Abstract

Consider a dynamic Bertrand competition in mixed oligopoly, where a private firm competes with a social welfare maximizing public firm. Firms produce substitute products, face stochastic demand and each firm receive noisy signals on common stochastic demand. In this mixed oligopoly, we examine incentives of public and private firms to share their private signals through an independent trade agency and we characterize equilibrium outcomes. We established two main effects of information sharing: information sharing increases production efficiency by enabling firms to predict stochastic demand shocks better. However, more precise signals increase power of private firm to capture consumer surplus and lowers social welfare. In Perfect Bayesian equilibrium of the mixed oligopoly game, private firm shares all signals it receives with the public firm, whereas public firm shares no information with the private firm. The market outcome is never optimal: it satisfy neither of informational efficiency, production efficiency and allocative efficiency.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

2.1 Introduction

Do firms in oligopolistic markets share information sufficiently or are oligopolistic markets informationally efficient? This question has become more important in the last decade as firms have started to use big data more intensely and competitive intelligence activities have started to be more central in firm activities. Framingham [3] reports that big data and business analytics revenues were 189 billion dollar in 2019. An example better crystallizing the argument is competitive intelligence system adoption of the European unit of Cisco Systems [1]. Cisco initially started to use this system to acquire information on firm demand, industry demand and competitors’ activities. Meanwhile, Cisco voluntarily disclosed some of information is gathered.

Acquiring and sharing information on demand and cost conditions is extensively analyzed for pure oligopolies in the literature. Early contributions to the literature were made by Ponssard [10], Novshek and Sonnenschein [9], Clarke [2], Fried [4], Vives [11] and Gal-Or [5]. In the following years, many other studies have been added to the literature such as Haraguchi and Matsumura [6], Myatt and Wallace [8]. The literature showed that information sharing behaviors of firms extensively depend on the type of competition (Cournot or Bertrand), types of products and nature of uncertainty (whether it is cost of demand uncertainty). When uncertainty is on common demand parameters, firms tend to share all information they have with each other if they compete in quantities and goods are complements or if they compete in prices and goods are substitutes [11]. The results are reversed if uncertainty is on cost parameters.

This study extends prior literature by examining firms’ incentives to acquire and share information on stochastic demand in mixed oligopolies. Mixed oligopolies, characterized as the competition between private firms with a public firm whose objective is not solely profit maximization, exist in many oligopolistic markets. 10% of world 2000 largest publicly listed firms are identified as state-owned enterprises [7]. State owned enterprises represent 62% of Russia’s stock market capitalization. Therefore, a sizeable part of economic activities are maintained in mixed oligopolies rather than in pure oligopolies. This study focuses on mixed oligopolies to extend the information sharing literature in this direction.

Specifically, we consider a mixed duopoly where a private firm competes a la Bertrand with a social welfare maximizing public firm. Firms produce substitute products under common demand uncertainty and each firm receives an observation sample on uncertain demand parameter. In this model economy, firms play two-stage game and decide the extent of information to reveal with the other firm in the first stage and decide pricing in the second stage. In equilibrium, private firm always shares all information it has, whereas social welfare maximizing public firm shares no information. These actions are dominant strategies for both firms. Moreover, we established that the market outcome is never optimal: it does not satisfy informational efficiency, production efficiency and allocative efficiency.

2.2 Model

We study a dynamic model economy where a social welfare maximizing public firm (firm 1) competes with a private firm (firm 2) in prices. In the economy, there are two differentiated, substitute goods, produced by each firm. To derive closed form solutions, utility function of consumers is assumed to be quadratic, strictly concave and symmetric in the quantity of the goods.

The specified utility function yields linear demand functions:

where α > 0, β > γ > 0 and the assumption γ > 0, guarantees that the goods are substitutes. Accompanying consumer surplus can be defined as follows:

To simplify the model, without loss of generality, marginal costs of both firms are assumed to be zero. As a result, the profit function of the private firm is equal to:

and total producer surplus is equal to:

Both firms are assumed to be risk neutral. The private firm aims to maximize solely its profit function. However, the public firm takes into account both its own profit function, private firm’s profit function (producer surplus) and consumer surplus. Public firm aims to maximize social welfare, defined by the following equation

The crucial part of the model is that we model uncertainty in demand and allow firms to choose information sharing about this uncertainty. Specifically, following to Vives (1984), we assume that demand intercept, α is a random variable and is normally distributed with mean \(\bar {\alpha }\) and variance V(α). Each firm starts to game with n i independent observation sample (t i1, t i2, t i3, …, t in), where t ik = α + u ik and u ik’s are independent and identically distributed random variables. Their mean is zero, variance \(\sigma _{u}^2\) and independent with α.

There is an independent trade agency that collects the observation samples. Firm 1 (public firm) receives n 1 observation sample and allows the trade agency to reveal λ 1n 1 observation where 0 ≤ λ 1 ≤ 1. Also, Firm 2 (private firm) receives n 2 observation sample and allows the trade agency to reveal λ 2n 2 observation where 0 ≤ λ 2 ≤ 1. There are λ 1n 1 + λ 2n 2 observation sample in the common pool after each firm shares λ in i observation it has.

As a result of this information sharing process, each firm observes a private noisy signal for the random variable α. The equation of signals is given as

We have bivariate, normally distributed error terms with zero means for s i, where \(v_i=\sigma _u^2/(n_{i}+\lambda _j n_j)\) and \(\sigma _{12}=((\lambda _1 n_1+\lambda _2 n_2)/(n_1 + \lambda _2 n_2)(n_2+\lambda _1 n_1))\sigma _u^2\), implies that v i ≥ σ 12 ≥ 0, i = 1, 2.

With these assumptions, we define following equations: \(E(\alpha | s_i)=(1-t_i)\bar \alpha +t_i s_i\) and \(E(s_j | s_i)=(1 - d_i)\bar \alpha + d_i s_i\), with t i = V (α)∕(V (α) + v i) and d i = (V (α) + σ 12)∕(V (α) + v i), i=1,2, i ≠ j, where 1 ≥ d i ≥ t i ≥ 0 since v i ≥ σ 12 ≥ 0.

The equations imply that signals give more precise information about the demand intercept as the variance decreases. The conditional expectation formula is as the following:

If the precision of the signals increase, t i increases because when t i increases E(α|s i) gets closer to s i than \(\bar \alpha \). Also, t i increases as v i increases because t i = V (α)∕(V (α) + v i). While the signal goes from being perfectly precise to being completely imprecise, v i goes from 0 to ∞ and t i goes from 1 to 0. Last, all of these are common knowledge.

Public and private firms play two-stage game. Timing of the game is as follows: in the first stage, both firms receive private noisy signal about the uncertain demand parameter. Each firm decides the amount of observation to share with its competitor. Then, the independent trade agency collects these observations and distributes these observations. In the second stage, given their received signal s i, based on their collected and received information about uncertain demand, each firm decides price to charge. The game ends at the end of the second stage.

2.3 Analysis

In this section, we determine Perfect Bayesian Equilibrium of the model. We start to solve model using backward induction. Equilibrium price strategies in the second stage are derived by establishing convergence points of “I think that he thinks that I think…” type model.

Public firm maximizes following expected social welfare function with respect to p 1.

While private firm maximizes following expected profit function with respect to p 2.

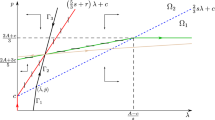

So, the best response functions for each firm are as follows:

This yields following equations:

After some messy calculations, we obtain following best response function in terms of exogenous variables:

and we can re-write expected social welfare function as the following:

Again, after proper substitution and calculations, we derive expected social function in exogenous terms:

where \(X_1 = \frac {\gamma (\beta -\gamma )} {2\beta ^2} \frac {2\beta ^2} {2\beta ^2-\gamma ^2} \bar \alpha \), \(x_2 = \frac {\gamma (\beta -\gamma )} {2\beta ^2} \frac {2\beta ^2} {2\beta ^2-\gamma ^2 d_1 d_2} d_1 \), and \(Z_1 = \frac {\beta -\gamma } {2\beta } \bar \alpha \frac {2\beta ^2} {2\beta ^2-\gamma ^2} \), \(Z_2 = \frac {\beta -\gamma } {2\beta } \frac {2\beta ^2} {2\beta ^2-\gamma ^2 d_1 d_2} \).

Then, we make a similar analysis to derive best response function and expected profit of the private firm in exogenous terms. We already derived the following function for the best response function of the private firm:

This yields,

After proper substitution and calculations, we derive best response function of the private firm in exogenous terms.

Or we can re-write this function in linear form as follows:

Then, the expected profit of the private will be equal to:

So far, we derived best response functions of both firms and corresponding expected values of their objective functions by solving each firm’s equilibrium price decisions in the second period. The derived conditional expected values of both firms’ objective functions, E(SW|s 1) and E(π 2|s 2), show how these functions are related to the signals s 1 and s 2. Now, following the backward induction, we turn to the first period and derive their information sharing decisions in the first period of the game. The following lemma summarizes our first result.

Lemma 2.1

An increase in the precision of private firm’s information, or in the precision of public firm’s information, or correlation of signals unconditionally raises expected profit of private firm.

Proof

The following equations show the derivative of expected profit of private firm with respect to the precision of private firm’s information (v 2), the precision of public firm’s information (v 1), and correlation of signals (σ 12).

where \(\zeta = \beta ^2 \left (V(\alpha )^2+(v_1+v_2) V(\alpha ) + v_1 v_2\right )\) and \(\eta = \frac {1} {2} \gamma ^2 \left (V(\alpha )+\sigma _{12}\right )^2\)

The derivative, \(\frac {\partial E(\pi _2 | s_2 )} {\partial v_2}\), is always negative for all values of the parameters. As a result, an increase in the precision of private firm’s information, the decrease of the variance (v 2), raises the expected profit of the private firm.

Then, as long as γ ≠ 0, \(\frac {\partial E(\pi _2 | s_2 )} {\partial v_1} < 0 \). As we assumed that goods are substitutes (γ > 0), then the derivative is negative.

Last,

The assumption β > γ > 0 guarantees that the derivative is positive, \(\frac {\partial E(\pi _2 | s_2 )} {\partial \sigma _{12}}>0\). As a result, the increase of the correlation of the signals raises expected profit of the private firm. ■

The first lemma summarizes that the increase of all kind of information in the pool has a positive effect on the expected profit of the firm. The reason of this result is simple. There are two effects of the increase of the information: the first one is the output adjustment effect. More information leads firms to adjust to shocks and increases efficiency. Evidently, through this effect, more information in the market has tendency to increase the expected profit of the private firm. The second effect is that: when the firm is price setter, more information leads greater scope to extract consumer surplus. As, the private firm solely aims to increase its profit, through this effect, more information again has tendency to increase the expected profit. Hence, as more information has positive impact on profit through both channels, the net effect is also positive on the expected profit.

The next lemma summarizes the effect of more information in the market on social welfare.

Lemma 2.2

An increase in the precision of private firm’s information, or in the precision of public firm’s information, or correlation of signals unconditionally lowers expected social welfare.

Proof

The derivative of the expected social welfare with respect to relevant parameters are as follows:

where β 2(V (α)2 + (v 1 + v 2)V (α) + v 1v 2) = ζ and \(\frac {1}{2} \gamma ^2 (V(\alpha )+\sigma _{12})^2=\eta \)

Then the derivative with respect to v 1 is positive, \(\frac {\partial E(SW | s_1 )} {\partial v_1} > 0\).

Similarly, the derivative with respect to v 2 is positive, \(\frac {\partial E(SW | s_1 )} {\partial v_2} > 0\). That implies an increase of the precision of information, a decrease in v 1 or v 2, lowers expected social welfare.

Last, the derivative with respect to σ 12 is negative, \(\frac {\partial E(SW | s_1 )} {\partial \sigma _{12}} < 0\), which completes the proof. ■

The reason behind the results summarized in Lemma II stems from the trade-off between increasing production efficiency versus increasing power of capturing consumer surplus. As the Lemma I shows more information in the market leads greater scope to extract consumer surplus of the private firm, this leads overall fall in the social welfare.

Lemma 2.3

An increase in λ jlowers v iand v iis independent of λ i, i = 1, 2, j ≠ i.

Proof

Equation is as follows:

v i is inversely related to λ j, while independent of λ i. ■

Lemma 2.4

If λ j < 1, i = 1, 2, j ≠ i, then σ 12increases with λ i, while if λ j = 1, then σ 12is independent of λ i

Proof

Equation for σ 12 is as follows:

Now for i = 1

If λ 2 = 1, the derivative is 0, if λ 2 < 1, then the derivative is positive.

Similarly for i = 2

If λ 1 = 1, the derivative is 0, if λ 1 < 1, then the derivative is positive. ■

The previous two lemmas, Lemma III and Lemma IV show effects of increasing the number of observations in the pool on variance, v i and correlation of signals, σ 12. After these lemmas, the next corollary summarizes net effect of information sharing on expected profit of the private firm and expected social welfare.

Corollary 1

More information sharing in the pool increases expected profit of the private firm while decreases expected social welfare.

Proof

Lemma I together with Lemma III and Lemma IV imply that increase in λ i, i = 1, 2, has increasing effect on expected profit of the private firm. Similarly, Lemma II together with Lemma III and Lemma IV imply that increase in λ i, i = 1, 2, has increasing effect on expected social welfare. ■

Table 2.1 summarizes the net effects of more information sharing and channels in which more information affects expected profit and social welfare.

The next proposition summarizes main result of the paper.

Proposition 1

Suppose goods are substitutes. Then the two-stage Bertrand game has a unique Perfect Bayes Equilibrium in dominant strategies. There is partial information pooling: the public firm does not share any information, while private firm completely shares all information it has.

Proof

As corollary shows, more information in the pool increases expected profit of the firm in all cases, independently of the best response of the public firm. As a result, dominant strategy of the private firm is to share all information it has. Conversely, more information in the pool decreases overall expected social welfare in all cases. Thus, no information sharing is the dominant strategy for social welfare maximizing public firm. ■

An important remark is that although one of the firms is social welfare maximizing public firm, the market outcome is never first-best optimal. As there is partial information sharing, the market outcome does not maximize production efficiency and does not enhance informational efficiency.

A relevant question here might be whether public firm may choose not to use the information that the private firm provides. As less information in the information pool has always social welfare increasing effect, one may argue that public firm may choose not to receive information provided by the private firm. If ex ante the public firm could guarantee that it would not use the information shared by the private firm, it would choose not to use the information shared by the private firm. However, once the private firm puts observations it has to the information pool and shares them, the public firm ex post cannot guarantee that it will not use the information that the private firm shares. Because as more information has always positive effect on enhancing production efficiency, once received the information shared, the best the public firm can do is to use this information. Hence, the public firm uses all information shared in equilibrium.

Last, we compare equilibrium outcomes established in mixed oligopoly with the ones in pure oligopolies. In a very similar two stage duopoly setting, Vives [11] analyzes informational equilibrium outcomes for a pure duopoly. The information setting and production functions of the firms are same in that paper with the ones assumed in this study. Vives [11] establishes that if goods are substitutes and firms compete a la Bertrand, in Perfect Bayesian equilibrium of the game, both private firms share all information that they have with each other. This implies that information sharing behavior of private firm does not change according to whether it competes in a pure oligopoly market or in a mixed oligopoly market. However, behavior of the public firm is totally different as we showed in this study. In sum, although there is full information sharing in a pure oligopoly with Bertrand competition, informational equilibrium is characterized with partial information sharing in mixed oligopoly. Thus, comparing with equilibrium outcomes in pure oligopoly, mixed oligopoly yields less information efficiency and less production efficiency but still enhances social welfare.

2.4 Conclusion

We have considered informational outcomes in a mixed oligopoly, where a private firm competes with a social welfare maximizing public firm. We analyzed firms’ incentives to share and diffuse information when firms produce substitute products and compete in prices under stochastic common demand shocks. It seemed there are two main effects: information sharing increases production efficiency by enabling firms to predict stochastic demand shocks better. The other effect is to increase power of capturing consumer surplus. For private firm, both effects work in the same direction and gives incentive to private firm to share all private signals it received with the public firm. As a result, in equilibrium, private firm always share all information it has. For the public firm, which aims to maximize social welfare, production efficiency motive gives it tendency to share information. However, as more information also increases private firm’s power of capturing consumer surplus, this second effect leads public firm to not to share the information it has. In equilibrium, the second effect dominates the first one and as a result, in order to reduce private firm’s power of capturing consumer surplus, the public firm shares no information with the private firm. Hence, the equilibrium is characterized with partial information sharing.

There are several lines to extend the analysis of this study. We have considered only Bertrand competition with substitute goods. The prior studies on the information sharing in pure oligopolies show that equilibrium outcomes heavily depend on type of goods and type of competition. Thus, extending analyzes for Cournot competition and for complement goods will be beneficial. Another line of research may focus on the effects of privatization with taking informational outcomes into account. This line of research may establish important policy implications.

References

Bagnoli, M., Watts, S.G.: Competitive intelligence and disclosure. RAND J. Econom. 46(4), 709–729 (2015)

Clarke, R.N.: Collusion and the incentives for information sharing. Bell J. Econom. 14(2), 383–394 (1983)

Framingham, M.: IDC forecasts revenues for big data and business analytics solutions will reach $189.1 Billion this year with double-digit annual growth through 2022. IDC, Framingham (2019). https://www.idc.com/getdoc.jsp?containerId=prUS44998419. Cited 29 Jan 2020

Fried, D.: Incentives for information production and disclosure in a duopolistic environment. Q. J. Econ. 99(2), 367–381 (1984)

Gal-Or, E.: Information sharing in oligopoly. Econometrica 53, 329–343 (1985)

Haraguchi J., Matsumura T.: Cournot-Bertrand comparison in a mixed oligopoly. J. Econom. 117(2), 117–136 (2016)

Kowalski, P., Büge, M., Sztajerowskai, M., Egeland, M.: State-Owned Enterprises: Trade Effects and Policy Implications. OECD Trade Policy Papers, No. 147, OECD Publishing, Paris. https://doi.org/10.1787/5k4869ckqk7l-en

Myatt D.P., Wallace C.: Cournot competition and the social value of information. J. Econom. Theory 158, 466–506 (2015)

Novshek, W., Sonnenschein, H.: Fulfilled expectations cournot duopoly with information acquisition and release. Bell J. Econom. 13, 214–218 (1982)

Ponssard, J.P.: The strategic role of information on the demand functions in an oligopolistic market. Manag. Sci. 25(3), 243–250 (1979)

Vives, X.: Duopoly information equilibrium: Cournot and Bertand. J. Econom. Theory 34, 71–94 (1984)

Acknowledgements

Haluk would like to acknowledge financial support from the Scientific and Technological Research Council of Turkey (TUBITAK International Cost Grant 217K428) and COST action European Network for Game Theory (GAMENET). The authors thank Hasan Karaboga, co-editors Leon Petrosyan, Vladimir Mazalov and Nikolay Zenkevich and seminar participants at International Meeting on Game Theory (ISDG12-GTM2019) Saint-Petersburg.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Citci, S.H., Uge, K. (2020). Information Exchange in Price Setting Mixed Duopoly. In: Petrosyan, L.A., Mazalov, V.V., Zenkevich, N.A. (eds) Frontiers of Dynamic Games. Static & Dynamic Game Theory: Foundations & Applications. Birkhäuser, Cham. https://doi.org/10.1007/978-3-030-51941-4_2

Download citation

DOI: https://doi.org/10.1007/978-3-030-51941-4_2

Published:

Publisher Name: Birkhäuser, Cham

Print ISBN: 978-3-030-51940-7

Online ISBN: 978-3-030-51941-4

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)