Abstract

The chapter presents a retrospective, systematic analysis of China’s place and role in the world and global economy. It analyses the evolution of Chinese economic strategy and development model; dynamics, proportions, and efficiency of economic growth; business structure; the role of human capital in innovative development, as well as the real, financial, foreign economic, and social sectors of the economy and society.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

The People’s Republic of China is the largest country in the world in terms of economy and population and the third in terms of territory. Systemic reforms in China, lasting more than four decades (since 1978), accelerated industrialisation and radically increased the weight and role of the country in the world and global economy. Having become a “global factory”, China faced an increase in a number of both traditional and new problems, such as demographic, raw materials, institutional, and environmental. By overcoming them, the country is now switching to a modern version of its economic model as a strategy of “harmonious”, sustainable development of the market economy. It is focused on refusing to maximise economic growth rates “at any cost”, and is instead turning its priorities to the tasks of social development, the balance of internal and external markets, the formation of a large middle class as a guarantor of socio-political stability, to overcoming the remnants of discrimination of private business and the formation of a modern model of its partnership with the state. As China’s role in the global economy increases, its global economic expansion is also expanding significantly, particularly within the framework of implementing the megaproject “One Belt, One Road”.

1.1 Chinese Economic Strategy and Modification of the Economic System

From the point of view of socio-economic strategy, the post-war economic and social development of China can be divided into four stages, during which different economic models were used.

The first stage (the end of the 1940s–the first half of the 1950s) covers the formation of the PRC (1949) and the post-war economic recovery based on Mao Zedong’s “New Democracy” model. The principal characteristics of this stage included the orientation of the ruling Communist Party of China (CPC) to a long-term economic union with national business as an important subject and source of financing for industrialisation; the limited admission of its representatives to legislative and executive authorities; and the CPC’s attempt to assume the role of a regulator of relations between labour and capital.

The second stage (the second half of the 1950s–1970s) was focused on the development of the administrative-command economy, using Mao Zedong’s model of “Traditional Socialism”. The defining features of this stage were industrialisation on the model and, with the help of the USSR in the 1950s, the priority development of heavy industry and the military-industrial complex; pumping out financial resources from the agricultural sector due to the price differences between industrial and agricultural products; nationalisation of private entrepreneurship; militarisation of production and life; an attempt to “overtake England and catch up with America” due to the adventure of the “Great Leap Forward” (1958–1960); people’s communes in the countryside with their total socialization of production and life; import substitution under the slogan of “self-reliance”, which intensified after the fatal disengagement from the USSR in the early 1960s. The implementation of this strategy, despite some achievements in the 1950s, eventually provoked an acute socio-economic crisis, especially during the “Cultural Revolution” (1966–1976).

The third stage (the late 1970s–1990s) is characterised by Deng Xiaoping’s model of transition to a market economy. The most distinctive features of this stage were maximising economic growth rates through the active formation of market mechanisms and institutions; the revival and admission of private business into most sectors of the economy; market reform of the public sector (corporatisation of large and privatisation of small and medium-sized enterprises); social differentiation of the population (encouraging “some people and regions to achieve prosperity before others”); the policy of foreign economic openness and export potential of coastal regions. Unlike the previous models, this model contributed to China’s rapid economic growth, although the cost of this growth turned out to be very significant. It made clear the shortage of natural resources, greater environmental pollution, and deepening social and interregional problems.

At the fourth stage (from the beginning of the 2000s to the present), Chinese leadership used the model of a more balanced, harmonious development of the market economy, the so-called model of Hu Jintao and his successor Xi Jinping. The main features of this stage are as follows: an attempt to reduce the gap in the levels of development between the city and the countryside, developed and less developed regions of the country, the economy and the social sphere, as well as greater attention to the environment, capacity of the domestic market, and technological level of exports. The national task is to build an “average-income” society for the majority of the Chinese population by reducing the gap between China and developed economies in major per capita indicators by the middle of the twenty-first century.

It can be said that the current stage of China’s economic strategy is a natural transformation of its previous stage, dictated by an increase in the maturity of the market economy and the growing opportunities to transition from an extensive, resource-intensive, non-ecofriendly model of economic growth to an intensive, resource-saving one, as well as from the social polarisation of society to the development and predominance of a stable and numerous middle class (as a factor of expanding the capacity of the domestic market and a guarantor of socio-political stability). This stage also marks the gradual end of a long phase of active industrialisation in China and the country’s increasing reliance on the service sector as the main and promising driver of development.

Among the current key problems and contradictions of China’s economic and social development, the following stand out:

-

A complex of demographic problems, manifested, on the one hand, in the still-existing opportunities for the flow of labour from the primary to the secondary and tertiary sectors of the economy (estimated at 150–200 million people until 2020–2025). On the other hand, there are the growing consequences of the strict “one family, one child” policy carried out in the 1980s–2000s, such as population ageing (by the early 2010s, the proportion of people over 65 reached 9.0% versus 7.6% world average), gender imbalance (51.5 out of every 100 people in the population are men and only 48.5 are women), and most importantly, the expected serious decrease in the growth rate of labour resources (up to a negative average annual level of −0.3% in 2020–2030).

-

The problem of food security, caused primarily by the relatively small and constantly decreasing per capita land fund (the per capita size of arable land decreased in the 1950s–2020s by 4.5–5 times), the ban on the privatisation of land restricting the development of farming, insufficient mechanisation, and, as a consequence, relatively low labour productivity in agriculture (an order of magnitude is lower than in developed countries).

-

The raw material problem, expressed in an acute imbalance between rapid economic growth and its limited natural resource base, the growing shortage of energy sources and some other types of mineral raw materials, the corresponding increase in the import dependence of the economy (for example, up to 50–70% and above for oil and gas).

-

Territorial unevenness of economic and social development, firstly, between the city and the countryside (the level of consumption in the countryside is 4–5 times lower than urban) and, secondly, between individual regions of the country (the more developed and rich East and South and the still relatively backward, poor West).

-

The problem of transferring the economy to an intensive path of development, which is becoming more and more urgent as China moves to the end of the phase of active industrialisation. This can be primarily explained by the fact that extremely high rates of economic growth in the 1980s and early 2010s were achieved on a predominantly extensive basis, due to incomparably high material, capital, and labour intensity of GDP compared to developed economies and, conversely, still low productivity of labour, capital, and technology.

-

The problem of the quality of manufactured and, in particular, exported products, not yet fully meeting the highest international standards, limiting the competitiveness of Chinese goods and services on the world market, as well as the underlying problem of increasing the technological level of production, the knowledge intensity of GDP and exported products, confirmed by the still high dependence of the economy on the import of technologies and high-tech equipment, the relative shortage of national technological innovations.

-

Institutional problems caused by the incomplete market reform of the banking system and public sector enterprises (their corporatisation and partial privatisation), the unprofitability or low profitability of some state-owned enterprises, and the still insufficient legitimacy of private property in its various forms, including social discrimination of entrepreneurs at the local level on taxation, lending, resource supply and the procedure for registering enterprises.

-

The contradiction between economic growth and social development, manifested in the lag of the social sphere due to the relatively low level of government spending on education, health, and social security, and the growing social stratification and polarisation during the years of reforms.

-

Environmental problems are caused primarily by the resource-intensive model of economic development and accelerated industrialisation of the rural areas—serious water erosion and soil salinisation, deforestation, desertification, atmospheric pollution, acid rain, and lack of water resources.

1.2 Dynamics, Proportions, and Efficiency of Economic Development

China’s economy developed at an extremely slow pace in the first half of the twentieth century (the average annual GDP growth rate was only 0.6%, which was 3.7 times lower than in the world—2.2%). In the 1950s, with the beginning of forced industrialisation in China with the support and on the model of the USSR, the country’s GDP growth rate increased (it amounted to 7.8% per year during the first five-year plan of 1953–1957). However, the subsequent political adventures of the “Great Leap Forward”, the people’s communes, and the “Cultural Revolution” again significantly slowed down China’s economic development: down to 0.6% in the 1960s and 3.1% on average in the 1970s (the global rates were 4.6 and 3.5%, respectively).

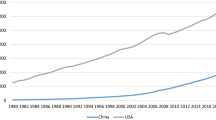

In the late 1970s, China began a period of rapid economic growth (see Table 1).

As a result, China’s GDP has grown more than 15 times over the first 30 years of market reforms, and the average per capita income of the population has increased 8 times. Such high and prolonged growth rates were large due to the alignment of the phase of active industrialisation in the PRC with the country’s evolutionary transition to market economy, which made it possible to fully identify and successfully implement national competitive advantages in the context of globalisation.

These advantages include, firstly, the world’s largest workforce, which has more than doubled over the years of reforms and exceeded 800 million people, or a quarter of the global level. The second advantage is the highest investment rate in the world (more than 45% of GDP on average in the 2010s). One of its sources is the growth of the gross savings rate (more than 50–70%), the other is the specifics of the state’s financial policy associated with the so-called emission pumping of banks (see Sect. 1.6). Another growing advantage is the gradual increase in the technological level of production, both due to the import of modern equipment and technologies, and—especially in the last 20 years—due to increasing expenditures on technological innovations (Sect. 1.4). Important sources and stimulators of China’s rapid economic growth can also include the effective national idea of “reviving the former greatness of China”, the strong economic role of the state, the systemic institutional effect of market transformations, increasing investment in human capital over the past two decades, and the prioritisation of the export potential of the real sector, especially in the 1990s–2000s (see Sects. 1.4 and 1.7).

The global economic crises have accelerated China’s transition to a new economic model, which assumes, among other things, an increasing expansion of the domestic market, more sustainable economic growth, but at a slower pace than before and marks, in fact, the beginning of the gradual completion of active industrialisation and the country’s transition to innovative development with a predominant reliance on the service sector. According to leading Chinese economists, the 2010s–2020s are becoming a period of new normality in the development of the national economy, the most important period of its structural transformations in more than 40 years since the beginning of the “reform and openness” policy in China.

The Chinese economy is now facing at least three serious internal and external challenges: firstly, with a gradual increase in the cost of production due to the constant increase in the cost of labour (by the beginning of the 2010s, the growth rate of net income of the population came close to the growth rate of GDP; according to Chinese data, the average salary in the country in 2000–2020 increased almost 10 times). Secondly, with an increase in environmental costs, as well as the growth of China’s costs for imported natural raw materials and foreign technologies. Thirdly, with inflation pressure on the economy is caused by both internal (money supply growth) and external factors, including the US sanctions policy. As a result, China is experiencing and will continue to experience a gradual decline in economic growth, a “long period of average development speed” is coming, which may amount to 5.5–6.5% of GDP growth per year (see Table 1).

For the Chinese economy in transition, the dynamics of such important proportions of economic development as the proportions between accumulation and consumption, as well as between the primary, secondary, and tertiary sectors of the economy are of great importance.

Having brought the rate of gross capital accumulation from 30–40% in the 1980s and 1990s to 48% in 2009, China exceeded its global average by more than 2.5 times and reached the absolute historical maximum of this indicator. In the 2010s, this rate began to decrease—to 42% in 2015 and 38% in 2020. According to the joint forecast of the World Bank and the State Council of the People’s Republic of China “China in 2030” (see sources in Table 1), this trend should continue to fall to 36% in 2025 and 34% in 2030. The consumption rate, on the contrary, is increasing and will continue to increase—from 49% in 2010 to 56% in 2015, 60% in 2020, 63% in 2025, and 66% in 2030. Such a changing proportion between accumulation and consumption is quite natural from the point of view of the prospects of the PRC entering a new, post-industrial stage of its economic development and means shifting the priorities of the country’s economic policy from physical to human capital (see Sect. 1.4).

Active industrialisation in China, as well as the country’s transition to post-industrial development, have radically changed the balance between the sectors of the Chinese economy. The share of the primary sector in GDP dropped in 1986–2010 from 30 to 10%—and decreased to 7% by 2020 and 4% by 2030. The share of the secondary sector, having reached a historical maximum of 53% in 2002, decreased to 47% in 2010, to 41% in 2020, and may decrease to 35% in 2030. The share of the service sector in 1980–2010 has more than doubled—from 21 to 43%—and continues to increase to 52% in 2020 and 61% in 2030. As noted at a plenum of the CPC Central Committee, China is making a “transition from a model of priority development of the industry to economic growth through strengthening the service sector” in the 2010–2020s.

As a result of China’s transition to a higher stage of economic development, the issues of the efficient use of economic resources are of high importance and, in particular, the problem of the changing the proportions between the contribution of extensive and intensive factors to the economic growth (i.e., labour, capital, and technology, on the one hand, and their individual and total factor productivity—TFP, on the other).

During the period of the administrative-command economy in China, the total factor productivity (TFP) as a whole was low, providing only 2–3% of the total GDP growth of the country in 1952–1978, which indicated extensive economic growth. With the transition of the PRC to a market economy, it increased significantly—up to 33% on average in 1979–1995 (according to Chinese calculations). However, later, when the capital intensity of the economy grew, the growth of TFP slowed down significantly despite the increase in labour productivity, encountering a very typical problem for active industrialisation: reducing capital-output ratio. Indeed, while the growth of investment in 1978–2015 was 2–3 times higher than the GDP growth rate, the efficiency of these investments (capital-output ratio) decreased (in 2006–2011, for example, by 1.3 times). As a result, the main source of GDP growth in the 2000s—the first half of the 2010s remained the extensive factor of massive capital investment growth, while the TFP share in GDP growth was still low—25–30% (for comparison: it was 43–44% in Taiwan, 45–46% in Thailand, 47–48% in South Korea).

At the same time, it should be noted that the average annual growth rate of TFP in China in the 2000s early 2020s, despite its decline during the global crises, as a rule, exceeded the corresponding rates in developed economies. This means that, as the phase of active industrialisation and the transition from predominantly capital-intensive to predominantly knowledge-intensive development comes to an end, China’s TFP should be gradually increasing, reducing the still significant gap with the more developed economies of the world.

1.3 Business Structure

Having undergone nationalisation in the mid-1950s, in the subsequent period of the administrative-command economy until the end of the 1970s, private business in China was outlawed, existing only within the narrow limits of the shadow economy (“we are engaged in socialism by day, in capitalism by night”). In the next decades, the Chinese government under the influence of both internal and external factors, and in the framework of the general course of market reforms gradually moved from a policy of forced prohibition of private entrepreneurship and its social discrimination to a strategy of balanced promotion and support.

In particular, the general political and legal status of entrepreneurship has radically changed. If in 1982, only small private business was legalised in the Constitution of the PRC, in 1988 it was already medium and large business (but only as an “addition to the socialist public economy”), then in 1999 the private sector received a significant new rank of “the important component of the socialist market economy”, and in 2004, as one of the consequences of China’s accession to the WTO, a fundamental amendment on the “inviolability of legitimate private property of citizens” was made to the country’s constitution.

In accordance with this, the entire system of political attitudes, legislation, and regulation of entrepreneurial activity was gradually changed and reformed, and focused on the inherent equality of the rights of enterprises of all forms of ownership in the market economy. In 2005, China adopted provisions that significantly expanded the scope of private business access to sectors of the economy previously monopolised by the public sector. In 2007 it was the law on property rights, which for the first time in the history of the PRC guaranteed equality of rights for state and private property enterprises. In 2010, they adopted a new set of rules aimed at encouraging the non-state sector and designed to stimulate private investment in infrastructure, housing construction, utilities, finance, and even some branches of the military-industrial complex.

One of the consequences of the positive changes in China’s state policy concerning private business has been its rapid development. During the 12th five-year plan (2011–2015), the value added of private industrial enterprises in China increased at an average annual rate of 17–19%, which was 1.8–2.2 times higher than the corresponding indicators of both enterprises with foreign capital and state and collective enterprises. As a result, the share of the public sector in the country’s GDP had already decreased to less than 30% by 2005, and about 25% by 2010. The private sector gradually began to play a major role in many branches of the national economy, including foreign trade. The total export volume of all non-state enterprises exceeded the corresponding indicator of the public sector by more than two times already in 2010. In 2020–2025, the real contribution of private and mixed forms of entrepreneurship to the country’s GDP is supposed to reach 80–85%.

At the same time, it is important to emphasise that although the reforms in China are aimed at increasing institutionalisation and legitimisation of private property, this process is not equivalent only to the privatisation of the national economy. China officially continues the “construction of socialism with Chinese specifics”: the public sector is being radically reformed and commercialised, while the number of enterprises and their share in the economy are reduced, but it still remains one of the most important elements of the national economy. “We encourage enterprises of different forms of ownership to compete with each other to ensure common development”—this is how the current Chinese leaders characterise the state policy on the mixed economy. The partnership between the Chinese state and private business continues to be maintained and at the same time improved with the increasing weight of the latter.

1.4 Human Capital and Innovative Development

In modern China, there is a growing understanding that in the process of globalisation and the growing level of economic development, it is not enough for China to just play the role of a “world factory” for assembling products based on borrowed technologies. Instead, it is necessary to move to more active, innovative development to become “a model of a creative, innovative economy and a new entrepreneurial culture” in the foreseeable future (by 2025–2030). That is why the two-tier ideology “reform and openness”, which has become traditional for reform in China in the twenty-first century, is being transformed into its expanded, three-tier version—“reform, openness and own innovations”. There is also an increasing awareness of the fact that the transition to innovative development is impossible without a significant increase in investment in human capital.

The PRC is developing and gradually implementing a “strategy for building China as an innovative country” (or “innovative development strategy”), also defined as “a strategy for raising the country through modernising education, developing science and technology, using the advantages and potential of Chinese scientific and technological developments by stimulating their commercialisation, the production of knowledge-intensive goods and the globalisation of knowledge-intensive industry under market requirements”. Within the framework of this strategy, in particular, the State Plan of Scientific and Technological Development of the People’s Republic of China for 2006–2020 was adopted and implemented. Its main goals were to transform the country into a modern information society by 2020, reduce dependence on imported technologies to less than 30%, increase the contribution of national science and innovation to the economic growth to at least 60%, as well as to lay the foundations for China as a world leader in R&D by 2050.

Among the main directions and forms of implementing this strategy are radical reforms of the education system and the Academy of Sciences of the PRC, special state programmes aimed at creating elements of innovation infrastructure, in particular, the scientific and technological market, university research and production centres, various zones where new and advanced technologies can be introduced, as well as developing the national high-tech industry by stimulating the innovative motivation of national corporate, small and medium-sized businesses, including various public–private partnership projects.

In accordance with this, investments in healthcare, social security (see Sect. 1.8), ICT services for the population, science, and especially in education, are increasing gradually but significantly. The share of government spending on education increased from 2.8% of GDP in 2005 to almost 4% in 2012 and approached the global average (4.5%) in 2017–2020. The literacy rate of the adult population (15+) increased from 69% in 1988 to 93–94% in the 2010s. In 2011, universal nine-year secondary education was officially introduced in China.

By 2003, the PRC took the first place in the world in terms of the total number of students in universities and colleges, becoming, in 2008, the world leader in the number of bachelor’s degree graduates of scientific and technical universities, and the leader in the number of graduates of master’s and doctoral studies in 2010–2015. The total number of universities in China increased 4.5 times in 1978–2013, while the international rankings of the country’s top universities have significantly increased. In 2010, 22 Chinese universities were included in the top 500 universities in the world, allowing China to take sixth place in the corresponding ranking after the United States, Germany, Great Britain, Japan, and Canada. The mass education of Chinese students in the most prestigious foreign universities has also become a noticeable phenomenon. The average annual number of students travelling abroad in 2011–2015 was 300,000–500,000, the number of graduates returning to the country was 180,000–250,000. In the 2020s, China plans to complete the modernisation of the education system, creating an “educated society” in which higher education is perceived as “fundamental”.

An essential means of improving the quality of human potential in China is its rapidly developing information resources. In the first half of the 2000s, China became a world leader in the production of telecommunications equipment. The country ranks first in the world in terms of the number of Internet and mobile phone users.

Since the mid-1980s–early 1990s, measures have been taken in China to increase R&D spending. It increased from 0.7% of the GDP level in 1990 to 0.9% in 2000, 1.35% in 2004, 1.7% in 2009, and 2.2% in 2015, approaching 2.5% of GDP by the early 2020s, which matches the average level of developed countries.

Over the past two decades, the Intellectual Renewal Programme, launched as part of the radical reform of the Chinese Academy of Sciences, has also been gradually implemented. In the 2010s, more than 30 out of 100 state research institutes of the Academy of Sciences of the People’s Republic of China were recognised as “world-famous” research institutions, and five to seven of them (according to various criteria and estimates) reached a “first-class” international level. It is to the Chinese Academy of Sciences that the role of scientific coordinator and driver of the country’s achievement of one of its long-term strategic goals is assigned—it should “ensure a leap acceleration in the next ten years and the sustainable development of innovative processes in the next foreseeable period”. The task is also set to gradually turn the Academy of Sciences of PRC into a “comprehensive state academy of world level”, one of the “symbols of the modernisation of science and technology in the country”.

The basis of the innovation infrastructure was the scientific and technical (technological) market, which for the first time received the official right to exist in the PRC in 1985. Over more than a 30-year period, the total volume of technology trade has increased a thousandfold, reaching the average annual level of 15–20 billion yuan in the 2010s. The structure of this market, which includes about 2000 organisations, has also been constantly improved. It includes the incubators of scientific and technical enterprises and university technoparks, high-tech zones, enterprises based on state technology development programmes, centres for increasing the productivity of medium and small enterprises (“productivity centres”), as well as a special innovation fund for small and medium-size scientific enterprises, Chinese foreign technoparks and high-tech enterprises of various forms of ownership.

The aforementioned high-tech zones are a very substantial segment of the innovation infrastructure (technology market). They employ 1.2 million researchers and 6.5 million staff. The zones include 45 “pilot cities of innovative type”, in which there are 54 special zones with special preferential tax and credit treatment for investors and their foreign trade activity. Among these zones, three zones stood out in terms of scale and innovative level—Zhongguancun in Beijing, Zhangjiang in Shanghai, and the zone in Shenzhen.

A prominent place in China’s innovation infrastructure is given to special state programmes for the development of high technologies (such as the Torch Programme), operating since the 1980s. Their main tasks include, besides creating innovations, forming a culture for their implementation and improving the environment for them (institutional, administrative, legal, and other conditions for introducing new technologies), supporting innovative activities of enterprises with an emphasis on the development of small and medium-size scientific and technical firms, stimulating the creation and development of innovative groups of enterprises competitive on the world market. These state programmes are varieties and forms of the Chinese model of public–private partnership in the field of innovation, and as such play one of the key roles in the formation of a competitive business sector as the main generator of innovations focused on maximising entrepreneurial income. In particular, since 1988, more than 1000 innovation and investment projects have been implemented annually within the framework of the Torch Programme, most of them with extra-budgetary funds that are own funds or bank loans of enterprises.

Hence, in recent decades, China has managed to improve significantly the quality of its human capital and start the transition to active innovative development. The most important achievements of the PRC in this area are:

-

The formation of a competitive business sector, which is the main generator of innovations.

-

The creation of effective forms of public–private partnership in innovation activities.

-

The creation of favourable institutional conditions for innovative growth.

-

The integration of the country into the global innovation sphere which is the most important condition for the development of national high-tech industries.

1.5 Real Sector

Active industrialisation in China made the country the largest industrial producer in the world by 2010, bringing its share of production of manufactured goods to almost 1/3 of the global volume by the early 2020s.

The largest contribution to the high growth rates of Chinese industry and the national economy as a whole is made by manufacturing industries focused on both export (90–95% of Chinese exports) and domestic consumption.

The most dynamic of these industries is mechanical engineering (15–25% of total industrial production), the annual growth rate of which in the 2000s, as a rule, exceeded 20%, slowing down somewhat only in the last decade. The fastest-growing sub-sectors of mechanical engineering are the production of electronics, office and telecommunications equipment (more than 90% of the world’s output of personal computers; 228 of the top 500 supercomputers in the world are produced in China), automotive, power equipment manufacturing, shipbuilding, and robotics. In particular, China has been the world’s largest carmaker since the early 2010s, bringing the production of cars to 25–30 million per year (more than 1/3 of the global output) and demonstrating record annual growth rates of more than 15–20%. The country is also a world leader in the production of sea vessels (more than 50% of world output) including high-tech LNG supertankers, air conditioners (more than 80%), household electrical appliances (refrigerators, washing and sewing machines, etc.), watches, radios, televisions, mobile phones (more than 70%), a variety of audio and video equipment. The aerospace industry and the defence industry are also developing rapidly.

The chemical industry is growing rapidly, including both basic and organic chemistry. China firmly ranks first in the world in the production of mineral fertilisers. The pharmaceutical industry has achieved significant success.

China’s fuel and energy complex is one of the largest in the world. Moreover, the share of coal in the country’s energy balance is still very high, although it is gradually decreasing for environmental reasons (from three-quarters to one-half in 1990–2020s). China consistently ranks first in the world in coal production (3.5–4.0 billion tons, or 45–48% of world production in the 2010s). Coal accounted for 55.5% of electricity production in 2020, crude oil—19.4%, natural gas—8.6%, hydro, solar and wind energy, nuclear energy, and other sources—16.5% in total.

In terms of electricity production, China ranks first in the world (more than 8.5 trillion kWh). Despite this, the high energy intensity of economic growth in China (almost 24% of global energy consumption versus 16% in the United States in 2020) still causes a noticeable lag in the electricity production and consumption. In the 2010s and 2020s, China began to solve this problem by accelerating the construction of nuclear and hydroelectric power plants, using alternative energy sources, boosting shale gas production, modernising coal mining, as well as by increasing energy imports. In the 2010s, China took a leading position in the world in the production of solar energy and the total capacity of wind power plants. At the same time, it has also become the largest importer of crude oil. In particular, in 2005–2020, its imports have increased by more than six times, and the Chinese dependence on them has exceeded 70–75%. In the 2010s, China also became one of the world’s largest importers of coal and liquefied natural gas.

Ferrous metallurgy is one of the traditionally developed industries in China. China firmly holds the position of world leader in the production of cast iron, steel, and steel pipes, significantly ahead of its closest competitor—Japan. However, China has had to import iron ore on a large scale since the beginning of the 2000s. In the 2000s, China came out on top in the world in terms of production in non-ferrous metallurgy. This industry is supplied with large domestic reserves of non-ferrous metals such as antimony, tungsten, zinc, lead, tin (the largest in the world), copper, manganese, deposits of rare metals of world importance, as well as increasing import supplies of relevant minerals.

The building material industry is significantly developed, which provides China the first place in the world in cement production (more than 60% of world production).

The light industry is represented primarily by the production of textiles (including clothing production). The textile industry of China is the largest in the world, and includes the production of cotton and silk fabrics. The shoe industry (about 65% of world production), the leather and food industries, the production of toys (more than 70% of the world), as well as porcelain and ceramics, all of which are largely export-oriented, are also developed.

Agriculture mainly meets the country’s food needs. At the same time, the agrarian economy remains the main source of the outflow of labour into the industrial and the service sector (the share of those employed in the primary sector of the economy decreased from 70% to less than 25% in the late 1970s–early 2020s). Chinese agriculture is characterised by small-scale farms and public ownership of land. The ban on land privatisation restricts the development of farming.

At the same time, with the sufficient investment into agriculture (in 1991–2020, the average annual growth rate of investments in agriculture was 8.0–8.5%) and government support (up to 8–9% of all budget expenditures) the structure of agriculture is being modernised, and the share of livestock in it is increasing (from 15% in the late 1970s to more than 30–40% in the 2000–2020s). In terms of grain production, China continues to be the world leader (570–650 million tons), partially with the budget subsidies to grain farmers (subsidies to them in the second half of the 2010s amounted to 120–140 billion yuan annually). China is also the world leader in the production of potatoes, apples, vegetables, cotton, and tobacco, as well as in fishing catch and meat production.

Transport has been developing particularly rapidly in the last two decades. The country is also a world leader in terms of the total passenger and cargo turnover of railway transport. China is constructing the world’s largest network of high-speed railways (with a train speed of 350–380 km/h), the length of which already exceeded 30% of the world share in the early 2010s and should increase in 2011–2025 from 8.5 to 38,000 km, connecting 340 cities and towns across the country. By 2015, China came out on top in the world in terms of the length of high-speed roads, which exceeded 100,000 km. However, China has the world’s highest congestion of rail transport (10% of the Chinese section of the global road network accounts for more than a quarter of global freight traffic) and this is still a serious problem.

In terms of cargo transportation, China’s maritime transport also occupies a leading position in the world (35–45% of the world volume in 2010–2020). Since 2015, seven Chinese ports, including Ningbo, Shanghai, Tianjin, Guangzhou, Qingdao, and Dalian, have already taken the first positions in the top ten world ports (in terms of cargo handling and passenger turnover). The country’s inland waterway network remains the largest in the world, although river transport is developing more slowly than other types of transport and requires serious modernisation in general.

Air transport demonstrates the highest growth rate in the transport services market of China, as a result of which PRC has become the second largest air carrier in the world after the United States. In the 2010s, three Chinese companies entered the top ten of the world’s largest airlines, and the two largest airports—Beijing and Shanghai—ranked second and third, respectively, in the world in terms of cargo transported.

The pipeline transport is a relatively lesser developed type of transport in China. In the 2010s, only 10–25% of petroleum products were supplied to consumers via pipelines (in developed countries, this rate is up to 80%). In the 2020s, China continues to create a unified network of trunk pipelines, providing the transfer of natural gas from the west to the east of the country (using both internal and external sources of gas). In 2007–2009, China built and commissioned the world’s longest main gas pipeline from Turkmenistan with a length of 6811 km, which provided more than 90% of all main gas supplies to China in the 2010s. In the 2020s, gas supplies to China from Russia have been gradually increasing.

Mobile communications are developing at the fastest pace in the service sector. The telecommunications system, which includes, among other things, a network of fibre-optic lines and satellite stations, provides stable telephone communication within the country and with subscribers abroad. The Chinese global satellite navigation system BeiDou using the 5G communication format, deserves special mention. This system competes successfully with the corresponding American and Russian GPS and GLONASS systems in terms of price parameters and communication quality. The number of Internet users in China in the early 2020s approached 700 million people (the largest in the world).

1.6 Financial Sector

This sector is becoming more and more significant in the Chinese economy, having both great achievements and certain problems.

1.6.1 Monetary System

It is characterised not only by the fact that China is a developing economy but also by the fact that elements of national specificity are strong in it. In particular, the commercialisation of banks (which are mainly in the hands of the state) is still constrained by a significant amount of “bad” loans since these state-owned banks have to lend to unprofitable or low-profit enterprises of the public sector. In addition, unlike most national central banks, the People’s Bank of China (PBC) is not independent of the government, retaining the status of direct administrative subordination to the State Council of the People’s Republic of China (according to the law of 1995), although the county and provincial branches of this bank have been gradually freed from the influence of local authorities in their decision-making.

The structure of China’s banking system is as follows. PBC is at the top of the pyramid, then come the five largest state-owned specialised banks (Bank of China, Industrial and Commercial Bank, People’s Construction Bank, Agricultural Banks of China, and Bank of Communications of China). The following level includes 12 large joint public–private banks (with assets of more than 1 trillion yuan each), then the next level is urban banks (more than 100) and, finally, the lowest level is urban and rural credit cooperatives (respectively, about 5 and 40,000 units in the 2010s).

The Big Five banks are diversified commercial structures operating in various fields. The total value of their assets in the 2010s exceeded $4 trillion, and they had more than 200,000 branches and about 1.5 million employees. In recent years, the number of city banks has been increasing, and credit cooperatives have been declining.

The active financial policy of the state is of the neo-Keynesian type, applied in China to stimulate economic growth, especially under conditions of still insufficiently solvent domestic demand, and deserves special attention. Its instruments are based on, firstly, a deliberately planned insignificant deficit of the state budget, secondly, the rapid growth of the money supply (M2), and thirdly, the issue of state loan bonds for investment purposes (so-called construction loans). In the 2000s and 2010s, these measures together provided an average of 1.5–2 percentage points of annual GDP growth. In general, in the 2010s and early 2020s, this deficit, as a rule, varied at the levels of 1.3–1.5% of GDP.

It should be emphasised that this form of monetary expansion of the state, despite a significant increase in the level of monetisation of the economy (up to 180–200%), does not provoke serious inflation, as it serves the fast-growing real sector of the economy. At the same time, this policy was, in fact, a compromise form of keeping afloat a relatively small part of low-profit enterprises in the public sector, delaying the final solution to the problem of “bad” loans from state banks.

Following its obligations to the WTO, China significantly liberalised its banking system in 2002–2020. The involvement of foreign investors provoked the partial privatisation of Bank of China and People’s Construction Bank (8% of their shares were sold in 2006), the problem of repurchasing debts on “bad” loans from banks began to be solved, and the system of state management of banks is gradually being reformed in the general direction of limiting subjective decisions of government officials on granting loans. Nevertheless, the share of one foreign strategic investor in a Chinese bank cannot exceed 20%, and the maximum share of foreign investors in the entire banking system of the country—25%. The inviolability of the principle of state control over the banking sector in China is still preserved, and it is increased under the conditions of global economic crises.

1.6.2 Fiscal System

Every year, the consolidated budget (state budget) is legislatively adopted in the PRC as a set of central and local budgets (at provincial and district levels). The central and local budgets are relatively autonomous, but they are interconnected by a system of targeted transfers from the central to local budgets and local budget allocations to the central. The share of local budgets in consolidated budget revenues is growing, as well in expenditures (in 2002–2019 from 45.0 to 53.1% and from 69.3 to 85.3%, respectively), which means shifting the “centre of gravity” of financing economic development from the central to the local level.

In China, the state budget expenditure, as a rule, exceeds revenues by 0.5–1.5 percentage points, e.g., the state budget in China constantly has a small deficit. This is due to the above-mentioned policy of emission-credit stimulation of the economy. One of the sources of such stimulation is a manageable, relatively small state budget deficit generated by the budget deficit of the central government and covered by government loans and a surplus of local budgets. In the 2000s and 2010s, the central budget deficit, as a rule, did not exceed 1.0–1.5%, while local budgets had a surplus (largely due to such a national phenomenon of public–private partnership in infrastructure development as central government loans to local governments for subsequent transfer to subcontractors).

As part of the transition to a new economic strategy, the PRC plans to keep the state budget deficit and state loans in reasonable amounts, without provoking inflation by excessive yuan emission and gradually reducing this deficit primarily by limiting lending to enterprises with high energy costs, pollution, and excess production capacity.

The dynamics of priority expenditure items largely reflect the development of the trend towards the social orientation of the state budget (see Table 2).

The main taxes in the PRC include value-added tax, customs duties, corporate income tax, personal income tax, and business activity tax. China’s tax system is under reform. It is being reformed in two main directions: easing the financial burden due to a general reduction in the number of taxes and attempts to unify taxation of enterprises of different forms of ownership.

For example, in 2006 the agricultural tax that had existed for more than 2600 years was abolished, as well as other local fees in the villages. This increased the competitiveness of the agricultural sector and contributed to the preservation of socio-political stability. In 2008–2010, income tax rates for enterprises of national and foreign capital, as well as income tax in the special economic zones and the rest of China were lowered and de facto unified (at the level of 25%), largely under the pressure of national business. Taxes on property, donation, inheritance, resources, use of arable land, etc., are subject to further reform.

1.7 External Sector

This sector has become one of the drivers of China’s rapid economic development.

1.7.1 China’s Foreign Economic Strategy

The openness of the economy is the strategic course of Chinese reformers in the field of international business. Its main components are as follows:

-

1.

The faster growth of international business in comparison with GDP growth. In 1978–2019, China’s foreign trade increased more than 120 times, significantly exceeding the corresponding—in themselves record-high—GDP growth rates. By 2010, China became the largest trade power in the world.

-

2.

Regulated diversification and improvement of merchandise trade structure. At the same time, China proceeded from such basic premises as the relative fall in world prices for low-value-added goods and the need to strengthen China’s activity as a recipient of advanced technologies. Therefore, the main efforts in the export policy were focused on ensuring a faster growth in the export of finished industrial products (in the 1980s and 2010s, their share in commodity exports doubled—from 47 to 93–95%). In the 2000s and 2010s, the emphasis was on improving the structure of exports of these products, reducing the share of labour-intensive goods and a corresponding increase in the share of capital- and knowledge-intensive goods (for example, the share of high-tech products in the structure of industrial exports in the 2000–2010s increased from 27 to 31–33%). The import policy encourages preferential imports of high-tech equipment, machinery, know-how, and components for export-oriented industries. Due to the cumulative effect of the purchase of these goods during the reform years, according to Chinese estimates, more than 2/3 of the increase in industrial production was provided in such priority sectors as radio electronics, energy, metallurgy, chemistry, and transport.

-

3.

Gradual systemic restructuring of the mechanism of managing and regulating international business. Its most important directions are consistent demonopolisation and decentralisation, the gradual transition of the government from direct administrative and directive management to primarily economic control of external economic relations. The right of independent entry into the foreign market is granted to associations of enterprises and individual enterprises, subject to their profitability and competitiveness, and—especially in the 2000s and 2010s—regardless of the form of their ownership. After joining the WTO (2001), China has taken a number of radical measures to liberalise foreign trade, such as an attempt to partially or completely abandon government subsidies for exports and reduce import customs duties.

-

4.

Introduction of a preferential system for the development of export-oriented industries. At the initial stage of the reform in China, the course was practically taken for state-administrative protection of the entire chain of export production—from the planning to the marketing of products. In particular, a system of economic preferences for producers of export goods was put into effect, which included a preferential regime for their taxation, lending, distribution of foreign exchange profits, and repeated devaluations of yuan. As a result of these and other measures, the export reorientation of the most profitable state-owned and municipal enterprises, the inflow of private national and foreign capital into the sphere of export production, and in the last 20 years, the record growth of official reserve assets were ensured.

-

5.

Attracting foreign capital, primarily in the form of FDI. The successes achieved here by the PRC are largely due to the creation of a favourable investment climate in a significant part of the country’s territory, primarily covered by free (special) economic zones. The main components of this climate are the relatively low cost of labour, the cheapness of land use rights, a fairly acceptable level of infrastructure development in the areas of preferential investment (achieved through massive public investments), a system of preferential taxation, preferential migration, and customs regime, sufficiently developed foreign investment, customs, currency, etc., and legislation. As one of the combined effects of these factors, China has managed to firmly establish itself among the world’s leading powers in attracting FDI in the 1990–2020s (see Sect. 1.7.4).

-

6.

Gradual formation of a multi-level territorial structure of an open economy. The economic space of the country is conditionally, and in a gradually changing proportion, divided into two sectors—the economy of internal and external orientation. The latter gradually expanded during the reforms, turning in the 1990–2020s from a small enclave consisting of four free economic zones into the so-called eastern and northern “belts of openness”, covering more than a third of the population and about a quarter of the country’s territory. Free economic zones were formed in these “belts” and their investors, subject to a 100% export orientation, were completely exempt from export–import duties and some taxes.

-

7.

The intensification of China’s economic presence abroad in the form of exports from China of economic factors such as capital (mainly in the form of foreign direct investment), labour, and knowledge. Since the 2000s, China has been implementing a long-term plan for “moving domestic enterprises abroad”, according to which the share of China in the global export of capital is constantly increasing (see Sect. 1.7.4). In addition, the number of projects where the Chinese side provides technological cooperation is increasing every year, while supplying both technology and labour (for example, from 2000 to 2010, the number of Chinese working abroad only under official contracts increased from 475,000 to more than one million people). The share and role of Chinese companies in the global economy are growing rapidly. According to Fortune Global 500 rating, China outperformed the United States as the world leader in terms of the number of its MNEs among the 500 largest companies in the world.

-

8.

The global initiative “One Belt, One Road” (also known as the “Silk Road Economic Belt”) put forward by China in 2013, which is intended in the future, according to the PRC, to “stimulate the free but orderly movement of factors of production, highly efficient resource allocation and deep merging of markets” of Europe, Asia, and Africa. This initiative and concrete measures for its implementation can be considered, on the one hand, as a logical development of China’s foreign openness policy, on the other—as a new stage of globalisation of its economy.

Giving a brief retrospective assessment of the main trends in the development of China’s foreign economic strategy, it is necessary to focus on the following; according to the so-called “grand strategy of China”, the country should turn from a “regional power with global influence” into a “global power” by 2020–2025. In this regard, in the twenty-first century, the tendency to consolidate the PRC’s rank as the main buyer in the world raw materials markets has been further developing, the disproportion between the country’s first position in world trade and its smaller role in international capital movement and knowledge exchange is gradually being overcome. Following the Belt and Road initiative, China is taking a more active part in the construction of transport and logistics corridors, the formation and expansion of “zones of openness”, special economic zones, etc., in both the neighbouring and more distant countries and regions of the world. Global economic expansion, referred to as the “peaceful economic offensive of China”, is thus significantly diversified and continues.

1.7.2 The Currency System

This system has gone through several stages of reform. At the first of them (1981–1993), several devaluations of the yuan took place and China used a double exchange rate system (the so-called two-track system). In 1994–2005, China pursued a policy of actually pegging the yuan to the US dollar based on the official exchange rate of 8.28 yuan per dollar, which was very favourable for Chinese exporters. In 2005, in response to the drop of the dollar against the euro, as well as due to the desire to reduce the overall dependence of the Chinese economy on the US emission policy, the PRC abandoned this peg and began to determine the yuan exchange rate against a basket of currencies (the euro, dollar, yen, etc.). As a result of these measures, a gradual, strictly controlled revaluation of the yuan against the dollar began, during which the yuan exchange rate rose to 6.2–6.3 yuan per dollar by 2013. In 2013–2019, however, in response to the increase in US customs duties on Chinese goods, the PRC began to resort to limited devaluation and subsequent stabilisation of its currency, and as a result of this, by July 2022, its exchange rate was 6.7 yuan per dollar.

The success of China’s monetary policy is manifested, in particular, in the constant surplus of its foreign trade balance, which is an important source of replenishment of the country’s official reserve assets. While China’s external debt in 2000–2010 decreased more than three times in relation to GDP and does not exceed 9–10% of GDP, the volume of its reserve assets in 1994–2013 increased from $52 billion to $3.88 trillion, or almost 75 times, and amounted to more than 40% in relation to GDP. In the second half of the 2010s, the growth rate of reserves slowed down, part of it was spent on the need of structural adjustment of the economy and maintaining the yuan exchange rate at the target level, and China switched to the tactics of relative stabilisation of its reserve assets at the level of $3.2–3.3 trillion(see Table 3). Nevertheless, in terms of the absolute volume of this indicator, China has been firmly ranked first in the world since 2006, many times ahead of other countries.

In the 2010s, the PRC actively pursued a policy of internationalisation of the yuan, as a result of which, in particular, starting in 2016, the IMF recognised the yuan as one of the world’s reserve currencies. By 2020, settlements in yuan already accounted for a significant part of world trade, but the yuan’s share in the foreign exchange reserves of the world’s countries so far was only 1.95% (against 61.8% for the US dollar, 20.2% for the euro, 5.25% for the yen, and 4.5% for the pound sterling).

1.7.3 Foreign Trade

By 2030, China may increase its share in world merchandise exports to 25% by strengthening the position as the first foreign trade power (see Table 4).

Trading partners of China in 2019 were the United States (they accounted for 16.8% of Chinese exports), Hong Kong (11.2%), Japan (5.7%), South Korea (4.4%), Vietnam (3.9%), Germany (3.2%), and Russia (2%). China has a very tangible trade surplus with most partner countries, for example, $295 billion with the United States in 2019, $270 billion with Hong Kong.

1.7.4 China in the International Movements of Capital

Until 1993, China participated little in the international movements of capital, the annual flows of which both to and from the country did not exceed $10 billion. Then the annual capital flows in both directions increased significantly, but did not exceed $100 billion. However, after 2004, China has become one of the leaders of the global capital movements with annual flows of export and import of capital in the amounts of $200–600 billion. As a rule, capital import was primarily used for direct and portfolio investments, and export was primarily for other investments (these are mainly loans and commodity loans). China has occupied second place in the world both in terms of the import and export of direct investment. The Chinese government is implementing a phased, regulated liberalisation of the imports of this capital. The areas of application of foreign direct investment (FDI) are divided into encouraged, permitted, restricted, and prohibited. In the 1990s, inward FDI was mainly directed to labour-intensive export production, while the products of enterprises with the participation of foreign capital were not allowed to enter the domestic market. After the PRC’s accession to the WTO, preferences and benefits were also provided to inward FDI in real estate, infrastructure, basic industries, mechanical engineering, electronic and chemical industries, and energy, along with conditions to develop energy-saving and environmentally friendly enterprises, as well as to increase the share of domestic components in the cost of products.

The continued growth of FDI flows to China is associated with a reduction in the “negative list” of closed and restricted industries from 166 to 63 in 2017 and 31 in 2021, primarily information services and technologies, software, research, and design services. The military-industrial complex and the mass media remained closed to FDI. China removes restrictions on the inflow of FDI into new areas only after it creates a competitive pool of national enterprises in these industries, provided with national personnel of appropriate qualifications.

FDI stock in China exceeded $3.4 trillion by the beginning of 2022. Its structure is dominated by the manufacturing industry (but its share fell from 61% in 2005 to 20% in 2021), real estate, business services, and R&D. It is estimated that the bulk of the capital came through offshore companies from developed countries. Although many investors have not fulfilled the requirements of the PRC to provide modern equipment and technologies, the Chinese experience of attracting FDI is generally considered successful.

It is not the effect of individual projects involving inward FDI that is being evaluated, but their complex positive affect for modernising the economy. In particular, the import of FDI provided an influx of currency from the export of traditional industries, and China managed to redirect it to the development of avant-garde industries, the products of which the PRC captured the traditional markets of developed countries. In addition, a tenfold increase in wages in China has weakened its comparative advantages in terms of costs from other developing countries, so foreign MNEs are conducting FDI in China not so much for the sake of exports, as for the development of the rapidly growing Chinese market and for using the developed human capital.

The volume of Chinese FDI accumulated abroad reached $2.5 trillion by the beginning of 2022. China’s largest projects are carried out through offshore investment in Latin America, while large and medium-sized investments are implemented in Hong Kong. Their geographical structure was highly diversified until 2013 but then concentrated on North America and Europe—up to 70–75% at the end of the last decade.

Before 2012, 70–80% of China’s largest investments abroad were in the extraction of raw materials for energy and metallurgy, which met the needs of China as a “global factory”, then the share of the raw materials sector in FDI accumulated abroad decreased to 24% by 2016, and to 6.8% (the share of the raw materials sector in outward FDI flows decreased to 4%) by 2020. The top places were occupied by the investments in leasing and business services (32.2%), trade (13.4%), information and telecommunication services (11.5%), manufacturing (10.8%), and financial services (10.5%).

At the same time, the growth of FDI accumulated abroad is largely due to tens of thousands of small and medium-sized Chinese MNEs. They already account for up to half of the accumulated FDI. Such mechanisms of state support for private MNEs include access to loans from the state financial system, especially abroad; the insurance of business risks in host countries; information, consulting, and staffing; the development of global yuan financial, settlement, and payment infrastructure. Although they make these MNEs dependent on the state, at the same time their interests are also bowed by the Chinese state.

Since 2015, there has been a rapid growth of Chinese portfolio investments abroad, but this does not mean the movement of speculative capital, since many of the largest investment transactions of Chinese companies represent the acquisition of stakes of less than 10%, i.e., formally they fall into the category of portfolio investments, but represent mutual cross-investment of Chinese and Western MNEs and banks. The volume of foreign loans and commodity loans provided by Chinese MNEs reaches a huge amount—$1.6 trillion. Their sale of goods with deferred payment makes products that are not of top quality and innovation, are not the cheapest, but are competitive, and displace enterprises and countries that do not have access to credit resources from the world market.

In order to actively influence other participants in the world economy, since 1992, the PRC government has been encouraging large-scale outward investment by local firms, known as the Go Out strategy (Zou Chuqu). The Chinese government believes that a developed country should have all industries, but not all operations should be carried out within its national borders. In addition, Chinese MNEs resolve the contradiction between ensuring industrial sovereignty and moving low-value-added operations abroad.

Looking at the challenges, the large-scale influx of foreign direct investment into China has exacerbated the issues of national industrial safety. In addition, developed countries have begun to resist the entry of competing high-tech Chinese goods and capital into their markets, thereby triggering a wave of protectionism in the global economy, and, despite the potential benefits, refuse to include even innovative Chinese goods and enterprises in their production chains.

China has also faced the problem of excessive international reserves due to the opposition of Western countries to the conversion of China’s export earnings into their real assets. Therefore, the Chinese MNEs have had to get out of Western global chains and create their own, relying on competitive advantage—the world’s largest domestic market. To protect it, China’s MNEs are replacing the budget subsidies prohibited by WTO rules with offshore operations. Most of China’s MNEs have one foreign branch each, using Hong Kong’s “offshore” to finance projects in China. The construction of Chinese global chains in developing countries means that China is creating markets capable of absorbing the products of its modern industries, and making the host countries dependent on Chinese standards, technologies, and equipment. At the first stage, Chinese MNEs are implementing large energy and infrastructure projects in these countries, building enterprises of basic industries. Then, taking advantage of preferential access to the infrastructure controlled by the PRC, a small private business enters the sphere of trade and production of consumer goods. This is the essence of the Chinese Belt & Road Initiative, which emerged as China’s response to the challenges of globalisation. Unlike the Western model, the Chinese model of building global chains represents more profitable cooperation for developing countries, since the growing income of the population of the Southern countries is a source of new market growth, which contributes to the modernisation of the PRC economy.

1.8 Social Sector

As a result of the rapid growth of the Chinese economy in the 1980s and 2010s, there was an unprecedented increase in per capita GDP production and, as a result, an overall increase in the standard of living. In 2021, the per capita GDP in China, calculated by PPP, amounted to $19,338. Over the years of reforms, the food problem and the problem of providing necessities for the majority of the population have been solved, and a level of so-called “small prosperity” has been reached. The number of poor has noticeably decreased, and great efforts are being made to solve the problems of employment and unemployment (in cities and towns, the rate of unemployment was 4.1% in 2019). According to Chinese estimates, the average level of nominal salaries of working citizens increased tenfold in 2000–2020.

At the same time, China continues to maintain a large property stratification and social polarisation of the population. The Gini index for expenditures over the years of reforms has increased, according to official data, from 0.20 to 0.45, and according to unofficial estimates—up to 0.60. This has happened since the average incomes of urban residents are at least 4–5 times higher than those of rural residents, and also because the difference in the incomes of entrepreneurs and employees is excessively large compared to developed countries. However, in the next 10–15 years, as the country transitions to a new development model, one can hope for softening in the property social stratification due to the expansion and strengthening of the Chinese middle class.

The reform of the social security system in the People’s Republic of China is moving towards the gradual transfer of relevant social functions to the state from enterprises in the city and production teams in the country, who used to carry the main burden of social spending. In the 2000s and 2010s, the total share of social expenditures of the state in the expenditure part of the state budget increased markedly (see Table 2). Despite significant social progress in comparison with developed, and with some newly industrialised countries, China still continues to significantly save on the social sphere. According to informal international estimates, in the 2010s, total government spending on social needs in the United States amounted to more than 17% of GDP, 14% in France, 11% in Sweden, while in China it is only 7–8% so far.

Today there are two different pension systems in the country—the one for workers and employees in cities and the one for peasants in the countryside. At least 60% of urban dwellers had signed up for the state pension insurance programme by 2012, the experiment of introducing the pension reform in the country only started in 2009. Nevertheless, the Chinese government is going to provide the majority of rural residents with at least a minimum pension by 2020–2025. The average pension in China increased from 640 yuan in 2005 to 2353 yuan in 2016. In 2020, it exceeded 2.5 thousand yuan. However, not all people over the age of 60, but only 60–65% of them, have received pensions yet.

State financing of healthcare is also gradually increasing. By 2020, the share of the population and the state in the total cost of healthcare has increased to 55% (for comparison: this rate is 31% in India, 46% in Brazil, 60% in Russia, 76% in Germany, and 80% in Japan). As a result, total healthcare expenditures reached 5.5% of GDP (for comparison: 3.5% in India, 5.3% in Russia, 9.5% in Brazil, 10.9% in Japan, and 11.3% in Germany).

It should be noted that the effectiveness of the Chinese healthcare system depends not only on the level of its direct financing by the state but also on the degree of centralisation of the economy and policy, the authoritarian form of public administration, the Confucian mass mentality focused on the mandatory implementation of state guidelines, and high discipline. It was these circumstances and factors in particular, that helped China to cope with the coronavirus pandemic in 2019–2020 relatively quickly and less painfully than many more developed countries.

The transition to a new economic model involves, among other things, the fight against the lag of the social sphere in China. At the same time, it should be borne in mind that one of the attributes of such a lag, namely the relative cheapness of labour, from the point of view of the export-oriented model of industrialisation in China is still one of the significant competitive advantages of the country. The restructuring of the Chinese economy, linked with the maximum possible preservation of its competitive advantages on the one hand and with the minimisation of socio-political risks on the other, is the fundamental task on which the Chinese government’s balanced solution will depend for the further successful and safe development of China.

2 Conclusions

-

1.

During the existence of the People’s Republic of China (since 1949), the Chinese economic model has undergone a gradual evolution as the country has moved from a backward semi-feudal market to an administrative command and then to a modern developing market economy.

-

2.

The national idea as the goal of China’s catching up, and according to some parameters, advancing development is “to revive the former greatness of the country”, the main means of achieving this goal is rapid economic growth due to active industrialisation, which reached its maximum average annual rates (about 10%).

-

3.

Such high and prolonged growth rates were largely due to the coincidence of the phase of active industrialisation in the PRC with the country’s evolutionary transition to a market economy, which made it possible to fully identify and generally successfully put national competitive advantages into practice in the context of globalisation. These include, foremost, huge labour resources; the highest gross accumulation rate in the world (the peak value was 48% in 2009); a gradual increase in the technological level due to both imports of modern equipment and technologies, and—especially in recent years—due to increasing own expenditures on technological innovations, an effective national idea; the strong economic role of the state; the systemic institutional effect of market transformations of the economy; investments in human capital increase in the last two decades; and priority export orientation of the real sector.

-

4.

Large-scale and rapid industrialisation, turning the People’s Republic of China into a kind of “world factory”, significantly aggravated and transformed traditional problems and brought to life several new problems, including demographic, resource, and raw materials, the problems of social differentiation, territorial unevenness of economic and social development, relative narrowness of the domestic market, the lagging of the social sphere compared to the economic, problems of efficiency of economic growth and product quality, institutional, environmental, and some others.

-

5.

Global economic crises have accelerated China’s transition to a modern version of its economic model as a strategy for the “harmonious development” of the market economy. It has focused on overcoming the above problems and, above all, on refusing to maximise economic growth rates “at any cost”, downgrading this growth in favour of the tasks of social development, on the balance of internal and external markets, on the formation of a large middle class as a guarantor of socio-political stability, overcoming the remnants of discrimination against private owners and forming a modern model of partnership between government and business.

-

6.

During the period of modern reforms and especially during the formation of a new model of economic and social development, China has managed to significantly improve the quality of its human capital and begin the transition to innovative development under the conditions of a new, high-tech stage of ongoing industrialisation in the country based on the digital economy. The most important achievements of the PRC in this area include the formation of a competitive business sector, which is the main generator of innovations; a productive model and forms of public–private partnership in innovation; the integration of the country into the global innovation sphere as the most important condition for developing national high-tech industries; the priority of state policy in the development of education, science, and technology; and the creation of favourable institutional conditions for innovative growth.

-

7.

The gradual completion of the active industrialisation phase in China is manifested, in particular, in increasing the degree of sustainability of economic growth while reducing its rate to 5–6% per year; changing the main macroeconomic proportions, in particular between accumulation and consumption by the primary, secondary, and tertiary sectors of the economy; and the country’s transition from priority industrial development to reliance on the service sector as the main promising driver of development as the centre of gravity in economic policy shifts from physical to human capital.

-

8.

The basis of the real sector of China’s economy is the manufacturing industry and, above all, mechanical engineering, which is growing at a rapid pace (15–20% per year in 2000–2010), and is focused both on exports and, especially after 2008, domestic consumption. The domestic mining industry does not fully meet the needs of the national economy due to the relative shortage of local natural raw materials. This means that China will gradually become the world’s largest importer of hydrocarbons and other mineral raw materials by 2020–2030.

-

9.

In China, in contrast to the very common world practice, there is practically no such negative phenomenon as the separation of the financial sector from the real one, which is largely due to the inviolability of state control over the financial system. China’s fiscal system is notable for the gradual development of the trend towards the budget’s social orientation, as well as for the almost constant, relatively small (1.5–2%) deficit of the central budget associated with a nationally specific kind of neo-Keynesian policy of emission-credit “pumping” the economy to stimulate its growth rates.

-

10.

The success of China’s monetary policy is manifested, in particular, in the constant surplus of its foreign trade balance, which is an important source of replenishment for the country’s official reserve assets, in terms of which, it has consistently ranked first in the world since 2006. The policy of internationalisation of the yuan has made it one of the world’s reserve currencies, and it is gradually increasing its share in international trade settlements and reserve assets of different countries.

-

11.