Abstract

In this paper we analyse the effect that the euro has had on trade using a gravity model for 28 countries and covering the period 1990–2013. Our gravity specification includes time-varying fixed effects, correcting any possible bias that may arise from multilateral resistance variables or unobserved time-varying heterogeneity. Additionally, we explore the potential complementarity or substitution relationship between FDI and trade by including FDI inward and outward stocks in the specification. The time period in the dataset covers the creation and evolution of the European Monetary Union (EMU), starting from the introduction of notes and coins and including the recent economic crisis. Overall, our results show a positive effect of the EMU on trade and reveal the existence of a complementary relationship between trade and FDI.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The introduction of the euro has raised new interest in measuring the impact of currency unions (CU) on trade flows. The very high estimates of trade induced by the creation of monetary unions reported in the seminal papers by Rose (2000) and Frankel and Rose (1998) has led to the concept of ‘endogeneity’ of optimum currency areas (OCA). For the euro area, this means that, even if the European Monetary Union (EMU) was not created as an OCA, it could be progressing in that direction (Frankel and Rose, 1998). Recent research surveyed by Rose and Stanley (2005) suggests that the introduction of the euro still has a sizable and statistically significant effect on trade among EMU members. Taking together all these estimates implies that the EMU has increased trade by about 8–23% in its first years of existence. Moreover, recent surveys of the empirical literature on the euro trade effect by Glick and Rose (2016) and Rose (2017) stress how the span of the sample has a major effect on the results. In particular, the EMU effect is much larger when the sample includes more than just EMU or OECD industrialized countries. This issue can be very relevant for prospective members of the EMU.

In 1999, eleven countries of the European Union (EU) adopted the euro as a common currency, while Greece entered in 2001. Since then, Slovenia, Cyprus, Malta, Slovakia and Estonia have also joined the euro area, while other members of the EU are ‘waiting and seeing’, the so-called derogation countries. Moreover, the introduction of the euro was preceded by other stages of economic integration (Customs Union, European Monetary System and the Single Market), so the EMU effect has to be analysed as an on-going process with a time dimension. It might be interesting to investigate whether there is an additional benefit of a common currency over (relative) exchange rate stability.

Parallel to the European integration process, a process of global economic integration has taken place in the world. Rapid technological changes and the gradual opening and liberalisation of markets have notably contributed to the increase in international direct investment, which is one of the key factors contributing to globalisation. Broadly defined, foreign direct investment (FDI) is considered as the investment made by a company or entity based in one country into a company or entity based in another country. The advantages of this type of investment are numerous for both the recipient and the investing economy. Besides creating direct, stable and long-lasting links between the economies, FDI can serve as a vehicle for local enterprise development and it can contribute to improving the competitive positions of the economies via the transfer of technology and innovation processes. This is particularly important for Europe, which is the main recipient and source of world FDI flows, followed by US and Japan.

Logically, this new phenomenon has attracted research interest in recent years. More specifically, the impact of FDI on trade has been widely debated in recent literature. The relationship between these two variables is complex and cannot be deduced simply from a theoretical perspective. Recent empirical works have shed some more light on this topic but are, however, far from conclusive. Although there are many aspects to be considered, the discussion has largely focused on the complementarity or substitution relationship between both variables. According to a Hecksher-Ohlin model with factor mobility, there would be a substitution relationship. In this case, FDI would be based on the improvement of market access. On the contrary, a complementarity relationship could be explained by the existence of different factor endowments across countries, which would increase FDI in order to achieve more efficiency. FDI would stimulate the growth of exports from originating countries. However, this relationship may vary from one country to another, and it may also differ by sector. Moreover, the recent economic crisis has had both positive and negative effects on FDI flows. Although the general contraction of the economy has, of course, discouraged investment flows all over the world, it has also reduced the price of some shares, thus leading to the emergence or extension of new domains of activity. The scarcity of data and the complex nature and evolution of this phenomenon make this issue a challenging research topic that requires further and more in-depth research.

The contribution of this paper to the existing literature about the euro effect on trade is twofold. First, unlike previous research (excepting Eicher and Henn, 2011), we address Baldwin and Taglioni’s (2006) (BT henceforth) critiques regarding the proper specification of gravity models and the definition of the variables, as we account for multilateral resistance in addition to unobserved bilateral heterogeneity. Second, we explore the role that FDI has on trade, finding a complementary relationship between both variables.

The paper is organised as follows. The next section reviews the empirical literature on the EMU, FDI, and trade. A third section presents the methodology and data used in the paper, correcting the failures in the specification noted by BT. The fourth section discusses the empirical results and the fifth presents some robustness checks to reinforce the results obtained. A final section concludes.

2 Literature Review

The literature examining the impact of CU on trade is a burgeoning field of research. All in all, the diversity of existing estimates indicates the potential bias inherent in applied specifications. Although in the beginning the gravity model was criticized for its lack of theoretical underpinnings, now rests on a solid theoretical background.Footnote 1 Therefore, as stated in Westerlund and Wilhelmsson (2009) the focus of this line of research has shifted from its theoretical soundness towards the estimation techniques used.

The econometric approach has changed over time as a result of a feedback process between theory and empirics. In this abundant literature, the traditional approach has been to use cross-section data. However, it is generally accepted that the results obtained were suffering from a bias, as the heterogeneity among countries was not properly controlled for. Thus, Rose’s (2000) initial estimates in a cross-sectional study suggested a tripling of trade. This result was quite striking, and as quoted by Faruqee (2004), is at odds with the related literature that typically finds very little negative impact of exchange rate volatility on trade. Not surprisingly, Rose’s findings have received substantial revisions, and subsequent analysis generally finds a smaller (albeit still sizable) effect of CU membership on trade. There are different reasons that make the implication of Rose’s (2000) work unclear. First, the sample countries were mostly small and poor, not including the EMU ones. This has led to question whether the results apply to bigger countries such as the EMU members. Second, the cross-sectional analysis included in Rose (2000) provides a comparative benchmark across members of a monetary union against third countries but the most relevant issue about EMU is the possible change in the level of trade for its member over time, before and after the introduction of the single currency. In order to solve this problem, a second string of literature started to use panel data estimation techniques, which permits more general types of heterogeneity. However, BT define what they call in this context ‘the gold medal error’, also known as the ‘Anderson-van Wincoop (A-vW) misinterpretation’ in the sense that A-vW developed a cross-section estimation technique to control for omitted variables with pair fixed effects.Footnote 2 However, this technique has been generalized to the panel data framework by many authors without considering the time dimension (see, for example, Glick and Rose, 2002 or Flam and Nordstrom, 2006). Country dummies (for exporters and importers) only remove the average impact leaving the time dimension in the residuals, which leads to biased results. Therefore, time-invariant country dummies are not enough and a proper treatment of the time dimension is needed. Moreover, BT also stress the importance of an omitted variable bias when the empirical specification does not account for unobserved determinants of bilateral trading relationships. They suggest the inclusion of time varying fixed effects in the specification.

In addition to the above-mentioned specification caveats, BT pointed out two additional minor problems, coined as ‘silver’ and ‘bronze’ medal errors. The silver medal error concerns the definition of the dependent variable. As BT point out, the gravity equation is an expenditure function that explains the value of spending by one nation on the goods produced by another nation; it explains uni-directional bilateral trade. Most gravity models, however, work with the average of the two-way exports and frequently the averaging procedure is wrong. The problem arises when authors use the log of the sum instead of the sum of the logs in the bilateral trade term. The silver medal mistake will create no bias if bilateral trade is balanced. However, if nations in a currency union tend to have larger than usual bilateral imbalances, as it has been the case in the Eurozone, then the silver medal misspecification leads to an upward bias as the log of the sum (wrong procedure) overestimates the sum of the log (correct procedure). Finally, the bronze medal mistake concerns the price deflator: all the prices in the gravity equation are measured in terms of a common numeraire, so there is no price illusion. However, many authors deflate trade flows and GDP using the US CPI (following Rose’s example).

More recently, Campbell (2013) has filtered Glick and Rose (2002) data, accounting for colonial linkages (that is, currency unions created as a result of colonization), excluding wars and riots as well as currency unions with missing observations, and concludes that the effect would be reduced to around 10% or even becoming non-significant. Also, using Glick and Rose (2002) data, Katayama and Melatos (2011) account for non-linear effects and interaction terms and obtain lower parameters (negative for 10% of the countries).

Micco et al. (2003) examined the dynamic impact of EMU on trade for 22 industrial countries using panel regressions based on a gravity model. Their findings suggest that EMU has fostered bilateral trade between 8 and 16% depending on the EMU membership of the countries and that the positive effect has been rising over time. Other studies, like Bun and Klaasen (2002) estimate a dynamic panel data model and distinguish between short (3.9%) and long-run effects (38%). In the same vein, but using panel cointegration techniques, it is worth to note the results obtained in Camarero et al. (2013, 2014). Rose and Stanley (2005) perform a meta-analysis of the results of 34 studies, and find a combined estimate of the trade effect between 30% and 90%, which is smaller than previous evidence. However, these papers generally use smaller and shorter datasets than Rose’s. When they focus on large panels, they find bigger estimates (over 100%). Serlenga and Shin (2007) use a generalized Hausman-Taylor methodology for the estimation of a gravity equation applied to 15 EU countries. They do not find a significant effect derived from EMU membership, although they admit that their sample ends too early (in 2001). However, according to Bergin and Lin (2012) the effects may be significant and occur relatively early in time due to the role of expectations: as the EU countries were already involved in a currency peg, the main effect of EMU has to do with a reduction of frictions and trade costs. Fontagné, Mayer, and Ottaviano (2009), focusing on the microeconomic impact of the euro, make an interesting contribution to this line of research, as they attribute the relatively small size effect of the common currency to the remaining obstacles to full European integration, and consider that there is margin for larger effects. Finally, Kelejian et al. (2012) conclude, using spatial econometric techniques, that the trade effect of the euro would only be “borderline” significant. Therefore, the empirical literature is far from conclusive and we can infer that dataset dimensions, and, especially, econometric approaches, influence the results.

On the other hand, FDI has gained an increasing importance over the last years. Recent literature covers a wide range of issues, some of them being the analysis of FDI determinants, the relationship between FDI and trade, or the relationship between FDI and growth. In this article, we aim at studying the relationship existing between trade and FDI. Fontagné (1999) is one of the first articles providing evidence on this relationship. Analyzing an OECD sample, he finds that both variables are complementary. In this line, Camarero and Tamarit (2004) also show a positive relationship for manufactured goods. They provide evidence of this relationship for each country, revealing the existence of some variation across countries. Mitze et al. (2010), in contrast, find substitution between both variables using a sample of German regional data. Also from a national perspective, Koike (2004) shows mixed evidence for Japan using sectoral data. In this line, Kreinin and Plummer (2008)‘s results point at a substitution relationship in a significant number of cases, but complementary in some others.

Other strand of literature has studied the effects of a currency union on FDI. According to Schiavo (2007) a currency union reduces exchange rate uncertainty and, therefore, may spur cross-country investment flows. In a gravity equation setting, even after controlling for Exchange Rate Mechanism membership, he finds a positive and significant effect of the euro.

Only a few papers have explicitly analysed the euro effect on trade in gravity equations extended with FDI variables. De Sousa and Lochard (2011) find a positive relationship between trade and FDI and a significant and positive euro effect as well. They deal with possible endogeneity problems. Brouwer et al. (2008) also support this conclusion, with a specific focus on the enlargement of the European Union. Petroulas (2007) uses a difference-in-differences approach and estimates the effect to be around 16% within the euro area.

We contribute to this literature by providing new evidence on this relationship with an appropriate specification of the gravity equation that correctly deals with all time-varying unobserved effects. We use a new dataset that covers 28 countries for the period 1990–2013. Our results point towards the existence of a complementarity relationship of FDI with trade.

3 Methodology and Data

The empirical tool we use in this exercise is the gravity equation. This model has largely proved to be successful when predicting trade flows, and it now rests on solid theoretical underpinnings. From the initial formulation made by Tinbergen in 1962, the specification of this equation has evolved to achieve increasing precision. Anderson (1979) and Bergstrand (1985) notably contributed to its theoretical foundation. Another substantial improvement was suggested by Baier and Bergstrand (2001) and Anderson and van Wincoop (2003). They included multilateral resistance terms and the alternative provided by Feenstra (2004) consisting in the inclusion of fixed effects to overcome the estimation of these terms, which were not easy to calculate. Another important step towards a better specification of the model was later given by Baldwin and Taglioni (2006), as we have explained above. Finally, several articles based on the gravity literature have focused on the zero flows issue: since the logarithm of zero is undefined, an important part of the dataset is automatically discarded, thus creating a bias in the estimation. Helpman et al. (2008) and Santos-Silva and Tenreyro (2006) are the main papers dealing with this issue.

In this article, we use a specification based on the structural equation proposed by Anderson and Yotov (2012) and extended in Baier et al. (2017) and Yotov et al. (2016). As they claim, econometric problems of exogeneity and omitted variables disappear when size and multilateral resistance variables are replaced by the proper set of fixed effects. Hence, we include time-varying fixed effects in our specification to capture all unobserved heterogeneity (and this addresses BT’s gold error as well). This implies that we cannot estimate the coefficient of country-specific varying variables as GDP or GDP per capita, but since our interest is focused on variables that vary for country pairs and time (FDI, EMU), this does not represent a problem. In addition, we include exports instead of the sum of imports and exports to avoid the incorrect averaging of the dependent variable (silver error) and we include flows in nominal terms to avoid the bronze error. All in all, our specification is as follows:

where X ijt are export flows from country i to country j in nominal terms obtained from the CHELEM-CEPII database and expressed in current dollars. FDI_inward ijt and FDI_outward ijt are FDI inward and outward position for each exporter country, expressed in current dollars as well. Both variables are obtained from the OECD International Direct Investment database and are included with the intention to explore the potential complementary or substitution relationship between FDI and trade. Using stocks, we avoid the high variability of FDI flow data. We include a set of bilateral variables to proxy for cultural effects from CEPII. More specifically, we include geographical distance (Dist i ), contiguity (Contig ij ), common language (Comlang ij ), number of hours of difference between exporter and importer (TimeDiff ij ), area of the countries (Area i , Area j ) and whether the exporter is current or former hegemon of the importer (Heg i ). Additionally, two dummy variables have been built to include the effect of particular integration agreements on trade. Specifically, RTA ijt , which is 1 if both countries have a free trade agreement at time t and is constructed according to De Sousa (2012), and finally the key variable of interest, EMUijt, which equals 1 if both trading partners belong to the euro area in year t and zero otherwise. This variable takes value 1 only from 1999 onwards; therefore, it captures the effect of the creation of the euro area on its members. Including this variable along with the rest of control variables allows isolating EMU effects on exports controlling for other factors that might have an influence on exports flows but are not related to the monetary union. Finally, η it and η jt are the exporter and importer time-varying sets of fixed effects and ε ijt is the error term.

The dataset contains annual data from the following 28 countries: Australia, Austria, Belgium, Canada, Chile, China, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Japan, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, South Korea, Spain, Sweden, Switzerland, United Kingdom, and United States. It covers the period 1990–2013. Hence, we have a balanced panel with dimension N = 28 × 27 = 756 (all possible bilateral combinations of countries) and T = 23.Footnote 3 The period is long enough to capture both the introduction of the euro and the effects of the recent economic crisis. Table 1 shows the summary statistics for the variables included.

We use Poisson Pseudo Maximum Likelihood (PPML) for the estimation of Eq. (1). As Santos-Silva and Tenreyro (2006) claim, this estimator is robust to different patterns of heteroscedasticity, which is potentially important in gravity models. It provides unbiased and consistent estimates and allows including zero flows in the estimation.

To gain a better understanding of the FDI and trade relationship, it is useful to have a first look at the evolution and patterns of these variables across countries and over time. Figure 1 shows outward and inward FDI and exports for EMU countries during the period under analysis. Both, inward and outward FDI variables are relatively stable, with inward stocks being slightly higher. These variables are affected by the global financial and economic turmoil that began in 2008, although the effect is faster for inward FDI. On the other hand, exports also show an increasing trend, with a slight decline at the beginning of the economic crisis. The evolution of exports is parallel to that of outward FDI stocks, which can be interpreted as a first signal of complementarity between the two variables. Figure 2 shows the same variables for European countries that are not EMU members. The trends for the three variables are quite similar, although outward FDI is higher than inward FDI in this case. A tentative explanation for this fact may be that the euro is a factor that contributes to attracting foreign capital.

Figure 3 shows the evolution of outward FDI as a percentage of GDP in each EMU country. Special-purpose entities play a special role in Luxembourg and Netherlands, and because of this, these two countries show the largest share of EU-27 FDI outward stocks. For the sake of clarity, we have excluded both countries from the graph. For the rest of the countries, the main leaders are Belgium and Ireland, whereas Greece and Poland remain at the tail. For the rest of the members, the proportion of outward FDI over the GDP lies in a range of approximately 10–40%.

The main partners of EMU countries for the period under analysis are detailed in Table 1. The principal locations of EMU outward FDI and exports are usually European countries or the US. This is also the case when looking at the main holders of inward FDI stocks. Geographical distance and/or language are important criteria for determining partnership. As the table shows, the dominant partners are usually close to each other (Spain-France, Austria-Switzerland, Finland-Sweden, etc.). All in all, the US, the Netherlands and the UK are the main location of EMU outward FDI; the US, France and the UK are the foremost investors in EMU; and Germany, France and the UK are the main destination of exports coming from EMU members.

Finally, Fig. 4 graphically shows the intra-euro area trade openness and the extra-euro area trade openness rate before and after the monetary union, defined as the sum of imports and exports over GDP. The most prominent feature is that this rate is substantially higher for intra-euro countries after the euro, whereas the difference is less pronounced for extra-euro countries.

4 Results

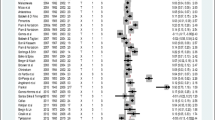

In Table 3 we compare our results with the results from other specification commonly used in the literature, but incorrect according to BT. The first column includes country-specific and time fixed effects. The second column corresponds to eq. (1), which is the correct one according to BT and Anderson and Yotov (2012). It includes exporter and importer time-varying effects. As can be seen in columns 1 and 2, the size effects are similar to those in the gravity literature, and have a positive and significant effect. The size of the importer affects trade more strongly than the size of the exporter.

Column 2 shows that FDI has a trade-creating effect, revealing a complementary relationship between both variables. Standard gravity variables have the expected sign, and show that distance, number of hours of difference and being current or former hegemon of importer in the past negatively impacts trade, whereas the area, having a common border, or sharing a language positively affects it. Being part of a regional trade agreement also contributes to increasing exports. Our variable of interest, the EMU, is positive and significant.

Following De Sousa and Lochard (2011), in the third column we run eq. (1) again, but dropping the FDI variables to account for the ‘FDI channel’. For the sake of comparison, we only include those observations for which FDI data are available. We observe that including FDI variables notably reduces the EMU coefficient, which may lead us to think that the FDI variable captures part of the euro effect. Overall, we can deduce that besides the positive direct effect that the euro has on trade, it also indirectly affects this variable through the stimulation of FDI. The Pseudo R-squared show that our specification explains more than 90% of the data variation.

One important concern in this estimation is endogeneity. We assume that FDI is a factor affecting trade, but it is clear that the reverse may also be true, leaving us with a problem of simultaneity bias. Furthermore, the positive correlation between trade and FDI that we observe in the results might be provoked by third unobserved factors. Following De Sousa and Lochard (2011), we account for the sequential nature of the FDI channel and lag the FDI and the EMU variables. The fourth column in Table 2 shows the results from the estimation of eq. (1) lagging both FDI variables by one year to remove contemporaneous shocks that simultaneously influence FDI and trade.

As De Sousa and Lochard (2011) point out, it could also be the case that the creation of a currency union first gives incentives to invest abroad and then, once the investment is operational, trade begins. Hence, some sequentiality may be present and it could be convenient to lag the EMU variable as well. Hence, column (5) shows the results of eq. (1) introducing one lag in FDI and EMU variables. Again, in column (6) we compare the specification dropping FDI variables to better isolate the EMU effect. For the sake of comparison, we only include those observations for which lagged FDI data are available. We can still observe a positive effect of the EMU on trade, and the introduction of FDI variables reduces its coefficients, again showing the existence of an FDI channel.

We check the goodness of fit of the results obtained by plotting the residuals versus the fitted values. As Fig. 5 shows, the pattern of the residuals is constant across the fitted values, suggesting that the variances of the error terms are equal and there are no biases in the estimation.

5 Robustness Checks

In our view, FDI stocks (as a valuation of the cumulative FDI) provide a better approximation to the long-run behaviour of investment decisions, the ones really relevant to capture growth and dynamic effects of economic integration. Moreover, Baldwin et al. (2008) explain that factors such as stock market fluctuations or exchange rate volatility cause short run fluctuations on FDI flows that may not always be linked to fundamental explanatory variables and therefore lead to worse model fit for flows than for stocks. In the same vein, other authors argue that there are several advantages in working using stocks rather than flows. First, foreign investors decide on the worldwide allocation of output, hence on capital stocks. Second, stocks account for FDI being financed through local capital markets; hence it is a better measure of capital ownership (Devereux and Griffith, 2002). Finally, stocks are much less volatile than flows which are sometimes dependent on one or two large takeovers, especially in relatively small countries (Benassy-Quéré et al. 2007, p.769).

However, a number of papers have examined the interaction between FDI and trade flows. See, for instance, Aizenman and Ilan (2006) or Albuquerque et al. (2005). In this section, we check the robustness of our results to FDI flows. Results in Table 4 show consistency with those in Table 3. The sign of coefficients of both inward and outward FDI flows are similar to those in Table 3 corresponding to the FDI position. The magnitude is slightly lower, but still similar. Gravity variables are also similar in size and magnitude. All in all, we can conclude that our results are robust to the type of FDI (Table 4).

6 Conclusions

In this article, we have performed an empirical exercise to analyse the effect of the EMU and the role of FDI on trade. We use a sample of 28 countries, 27 of which are OECD members, over a time period that covers both the introduction of the euro and the recent economic crisis. We deal with possible endogeneity that may arise in the FDI, EMU and trade relationship.

Overall, our results show first, that the effect of the euro on trade has been positive and significant. Second, both inward and outward FDI positions have also contributed to increasing trade within these countries, thus showing a complementary relationship between both variables. Third, although we argue that using FDI stock data may help to grasp better the long run effects, our results are robust to the use of both FDI flows and stocks. Finally, we have also shown that the omission of FDI in the gravity equation would wrongly attribute a larger effect to the introduction of the euro, reinforcing the role of the FDI-channel. An interesting extension to this line of research would be the analysis of FDI at the sectoral level.

Notes

References

Aizenman J, Ilan N (2006) FDI and trade – two way linkages? The Quarterly Review of Economics and Finance 46:317–337

Albuquerque R, Loayza N, Serven L (2005) World market integration through the lens of foreign direct investors. J Int Econ 66:267–295

Anderson JE, Yotov Y (2012) Gold standard gravity. NBER working papers 7835

Anderson J (1979) A theoretical foundation for the gravity equation. Am Econ Rev 69:106–116

Anderson JE, van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93:170–192

Baier S, Bergstrand J (2001) The growth of world trade: tariffs, transport costs, and income similarity. J Int Econ 53:1–27

Baier S, Kerr A, Yotov Y (2017) Gravity, distance, and international trade. Survey to be published in a book by Edgar Elgar publishing, draft

Baldwin R, Taglioni D, (2006) Gravity for dummies and dummies for gravity equations. NBER working paper no. 12516

Baldwin R, Di Nino V, Lionel Fontagné RADS, Taglioni D (2008) Study on the impact of the euro on trade and foreign direct investment. Econ Pap 321

Bénassy-Quéré A, Coupet M, Mayer T (2007) Institutional determinants of foreign direct investment. World Econ 30:764–782

Bergin PR, Lin CY (2012) The dynamic effects of a currency union on trade. J Int Econ 87:191–204. https://doi.org/10.1016/j.jinteco.2012.01.005

Bergstrand J (1985) The gravity equation in international trade: some microeconomic foundations and empirical evidence. Rev Econ Stat 67:474–481

Brouwer J, Paap R, Viaene JM (2008) The trade and FDI effects of EMU enlargement. J Int Money Financ 27:188–208

Bun MJ, Klaassen FJ (2002) Has the euro increased trade? Tinbergen institute discussion paper no. 02-108/2, University of Amsterdam

Camarero M, Tamarit C (2004) Estimating exports and imports demand for manufactured goods: the role of FDI. Weltwirtsch Archiv 140:347–375

Camarero M, Gómez E, Tamarit C (2013) EMU and trade revisited: long-run evidence using gravity equations. World Econ 36:1146–1164

Camarero M, Gómez E, Tamarit C (2014) Is the ‘euro effect´ on trade so small after all? New evidence using gravity equations with panel cointegration techniques. Econ Lett 124:140–142

Campbell DL (2013) Estimating the impact of currency unions on trade: solving the Glick and rose puzzle. World Econ 36:1278–1293. https://doi.org/10.1111/twec.12062

De Sousa J, Lochard J (2011) Does the single currency affect foreign direct investment?, scan. J Econ 113:553–578

De Sousa J (2012) The currency union effect on trade is decreasing over time. Econ Lett 117:917–920

Devereux MP, Griffith R, Klemm A (2002) Corporate income tax reforms and international tax competition. Econ Policy 17(35):449–495

Eicher TS, Henn C (2011) One money, one market. A revised benchmark. Rev Int Econ 19:419–435

Faruqee H (2004) Measuring the trade effects of EMU. IMF Working Paper No 04/154

Flam H, Nordstrom H (2006) Trade volume effects of the euro: aggregate and sector estimates. Institute for International Economic Studies Seminar Papers no. 746, Stockholm University

Fontagné L (1999) Foreign direct investment and international trade: complements or substitutes?. OECD science, technology and industry working papers 1999/3

Fontagné L, Mayer T, Ottaviano GIP (2009) Of markets, products and prices: the effects of the euro on European firms. Intereconomics 44:149–158. https://doi.org/10.1007/s10272-009-0289-8

Frankel J, Rose AK (1998) The endogeneity of the optimum currency area criteria. Econ J 108:1009–1025

Feenstra R (ed) (2004) Advanced international trade: theory and evidence. Princeton University Press, Princeton

Feenstra R, Markusen J, Rose A (2001) Using the gravity equation to differentiate among alternative theories of trade. Can J Econ 34:430–447

Glick R, Rose AK (2002) Does a currency union affect trade? The time-series evidence. Eur Econ Rev 46:1125–1151

Glick R, Rose AK (2016) Currency unions and trade: a post-EMU reassessment. Eur Econ Rev 87:78–91

Helpman E, Melitz M, Rubinstein Y (2008) Estimating trade flows: trading partners and trading volumes. Q J Econ 123:441–487

Katayama H, Melatos M (2011) The nonlinear impact of currency unions on bilateral trade. Econ Lett 112:94–96

Kelejian H, Tavlas GS, Petroulas P (2012) In the neighborhood: the trade effects of the euro in a spatial framework. Reg Sci Urban Econ 42:314–322

Koike R (2004) Japan's foreign direct investment and structural changes in Japanese and east Asian trade, monetary and economic. Studies 22:145–182

Kreinin M, Plummer M (2008) Effects of regional integration on FDI: an empirical approach. Journal of Asian Economics 19:447–454

Micco A, Stein E, Ordonez G (2003) The currency union effect on trade: early evidence from the European Union. Econ Pol 18:315–356

Mitze T, Bjorn A, Gerhard U (2010) Trade-FDI linkages in a simultaneous equations system of gravity models for German regional data. Economie Internationale 122:121–162

Petroulas P (2007) The effect of the euro on foreign direct investment. Eur Econ Rev 51:1468–1491

Rose AK (2000) One money. One Market: The Effect of Common Currencies on Trade, Econ Pol 15:9–45

Rose AK, Stanley TD (2005) A meta-analysis of the effect of common currencies on international trade. J Econ Surv 19:347–365

Rose A (2017) Why do estimates of the EMU effect on trade vary so much? Open Econ Rev 28:1–18

Santos-Silva JM, Tenreyro S (2006) The log of gravity. Rev Econ Stat 88:641–658

Schiavo S (2007) Common currencies and FDI flows. Oxf Econ Pap 59:536–560

Serlenga L, Shin Y (2007) Gravity models of intra-eu trade: application of the ccep-ht estimation in heterogeneous panels with unobserved common time-specific factors. J Appl Econ 22:361–381

Yotov YV, Piermartini R, Monteiro J-A, Larch M (2016) An advanced guide to trade policy analysis: the structural gravity model. UNCTAD and WTO, Geneva, p 67

Westerlund J, Wilhelmsson F (2009) Estimating the gravity model without gravity using panel data. Appl Econ 43:1–9

Acknowledgments

The authors acknowledge ISCEF Organizing Committee for the opportunity of presenting this article at the 4th International Symposium in Computational Economics and Finance. We also thank the Editor in Chief, the Guest Editor and the anonymous referees for their contribution to the improvement of this paper. Finally, the authors also acknowledge the financing from Spanish MINEIC and FEDER [project ECO2017-83255-C3-3-P].

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Camarero, M., Gómez-Herrera, E. & Tamarit, C. New Evidence on Trade and FDI: how Large is the Euro Effect?. Open Econ Rev 29, 451–467 (2018). https://doi.org/10.1007/s11079-018-9479-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-018-9479-y