Abstract

One of the reasons behind environmental degradation and climate change is greenhouse gases that are mainly consisted of carbon dioxide (CO2) emissions. Besides, CO2 emissions negatively affect human health. Consequently, national institutions should understand which factors are affecting carbon emissions in order to achieve sustainable (environmental, social and economic) development. The main objective of this paper is to examine the symmetric and asymmetric effects of oil price, foreign direct investments and economic growth on carbon emissions in Italy. To this purpose, the long and short-run impact of these variables on carbon emissions have been investigated by applying the autoregressive distributed lag (ARDL) and non-linear ARDL methodologies to Italian data for the period 1970–2019. The symmetric results show that economic growth and foreign direct investments intensify carbon emissions both in the long and short-run, while the impact of oil price on emissions is negative in the long-run and positive in the short-run, suggesting that oil price is responsible for environmental degradation only in the short run. The asymmetric results reveal that both in the long and short-run an increase in the oil price imply reductions in carbon emission.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Environmental degradation and climate change have become eminent risk factors around the world. Global warming shows no signs of slowing. One of the reasons behind those risk factors is greenhouse gases (GHGs) that are mainly consisted of carbon dioxide (CO2) emissions. Besides, CO2 emissions also have harmful effects on human health, by contributing to respiratory and cardiovascular disease from smog and air pollution.

It has been demonstrated that if we continue as usual, we will emit 65 billion tonnes of GHGs in 2030. According to the Circularity Gap Report published by Circle Economy (2021), however, a circular economy could be the key to reduce greenhouse gases emissions and meet climate targets. In Europe, switching to a circular economy could reduce greenhouse gas emissions by 39%. If those principles were applied, 22.8 billion tonnes of carbon emissions could be saved and help avoid climate breakdown, according to the above study. Consequently, nowadays it is very important for national institutions to investigate which factors are affecting carbon emissions in order to minimize environmental disamenities and achieve sustainable (environmental, social and economic) development, as suggested also by sustainable development goals of Agenda ONU 2030. For example, the 2020 EU Circular Economy Strategy Action Plan developed a policy framework to attain a cleaner and competitive economy (Gastaldi et al. 2020; Lombardi et al. 2021).

In this context, the aim of this article is to examine the symmetric and asymmetric effects of oil price, foreign direct investments and economic growth on carbon emissions in Italy. To this purpose, the impact of these variables on CO2 emissions will be assessed both in the long-run and in the short-run by using the autoregressive distributed lag (ARDL) and non-linear autoregressive distributed lag (NARDL) models. In particular, the analysis focuses on Italian data for the period 1970–2019, by also investigating the existing nexus between economic growth and environmental degradation in the form of Environmental Kuznets Curve (EKC).

The article is organized as follows. Section 2 reviews the literature, Sect. 3 presents the data used and reviews the methodology used, Sect. 4 describes the results obtained and Sect. 5 gives the conclusions.

2 Literature Review

2.1 Economic Growth and Carbon Emission

Many researchers have examined the relationship between economic growth and carbon emissions to test the EKC hypothesis. However, the results of these studies are inconclusive: some studies support the existence of EKC hypothesis (Grossman and Krueger 1995; Schmalensee et al. 1998; Selden and Song 1994; Lee and Oh 2015; Baek 2016; Alpher and Onur 2016; Zambrano-Monserrate et al. 2018: Usman et al. 2019), whereas other studies do not support the EKC hypothesis (Bartlett 1994; Coondoo and Dinda 2002; Galeotti et al. 2006).

By employing ARDL and VECM, Ahmad et al. (2017) investigated the long-run and causal relationship between economic growth and carbon emission in Croatia for the period 1992–2011. The results demonstrated a long-run relationship and confirmed the existence of EKC. Bölük and Mert (2015) examined the short and long-run association between carbon emissions, GDP and electricity produced from renewable resources from 1961 to 2010. The findings of this study support the existence of EKC hypothesis by using ARDL cointegration approach. Farhani and Shahbaz (2014) explored the causal relationship between electricity consumption, output and carbon emissions in 10 MENA countries for the period 1980–2009, confirming the existence of EKC hypothesis in all these countries. Using time series data from 1995 to 2014, Fan and Lei (2017) investigated the relationship between environmental deterioration, transportation, and economic development in Beijing. According to the estimated results, transportation and CO2 emissions show a positive impact on economic growth. Using the ARDL model, Sulaiman and Abdul-Rahim (2017) evaluated the relationship between CO2 emissions, energy consumption, and economic growth in Malaysia from 1975 to 2015. The findings revealed that energy consumption and CO2 emissions had no effect on economic growth, but that energy consumption and economic growth had a positive impact on CO2 emissions. Finally, Saboori et al. (2017) used the Johansen cointegration test to investigate the link between the research variables and oil consumption, economic growth, and environmental deterioration in three Asian nations from 1980 to 2013. The results revealed a one-way correlation between oil consumption and economic growth in China and Japan, and oil consumption and CO2 emissions in South Korea.

Hence, in order to check the long run economic growth in Italy, we aim to investigate the hypothesis that economic growth has a positive association with carbon emissions.

2.2 Foreign Direct Investment and Carbon Emission

Foreign direct investment (FDI) benefits countries in a variety of ways, including enhancing production capacity and employment (Oxelheim and Ghauri 2008), increasing innovation (Ito et al. 2012) and upgrading managerial abilities (Lin et al. 2009). However, as a result of global warming, the environmental impact of FDI is also picking up steam. Evidence of a connection between carbon emissions and FDI is complicated, as some researchers have demonstrated that this association is positive (Haug and Ucal 2019), while some others have proved that the relationship is negative (Jiang et al. 2018; Tang and Tan 2015).

With regard to the direct impact of FDI on environment, the relationship between FDI and pollutant emissions involves two challenging scenarios: the pollution haven and halo hypotheses (Antweiler et al. 2001; Zhang and Zhou 2016; Sarkodie and Strezov 2019). According to the pollution haven theory, due to improved environmental restrictions in developed economies, some businesses with high pollution and high energy consumption are relocated to developing and transition nations via FDI, thus resulting in significant contamination discharge. On the other hand, the pollution halo hypothesis claims that the emergence of foreign enterprises will result in positive environmental overflows in the host country because multinational corporations have more cutting-edge technologies than their domestic counterparts and are more likely to spread clean and environmentally friendly technologies (Birdsall and Wheeler 1993). Zhang and Zhou (2016) used a linear panel data model to confirm the presence of the pollution halo hypothesis, arguing that inflows of FDI with advanced technology result in a decrease in pollutant emissions rather than environmental degradation. Koçak and Şarkgüneşi (2018) evaluated the influence of FDI on CO2 emissions in Turkey, using a variety of cointegration approaches to analyse data from 1974 to 2013. The findings suggest that FDI has a positive impact on CO2 emissions.

Conversely, some studies suggest that FDI inflows have a negative impact on CO2 emissions (Al-Mulali and Tang 2013; Sung et al. 2018; Jiang et al. 2018), thus backing up the pollution halo hypothesis. Other researchers, on the other hand, claim that FDI flows are not harmful to the environment (Lee 2013; Chandran and Tang 2013; Hakimi and Hamdi 2016). In addition, several studies do not support either the good or negative effects of FDI and have found inconsequential outcomes, such as the study by Kivyiro and Arminen (2014) on various Sub-Saharan African nations. Surprisingly, research on BRICS countries also show contradictory results (Dong et al. 2017; Azevedo et al. 2018; Danish and Wang 2019). These studies, however, do not consider the crucial elements of financial development and growth, which can yield more accurate results when combined with FDI.

Hence, based on the above literature, in this study we aim to demonstrate the hypothesis that in Italy FDI has a positive association with carbon emissions.

2.3 Oil Price and Carbon Emission

The impact of oil prices on energy use and carbon dioxide emissions has been studied in a few empirical works. Suliman and Abid (2020) claimed that there is a causal relationship between oil price and energy consumption in Tunisia. Agbanike et al. (2019) investigated the causal relationship between oil price and carbon emissions by using the ARDL model. According to their results, there is a positive relationship between oil prices and carbon emissions in Venezuela. Apergis and Payne (2015) applied a panel data model to show that there was a positive and statistically significant relationship between oil price and carbon emissions per capita in 11 South American countries in the period 1980–2010. Simsek and Yigit (2017) applied the vector autoregression model to examine the relationship between carbon emissions and oil prices in Brazil, Russia, India, China, and Turkey. The results revealed that oil prices have a significant impact on carbon emissions in all the countries examined. The ARDL model was also used by Malik et al. (2020) to explore the impact of oil price on the carbon emissions level in Pakistan. The results of this study revealed that oil price increases carbon emissions in the short term while reduces them in the long term. Finally, Katircioglu (2017) examined the impact of oil prices on carbon emissions in Turkey by using the ARDL methodology, showing that there is an inverse relationship between oil prices and carbon emissions levels, while Zou (2018) concluded that there are no significant interactions between oil price and carbon emissions in China.

Based on the above studies, we expect a negative impact of oil price on environmental quality in Italy. Hence, in this study our hypothesis is that in Italy oil price has a negative association with carbon emissions.

3 Methodology and Data

3.1 Model Specification

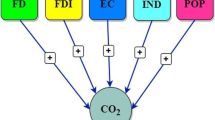

The empirical model we used in this study is specified as follows:

where \({LnCO2}_{t}\) is the logarithm of per capita carbon emissions in Italy at time t, \({LnGDP}_{t}\) is the logarithm of per capita GDP, \({LnGDP}_{t}^{2}\) is the logarithm of the square term of per capita GDP, \({LnFDI}_{t}\) is the logarithm of per capita foreign direct investment, \({LnOP}_{t}\) is the logarithm of oil prices, Control means control variables included in the model, and \({\varepsilon }_{t}\) is the error term.

According to the EKC hypothesis, the relationship between the square term of per capita GDP and environmental quality is represented by an inverted U-shape curve. Hence, if the sign of \({\beta }_{1}\) is positive and the sign of \({\beta }_{2}\) is negative, the EKC hypothesis is proved to be true for Italy.

Autoregressive distributed lag model. In order to examine the long-run cointegration relationship among variables, literature provides several techniques (Engle and Granger 1987; Johansen and Juselius 1990; Saikkon 1991; Stock and Watson 1993; Johansen 1996). In this study we use a new cointegration approach developed by Pesaran and Smith (1995) and Pesaran et al. (2001), the autoregressive distributed lag (ARDL) model, also known as the bounds testing approach. This methodology has several econometric advantages in comparison with other multivariate cointegration techniques: first of all, it overcomes the problem of the same order of integration of regressors, as it could be applied with regressors integrated of order I(0) or I(1) or combination of both; second, it avoids the problem of endogeneity and serial correlation among variables; finally, it estimates long and short-run parameters of the model simultaneously and it provides better results even with small sample.

Hence, in this work we apply the ARDL methodology to investigate the existence of a long-run relationship between per capita income, FDI, oil price, and carbon emissions. The Unrestricted Error Correction Model (UECM) corresponding to the ARDL bounds test is specified as follows:

where \(\Delta\) is the difference operator; p defines the lagged value of both the dependent variable and each independent variable; \({\beta }_{1}\), …, \({\beta }_{5}\) denotes the short-run coefficients; \({\lambda }_{1}\), …, \({\lambda }_{5}\) denotes the long-run coefficients; \({\varepsilon }_{t}\) is the error term.

In order to examine the existence of a long-run relationship between a dependent variable and a set of regressors, Pesaran et al. (2001) proposed a test based on the F-statistic for the joint significance of the estimated coefficients of the lagged level of variables. The null hypothesis \({H}_{\mathrm{o}}: {\lambda }_{1}={\lambda }_{2}={\lambda }_{3}={\lambda }_{4}={\lambda }_{5}=0\) implies that there is no cointegration between variables. If the F-statistic value is lower than the lower bound critical value I(0), the null hypothesis of no long-run relationship cannot be rejected; if the F-statistic value is higher than the upper bound critical value I(1), the null hypothesis is rejected: this implies that cointegration exists between variables. However, if the F-statistic value falls between the lower I(0) and upper I(1) bound critical value, the results are inconclusive. For this reason, an alternative way to test for the existence of long-run cointegration is to consider the lagged value of the error correction term \({ECT}_{t-1}\). If the value of \({ECT}_{t-1}\) is significant and holds the negative sign, it confirms the existence of a long-run relationship between variables. Moreover, we use the critical bounds suggested by Narayan (2005), which are more appropriate for small sample size (\(30\le n\le 80)\).

If the long-run relationship exists, we examine the short-run relationship between the variables considered by means of the following error correction model associated with the long-run estimates:

where \(\theta\) i is the coefficient of the error correction term; it represents the speed of the adjustment required for long-run equilibrium after a shock in the short-run.

Non-linear autoregressive distributed lag model. In order to investigate the asymmetric relationship among the variables considered both in the short and long-run, in this work we apply the non-linear ARDL methodology developed by Shin et al. (2014). Similar to ARDL model, NARDL model also overcomes the variables requirement to be integrated at the same order.

Hence, we extended the model given in Eq. (1) as follows:

where \({{\varvec{L}}{\varvec{n}}{\varvec{F}}{\varvec{D}}{\varvec{I}}}_{{\varvec{t}}}^{+}\) and \({{\varvec{L}}{\varvec{n}}{\varvec{F}}{\varvec{D}}{\varvec{I}}}_{{\varvec{t}}}^{-}\), \({{\varvec{L}}{\varvec{n}}{\varvec{O}}{\varvec{P}}}_{{\varvec{t}}}^{+}\) and \({{\varvec{L}}{\varvec{n}}{\varvec{O}}{\varvec{P}}}_{{\varvec{t}}}^{-}\) represent the partial sum of positive and negative changes in FDI and OP at time t, respectively.

The NARDL model is specified for this study as follows:

where \(\sum_{i}^{p}{(\delta }_{i}^{+}{\Delta lnFDI}_{t-1}^{+}+{\delta }_{i}^{-}{\Delta lnFDI}_{t-1}^{-})\) and \(\sum_{i}^{p}{(\delta }_{i}^{+}{\Delta lnOP}_{t-1}^{+}+{\delta }_{i}^{-}{\Delta lnOP}_{t-1}^{-})\) captures the short-run positive and negative asymmetric effects of FDI and OP on carbon emissions, while \({\lambda }_{4}^{+}{\Delta lnFDI}_{t-1}^{+}, {\lambda }_{5}^{-}{\Delta lnFDI}_{t-1}^{-},{\lambda }_{6}^{+}{\Delta lnOP}_{t-1}^{+},{\lambda }_{7}^{+}{\Delta lnOP}_{t-1}^{+}\) captures the long-run positive and negative asymmetric effects.

The error correction model for Eq. (5) is specified as follows:

where \(\theta\)i is the coefficient of the error correction term; it represents the long-run equilibrium speed of adjustment after the shock in the short-run.

In order to test the existence of a long-run cointegration between variables, also in this case we perform the F-test for the joint significance of the coefficients of the lagged level of variables. Furthermore, we conduct the Wald test to check long-run (H0: \({\lambda }^{+}={\lambda }^{-})\) and short-run (H0: \({\delta }^{+}={\delta }^{-})\) asymmetries of FDI and OP on CO2 emissions.

3.2 Data

This study uses annual data for the period 1970–2019. The dependent variable is carbon emissions (CO2, metric tons per capita), while the independent variables are gross domestic product per capita (GDP), inflow of foreign direct investment per capita (FDI) and cured oil price per barrel (OP). Besides, the following control variables are included in the model: human capital index, based on years of schooling and returns to education (HC), inflation per capita (INF), exports of goods and services per capita (EXP), financial development (domestic credit to the private sector, FD) and urban population as percentage of total population per capita (UP). All the variables are transformed in logarithm form. Our principal source of information regarding these data was World Bank, while data regarding HC, FDI and OP were extracted from Peen World Table, UNCTAD and Statista database, respectively.

Table 1 provides the descriptive statistics of the variables for the examined years.

Unit root tests. Before running the ARDL cointegration procedure, we tested our variables for stationarity by implementing different unit root tests (Agovino et al. 2019). In particular, we applied the augmented Dickey-Fuller (ADF) test and the Phillips-Perron (PP) test to check for the stationarity of the data. Both tests indicate that the variables under analysis are stationary at first difference (Table 2). Furthermore, we performed the Zivot-Andrews unit root test with structural breaks to accommodate any structural break in the data (Table 3). The results confirm that variables are not stationary in level, but they become stationary at the first difference.

4 Results and Discussion

4.1 ARDL Model

This paragraph presents the results of the ARDL model estimation. Before proceeding with the ARDL bound test, we first tested for the stationarity status of the variables under analysis, in order to ensure that none of the variables is integrated of order two (this procedure is not valid in the presence of I(2) series). As reported in paragraph 3.2, unit root tests applied show that all variables are integrated of order one. Then, we focused on lag order selection. The lag-length criteria used (LR, FPF, AIC, SC, HQ) indicate lag-length equal to 4 for conducting the cointegration.

In order to investigate the long-run relationship between the variables considered, we performed the F-statistic joint significance test against the bound critical values provided by Pesaran et al. (2001). The computed F-statistic value confirms the existence of la long-run association between the variables considered, as shown in Table 4. F-statistic value is also higher than the upper bound values suggested by Narayan (2005), and found to be statistically significant at 1% level, thus confirming the existence of long-run cointegration among per capita income, FDI, oil price, and carbon emission. This is confirmed also by the coefficient of error correction term \({ECT}_{t-1}\), which is negative and statistically significant.

Tables 5 and 6 list the long-run and short-run results of ARDL bounds testing approach. The results show that both in long and short-run the relationship between per capita income and carbon emission is positive and statistically significant. In Italy economic growth, both in the short and in the long-run, has the largest influence on carbon dioxide emissions, thus increasing environmental degradation. These results are expected and in line with previous literature (Behera and Dash 2017; Zhang and Zhang 2018; Naz et al. 2019; Malik et al. 2020). Furthermore, we can observe that the relationship between the square term of per capita GDP and environmental quality (measured by CO2 emissions) is negative and statistically significant. Hence, we confirm for Italy the EKC hypothesis, given that the coefficients of GDP and GDP2 are statistically significant with positive and negative signs, respectively. These findings are also in line with the literature (Nasir and Ur Rehman 2011; Shujaj ur et al. 2019).

With regard to FDI, both the long and short-run results indicate that in Italy FDI has a positive and significant impact on carbon emission. These results are consistent with the findings of Danish et al. (2018) and Zhang and Zhang (2018). Besides, the ARDL results show that in the long-run oil price negatively affects carbon emission, as its estimated coefficient is statistically significant and equal to −0.044. This implies that in the long-run any increase in oil price could imply reductions in carbon emissions. On the contrary, oil price tends to increase environmental degradation in the short-run. In the case of exports our results show significant and positive relationship with carbon emission both in the short and long-run, suggesting that higher exports enhance the demand and use of energy consumption and other resources and, as a result, carbon emission increases (Tables 5 and 6, Model 4). Finally, we do not find any statistically significant findings for the relationships between human capital and carbon emission and urbanization and carbon emission in the long-run (Table 5, Models 2 and 6), while both of them are positive and statistically significant in the short-run, with the estimated coefficients equal to 16.872 and 26.146, respectively (Table 6, Models 2 and 6). Finally, by focusing on the short-run results (Table 6), we can observe that the coefficient value of the error correction term (negative and statistically significant) indicates that any deviation from long-run equilibrium is adjusted at the speed of 10% yearly.

We performed several diagnostic tests, such as Jarque-Bera test for normality, Breusch-Pagan-Godfrey heteroscedasticity test, LM-ARCH heteroscedasticity test, Breusch-Godfrey serial correlation test. We also tested for the dynamic stability of the model by applying the cumulative sum of recursive residuals (CUSUM) and cumulative sum of recursive residuals square (CUSUM-Sq) stability test. The results of these tests show that there is no problem of normality, heteroscedasticity and serial correlation (Table 5).

4.2 NARDL Model

This section presents the results of the NARDL model estimation. Table 7 presents the results of F-statistic in the case of NARDL methodology. The results show that the F-statistic value is higher than the upper bound critical values suggested by Narayan (2005). Hence, we can reject the null hypothesis of no cointegration against the alternative hypothesis of cointegration. Furthermore, the value of the coefficient of the lagged error correction term confirms the existence of long-run cointegration among per capita income, FDI positive, FDI negative, OP positive, OP negative, and carbon emissions.

After confirming the long-run cointegration relationship between the variables considered, we determined the long and short-run asymmetric results. Tables 8 and 9 present the results for long and short-run models, respectively. The results show that the relationship between economic growth and carbon emission is positive and statistically significant both in the short and in the long-run, in line with the results of ARDL model. Moreover, the negative and statistically significant value of the square term of per capita income (GDP2) confirms the presence of EKC hypothesis also in this case.

In the case of the long-run asymmetric relationship between FDI and carbon emission we can note that increases in FDI (positive changes in the partial sum of FDI) enhance carbon emissions. The short-run results are also statistically significant and explain that any positive shock in FDI increases carbon emissions, while negative shocks in FDI reduce carbon emissions. With regard to oil price, the results for the long-run relationship between oil price and carbon emission show that any increase in the oil price (positive variations in the partial sum of OP) imply reductions in carbon emission, whereas a decline in the oil price (negative shocks in the OP) does not show any significant impact on carbon emissions. The results of short-run asymmetric relationship between oil price and carbon emission are statistically significant. In particular, an increase in the oil price imply reduces CO2, while a decrease in the oil price increases CO2 in the short run. Finally, the coefficient value of the error correction term indicates that any disequilibrium in past years is adjusted at the speed of 19% yearly.

The results of the Wald Test for assessing the equality of short-run and long-run positive and negative shocks of FDI and OP on carbon emissions are presented in Table 10. With regard to FDI, the Wald Test value is statistically significant both in short and in long-run: it means that we can reject the null hypothesis of symmetry against the alternative hypothesis and we can conclude that the impact of FDI on carbon emission is asymmetric. In the case of OP, the results confirm the asymmetric effect of OP on carbon emission only in the long-run.

The results of the diagnostic tests provide no evidence of serial correlation, heteroscedasticity, normality, and stability issues (Table 8).

Causality analysis and robustness analysis. We also checked the direction of causality among the variables considered. For the causality analysis, we performed the block exogeneity Wald test, which gives the causality results for both short and long-run. The results show an unidirectional causality running from per capita income (economic growth), the square term of per capita income, FDI, oil price, human capital, exports, urban population, inflation, and financial development towards carbon emission (Table 11).

In order to check for the robustness of the long-run results obtained from the ARDL methodology, we applied another univariate cointegration technique, the dynamic ordinary least square (DOLS). The DOLS results are in line with the results of the long-run ARDL model (Table 12). These results also confirm the existence of EKC hypothesis in Italy under all methodologies used.

5 Conclusion

In this work we have examined the symmetric and asymmetric effects of oil price, foreign direct investments and economic growth on carbon emissions in Italy. To this purpose, the long and short-run impact of these variables on carbon emissions have been investigated by applying the ARDL and non-linear ARDL methods to Italian data for the period 1970–2019. Lastly, we have investigated the combined direction of causality between carbon emissions and its determinants.

The results of the study confirm the presence of cointegration between carbon emissions and the set of regressors considered, as well as the presence of the EKC hypothesis for Italy. In particular, the results provided by ARDL model show that economic growth and FDI intensify carbon emissions both in the long and short-run, while the impact of oil price on emissions is negative in the long-run and positive in the short-run, suggesting that OP is responsible for environmental degradation only in the short run. The results obtained from NARDL model reveal that both in the long and in the short-run an increase in the oil price imply reductions in carbon emissions.

Hence, the present study represents an additional source of useful information to policy makers for future environmental protection policies in order to take care of environmental quality.

References

Agbanike, T.F., Nwani, C., Uwazie, U.I., Anochiwa, L.I., Onoja, T.G.C., Ogbonnaya, I.O.: Oil price, energy consumption and carbon dioxide (CO2) emissions: insight into sustainability challenges in Venezuela. Latin American Economic Review 28(1), 1–26 (2019)

Agovino, M., Bartoletto, S., Garofalo, A.: Modelling the relationship between energy intensity and GDP for European countries: an historical perspective (1800–2000). Energy Economics 82, 114–134 (2019)

Ahmad, N., Du, L., Lu, J., Wang, J., Li, H.Z., Hashmi, M.Z.: Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123, 164–172 (2017)

Al-Mulali, U., Tang, C.F.: Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60, 813–819 (2013)

Alper, A., Onur, G.: Environmental Kuznets curve hypothesis for sub-elements of the carbon emissions in China. Nat. Hazards 82(2), 1327–1340 (2016)

Antweiler, W., Copeland, B.R., Taylor, M.S.: Is free trade good for the environment? American economic review 91(4), 877–908 (2001)

Apergis, N., Payne, J.E.: Renewable energy, output, carbon dioxide emissions, and oil prices: evidence from South America. Energy Sources Part B 10(3), 281–287 (2015)

Azevedo, V.G., Sartori, S., Campos, L.M.: CO2 emissions: a quantitative analysis among the BRICS nations. Renew. Sustain. Energy Rev. 81, 107–115 (2018)

Baek, J.: Do nuclear and renewable energy improve the environment? Empirical evidence from the United States. Ecol. Ind. 66, 352–356 (2016)

Bartlett, A.A.: Reflections on sustainability, population growth, and the environment. Popul. Environ. 16(1), 5–35 (1994)

Behera, S.R., Dash, D.P.: The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew. Sustain. Energy Rev. 70, 96–106 (2017)

Birdsall, N., Wheeler, D.: Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2(1), 137–149 (1993)

Bölük, G., Mert, M.: The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew. Sustain. Energy Rev. 52, 587–595 (2015)

Chandran, V.G.R., Tang, C.F.: The impacts of transport energy consumption, foreign direct investment and income on CO2 emissions in ASEAN-5 economies. Renew. Sustain. Energy Rev. 24, 445–453 (2013)

Circle Economy: Circularity Gap Report (2021)

Coondoo, D., Dinda, S.: Causality between income and emission: a country group-specific econometric analysis. Ecol. Econ. 40(3), 351–367 (2002)

Danish, T.H., Baloch, M.A., Suad, S.: Modeling the impact of transport energy consumption on CO2 emission in Pakistan: evidence from ARDL approach. Environ. Sci. Pollut. Res. 25(10), 9461–9473 (2018)

Dong, K., Sun, R., Hochman, G., Zeng, X., Li, H., Jiang, H.: Impact of natural gas consumption on CO2 emissions: panel data evidence from China’s provinces. J. Clean. Prod. 162, 400–410 (2017)

Engle, R.F., Granger, C.W.: Co-integration and error correction: representation, estimation, and testing. Econ. J. Econ. Soc. 251–276, (1987)

Fan, F., Lei, Y.: Responsive relationship between energy-related carbon dioxide emissions from the transportation sector and economic growth in Beijing—Based on decoupling theory. Int. J. Sustain. Transp. 11(10), 764–775 (2017)

Farhani, S., Shahbaz, M.: What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renew. Sustain. Energy Rev. 40, 80–90 (2014)

Galeotti, M., Lanza, A., Pauli, F.: Reassessing the environmental Kuznets curve for CO2 emissions: a robustness exercise. Ecol. Econ. 57(1), 152–163 (2006)

Gastaldi, M., Lombardi, G.V., Rapposelli, A., Romano, G.: The efficiency of waste sector in Italy: an application by data envelopment analysis. Environ. Clim. Technol. 24(3), 225–238 (2020)

Grossman, G.M., Krueger, A.B.: Economic growth and the environment. Q. J. Econ. 110(2), 353–377 (1995)

Hakimi, A., Hamdi, H.: Trade liberalization, FDI inflows, environmental quality and economic growth: a comparative analysis between Tunisia and Morocco. Renew. Sustain. Energy Rev. 58, 1445–1456 (2016)

Haug, A.A., Ucal, M.: The role of trade and FDI for CO2 emissions in Turkey: nonlinear relationships. Energy Econ 81, 297–307 (2019)

Ito, B., Yashiro, N., Xu, Z., Chen, X., Wakasugi, R.: How do Chinese industries benefit from FDI spillovers? China Econ. Rev. 23(2), 342–356 (2012)

Jiang, L., Zhou, H.F., Bai, L., Zhou, P.: Does foreign direct investment drive environmental degradation in China? An empirical study based on air quality index from a spatial perspective. J. Clean. Prod. 176, 864–872 (2018)

Johansen, S., Juselius, K.: Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxford Bull. Econ. Stat. 52(2), 169–210 (1990)

Johansen, S.: Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford University Press, Oxford (1996)

Katircioglu, S.: Investigating the role of oil prices in the conventional EKC model: evidence from Turkey. Asian Econ Financ Rev 7(5), 498–508 (2017)

Kivyiro, P., Arminen, H.: Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy 74, 595–606 (2014)

Koçak, E., Şarkgüneşi, A.: The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ. Sci. Pollut. Res. 25(1), 790–804 (2018)

Lee, J.W.: The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55, 483–489 (2013)

Lee, S., Oh, D.W.: Economic growth and the environment in China: empirical evidence using prefecture level data. China Econ. Rev. 36, 73–85 (2015)

Lin, P., Liu, Z., Zhang, Y.: Do Chinese domestic firms benefit from FDI inflow?: Evidence of horizontal and vertical spillovers. China Econ. Rev. 20(4), 677–691 (2009)

Lombardi, G.V., Gastaldi, M., Rapposelli, A., Romano, G.: Assessing efficiency of urban waste services and the role of tariff in a circular economy perspective: empirical application for Italian municipalities. Working Paper (2021)

Malik, M.Y., Latif, K., Khan, Z., Butt, H.D., Hussain, M., Nadeem, M.A.: Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: evidence from ARDL and non-linear ARDL approach. Sci. Total Environ. 726, 138421 (2020)

Mohammed Suliman, T.H., Abid, M.: The impacts of oil price on exchange rates: evidence from Saudi Arabia. Energy Explor. Exploit. 38(5), 2037–2058 (2020)

Narayan, P.K.: The saving and investment nexus for China: evidence from cointegration tests. Appl. Econ. 37(17), 1979–1990 (2005)

Nasir, M., Rehman, F.U.: Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39(3), 1857–1864 (2011)

Naz, S., Sultan, R., Zaman, K., Aldakhil, A.M., Nassani, A.A., Abro, M.M.Q.: Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: evidence from robust least square estimator. Environ. Sci. Pollut. Res. 26(3), 2806–2819 (2019)

Oxelheim, L., Ghauri, P.: EU–China and the non-transparent race for inward FDI. J. Asian Econ. 19(4), 358–370 (2008)

Pesaran, M.H., Smith, R.: Estimating long-run relationships from dynamic heterogeneous panels. J. Econ. 68(1), 79–113 (1995)

Pesaran, M.H., Shin, Y., Smith, R.J.: Bounds testing approaches to the analysis of level relationships. J. Appl. Economet. 16(3), 289–326 (2001)

Saboori, B., Rasoulinezhad, E., Sung, J.: The nexus of oil consumption, CO2 emissions and economic growth in China, Japan and South Korea. Environ. Sci. Pollut. Res. 24(8), 7436–7455 (2017)

Saikkonen, P.: Asymptotically efficient estimation of cointegration regressions. Econ. Theory 1–21 (1991)

Sarkodie, S.A., Strezov, V.: Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci. Total Environ. 646, 862–871 (2019)

Schmalensee, R., Stoker, T.M., Judson, R.A.: World carbon dioxide emissions: 1950–2050. Rev. Econ. Stat. 80(1), 15–27 (1998)

Selden, T.M., Song, D.: Environmental quality and development: is there a Kuznets curve for air pollution emissions? J. Environ. Econ. Manag. 27(2), 147–162 (1994)

Shin, Y., Yu, B., Greenwood-Nimmo, M.: Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in Honor of Peter Schmidt, pp. 281–314. Springer, New York, NY (2014)

Shujah ur, R., Chen, S., Saleem, N., Bari, M.W.: Financial development and its moderating role in environmental Kuznets curve: evidence from Pakistan. Environ. Sci. Pollut. Res. 26(19), 19305–19319 (2019)

Simsek, T., Yigit, E.: Causality Analysis of BRICT Countries on Renewable Energy Consumption, Oil Prices, CO2 Emissions, Urbanization and Economic Growth (2017)

Stock, J.H., Watson, M.W. A simple estimator of cointegrating vectors in higher order integrated systems. Econ. J. Econ. Soc. 783–820 (1993)

Sulaiman, C., Abdul-Rahim, A.S.: The relationship between CO 2 emission, energy consumption and economic growth in Malaysia: a three-way linkage approach. Environ. Sci. Pollut. Res. 24(32), 25204–25220 (2017)

Sung, B., Song, W.Y., Park, S.D.: How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: evidence from panel data. Econ. Syst. 42(2), 320–331 (2018)

Tang, C.F., Tan, B.W.: The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79, 447–454 (2015)

Usman, O., Iorember, P.T., Olanipekun, I.O.: Revisiting the environmental Kuznets curve (EKC) hypothesis in India: the effects of energy consumption and democracy. Environ. Sci. Pollut. Res. 26(13), 13390–13400 (2019)

Wang, Z.: Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Sci. Total Environ. 670, 1075–1083 (2019)

Zambrano-Monserrate, M.A., Silva-Zambrano, C.A., Davalos-Penafiel, J.L., Zambrano-Monserrate, A., Ruano, M.A.: Testing environmental Kuznets curve hypothesis in Peru: the role of renewable electricity, petroleum and dry natural gas. Renew. Sustain. Energy Rev. 82, 4170–4178 (2018)

Zhang, C., Zhou, X.: Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 58, 943–951 (2016)

Zhang, Y., Zhang, S.: The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 120, 347–353 (2018)

Zou, X.: VECM model analysis of carbon emissions, GDP, and international crude oil prices. Discret. Dyn. Nat. Soc. 2018, 1–11 (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Javed, A., Rapposelli, A. (2023). Examining Environmental Sustainability in Italy: Evidence from ARDL and Non-linear ARDL Approaches. In: Za, S., Winter, R., Lazazzara, A. (eds) Sustainable Digital Transformation. Lecture Notes in Information Systems and Organisation, vol 59. Springer, Cham. https://doi.org/10.1007/978-3-031-15770-7_6

Download citation

DOI: https://doi.org/10.1007/978-3-031-15770-7_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-15769-1

Online ISBN: 978-3-031-15770-7

eBook Packages: Business and ManagementBusiness and Management (R0)