Abstract

Entering the era of technology modernization, E-wallet can be considered as a leading method of payment that is continuously being used by the worldwide consumers. However, this type of services is still in the early stages and unfamiliar among Malaysian consumers. Until now, only few research papers were discovered toward the measurement of E-wallet usage intention in Malaysia. The factors affecting consumers’ intention toward the usage of E-wallet specifically among youth with range of age of 18–30 years old need to be examined in this paper. Perceived usefulness, perceived ease of use, perceived risk, and reward are the variables that are being used to identify the relationships with E-wallet usage intention by the consumers in Malaysia. To construct the conceptual framework, technology acceptance model (TAM) is selected for this research. The results show that perceived usefulness, perceived ease of use, and reward have a direct effect toward intention to use E-wallet. However, perceived risk has no direct effect toward intention to use E-wallet. There were 251 respondents, and an online questionnaire was used for data collection. This research paper expected to contribute to the literature particularly on E-wallet by finding causes that influence consumer usage intention toward E-wallet.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Information and communication technology (ICT) improvement had change the life span of one person as well as the responsibilities of the company supportively. Advancement in technology gives massive effect and also offers a lot of enhancements in terms of financial, economic, and working expenses (Slozko and Pelo 2015) as well as reinforcing the organizational accomplishment (Ali 2010). Nowadays, the technological era transformation has brought new exchange into world business environment, whereby the business trades without fail have shifting from cash to electronic payment (Mohamad, Haroon, and Najiran 2009). Furthermore, the boost of network usage from worldwide have contribute in smoothing the global e-commerce businesses (Fernandes 2013).

There are numerous types of cash that are being applied by using new technology payment, and most of them are combined together with electronic method such as funds transfer, business trades process of payment on business consumptions, postpaid gadget, and electronic wallet (Misra et al. 2004). In addition, evolution of payment starts from the barter system and then change to money, after that change to cheque, and then change to credit card and currently process of settlement are concentrating towards the ebusiness and m-commerce which also recognized as electronic wallet. Furthermore, there are a lot of m-payment programs, which are already invented to make it easier for the consumer to do settlement, transfer cash, and also handle financial affairs (Dahlberg et al. 2008, Thakur and Srivastava 2014, Tam and Oliveira 2017). So far, in Malaysia there are more than 30 E-wallet licenses that have been approved by the Central Bank of Malaysia. However, 80 percent of the transactions is still in cash, while another 20 percent is from online banking and credit cards. It shows that Malaysian still do not embrace on the usage of E-wallet. There are limited studies that can be found in the literature which discussed on the intention to use E-wallet by youth in Malaysia. Therefore, the purpose of conducting this research is to examine the effect of perceived usefulness, perceived ease of use, perceived risk, and reward toward E-wallet usage intention. This study is focusing more in Malaysia because of the limited usage of E-wallet in the country.

In Malaysia, the technology keeps on advancing and improving, but still exploitation of E-wallet by the consumer is still low, and most business trades in Malaysia are in cash. It demonstrates that electronic wallet usage is currently in the infancy stage and also the society is not well prepared to adapt and practice this new method of payment. Based on the above consideration, this research examines the E-wallet usage intention among youth in Malaysia and complete the literatures which currently exist with regard to perceived usefulness, perceived ease of use, reward, and perceived risk among Malaysian youth.

2 Literature Review

2.1 E-Wallet

E-wallet can be considered as the most valuable tools of smartphones by utilizing the NFC technology chip, which function is to let the consumers perform quick and safe payment without using any cash or debit card (Pal et al. 2015). As mentioned by Qasim et al. (2012), E-wallet is specified as an application which is being installed by smartphones users and allows consumers make different types of financial transaction. Husson (2015) adds that by utilizing the new technology payment such as E-wallet, QR code, and cloud computing, it could help the consumer to perform more effective and efficient payment in the future.

Recent study conducted by Al-Amri et al. (2018) on customers of a bank institution which have an intention to use mobile wallet using a smartphone. The result shows that perceived ease of use, perceived risk, perceived usefulness, and trust have positive effect toward the intention to adopt near field communication (NFC) mobile wallet proximity payment among smartphone user. Moreover, a study conducted by Madan and Yadav (2016) stated that perceived risk has no significant effect toward the intention to accept mobile wallet. The results explained that the service workers on telecommunication sector and companies that take part on designing a payment activity and also the business associations should develop a multilayer security system so as to reduce any consequence that is suffered by mobile wallet users.

Studies on electronic wallet in Malaysia is very limited. In addition, numerous research paper was conducted by the developed countries due to the advancement in term of technology (Shaw 2014; Shin 2009). E-wallet in Malaysia is in a grow-up phase, and because of its limited information, the consumers had no opportunity to go through the process of using the E-wallet when making a payment. Therefore, as a result of the mix findings and limited literature specifically on E-wallet, a resolution to perform a research toward the usage intention on E-wallet must be done in Malaysia.

2.2 Technology Acceptance Model (TAM)

Technology acceptance model (TAM) is invented by Davis (1986). It is a modification from the Theory of Reasonable Action. The purpose of it being designed was to measure the acceptance by the consumer toward information system and technology. This theory consists of two specific elements which are recommended by the scholar where it can give a good understanding in terms of technology recognition. The first elements were perceived usefulness, and the second elements were perceived ease of use.

Technology acceptance model has become one of the best tools that is being used in order to understand the acceptance toward the technology in many fields, for instance, commerce (Ha and Stoel 2009), learning sector (Huang et al. 2007), and manufacture (Davies and Harty 2013). The objective of the TAM was to have a better understanding and to improve acceptance by the user and also serve as guide on the theory part.

TAM was already well acknowledged and was cited in many studies mostly on the topics of the acceptance of technology (Lee and Kozar 2013). Slade et al. (2015) add more that TAM has turn out to be the framework that often is being used for the evaluation of technology information research. Technology acceptance model helps scholars and experts to identify the acceptance and rejection of technology or system together with better explanation and valuation (Lai 2017). There are a number of factors in choosing technology acceptance for the supporting theory: first of all, straightforwardness and accurate estimation toward different types of data from the system itself (Guriting and Ndubisi 2006; Pikkarainen et al. 2004; Kleijnen et al. 2004; and Venkatesh and Morris 2000) and, second, a significant percentage of research paper using TAM particularly in the context of mobile wallet (Slade et al. 2015).

Despite the fact that technology acceptance model (TAM) is often applied in order to determine the information system acceptance and usage (Mathieson 1991; Davis and Venkatesh 1996), there may a posibbility of adding an extension of variables on this model and it was already been confirm and tested (Lai and Zainal 2014, 2015 and Lai 2016). Therefore, several variables will be added in this study as an extension of this model which will help to clarify usage intention on E-wallet among youth in Malaysia.

2.3 Perceived Usefulness

Perceived usefulness can be explained as ones’ views toward the use of specific system to enhance the given task performance (Agrebi and Jallais 2015). According to Pham and Ho (2014), people beliefs that using a specific system which have a new features and easy to be used can enhance one’s job performance enhancement. When the consumers perceived the technology is very convenient, it will lead the them have the intention of using a specific technology system (Venkatesh and Davis 2000).

Shaw (2014) suggests that perceived usefulness affects the decision to use a mobile wallet substantially. The results clarified the expectation that a desired outcome would result in individuals using the systems. Because mobile phones are ready at hand, fast transaction can be performed easily as this was mentioned by the participants in the mobile payment circumstance. Smartphones, on the other side, often give special offer of collecting bonuses and receipt which turn into more convenient to use.

Most research used perceived usefulness as variable, and many results indicate that there is a significant impact between perceived usefulness and an adoption of technologies. It illustrates that perceived usefulness has a vital role in verifying the technology acceptance where it will give a better outcome for the upcoming studies. Therefore, examining perceived usefulness from the perspective of mobile payment is essential for this study.

2.4 Perceived Ease of Use

As stated by Saadé and Bahli (2005), perceived ease of use can be clarified by way of ones’ viewpoints of a smaller amount of effort that needs to be used when operating a particular system. As said by Al-Amri et al. (2018), consumer trust can be earned if there is a user-friendly combination and impressive guide on how to use mobile payment practices and also by showing the capability and kindness from the service providers’ side. Perceived ease of use is also defined as view on operating a technology by using least attempts (Pham and Ho 2015). Consumer acceptance toward a system can be measured by the easiness when using it.

In study by Mun et al. (2017), the result shows a positive impact of perceived ease of use toward the usage intention on service that uses mobile phone to make a payment. One more study conducted by Guriting and Ndubisi (2006) demonstrates that there is a positive effect of perceived ease of use toward consumer’s behavioral intentions on e-payment usage. Abrazhevich (2001) clarifies that e-payment system with an effective design will attract more consumer and if the new payment method is easy to understand and use, the consumer tends to be attracted to adopt and try to use e-payment in Malaysia (Abrazhevich 2001).

From all of the findings above, perceived ease of use and the technology usage intention were discovered to have a significant relationship from other cultures and also response from users (Natarajan et al. 2017; Kwon et al. 2020). Because of the different results from previous scholars, it is crucial for this research paper to explore the effect of perceived ease of use with respect to E-wallet usage intention.

2.5 Reward

Rewards can be referred as a benefit of expectations from the selected behaviors (Lee et al., 2008). Effort will be made by consumers in order for them to receive rewards or incentives (Kim and Han 2014; Varnali et al. 2012). According to study conducted by Saprikis (2018), reward shows a positive effect toward the social commerce behavioral intention. The findings clarify that reward can attract social network service users to conduct online buying purchases. In regard to its impacts, these types of actions can convince even more individuals to adopt social commerce (Saprikis 2018). Consumers treasure all of the possible rewards that are offered to them. Similarly, according to Tavilla (2012), consumer will be attracted to use mobile payment if there are discounts or other incentives offered to them.

However, a study performed by Ahn and Park (2016) indicates that reward has no significant impact to behavioral intention toward organ donation. The findings state that the individuals who are aware to unmaterial reward did not have any plan to join the donation of organ. Rewards for material type are such a maximum of six million KRW including costs and interment costs, and nonmaterial rewards are honoring medal for a donation (Park 2016). The types of rewards offered can be a motivation for people to make a contribution of donating an organ (Ariely et al. 2009; Lacetera and Macis 2010a, b).

Investigation on reward had been conducted in many areas, including societal education, behavioral transformation progressions (Schunk et al. 2008; Lacetera and Macis 2010a, b, declaimed in Petri 2003; Weibel et al. 2010), office competence (Porter et al. 2003; Oluleye 2011), educational approach and performance (Eberts et al. 2002), and physical condition behaviors (Carlson and Tamm 2000; Volpp et al. 2006; Custers et al. 2008; Lacetera and Macis 2010a, b).

Even though some research has been conducted on reward as an independent variable in numerous areas, in regard to the lack of empirical research indication on young adults in the context of E-wallet, this has sparked an interest for this study to examine reward toward the intention to use E-wallet.

2.6 Perceived Risk

Perceived risk was clarified as “an observation on hesitation that made by users and also an unpleasant aftermaths of business deal done by a wholesaler” (Gupta and Kim 2010, p. 19). Risk can be considered as an important factor during the process of operating the latest technology of mobile wallet. Most of the consumers believe that wallet is more important than the mobile phone that is being used by them. Wu and Wang (2005) conducted a research in Taiwan between perceived risk and behavioral usage intention toward m-commerce and found out that there is a significant relationship between the two variables. The results clarified that having excellent knowledge and experiences in doing business through m-commerce can make consumer more aware toward the potential risk.

In addition to this, a study performed by Thakur and Srivastava (2014) confirmed that there is a negative relationship between perceived risk and behavioral intention to use of mobile payments. The findings clarified that legal and technological structures need to be adopted by mobile service providers such as certifications to guarantee the payment security and continuous mechanism improvement to ensure the personal information is safe. Some study pointed out that uneasiness on security and privacy risk can strengthen the consumer trust and intention to use specific services (Kumar et al. 2012; Sanayei et al. 2011).

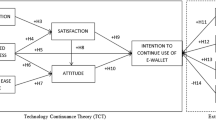

Hence, it indicates that perceived risk is also an important factor that needs to be investigated in gaining the result on the acceptance of the consumer toward mobile payment. Reliable and safe system will make more consumers use mobile payment. Therefore, due of the mix findings from numerous researches, perceived risk need to be examine particularly from the context of e-wallet. As a result, several hypotheses are developed (Fig. 1):

H1 | : There is a positive relationship between perceived usefulness and E-wallet usage intention. |

H2 | : There is a positive relationship between perceived ease of use and E-wallet usage intention. |

H3 | : There is a negative relationship between perceived risk and E-wallet usage intention. |

H4 | : There is a positive relationship between reward and E-wallet usage intention. |

Research framework. Source: Technology acceptance model (TAM) adapted by Davis (1986)

3 Data and Methodology

Youth will be the targeted group for this research. The purpose of choosing youth as respondents is because youths tend to have a lot of information on advancement of technologies and also know how to use the latest technologies on the method of payment known as electronic wallet. According to Mun et al. (2017), stated that a better response able to be obtained by the youth regarding the technologies and can be considered as the mobile payment services potential user. Norizan Sharif (2003) states that the National Youth Development Policy 1997 range of age for youth is from 15 to 40 years old. However, Khairy Jamaluddin, the Ministry of Youth and Sports of Malaysia, stated that “The Malaysian Youth Policy (MYP) to be implemented in 2018 will replace the National Youth Development Policy (NYDP) 1997 and the MYP age limit is from 15 to 30 years compared to 15 to 40 years under the NYDP” (Borneo Post Online 2015). Mun et al. (2017) also conducted a study toward youth, and the range of age is from 18 to 39 years old. Therefore, the range of age that will be used in this study is from 18 to 30 years old. The range of age is applicable within that range. This study used purposive and convenience sampling techniques. The research instrument that used for this study is an online questionnaire. There are 251 respondents that will be examined in order to obtain an appropriate data. The least sample size that required in this research is 129 respondents (f2 = 0.15, number of predictors = 4). IBM measurement SPSS Statistics Version 23 and Smart PLS 3.0 will be used to examine the end result. The items in questionnaire are measured by using five-point Likert scale which starts with “Strongly Disagree” (1) to “Strongly Agree” (5) (Table 1).

4 Results and Discussions

4.1 Profile of the Respondents

The demographic profile of the final sample consists of 251 respondents. The largest group of the sample was the age of 22–25 years old (57%), followed by 18–21 years old (22.3%) and 26–30 years old (20.7%). For demographic analysis, it revealed that most of respondents were female with (63.7%), while the male respondents were only 36.3%. The occupations part reveals that most of the respondents are student with the total of 51.8%, followed by 38.6% of employed, 4.8% of self-employed, and lastly with 4.4% of unemployed. Next, for the level of income part, it shows that (52.6%) of the respondents are fall under the category of none income, followed by (31.1%) which are in the category that the income range are between “RM1000–RM3000” ($241–$724), after that, (8.8%) of the respondents are under the category of income that the range are below “RM1000” ($241), followed by (7.2%) of the of the respondents are under the category that the income level is between “RM3000–RM5000” ($724–$1207), and lastly, only (0.4%) of the respondents are from the category that the income level are more than “RM5000” ($1207).

For the state of origin part, the most respondents participate in the study were from Sabah with 37.1%, followed by Johor (14.3%), Sarawak (10.8%), Selangor (8.4%), Kedah (5.6%), Kelantan (4.4%), Pulau Pinang (3.6%), Wilayah Persekutuan Kuala Lumpur (3.6%), Melaka (2.8%), Terengganu (2.0%), Perlis (2.0%), Negeri Sembilan (2.0%), Wilayah Persekutuan Labuan (1.6%), Perak (1.2%), and lastly Pahang with (0.8%).

4.2 Measurement Model Analysis

To assess superiority of the model measurement, the process of convergent and discriminant validities is used (Hair Jr et al. 2017). Table 2 shows that all of the constructs is discriminant toward one and another because the value of HTMT is not exceeding 0.90 (Hair Jr et al. 2017). In Table 3, the data analysis shows that all of the indicators exceed the convergent validity requirement. The value of all the loadings exceeds 0.70, and all of the indicators can be considered as significant. Apart from that, the value of average variance extracted (AVE) for all constructs was above 0.50. Moreover, composite reliability and Cronbach’s alpha of all constructs were more than 0.70. The use of heterotrait-monotrait (HTMT) method is to confirm the discriminant validity. From the results, it shows that the measurement model has exceeded the least standard of the convergent and discriminant quality features; thus, evaluation of the structural model needs to be conducted.

4.3 Significance and Relevance of the Structural Model Relationships

There are four direct hypotheses that have been developed to test the significance level. SmartPLS 3.0 bootstrapping function is used to generate the t-statistic for all paths. Based on the evaluation of the path coefficient as shown in Table 4, only three of the relationship are found to have t-values ≥1.96, hence significant at 0.05 level of significance. The first predictor is perceived usefulness (β = 0.201, t = 2.942, p < 0.05). Next, predictor of perceived ease of use with β = 0.171, t = 2.485, p < 0.05, and lastly, predictor of reward (β = 0.489, t = 9.751, p < 0.05); both are found to be positively related with intention to use. Thus, H1, H2, and H4 are supported. However, the assessment of other variables is found to be not significant. To be specific, the predictor of perceived risk (β = −0.081, t = 0.683, p < 0.05) is found to be negatively associated to intention to use E-wallet. Therefore, H3 is not supported. The R2 for intention to use E-wallet is 0.565 exceeding the value of 0.26 which was suggested by Cohen (1988) which shows the considerable paradigm.

The next process will be assessing the effect size (f2) of the variables. As stated by Sullivan and Feinn (2012), p-value tells the existence of an effect, but the size of effect does not be informed. In order to evaluate the effect size, this study follows the guideline by Cohen (1988). According to Cohen (1988), the amount of 0.02 is measured as small effects, and followed by 0.15 as medium effects and 0.35 as a large effect. Table 5 shows that the highest effect size is trust and can be considered as large effect.

5 Conclusion

The aim of this study is to evaluate the factors that affect youths’ usage intention towards E-wallet and gives a review in the literature on the factors that effect youth usage intention which are the factors of perceived usefulness, perceived ease of use, perceive risk, and reward. The technology continuously transforming from one period to another period. Hence, for sure the advancement of payment method will be more unique and advance in the future. However, cash is still the top method of payment that is being used by Malaysian. New method or tactic is needed in order to overcome this issue. In fact, this research used TAM model as an underpinning theory and proved that perceived usefulness, perceived ease of use, and reward have a significance effects toward the usage intention of E-wallet among youth, while perceived risk has no significant effect toward E-wallet usage intention.

Consumers in Malaysia tend to use this new technology payment if they found it is easy to be used and useful to them. Risk will be the major factors that makes consumers to have no interest to use this new technology payment. From that, the service providers or the government should take a quick action to this matter and try to create more new ideas that can make the consumer attracted more and encourage them to use the updated technology method of payment in the future and also strengthen the security system of this E-wallet so that when the consumers used this method of payment, they will feel secure when using it. Moreover, the service provider also should provide more rewards so that the consumers are willing to use this new technology payment. This is because most of the consumers in Malaysia tend to be attracted to better rewards which can give more benefits to them.

This study also has a limitation where most of the study is focusing more on e-payment, e-banking, and e-commerce, and limited study was conducted in the context of E-wallet. As for recommendation for future research, researchers can extend the study by measuring other factors by adding new variable such as perceived enjoyment because there is limited study that uses this variable specifically in the context of E-wallet in Malaysia. This study only focuses on youths; therefore, future research can change the target respondents to older consumers. As for conclusion, this study hopes to provide some insight and complete the literature which currently exists with regard to perceived usefulness, perceived ease of use, perceive risk, and reward among Malaysian youth toward the E-wallet usage intention.

References

Abrazhevich, D. (2001). Electronic payment systems: Issues of user acceptance. Proceedings of the eBusiness and eWork,1, pp. 354-360.

Agrebi, S., & Jallais, J. (2015). Explain the intention to use smartphones for mobile shopping. Journal of Retailing and Consumer Services, 22, 16–23.

Ahn, J., & Park, H. S. (2016). Reward for organ donation: Is it effective or not as a promotion strategy? International Journal of Nonprofit and Voluntary Sector Marketing, 21(2), 118–129.

Al-Amri, R., Maarop, N., Jamaludin, R., Samy, G. N., Magalingam, P., Hassan, N. H., Ten, D. W. H., & Daud, S. M. (2018). Correlation analysis between factors influencing the usage intention of NFC mobile wallet payment. Journal of Fundamental and Applied Sciences, 10(2S), 215–228.

Ali, R. (2010). E-government adoption in developing countries: The case of Indonesia. Journal of Emerging Trends in Computing and Information Sciences, 2(5).

Ariely, D., Bracha, A., & Meier, S. (2009). Doing good or doing well? Image motivation and monetary incentives in behaving prosocially. American Economic Review, 99(1), 544–555.

Aydin, G., & Burnaz, S. (2016). Adoption of mobile payment systems: A study on mobile wallets. Journal of Business Economics and Finance, 5(1), 73–92.

Bornoe Post Online. (2015). Khairy: New definition of youth age to be implemented in 2018. Accessed May 10, 2020, from https://www.theborneopost.com/2015/05/17/khairy-new-definition-of-youth-age-to-be-implemented-in-2018/

Carlson, C., & Tamm, L. (2000). Responsiveness of children with attention deficit-hyperactivity disorder to reward and response cost: Differential impact on performance and motivation. Journal of Consulting and Clinical Psychology, 68(1), 73–83.

Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). New York: Lawrence Erlbaum Associates.

Custers, T., Hurley, J., Klazinga, N., & Brown, A. (2008). Selecting effective incentive structures in health care: A decision framework to support health care purchasers in finding the right incentives to drive performance. BMC Health Services Research, 8(66), 1–14.

Dahlberg, T., Mallat, N., Ondrus, J., & Zmijewska, A. (2008). Past, present and future of mobile payments research: A literature review. Electronic Commerce Research and Applications, 7(2), 165–181. https://doi.org/10.1016/j.elerap.2007.02.001.

Davies, R., & Harty, C. (2013). Measurement and exploration of individual beliefs about the consequences of building information modelling use. Construction Management and Economics, 31(11), 1110–1127.

Davis, F. D. (1986). A technology acceptance model for testing new end-user information systems: Theory and results. Sloan School of Management, 291.

Davis, F. D., & Venkatesh, V. (1996). A critical assessment of potential measurement biases in the technology acceptance model: Three experiments. International Journal of Human-Computer Studies, 45(1), 19–45.

Eberts, R., Hollenbeck, K., & Stone, J. (2002). Teacher performance incentives and student outcomes. Journal of Human Resources, 37(4), 913–927.

Featherman, M. S., & Pavlou, P. A. (2003). Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human-Computer Studies, 59(4), 451–474.

Fernandes, L. (2013). Fraud in electronic payment transactions: Threats and countermeasures. Asia Pacific Journal of Marketing & Management Review, 2(3), 23–32.

Gupta, S., & Kim, H. W. (2010). Value-driven internet shopping: The mental accounting theory perspective. Psychology & Marketing, 27(1), 13–35.

Guriting, P., & Ndubisi, N. O. (2006). Borneo online banking: Evaluating customer perceptions and behavioural intention. Management Research News, 29(1/2), 6–15.

Ha, S., & Stoel, L. (2009). Consumer e-shopping acceptance: Antecedents in a technology acceptance model. Journal of Business Research, 62(5), 565–571.

Hair, J. F., Jr., Hult, G. T. M., Ringle, C., & Sarstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM) (2nd ed.). Thousand Oaks: Sage publications.

Huang, J. H., Lin, Y. R., & Chuang, S. T. (2007). Elucidating user behavior of mobile learning. The Electronic Library, 25(5), 585–598.

Husson, T. (2015) The future of mobile wallets lies beyond payments Accessed Sep 8, 2020, from https://go.forrester.com/blogs/15-02-09-the_future_of_mobile_wallets_lies_beyond_payments/

Kim, Y. J., & Han, J. (2014). Why smartphone advertising attracts customers: A model of web advertising, flow, and personalization. Computers in Human Behavior, 33, 256–269.

Kleijnen, M., Wetzels, M., & De Ruyter, K. (2004). Consumer acceptance of wireless finance. Journal of Financial Services Marketing, 8(3), 206–217.

Kumar, R. G., Rejikumar, G., & Ravindran, D. S. (2012). An empirical study on service quality perceptions and continuance intention in mobile banking context in India. Journal of Internet Banking and Commerce, 17(1), 1–22.

Kwon, K. J., Mai, L. W., & Peng, N. (2020). Determinants of consumers’ intentions to share knowledge and intentions to purchase on s-commerce sites: Incorporating attitudes toward persuasion attempts into a social exchange model. Eurasian Business Review, 10(1), 157–183.

Lacetera, N., & Macis, M. (2010a). Do all material incentives for pro-social activities backfire? The response to cash and non-cash incentives for blood donations. Journal of Economic Psychology, 31(4), 738–748.

Lacetera, N., & Macis, M. (2010b). Social image concerns and prosocial behavior: Field evidence from a nonlinear incentive scheme. Journal of Economic Behavior & Organization, 76(2), 225–237.

Lai, P. C. (2016). Design and security impact on consumers' intention to use single platform E-payment. Interdisciplinary Information Sciences, 22(1), 111–122.

Lai, P. C. (2017). The literature review of technology adoption models and theories for the novelty technology. JISTEM-Journal of Information Systems and Technology Management, 14(1), 21–38.

Lai, P.C., & Zainal, A. A. (2014, April). Perceived Enjoyment of Malaysian consumers’ intention to use a single platform E-payment. In International Conference on Liberal Arts & Social Sciences., 25th–29th April.

Lai, P. C., & Zainal, A. A. (2015). Perceived risk as an extension to TAM model: Consumers’ intention to use a single platform E-payment. Australia Journal Basic and Applied Science, 9(2), 323–330.

Lee, Y., & Kozar, K.A. (2013). Larsen. 2003. The Technology Acceptance Model: past, present, and future, pp. 752–780.

Lee, D., Larose, R., & Rifon, N. (2008). Keeping our network safe: A model of online protection behavior. Behaviour and Information Technology, 27(5), 445–454.

Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: A developing country perspective. Journal of Indian Business Research, 8(3), 227–244.

Mathieson, K. (1991). Predicting user intentions: Comparing the technology acceptance model with the theory of planned behavior. Information Systems Research, 2(3), 173–191.

Misra, S. K., Javalgi, R. G., & Scherer, R. F. (2004). Global electronic money and related issues. Review of Business, 25(2), 15–24.

Mohamad, A., Haroon, A., & Najiran, A. (2009). Development of electronic money and its impact on the central bank role and monetary policy. Issues in Information Science and Information Technology, 6(1), 339–344.

Mun, Y. P., Khalid, H., & Nadarajah, D. (2017). Millennials’ perception on mobile payment services in Malaysia. Procedia Computer Science, 124, 397–404.

Natarajan, T., Balasubramanian, S. A., & Kasilingam, D. L. (2017). Understanding the intention to use mobile shopping applications and its influence on price sensitivity. Journal of Retailing and Consumer Services, 37, 8–22.

Nguyen, T. D., & Huynh, P. A. (2018, January). The roles of perceived risk and trust on e–payment adoption. In International econometric conference of Vietnam (pp. 926–940). Cham: Springer.

Oluleye, F. A. (2011). Reward economics and organisation: The issue of effectiveness. African Journal of Business Management, 5(4), 1115–1123.

Pal, D., Vanijja, V., & Papasratorn, B. (2015). An empirical analysis towards the adoption of NFC mobile payment system by the end user. Procedia Computer Science, 69, 13–25.

Petri, H. (2003). In S. H. Park & M. S. Kim (Eds.), Motivation: Theory, research, and applications (4th Trans. ed.). Seoul: Sigmapress.

Pham, T. T. T., & Ho, J. C. (2014, July). What are the core drivers in consumer adoption of NFC-based mobile payments?: A proposed research framework. In Proceedings of PICMET'14 conference: Portland International Center for Management of Engineering and Technology; Infrastructure and Service Integration (pp. 3041–3049). IEEE.

Pham, T. T. T., & Ho, J. C. (2015). The effects of product-related, personal-related factors and attractiveness of alternatives on consumer adoption of NFC-based mobile payments. Technology in Society, 43, 159–172.

Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance of online banking: An extension of the technology acceptance model. Internet Research, 14(3), 224–235.

Porter, L. W., Bigley, G. A., & Steers, R. M. (2003). Motivation and work behavior (7th ed.). Boston: McGraw-Hill/Irwin.

Qasim, T., Siddiqui, S., & Ur Rehman, S. (2012), November. Interactive shopping with mobile wallet. In World congress on sustainable technologies (WCST-2012) (pp. 32–36). IEEE.

Saadé, R., & Bahli, B. (2005). The impact of cognitive absorption on perceived usefulness and perceived ease of use in on-line learning: An extension of the technology acceptance model. Information & Management, 42(2), 317–327.

Sanayei, A., Ranjbarian, B., Shaemi, A., & Ansari, A. (2011). Determinants of customer loyalty using mobile payment services in Iran. Interdisciplinary Journal of Contemporary Research in Business, 3(6), 22–34.

Saprikis, V. (2018). Examining behavioral intention towards social commerce: An empirical investigation in university students. In Proceedings of the 32 nd IBIMA Conference, November (pp. 15-16).

Schunk, D. H., Pintrich, P. R., & Meece, J. L. (2008). Motivation in education: Theory, research, and applications (3rd ed.). Upper Saddle River, N.J: Merrill/Prentice Hall.

Sharif, N. (2003). Perpaduan Belia Pelbagai Agama di Malaysia. Dalam Agama Dan Perpaduan Kaum Di Malaysia, Fakulti Pengajian Islam, Universiti Kebangsaan Malaysia.

Shaw, N. (2014). The mediating influence of trust in the adoption of the mobile wallet. Journal of Retailing and Consumer Services, 21(4), 449–459.

Shin, D. H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343–1354.

Slade, E. L., Dwivedi, Y. K., Piercy, N. C., & Williams, M. D. (2015). Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: Extending UTAUT with innovativeness, risk, and trust. Psychology & Marketing, 32(8), 860–873.

Slozko, O., & Pelo, A. (2015). Problems and risks of digital technologies introduction into E-payments. Transformations in Business & Economics, 14(1), 225–235.

Sullivan, G. M., & Feinn, R. (2012). Using effect size—Or why the P value is not enough. Journal of Graduate Medical Education, 4(3), 279–282.

Tam, C., & Oliveira, T. (2017). Understanding mobile banking individual performance: The deLone & McLean model and the moderating effects of individual culture. Internet Research, 27(3), 538–562.

Tavilla, E. (2012). Opportunities and challenges to broad acceptance of mobile payments in the united states. Federal Reserve Bank of Boston. Accessed Sep 6, 2020, from https://www.bostonfed.org/-/media/Documents/PaymentStrategies/opportunities-and-challanges-to-broad-acceptance-of-mobile-payments.pdf/

Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369–392.

Varnali, K., Yilmaz, C., & Toker, A. (2012). Predictors of attitudinal and behavioral outcomes in mobile advertising: A field experiment. Electronic Commerce Research and Applications, 11(6), 570–581.

Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186–204.

Venkatesh, V., & Morris, M. G. (2000). Why don’t men ever stop to ask for directions? Gender, social influence, and their role in technology acceptance and usage behavior. MIS quarterly, pp., 115–139.

Venkatesh, V., Thong, J.Y., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS quarterly, pp. 157–178.

Volpp, K. G., Troxel, A. B., Pauly, M. V., Glick, H. A., Puig, A., & Asch, D. A. (2006). A randomized, controlled trial of financial incentives for smoking cessation. The New England Journal of Medicine, 360(7), 699–709.

Weibel, A., Rost, K., & Osterloh, M. (2010). Pay for performance in the public sector—Benefits and (hidden) costs. Journal of Public Administration Research and Theory, 20(2), 387–412.

Wu, J. H., & Wang, S. C. (2005). What drives mobile commerce?: An empirical evaluation of the revised technology acceptance model. Information & Management, 42(5), 719–729.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Malik, A.N.A., Annuar, S.N.S. (2021). The Effect of Perceived Usefulness, Perceived Ease of Use, Reward, and Perceived Risk toward E-Wallet Usage Intention. In: Bilgin, M.H., Danis, H., Demir, E. (eds) Eurasian Business and Economics Perspectives. Eurasian Studies in Business and Economics, vol 17. Springer, Cham. https://doi.org/10.1007/978-3-030-65147-3_8

Download citation

DOI: https://doi.org/10.1007/978-3-030-65147-3_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-65146-6

Online ISBN: 978-3-030-65147-3

eBook Packages: Business and ManagementBusiness and Management (R0)