Abstract

In this paper, a Cournot duopoly model with homogeneous goods is examined with uncertain cost function. A random linear cost function is introduced in this model for the first player. The case of homogeneous expectations is studied. The existence and uniqueness of the equilibrium are obtained. The asymptotic behavior of the equilibrium point is also investigated. Complete stability and bifurcation analysis are provided. The obtained theoretical results are verified by numerical simulations.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Cournot duopoly game

- Cost uncertainty

- Relative profit maximization

- Discrete dynamical system

- Nash equilibrium

- Stability

- Bifurcation diagrams

- Lyapunov numbers

- Strange attractors

- Chaotic behavior

1 Introduction

An Oligopoly is a market structure between monopoly and perfect competition, where there are only a few number of firms in the market producing homogeneous products. The dynamic of an oligopoly game is more complex because firms must consider not only the behaviors of the consumers, but also the reactions of the competitors i.e. they form expectations concerning how their rivals will act. Cournot, in 1838 has introduced the first formal theory of oligopoly. In 1883 another French mathematician Joseph Louis Francois Bertrand modified Cournot game suggesting that firms actually choose prices rather than quantities. Originally Cournot and Bertrand models were based on the premise that all players follow naive expectations, so that in every step, each player (firm) assumes the last values that were taken by the competitors without estimation of their future reactions. However, in real market conditions such an assumption is very unlikely since not all players share naive beliefs. Therefore, different approaches to firm behavior were proposed. Some authors considered duopolies with homogeneous expectations and found a variety of complex dynamics in their games, such as appearance of strange attractors (Agiza [1]; Agiza et al. [4]; Agliari et al. [5, 6]; Bischi and Kopel [11]; Kopel [18]; Puu [23]; Sarafopoulos [24, 25]; Sarafopoulos et al. [28]; Zhang et al. [32]). Also models with heterogeneous agents were studied (Agiza and Elsadany [2, 3]; Den Haan [12]; Fanti and Gori [15]; Hommes [17]; Sarafopoulos et al. [26, 27, 29]; Tramontana [30]; Zhang et al. [31]).

In the real market producers do not know the entire demand function, though it is possible that they have a perfect knowledge of technology, represented by the cost function. Hence, it is more likely that firms employ some local estimate of the demand. This issue has been previously analyzed by Baumol and Quandt [9]; Puu [22]; Naimzada and Ricchiuti [20]; Askar [7]; Askar [8]. Bounded rational players (firms) update their strategies based on discrete time periods and by using a local estimate of the marginal profit. With such local adjustment mechanism, the players are not requested to have a complete knowledge of the demand and the cost functions (Agiza and Elsadany [2]; Naimzada and Sbragia [21]; Zhang et al. [32]; Askar [8]; Bischi et al. [10, 11]).

In this paper we study the dynamics of a Cournot-type duopoly with homogeneous goods where each firm behaves with homogeneous expectations. We show that the model gives more complex chaotic and unpredictable trajectories as a consequence of change in the speed of players’ adjustment. The paper is organized as follows: In Sect. 2, the dynamics of the duopoly game with homogeneous expectations, linear demand and cost functions and relative profit functions for two players are analyzed. A cost uncertainty is introduced into first player’s utility function. We set both players as bounded rational players. The existence and local stability of the equilibrium points are also analyzed. In Sect. 3 numerical simulations are used to verify the algebraic results of Sect. 2 plotting the bifurcation diagrams of the game’s system and to show the complex dynamics via computing Lyapunov numbers, and sensitive dependence on initial conditions.

2 The Game

2.1 The Construction of the Game

In this study we assume that in the two companies there is a separation between ownership and management, so there is a possibility that the managers who make decisions for the company to decide at the expense of their company trying to increase the profits of the competitor. Also, we consider homogeneous players and more specifically, we consider that both firms choose the quantity of their productions in a rational way, following an adjustment mechanism (bounded rational players). We consider a simple Cournot-type duopoly market where firms (players) produce the same good and offer it at discrete-time periods on a common market. Production decisions are taken at discrete time periods t = 0, 1, 2,… At each period t, every firm must form an expectation of the rival’s strategy in the next time period in order to determine the corresponding profit-maximizing prices for period t + 1. We suppose that q1, q2 are the production quantities of each firm. Also, we consider that the preferences of consumers represented by the equation:

where α is a positive parameter (α > 0), which expresses the market size and \(d \in \left[ { - 1,1} \right]\) is the parameter that reveals the differentiation degree of products [13]. For example, if \(d = 0\) then both products are independently and each firm participates in a monopoly. But, if \(d = 1\) then one product is a substitute for the other, since the products are homogeneous. It is understood that for positive values of the parameter d the larger the value, the less diversification we have in both products. On the other hand negative values of the parameter d are described that the two products are complementary and when \(d = - 1\) then we have the phenomenon of full competition between the two companies. The inverse demand functions (as functions of quantities) coming from the maximizing of (1) are given by the following equations (assuming d = 1):

In this work we suppose that the first player’s cost function contains an uncertainty by which the marginal cost (linear cost function) is equal to the combination between the parameters:\(c_{1} ,c_{2} > 0\), which is described by the following equation:

where \(p \in \left[ {0,1} \right]\), is the positive uncertainty cost parameter.

On the other hand the second player uses a simple linear cost function that its marginal cost is equal to \(c_{1} > 0\) and it is described by the equation:

With these assumptions the profits of the firms are given by:

and

Then the marginal profits at the point of the strategy space are given by:

and

As it is noticed both managers care about the maximization of a utility function that contains a percentage of opponent company’s profits (generalized relative profit function), which is given by:

where \(\mu \in \left[ {0,1} \right]\) is the percentage that the player i takes into account the opponent company’s prifots. So, the marginal utility of the player i is given by the following equation:

and the marginal utilities for each player are:

and

Both players are characterized as bounded rational players. According to the existing literature it means that they decide their productions following a mechanism that is described by the equation:

Through this mechanism the player increases his level of adaptation when his marginal utility is positive or decreases his level when his marginal utility is negative, where k is the speed of adjustment of player, it is a positive parameter (k > 0), which gives the extend variation of production quantity of the each company, following a given utility signal.

The dynamical system of the players is described by:

We will focus on the dynamics of this system to the parameter k.

2.2 Dynamical Analysis

The dynamical analysis of the discrete dynamical system involves finding equilibrium positions and studying them for stability. The ultimate goal of this algebraic study is to formulate a proposition that will be the stability condition of the Nash Equilibrium position. Finally, these algebraic results are verified and visualized doing some numerical simulations using the program of Mathematica.

2.2.1 The Equilibrium Positions

The equilibriums of the dynamical system (14) are obtained as the nonnegative solutions of the algebraic system:

which is obtained by setting: \(q_{1} \left( {t + 1} \right) = q_{1} \left( t \right) = q_{1}^{*}\) and \(q_{2} \left( {t + 1} \right) = q_{2} \left( t \right) = q_{2}^{*}\).

-

If \(q_{1}^{*} = q_{2}^{*} = 0\) then the boundary equilibrium position is the point:

$$E_{0} = \left( {0,0} \right)$$(16) -

If \(q_{1}^{*} = 0\) and \(\frac{{\partial U_{2} }}{{\partial q_{2} }} = 0\) then: \(q_{2}^{*} = \frac{{\alpha - c_{1} }}{2}\) and the equilibrium position is the point:

$$E_{1} = \left( {0,\frac{{\alpha - c_{1} }}{2}} \right)$$(17) -

If \(q_{2}^{*} = 0\) and \(\frac{{\partial U_{1} }}{{\partial q_{1} }} = 0\) then: \(q_{1}^{*} = \frac{{\alpha - p \cdot c_{1} - \left( {1 - p} \right) \cdot c_{2} }}{2}\) and the equilibrium position is the point:

$$E_{2} = \left( {\frac{{\alpha - p \cdot c_{1} - \left( {1 - p} \right) \cdot c_{2} }}{2},0} \right)$$(18) -

If \(\frac{{\partial U_{1} }}{{\partial q_{1} }} = \frac{{\partial U_{2} }}{{\partial q_{2} }} = 0\) then the following system is obtained:

$$\left\{ \begin{gathered} \alpha - p \cdot c_{1} - \left( {1 - p} \right) \cdot c_{2} - 2q_{1}^{*} - \left( {1 - \mu } \right) \cdot q_{2}^{*} = 0 \hfill \\ \alpha - c_{1} - \left( {1 - \mu } \right) \cdot q_{1}^{*} - 2q_{2}^{*} = 0 \hfill \\ \end{gathered} \right.$$(19)

and the nonnegative solution of this algebraic system will give the Nash Equilibrium position \(E_{*} = \left( {q_{1}^{*} ,q_{2}^{*} } \right)\) where:

and

This means that:

and

2.2.2 Stability of Equilibrium Points

To study the stability of the equilibrium positions we need the Jacobian matrix of the dynamical system Eq. (15) which is the matrix:

where:

and as a result the Jacobian matrix of game’s discrete dynamical system Eq. (14) is the following matrix:

For the \(E_{0}\) the Jacobian matrix becomes as:

with \(Tr = {\rm A} + B\) and \(Det = A \cdot B\).

From the characteristic equation of \(J\left( {E_{0} } \right)\), we find the nonnegative eigenvalues:

it’s clearly seems that \(\left| {r_{1} } \right|,\left| {r_{2} } \right| > 1\) and the \(E_{0}\) equilibrium is unstable.

For the \(E_{1}\) the Jacobian matrix becomes as:

with \(Tr = C + E\) and \(Det = C \cdot E\).

From the characteristic equation of \(J\left( {E_{1} } \right)\), we find the nonnegative eigenvalue:

it’s clearly seems that \(\left| {r_{1} } \right| > 1\), because:

\(\alpha \left( {1 + \mu } \right) + \left( {1 - \mu - 2p} \right) \cdot c_{1} - 2\left( {1 - p} \right) \cdot c_{2} > 0\) Eq. (22) and the \(E_{1}\) equilibrium is unstable.

For the \(E_{2}\) the Jacobian matrix becomes as:

with \(Tr = F + H\) and \(Det = F \cdot H\).

From the characteristic equation of \(J\left( {E_{2} } \right)\), we find the nonnegative eigenvalue:

it’s clearly seems that \(\left| {r_{2} } \right| > 1\), because:

\(\alpha \left( {1 + \mu } \right) - \left( {2 - p + p \cdot \mu } \right) \cdot c_{1} + \left( {1 - p} \right) \cdot \left( {1 - \mu } \right) \cdot c_{2} > 0\) Eq. (23) and the \(E_{2}\) equilibrium is unstable.

For the \(E_{*}\) the Jacobian matrix becomes as:

with

and

To study the stability of Nash equilibrium we use three conditions that the equilibrium position is locally asymptotically stable when they are satisfied simultaneously [14, 16, 19]:

The condition (i) gives:

It’s easy to find that the first condition (i) is always satisfied:

because: \(\left[ {4 - \left( {1 - \mu } \right)^{2} } \right] > 0\).

Finally, the condition (iii) becomes as:

Proposition:

The Nash equilibrium of the discrete dynamical system Eq. (15) is locally asymptotically stable if:

and

3 Numerical Simulations Focusing on the Parameter k

From the condition (i) focusing on the parameter k we take the following inequality:

The condition (iii) is the following:

And its discriminant is positive:

so the condition (iii) is satisfied if:

where:

are its two positive roots.

To provide some numerical evidence for the chaotic behavior of the system Eq. (14), as a consequence of change in the parameter k (the speed of adjustment), we present various numerical results here to show the chaoticity, including its bifurcations diagrams, strange attractors, Lyapunov numbers and sensitive dependence on initial conditions.

In order to study the local stability properties of the equilibrium points, it is convenient to take specific values for the other parameters: α = 5, c1 = 1, c2 = 0.5 and p = μ = 0.5. So, as a result we find that \(q_{1}^{*} \simeq 1.73\) and \(q_{2}^{*} \simeq 1.57\) and the stability condition becomes as:

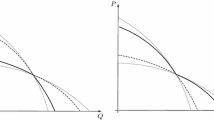

This algebraic result is verified by the bifurcation diagrams of \(q_{1}^{*}\) (Fig. 1) and \(q_{2}^{*}\) (Fig. 2) with respect to the parameter k. As it seems there is a locally asymptotically stable orbit until the value of 0.48 for the parameter k and after this value doubling period bifurcations are appeared and finally, for higher values of the parameter k the system’s behavior becomes chaotic and unpredictable (Fig. 3).

Bifurcation diagram with respect to the parameter d against the variable \(q_{1}^{*}\) with 400 iterations of the map Eq. (15) for α = 5, c1 = 1, c2 = 0.50, p = 0.50 and μ = 0.50

Bifurcation diagram with respect to the parameter d against the variable \(q_{2}^{*}\) with 400 iterations of the map Eq. (15) for α = 5, c1 = 1, c2 = 0.50, p = 0.50 and μ = 0.50

This chaotic trajectory can create strange attractors (Fig. 4) for a higher value of the parameter k like 0.675, outside the stability space. Also, computing the Lyapunov numbers (Fig. 5) for this value of the parameter k and setting the same fixed values for the other parameters α, c1, c2, p and μ it seems that they are getting over the value of 1 as an evidence for the chaotic trajectory.

Phase portrait (strange attractor) of the orbit of (0.1,0.1) with 8000 iterations of the map Eq. (15) for α = 5, c1 = 1, c2 = 0.50, p = 0.50, μ = 0.50 and k = 0.675

Lyapunov numbers of the orbit of (0.1,0.1) with 8000 iterations of the map Eq. (15) for α = 5, c1 = 1, c2 = 0.50, p = 0.50, μ = 0.50 and k = 0.675

This chaotic trajectory makes the system sensitive on initial conditions, which means that only a small change on a coordinate may change completely the system’s behavior. For example, choosing two different initial conditions (0.1,0.1) (Fig. 6) and (0.101,0.1) (Fig. 7) with a small change at the \(q_{1}^{*}\)-coordinate and plotting the time series of system it seems that at the beginning the time series are indistinguishable, but after a number of iterations, the difference between them builds up rapidly.

Sensitive dependence on initial conditions for \(q_{1}^{*}\)-coordinate plotted against the time: the orbit of (0.1,0.1) of the system Eq. (15) for α = 5, c1 = 1, c2 = 0.50, p = 0.50, μ = 0.50 and k = 0.675

Sensitive dependence on initial conditions for \(q_{1}^{*}\)-coordinate plotted against the time: the orbit of (0.101,0.1) of the system Eq. (15) for α = 5, c1 = 1, c2 = 0.50, p = 0.50, μ = 0.50 and k = 0.675

4 Conclusions

In this paper we analyzed the dynamics of a differentiated Cournot duopoly with homogeneous expectations, linear demand and cost functions. An uncertainty of the first firm’s cost function is introduced. By assuming that at each time period each firm maximizes its expected relative profit under the same expectations, a discrete dynamical system was obtained. Existence and stability of equilibrium of this system are studied. We showed numerically that the model gives chaotic and unpredictable trajectories. The main result is that higher values of the speed of adjustment may destabilize the Cournot–Nash equilibrium.

References

H.N. Agiza, On the analysis of stability, bifurcation, chaos and chaos control of Kopel map. Chaos Solitons Fract. 10, 1909–1916 (1999)

H.N. Agiza, A.A. Elsadany, Chaotic dynamics in nonlinear duopoly game with heterogeneous players. Appl. Math. Comput. 149 843–60 (2004)

H.N. Agiza, A.A. Elsadany, Nonlinear dynamics in the Cournot duopoly game with heterogeneous players. Phys. A 320, 512–524 (2003)

H.N. Agiza, A.S. Hegazi, A.A. Elsadany, Complex dynamics and synchronization of duopoly game with bounded rationality. Math. Comput. Simulat. 58, 133–146 (2002)

A. Agliari, L. Gardini, T. Puu, Some global bifurcations related to the appearance of closed invariant curves. Math. Comput. Simulat. 68(3), 201–219 (2005)

A. Agliari, L. Gardini, T. Puu, Global bifurcations in duopoly when the cournot point is destabilized via a subcritical neimark bifurcation. Int. Game Theory Rev. 08(01), 1–20 (2011)

S.S. Askar, On complex dynamics of monopoly market. Econ. Model. 31, 586–589 (2013)

S.S. Askar, Complex dynamic properties of Cournot duopoly games with convex and log-concave demand function. Oper. Res. Lett. 42, 85–90 (2014)

W.J. Baumol, R.E. Quandt, Rules of thumb and optimally imperfect decisions. Am. Econ. Rev. 54(2), 23–46 (1964)

G.I. Bischi, M. Kopel, Equilibrium selection in a nonlinear duopoly game with adaptive expectations. J. Econ. Behav. Org. 46, 73–100 (2001)

G.I. Bischi, A. Naimzada, Global analysis of a dynamic duopoly game with bounded rationality, in Advances in dynamic games and applications, vol. 5, ed. by J.A. Filar, V. Gaitsgory, K. Mizukami (Birkhauser, Basel, 2000), pp. 361–385

W.J. Den Haan, The importance of the number of different agents in a heterogeneous asset-pricing model. J. Econom. Dynam. Control 25, 721–746 (2001)

A.A. Elsadany, Dynamics of a Cournot duopoly game with bounded rationality based on relative profit maximization. Appl. Math. Comput. 294, 253–263 (2017)

S. Elaydi, An Introduction to Difference Equations, 3rd edn. (Springer-Verlag, New York, 2005)

L. Fanti, L. Gori, The dynamics of a differentiated duopoly with quantity competition. Econ. Model. 29(2):421–427 (2012)

G. Gandolfo, Economic Dynamics, (Springer, Berlin, 1997)

C.H. Hommes, Heterogeneous agent models in economics and finance, in: L. Tesfatsion, K.L. Judd (Eds.), Handbook of Computational Economics, Agent-Based Computational Economics, vol. 2, Elsevier Science B.V: 1109–1186, (2006)

M. Kopel, Simple and complex adjustment dynamics in Cournot duopoly models. Chaos Solitons Fract. 12, 2031–2048 (1996)

M. Kulenonic, O. Merino, Discrete Dynamical Systems and Difference Equations with Mathematica, Chapman & Hall/Crc., (2002)

A.K. Naimzada, G. Ricchiuti, Complex dynamics in a monopoly with a rule of thumb. Appl. Math. Comput. 203, 921–925 (2008)

A. Naimzada, L. Sbragia, Oligopoly games with nonlinear demand and cost functions: Two boundedly rational adjustment processes. Chaos Solitons Fractals 29, 707–722 (2006)

T. Puu, The chaotic monopolist. Chaos, Solitons Fractals 5(1), 35–44 (1995)

T. Puu, The chaotic duopolists revisited. J Econom. Behav. Org. 37, 385–394 (1998)

G. Sarafopoulos, Οn the dynamics of a duopoly game with differentiated goods. Procedia Econ. Finan. 19, 146–153 (2015)

G. Sarafopoulos, Complexity in a duopoly game with homogeneous players, convex, log linear demand and quadratic cost functions. Procedia Econ. Finan. 33, 358–366 (2015)

G. Sarafopoulos, K. Papadopoulos, On a Cournot duopoly game with differentiated goods, heterogeneous expectations and a cost function including emission costs. Sci. Bull. Econ. Sci. 1(1), 11–22 (2017)

G. Sarafopoulos, K. Papadopoulos, On the stability of a Cournot dynamic game under the influence of information, Knowledge E Publishing, ISSN: 2518–668X, 131–144, (2018)

G. Sarafopoulos, K. Papadopoulos, Chaos in oligopoly models. Int. J. Prod. Manage. Assess. Technol. 7(1), 50–76 (2019)

G. Sarafopoulos, K. Papadopoulos, Complexity in Bertrand duopoly game with heterogeneous players and differentiated goods, Economic and Financial Challenges for Eastern Europe, Article 2 ( p. 15–26), Springer, (2019)

F. Tramontana, Heterogeneous duopoly with isoelastic demand function. Econ. Model. 27, 350–357 (2010)

J. Zhang, Q. Da, Y. Wang, Analysis of nonlinear duopoly game with heterogeneous players. Econ. Model. 24, 138–148 (2007)

J. Zhang, Q. Da, Y. Wang, The dynamics of Bertrand model with bounded rationality. Chaos, Solitons Fractals 39, 2048–2055 (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Sarafopoulos, G., Papadopoulos, K. (2021). On a Cournot Dynamic Game with Cost Uncertainty and Relative Profit Maximization. In: Skiadas, C.H., Dimotikalis, Y. (eds) 13th Chaotic Modeling and Simulation International Conference. CHAOS 2020. Springer Proceedings in Complexity. Springer, Cham. https://doi.org/10.1007/978-3-030-70795-8_54

Download citation

DOI: https://doi.org/10.1007/978-3-030-70795-8_54

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-70794-1

Online ISBN: 978-3-030-70795-8

eBook Packages: Physics and AstronomyPhysics and Astronomy (R0)