Abstract

International trade was one of the most affected following the Covid-19 crisis and it is also envisaged to be shaped by important alterations. Romania, being part of global value chains, is prone to such mutations. Therefore, our aim is to draw a picture of actual evolutions and to identify risks and opportunities in international trade’s development. We notice that the containment measures have already had an uneven impact on international trade, generating the largest drop in both trade of goods and services in the last years. We deepen our investigation on the evolution of Romania’s international trade using monthly data in order to evidence the changes induced during the spread of the pandemic. We discover that the Covid-19 crisis had a larger impact on Romania’s international trade than the one felt during the economic crisis during 2008–2009. In addition, we use a VECM model and Granger analysis for examining the nature of the relationship between Romanian exports of goods and services and EU international trade for the period 2000–2019, based on quarterly data. Our aim is to examine if Romanian exports bring their contribution to the total EU imports as well as to the total EU exports, highlighting the long-run equilibrium relationship. We find that that a 1% increase in Romanian exports contributes to an increase in the EU exports and imports to about 0.55% over the next four quarters.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Seen as a minor threat at the end of 2019, the Covid-19 virus soon engulfed the whole world and only three months after China has officially reported the several cases of pneumonia caused by a novel coronavirus, it generated measures hard to imagine before, which restricted free movement and led to the closure of manufacturing and of a large part of the economic activity. The pandemic has severely affected the global economy and daily life (Baicu et al. 2020). Globalization at its highest was hardly hit, vulnerabilities being exposed, while the largest economic drop in the last 40 years (IMF 2020), altogether with the most difficult health crisis were experienced. The crisis had asymmetrical impact on industries (Staszkiewicz et al. 2020) and, like any other crisis, will generate lasting consequences for a vast number of sectors. Among them, international trade was one of the most affected and it is also envisaged to be shaped by important alterations.

International trade was affected by the containment measures which included the closure of the borders, the reduction of the transport activity or restrictions on trade. In addition, the development of international trade based on global production networks or global supply chains had a supplementary effect in quantifying the impact of the pandemic (Fonseca and Azevedo 2020). Literature evidence that the actual crisis was different than the one in 2008–2009 because it generated not only a shock in demand, where uncertainty affected the economic agents’ behavior, but also a shock in supply, exacerbated by the lockdown policies and after that by the contagion which spread all over the supply chains (IFC 2020) due to spill-over effect (Brinca et al. 2020). Saif et al. (2021, p. 6) describes the actual crisis as a “hybrid supply–demand shock generating domino effect”, while Baldwin and Tomiura (2020), Friedt and Zhang (2020) and Kejžar et al. (2021) point towards the “triple pandemic effect” related to trade, as a consequence of the reverberations on supply, demand and value chains shocks. In order for Romanian micro and small businesses to better cope with the disruption created by the Covid-19 pandemic, they must, first and foremost, demonstrate openness to production innovation and adaptability to new demand, as well as provide strong support for customers and communities (Păunescu and Mátyus 2020).

This paper analyzes the evolution of Romania’s exports and imports during the development of Covid-19 crisis, in an analysis of monthly data since the beginning of 2020. Romania is integrated in global value chains, the automotive industry being one of the most important sector for the economy. The paper begins with a brief literature review related to the consequences of the measures taken at domestic and international level on international trade. This provide the opportunity to further place the evolutions in Romania in the global context and to identify the medium and long term expected transformations. We then assess the evolution in the trade of goods in Romania and make comparison with the evolution of international trade during the actual crisis and the one in 2008–2009. Back then, Romania had the opportunity of a quick recovery in exports, which also influenced the restoration of the whole economic activity. Based on that, we can draw a picture of actual evolutions and risks.

In the context of Romania’s integration in the global value chains, high trade dependence with the EU market, and increasing importance of China’s as a supplier for the Central and Eastern European countries, we are interested in investigating the relationship between Romanian exports and EU imports and exports of goods and services using the Granger causality analysis. In this aim, we perform a VECM analysis using quarterly data from 2000 until 2019.

2 Measures and Consequences Affecting International Trade as a Result of the Covid-19 Pandemic

Starting with March 2020 and even earlier in China, countries in the European Union (EU) resorted to lockdown and social distancing measures, which affected both supply and demand in each economy and which subsequently influenced the performance in international trade. Demand was affected by a more cautious behavior of both consumers, which oriented towards savings, and companies, which delayed their investments, due to uncertainty, while public spending patterns were affected (Gruszczynski 2020; Saif et al. 2021). Supply was hit by the closure of factories following containment measures, which further affected manufacturing in the other countries integrated in global value chains. Estimates at the beginning of the pandemic showed that almost one fifth of global trade in intermediate goods originated in China (Milea 2020). Therefore, the reduction of China’s supply of intermediate goods also had a major impact on the global economy, given its importance in world trade (Vidya and Prabheesh 2020). This have led to the closure of factories in North America, Europe and the rest of Asia, due to shortage of supplies (ECLAC 2020). Moreover, EU is one of the most affected economies, according to UNCTAD (2020). A drop in the production of intermediate goods in China highly impact the sectors of construction, equipment, cars and chemicals.

Shutdown and lockdown measures led, in a first instance, to a shortage of resources and inputs. Secondly, commodities were confronted with an increase in prices (Saif et al. 2021). These factors affected the domestic capacity of production which further resulted in lower capacity to export. Vidya and Prabheesh (2020) describe a global production network that characterized international trade, which include trade diversification, production fragmentation and a multitude of intermediaries intervening in the production of the final good. In fact, global value chains are responsible for the reduction of the average real GDP downturn by a quarter, according to Bonadio et al. (2020), while IFC (2020) goes further and describe a “contagion” of such networks. In a gravity model including final goods trade in the EU countries, Kejžar et al. (2021) establish that the transmission channels for the shocks generated by the pandemic were mostly caused by the position of a certain country in the supply chain. Therefore, increase of Covid-19 incidence affected the exports toward countries which were positioned downstream in the global supply chain, which further determined a decrease in imports. The role of the Central and Eastern European countries in the global value chains (GVC), among which Romania, is to provide mostly advanced manufacturing and business services exports (World Bank 2020). Therefore, they were caught in the middle, strongly depending on both the demand of older EU Member States specialized in innovative and sophisticated GVC, and on the supply of inputs from factories located in countries such as China. At the same time, they were also confronted with social distance measure. This vicious circle strongly affected their performance in trade.

Soon after the first set of containment measures, several countries turned to export prohibitions and restrictions, given the need to secure medical and food supplies (Gruszczynski 2020; Saif et al. 2021). The closure of free trade agreement fell into the background, prioritizing the resources towards supporting the epidemiological situation, even in the EU (Milea 2020).

Reorientation and readjustment of the supply chains may follow (OECD 2020), as the need of having production facilities closer to the sale market and more regionally diversified was highlighted during this crisis. Not only US (Gruszczynski 2020), but also European countries (Baldwin and Tomiura 2020) envisage such a solution in the near future, which could be helpful in eliminating supply shortages. Given the strong international trade in intermediate goods, a change in the pattern of global imports and exports might appear. Vidya and Prabheesh (2020) show that we assist at changes in the structure of the trade network, characterized by an important reduction of trade interconnectedness as a result of COVID-19 outbreak. IFC (2020) envisages the emergence of smaller trade hubs, which will reduce the previous long global supply chains. Positive repercussions might appear, as a result, for countries harnessing their competitive advantages, with influence on the reorientation of trade all over the world.

3 The Evolution of International Trade in Romania During the Covid-19 Pandemic

3.1 The Situation in Romania’s International Trade Before the Covid-19 Crisis

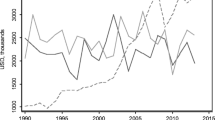

After the fall of the communism, Romania’s trade in goods was enhanced by the opening of the economy and the perspectives of the EU adhesion. A positive and sustained growth rate in both exports and imports could be noticed since the beginning of 2000s (Fig. 1). Before the pandemic, in 2019, the value of exported goods amounted to EUR 63.1 billion, while imports hit EUR 80.1million. The financial crisis in 2008–2009 generated a shock which was reabsorbed in 2010 and, for a period of five-six years, the trade deficit was under control. In the last two years before the pandemic, the trade deficit burst on the background of a rapid increase in the purchasing power generated by increases in pensions and public wages. The deficit of consumer goods is mainly generated by food goods (National Bank of Romania 2018), although the agricultural potential of the country is one of the most important in the EU. The roots of this situation resides in the lack of investment made in time and a severe fragmentation of agricultural areas.

3.2 Romania’s Trade in Goods During the Covid-19 Pandemic

Figure 2 presents the evolution of the exports in goods, in a comparative framework based on the value in 2019 and 2020. The latest available data for 2021, covering the period January-March, are also added. Goods exports started the year of 2020 with higher values than in the previous year, on an ascending trajectory. Exports in January 2020 were 3.2% higher than in the same month of 2019, even better than the debut they had in 2019. However, in the month of February, the global tensions started to be felt in Romania, and the level of exports was only 0.7% higher than in February 2019, a much more reduced increase than in 2019 (when the growth was 8% higher than in February 2018). Lockdown measures in China and in Italy started to be already implemented (Minodo 2021). Since March, there is an acute drop in exports, following the quarantine measure and the emergency state which was adopted in Romania and in all the EU countries, which are Romania’s most important trade partners. As a consequence, exports were 11.4% lower in March 2020 than on the same month of the previous year, the negative evolution sharpening until a 47% drop in April. The comeback in May, once with the end of the emergency state, was lower than expected. The gap as compared to the previous year reduced only to 40%. We notice a similar evolution of exports in Romania with the one noted by Minodo (2021) for Spain: the relaxation of the measures taken by the governments reduced the difference as compared to 2019 until 12.9% in June and 5.1% in July. However, in August it increased again to 8%, potentially as a result of new restriction measures taken in some European countries, among which Germany, which is Romania’s largest trade partner. After this month, exports started to raise again at the value level in 2019, in December even surpassing by 5% the previous year’s value. The start of the year was again weaker than in 2020 in January and February, with values almost similar for 2019. However, a surge of 20.1% was registered for March as compared to the previous year, which could be a good sign for exports’ recovery.

A similar evolution, in which a shock generated by the restriction measures during pandemics is noticed, was registered for imports (Fig. 3). The first two months saw a higher volume of imports than the one in 2019, when imports were larger by 3.3% in January and 2.6% in February. The introduction of restriction measures in March brought a brief decline (−1.9%), but the significant drop in imports was recorded for April and May, when the volume was 34% and 35.3% respectively lower on a year-on-year basis. Romanian imports recovered faster than exports. The gap stabilized at around 7.9–9.9% in June and July. After that, it started to return to the values in 2019 or to surpass them, with the exception of August and October. We notice a larger drop in exports of goods than in imports in Romania, which could point towards a decrease of the foreign demand for Romanian goods, meaning that the other economies were harder hit by the crisis than Romania.

4 Comparison with the 2008–2009 Financial Crisis

At the beginning of the pandemic, studies envisaged already that its impact on international trade might be higher than that of the Great Recession in 2008–2009. Yagi and Managi (2021) estimated an economic damage up to 1.4 higher than that of the financial crisis, by analyzing the global supply constraints. Very soon after the implementation of the lockdown policies, studies started to point that there is a major difference as compared to the pattern followed by the crisis a decade ago, as the channels of transmission were different. While the financial crisis affected firstly the demand in developed countries which further led to negative impact on production, the pandemic distorted the supply by generating a massive closure of factories and thus altering the production networks (Baldwin 2020; Vidya and Prabheesh 2020). Now, all authors agree that the impact induced by the actual crisis caused by the pandemic was more significant than the one following the financial crisis in 2008–2009 (Kejžar et al. 2021). Recent analysis confirms the expectations, showing that trade in merchandise dropped by more than 20% in the second quarter of 2020 as compared to the same quarter of 2019 (UNCTAD 2020), when the extent of the decline was only half (10.2%) during the recession at the end of 2008 and the beginning of 2009 (Minodo 2021).

Romania experienced nine months of recession, from the fourth quarter of 2008 until the second quarter of 2009. Figure 4 shows that both exports and imports of merchandise registered a gap as compared to the volumes in the similar period of the previous year starting with the last months of 2008. The decrease has worsened in the second quarter of the crisis, hitting an export reduction of 15.7% in the first part of 2009 and 19.7% in the second quarter of 2009 as compared to the situation in the year before. The reduction in imports was even higher, and was felt since the first quarter of crisis when, at the end of 2008, imports dropped by 6.8% as compared to the similar period a year before. The gap increased significantly, being of 32.1% and 38.3% respectively in the following two quarters of the crisis.

Taking into account the general reduction in trade of goods during the quarters of recession in 2008 and 2009 as compared with the similar period of the previous year, we could notice a drop by 11.2% in exports and 26.3% in imports. Therefore, exports suffered the most drastic reduction during the lockdown months of 2020 than during the financial crisis, but imports had a different evolution. Moreover, if we look at the reduction in imports of goods in the two periods, we can notice a more severe drop in the second quarter of 2009 (38.3%) than during March–May 2020 (23.7%). In addition, imports had a difficult recovery after the financial crisis, the first quarter of growth being in the first part of 2010, and at a slower pace than the restoration of exports.

How is it possible that the magnitude of the impact in imports to be lower than during the financial crisis? Comparing Romania’s international trade evolution from 2008 until 2019, Davidescu et al. (2021) point that Romania became an intermediary in the production network between manufacturing countries, like China, and final destinations, such as developed countries in the EU. A stronger integration of Romania in global value chains after the financial crisis could be partially an explanation for the discrepancy in the evolution of imports during the financial crisis in 2008–2009 versus the one during 2020. Imports for the production of goods restarted once with the relaxation of restrictions, therefore imports had to be resumed, while such a pressure was not obvious back in 2009, or it was only in preliminary phases.

5 Investigating the Relationship Between Romanian Exports and EU Imports and Exports. An Empirical Investigation Based on Granger Causality Analysis

In the context of Romania’s integration in the global value chains, high trade dependence with the EU market, and increasing importance of China’s as a supplier, which represent major factors characterizing Romania’s trade before the pandemic, an important research interest is to assess the way in which Romania’s trade is integrated in that of the EU. Therefore, we are interested into investigating the relationship between Romanian exports and EU imports and exports of goods and services using the Granger causality analysis. This approach builds on a previous research, in which Davidescu et al. (2021) have used panel data gravity models for the 2008–2019, in order to identify the dependency level of Romanian exports to China. The authors have stated that the most important channels that could affect Romania's exports in case of crises such as the one generated by the pandemic were the following:

-

The decrease of the demand on the markets of Romania’s main EU trade partners;

-

The increase of the domestic demand, which reconfigures the distribution of the products that would have otherwise been exported;

-

The decrease of Romania’s imports from China, either because China partially closed its production, or due to import restrictions, reductions in the transport activity etc.;

-

The decrease of the EU member states’ exports to China, due to import restrictions, reductions in the transport activity, etc.

-

The decrease of Romania's imports from the rest of the world, as a result of restrictions (isolation, reduction of transport activity, decrease of orders, etc.).

-

The decrease of the EU member states’ exports to the rest of the world, due to the same causes mentioned above.

Starting from these results, it is worth to analyze the nature of the relationship between Romanian exports of goods and services and EU-28 exports and imports of goods and services using VAR/VECM models for the period 2000–2019, based on quarterly data. Therefore, the main aim is to investigate if Romanian exports bring their contribution to the total EU imports as well as to the total EU exports, highlighting the long-run equilibrium relationship.

The graphical evolution of both Romanian exports and EU exports as well Romanian exports and EU imports revealed a positive relationship between variables, very high in intensity, which hits a value of 0.93 for Romanian exports and EU exports and 0.87 for Romanian exports and UE imports, respectively (Fig. 5).

5.1 Methodology and Data

The data used in the research covers the period 2000:Q1–2019:Q4, with a total number of 80 observations. The variables used are as follows: Romanian exports of goods and services (expressed in % of GDP), EU imports of goods and services (% of GDP) and EU exports of goods and services (% of GDP). The Romanian exports have been seasonally adjusted using Census X-13 method. The main source of the data was the Quarterly National Accounts Database of Eurostat.

The methodology we have followed started with the stationarity analysis based on unit root tests (ADF and PP tests), cointegration analysis based on Johansen methodology, estimation of VAR/VECM models based on the decision regarding the presence of a long-run relationship, the Granger causality analysis on long run or/and short run term together with the impulse response function capturing the effect of a shock in the Romanian exports on both EU imports and exports.

Since most of the time the series exhibit a non-stationary pattern, if the both variables are I(1) and cointegrated, then the Granger causality test will be run under VECM (t-ratio of ECM and F-test should be statistically significant). Therefore, the Granger causality will take into account the results of co-integration. It becomes necessary to augment the simple Granger causality test with the error correction mechanism (ECM), derived from the residuals of the appropriate co-integration relationship to test for causality:

where: \(Y,X\) are the variables, \(p_{i}\) is the adjustment coefficient while \(ECT_{t - 1}\) expresses the error correction term. In Eq. (1), \(X\) Granger causes \(Y\) if \(\alpha_{i} ,\,p_{i}\) are significantly different from zero. In Eq. (2) \(Y\) Granger causes \(X\) if \(\zeta_{i} ,\,\eta_{i}\) are significantly different from zero. F-test alone is not enough to have causation; t-ratio of ECM term should be also negative and statistically significant together with F value of the model to have causation in the models.

5.2 Empirical Results

Based on the empirical results of unit roots tests applied for all series, we can state that all our time series are non-stationary in level and they become stationary in first differences, being therefore integrated of the same order, I(1). As a result, we will apply Johansen and Juselius cointegration approach in order to investigate if there is a long run relationship between both relationships.

In order to do that, two VAR models in levels have been developed, and the optimal number of lags have been identified to be one (according to LR, FPE, AIC, HQ, SC criterions) for both models, assuming a maximum number of 4 lags.

The results of the co-integration tests based on trace statistics and maximum eigenvalues pointed out the existence of a unique long run relationship in the case of both models. We have found a long run equilibrium relationship between, on one hand, Romanian exports and EU imports, and on the other hand, between Romanian exports and EU import. Therefore, we have built two VECM models in order to determine the direction of causality. The results of the VECM models are presented in Tables 1 and 3.

The long-run relationship proved its validity, the Romanian exports exhibiting a long run statistically significant and positive impact on the EU imports. The long-run coefficient is strongly significant inferring that a 1% increase of Romanian exports would imply an estimated increase of 0.44% in UE imports.

The estimated speed of adjustment to disequilibrium (error correction term ECT) indicates how fast equilibrium is restored. The significance of the error correction term shows causality in at least one direction. The lagged error term in our results is negative and highly significant.

The error correction term for EU imports is −0.11, indicating that the deviation from the long-term equilibrium is corrected by almost 12% over each quarter.

On the short run, the empirical results infirmed any Granger causality due to the lack of statistical significance of the lagged coefficient.

The results of VECMs support that Romanian exports explains about 13% of the variation in EU imports, while the model is well specified and the residuals satisfied the conditions of non-autocorrelation and homoscedasticity.

Table 2 reports the F-statistics and t-statistics for error correction term defined for the null hypothesis of no-causality. We can conclude that we have a Granger causality that runs from Romanian exports to EU imports (t-ratio of ECT and F-ratio are statistically significant at 1 and 5% levels, and the ECT is negative).

In order to quantify the effects of a shock in Romanian exports in the magnitude of EU imports, we have applied the generalized impulse response functions (GIRFs) proposed by Pesaran and Shin (1998). The results suggest that an increase of 1% in the Romanian exports will increase the EU imports with 0.50% at the level of fourth quarter (Fig. 6).

The relationship between Romanian exports and EU exports exhibited a long-run equilibrium, the Romanian exports having a long run statistically significant and positive impact on the EU exports. The long-run coefficient is strongly significant inferring that a 1% increase of Romanian exports would imply an estimated increase of 0.57% in UE exports.

The estimated speed of adjustment to disequilibrium (error correction term ECT) is −0.149, indicating that the deviation from the long-term equilibrium is corrected by almost 15% over each quarter. The negative sign of the ECT and the high significance of the coefficient reveals the existence of a long-run Granger causality from Romanian exports to EU exports.

However, on the short run, the empirical results infirmed any Granger causality due to the lack of statistical significance of the lagged coefficient.

The results of VECMs support that Romanian exports explains about 13% of the variation in EU imports, while the model is well specified and the residuals satisfied the conditions of non-autocorrelation and homoscedasticity.

Table 4 reports the F-statistics and t-statistics for error correction term defined for the null hypothesis of no-causality. We can conclude that we have a Granger causality that runs from Romanian exports to EU exports (t-ratio of ECT and F-ratio are statistically significant at 1 and 5% levels, and the ECT is negative).

The effect of a shock in Romanian exports in the magnitude of EU exports, evaluated based on the generalized impulse response functions (GIRFs) of Pesaran and Shin (1998), suggest that an increase of 1% in the Romanian exports will increase the EU exports with at most 0.55% at the level of fourth quarter (Fig. 7).

6 Conclusions

Covid-19 crisis was devastating for Romania’s international trade, causing one of the largest drop in both trade of goods and services in the last years. In addition, the economic recovery which was enhanced by the increase of exports after the crisis in 2008–2009 is hard to be replicated, due to the specific of the actual crisis, which generated a shock crisis in both supply and demand, which was spread all over the global production networks.

Based on the analysis of monthly data since the start of pandemic, we conclude that exports of goods saw a larger drop than imports, while the decrease in imports of services surpassed the reduction of exports both during the whole year 0f 2020 and during the lockdown months, as compared to the similar periods in the previous year. As indicated in literature, exports and imports of Machinery and transport equipment and Miscellaneous manufactured articles were the most affected during March–May 2020. Another significant mutation was noticed in Romania’s trade partners. The total values of exports and imports carried out with EU Member States started to drop in the favour of non-EU countries, which hit unprecedented levels in the last decade, especially during the months when the emergency state was imposed. This could be a consequence of the fact that the EU countries were among the most hit by the pandemic, enhancing restriction measures for a longer period, and thus experiencing at the same time low levels of demand. For Romania, it could the start for diversifying international trade partners, for reducing the high EU dependency. We also confirm that the Covid-19 crisis had a larger impact on Romania’s international trade than the one felt during the economic crisis during 2008–2009.

In this context of strong dependency on the EU and integration in global value chains where China is an important supplier, we have also investigated the causality relationship between Romanian exports, EU imports and exports, expressed as % of GDP using Granger causality tests. Our results indicate that there exists a direct long-run relationship statistically significant between Romanian exports and EU exports and imports. The analysis leads to the finding that a 1% increase in Romanian exports contributes to an increase in the EU exports and imports to about 0.55% over the next four quarters. Although this analysis is only a starting point for more in-depth studies regarding the role and place of Romania’s trade with the EU, it is a preliminary confirmation of the strong connections between these countries, that could further exacerbate vulnerabilities or enhance a common recovery. Romania should take into account such interconnectedness, given the actual proposals related to shortening and diversifying the global value chains, and creating a sustainable pool of competitive advantages for attracting the location of important industries.

References

Baicu, C.G., Gârdan, I.P., Gârdan, D.A., Epuran, G.: The impact of COVID-19 on consumer behavior in retail banking, evidence from Romania. In: Management & Marketing. Challenges for the Knowledge Society, vol. 15, No. Special Issue, pp. 534–556. https://doi.org/10.2478/mmcks-2020-0031 (2020)

Baldwin, R.: The Greater Trade Collapse of 2020: Learnings from the 2008–09 Great Trade Collapse. VoxEu CEPR. https://voxeu.org/article/greater-trade-collapse-2020 (2020)

Baldwin, R., Tomiura, E.: Thinking Ahead About the Trade Impact of COVID-19. https://cepr.org/sites/default/files/news/COVID-19.pdf (2020)

Bonadio, B., Huo, Z., Levchenko, A. A., Pandalai-Nayar, N.: Global Supply Chains in the Pandemic. National Bureau of Economic Research, w27224 (2020)

Brinca, P., Duarte, J.B., Faria-e-Castro, M.: Is the COVID-19 Pandemic a Supply or a Demand Shock?, vol. 31. Economic Synopses (2020)

Davidescu, A.A., Popovici, O.C., Strat, V.A.: An empirical analysis using panel data gravity models and scenario forecast simulations for the Romanian exports in the context of COVID-19. Econ. Res. Ekon. Istraživanja (2021). https://doi.org/10.1080/1331677X.2021.1907205

ECLAC: The Effects of the Coronavirus Disease (COVID-19) Pandemic on International Trade and Logistics, vol. 6. https://repositorio.cepal.org/bitstream/handle/11362/45878/1/S2000496_en.pdf (2020)

Eurostat data. https://ec.europa.eu/eurostat/data/database

Fonseca, L., Azevedo A.: COVID-19: outcomes for global supply chains. In: Management & Marketing. Challenges for the Knowledge Society, vol. 15, No. Special Issue, pp. 424–438. https://doi.org/10.2478/mmcks-2020-0025 (2020)

Friedt, F.L., Zhang, K.: The triple effect of Covid-19 on Chinese exports: first evidence of the export supply, import demand and GVC contagion effects. Covid Econ. 53, 72–109 (2020)

Gruszczynski, L.: The COVID-19 pandemic and international trade: temporary turbulence or paradigm shift? Eur. J. Risk Regul. 7, 1–6 (2020). https://doi.org/10.1017/err.2020.29

IFC: When Trade Falls-Effects of COVID-19 and Outlook. https://www.ifc.org/wps/wcm/connect/78f10cad-7e00-440d-b6fd-da210e5a6d1e/20201023-Trade-and-COVID-19-Note-1.pdf?MOD=AJPERES&CVID=nllE81b (2020)

IMF: World Economic Outlook: International Monetary Fund, p. 2020. DC, Washington (2020)

Kejžar, K.Z., Velić, A., Damijan, J.: Covid-19, trade collapse and GVC linkages: European experience. GROWINPRO Working Paper 38/2021 (2021)

Milea, C.: Consequences of covid-19 on the international trade in goods and services: forecasts, developments, restrictions. Financ. Stud. Victor Slăvescu Cent. Financ. Monet. Res. Buchar. 24, 4(90), 29–40 (2020)

Minodo, A.: Impact of COVID-19 on the trade of goods and services in Spain. Appl. Econ. Anal. 29(85), 58–76 (2021). https://doi.org/10.1108/AEA-11-2020-01562021

National Bank of Romania: Raport Asupra Inflatiei, February 2018. https://www.bnr.ro/Publicatii-periodice-204.aspx (2018)

National Institute of Statistics, Romania. http://statistici.insse.ro:8077/tempo-online/

OECD: COVID-19 and International Trade: Issues and Actions. https://www.oecd.org/coronavirus/policy-responses/covid-19-and-international-trade-issues-and-actions-494da2fa/ (2020)

Păunescu, C., Mátyus, E.: Resilience measures to dealing with the Covid-19 pandemic. In: Evidence from Romanian Micro and Small Enterprises. Management & Marketing. Challenges for the Knowledge Society, vol. 15, No. Special Issue, pp. 439–457. https://doi.org/10.2478/mmcks-2020-0026 (2020)

Pesaran, M., Shin, Y.: Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1), 17–29 (1998)

Saif, N.M.A., Ruan, J., Obrenovic, B.: Sustaining trade during COVID-19 pandemic: establishing a conceptual model including COVID-19 impact. Sustainability 13, 5418 (2021). https://doi.org/10.3390/su13105418

Staszkiewicz, P., Chomiak-Orsa, I., Staszkiewicz, I.: Dynamics of the COVID-19 contagion and mortality: country factors, social media, and market response evidence from a global panel analysis. IEEE Access. 8, 106009–106022 (2020)

UNCTAD: Global Trade Impact of the Coronavirus (COVID-19) Epidemic. https://unctad.org/en/PublicationsLibrary/ditcinf2020d1.pdf (2020)

UNCTAD: Key Statistics and Trends in International Trade 2020. United Nations, Geneva. https://unctad.org/system/files/official-document/ditctab2020d4en.pdf (2021)

Vidya, C.T., Prabheesh, K.P.: Implications of COVID-19 pandemic on the global trade networks. Emerg. Mark. Financ. Trade 56(10), 2408–2421 (2020). https://doi.org/10.1080/1540496X.2020.1785426

World Bank: World Development Report 2020. World Bank Publications, The World Bank, 32437 (2020)

Yagi, M., Managi, S.: Global supply constraints from the 2008 and COVID-19 crises. Econ. Anal. Policy 69, 514–528 (2021). https://doi.org/10.1016/j.eap.2021.01.008

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Mihai, P.D., AnaMaria, D.A., Cristina, P.O., Cazabat, G. (2021). Romania’s International Trade in Goods After the COVID-19 Crisis: Where to? An Empirical Investigation Based on Granger Causality Analysis. In: Dima, A.M., Anghel, I., Dobrea, R.C. (eds) Economic Recovery After COVID-19. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-86641-9_6

Download citation

DOI: https://doi.org/10.1007/978-3-030-86641-9_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-86640-2

Online ISBN: 978-3-030-86641-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)