Abstract

In the light of the current research, we propose a more general and realistic model based on approximative fractional Brownian motion studies. This framework presents an option pricing model under the double Heston Jump-Diffusion model, including approximative fractional motion with stochastic interest rate and stochastic intensity. The stochastic interest rate is determined using a two-factor Vasicek model. The negative interest rate is allowed for this model. Therefore, we are constructing a multi-factor model with a stochastic interest rate structure. We derive a closed-form pricing formula with an analytical solution for European options. Finally, some numerical results are presented to illustrate the value of a European call option comparing to other classical models.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

1 Introduction

In 1997 Black & Scholes [4] published a groundbreaking paper in which they proposed an elegant model focused on Brownian motion to explain the complexities of the underlying asset price and presented a closed-form formula for European options. According to Duan and Wei [7], the Black-Scholes model cannot explain the phenomena of the asymmetric leptokurtic and also the volatility smile that is observed in the real market. Since That point, academic researchers have created different models by joining in the Black-Scholes model the non-constant volatility . The Scott [19] model, Hull and White [13] model, the Stein and Stein [22] model and the Wiggins [26] model. However, the majority of these stochastic volatility models are unsuitable for use. In 1993 Heston [11] describe the variance (the square of volatility) by Cox-Ingersoll-Ross process [5] and deriving a closed-form formula for European options.

On the other side, a single factor model cannot describe the shapes of the volatility smile with precision. Multi-factor stochastic volatility models are useful for expressing return data in various ways, such as using a stylized effect or fitting the implied surface. We choose to investigate option pricing under two-factor stochastic volatility in this study since it is more appropriate for practical applications.

Otherwise, the financial market owns long-range persistence and self-similarity traits, and fractional Brownian motion has these two essential properties. Moreover, fractional Brownian motion is not a Markov process or semi-martingale; the classical Ito calculus cannot be used in this case. Wick products have been created by Hu and Oksendal [12] for analyzing it. In addition, Xiao and Al [27] used the Wick products to define a fractional stochastic integral. Björk and Hult [3] demonstrated that the model lacks an economic interpretation. To solve this problem is appropriate to use the mixed fractional Brownian motion [8, 17, 23, 28]. Approximation Fractional Brownian motion [24] can also be used instead of fractional Brownian motion. Thao [24] showed that Approximation Fractional Brownian motion is a semi-martingale. Furthermore, many researchers (see [6]) adopted Approximation Fractional Brownian motion in building stochastic volatility models.

Many authors have worked on a hybrid model in recent years by incorporating the stochastic interest rate into stochastic models [9, 10, 14, 21]. In addition, empirical studies show that using stochastic interest rates into option pricing models will contribute to improved model results [18].

Roughly speaking, permitting for changes in volatility and interest rate and the presence of jumps and the jump intensity changing over time indicate realistic asset return dynamics. In a parallel development, incorporating jump into models for pricing option also proposes describing the discontinuous behavior of the underlying asset (see [1, 2, 15, 16, 20]).

The rest of the paper is organized as follows. We adopt the double-Heston jump-diffusion (DHJD) model with approximative fractional Brownian motion, stochastic intensity, and interest rate follow a two-factor model in Sect. 2. In Sect. 3, we derive analytical pricing formula for European call option. In Sect. 4, we present some numerical illustrations. Finally, we conclude in Sect. 5.

2 The Model

We present some basic information on approximative fractional Brownian motion. At the first, we present an analysis of fractional Brownian motion \((B_{t}^{H})_{t\ge 0}\) with the Hurst index \(H\in (0, 1).\) It is a Gaussian process with zero mean and the following covariance:

The decomposition of a fractional Brownian motion B is as follows:

where

\(W_{t}\) indicates standard Brownian motion, and \(\Gamma \) indicates the gamma function. It is sufficient to focus exclusively on the term:

that has a long-range memory. Note that The approximation of \(B_{t}\) is \(\tilde{B}_{t}^{\epsilon ,H}\) which can be expressed as [26]

where H is a long-memory parameter, \(\varepsilon \) is non negative approximation factor. Thao [24] proved that for \(\varepsilon \rightarrow 0,\quad (B_{t}^{\varepsilon ,t})_{\varepsilon }\) converges uniformly to a non-Markov process. In addition, if \(\varepsilon >0\) then \(B_{t}^{\varepsilon ,t}\) is a semi-martingale [24]

\(\psi _{t}\) is a stochastic processes expressed as

where\((W_{t}^{\psi })_{t\in [0,T]}\) and \((W_{t}^{v})_{t\in [0,T]},\) are independent standard Brownian motions.

Let\((\Omega ,\mathcal {F}, (\mathcal {F}_{t})_{t\in [0,T]},\mathbb {Q})\) be a complete probability space with a filtration and \(\mathbb {Q}\) presents a risk-neutral measure.The stock price \(S_{t}\) is expressed by the following dynamic system:

where \(W_{1}^{s}, \hat{W}_{t}^{s}, W_{t}^{v}, W_{t}^{r_{1}}, W_{t}^{r_{2}}\) and \(W_{t}^{\lambda }\) are the standard Brownian motions. We assume that \(W_{t}^{s}\) is correlated with \(W_{t}^{v},\) \(dW_{t}^{s}.dW_{t}^{v}=\rho _{1} dt\),\(\hat{W}_{t}^{s}\) correlated with \(W_{t}^{\hat{v}},\) \(d\hat{W}_{t}^{s}dW_{t}^{\hat{v}}=\rho _{2}dt\) and \( W^{r_{1}}_{t}\) correlated with \( W^{r_{2}}_{t},\) \(dW_{t}^{r_{1}}.dW_{t}^{r_{2}}=\rho _{r}dt.\) Any other Brownian motions are pairwise independent.

\( v_{t},\hat{v}_{t}\) are variances, and \(\lambda _{t}\) is the jump intensity. \(k, \hat{k}\) and \(k_{\lambda }\) are mean reversion rates, \(\theta ,\) \(\hat{\theta }\) and \(\theta _{\lambda }\) are mean reversion levels, \(\sigma _{v},\) \(\sigma _{\hat{v}}\) and \(\sigma _{\lambda }\) are the volatilities of the variances. and the short rate is follow two-factor Vasicek model where the short rate is given as a sum of two factors \(r_{1}\) and \(r_{2},\) where \(\beta _{1},\beta _{2}\) are their mean-reversion , \(\alpha _{1},\alpha _{2}\) are theire mean-reversion speed, \(\sigma _{1},\sigma _{2}\) are their volatilities, \(N_{t}\) represents Poisson process with intensity \(\lambda _{t}\) and J represents the jump size, and we suppose that lnJ has an asymmetric double exponential distribution with density function \(p d f_{u}(z):\)

where \(\eta _{1}>1, \eta _{2}>0, p, q >0, \) and \(p + q =1, \) where q and p represent the probabilities for positive and negative jumps, respectively. As a result we can obtain that \(\mu _{J} =\mathbb {E}^{\mathbb {Q}}(J-1) =(p\eta _{1}/\eta _{1}-1) + (q\eta _{2}/\eta _{2} + 1)-1.\)

We set \(\tau =T- t,\) \(X_{t} =ln S_{t}, \) \(Y =lnJ,\) the interest rate r are determined by the sum of the two factors \(r_{1}\) and \(r_{2}\) \( (r=r_{1}+r_{2})\) and \(k = lnK,\) where T is the maturity date, and K is the strike price. In the risk-neutral world, the price of a call option \(C(S,V1,V2, r, \lambda , t)\) at time \(t \in [0, T]\) with strike price K and maturity date T is given by

we convert measure \(\mathbb {Q}\) to the measure \(\mathbb {Q}^{S}\) and the T forward measure \(\mathbb {Q}^{T}.\) By applying Radon-Nikodym derivatives,

where

\(P(t,T):=\mathbb {E}^{\mathbb {Q}}\bigg (e^{-\int _{t}^{T}r_{s}ds+}|\mathcal {F}_{t}\bigg ),\) is the price at time t of a zero-coupon bond which matures at time T (see appendix). Then, we can have the following expression:

we define

where \(\varphi _{S}(u)\) denotes the characteristic function under \(\mathbb {Q}^{S},\) \(\varphi _{T}(u)\) denotes the characteristic function under \(\mathbb {Q}^{T}\), and \(\varphi (u)\) denotes the discounted characteristic function under \(\mathbb {Q}.\) Furthermore, by using Radon-Nikodym derivatives we can have the following expression:

all we need to do is to derive the formula of \(\varphi (u)\) to have the pricing formula.

Theorem 1

If the asset price is governed by the dynamic system (1), the discounted characteristic function \(\varphi (u; X,v,\hat{v}, r_{1},r_{2} ,\lambda , \tau ) \) takes the following form:

where

Proof

\(\varphi (u;X,v,\hat{v},r_{1},r_{2},\lambda ,\tau )\) satisfies a PIDE by applying the Feynman-Kac theorem:

If we assume that \(\varphi (u;X,v,\hat{v},r_{1},r_{2},\lambda ,\tau )\) takes the form of

and substitute into Eq. (20), we can obtain

with boundary conditions \(C(u,0)=D_{v}(u,0)=D_{\hat{v}}(u,0)=E(u,0)=F(u,0)=G(u,0)=0.\) by applying some algebraic calculations, we will obtain the result.

3 Numerical Discussion

We’ll analyze European option prices under DHJDF with two-factor stochastic interest rate model parameters in this section. The parameters we use are listed in Table 1.

Figure 1 shows that changes in the mean-reversion level \(\theta _{\lambda }\) have a significant effect on call option prices, while changes in the mean-reversion rate \(k_{\lambda }\) have little effect on call option prices. The obtained results show that an increase in the value of \(\theta _{\lambda }\) leads to an increase in the value of the call option price.

Figure 2 illustrate the effect of the presence of the jump intensity process on call option prices. It shows that the price of a call option with stochastic jump intensity is greater than the price of a call option with a constant jump intensity.

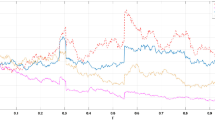

On the other hand. By using theoretical results of pricing formula, we can investigate the impact of incorporating a two-factor stochastic interest rate into DHJD model with approximative fractional Brownian motion and stochastic intensity under the chosen set of parameters. It can be distinctly observed that our price model’s is high that the Heston’s price. Specifically, depicted in Fig. 3 is the option prices with different time to expiry. Clearly, our price and the price of Heston are about the same when the time of expiry increases, the gap between our price and the Heston price increases. The reason that this phenomenon happens is increasing time to expiry implies a longer period of time for the interest rate changes which can thus definitely rate that can reflect the widened divide.

4 Conclusion

This paper introduces the European option under double Heston jump-diffusion hybrid model based on approximative fractional Brownian motion by adding interest rate follow two-factor Vasicek model and jump intensity follow a stochastic process. We derived a closed pricing formula for European option under this model by used the Radon-Nikodym derivative. The numerical results show that European call option prices under this model are higher than those under the double Heston model and Heston model.

References

Bakshi, G., Cao, C., Chen, Z.: Empirical performance of alternative option pricing models. J. Finance 52(5), 2003–2049 (1997)

Bates, D.S.: Jumps and stochastic volatility: exchange rate processes implicit in deutsche mark options. Rev. Financ. Stud. 9(1), 69–107 (1996)

Björk, T., Hult, H.: A note on Wick products and the fractional Black-Scholes model. Finance Stoch. 9, 197–209 (2005)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–659 (1973)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econometrica 53, 385–407 (1985)

Chang, Y., Wang, Y., Zhang, S.: Option pricing under double Heston jump-diffusion model with approximative fractional stochastic volatility. Mathematics 9, 126 (2021). https://doi.org/10.1155/2021/6634779

Duan, J., Wei, J.: Pricing foreign-currency and cross-currency options under GARCH. J. Deriv. 7(1), 51–63 (1999)

El-Nouty, C.: The fractional mixed fractional Brownian motion. Statist. Probab. Lett. 65(2), 111–120 (2003)

Goard, J.: Closed-Form formulae for European options under three-factor models. Commun. Math. Stat. 8, 379–408 (2018)

Grzelak, L.A., Oosterlee, C.W., Van Weeren, S.: Extension of stochastic volatility equity models with the Hull-White interest rate process. Quant. Financ. 12(1), 89–105 (2012)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6(2), 327–343 (1993)

Hu, Y., Øksendal, B.: Fractional white noise calculus and application to finance. Infin. Dimens. Anal. Quantum Probab. Relat. Top. 6(1), 1–32 (2003)

Hull, J., White, A.: The pricing of options on assets with stochastic volatility. J. Financ. 42(2), 281–300 (1987)

Hull, J.C., White, A.D.: Using Hull-White interest rate trees. J. Deriv. Spring 3(3), 26–36 (1996)

Jiang, G.J.: Testing option pricing models with stochastic volatility, random jumps and stochastic interest rates. Int. Rev. Financ. 3(3–4), 233–272 (2002)

Kou, S.G.: A jump-diffusion model for option pricing. Manag. Sci. 48(8), 1086–1101 (2002)

Mishura, Y.: Stochastic Calculus for Fractional Brownian Motions and Related Processes. Springer, Heidelberg (2008). https://doi.org/10.1007/978-3-540-75873-0

Rindell, K.: Pricing of index options when interest rates are stochastic: an empirical test. J. Bank. Financ. 19(5), 785–802 (1995)

Scott, L.O.: Option pricing when the variance changes randomly: theory, estimation and an application. J. Financ. Quant. Anal. 22(4), 419–438 (1987)

Scott, L.O.: Pricing stock options in a jump-diffusion model with stochastic volatility and interest rates: applications of Fourier inversion methods. Math. Financ. 7(4), 413–426 (1997)

Schöbel, R., Zhu, J.: Stochastic volatility with an Ornstein-Uhlenbeck process: an extension. Eur. Rev. Financ. 3(1), 23–46 (1999)

Stein, E.M., Stein, J.C.: Stock price distributions with stochastic volatility: an analytical approach. Rev. Financ. Stud. 4(4), 727–752 (1991)

Sun, L.: Pricing currency options in the mixed fractional Brownian motion. Phys. A 392(16), 3441–3458 (2013)

Thao, T.H.: An approximate approach to fractional analysis for finance. Nonlinear Anal. Real World Appl. 7, 124–132 (2006)

Vasicek, O.: An equilibrium characterization of the term structure. J. Financ. Econ. 5(2), 177–88 (1977)

Wiggins, J.B.: Option values under stochastic volatility: theory and empirical estimates. J. Financ. Econ. 19(2), 351–372 (1987)

Xiao, W., Zhang, W., Xu, W.: Parameter estimation for fractional Ornstein-Uhlenbeck processes at discrete observation. Appl. Math. Model. 35(9), 4196–4207 (2011)

Xiao, W., Zhang, W., Xu, W., Zhang, X.: The valuation of equity warrants in a fractional Brownian environment. Phys. A 391(4), 1742–1752 (2012)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

If the risk-free interest rate follows the Two-Vasicek model, then \(P(r_{1},r_{2},t,T)\) should satisfy the following PDE problem:

If we assume that \( P(r_{1},r_{2},t,T)\) takes the form of

and substitute it into PDE (23), we can obtain:

with the terminal condition \(B_{1}(0)=B_{2}(0)=A(0)=0\) Then we have :

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Bayad, S., El Hajaji, A., Hilal, K. (2023). Valuing Option Under Double Heston Jump-Diffusion Model with Stochastic Interest Rate and Approximative Fractional Brownian Motion. In: Melliani, S., Castillo, O. (eds) Recent Advances in Fuzzy Sets Theory, Fractional Calculus, Dynamic Systems and Optimization. ICPAMS 2021. Lecture Notes in Networks and Systems, vol 476. Springer, Cham. https://doi.org/10.1007/978-3-031-12416-7_33

Download citation

DOI: https://doi.org/10.1007/978-3-031-12416-7_33

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-12415-0

Online ISBN: 978-3-031-12416-7

eBook Packages: EngineeringEngineering (R0)