Abstract

Technological breakthroughs, such as the Internet of Things, Big Data repositories, artificial intelligence or additive manufacturing, are triggering a Fourth Industrial Revolution. This new revolution, also known as Industry 4.0, is characterized by the combination of physical and digital worlds in digital ecosystems that connect the different members in the value chain from clients to suppliers and distributors. Companies are redefining their strategies based on this new paradigm to obtain a competitive advantage. They aim to achieve more efficient and flexible productive processes that can produce high-quality products at low costs, investing on mass customization to satisfy their clients. Accordingly, governments are implementing support programs that create a suitable environment for the adoption of technological innovation strategies by the companies. Although some programs may diverge in some objectives, they all aim to promote workers' skills adaptation, technological supply development, and business modernization. The Portuguese Government also released its program for Industry 4.0 support, known as Portugal i4.0, which is intended to stimulate Portuguese economy digitalization. Furthermore, in latest years, it has been supporting projects through European funds mobilizations from Portugal 2020 program. The present study analyses whether companies that received financial support from Portuguese government to implement innovative projects, within the Industry 4.0 paradigm, were able to improve economic and financial performance and competitivity gains. For such purpose, it was applied an inference statistical method to analyse the differences verified in economics and financial indicators between the periods before and after projects implementation in a selected group of companies.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Industry 4.0

- Digitalization

- Technology innovation

- Competitiveness

- Economic performance

- Financial performance

1 Introduction

The 4th Industrial Revolution paradigm is a current priority on the executive committees' agenda seeking to identify new opportunities to diversify markets and increase revenues [1]. By adopting new technology tools, companies seek to transform operations throughout the value chain, increasing efficiency, flexibility and reliability to make them more agile [1]. The digitalization of business and production processes is critical as it enables better communication and cooperation throughout the value chain. The constant information sharing with customers enables companies to offer customized products, which can be obtained at more competitive prices due to the advances in manufacturing processes [2]. Similarly, the direct link with different elements of the supply chain makes its management much more efficient.

The new industrial revolution is a result of the technological advances of recent years. The next-generation information networks emergence, the Internet of Things (IoT) application to the industrial sector (Industrial IoT - IIoT), the radio frequency identification (RFID) use, and the Big Data analysis and Cloud Computing use have allowed data collection and analysis make the processes more productive flexible, faster, and efficient, capable of manufacturing products with higher quality at reduced costs [3].

Therefore, it is crucial that companies assess their current digital maturity and define an appropriate strategy in order to meet the challenges of this new technological context. According to a PWC study, published in 2016, based on responses from more than 2000 companies from 26 countries, at that time only 33% of the respondents considered their company digitally advanced (i.e., had a high degree of their products, processes and services digitalized) [6].

In this context, it is crucial that governments implement measures that promote the creation of favorable conditions for the industrial sector digital evolution. These conditions encompass numerous factors, such as the creation of financing channels, tax incentives, technological infrastructures, access to global markets, proximity to teaching and research centers and the training of human resources [5]. Therefore, the aim of this study is to analyse whether the government financial support that is being invested in Portuguese companies in the industrial sector, to implement projects within the Industry 4.0 paradigm, are allowing them to improve economic and financial performance and competitivity gains.

2 Industry 4.0 Impacts and Challenges

After the evolution enabled by the steam engine, electricity, mass production, electronics and automated production, the next phase of manufacturing evolution is now being discussed towards a complete production system digitalization, interconnecting machines, people and processes [2]. Industry 4.0 aims to take advantage of emerging technological advances to improve the industrial sector performance, enabling organizations to remain competitive. The purpose of this new paradigm is to combine the physical and digital worlds, namely through the creation of Cyber-Physical Systems (CPS), which allow full digitalization of the physical assets and their integration into digital ecosystems [1]. This principle is fundamental to the development of intelligent production processes composed by sensorized machines and devices, with the ability to communicate in real-time with each other and with other elements of the value chain in order to adapt to different scenarios [6].

The previous industrial revolutions had a strong impact, especially on the factory floor and production processes. However, the 4th Industrial Revolution is expected to have a broader impact, changing organizations' versatility. In addition to anticipating an improvement in the production processes with the introduction of new technologies, this new paradigm has implications throughout the value chain, changing the way that organizations relate to their suppliers and customers [2]. For example, according to the study of Simões et al. (2019) [7], one of the main expected impacts of collaborative robot's adoption on assembly production lines is to obtain operational efficiency gains. Participants in this study noted that the introduction of this technology improves product quality and productivity, increases flexibility, and optimizes workspace utilization.

On the other hand, with IoT use in equipment monitoring it becomes possible to detect and predict anomalies, through the processing of the collected information [8]. Another advantage of the use of IoT is energy efficiency improvement. Using production cycle analysis, it is possible to make decisions that improve production lines’ planning towards an energy consumption minimization [8]. Through the adoption of disruptive technologies and new business models developed towards the Industry 4.0 paradigm, approximately 57% of Portuguese industrial companies expect an average revenue increase of up to 10% [4]. While around 55% of them expect cost reductions above 10% and roughly 70% expect efficiency gains above 10% [4].

With the sophistication of the productive and organizational processes and their interconnectedness, there are several changes in the products’ life cycle, working environment and labor market, leading to the emergence of new challenges [1]. Thus, in order to achieve better competitive levels, it is crucial that companies are prepared for digital transformation by adopting the resources, strategies and frameworks best suitable to face those challenges [9].

Along with capital investment, investment in human resources will be a critical factor in this transformation process. According to Eurostat data, about 40% of European workers have insufficient digital skills [10]. Jobs in this new context will require a combination of multidisciplinary skills, which the current education and training system cannot answer. According to Maresova et al., this is a field that should receive greatest attention from companies and governments, these entities should combine efforts to train workers in order to fit their skills with new technological trends and opportunities [11].

As the number of connected equipment and products increases, issues related to reliability, system availability, and operational security become major challenges in organizations' management. Therefore, investments in cybersecurity also become essential to prevent data manipulation situations, unauthorized remote access, loss of intellectual property, or in extreme cases “sabotage” of the facilities [12].

Table 1 lists the major impacts and challenges of implementing a pro-Industry 4.0 strategy that emerge from the previous literature review.

3 Industry 4.0 Support Programs

Governmental institutions in various countries have, over the last few years, developed strategic programs aimed at supporting the transformation of their industrial sectors. Conscious of the potential impacts that the adoption of new digital technologies can have on the efficiency and competitiveness of their economies, governments have been implementing policies that seek to capitalize on the strengths of their industries but also to mitigate their gaps.

The strategic programs of the different countries seek to adapt their context to the 4th Industrial Revolution and undertake different approaches depending on their political traditions, degree of centralization, institutional infrastructures, and type of technologies [13]. However, there are significant commonalities between the different strategic programs, particularly in what concerns workers' skills adaptation, technological supply development and companies’ modernization [14]. Furthermore, there is an effort of international cooperation towards a joint priority regarding the standardization of digital technologies and the transference of scientific and technological knowledge [2]. Some programs that are being implemented are Platform Industry 4.0 from Germany, Alliance pour l'Industrie du Futur from France, Advanced Manufacturing Partnership from the USA, Made in China 2025 from China, Make in India from India, and Industry Innovation Movement 3.0 from South Korea.

The 4th Industrial Revolution is a notable opportunity for Portugal to overcome some of its competitive barriers, such as lack of internal market scale and peripheral location. According to the 2016 Digital Economy & Society Index of the European Commission, Portugal was in 15th position, in terms of the level of digital competitiveness, above the European Union (EU) average. In another UBS study, which analysed 45 countries, Portugal was the 23rd most well-prepared economy to adopt Industry 4.0, with its infrastructures, innovation capacity and general competences as its main added value. As a conclusion of these studies, it can be inferred that although the country is reasonably well prepared for this transformation, that preparation is not yet reflected in its current level of competitiveness [15].

With the aim of generating the conditions for the development of industry and national services in the digital age and promoting the adoption of new technologies, the Ministry of Economy launched in 2017 the first phase of the program “Portugal i4.0”. For the elaboration of this program, interviews, workshops, and auditions were carried out with the main stakeholders from different sectors of the Portuguese economy, with the participation of more than 200 entities and companies, including multinational companies such as Bosch, Volkswagen, Altice-PT, Siemens, Microsoft, Google, Huawei or Deloitte [16]. The strategic plan consisted of 60 public and private measures grouped into six major areas of priority action: Human Resources Training; Cooperation Ecosystem; StartUp i4; Financing and investment support; Internationalization; Legal and regulatory adaptation. These areas aimed to achieve three main objectives: accelerate the adoption of Industry 4.0 technologies and concepts in the Portuguese companies; promote internationally the Portuguese technology companies; and, make Portugal an attractive hub for investment in the Industry 4.0 context [17].

In order to accelerate the investments and adhesion by the national companies, the Government has forecast the injection of up to 4.500 million euros in the Portuguese economy in the following years, with about half of that amount (up to 2.26 billion) being mobilized from the European Structural and Investment Funds through Portugal 2020. After two years of implementation of the first phase of the Portugal i4.0 program, which was mainly mobilizing and demonstrating, 95% of the measures were implemented, with over 24,000 companies and 550,000 people covered by the different initiatives [18].

In April 2019, the second phase of the program was launched, featuring a more transformative logic, designed to expand the number of companies that truly capitalize on the benefits of Industry 4.0 [18]. Analyzing the results of the first phase, the companies that benefited most from the initiatives implemented were those with a greater awareness of the themes and benefits related to Industry 4.0 and with greater availability of resources and skills [18]. Therefore, for Phase 2 to truly have the intended transformative impact, it would be necessary to mobilize companies with a lower level of maturity in terms of digitalization. To this end, it was necessary to implement measures aiming to mitigate the difficulties of companies in the implementation of this type of project, usually associated with a smaller financial and human resources capacity, and it was also fundamental to promote the sharing of resources and knowledge among SMEs [19].

In order to bridge the identified gaps and leverage a generalized transition to Industry 4.0, the 2nd phase of Portugal i4.0 considers it necessary to act on three strategic lines: Generalize i4.0, Enable i4.0, Assimilate i4 .0 [18]. In this phase it is estimated a mobilization of public and private investments in the amount of 600 million euros over the following two years. The goal is to involve more than 20,000 companies in various initiatives, train more than 200,000 workers, and finance more than 350 manufacturing projects [20].

4 Method

Companies and Governments have over the past few years joined forces to improve the digital capabilities of the Portuguese industry. The definition of appropriate policies and strategies are crucial to ensure a successful transition to the digital age. Taking this into consideration, this study aims at understanding whether the government financial support provided for the Portuguese companies in the industrial sector to implement projects within the Industry 4.0 paradigm in recent years are allowing them to improve economic and financial performance and competitivity gains.

4.1 Sample Selection

To conduct this study the companies in the Portuguese industrial sector that had implemented projects within the Industry 4.0 paradigm were considered. The sample of companies in this study consists of those that received financial support to conduct the projects, under the Portugal 2020 program. The database of Portugal 2020 program (available on the official website) was used to identify the companies with approved projects between January 2014 and September 2018. Since the aim of this study is to analyse the impacts resulting from the implementation of the Industry 4.0 paradigm, a minimum of 2 years in the time gap was considered for each company. Therefore, in this study, only companies with projects approved before 2017 were considered.

The projects in the Portugal 2020 official database were not typified within the Industry 4.0 paradigm. To overcome this difficulty, it was decided to select projects that promote the digitalization, the use of information and communication technologies, and the development of intelligent and interconnected systems in the productive and business context. The projects were selected searching for keywords related to Industry 4.0 paradigm in the descriptive texts, in the titles, and the synthesis of the project proposals, similar to the technique applied in the study of the Agência Nacional de Inovação, in its study about R&D projects related to Industry 4.0, co-financed in QREN and PT2020. The keywords used were: Smart Factory; Business intelligence; Digitalization; Robotics; Automation; Internet of Things; Cloud computing; Artificial intelligence; Big data; Machine learning; Data mining; Additive Manufacturing; Advanced Materials; Industry 4.0; i4.0.

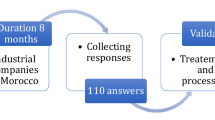

Based on the previous criteria, a first sample of 89 projects was obtained. However, this first selection of projects, included projects implemented by companies, as well as Universities, Research Institutions, Business Associations or Municipalities. Since the scope of this study is focused on projects implemented in companies, a new filter was applied and a final sample of 54 projects were selected (those conducted in companies). As referred before, the database is organized by projects, and a company can have more than one project. The 54 projects selected were implemented in 41 companies. A detailed analysis on the project description of these 54 projects allowed to exclude 12 projects that did not fit the study objective. After this detailed analysis, the final sample resulted in 42 projects, corresponding to 31 companies (Fig. 1).

4.2 Variables Selection

A literature review was performed to identify the variables to use that best represent the measures aimed for this study: economic and financial performance, and competitivity gains. However, there is no consensus regarding the variables that should be used [22]. Therefore, the variables to conduct the analysis were defined based on their capacity to measure the economic and financial performance within the context of this study. In the following paragraphs the selected variables are presented.

Turnover (NR), which allows companies to measure corporate growth, while their competitive position in the global market may be evaluated through the Exports variable (EXP). One of the most anticipated effects of the implementation of Industry 4.0 is the impact on business productivity [2]. Thus, by assessing the evolution of Gross Value Added (GVA), one can see if there was an exponential impact on resource use optimization [23]. Similarly, by relating the GVA and the average number of workers with the Apparent Labor Productivity (ALP) variable, one can evaluate the efficiency of the use of human resources in productivity.

The evolution of Industry 4.0 paradigm requires companies to make high investments. Through the Return on Assets (ROA) analysis, it is possible to measure the return on capital of the company, since this variable allows us to evaluate the capacity of companies to generate profit by making investments [24]. However, it is important that these investments do not compromise the company's ability to pay off its debts in the short term, so this study will also consider developments in the liquidity ratio (LQD), namely the overall liquidity ratio [23]. Similarly, the financial health of companies can also be assessed through Financial Autonomy (FIN AUT) [25]. Regarding the long term, it is advisable to resort to the degree of solvency (SOLV), since it allows to measure, for long periods of time, the firm’s solidity against the foreign capital invested in the company [26].

Having defined the companies’ sample and the variables to use, the data (values for the variables) were collected using the Sabi database [https://sabi.bvdinfo.com/]. This is a private database that contains historical detailed financial information for the Portuguese companies. Based on the financial data collected in Sabi, on the two time periods of the analysis, the values of the economic and financial variables were calculated.

4.3 Data Analysis

This study aims to analyse whether companies that received financial support from Portuguese government to implement innovative projects, within the Industry 4.0 paradigm, were able to improve economic and financial performance and competitivity gains. In this way, it is intended to assess the differences in economic and financial performance between the ex-ante and ex-post periods. To conduct the data analysis a paired samples method was applied, since it is intended to analyse the behavior of quantitative variables of the same group of companies at two different instants in time, between which occurred events that may have influenced the evolution of variables [21]. The analysis of variables differences in these two instants in time, aims to assess the existence of statistically significant differences between the preceding period and the period after the financial incentive application.

In this type of studies, it is usual to use the parametric test, t-test, as it is a test that allows verifying if there are statistically significant differences between the variables average, considering the two time periods, through a test of hypothesis (t-test) (Eq. 1) [21]. However, given the small size of the sample (31 companies), it is recommended, before applying the t-test, to test the variables for the normal distribution. If the test rejects a normal distribution of the variables, a nonparametric test, such as the Wilcoxon test, should be used [21].

5 Results Presentation and Discussion

The sample consists of 7 large, 10 medium, and 14 small companies. In terms of location (NUTS II), the 31 companies are mainly located in the North region, in a total of 17 companies, followed by the Center region with 10 companies. Overall, the 31 companies had a total eligible expenditure allocated to the operation of € 82 330 950, resulting in a total approved funding of € 36 728 950. Regarding the funding, the projects were financed by European Structural and Investment Funds, more specifically, 35 funded by the European Regional Development Fund (ERDF), and 7 by the European Social Fund (ESF).

5.1 Hypothesis Test Results

For the data analysis, the advanced statistical analysis software, SPSS (Statistical Package for the Social Sciences), version 25, was used. Since, the sample contains only 31 values for each variable, the Shapiro-Wilk test was used to assess the normal distribution of the variables.

After this test, it was possible to conclude that only the “financial autonomy” variable follow a normal distribution (for both periods, before and after the project implementation) with a significance value higher than 0.05. The t-test was only used for this variable. For the remaining variables, the Wilcoxon test was applied.

These two tests were applied to the variables according to their distribution, in order to assess if there were statistically significant differences between the values in the two periods, ex-ante and ex-post the allocation of the structural fund. Table 2 presents, for each variable, the type of test that was applied, the Hypothesis test results and the significance value. In order to understand the evolution direction of the variables, it was decided to calculate the growth rates for each of the variables.

5.2 Hypothesis Test Results

The hypothesis test results allows to conclude that only three variables, turnover (NR), gross value added (GVA) and exports (EXP), presented statistically significant differences between the two periods. As such, only for these three variables is possible to conclude that the technology/process implementation have statistically significant differences regarding the Community funds application.

By analyzing the growth rate of these three variables, it can be seen that they evolved favorably, which corroborates the expectation on improving operational efficiency and competitiveness gains associated with the implementation of projects within the Industry 4.0 paradigm. The results obtained are significant, especially when compared with the aggregate results of the manufacturing sector for the period 2014–2017. For example, in the case of turnover, between this period, it appears that the sector grew 12,07% [27], significantly lower than the 28,17% growth rate for the companies in the sample. Similarly, in the case of the value-added and exports variables, there are significant differences. In the case of gross value added, the sector grew by 25,35% [28], also below the 38,89% of the companies in the sample. In the case of the value of exports, it was estimated that the sector grew by 8% [29], considerably below to the 25,93% for the companies in the sample.

On the other hand, it is also important to understand why the remaining five variables (apparent labor productivity, return on assets, liquidity, financial autonomy, solvency) did not yield statistically significant results. The first explanation could be the presence of “other non-considered factors”, that go beyond the implementation of co-financed projects, which could influence the evolution of variables. For example, for the apparent labor productivity one possible explanation could be the lack of adequate skills of human resources to take full advantage of the technology, or the lack of investment in training the human resources to optimize the use of new technologies. In the case of the return on assets variable, the results may have been influenced by the short period considered in the study. Therefore, it may suggest considering a longer post-implementation period for analysis. Although this suggestion may also be considered to justify the negative results on the financial variables (ROA and LQD), the results may also be justified by the financial situation of each company prior to project implementation.

5.3 Discussion

During the research, it was not possible to find quantitative studies that assessed the impact of Industry 4.0 strategy on the companies’ performance variables. However, there are several studies that, although not focusing directly on Industry 4.0 technologies implementation impact, analyse the performance of companies that have applied innovation strategies. The results of those studies can be useful to compare with the results of this study, since the last ones also involve innovation.

For example, the study “Destination: Growth and Innovation” conducted by COTEC Portugal (2017) [30] concludes that the most innovative SMEs tend to outperform other SMEs. This study indicates that when comparing these two groups of companies, the most innovative SMEs have a net result 7.8 times higher and a turnover 3.7 times higher. Our results are in line with the results obtained in this study, since the companies analysed had a higher turnover than their sector. Similarly, the results of Correia & Costa (2016) [26], shows that for the total sample of companies that implemented co-financed projects, aiming at innovation, technological development, qualification, and internationalization, all the variables, except apparent productivity of the work, presented similar results.

On the other hand, the results of our study can also be compared with the perspectives that entities and entrepreneurs have on the implementation of Industry 4.0 related projects. For example, according to a study conducted by PWC [4], 43% of Portuguese industrial companies are expected to achieve revenue increases of over 10% by implementing Industry 4.0 projects, in addition to an improvement in resource efficiency and cost reduction. This study also estimates that production times can be accelerated by about 120% and the time to put the products on the market can be reduced by about 70% [4]. The results obtained for the evolution of gross added value, turnover and exports allow us to conclude that expectations about efficiency gains, cost reduction and increased revenues can be achieved through a strategy of technological updating.

Another conclusion from this PWC study is that more than half (60%) of the national companies surveyed expect that investments in Industry 4.0 can be paid back within 2 years or less through an investment of approximately 5% of annual revenues. A similar value (56%) was presented in this PWC study for the overall companies on the other countries surveyed [4]. However, in our study, the hypothesis test results for the asset return variable did not allow to verify the existence of statistically significant differences, so, as already mentioned, it will be expected that a period of more than two years will be necessary in order to truly return on the investments made in this area. Therefore, the optimistic expectations of most respondents in the PWC study may not be true.

6 Conclusions

The implementation of the Industry 4.0 paradigm in the industrial sectors is expected to improve companies' performance and competitivity gains. The financial support provided by governments is crucial for the ability of making such investments, and, consequently, improve local economies. This study aimed to analyse whether government financial support invested in Portuguese companies of the industrial sector to implement projects within the Industry 4.0 paradigm are allowing those companies to improve economic and financial performance. The results show that turnover, gross value added, and exports of companies supported by the government in projects within the Industry 4.0 paradigm present statistically significant differences for the results before and after the implementation of the projects. Given the high growth rates for turnover and exports, it can be argued that the expectations of increased revenue and competitiveness associated with the implementation of Industry 4.0 were met. Similarly, the increase in gross value-added shows that the adoption of new technologies and new organizational models makes possible to optimize the use of resources, and, therefore, increase operational efficiency and cost savings.

Taking into account the results of this study, to achieve the full potential of Industry 4.0, it will be necessary that Governments promote measures that allow the industrial sector to digital update itself. The current industrial revolution requires that the various elements of the value chain (suppliers, producers, distributors, retailers) be at similar digital maturity levels, in order to guarantee a fluid and efficient exchange of information, capable of promoting the optimization of processes and cost reduction.

The short period of analysis may have been one of the major study's limitations. This study only considered projects targeted at Industry 4.0 that were implemented with support from the Portugal 2020 program. In order to have data to compare the performance and competitiveness of companies before and after the project, it was decided to limit the analysis to companies that received funding between 2014 and 2016. Since the nature of this type of projects, in general, implies a significant transformation of production processes and management practices, which are assumed to take a long time to operationalize and realize the expected performance gains, the time window analysed may be too short to evaluate the impact in some performance and competitive dimensions, such as apparent labor productivity, return on assets, liquidity, financial autonomy, and solvency, which did not yield statistically significant results in this study. Another limitation of the present study is the difficulty in isolating the origin of the impacts analysed. In other words, it is assumed that the financial support and the nature of the implemented projects were responsible for improving the competitiveness indicators that proved to be statistically significant (turnover, gross value added and exports). However, one cannot completely exclude the possibility that other factors related to the companies’ context could also have impact on these results.

This study could be complemented, in the future, with interviews with companies’ managers in order to understand and contextualize the quantitative results. These interviews can be used to understand how the projects were implemented, what synergies were created within the company and with the other elements of the value chain, what major changes occurred at the level of structures and organization, what were the major obstacles and challenges they faced during the implementation.

References

Kagermann, H., Wahlster, W., Helbig, J.: Recommendations for implementing the strategic initiative INDUSTRIE 4.0. In: Final report of the Industry 4.0. Working Group. Acatech, Frankfurt am Main, Germany (2013)

Pereira, A.C., Romero, F.: A review of the meanings and the implications of the Industry 4.0 concept. Procedia Manuf. 13, 1206–1214 (2017)

Rüßmann, M., et al.: Industry 4.0: the future of productivity and growth in manufacturing industries. Boston Consult. Group 9(1), 54–89 (2015)

Correia, A.B., Deus, P., Baptista, J.R.: Indústria 4.0: Construir a empresa digital. PricewaterhouseCoopers Portugal, vol. 1, pp. 1–30 (2016)

Balasingham, K.: Industry 4.0: securing the future for German manufacturing companies (Master's thesis, University of Twente) (2016)

Chen, Y.: Integrated and intelligent manufacturing: perspectives and enablers. Engineering 3(5), 588–595 (2017)

Simões, A.C., Lucas Soares, A., Barros, A.C.: Drivers impacting cobots adoption in manufacturing context: a qualitative study. In: Trojanowska, J., Ciszak, O., Machado, J.M., Pavlenko, I. (eds.) MANUFACTURING 2019. LNME, pp. 203–212. Springer, Cham (2019). https://doi.org/10.1007/978-3-030-18715-6_17

Nagy, J., Oláh, J., Erdei, E., Máté, D., Popp, J.: The role and impact of Industry 4.0 and the internet of things on the business strategy of the value chain the case of Hungary. Sustainability. 10(10), 3491 (2018)

Erol, S., Jäger, A., Hold, P., Ott, K., Sihn, W.: Tangible Industry 4.0: a scenario-based approach to learning for the future of production. Procedia CiRp 54, 13–18 (2016)

Comissão Europeia.: Digitising European Industry - Reaping the full benefits of a Digital Single Market (2016). https://ec.europa.eu/digital-single-market/en/policies/digitising-european-industry

Maresova, P., et al.: Consequences of Industry 4.0 in business and economics. Economies. 6(3), 46 (2018)

Thames, L., Schaefer, D. (eds.): Cybersecurity for Industry 4.0. SSAM, Springer, Cham (2017). https://doi.org/10.1007/978-3-319-50660-9

IEDI.: Estratégias nacionais para a Indústria 4.0: Brasil. São Paulo, IEDI (2018)

Bidet-Mayer, T., Ciet, N.: L'industrie du futur: une compétition mondiale. La Fabrique de l'Industrie (2016)

COTEC.: Programa Portugal i4.0 (2018). https://www.industria4-0.cotec.pt/programa/medidas/

República Portuguesa.: Portugal i4.0 (2018). http://www.dgae.gov.pt/comunicar-as-empresas/financiamento/industria-40.aspx

IAPMEI.: Indústria 4.0 (2018). https://www.iapmei.pt/Paginas/Industria-4-0.aspx

KPMG Portugal.: Portugal i4.0 (Indústria 4.0) – Fase II (2019)

IAPMEI.: Indústria 4.0 - Governo lança Fase II do programa (2019). https://www.iapmei.pt/NOTICIAS/Industria-4-0-Governo-lanca-2-fase-do-programa.aspx

República Portuguesa.: Apresentação na nova fase do i4.0 (2019). https://www.portugal.gov.pt/pt/gc21/comunicacao/comunicado?i=primeiro-ministro-e-ministro-adjunto-e-da-economia-na-apresentacao-na-nova-fase-do-i40

Hall, A., Neves, C., Pereira, A.: Grande Maratona de Estatística no SPSS: Escolar Editora (2011)

Neves, J. C. D.: Avaliação e gestão da performance estratégica da empresa. Texto Editora, Lisboa (2011)

Martins, A.: Introdução à Análise Financeira de Empresas. 2ªEdição. Porto: Grupo Editorial Vida Económica (2004)

Marco, R.: Gender and economic performance: evidence from the Spanish hotel industry. Int. J. Hosp. Manag. 31(3), 981–989 (2012)

Moreira, J.: Análise Financeira de Empresas - da Teoria à Prática. 4ªEdição. Porto: Associação da Bolsa de Derivados do Porto (2001)

Correia, C., Costa, V.: Avaliação do Impacto dos Fundos do QREN no Desempenho Económico e Financeiro das PME: O Caso da Indústria Transformadora do Concelho de Barcelos. Portuguese J. Financ. Manag. Accounting 2(4) (2016)

PORDATA.: Volume de negócios das empresas: total e por sector de actividade económica (2019a). https://www.pordata.pt/Portugal/Volume+de+negócios+das+empresas+total+e+por+sector+de+actividade+económica-2913

PORDATA: Valor acrescentado bruto das empresas: total e por sector de actividade económica (2019b). https://www.pordata.pt/Portugal/Valor+acrescentado+bruto+das+empresas+total+e+por+sector+de+actividade+econ%C3%B3mica-2915

INE.: Estatísticas da Produção Industrial 2017, Instituto Nacional de Estatística (2018)

COTEC: Destino: Crescimento e inovação, O impacto da inovação na performance económico-financeira das PME e no seu crescimento (2017). http://www.cotecportugal.pt/imagem/Relatorios/20170523_Relato%CC%81rio%20agregadoEstudoDestino.pdf

Acknowledgments

This work is financed by the ERDF – European Regional Development Fund through the Operational Programme for Competitiveness and Internationalisation - COMPETE 2020 Programme and by National Funds through the Portuguese funding agency, FCT - Fundação para a Ciência e a Tecnologia within project POCI-01-0145-FEDER- 016418 and this project was also financed by the Portuguese funding agency, FCT - Fundação para a Ciência e a Tecnologia, through national funds, and co-funded by the FEDER, where applicable.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Faria, B.S., Simões, A.C., Rodrigues, J.C. (2022). Impact of Governmental Support for the Implementation of Industry 4.0 in Portugal. In: Machado, J., Soares, F., Trojanowska, J., Ivanov, V. (eds) Innovations in Industrial Engineering. icieng 2021. Lecture Notes in Mechanical Engineering. Springer, Cham. https://doi.org/10.1007/978-3-030-78170-5_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-78170-5_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-78169-9

Online ISBN: 978-3-030-78170-5

eBook Packages: EngineeringEngineering (R0)