Abstract

This paper surveys the recent development in energy finance, a booming inter-disciplinary subject of research. By looking back to the history of its development, we aim to clarify the conceptual issues and try to summarize the current research streams of this subject. The survey starts from financialization in energy markets, making use of the most recent empirical evidence and theoretical arguments to revisit the relationship between energy and financial markets. Corporate finance issues in energy sector are another main stream of research, which is based on the assumption that energy firms are different. A new direction of research is on green finance and investment, mainly related to financing, investment and governance in energy transition process. Through the survey, we show that energy finance is a promising research subject, and there are many exciting topics worth further investigation.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

Energy finance has arisen in recent years, and it has become a booming subject of research. A large strand of literature has developed looking into the financial characteristics of energy products, for example, oil (Zhang, 2017). Other researchers have been paying attention to the general financing and investment issues of the energy sector (Haushalter, 2000). New models have been developed to study risk spillovers in the energy sector, and these have been applied to enrich the current models for energy risk management (Zhu et al., 2020). With more attention towards sustainable development and climate change, green finance (or climate finance) has also appeared as the new hotspot (Zhang & Rong et al., 2019).

In fact, studying the links between energy markets and financial markets is not new (e.g., Jones & Kaul, 1996; Park & Ratti, 2008; Sadorsky, 1999). However, these studies follow Hamilton (1983) and generally take oil prices as an external shock to stock markets. As the most important input factor for production, oil price changes will affect firms’ cash flows or change expected returns (Jones & Kaul, 1996)—although their empirical results show that the price reaction is higher than what can be explained by the changes of real cash flows or future expected returns. Using a sample of energy firms, Broadstock et al. (2014) proposed the idea that oil shocks may pass through stock markets via a direct and an indirect channel. The variability in oil prices is considered an additional risk factor that enters the basic Capital Asset Pricing Model (CAPM); it can also pass to individual stocks by affecting market returns.

Despite the differences in methodology or markets in the studies mentioned above, the fundamental logic of oil shocks is that these firms or markets are price takers. This is consistent with the fact that the global oil markets are largely influenced by the Organization of Petroleum Exporting Countries (OPEC), an intergovernmental organization of 13 oil producers. Although there are some controversies about OPEC’s role (Kaufmann et al., 2004; Wirl & Kujundzic, 2004), the general belief is that OPEC has fundamental impacts on the world oil markets, especially in the early years (Gately, 1984). The global crude oil market can be treated as a single market (Adelman, 1984), or prices in different regions tend to move together.

The situation, however, has changed in the new century. The Shale Revolution led by the U.S. is one of the most fundamental shocks. Bataa and Park (2017), for example, showed that the increase of U.S. oil production from shale oil contributes critically to oil price movements. Another important issue contributing to OPEC’s weakening power is commodity financialization (e.g., Cheng & Xiong, 2014; Henderson et al., 2015; Tang & Xiong, 2012). While the Shale Revolution changed the general landscape of global oil supplies, the financialization process in the new century has brought fundamental changes to our traditional view of energy markets. It has also directly contributed to the development of energy finance.

In this chapter, we will start from financialization in energy markets, making use of the most recent empirical evidence and theoretical arguments to revisit the relationship between energy and the financial market in Sect. 1.2. In particular, we emphasize the concept that energy products, such as oil, intrinsically have the characteristics of financial products. Its linkage with financial markets is not simply via fundamental shocks but via more complicated mechanisms. Moreover, we also review some recent risk spillover techniques, paying special attention to the implications for energy risk management. Section 1.3 moves to the micro-firm-level issues in the energy sector. Specifically, we will introduce the most recent developments in corporate finance for energy firms. Section 1.4 reviews the literature on green finance and investment, and then the last section summarizes and discusses future directions in this newly developed subject.

2 Energy Financialization

2.1 Conceptual Issues

As a relatively new concept, there is no clear definition of energy financialization. Nevertheless, we can go back to the idea of commodity financialization, wherein Cheng and Xiong (2014) observed a large inflow of investment into commodity futures markets. They found that the investments go beyond the fundamental role of commodity futures as a risk-hedging instrument. These capital inflows substantially change commodity markets and affect the traditional risk-sharing and information discovery mechanisms. As one of the most important commodities, energy products share similar changes but behave differently, making the need to study energy financialization more urgent.

A few recent collections of articles may present a clue about how energy financialization is defined among researchers. In an editorial introduction on a special issue in Emerging Markets Finance and Trade, Ji and Li et al. (2019) stated that “energy financialization refers to the financial behavior of energy prices and the integration of energy and financial markets considering the increasing innovation of energy-oriented products in the financial markets”. They suggested that energy financialization provides “new research ideas and directions for the study of price behavior, risk contagion mechanisms and risk management in the energy market”.

In 2020, Ji, Zhang, and Kutan organized another special issue in the International Review of Financial Analysis on “Energy financialization, risk and challenges”. They further elaborated on the concept of energy financialization in their editorial introduction. Starting from the structural changes due to the 2008 global financial crisis and recent geopolitical risks, they illustrated several clear fundamental changes in global energy markets. For example, extreme price fluctuations, more active energy financial derivatives and the associated high capital flows by hedge funds, and the need to diversify portfolio risks by financial investors. The consequence of these changes is the increasing co-movements among energy markets, commodity markets and financial markets, which lead to more complicated risk spillovers than before and more challenges to energy risk management. In general, they believe that energy financialization brings new risks and challenges to energy markets and inevitably leads to new research issues and the need to develop new methodologies.

2.2 Energy–Stock Market Relationship

As mentioned above, the energy–stock market relationship, particularly the relationship between oil shocks and the stock market, has been an interesting topic among researchers for a reasonably long time. While the early researchers took oil shocks as exogenous and tried to understand the channel of oil passing through to stock prices, recent researchers have taken a distinctive approach and found something very different. From the numerous research articles that have appeared in recent years, this section uses Zhang (2017) as an example to demonstrate how to study the energy–stock market relationship in a different way and illustrate the empirical evidence supporting energy financialization.

The first and perhaps the most important contribution of Zhang (2017) is to adopt a network approach to study the oil–stock relationship. A Vector Autoregressive (VAR)-based approach—developed initially by Diebold and Yilmaz (2009) and subsequently refined by Diebold and Yilmaz (2012, 2014)—is the key of this research. In time series models, when we have no prior information about the causality of the variables studied, it is often more appropriate to assume all endogeneity and let the data speak. The VAR model is, therefore, a widely applied empirical method in macroeconomics and financial econometrics. Unfortunately, the standard VAR model is difficult to interpret due to the many estimated parameters. It is also hard to link these estimated coefficients directly to economic meanings.

Diebold and Yilmaz (2009) and their following works have made a very simple twist on interpreting the VAR models, and thus, become an extremely effective tool. We know that the Impulse Response Function (IRF) and the Forecasting Error Variance Decomposition (FEVD) are two commonly used approaches to interpreting VAR estimations. The IRF shows to what extent the system responds to the shock on one (or any) of the variables in the system. In contrast, the FEVD takes an alternative angle by estimating how much the variations of one variable are due to the changes of other variables (including itself). Defining \(\theta_{ij}\) as the contribution of variable \(j\) on variable \(i\), then \(\sum\nolimits_{i = 1}^{k} {\theta_{ij} = 1}\), meaning that the total changes of variable \(i\) (normalized as 1) can be decomposed into contributions from the whole system (K variables). Diebold and Yilmaz (2009) repackaged the estimated FEVD (or \(\theta_{ij}\)) and created a connectedness matrix (see Table 1.1) to illustrate how variables interact with each other.

A few important messages can be extracted from the connectedness matrix: first, the matrix is asymmetric, meaning that \(\theta_{ij} \ne \theta_{ji}\). This allows us to calculate the relative importance between any two variables, and then the net contributions can create directional connectedness (defined as the net directional connectedness or NDC). The column summation of the matrix (excluding self-contributions or diagonal elements) can be taken as the informational gain from the system (all other variables or From). The row summation of the matrix (excluding self-contributions or diagonal elements again) can be taken as the contribution of each variable to the system (all other variables or To). The last information from the matrix, and the most important one, is \(\frac{1}{K}\mathop \sum \nolimits_{i,j = 1}^{K} \theta_{ij}^{H} ,i \ne j\). It shows the share of explanatory power other than self-contributions, which can also be interpreted as the level of systemic interaction or systemic risk (Diebold & Yilmaz, 2009).

Following this repackaging, a number of improvements were made by Diebold and Yilmaz (2012, 2014). First, it is well known that the FEVD in a typical VAR model is affected by the ordering of variables, thus making the connectedness matrix unstable. To control for this, Diebold and Yilmaz (2012) adopted the approach suggested by Koop et al. (1996) to use a generalized FEVD or GFEVD. Second, the interactions of any system or the estimation of a VAR model can be affected by structural changes or containing time-varying characteristics. Dividing samples using known structural changing points can solve the first problem, but it is often difficult to identify breaking points, and there is also the possibility of multiple breaks. Diebold and Yilmaz (2009) proposed a simple rolling-window approach to solve this problem, allowing us to evaluate time-varying systemic risks in financial markets. The last improvements in the interpretation of systemic connectedness were by Diebold and Yilmaz (2014), who suggested using a network approach. Using the pairwise NDC as the foundation, we can establish a directional network to give a more intuitive illustration of how the system works.

After these improvements, this approach has been used extensively and has become a powerful tool to study systemic interactions in financial markets. Zhang (2017) is one of the earliest empirical studies using this approach. In this paper, a seven-variable system was established using monthly data from 2000 to 2016. The Brent crude oil price was used together with six major stock market indices, including the Dow Jones Industrial Average, FTSE 100, DAX, Nikkei 225, Singapore Straits Times Index (STI) and the Shanghai Stock Exchange (SSE) composite index.

Unlike previous research taking oil shocks as exogenous, this paper allows all variables to be endogenous in the system, and all of them can interact with each other. Interestingly, the empirical results show that crude oil prices are a net information taker in the system, which contradicts the common finding that oil shocks drive stock market movements. The level of connectedness in this seven-variable system demonstrates clear time-varying patterns. A sharp increase in the total connectedness is found following the 2008 global financial crisis, reaching an overall 49.62%, but the level of connectedness falls back after 2013. We are also interested in whether oil shocks matter and, if so, when they matter. The evidence suggests a positive answer to the first part of this question, and then a large variation was found for oil shocks’ contribution to the system. Oil shocks’ contribution can range from 10% to 37%, depending on the market conditions.

While several other findings from Zhang (2017) are interesting, this study’s key message is that oil shocks are no longer independent from global financial markets. The general situation has changed fundamentally since the 2008 global financial crisis. In recent years, movements in the major global financial markets, especially the rise of the Chinese stock market, have strongly influenced the dynamics of oil prices. This research, together with other subsequent studies (e.g., Degiannakis et al., 2018; Ferrer et al., 2018; Wei et al., 2019; Wen et al., 2019; Xu et al., 2019; Zhang et al., 2018), has established a large amount of empirical evidence supporting the concept of energy financialization.

2.3 Price Determination with Financialization

Knowing that energy prices are affected more than their fundamental factors (such as demand and supply), the next step is to rethink the price determination mechanisms of energy products. Obviously, we would expect to see an increasing role of financial factors due to the financialization process in energy markets. Morana (2013), for example, finds that financial shocks have made a sizeable contribution to oil prices. One of the main characteristics of these empirical studies is that the factors influencing energy prices are time-varying.

Following this idea, a strand of works (e.g., Drachal, 2016, 2018) adopts a new approach named the dynamic model averaging (DMA) model to study the determining factors of oil prices. This approach is a useful method to perform empirical analyses when a clear theoretical foundation is lacking. The idea is to let the data tell which factors are important determinants. The DMA approach was further developed by Raftery et al. (2010) and Koop and Korobilis (2011). It has been widely used for forecasting the prices of crude oil and other products. The DMA model’s main advantage is that it allows parameters in an estimated model to vary over time, and thus, it can uncover information that a stable model framework cannot (Wang et al., 2019).

In this section, we move from oil to natural gas and illustrate how to rethink price determination with energy financialization. Specifically, we briefly introduce one of our research works on natural gas price determination. This is a study by Wang et al. (2019), who used the DMA approach presented above to study the time-varying determining factors of natural gas prices.

Historically, natural gas was determined by the price of oil, a mechanism called oil-indexation (Zhang et al., 2018). The reason behind this is that oil and gas are substitutable in nature. Brown and Yucel (2008) introduced a “rule of thumb” that the gas and oil price ratio should be one to ten or one to six in the U.S. market. The Shale Revolution in the early 2000s marked a fundamental change that led to a general movement away from oil indexation. Although the oil price remains the most important driving factor of the natural gas price (Zhang et al., 2018), clear evidence of oil–gas price decoupling has been found (Zhang & Ji, 2018). Together with energy financialization, the determinants of natural gas prices can be more complicated.

Taking this question forward, Wang et al. (2019) performed an empirical study using the DMA approach to examine the main driving factors and how their influential power has changed over time. Specifically, financial factors are explicitly introduced to their empirical framework. In this study, monthly data from 2001 to 2018 are used. Some typical fundamental factors—such as gas consumption, production, storage, heating degree days and cooling degree days—are included in the model. An interesting feature of this work is that a number of financial factors are studied.

Following Zhang et al. (2017) and Ji and Liu et al. (2018), the paper includes the Chicago Board Options Exchange Volatility Index (VIX), a couple of speculation factors (long and short) and the weighted U.S. dollar index. These financial factors are then fitted into the regression models together with other factors. Consistent with most of the recent literature (e.g., Ji & Zhang, 2019), the explanatory power of crude oil prices (i.e., the West Texas Intermediate [WTI] oil price) has been declining, especially since the 2008 global financial crisis. Most importantly, the DMA estimation shows that financial factors are becoming more important over time. Among all four financial indicators, the long-speculation proxy is the most important determinant, and it dominates all other financial factors in the model. It is significant for 65.59% of the whole sample period, and the values of inclusion probability are often close to 80% with an increasing trend.

2.4 Energy Risk Management

Energy financialization can undoubtedly enrich the traditional energy pricing system by introducing more efficient market mechanisms. It also brings significant challenges to energy risk management. The declining power of OPEC may give a chance for a better-functioned pricing mechanism. Still, it will definitely raise uncertainties and energy security issues in certain oil-importing countries, for example, China, Japan and South Korea (Ji & Zhang et al., 2019). Increased volatility spillovers and risk contagion between energy and financial assets give investors opportunities to diversify their portfolios. However, at the same time, extra financial market activities and speculative trading behaviour can bring serious challenges to standard risk management frameworks.

A set of new models has been developed to model systemic risks since the 2008 global financial crisis (e.g., Acharya et al., 2012, 2017; Adrian & Brunnermeier, 2016). The influence of this crisis on the global economy is fundamental, and its aftermath carries on influencing the global financial system. Financial markets have become remarkably more volatile (Wu et al., 2019), and risks spreading across countries, markets, sectors and individual assets have made systemic risk a much more important issue. Financialization in energy markets means that extreme events are more likely to happen, and risk contagions between financial markets and energy markets will lead to higher systemic risk. Thus, it is much more complicated for individual investors or a nation to form a proper risk management strategy. The need to reconsider the traditional energy risk management framework is more urgent than ever.

The COVID-19 pandemic outbreak in 2020 is a clear example that shook global financial markets and also crude oil markets. On 20 April 2020, crude oil futures for the WTI closed at −$37.63 per barrel, making it an unprecedented event throughout history. Technically, how to form a strategy to hedge against such a “once-in-a-century” pandemic (Gates, 2020) and find safe-haven assets became challenging (Ji et al., 2020).

Indeed, a large volume of research is taking extreme risk spillovers among asset classes (including energy) into consideration. Du and He (2015), for example, apply Granger causality on the Value at Risk (VaR) of the S&P 500 index and WTI crude oil future returns to show extreme risk spillovers between oil and stock markets. Wen et al. (2019) used a VAR for VaR approach and demonstrated that the extreme risk spillovers between oil and stock markets increased after the 2008 global financial crisis. Yang et al. (2020) built VaR into a connectedness network to model extreme risk spillovers between the Chinese crude oil futures and other global crude oil futures markets. They reported a sharp increase in spillovers due to the COVID-19 pandemic.

With new techniques developed, more complicated models are used to study extreme risk spillovers among energy, commodity and financial markets. First, the CoVaR and the Delta CoVaR approach in Adrian and Brunnermeier (2016) are used. Second, copula models or dynamic copula models are adopted to provide a better estimation of extreme risks (Patton, 2012). Third, the estimated extreme risks are further investigated via a network-based approach (Yang et al., 2020). There is also evidence showing asymmetric effects in the spillover (e.g., Ji & Zhang et al., 2018), giving risk management more challenges.

2.5 Is Financialization Temporary or Permanent?

Despite abundant evidence found in the literature supporting the financialization of energy markets, our understanding of the underlying mechanism remains limited. The majority of the existing efforts are to build evidence and identify empirical patterns. Without a solid theoretical foundation, it is hardly possible to reconcile the current differences in empirical works. Some have already raised questions about whether energy financialization is the “new normal” or merely a passing trend (Adams & Gluck, 2015). Zhang et al. (2017) studied whether there is de-financialization in energy commodity markets. In Zhang and Broadstock (2020), rising connectedness in the global commodity markets is found to be only relevant to the 2008 global financial crisis period, and certain patterns have disappeared in recent years.

Of course, none of the studies mentioned above provides strong evidence against energy financialization; rather, their findings generally support it. However, these challenges and issues deserve further investigation. Over ten years have passed since the 2008 global financial crisis, but the sample we have is still relatively small and hardly sufficient to give a deterministic confirmation. Nevertheless, we strongly believe that the energy financialization process will be irreversible.

3 Corporate Finance in the Energy Sector

Compared to the booming research output in energy financialization, corporate finance issues in the energy sector have received less attention in the energy finance literature. However, it is an essential part, as suggested by Zhang (2018). Given the strategically important position of the energy sector in any nation’s economy, financing and investment decisions in the energy sector are critical. These decisions are not only relevant at the macro-level but are also major issues at the micro-level, as firms are the essential units delivering energy products and services.

3.1 Why Are Energy Firms Special?

Financing and investment decisions are core elements in corporate finance, and the general issues have already been studied in the mainstream corporate finance literature. Like other industries, the energy industry is often part of the picture and will only be controlled as an industrial dummy in most empirical studies. In theory, energy firms should face the same challenges as other types of firms. They need to invest in projects with positive NPVs, and they also have to choose an optimal capital structure to maximize their value when making financing decisions. At the same time, being a corporation, an energy firm also needs to resolve agency problems by designing an effective governance system. The question of making energy corporate finance a separate issue is whether energy firms are special and in what aspects they should be treated differently. This is the obvious challenge that has limited the development of energy corporate finance (Zhang, 2018).

Back to Jensen (1986), who raises the free cash flow (FCF) problems that lead to the following discussions on the agency problems of corporate decision-making. The example used in his argument is a sample of oil companies. In the 1970s, oil prices went up sharply after several oil crises. Consequently, these oil companies accumulated a large amount of cash. Instead of distributing this cash to their shareholders after investing in good (positive NPV) projects, the managers kept investing in poor-quality projects (negative NPV). Their behaviour brought benefits to themselves at the cost of the shareholders, thus becoming a typical example of agency conflicts. Similar issues have been found recently in China by Zhang et al. (2016a)—average cash flows held by energy firms are substantially higher than other firms in the Chinese stock market. Once again, these firms expand and invest in projects that are not optimal.

Energy is the foundation of the modern industrial economy, and its supply relates directly to general economic development. For countries like China, energy supply relies heavily on the international energy markets (Zhang & Rong et al., 2019), and thus, shocks to energy markets can lead to serious concerns about energy security. To ensure a stable supply of energy, China continues to invest in the international energy market. Tan (2013), for example, showed that a large proportion of international investment from China is in the energy and resource sector. These investments are primarily executed through energy firms. From this perspective, when making decisions, energy firms are different because standard profit maximization may not be the only concern.

In addition to the arguments above, there are potentially other major issues that distinguish energy firms from other sectors. For example, their governance structure can be different; energy firms tend to have large state ownership. Like the banking industry, major energy firms in China are a consequence of a series of reforms. However, they generally have a very significant state presence and operate differently (Zhang et al., 2016a). These differences between energy firms and other firms have clear country-specific features and warrant further investigation.

3.2 Investment Decisions by Energy Firms

Bearing in mind that energy firms may behave differently from firms in other industries, we introduce a few studies looking into energy firms’ investment decisions. The first issue worth exploring is whether these firms invest according to the standard corporate finance theory. For example, Lang et al. (1991) proposed using Tobin’s Q to measure investment opportunities. Q equals the market value of a company divided by its assets’ replacement cost. Higher Q is often considered to indicate good investment opportunities for the underlying firm. Lang and Litzenberger (1989) took the unity value of Q as a threshold; in other words, when Q is less than one, the firm’s investment opportunity is poor.

Empirically, Fazzari et al. (1988) set up a benchmark regression model:

where I/K stands for the investment (I) divided by the beginning-of-period capital stock (K), and CF/K stands for the cash flow scaled by the same capital stock. Q is the proxy for investment opportunities, such as Tobin’s Q. Both \({\upbeta }_{1}\) and \({\upbeta }_{1}\) are expected to be positive. Following Lang et al. (1991), an interaction term is created, which then moves to Eq. (1.2):

\({\text{D(Q}}_{{{\text{it}}}} { < 1)}\) is a dummy variable that equals one if Tobin’s Q is less than unity. Other things being equal, if \({\upbeta }_{3}\) is positive, then firms invest even if their investment opportunity is poor. In other words, they tend to have agency problems.

Zhang et al. (2016a) followed these arguments and investigated these models with a sample of energy firms listed on the Chinese stock market. The sample firms cover electricity, coal, oil and gas, the new energy sector and related sectors from 2001 to 2012. One additional contribution of their work is to use a new measure of Q: the fundamental Q. This was proposed by Gilchrist and Himmelberg (1995) to overcome the problems of basic Q in measuring investment opportunity. In general, the empirical analyses show clear evidence supporting the FCF hypothesis for Chinese energy-related firms. These firms tend to overinvest, even when future investment opportunities are poor. Furthermore, Zhang et al. (2016a) controlled for several corporate governance factors, such as degrees of state ownership and managerial shareholder levels. Not surprisingly, these factors can play a role in firms’ investment decisions.

Inspired by Zhang et al. (2016a), a series of subsequent works began to further investigate in this direction. For example, Yu et al. (2020) explored the role of political connection on the overinvestment problems of Chinese energy firms. Kong et al. (2020) studied the effects of foreign investment in Chinese energy firms’ innovation. Cao et al. (2020) used listed firm data to show that oil price uncertainty can affect renewable energy firms’ investment.

3.3 Financing Decisions by Energy Firms

An equally important issue for energy corporate finance is firms’ financing decisions or how they choose their capital structure. According to the standard corporate finance theory (e.g., the pecking order theory of financing), firms should use internal capital, followed by debt and then equity financing. In a perfect market, firms’ value is not affected by their specific capital structure (debt/equity ratio), but the tax benefit of debt and bankruptcy cost bring forward the trade-off theory (see Myers, 2001). The literature in this area is abundant for general corporate finance studies but limited for general energy firms. An exception is renewable energy firms, which will be illustrated later in the next section.

Here, we take a couple of examples to elaborate on what can be done in this area. The first study is by Narayan and Nasiri (2020), who used a sample of 726 energy firms from 56 countries to study whether oil market activities can affect these firms’ capital structure. Their first argument is that oil companies are different from non-oil companies, similar to the earlier arguments. Meanwhile, energy firms are more likely to be affected by oil price shocks (see Broadstock et al., 2012; Ma et al., 2019), as price movements in oil markets can directly affect the cost and revenue of these firms. Empirical analyses of this cross-country study demonstrate both statistically and economically significant effects of international oil market changes on energy firms. However, similar effects cannot be found in non-oil companies. Kim and Choi (2019) took a different approach and also showed that hedging can affect oil and gas project companies’ capital structure. The capital structure may also affect firms’ performance (e.g., Zhang et al., 2016b). Cole et al. (2015) used the data of a sample of U.S. firms covering industrial, healthcare and energy sectors to see whether there is a relationship between capital structure and firm performance. They showed a clear difference in the energy sector relative to others.

The second example is on the financing constraints of energy investment. It is a well-explored area that financing constraints can directly affect corporate investment (Fazzari et al., 1988). Si et al. (2021) used a sample of 230 energy firms from 2003 to 2018 to show that financial deregulation can lower these firms’ operational costs by alleviating financing constraints. Once again, this research direction is a much more relevant issue for renewable energy investment, so we will cut it short here and discuss it more in the following sections.

3.4 Governance in the Energy Sector

As mentioned above, corporate governance factors can impose a substantial impact on firms’ decisions. There are no exceptions for energy firms. Also, due to the special features of the energy industry, it is typically more complicated for the internal governance system to work out properly (Zhang et al., 2016a). Meanwhile, firms’ behaviour/performance can also be affected by the institutional environment or external governance. The interaction of internal and external governance can impose a significant impact on firms’ behaviour (Liu et al., 2019). For example, a large volume of literature following La Porta et al. (1997) discusses the financial impacts of legal origins. The general idea is that the common law system tends to give higher weight to shareholders’ interests, whereas the civil law system emphasizes general stakeholders’ benefits. Investment in the energy sector is shown to be affected by legal differences, together with some internal governance issues (e.g., Liu et al., 2019). Of course, there are also other external governance factors to be considered.

The corporate governance system is designed to reduce agency costs and improve the efficiency of firms. The first and perhaps the most widely used governance factor is ownership structure. It is often argued that state ownership tends to bring inefficiency into corporate operations. Thus, empirical findings often demonstrate that private companies outperform their state-owned counterparts (e.g., Ohene-Asare et al., 2017). Conversely, foreign ownership or institutional ownership can improve firms’ performance. Kong et al. (2020), for example, studied energy firms’ innovation performance and showed that foreign institutional investors can improve energy firms’ innovation via three possible channels: investment, governance and human capital. Filippini and Wetzel (2014) used 28 electricity distribution companies in New Zealand to show that separating the ownership of electricity generation and retail operations from the distribution network can improve these firms’ cost efficiency. In a cross-country study, Clo et al. (2017) found that public ownership is associated with lower emissions than private ownership in the power industry. The results are obviously different across countries. Wang et al. (2021) reported that equity concentration can improve Chinese energy companies’ investment efficiency.

From these studies, we can see that private ownership (or foreign ownership) tends to give more weight to efficiency and thereby improves performance, whereas public ownership may improve energy sectors’ environmental performance. Given that energy firms bear more of the burden for carbon reduction or environmental benefits than the general society, they must also be responsible for energy security issues (Zhang & Rong et al., 2019), which is not a major concern for firms in other sectors. Hence, it is important for us to investigate whether there is an optimal ownership structure.

Other issues in the corporate governance literature also have clear, unique features in the energy industry. For example, manager characteristics, political connections and executives’ compensation schemes may also differ from other sectors (subject to country-specific institutional environments). Using a sample of Chinese energy firms, Yu et al. (2020) explored the relationship between firms’ political connections and investment behaviour, demonstrating a statistically significant relationship. Overinvestment is more likely to happen when local politicians approach promotion lines.

4 Green Finance and Investment

The concept of “green finance” has arisen in recent years due to increasing pressure from climate change and the need to pursue a sustainable growth path in the global society. In 2015, the Paris Agreement was signed within the United Nations Framework Convention on Climate Change (UNFCCC). Member countries have agreed to work cooperatively to mitigate the severe problem of greenhouse gas (GHG) emissions.

Five years after adopting the Paris Agreement, the world remains a long way behind the race against climate change. Ambitious commitments and urgent actions are needed for transitioning to net-zero emissions (or carbon neutrality) by 2050. A significant amount of investment is required to solve the problem. For example, maintaining the 2 °C temperature threshold of the Paris Agreement requires $53 trillion in energy-related investments by 2035 (IEA, 2014). The European Commission (2020) estimated that for the EU alone, more than EUR 270 billion of investment per year would be necessary to achieve an 80% reduction of emissions by 2050. Global investments in low-carbon solutions are growing, and the cumulative clean energy investment was around USD 3.7 trillion from 2004 to 2018, although it is still not sufficient to meet the required pace (Climate Finance Leadership Initiative, 2019). A substantial investment gap remains between the current development and the requisite level of emissions.

4.1 Green Finance or Climate Finance

In 2010, the Green Climate Fund (GCF) was established by 194 countries, aiming to provide financial support to developing countries to mitigate GHG emissions and adapt to climate change. Since then, the term “green finance” has frequently appeared in the reports of international organizations (e.g., the International Finance Corporation [IFC], 2017) and national governments. Relevant discussions have also attracted enormous attention from academics. Green finance per se, however, remains vaguely defined and is often mixed with climate finance. Zhang and Rong et al. (2019) reviewed the existing literature in a simple bibliometric analysis. They did not explicitly distinguish the difference between green finance and climate finance but instead used them in the same way. In total, 381 papers were included in their survey, and there has been a clear upward trend of research interest since 2011. Their research may provide some clues about the concept of green finance.

According to the IFC (2017), green finance is defined as the “financing of investments that provide environmental benefits”. A related concept named “climate finance” is proposed and defined by the UNFCCC as “local, national or transnational financing—drawn from public, private and alternative sources of financing—that seeks to support mitigation and adaption actions that will address climate change”. In their simple bibliometric analysis, Zhang and Rong et al. (2019) showed that at the heart of both terms is the financing tools for coping with climate change and other issues for sustainability. Moreover, these two concepts are relevant to energy finance, as major changes are expected to apply to the energy sector, such as developing the renewable energy sector or achieving energy transition to a sustainable regime.

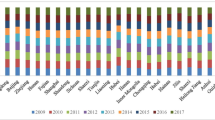

To get a general idea of the current status of the global energy structure, Fig. 1.1 plots the world’s total energy production structure from 1980 to 2018.Footnote 1 Clearly, total primary energy production keeps increasing to fuel global economic development. Although the renewable energy sector has already experienced a significant increase in recent years, its share remains low, and three main fossil fuel energy sources (i.e., coal, petroleum and natural gas) together account for over 84% of the world’s total energy production. To achieve the climate goal, there is obviously much more work to be done to change the energy structure or make a substantial transition towards renewable energy.

(Source www.eia.gov)

World energy structure

4.2 Financing the Energy Transition

Speeding up the energy transition process is challenging, and an enormous amount of investment is needed. Note that the information presented in Fig. 1.1 is the status of the whole world; there are clearly regional/country-specific differences. Together with the large variation in the world’s economic development, a general improvement is hard to achieve. Taking China, the largest emitter of GHG in the world, as an example, fossil fuel accounts for about 90% of the total energy consumption (Ji & Zhang, 2019). Despite this, the leaders of China made strong commitments and pledged to reach peak GHG emissions in 2030 and achieve carbon neutrality by 2060. To realize such an ambitious plan, a combination of efforts is needed, and one of the major constraints is financing.

Ji and Li et al. (2019) presented a simple empirical study for the case of China. They used historical data to investigate the main contributing factors that are pushing China’s energy transition. Through the Diebold and Yilmaz (2014) network approach, they found some very interesting results. The main message from this research is that financial development is critical to the development of the renewable energy sector. Among the stock market, the credit market and foreign capitals, the stock market takes the leading position in providing the most explanatory power for the changes in renewable energy growth. An additional analysis using U.S. and EU data shows that they are considerably different. While the U.S. energy transition is mainly due to the stock market, the credit market demonstrates a dominating role in Europe.

Le et al. (2020) further confirmed the role of financial development on renewable energy development using a sample of 55 countries in the 2005–2014 period. They suggested that policymakers should facilitate renewable financing through proper policy designs. Taking Europe as an example, Polzin and Sanders (2020) identified a clear investment gap for the European energy transition and limited participation of institutional investors and risk-carrying capitals. In a sub-regional study, Wang et al. (2020) established a regional-level index for China to show its unbalanced development status and potential for the renewable energy sector. In their study, financial development or support was used as a key dimension of interest. There is clear evidence of unbalanced inter-provincial development in renewable energy development.

These macro-level studies may provide critical information on the big picture; however, a much larger volume of literature using micro-level data has appeared recently. The main objective of these studies is to determine the main issues for the financing of the world’s energy transition. Using a bibliometric analysis approach, Elie et al. (2021) surveyed the literature on renewable energy finance and discovered eight clusters based on the type of finance, location and technology. Their results show that policy-relevant studies are the most popular.

It is obvious that renewable energy development or financing depends largely on policy support. Liu et al. (2021) showed that the listed Chinese solar PV firms responded significantly to subsidy policy changes. Understanding capital market responses to policy shocks is essential for policymakers. Financing the renewable energy transition requires private capital participation; a favourable capital market condition can reduce the cost of financing for renewable energy firms. Appropriate policy instruments can also facilitate the financing process by reducing operational risks and providing support for start-ups. Although this study is based on listed firms, it is worth noting that most newly established renewable energy firms rely on equity financing. Thus, the findings on capital market responses to policy shocks matter to more than listed firms.

One has to realize that financing the renewable energy transition also needs financial innovation (Horsch & Richter, 2017). For example, green bonds have emerged in recent years as a major source of financing green development, and they have attracted a great deal of attention in the literature. Since the first green bonds in 2007 by the European Investment Bank, green bond assurance has reached USD 167.3 billion by international organizations, governments, banks and the corporate sector. Initially led by international organizations, corporate green bonds have grown at a much faster pace since 2014, becoming the main player in the global green bond markets. There are numerous issues that have been discussed intensively in the literature. For example, are green bonds different from other traditional bonds (Ferrer et al., 2021)? Can green bond issuance benefit shareholders (Tang & Zhang, 2020)? How do investors respond to the issuance of corporate bonds (Flammer, 2021)? More empirical evidence is needed to provide a solid understanding and make proper policy suggestions. There is also a need for governments to engage further in financial innovation, such as introducing more financial instruments, using derivatives or structuring financial products. Of course, it is also necessary for more sophisticated risk management tools to be developed.

4.3 Investment in the Energy Transition

Financing is only one side of the story; how to support investment in energy transition is another major issue. We do expect to see large-scale investment employed in the near future, but challenges remain concerning how to make sure the investment is efficient and how to encourage a sustainable investment strategy. Once again, there is a large volume of literature discussing relevant issues from both the aggregate (Fadly, 2019) and disaggregate (Liu et al., 2019) levels. Relevant issues include how to improve investment efficiency, promote green innovation, invest in energy-efficient projects and so forth.

Like other energy firms, renewable energy firms also tend to be affected by agency costs; in other words, managers may choose investment decisions that are not necessarily optimal (Zhang et al., 2016b). For example, China experienced significant overinvestment in the wind and solar PV industry, resulting in a large volume of wind curtailments and overcapacity. Therefore, proper governance is important. It is also worth noting that renewable energy investment can be affected by external governance or institutional environments (Liu et al., 2019). Using a sample of renewable energy companies around the world, Liu et al. (2019) examined the role of legal systems and national governance on these firms’ investment decisions. Firms under the civil law system are more likely to invest relative to those in the common law system. This is consistent with the legal origin literature, which states that the common law system gives more weight to shareholders’ interests, whereas the civil law system encourages the broader social responsibilities of firms. The level of national governance can also play a role here.

Technological progress is critical for energy transition and achieving carbon neutrality; therefore, green technology investment is another crucial issue attracting a great deal of attention. Firms are profit maximization entities; thus, they only engage in green innovation if it can create value by sending a positive signal to the investors. Zhang and Zhang et al. (2019) used a sample of Chinese listed firms to examine the famous Porter hypothesis (Porter & Van der Linde, 1995), which suggests that strict environmental regulations can induce efficiency and encourage innovation. Green innovation can then help improve the commercial competitiveness of firms. Based on their empirical analysis, Zhang and Zhang et al. (2019) confirmed the hypothesis that green innovation can improve firms’ subsequent performance. In other words, green innovation is associated with higher sales growth and higher net profits. In their study, the evidence also shows that ownership matters: state-owned firms tend to gain more of the economic benefits.

While there is a long way to go to remove fossil fuel energy completely, improving energy efficiency is another major step towards sustainability. In a recent study, Zhang et al. (2020) used firm-level data from the World Bank Enterprise Survey to investigate whether access to credit can affect energy intensity in a sample of Chinese manufacturing firms. Their research is related to the “efficiency paradox” proposed by DeCanio (1998), in which firms may not take profitable investment opportunities in energy efficiency. The underlying reasons for this paradox include market failure, bounder rationality, asymmetric information and inefficient energy management. Zhang et al.’s (2020) empirical results support the paradox that firms with credit access tend to have significantly higher energy use per unit of output, although local government environmental regulations can mitigate this inefficient relationship. This suggests that local government may play an important role in correcting firms’ irrational behaviour and pushing for efficient energy use.

5 Summary and Looking Forward

This chapter provides a survey of the literature related to energy finance. We hope to provide a general structure that gives readers some general ideas about how this subject has developed over time and what topics energy finance covers. In particular, we focus on three categories of research, namely, energy financialization, energy corporate finance and green finance. We have to acknowledge, once again, that this subject is still emerging, and an accurate conceptual framework remains unavailable. Furthermore, with the ever-increasing pressure of climate change, energy finance as a major element of climate finance will inevitably attract more attention.

Extending from the literature review above, we also list several exciting research directions. First, supported by richer empirical evidence and policy discussions, theoretical investigations are needed to complete the general picture. Up to now, we have accumulated a large volume of empirical literature justifying the need for energy finance research and clarifying its relevance. It is time to consider establishing a more solid theoretical framework that allows us to consolidate this subject area further.

Second, despite the booming literature on green/climate finance, the need to move in this direction is still urgent. This is especially relevant as more countries begin setting up a clear timetable for reaching carbon–neutral. For example, there is enormous demand for research on the pathways to carbon neutrality for China. Being the largest emitter in the world and the biggest emerging economy, balancing the needs of economic development while achieving the tight goal of carbon–neutral in 2060 is almost a mission impossible. Searching for feasible pathways not only requires developing technological advances but also looking for financial solutions.

Third, corporate financial decisions remain an interesting direction of research. Currently, we have very limited information about this due to sampling issues and limited attention. Academic research on corporate social responsibility (CSR) or ESG has already developed rapidly, but linking this to energy-related firms is needed to understand the fundamental decision-making by firms.

Lastly, there is a clear need to make international comparisons. Most current studies focus on a single country or sector, which is not sufficient, given the large variety of institutional environments among countries worldwide. There are also cultural differences yet to be explored.

Notes

- 1.

Source: www.eia.gov.

References

Acharya, V., Engle, R., & Richardson, M. (2012). Capital shortfall: A new approach to ranking and regulating systemic risks. American Economic Review, 102(3), 59–64.

Acharya, V. V., Pedersen, L. H., Philippon, T., & Richardson, M. (2017). Measuring systemic risk. The Review of Financial Studies, 30(1), 2–47.

Adams, Z., & Glück, T. (2015). Financialization in commodity markets: A passing trend or the new normal? Journal of Banking and Finance, 60, 93–111.

Adelman, M. A. (1984). International oil agreements. The Energy Journal, 5(3), 1–9.

Adrian, T., & Brunnermeier, M. K. (2016). CoVaR. The American Economic Review, 106(7), 1705–1741.

Bataa, E., & Park, C. (2017). Is the recent low oil price attributable to the shale revolution? Energy Economics, 67, 72–82.

Broadstock, D. C., Cao, H., & Zhang, D. (2012). Oil shocks and their impact on energy related stocks in China. Energy Economics, 34(6), 1888–1895.

Broadstock, D. C., Wang, R., & Zhang, D. (2014). Direct and indirect oil shocks and their impacts upon energy related stocks. Economic Systems, 38(3), 451–467.

Brown, S. P., & Yucel, M. K. (2008). What drives natural gas prices? The Energy Journal, 29(2), 45–60.

Cao, H., Guo, L., & Zhang, L. (2020). Does oil price uncertainty affect renewable energy firms’ investment? Evidence from listed firms in China. Finance Research Letters, 33, 101205.

Cheng, I. H., & Xiong, W. (2014). Financialization of commodity markets. Annual Review of Financial Economics, 6(1), 419–441.

Climate Finance Leadership Initiative. (2019). Financing the low-carbon future: A private-sector view on mobilizing climate finance.

Clò, S., Ferraris, M., & Florio, M. (2017). Ownership and environmental regulation: Evidence from the European electricity industry. Energy Economics, 61, 298–312.

Cole, C., Yan, Y., & Hemley, D. (2015). Does capital structure impact firm performance: An empirical study of three US sectors. Journal of Accounting and Finance, 15(6), 57.

DeCanio, S. J. (1998). The efficiency paradox: Bureaucratic and organizational barriers to profitable energy-saving investments. Energy Policy, 26(5), 441–454.

Degiannakis, S., Filis, G., & Arora, V. (2018). Oil prices and stock markets: A review of the theory and empirical evidence. The Energy Journal, 5(39), 85–130.

Diebold, F. X., & Yilmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal, 119(534), 158–171.

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66.

Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134.

Drachal, K. (2016). Forecasting spot oil price in a dynamic model averaging framework—Have the determinants changed over time? Energy Economics, 60, 35–46.

Drachal, K. (2018). Determining time-varying drivers of spot oil price in a dynamic model averaging framework. Energies, 11(5), 1207.

Du, L., & He, Y. (2015). Extreme risk spillovers between crude oil and stock markets. Energy Economics, 51, 455–465.

Elie, L., Granier, C., & Rigot, S. (2021). The different types of renewable energy finance: A Bibliometric analysis. Energy Economics, 93, 104997.

European Commission. (2020). Roadmap for moving to a competitive low carbon economy. https://ec.europa.eu/clima/sites/clima/files/strategies/2050/docs/roadmap_fact_sheet_en.pdf

Fadly, D. (2019). Low-carbon transition: Private sector investment in renewable energy projects in developing countries. World Development, 122, 552–569.

Fazzari, S., Hubbard, R. G., & Petersen, B. C. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1, 141–195.

Ferrer, R., Shahzad, S. J. H., & Soriano, P. (2021). Are green bonds a different asset class? Evidence from time-frequency connectedness analysis. Journal of Cleaner Production, 292, 125988.

Ferrer, R., Shahzad, S. J. H., López, R., & Jareño, F. (2018). Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Economics, 76, 1–20.

Filippini, M., & Wetzel, H. (2014). The impact of ownership unbundling on cost efficiency: Empirical evidence from the New Zealand electricity distribution sector. Energy Economics, 45, 412–418.

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics. https://doi.org/10.1016/j.jfineco.2021.01.010

Gately, D. (1984). A ten-year retrospective: OPEC and the world oil market. Journal of Economic Literature, 22(3), 1100–1114.

Gates, B. (2020). Responding to Covid-19—a once-in-a-century pandemic? New England Journal of Medicine, 382(18), 1677–1679.

Gilchrist, S., & Himmelberg, C. P. (1995). Evidence on the role of cash flow for investment. Journal of Monetary Economics, 36(3), 541–572.

Hamilton, J. D. (1983). Oil and the macroeconomy since World War II. Journal of Political Economy, 91(2), 228–248.

Haushalter, G. D. (2000). Financing policy, basis risk, and corporate hedging: Evidence from oil and gas producers. The Journal of Finance, 55(1), 107–152.

Henderson, B. J., Pearson, N. D., & Wang, L. (2015). New evidence on the financialization of commodity markets. The Review of Financial Studies, 28(5), 1285–1311.

Horsch, A., & Richter, S. (2017). Climate change driving financial innovation: The case of green bonds. The Journal of Structured Finance, 23(1), 79–90.

IEA. (2014). WEO-2014 special report. World Energy Investment Outlook, Paris. International Energy Agency.

IFC. (2017). Green finance: A bottom-up approach to track existing flows. International Finance Corporation.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323–329.

Ji, Q., Li, J., & Sun, X. (2019). New challenge and research development in global energy financialization. Emerging Markets Finance and Trade, 55, 2669–2672.

Ji, Q., Liu, B. Y., Nehler, H., & Uddin, G. S. (2018). Uncertainties and extreme risk spillover in the energy markets: A time-varying copula-based CoVaR approach. Energy Economics, 76, 115–126.

Ji, Q., & Zhang, D. (2019). How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy, 128, 114–124.

Ji, Q., Zhang, D., & Kutan, A. M. (2020). Energy financialization, risk and challenges. International Review of Financial Analysis, 68, 101–485.

Ji, Q., Zhang, D., & Zhao, Y. (2020). Searching for safe-haven assets during the COVID-19 pandemic. International Review of Financial Analysis, 71, 101526.

Ji, Q., Zhang, H. Y., & Geng, J. B. (2018). What drives natural gas prices in the United States? –A directed acyclic graph approach. Energy Economics, 69, 79–88.

Ji, Q., Zhang, H. Y., & Zhang, D. (2019). The impact of OPEC on East Asian oil import security: A multidimensional analysis. Energy Policy, 126, 99–107.

Jones, C. M., & Kaul, G. (1996). Oil and the stock markets. The Journal of Finance, 51(2), 463–491.

Kaufmann, R. K., Dees, S., Karadeloglou, P., & Sanchez, M. (2004). Does OPEC matter? An econometric analysis of oil prices. The Energy Journal, 25(4), 67–90.

Kim, S. T., & Choi, B. (2019). Price risk management and capital structure of oil and gas project companies: Difference between upstream and downstream industries. Energy Economics, 83, 361–374.

Kong, D., Zhu, L., & Yang, Z. (2020). Effects of foreign investors on energy firms’ innovation: Evidence from a natural experiment in China. Energy Economics, 92, 105011.

Koop, G., & Korobilis, D. (2011). UK macroeconomic forecasting with many predictors: Which models forecast best and when do they do so? Economic Modelling, 28(5), 2307–2318.

Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1997). Legal determinants of external finance. The Journal of Finance, 52(3), 1131–1150.

Lang, L. H., & Litzenberger, R. H. (1989). Dividend announcements: Cash flow signalling vs. free cash flow hypothesis? Journal of Financial Economics, 24(1), 181–191.

Lang, L. H., Stulz, R., & Walkling, R. A. (1991). A test of the free cash flow hypothesis: The case of bidder returns. Journal of Financial Economics, 29(2), 315–335.

Le, T. H., Nguyen, C. P., & Park, D. (2020). Financing renewable energy development: Insights from 55 countries. Energy Research and Social Science, 68, 101537.

Liu, C., Liu, L., Zhang, D., & Fu, J. (2021). How does the capital market respond to policy shocks? Evidence from listed solar photovoltaic companies in China. Energy Policy, 151, 112054.

Liu, J., Zhang, D., Cai, J., & Davenport, J. (2019). Legal systems, national governance and renewable energy investment: Evidence from around the world. British Journal of Management. https://doi.org/10.1111/1467-8551.12377

Ma, Y. R., Zhang, D., Ji, Q., & Pan, J. (2019). Spillovers between oil and stock returns in the US energy sector: Does idiosyncratic information matter? Energy Economics, 81, 536–544.

Morana, C. (2013). Oil price dynamics, macro-finance interactions and the role of financial speculation. Journal of Banking and Finance, 37(1), 206–226.

Myers, S. C. (2001). Capital structure. Journal of Economic Perspectives, 15(2), 81–102.

Narayan, P. K., & Nasiri, M. A. (2020). Understanding corporate debt from the oil market perspective. Energy Economics, 92, 104946.

Ohene-Asare, K., Turkson, C., & Afful-Dadzie, A. (2017). Multinational operation, ownership and efficiency differences in the international oil industry. Energy Economics, 68, 303–312.

Park, J., & Ratti, R. A. (2008). Oil price shocks and stock markets in the US and 13 European countries. Energy Economics, 30(5), 2587–2608.

Patton, A. J. (2012). A review of copula models for economic time series. Journal of Multivariate Analysis, 110, 4–18.

Polzin, F., & Sanders, M. (2020). How to finance the transition to low-carbon energy in Europe? Energy Policy, 147, 111863.

Porter, M. E., & Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives, 9(4), 97–118.

Raftery, A. E., Kárný, M., & Ettler, P. (2010). Online prediction under model uncertainty via dynamic model averaging: Application to a cold rolling mill. Technometrics, 52(1), 52–66.

Rashid, A. (2013). Risks and financing decisions in the energy sector: An empirical investigation using firm-level data. Energy Policy, 59, 792–799.

Sadorsky, P. (1999). Oil price shocks and stock market activity. Energy Economics, 21(5), 449–469.

Si, D. K., Li, X. L., & Huang, S. (2021). Financial deregulation and operational risks of energy enterprise: The shock of liberalization of bank lending rate in China. Energy Economics, 93, 105047.

Tan, X. (2013). China’s overseas investment in the energy/resources sector: Its scale, drivers, challenges and implications. Energy Economics, 36, 750–758.

Tang, D. Y., & Zhang, Y. (2020). Do shareholders benefit from green bonds? Journal of Corporate Finance, 61, 101427.

Tang, K., & Xiong, W. (2012). Index investment and the financialization of commodities. Financial Analysts Journal, 68(6), 54–74.

Wang, J., Wang, H., & Wang, D. (2021). Equity concentration and investment efficiency of energy companies in China: Evidence based on the shock of deregulation of QFIIs. Energy Economics, 93, 105032.

Wang, T., Zhang, D., & Broadstock, D. C. (2019). Financialization, fundamentals, and the time-varying determinants of US natural gas prices. Energy Economics, 80, 707–719.

Wang, Y., Zhang, D., Ji, Q., & Shi, X. (2020). Regional renewable energy development in China: A multidimensional assessment. Renewable and Sustainable Energy Reviews, 124, 109797.

Wei, Y., Qin, S., Li, X., Zhu, S., & Wei, G. (2019). Oil price fluctuation, stock market and macroeconomic fundamentals: Evidence from China before and after the financial crisis. Finance Research Letters, 30, 23–29.

Wen, D., Wang, G. J., Ma, C., & Wang, Y. (2019). Risk spillovers between oil and stock markets: A VAR for VaR analysis. Energy Economics, 80, 524–535.

Wirl, F., & Kujundzic, A. (2004). The impact of OPEC conference outcomes on world oil prices 1984–2001. The Energy Journal, 25(1), 45–62.

Wu, F., Zhang, D., & Zhang, Z. (2019). Connectedness and risk spillovers in China’s stock market: A sectoral analysis. Economic Systems, 43(3–4), 100718.

Xu, W., Ma, F., Chen, W., & Zhang, B. (2019). Asymmetric volatility spillovers between oil and stock markets: Evidence from China and the United States. Energy Economics, 80, 310–320.

Yang, Y., Ma, Y. R., Hu, M., Zhang, D., & Ji, Q. (2020). Extreme risk spillover between chinese and global crude oil futures. Finance Research Letters, 101743.

Yu, X., Yao, Y., Zheng, H., & Zhang, L. (2020). The role of political connection on overinvestment of Chinese energy firms. Energy Economics, 85, 104516.

Zhang, D. (2017). Oil shocks and stock markets revisited: Measuring connectedness from a global perspective. Energy Economics, 62, 323–333.

Zhang, D. (2018). Energy finance: Background, concept, and recent developments. Emerging Markets Finance and Trade, 54, 1687–1692.

Zhang, D., & Broadstock, D. C. (2020). Global financial crisis and rising connectedness in the international commodity markets. International Review of Financial Analysis, 68, 101239.

Zhang, D., & Ji, Q. (2018). Further evidence on the debate of oil-gas price decoupling: A long memory approach. Energy Policy, 113, 68–75.

Zhang, D., Cao, H., & Zou, P. (2016b). Exuberance in China’s renewable energy investment: Rationality, capital structure and implications with firm level evidence. Energy Policy, 95, 468–478.

Zhang, D., Cao, H., Dickinson, D. G., & Kutan, A. M. (2016a). Free cash flows and overinvestment: Further evidence from Chinese energy firms. Energy Economics, 58, 116–124.

Zhang, D., Li, J., & Ji, Q. (2020). Does better access to credit help reduce energy intensity in China? Evidence from manufacturing firms. Energy Policy, 145, 111710.

Zhang, D., Rong, Z., & Ji, Q. (2019). Green innovation and firm performance: Evidence from listed companies in China. Resources, Conservation and Recycling, 144, 48–55.

Zhang, D., Shi, M., & Shi, X. (2018). Oil indexation, market fundamentals, and natural gas prices: An investigation of the Asian premium in natural gas trade. Energy Economics, 69, 33–41.

Zhang, D., Zhang, Z., & Managi, S. (2019). A bibliometric analysis on green finance: Current status, development, and future directions. Finance Research Letters, 29, 425–430.

Zhang, Y. J., Chevallier, J., & Guesmi, K. (2017). “De-financialization” of commodities? Evidence from stock, crude oil and natural gas markets. Energy Economics, 68, 228–239.

Zhu, B., Lin, R., & Liu, J. (2020). Magnitude and persistence of extreme risk spillovers in the global energy market: A high-dimensional left-tail interdependence perspective. Energy Economics, 89, 104761.

Acknowledgements

We acknowledge support from the National Natural Science Foundation of China under Grants 71974159, 72022020 and 71974181.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Zhang, D., Ji, Q. (2022). Review of the Development of Energy Finance. In: Floros, C., Chatziantoniou, I. (eds) Applications in Energy Finance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-92957-2_1

Download citation

DOI: https://doi.org/10.1007/978-3-030-92957-2_1

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-92956-5

Online ISBN: 978-3-030-92957-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)