Abstract

As clean and green energy, natural gas has an immense potential for utilization and is becoming dominant in global energy consumption structure. To satisfy the large energy demand in China, natural gas industry is developing towards large scale, diversification and complication. In recent years, the optimization of natural gas supply chain has been studied extensively. However, most of the studies focused on supply security and the optimal distribution of single supplier to demand sides, while the optimization of natural gas supply chain under multi-party competition is rarely considered. Aiming at the competition between the multiple suppliers for the same market, the paper developes a universal mixed integer linear programming (MILP) model for the optimal design and operation of the natural gas supply chain system. The model takes the maximum profit of each supplier as the objective function, and considers the constraints of balance between supply and demand, pipeline construction, station construction, underground reservoir construction and so on. Through using particle swarm optimization (PSO) algorithm, the model is successfully solved to obtain the gas supply scheme and construction scheme of each supplier. Finally, the applicability of the model is illustrated by applying it to a real world natural gas supply chain in China. The results show that the solution is reasonable and can converge to a better value. The research has guiding significance for optimizing natural gas supply chain and ensuring the economic and stability of natural gas supply.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

1.1 Background

Natural gas, as clean and green energy, has been widely used in various countries around the world [1]. In China, the use of natural gas is gradually increasing [2]. According to the statistical data of national energy administration, the natural gas consumption of China has increased from 245 × 108m3 to 3025 × 108m3, which indicates that China's natural gas market has entered a stage of rapid development. Nowadays, the multi-source pattern consisiting of domestic natural gas, imported LNG, imported pipeline natural gas has been formed in China [3]. Due to the existence of multi-source pattern, the suppliers will compete in the downstream market. To maximize their own interests, each supplier will constantly adjust the strategies and optimize resource allocation. Thus, it is of great significance to consider market competition in the optimization of natural gas supply chain.

As the main transportation mode of natural gas, pipelines are safe and economical, which makes most of the suppliers adopt this mode to transport natural gas [4]. A well-designed supply chain system should be able to resist outside interference and ensure the secure downstream supply [5,6,7], which will increase the profits of energy companies. Therefore, each supplier should not only ensure the stable supply in the downstream market while constructing the supply chain system, but also consider how to obtain the optimal pipeline layout scheme under the market competition, so as to minimize the construction cost and maximize their own profits.

1.2 Related Work

Currently, most of the research on the optimization of the natural gas supply chain focused on the supply security [8,9,10], price mechanism [11, 12] and so on. Among them, the studies on the optimal distribution of single supplier to demand side are the majority [13, 14], while the optimization of natural gas supply chain under market competition is rarely considered. Some scholars have worked out the integrated optimization of natural gas supply chain which mainly includes the pipeline layout scheme and detailed supply scheme [15, 16]. Since the operational optimization of natural gas networks is a complex nonlinear problem, Zhang et al. [17] introduced a multi-period optimization framework for the large scale natural gas network. On this basis, a non-convex MINLP model is established to improve the economic performance of the network. Azadeh et al. [18] considered the impact of greenhouse gas produced during natural gas production and transportation on the environment, and then presented a dual-objective fuzzy linear programming model with minimum economic cost and minimum greenhouse gas emission cost to optimize a natural gas supply chain. Finally, the solution was evaluated. Aiming at a small-scale LNG supply system in coastal area, Jokinen et al. [19] developed a MILP model that minimized the cost of fuel purchase to obtain the optimal distribution scheme. By taking the minimum daily cost including transportation cost, liquefaction cost, purchase cost and construction cost as the objective function, Zhang et al. [20] put forward a three-stage stochastic programming method to optimize infrastructure development and inventory routing of the LNG supply system.

There are also studies on the game between different levels of natural gas supply chain [21,22,23]. According to the link-based flexible network allocation rule, Nagayama et al. [24] developed a network game model to analyze the relative power structure among gas-trading countries. Castillo et al. [25] proposed a framework of LNG supply chain with multiple levels, and established a multi-objective model based on the game theory. Considering the competition among third-party marketers, Steven et al. [26] put forward a linear complementarity model for the North American natural gas market to obtain the demand distribution scheme. Daniel et al. [27] proposed a dynamic upstream gas supply model which could stimulate the investment and operation decision of the upstream gas industry. By imposing an agent-based framework, Guo et al. [28] developed a global-scale model Gas-GAME to analyze the impact of US liquefied natural gas exportation strategies on global gas market. The above research mainly concentrated on policy analysis, but did not optimize the design of supply chain system.

In summary, the previous works on the optimization of natural gas supply chain were relatively mature, with a wide range of research directions and rich achievements. However, at present, few studies account for the optimization of natural gas supply chain under multi-source pattern. Aiming at this issue, a universal MILP model is proposed for the design and operation of the natural gas supply chain under multi-source. Through solving the model, the construction scheme of infrastructure and the detailed seasonal supply and storage scheme can be obtained.

2 Problem Description

2.1 Background

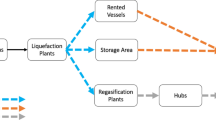

Similar to other fuel supply chains, the structure of natural gas supply chain also can be divided into three parts [29, 30]. The upstream part of natural gas supply chain is the gas production or import, the middle part mainly includes the transportation and storage of natural gas, and the downstream part is the sale of natural gas products [14]. The problem studied in this paper is based on the supply chain system in Fig. 1. It can be seen that there are multiple natural gas suppliers in upstream part. Each supplier relies on its own gas fields to produce natural gas or import natural gas from abroad to supply the downstream market, thus forming the pattern of multi-party competition. The market is the downstream part of natural gas supply chain, and its demand may fluctuate due to the influence of seasonal factors. To satisfy the seasonal demand of the downstream market and reduce the risk caused by demand fluctuation, it is indispensable to construct the underground gas storage near the market [31].

Transportation is the main part of the midstream of natural gas supply chain, which has large impact on economy [32]. Natural gas can be transported by many different modes, among which pipeline is the most used one [33]. Pipeline has a large transport capacity and requires less space [34]. In particular, it is not affected by any extreme weather conditions and can operate continuously for a long time [35, 36].

2.2 Model Requirement

Given:

-

The seasonal demand of each city.

-

The maximum production and external production of each gas field.

-

Geographical locations of gas fields, cities, existing pipelines, stations, and underground gas storages.

-

Various costs, including station construction cost, pipeline construction cost and maintenance cost, gas storage construction cost and so on.

-

The annual depreciation rate of each equipment.

-

The maximum and minimum capacity of underground gas storages.

Determine:

-

Construction scheme of infrastructure of each supplier.

-

Seasonal supply scheme and purchase scheme of natural gas of each supplier.

-

Seasonal storage and peak shaving volume of each gas storage.

Objective:

The objective function is to maximize the profit of each supplier under market competition. To develop the model effectively, this paper proposes the following assumptions:

-

The gas fields and cities are set as one node.

-

The energy consumption cost is considered to be linearly related to the distance and the flow.

-

The difference of gas quality between different gas sources is not considered.

3 Mathematical Model

3.1 Objective Function

In this paper, the infrastructure investment of each supplier is dynamically depreciated in the way of equivalent payment by installments. The objective function (\(\max F_{i} = f_{i,1} - (f_{i,2} + f_{i,3} + f_{i,4} + f_{i,5} + f_{i,6} + f_{i,7} + f_{i,8} )\)) of the model is to maximize the total profit of each supplier. The total profit includes the annual net profit on sales of natural gas (\(f_{i,1} = \sum\limits_{k \in K} {\sum\limits_{j \in J} {\sum\limits_{i^{\prime} \in I} {VS_{k,i,i^{\prime},j} } (p_{k,i}^{sale} - co_{i}^{production} )} } \, i \in I\)), the annual depreciation cost of station construction (\(f_{i,2} = co^{station} dy^{station} \sum\limits_{j \in J} {C_{i,j}^{station} } \, i \in I\)), the annual depreciation cost of pipeline construction (\(f_{i,3} = co^{pipe} dy^{pipe} \sum\limits_{j \in I \cup J} {\sum\limits_{j^{\prime} \in I \cup J} {B_{i,j,j^{\prime}} l_{j,j^{\prime}} } } \, i \in I\)), the annual maintenance cost of pipeline (\(f_{i,4} = co^{{ma{\text{int}} enace}} \sum\limits_{j \in I \cup J} {\sum\limits_{j^{\prime} \in I \cup J} {(B_{i,j,j^{\prime}} + s_{i,j,j^{\prime}}^{pipe} )l_{j,j^{\prime}} } } \, i \in I\)), the annual cost of energy consumption (\(f_{i,5} = co^{energy} \sum\limits_{k \in K} {\sum\limits_{j \in I \cup J} {\sum\limits_{j \in I \cup J} {Q_{k,j,j^{\prime}} l_{j,j^{\prime}} } } } \, i \in I\)), the annual depreciation cost of storage construction (\(f_{i,6} = co^{storage} dy^{storage} \sum\limits_{j \in J} {C_{i,j}^{storage} \, i \in I}\)), the purchase cost for natural gas (\(f_{i,7} = \sum\limits_{k \in K} {p_{k,i}^{purchase} V_{k,i}^{purchase} } \, i \in I\)) and the transportation cost (\(f_{i,8} = \sum\limits_{k \in K} {\sum\limits_{i^{\prime} \in I} {\sum\limits_{j \in J} {p_{i^{\prime}}^{pipe} VS_{k,i,i^{\prime},j} } } } \, i \in I,i \ne i^{\prime}\)).

3.2 Pipeline Construction Constraints

If there is a pipeline between nodes \(j\) and \(j^{\prime}\), it is not indispensable to construct a new one, as stated in constraints (1–2). Equation (3) indicates that no pipeline will be constructed among the gas sources. To avoid the repeated construction, if the supplier \(i\) has already constructed the pipeline between node \(j\) and node \(j^{\prime}\), other suppliers cannot construct more(i.e., (4)). The topology of pipeline network considered in this paper is branch pipeline network, so the relationship between the number of pipeline segments and nodes can be expressed by Eq. (5).

3.3 Volume Constraints

The variable \(VS_{k,i,i^{\prime},j}\) indicates the volume supplied by the supplier \(i\) to node \(j\) through its own pipeline or other suppliers’ pipeline in the season \(k\). Specially, if \((C_{i,j}^{station} + s_{j}^{station} )\) equals 0, \(VS_{k,i,i^{\prime},j}\) will equal 0 (i.e., (6)). The supplier \(i\) can supply natural gas to node \(j\) through its own pipeline when the supplier \(i\) has constructed the pipeline to node \(j\) (\(\sum\limits_{j^{\prime} \in I \cup J} {B_{i,j,j^{\prime}} } = 1\)). Or else, if the supplier \(i^{\prime}\) has constructed the pipeline to node \(j\), the supplier \(i\) can adopt the pipeline of the supplier \(i^{\prime}\) to supply, as stated in constraint (7).

As stated in constraint (8), the purchased natural gas volume of the supplier \(i\) in the season \(k\) should be less than the maximum purchased volume of the supplier \(i\)(\(vpr_{k,i}^{\max }\)). The summation of the total volume of supplier \(i\) for each node through its own pipeline and the supply through other suppliers’ pipelines (\(\sum\limits_{k \in K} {\sum\limits_{i^{\prime} \in I} {\sum\limits_{j \in J} {VS_{k,i,i^{\prime},j} } } }\)) should not be greater than the maximum supply of supplier \(i\) (i.e., (9)).

Only if there is a storage in node \(j\) (\(C_{i,j}^{storage} + s_{j}^{storage} = 1\)) can the storage be operated for injection or export (i.e., (10)). As stated in constraint (11), the peak shaving volume (\(VTF_{k,i,j}\)) should be within the allowable volume of the underground gas storage. The demand of node \(j\) in the season \(k\)(\(d_{k,j}\)) equals to the summation of the volume supplied by each supplier through its own pipeline and other suppliers’ pipelines (\(\sum\limits_{i \in I} {\sum\limits_{i^{\prime} \in I} {VS_{k,i,i^{\prime},j} } }\)) and the peak shaving volume of storage (\(\sum\limits_{i \in I} {VTF_{k,i,j} } n^{season}\)) (i.e., (12)).

3.4 Flowrate Constraints

The transportation of natural gas considered in the model is unidirectional transportation. If there is no pipeline between the two nodes, the pipeline flowrate will equal to 0(i.e., (13)). Or else, the flowrate must have boundaries for economic concerns (i.e., (14)). The flowrate out of the gas source is calculated through Eq. (15). Equation (16) indicates that the volume into node \(j\) minus the delivery volume is equal to the volume out of node \(j\).

3.5 Station and Storage Construction Constraints

If the station has been constructed at node \(j\), the supplier \(i\) cannot construct more. To avoid the repeated construction, only one supplier can construct station at node \(j\)(i.e., (17)–(18)). Only the city that satisfies special geological conditions can construct the storage (i.e., (19)). Similar to the station construction, constraints (20)–(21) limit the storage construction of supplier \(i\).

4 Methodology

This paper imposes particle swarm optimization (PSO) algorithm to solve the model. PSO method is one of the intelligent algorithms, which has been widely applied to many engineering optimization problems since it was proposed [37, 38]. The calculation process of the method is shown as follow. Firstly, the number of suppliers should be determined, that is, the number of elements in set \(I\). For different suppliers, we can divide the universal MILP model into several MILP models. Each MILP model corresponds to one supplier, and the model can be decomposed into a pipeline layout model and a gas allocation model. Finally, PSO algorithm is utilized to randomly generate the initial supply of each supplier (\(i = 2, \ldots \ldots ,i_{\max }\)) for demand cities, and the objective function of MILP model of supplier \(i_{\max }\) is set as the fitness function (\(\max F_{{i_{\max } }} = f_{{i_{\max } ,1}} - (f_{{i_{\max } ,2}} + f_{{i_{\max } ,3}} + f_{{i_{\max } ,4}} + f_{{i_{\max } ,5}} + f_{{i_{\max } ,6}} + f_{{i_{\max } ,7}} + f_{{i_{\max } ,8}} )\)). Through the iterative solution, the optimal infrastructure construction scheme and gas supply scheme can be obtained. The overall structure of the proposed method is shown as Fig. 2.

5 Results and Discussion

5.1 Basic Data

This paper optimizes a real natural gas supply chain system in China. The Positions and numberings of all nodes are shown in Fig. 3. This system includes two gas fields S1 and S2, ten demand cities from D1 to D10. In this system, the demand of each city mainly is supplied by the two gas fields S1 and S2 that belong to supplier 1 and supplier 2 respectively. The seasonal demand of each city is shown in Fig. 4. Currently, pipelines from S1 to D1 and from D1 to D2 have already existed, and stations of these nodes have been constructed. Considering the geological conditions of each city, D2, D3, D8, and D9 are chosen to build underground natural gas storages. The maximum of underground gas storage capacity is 10 × 108 m3 of which the base load is 20%. A year is divided into four seasons with equal duration. In the paper, the depreciation rate of each equipment is considered as 7.1%. The construction cost of infrastructure is shown in Table 1. The maximum annual production and purchased volume of each supplier are shown in Table 2. The case is programmed by Matlab R2014a and solved by Gurobi 7.5.1 MILP solver.

5.2 Case Study

The convergence curve of PSO algorithm is shown in Fig. 5. As can be seen from the figure, the algorithm basically starts to converge at the 12th iteration, and then reaches the minimum value. Table 3 shows the calculation results of model.

The optimized structure of studied supply chain is shown in Fig. 6. It can be seen that supplier 1 constructs pipelines from D2 to D8, D6 to D3, D3 to D4. Pipelines from S2 to D7, D7 to D8, D8 to D6, D6 to D5, D6 to D10, D10 to D9 are constructed by supplier 2. Pipelines constructed by each supplier can connect into a network, improving the flexibility of the integral transportation system. The detailed construction scheme of each supplier is shown in Table 4. As shown in table, supplier 1 constructs stations at D3 and D4, underground gas storages at D2 and D3, and supplier 2 constructs stations at D5-D10.

Figure 7 shows the purchased schemes of supplier 1 and supplier 2 at different seasons. Due to the limitation of gas field production, each supplier also needs to import natural gas from abroad or purchase gas from other land fields, so as to satisfy downstream demand. It can be seen that each city has high demand for natural gas in the winter. To meet downstream demand, supplier 1 purchases natural gas with volume of 150 × 106m3 and 200 × 106m3 in the autumn and the winter respectively, while supplier 2 purchases natural gas with volume of 300 × 106m3 in each season. The gas supply schemes of supplier 1 and supplier 2 are shown in Fig. 8. As can be seen from Fig. 6, supplier 1 transports gas to D1-D4 through its own pipelines and supplies gas to D6 and D8 through the pipelines constructed by supplier 2, while supplier 2 only supplies gas to D5-D10 by its own pipelines. The total volume supplied by each supplier can satisfy the demand of the downstream cities.

The optimization result indicates that supplier 1 builds underground gas storages at D2 and D3 for peak shaving in winter. The storage schemes of underground gas storages D2 and D3 are shown in Fig. 9, where the negative value represents the injection scheme and the positive value represents the production scheme. It can be seen that there will be shifts of storage plans in different seasons. In the summer, amounts of natural gas will be injected into storage and stored for use in the winter or next spring. As can be seen from Fig. 8 and Fig. 9, part of the supply of D2 and D3 from supplier 1 is injected into the storage in the summer, with the volume being 10.41 × 106m3/d and 6.46 × 106m3/d, respectively. During the spring and the winter, the storages at D2 and D3 export natural gas with the volume being 3.72 × 106m3/d and 3.12 × 106m3/d, respectively, to meet the demand of D2 and D3 in these two seasons.

6 Conclusion

This paper puts forward a universal MILP model for the design and operation of natural gas supply chain under multi-source. Infrastructure construction cost and transportation cost are considered in the model. Based on the above cost, this model takes the maximum profit of each supplier as the objective function, and considers the constraints of balance between supply and demand, pipeline construction, station construction, underground reservoir construction and so on. In the paper, PSO algorithm is imposed to solve the model. Finally, a real case is presented to illustrate the applicability of the proposed model. The result shows that the solution can converge to a better value in an acceptable time. For the future works, the authors intend to take the uncertainties of supply chain into consideration.

Abbreviations

- \(i,i^{\prime} \in I{ = }\left\{ {{1,2,} \ldots \ldots ,i_{\max } } \right\}\) :

-

Set of supply node.

- \(J{ = }\left\{ {i_{\max } + 1,i_{\max } + {2,} \ldots \ldots ,i_{\max } + j_{\max } } \right\}\) :

-

Set of demand node.

- \(j,j^{\prime} \in I \cup J\) :

-

Set of all nodes.

- \(k \in K{ = }\left\{ {1,2,3,4} \right\}\) :

-

Set of seasons.

- \(M\) :

-

A big number.

- \(co_{i}^{production}\) :

-

Unit price of gas production of supplier \(i\)(CNY/m3).

- \(co^{station}\) :

-

Station construction cost (CNY).

- \(co^{pipe}\) :

-

Unit price of pipeline construction (CNY/km).

- \(co^{{ma{\text{int}} enace}}\) :

-

Unite price of pipeline maintenance (CNY/km).

- \(co^{energy}\) :

-

Unit price of energy consumption for pipeline transportation (CNY/(km·m3/h)).

- \(co^{storage}\) :

-

Storage construction cost (CNY).

- \(d_{k,j}\) :

-

Demand at node \(j\) in season \(k\)(m3).

- \(dy^{station}\) :

-

Depreciation rate of station.

- \(dy^{pipe}\) :

-

Depreciation rate of pipeline.

- \(dy^{storage}\) :

-

Depreciation rate of storage.

- \(l_{j,j^{\prime}}\) :

-

Distance between nodes \(j\) and \(j^{\prime}\)(km).

- \(n^{season}\) :

-

The number of days in a season.

- \(p_{k,i}^{purchase}\) :

-

Unit purchase price of natural gas of supplier \(i\) in the season k(CNY/m3).

- \(p_{k,i}^{sale}\) :

-

Sale price of natural gas of supplier \(i\) in the season k(CNY/m3).

- \(p_{i^{\prime}}^{pipe}\) :

-

Unit price of transportation through the pipeline of supplier \(i^{\prime}\)(CNY/m3).

- \(q_{j,j^{\prime}}^{\min }\) :

-

Lower boundary of flowrate between node \(j\) and node \(j^{\prime}\)(m3/h).

- \(q_{j,j^{\prime}}^{\max }\) :

-

Upper boundary of flowrate between node \(j\) and node \(j^{\prime}\)(m3/h).

- \(sv_{i}^{\max }\) :

-

Maximum production of gas field of supplier \(i\)(m3).

- \(vos_{j}^{\min }\) :

-

Lower boundary of the storage ability at node \(j\)(m3).

- \(vos_{j}^{\max }\) :

-

Upper boundary of the storage ability at node \(j\)(m3).

- \(vpr_{k,i}^{\max }\) :

-

Maximum purchase of natural gas by supplier i during the season k(m3).

- \(s_{i,j,j^{\prime}}^{pipe}\) :

-

Binary parameters of existing pipelines, \(s_{i,j,j^{\prime}}^{pipe} = 1\) if supplier i has constructed the pipeline between nodes \(j\) and \(j^{\prime}\), or else \(s_{i,j,j^{\prime}}^{pipe} = 0\).

- \(s_{j}^{station}\) :

-

Binary parameters of existing stations, \(s_{j}^{station} = 1\) if there is a station at node \(j\), or else \(s_{j}^{station} = 0\).

- \(s_{j}^{storage}\) :

-

Binary parameters of existing underground gas storages, \(s_{j}^{storage} = 1\) if there is a storage at node \(j\), or else \(s_{j}^{storage} = 0\).

- \(sc_{j}^{storage}\) :

-

Binary parameters of underground gas storage construction, \(sc_{j}^{storage} = 1\) if node \(j\) is suitable for constructing a underground gas storage, or else \(sc_{j}^{storage} = 0\).

- \(fl_{j,j^{\prime}}\) :

-

Binary parameters of gas flow, \(fl_{j,j^{\prime}} = 1\) if gas flows from node \(j\) to node \(j^{\prime}\), or else \(fl_{j,j^{\prime}} = 0\).

- \(Q_{k,j,j^{\prime}}\) :

-

Flowrate between node \(j\) and node \(j^{\prime}\) in the season k(m3/h).

- \(VTF_{k,i,j}\) :

-

Daily peak shaving volume of the storage \(j\) constructed by supplier i in the season k(m3/d).

- \(V_{k,i}^{purchase}\) :

-

Purchased volume of natural gas by supplier i during the season k(m3).

- \(VS_{k,i,i^{\prime},j}\) :

-

The volume supplied by the supplier \(i\) to node \(j\) through the pipeline of the supplier \(i^{\prime}\) in season \(k\)(m3).

- \(B_{i,j,j^{\prime}}\) :

-

Pipeline construction binary variables, \(B_{i,j,j^{\prime}} = 1\) if supplier i will construct a pipeline between nodes \(j\) and \(j^{\prime}\), or else \(B_{i,j,j^{\prime}} = 0\).

- \(C_{i,j}^{station}\) :

-

Station construction binary variables, \(C_{i,j}^{station} = 1\) if supplier i will construct a station at node \(j\), or else \(C_{i,j}^{station} = 0\).

- \(C_{i,j}^{storage}\) :

-

Binary variables of underground gas storage construction, \(C_{i,j}^{storage} = 1\) if supplier i will construct a storage at node \(j\), or else \(C_{i,j}^{storage} = 0\).

References

Liang, T., et al.: Refined analysis and prediction of natural gas consumption in China. J. Manag. Sci. Eng. 4(2), 91–104 (2019)

Wang, T., Lin, B.: China’s natural gas consumption peak and factors analysis: a regional perspective. J. Clean. Prod. 142, 548–564 (2017)

Wang, T., Lin, B.: China’s natural gas consumption and subsidies—from a sector perspective. Energy Policy 65, 541–551 (2014)

Wang, B., et al.: Multi-objective site selection optimization of the gas-gathering station using NSGA-II. Process Saf. Environ. Prot. 119, 350–359 (2018)

Wang, B., et al.: Sustainable refined products supply chain: a reliability assessment for demand‐side management in primary distribution processes. Energy Sci. Eng. 8, 1029–1049 (2019)

Yuan, M., et al.: Downstream oil supply security in China: policy implications from quantifying the impact of oil import disruption. Energy Policy 136, 111077 (2020)

Zhou, X., et al.: Future scenario of China’s downstream oil supply chain: low carbon-oriented optimization for the design of planned multi-product pipelines. J. Clean. Prod. 244, 118866 (2020)

Su, H., et al.: A method for the multi-objective optimization of the operation of natural gas pipeline networks considering supply reliability and operation efficiency. Comput. Chem. Eng. 131, 106584 (2019)

Zarei, J., Amin-Naseri, M.R.: An integrated optimization model for natural gas supply chain. Energy 185, 1114–1130 (2019)

Yu, W., et al.: A methodology to quantify the gas supply capacity of natural gas transmission pipeline system using reliability theory. Reliab. Eng. Syst. Saf. 175, 128–141 (2018)

Rioux, B., et al.: The economic impact of price controls on China’s natural gas supply chain. Energy Econ. 80, 394–410 (2019)

Geng, J.-B., Ji, Q., Fan, Y.: The behaviour mechanism analysis of regional natural gas prices: a multi-scale perspective. Energy 101, 266–277 (2016)

Hamedi, M., et al.: A distribution planning model for natural gas supply chain: a case study. Energy Policy 37(3), 799–812 (2009)

Zhang, H., et al.: Optimal design and operation for supply chain system of multi-state natural gas under uncertainties of demand and purchase price. Comput. Ind. Eng. 131, 115–130 (2019)

An, J., Peng, S.: Layout optimization of natural gas network planning: synchronizing minimum risk loss with total cost. J. Nat. Gas Sci. Eng. 33, 255–263 (2016)

An, J., Peng, S.: Prediction and verification of risk loss cost for improved natural gas network layout optimization. Energy 148, 1181–1190 (2018)

Zhang, W.W., et al.: Multi-period operational optimization of natural gas treating, blending, compressing, long-distance transmission, and supply network. In: Eden, M.R., Ierapetritou, M.G., Towler, G.P., (eds.) Computer Aided Chemical Engineering, pp. 1249–1254. Elsevier (2018)

Azadeh, A., Raoofi, Z., Zarrin, M.: A multi-objective fuzzy linear programming model for optimization of natural gas supply chain through a greenhouse gas reduction approach. J. Nat. Gas Sci. Eng. 26, 702–710 (2015)

Jokinen, R., Pettersson, F., Saxén, H.: An MILP model for optimization of a small-scale LNG supply chain along a coastline. Appl. Energy 138, 423–431 (2015)

Zhang, H., et al.: A three-stage stochastic programming method for LNG supply system infrastructure development and inventory routing in demanding countries. Energy 133, 424–442 (2017)

Massol, O., Tchung-Ming, S.: Cooperation among liquefied natural gas suppliers: is rationalization the sole objective? Energy Econ. 32, 933–947 (2010)

Csercsik, D., et al.: Modeling transfer profits as externalities in a cooperative game-theoretic model of natural gas networks. Energy Econ. 80, 355–365 (2019)

Gong, C., et al.: An optimal time-of-use pricing for urban gas: a study with a multi-agent evolutionary game-theoretic perspective. Appl. Energy 163, 283–294 (2016)

Nagayama, D., Horita, M.: A network game analysis of strategic interactions in the international trade of Russian natural gas through Ukraine and Belarus. Energy Econ. 43, 89–101 (2014)

Castillo, L., Dorao, C.: Decision-Making on Liquefied Natural Gas (LNG) projects using game theory (2011)

Gabriel, S.A., Zhuang, J., Kiet, S.: A large-scale linear complementarity model of the North American natural gas market. Energy Econ. 27(4), 639–665 (2005)

Crow, D.J.G., Giarola, S., Hawkes, A.D.: A dynamic model of global natural gas supply. Appl. Energy 218, 452–469 (2018)

Guo, Y., Hawkes, A.: Simulating the game-theoretic market equilibrium and contract-driven investment in global gas trade using an agent-based method. Energy 160, 820–834 (2018)

Zhang, W., et al.: A stochastic linear programming method for the reliable oil products supply chain system with hub disruption. IEEE Access 7, 124329–124340 (2019)

Zhou, X., et al.: A two-stage stochastic programming model for the optimal planning of a coal-to-liquids supply chain under demand uncertainty. J. Clean. Prod. 228, 10–28 (2019)

Yu, W., et al.: Gas supply reliability analysis of a natural gas pipeline system considering the effects of underground gas storages. Appl. Energy 252, 113418 (2019)

Yuan, M., et al.: Future scenario of China’s downstream oil supply chain: an energy, economy and environment analysis for impacts of pipeline network reform. J. Clean. Prod. 232, 1513–1528 (2019)

Wang, B., et al.: An MILP model for the reformation of natural gas pipeline networks with hydrogen injection. Int. J. Hydrogen Energy 43(33), 16141–16153 (2018)

Wang, B., et al.: Optimisation of a downstream oil supply chain with new pipeline route planning. Chem. Eng. Res. Des. 145, 300–313 (2019)

Liu, E., Changjun, L., Yang, Y.: Optimal energy consumption analysis of natural gas pipeline. Sci. World J. 2014, 506138 (2014)

Ríos-Mercado, R.Z., Borraz-Sánchez, C.: Optimization problems in natural gas transportation systems: a state-of-the-art review. Appl. Energy 147, 536–555 (2015)

Zhang, H., et al.: An improved PSO method for optimal design of subsea oil pipelines. Ocean Eng. 141, 154–163 (2017)

Zhang, H., et al.: A risk assessment based optimization method for route selection of hazardous liquid railway network. Saf. Sci. 110, 217–229 (2018)

Acknowledgements

This work was partially supported by the National Natural Science Foundation of China (51874325) and the Grant-in-Aid for Early-Career Scientists (19K15260) from the Japan Ministry of Education, Culture, Sports, Science and Technology. The authors are grateful to all study participants.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Li, Z., Liang, Y., Duan, Z., Liao, Q., Zhang, H., Wang, Y. (2021). The Optimization for Natural Gas Supply Chain Under Multi-source Pattern. In: Atluri, S.N., Vušanović, I. (eds) Computational and Experimental Simulations in Engineering. ICCES 2021. Mechanisms and Machine Science, vol 98. Springer, Cham. https://doi.org/10.1007/978-3-030-67090-0_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-67090-0_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-67089-4

Online ISBN: 978-3-030-67090-0

eBook Packages: EngineeringEngineering (R0)