Abstract

In recent years, supply chain disruptions caused by unexpected events have occurred more and more frequently, and these disruptions have been proven to have both short- and long-term negative impacts on supply chain operations and on corporate profitability. Thus, it is imperative to first analyze and understand the effects of these risks and then develop solutions to mitigate their impacts. In this study, an optimization approach is developed for integrated design and operations for resilient supply chain networks with disruption risk considerations. A mixed binary integer programming model is formulated for this purpose. Scenarios are used to describe disruption events of the facilities, and disruption events may take place at multiple facilities at the same time in a scenario. Uncertainties in supplies, demands, and prices are also considered. A region-wide dual-sourcing strategy, strategic emergency inventories, and alternative sourcing facilities are used in the supply chain network design stage to increase network resilience. The Sample Average Approximation method is used to solve the proposed model with disruption risk considerations. An illustrative example is used to demonstrate the validity of the model and sensitivity analysis results are reported to examine the effects of important parameters on the performance of the resulting resilient supply chain networks.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

With the economic globalization, many supply chain networks (SCNs) span wide geographic areas and involve many business firms. The relationship among the business firms in a SCN has become increasingly complex. At the same time, SCNs have changed the environment and conditions of the global economy. While helping business firms increase their profits, SCNs also face challenges of supply chain disruption risks. Supply chain disruption risks may cause significant casualties, property losses, ecological environment destructions, and/or serious social harms. According to the origins, characteristics, and mechanisms, disruption risks generally can be divided into natural hazards, accidental disasters, public health emergencies, and public safety events. In spite of the low occurrence probabilities of these disruption risks, the subsequent impacts are huge and the consequences are difficult to control once happened. A disruption event may cause irrevocable damages on the whole SCN. All such disruption events are considered to be low probability and high impact causing significant damages to business operations.

In recent years, supply chain disruptions caused by unexpected events have occurred frequently. Events like the September 11 Attacks and Hurricane Katrina brought huge disasters to different SCNs (Tang, 2006a; Snyder, 2003; Sheffi, 2005; Barrionuevo & Deutsch, 2005; Latour, 2001; Mouawad, 2005). These disruption events showed high risks and changed the characteristics of the modern business environment. Although international SCNs are believed to be stronger and more reliable, in fact, many such international SCNs are fragile and easy to fail when unexpected disruption events happen. For example, the disastrous earthquake and the following tsunami struck Japan in March 2011 not only caused heavy casualties and property losses, but also halted the production in a broad spectrum of the industries in the northeast of the country because of plant ruins, transportation blockages, and/or power outages. As a consequence, the global electronics industries underwent a large supply shortage since Japan is the major supplier for electronics components such as semiconductors, LCD panels, flash memory chips, and so on (Clark & Takahashi, 2011). Many such disastrous SCN disruption events have happened in the last two decades (e.g., Miller, 1992; Christopher & Peck, 2004; Yang et al., 2004; Boyle et al., 2008; Tang, 2006b; Rodrigues et al., 2008; Kleindorfer & Saad, 2005; Prater, 2005; Tomlin, 2006). The COVID-19 pandemic is a more recent noteworthy incident in supply chain disruptions. A hard-hit area is the auto parts and supplies industry. More than 80% of the world's auto parts are made in China. According to data reported, the export value of auto parts from China exceeded 60 billion US dollars in 2019, of which 40% was exported by subsidiaries of foreign-funded enterprises in China. According to reports, Hyundai Motor Company closed a major assembly line in Ulsan, South Korea, due to the disruption of parts supply from China caused by the COVID-19 pandemic, and further aggravation of the impact of the pandemic may force it to stop the operation of three factories in South Korea, which account for 40% of its global productionFootnote 1.

Traditional SCN design theory and methods are facing new challenges because of the huge destructions caused by disruption events. Compared with the traditional risks such as demand and price uncertainties, these disruption risks are accidental but more destructive to SCNs, which makes the study of SCN optimization under disruption risk considerations particularly important (Park et al., 2013; Fujimoto & Park, 2014; Paul et al., 2016; Gao et al., 2019). So far, most of the studies assume that facilities are always available. Carefully constructed plans from traditional SCN design models can be severely ruined if they fail to consider disruption risks in the design phase and therefore do not have countermeasures when disruptions do strike. However, no matter how secure a SCN is, it cannot completely avoid disruption risks such as natural disasters, operational accidents, etc. Since disruption events cannot be avoided completely, the key is to reduce the impacts of disruption events to SCNs. Therefore, considering the disruption risks in the designing process, giving the SCNs the ability to quickly return to normal operational conditions after disruptions, and designing resilient SCNs will undoubtedly have important value and significance.

The design and operations of SCNs in the petroleum industry motivated this study and the oil industry in northeast China is used as an illustrative example. Crude oil plays a vital role in the development of the world economy because it is one of the most important energy sources and the most important raw material of the petrochemical industry. Two oil crises in the 1970s caused tremendous damages and impacts to the economies and social lives of the oil importing and consuming countries. In recent years, there is an upward trend in the occurrences of unexpected oil supply disruption events causing oil supply failures (Manuj & Mentzer, 2008; Tong et al., 2011; Tverberg, 2012; McKillop, 2005; Mitchell & Mitchell, 2014). An oil SCN is a complex system that connects the business firms of different functions including supplies, production, storage, alternative sourcing facilities, transportation, and sales. Currently, oil SCNs have various problems (Varma et al., 2008;Chen, 2008) such as unreasonable locations of refineries, unreasonable locations of crude oil reserve bases and oil product reserve bases, imperfect transportation networks, lack of the ability to cope with emergencies, and so on. Based on the above reasons, oil energy security has become a strategic issue for the sustainable economic development and national security of China in the new century and has now caused wide concerns of relevant government departments and the general public. Therefore, considering disruption events in the SCN design and operations decisions will enable the SCN to recover quickly from disruptions and ensure stable operations and profits of the business firms involved in oil SCNs.

The remainder of this chapter is organized as follows. In Sect. 2, a general review of the relevant literature is provided. Section 3 describes the problem studied. Section 4 presents the mathematical model. Section 5 describes the solution method. Section 6 shows an illustrative example for verifying the proposed model and presents the sensitivity analysis results. Most of the data used in the illustrative example are presented in the Appendix. Finally, conclusions are drawn and future works are outlined in Sect. 7.

2 Literature Review

There is an emerging literature dealing with disruption risks in SCN design and operations. About SCN resilience, Muckstadt et al. (2001) considered that enhancing cooperation among SCN members and reducing uncertainty of the operating environment were effective methods to make supply chain resilient. Sheffi (2001) proposed the use of double suppliers to improve SCN resilience and provided a qualitative analysis. More and Babu (2008) developed a unified SCN resilient research framework. Soni and Jain (2011) proposed a new framework for supply chain resilience leveraging existing knowledge and offering a better understanding of the available notion in the literature. Boin et al. (2010) outlined a new method of studying resilient supply chains for extreme situations. Hasani and Khosrojerdi (2016) studied SCN design under disruption and uncertainty considering resilience strategies. Fattahi et al. (2017) considered a responsive and resilient SCN design under operational and disruption risks with delivery lead-time sensitive customers. Ghavamifar et al. (2018) explored the practical application of a bi-level model in a resilient competitive SCN. Azad and Hassini (2019) investigated the design of reliable SCNs to make them resilient to unpredictable disruptions.

Many scholars studied SCN resilience and some of them proposed quantitative models to enhance SCN resilience. However, most of the models consider only one resilience strategy, and cannot increase the SCN resilience obviously when multi disruption events strike.

Many scholars reported studies about SCN design (Bidhandi et al., 2009) and some of them studied SCN design and operations under risks using quantitative models. Klibi et al. (2010) presented a critical review of the optimization models proposed in the literature and also discussed the importance of robustness, responsiveness, and resilience of SCNs. Peidro et al. (2009) reviewed the relevant literature in supply chain planning methods under uncertainty. Cui et al. (2010) developed a mixed integer programming (MIP) model and a continuous approximation of the model for the uncapacitated fixed cost facility location problem under facility disruption risks. Peng et al. (2011) proposed a MIP model minimizing the nominal, i.e., without disruptions, cost while reducing the disruption risks using thep-robustness criterion, and solved the problem with a heuristic procedure. They demonstrated the tradeoffs between nominal cost and system reliability concluding that substantial improvements in reliability were often possible with minimal increase in cost. Klibi and Martel (2012) provided a risk modeling approach to facilitate the design of SCNs and to evaluate operations under uncertainty. Two cases were studied to illustrate the key aspects of the approach and to show how the approach could be used to obtain resilient SCNs under disruptions. Baghalian et al. (2013) developed a stochastic mathematical programming formulation for designing a multi-product SCN comprising of several capacitated production facilities, distribution centers (DCs) and retailers under disruptions. Sabouhi et al. (2018) proposed a two-stage possibilistic-stochastic programming model for integrated supplier selection and SCN design under disruption and operational risks. Al-Othman et al. (2008) developed a multi-period stochastic planning model of a petroleum business operating in an oil producing country under uncertain market conditions. In the model, the uncertainties are introduced in market demands and prices. Oliveira and Hamacher (2012) presented a multi-product and multi-period supply investment planning problem considering network design and discrete capacity expansion under demand uncertainty. Hamdan and Diabat (2020) proposed a bi-objective two-stage model using robust optimization techniques under the disaster scenarios. Goh et al. (2007) developed a multi-stage stochastic programming model for a global SCN with objective functions of maximizing profits and minimizing risks, and proposed a solution method based on the Moreau-Yosida regularization (Hiriart-Urruty & Lemarchal, 1993). Mitra et al. (2009) used fuzzy mathematical programming methods for multi-site, multi-product, and multi-period SCN design under an uncertain environment. Georgiadis et al. (2011) used a linear MIP model to study the SCN design problem under time varying demand uncertainty. The global optimal solution of the linear MIP model was obtained by using the standard branch and bound technique. Mirzapour Al-e-hashem et al. (2011) proposed a multi-objective nonlinear MIP model for a SCN with multiple suppliers, multiple manufacturers, and multiple customers, addressing a multi-site, multi-period, and multi-product aggregate production planning problem under uncertainty. The objectives are the minimization of the total cost and the minimization of the total customer dissatisfaction represented by the sum of the maximum shortages. Li et al. (2013) explored a generalized supply chain model with supply uncertainty. Although an approach has not been developed for systematic SCN design under disruption risks, the results of these studies provide theoretical basis and technical methods for this study. However, as Paul et al. (2016) pointed out, most of the previous studies considered only one risk factor such as uncertainty or disruption in a single stage and very little has been done in developing quantitative models to manage other risks, such as imperfect production processes, and disruptions in production, supply, and demand, as well as their combinations.

There is also a growing body of literature addressing strategic emergency inventories (Schmitt, 2011; Sheffi, 2005; Lücker et al., 2019), which should be held throughout the supply chain to withstand disruption risks. Yin and Rajaram (2007) considered the joint pricing and inventory control problem using a Markov chain. In addition, many researchers studied the problem of supplier selection. Sawik (2013, 2014a, b, 2015) studied the problem of optimal selection and protection of portion suppliers and determined order quantity allocation in a supply chain with disruption risks. Considering the static and price-sensitive demand environment, Yu et al. (2009) assessed the effect of disruption risks to the single- and dual-sourcing models through the comparison of the expected profit functions, and illustrated how to make purchase decisions through a numerical example.

In this study, an integrated optimization approach is developed for the design and operations decisions of resilient SCNs under facility disruption risks and conventional risks. A binary MIP model based on stochastic scenarios is proposed to solve the problems. This study is different from previous studies mainly in the following three aspects: (1) According to the specific characteristics of oil supply chains, a four-echelon supply chain structure, including suppliers, plants, DCs, and demand areas, is studied. The optimization of design and operations from the perspective of the whole oil SCN in northeast China is studied as an illustrative example. The conclusions drawn from the numerical analysis provide more insights into the oil SCNs. (2) Rather than considering only disruption risks or conventional risks as in previous studies, both disruption events such as natural hazards and uncertainties such as fluctuations in prices and demands are considered in this study. Disruption events may take place at multiple facilities in a SCN at the same time. Stochastic scenarios are used to describe uncertainty risks which make the solutions of the proposed model closer to reality. (3) Three resilient strategies, i.e., region-wide dual-sourcing, strategic emergency inventories, and alternative sourcing, are used in SCN design. (4) An optimization approach is designed for problems with a large number of scenarios. As pointed out by Santoso et al. (2005), most existing approaches for SCN design under uncertainty are suited for small numbers of scenarios. Considering a SCN with just 50 facilities, each facility is vulnerable to two possible disruption conditions, and each disruption event is independent, then there are a total of 450 possible scenarios, that is far more than most of the existing approaches for SCN design can handle. In this study, a recently proposed sampling strategy, the Sample Average Approximation (SAA) method (Kleywegt et al., 2001; Shapiro & Homem-de-Mello, 2000; Mak et al., 1999), is used to solve the integrated optimization problem of SCN design and operations decisions under disruption risks and conventional risks. The SAA method uses discrete scenarios to handle the randomness in a stochastic optimization model by means of Monte Carlo simulation, so as to facilitate the solution process of the model. As the number of scenarios becomes large, the sample average of the objective function values will approach the expected value of the objective function, and the solution obtained will be a good approximation of the optimal solution, of the model. Furthermore, the number of scenarios can be adjusted in the solution process to achieve the desired precision of the approximation. Given the stochastic nature of the disruptive risks considered in the SCN, the SAA method is suitable in solving the resilient SCN design problem under disruption risks. Because of the stochastic nature of the model and the large number of binary variables involved in the model, exact solution methods directly using a commercial software such as IBM® ILOG® CPLEX® (IBM, 2022) may not be able to solve the problem within a reasonable amount of computation time.

3 Problem Description

A manufacturer usually purchases its raw materials from a number of suppliers and distributes its final products to many customers through DCs. In the oil industry, a manufacturer needs to choose locations for its refineries and DCs among several candidate sites. With the rapid development of the global economy, the market environment is becoming more dynamic and unstable. Transactions between business firms are becoming complicated. Many disruption risks exist in the business environment. To avoid losses caused by disruptions, a business firm needs to consider the reliability of the whole SCN from a strategic perspective. When disruptions occur, the business firm should have the ability of mitigating risks in the SCN through coordination and cooperation among the members of the SCN.

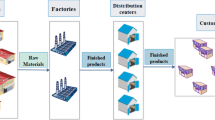

In this study, a four-echelon SCN optimization problem is considered. The four echelons include suppliers, plants, DCs, and customer demand areas. The suppliers, plants, and DCs are collectively called facilities. In the following, a customer demand area is simply called a customer. The locations of the suppliers and customers are given and candidate or potential sites for plants and DCs are chosen. It is not necessary to use all potential suppliers and it is also not necessary to construct plants or DCs at all potential sites. Therefore, the SCN design problem is to determine which potential suppliers to use, at which potential sites to construct plants and DCs, and the quantities of materials and products to transport among the various facilities and customers. A typical SCN is depicted graphically in Fig. 1. The facilities and customers are called nodes and the roads between facilities and/or customers are called arcs in the SCN.

Two types of risks in a SCN are considered. The first type of risks includes conventional risks coming from uncertainties in supplies, demands, and prices such as production delays, demand variations, and price fluctuations. To deal with the conventional risks, each plant or DC may hold a certain amount of safety stock, a plant may choose more than one supplier to purchase its raw materials, and a DC may choose more than one plant to purchase its products. The second type of risks includes disruption risks stemming mainly from the following three factors: (1) emergencies in daily operations, such as industrial accidents that may cause equipment, vehicle, and/or inventory damages, (2) natural disasters such as earthquakes, hurricanes, storms, debris flows, etc., and (3) terrorism and political instability. Due to disruption risks, the supplies of facilities in a SCN may stagnate.

Scenarios are used to describe the disruptions of the facilities and the fluctuations in supplies, demands, and prices. However, the influence of each scenario on the capacities of the SCN facilities is different. Disruption events may take place at multiple SCN facilities, i.e., at suppliers, plants, and/or DCs, at the same time in one scenario. Three strategies, i.e., dual-sourcing or region-wide dual-sourcing, strategic emergency inventories, and alternative sourcing facilities, are proposed to cope with disruption events. When disruption events happen, strategic emergency inventories can provide different quantities of key raw materials or products to other facilities in the SCN. Therefore, overall collaboration among facilities in the SCN is achieved and the ability of the SCN to cope with failure events is enhanced with low sharing costs. After the disruption events, plants and DCs in the SCN can choose alternative sourcing facilities to provide the unmet demand of raw materials/products to ensure that the facilities in the SCN will continue to operate. A dual-sourcing strategy indicates that a buyer uses two suppliers, one of which may dominate the other in terms of business share, price, reliability, and so on. A region-wide dual-sourcing strategy is on the basis of the dual-sourcing strategy by selecting different upstream facilities from a different region to provide better network coverage and, hence, to enhance the resilience of the network infrastructure in the SCN. Once a supply chain infrastructure is constructed, it will be very difficult and costly to modify. Therefore, it is important to design a SCN with stability and efficiency in the presence of all types of disruption risks.

The following assumptions are made about the operations of the SCN: (1) the occurrence of each scenario is independent; (2) strategic emergency inventories and alternative sourcing facilities will never be disrupted and will be used only when disruption events happen; and (3) a facility loses all its capacity when it is disrupted. The SCN design needs to achieve a reasonable profit level by reducing losses caused by disruptions and by balancing the various SCN parameters.

4 Mathematical Model

The binary MIP formulation is discussed in this section. The notations, including sets and indices, parameters and decision variables, used in the model are introduced first. The model is then formulated with further explanations.

4.1 Sets and Indices

Different sets of facilities and transportation modes are considered in the SCN design. The notations for these sets are presented in Table 1.

4.2 Parameters

Various parameters are used in the binary MIP model. The values of these parameters need to be determined before the model is formulated. These parameters are listed in Table 2.

4.3 Decision Variables

Both continuous and binary decision variables are used in the binary MIP model. These variables are defined in Table 3.

4.4 The Model

The objective function and the constraints of the binary MIP model are presented first. Further explanations are then given.

The objective function (1) maximizes the total weighted SCN profit. The profit is the difference between sales revenue (the first term in the bracket in (1)) and the total costs. The total costs consist of raw material cost (the second term in the bracket in (1)), production cost (the third term in the bracket in (1)), transportation cost (represented by \( {C}_s^t \) (2)), stockout penalty cost (the last term in the bracket in (1)), strategic emergency inventory holding cost (represented by Ce (3)), alternative sourcing facility cost (represented by Ca (4)), and fixed operating costs of the whole SCN (represented by F (5)). Constraints (2)–(5) are used to compute the different costs. These costs (2)–(5) are substituted into the objective function directly in the solution process.

Constraints (6)–(9) are the conservation of flow constraints for the suppliers, plants, DCs, and customers, respectively, in each scenario. The constraints in (6) also serve as the capacity constraints of the suppliers and the constraints in (9) also serve as the demand constraints of the customers. Constraints (10) and (11) represent the capacities of the plants and the DCs, respectively, in each scenario. Constraints (12) and (13) restrict the total quantities provided by the alternative sourcing facilities to be within their respective capacities for the plants and the DCs, respectively. Constraints (14) and (15) represent the requirements that the strategic emergency inventories used by the plants and DCs, respectively, must be within their respective capacities. Constraints (16) and (17) restrict the strategic emergency inventories to be used only if a facility has chosen to use them for the plants and the DCs, respectively. Constraints (18)–(20) are the capacity constraints of logistics service providers or transportation modes for each scenario. Constraint (21) restricts the total stockout quantity to be within the tolerance for each scenario. Constraints (22)–(24) represent dual-sourcing strategy restrictions. Each plant is served by exactly 2 suppliers (22), each DC is served by exactly 2 plants (23), and each customer is served by exactly 2 DCs (24). Constraints (24) and (25) are sourcing strategy constraints of the customers. Each customer can only choose 2 DCs (24) one of which is not in the same region (25). Constraints (26)–(28) restrict materials or products to flow on a road only when the corresponding upstream facility is chosen to serve the downstream facility. Constraints (29)–(31) restrict an arc to be chosen only when both the origin and the destination nodes are chosen.

5 A Solution Method

The solution procedure is described in this section. The approach used for scenario generation is discussed first. The SAA method tailored to the binary MIP model in (1)–(31) is then described in detail.

5.1 Scenario Generation

Different types of possible disruption events, such as earthquakes, rainstorms, floods, and other types of environmental issues, may strike the facilities in a SCN. In the scenario generation process, Nd is used to represent the index set of the types of disruption events. Historical data and related statistics are used to determine ϕn representing the number of occurrences of disruption event n within time period T. A good estimate of the expected frequency of disruption event n is ϕn/T. The occurrences of the disruption events are assumed to follow Poisson distributions, as the Poisson distribution is suitable and is usually used to describe the number of occurrences of a random event per unit of time (Neter et al., 1993). The probability of any disruption event occurring more than once in any one unit of time is set to 0 to more accurately describe the characteristics of disruption events. The probability of disruption event n occurring in a time unit is then given by \( p(n)=1-{e}^{-{\phi}_n/T} \). In the scenario generation process, to determine whether disruption event n occurs in a facility, a random number rn is generated first, and then the disruption event n occurs if rn ≤ p(n). The facility is disrupted if one or more disruption events occur in the facility.

The supply of the raw material and the demand of the final product are treated as normal random variables. The prices of the raw material and the final product are generated using the Geometric Brown Motion proposed by Awudu and Zhang (2012), a continuous-time stochastic process in which the logarithm of the randomly varying quantity follows a random movement. Let Pt represent the price to be generated at time t and t is a continuous variable, then

where P0 is the initial price with P0 > 0,μ and σ are the mean and standard deviation of the price of either the raw material or the final product, ε is a standard normal random variable, and dt is a time interval. Given the mean μ and the standard deviation σ, the values of the prices Pt of either the raw material or the final product in the scenarios are randomly generated by using the function above (32). The procedure of scenario generation is shown in Fig. 2. In this scenario generation procedure, \( {F}^{\mathrm{norm}}\left({\mu}_i,{\sigma}_i^2\right) \) returns a normal random variable with mean μi and a variance \( {\sigma}_i^2 \).

5.2 The Solution Procedure

Because of the large number of binary variables in the model, the time needed to solve the problem in (1)–(31) using a general purpose mathematical programming software through the calculation of mathematical expectations is unimaginable. Therefore, a scenario-based approach is used to obtain an approximate final solution. However, the computational time needed to solve a real-life problem increases rapidly as the number of scenarios increases. The SAA method (Kleywegt et al., 2001; Shapiro & Homem-de-Mello, 2000; Mak et al., 1999) can be applied to the model to reduce the computation time. The SAA method is a solution approach for stochastic optimization problems with large numbers of scenarios. This approach approximates the expected objective function value utilizing Monte Carlo simulation. The idea of this technique is to generate a sample of scenarios to construct an approximation and to solve the approximation instead of the actual problem.

The approximation is a binary MIP model that is set up by using N scenarios. The objective function of the approximation is given in Eq. (33) in the following

and the constraints are the union of all the constraints of the N scenarios. The value of the objective function FN (33) is an estimate of the expectation of the original problem.

The SAA method tailored to the binary MIP model in Eqs. (1)–(31) is described step-by-step in the following.

-

Step 1: Randomly generate M sets of, each containing N, scenarios. One binary MIP problem is solved for each set. The objective function of the binary MIP problem is in (33) and the constraints are the union of all the constraints of the N scenarios in the set. As a result, M solutions are obtained. Denote the optimal value of the objective function (33) for set m by \( {F}_m^N \). The SCN structure whose objective function value is the largest among the M sets is the tentative solution.

-

Step 2: Compute the average of the M optimal objective function values

The expectations of FN is not less than the optimal value of the original problem, and \( \overline{F^{MN}} \) is an unbiased estimate of the expectation of FN (Mak et al., 1999). Hence, \( \overline{F^{MN}} \) can be considered as the upper bound on the objective function of the original problem.

-

Step 3: Randomly generate a set of N′, with N′ > > N, scenarios. Use the SCN structure of the tentative solution in Step 1 to form a network optimization problem with the objective function in Eq. (33) but with N′ replacing N and with the union of the constraints of the N′ scenarios as the constraints. Note that the values of the binary variables are known in this network optimization problem. Solve the network optimization problem to obtain the value FN' for the objective function. Obviously FN' is a lower bound on the objective function of the original problem (Mak et al., 1999). The lower bound FN' will be close to the true objective function value when N′ is large.

-

Step 4: Evaluate the quality of the tentative solution by computing the estimated optimality gap gapN, M, N' using the estimated lower and upper bounds from Steps 2 and 3, as follows:

-

Step 5: If the value of gapN, M, N' is unsatisfactory, a larger value of N or M is used and Steps 1–4 are repeated until the value of gapN, M, N' becomes satisfactory (e.g., gapN, M, N' ≤ 0.05). The tentative solution is then the final solution.

6 An Illustrative Example

In this section, the model and the solution procedure are used to solve an integrated problem of SCN design and operations in an illustrative example. This illustrative example is based on a real-life SCN optimization problem of the oil industry in northeast China. China has several large-scale oilfields with annual output exceeding 100,000 tons (1 ton ≈ 7.40 barrels), such as Daqing, Liaohe, etc. Because of the frequent fluctuations in outputs, prices and demands of crude oil and petroleum products as well as all kinds of factors that may lead to disruption risks, it has been a difficult and crucial problem for the oil supply chain to coordinate its production and operations activities to improve efficiency, reliability, and stability. An integrated optimization model will help optimize the facility location, logistics assignment, and inventory strategy to reduce cost and improve efficiency of the whole SCN, so that the SCN participants may then adjust their plans quickly when responding to changes in the market and to disruption events by making the right decisions.

In this illustrative example, the oil SCN optimization problem in Liaoning province is considered. In order to fulfill the needs of provincial gasoline consumption, the oil refineries in Liaoning province purchase crude oil from Liaohe, a local oilfield, and some oilfields in the surrounding provinces, i.e., Daqing (in Daqing, Heilongjiang), Shengli (in Dongying, Shandong), Dagang (in Tianjin), and Jilin (in Songyuan, Jilin). The gasoline produced by the refineries is distributed by DCs (i.e., gasoline distributors) to the demand areas in the cities of Liaoning province. Due to disruption risks, the emergency facilities including alternative sourcing facilities and strategic emergency inventories are used in this supply chain. Under the above conditions, the following decisions need to be made: (1) locations of the refineries and DCs, (2) the use of strategic emergency inventories and/or alternative sourcing facilities, and (3) the logistics assignments between the SCN facilities as well as the customers. The locations of the 5 major crude oil suppliers (oil fields) and the 14 major gasoline consumption areas (cities), and the candidate locations of the 5 major potential refineries and the 7 major potential gasoline DCs, are shown in Fig. 3.

6.1 Model Inputs

The main input parameters are listed in Tables 4, 5, and 10–18. The values of these parameters are found or estimated from the data on websites or statistical year books of relevant government departments. According to the actual situation of Liaoning province, two transportation modes (NL = 2), i.e., highway and railway, are considered. The distance between any two facilities is estimated using Google Earth. In order to make the distances more realistic, tortuosity factors \( {c}_1^{tor}=1.1 \) and \( {c}_2^{tor}=1.5 \) are used for highway and railway, respectively.

The planning period is one month for this illustrative example. The monthly amortizations of fixed construction costs of refineries and DCs are given by\( \overline{f}=\left(r/\left(1-1/{\left(1+r\right)}^t\right)\right)\cdot f \), where f is the total investment in the facility, r = 0.0035 is the interest rate, and t = 60 is the asset depreciation period in months. The monthly amortizations of fixed construction costs are reflected in the fixed operating costs shown in Tables 11 and 12.

Table 4 shows the values of the related parameters of facility capacities, productions, and demands. As the crude oil productions of the major oil fields and gasoline demands of different demand areas are available for recent years from the government websites, their means and variances can be estimated. The demand of a demand area is further estimated based on the total demand of the whole province according to the population of each city. The means and variances of the prices of crude oil and gasoline are undifferentiated among all suppliers and demand areas because of market volatility.

Furthermore, the maximum tolerable stockout quantity is B = 100 × 103 tons. The capacities of the strategic emergency inventories for refineries and DCs are ηM = 100 × 103 tons and ηD = 100 × 103 tons, respectively. The radius of a region is 200 km for the purpose of the region-wide dual-sourcing strategy. The production transformation coefficient is ρ = 0.7. Some other input parameters are listed in the Appendix. All quantities and costs are for a month for this illustrative example.

Scenarios are generated using the method in Sect. 5.1. Disruption events considered in this illustrative example include earthquake (magnitude scale ≥ 5), rainstorm (daily precipitation ≥ 200 mm), flood, and typhoon as shown in Table 5. These are major natural disasters that may take place in Liaoning province. Table 5 also shows the frequency of each disruption risk in each city of Liaoning province, calculated based on the historical data since 1949. The probabilities of the disruption risks can be estimated by the method described in Sect. 5.1. Because there is no record that any of the crude oil suppliers was disrupted by environmental events, the probabilities of the suppliers being disrupted are set to 0.

6.2 Numerical Results

The binary MIP model is solved with the SAA method on a laptop computer with an Intel i7-5500U processor and 8G RAM. The SAA method is implemented using IBM® ILOG® CPLEX® 12.2.Footnote 2 The scale of the model, measured in the number of constraints and the numbers of different types of decision variables, is given in Table 6.

The optimized SCN structure is shown in Fig. 4. Crude oil suppliers chosen in the result are Jilin, Liaohe, Dagang, and Shengli. Because refineries at Liaoyang and Dandong are more exposed to disruption risks, all the downstream DCs served by these refineries have chosen alternative sourcing facilities to secure their supplies. Figure 4 also shows the corresponding assignments of supplies and transportation modes between the different nodes. The quantities shipped between the facilities are not shown because they vary from scenario to scenario. The total profit of the SCN is ¥27222393.73 × 103. Numerical results show that customer demands can still be satisfied within the tolerable stockout quantity when multiple facilities are disrupted. This result shows that the SCN is resilient and the proposed approach is effective.

The computation time used is 115.01 s to solve the illustrative example in CPLEX® by using the SAA method with a gap = 0.0004. CPLEX® is also used directly to solve the problem without using the SAA method. Unfortunately it is not able to obtain a feasible solution within the running time limit of 6 h.

6.3 Numerical Analysis

Sensitivity analysis results are reported in this section. Specifically, the profit levels with and without disruption risk considerations are compared, customer service levels of using the conventional and resilient strategies are evaluated, the effects of changes in alternative sourcing and strategic inventory costs and of changes in demand on profit levels are examined.

6.3.1 With vs. Without Disruption Risk Considerations

In this subsection, the performances of the SCN with and without disruption risk considerations are compared. With disruption risk considerations, the final solution is obtained with the SAA method as discussed above. Without disruption risk considerations, the model is solved assuming the facilities are never disrupted but the supplies, demands, and prices are stochastic. Disruption events are then introduced into the optimal SCN structure. For comparison purpose, the disruption events in these two cases are the same and N = 1000 scenarios are generated by the method described in Sect. 5.1. In order to ensure feasibility of the two cases above, the total stockout quantity in constraint (21) is relaxed by increasing the value of B to B = 1000 × 103 tons.

The performances of the final SCNs with and without disruption risk considerations are compared in Fig. 5. The bar labeled Case 1 represents the profit obtained by the SCN without disruption risk considerations when no disruption event strikes. The bars labeled Case 2 and Case 3 represent the profits obtained by the SCNs without and with disruption risk considerations, respectively, when disruption events do happen. As shown in Fig. 5, the SCN without disruption risk considerations performs best when no disruption event occurs but worst when it operates in an environment with disruption risks. On the other hand, the SCN with disruption risk considerations performs better even when disruption events happen. When compared with Case 1, the profit levels of Cases 2 and 3 decrease by 45.84% and 4.04%, respectively. Obviously, the SCN with disruption risk considerations is superior to that without disruption risk considerations when disruption risks exist in the supply chain.

6.3.2 Conventional vs. Resilient Strategies

In this subsection, the advantages of resilient SCNs over the conventional SCNs, i.e., without using the strategic emergency inventories and alternative sourcing, are discussed. The profits and service levels of the two cases are compared. The cycle service level is used, which is defined by \( 1-{\sum}_{h\in H}{b}_{sh}/{\sum}_{h\in H}{D}_{sh}^{dem} \) for each scenario s. To ensure feasibility of both cases, the total stockout quantity in constraint (21) is relaxed by increasing the value of B to B = 1000 × 103 tons. Constraints associated with resilient SCNs are also relaxed and the values of the parameters related to alternative sourcing facilities (wm, wd, Ssubs, Msubm) are all set to zero for the conventional SCNs.

Result shows that there is not much difference in the profit levels between these two SCNs, but there is a big difference in their service levels as shown in Fig. 6. The bars labeled Case 4 represent the minimum and maximum service levels with the conventional strategy. The bars labeled Case 5 represent the minimum and maximum service levels with the resilient strategy. The minimum service level in Case 4 is 21.63%. Although it occurred in only one scenario, it causes a great loss to the entire SCN once it happens. In contrast, the lowest service level in Case 5 with the resilient strategy is 86.32%. Compared with Case 4, Case 5 increases the lowest service level by 299.08%. Apparently, decision makers would prefer the resilient strategy.

6.3.3 Changes in Alternative Sourcing and Strategic Inventory Costs

In this subsection, the effects of changes in variable costs of alternative sourcing and strategic emergency inventories for the DCs are analyzed. The results are graphically shown in Fig. 7. As the supply chain relies on alternative sourcing and strategic emergency inventories to deal with disruption risks, the profit of the SCN linearly decreases as the average variable costs of these two strategies increase. Furthermore, the effect of the average variable cost of alternative sourcing is much greater than that of strategic emergency inventories. To improve the SCN profit and stability, the decision makers should pay more attention to the average variable cost of alternative sourcing. Finding the appropriate alternative sources and negotiating reasonable prices would help in improving the SCN profit.

6.3.4 Changes in Demands

Changes in demands are always key factors influencing the supply chain performance. Sensitivity analyses are performed when the means and standard deviations change to see their effects on the SCN profit and service levels.

Results are obtained when the means or standard deviations of demands increased and decreased by 20% from their current values. Figure 8 compares the SCN profits using the profit level of the SCN with the current demands as a benchmark. Both of the changes in the means and standard deviations affect the SCN profit. However, the changes in the means of demands have much greater impacts.

Comparisons of the expected service levels are shown in Tables 7 and 8 when the means or standard deviations in demands change. Changes in the means of demands do not affect much in the expected service levels of each demand area. However, when the standard deviations of demands change, the expected service levels fluctuate. Specifically, the expected service levels of some demand areas decrease (increase) when the standard deviations of demands increase (decrease). Table 9 shows the minimum service levels of the demand areas when the means of demands change. Some demand areas suffer much lower (higher) minimum service levels when the means of demands increase (decrease). Hence, the uncertainties in, rather than the averages of, the demands have strong impacts on the SCN performance. These results show the importance of disruption risk considerations in the integrated optimization of design and operations for resilient SCNs. For this illustrative example, the expected service levels are all higher than the service level requirement (85%) under all of the changes.

7 Conclusions

An integrated optimization approach is developed for resilient SCN design and operations with disruption risk considerations and a binary MIP model is formulated for this purpose. Resilient strategies like region-wide dual-sourcing, strategic emergency inventories, and alternative sourcing are used in buffering disruption risks in the SCN designing process to increase the resilience of the resulting SCN. Scenario generation is used to evaluate the effectiveness of the approach. Disruption events are allowed to take place at multiple facilities in a SCN at the same time in one scenario. With these scenarios used in the integrated optimization approach, the obtained SCN is much more resilient and much more suitable for the real-life applications.

The SAA method is used to solve the proposed model under disruption risk considerations. An illustrative example based on a real-life problem is studied to demonstrate the validity and effectiveness of the integrated optimization approach. The results show that a good and resilient solution can be obtained with the SAA method. Profit levels and customer service levels are used to measure the SCN performance. The numerical analysis results show that the SCN obtained with disruption risk considerations performs much better than the conventional SCN. Compared with that of strategic emergency inventories, the average variable cost of alternative sourcing is a more important factor affecting the profit level of the SCN. The uncertainties or fluctuations in demands have a strong impact on the SCN profit and service levels. Therefore, the consideration of demand uncertainties is important in the integrated optimization of SCN design and operations.

There are still some limitations in this study. First, all the disruption events, such as earthquakes, rainstorms, floods, and Typhoons, are assumed to have the same disruption severity. In reality, the impacts of these disruption events may not be the same. Another related limitation is that a facility is assumed to lose all its capacity when disrupted. In reality, the disrupted facility may still be partially operational. For future works, more complex stochastic processes may be considered to overcome these limitations by generating scenarios that are closer to reality when more sophisticated disruption risks are considered. As the scale of the binary MIP model can be extremely large and the SCN integrated optimization problem can be hard to solve when more complex scenarios are considered, more efficient solution methods should be designed to solve the problem. Analytical, simulation, and other hybrid methods may also be helpful in solving these SCN integrated optimization problems.

References

Al-Othman, W. B., Lababidi, H., Alatiqi, I. M., & Al-Shayji, K. (2008). Supply chain optimization of petroleum organization under uncertainty in market demands and prices. European Journal of Operational Research, 189(3), 822–840.

Awudu, I., & Zhang, J. (2012). Stochastic production planning for a biofuel supply chain under demand and price uncertainties. Applied Energy, 103(1), 189–196.

Azad, N., & Hassini, E. (2019). A benders decomposition method for designing reliable supply chain networks accounting for multimitigation strategies and demand losses. Transportation Science, 53(5), 1287–1312.

Baghalian, A., Rezapour, S., & Farahani, R. Z. (2013). Robust supply chain network design with service level against disruptions and demand uncertainties: A real-life case. European Journal of Operational Research, 227(1), 199–215.

Barrionuevo, A., & Deutsch, C. (2005, September 1). A distribution system brought to its knees. New York Times.

Bidhandi, H. M., Yusuff, R. M., Ahmad, M. M. H. M., & Bakar, M. R. A. (2009). Development of a new approach for deterministic supply chain network design. European Journal of Operational Research, 198(1), 121–128.

Boin, A., Kelle, P., & Whybark, D. C. (2010). Resilient supply chains for extreme situations: Outlining a new field of study. International Journal of Production Economics, 126(1), 1–6.

Boyle, E., Humphreys, P., & McIvor, R. (2008). Reducing supply chain environmental uncertainty through e–intermediation: An organisation theory perspective. International Journal Production Economics, 114(1), 347–362.

Chen, M. E. (2008). Chinese national oil companies and human rights. Orbis, 51(1), 41–54.

Christopher, M., & Peck, H. (2004). Building the resilient supply chain. The International Journal of Logistics Management, 15(2), 1–14.

Clark, D. and Takahashi, Y. (2011, March 12). Quake disrupts key supply chains. The Wall Street Journal Asia.

Cui, T., Ouyang, Y., & Shen, Z. J. M. (2010). Reliable facility location design under the risk of disruptions. Operations Research, 58(4), 998–1011.

Fattahi, M., Govindan, K., & Keyvanshokooh, E. (2017). Responsive and resilient supply chain network design under operational and disruption risks with delivery lead-time sensitive customers. Transportation Research Part E: Logistics and Transportation Review, 101, 176–200.

Fujimoto, T., & Park, Y. W. (2014). Balancing supply chain competitiveness and robustness through “virtual dual sourcing”: Lessons from the Great East Japan Earthquake. International Journal of Production Economics, 147, 429–436.

Gao, S. Y., Simchi-Levi, D., Teo, C.-P., & Yan, Z. (2019). Disruption risk mitigation in supply chains: The risk exposure index revisited. Operations Research, 67(3), 831–852.

Georgiadis, M. C., Tsiakis, P., Longinidis, P., & Sofioglou, M. K. (2011). Optimal design of supply chain networks under uncertain transient demand variations. Omega–International Journal of Management Science, 39(3), 254–272.

Ghavamifar, A., Makui, A., & Taleizadeh, A. A. (2018). Designing a resilient competitive supply chain network under disruption risks: A real-world application. Transportation Research Part E: Logistics & Transportation Review, 115, 87–109.

Goh, M., Lim, J. Y. S., & Meng, F. W. (2007). A stochastic model for risk management in global supply chain networks. European Journal of Operational Research, 182(1), 164–173.

Hamdan, B., & Diabat, A. (2020). Robust design of blood supply chains under risk of disruptions using Lagrangian relaxation. Transportation Research Part E: Logistics & Transportation Review, 134, 1–18.

Hasani, A., & Khosrojerdi, A. (2016). Robust global supply chain network design under disruption and uncertainty considering resilience strategies: A parallel memetic algorithm for a real-life case study. Transportation Research Part E: Logistics & Transportation Review, 87, 20–52.

Hiriart-Urruty, J. B., & Lemarchal, C. (1993). Convex analysis and minimisation algorithms II. Springer.

IBM. (2022). IBM ILOG CPLEX Optimization Studio, build and solve complex optimization models to identify the best possible actions. Retrieved from https://www.ibm.com/products/ilog-cplex-optimization-studio?utm_content=SRCWW&p1=Search&p4=43700050328194740&p5=e&gclid=CjwKCAiA5t-OBhByEiwAhR-hmxqKlDEpg09sjw6c-vbrdib-JSDW_pwnfac8F1diTNY4csLCY0K7rRoCneIQAvD_BwE&gclsrc=aw.ds

Kleindorfer, P. R., & Saad, G. H. (2005). Managing disruption risks in supply chains. Production and Operations Management, 14(1), 53–68.

Kleywegt, A. J., Shapiro, A., & Homem-de-Mello, T. (2001). The sample average approximation method for stochastic discrete Optimization. SIAM Journal of Optimization, 12(2), 479–502.

Klibi, W., & Martel, A. (2012). Scenario-based supply chain network risk modeling. European Journal of Operational Research, 223(3), 644–658.

Klibi, W., Martel, A., & Guitouni, A. (2010). The design of robust value–creating supply chain networks: A critical review. European Journal of Operational Research, 203(2), 283–293.

Latour, I. A. (2001, January 29). Trial by fire: A blaze in Albuquerque sets off major crisis for cellphone giants. Wall Street Journal.

Li, X., Li, Y., & Cai, X. (2013). Double marginalization and coordination in the supply chain with uncertain supply. European Journal of Operational Research, 226(2), 228–236.

Lücker, F., Seifert, R. W., & Biçer, I. (2019). Roles of inventory and reserve capacity in mitigating supply chain disruption risk. International Journal of Production Research, 57(4), 1238–1249.

Mak, W.-K., Morton, D. P., & Wood, R. K. (1999). Monte Carlo bounding techniques for determining solution quality in stochastic programs. Operations Research Letters, 24(1–2), 47–56.

Manuj, I., & Mentzer, J. T. (2008). Global supply chain risk management strategies. International Journal of Physical Distribution & Logistics Management, 38(3), 192–223.

McKillop, A. (2005). Oil: No supply side answer to the coming energy crisis. Refocus, 6(1), 50–53.

Miller, K. D. (1992). A framework for integrated risk management in international business. Journal of International Business Studies, 23(2), 311–331.

Mirzapour Al-e-hashem, S. M. J., Malekly, H., & Aryanezhad, M. B. (2011). A multi-objective robust optimization model for multi-product multi-site aggregate production planning in a supply chain under uncertainty. International Journal of Production Economics, 134(1), 28–42.

Mitchell, J. V., & Mitchell, B. (2014). Structural crisis in the oil and gas industry. Energy Policy, 64(5), 36–42.

Mitra, K., Gudi, R. D., Patwardhan, S. C., & Sardar, G. (2009). Towards resilient supply chains: Uncertainty analysis using fuzzy mathematical programming. Chemical Engineering Research & Design, 87(7A), 967–981.

More, D., & Babu, A. S. (2008). Perspectives, practices and future of supply chain flexibility. International Journal of Business Excellence, 1(3), 302–336.

Mouawad, J. (2005, September 4). Katrina’s shock to the system. The New York Times.

Muckstadt, J. A., Murray, D. H., Rappold, J. A., & Collins, D. E. (2001). Guidelines for collaborative supply chain system design and operation. Information Systems Frontiers, 3(4), 427–453.

Neter, J., Wasserman, W., & Whitmore, G. A. (1993). Applied Statistics (4th ed.). Allyn and Bacon.

Oliveira, F., & Hamacher, S. (2012). Stochastic benders decomposition for the supply chain investment planning problem under demand uncertainty. Pesquisa Operacional, 32(3), 663–678.

Park, Y., Hong, P., & Roh, J. J. (2013). Supply chain lessons from the catastrophic natural disaster in Japan. Business Horizons, 56(1), 75–85.

Paul, S. K., Sarker, R., & Essam, D. (2016). Managing risk and disruption in production-inventory and supply chain systems: A review. Journal of Industrial & Management Optimization, 12(3), 1009–1029.

Peidro, D., Mula, J., Poler, R., & Lario, F. C. (2009). Quantitative models for supply chain planning under uncertainty: A review. The International Journal of Advanced Manufacturing Technology, 43(3–4), 400–420.

Peng, P., Snyder, L. V., Lim, A., & Liu, Z. (2011). Reliable logistics networks design with facility disruptions. Transportation Research Part B: Methodological, 45(8), 1190–1211.

Prater, E. (2005). A framework for understanding the interaction of uncertainty and information systems on supply chains. International Journal of Physical Distribution and Logistics Management, 35(7–8), 524–539.

Rodrigues, V. S., Stantchev, D., Potter, A., Naim, M., & Whiteing, A. (2008). Establishing a transport operation focused uncertainty model for the supply chain. International Journal of Physical Distribution and Logistics Management, 38(5), 388–411.

Sabouhi, F., Pishvaee, M. S., & Jabalameli, M. S. (2018). Resilient supply chain design under operational and disruption risks considering quantity discount: A case study of pharmaceutical supply chain. Computer & Industrial Engineering, 126, 657–672.

Santoso, T., Ahmed, S., Goetschalckx, M., & Shapiro, A. (2005). A stochastic programming approach for supply chain network design under uncertainty. European Journal of Operational Research, 167(1), 96–115.

Sawik, T. (2013). Selection of resilient supply portfolio under disruption risks. Omega–International Journal of Management Science, 41(2), 259–269.

Sawik, T. (2014a). Joint supplier selection and scheduling of customer orders under disruption risks: Single vs. dual sourcing. Omega–International Journal of Management Science, 43, 83–95.

Sawik, T. (2014b). Optimization of cost and service level in the presence of supply chain disruption risks: Single vs. multiple sourcing. Computer & Operation Research, 51(3), 11–20.

Sawik, T. (2015). On the risk-averse optimization of service level in a supply chain under disruption risks. International Journal of Production Research, 54(1), 1–16.

Schmitt, A. J. (2011). Strategies for customer service level protection under multi-echelon supply chain disruption risks. Transportation Research Part B: Methodological, 45(8), 1266–1283.

Shapiro, A., & Homem-de-Mello, T. (2000). On rate of convergence of Monte Carlo approximations of stochastic programs. SIAM Journal on Optimization, 11, 70–86.

Sheffi, Y. (2001). Supply chain management under the threat of international terrorism. The International Journal of Logistics Management, 12(2), 1–11.

Sheffi, Y. (2005). The resilient enterprise: Overcoming vulnerability for competitive advantage. MIT Press.

Snyder, L. M. (2003). Supply chain robustness and reliability: Models and algorithms. Northwest University.

Soni, U., & Jain, V. (2011). Minimizing the vulnerabilities of supply chain: A new framework for enhancing the resilience. In IEEE International Conference on Industrial Engineering and Engineering Management (IEEM) (pp. 933–939). Springer.

Tang, C. S. (2006a). Robust strategies for mitigating supply chain disruptions. International Journal of Logistics Research and Applications, 9(1), 33–45.

Tang, C. S. (2006b). Perspectives in supply chain risk management. International Journal of Production Economics, 103(2), 451–488.

Tomlin, B. (2006). On the value of mitigation and contingency strategies for managing supply chain disruption risks. Management Science, 52(5), 639–657.

Tong, K., Feng, Y., & Rong, G. (2011). Planning under demand and yield uncertainties in an oil supply chain. Industrial & Engineering Chemistry Research, 51(2), 814–834.

Tverberg, G. E. (2012). Oil supply limits and the continuing financial crisis. Energy, 37(1), 27–34.

Varma, S., Wadhwa, S., & Deshmukh, S. G. (2008). Evaluating petroleum supply chain performance: Application of analytical hierarchy process to balanced scorecard. Asia Pacific Journal of Marketing and Logistics, 20(3), 343–356.

Yang, B., Burns, N. D., & Backhouse, C. J. (2004). Management of uncertainty through postponement. International Journal of Production Research, 42(6), 1049–1064.

Yin, R., & Rajaram, K. (2007). Joint pricing and inventory control with a Markovian demand model. European Journal of Operational Research, 182(1), 113–126.

Yu, H. S., Zeng, A. Z., & Zhao, L. D. (2009). Single or dual sourcing: Decision-making in the presence of supply chain disruption risks. Omega–International Journal of Management Science, 37(4), 788–800.

Acknowledgments

This work was partially supported by the Chinese National Natural Science Foundation (No. 70972100).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Guan, Z., Tao, J., Sun, M. (2022). Integrated Optimization of Resilient Supply Chain Network Design and Operations Under Disruption Risks. In: Khojasteh, Y., Xu, H., Zolfaghari, S. (eds) Supply Chain Risk Mitigation. International Series in Operations Research & Management Science, vol 332. Springer, Cham. https://doi.org/10.1007/978-3-031-09183-4_10

Download citation

DOI: https://doi.org/10.1007/978-3-031-09183-4_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-09182-7

Online ISBN: 978-3-031-09183-4

eBook Packages: Business and ManagementBusiness and Management (R0)