Abstract

In this chapter, the Smart Production vision is discussed. The Smart Production approach is developed and described, and Smart Production is positioned in relation to Industry 4.0. Smart Production operationalize the journey towards Industry 4.0 and beyond. First, the need for a new approach to manufacturing is discussed, and from the perspectives of Industry 4.0, the Smart Production concept is derived. Then the framework is explored and finally, the approach is outlined. The Smart Production vision is an approach to make an integrated production system smarter by continuous digitizing, automating, and organizing towards supporting the company specific missions.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

For decades, outsourcing and offshoring resulting from globalization has built up fundamental tensions around manufacturing and global supply chains. However, after the financial crisis, a new industrial paradigm emerged. This was driven by the ubiquitous and extensive digitalization of society.

In most of the Western countries, an increased awareness of the importance of the manufacturing industry, spurred corporate and national initiatives aimed at reversing the flow of jobs and knowledge to low-cost countries (Pisano & Shih, 2012). This has led to appreciating the large base of small and medium-sized manufacturers, the SMEs, and their importance to the economy. It has been realized that digitalization of the industry is key to restore national competitiveness.

So, while the large enterprises were able to implement large scale digital transformation programs, the SMEs have been more challenged. In most of the extant literature (Modrak et al., 2020), the small manufacturers are in fact considered disadvantaged per se. But while the SMEs are disadvantaged by having limited access to investments and knowledge, the SMEs are in fact often highly customer-oriented and quite agile (Chan et al., 2019; Jafari-Sadeghi et al., 2022) But there is an unmet need for qualifying the visions and to operationalize the journey into a systematic approach.

The most prominent manifestation of the vision of future manufacturing is Industry 4.0. Based on these ideas, we have formulated an approach to support the transformation towards Industry 4.0, and we have coined this approach Smart Production.

In the next section we discuss the different perspectives on Industry 4.0. Following this, we present the Smart Production framework and finally we formulate a journey for SMEs to become smarter. This chapter will primarily build on practical experiences gained by Smart Production teams in Denmark and Germany.

2 Industry 4.0

Industry 4.0 is a concept first introduced in 2011 during the Hannover Industry Fair in Germany by the Industry 4.0 Working Group (Kagermann et al., 2013). The working group consisted of a group of industry leaders aiming to change the public opinion on manufacturing and industry in Germany and recommending national and industrial actions.

After its tenth anniversary, it is obvious that Industry 4.0 is more than a passing fad. Although there were many similar concepts and initiatives, like: Factories of the future (Usine du future), Smart Industries, Society 5.0, Smart Manufacturing, etc., Industry 4.0 has established itself as a overarching concept. Today it is used and widely understood in both society, industry, and in academia (Culot et al., 2020). So, what is Industry 4.0?

2.1 Six Perspective on Industry 4.0

What started out as a clever rhetorical trope to frame the next generation industrialization, has now become a complex and multi-facet phenomenon with multiple meanings. While it is not the intent to provide a comprehensive review of Industry 4.0, we will briefly cover six important perspectives on Industry 4.0.

Industry 4.0 as industry politics

The Industry 4.0 concept and the established national platform, is very clearly an instrument for lobbying for a (German) national public–private partnership to promote a major investment in research and development of both the German manufacturing industry, and its key vendors. The German “Industrie 4.0 Plattform” develop concepts, solutions, and recommendations, and they succeeded in advancing some major issues and technologies on the national and European agenda.

However, these are the same conclusions that most countries have arrived at, and in most countries, national research and innovation initiatives and national incentive programs have been put in place. In Denmark the Manufacturing Academy of Denmark (MADE) was launched to advance the manufacturing agenda, but also in countries like China (Made in China 2025) and India (Make in India), large scale programs have been put in place. Industry 4.0 was not the first national initiative, but gradually, the concept has been adopted across Europe, in Asia and in the US.

Industry 4.0 as a globalization agenda

World Economic Forum (WEF) has taken the baton from the Industry 4.0 Working Group and have adapted and promoted I4.0 actively since 2016. WEF has continuously used the “fourth industrial revolution” as a proxy for a new technological driven transformation of society (Bai et al., 2020).

WEF argues that the exponential development of the new technologies has the potential to solve a lot of the grand challenges, such as climate change, inequality, and migration. However, WEF is not blind to the potential downsides of such rapid technological development, such as security, privacy, and lack of democratic control (Schwab, 2016).

However, in the most recent years, the WEF has refocused, triggered by crises such as the pandemic and the Ukraine wars. But still the “fourth industrial revolution” is the underlying force.

Industry 4.0 as technology

It is difficult to discuss Industry 4.0 without considering technology (Oztemel & Gursev, 2018; Zheng et al., 2021). The fourth industrial revolution has been defined as the convergence of physical, digital, and biological technologies. The introduction of Industry 4.0 is triggered by an exponential growth in computer power which forms the basis for a very large suite of new digital technologies such as: Big Data, Internet of Things, Digital Twins, Cloud Computing, Artificial Intelligence, advanced robotics, etc. Through the enabling of data ubiquity and connectivity capabilities, these provide an increasing number of new possibilities for the development of new products, processes, and services. However, a preliminary conclusion may be that there is no one single technology that can be characterized as Industry 4.0. Industry 4.0 technologies are the amalgamation of different technologies into industrial applications, and thus can be characterized as networked technologies. Consequently, interoperability might be a critical success factor, not only to end-users, but also to vendors of Industry 4.0 technologies (Bai et al., 2020).

Industry 4.0 as standards

Industry 4.0 can be seen as a battle of standards, or rather as a battle between vendors. Standardization and reference architectures is one of the key areas of Industry 4.0 (Kagermann et al., 2013). With interoperability as the central feature, vendors are obviously using considerable resources in complying to, and affecting standards.

In Europe, there is a massive momentum to formulate European and International standards which will ensure that vendors can concentrate on developing core technologies. From an end-user perspective, standards and reference architectures help protecting the value of investments in new technologies (Grangel-Gonzalez et al., 2017; Trappey et al., 2017). However, innovation processes can be highly unpredictable, and through-out history we have seen how inferior technologies win market dominance because of higher adoption rates. Consequently, this could mean, that cheaper and inferior technologies, will disrupt incumbent vendors technologies.

Industry 4.0 as affordances

One the main features of Industry 4.0 is that technology development happens exponentially. This not only means technology gets better, but more importantly, it means that advanced technology gets cheaper and ultimately commoditized. While an abundance of technology not necessarily bring any benefits in itself; it is the essence of the Industry 4.0 promise.

This makes it more difficult to compete on technological advances, and therefore companies must compete on solutions rather than technology alone (Culot et al., 2020). The idea is that digitalization will enable a wide range of new solutions to the industrial challenges and that the potentials are awaiting to be actualized. Furthermore, going from technologies to solutions also requires that companies consider adoption and use, and this requires new knowledge, competences, and skills.

Consequently, to realize the potentials, the organization needs to be mobilized, and this require considerable managerial effort in staging the change.

Industry 4.0 as a transformation journey

Even though we are referring to Industry 4.0 as “the fourth industrial revolution”, the journey towards the I4.0 vision will be an evolutionary process rather than a radical transformation (Kagermann et al., 2013):

Current basic technologies and experiences will have to be adapted to the specific requirements of manufacturing engineering, and innovative solutions for new locations and new markets will have to be explored. Achieving the benefits from digital manufacturing is a long-term endeavor and will involve a gradual experimental learning process involving both technology, systems, and management processes. For the individual manufacturing company, it will be key to ensure that the value of existing manufacturing systems is preserved. This emphasizes the need for a brown-field approach to the transformation. At the same time, it will be necessary to come up with migration strategies that deliver benefits and productivity from an early stage.

These considerations have several implications for the journey ahead. First, it is clear that Industry 4.0 is a company specific journey with no specific end-state, and that no universal solutions are provided. Second, it is clear that the solutions need to be grounded in the specific conditions and constraints. Third, it is clear that experimentation and learning are central to find the best path for each individual organization’s journey.

Even the European Commission has positioned Industry 5.0 as its transformative vision for Europe in relation to Industry 4.0 as: “It complements the existing Industry 4.0 approach by specifically putting research and innovation at the service of the transition to a sustainable, human-centric and resilient European industry” (European Commission, 2021).

2.2 Industry 4.0 as a Vision

In summary, Industry 4.0 started out as a story framing a manufacturing digitalization initiative and have evolved into an all-compassing vision of a society of the future driven by technological advances.

In academia there have been a huge interest in Industry 4.0. However, diving into the literature, it mainly deals with review of the technologies or digital readiness and maturity models. The detailed industry 4.0 scenarios have been analyzed, generalized, and characterized by the four design principles: (1) Decentralized decisions; (2) Information transparency; (3) Interconnection; and (4) Technical assistance (Hermann et al., 2016) These guidelines operationalize the technical solutions, but fails to address the system level of Industry 4.0, and provide little guidance to the managers in SMEs.

McKinsey (Baur & Wee, 2015) defines Industry 4.0 as: The next phase in the digitization of the manufacturing sector, driven by four disruptions:

-

The astonishing rise in data volumes, computational power, and connectivity, especially new low-power wide-area networks;

-

The emergence of analytics and business-intelligence capabilities;

-

New forms of human–machine interaction such as touch interfaces and augmented-reality systems; and

-

Improvements in transferring digital instructions to the physical world, such as advanced robotics and 3-D printing.

This definition points back to the original definition of Industry 4.0 (Kagermann et al., 2013). As a vision, Industry 4.0 is generic and open to new challenges and actual technological opportunities. In the consulting industry, Industry 4.0 have extensively been used for branding digital transformation, and in academia, numerous studies have reviewed Industry 4.0 as a concept (Culot et al., 2020), as technologies (Oztemel & Gursev, 2018), readiness (Hizam-Hanafiah et al., 2020) or as cases (Ortt et al., 2020).

Although some guidance in the form of maturity models and roadmaps from consultants and vendors are available, the Industry 4.0 vision is not absolute, but more a vision of future manufacturing context and the potentials of using advanced manufacturing technology. We need a more operational approaches and in particular approaches that addresses the large base of SMEs.

3 Smart Production

As the analysis of Industry 4.0 indicate, Industry 4.0 is a vision of a future state of the manufacturing industry, mainly driven by technology and automation. However, we find companies are struggling with getting started and embarking on the journey, and one of the reasons are, that the Industry 4.0 concept is an industry perspective, not a company perspective.

To support manufacturing organizations, and in particular SMEs, we have formulated the Smart Production framework as an integrative approach and as a guideline for managing and organizing the journey towards Industry 4.0. The Smart Production framework include the conceptualization of the integrated production system as interacting value streams, and an approach to make the production smarter based on agile practices. The objective is to generalize, simplify and operationalize the journey and to guide the company in the process.

The starting point for conceptualizing Smart Production is to formulate the outcome of the transformation in terms of a strategic gap. This strategic gap is company specific and consist of a concrete Smart Production vision and an assessment of the current maturity. The Smart Production vision is obviously inspired by the visions of Industry 4.0 but need not to be either disruptive or based on any specific technology. Based on the strategic gab, we formulate the desired outcome of the company specific journey. It is these company specific outcomes that is the guideline for continuous improved value delivery.

3.1 Smart Production System

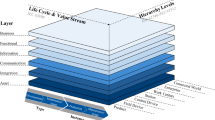

An integrated production system is the conceptualization of a manufacturing business in terms of customer value delivery. Business value is enabled by the products and services, and these are enabled by the business processes. The business processes are enabled by both technology and people. The transformation and alignment of the business towards its vision and future missions, is governed by the strategies and supported by existing infrastructure. This conceptualization is aligned with the work systems theory, socio-technical systems, and other activity-based frameworks (Alter, 2013).

An integrated production system is the socio-technical system that creates the business value from production, and as already indicated, we must view the production system from a perspective much broader than the just transformation of materials.

An integrated production system extends in the entire manufacturing eco-system, and include multiple stakeholders, such as vendors and partners, customers, and end-users, and obviously the focal organization and central value streams.

This understanding of Integrated Production is the foundation of the conceptualization of the Smart Production System as an integrated production system characterized by being instrumented, inter-connected and intelligent (Butner, 2010) which enable employees to collaborate internally and with external partners and customers in a digital ecosystem in order to continuously deliver value to the customers and end-users and optimize performance.

3.1.1 Instrumented

In a Smart Production, all assets and people must be instrumented. In recent years, we have seen the concept of Digital Twins emerge within manufacturing. Gartner defines a Digital Twin as (Gartner, 2021): “A digital twin is a digital representation of a real-world entity or system. The implementation of a digital twin is an encapsulated software object or model that mirrors a unique physical object, process, organization, person, or other abstraction. Data from multiple digital twins can be aggregated for a composite view across a number of real-world entities, such as a power plant [, or a factory] or a city, and their related processes” (Gartner, 2021). An instrumented production system requires an aggregated Digital Twin of the entire production ecosystem (Fig. 1).

Digital twin, adopted from (Deloitte, 2017)

Obviously, the digital twin is not the first step of digitalization. Any digital system, such as an ERP system may be synchronized manually with the physical processes, in which case it is referred to a “digital model”, or with automated data collection in which case it is referred to as a “digital shadow”.

The primary technological enabler is Cyber-Physical Systems (CPS). CPS is the result of things being equipped with electronics as an interface to the digital world. CPS also include other technologies that bridges the physical and digital worlds such as additive manufacturing (3D printing), robotics, and AR/VR. All these technologies will be elaborated later in this book (Madsen et al., 2022).

3.1.2 Interconnected

In a Smart Production, assets and people need to be interconnected in order to support the main functions of manufacturing. Leveraging the Digital Twin, Smart Production needs to facilitate the “grand” end-to-end processes of operations and supply chains. In an Industry 4.0 context this refers to horizontal and vertical integration. Operations is the vertical integration of networked manufacturing systems, while supply chain is the horizontal integration through value networks. Furthermore, Smart Production includes the end-to-end engineering across the entire value chain. This is often referred to as a digitalized system lifecycle. The Smart Production system also includes the costumers and end-users and connects organizations in the manufacturing eco-system into “systems of systems”.

In a company perspective there are three integrated value streams. The supply chain with generic activities such as Buy, Make, Deliver, Use and Dispose. Operations with the generic activities such as Plan, Make and Enable, and the engineering processes covering generic activities such as: Develop, Make, Redeploy and Use.

The activities are supported by digital tools and enterprise systems such as ERP, PLM, CRM system etc. The primary enabler of inter-connection is Internet of Things (IoT). IoT are technologies that enable the connection of data from CPS leading to transparency. Later in this book IoT and its applications in SME’s is elaborated and examples of solutions suitable for SMEs are covered.

We see a pattern of some high-level generic solution or digital capabilities that are needed, as illustrated in the figure below (Fig. 2)

Customer Engagement refer to the capability to create and capture value from connected customers and end-users. Customers and end-users being instrumented through smart products and/or services are inter-connected with the organization. Having the insights into customers and end-users enable a business to act not only to predict customer needs but also prescribe and influence customer choices.

An example of a company leveraging prescriptive analytics is Amazon (Nichols, 2018). Through the massive amount of customer insights e.g., collected through Alexa, Amazon can offer anticipatory shipping to their customers.

Intelligent Supply Chains refer to the horizontal integration of demand and supply into value networks by connecting the organization and its partner. This requires an instrumented supply chain where the organizations (and silos) can exchange information in order to build a transparent supply chain.

An example of a company leveraging an Intelligent Supply Chain is Maersk and the IBM joint venture: Tradelens (Moller & Maersk, 2019). Through the Tradelens platform, Maersk have access to almost the entire eco-system of container logistics and may reap the marginal benefits from a balanced demand and supply. In another example, an SME repositioned its role in the supply chain from Engineer-to-order to Assemble-to order, by utilizing digital technologies to integrate the supply chain (Bejlegaard et al., 2021).

Virtual Manufacturing refer to the integration of engineering activities across the entire lifecycle. Having engineering activities digitally connected enables concurrent engineering, and verification and validation of new products or changes in products or manufacturing systems without building physical products or factories.

An example of the potentials of end-to-end digital manufacturing is Vestas (Yidiz et al., 2021) By building a digital twin-based virtual factory, Vestas is able to train the employee (in a VR setting) before the physical factory is build, and before the turbines are final, and thus increasing time to market.

Collaborating Smart Factories across the entire manufacturing eco-system is the foundation for Industry 4.0. According to Schou et al. (2021). A smart factory is:

… a factory which by interconnecting its assets into a digital ecosystem, uses in-formation to adapt, run and optimize its operations according to actual business conditions, thereby generating and appropriating business value while reflecting societal requirements.

An example of a greenfield Smart Factory is the flexible, digital, efficient and sustainable: Factory 56 of Daimler AG (Daimler, 2020). Factory 56 were opened in 2020 and it embodies the Smart Factory and Smart Production.

An empowered and agile organization is a key capability in industry 4.0 and Smart Production. An organization may be empowered by instrumenting employees at all levels, from shop floor to boardroom, and inter-connecting them for optimal decision-making. This requires timely and right level of information needed for informed decision making and presented in an actionable way.

Arla is an example of how a company may empower an organization by decentralizing analytical data in order to support local data exploration and decision making (Asmussen et al., 2021).

3.1.3 Intelligent

In Smart Production, the production system must be intelligent. Intelligence refers to both human intelligence and artificial intelligence, however the appropriation of intelligence opens lots of challenging issues and interesting topics that are not covered here (Møller & Siurdyban, 2012). Intelligence is mainly enabled by Big Data and Analytics (BDA). BDA covers a wide range of tools and technologies such as AI and machine learning (ML). These are elaborated further in part 3 of this book (Møller, 2022). BDA can be defined as the complex process of analyzing large amounts of data in order to support an organization in making informed business decisions. Depending on the level of automation, Smart Production can be completely autonomous (and self-learning/optimizing), or Smart Production can offer decision support to the relevant decision-maker.

Meulen & Rivera, (2014) usually defines four types of analytics capabilities: (1) Descriptive analytics, that enable to understand what have happened; (2) Diagnostic analytics, that explain why it happened; (3) Predictive analytics to foresee what will happened; and (4). Prescriptive analytics that will either provide decision support or autonomous for actions to reach a certain goal (see Fig. 3). While the Descriptive, Diagnostic and Predictive analytics aims to enhance human decision making, Prescriptive analytics may be completely autonomous.

Analytical capabilities (adopted from (Meulen & Rivera, 2014))

Reaching these levels of analytical maturity is increasingly difficult, and in most cases, SME’s will need to work on very basic analytical capabilities, and gradually learn to use data to make decisions. In another chapter (Palade & Møller, 2022) we demonstrate how SMEs can get started with building a simple data-driven demonstrator and use this a basis for starting the journey.

3.2 Transformation Towards Smarter Production

Having framed Smart Production, as an integrated production system characterized as being instrumented, inter-connected and intelligent, we will now build guidelines for how a company can become smarter.

The guiding “North-Star” of the Smart Production vision is obviously Industry 4.0, however, a company specific Smart Production vision will more often be based in the specific competitive situation of the company.

We have identified four generic missions which seems to capture the general tasks for a manufacturing SMEs: Productivity, Flexibility, Innovation, and Sustainability. These generic missions are useful concepts for guiding the transformation.

Development efforts in a company needs to address a performance gap. Peter Checkland (1999) operates with three types of performance: (1) Efficacy, which is getting the desired results; (2) Efficiency, which is using the minimum number of resources to achieve the results; and (3) Effectiveness, which is doing the right things. These goals are obviously inter-related, and Hammer argues that benefits emerge in stages (Hammer, 2004). Most companies will embark on Smart Production due to cost savings and aim for operational gains. This would lead to the second wave of benefits, now aiming for tactical gains from being more effective. The third stage of benefits emerge when the company learn to systematically capture value from innovations and new ways of working. Hammer (2004) argues that it is necessary to spend time to master each stage, and therefore the last stage: “operational innovation” is a strategic capability it is difficult to replicate for competitors. However, the implication is also that manageable small steps and right level of ambitions should be considered. The generic missions of Smart Production represent general goals to ensure sustained competitive advantage, efficiency, effectiveness, robustness, and viability.

Technology is mainly based on the infrastructural assets of a company, but also the digital interconnection with suppliers and customers (Toro et al., 2021). Knowledge is mainly based on human resources, encompassing the digital qualification level of all staff members and the seamless and transparent access to data and information. Digital readiness is a collective term for a company to assess and take risks according to the principle: Aim high, fail fast.

When we refer to Smarter Production, it is the transformation of the integrated production system, capable of supporting the company vision and future missions, mainly by means of digital technologies. The transformation towards Smart Production evolves through a continuous cycle of digitalizing, automatization, and organization of new ways of working, and it requires systematic learning through experimentation along the way.

Smart Production is not an end-goal or a destination. The journey towards Smart Production will be a continuous process of experimenting with new technologies, learning, and building new capabilities and business models, and it requires adapting management approaches, new ways of working and new integrated solutions (Kagermann et al., 2013).

In Smart Production we refer to this continuous process of exploration (operations) and exploitations (innovation) as Digitize, Automate, and Organize (DAO). The DAO process refers to the transformation of business and manufacturing processes. Digitalization allows work processes to be automated end-to-end, which again enables new ways of working, making it relevant to digitalize new processes etc.

For SMEs to embark on this journey, they need a systematic approach and solid guidance, which can be provided in the form of guidelines and transformation roadmaps. In this book we cover several transformation approaches that applies to SMEs.

The transformation guidelines for developing Smart Production, are based on formulating a company specific TO-BE vision based in a company specific assessment of the AS-IS maturity or readiness.

There are numerous Industry 4.0 readiness or maturity models. Hizam-Hanafiah (Hizam-Hanafiah et al., 2020) reviewed 30 models from 2016 to 2018 and identifies six main groups of dimensions: (1) Technology; (2) People; (3) Strategy; (4) Leadership; (5) Process; and (6) Innovation. In our own maturity model (Colli et al., 2019), we operate with five dimensions: (1) Technology; (2) Competences (People); (3) Connectivity (Process); (4) Governance (Strategy, Leadership) and (5) Value Creation (Innovation). In both cases the dimensions represent systemic elements of Smart Production, as an integrated production system (Table 1).

Most methodologies use the term digital maturity and often have a multidimensional approach (Mittal et al., 2018; Schuh et al., 2017). Also, suitable roadmaps for achieving the expected goals are available and will be disclosed in part 2 in this book (Berger & Madsen, 2022).

In Industry 4.0 there is an emphasis on technology as an enabler of value and the organization as the barrier. To approach the transformation from a holistic perspective, we need to look for solutions that are balanced across all dimensions, hence we refer to these as integrated solutions.

In this book we put emphasis on the combination of technological and people (competence) dimensions, since working on these two in tandem is the best approach in SME. However, in many companies, the transformation process starts with managerial awareness and new mindset, and in Colli et al. (2018) we have presented a “holistic” approach for conceiving context specific transformation roadmaps, and this approach have also been applied in the Innovation Factory North project (Møller et al., 2022).

4 Summary and Conclusion

We have now formulated the Smart Production vision as an approach to make the integrated production system smarter by continuous digitizing, automating, and organizing towards supporting the company specific missions.

In this book (Madsen et al., 2022) we will cover the steps of this approach: Vision, Transformation, Solutions, Technologies, and People. Solutions enabled by both technology and people, are used to transform the company towards the company specific vision.

Huge investments in technical infrastructure and human potential have been made during the last decade from worldwide operating companies, but the success was not always as expected (Mittal et al., 2018). Consequently, we need a framework, which supports SME’s in analyzing and understanding its current situation, formulating company specific future visions, setting strategic goals, and finally providing operational guidance towards reaching these goals.

Industry 4.0 and Smart Production are two similar concepts with many similarities, but also with distinct differences. Industry 4.0 is first and foremost an industry perspective, whereas Smart Production is a company perspective. Smart Production is based on the company specific mission as an outset for iteratively reducing the gap. Industry 4.0 is first and foremost a technology driven concept whereas Smart Production is also human-centered. The Industry 4.0 journey is the “autobahn” whereas the Smart Production journey is along the small roads, with plenty of time to learn and to look for new opportunities.

As such, Smart Production is the continuation of an company-specific approach to develop production systems, which we have been working with at Aalborg University for several years (Johansen et al., 2006). At the same time, we incorporate the experiences from working with joint academia and industry projects. Over the last decade we have researched and consulted many manufacturing companies in Germany and Denmark, who experience that the environment in which they operate is becoming more and more unpredictable and dynamic. Industry 4.0 provide the direction; Smart Production shows the way.

References

Alter, S. (2013). Work system theory: Overview of core concepts, extensions, and challenges for the future. Journal of the Association for Information Systems, 14(2), 72–121. https://doi.org/10.17705/1jais.00323

Asmussen, C. B., Jørgensen, S. L., & Møller, C. (2021). Design and deployment of an analytic artefact–investigating mechanisms for integrating analytics and manufacturing execution system. Enterprise Information Systems, 1–30. https://doi.org/10.1080/17517575.2021.1905881

Bai, C., Dallasega, P., Orzes, G., & Sarkis, J. (2020). Industry 4.0 technologies assessment: A sustainability perspective. International Journal of Production Economics, 229, 107776. https://doi.org/10.1016/j.ijpe.2020.107776

Baur, C., & Wee, D. (2015). Manufacturing’s next act. McKinsey Quarterly, 1(5).

Bejlegaard, M., Sarivan, I., & Waehrens, B. V. (2021). The influence of digital technologies on supply chain coordination strategies. Journal of Global Operations and Strategic Sourcing, 14(4), 636–658. https://doi.org/10.1108/JGOSS-11-2019-0063

Berger, U., & Madsen, O. (2022). Part 2—Transformation of SMEs towards smart production. In O. Madsen, U. Berger, C. Møller, A. H. Lassen, B. V. Waehrens, & C. Schou (Eds.), The future of smart production for SMEs: A methodological and practical approach towards digitalization in SMEs. Springer International Publishing.

Butner, K. (2010). The smarter supply chain of the future. Strategy and Leadership, 38(1), 22–31. https://doi.org/10.1108/10878571011009859

Chan, C. M. L., Teoh, S. Y., Yeow, A., & Pan, G. (2019). Agility in responding to disruptive digital innovation: Case study of an SME. Information Systems Journal, 29(2), 436–455. https://doi.org/10.1111/isj.12215

Checkland, P. (1999). Systems thinking, systems practice. Wiley.

Colli, M., Madsen, O., Berger, U., Møller, C., Waehrens, B. V., & Bockholt, M. (2018). Contextualizing the outcome of a maturity assessment for Industry 4.0. Ifac-Papersonline, 51(11). https://doi.org/10.1016/j.ifacol.2018.08.343

Colli, M., Berger, U., Bockholt, M., Madsen, O., Møller, C., & Waehrens, B. V. (2019). A maturity assessment approach for conceiving context-specific roadmaps in the Industry 4.0 era. Annual Reviews in Control, 48, 165–177. https://doi.org/10.1016/j.arcontrol.2019.06.001

Culot, G., Nassimbeni, G., Orzes, G., et al. (2020). Behind the definition of Industry 4.0: Analysis and open questions. International Journal of Production Economics, 226, 107617. https://doi.org/10.1016/j.ijpe.2020.107617

Daimler, A. G. (2020). With its factory 56, Mercedes-Benz is presenting the future of production. Accessed December 22, 2021, from https://www.daimler.com/innovation/digitalisation/industry-4-0/opening-factory-56.html

Deloitte. (2017). Industry 4.0 and the digital twin: Manufacturing meets its match. Deloitte University Press.

European Commission. (2021). Industry 5.0: What this approach is focused on, how it will be achieved and how it is already being implemented. Accessed June 13, 2022, from https://ec.europa.eu/info/research-and-innovation/research-area/industrial-research-and-innovation/industry-50_en

Gartner. (2021). Definition of big data-gartner information technology glossary. Gartner. Accessed December 22, 2021, from https://www.gartner.com/en/information-technology/glossary/digital-twin

Grangel-González, I., Baptista, P., Halilaj, L., Lohmann, S., Vidal, M. E., Mader, C., & Auer, S. (2017). The industry 4.0 standards landscape from a semantic integration perspective. In 2017 22nd IEEE international conference on emerging technologies and factory automation (ETFA) (pp. 1–8). IEEE.

Hammer, M. (2004). Deep change: How operational innovation can transform your company. Harvard Business Review, 82(4), 84–141.

Hermann, M., Pentek, T., & Otto, B. (2016). Design principles for industrie 4.0 scenarios. In 2016 49th Hawaii international conference on system sciences (HICSS) (pp. 3928–3937). IEEE.

Hizam-Hanafiah, M., Soomro, M. A., Abdullah, N. L. (2020). Industry 4.0 readiness models: A systematic literature review of model dimensions. Information, 11(7), 364. https://doi.org/10.3390/info11070364

Jafari-Sadeghi, V., Mahdiraji, H. A., Busso, D., & Yahiaoui, D. (2022). Towards agility in international high-tech SMEs: Exploring key drivers and main outcomes of dynamic capabilities. Technological Forecasting and Social Change, 174, 121272. https://doi.org/10.1016/j.techfore.2021.121272

Johansen, J., Riis, J. O., & Arlbjørn, J. S. (2006). Analyse og design af produktionssystemer; Analyse og design af produktionssystemer. Aalborg Universitet.

Kagermann, H., Wahlster, W., & Helbig, J. (2013). Recommendations for implementing the strategic initiative industrie 4.0: Final report of the industrie 4.0 working group. Forschungsunion.

Madsen, O., Berger, U., Møller, C., Lassen, A. H., Waehrens, B. V., & Schou, C. (2022). The future of smart production for SMEs: A methodological and practical approach towards digitalization in SMEs. Springer International Publishing.

Mittal, S., Khan, M. K., Romero, D., et al. (2018). A critical review of smart manufacturing & industry 4.0 maturity models: Implications for small and medium-sized enterprises (SMEs). Journal of Manufacturing Systems, 49, 194–214. https://doi.org/10.1016/j.jmsy.2018.10.005

Modrák, V., Zsifkovits, H., & Matt, D. T. (2020). Industry 4.0 for SMEs: Challenges, opportunities and requirements. Springer International Publishing.

Moller, A. P., & Maersk. (2019). TradeLens blockchain-enabled digital shipping platform continues expansion with addition of major ocean carriers Hapag-Lloyd and ocean network express. Accessed December 22, 2021, from https://www.maersk.com/news/articles/2019/07/02/hapag-lloyd-and-ocean-network-express-join-tradelens

Møller, C., et al. (2022). Innovation factory North—An approach to make small and medium sized manufacturing companies smarter. In O. Madsen, U. Berger, C. Møller, A. H. Lassen, B. V. Waehrens, & C. Schou (Eds.), The future of smart production for SMEs: A methodological and practical approach towards digitalization in SMEs. Springer International Publishing.

Møller, C. (2022). Part 3—Integrated solutions for smart production. In O. Madsen, U. Berger, C. Møller, A. H. Lassen, B. V. Waehrens, & C. Schou (Eds.), The future of smart production for SMEs: A methodological and practical approach towards digitalization in SMEs. Springer International Publishing.

Møller, C., & Siurdyban, A. (2012). Towards intelligent supply chains: A unified framework for business process design. International Journal of Information Systems and Supply Chain Management (IJISSCM), 5(1), 1–19. https://doi.org/10.4018/jisscm.2012010101

Nichols, M. R. (2018). Amazon wants to use predictive analytics to offer anticipatory shipping.

Ortt, R., Stolwijk, C., & Punter, M. (2020). Implementing industry 4.0: Assessing the current state. Journal of Manufacturing Technology Management, 31(5), 825–836. https://doi.org/10.1108/JMTM-07-2020-0284

Oztemel, E., & Gursev, S. (2018). Literature review of industry 4.0 and related technologies. Journal of Intelligent Manufacturing, 31(1), 127–182. https://doi.org/10.1007/s10845-018-1433-8

Palade, D., & Møller, C. (2022). Paperless production—Jumpstarting digital transformation. In O. Madsen, U. Berger, C. Møller, A. H. Lassen, B. V. Waehrens, & C. Schou (Eds.), The future of smart production for SMEs: A methodological and practical approach towards digitalization in SMEs. Springer International Publishing.

Pisano, G. P., & Shih, W. C. (2012). Does America really need manufacturing? Harvard Business Review (March).

Schou, C., Colli, M., Berger, U., Lassen, A. H., Madsen, O., Møller, C., & Waehrens, B. V. (2021). Deconstructing Industry 4.0: defining the smart factory. In Towards sustainable customization: Bridging smart products and manufacturing systems (pp. 356–363). Springer International Publishing.

Schuh, G., Anderl, R., Gausemeier, J., Ten Hompel, M., & Wahlster, W. (2017). Industrie 4.0 maturity index: Managing the digital transformation of companies. acatech.

Schwab, K. (2016). The fourth industrial revolution, Crown Business.

Toro, C., Wang, W., & Akhtar, H. (2021). Implementing industry 4.0: The model factory as the key enabler for the future of manufacturing. Springer.

Trappey, A. J., Trappey, C. V., Govindarajan, U. H., Chuang, A. C., & Sun, J. J. (2017). A review of essential standards and patent landscapes for the internet of things: A key enabler for industry 4.0. Advanced Engineering Informatics, 33(8). https://doi.org/10.1016/j.aei.2016.11.007

van der Meulen, R., & Rivera, J. (2014). Gartner says advanced analytics is a top business priority. Accessed June 14, 2022, from https://www.gartner.com/en/newsroom/press-releases/2014-10-21-gartner-says-advanced-analytics-is-a-top-business-priority

Yildiz, E., Møller, C., & Bilberg, A. (2021). Demonstration and evaluation of a digital twin-based virtual factory. The International Journal of Advanced Manufacturing Technology, 114, 185–203.

Zheng, T., Ardolino, M., Bacchetti, A., & Perona, M. (2021). The applications of industry 4.0 technologies in manufacturing context: A systematic literature review. International Journal of Production Research, 59(6), 1922–1954. https://doi.org/10.1080/00207543.2020.1824085

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Møller, C., Madsen, O., Berger, U., Schou, C., Lassen, A.H., Waehrens, B.V. (2023). The Smart Production Vision. In: Madsen, O., Berger, U., Møller, C., Heidemann Lassen, A., Vejrum Waehrens, B., Schou, C. (eds) The Future of Smart Production for SMEs. Springer, Cham. https://doi.org/10.1007/978-3-031-15428-7_2

Download citation

DOI: https://doi.org/10.1007/978-3-031-15428-7_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-15427-0

Online ISBN: 978-3-031-15428-7

eBook Packages: EngineeringEngineering (R0)