Abstract

Although technological innovation’s impact on society is well-known, the stylized facts of financing decisions in the technology sector are yet to be established. The present paper contributes towards bridging this knowledge gap. The study investigates the combined effect of stock market activity and vertical integration of upstream-downstream innovation on financing decisions of the technology industry. The study applies an econometrics-validated random effects model and a carefully screened panel dataset of 11 stock exchange-listed firms over twenty years. The study results are enlightening for this emerging market technology sector of South Africa. First, variation in vertical integration affects changes in leverage. Second, stock market activity affects leverage, but upstream-downstream innovation does matter. This study’s outcomes will benefit innovation industrialists, policymakers, and technology-oriented investors interested in emerging markets.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The financing decisions of a firm generally manifest through the resultant capital structure. The phrases firm financing and capital structure typically mean the same thing and will be used interchangeably in this paper. For a business to exist and operate, it may be financed through loans (commonly known as debt, D) or listing on the stock market (equity financing, E). Other financing instruments exist, but D and E are considered representative enough in the literature. Therefore, a firm’s capital structure is defined as proportions of debt and equity known as the debt-equity ratio, \(\left(\frac{D}{D+E}\right)\) or leverage.

Capital structure is one of the critical areas in corporate finance (Dao & Ta, 2020) because of its significant influence on financial stability and business profitability. The literature on capital structure has historically worried about the question: what is the optimal capital structure of a firm, and how is it determined? In response, pioneering academic research proposed several answers which were further refined over time, including irrelevance theory (Modigliani & Miller, 1958, 1963), trade-off theory (Kraus & Litzenberger, 1973), agency theory (Jensen & Meckling, 1976), and pecking order theory (Myers, 1984) to mention the main ones. The literature assumed static capital structure for a long time, but this has since adapted to the reality of changing business and economic environment. Consequently, a dynamic capital structure emerged. Studies of dynamic capital structure tend to ask whether firms rebalance (Welch, 2004) their capital structures over time, and if so, what is the speed of adjustment (Fischer et al., 1989; Flannery & Rangan, 2006; Ozkan, 2001). Whether static or dynamic, empirical studies are by and large structured in a similar manner, to investigate the determinants of capital structure, and this is evident in literature reviews (Harris & Raviv, 1991; Iqbal et al., 2012; Kumar et al., 2017; Miglo, 2011).

While the typical research of capital structure determinants focuses on a firm’s financial characteristics, another stream of literature examines capital structure by questioning the role of prevailing business environments. Such business factors include non-financial stakeholders (Istaitieh & Rodríguez-Fernández, 2006), suppliers-customer characteristics (Kalea & Shahrurb, 2007), supplier chain management (Son & Kim, 2022), and corporate strategy (Barton & Gordon, 1988; Cappa et al., 2020; Kochhar & Hitt, 1998). The current study contributes to the latter sub-group, and it warrants a close interrogation because research on the “impact of corporate strategy decisions on capital structure” often culminates in “mixed and inconclusive results” (Cappa et al., 2020, p.379).

The current study asks whether integration (upstream-downstream) in the technology industry affects firm financing decisions. In this regard, the present study is closest to the literature dimension examining the business environment, especially corporate strategy but differs in one important respect. The similarity is that vertical integration or industry structure is a common consideration in both the present study and the aforesaid literature stream. The distinguishing factor is that business environment studies of capital structure evolve around the renowned issue of relationship-specific investment. This is the idea that the value of the investment is maximised within a continued relationship more than without. For example, the relationship may “involve an upstream supplier who makes investments to customize her product for the needs of the downstream purchaser” (Strieborny, 2016, p.1488). In contrast, the present inquiry zooms into whether there is a common effect of equity activity and upstream-downstream innovation in financing decisions of the technology industry.

The current study adds value to the literature in several ways. First, we correct the imbalance in the literature. A recent systematic review (Bajaj et al., 2021, p.173) of capital structure studies found that most studies tend to stack firms from different industries into the same sample “… whereas the focus on a particular industrial sector was meagre.” Second, since the dynamics of technology sectors in “emerging and developing markets” differ from developed economies (Kedzior et al., 2020) it is crucial to spread the knowledge horizon to enrich future stylised facts that emerge from global research. Third, and more importantly, the technology transfer or innovation upstream and downstream has the potential to have different financing decisions since they effectively have different business models even though they are operating within the same industry. In our view, the above factors necessitate the current research initiative.

The rest of the paper is organised as follows: Sect. 2 lays the background of the study by explaining the technology sector, innovation, and the South African experience. Section 3 introduces the econometric model, empirical design, model validation procedures, and data characteristics. Section 4 presents and interprets the results. Section 5 discusses the results, while Sect. 6 concludes the study.

2 Technology, Innovation, and the South African Experience

The technology sector is involved in inter- and intra-industry innovation, diffusion, and digitalisation (Gopane, 2020; Rasiah & Gopane, 2004). Business activities of technology firms include manufacturing electronics, building computer hardware, producing computer software, and marketing end-user products and services in information technology and data analytics, among others. Technological advancement continues to introduce innovation in business operations and improve the quality of life for ordinary citizens. For example, the convergence of mobile, Internet technologies, and the Internet of Things is causing a significant socioeconomic change in many economies, including South Africa. For instance, there is growing evidence that broadband directly promotes economic performance, including job creation, the expansion of educational opportunities, improved public service delivery, and rural development, among others. However, to optimise beneficiation, all these technological innovations require critical mass in modern computerised hardware and software capabilities such as broadband networks and infrastructure (Roller & Waverman, 2001).

It is now accepted wisdom (Khalil & Kenny, 2008) that investments in information technology, telecommunications, and mobile telecommunications significantly influence economic growth or gross domestic product (GDP) in developed and developing nations. In this regard, the information communication technology (ICT) sector has played an important role in South Africa since the fourth industrial revolution (4IR) commenced. Private and public sector organisations that promote the ICT sector in South Africa include the Department of Communications and Digital Technologies (DCDT), State Information Technology Agency, Computer Society South Africa, Tech Central, Fitch Connect, Internet Service Providers Association (ISPA), Information Technology Association (ITA), and the South African Communications Forum (SACF). As a reflection of some of its value-add, the ICT sector has drastically decreased transaction costs and boosted productivity over time, providing instant connectivity in terms of voice, data, and visuals leading to enhanced efficiency, accuracy, and transparency in business processes. Further, the ICT sector has facilitated the increase in software and hardware by providing access to previously unavailable goods and services. Also, the ICT sector has expanded the outlook of different markets and business operations through technology diffusion and equipping the workforce with critical technical vocational skills.

In their study, Rosin et al. (2020) concur that firms that have adopted digital technologies have improved value and maximised growth. Further, business decisions and actions can be streamlined when companies, for instance, digitalise information-intensive procedures to replace manual stages. Digitalisation promotes cost-effectiveness by helping businesses automate data collection, performance analysis, supply-chain management, and business expansion (Ladeira et al., 2019). The value of technological progress and digitalisation in domestic and global economies is indisputable. A dedicated dimension of combative research that seeks to understand the intricacies of capital structure in the technology industry is missing, particularly in the emerging market of South Africa. The current study contributes towards this goal.

3 Methodology

3.1 Econometric Model

The panel data specification’s random effects model (REM) is appropriate for this study. We follow the usual modeling selection process to arrive at the appropriate version of the panel data model, the REM specification. First, the panel data setup is ideal for ameliorating data constraints in which we have 11 firms that satisfy the selection criteria over 20 years (2000 to 2019). Therefore, pooling the data allows us to maximise the sample size to 220 (=11 x 20). Second, we use the Chow Test (Chow, 1960), and Hausman test (Hausman, 1978) to guide the decision against pooled ordinary least square (POLS) and fixed effects model (FEM), respectively, in favour of REM presented in Eq. (1). Although we use a different econometric model, the empirical framework is similar to Welch (2004)

where,

In the equations above, the subscript \(i\) is an index of firms (\(i=1, 2, 3\dots 11)\), and \(t\) is time in years (\(t=1, 2, 3\dots 20\)). The dependent variable, leverage (\(\Delta {Lev}_{it}\)), is computed from Eq. (5), and it is the change in actual debt-equity ratio (ADR, see Eq. (2). In debt-equity ratio, D is proxied with the firm’s total debt, and E is the product of the firm’s market price and the total number of issued shares. The first covariate, \(\Delta Equity\), , is the change in equity which manifests in the implied debt ratio (IDR, see Eq. 3) being a debt ratio net of variation in equity, as per Eq. (6). The variable, \(r\), is the return on equity calculated from Eq. (4). The variable, \(Integrate\), measures the degree of integration (Cappa et al., 2020), and it is computed from Eq. (7). This valued-added variable is bound between 0 and 1. The variable uses the intuition that as the cost of purchases decreases, this indicates reliance on internal inputs for the firm’s operations. That is vertical integration. The variables, \(Upward\) and \(Down\) are dummy variables for upstream and downstream integration, respectively. The last variable, \(Contrl\), , represents a list of control variables namely, firm’s number of years in existence (age), a measure of firm size (size), book-to-market ratio (bkratio), and a proxy for market risk (risk). These variables have been used in the literature in one form or another (see review, Kumar et al., 2017)The parameters, \({\upbeta }_{1}\), \({\upbeta }_{2}\), \({\upbeta }_{3}\), \({\upbeta }_{4}\), \(\delta \) are estimated in the model while \(\varepsilon \) is the regression error term, and it is assumed to follow a normal distribution.

3.2 Study Objective and Analytical Approach

We have some indication from previous studies (Welch, 2004) that changes in equity affect capital structure which we set out to confirm in the current study. Next, we extend this result by inquiring whether these changes differ according to the upstream and downstream integration in the technology industry. Applying econometrics rationale, we can measure these joint effects with two sets of three-way interaction of the variables \(\Delta Equity\), \(Intgrte\), and \(Hdware\). In the second three-way interaction, we substitute hardware with software. So, to proceed with the analysis, in Eq. (1), we recall that the variables, upward, and downward are equivalent to \(\left(\Delta Equity\times Intgrte\times Hdware\right)\), and \(\left(\Delta Equity\times Intgrte\times Sware\right)\), respectively. With this in mind, we take the partial derivatives of Eq. (1) and report the answer in Eq. (8). We disregard subscripts for clarity.

Equation (8) says that the slope (\({\upbeta }_{1}\)) of leverage (\(\Delta Lev\)) with respect to change in equity (\(\Delta Equity\)), is affected by integration (\(Intgrte\)), a dummy for upstream (upward) proxied by hardware firms (\(Hware\)), and a dummy for downstream proxied by software firms (\(Sware\)). We quantify Eq. (8) for numerical analysis with regression results from Eq. (1). The numerical solution will inform us whether changes in equity affect leverage differently for upstream and downstream innovation.

3.3 Data Characteristics

This study is based on technology firms listed on Johannesburg Stock Exchange (JSE) in South Africa. The dataset is obtained from financial statements sourced from the Iress online database (Iress, n.d). The study uses annual data from 2000 to 2019. The database lists 63 technology firms which we subject to a relevant selection criterion. Firms with unique capital structures, such as parastatals, banking, and insurance companies, are excluded. All the firms that have insufficient data are excluded. The total firms that satisfied the selection process resulted in a balanced panel of 11 firms over 20 year-period which aggregates to 220 observations. Due to the necessary screening and data constraints, sample sizes of this magnitude are common in the literature. For instance, Choua et al. (2021) estimated a panel data model with 14 firms over 11 years (1999 to 2009), resulting in 140 observations.

3.4 Model Validation

It is essential to conduct and report the outcome of model validation before interpreting the results. First, we have the assurance that pre-modelling validation is satisfactory after conducting the REM panel data specification test (Hausman, 1978). Second, in Table 2 (Appendix), we note the absence of multicollinearity among the model covariates. Third, the post-estimation validation corroborates pre-estimation tests. All covariates are individually significant, and the overall model fit is adequate, judging by the statistical significance of the F-test. Fourth, the inspection of normality in Fig. 2 shows that residuals reasonably satisfy the assumption of normal distribution for error terms in Eq. (1). Lastly, in order to control for the potential problem of heteroscedasticity and serial correlation, we apply White’s (1980) robust cluster standard errors in REM estimation. Overall, the model validation is satisfactory, allowing for a reliable results interpretation.

4 Empirical Results

The results of the study are presented in Table 1. Our empirical objective is to examine whether changes in equity affect leverage differently in upstream and downstream technology firms. In this regard, Table 1 shows that the variables of interest, ∆Equity, Integrate, Down, Upward, and Down are positive and significant, indicating that changes in equity affect leverage differently for upstream and downstream firms. Also, judging by the coefficient magnitudes, it is evident that changes in equity for the upstream firms affect leverage more than the downstream firms. In Eq. (8), if we substitute for the variable, \(Integrate\) with its average, 0.4713 and use the values of coefficients (\({\upbeta }_{1}, {\beta }_{3}\), \({\beta }_{4}\)) from Table 1, we find that the change in leverage with respect to change in equity is 0.31 for the upstream firms (hardware), and 0.18 for the downstream firms. Thus far, the results may be construed as saying changes in equity do affect leverage in the technology sector. It does so more in the upstream firms (with an intensity of 30%) compared to downstream firms (with an intensity of around 20%) on average.

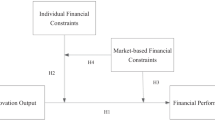

To have a graphical view of the above interpretation, we repeat the calculations for Eq. (8), but this time rather than use average, we compute for a range of values for \(Integrate\) between 0 and unity when \(hardware=1\) and for \(software=0\). We reverse the values of the dummy variables and then repeat the computations. The results are plotted in Fig. 1. The vertical axis shows the linear predictions for leverage changes while the horizontal axis labels the proxies for integration which is value-added calculated in Eq. (7). The dots are a scatter plot of changes in leverage against integration. The straight lines are the focus of this interpretation and are a graphical representation of Eq. (8). The upper straight line says that the change in leverage with respect to changes in equity as integration varies from 0 to 1 has a steeper slope for upstream firms and a gentle slope for downstream firms. This means that changes in equity affect leverage more in the upstream firms of technology innovation than downstream.

Linear predictions of leverage changes in response to equity changes are affected by integration upstream and downstream in the technology industry. Integration is proxied by the value-added ratio in Eq. (7), while proxies for upstream and downstream are dummies for hardware and software firms.

In Table 1, the rest of the regression output relates to control variables namely, firm age, sales (proxy for size), book-to-market ratio, and market risk which are all statistically significant with economically intuitive signs. Firm age and market risk are each negatively correlated with changes in leverage. The negative sign on firm age or number of years in existence is consistent with the pecking order theory (Myers, 1984) that old and established firms prefer to utilise internal funding as a priority rather than use debt financing. This finding is similar to that of (Huynh & Petrunia, 2010). Book to market ratio is positive as expected because it is a proxy for profitability indicating that profitable firms can take on more debt. This result is similar to the finding of (Flannery & Rangan, 2006). The negative association between leverage and market risk reflects the intuition that banks are less likely to approve debt for high-risk firms (Barton & Gordon, 1988). In tandem with the study of Al-Najjar & Hussainey (2011), these results reflect the idea that high-risk firms imply high risk of default in debt financing. The positive sign on firm size is in line with the rationale that large firms are more entrenched with a lower likelihood of debt default so that they can acquire more debt successfully (Rajan & Zingales, 1995).

5 Discussion of Results

This study aims to confirm whether changes in equity affect leverage and whether such changes differ in upstream firms compared to downstream firms in the technology industry. Our results confirm prior studies (Baker & Wurgler, 2002; Welch, 2004) that changes in equity affect leverage. Further, the results reveal that the impact of equity changes on leverage differ according to the mapping of vertical integration for technology firms, affecting the upstream firms more than the downstream firms. That is, leverage is positively correlated with vertical integration. These results contradict the related study of (Cappa et al., 2020), who found a negative association. They interpret their results as implying that vertically integrated firms are more entrenched, stable and with reasonable control over their value chains. As such, they prefer their adequate internal resources to debt financing. This reasoning is intuitive especially for non-technology industries which seems to be consistent with the aggregated sample of the listed firms that (Cappa et al., 2020) examined. On the contrary, technology firms’ unique capital structure environment is characterized by the limited availability of physical assets. Technology firms are known to be endowed more with intangible assets such as intellectual property and skilled human resource capital. Since vertical integration is known to increase economic power, we conjecture that integration should be seen as capacitating technology firms to take more debt financing as needed. Consequently, the given explanation highlights the uniqueness of technology firms in capital structure matters and explains why the positive association with integration is possible and intuitive.

The results of this study are important for several reasons. First, this study highlights the uniqueness and importance of technology considerations in financing decisions. It is consistent with Lederer & Singhal’s (1994, p.333) advice that “financing and technology choice is long-term strategic decisions that should be made jointly.” Second, the literature on the relationship between capital structure and product markets (Miao, 2005, p.2621) makes an important observation that, “there is substantial inter- and intra-industry variation in leverage.” Through their empirical inquiry, Aghion et al. (2004, p.284) investigated the inter-industry difference relating to technology firms and concluded that: “Our results suggest that the financial behavior of more innovative firms … differs from the financial behavior of less innovative firms”. The current study completes the picture and confirms that there is variation in the intra-industry behaviour of the technology sector’s financing decisions. Therefore, this study concludes that upstream and downstream innovation matters in the technology industry’s financing decisions. Regarding capital structure studies, the above insight makes the wisdom of aggregating technology firms with other industries into one sample questionable.

6 Conclusion

This study has examined the question of whether upstream-downstream innovation matters in financing decisions of the technology industry. In particular, the investigation has empirically confirmed that changes in equity affect capital structure and has extended these results to show that the effect of equity changes affects leverage differently in the upstream and downstream firms of the technology industry. The literature has already demonstrated that “equity financing is the optimal strategy for innovating firms, which can use their financial structure as a signalling device to attract outside investors” (Santarelli, 1991, p.279). The discovery from the current study is important because it reveals that the mentioned equity signalling is likely to vary based on the degree of vertical integration upstream and downstream in the technology industry. Although the sample size in the current study satisfies econometric analysis, a re-examination with generous data availability is desirable. Further, the present study looked at two polar relationships of upstream and downstream innovation. Further study is recommended to evaluate the same problem under vertical integration within different phases of product development, such as new product design, manufacturing process, inventory management, and distribution chains. Overall, the observations from prior studies, coupled with wisdom emerging from the current study, allow us to conclude that the financing decisions of technology firms vary within and from other industries.

References

Aghion, P., Bond, S., Klemm, A., Marinescu, I.: Technology and financial structure: are innovative firms different? J. Eur. Econ. Assoc. 2(2–3), 277–288 (2004). https://doi.org/10.1162/154247604323067989

Al-Najjar, B., Hussainey, K.: Revisiting the capital-structure puzzle: UK evidence. J. Risk Finance 12(4), 329–338 (2011)

Bajaj, Y., Kashiramka, S., Singh, S.: Application of capital structure theories: a systematic review. J. Adv. Manage. Res. 18(2), 173–199 (2021). https://doi.org/10.1108/JAMR-01-2020-0017

Baker, M., Wurgler, J.: Market timing and capital structure. J. Finance 57(1), 1–32 (2002). https://doi.org/10.1111/1540-6261.00414

Barton, S.L., Gordon, P.J.: Corporate strategy and capital structure. Strateg. Manag. J. 9(6), 623–632 (1988). https://doi.org/10.1002/smj.4250090608Berger

Cappa, F., Cetrini, G., Oriani, R.: The impact of corporate strategy on capital structure: evidence from Italian listed firms. Quart. Rev. Econ. Finance 76, 379–385 (2020). https://doi.org/10.1016/j.qref.2019.09.005

Choua, C.C., Linb, W.T., CLeec, C., Taod, X., Qiane, Z.: The impacts of information technology and E-commerce on operational performances: a two-stage dynamic partial adjustment approach. J. Industr. Prod. Eng. 38(4), 291–322 (2021).https://doi.org/10.1080/21681015.2021.1887381

Chow, G.C.: Tests of equality between sets of coefficients in two linear regressions. Econometrica: J. Econometric Soc. 28(3), 591–605 (1960)

Dao, B.T.T., Ta, T.D.N.: A meta-analysis: capital structure and firm performance. J. Econ. Dev. 22(1), 111–129 (2020). https://doi.org/10.1108/JED-12-2019-0072

Fischer, E.O., Heinkel, R., Zechner, J.: Dynamic capital structure choice: Theory and tests. J. Finance 44(1), 19–40 (1989). https://doi.org/10.1111/j.1540-6261.1989.tb02402.x

Gopane, T.J.: Digitalisation, productivity, and measurability of digital economy: evidence from BRICS. In: Bach Tobji, M.A., Jallouli, R., Samet, A., Touzani, M., Strat, V.A., Pocatilu, P. (eds.) Digital Economy. Emerging Technologies and Business Innovation. ICDEc 2020. Lecture Notes in Business Information Processing, vol. 395. Springer, Cham (2020). https://doi.org/10.1007/978-3-030-64642-4_3

Flannery, M.J., Rangan, K.P.: Partial adjustment toward target capital structures. J. Financ. Econ. 79(3), 469–506 (2006)

Harris, M., Raviv, A.: The theory of capital structure. J. Finance 46(1), 297–355 (1991)

Hausman, J.A.: Specification tests in econometrics. Econometrica : J. Econometric Soc. 46(6), 1251–1271 (1978)

Huynh, K.P., Petrunia, R.J.: Age effects, leverage and firm growth. J. Econ. Dyn. Control 34(5), 1003–1013 (2010)

Iqbal, J., Muhammad, S., Muneer, S., Jahanzeb, A.: A critical review of capital structure theories. Inf. Manag. Bus. Rev. 4(11), 553–557 (2012)

Iress. (n.d). McGregor-BFA Online Financial Database. Verfügbar unter: http://research.mcgregorbfa.com/Default.aspx

Istaitieh, A., Rodríguez-Fernández, J.M.: Factor-product markets and firm’s capital structure: a literature review. Rev. Financ. Econ. 15(1), 49–75 (2006). https://doi.org/10.1016/j.rfe.2005.02.001

Jensen, M.C., Meckling, W.H.: Theory of the firm: managerial behaviour, agency costs and ownership structure. J. Financ. Econ. 3(4), 305–360 (1976). https://doi.org/10.1016/0304-405X(76)90026-X

Kalea, J.R., Shahrurb, H.: Corporate capital structure and the characteristics of suppliers and customers. J. Financ. Econ. 83, 321–365 (2007)

Kedzior, M., Grabinska, B., Grabinski, K., Kedzior, D.: Capital structure choices in technology firms: empirical results from Polish listed companies. J. Risk Financ. Manage. 13(9), 221 (2020). https://doi.org/10.3390/jrfm13090221

Khalil, M., Kenny, C.: The next decade of ICT development: access, applications, and the forces of convergence. Inf. Technol. Int. Dev. 4(3), 1–6 (2008)

Kochhar, R., Hitt, M.A.: Linking corporate strategy to capital structure: diversification strategy, type and source of financing. Strateg. Manag. J. 19(6), 601–610 (1998)

Kraus, A., Litzenberger, R.H.: A state-preference model of optimal financial leverage. J. Financ. 28(4), 911–922 (1973). https://doi.org/10.1111/j.1540-6261.1973.tb01415.x

Kumar, S., Colombage, S., Rao, P.: Research on capital structure determinants: a review and future directions. Int. J. Manag. Finance 13(2), 106–132 (2017). https://doi.org/10.1108/IJMF-09-2014-0135

Ladeira, M.J.M., Ferreira, F.A.F., Ferreira, J.J.M.: Exploring the determinants of digital entrepreneurship using fuzzy cognitive maps. Int. Entrepreneurship Manage. J. 15(4), 1077–1101 (2019). https://doi.org/10.1007/s11365-019-00574-9

Lederer, P.J., Singhal, V.R.: The effect of financing decisions on the choice of manufacturing technologies. Int. J. Flex. Manuf. Syst. 6(4), 333–360 (1994). https://doi.org/10.1007/BF01324800

Miao, J.: Optimal capital structure and industry dynamics. J. Finance 60(6), 2621–2659. American Finance Association, Wiley (2005)

Miglo, A.: Trade-off, pecking order, signaling, and market timing models. (H.K. Baker & G.S. Martin, eds.) (pp. 171–191). Wiley and Sons (2011). https://doi.org/10.2139/ssrn.1629304

Modigliani, F., Miller, M.H.: The cost of capital, corporation finance and the theory of investment. Ame. Econ. Rev. 48(3), 261–297 (1958)

Modigliani, F., Miller, M.H.: Corporate income taxes and the cost of capital: a correction. Am. Econ. Rev. 53(3), 433–443 (1963)

Myers, S.C.: The capital structure puzzle. J. Finance 39(3), 574–592 (1984). https://doi.org/10.1111/j.1540-6261.1984.tb03646.x

Ozkan, A.: Determinants of capital structure and adjustment to long-run target: evidence from UK company panel data. J. Bus. Financ. Acc. 28(1–2), 175–198 (2001). https://doi.org/10.1111/1468-5957.00370

Rasiah, R., Gopane, T.: Technology, local sourcing and economic performance in South Africa (pp. 50–71) (2004). https://doi.org/10.4337/9781845423551.00009

Rajan, R.G., Zingales, L.: What do we know about capital structure? Some evidence from international data. J. Finance 50(5), 1421–1460 (1995). https://doi.org/10.2307/2329322Ramaswamy

Roller, L.H., Waverman, L.: Telecommunications infrastructure and economic development: a simultaneous approach. Am. Econ. Rev. 91(4), 909–923 (2001)

Rosin, A.F., Proksch, D., Stubner, S., Pinkwart, A.: Digital new ventures: assessing the benefits of digitalization in entrepreneurship. J. Small Bus. Strateg. 30(2), 59–71 (2020)

Santarelli, E.: Asset specificity, R&D financing, and the signalling properties of the firm’s financial structure. Econ. Innov. New Technol. 1(4), 279–294 (1991). https://doi.org/10.1080/10438599100000008

Son, I., Kim, S.: Supply chain management strategy and capital structure of global information and communications (2022). https://doi.org/10.3390/su14031844

Strieborny, M.K.M.: Investment in relationship-specific assets: does finance matter? Rev. Finance 20(4), 1487–1515 (2016). https://doi.org/10.1093/rof/rfv049

Welch, I.: Capital structure and stock returns. J. Polit. Econ. 112(1), 106–131 (2004). https://doi.org/10.1086/379933

White, H.: A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica: J. Econometric Soc. 48(4), 817–838 (1980). https://doi.org/10.2307/1912934

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Gandanhamo, T., Gopane, T.J. (2023). Stock Market Activity and Financing Decisions in the Technology Industry: Does Upstream-Downstream Innovation Matter?. In: Jallouli, R., Bach Tobji, M.A., Belkhir, M., Soares, A.M., Casais, B. (eds) Digital Economy. Emerging Technologies and Business Innovation. ICDEc 2023. Lecture Notes in Business Information Processing, vol 485. Springer, Cham. https://doi.org/10.1007/978-3-031-42788-6_19

Download citation

DOI: https://doi.org/10.1007/978-3-031-42788-6_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-42787-9

Online ISBN: 978-3-031-42788-6

eBook Packages: Computer ScienceComputer Science (R0)