Summary

Macroeconomics studies the performance of the economy as a whole. Trajectories of aggregate variables, as income, consumption, investment, or unemployment, are typically determined, in standard economic theory, through simple mechanic models based on strong assumptions of rationality, efficiency, optimality, and equilibrium. These models have been useful to address many relevant issues and have contributed to a solid understanding of how macro-variables relate and how economic policies might be implemented to increase welfare and enhance growth. Notwithstanding, there is, in such settings, an unrealistic view of how people act: Economic agents are identical in their endowments, preferences, decision-making capabilities, and other features, implying that standard macro-analysis might be pursued under the convention that exists a unique representative agent that solves an infinite horizon optimal control planning problem. As it is frequently pointed out, standard economic theory considers a simple world where a sophisticated agent makes choices. Though, in reality, the opposite occurs: Agents are not sophisticated decision-makers, and the world is complex and impossible to process in its entirety by any individual agent. To better understand macro-phenomena, a methodological change is required: Heterogeneity, interaction, bounded rationality, and the use of decision heuristics must be accounted for, in order to further explore the dynamics of collective economic behavior and, therefore, to better understand, predict, and act upon important macro-problems, as recessions, persistent unemployment, or rising inflation.

Credits should be acknowledged to Dr. Filipe Inteiro, Communication Department, ISCAL.

The code of this chapter is 01001101 01100001 01100011 01110010 01101111 01100101 01100011 01101111 01101110 01101111 01101101 01101001 01100011 01110011.

John Maynard Keynes [1] famously opined, “If economists could manage to get themselves thought of as humble, competent people on a level with dentists, that would be splendid.” He was expressing a hope that the science of macroeconomics would evolve into a useful and routine type of engineering. In this future utopia, avoiding a recession would be as straightforward as filling a cavity.

Mankiw N. G. [2, p. 44].

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Macroeconomics

- Representative agent

- Behavioral heterogeneity

- Decision-making heuristics

- Interaction and coordination

1 Introduction

Research in macroeconomics poses two fundamental challenges. First, one should remark its forward-looking nature. Economics in general, and specifically macroeconomics, deals with future events and their inherent uncertainty, with the way in which such events can be predicted, and with how agents form expectations about the foreseeable evolution of income, investment, employment, inflation, and other aggregate variables. Second, macroeconomics is associated with the study of collective behavior, which is particularly difficult to stylize and model, given the complex dynamic interactions that emerge whenever individual agents engage in contact with one another with the goal of promoting their specific self-interests.

The business transactions that decentralized interaction processes allow for, the institutions that the interplay among agents creates and consolidates, and the policies that public authorities implement to influence aggregate outcomes, are, in fact, pieces of a complex world that constitute the object of study of macroeconomics. As such, it makes sense to associate macroeconomics to the realm of complexity sciences, and one would expect the research in this field of knowledge to rely upon such approaches as agent-based modeling or large-scale simulation studies (techniques that might be, as well, suitable instruments to address the uncertainty issues that were first mentioned).

However, since its inception, macroeconomics has shown resistance regarding the adoption of a multi-agent simulation perspective and, instead, has opted to propose simple toy models built upon basic equilibrium concepts. Partially, this methodological choice has been successful. Many scientific results accomplished in the field are, nowadays, perceived as important tools for policy guidance. Both fiscal policy and monetary policy are, in current days, well supported in scientific knowledge, and scientific breakthroughs have helped many countries in the adoption of successful policies regarding price stability, output and employment stabilization, and poverty alleviation (in this last case, mainly through welfare-state measures).

Notwithstanding, there is a large consensus among macroeconomists that much is yet to be done. Crises as the great recession of 2007–2008 or the most recent negative economic impact of the COVID-19 is difficult to fit into the suit that economists have sewed. Macro-models are elegant representations of how a rigid set of assumptions about the behavior of people and institutions deliver unequivocal results on the performance of the economy. Most of the time, the problem resides on the assumptions, that might be adequate to describe the actions of economic agents in normal circumstances to allow for relevant policy guidance, but frequently fail to represent the behavior of people in periods marked by some sort of disruption or distress. The prototype model, under which a representative rational agent maximizes consumption utility, apparently collapses when the premises in which it holds are no longer adequate to describe the world that we live in.

Gradually, the path followed by macroeconomics is shifting. Macroeconomists have realized that to conceive and consolidate a structure of analysis that is simultaneously helpful for a deep understanding of reality and to allow for relevant policy guidance. Some new elements must be brought into the design of the theories. Among these new features, one might highlight heterogeneity (of behavior, endowments, skills, expectations), decentralized interaction, and the use of simple heuristics to replace sophisticated optimal planning.

As the following sections will discuss, some of the above-mentioned features are being introduced in macroeconomic theory in a variety of different modalities. However, a fully integrated approach of heterogeneity-interaction-heuristics in macroeconomics is still missing in the academic literature. The main purpose of this manuscript is to stress the need to develop such a framework, where the parsimony of a single agent taking a limited number of decisions at some initial date for an unspecified time horizon is replaced by a wide array of distinct behaviors, a large number of diverse interaction rules, and a profusion of decision heuristics.

All of this might be combined into complex simulation models that, although somehow voluminous, are capable of representing, characterizing, and predicting observable phenomena with much more accuracy and detail than the standard macro-models. In a way, the fundamental shift consists in putting people into economic models, with their limited knowledge, with their idiosyncrasies, and with their will to benefit from participating in markets and institutions.

The remainder of the chapter is organized as follows. Section 2 reflects on the object of macroeconomics. Section 3 engages in a brief tour through the history of mainstream macroeconomic thought. In Sect. 4, it is emphasized how macro-theory is being reshaped with the help of some important contributions that put in the center of the analysis the idea of multi-agent virtual worlds, where heterogeneous agents endowed with limited knowledge and skills locally interact. Section 5 presents a brief suggestion on how heterogeneity, heuristics, and interactions can be added to macro-frameworks, in the case of a macro-framework dealing with consumption-savings choices. Finally, Sect. 6 concludes.

2 What is Macroeconomics About?

Everyday life decisions require knowledge about how the economy as a whole is structured and how it works. Macroeconomics is the science that studies the overall performance of the economy, by looking at the intertemporal behavior of aggregate variables and how they relate to and influence one another. Such aggregate variables include real values, such as output (GDP—gross domestic product), income (GNI—gross national income), consumption, investment, employment, government expenditures, or taxes; and also nominal variables, including the interest rate, the price level, or the inflation rate.

Understanding macroeconomics requires aggregation, i.e., not only variables, but also agents and markets must be subject to some form of clustering. Concerning economic agents, these are typically aggregated in four different classes: households, firms, financial institutions, and the government. The first three of these classes of agents put together a large array of individuals and entities with distinct endowments, preferences, and objective functions. Government, in turn, is a unique agent that has the capacity and the possibility to take centralized actions with impact over the entire macroeconomic system. The actions taken by governments in an economic context are known as economic policy and they take essentially two forms: fiscal policy (management of tax collection and government expenditures) and monetary policy (manipulation of interest rates with the goal of determining money supply).

In what respects markets, it is typically stipulated that the understanding of the macroeconomy requires conceiving a market for all the goods and services that are transacted (the real market), which is analyzed alongside the money market (supply and demand for money, taking as counterpart other, less liquid, financial assets) and also the markets for production inputs, most predominantly the labor market. The real and money markets constitute the demand side of the macroeconomy and typically receive the greatest attention by economists (who tend to attribute to aggregate demand a particularly important role in the formation of business cycles), while the labor market and the markets for physical capital and technology are the ones that explain the behavior of aggregate supply.

Macroeconomics is essentially about two subjects: the long-term process of wealth accumulation and economic growth; and the short-run aggregate fluctuations that constitute business cycles. Economists typically agree on which are the main determinants of economic growth and on how these might generate a significant and sustained in time increase in per capita income (they include the accumulation of physical inputs—capital and labor—innovation and, at the basis, the consolidation of credible and reliable institutions). They disagree, however, to a large extent, about the causes and propagation mechanisms underlying short-term fluctuations. At this latest level, there is a long-lasting debate between the Keynesian view, grounded on the teachings of [1], and the neoclassical theory, inspired in the work of [3,4,5], among others.

The main beacon of neoclassical macroeconomists is the faith in the self-regenerating capacity of markets to restore their own equilibrium. If markets are permanently in equilibrium, aggregate fluctuations cannot be associated with any kind of market failure or lack of coordination. In other words, the causes of business cycles must be real in nature and associated with the supply-side of the economy: Technological shocks, disturbances in input markets, or preference changes regarding labor-leisure choices of households, are the candidate triggers of observed fluctuations. On the other hand, Keynesian scholars interpret market imperfections, lack of coordination, information failures, and the sluggish adjustment of prices and wages as the fundamental features underlying business cycles which can, in this case, be characterized as a systematic and continuous departure of markets from their alleged equilibrium position.

In synthesis, despite the disagreement in the interpretation of some phenomena, the object of macroeconomics is well defined: It studies the evolution of aggregate real and nominal variables over time, providing important information for the everyday life of households and firms. Having knowledge on how GDP, employment, investment, inflation, or interest rates evolve is fundamental to make well-informed decisions that allow agents to thrive and prosper. Information on macroeconomic variables and their relationships is also essential for governments to take decisions and implement policies that contribute to increasing prosperity and to a balanced and equitable distribution of the generated wealth.

Looking at the world we live in today, we encounter multiple macroeconomic problems that require attention and action: There are huge per capita income differences between developed and developing countries; income inequality within countries is very high and it is still increasing almost everywhere; the world economy continues to be prone to severe recessions, as the 2007–2008 great recession; the economy reveals its fragility in moments of global turmoil or distress, as the coronavirus pandemic under way; there are still many countries suffering recurrent problems of high unemployment or high inflation, or both.

Macroresearch, as developed in the last decades, was able to build a consistent theory that with relative success addresses some of the issues mentioned in the previous paragraph. However, this theory presents limitations: It cannot explain all observable phenomena and it is often surprised by how reality evolves. Furthermore, it has not provided the policy guidance that many states would desire to solve or soften the most pressing problems concerning poverty, unemployment, or increased cost of living. In the following section, a brief tour of the success and failures of mainstream macro-theory is undertaken, paving the way for the discussion that follows on alternative approaches to characterize and explain the macroeconomy.

3 Mainstream Macro-Theory

Despite the well-known Keynesian—neoclassical controversy in macroeconomics, there is a relatively wide consensus regarding the techniques of analysis to employ to approach macro-events and macro-relations. This consensus is built upon the use of representative agent models and intertemporal optimization problems. Because agents form expectations and make decisions rationally, they adopt a similar behavior, and therefore the macroeconomy might be scrutinized through the analysis of the behavior of a median or representative agent. Heterogeneity plays no role in orthodox macroeconomic thinking, although heterogeneity is, in fact, the element that, in reality, underlies the richness associated with collective actions.

In the paragraphs that follow, we undertake a brief tour over the most emblematic macroeconomic theories produced over the last few decades.Footnote 1 In them, there is a pervasive feature, which is precisely the notions of representative household and representative firm (or a single representative agent), accompanied by a planning behavior that frequently consists of maximizing or minimizing an objective function over a long or even infinite horizon. We go through growth theory, households’ consumer choice, dynamic stochastic general equilibrium models, new Keynesian theory, and models of matching unemployment.

In growth theory, the benchmark model that explains intertemporal consumption choices is the optimal control problem designed by Ramsey [7] and further elaborated by [8, 9]. In this model, a forward-looking representative agent plans, at a given initial date, the future trajectory of consumption that serves the goal of maximizing consumption utility over an infinite horizon. Basically, the decision to make is how much to consume on every date, which is the same as saying that the decision is about how much to save and spend along the assumed lifecycle.

In growth models, the decision of the representative agent is subject to a series of constraints, mainly related to the accumulation of material inputs (physical capital and human capital), but also with innovation and the generation of new ideas, processes that are fundamental to enhance the total factor productivity with which material inputs contribute to production. These prototypical models allow for relevant insights into the growth process. Overall, they indicate that long-term sustained growth requires more than capital accumulation, which is subject to decreasing marginal returns. Innovation and education are fundamental drivers of growth in the long term and, therefore, they must play a central role in any theory of economic growth.

Benchmark growth theory also offers a good platform to discuss convergence and divergence of income across nations. While a simplistic view based on the diminishing marginal returns approach may point to convergence (diminishing returns affect more intensely those economies in an advanced capital accumulation stage), the empirical experience reveals a strong variety of outcomes: Some countries are effectively converging, while other economies diverge, what points to a possible polarizing process regarding the pace of growth in our world. This diversity of growth processes is well accommodated by the simple paradigm of the representative agent who maximizes utility subject to wide economy constraints, as long as one accounts for a series of heterogeneous exogenous factors (i.e., different rates of population growth, different savings rates, different rates of technological progress, and different rates of capital depreciation).

Unlike growth models, macro-theories focused on the short-run, which are essentially related to the explanation of causes and consequences of cyclical fluctuations, tend to consider uncertainty and, thus, a stochastic component. This stochastic component is essentially associated with the formation of expectations. Since [10], the main assumption underlying the formation of expectations by economic agents is the rational expectations hypothesis. If agents formulate expectations in the same rational way, the immediate corollary is that agents are identical and, also in this context, the economy might be analyzed under the perspective of the representative agent.

Again, the fundamental piece of the theoretical reasoning is the intertemporal consumption utility framework. Given the budget constraint of the household, she will maximize the expected utility. The result is basically such that the agent desires to smooth consumption over the life cycle, an outcome first highlighted by [11, 12] in their life cycle and permanent income theories.

Putting together the consumption optimization framework with a capital accumulation constraint and adding to this setup labor-leisure choices, which allows to endogenize labor supply, it is possible to transform the typical optimal growth model into a dynamic stochastic general equilibrium (DSGE) model. The popular DSGE models are the basic framework through which neoclassical economists approach business cycles. Following the work of [5], which has initiated the Real Business Cycle (RBC) theory, one may add to such framework the possibility of exogenous shocks over technology. This allows us explaining how eventual stochastic innovation processes trigger fluctuations, i.e., periods of expansion followed by periods of recession. The popularity of RBC models came from the fact that a relatively simple model, based on the foundations of rational decision and rational behavior, could replicate with some degree of accuracy the stylized facts on short-term business cycles.

The neoclassical theory of business cycles, i.e., the RBC model, is subject to criticism, namely because the mechanism of propagation of fluctuations in this setting is essentially labor supply. If one recognizes that the wage elasticity of labor supply is low, this signifies that the underlying causes of business cycles must be other than supply-side shocks and their effect on labor-leisure choices. Keynesian authors have adopted a different view, namely a perspective in which the main underlying causes of business cycles are essentially attached to the rigidity of prices and wages and how this rigidity provokes inertia whenever a policy shock or a preference shock takes place.

The staggered prices model of [13] and the menu costs framework proposed by Mankiw [14] are two good examples of how the Keynesian view of imperfect markets and semi-rational behavior could be adapted in order to integrate the standard framework of analysis, which is still the representative agent DSGE framework.

One of the issues that mainstream macro-theory had difficulty in dealing with is unemployment. After all, if markets are permanently in equilibrium or even if they are just sluggish to adapt given the rigidity of prices and wages, unemployment would not be a fundamental problem, but only a transitory inconvenience. In any circumstance, the labor market, as any other market, would exhibit a tendency to adjust to the equilibrium position, an equilibrium that is Pareto efficient and, therefore, where unemployment cannot persist. However, reality shows that unemployment tends to be persistently high even in developed economies where institutions work well, information circulates freely, and agents are also free to react to incentives.

The most celebrated model of unemployment in economics is the search and matching model proposed by [15, 16]. The search and matching model takes not one representative agent but two agents, households and firms, that solve distinct optimization problems. The optimal control problem of firms consists in maximizing profits given their estimated revenues and the costs associated with paying wages and hiring new employees; in turn, households maximize their income, which comes from wages when employed and from some type of public assistance when unemployed. The solution of each of the above problems gives place to two different wages: The wage employees optimally expect to receive, and the wage employers optimally want to pay. There is no reason for these to coincide, and therefore, only through negotiation the two agents might reach a mutually beneficial outcome, which culminates with the worker occupying the vacancy offered by the employer.

The search and matching model introduces a minimal degree of heterogeneity. Unlike other macro-models, there is no merging of households and firms into a single agent with a common goal and common constraints. Nevertheless, the analysis continues to be based on an extreme degree of aggregation, where the interaction between agents with distinct preferences, endowments, and expectations dominates.

The frameworks that mainstream macro-theory was able to construct are relevant to understand important phenomena regarding the link between the behavior of agents and short-term and long-term performance of the economy and of the main economic aggregates. It has been successful in many respects, namely concerning the way it can inform political decision-makers. Through fiscal policy and monetary policy, governments and central banks have been able to tackle, with more or less success, the problems of recessions, unemployment, income inequality, price stability, and interest rate stability. We would not have growing economies with good living standards all around the world without following the powerful teachings that come from decades of a thorough analysis and modeling of the macroeconomic system.

Nevertheless, much is still to be done in what concerns the understanding of the functioning of the economy and the implementation of successful public policies. Additional steps must be taken in order to arrive in a more comprehensive theory capable of taking into account the idiosyncrasies of individual agents and the way the interaction among heterogeneous agents produces unique emergent phenomena. Until now, macroeconomics has put itself in a position where it can be contested on the grounds of the fallacy of composition: In the economy, as with regard to any other social or natural object, the whole is in no way the sum of the parts. The whole is the outcome of the complex interaction among simple but distinct individual pieces.

4 The Way Forward: Non-Optimal Decision-Making, Heterogeneity, and Interaction

The representative agent model frontally clashes with the observable evidence. Benartzi and Thaler [17] highlight that associated with the explicit representative agent assumption, there is a pair of two additional implicit assumptions that are in clear contrast or conflict with reality: First, in such a setting, agents cannot face any cognitive constraints and, second, agents must have the required willpower to fully and successfully execute the optimal plans they formulate.

As such, macro-theories based on the assumption of optimality and rational behavior suggest a planning ability, a cognitive capacity, and an unshakable will that represent a homo-economicus which can only be found in books written by economists. As [18] put it, it would be necessary for a supercomputer and a Ph.D. degree in economics for common households to be able to formulate and solve the kind of plans economists consider in their macroeconomic frameworks.

Frequently, household decisions are based on heuristics or rules-of-thumb, which do not conduct to the optimal outcome, but is feasible to formulate under the cognitive constraints faced by human beings. In the real world, populated by homo-sapiens and not by homo-economicus, individual agents face a multiplicity of constraints and obstacles when collecting and processing the relevant information required for decision-making. Such obstacles justify the reason why computation of optimal solutions is, frequently, from the start, replaced by the adoption of simple idiosyncratic choice rules.

Explaining human behavior, in the context of science, through heuristics, might be controversial, and certainly a less elegant solution than the one provided by the rationality approach. Finding heuristics that are pervasive in use and that unambiguously capture human behavior is a messy task, as highlighted by Haldane and Turrell [19], who indicate that for such a trivial subject as the formulation of a simple household consumption rule, the relevant literature has proposed an endless list of possible candidates. Nevertheless, this is the work of science: going through messy processes to arrive at frameworks of analysis that constitute important breakthroughs, and in what concerns decision heuristics this has been accomplished.

In [20,21,22], heuristics are classified as fast and frugal rules that make the best possible use of the available information given the constraints of time and knowledge that individuals face while conducting their deliberation processes. On many occasions, making well-thought, deep and careful decisions is not just possible. These authors go even further by claiming that on many occasions less processing might imply better inferences. This is the less-is-more principle, which has been used to justify that heuristics are not necessarily second-best approximations to optimal planning. Rules-of-thumb may outperform sophisticated forecasting tools-based onstrict rationality principles.

The use of simple decision rules in macrosettings, as highlighted in [23,24,25,26,27,28,29], is a possible path to replace the orthodoxy of optimal behavior and optimal forecasting. They are an important piece of the novel macroeconomic paradigm, but not the single one. While the optimal behavior assumption automatically implies that all agents behave identically, decision heuristics may diverge across individuals, opening the door to another fundamental feature underlying the new paradigm of analysis: heterogeneity.

The main problem with standard macroeconomics is that it falls in the so-called fallacy of composition, in which the whole is interpreted as being the mere sum of the parts. This overlooks the richness that arises once we consider the heterogeneity of preferences, endowments, capabilities, and expectations that lead, through interaction, to the prevalence of emergent phenomena. Even within the current orthodoxy, though, many macro-models are evolving in the direction of including elements of heterogeneity and interaction, as we remark in what follows.

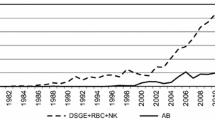

In two relevant studies, [30, 31] have proposed macro-models with two different classes of agents: the optimal planners or Ricardian consumers, and those who live hand-to-mouth (the non-Ricardian consumers, who ignore intertemporal trade-offs). These models are suitable to address monetary and fiscal policy implications in economies where agents do not share the exact same behavior. In [32] such type of analysis is extended, assuming instead of a two-agent framework, a setting where a multiplicity of different household consumption and savings behavior is allowed for. The Kaplan model received the designation of HANK (heterogeneous agents New Keynesian) model, to contrast with the TANK (two-agent New Keynesian) model and the RANK (representative agent New Keynesian) model.

Also, in [33] a standard optimal growth model is adapted in order to contemplate agent heterogeneity, decentralized interaction, and non-optimal behavior. This model constitutes a guide on how a conventional equilibrium growth model can be transformed into a multi-agent setting, with decentralized interaction among boundedly rational heterogeneous agents.

Under this more reasonable interpretation of human behavior, where agents are allowed to follow diverse strategies regarding decision-making and where such strategies do not have to coincide with optimal rational planning, and instantaneous relevant corollary emerges: psychological profiles matter for macroeconomics. This is true, for instance, in what concerns the fundamental choice between consuming now or later, i.e., the fundamental choice between consumption and savings.

The theory of rational behavior indicates that agents will want to smooth consumption, and therefore to save when their income is high to spend above income when their income is low. However, evidence shows that there is sentiment heterogeneity regarding savings (see [34]): There is a multiplicity of psychological factors influencing savings behavior (personality traits, self-control, regulatory focus, degree of optimism) that make some people be savers while others are, in a larger or smaller extent, spenders. At the end of the day, not all psychological profiles generate consumption smoothing; some households continue to save even when future consumption is more than guaranteed, while other households adopt a hand-to-mouth behavior with no concern about the future. We will get back to consumption-savings heterogeneity later in Sect. 5.

Synthesizing the discussion so far, one might say that there is an important evolution under way in economic thinking: The standard optimal planning framework has been refined or even replaced with behavioral features, where the actions of agents are modeled in a way that is more compatible with actual and observable decision-making processes. As remarked, for instance, by [35, 36], the world is too complex to be fully understood even by agents with an influential role in the economy, like governments or large corporations. In such a context, agents adopt different strategies and courses of action and promote interaction to attain their goals; in such a context, as well, the use of heuristics in the decision-making process is not a symptom of lack of rationality, rather a way to cope with the complexity of the world.

Typical economic models, where economic agents make use of a supernatural capacity to collect and process information to solve intertemporal optimization problems, are, therefore, receding in their scientific status, given the recognition that they are not truly reflexive of the complexity of the world and of the dynamics that emerge once interaction among different people is considered. In [37], it is pointed out that the economy and its agents are, indeed, complex systems. They are composed of a series of elements that interact in non-trivial ways to generate unique and unrepeatable outcomes.

In complex systems, spontaneous orders emerge and evolve without the intervention of any global controller or central planner. This results in an aggregate outcome that is path-dependent (events are historically determined) and that contrasts with the economic orthodoxy built upon the concepts of equilibrium, efficiency, optimization, and rationality. Under the complexity view, matters most the actual behavior of people than the conceptual framework associated with ideal optimal behavior. The “as is” gains predominance over the “as if” as a scientific premise.

Adopting a complexity perspective implies understanding that there is a permanent interaction between the micro- and the macro-levels. Micro-decisions and micro-actions shape the macro-dynamics, but these also influence the posterior behavior of the individual entities, and so forth. A successful macro-model, capable of giving a robust and intuitive explanation of reality, must account for the mentioned elements of complexity.

[38, 39] discusses the notion of the artificial world in the context of the study of the macroeconomy. The author’s interpretation of artificial world consists of a complex system based on an emergent hierarchical organization. Agents interact within a system composed of different hierarchical levels, and the hierarchical levels are formed and eventually disappear through the different types of relations established among agents. Every artificial world conceived under this perspective will share three elements: a set of entities at the micro-level, an environment where to interact, and a dynamic interaction process. The attributes of the microentities and the shape of the macroenvironment are constantly being reshaped under the designed interaction process.

Artificial worlds, generated in the way characterized above or in other similar ways, allow for the identification of emergent properties and macro-patterns. The dynamics of an artificial world are, in fact, an evolutionary process where mechanisms of replication, selection, and variation lead to an infinity of possible outcomes.

The new path for macroeconomic analysis is also strongly associated with the agent-based literature. According to [24], an agent-based approach is a bottom-up approach in which heterogeneous agents adopt simple rules to interact in a complex world. Furthermore, the resulting aggregate phenomena are emergent phenomena that arise from the apparently uncoordinated actions of a large number of individuals, who are not guided by any pre-determined equilibrium (differently from what happens in standard macro-theory).

The agent-based approach is a part of a wider trend in science in general, and in economics in particular, regarding the replacement of the mechanic equilibrium perspective, by another perspective that is more procedural, algorithmic, and simulation-based [40]. This is the complexity view, which sees socio-economic systems as complex systems that might be modeled through the simulation of artificial worlds. The ideas and notions of agent heterogeneity, bounded rationality, network connectivity, emergence, and out-of-equilibrium dynamics are the key concepts of this new paradigm, as characterized in [41,42,43,44,45,46].

The main obstacle associated with the implementation of a complexity view in macroeconomics concerns the many degrees of freedom that such an approach allows for. There is still, in the current state of affairs, too much arbitrariness in the definition of assumptions, in the selection of heuristics, in the formalization of sequences and timing of events, and in the design of rules of interaction. Conceiving a well-structured complex system capable of capturing the subtleties of the interaction of agents in a large-scale economy is a difficult task, which requires a sensible balance between simplicity and comprehensiveness. This is not easy to accomplish, but it is the endeavor that science must persist in trying to accomplish.

5 Heuristics and Heterogeneity: An Example

To briefly illustrate the path macroeconomics might follow once the notions of heterogeneity, local interaction, and rule-of-thumb behavior are fully assimilated, I recover the consumption decision rule proposed in [47]. This rule replaces the typical optimal household behavior with a static rule, in which agents might adopt different attitudes toward consumption and savings. Taking the terminology employed in [47], individual households might be ants (savers) or grasshoppers (spenders) in different degrees.

Agents are indexed by \(x \in \rm{\mathbb{R}}\). If \(x < 0\), then the agent is an ant, i.e., an agent with a given propensity to save, which increases with the absolute value of the index; if \(x > 0\), then the agent might be classified as a grasshopper, i.e., an agent that spends in consumption all of its income or an amount larger than current income. The design of the consumption rule requires the definition of the desired consumption threshold, such that

In Eq. (1), \(\overline{C}_t\) is the agent’s desired consumption which equals the agent’s income level, \(Y_t\), multiplied by a term that reflects the household’s psychological profile. Whenever \(x < 0\), the consumption level desired by the agent remains below the received income (this is the definition of an ant, in the current context). In the case \(x > 0\), desired consumption exceeds income, what is the characterization of the behavior of a grasshopper.

To simplify the presentation, assume that the agent’s income corresponds solely to the returns from wealth accumulation (i.e., labor returns are ignored). Considering that wealth, \(A_t \ge 0\), is remunerated at a rate of return r, the income level at period t is \(Y_t = rA_t\).

Given the above definitions, the proposed consumption rule is

Wealth accumulation obeys the following simple dynamic process,

where \(r \ge 0\) is the real interest rate. Wealth increases with asset returns and decreases with consumption.

Equation (2) has the following interpretation: When households are grasshoppers at an extreme point in which they would want to consume more than the accumulated wealth plus current income, they will in fact consume the aggregate wealth level plus income they possess in that specific time period. If the household is a grasshopper but her desired consumption remains below the accumulated wealth and income levels, then consumption will coincide with desired consumption. Whenever the agent desires to consume less than current income, the agent will save a share \(1 - \zeta \in \left( {0,1} \right)\) of the difference between income and desired consumption.

Consumption heuristic (2) might be rewritten under the following form,

Equation (4) makes it explicit the existence of two relevant thresholds: An agent for whom \( x \ge \ln \left( {\frac{{1 + r}}{r}} \right) \) will consume all her available wealth; an agent for whom \( 0 \le x < \ln \left( {\frac{{1 + r}}{r}} \right) \) consumes a multiple of her income; a household such that \(x < 0\) consumes a share \(e^x + \zeta \left( {1 - e^x } \right)\) of the corresponding income. The savings rate of this last type of agent is \(\left( {1 - \zeta } \right)\left( {1 - e^x } \right)\). Note that the heterogeneity in this rule is present in the level of parameter x which indicates the extent in which an agent is an ant or, alternatively, a grasshopper.

Given the established relations, it is straightforward to compute the growth rate of consumption in any of the three considered circumstances. Computation allows deriving the following outcome,

In the scenarios given by the first two segments of the consumption rule, consumption falls to zero. In the first case, this occurs instantly, as the household consumes all the available wealth at t = 0 and, thus, no more wealth is available to generate new income. In the second case, accumulation of wealth continues after the first period, as long as \(x < ln\left( {\frac{1 + r}{r} } \right)\), but the growth rate of consumption will be negative and, therefore, in this case, consumption also falls to zero. The only scenario in which consumption continues to grow in the long-term is the third one, i.e., the scenario in which agents save part of the income they access to in each period. This positive and constant growth rate means that the third scenario is the only one feasible if the agent intends to perpetuate consumption over time.

The long-run scenario contrasts with the short-run outcome. Observe that, at \(t = 0\), the following inequality holds,

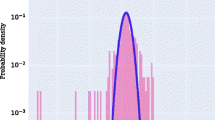

Therefore, the best solution in the long run, the one that allows consumption to continue to grow indefinitely, is the one that penalizes most the agent in the current initial period. Figure 1 depicts this outcome, for three different values of x, each one representing one of the three possible cases.

The above reasoning, synthesized in the graphic of Fig. 1, allows for two important considerations in the context of the macroeconomics change of paradigm: First, agents do not necessarily formulate sophisticated plans; for instance, regarding consumption, as is the case, agents may simply establish a benchmark of how much to spend given their prospective income. Second, by adopting a simple rule, one also opens the door to eventual heterogeneity of behavior; the specific assumed rule allows for agents to choose if they are spenders or savers to a certain extent. Not all agents are identical and some will give preference to the short-run relatively to the long-run or the opposite. Ants and grasshoppers certainly coexist in the economy given different degrees of impatience and care about future outcomes.

A third element, which can be added to the analysis, is the possibility of changing behavior through local interaction. Grasshoppers in contact with ants may perceive the advantages of saving for the future, in order to perpetuate consumption growth; or the opposite: Ants in contact with grasshoppers may be convinced of the short-run advantages of decreasing the absolute value of their x or even of putting it in the positive side. If this type of local interaction is systematic, leading to constant changes of adopted behavior, nonlinear aggregate outcomes will be found, as agents are constantly changing their strategies in order to balance the short-run/long-run trade-off.

6 Conclusion

Modeling the macroeconomy is not, in any circumstance, an easy task. There are too many variables that are intertwined in many ways. Moreover, each aggregate variable represents a large set of features that lose their individuality when placed under a single aggregate. Macroeconomics has made important progress along the last few decades in presenting relevant explanations for phenomena concerning the consumption-savings decisions of households, the investment decisions of firms, the policy choices made by governments and central banks, and the evolution of relevant macro-indicators as the unemployment rate or the inflation rate.

Nevertheless, and despite the elegance and robustness of the proposed models, researchers, policymakers, and the general public tend to feel that macroeconomics should go further and deeper in its explanatory capacity. The main failure seems to be related to the simplifying assumption regarding the notion of the representative agent. No meaningful explanation of macro-events is possible without understanding the dynamics of collective action and the way aggregate outcomes emerge, not from the simple averaging of individual behaviors but instead from complex decentralized interaction processes.

Therefore, macroeconomics needs a paradigm shift. Without neglecting all the scientific progress that has been accomplished, it is now clear in the mind of the economists that the science can only progress, in the benefit of a sounder understanding of actual phenomena, if the equilibrium-based analysis is replaced by a procedural, algorithmic and organic interpretation of reality. This new interpretation of reality necessarily relies on what complexity science has to offer, and in three pillars that are essential to construct a macro-complex theory. These are heterogeneity, decentralized interaction, and decision-making under simple rules. Developing macroeconomic models based on these three vectors will be a fundamental step to gain better knowledge on the collective processes that generate the observable aggregate phenomena.

After reviewing the accomplishments of macroeconomic theory, and emphasizing the paths for a new paradigm, the manuscript has proposed a simple piece to fit the puzzle of the new approach. When making the important decision of consuming now or saving to consume later, there are two elements of primordial relevance: First, the fact that such decision is typically made under a certain view of the world that make people more or less propensity to save; and, second, the fact that such heterogeneous agents are unsophisticated decision-makers that simply choose to consume relatively more or less to the received income; no intricate optimization problem is effectively solved by those who have to equate how much to spend each week, month, or year, given their current and expected income levels.

As with regard to consumption decisions, in any area of macroeconomics it is necessary to transform the current frameworks of analysis into worlds populated by a multitude of agents with different characteristics, endowments, behaviors, and expectations. The analysis of the interplay between individual agents in more or less structured networks of relations will certainly result in a much richer understanding of the relevant phenomena and a better capacity for public agents to act upon reality.

Core Messages

-

Macroeconomics has made important progress over the last decades;

-

Conventional macro-models are based on the notions of equilibrium, rational behavior, and optimal planning;

-

The science of macroeconomics needs a paradigm shift;

-

The equilibrium-based analysis must be replaced by a complexity approach;

-

Three pillars are essential to construct a macro-complex theory: heterogeneity, decentralized interaction, and decision-making based on simple heuristics;

-

Consumption-savings decisions are better understood under the heterogeneity-interaction-heuristics framework.

Notes

- 1.

See [6] for a detailed and comprehensive study of the most prominent theories developed under the auspices of modern macroeconomics.

References

Keynes JM (1936) The general theory of employment, interest, and money, 2018th edn. Palgrave Macmillan, Cham, Switzerland

Mankiw NG (2006) The macroeconomist as scientist and engineer. J Econ Perspect 20:29–46

Friedman M (1968) The role of monetary policy. Am Econ Rev 58:1–17

Lucas RE (1977) Understanding business cycles. Carnegie Rochester Conf Ser Public Policy 5:7–21

Kydland FE, Prescott EC (1982) Time to build and aggregate fluctuations. Econometrica 50:1345–1370

Alogoskoufis G (2019) Dynamic macroeconomics. MIT Press, Cambridge, MA

Ramsey F (1928) A mathematical theory of saving. Econ J 38:543–559

Cass D (1965) Optimum growth in an aggregative model of capital accumulation. Rev Econ Stud 32:233–240

Koopmans TC (1965) On the concept of optimal economic growth. In: The econometric approach to development planning. North Holland, Amsterdam

Lucas RE (1972) Expectations and the neutrality of money. J Econ Theory 4:103–124

Modigliani F, Brumberg R (1954) Utility analysis and the consumption function: an interpretation of cross section data. In: Kurihara K (ed) Post Keynesian economics. Rutgers University Press, New Brunswick, NJ, pp 388–436

Friedman M (1957) A theory of the consumption function. Princeton University Press, Princeton, NJ

Calvo GA (1983) Staggered prices in a utility maximizing framework. J Monet Econ 12:383–398

Mankiw NG (1985) Small menu costs and large business cycles: a macroeconomic model of monopoly. Quart J Econ 100:529–537

Pissarides CA (1985) Short run dynamics of unemployment, vacancies and real wages. Am Econ Rev 75:676–690

Mortensen DT (1986) Job search and labor market analysis. In: Ashenfelter O, Layard PRG (eds) Handbook of labor economics, vol 2. Elsevier, Amsterdam, pp 849–919

Benartzi S, Thaler R (2007) Heuristics and biases in retirement savings behavior. J Econ Perspect 21:81–104

Allen TW, Carroll CD (2001) Individual learning about consumption. Macroecon Dyn 5:255–271

Haldane AG, Turrell AE (2019) Drawing on different disciplines: macroeconomic agent-based models. J Evol Econ 29:39–66

Gigerenzer G, Brighton H (2009) Homo heuristicus: why biased minds make better inferences. Top Cogn Sci 1:107–143

Gigerenzer G, Gaissmaier W (2011) Heuristic decision making. Annu Rev Psychol 62:451–482

Dosi G, Napoletano M, Roventini A, Stiglitz JE, Treibich T (2017) Rational heuristics? Expectations and behaviors in evolving economies with heterogeneous interacting agents. LEM papers series 2017/31, Sant'Anna School of advanced Studies, Pisa, Italy

Dosi G, Fagiolo G, Roventini A (2010) Schumpeter meeting Keynes: a policy-friendly model of endogenous growth and business cycles. J Econ Dyn Control 34:1748–1767

Dosi G, Fagiolo G, Napoletano M, Roventini A (2013) Income distribution, credit and fiscal policies in an agent-based keynesian model. J Econ Dyn Control 37:1598–1625

Dosi G, Fagiolo G, Napoletano M, Roventini A, Treibich T (2015) Fiscal and monetary policies in complex evolving economies. J Econ Dyn Control 52:166–189

Dosi G, Roventini A (2019) More is different … and complex! The case for agent-based macroeconomics. J Evol Econ 29:1–37

Dosi G, Roventini A, Russo E (2019) Endogenous growth and global divergence in a multi-country agent-based model. J Econ Dyn Control 101:101–129

Dawid H, Harting P, Neugart M (2014) Economic convergence: policy implications from a heterogeneous agent model. J Econ Dyn Control 44:54–80

Dawid H, Harting P, Neugart M (2018) Cohesion policy and inequality dynamics: insights from a heterogeneous agents macroeconomic model. J Econ Behav Organ 150:220–255

Gali J, López-Salido JD, Vallés J (2004) Rule-of-thumb consumers and the design of interest rate rules. J Money Credit Bank 36:739–763

Gali J, López-Salido JD, Vallés J (2007) Understanding the effects of government spending on consumption. J Eur Econ Assoc 5:227–270

Kaplan G, Moll B, Violante GL (2018) Monetary policy according to HANK. Am Econ Rev 108:697–743

Gomes O (2020) From conventional equilibrium models to multi-agent virtual worlds: a prototype economic growth example. Nonlinear Dyn Psychol Life Sci 24:233–260

Gerhard P, Gladstone JJ, Hoffmann AOI (2018) Psychological characteristics and household savings behavior: the importance of accounting for latent heterogeneity. J Econ Behav Organ 148:66–82

De Grauwe P (2011) Animal spirits and monetary policy. Econ Theor 47:423–457

Gabaix X (2014) A sparsity-based model of bounded rationality. Quart J Econ 129:1661–1710

Gomes O (2019) Simulation games in economics and business: building artificial worlds for flesh and blood players. In: Gomes O, Gubareva M (eds) Contributions on applied business research and simulation studies. Nova Science Publishers, Inc., Hauppauge, New York, Chapter 8

Lane DA (1993) Artificial worlds and economics, part I. J Evol Econ 3:89–107

Lane DA (1993) Artificial worlds and economics, part II. J Evol Econ 3:177–197

Arthur WB (2013) Complexity economics: a different framework for economic thought. Santa Fe Institute working paper no 2013-04-012

Delli GD, Gaffeo E, Gallegati M (2010) Complex agent-based macroeconomics: a research agenda for a new paradigm. J Econ Interact Coord 5:111–135

Fagiolo G, Roventini A (2017) Macroeconomic policy in DSGE and agent-based models redux: new developments and challenges ahead. J Artif Soc Soc Simul 20(1)

Holt RPF, Rosser JB, Colander D (2010) The complexity era in economics. Middlebury College Economics discussion paper no 10-01

Le Baron B, Tesfatsion L (2008) Modeling macroeconomies as open-ended dynamic systems of interacting agents. Am Econ Rev 98:246–250

Rosser JB, Rosser MV (2015) Complexity and behavioral economics. Nonlinear Dyn Psychol Life Sci 19:201–226

Stiglitz JE, Gallegati M (2011) Heterogeneous interacting agent models for understanding monetary economies. East Econ J 37:6–12

Gomes O (2020) Growth theory under heterogeneous heuristic behavior. Forthcoming. J Evol Econ 31:533–571

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Gomes, O. (2022). Macroeconomics: From Equilibrium Settings to Multi-agent Worlds. In: Rezaei, N. (eds) Transdisciplinarity. Integrated Science, vol 5. Springer, Cham. https://doi.org/10.1007/978-3-030-94651-7_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-94651-7_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-94650-0

Online ISBN: 978-3-030-94651-7

eBook Packages: Biomedical and Life SciencesBiomedical and Life Sciences (R0)