 6.2 p.p. of total employment, according to the employment criteria, and even more according to the turnover criteria (−6.6 p.p. employment-wise), attaining in 2007 an employment share in the country of slightly over a quarter (27 % and 29 %, according to employment and turnover definitions, respectively) (Fig. 17.5).

The regions of Centro, Algarve, and Alentejo got into a similar downward spiral over time, especially when accounted by the employment criteria. High-growth firms in peripheral regions, such as the Archipelago of Madeira increased substantially their representativeness in the country, more than doubling its share, to around 3 %, while the Azores also shows a noteworthy increase, from 0.1 % to 2 % from 1990 to 2007, according to the turnover criteria. However, when accounted by the employment criteria, these regions’ weight of high-growth firms’ employment in the country’s total has not experienced substantial changes between 1990 and 2007. Yet, when accounted by the turnover criteria, both Madeira and the Azores increased their share in national high-growth employment by 1.2 p.p.

Now turning to the regional distribution of gazelles, Norte displays the sharpest decrease of all regions, losing its prevalence as the region with the highest gazelle employment in the country at the start of the 1990s. In 1992, Norte generated 44.3 % of gazelles according to employment definition and 52.3 % according to the turnover.

After Portugal’s accession to the European Union (EU) in 1986, the manufacturing sector, in which Norte was particularly specialized, was severely hit by the restructuring of many firms. By 2000, this region’s share of gazelles was considerably reduced to a quarter (25 %), by the employment criteria, and to 35.2 %, according to the turnover. It is only in 2007 that signs of a mild recovery in these regions’ quota of gazelle’s employment can be found.

Another aspect worth highlighting is that the share of gazelles lost by the Norte and Centro seems to have been relocated to Lisbon and Vale do Tejo, where their share of employment accounted by the employment criteria surpasses that accounted by turnover’s, and where the gap between both measurements escalates over time (8 p.p. in 1992 to 17 p.p. in 2007, the latter difference being twice as high as that of high-growth firms), indicating a relatively faster growth in employment terms than in turnover’s, related to a higher concentration of services in Lisbon.Footnote 14 When analyzed from the employment definition perspective, Algarve is the sole region that manages to recover slightly its share of gazelles in 2007 (3.1 %), whereas Centro faces loses initially, but manages to stabilize around a quota of 10 % after 2000.

The perspective of high-growth and gazelle’s employment share within the region where they are located, also confirms the loss of importance of these types of firms in all regions, except that of Lisbon (Tables 17.2 and 17.3). Within the region’s employment, Lisbon displays a higher proportion of high-growth firms’ later in 2007 (10.5 %) than initially in 1990 (7.6 %). On the other hand, in five other regions, high-growth firms’ share of regional employment in 2007 was reduced by almost a half compared to 1990 (Algarve, −6.1 p.p.; Açores, −5 p.p.; Madeira, −2.1 p.p.; Alentejo, −5.5 p.p.; Centro, −2.7 p.p), with Norte suffering a more modest decrease of −0,5 p.p.. Comparing 2007 shares of regional employment, high-growth firms’ employment in Lisbon (10.5 %) is almost twice as higher as that of the Norte (6.1 %) and the Algarve (6 %). The regions where high-growth employment is lower in the regions’ employment are Madeira and Azores (1.1 % by employment and 1.3 % in Madeira, and 1.5 % in Açores).

Lisbon increased its share of gazelles in the region’s employment, surpassing both Norte and Centro over time. In 2007, gazelles’ employment share in most regions’ employment was below 1.1 %, except for Lisbon which held a share twice as large (2.1 %) and Algarve, with the second highest percentage (1.6 %) (Table 17.4). In 1992, Algarve held the highest share of gazelles in the region’s employment (3.8 % according to employment and 6.9 % to the turnover criteria). Despite declining over time to 1.6 % and 3.2 % in 2007, by employment and turnover criteria respectively, its performance was enough to confirm these regions’ second and first highest positions in the regional ranking, respectively (Table 17.5).

In 2007, Madeira and Centro are featured as the regions with the smallest share of the region’s employment in gazelles (0.4 % in Madeira, according to the employment criteria and 1.5 % in Centro according to the turnover).

Finally, considering the enlarged European Union region, the latest evidence that uses the same methodology we have applied in this paper, points to Portugal being ranked within the middle (bottom) of the ranking of the OECD’s Entrepreneurship Monitor 2013 (OECD 2013b), when the indicator “high-growth enterprises rate” is used. In what concerns high-growth firms measured by employment growth, Portugal ranked 11th amongst 16 countries, in the manufacturing sector and 11th amongst 14 countries in the service sector in 2010. Considering the measurement by turnover growth, it scored 7th amongst 11 countries in manufacturing and 6th amongst ten countries in services. In what concerns gazelles, the positioning is comparatively better for the manufacturing sector, 7th in 16 countries and 2nd in ten countries, by the employment and turnover criteria, respectively. In what regards services, it was positioned as 11th amongst 15 countries and 8th amongst ten, by the employment and turnover criteria, respectively.

4 Employment and Job Creation

It is well documented in the empirical literature, the disproportionate contribution of young and small firms to the generation of employment, earnings, productivity growth, and overall wealth creation (Henrekson and Johansson 2009; Acs and Mueller 2008; Van Praag and Versloot 2008; Birch et al. 1995; Storey 1994). However, the claim that small businesses generate a large percentage of new jobs has been openly criticized by Davis et al. (1996). Previous findings need to be evaluated in the light of different definitions of small businesses coexisting in the literature, being applied to databases with dissimilar characteristics, but also has to take into account that smaller firms destroy more jobs due to their higher failure rates. Thus, when job destruction is accounted for, a significantly smaller share of net new jobs are created by these firms. A number of studies have also maintained that high-growth firms account for a significant percentage of net job creation (Anyadike-Danes et al. 2013; Salas et al. 2010; NESTA 2009; Anyadike-Danes et al. 2009; OECD 2002; Schreyer 2000). In this section, we will approach high-growth and gazelle employment and job creation according to the employment criteria, in order to understand which types of firms engender more job creation.

For the count of job creation several precisions need to be made, namely flows of gross job creation and loss must be distinguished from net job creation (the difference between job gains and job losses). Although obtaining net job creation is commonly the target, information on gross flows can also be of interest to policy, as simultaneous job creation and destruction shows evidence of labor market churning, which is part of firm dynamics and the process of market adjustment.Footnote 15

In Portugal, much of this churning is size related. Within the period 1990–2005 the average enterprise churn rate for the overall economy was 28 %, where small enterprises under 50 employees displayed a churn of 29 %, while large enterprises over 250 employees showed a turbulence rate of 5.5 %. However, it is also important to disentangle the relative importance of birth rates, the decline of larger firms and the survival and growth of existing firms and its contribution to employment growth. Within the period 1987–2005, an average of over 20 % of all jobs in active employer enterprises were being created and destroyed within a single year. For the largest firms (+250), we observe that the percentage created by firm rotation (entries and exits) was low (3 %, with the share of job creation due to entry of new firms being 2.6 %), thus existing firms created most jobs (97 %). In the overall economy, 83.9 % of new jobs were created by existing firms and 16.1 % by firm rotation within a year. The percentage of job creation due solely to the entry of new firms recorded 6.7 %. Thus, small firms contributed the most for net job creation through firm rotation, while in larger firms the majority of job creation originated from established firms.

Secondly, when analyzing net job creation, beyond taking into consideration the aggregate level of employment, one should also consider the relative importance of firm characteristics and the role played by particular groups of firms, as net job creation may differ substantially across levels and collections of firms. For instance, even though total employment may decrease, certain groups of firms (e.g., large) may enjoy net job growth. Thus, one of the most common appraisal indicators is net job creation rates for different firm characteristics, notably different size-classes to account for the contribution of small and large firms.

Thirdly, net job creation rates are percentage ratios relating net job gains to the total number of employees.Footnote 16 However, a large job creation rate does not necessarily mean a large absolute contribution to the total number of net jobs created.Footnote 17 Thus, a size-class with a high net job creation rate but with a small share of initial employment, may still cause a minor impact on overall job creation, whereas a size-class with a large share of employment may contribute more substantially to overall net job creation, even with a small rate of net job creation.

It might be useful to consider more in detail the way in which high-growth firms are measured in the Eurostat/OECD (2007) adopted methodology. In this paper, job creation is not being measured in three-year spans, that is, each firm’s employment growth is not being accounted from its first relative to its third year of growth. In other contemporary high-growth research, job creation is measured otherwise, within 3-year spells where growth is measured, for instance, between the first and third year for firms which were already selected precisely because they were already growing fast. It is then obvious that job creation has to be positive, as no job destruction is accounted for. Furthermore, in this “static” 3-year measurement, firms do not “leave” the group of high-growth firms. Clearly, beyond obtaining a positive count of jobs, it will also tend to be large, as the best performing firms are being measured precisely during the periods they perform the best, leading to the conclusion that high-growth firms are responsible for a disproportionately high share in employment relative to its share in total enterprises.

On the other hand, in our methodology, as reported in Sect. 17.2, firms have to comply with a sequence of 3 years of annualized average growth of 20 % (in either employment or turnover) in order to qualify for the category of high-growth firm or gazelle. After being classified as a high-growth or gazelle in a given year, if in the following year that particular firm does not add up to 20 % of annualized growth (making it three successive years of growth), they are removed from the group of fast-growing firms. Another aspect worth mentioning is that when a given firm does not manage to grow at this rate and withdraws from this fast-growing “group,” it removes its employees from this count, which represents a kind of “job destruction” given the way the data is conveyed, which will only be cancelled out if incoming high-growth firms or gazelles to the group bring along an equivalent amount of employees to during that same year. Because not every firm is able to sustain indefinitely this rhythm of rapid growth, net job creation might be negative in a given year, if the amount of employment of excluded high-growth firms (that were not able to sustain that amount of growth the following year) is greater than the amount of employment brought forward by incoming firms (included that year in the count of high-growth firms).

Given our methodology, job creation is dependent not only on the amount of turnover of firms that qualify (and leave) each year the pool of high-growth and gazelles, but also on their relative size as compared to the firms which leave the group. In other words, incoming and outgoing fast-growing firms’ average size also matters. Despite the waves of new incoming firms, if outgoing firms are on average larger employers than incoming, negative job creation might occur. Consequently, net job creation results from the interaction of both quantity and size of firms entering and leaving the group of fast-growing firms each year. Thus, with our methodology and such an indicator as net job creation, periods of negative job creation can occur, whereby the outflow of high-growth firms with larger average employment is greater than that brought in by incoming firms.

For fast-growing enterprises, the debate concerning whether it is the high growth of a few number of firms or the entry of many new incumbents that engenders employment growth is ongoing and is still being fuelled by new evidence (Lawless 2013; Davidsson and Delmar 2006). In what concerns gazelles, Henrekson and Johansson (2009) point to a complementarity between these two views, whereby employment in the average new firm is as important as the net job contribution of these firms. Put differently, a continuous entry of new firms is necessary to achieve net job creation, given that only a small subset of gazelles manages to achieve sustained growth (Parker et al. 2010; Henrekson and Johansson 2009).

We find this to be the case of Portuguese employer enterprise data, according to the criteria we use for accounting high growth. Particularly due to the high turbulence related to firm churning, especially in sectors such as services (Sarmento and Nunes 2010a, 2012), both the amount and relative size of firms that go in and out of the category of fast-growing firms each year cannot be neglected by the analysis. We should also draw the attention to the fact that the method by which fast-growing firms are selected matters to the results and hardens comparability between different studies. Different definitions and methodologies used for classifying fast-growing firms in specific settings and countries can yield diverse results and caution must be employed not to overstate their relative importance.

In Fig. 17.6, we portray net job creation in active employer enterprises with over ten employees, along with that of high-growth firms and of gazelles. Given the employment and job creation focus of this section, we will privilege the usage of the employment definition to account for high-growth and gazelles, which despite being more demanding on the firm, yields better results for international comparability across countries, being more “resistant” and less biased towards other influencing factors such as taxation systems, which can blur turnovers.

Given the longitudinal perspective of this research, net job creation is measured by the difference between gross job creation and gross job destruction in consecutive years. Gross job creation (or destruction) is the sum of employment gains (loss) for all (new and existing) employer enterprises whose employment level is greater (smaller) than that of the previous year.Footnote 18 We observe high-growth and gazelle’s net job creation accompanies the major upward and downward job creation cycles, but its peaks are more softened, especially in the case of gazelles, which seem to suffer from a lower volatility and exposure to the business cycle. The negative peaks have been shown to be related to periods of economic downturnFootnote 19 (e.g., Sarmento and Nunes 2010b, 2012).

In order to facilitate this investigation, we group the study period into subperiods (1991–1995, 1996–2001, 2002–2007, and 2003–2007), due to the substantial volatility surrounding the two main years of economic slowdown, 1993 and 2000 (Table 17.6). During the first sub-period, high-growth enterprises were responsible for the destruction of 20 % of employment of firms with over ten employees, as the number of firms that managed to sustain that rate of growth decreased visibly between 1991 and 1995, with the exception of 1994, where there was a net increase of ten firms. Due to the methodology used, the effect of crisis of 1993 is still observable during the following 3 years, and only from 1996 onwards is the count of both high-growth and gazelles (by employment) positive, the same happening for turnover one year later, in 1997. Thus, the number of firms able to sustain the rhythm of growth of 20 % in three consecutive years in order to qualify for the category high-growth firms decreased considerably over this period, bringing about considerable job destruction. Gazelles, however, managed to create 80 net jobs from 1992 to 1995, showing a better endurance to the economic slowdown.

Between 1996 and 2001, a recovery period mediating between the two downturn periods, net job creation in fast-growing firms amounted to 111,568 jobs, over a quarter (29.4 %) of the total net job creation in firms with more than ten employees. High-growth firms, which represented an average of 3.3 % of total active firms with over ten employees throughout this period, engendered 26 % of overall net job creation and accounted for the bulk of the net job creation (88 %) as compared to gazelles (22 %), which represented 0.8 % of all firms, creating 3.4 % of total net job creation. In contrast, the following period 2002–2007 depicts net job destruction for both types of firms if the year of 2002 is included in the count, which indicates that a combination of more numerous and possibly larger fast-growing firms exited these categories (Table 17.6).

Because of the methodology and the count of 3 years of successive growth, the impact of the 2000 crisis is shown to be more prominent in the year 2002, as several firms were not able to maintain their growth trajectories. Over the sub-periods, it is observable that although gazelle job creation rates are lower than high-growth’s, due to being less abundant in the economy, they display nonetheless better resilience to the business cycle, not only by creating but also by destroying a lesser amount of jobs.

In order to provide a perspective of these firms’ importance for the Portuguese economy, Table 17.7 displays a summary of their shares in the number of enterprises, employment, and job creation.

Within the extended period, high-growth firms represented 3.1 % of all active enterprises with over ten employees and 7.5 % of its employment, but generated 7.9 % of its jobs, which corresponds to 4 % of all active employer enterprises job creation. Gazelles displayed a more striking performance, even though they created a lesser amount of jobs, given they are less abundant than high-growth firms in the economy. Gazelles represented less than 1 % of all active enterprises with over ten employees and less than 2 % of its employment, but generated a considerable higher proportion of job creation, 7 %, which corresponds to 3.5 % of all job creation by all active employer enterprises. Thus taken together, fast-growing firms, roughly 4 % of firms with over ten employees, employing 9 % of its workforce, created 15 % of all jobs (and 7.5 % when firms of all size-classes are considered).

Next, we attempt to disentangle the effects of size in job creation for fast-growing firms, dividing firms into two main groups, SMEs and large firms. We have first computed a shift-share analysis of job creation by size-class to later arrive at the summary of shares for the most relevant economic variables, shown in Table 17.8.

In Portugal, over the period 1990–2007, 98 % of enterprises (10–249 employees) were SMEs. When all active employer enterprises are considered (1–250), this proportion raises to 99.6 %. In what concerns high-growth firms, 93 % are SMEs (10–249) and only 7 % stand as large enterprises. We observe that this small number of large high-growth firms employing more than 250 employees (over 100 enterprises during the extended period, weighing 52 % in overall high-growth employment), were responsible for 95 % of the total jobs created by high-growth firms from 1990 to 2007. This amounts to 38,706 jobs or 65 % of all jobs created by active enterprises with over ten employees and more than half of all jobs created by all employer enterprise firms. This is striking when compared to the universe of Portuguese active employer enterprises with over ten employees, which only accomplished a mere 11 % of job creation and 7 % when all active enterprises are considered.

Four main reasons lie behind this ravishing performance of the largest high-growth firms. Their number and relative abundance over time, coupled with size and age characteristics. Firstly, their average size (803 employees) is disproportionately higher than that of high-growth firms in other size-classes (55 for high-growth SMEs) and greater than that of active firms of the same size-class (763 workers in all employer enterprises). Secondly, employment in the largest size-class of high-growth firms, as compared to remaining smaller size-classes of firms increased considerably over time during this period. Furthermore, by the late 2000s the biggest size-class of high-growth firms were more abundant than at the start of the 1990s (the share of firms with over 250 employees increased 10 p.p. from 43 % in 1990 to 53 % in 2007). Fourthly, high-growth firms are on average older than gazelles. Their ability to thrive has already been put to test as they have stood for longer in the market. According to the age-survival relationship found in previous research, larger firms exhibit higher average survival rates (Nunes and Sarmento 2012). Thus, taken as a size-class, its job creation ability has been above the average of other size-classes and also above that of the largest size-class of gazelles, making them extremely resilient to job destruction and hence a massive net positive contributor to job creation.

But within younger firms,Footnote 20 size seems to also matter. Despite gazelle’s large average size (764 employees), similar to that of the average large firm (762), their average size as a size-class is substantially higher than that of other gazelle’s size-classes (52). Considered from a size-class perspective, largest firms amass 47 % of gazelle’s employment over the extended period. The larger gazelles with over 250 employees (6 % of all gazelles, corresponding to an average of 20 enterprises over the extended period) are responsible for 66 % of gazelles’ job creation, contributing with 20,592 jobs (22 % of all jobs created by active enterprises with over ten employees and 20 % of jobs created by all active enterprises). This performance is overwhelming when compared to active employer enterprises in the period 1992–2007, which only managed to create 19 % of jobs in overall jobs created by firms with over ten employees and 11 % when job creation in all active enterprises is considered.

Despite the smaller amount of gazelles (averaging 22.5 % of that of high-growth firms within the period 1992–2007), they managed to create 58 % of high-growth firms’ jobs, and 37 % of all job creation of fast-growing firms, thus engendering relatively more jobs per firm than high-growth enterprises (1,148 new jobs created on average compared to 203 for all high-growth firms). This seems to be attributed to these younger firms capacity not only to foster faster job creation, but to better endure unfavorable business cycles, thus triggering less job destruction than their high-growth counterparts.

Six main findings arise from the analysis of these empirical facts. Firstly, net job gains are significantly smaller than gross job gains. Secondly, fast-growing firms are outstanding job creators, being 3.9 % of all firms over ten employees, but employing 9.2 % of the workforce and being responsible for 15 % of jobs and 7.5 % of those created by all active enterprises.

Thirdly, from the group of fast-growing firms, gazelles are the most outstanding job creators. They are less relatively abundant and smaller than high-growth, thus their absolute share in job creation is lower, though close, to that of high-growth firms. Nonetheless, their impact is strikingly higher. Their job creation ability is disproportionately higher given their smaller weight in the share of firms and employment. Gazelles constitute only 0.8 % of all firms, with an employment share of 1.7 %, but manage to create 7 % of jobs in active enterprises with over ten employees, which represents four times its employment share.

Fourthly, net job creation tends to be the highest among the largest high-growth and gazelle firms (over 250 employees), contrary to what is verified in the universe of active employer enterprises. Thus, the largest high-growth firms and gazelles are responsible for the bulk of job creation. In fact, a very few firms, a total of 120 high-growth firms and gazelles on average in the period, generated 44 % of the total jobs created by large firms in the extended period (65 % by high-growth firms and 23 % by gazelles), corresponding to a share of 9.5 % of the total job creation in enterprises with over ten employees (compared to a share of 9.7 % for all high-growth firms) and 4.3 % for gazelles (7 % for all gazelles).

This evidence for fast-growing firms challenges the standard assumption of the negative relationship between size and net job creation, whereas most job creation is attributed to small firms. This however still holds true when the overall set of enterprises is considered, where 99.6 % of enterprises are SMEs, responsible for 95 % of all job creation.

Fifthly, considering the largest size-class, high-growth firms create comparatively more (net) jobs than gazelles (95 % and 61 % respectively). This group of the largest high-growth firms, not as young as gazelles, but of a larger average sizeFootnote 21 are of critical importance as a source for job creation in the Portuguese economy.

Sixthly, when comparing the contribution to job creation of these two types of fast-growing firms, we find that is not firm age per se that drives the bulk of net job creation, but rather firm size along with the turnover of firms that are able to attain and sustain high growthFootnote 22. Thus, for the group of employer enterprise firms with over ten employees, size seems to bring about a relatively more significant impact in job creation than age. As mentioned, the discrepancy between average firm sizes for the largest size-class of both gazelles and high-growth is staggering. Another fact which can also help explaining this phenomenon can be traced back to the characteristics of Portuguese entrepreneurial fabric, which displays a smaller average size as compared to most of their European and American counterparts (Sarmento and Nunes 2010a; OECD 2008, 2009) and a sustained decreasing average firm size over the last two decades (Sarmento and Nunes 2010a, c). In this setting, firms with a larger than average size, such as large fast-growing firms, can bring about a more significant impact on job creation.

Another factor worth pointing out is whether the relative impact of the largest size-class of high-growth and gazelles in job creation would be reduced if we considered all firms and not only, those with more than ten employees also depend on the amount of high-growth and gazelles in the population of micro-firms. It is acknowledged that attaining higher rates of growth in employment is relatively easier for smaller than for larger firms (e.g., for firms with one employer, the hiring of another already qualifies them as high-growth). However, there are many methodological issues that make these firms’ inclusion problematic, hindering comparability at the international level, and arguing for their exclusion from the pool of firms where fast-growing firms are drawn. A last remark to mention that if we took the more positive stance of the turnover criteria, bearing in mind that the turnover criteria always yield a greater amount of employment for Portuguese firms, the impact of these fast-growing firms in job creation would have been even higher.

5 High-Impact Growth and Policy Design

As already mentioned, there is wide agreement surrounding the significant generation of broader social benefits, arising from the activities of high-growth and gazelles, in terms of both employment and earnings and the spread of its benefits to the economy as a whole. This evidence has turned high-growth and gazelles into a row model that many aim to follow. Accordingly, several authors have advocated the adoption of selective assistance interventions, focused on firms that have the potential of becoming high growth and impacting the real economy. In view of this line of argument, one might be led to think that all that remains to be done is to provide fast-growing firms with the conditions, means, and support to ensure that their growth is sustainable and more widespread.

In this quest, policy-makers are often left to figure out for themselves the right kind of policy-mix and geographical scale of intervention that better supports these fast-growing firms, some even without a clear understanding if these are worth pursuing or not, given the usual market failure rational behind policy intervention and the potential for deadweight loss. But how close should policy zoom into these firms for an optimal policy fit and maximum impact is a matter still under considerable debate.

This section intends to tackle these issues and contribute to the discussion by shedding some clarity onto the process of policy design for fast-growing ventures. The challenge is to translate our present (limited) knowledge on these issues into a conceptual framework for conceiving policy support, which remains sufficiently robust to be used within a policy context. This is approached through a conceptual modular framework, divided into six building blocks of questions that ought to be answered sequentially: “why,” “what,” “who,” “when,” and “how” to provide support, to finally arrive at the “so what” fundamental question.

By definition, fast-growing enterprises create more jobs, being crucial for change and renewal of productive sectors (Schreyer 2000). But is there an economic rational or some form of policy justification to provide specific support to successful enterprises? Why should high-growth firms and gazelles be offered more (targeted) support than other ventures, when they appear to need it the less? These overperforming firms present a major challenge to policy-makers, as high-growth firms are themselves the product of a dynamic growth process of a market, whereas gazelles are in a constant state of change. Thus, what makes a clear target for policy?

Knowledgeable policy-makers demand to use the best available evidence in order to make evidence-based decisions or, at best, informed-based decisions. By looking into the empirical evidence for an answer, one realizes that no matter how carefully empirical studies are laid out, most suffer from data and methodological constraintsFootnote 23 and are often by themselves not able to provide an insight on how to connect observable facts with the best policies, and thus lead firms, regions, and national economies into the best growth path (Anyadike-Danes et al. 2013; Basu 2013). Furthermore, there is a considerable scope for human subjective reasoning, as linking data and statistical procedures with policy entails invariably a leap of imagination.

It is also common to ascertain that beyond data, theory must be employed to make policy prescriptions. Moreover, in order to decide appropriately, one also needs reason and “that is often a stumbling block” (Basu 2013, p. 17). In such a case, what is the role of theory in all this process? Are there instances where theory can be made expendable, cases where spotting regularities in data, coupled with reasoned intuition can lead into useful policy prescriptions? Hitherto, one of the main roles of theory has been to allow consistency checks on our intuitive beliefs.

And is entrepreneurial success determined internally by the assembled resources of the firm, or is it environmentally determined? Or is it derived from the interaction of both internal and external factors? Different theories contend different approaches.

Consequently, how to address all these innumerable and conflicting demands? Primarily, we have to acknowledge the limitations of the present exercise. No matter the size of the population from which we draw our analysis, since it is impossible to draw even the smallest samples from tomorrow’s businesses, and given that the policies we craft today are due for future implementation, there is actually no scientific way to go from today’s evidence regularities into tomorrow’s policy. We are then left to rely heavily on reasoned intuition, common sense, and good judgement to bring about clairvoyance to informed decision-making.

5.1 Why “Type” of Questions

Thereby, we start by acknowledging the importance of asking the “why” type of questions, a fundamental ingredient of human understanding. In our view, when considering policy and/or support design, the “why” type of questions have to be addressed right from the start and well ahead before dwelling into other considerations.

However, providing answers to these interrogations is neither easy nor straightforward. Thus, for the time being, what can we pinpoint that can still be put to good use from a policy perspective? Firstly, there is still no consensus surrounding the validity of market failure arguments in support of high-growth ventures. In most common frameworks of policy action, support to firms is justified where a problem of some kind arises in a given market, usually related to market failures. These can be derived from situations such as low skill levels, low supply of capital, informational barriers, and low investment levels in areas where R&D has a public good nature. Many caution that there is no market failure rational behind these types of policy interventions and that those focused on fast-growing firms amount to “picking winners,” which should not be the primary aim of government support. Gazelles might even make a stronger case to receive some type of support, given that market failures are more susceptible to arise from the additional risk derived from their activity and investment decisions, as they usually engage in more uncertain activities. But gazelles are by definition successful. They are the living proof of far better achievements at handling risk, which growth and expansion entails, than most other firms. Thus, what does often legitimize support is the realization of market failures arising from the specific needs of these firms not being adequately addressed by the market and the private sector due to asymmetric and incomplete information, as well as moral hazard issues.

Secondly, policy support can also be legitimized by system failures, such as the lack of interaction with innovative systems, academic and knowledge networks or situations where impairments of some kind limit the absorption of new scientific knowledge. Thirdly, it can also be legitimized by broader macroeconomic goals such as employment creation or productivity growth related to competitiveness issues. These do not necessarily need to go together. They are often mutually exclusive in terms of policy options and design. The underlying motivation is that the market might be generating a suboptimal level of fast-growing enterprises and thus employment and wealth creation, leading to inefficient allocation of resources, stemming from market failures or suboptimal levels of value creation, this time derived from system failures. An obvious outcome of policy support is the increase in the number and incidence of high-impact firms that can spur faster growth in key economic variables. The ultimate outcome can be more employment or new value creation through production growth, achieved by increased innovation and productivity.

As current practice is concerned in this particular field, high-growth firm policy has been promoted enthusiastically, despite the known weaknesses lying at the base of its evidence and the lack of impact studies demonstrating clear positive effects in firm growth and performance and its relation to macroeconomic variables such as employment or job creation. Somehow, policy-making has been running ahead of evidence, frequently driven by government policy rhetoric, political headlines, benchmarking, and “arms race” competitions with other countries (or regions), thus implemented based on the assumption that more is better than less, that higher rates of ambitious entrepreneurship are preferable to feeble ones and that some regions can instantaneously become more attractive to capital and investment. These motivations are particularly emphasized when output indicators, such as unemployment rates behave unfavorably. The lack of a clear economic rational, such as when policy support only stems from a coordinated reaction of some regions/countries to others, might explain the absence of the positive estimated aggregate effects on GDP and employment levels.

In the early days, since its inception in 1990, entrepreneurship promotion efforts were geared towards increasing the rate of entrepreneurship, rather than targeting specific types of entrepreneurs or firms. By then, distinction was not made between high or low rhythms of growth. Today, in contrast, several countries (e.g., Denmark; Finland; Sweden; France; Netherlands; UK, and Scotland in particular, Germany, Canada, US, and New Zealand)Footnote 24 have geared some of its policies towards nurturing an increasing number of fast-growing firms, especially gazelles, which can yield higher and faster job creation rates. Some already have mechanisms in place (Stam et al. 2012; Europe INNOVA 2011; Lilischkis 2013). But most of these policies still draw on the standard arsenal conceived for intervening at the national level, through mechanisms such as industrial policy, whereas employing regional and local policies for engendering and stimulating higher growth firms is still found to be uncommon (OECD 2013a). These facts point to the need of undergoing a preliminary mapping of existing policies, and uncovering those which are already affecting fast-growing enterprises, either positively or negatively, and directly or indirectly. It might be the case that only some fine-tuning on instruments and/or targets is required for policies or programs in progress.

In Denmark, policy design starts by approaching the business cycle. Depending on how well the economy is progressing, the emphasis shifts between fostering productivity or job creation. During the last few years, the emphasis has been on job creation, although in reality the end effect may well be on both. After the support is provided, Danish authorities also conduct surveys in order to track and assess real progress in performance and job creation.

In connection to the way Danish authorities approach this matter, more fundamental questions arise, concerning for instance whether the lack or underperformance of fast-growing firms is the consequence or the cause of the economic performance of a region or an economy. The case of Portugal shows that the country has some of the highest rates of new firm formation relative to the existing stock of firms and some of the highest death rates of its European counterparts, particularly in the services sector (Sarmento and Nunes 2010a, b, 2012). The available evidence for Portuguese micro-firms seems to point to the fact that high growth does not seem to grant better survival chances. Gazelles seem more prone to dying than high-growth firms, showing that rapid growth based on short-run factors, such as the business cycle does not grant longevity or sustained growth.Footnote 25 Firms’ behavior and performance thus seem to a large extent to be a by-product of the economy’s own economic performance and its subdued pattern of structural reforms (e.g., OECD 2012).

The fact that job creation in fast-growing firms stems from a long line of empirical research, proven to be consistent among different settings and countries, provides a starting point and a reasoning for considering some form of policy intervention, or at least of looking into ways of synergizing with existing policies so as to include these firms.

After identifying the exact market failure to be addressed, or in case there is none, after devising a sufficiently robust economic rational, the raison d’être, for policy support in favor of fast-growing firms, policy design should focus on clarifying sequentially other five types of questions, “what” is the purpose, “who” to support, to later address the combination of “when” and “how” to intervene in the market with the right support propositions.

5.2 What Are the Intended Results?

In case a decision is taken to formally support fast-growing firms, a policy and strategy is known to be able to facilitate high impact entrepreneurship through delivered outputs and outcomes of policy support. From a macroeconomic perspective, decisions have to be made whether in the particular situation of a region/country, priority is given to job creation and employment or to productivity increases, faster growth, and value creation. These two different options lead to different outputs and outcomes for non-high-growth firms and entrepreneurs and for firms who are already growing at a faster rate. From a more microeconomic perspective, a fundamental choice has to be made ahead, if the intended purpose is to increase the quantity or improve the quality of entrepreneurial ventures. This entails deciding on the intervention reach (if broad or more targeted) and determining whether policy support will aim at facilitating entry, new firm operation, business growth, awaking dormant firms, or support the repetition of period of high-growth.

Consequently, different policies, strategies, and combinations of instruments ought to be devised according to the desired results of policy support but need to be tailored to target audiences, which often overlap. As its distinction and specific linkages to the remainder modules of this framework is not always obvious, we propose to look at the actors in more detail in the next section.

5.3 Who to Support?

When applying the “who” to support criteria for arriving at a suitable policy design, several successive layers of selectivity questions have to be thought through. In the first place, are fast-growing enterprises/ambitious entrepreneursFootnote 26 the most appropriate target for reaching the desired economic goals? Further down the road, the answer to this question makes a difference for the chosen policy-mix, as a more general “enabling” policy might be able to deliver the intended results and be better suited to bring about the intended benefits, which can be more widespread to the general entrepreneurial fabric. We propose a segmentation criteria to be made on the basis of firm growth or growth prospects according to pretested variables, instead of the most commonly used age or size. Then, further selection layers can be applied according to most prevalent characteristics of firms, such as age, size, industry, and technology intensiveness. The way to slice across the population of enterprises to obtain different groups of firms with a given range of characteristics considered useful to target, is highly dependent on the policy purpose.

Secondly, it is relevant to distinguish between targeting the entrepreneur or the firm. We have chosen to include both. One of the possibly ways to tackle who to support is to start by segmenting actors based on their growth pattern and secondly age, so as to distinguish fast-growing ventures from static and former fast-growing firms and among them, young from old (in order to isolate gazelles from high-growth firms).

Thirdly, whether the former or the latter, or both, are chosen to receive support, a detailed characterization is needed for identifying exactly who, amongst all actors, will be targeted for support. If the objective is targeting a firm/entrepreneur that has a potential or is already engaged in some kind of high-growth, some sort of definition of “what” constitutes high-growth is also required. As mentioned earlier, there are no universal definitions for entrepreneurship, let alone for high-growth entrepreneurship. At the international level, the most commonly used has been the OECD/Eurostat’s (2007), but other countries and authors have devised and employed a diverse array. For instance, in Denmark, the threshold for a high-growth enterprise is not ten employees, but five, as firms are considered too small. In the Netherlands, the OECD definition was not fully adopted as the size of the firm is taken at the end of the three year period of growth. Parker et al. (2010) makes use of the definition of a firm belonging to the group with the highest rate of growth of a population, in a particular period (e.g., the so-called “ten-percenters”). given the economic circumstances and specificities of a country, its policy objectives and the type of entrepreneurial fabric, existing definitions might still need to be subject to fine-tuning and updating.

Fourthly, after the first round of actor identification, it is imperative to define the correct support thresholds to discern exactly who of a given category of entrepreneurs/firms is actually eligible for support (often a combination of age, size, industry, technology intensiveness, and growth patterns). Though opportunities to take advantage of fast-growing firms exist in every region, there might also be instances where a regional dimension needs to be added to the selection of variables, mostly due to the fact that resources are limited and that areas of intervention must be established either to pilot programs or to guarantee better effectiveness, especially when a more direct and targeted approach is the chosen tactic.

But there might well be no universal criteria to determine whether firm A deserves better support than firm B. There are many elements of discretionary choice involved. Indeed, what constitutes a meaningful measure of the potential success of a firm can actually be a function of different types of considerations, such as the nature of the firm’s activity (e.g., manufacturing versus services, innovative versus non-innovative), its governance structure, along with other economic and financial indicators, such as its capital and equity structure.