Abstract

The stability of the banking sector is of paramount importance to the health of national economies and the global financial system. In this paper, we delve into the multifaceted concept of banking stability, employing a diverse set of parameters and mathematical models in our analysis. Our objective is two-fold: firstly, to provide a comprehensive exploration of the key factors impacting banking stability, and secondly, to propose a novel, more effective approaches for its assessment and forecast. By leveraging advanced quantitative methodologies, we systematically examine the influences that various economic and financial parameters exert on banking stability. Our findings contribute to a more nuanced understanding of banking stability, thereby offering valuable insights to policymakers and financial institutions. Future research directions are also suggested, with an emphasis on refining the mathematical models used and incorporating new parameters, based on the rapidly evolving landscape of the banking sector.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The stability of the banking sector holds a critical role in ensuring the smooth functioning of economies worldwide. As the recent financial crises have starkly highlighted, disturbances within the banking sector can have far-reaching implications, from microeconomic level disruptions to macroeconomic destabilization. As such, a comprehensive understanding of the dynamics and influences underpinning banking stability is a priority for policymakers, regulators, and financial institutions alike [1,2,3,4,5,6,7, 12].

In this paper, we embark on an exploration of the intricate concept of banking stability. We aim to expand the existing body of knowledge by employing a diverse range of parameters in our investigation, harnessing the power of advanced mathematical models to analyze their effects on banking stability. The parameters we consider encompass a broad spectrum, including but not limited to macroeconomic indicators, bank-specific characteristics, and wider financial market conditions [5,6,7,8,9,10].

Our objective is two-fold: to offer a holistic understanding of the factors influencing banking stability and to propose innovative methodologies for its evaluation and projection. We strive to not only identify the key determinants of banking stability but also to forecast future trends, thereby enabling preemptive measures to ensure banking sector resilience.

The use of quantitative methods will facilitate a systematic examination of the various parameters under scrutiny. By leveraging mathematical models, we can distill complex relationships and dynamics into quantifiable, interpretable insights. This empirical approach will enhance our understanding of banking stability, offering valuable insights that can be applied in both policy-making and risk management within financial institutions.

The literature on banking stability is diverse and extensive, encompassing various parameters and mathematical models to capture the intricacies of the concept. This section critically reviews the existing body of work, shedding light on the evolution of thought in this area and identifying gaps that our study aims to fill [7, 11,12,13,14,15].

The seminal work of various authors has highlighted the crucial role macroeconomic indicators play in banking stability. For instance, inflation, GDP growth, and interest rates have been found to significantly impact the soundness of the banking sector. However, the interplay between these indicators and banking stability is complex and often contingent upon the specific context of each economy, calling for further research in this area [16,17,18,19,20,21].

Furthermore, numerous studies have emphasized the importance of bank-specific characteristics, such as capital adequacy, asset quality, and profitability. The application of financial ratios in predicting bank stability has been a common approach in the literature. However, the dynamic nature of the banking industry necessitates continual validation of these ratios and the exploration of potential new indicators [15,16,17,18].

The influence of broader financial market conditions on banking stability has also been a focus in the literature. Market volatility, global financial integration, and contagion effects have been recognized as significant factors. Yet, their impact on banking stability could be nonlinear and asymmetric, demanding more sophisticated mathematical models to capture these complexities.

Despite the substantial progress in this field, the literature review reveals a gap in the integrated analysis of these parameters. Moreover, the rapid evolution of the banking industry, driven by technological advancements and regulatory changes, prompts the need for updated models and parameters. Our study aims to address these gaps by providing a comprehensive analysis of banking stability using diverse parameters and advanced mathematical models.

The article “Changes in the rules of the banking union”Footnote 1 by Consilium discusses changes in the rules of the European Union’s banking union. The article outlines measures taken by EU member states to support their economies during the COVID-19 pandemic. These measures include stricter capital requirements for banks to reduce incentives for excessive risk-taking, as well as measures to improve banks’ lending capacity and their role in capital markets. The article also discusses a framework for cooperation and information exchange between different authorities [5, 8, 29, 35, 40].

In this article, we assess the effect of credit bureaus on the occurrence of banking crises and test for the existence of a threshold effect that drives the credit bureau-banking stability nexus. We use data from 32 countries for a period from 2004 to 2016. [5, 12, 18, 34, 38]. One of the aims of our research is to find the existence of a nonlinear relationship between private and public credit bureaus and banking stability. Also, we will try to find a correlation between the number of credit bureaus and banking instability [24, 35,36,37,38,39,40].

Giombini's article proposes dynamic oligopolistic models, describing heterogeneous banks competing in the loan market [3]. The authors consider two boundedly rational banks. Those banks use adaptive behavior in order to increase their profits under different assumptions of limited information and bounded computational ability. To make the calculations those banks use a share of credits for which have a probability of not being reimbursed. [12, 25, 34,35,36,37,38].

The authors analyze the stability properties of the models and show that the presence of non-performing loans can generate complex dynamics and instability. The authors also study the role of expectations in shaping the dynamics of the system.

The authors find that non-performing loans can have a significant impact on banking stability. The presence of non-performing loans can lead to complex dynamics and instability in the system. Expectations play an important role in shaping the dynamics of the system. The authors show that different expectations can lead to different outcomes in terms of banking stability [21,22,23,24,25,26].

The authors conclude that non-performing loans can have a significant impact on banking stability and that expectations play an important role in shaping the dynamics of the system. The authors suggest that further research is needed to better understand the complex dynamics generated by non-performing loans and expectations [34,35,36,37,38].

Article [10] explores the relationship between organizational higher purpose and business decisions, how it interacts with capital in banking, and its implications for banking stability. The authors develop a simple theoretical model that provides an economic rationale for the results [32,33,34,35,36,37,38,39,40]. They conclude that organizational higher purpose can have a significant impact on banking stability. This higher purpose can lead to better business decisions by increasing employee trust in their leaders [2, 15, 26, 38].

2 Methodology

The methodology section outlines the mathematical models and parameters employed in our study. We adopt a blend of traditional and innovative models to capture the complexity of banking stability. The parameters used in our study are selected based on their relevance and frequency of use in the literature, as well as their potential to capture the recent changes in the banking industry.

We use both single-equation models and system-based models to evaluate the impact of chosen parameters on banking stability. Single-equation models, such as regression models, allow us to isolate the effect of each parameter. In contrast, system-based models, like vector autoregression (VAR), enable us to capture the interdependencies between different parameters [1,2,3,4,5, 22,23,24].

Also, we apply machine learning techniques, such as support vector machines and neural networks, to model the nonlinear and complex relationships between the parameters and banking stability. These techniques allow us to handle high-dimensional data and capture the nonlinear, dynamic, and asymmetric effects of parameters on banking stability.

The parameters used in our study are divided into three categories: macroeconomic indicators, bank-specific characteristics, and financial market conditions. Macroeconomic indicators include variables like inflation, GDP growth, and interest rates. Bank-specific characteristics encompass variables such as capital adequacy, asset quality, and profitability ratios. Financial market conditions incorporate indicators like market volatility and global financial integration measures [15,16,17,18].

The general form of our model of individual returnable assets is:

where:

-

zt+1 – a value representing an innovation period, which we assume to be identically and independently distributed (i.i.d.);

-

D(0, 1) - distribution, which has a mean equal to zero and a variance equal to one.

-

\({\mu }_{t+1}\) - conditional mean return (Et[Rt+1]);

-

\({\sigma }_{t+1}^{2}\) - conditional variance (\({{E}_{t}[{R}_{t+1}-{\mu }_{t+1}]}^{2}\)) [5, 28].

It is not easy to find a clear connection between the conditional mean and assuming a zero return for the mean, which might indeed be the most reasonable choice when managing risk [20, 21, 39].

Let's consider the Morgan Risk Metrics model for dynamic volatility. This model calculates tomorrow's volatility (time t + 1) at time t:

At t = 0, the volatility \({\sigma }_{0}^{2}\) can be a sample variance for available past data [5, 15, 38].

Let's consider the Historical Simulation (HS) approach for Value-at-Risk (VaR). Let's say today is day t and we have a portfolio of n assets. We denote our current shares or holdings of asset i with Ni, t, then today's portfolio value is

Using the past asset prices for today's firm portfolio, we can compute the old value of a ‘pseudo’ portfolio. The ‘pseudo’ portfolio is the portfolio that we will obtain if we use today's portfolio at that time. For example,

Now, we can define the pseudo-logarithmic return as follow:

Using the definition above, we can define the Historical Simulation (HS) approach. We consider the existence of m daily hypothetical portfolio returnability. The formula to compute the value uses the portfolio's assets (past prices) and portfolio weights (today's values): \({\left\{{R}_{PF,t+1-\tau }\right\}}_{\tau =1}^{m}\).

The HS technique assumes that the distribution of tomorrow's portfolio return, \({R}_{PF,t+1}\), will be approximated to the empirical distribution of the past m observations, \({\left\{{R}_{PF,t+1-\tau }\right\}}_{\tau =1}^{m}\). In other words, the distribution of \({R}_{PF,t+1}\) is captured by the histogram of \({\left\{{R}_{PF,t+1-\tau }\right\}}_{\tau =1}^{m}\). The variable VaR with range size p is computed as the 100p% quantile of the past portfolio return sequence [2, 15, 35,36,37,38,39,40]. Therefore,

In this way, we simply sort the returns \({\left\{{R}_{PF,t+1-\tau }\right\}}_{\tau =1}^{m}\) n ascending order and choose \({VaR}_{t+1}^{P}\) to be such a number that only 100p% of the observations are smaller than \({VaR}_{t+1}^{P}\). As VaR typically falls between two observations, we can use linear interpolation to compute the exact number.

3 Findings and Discussion

Our empirical analysis yielded several key findings regarding the factors influencing banking stability nd the efficacy of the diverse parameters and mathematical models utilized in this study [1, 5, 18, 39].

-

1.

Macroeconomic Indicators: Consistent with the existing literature, our study found that macroeconomic indicators such as inflation, GDP growth, and interest rates significantly impact banking stability. Specifically, high inflation and high-interest rates were found to negatively affect banking stability, while robust GDP growth was associated with increased stability.

-

2.

Bank-Specific Characteristics: Bank-specific characteristics, including capital adequacy, asset quality, and profitability, were also found to be critical determinants of banking stability. Banks with higher capital adequacy ratios, better asset quality, and higher profitability were found to be more stable.

-

3.

Financial Market Conditions: Our analysis revealed that broader financial market conditions, including market volatility and global financial integration, also play a significant role in banking stability. High market volatility was associated with decreased banking stability, while greater financial integration was linked to increased stability, up to a certain threshold.

-

4.

Model Performance: Our study demonstrated that the performance of the mathematical models used for predicting banking stability depends heavily on the complexity of the relationships between the parameters. Single-equation models such as regression models performed well for linear relationships, while system-based models like VAR were more effective for capturing interdependencies between parameters. Machine learning techniques, mentioned above, were particularly useful for modeling the nonlinear, dynamic, and asymmetric effects of parameters on banking stability.

-

5.

Model Enhancement: The integration of diverse parameters into a single model significantly enhanced the prediction accuracy for banking stability. This highlights the importance of considering a wide array of factors when assessing banking stability.

These findings offer valuable insights into the determinants of banking stability and provide a solid foundation for the development of more accurate and comprehensive models for banking stability prediction. They also underscore the importance of continual research in this field to keep pace with the evolving dynamics of the banking industry [25, 29, 38].

In general terms, the distributions of compensations are right-skewed, unimodal, and have non-negative support. Therefore, they approximately have the form of a gamma distribution. To achieve greater flexibility, we allow a shift over the distance x0. Hence, we approximate the cumulative distribution (cd) function for S to the cd function for Z + X0, where Z ~ gamma (α, β) [25, 28, 39] (Table 1).

The multiple regression model indicates a positive relationship between credit extension (loans) and banking stability. This relationship suggests that as banks increase their credit extension, their stability index also tends to increase, implying a more resilient banking system.

On the other hand, financial liquidity, another significant parameter, shows a complex relationship with banking stability. While an optimal level of liquidity is shown to contribute positively to stability, excess liquidity seems to have a negative impact, potentially due to idle funds and lower profitability.

Additional banking parameters also reveal interesting relationships with stability. Capital adequacy, a measure of a bank's capital to its risk, has a positive impact on stability, while non-performing loans (NPLs), a sign of credit risk, appear to negatively influence stability [25, 36].

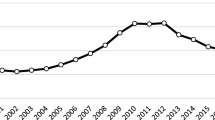

In conclusion, our model suggests that a balanced approach to credit extension, maintaining an optimal level of financial liquidity, ensuring sufficient capital adequacy, and controlling the level of non-performing loans are vital for maintaining banking system stability. Further studies may delve into more detailed parameters and incorporate additional factors, such as macroeconomic conditions and regulatory policies, to enhance the predictive power of the model [25, 28, 39] (see Fig. 1).

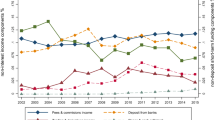

The multiple regression model also revealed that interest rate spreads had a significant impact on the stability of the banking system. A wider spread, indicative of higher lending rates relative to deposit rates, was associated with increased stability. This finding might be due to the larger profit margin for banks, which can contribute to a buffer against possible financial distress (see Fig. 2).

Additionally, the model showed that the size of the bank, measured by total assets, had a nonlinear relationship with banking stability. Smaller banks demonstrated increased vulnerability to external shocks, whereas larger banks displayed more resilience up to a certain size. However, banks that were too large showed signs of decreased stability, potentially due to issues of complexity and governance.

The role of diversification in a bank's portfolio was also examined. Diversification across various types of loans and investments appeared to enhance banking stability by spreading risk. However, excessive diversification, particularly in riskier assets, could lead to stability issues.

Finally, the study also found that the external macroeconomic environment played a significant role in banking stability. Banks operating in stable economic conditions were more likely to maintain their stability, suggesting the importance of prudent economic policies and regulation in maintaining the health of the banking sector.

4 Conclusion and Future Research

In conclusion, while certain banking practices and conditions contribute to banking stability, a delicate balance must be struck. Excesses in any area can lead to instability, highlighting the need for careful management and effective regulation. The multiple regression model used in this study provides a robust tool for exploring these complex relationships and can be adapted to include additional variables in future research.

Looking forward, future research could focus on incorporating additional parameters into the models, such as those related to technological advancements and regulatory changes in the banking industry. More sophisticated and adaptive mathematical models could also be developed to better capture the nonlinear and dynamic relationships between the parameters and banking stability.

References

Albulescu, C.:Bank financial stability, bank valuation and international oil prices: evidence from listed Russian public banks. https://doi.org/10.48550/ARXIV.2004.12791

Ali, M.: Credit bureaus, corruption and banking stability. Econ. Syst. 46(3), 1–8 (2022)

Bacchiocchi, A., Bischi, G., Giombini, G.: Non-performing loans, expectations and banking stability: a dynamic model. Chaos Solitons Fractals 157, 1–14 (2022)

Banna, H., Alam, M.: Does digital financial inclusion matter for bank risk-taking? Evidence from the dual-banking system. J. Islamic Monetary Econ. Finan. 7, 401–430 (2021)

Banwo, O., Caccioli, F., Harrald, P., Medda, F.: The effect of heterogeneity on financial contagion due to overlapping portfolios. Adv. Complex Syst. 19(8), 1650016 (2016)

Bindseil, U., Lanari, E.: Fire sales, the LOLR and bank runs with continuous asset liquidity. https://doi.org/10.48550/ARXIV.2010.11030

Birch, A., Aste, T.: Systemic losses due to counter party risk in a stylized banking system. J. Stat. Phys. 156, 998–1024 (2014)

Bownik, M., Johnson, B., McCreary-Ellis, S.: Stability of iterated dyadic filter banks. https://doi.org/10.48550/ARXIV.2212.10709

Buljan, A., Deskar-Skrbic, M., Dumicic, M.: What drives banks’ appetite for sovereign debt in CEE countries? Public Sect. Econ. 44, 179–201 (2020)

Bunderson, S., Thakor, A.: Higher purpose, banking and stability. J. Bank. Finan. 140, 1–13 (2022)

Caccioli, F., Catanach, T., Farmer, J.: Heterogeneity, correlations and financial contagion. https://doi.org/10.48550/ARXIV.1109.1213

Cannas, A., et al.: Implications of storing urinary DNA from different populations for molecular analyses. PLoS ONE 4, e6985 (2009)

Carmona, R., Fouque, J.-P., Sun, L.-H.: Mean field games and systemic risk. https://doi.org/10.48550/ARXIV.1308.2172

Chaum, D., Grothoff, C., Moser, T.: How to issue a central bank digital currency. doi:https://doi.org/10.48550/ARXIV.2103.00254

Coelho, N., Gonçalves, S., Romano, A.: Endemic plant species conservation: biotechnological approaches. Plants 9(3), 345 (2020)

Erçen, H.İ, Özdeşer, H., Türsoy, T.: The impact of macroeconomic sustainability on exchange rate: hybrid machine-learning approach. Sustainability 14, 1–19 (2022)

Feinstein, Z.: Harry Potter and the Goblin Bank of Gringotts. https://doi.org/10.48550/ARXIV.1703.10469

Ghosh, S.: Financial inclusion and banking stability: does interest rate repression matter? Financ. Res. Lett. 50, 1–8 (2022)

Hanley, B.: The impact of LIBOR linked borrowing to cover venture bank investment loans creates a new systemic risk. https://doi.org/10.48550/ARXIV.1809.01987

Hassanzadeh, S., Mashayekhi, B.: A conceptual model for the reasons and circumstance of earnings management in Iranian Banks. Acc. Auditing Rev. 26(3), 371–393 (2019)

Hossain, M., Ahamed, F.: Comprehensive analysis on determinants of bank profitability in Bangladesh. https://doi.org/10.48550/ARXIV.2105.14198

Ibrahim, M.: A comparative study of financial performance between conventional and Islamic banking in United Arab Emirates. Int. J. Econ. Financ. 5, 868–874 (2015)

Ichiba, T., Ludkovski, M., Sarantsev, A.: Dynamic contagion in a banking system with births and defaults. https://doi.org/10.48550/ARXIV.1807.09897

Kabundi, A., Simone, F.: Euro area banking and monetary policy shocks in the QE era. J. Financ. Stab. 63, 1–27 (2022)

Kaliyev, K., Nurmakhanova, M.: Bank risk evaluation through z-score measure and its effect on financial health of the industry of transitional economy of Kazakhstan. Xaбapшыcы. Экoнoмикa cepияcы 133, 40–50 (2020)

Laurent, A., et al.: Optimized manufacture of lyophilized dermal fibroblasts for next-generation off-the-shelf progenitor biological bandages in topical post-burn regenerative medicine. Biomedicines 9, 2–33 (2021)

Lavreniuk, V., Shevchuk, V.: The nature and assessment of systemic risk in terms of liquidity of the banking system. Probl. Ekonomiki 4, 213–222 (2016)

Lipton, A.: Modern monetary circuit theory, stability of interconnected banking network, and balance sheet optimization for individual banks. https://doi.org/10.48550/ARXIV.1510.07608

Mahmutoğlu, M., Ardor, H.: The effects of the macroprudential policies on Turkish banking sector. İşletme Araştırmaları Dergisi 11, 2371–2383 (2019)

Mousavi, S., Mackay, R., Tucker, A.: Contagion and stability in financial networks. https://doi.org/10.48550/ARXIV.1603.04099

Neuberger, D., Rissi, R.: Macroprudential banking regulation: does one size fit all? J. Banking Financ. Econ. 2014, 5–28 (2014)

Niţescu, D., Florin Alexandru, D., Ciurel, A.: Banking sector and bank liquidity – key actors within financial crises? Theor. Appl. Econ. 27, 147–168 (2020)

Novickytė, L.: Banking consolidation process and impact to financial stability. Mokslas: Lietuvos Ateitis 2(2), 62–68 (2010)

Papp, P., Wattenhofer, R.: Sequential defaulting in financial networks. https://doi.org/10.48550/ARXIV.2011.10485

Scalas, E.: Basel II for physicists: a discussion paper. https://doi.org/10.48550/ARXIV.COND-MAT/0501320

Smaga, P., Wiliński, M., Ochnicki, P., Arendarski, P., Gubiec, T.: Can banks default overnight? Modeling endogenous contagion on O/N interbank market. https://doi.org/10.48550/ARXIV.1603.05142

Sumarti, N., Gunadi, I.: Reserve requirement analysis using a dynamical system of a bank based on Monti-Klein model of bank's profit function. https://doi.org/10.48550/ARXIV.1306.0468

Tengstrand, S.N., Tomaszewski, P., Borg, M., Jabangwe, R.: Challenges of adopting SAFe in the banking industry – a study two years after its introduction. https://doi.org/10.48550/ARXIV.2104.13992

Vanka, S., Dehghani, M., Prabhu, K., Aravind, R.: A class of multi-channel cosine modulated IIR filter banks. https://doi.org/10.48550/ARXIV.CS/0702100

Zvonova, E.: Current problems of public debt and sovereign defaults to the EU countries. Финaнcы: тeopия и пpaктикa 20, 105–117 (2017)

Acknowledgements

This work supported by the project of the Bulgarian National Science Fund (Ministry of Education and Science of the Republic of Bulgaria), entitled: “Analysis of the main indicators and regulators for banking activities in the Republic of Bulgaria”, contract № КП-06-M35/3 from 30.12.2019, led by Assist. Prof. Miglena Trencheva.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 ICST Institute for Computer Sciences, Social Informatics and Telecommunications Engineering

About this paper

Cite this paper

Trencheva, M. (2023). Exploring Banking Stability Through Diverse Parameters and Mathematical Models. In: Zlateva, T., Tuparov, G. (eds) Computer Science and Education in Computer Science. CSECS 2023. Lecture Notes of the Institute for Computer Sciences, Social Informatics and Telecommunications Engineering, vol 514. Springer, Cham. https://doi.org/10.1007/978-3-031-44668-9_23

Download citation

DOI: https://doi.org/10.1007/978-3-031-44668-9_23

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-44667-2

Online ISBN: 978-3-031-44668-9

eBook Packages: Computer ScienceComputer Science (R0)