Abstract

In this book the authors explore and debate through a fine lens the economic, social, and policy approaches that characterize fruitful research on entrepreneurial ecosystems with economically meaningful implications for policy. The collection of chapters included in the book is an important manifestation that presents various challenges that exist ‘on the ground’ so to speak that influence the shaping and output of entrepreneurial ecosystems. The approach taken up in this book is a systematic one oriented to understanding different aspects of entrepreneurial ecosystems (i.e., definitional and measurement issues, and the complementary role of the ecosystem framework to analyze the digital economy) and to contrast these two aspects with positions reported by relevant contemporary empirical work rooted in different theoretical groundings.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

This book is about the rapidly expanding field of entrepreneurial ecosystems and how it contributes to economic development. The topic of sustainable development is very broad and covers many topics including, but not limited to, sustainability of communities and the environment, the effect of work force on poverty divides, responsible consumption and production, and issues of environmental justice. While a holistic approach is laudable, the scope of this book is much more limited and focuses on the fundamental economic analysis of entrepreneurial ecosystems and productive entrepreneurship at the regional, national, and global levels. While the volume does deal with issues of inequality along the lines of the digital divide and reining in the digital expanse via regulation, its overall aims remain much more limited in scope. Its focus is first and foremost on understanding the question at hand, the role of entrepreneurial ecosystems in digital transformation, and to identify their economically meaningful implications for policy. Each chapter is an important manifestation that exhibits various challenges that exist ‘on the ground’ so to speak that influence the shaping and output of the economic analysis at the regional level.

This book The Entrepreneurial Ecosystem constitutes a systematic attempt to show how a substantial contribution to entrepreneurial ecosystem can be implemented. Building on the original contributions of many writers, the collection of chapters in this volume explores through a fine lens the economic, social, and policy approaches that characterize fruitful research on entrepreneurial ecosystems with economically meaningful implications for policy.

The temporal evolution of the entrepreneurial ecosystem, as a research stream, is a story strictly tied to the entrepreneurship field, and is characterized by significant advances in recent decades (see, e.g., Acs et al. (2017) and the recent surveys by Cao and Shi (2021) and Wurth et al. (2022)). Since Schumpeter’s (1934) seminal work, academics, policy makers and strategy makers in general have awakened that societies need entrepreneurs to ignite new ideas that, in turn, can materialize in organizations with the potential to lift up the economy either by addressing specific market needs or by injecting potentially transformative innovations that otherwise may have gone unnoticed.

As a result of the natural evolutionary process of scientific fields, scholars have come to an agreement that, besides the entrepreneur, the multiple (and mostly complex) interactions that occur between entrepreneurs, other organizations, investors, and public administrations have the capacity to reshape local conditions and create an environment more conducive to productive entrepreneurship. This research stream, inspired in Marshall’s (1920) work, found echo in subsequent research devoted to the study of national systems of innovation (Lundvall, 1992), regional clusters (Porter, 1998), and regional innovation systems (RISs) (Cooke et al., 1997).

Rooted in ecological metaphors originally proposed by Moore (1993) and popularized by Isenberg (2010), and in parallel to the institutional, technological, and industrial changes observed in many economies, it became clear that the accurate analysis of the entrepreneurship function needed to go beyond the entrepreneur. This way, the analysis of entrepreneurial ecosystems gradually started the journey toward becoming a research field in its own right.

As a result, the entrepreneurial ecosystem concept has rapidly gained legitimacy and become a ‘trendy’ topic that has entered the agenda of scholars from different disciplines as well as of policy-makers interested in comprehending how economic agents and local conditions interact to trigger productive entrepreneurship. Despite that the entrepreneurial ecosystem frame can be regarded as an integrative component of other existing theories (e.g., economics as well as the institutional and evolutionary theories), the ecosystem approach is proving itself effective in offering a solid theoretical apparatus for research and policy.

The dominant ‘orthodoxy’ in the entrepreneurship ecosystem literature clearly emphasizes an entrepreneurship function in which local conditions have a transformative role with the potential to support economic growth at the city, regional, and national levels. In this sense, we briefly present what we consider the two most prominent aspects guiding research on the entrepreneurial ecosystem, namely, the definitional and measurement issues of the ecosystem and the complementary role of the ecosystem framework, to analyze the rise of technology-led entrepreneurship in the digital economy.

The first issue relates to the definition of the entrepreneurial ecosystem. Scholars agree that, at territorial level, entrepreneurship is much more than mere business formation rates. Different from canonical work on entrepreneurship, the entrepreneurial ecosystem frame accentuates the role of the spatially bounded context backing entrepreneurial action, and how it affects both the ecosystem constituents and territorial outcomes. The academic enthusiasm for consolidating the entrepreneurial ecosystem as a research field not only has contributed to produce a uniform definition of this ecosystem, but also has materialized into a significant stock of scientific work that will continue to grow. Nowadays, the entrepreneurial ecosystem is conceived as a dynamic, spatially bounded umbrella that favors the interaction between multiple economic and political agents, which, in turn, supports productive entrepreneurship by enhancing resource mobilization processes and fuels territorial outcomes.

This renewed definitional approach, which is the result of a paradigm shift, has brought two interconnected consequences for ecosystem research. On the one hand, the entrepreneurial ecosystem approach entails a change in the unit of analysis to focus on the actors and factors affecting productive entrepreneurship. Contrary to new business counts, the entrepreneurial ecosystem is an artificial unit of analysis whose elements coexist and interact with different intensity at all spatial levels.

On the other hand, in a closely related manner, scholars are faced with a controversial issue linked to the measurement of the ecosystem and to the evaluation of ecosystem policies. By situating ecosystem constituents and productive entrepreneurship at the heart of the research agenda, the identification as well as the operationalization and quantification of ecosystem elements is a challenging task. In practical applications, research studies have used metrics based on either firm-level (e.g., stock or rate of new businesses) or individual-level (e.g., the GEM’s entrepreneurial activity variables) data to equip policy-makers with means to understanding entrepreneurship at the territorial level. Because of the mismatch between the analyzed concept (i.e., entrepreneurial ecosystem) and the measurement approach chosen (firm- and individual-level data), studies based on this narrow view often produce little information on the configuration of the local ecosystem and the connection between ecosystem elements and territorial outcomes (e.g., Lafuente et al., 2020; Cao and Shi, 2021; Lafuente et al., 2022; Wurth et al., 2022).

Entrepreneurial ecosystems are not checklists, and what is desirable in one territory might not be so in another context. Underlying the holistic view of the entrepreneurial ecosystem frame is the need to critically evaluate this approach to policy-making. This is particularly relevant when considering the policy push for using the entrepreneurial ecosystem framework as an economic development tool in different geographies.

The competitive advantage of countries’ entrepreneurship policy hinges on the capacity to match investments with available resources. Ecosystem scholars must therefore transcend the ‘geographic barrier’ resulting from researchers’ excessive focus on developed settings and provide answers as to what is generalizable about entrepreneurial ecosystems, and as to whether the entrepreneurial ecosystem frame has the capacity to explain the configuration and dynamics of the entrepreneurship function in heterogeneous contexts or, on contrary, whether the ecosystem approach is limited to a reduced number of mostly developed territories.

The second issue relates to the capacity of the ecosystem framework to percolate through theories, as it happens with the economics, institutional, and evolutionary fields, and further fertilize the analysis of the digital economy by adding entrepreneurship to the equation. Rather than calling for a new theoretical apparatus, we argue that the ecosystem approach represents a fundamental insight with the potential of reworking digital economics by offering new viewpoints for studying observable phenomena of the digital ecosystem.

The entrepreneurial and the digital ecosystems share common properties (e.g., construct complexity and multilayered structure of participating agents). Besides, some theoretical overlaps can be identified: digital economics is rooted in solid policy-led disciplines such as economics, sociology, and strategic management (e.g., Goldfarb & Tucker, 2019), whereas the entrepreneurial ecosystem frame is anchored in economics and management studies in a broader sense (e.g., Acs et al., 2014; Lafuente et al., 2022; Wurth et al., 2022).

Many entrepreneurial businesses operate within the platform economy, and cross-regional and cross-national interactions, in terms of labor division and business operations, are archetypal characteristics of digital entrepreneurial ventures. Obviously, the relationship between digital economics and entrepreneurial ecosystem is complicated; however, there is increased interest in integrating the ecosystem approach into the analysis of digital economics for building joint knowledge and for better grasping the observed dynamics in the economy.

Opportunities for collaboration between the two fields might well emerge from the identification of common, economically relevant research questions. For example, following the Schumpeterian legacy of both fields, when theorizing about the connection between the entrepreneurial and the digital ecosystem, we argue that scholars should look beyond and enrich this emerging debate by addressing issues related to how the structure (i.e., connectivity, e-security, among others) and market configuration (i.e., oligopolistic competition among digital platforms) of the digital ecosystem affect the entrepreneurial ecosystem, and how high-tech ventures adapt to the digital ecosystem, especially if these high-tech ventures operate in multiple settings with heterogeneous digital ecosystems.

Policy-makers are increasingly regarding the entrepreneurial ecosystem approach as an economic development tool; therefore, the analysis of the abovementioned (and many more!) questions not only can stimulate a closer interaction between both fields, but also can unveil potentially new recovery pathways for territories in the post-Covid-19 pandemic.

2 Entrepreneurial Ecosystems

It is unquestionable that the intensive intellectual activity developed around the entrepreneurial ecosystem over the last decades has produced an impressive and well-organized stock of theoretical and empirical knowledge. Despite the immense value of existing work, it is obvious that the drastic changes observed in the global economic landscape, of which no territory and no industry is immune, demand a further revision of the theoretical predictions of the ecosystem framework. Thus, we argue that further integration between the entrepreneurial ecosystem and other disciplines is a prerequisite for producing what we believe would be a solid cross-disciplinary research frame that would open and/or enrich a debate that includes a more nuanced discussion of the entrepreneurial ecosystem constituents, as well as of the value of the ecosystem approach for policy.

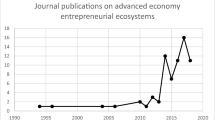

Over the past decade, a research stream that focuses on a systemic approach to entrepreneurial ecosystems has emerged using data from the Global Entrepreneurship and Development Index (GEDI) project and the Regional Entrepreneurship and Development Index (REDI) project (Acs, Autio et al., 2015; Szerb et al., 2019). These papers can be classified into three groups: the first group focuses on definitional and measurement issues of entrepreneurial ecosystems (Table 1.1), the second group focuses on empirical contributions to the literature (Table 1.2), and the third group covers the digital aspects of entrepreneurial ecosystems and the platform organizations that dominate them (Table 1.3).

Perhaps the first shot was fired in 2014 with the publication of the National System of Entrepreneurship in Research Policy (Acs et al., 2014) (Table 1.1). Working at Imperial College Business School, the authors argued that the entrepreneurial ecosystem could be best understood as a system and the interrelated parts of the system could be optimized. It also laid out the different aspects of the existing literature on entrepreneurship at the individual, firm, and economy level. It was the economy level that posed the greatest challenge to the system. To overcome this challenge, they introduce a novel concept of National Systems of Entrepreneurship (NSE) and provide an approach to characterizing them. National Systems of Entrepreneurship are fundamentally resource allocation systems that are driven by individual-level opportunity pursuit, through the creation of new ventures, with this activity and its outcomes regulated by country-specific institutional characteristics.

This led to an important question, namely, ‘Was the entrepreneurial ecosystem approach superior to one that only encompassed startups?’ Of course that question was not accepted by much of the profession on systems, including national and regional systems of innovation and clusters who argued that what was the core firm focus was innovative/high-tech firms and export-based firms, not start-ups (Qian & Acs, 2013). To address this issue, Acs et al. (2018), at the London School of Economics, tested whether an entrepreneurial ecosystem approach contributed to total factor productivity (TFP). They analyzed conceptually and in an empirical counterpart the relationship between economic growth, factor inputs, institutions, and entrepreneurship. In particular, they investigate whether entrepreneurship and institutions, in combination in an ecosystem, can be viewed as a ‘missing link’ in an aggregate production function analysis of cross-country differences in economic growth. To do this, they build on the concept of National Systems of Entrepreneurship (NSE) as resource allocation systems that combine institutions and human agency into an interdependent system of complementarities. They explored the empirical relevance of these ideas using data from a representative global survey and institutional sources for 46 countries over the period 2002–2011. They found support for the role of the entrepreneurial ecosystem in economic growth.

The next question revolved around the issue of, how and if, the entrepreneurial ecosystem could be optimized for maximum economic benefit. Working at the University of Pecs and the Polytechnic University of Barcelona, Lafuente et al. (2022) employ the ‘benefit of the doubt’ approach rooted in nonparametric techniques to evaluate the entrepreneurial ecosystem of 71 countries for 2016. By scrutinizing the relative efficiency of countries’ entrepreneurial ecosystems, their analysis of composite indicators allows the computation of endogenous (country-specific) weights that can be used for developing more informed policy-making. The results show that countries prioritize different aspects of their national system of entrepreneurship, which confirms that, contrary to homogeneous prescription, tailor-made policy is necessary if the objective is to optimize the resources deployed to enhance the local entrepreneurial ecosystem. The authors also found that significant improvements in the quality of this ecosystem can be realized by targeting the policy priorities of the local entrepreneurship system identified by their model. The three papers covered the key definitional and measurement issues of entrepreneurial ecosystems (Table 1.1).

Next, we turn to empirical studies that, at the national and regional levels, put to the test different postulates of the entrepreneurial ecosystem approach (Table 1.2). Two papers, Lafuente et al. (2020) and Lafuente et al. (2016), evaluate how countries’ system of entrepreneurship is conducive to greater efficiency.

Concretely, in their study of 45 developed and developing countries during 2002–2013, Lafuente et al. (2020) built a world technology frontier and computed TFP estimates in order to evaluate how the national system of entrepreneurship—measured by the GEI indicator—triggers total factor productivity (TFP) by increasing the effects of Kirznerian and Schumpeterian entrepreneurship. The results of the common factor models reveal that the national system of entrepreneurship is a relevant conduit of TFP, and that this effect is heterogeneous across countries. Policies supporting Kirznerian entrepreneurship—for example, increased business formation rates—may promote the creation of low value-adding businesses which is not associated with higher TFP rates. Also, policy interventions targeting Schumpeterian entrepreneurship objectives—for example, innovative entrepreneurship and the development of new technologies—are conducive to technical change by promoting upward shifts in the countries’ production function and, consequently, productivity growth.

While the above papers were at the national level, entrepreneurial ecosystems also operate at the regional level. The next set of papers focused on the regions of the countries of the European Union. The development of the methodology for studying regional entrepreneurial ecosystems that were comparable with national data was an important advance.

The second shot was fired in 2015 in a paper in Regional Studies in which Acs, Szerb, Ortega-Argilés, Coduras, and Aidis demonstrated that the systemic approach to entrepreneurship can also be applied at the regional level. Working with the European Union, the paper constructs a regional application of the methodology that captures the contextual features of entrepreneurship across regions. The resulting composite indicator—the Regional Entrepreneurship and Development Index (REDI)—identifies weaknesses in the incentive structure that affect regional development. Similar to the GEI indicator, the entrepreneurial disparities among regions are analyzed at the country and regional levels, using the penalty for bottleneck (PFB) methodology. This approach allows public policy action to be coordinated at both national and regional levels. It was found that the REDI indicator provides a valuable tool for understanding regional differences across Spanish regions. Three papers followed that expanded the results reported for the European Union: Szerb et al. (2019 in Regional Studies), Szerb et al. (2020 in Papers in Regional Science), and Varga et al. (2020 in Regional Studies) (Table 1.2).

The third shot across the bow happened in 2017 when Small Business Economics published a special issue on entrepreneurial ecosystems (Table 1.3). The introductory paper laid out a broad sweep of the topic, and the issue covered several topics (Acs et al., 2017). In one of the most provocative papers included in the special issue, Sussan and Acs (2017) argued that the entrepreneurship literature had ignored the role of technology, especially digital technology. According to the authors, a significant gap exists in the conceptualization of entrepreneurship in the digital age. This paper introduces a conceptual framework for studying entrepreneurship in the digital age by integrating two well-established concepts: the digital ecosystem and the entrepreneurial ecosystem. The integration of these two ecosystems helps to understand the interactions of agents and users that incorporate insights of consumers’ individual and social behavior. The digital entrepreneurial ecosystem framework consists of four concepts: digital infrastructure governance, digital user citizenship, digital entrepreneurship, and digital marketplace. The paper develops propositions for each of the four concepts and provides a framework of multisided platforms to better grasp the digital entrepreneurial ecosystem. Finally, it outlined a new research agenda to fill the gap in our understanding of entrepreneurship in the digital age.

Acs (2022) and Acs et al. (2021) further developed the topic. The emergence of digital technologies has significantly reduced the economic costs of data—search, storage, computation, transmission—and enabled new economic activities (Goldfarb & Tucker, 2019). Over the years, firms able to create a platform-based ecosystem have become a force of ‘creative construction’. Economic activities (C2C, B2C, B2B) have been reorganized around platform-based ecosystems for value creation, which are orchestrated by multisided platforms via the ‘digital hand’. Acs et al. (2021) provide a conceptual framework consisting of three interrelated concepts: digital technology infrastructure, multisided platforms, and platform-based ecosystems (users and entrepreneurs). Using a unique database over five decades, the authors revisit the hypothesis that new firms were needed to introduce digital technologies.

Finally, Lafuente et al. (2023) integrate the platform economy and entrepreneurial ecosystems to evaluate the quality of the digital platform economy at the global scale by employing a network model rooted in nonparametric linear techniques (data envelopment analysis) on a sample of 116 countries for 2019. The proposed model is in accordance with the geographic diversity (country heterogeneity) and the multilayered structure characterizing the interactions between system participants: governments, digital platforms, platform-dependent firms, and end users. The core finding of the study is that the configuration of countries’ platform economy is heterogeneous, which suggests that an informed, tailor-made approach to policy produces more effective outcomes. Policies aimed at enhancing the digital platform economy should emerge from the analysis of its main factors if the development of a strategy supporting qualitative changes in the system is the desired goal.

3 Digital Entrepreneurial Ecosystems

Entrepreneurial ecosystems are not a brand-new idea. In the context of regional economic development, it has its origins in regional innovation systems (RISs) and clusters (Qian et al., 2013; Acs et al., 2014; Acs et al., 2017; Szerb et al., 2019). In an attempt to clarify the relationships between RISs, clusters, and entrepreneurial ecosystems, Table 1.4 compares RISs, clusters, and entrepreneurial ecosystems using multiple criteria. The RIS approach focuses on regionally bounded resources and formal and informal institutions that underpin firm innovation, while highlighting the nonlinear and systemic nature of learning and firm innovation processes (Cooke et al., 1997; Asheim et al., 2011). Based on the so-called triple-helix model, firms, governments, and universities are often considered core players in an innovation system, where firms commercialize (typically) government-funded university research (Leydesdorff & Meyer, 2006). An RIS typically has an industry boundary and is often discussed in a particular industrial context, for example, biotechnology. Depending on the knowledge base of regions, the organization of RISs (i.e., the key players and their interactions) can be very different (Asheim & Coenen, 2005). Public R&D investment, support for universities, and fostering a culture of collaboration are common policies emerging from analyses based on the RIS framework.

Clusters are ‘geographic concentrations of interconnected companies and institutions in a particular field’ (Porter, 1998, p. 78). To a large extent, the clusters and RIS approach cover the same actors, which include firms, universities, and governments, but universities and governments play only supporting roles in clusters. Productive, export-based firms in a particular field are the core actors in a competitive cluster, which are also supported by other firms or industries through, for example, buy–sell relationships, shared specialized labor, and knowledge spillovers. Therefore, a cluster involves multiple industries that are economically interconnected. The popularity of clusters among economic development practitioners arises in part from some clear measures of clusters that make it possible to identify the scale of clusters at different geographical levels (Delgado et al., 2016). Echoing Porter (2007), regional economic development policy toward clusters includes building connections among cluster participants and investing in infrastructure such as universities. Interestingly, even though clusters are identified through industries, Porter advocates for an industry-neutral approach to cluster policy. Also, cluster-based policy efforts are not much different from those suggested by RIS scholars, and monotonous (repetitive) policy implications are considered the major weakness of the cluster theory (Motoyama, 2008).

How are entrepreneurial ecosystems different from RISs and clusters? The most remarkable difference for the entrepreneurial ecosystems approach perhaps lies in the shift from a focus on firms to a focus on people, including entrepreneurs, investors, dealmakers, and other entrepreneurship supporters (Acs et al., 2014; Motoyama, 2019; Qian et al., 2013; Stam & Spigel, 2022), even though the outcome of the entrepreneurial ecosystem is typically measured by productive start-up or scale-up businesses (Stam & Spigel, 2022; Wurth et al., 2022). Among all these actors, entrepreneurs should play a leading role in this ecosystem, either through their own entrepreneurial process or via engagement with the local start-up community (Acs et al., 2014). ‘Blockbuster’ entrepreneurs help sustain a strong entrepreneurial ecosystem when they invest their capital gains in local start-ups, mentor new entrepreneurs, and build a collaborative and giving culture. Networks developed through entrepreneurship events, support organizations, or even serendipitous meetings are of particular importance to the vibrancy of entrepreneurial ecosystem. Another notable distinction of entrepreneurial ecosystems is that they are not constrained by industry boundaries, as the same stock of entrepreneurial process knowledge circulated in the region benefits local entrepreneurs from all sectors (Wurth et al., 2022).

As shown in Table 1.4, even with some notable differences, entrepreneurial ecosystems share some features with clusters and RISs, such as the importance of organizations, institutions, networks, risk-raking culture, and the needs for technical, managerial, and market knowledge. These similarities may make economic development policy-makers wonder whether entrepreneurial ecosystems are substitutes for RISs and clusters. The answer is no. Entrepreneurial ecosystems should not be considered as a replacement of its two precedents, because they are interested and target different economic outcomes (see Table 1.4). The outcome of RISs is mostly linked to product and process innovation processes, clusters’ outcome is measured by competitive firms and industries, whereas the outcome of entrepreneurial ecosystems is primarily measured by productive start-up and scale-up businesses. Therefore, entrepreneurial ecosystems should be considered complementary to RISs and clusters (Audretsch et al., 2021). Ideally, a region has a strong innovation system, competitive cluster, and vibrant entrepreneurial ecosystem at the same time (such as Silicon Valley), but most regions do not.

In parallel to the rapid development of the entrepreneurial ecosystem literature, academics and policy-makers have recently witnessed the emergence of a new research strand focused on the study of the digital entrepreneurial ecosystem. But, why do we need to update existing theories in order to study the role of digitalization in entrepreneurial ecosystems?

The world is today a more digitally integrated place. The accelerated digitization of the economy—in terms of drastic improvements in digital infrastructures and trade—is transforming the functioning of the economy, which has led to consolidate digital markets, ranging from smartphone applications to different forms of digital products and services (e.g., Brynjolfsson & McAfee, 2014; Lafuente et al., 2023). In this new economic scenario, it soon became clear that the entrepreneurial ecosystem literature was falling short in the conceptualization of entrepreneurship in the digital age, mostly because it ignores the decisive role of knowledge as a resource in the economy as well as how platforms govern and nurture platform-based ecosystems (Acs et al., 2021; Lafuente et al., 2023).

The digital entrepreneurial ecosystem literature is still evolving, but so far we can identify at least two features that distinguish conventional entrepreneurial ecosystems from digital entrepreneurial ecosystems: one institutional that puts digital platforms at the heart of this ecosystem, and one market-related that emphasizes the role of platform-dependent firms and digital entrepreneurs (Table 1.4).

This approach emphasizes the leading role of platforms in this ecosystem. Digital entrepreneurial ecosystems are developed and nurtured not by regions or governments but by multisided digital platforms (Sussan & Acs, 2017; Acs et al., 2021). Ecosystem governance, the rules by who gets on a platform, and the rules of good behavior are determined by the owners of multisided platforms (Goldfarb & Tucker, 2019; Lafuente et al., 2023).

Because digital platforms are powerful players of the digital economy connecting digital users, digital entrepreneurs, and incumbent digital businesses whose competitive advantage relies on their capacity to exploit digital technologies and platforms’ offering (platform-dependent firms), governments are increasingly interested in interacting with platforms in order to safeguard public interests as platforms pursue their economic goals. In their effort to consolidate their position in digital markets and their product offering, platform organizations need to manage their ecosystem for billions of users and millions of entrepreneurs across the world. They are also embedded in local ecosystems, such as Silicon Valley, Seattle, and Beijing. Thus, a closer monitoring and updated regulation will likely contribute to ensure the efficient functioning of the system, in terms of the connections between platforms, platform-dependent firms, and end users (Lafuente et al., 2023).

Digital platforms offer important benefits to users, digital entrepreneurs, and platform-dependent firms, such as access to established markets, reliable transactions, and guaranteed operability. Indeed, platforms have dramatically lowered the cost of developing and distributing mobile applications and other complementary products that connect to platforms, which worldwide app developers and other agents can exploit using heterogeneous knowledge-based resources. In short, in a digital entrepreneurial ecosystem governed by multisided platforms, digitally led entrepreneurial innovation closes the gap between supply opportunity seeking, product development, and consumer needs.

To sum up, digital entrepreneurial ecosystems are environments characterized by the lack of regulation and monopolistic competition. In this setting, digital platforms dominate their relationships with platform-dependent firms and end users. The ‘platformization’ of the economy has undoubtedly produced large benefits to the market: platforms support innovation efforts of platform-dependent firms and digital entrepreneurs, and provide increased offering of digital goods and services at minimum search, reproduction, and verification costs (for example, Goldfarb & Tucker, 2019; Sussan & Acs, 2017). These benefits are also evident at the territorial level, in terms of the higher adoption of ICTs in urban settings (agglomeration effects), the increased flow of digital and physical goods in rural or low-density areas, and the reduced need for a task-specific workplace which favors that tech entrepreneurs locate their businesses in rural areas (Kolko, 2012; Lafuente et al., 2010).

4 Structure of the Book

As the reader will discover, the approach taken up in this book, The Entrepreneurial Ecosystem, is a systematic one oriented to understanding the aspects of the entrepreneurial ecosystem outlined in this introduction (i.e., definitional and measurement issues, and the complementary role of the ecosystem framework to analyze the digital economy), and to contrast these two aspects with positions reported by relevant contemporary empirical work rooted in different theoretical groundings. The rest of the book is as follows.

Chapter 2, titled ‘Building Composite Indicators for Policy Optimization Purposes’ by László Szerb, Zoltán J. Ács, Gábor Rappai, and Dániel Kehl, discusses the importance of composite indicators as valuable tools that capture the complexity and multidimensionality of a particular phenomenon and proposes an analysis based on the penalty for bottleneck (PFB) method to show how plausible policy recommendations can be extracted from composite indicators. The basic problem of the policy application of composite indicators lies on their incapability to handle the ingredients from the system perspective. The PFB methodology is based on the assumption that the performance of the system depends on the weakest link, that is, the variable that has the lowest value. The resulting PFB-based policy recommendation is clear: the bottleneck should be improved first because it has a magnifying effect on the other indicators in the system. Unlike other indexes or regression methods, the PFB provides a multivariate marginal analysis that allows to create a policy-portfolio mix that optimizes the use of additional resources. For a more precise policy application, the authors equalized the variable averages in order to derive homogeneous marginal effects over the averages of the variables. The authors present a practical application of the PFB methodology to the Global Entrepreneurship Index data with an exponential penalty function. Policy simulations with three country examples are also provided. The authors conclude that, compared to other methods that do not take a system-based bottleneck approach, the PFB can be successfully applied to numerous fields, thus facilitating the development of more accurate policy recommendations.

In Chap. 3, titled ‘World Technology Frontier: Directed Technical Change and the Relevance of the Entrepreneurial Ecosystem’, Esteban Lafuente evaluates the determinants of total factor productivity in a model that integrates differences in technology choices for a comprehensive sample for 73 countries during 2002–2013. The proposed TFP model is rooted in nonparametric techniques to compute the Malmquist productivity index and its components. The author finds that, for both OECD and non-OECD countries, technical change and total factor productivity growth is associated with higher rates of capital deepening. Results also indicate that the countries’ technology choices (biased technical change) have an impact on productivity results. Public policies promoting economic growth should consider the national system of entrepreneurship as a critical priority, so that entrepreneurs can contribute to effectively allocate resources in the economy.

Chapter 4, titled ‘The Entrepreneurship Paradox: The Role of the Entrepreneurial Ecosystem on Economic Performance in Africa’ by Esteban Lafuente, László Szerb, and Zoltán J. Ács, discusses how increased globalization, economic complexity, and dynamism exacerbate contradictions between theoretical and empirical-driven arguments. Specifically, this chapter analyzes the entrepreneurship paradox—that is, entrepreneurship is good for the economy, but entrepreneurial activity is consistently higher in less developed and developing countries over time—through the lenses of two relevant tensions that underlie this paradox: the development tension (i.e., the inconsistent relationship between entrepreneurship and economic performance) and the policy tension (i.e., the unclear role of entrepreneurship policy on entrepreneurship outcomes). Building on a sample of 81 countries from Africa, America, Asia, and Europe for 2013–2014, the authors employ regression models and cluster analysis to scrutinize the effect of both the rate of entrepreneurial activity (quantity-based entrepreneurship) and the entrepreneurial ecosystem (quality-based entrepreneurship) on economic performance (GDP per capita). The analysis focuses on how the development tension and the policy tension shape the entrepreneurship paradox. In exploring these two elements of the entrepreneurship paradox, the proposed analysis defines and distinguishes quantitative entrepreneurship from the systemic, quality-based entrepreneurial ecosystem and sets forth alternative policies to reconcile the tensions between entrepreneurship and development that fuel the entrepreneurship paradox. The analysis proposed in this chapter contributes to a better understanding of the entrepreneurship paradox. The findings support the notion that African countries—and economies in general—do not need more entrepreneurs but rather a healthy entrepreneurship ecosystem that contributes to optimally channel the outcomes of entrepreneurial actions to the economy.

Chapter 5, titled ‘The Monetization of the Regional Development and Innovation Index: Estimating the Cost of Entrepreneurship Ecosystem Policies in European Union Regions’ by Tamás Sebestyén, Éva Komlósi, and László Szerb, provides a methodology to monetize the different pillars of the Regional Entrepreneurship Development Index (REDI). The REDI methodology provides a normalized value to describe the entrepreneurial ecosystem using natural units of the different measures as inputs to the calculation. To offer more informed policy analyses, the chapter adopted a two-step approach. First, the authors employ econometric techniques to assign a monetary value to the REDI variables. By entering the REDI scores into a production function explaining regional GDP levels, the authors estimate the marginal contribution of the REDI to monetized regional output, which they link to the marginal value of the REDI in a given region. Second, the authors employ a standard shadow pricing approach in which the resulting monetized REDI score is traced back to its components, thus offering a monetized approximation of the pillars that form the REDI composite indicator.

Chapter 6, titled ‘Entrepreneurial Ecosystem in the European Union Regions: Identification of Optimal Ecosystem Configurations for Informed Policy’ by László Szerb and Éva Komlósi, offers a direct empirical analysis of regional ecosystem measure based on complexity theory: the Regional Entrepreneurship and Development Index (REDI). The authors acknowledge that the REDI approach is based on homogeneous (across regions) and fixed (across pillars) pillar weights, thus ignoring part regions’ heterogeneity. Therefore, they also enhance the REDI methodology by building on the benefit of the doubts (BOD) weighting technique. This weighting system reflects a value judgment on what are the optimal configurations of REDI constituents. If policy-makers are given objective, nonarbitrary information about the importance of REDI pillars, resource allocation should follow an economically meaningful process. Quantity improvements are ensured if additional resources are deployed, but for an equal quantitative change in the REDI score, enhancements will be qualitatively superior if policy-makers target a clear set of priorities. Based on the BOD enhanced REDI (REDIBOD), the authors provide a score on the quality of the entrepreneurial ecosystem (REDIBOD) for 125 European Union (EU) regions, conduct a grouping by cluster analysis, and offer policy suggestions for 23 large EU city regions.

Chapter 7, titled ‘Measuring the Effects of Policies Targeting Entrepreneurial Ecosystems: An Application of the GMR Framework with REDI’ by Attila Varga, Tamás Sebestyén, Norbert Szabó, and László Szerb, estimates the economic impact of entrepreneurship policy. Entrepreneurship policy should be added to the palette of public interventions promoting economic growth. Despite the growing evidence, it is still unknown to what extent a given policy intervention would affect economic growth in a particular country or region and how these effects might change over time. These effects can be estimated with economic impact models. In this chapter, the authors introduce the most recent version of GMR-Europe to determine the economic repercussion of policy interventions targeting entrepreneurship. To illustrate the capacity of the model, the paper provides a detailed policy impact assessment analysis.

The world is today a more digitally integrated place; however, digital inequality still prevails, and its repercussions (e.g., poor access to information, e-commerce, remote education, remote work, and remote healthcare) have aggravated with the Covid-19 pandemic. In Chap. 8, titled ‘Digital inequality and the signature of digital technologies and the digital ecosystem: Analysis of deviations in the rank-size rule of Internet access data’, Esteban Lafuente, Zoltán J. Ács, and László Szerb adopt a power-law approach to scrutinize global digital inequality on a sample of 107 countries between 2000 and 2019. Also, the authors take the digital inequality discussion to a more qualitative level by connecting their findings to the quality of countries’ digital ecosystem. Building on the nuance that digital integration encompasses digital technologies and a healthy digital ecosystem, the scrutiny of rank deviations in the Internet access data shows significant progress in digital integration during 2000–2019; however, digital integration is slowing down since 2015. Investments in digital technologies support digital integration. The inspection of countries’ digital ecosystem suggests that digital policies targeting governance (e.g., regulation and data privacy) and platforms’ activities (e.g., social media and online payments) are critical to enhance the digital system and, consequently, reduce digital inequality and its negative manifestations.

Chapter 9, titled ‘A Tale of Two Cities: How Arlington Won and Baltimore Lost in Battle for Amazon’s HQ2’ by Abraham Song and Keith Waters, narrates a tale of two cities, namely, Washington metropolitan area and Baltimore metropolitan area: about the rise of one and the fall of the other; about a metro that landed Amazon’s distribution centers and the other, highly coveted HQ2. In today’s knowledge economy where the most valuable companies are digital platforms, it’s a winner-take-all when it comes to regional economic development. The paradigm of place-based policies of the industrial age that sought to attract large manufacturing plants with tax incentives is outdated. There is no better example of this paradigm shift in economic development from cost minimization to value maximization, from emphasis on physical capital to human capital, embodied in the case of Amazon HQ2 race, which ultimately landed in Crystal City, Virginia. Amazon HQ2 race represents a great lesson for what technology businesses value: talent. Virginia demonstrated a good understanding of tech firms’ market needs, and its development strategy evidenced the importance of prioritizing the talent pipeline.

Chapter 10, titled ‘Measuring the Modern Entrepreneur: An Evaluation of Elon Musk’ by Camilla Bosanquet, qualitatively considers various arguments that characterize the entrepreneurial profile of Elon Musk. The chapter first contemplates entrepreneurship in an effort to develop baseline standards by which we might then evaluate Elon Musk. A secondary analysis compares Elon Musk against two of his predecessors, Henry Ford and Kiichiro Toyoda. Likewise, the author compares Tesla Motors with Ford Motor Company and Toyota Motor Corporation. Several accusations against Elon Musk will also be weighed, especially those which might challenge notions of Musk as an innovator, founder, and (ultimately) entrepreneur.

Chapter 11, titled ‘How to Tame the Beast? Toward a ‘Regulation Revolution’ in the Digital Platform Economy’ by Márton Sulyok, offers a broad frame to talk about legal and regulatory issues that arise in a ‘platform context’. The author contrasts some of the natural drivers nurturing the digital platform ecosystem and incentivizing technological and digital progress, pushing the final frontier of law (understood as the means to create order) further, and testing the limits of states as regulators. The ‘IT-debate’, which today revolves around how to tackle growing pressures by recent IT-developments, in other words, how ‘tame the beast’, and the ‘how’ and ‘when’ to regulate digital platforms that are the foundations of the ‘digital platform economy’, has gained weight in public discourse. In discussing this essential function, relevant questions for legal scholars, regulators, and economists are addressed, including when and to what extent states should regulate digital markets to set rights and delimitate possible violations that range from privacy to freedom of speech. As states breach the digital barrier through technological evolution, the concept of sovereignty emerges in the digital sphere. Many actors with a marked economic footprint appear in the life of states which have different means to affect the ‘analog context’ of traditional sovereignty (i.e., population and decision-making). This leads to a ‘regulatory revolution’ that materializes in increased regulation of big data, actions of the ‘big five’, algorithmic decision-making, among others. A long-standing question in the legal community is whether law has primacy over politics and policy, or vice versa. In the current digital context, the question should rather be whether the platform economy has primacy over law (politics and policy), or whether it should be the other way around.

In the concluding chapter—Chap. 12, titled ‘The Ecology of Innovation: The Evolution of a Research Paradigm’—Hilton L. Root proposes a framework in which complex system analytics plays a pivotal role for enhancing entrepreneurship scholarship and policy. Following a review of research on entrepreneurial ecosystems from an evolutionary perspective, the chapter forges a new research direction that pays close attention to the relationships between the decisions and strategies of agents and the structure of the environment in which choices are made. The chapter suggests new ways to evaluate the connections between system variables at their macroscopic scale, in the hope of defining global properties that are independent of the details at the microscopic scale. The analysis of entrepreneurial ecosystems through the complex adaptive systems lens has the potential to produce a literature that is richer in insights about the informal constraints, such as social norms, beliefs and ideologies, and the cognitive processes and cultural elements that underpin them, leading to a meta-theory that integrates a community’s culture and its historical specificity with its entrepreneurship ecosystem.

In summary, this book on the entrepreneurial ecosystem is a timely intervention to document different shades of entrepreneurship which might be of value to scholars, policy-makers, strategy makers, students, as well as the general public.

References

Acs, Z. J. (2022). The global digital platform economy and the region. Annals of Regional Science, in press. https://doi.org/10.1007/s00168-022-01154-6.

Acs, Z. J., Autio, E., & Szerb, L. (2014). National Systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476–494.

Acs, Z. J., Autio, E., & Szerb, L. (2015a). Global entrepreneurship and development index 2014. Springer Nature.

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics and economic growth: An ecosystem systems perspective. Small Business Economics, 51(2), 501–514.

Acs, Z. J., Song, A., Szerb, L., Audretsch, D., & Komlosi, E. (2021). The evolution of the digital platform economy: 1971–2021. Small Business Economics, 57(4), 1629–1659.

Acs, Z. J., Stam, E., Audretsch, D., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1–10.

Acs, Z. J., Szerb, L., Ortega-Argilés, R., Coduras, A., & Aidis, R. (2015). The regional application of the global entrepreneurship and development index (GEDI): The case of Spain. Regional Studies, 49(12), 1977–1994.

Acs, Z. J., Szerb, L., Song, A., Lafuente, E., & Komlosi, E. (2022). Measuring the digital platform economy. In M. Keyhani, T. Kollmann, A. Ashjari, A. Sorgner, & C. Eiríkur Hull (Eds.), Handbook of digital entrepreneurship, chapter 5 (pp. 91–120). Edward Elgar Publishing. ISBN 978-1-800-37362-4.

Asheim, B. T., & Coenen, L. (2005). Knowledge bases and regional innovation systems: Comparing Nordic clusters. Research Policy, 34(8), 1173–1190.

Asheim, B. T., Boschma, R., & Cooke, P. (2011). Constructing regional advantage: Platform policies based on related variety and differentiated knowledge bases. Regional Studies, 45(7), 893–904.

Audretsch, D., Mason, C., Miles, M. P., & O’Connor, A. (2021). Time and the dynamics of entrepreneurial ecosystems. Entrepreneurship & Regional Development, 33(1–2), 1–14.

Brynjolfsson, E., & McAfee, A. (2014). The second machine age: Work, Progress, and prosperity in a time of brilliant technologies. W.W. Norton & Company.

Cao, Z., & Shi, X. (2021). A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Business Economics, 57(1), 75–110.

Cooke, P., Gomez Uranga, M., & Etxebarria, G. (1997). Regional innovation systems: Institutional and organizational dimensions. Research Policy, 26(4–5), 475–491.

Delgado, M., Porter, M. E., & Stern, S. (2016). Defining clusters of related industries. Journal of Economic Geography, 16(1), 1–38.

Feld, B. (2012). Start-up communities: Building an entrepreneurial ecosystem in your city. Hoboken, NJ: John Wiley & Sons.

Goldfarb, A., & Tucker, C. (2019). Digital economics. Journal of Economic Literature, 57(1), 3–43.

Isenberg, D. J. (2010). How to start an entrepreneurial revolution. Harvard Business Review, 88(6), 41–50.

Kolko, J. (2012). Broadband and local growth. Journal of Urban Economics, 71(1), 100–113.

Lafuente, E., Acs, Z. J., Sanders, M., & Szerb, L. (2020). The global technology frontier: Productivity growth and the relevance of Kirznerian and Schumpeterian entrepreneurship. Small Business Economics, 55, 153–178.

Lafuente, E., Acs, Z.J., Szerb, L. (2022). A composite indicator analysis for optimizing entrepreneurial ecosystems. Research Policy, 51(9), 104379.

Lafuente, E., Acs, Z. J., & Szerb, L. (2023). Analysis of the digital platform economy around the world: A network DEA model for identifying policy priorities. Journal of Small Business Management, in press. https://doi.org/10.1080/00472778.2022.2100895.

Lafuente, E., Szerb, L., & Acs, Z. J. (2016). Country level efficiency and National Systems of entrepreneurship: A data envelopment analysis approach. Journal of Technology Transfer, 41(6), 1260–1283.

Lafuente, E., Vaillant, Y., & Serarols, C. (2010). Location decisions of knowledge-based entrepreneurs: why some Catalan KISAs choose to be rural? Technovation, 30(11–12), 590–600.

Leydesdorff, L., & Meyer, M. (2006). Triple Helix indicators of knowledge-based innovation systems: Introduction to the special issue. Research Policy, 35(10), 1441–1449.

Lundvall, B. Å. (1992). National Systems of innovation: Towards a theory of innovation and interactive learning. Pinter Publishers.

Marshall, A. (1920). Principles of economics (Revised ed.). Macmillan.

Moore, J. (1993). Predators and prey: A new ecology of competition. Harvard Business Review, 71(3), 75–86.

Motoyama, Y. (2008). What was new about the cluster theory? What could it answer and what could it not answer? Economic Development Quarterly, 22(4), 353–363.

Motoyama, Y. (2019). From innovation to entrepreneurship: Connectivity-based regional development. Edward Elgar Publishing.

Porter, M. E. (1998). Clusters and the new economics of competition. Harvard Business Review, 76(6), 77–90.

Porter, M. E. (2007). Clusters and economic policy: Aligning public policy with the new economics of competition. Institute for Strategy and Competitiveness at Harvard Business School.

Qian H., & Fu W. (forthcoming, 2023). Entrepreneurial ecosystem versus regional innovation system: conceptualization and application to Chinese cities. In Huggins R., Kitagawa F., Prokop D., Theodoraki C., Thompson P. (Eds.), Entrepreneurial ecosystems in cities and regions: Emergence, evolution, and future. Oxford University Press.

Qian, H., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40(2), 185–197.

Qian, H., & Acs, Z. J. (2022). Entrepreneurial ecosystems and economic development policy. Economic Development Quarterly. in press.

Qian, H., Acs, Z. J., & Stough, R. R. (2013). Regional Systems of Entrepreneurship: The nexus of human capital, knowledge and new firm formation. Journal of Economic Geography, 13(4), 559–587.

Schumpeter, J. A. (1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. Cambridge, MA: Harvard University Press.

Song, A. (2019). The digital entrepreneurial ecosystem—A critique and reconfiguration. Small Business Economics, 53(3), 569–590.

Spigel, B., & Harrison, R. (2018). Toward a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 151–168.

Stam, E., & Spigel, B. (2022). Entrepreneurial Ecosystems. The SAGE Handbook of Small Business and Entrepreneurship (pp. 407–421). SAGE.

Sussan, F., & Acs, Z. J. (2017). The digital entrepreneurial ecosystem. Small Business Economics, 49(1), 55–73.

Szerb, L., Acs, Z. J., Lafuente, E., Komlosi, E., & Song, A. (2022). The digital platform economy index 2020. Springer Nature.

Szerb, L., Lafuente, E., Horváth, K., & Páger, B. (2019). The relevance of quantity and quality entrepreneurship for regional performance: The moderating role of the entrepreneurial ecosystem. Regional Studies, 53(9), 1308–1320.

Szerb, L., Ortega-Argilés, R., Acs, Z. J., & Komlósi, É. (2020). Optimizing entrepreneurial development processes for smart specialization in the European Union. Papers in Regional Science, 99(5), 1413–1457.

Varga, A., Sebestyén, T., Szerb, L., & Szabó, N. (2020). Estimating the economic impacts of knowledge network and entrepreneurship development in smart specialization policy. Regional Studies, 54(1), 48–59.

Wurth, B., Stam, E., & Spigel, B. (2022). Toward an entrepreneurial ecosystem research program. Entrepreneurship Theory and Practice, 46(3), 729–778.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Acs, Z.J., Lafuente, E., Szerb, L. (2023). Introduction: Entrepreneurial Ecosystems. In: Acs, Z.J., Lafuente, E., Szerb, L. (eds) The Entrepreneurial Ecosystem. Palgrave Studies in Entrepreneurship and Society. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-031-25931-9_1

Download citation

DOI: https://doi.org/10.1007/978-3-031-25931-9_1

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-031-25930-2

Online ISBN: 978-3-031-25931-9

eBook Packages: Business and ManagementBusiness and Management (R0)