Abstract

During the last decade, and especially after the financial crisis, the problem of providing supplementary pensions to the retirees has attracted a lot of attention from official bodies, as well as private financial institutions, worldwide. In this effort, there are various possible solutions, one of which is provided by pension fund schemes. Essentially, a pension fund scheme constitutes an independent legal entity that represents accumulated wealth stemming from pooled contributions of its members. The aim of the proposed research is to study the problem of optimal management of defined contribution (DC) pension fund schemes within general, complex and (as much as possible) realistic frameworks. From both a theoretical and practical point of view, one of the most important issue regarding fund management is the construction of optimal investment portfolio, because the success of a DC plan crucially depends on the effective investment of the available funds. Even though this problem has been heavily studied in the relative literature, the vast majority of the available works focuses: (i) on simple stylized models which allow for a very general understanding and are mainly based on intentionally unrealistic assumptions in order to provide closed-form (and paradigmatic) solutions, and (ii) on risk levels (unrealistic) rather than uncertainty (realistic). This chapter presents preliminary results/general ideas of our project and aims to provide a detailed and an (as much as possible) realistic framework that takes into account the exposure of the fund portfolio into several market risks as well as model uncertainty with respect to the evolution of several unknown market parameters that govern the behavior of the fund portfolio. Our research will be directed towards the new public and occupational pension schemes in Poland.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Optimal portfolio

- Defined contribution

- Pension reform

- Public and occupational pension schemes in Poland

- Stochastic optimal control

- Stochastic games

1 Introduction

Saving for retirement—like any form of long-term savings—involves various risks. The problem of optimal management of assets accumulated in pension funds under risk and uncertainty is a matter of fundamental importance—both in the theoretical (theory of finance, stochastic analysis) and practical dimension. It is part of a wider problem of planning, saving and optimal investment of pension funds. Optimal investment issue concerns not only additional pension systems (occupational and individual private pension schemes). In many countries around the world, capital solutions were first introduced and then limited also in public pension systems. Population ageingFootnote 1 and financial sustainability concerns have created pressures on policy makers to introduce pension reforms at the end of twentieth and in first decade of twenty-first centuries. The primary goal of these reforms was to reduce the risk in pension systems, ensure their long-term stability and adequacy of benefits. Some of these reforms of public pension consisted of changing the parameters in the system (e.g., extending the required periods of payment of retirement contributions allowing for the payment of a pension, extension of the statutory retirement age), others were systemic (e.g., full or partial privatization of public pension systems in Latin America, most of the countries of Central and Eastern Europe and of former Soviet Union from 1981 until 2014).

This second solution was supported in the 1990s by the World Bank [World Bank 1994]. The introduction of a capital-financed pillar to public pension systems and development of addition pension schemes (occupational and individual pensions savings, usually supported by the State in form of tax incentives) was to ensure risk diversification. Traditional public pension systems have been—and most countries still are—financed using the Pay-As-You-Go (PAYG) method: contributions from current workers are used to pay benefits to current retirees, giving current workers “promises” in return of contributions (these “promises” have different legal weights in different countries). The realization of these “promises” or legal obligations will be financed from contributions or general taxes of the next working generation. In such an unfunded pension system, no pension fund investments are needed. In the literature on pension economics, attention is also drawn to the political risk related to PAYG financing: the “promises” currently being submitted, what amounts of future pensions may not be kept, and system parameters, e.g., premiums, retirement age, valorization (indexation) of retirement benefits in relation to the in-crease in inflation and average pay of benefits, are easily changed. In addition, the increase in pensions depends on the labor force and wage growth rate, which in long term is likely to slow down in an aging population. Capital financing of pension systems is based on the use of contributions from current workers to accumulate assets; these assets are employed in part or in full to pay benefits in the future. Pension systems can be partially financed with PAYG, and partially funded.

Full or partially funded pension schemes were to provide higher benefits from the same pension contributions (because the rate of investment in the financial market in the long run exceeds the rate of labor incomes) and reduce the politicization of pension systems. Of course, capital-financed, fully or partially funded pension systems are exposed to investment risk, which is transferred to the system participants. Proponents of the privatization of public pension systems, however, have assumed that the risk could be reduced by an appropriate selection of financial instruments with different risk levels and proper investment policy conducted by specialized financial institutions which are managing pension funds.

Partial privatization of public pension systems (the introduction of a multi-pillar system, partially financed by the PAYG method, and partly on a capital basis) has found application in pension reforms in post-socialist countries in the 1990s and early 21st century. Along with multi-pillar pension systems (consisting of public, occupational and individual pillars) and the diversification of financing methods and related risks in the public, basic pension system first seemed to be an attractive, efficient, more safe and generally rational and profitable solution for all stakeholders (workers and future retirees, financial market institutions, private financial services providers, and the State).

This “experimentation” in social security systems proved to be unsuccessful. Sixty percent of countries that had privatized public mandatory pensions having reversed the privatization until 2018 [50]. One of the reasons was the realization of investment risk in pension funds as a result of the global financial and economic crisis of 2007–2009. That crisis has caused a fall in the value of assets of pension funds, with a particularly drastic impact on funds with the formula of a defined contribution. The privatization of public pension systems has not contributed to the adequacy of pension benefits; on the contrary—they have been reduced [28, 50]. The true beneficiaries of the privatization of public pension systems were private financial service providers managing pension funds, who generated high profits from various types of fees for asset management.

At this point it is worth recalling that the main types of retirement plans, in terms of determining the amount of the expected benefit are defined as defined benefit (DB) and defined contribution (DC) schemes. Their design causes the polarization of risk distribution associated with pension provision. Most of the risks in DB plan are borne by the organizer, while in DC plan they are carried by the participant. Hybrid plans offer the possibility of risk-sharing between the stakeholders of a pension plan. Much less popular are hybrid solutions, especially in the context of occupational pension schemes associated with providing the expected level of pension. The investment risk occurs both in the accumulation and in the deccumulation (consumption) phase of pension funds (see, e.g., Lin et al. [44], Szczepański [57] and references therein).

While the investment risk in public pension systems has diminished due to the total or partial reduction of privately funded pension funds in public pension systems (reversing pension privatization), it remains still high in additional DC (private and occupational) pension systems. This wealth is to be invested over a long period of time (usually from 20 to 40 years) in order to provide its members with retirement benefits (in the form of periodic pension payments or a one-off payment). Employers, as well as employees (e.g., countries or other official bodies), that are part of the fund, periodically pay contributions before retirement (according to certain rules) which are appropriately invested in the financial market, in order for retirees to receive benefits at the time of retirement.

In general, as already mentioned, there are two completely different methods to design a pension fund scheme: (i) DC plan, and (ii) DB plan. According to a DC plan, every member of the fund contributes a fixed proportion of her income (before retirement), which are collected in an individual investment account and the benefits to be received (after retirement) consist of a fraction of the true fund value. Thus, they solely depend on the investment performance of the fund portfolio during its lifetime. In other words, for the DC case, the benefits to be received are not known before they are really obtained, i.e., that is, they are random variables. On the other hand, according to a DB plan, the benefits are usually initially fixed while the contributions are dynamically adjusted in order to keep the fund in balance. Today, the DC pension plans are far more popular, mostly due to the rapid dynamic development of financial markets, especially during the last twenty years, which has provided investors with a selection of attractive and advanced financial products. In some countries (including the USA and Great Britain) hybrid retirement programs are used, which are a combination of elements of DC and DB programs. However, they have a limited scope, they are used only in occupational pension schemes, and not in public pension systems.

Since the success of a DC plan crucially depends on the effective investment of the available funds due to contributions, the optimal management of the fund reduces to the problem of optimal portfolio selection from an available collection of financial assets. A prominent feature of this problem is encapsulated by the fact that the underlying financial variables that govern the evolution of the portfolio’s value at each instant of time (like, e.g., volatility of assets returns, interest rates, etc.) are of stochastic nature, which is a typical characteristic of financial markets. To be more precise, it is well-known and clearly evidenced in the relative literature, that both volatility of asset returns (cf., e.g., Andersen and Bollerslev [3], Andersen et al. [38], Bates [8], Engle [30], Fama and French [31], Jones [41], Chen et al. [20] and references therein) and interest rates (cf., e.g., Brennan and Schwartz [15], Brown and Schaefer [17], Deelstra [25], Markellos and Psychoyios [46] and references therein) are not constants but display a stochastic (random) behavior. Hence, in order to provide a realistic framework for the proposed research, it is of utmost importance to appropriately capture this behavior. In this attempt, we will resort to Stochastic Analysis, in particular, to Stochastic Modeling, Optimization and Optimal Control techniques.

Our chapter presents preliminary results/ideas of a broader research project. The aim of the proposed research is to study the problem of optimal management of DC pension fund schemes within general, stochastic and, hence (as much as possible), realistic frameworks in both continuous and discrete time frameworks. Even though the problem of optimal management of pension funds (in both DC case and DB case) has been extensively studied (especially in the continuous time framework) in the related literature (cf., e.g., Battocchio and Menoncin [9], Bodie et al. [11], Boulier et al. [12], Deelstra et al. [26], Di Giancinto et al. [34], Guan and Liang [36, 37], Zhang et al. [60] and references offered there), the vast majority of the available related literature focuses: (i) on simple stylized models including a very limited pool of risk factors (typically focusing on volatility risk or interest rates risk) and adopting some rather unrealistic modeling assumptions (e.g., volatility being constant through time, etc.) in order to provide closed-form solutions, (ii) on the extremely restricting and unrealistic assumption that the underlying probability model for the risk factors is known with certainty, i.e., focus on investment risk and ignoring the effects of uncertainty, which has been acknowledged by many authors (cf., e.g., Anderson et al. [2, 3], Hansen and Sargent [38] and references offer there) as the key factor when it comes to realistic modeling. Hence, it is apparent that these models are not sufficient for a detailed and realistic quantitative treatment of the problem under consideration.

In contrast to the existing literature, our proposal aims to provide a detailed and an (as much as possible) realistic framework that takes into account the exposure of the fund portfolio not only into several market risks (e.g., interest rate risk, volatility risk, etc.) but also to uncertainty with respect to the evolution of several unknown market parameters that characterize the behavior of the fund portfolio. To be more precise, due to the stochastic character of the benefits of a DC plan, in combination with the fact that the investment horizon of such schemes is usually large, the return from such an investment is highly exposed to both microeconomic and macroeconomic factors that affect the behavior of the underlying financial variables (e.g., bonds, stocks, various financial derivatives, etc.) which compose the fund portfolio. Therefore, it is obvious that the proposed problem is a highly complicated one, that requires a very delicate approach in order to exploit its qualitative and quantitative nature. More specifically, we are going to investigate the following main questions:

-

What is the optimal investment strategy for a DC pension fund scheme if we consider the stochastic nature of all the (known) underlying variables? Namely, among others, we will consider the case of: (a) stochastic interest rates, (b) stochastic volatility, (c) stochastic salaries, and (d) combination of the above.

-

What is the sensitivity of the optimal investment strategy for the DC pension fund scheme with respect to the fund manager’s risk “appetite”?

-

Given the fact that many of the parameters involved are subject to uncertainty, what is the optimal investment decision for a DC pension fund portfolio within the worst-case scenario for the underlying financial market?

The above questions are of crucial importance and must be effectively addressed in order to make the best decision possible at each instant of time for the fund portfolio. In fact, due to their importance, each one of them constitutes a research area on its own and dictates for an elegant approach (from both a quantitative and qualitative point of view). From a general standpoint, the first two questions constitute a natural extension of the available relative literature and are mainly risk-oriented. That is, we are mainly interested in providing the very best decision possible, at each instant of time, by solely focusing on the exposure of the fund portfolio to the several underlying market risks, like, e.g., volatility risk, interest rate risk, inflation risk, etc. To be more precise, (Q1) focuses on the stochastic character of the financial variables that govern the evolution of the fund portfolio, with the most prominent ones, being, volatility of asset returns and interest rates. Even though this problem has been studied in the relative literature (mainly, in the continuous time framework) our proposal aims to move a step further by adopting a discrete time framework, in order to provide an as much as realistic setting. Furthermore, we will also consider combinations of the above stochastic factors, in order to provide practitioners with an (as much as possible) realistic model that can be adopted in a wide variety of cases. This stage also requires the calibration of the results according to real financial market data and appropriate testing. (Q2) has its origins to enterprise risk management and aims to touch the problem of decision making by incorporating decision maker’s preferences towards risk, a subject that has been highlighted by many authors (cf., e.g., Breen et al. [14], Maringer [45] and references therein) as being of crucial importance within an expected Von Neumann-Morgenstern utility maximization framework. As most of the problems studied within the pension fund management framework are basically utility maximization problems, it is of great interest to examine the sensitivity of the results with respect to various utility functions, i.e., with respect to various attitudes towards risk. Finally, (Q3) (which, to the best of our knowledge, has only been partially studied in the relative literature, see, e.g., Sun et al. [56]) aims to study the above problems from a completely different point of view, by introducing uncertainty (in the Knightian sense) rather than risk in the model at hand. This approach has its origins in game theory and aims to place the first stones towards realistic risk management.

An outline of this chapter is as follows. In Sect. 2, we present the general framework in order to introduce model uncertainty aspects to a stochastic control problem. Although this setting is well known, the presentation adopted here is DC pension fund management—oriented and will lay the ground for our future research. In Sect. 3, as a illustration, we present a simple stochastic model for the optimal management of DC pension funds under risk and uncertainty. Finally, in Sect. 4, we focus on the design of a pension fund scheme, from a risk management point of view, presenting a detailed study concerning the case of Poland.

2 Optimal Management of Defined Contribution Pension Funds Under Model Uncertainty

Stochastic optimal control is an important branch of Mathematics that has found interesting applications in a wide variety of fields, such as, mathematical economics, mathematical finance, actuarial mathematics and modern portfolio risk management (see, among others, Akume and Weber [1], Baltas and Yannacopoulos [6], Browne [18], Duarte et al. [29], Savku et al. [55] and references therein). More precisely, its use has contributed a lot in mathematical modeling in Finance and has led to a deep understanding of the interplay of various sources of risk in optimal portfolio management (see, e.g., Merton [49]). However, despite its importance and wide range of applicability, within this framework it is tacitly assumed that the decision maker has complete faith in the model she faces, in the sense that the exact probability law of the stochastic risk factors in the underlying model, is precisely known. As it turns out (see, e.g., Anderson et al. [2, 3], Hansen and Sargent [38] and references therein) this assumption is far from being realistic, as often more than one possible models can be plausible representations for the system at hand, compatible with the observed data.

A very convenient way to introduce model uncertainty aspects to a stochastic control problem, is to let the decision maker distrust the model she faces. Even though this idea is rather simple, it is quite effective and constitutes the cornerstone of realistic, robust modeling. To be more precise, let us consider a fund portfolio manager who, at each instant of time, is responsible for optimally distributing the accumulated wealth (that stems from pooled contributions of the DC fund members) among several risky assets (e.g., bonds, stocks, derivatives, etc.), according, of course, to certain investment rules. The fund manager is responsible for making all the necessary investment decisions that will yield the highest return, or in mathematical terms, to drive the fund portfolio (whose wealth is subject to random fluctuations modeled by a number of risk factors) to a desired optimal state. In the language of stochastic control, the fund manager chooses the control process. In this framework, optimality is usually meant in the sense of maximizing the portfolio returns (of course other equivalent goals are also possible, e.g., maximizing the expected utility of its terminal wealth for some appropriately defined utility function, or minimizing a penalized distance of the portfolio’s terminal wealth from a predefined goal). In order to introduce model uncertainty aspects to this problem, we let the fund portfolio manager, who controls the evolution of the system by selecting the associated control process (that is, the proportion of the fund’s wealth to be distributed among the several risky assets), to question its validity as an appropriate model to describe the future states of the world. The basic philosophy of this specific form of uncertainty is the structural assumption that there exists a “true” benchmark probability model (which is represented by a probability measure \(\mathbb {P}\)) related to the exact law of the process that introduces stochasticity in the system (e.g., a driving multi-dimensional Brownian motion), the fund manager is unaware of, and a probability model (which is represented by a probability measure \(\mathbb {Q}\), not necessarily coinciding with \(\mathbb {P}\)) which is the fund manager’s “idea” about how this “true” law in fact looks like. Clearly, the optimal decision rule depends on the underlying model, of which, the fund manager is uncertain (this risk, is often referred to, as model risk). Within this framework, the fund manager faces again the initial optimal control problem (e.g., a mean variance portfolio optimization problem) but this problem is now considered over the worst possible scenario, that is, by using the probability model that may create the most unfavorable scenario for the problem at hand.

From a mathematical standpoint, the above situation raises many challenges and dictates for a delicate approach in order to be effectively treated. In this vein, the classical techniques of stochastic optimal control are augmented with model selection techniques, resulting to what is widely known as robust optimal control theory. Technically speaking, robust control has close connections with game theory. In fact, a robust control problem can always be restated as a two player (in its simplest form) zero sum stochastic differential game. Within the DC fund management framework adopted in our research, the first player is the fund manager (the decision maker) and the other one is, a fictitious malevolent player, called Nature. Of course, this setting can be easily relaxed to cover many different situations of great interest (e.g., to consider competition between two different fund management companies). Under a measure change framework, the fund manager chooses the control process (that is, the investment policy) so as to drive the underlying system to a desired state. On the other hand, Nature, antagonistically chooses the probability model in order to create the most unfavorable scenario for the fund manager. Therefore, the two players engage in a game, whose Nash equilibrium corresponds to the optimal robust decision. In the context of continuous time diffusion processes and restricting ourselves to a class of measures which have exponential density with respect to the Lebesgue measure, a direct application of the celebrated Girsanov’s theorem leads to the reformulation of the above game, as a stochastic differential game, amenable to the powerful tools of dynamic programming.

In general, by employing the classical techniques of dynamic programming, the value function of a stochastic differential game is associated with a second order partial differential equation, known as the Bellman-Isaacs (BI) equation. This is a highly nonlinear equation (for most problems of interest) and, as expected, classical (smooth) solutions are found only in some special cases. In fact, as it turns out, the most natural concept of a solution for this equation, is the notion of viscosity solutions (for more information on this subject, the interested reader is referred to Crandall et al. [22], Fleming and Souganidis [32] and references therein). Within this framework, even though the derivation of the optimal controls of the two players (which may act as a useful benchmark for the fund manager when looking to decide for the optimal investment strategy) is not possible, we can shed light into the underlying mechanisms that govern the evolution of the pension fund stochastic system. On the other hand, under the additional assumption of smoothness of the value function of the game, it is possible to provide some closed form solutions for the BI equation (and as a result, to derive, in closed form, the optimal strategies for both players). This approach has been heavily used with success by many authors and within a wide range of robust control applications (different from the one proposed here); see, e.g., Baltas and Yannacopoulos [6, 7], Brock et al. [16], Branger et al. [13], Flor and Larsen [33], Kara et al. [42], Mataramvura and Øksendal [47], Pinar [52], Rieder and Wopperer [53], Zawisza [58], and references therein.

Concerning the application of robust control techniques to the problem of optimal management of DC pension funds, there exists only a limited body of work (see, e.g., among others, Sun et al. [56]). Our research aims to fill this gap by: (a) adopting a discrete-time framework, (b) making more realistic assumptions concerning the structural characteristics of the associated robust control problem, most of which stem from the new Polish pension system, and (c) provide a detailed numerical study for the problem at hand. It is our strong belief, that our results, apart from the mathematical interest, will also be very useful for pension fund managers, from both an investment and a risk management point of view.

3 A Simple Model

In the present section, as an illustration of the above theoretical discussion, we present a simple model for the optimal management of DC pension funds under uncertainty. First of all, we need to define the underlying probability space that will lay the ground for the definition of our stochastic financial market. In this vein, let us consider the filtered probability basis \((\Omega , \mathbb {F}, (\mathscr {F}_{t})_{t\in \mathbb {R}_{+}}, \mathbb {P})\) that satisfies the usual hypotheses, where \(\mathscr {F}_{t}=\sigma (W_{1}(s), W_{2}(s);\,\, s\le t)\) is the natural filtration induced by the standard independent Brownian motions \(\left( W_{1}(t);\, t\ge 0\right) \) and \(\left( W_{2}(t);\, t\ge 0\right) \).

3.1 The Financial Market

We adopt a continuous time model for the financial market on the fixed finite time horizon [0, T], with \(T\in (0,\infty )\), consisting of the following investment opportunities:

-

A zero coupon bond with maturity \(T>0\) and dynamics described by

$$\begin{aligned} \begin{aligned} \frac{dP(t,T)}{P(t,T)}&= (r + \alpha \theta )dt + \alpha dW_{2}(t), \\ P(0,T)&>0, \end{aligned} \end{aligned}$$(1)where P(t, T) denotes the price of the bond at time \(t\in [0,T]\). Here, \(r>0\) and \(\alpha >0\) stand, respectively, for the interest rate and the volatility of bond prices (and are assumed, for simplicity reasons, to be constants—case of flat interest rate). Moreover, \(\alpha \theta \) (for some \(\theta >0\)) stands for the excess return on the bond.

-

Another risky asset (e.g., a financial index or stock) which evolves according to the stochastic differential equation

$$\begin{aligned} \begin{aligned} \frac{dS(t)}{S(t)}&= \mu dt + \sigma dW_{1}(t),\\ S(0)&=S_{0}>0, \end{aligned} \end{aligned}$$(2)where S(t) denotes the price of the index at time \(t\in [0,T]\). Here \(\mu>r>0\) stands for the appreciation rate of the stock prices and \(\sigma >0\) stands for the volatility of the stock prices.

-

A risk free asset (bank account) with unit price B(t) at time \(t\in [0,T]\) and dynamics described by the ordinary differential equation

$$\begin{aligned} \begin{aligned} dB(t)&= rB(t)dt, \\ B(0)&=1. \end{aligned} \end{aligned}$$(3)

It has to be pointed out, that as the number of traded assets on the market (zero-coupon bond and stock) equals the number of sources of noise (the \((\mathbb {F},\mathbb {P})\)-Brownian motions \(\left( W_{1}(t);\, t\ge 0\right) \) and \(\left( W_{2}(t);\, t\ge 0\right) \)), the market is complete. As a result, we have placed ourselves within a very convenient framework in order to demonstrate our robust approach to the problem of optimal management of DC pension funds.

3.2 The Stochastic Salary

Salaries of the contributors are in general stochastic, in the sense that it is not possible today to know with certainty their level after such a large time interval (due to e.g., impossible to predict external both macroeconomic and micro economic factors). As a result, in the present work we consider the stochastic process \(\left( L(t);\, t\ge 0\right) \) that denotes the average salary at time \(t\in [0,T]\). Furthermore, we assume that this process evolves according to the stochastic differential equation

where \(l_{0}\in \mathbb {R}_{+}\) denotes the initial average salary level. In the above equation, \(\mu _{L}(r)\) may be considered as the expected instantaneous growth rate of the average salaries and is considered to be a function of the interest rate (see, e.g., Battocchio and Menoncin [9], Zhang et al. [60] and references therein), whereas the terms \(\int _{0}^{t}k_{2}dW_{1}(s)\) and \(\int _{0}^{t}k_{2}dW_{2}(s)\) may be considered as the fluctuations around this growth rate (two sources of uncertainty stemming from the stochastic interest rates and the stochastic volatility). More precisely, \(k_{1},k_{2}\in \mathbb {R}\) are appropriate constants (scaling factors), that aim to capture the effect that stochastic interest rates and stochastic volatility have on the evolution of the average salary.

3.3 Contributions

According to the defined contribution pension scheme that is employed in the present section, employees that become part of the pension fund under consideration (at time \(t=0\)) have to pay contributions. These contributions, according to various pension funds schemes (e.g. the new Polish pension scheme), are defined as proportion of their salary (in fact, this is an assumption that has been heavily used with success in the relative literature; see e.g., Korn et al. [43], and references therein). In what follows, we deal with a specific class of employees (for now—on future works we will consider many different classes) that share the same structural characteristics (these characteristics might be, for example, profession, years of experience, education level, etc.). We also let the contributions to be paid continuously. In this vein, the term qL(t) denotes the aggregate contributions up to time \(t\in [0,T]\), where q stands for the average contribution rate and, as already stated before, L(t) stands for the average salary of the class under consideration. A natural restriction is to let \(0<q<1\): The inequality \(q>0\) means that every member has to contribute something to become part of the fund, while, on the other hand, the inequality \(q<1\) means that the maximum average contribution is less that the average salary.

3.4 Stochastic Differential Equation for the Fund’s Wealth

We envision a fund manager, who, at time \(t=0\), is endowed with some initial wealth \(x>0\) and whose actions cannot affect the market prices. The portfolio process \(\pi (t)=\pi (t,\omega ):[0,T]\times \Omega \rightarrow \Pi _{1}\subset \mathbb {R}\) denotes the proportion of of the fund’s wealth X(t) invested in the stock and the process \(b(t)=b(t,\omega ):[0,T]\times \Omega \rightarrow \Pi _{2}\subset \mathbb {R}\) denotes the proportion of of the fund’s wealth X(t) invested in the zero coupon bond at time \(t\in [0,T]\). The remaining proportion \((1-\pi (t)-b(t))X(t)\) is invested in the remaining asset (bank account). Here, \(\Pi _{1},\Pi _{2}\) are fixed closed and convex subsets of \(\mathbb {R}\); typically compact. As a result, the wealth process corresponding to the strategy \((\pi (t),b(t))\), is defined as the solution of the following stochastic differential equation

Therefore, and referring to the initial wealth as x:

Definition 1

Let \(\mathbb {F}\) be a general filtration. We denote by \(\mathscr {A}({\mathbb {F}};T)\) the class of admissible strategies \((\pi (t),b(t))\) that satisfy the following conditions:

-

(i)

\(\pi (t),b(t)\) are progressively measurable mappings with respect to the filtration \(\mathbb {F}\);

-

(ii)

\(0\le \pi (t) \le 1\) and \(0\le b(t) \le 1\);

-

(iii)

\(\mathbb {E}\left[ \displaystyle \int _{0}^{T} \left( \sigma \pi (t)\right) ^{2}dt \right]< \infty \,\, \text {and}\,\, \mathbb {E}\left[ \displaystyle \int _{0}^{T} \left( \alpha b(t)\right) ^{2}dt \right] < \infty ,\,\, \mathbb {P}\)-a.s.;

-

(iv)

The SDE (5) admits a unique strong solution, denoted by X(t).

3.5 Model Uncertainty Concerns

The aim of the present section is to place the problem of optimal DC pension fund management within a model uncertainty framework. In fact, this is the reason we chose to work within such a simple framework, as it allows to focus more on model uncertainty aspects. Of course, this work can be extended in a handful of ways. In order to fulfill our goal, we curry on our program by assuming that the portfolio fund manager is uncertain as to the true nature of the stochastic processes \(W_{1}\) and \(W_{2}\) that drive uncertainty into the state Eq. (5) that describes fund’s wealth at time \(t>0\), in the sense that the exact law for \(W_{1}\) and \(W_{2}\) is not known. In an attempt to adopt a measure theoretic framework, we furthermore assume that there exists an unknown drift process u(t) related to the Brownian motion \(W_{1}\) and an unknown drift process \(\lambda (t)\) related to the Brownian motion \(W_{2}\). Of course, this is not the most general way to introduce uncertainty to our model (or, better stated, concerning the stochastic processes \(W_{1}\) and \(W_{2}\)); however, it provides a simple, well-known and heavily studied framework to effectively study the problem at hand (see, e.g., Baltas and Yannacopoulos [5]). This is equivalent to state (thanks to Girsanov’s theorem) that there exists a “true” probability measure related to the true law of the processes \(W_{1}\) and \(W_{2}\), the fund manager is unaware of, and a probability measure Q, which is the manager’s idea of what the exact law of \(W_{1}\) and \(W_{2}\) looks like.

In the present section, we assume that the fund manager faces an expected utility maximization problem. However, this problem is considered under the probability measure Q (which is the manager’s idea of the future states of the world). In other words, the fund manager seeks to solve the optimal control problem

for some appropriately defined utility function \(U(\cdot )\). However, as the manager is uncertain about the validity of Q as the appropriate way to describe the future (states of the world) evolution of state equation (5), she seeks to adopt a more careful (i.e., robust) approach, that of seeking to minimize the worst possible scenario concerning the true description of the noise terms. In other words, she seeks to maximize the minimum possible value of the expected utility over all possible scenarios concerning the true state of the system, which is quantified as

where \({\mathscr {Q}}\) is an appropriate class of probability measure. Putting all these together, the risk manager faces the robust stochastic optimal control problem

subject ot the state process (5).

Definition 2

(The set \(\mathscr {Q}\)) The set of acceptable probability measures \(\mathscr {Q}\) for the agent is a set enjoying the following two properties:

-

(i).

We will only consider the class of measures \(\mathscr {Q}\), such that considering the stochastic process W under the reference probability measure \(\mathbb {P}\) and under the probability measure \(\mathscr {Q}\) results to a change of drift to the Brownian motion W.

-

(ii).

There is a maximum allowed deviation of the managers measure \(\mathscr {Q}\) from the reference measure \(\mathbb {P}\). In other words, the manager is not allowed to freely choose between various probability models as every departure will be penalized by an appropriately defined penalty function, a special case of which is the Kullback-Leibler relative entropy \({\mathscr {H}}(\mathbb {P}|\mathscr {Q})\).

The above two conditions specify the set \({\mathscr {Q}}\). Here, we briefly discuss the mathematical details surrounding the model uncertainty framework adopted in the present section. For more information, the interested reader is referred to Anderson et.al [2, 3], Hansen and Sargent [38] and references therein. To be more precise, let us consider the progressively measurable and square integrable stochastic processes \((u,\lambda ):=\big (\left( u(t), \lambda (t)\right) ;\,t\in [0,T]\big )\) taking values in some compact and convex set \({\mathscr {Y}}:={\mathscr {Y}}_{1}\times {\mathscr {Y}}_{2}\subset \mathbb {R}^{2}\). Each one of these processes may be considered as an unknown drift process related to the Brownian motions \(\left( W_{1}(t);\, t\ge 0\right) \) and \(\left( W_{2}(t);\, t\ge 0\right) \). We define the probability measure Q on on \({\mathscr {F}}_{T}\) as \(dQ/d\mathbb {P}:=\mathscr {E}\big (\int _{0}u(t)dW_{1}(t) + \int _{0}\lambda (t)dW_{2}(t)\big )_{T}\), where \(\mathscr {E}\big (M\big )_{t}:=\exp \big (M(t) - \langle M\rangle _{t}/2 \big )\) denotes the Doléans-Dade exponential of a continuous local martingale M(t). Under the additional assumption that the processes \((u,\lambda )\) satisfy Novikov’s integrability condition, it follows from the celebrated Girsanov’s theorem that the processes \(\widetilde{W}_{1}(t) = W_{1}(t) - \int _{0}^{t}u(s)ds\) and \(\widetilde{W}_{2}(t) = W_{2}(t) - \int _{0}^{t}\lambda (s)ds\) are \((\mathbb {F},Q)\)-Brownian motions. In this vein, we have the following result.

In what follows, we define the new state variable Y(t) as

where \(\widetilde{X}(t)\) and \(\widetilde{L}(t)\) denote the fund’s wealth process and the stochastic salary process, under the equivalent probability measure. This new variable is often referred to, as relative wealth (see, e.g., Zhang and Rong [59]). In fact, this new variable stands for a measure of attractiveness of the pension fund scheme, as it allows to compare with the true current financial situation of the fund members.

Proposition 1

The relative wealth process under the equivalent probability measure \(Q\in {\mathscr {Q}}\) is denoted as Y(t) and is defined as the solution of the following stochastic differential equation:

with initial condition \(Y(0)=y>0\).

Proof

The proof follows immediately by substituting the semimartignale decompositions \(\widetilde{W}_{1}(t) = W_{1}(t) - \int _{0}^{t}u(s)ds\) and \(\widetilde{W}_{2}(t) = W_{2}(t) - \int _{0}^{t}\lambda (s)ds\) in Eqs. (4) and (5) and by a straightforward application of the quotient Itô rule on (7).

As a result, from now on we consider the robust control problem

subject to the state dynamics (8). The intuition behind the robust control problem (9) is that we do not allow the fund manager to freely choose between different probability measures, that is, we prevent the fund manager from considering models that deviate “too much” from the reference model. This is accomplished by constraining this choice by an appropriate penalty function, namely, the Kullback-Leibler divergence, which, in our case is defined as \(\mathbb {E}_{Q}\left( \frac{1}{2}\int _{0}^{T}\left( u^{2}(t) + \lambda ^{2}(t)\right) dt \right) \). Moreover, this penalty function is weighted by the term \(1/\beta \). The positive constant \(\beta \) is referred to as the preference for robustness parameter, and serves as a measure to quantify the preference for robustness of the fund manager. In fact, concerning the possible allowed values for this parameter, there exist two interesting limiting cases:

-

\(\beta \rightarrow 0\). In this case, the fund manager fully trusts the model she is offered and seeks no robustness. In this case, the robust stochastic optimal control problem (9) reduces to the (simple) stochastic optimal control problem:

$$\begin{aligned} \sup _{(\pi ,b)\in \mathscr {A}^{\mathbb {F}}}\mathbb {E}_{\mathbb {P}}\Big [U(Y(T))\Big |\mathscr {F}_{t}\Big ], \end{aligned}$$(10)subject to the state dynamics

$$\begin{aligned} \begin{aligned} dY(t)&= \Big [r + (\mu -r-\sigma k_{2})\pi (t) + (\theta -k_{3})\alpha b(t) - \mu _{L}(r)+ k_{2}^{2} + k_{3}^{2} \Big ]Y(t)dt \\&+ qdt + (\sigma \pi (t)-k_{2})Y(t)dW_{1}(t) + (\alpha b(t)-k_{3})Y(t)dW_{2}(t), \end{aligned} \end{aligned}$$(11)with initial condition \(Y(0)=y>0\). This problem can be easily addressed by adopting dynamic programming techniques.

-

\(\beta \rightarrow \infty \). In this case, the fund manager has no faith in the model she faces and seeks alternative models with larger entropy. However, it has to be pointed out that this case is not easily treatable as the inner minimization problem becomes undefined (since it looses its convex character). For more information on this subject, see, e.g., Baltas et al. [5] for a detailed study of a related robust control problem, in this limit.

Remark 1

The robust optimal control problem (9) is in the form of a two player, zero-sum stochastic differential game. The first player is the fund manager (player I) and the second player (player II) is a fictitious adversarial agent, commonly referred to, as Nature. Player I, is endowed with some initial wealth and decides the optimal proportion of the fund’s wealth to be invested in the stock and bond markets, as well as, the bank account. On the other hand, player II antagonistically chooses the probability measure \(Q\in {\mathscr {Q}}\) (that is the probability model, as there exists a one to one relationship between a probability model and a probability measure) in order to create the worst possible scenario for the fund manager.

In the present section, we constructed a simple stochastic model that introduces uncertainty aspects to the problem of optimal management of DC pension funds. In order to solve the problem (9) subject to the dynamic constraint (8), one has to derive the associated Bellman-Isaacs (BI) equation and solve it, as the optimal controls are defined as functions of the derivative of this solution. However, as already mentioned in Sect. 2, at this stage a major obstacle arises, as it is not in general possible to find a smooth solution to the BI. This is an area that our future research aims to contribute by following: (a) a weak solution point of view, and (b) an algorithmic approach to numerically solve the BI. Of course, the model presented here can be extended in a variety of ways (e.g., consider the case of stochastic volatility, stochastic interest rates, the effect of mortality, etc.) but each one of these extension comes with an associated complexity cost. Finally, from a quantitative point of view (and this is another future focus point of our group), the stochastic models adopted in the present section (and the ones that will be used in our future endeavors), will be calibrated to the specific case of the new Polish pension scheme, in order to make our results as realistic as possible.

4 Risk Distribution and Design of Pension Scheme: A Case Study of Poland

4.1 Design of Polish Pension Scheme from the Point of View of Risk Management

Poland introduced a comprehensive reform of its old-age pension system in 1999. The reform established a defined-contribution, multi-pillar system involving: a PAYG pillar based on notional (non-financial) defined contributions (NDC) and administered by the Social Insurance Institution (in Polish: Zaklad Ubezpieczeń Spolecznych; in short: ZUS), a mandatory funded pillar in which private pension funds manage individuals’ contributions, and a voluntary third pillar consisting of company pension plans and other savings vehicles (cf. Table 1Footnote 2).

The total pension contribution rate amounts to 19.52% of gross wages (by along pillar 1 and pillar 2). The contributions (premiums) are financed equally by both employer and employee. In fact, 16.60% of pension contributions are transferred to pillar 1 (being written down on the individual accounts and sub-accounts of those insured) and 2.92%Footnote 3 goes to open pension funds (pillar 2), if the insured person is a member of an OFE. If not, the entire 19.52% are transferred to the pillar 1 (see Rutecka [54], p. 130). The notional interest rate is defined as 100% of the growth of the real covered wage bill, and no less than the price of inflation. The pillar 2 is a voluntary funded defined contribution (FDC) scheme. Contributions paid into the second pillar are indexed with the rate of return on pension fund investments. One of its main objectives in the economic dimension was the division of risk between the financial market and the labor market by introducing a three-pillar structure and, in particular the second capital funded pillar and OFEs operating within it (see Góra [35]). After retirement (in the deccumulation phase of a pension system), pension benefits are indexed annually by inflation with at least 20% of the real average wage growth. The pension formula is to a large extent similar to the first and the second pillar. Benefits are equal to the accumulated capital from contributions (plus indexation) divided by life expectancy, obtained from the observed unisex period mortality tables. Mortality tables are recalculated by Polish Central Statistical Office (in short: GUS) every year.

The assumptions of the systemic pension reform introduced in Poland in 1999 predicted the development of additional voluntary pension schemes (“the third pillar of the pension scheme”; see Table 1). The pillar 3 consists of voluntary and quasi-obligatory private pension plans:

-

occupational pension plans (in Polish: “Pracownicze Programy Emerytalne”; in short: PPE),

-

individual retirement accounts (in Polish: “Indywidualne Konta Emerytalne”; in short: IKE),

-

individual retirement saving accounts (in Polish: “Indywidualne Konta Zabezpieczenia Em-erytalnego”; in short: IKZE).

-

employee capital plans (in Polish: “Pracownicze Plany Kapitałowe”; in short: PPK)—new, quasi-obligatory occupational pension schemes, introduced in 2019; they have been introduced since the 1, July, 2019 first in big companies with 250 or more employees, than in small and medium companies in 2020, and in public sector in 2021.

In the years 1999–2004 (until the introduction of IKEs), the only form of saving for retirement, benefiting from certain (relatively modest) economic and fiscal incentives from the state, were PPEs. However, the current development of PPE in Poland has been very slow. Only a little bit more than 1,000 employers offer their employees the opportunity to participate in pension schemes (1 053 PPEs at the end of 2017, of which 645 in form of a contract with insurance company, 382 in the form of a contract with mutual investment fund and implemented with an employee pension fund, the so called “Pracownicze Fundusze Emerytalne”; in short: PFE). The number of participants at the end of 2017 was about 400 000 and total value of assets was 1.224,6 bln PLN (about 360 bln EUR). In this respect, Poland does not compare favorably with other EU countries, including some former socialist states (e.g., Slovakia and the Czech Republic), where occupational pension schemes are more prevalent.

While pillar 1 (PAYG) is in the accumulation (savings) phase, the pension system is more sensitive to the risk of demographics which increases with the aging of the population, and the funded pillar in public system is subject to different (demographically uncorrelated) kinds of risk (including investment risk). Additional pension schemes (individual ones: IKE, IKZE, and occupational ones: PPE and PPK) with DC formula are exposed to investment risk in accumulation (savings) phase and to longevity risk in payout phase of the scheme (deccumulation of pension capital).

Due to different regulations concerning acceptable investment strategy and available financial instruments, the problem of optimal investment portfolio management must be analyzed differently in comparison to pension funds operating in the public pension system (OFE), and differently to additional pension systems which are individual (IKE, IKZE) and occupational pension schemes (PPE, PPK).

4.2 Analysis of Investment Policy and Risk Management in Open Pension Funds

A brief history of OFEs in Poland can be divided into two main stages. The first one took place in the years 1999–2014. During this period the contribution to OFEs was compulsory for every employee and covered by the general pension system. The second stage began in 2014 and continues to this day. Its essential feature is the optional nature of OFE. By default, every system participant pays a full mandatory pension contribution to ZUS, including a special ZUS sub-account, while participation in an OFE requires an opt-out decision.

At the beginning of this subsection, let us return to the end of the 1990s. At that time, the Polish parliament defined the principles of investment activity for OFE introducing the second mandatory fully funded pillar. In article 139, the following entry appears: The Fund places its assets in accordance with the provisions of this Act, striving to achieve the maximum level of security and profitability of investments made. Thus, already in 1997, it was emphasized that not only investment profitability is important, but also the risk closely related to the process of in-vesting the capital of future pensioners. Mazurek-Krasodomska [48] noted that stressing the security at the start of pillar 2 in Poland was justified by the peculiarity of OFEs, which consisted in the compulsory payment of contributions by future pensioners (see Mazurek-Krasodomska [48], p. 24).

In the above-mentioned Act, there were more rules that aimed at limiting the investment risk. These included provisions limiting the risks related to: OFEs operations, Pension Fund Societies (in Polish: “Powszechne Towarzystwa Emerytalne”; in short: PTE) operations, control over OFEs and PTEs, and investment policy. However, legal investment limits for OFEs changed signifi-cantly with the transfer of assets to ZUS in 2014 (cf. Table 2). Jakubowski [40] states that initially OFEs assets were managed like in balanced funds, now OFEs are managed just like equity funds (for more information, the interested reader is referred to Jakubowski [40], pp. 42–43).

As Czerwińska [23] observed, strategies implemented by OFE in the years 1999–2009 show the model of investment portfolio allocation −30% of shares and 65% of debt instruments (mainly government bonds). Thus, the shares of companies were only the second-largest category of investment instrument used by pension funds. In the indicated period, these shares accounted for 22% of the investment portfolio in 2008 (the lowest level) up to 35% in 2000 and 2007 (the highest level).

Czerwińska [23] explains that such a structure of a typical portfolio was determined to a decisive extent by: situation on the Polish financial market (shallow market with low liquidity), high sup-ply and high profitability of Treasury debt securities and unfavorable situations on the stock market in 2001–2002 and 2008, no restrictions on investment in treasury securities, and regulations that limit both the concentration of fund capital in one company and activity on foreign financial markets.

However, as noted before, the conditions of OFEs activity changed very significantly in 2014. The Polish Financial Supervision Authority (in Polish: “Komisja Nadzoru Finansowego”; in short: KNF) has briefly summarized the main changes in one of its studies [Polish Financial Supervision Authority [4], pp. 13–16]. Among these changes, it should be state:

-

reclassification of 51.5% of OFE members funds to the ZUS sub-account,

-

enabling system participants to choose which institution will receive a part of the retirement contribution (ZUS or OFE),

-

elimination of a minimum rate of return and reduction of fees,

-

introduction of a so-called safety slider,

-

strengthening pillar 3 (the possibility of additional savings on IKZE).

From the point of view of OFEs and TFEs, these changes meant completely new operating conditions and the need to adjust the investment policy. Firstly, a transfer of assets from OFEs to the ZUS cuts drastically the size of the pension market of Poland. Secondly, lower contribution paid to OFEFootnote 4 narrowed the capital inflow to these funds. Thirdly, introduction of freedom to pay contributions to OFEs led to a significant drop in the value of the contributions paid to pillar 2 (Jakubowski [40], pp. 44).

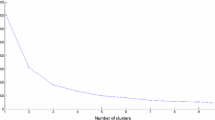

The evaluation of the results of OFEs investment activity is a very complex matter (cf. Chybalski [21]). For the purposes of this study, only the measure resulting directly from the 1997 Act and its subsequent amendments have been used. This indicator of OFE investment performance is the Weighted Average Rate of Return. Initially, it was calculated on the basis of changes in the value of OFE accounting unit in the 24-month period preceding the end of each quarter. Then, from the second quarter of 2004, the measurement period was extended to 36 months. In addition, it was decided to limit up to 15% of the weight that can be attributed to a single OFE (cf. Buchowiec [19], pp. 409–422). Figures 1 and 2 show the calculation of OFEs return rates made employing both of these methods. OFEs investment achievements turned out to be the largest in the first years of the new system operation. But in the long-term there was a clear downward trend.

4.3 Risk in Occupational Pension Schemes

Defined contribution occupational pension schemes are often referred to as money purchase pension schemes, because in return for invested premiums, recorded in the personalized retirement accounts, the program participant will in future receive a certain cash benefit, whose value will depend on the contributions made and the result of investments. In this system, the amount of future benefits is not pre-defined and depends largely on the effects of investment in the financial market. Needless to say, also in a defined contribution scheme the amount of future pension is essentially determined by the value of contributions made to a pension scheme and can be predicted with reasonable accuracy. It requires certain financial simulations, making assumptions regarding the profitability of investments, situation of the national and global economy, and in the financial markets, etc. However, the amount of future benefits is not guaranteed by the occupational pension contract in proportion to the remuneration, as in defined benefit schemes.

In many DC pension plans, payment of the “purchased” in this way of an occupational pension is divided into two parts. The first part is a one-time payment of a sum of gathered pension capital (lump sum), usually exempt from tax, and the second part forms a constant stream of payments (annuities) coming from the resources left in a pension fund or from benefits purchased with these resources, provided by third parties (mainly the insurance companies).

DC occupational pension schemes are usually fully funded. In such systems, the real money is invested in the financial markets [World Bank 1994: p. 172]. Very often the DC systems are managed by external financial institutions (insurance companies, mutual funds, banks).

In general, it is assumed that these systems are safer for an employer, who is not required to pay in future a pension of a predetermined value. Investment risk is largely passed on the employee. In exchange for risk allocation from employer to employee, program participants can count on certain benefits. They often have the choice between several investment funds and at least a partial influence on investment strategies (for example, what percentage of the premiums paid to a pension scheme is to be invested in stocks, bonds or other financial instruments). DC schemes are more transparent to employees, who can systematically track the status of their individual savings account in a given program. Typically, the DC schemes are not subject to so many restrictions regarding defined benefit schemes. However, there is a number of risks regarding DC equity funded pension schemes, which their participants are not always aware of (cf. Table 3).

In an unprotected pension plans there are no guarantees from either the pension fund or from a financial services provider as to the rate of return on investment, or other obligations regarding the entire pension plan. The protected pension plans, on the other hand, offer such guarantees. For example, the return on investment not lower than the yield of safe debt securities, or higher than the rate of inflation or other benchmark indicator.

In the further part of this study, the subject of analyzes will be the investment risk occurring in additional pension systems in Poland (namely, business and individual ones) with a defined premium (DC).

4.4 Analysis of Risk Management in Some of the PPEs in Poland

From the free forms of occupational pension schemes operating on the market since 1999, only statistical data on the value of participation units (after deducting service costs) of PFEs were published in a systematic manner and can be used to assess their investment performance (cf. Fig. 3). PPE in the form of an agreement with an investment fund or life insurance company were of individual nature, based on arrangements between financial services providers and with the companies’ employers and the representation of employees (mostly trade unions). That and the service costs were not made public, and it is not possible to analyze precisely their rates of return.

The standard deviation of the rates of return on investments realized by PFE in the years 2000–2018 (cf. Fig. 4) was 8,16292. Only in 2008, at the peak of the global financial crisis, there was a negative double-digit rate of return (−13.5%). It is difficult to make it different, because during this period the value of financial assets dropped sharply in most countries of the world, while the value of assets of pension funds in many EU countries was higher than in Poland (e.g., in Ireland minus 30%). As early as in 2009, the value of participation units of PFE Nowy Świat has increased enough to fully recuperate the 2008 losses (+15.2%). In the nearly twenty-year period of operation of the tested PFE, the rate of return on investments was negative also in 2011 and 2018 (−5% in 2011 and −2,2%), but it was much lower than in the timer of crisis in 2008. The recession from 2011 was connected with the Greek debt crisis, which strongly affected global equity markets, while 2018 correction was directly caused by US interest rates increase. A similar distribution of investment returns can be observed on the OFEs market in the public pension system 1999–2014. In this period, both PFEs and OFEs had similar portfolio structure, typical for mixed assets stable growth funds.

As a result of systemic legal changes and retreat from mandatory pension funds in public pension system,Footnote 5 the OFEs at the beginning of February 2014 became de facto funds of Polish shares and changed their status from obligatory to voluntary. At the end of March 2018, up to 12 OFEs had 16 million members, and their net assets amounted to PLN 166 billion. At that time, up to 2 employees of pension funds had 35 thousand members, and their assets amounted to PLN 1.8 billion. Up to 8 voluntary pension funds accounted for 99 thousand members and their assets amounted to PLN 316 million.

Due to the limited possibility of rebuilding OFE portfolios, in particular a prohibition on investing in OFE assets in government bonds, limited supply of instruments from other asset classes and a significant current involvement of OFE in shares listed on the WSE (Warsaw Stock Exchange), the investment profile of OFE is forced by the reform. At the end of March 2018, the share of domestic equity instruments in the OFE portfolio was 78%, the debt part constituted only 8%, bank deposits 7%, and investments in foreign securities 7%. This resulted in a greater variability in the return on investment realized by OFEs and by PFEs (cf. Fig. 5), while the non-diversified risk of investments in OFE is correspondingly higher. In the case of the PFE portfolio, the treasury bonds (66%) and shares listed on the WSE (26%) constituted the basis.

The PPEs operate in Poland nearly two decades. This is a relatively short time in the perspective of a professional career and saving for retirement, where a typical savings period (accumulation phase) is about 40 years. That is why the phenomenon of the so-called “a bad date”—the need to payout of occupational savings during the financial crisis, when the value of pension assets drops sharply—it only occurred to a very small group of employees paying their occupational pension in 2018 (less than 500 people according to data from KNF).

To avoid a similar situation (“bad-date” risk), the newly created employee capital plans will be defined-date funds (life-cycle funds). It should be adjusted to take into account the need to limit the level of investment risk as the participant approaches retirement age. In connection with the conclusion of a contract for the conduct of a PPK, funds collected by a participant may be placed in one of at least five funds of a defined date, applying different investment policy principles, appropriate for the date of birth of the participant (cf. Fig. 6).

At the participant’s request, it is possible to change the fund of a defined date. This means that in the first phase of accumulating pension capital, most of the funds from contributions paid by the employee, employer and subsidies from the state budget will be invested in shares, while as the retirement age approaches, an increasingly larger share in the investment portfolio will have more secure debt securities, mostly treasury bonds and treasury bills.

4.5 Analysis of Investment Policy and Risk Management in Individual Additional Pension Schemes

In Poland, the first form of individual additional pension schemes were IKEs, which started to operate in 2004. IKEs were dedicated to people who cannot make saving for retirement using PPE.

IKE is a form of pension protection, which gives a wide spectrum of investment possibilities. Participants can choose from a variety of instruments, depending on their risk appetite, knowledge and available time for pension assets management. IKE can be conducted by five types of institutions: mutual funds, brokerage firms, insurance companies, banks and voluntary pension funds. Each member may have only one IKE and must be at least 16 years old to start saving for retirement. Participants can pay retirement contributions on a monthly, quarterly or annual basis. One of the important aspects of IKE is tax privilege. In Poland, income from financial instruments is taxable at 19%. In the case of IKE, the income is calculated as the difference between the sum of funds accumulated on the account and the sum of contributions made on them. Participants of IKE are exempted from this tax, if they meet the following criteria: pay contributions for at least five years and begin to pay out funds after reaching the age of 60. The maximum annual contribution to the IKE cannot be higher the sum of three average monthly salaries which was projected in the Polish national economy for a current year (cf. Fig. 7).

Another form of individual additional pension schemes are IKZEs, which were introduced in 2012. IKE and IKZE have quite similar principles of operation and may be conducted by the same type of institutions. However, IKZE and IKE differ from each other primarily by the annual contributions limit and the type of tax privilege for the account holder. The annual contributions to IKZE cannot exceed the amount equal to 1.2 times the average monthly salaries which was projected in the Polish national economy for a current year. Moreover, in the case of an IKZE, the tax privilege consists in deducting the sum of paid contributions from the personal income tax base.Footnote 6 The pension payment from IKZE takes place at the request of the account holder after reaching the age of 65. An additional condition is the payment of contributions for at least 5 calendar years. It is possible to withdraw the savings once or in installments.

The selection of a financial institution, where IKE and IKZE are available, has a significant impact on the investment risk. Accounts maintained by banks take the form of simple and secure savings accounts, and their profitability depends only on the level of interest rates. Brokerage firms provide access to brokerage accounts; therefore, it is possible to invest directly in the capital market by individuals. In this case, each person has the opportunity to create an investment portfolio, which is tailored to individual needs and risk appetite. Saving in mutual funds, insurance companies and voluntary pension funds assumes the use of the idea of collective in-vestment. The largest part of pension assets at IKE and IKZE is managed by mutual funds and insurance companies. In 2018, in the case of IKE, this was 31.0% and 30.9% of total assets, while in the case of IKZE, 39.5% and 35.0% respectively. In the majority of cases, insurance companies in Poland do not manage the retirement savings by themselves, but purchase mutual fund units available on the Polish market (Dopierala [27]). Moreover, the unit linked insurances are a pure DC pension plans. It follows that profitability and investment risks in IKE and IKZE depend mainly on the mutual fund portfolios. At the same time, savers take the entire investment risk in the case of all types of institutions.

Number of mutual funds available under IKE and IKZE by company and by fund type. Source own elaboration based on: https://www.analizy.pl/ (access: 22.02.2018)

Among the mutual funds operating within IKE and IKZE, the equity funds are the largest group (IKE 86 funds, IKZE 78 funds; cf. Fig. 8). In this group, there is a large diversity of applied investment strategies. Examples include funds investing in small and medium-sized companies, but also funds investing in large capitalization companies paying dividends. There is also a significant geographic diversity of asset placement. Although the Polish funds dominate, a group of abroad funds is also available. Among them are those that invest in developed markets as well as emerging markets. The funds investing in fixed income instruments are the second largest group (73 IKE funds, 67 IKZE funds), which invest mainly in the bond and money market. The bond funds invest both in government and corporate bonds in Poland and abroad.

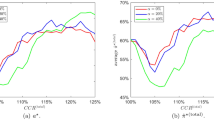

The mixed funds are also a large group (IKE 63 funds, IKZE 54 funds) investing in both shares and debt instruments. The mixed funds group includes maturity target funds (defined-date funds, life-cycle funds) in which the investment portfolio changes from aggressive to safe as the fund approaches the target date. For example, this type of funds are provided by the investment company Universal Savings Bank (in Polish: “Powszechna Kasa Oszczędności”; in short: PKO), which offer five funds with different maturity dates from 2020 to 2060. At the moment, the funds differ significantly in the volatility of investment results (cf. Fig. 9). Moreover, for the participants who save on IKE and IKZE it is also possible to choose the funds that invest in the commodity and alternative assets market.

In Poland, the forms of individual additional pension schemes operate under complex rules. It is possible to invest in various markets both individually and collectively using IKE and IKZE. In addition, financial institutions in which IKE and IKZE are available, offering the opportunity to choose from a wide range of investment strategies. However, the low level of financial knowledge of participants may lead to difficulties in choosing the best method of pension saving. Moreover, savers can use both IKE and IKZE in the same time. It follows that the construction of real investment portfolios depends on many factors. For this reason, the development of an optimal investment portfolio is an important issue.

4.6 Conclusions Concerning Managing Additional Pension Schemes in Poland

Neither PPEs nor PPKs guarantee a minimum rate of return or protection of capital from pension contributions. The same applies to individual forms of additional retirement savings—IKEs and IKZEs. These are typical funds with the DC formula, where the entire investment risk has been passed on to the program participant. Until now, there has been no discussion in the Polish literature on the subject of pension economics and finances regarding the optimal management of pension funds in conditions of risk and uncertainty.

5 Concluding Remarks

During the last decade, and especially after the financial (credit) crisis, the problem of providing supplementary pensions to the retirees has attracted a lot of attention (under the framework of the second and the third pillar, as outlined by the World Bank) from official bodies, as well as private financial institutions (e.g., insurance companies and banks), worldwide. In this effort, there exist various possible solutions, one of which (in fact, the most popular) is provided by pension fund schemes. In plain words, a pension fund scheme represents accumulated wealth stemming from pooled contributions of its members. This accumulated wealth is collected in a portfolio of assets and is invested over a very long period of time in the financial market, in order to provide its members with retirement benefits. Hence, it is clear that the success of such a plan, heavily depends on the successful investment of the available accumulated funds. In fact, this remark places the problem of optimal pension fund management within a broader stochastic (due to the random character of the underlying financial variables) portfolio selection framework.

In the present chapter, we presented general ideas and preliminary results of our planned research project on defined contribution pension funds management, that is, on pension schemes according to which the contributions are fixed but benefits are unknown, as they depend on the performance of the fund portfolio. Our aim is to provide a detailed study for this problem, within an (as much as possible) realistic (stochastic) framework, by fully exploring its two different dimensions, to wit, risk and uncertainty. To be more precise, risk arises due to the exposure of the fund portfolio to the several macroeconomic and microeconomic factors that govern the evolution of the underlying financial markets (and the surrounding social/economic environment) and, in advance, of the financial variables that compose the fund portfolio. In this direction, we focused on the design of a pension fund scheme, from a risk management point of view, presenting a detailed study concerning the case of Poland. On the other hand, uncertainty (in the Knightian sense) arises when the fund manager distrusts the model according to which he/she makes the investment decisions. Model uncertainty is a very important concept, as it places the first stones towards realistic modeling and risk management (see, e.g., Hansen and Sargent [38]). In fact, there exists a limited amount of literature that considers defined contribution pension fund schemes within a model uncertainty framework (especially in discrete time), something that highlights the importance of our research.

From a mathematical point of view, in order to effectively study the problem of DC pension fund management under risk and uncertainty, we will resort to Stochastic Analysis and, in particular, to stochastic (and robust) optimal control theory. The first step of our research is to construct a general, robust investment scheme for the optimal management of DC pension funds. This represents a huge amount of work that lies in the interplay between Mathematics, Finance and risk management. In a second step, we will embaptize the aforementioned derived robust scheme to the new Polish pension system. This will be carried out in two major ways: (a) by taking into account (and modeling) all the legal restrictions entitled by the new Polish pension system, and (b) by calibrating the results obtained in the first step to real market data, with focus on the Polish economy (e.g., interest rates, inflation, salaries, etc.). It is our strong belief that the results will act as a very useful benchmark to pension fund managers when trying to decide the appropriate investment (or hedging) strategy.

Notes

- 1.

The demographic aging of the population (due to the extension of the average life expectancy and the reduction of fertility) means a reduction in the number of working population in relation to pensioners. This is a challenge for the long-term financial stability of pension systems, public finances, as well as the labor market and the pace of economic growth.

- 2.

Open Pension Funds (in Polish: Otwarte Fundusze Emerytalne; in short: OFE) were introduced in 1999 and have been obligatory since 1999. As of 1 April 2014, they are voluntary. The role of the pillar 2 has been marginalized. Source: own elaboration.

- 3.

Initially, from 1999 to 2011, contributions to the 2nd pillar of the reformed public pension systems were much higher and were equal to 7.3% of gross wages.

- 4.

In this case, it should be clarified that the amount of the contribution transferred to OFE was actually reduced earlier because already in 2011. In the face of financial pressure caused by the slowdown of the Polish economy, the contribution to OFE was reduced from 7.3% to 2.3%. In the initial period the contribution was reduced from 7.3% to 2.3%. In subsequent years, a gradual increase to 3.5% was programmed. The remaining part of the contribution (from 7.3%, which was previously transferred to OFE) is recorded on the ZUS sub-account.

- 5.

The same process has been observed in other Eastern and Central European Union countries (Bielawska et al. [10]).

- 6.

There are two PIT rates in Poland: 17% and 32%.

References

Akume, D., Weber, G.-W.: Risk-constrained dynamic portfolio management. Dyn. Contin. Discrete Impulsive Syst. (Series B) 17, 113–129 (2010)

Anderson, E., Ghysels, E., Juergens, J.: The impact of risk and uncertainty on expected returns. J. Finan. Econ. 94, 233–263 (2009)

Anderson, E., Hansen, L., Sargent, T.: A quartet of semigroups for model specification, robustness, prices of risk, and model detection. J. Europ. Econ. Assoc. 1, 68–123 (2003)

Authority, P.F.S.: Sektor funduszy emerytalnych w Polsce-ewolucja, kształt, perspektywy. Warszawa (2016)

Baltas, I., Xepapadeas, A., Yannacopoulos, A.: Robust portfolio decisions for financial institutions. J. Dyn. Games 5, 61–94 (2018)

Baltas, I., Yannacopoulos, A.: Optimal investment and reinsurance policies in insurance markets under the effect of inside information. Appl. Stochastic Models Bus. Industry 28, 506–528 (2012)

Baltas, I., Yannacopoulos, A.: Uncertainty and inside information. J. Dyn. Games 3, 1–24 (2016)

Bates, D.: Post-87 crash fears in the s&p 500 futures option market. J. Econ. 94, 181–238 (2000)

Battocchio, P., Menoncin, F.: Optimal portfolio strategies with stochastic wage income and inflation. The case of a defined contribution pension fund. CeRP Working Papers 19, 1–24 (2002)

Bielawska, K., Chlon-Dominczak, A., Stanko, D. Retreat from mandatory pension funds in countries of the eastern and central europe in result of financial and fiscal crisis: Causes, effects and recommendations for fiscal rules. Research financed from research grant number UMO-2012/05/B/HS4/04206 from National Science Centre in Poland, Warsaw (2015)

Bodie, Z., Detemple, J., Otruba, S., Walter, S.: Optimal consumption-portfolio choices and retirement planning. J. Econ. Dyn. Control 28, 1115–1148 (2004)

Boulier, J., Huang, S., Taillard, G.: Optimal management under stochastic interest rates: the case of a protected defined contribution pension fund. Insur. Math. Econ. 28, 173–189 (2001)

Branger, N., Larsen, L., Munk, C.: Robust portfolio choice with ambiguity and learning predictability. J. Banking Finan. 37, 1397–1411 (2013)

Breen, R., van der Werfhorst, H., Jaeger, M.: Deciding under doubt: a theory of risk aversion, time discounting preferences, and educational decision-making. Europ. Sociol. Rev. 30, 258–270 (2014)

Brennan, M.J., Schwartz, E.S.: Regulation and corporate investment policy. J. Finan. 37, 289–300 (1982)

Brock, W., Xepapadeas, A., Yannacopoulos, A.: Robust control and hot spots in spatiotemporal economic systems. Dyn. Games Appl. 4, 257–289 (2014)

Brown, R.H., Schaefer, S.M.: The term structure of real interest rates and the cox, ingersoll, and ross model. J. Finan. Econ. 35, 3–42 (1994)

Browne, S.: Optimal investment policies for a firm with a random risk process: Exponential utility and minimizing the probability of ruin. Mathem. Oper. Res. 20, 937–958 (1995)

Buchowiec, M.: Ustawowe mierniki efektywnosci inwestycyjnej otwartych funduszy emerytalnych w polsce w latach 1999–2012—metodyka obliczania, ocena oraz postulowane kierunki zmian. zeszyty naukowe uniwersytetu szczecinskiego. Finanse, Rynki Finansowe 59, pp. 409–422 (2013)